ExxonMobil Quits Climate Change Denial Group, But Don't Be Fooled

The Intertubes are buzzing over news that global oil giant ExxonMobil has finally quit ALEC, the powerful lobbying organization known for its promotion of climate change denial. That's good news in terms of driving down support for the U.S. coal industry. However, it's not necessarily a big step forward for climate action.

ExxonMobil diversifies...into natural gas

Royal Dutch Shell, BP and other legacy oil and gas companies are diversifying into wind and solar with shovels-in-the-ground projects, but so far ExxonMobil has refrained from attaching its name to anything concrete. Instead, it has been plowing millions into research that focuses more generally on reducing emissions.The broad focus on reducing emissions supports ExxonMobil's growing interest in natural gas. Though best known for its roots in The Standard Oil Company, ExxonMobil has also been in the vanguard of the U.S. shale gas revolution.

Even if the global market for natural gas as a fuel begins to stall, ExxonMobil has a fallback plan: plastics. Triple Pundit took note of the strategy last year:

...ExxonMobil is planning to build what is reported to be the world’s largest ethane cracker. It is on track to be constructed in the Corpus Christie area of Texas, unless local protestors succeed in blocking it.

Crackers use high heat to break ethane down into the chemical building block ethylene, which is this:

Ethylene is the most commonly produced petrochemical. It is the root chemical for a kingdom of plastics, resins, adhesives and synthetic products used in virtually every aspect of modern life. It’s used as the basis for plastics like beverage containers, food wrap, polyvinyl chloride (PVC), polyester, and chemicals like those found in antifreeze, solvents, urethanes and pharmaceuticals.

As of this writing, the $10 billion (yes, that's $10 billion) project is still moving forward. It will also include facilities for producing polyethylene and monoethylene.

Several years ago the company also undertook a major expansion of its Baytown, Texas petrochemical facility, and last spring Platt's listed several other new ExxonMobil projects aimed at leveraging access to cheap shale gas.

All of this activity is in anticipation of a global rebound in the plastics market through 2040, fueled in part by growing demand for convenience products in Asia, India and elsewhere.

ExxonMobil could also piggyback on the rapid growth of the hydrogen fuel cell field. Although renewable hydrogen is rapidly beginning to emerge as an alternative, the primary source of hydrogen today is natural gas.

What's so bad about natural gas?

Natural gas produces less emissions at the burn point than coal, and for that reason it has been widely touted as a cleaner fuel -- especially among natural gas stakeholders.

ExxonMobil has been aggressively leveraging promoting the emissions advantage to help push coal out of the power generation field. Among other efforts, the company has voiced support for the goals of the 2015 Paris Agreement on climate change.

The problem is that natural gas is not necessarily a sustainable solution. Reducing emissions from smokestacks is all well and good, but there is mounting evidence of local air and water impacts as well as poor public health outcomes and other risks related to natural gas drilling operations.

In addition, the massive leakage discovered at a California natural gas storage facility in 2016 underscores the impact of natural gas operations on climate change.

From the wellhead through to transportation and storage, leaks and other "fugitive emissions" of the potent greenhouse gas methane have historically been a feature, not a bug, of natural gas operations.

The Rocky Mountain Institute explains:

Simply put, the high levels of methane emissions from the oil and gas industry are responsible for one of the most urgent climate “forcing” problems we face today. Natural gas, long touted as a cleaner and more climate-friendly alternative to burning coal, is expected to continue to increase as market forces drive the replacement of coal. However, methane leaks of just 3 percent from the natural gas supply chain double the carbon impact of gas, rendering it on par with coal from an environmental perspective.

The climate change denial fox in the henhouse

This brings us back around to ALEC and the climate change denial movement.

For those of you new to the topic, ALEC stands for the American Legislative Exchange Council. Loosely described as a conservative lobbying organization, ALEC is better known as a "bill mill." Its effectiveness lies in its ability to write model bills that advance climate change denial and other interests of its members, and to enlist state-level representatives who shepherd those bills through to passage.

Among ALEC's supporters are the notoriously conservative Koch brothers, whose family business leans heavily on fossil fuels. By 2012 ALEC's extremist position on climate change and other issues began to conflict with the corporate social responsibility movement, leading Pepsico, Amazon, and other high profile members to exit the group.

Earlier this year, ExxonMobil put ALEC on notice that the company could not support its climate change denial position.

To be clear, ALEC's official statement on global warming is not a straight-up refusal to acknowledge the evidence. Instead, the organization takes the now-familiar climate change denial position that we don't know enough about global warming to justify policies that curb greenhouse gas emissions:

Climate change is a historical phenomenon and the debate will continue on the significance of natural and anthropogenic contributions.

In particular, ALEC opposes government policies that accelerate decarbonization:

Mandates to transform the energy sector and use renewable energy sources place the government in the unfair position of choosing winners and losers, keeping alive industries that are dependent on special interest lobbying.

And, this is probably the straw that broke the camel's back, in consideration of ExxonMobil interest in natural gas (emphasis added):

Government programs designed to encourage and advance energy technologies should not reduce energy choices or supply. They should not limit the production of electricity, for example, to only politically preferable technologies.

As of now, that is still the official ALEC position on climate change, and as of this month, ExxonMobil is no longer a member of the organization. According to a spokesperson for the company, its membership expired in June and the company chose not to renew it.

That seems to have gotten some environmental advocates excited, but make no mistake: ExxonMobil is far from ready to give up on fossil fuels.

Photo (cropped): Mike Mozart/flickr.

Collaborative World Shaping: Why Open-Source Tech Matters in a For-Impact Future

"Governments, business and civil society can't alone address the multifold challenges we have on the global agenda. We need collaboration." - Klaus Schwab, founder and executive chairman of the World Economic Forum

By Eric Boucher and Mia Shaw

How many lives could be saved if there was a way to vastly cut down inefficiency and through bureaucracy, by problem solving at a global scale? Could technology help us reach more individuals in need more meaningfully, substantially helping people affected by disasters - in less time?

The technology is already out there - but not enough people know about it.

In 2017, Hurricane Irma—the strongest hurricane ever recorded in the Atlantic Ocean—made landfall; with widespread, “catastrophic” damage, disaster relief organizations were overwhelmed. “A lot of traditional means of crisis response are very top down, and they didn’t really kick in — we saw headlines about how the Red Cross didn’t show up to shelters,” said Greg Bloom, a community organizer and civic hacker who knew he had to step in to assist.

“It was just not clear what the plan was for very anticipatable crises, so on the spot we created place where people could process options and information,” said Bloom.

Within 24 hours, 100 people from Florida and around the country went to work compiling information on shelters making resources accessible to the public; after a week, nearly 700 volunteer hackers were using tools and code created for Harvey relief to do everything from coordinating rescues to food supply.

Maybe the best part of it is that the resources that the team created are still out there - open and available to be put to good use again by anyone willing to work on solutions.

Open-source is more than simply “published code” - open-source development is about acknowledging that many people face the same challenges, and that those people are stronger together to overcome them.

OpenMRS is a collaborative open source project “by and for the entire planet” to support the delivery of health care in developing countries. Growing from the critical need to scale up the treatment of HIV in Africa, since 2014, it has brought together hundreds of volunteer coders, becoming a critical piece of health management systems in the developing world.

Being open-source enabled OpenMRS to create a robust yet transparent system - easy to set up worldwide. It is intended as a platform that many organizations can adopt and modify - avoiding the need to develop a system from scratch.

In previous unimaginable ways, open source technology makes possible collaboration on urgent issues by partners across continents. It has the potential to significantly lower costs and wait times for (sometimes desperately needed) assistance - all by more efficiently utilizing the community, and building tools that are adaptable.

Sadly, many impact organizations end up developing with contractors without the same principle of openness. Leading to higher costs and creating expensive dependencies for the future of the project.

While nonprofits have been lagging in adopting and utilizing technology to its full potential, open-source provides a unique opportunity of overcoming this challenge.

As modern societies face a barrage of potential catastrophes - from natural disasters escalating in intensity due to climate change, to increases in extreme inequality - this kind of international, collaborative problem-solving can save the world.

Eric Boucher is CEO, Oviohub.

Mia Shaw is an independent journalist covering tech and society.

Illustration: Oviohub

Do CSR Initiatives Influence Millennial Consumers?

By Krystal Rogers-Nelson

Do consumers' favorite brands care about equity and the environment or just the bottom line? Corporations are increasingly pursuing social responsibility initiatives, but the trend may not be completely benevolent. Millennials, the fastest-growing consumer segmentin the market, are increasingly asking more from the companies they buy from. Corporations that show a little bit of conscience stand to gain big with consumers, perhaps indicating a greener future for the economy.

The New Economy

Corporate social responsibility is principally found in CSR reports — those public documents that report a company’s sustainability initiatives. In 2014, 7,838 corporations released CSR reports, a 30% increase over the previous four years. This trend is also blossoming in the world’s top companies: roughly 80%of Fortune 500 companies released CSR reports in 2016.

In the 1970s, CSR was considered a dead end. Companies that spent resources on anything other than profit would be putting themselves at a disadvantage in the economy. The current shift in priorities for today’s companies indicates new market trends — sustainability and social responsibility are now big selling points across almost all sectors, and the millennial generation is leading the charge.

Millennial Consumers

Years of Internet use, television, mass media exposure, and fake news have left most millennials more resilient to the typical marketing structures of the past half-century. Corporations are less and less able to rely on advertising, celebrity spokespeople, and heavy-handed product placement strategies in movies and television. The 2017 Millennial Impact Report indicates that millennials are even more invested in philanthropy than they were in 2016, indicating that a focus on CSR is here to stay.

Millennials have different buying habits, too. They’re very tech-friendly and have led the rapid rise of technologies like digital assistants. Amazon’s Echo line alone brought an entire segment of new technology to market, playing off of millennials’ desire for convenience with voice commands and connectivity. As the economic power of the millennial generation grows, companies are shifting towards sustainable business practices in an effort to win their trust (and their money).

Companies Leading by Example

The economic viability of CSR initiatives has put some companies ahead of their peers, both socially and economically. Millennial consumers have pushed these companies ahead of the competition, making them leaders in their respective fields and perfect examples of CSR in action.

Honda

Honda is one of the most popular brands among millennial consumers, and their CSR initiatives may be part of their recipe for success. The Honda Clarity was the 2017 Green Car of the Year, and the brand ranks second worldwide in fuel economyacross their line. Honda has several green initiatives that are aimed at consumers looking for a deeper commitment to social and environmental responsibility — its Sustainability Reporttracks their accountability across several metrics, including the social goals the company holds for its operations worldwide.

TOMS Shoes

TOMS founder Blake Mycoskie’s vision for his shoe and apparel company centers on corporate responsibility, and that focus could be part of the reason his venture has been so successful. TOMS shoes uses a sizeable percentage of its profits to provide shoes for children in needacross over seventy countries. The brand has leveraged its success to begin producing eyewear, coffee beans, bags, and more, with an ethos of sustainability at the center of every new product.

Microsoft

Technology products are especially popular among millennials, and Microsoft’s attention to CSR may account for some of its influence in the market. Microsoft’s commitments to renewable energy and carbon offsetsare substantial — to date, the company has reduced their emissions by 9.5 metric tons, and their investments in renewable energy now total over 500 megawatts of power production. Bill Gates, the company’s founder and current technology advisor, has leveraged the company’s billion-dollar success story into one of the world’s most successful nonprofit organizations, the Bill and Melinda Gates Foundation, which tackles health inequities worldwide.

Millennials and markets

Large corporations sit in a unique position when it comes to social initiatives. Their resources and economic power make them significant catalysts for change, and their profit-driven approach places the power to direct this energy firmly with their consumers. Millennials are certainly a driving force in the market, but every individual can use their buying decisions to become an agent for positive change.

Krystal Rogers-Nelson is a freelance writer with a special interest in tech.

Photo: TOMS

My Favorite Midwestern Spice Chain, Quietly Fighting Fascism

Have you tried Penzeys' spices? My mother-in-law introduced me. The flavor, freshness, variety and price point are top notch and make this brand beloved by home cooks and bakers all around the U.S. Look in the stores or at the company's primary-crayon colored logo, and you'll see a brand rooted in family, the home, the hearth, the kitchen. In a time of deep political division, #fakenews, Red Teams and Blue Teams, most marketers would advise Penzeys to steer very clear of politics.

Traditional advice would say there's a lot to lose and very little to gain from getting political. Of course, we don't live in traditional times, and we do have case studies from brands like Ben & Jerry's and some exciting new research from Daniel Korschun's team at Drexel that consumers will reward companies that make a political stand with their purchases -- so long as the brand is consistent in its values.

Still these are early days in the #BrandsTakingStands movement and no one would fault a company like Penzeys, a private company based in the midwest, for steering clear of politics.

But that's not what has happened. Penzeys founder and CEO Bill Penzey has long shared his liberal views in the company's weekly newsletter and active Facebook page. And he's not holding back punches in the Trump era. Just take a look at this post from last Friday:

The posts are shared via newsletter and Facebook -- you won't find them on the company's web page. The company hasn't made a Twitter post since 2017 and as you can see, the copy is on the long side and could seriously use an edit (call me Bill -- I can hook you up!).

In this most recent diatribe he even notes that Facebook has marked the company's fan page as political:

And since we believe cooking is all about taking care of humanity, our posts now fall into the new political category. Your shares, likes, and comments really now mean more than ever, as they help overcome the extra barriers our posts face. Thanks for your help.

All of these signs lead me to believe that Bill's activism are rooted in his heart and passion for the cause -- not business.

And yet, he's killing it.

Bill explains: ...Standing up against everything the Republican Party has come to stand for is really, really, really (+76 more reallys), really good for business….This chart is our weekly online sales this year vs last year starting with the week of April 1st. It mostly is the tale of just two offers. The first was calling out the President for claiming that he was above the law; he isn’t, this is America where no one is above the law. No one can pardon themselves.

The second came with us pointing out that whatever the results turn out to be the President only has himself to blame for the Russia probe….

That second offer, that big pyramid there, just ran for eighteen hours over a Thursday night. With that offer we received an eighty-fold increase in sales over the same time period last year. Along with those orders we get comments like: “Don’t mix business and politics, Bill. It’s bad for the bottom line.” “I was taught years ago, you don’t mix politics or religion with your business.” But look at the chart. This is not 80% growth, this is 80 times as much in sales!

He uses his success to call for other business owners and marketers to do the same:

If you are involved in a business that has been uncomfortable with the attacks on human decency the Republicans have been committing, there is really no better time to share those concerns with your customers than now. Your country needs you.And if you are a marketer, please be aware that the times are changing. Maybe it's time to stop saying young people can’t be reached and instead try to get your clients to look into the values young people demand. At some point some breakfast cereal maker is going to celebrate the bravery of Colin Kaepernick by putting him taking a knee on the cover of their box. In that moment they will lose a third of their customers over 55 for what I imagine might be another year or two. In that moment they will win all of the younger generations for all of the rest of their lives.

For Americans of all political persuasions, these are scary uncertain times. Fortune favors the bold, and we all must use our platforms -- wherever they are -- to fight for the causes of civility, decency, kindness and respect. Bill Penzey shows us the way and is an example many business owners can learn from.

To join his cause and get some delicious spices, sign up for his newsletter here.

Making the Case for Connecting Efficiency and Sustainability Teams

By Schneider Electric

Energy and sustainability are inherently linked. Energy efficiency pays dividends by trimming consumption and costs. According to the International Energy Agency (IEA), implementing energy efficiency initiatives is the best way to act on climate change as it can reduce CO2 emissions by 38 percent. Companies that operate efficiency and sustainability initiatives in tandem improve productivity, maximize impact and see a greater return on investment. However, silos often exist in companies between global and local teams as well as across different departments, preventing them from reaching their sustainability vision. For example, nearly half of the 236 professionals who weighed in on The State of Corporate Energy & Sustainability Programs in 2018 said that lack of coordinated project and strategic planning is a major challenge.

Many companies face internal barriers such as siloed departments or expertise that prevent them from reaching their energy and sustainability potential. To clear these hurdles, organizations are starting to integrate how they buy and use energy with sustainability initiatives, an approach that maximizes investments, delivers greater returns and builds more robust, viable operations. Schneider Electric for example, has developed the concept of Active Energy Management - a process of integrating energy supply, energy demand, and sustainability data, programs, and strategies for greater efficiency and maximum results. Simply put, this means that the procurement officer, operations manager, and sustainability director in an organization need to work together — to form a cohesive strategy, share data, and deploy joint initiatives.

Organizations that develop a sound strategy and plan can get a head start in ensuring their sustainability and energy efficiency goals are achieved in tandem. Here is a short six-step overview on how corporations can achieve this:

- Build a joint governance plan

- Define common and meaningful targets and KPIs and track performance jointly

- Incentivize cross-functional staff to work as a team

- Implement a single source of data

- Establish a joint budget for efficiency and sustainability initiatives

- Increase transparency: internally and externally

Originally distributed by 3BL Media

Photo: Schneider Electric

Church of England Pushes Forward on Divesting from Fossil Fuels

This week, the Church of England reaffirmed its stance on climate change by voting to divest from any fossil fuel company lacking decarbonization strategies not in alignment with the Paris Accords. The church’s governing body, the General Synod, voted 347 to 4 in favor of a plan that calls for divestment from any company not on track to meet the Paris Agreement by 2023.

This week’s vote was a slight change from the Church of England’s original plan, which was to unilaterally divest from any fossil fuel producers by 2020. The logic behind giving companies another three years to comply with the Paris Accords’ goals is that the faster timeline risked weakening any influence the church has on private companies to rethink their strategies. “Unilateral, whole-scale disinvestment from fossil fuel producers in 2020, or beginning in 2020 based on assessments in 2020, would leave our strategy, and influence, in tatters,” said David Walker, Bishop of Manchester and Deputy Chair of the Church Commissioners in a public statement.

Not everyone agreed with the Church of England’s strategy of engagement over faster divestment.

“Waiting until 2023 would mean another five years of money still invested in fossil fuels which could be instead used to support renewable energy and low-carbon projects. The fossil fuel industry had plenty of opportunities to redeem itself; it never did. They need to be stopped now,” said May Boeve, Executive Director of 350.org.

Sunday’s vote comes just a few days after Pope Francis urged world leaders to follow through on their climate change commitments, saying that unsustainable development would turn the planet into a pile of “rubble, deserts and refuse.” Last fall, the Catholic Church announced it would start divesting from the billions of dollars in energy company securities its churches have held. Watch for more governments to make similar moves: Ireland announced yesterday that its national investment fund would sell off all investments in oil, gas and peat, making the country the first in the world to take on such divestment.

In this era of more brands taking stands on climate change, many of the world’s most influential religious institutions are finding themselves aligned with the global business community. For example, France’s energy giant, Total, said this week it would sell off $1.5 billion worth of assets in North Sea oil fields. Earlier this year, Shell said in its annual report filing to the U.S. Securities and Exchange commission that the oil and gas divestment movement “could have a material adverse effect on the price of our securities and our ability to access equity capital markets.”

Multiply the Church of England’s investment portfolio, worth about $16 billion, with other endowments across the world, and it’s becoming even more clear to the energy sector that the time to adapt to the 21st-century economy . . . was yesterday.

Image credit: Marco Verch/Flickr

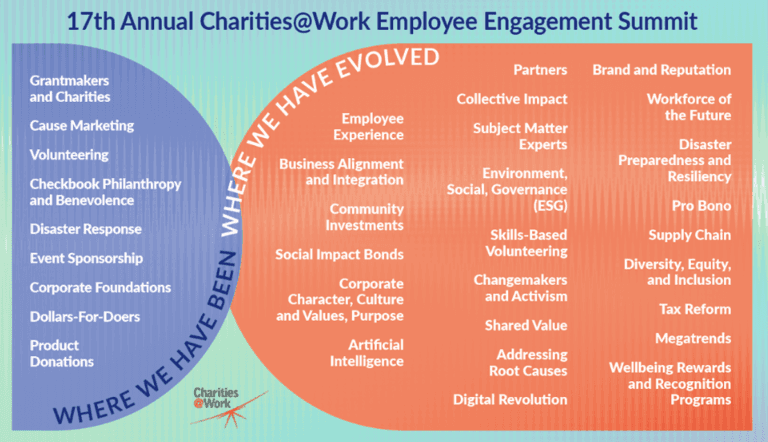

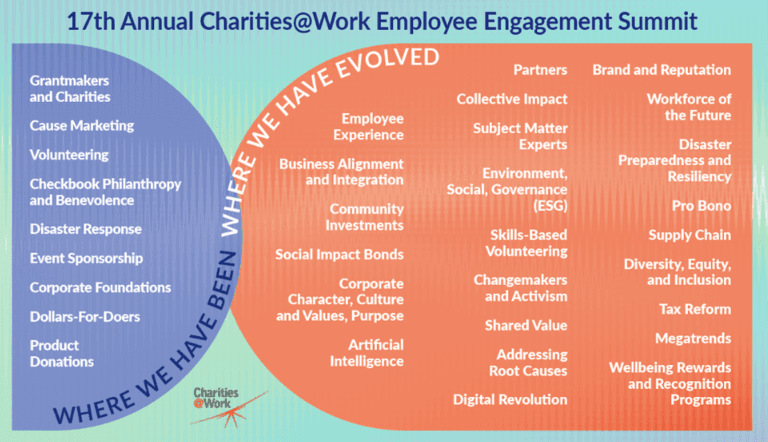

From Philanthropy to AI, the Evolution of Corporate Responsibility

What a difference a few decades make.

CEOs from mega-cap companies are increasingly briefing institutional investors on their environmental, social and governance (ESG) agenda. It’s the work of corporate responsibility and sustainability professionals that provides the substance of those high-stakes presentations to portfolio managers who control trillions of investment dollars.

The practice of corporate responsibility has evolved into a complex role that touches every corporate function – from HR and Marketing to Manufacturing and IR.

While attending the recent Charities@Work employee engagement conference in New York, Michael Carren of Guardian Life summarized the company's shift from philanthropy and volunteering to AI and brand reputation.

“CSR has become an absolute business fundamental. It’s a culture driver, it’s a business driver and it’s a skillset that young people who are coming into the professional really need to master very, very quickly because the expectations of companies and their shareholders are very, very high,” said Carren, who served as the United Way of New York’s chief strategy and operations officer before taking on the CSR role at Guardian Life.

Watch our full interview with Carren here:

Unilever Heads New Global Effort to Rev Up Electric Vehicle Market

Fleet owners, start your zero emission engines! The Climate Group has just launched its new "ZEV Challenge," aimed at accelerating the global transition out of internal combustion engines and into electric vehicle technology and other zero emission options. The ZEV Challnege targets in order to build economies of scale, so it makes sense that the founding membership consists mainly of government entities along with the energy company EDF and the fleet management firm LeasePlan.

What makes the ZEV Challenge especially interesting from a corporate social responsibility perspective is the presence of Unilever among the founding members. Unilever is the home of scores of the world's best known personal care and food brands, from Dove and Pepsodent to Marmite and Breyer's.

So, what does all that have to do with ramping up the electric vehicle market of the future?

The ZEV Challenge

The Climate Group already has a head start on the electric vehicle fleet sector, through its EV100 initiative for businesses.

The ZEV Challenge expands the initiative into cities, states and regions that are already active in the electric vehicle transition. Aside from EDF, LeasePlan and Unilever the founding members listed as supporters are California and New York City.

Other members cited in the launch are Paris, Los Angeles, London Milan, Rome, Copenhagen, Pittsburgh, Mexico City, Medellin and the regions of Australian Capital Territory and Navarra.

Unilever raises its electric vehicle voice

Unilever is already a member of the EV100 electric vehicle initiative as well as The Climate Group's RE100 initiative for renewable energy.According to The Climate Group, business fleets are the fastest-growing contributor to climate change and currently account for 23% of greenhouse gas emissions related to energy use.

Unilever's participation in the new ZEV Challenge helps underscore the importance of cooperation and coordination between private and public sector efforts to reduce vehicle emissions.

As an EV100 member, Unilever has already committed to making EV transportation the "new normal" by 2030. For that to happen, companies like Unilever need government to support electric vehicle charging networks and other infrastructure related to zero emission vehicles.

Unilever is a major employer in many markets with a global workforce of 161,000 people, and its supply chain accounts for additional jobs as well.

That means Unilever, and companies like it, have a powerful voice when it comes to advocating for electric vehicle infrastructure and influencing government policy.

An ambitious plan for EVs

Unilever already has a solid start on its EV100 commitment. As outlined on the company's website, the aim is to "send a strong market signal that there is mass demand for electric vehicles (EVs) by 2030 or before."

To be clear, the EV100 goal includes hybrids as well as 100% zero emission vehicles. That's still a significant improvement over diesel and gas.

So far, Unilever is focusing on its fleet of 13,300 company cars. The goal is for 25% electric vehicle or hybrid by 2020, 50% by 2025 and 100% by 2030.

Those milestones are well within reach, as Unilever can simply stipulate its demand for EV automotive technology as its supply contracts come up for renewal.

Emissions related to Unilever's work vehicles and "benefit" vehicles (cars provided as employee perks) are being handled by capping total carbon emissions.

The company has less control over its use of non-owned vehicles, and that explains why LeasePlan is among the short list of companies to launch the ZEV Challenge. LeasePlan is aiming for net zero emissions by 2030.

Unilever explains:

In addition, we will choose to partner with car hire and taxi companies who offer or use electric vehicles. We are also looking to negotiate discounts with car leasing companies for employees who want to lease electric cars for personal use.

On beyond zero emission vehicles

As regular readers of Triple Pundit know, Unilever is a sustainability leader, and its plans for future growth lean heavily on acquiring brands with a clear sustainability reputation.

By participating in the ZEV Challenge, Unilever is expanding the sustainable business model to include aggressively advocating for public policies that advance sustainable development goals.

That's not the only area in which Unilever is flexing its corporate social responsibility muscles. The company recently laid down an ultimatum for Facebook and Google/YouTube to wash hate speech and other disturbing content from their sites.

Image: via Unilever.

Why the energy businesses of the future will focus on re-using energy and why this is the only way we’ll slow climate change

Much of the debate around climate change has focused on reducing our carbon footprints, in particular by cutting our energy usage.

However, the future won’t just be about saving energy, it will be about looking at ingenious ways to reuse energy that would otherwise be wasted. We need to find new sources of energy and also find inventive ways for recapturing and reusing it.

Massive amounts of energy are being lost when we heat homes, businesses and other buildings; the world over, energy wastage such as this is happening on a huge scale. And this needs to change if we’re to slow climate change and create a future with a sustainable energy system.

More energy is wasted than used

In the UK alone, more than half of the energy produced is wasted at the source. According to a 2015 report by the Association for Decentralised Energy, 54 percent of heat energy generated at power plants escapes before it can be turned into useful electricity,.

This wasted energy is worth £9.5bn per year. Per person, that’s equivalent to more than half the average UK annual electricity bill – about £592.

Significant heat energy is lost in homes and buildings that are not energy efficient as well. This is why the 2012 Energy Efficiency Directive requires all new homes in the EU to have nearly zero-energy building (NZEB) status by 2020, and all new public buildings to be NZEBs by 2018.

According toTheGreenAge, a UK energy saving advice website, 35 percent of heat energy is lost in the home through the walls and gaps in and around windows and doors. 25 percent is lost through the roof, and an additional 10 per cent is lost through the floor.

Obvious ways of reducing this kind of home energy wastage include: insulation, sealing gaps, switching to more efficient modern boiler systems, and installing double glazed windows.

Another, often overlooked problem is water heat wastage.

Around 15-30 percent of a typical home energy bill is spent on heating water, while almost 90 percent of the energy used to heat shower water is wasted.

This inspired me to design Zypho, a water heat recovery device that’s installed under a shower tray or bathtub to capture and reuse around 10°C of lost heat energy that would otherwise go down the drain.

This energy is then reused to heat the cold water travelling to the shower tap, cutting carbon footprints and reducing energy bills by up to 30 per cent.

Energy recovery is also occurring in different forms, and on a larger scale. For example, in the Swedish capital, the Stockholm Data Parks project is harvesting heat energy generated from the masses of computers in its data centres to help heat the homes of over 900,000 people in the city.

The cold water used to cool the air in data centres to stop servers from overheating is, in turn, heated-up itself. But rather than wasting this now-hot water, it is distributed back to a cooling and heating agency and redistributed for heating homes.

These two examples, Zypho and Stockholm Data Parks, illustrate how a combination of small scale units and large industrial scale projects can help us get more from the energy we are currently using. In the future, this heat recovery will be the key to reducing our energy use.

New and unlikely ways to generate energy

As well as reusing wasted energy, pioneers are also looking at using energy from some unlikely sources.

For instance, Belgian company Turbulent is pioneering whirlpool turbines, which harvest river or canal water to provide low-cost energy to small rural communities, 24 hours a day.

It’s even possible to harvest piezoelectric energy – electricity generated by the use of pressure – as the Institute of Physics (IoP) explains.

One example involves using the force required to press a button to charge small, low-power electronic devices, thus replacing the need for batteries. This would also cut down the use of batteries, which are already complicated to dispose of as they contain chemicals and metals that are harmful to the environment, and to humans.

On a larger scale, piezoelectric floor tiles could harvest “the kinetic energy generated by the footsteps of crowds to power ticket gates and display systems”. One company making this a reality is Pavegen which has installed smart floors and pavements in a number of locations.

As well as harvesting otherwise wasted energy, we will also see a shift towards the reuse of waste itself.

Marcus Gover, director at the UK advocacy group WRAP, told the Guardian that by 2025, waste disposers “won’t be burying or burning people’s rubbish as they do today”, they will instead be returning “valuable resources to manufacturers”.

One solution, the Guardian highlights, “is turning waste into energy” – a market predicted to be worth $37.64bn by 2020.

The article also references U.S. biotech firm, LanzaTech, “that uses patented microbes to convert carbon-rich waste into biofuel via a gas fermentation technology” and Novozymes, a Danish biotech firm that uses “an enzyme-based solution that converts used cooking oil or other lower grade oils into biodiesel”.

All around the world, solutions are being tried and tested to create a greener and more energy efficient future. Some are city-wide and large scale, others are in small communities or even within individual homes. Pioneers are crafting new energy efficient solutions, as well as promoting a whole new way of thinking.

These steps may seem small and insignificant on their own, but by implementing many small steps at once, we can recapture and reuse a huge amount of energy that would otherwise be wasted heating our atmosphere. This new mindset will be key to solving the future energy challenges which will face us.

José Melico is Founder, Zypho, a water heat recovery device that reduces shower water heating energy bills by up to 30 per cent and improves energy efficiency.

Photo: Zypho

Citations

54 per cent of heat energy generated at electricity plants escapes before it even reaches households, according to a 2015 report by the Association for Decentralised Energy:

https://www.lowcarbonenergy.co/wp-content/uploads/2015/less-waste-more-growth/lwmg.pdf

2012 Energy Efficiency Directive:

http://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1399375464230&uri=CELEX:32012L0027

TheGreenAge: Energy lost in the home stats: https://www.thegreenage.co.uk/where-am-i-losing-heat-home/

Stockholm Data Parks project harvesting heat energy generated from the masses of computers in its data centres to heat 900,000 homes in the city:

http://www.bbc.com/future/story/20171013-where-data-centres-store-info—and-heat-homes

Belgian company Turbulent are pioneering whirlpool turbines, which harvests river or canal water to provide low-cost energy to small rural communities, 24 hours a day:

http://uk.businessinsider.com/whirlpool-turbine-water-energy-turbulent-belgian-green-energy-2018-2

Harvest piezoelectric energy – electricity generated by the use of pressure – the Institute of Physics (IoP):

http://www.iop.org/resources/energy/materials/page_50300.html

The Guardian, waste reuse:

https://www.theguardian.com/sustainable-business/2015/feb/23/future-of-waste-five-things-look-2025

CSR Investing Summit 2018 to Update SRI

The socially responsible investment landscape is changing quickly—it’s like a fast-motion film mounted on a moving truck viewed from a car traveling at high speed.

The unprecedented acceleration of interest year began early this year with the paradigm-shifting letter from BlackRock’s Larry Fink about the company’s new focus on social factors among the 4,000 companies in its portfolio as criteria for its investment. That announcement prompted Andrew Sorkin of the NY TimesDealBook to claim “[It’s] “a watershed moment on Wall Street, one that raises all sorts of questions about the very nature of capitalism.” Since then, the news has continued to deliver headline after headline that investment entities are stepping up their concerns about how values are affecting valuation. Products are proliferating—from green bonds to impact investments, asset managers are crafting new ways to respond to the growing demand for socially responsible investments from values-conscious investors. And a large majority of millennial investors are viewing potential activity through ESG-driven filters.

One of the best check-in/guides to these fast-moving changes in the sector is the annual CSR Investing Summit, “Summer in the City.” I have attended five of the previous six editions, and have found the event to be a concise, thought-packed, and insightful update to current and future practices and strategies.

The sixth edition takes place Wednesday, July 18th, in New York City. At the all-day conference, a select group of 150 expert practitioners—plan sponsors, endowments, consultants, academics, non-governmental organizations, the sell side, and media—will discuss how to define, manage, and measure responsible investing, now and in the future.

Among the topics to be covered are ESG data quality, how climate change risks will transform business, the valuation of diversity and inclusion, the forces of ESG and CSR in Latin America, and how the UN Sustainable Development Goals (SDGs) are being linked to investor values.

Speakers will include professionals from Morgan Stanley, UBS, Pirelli, GRI, Deloitte & Touche, Gitterman Wealth Management, and the Inter-American Development Bank, among others.

Yours truly will close out the conference by moderating a session titled“November 8, 2016 Report: How has socially responsible and impact investing changed since the 2016 presidential election?”, featuring panelists from UBS, Pirelli, and Drexel University.

The event is produced by S-Network Global Indexes and sponsored by Thomson Reuters, the Inter-American Bank, and OppenheimerFunds.

Photo: CSR Investing Summit

For more info: click here.