It's Time to Move Away From Sustainability-As-Usual

This has been a weird summer so far, with deadly heat waves and other extreme weather events taking place around the world, as well as plenty of corporate activity on sustainability, with companies making progress on different fronts from plastic use to carbon reduction.

This all coincided with another important piece of news – John Elkington’s recall of the term ‘Triple Bottom Line’ (TBL), which he coined in 1994. In an HBR article Elkington made the case that while the concept was valuable in helping many companies rethink how they do business, it did not succeed to serve as a catalyst for system transformation, as Elkington was hoping for.

Elkington’s recall is more than just an interesting thought experiment – it is a wake-up call. “To truly shift the needle, however, we need a new wave of TBL innovation and deployment,” he writes. I agree. TBL was instrumental in shaping business thinking about sustainability issues in the last couple of decades, helping create a sandbox in which most corporations operate now to address their social and environmental impacts. While this sandbox was fresh and promising in the 90s, offering companies new ways to shift from business-as-usual practices, it is growingly becoming a quicksand, where companies get stuck with a sustainability-as-usual mindset that puts our future in danger.

Elkington himself described this well in a video he prepared for the 5th International Reporting 3.0 Conference: “It is almost as if we’re on a commercial airline and we’re headed at full speed towards a very big mountain. Now, if you look at the dashboards, at the dials at the cockpit it is clear that we have enough fuel, we’re going in the right speed, the temperature in the cabin is wonderful, the food is being served, the audio system is working quite nicely, but we’re still headed for that mountain, and most of the reporting that we do doesn’t take this mountain properly into account.”

This is not just about reporting of course, but also about the action reported. Take for example Starbucks’ decision to eliminate plastic straws globally by 2020, which is a good representation of the sustainability-as-usual sandbox. It sounds like a worthy effort – after all, Starbucks uses more than 1 billion straws every year and it takes “about 200 years for polypropylene plastic straws to break down under normal environmental conditions,” according to Sam Athey of the Plastic Ocean Project. It’s also a move that can have a ripple effect, with more companies following Starbucks, helping making plastic straws a thing of the past. So, what’s wrong with it?

Well, nothing and everything is wrong with it at the same time. It is a good move with a probable positive impact, but it is also not good enough because it doesn’t help steer away the airplane in Elkington’s metaphor from the mountain in time. Nevertheless, the sandbox celebrates these steps because we got used to believe that no matter how incremental these actions are (“straws make up only about 4% of the plastic trash by number of pieces, and far less by weight” according to As You Sow), they are still important because they can add up and thus make a difference. This wasn’t just a matter of wishful thinking, but also a reflection of the sandbox’s mindset, where every little step helps us move in the right direction.

While the sustainability-as-usual sandbox pushed companies to listen to their stakeholders, not just their shareholders, and take notice of sustainability issues, it didn’t provide them (and us) clear benchmarks articulating what ‘good enough’ actually means. The numerous frameworks developed in the sandbox over the years (ESG, CSR, GRI, EP&L, Shared Value, Integrated Reporting, and B Corps, to name a few) created for the most part more noise than signal, adding rather than reducing the complexity of addressing sustainability challenges and evaluating progress. In addition, the sustainability-as-usual solutions have been for the most part voluntary-based, making it easier for companies to get away with incremental steps and vague reporting on their progress.

Furthermore, there was no clear sense of urgency in this sandbox. Even if we had a sense that we’re flying towards the mountain, the underlying assumption was that it’s far enough and we still have time to change course. This may explain perhaps why the sandbox tolerated incrementalism and inconsistent action, not to mention what Alex Steffen calls “predatory delay” - "the blocking or slowing of needed change, in order to make money off unsustainable, unjust systems in the meantime."

Now we have two options in front of us. One is to keep working on improving the sustainability-as-usual sandbox, assuming that given the systemic constraints (markets driven by short-termism and shareholder primacy, for example) of implementing a more radical sustainability agenda, this route is still our best hope. The second option is to follow Bucky Fuller’s advice - "you never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete" - and design a new sandbox, one that is optimized to effectively address “the single greatest crisis the planet has ever faced” – climate change.

I believe that while a new sandbox is not a guarantee for success, staying within the current one is a recipe for failure, and the reason is simple – time, or the lack of it. At this point, we can’t win this fight unless we win fast, and we can’t win fast with a sustainability-as-usual mindset. As Alex Steffen puts it: “In the face of both triumphant denialism and predatory delay, trying to achieve climate action by doing the same things, the same old ways, means defeat. It guarantees defeat.”

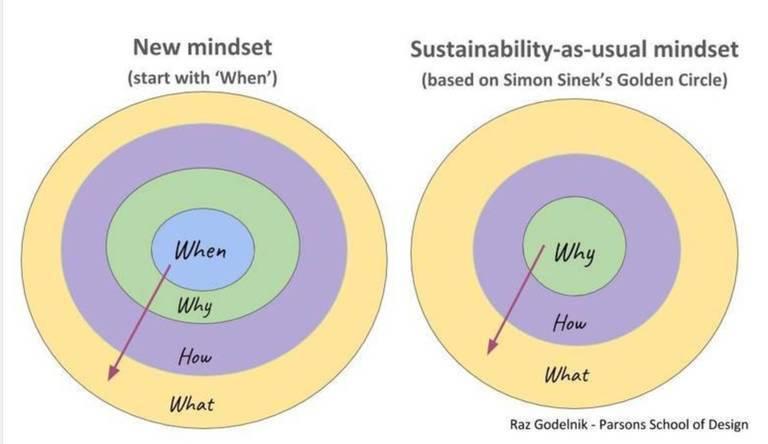

A clear sense of urgency is not just the raison d'etre of a new sandbox, but also its dominating feature. The sustainability-as-usual sandbox was and still is dominated by the need to articulate, clarify and justify the business case for sustainability. In the terms of Simon Sinek’s golden circle, this is the ‘Why’ element (why you do what you do? What’s your motivation? What’s your purpose). The ‘When’ element has been absent, and thus the ‘How’ and ‘What’ were influenced very little by it. The new sandbox, on the other hand, will be grounded in the ‘When’, which means that the basic question needs to change from ‘is there a business case for it?’ to ‘can it make an impact in time?’.

In the next couple of articles I will share my ideas for the new sandbox. Not sure they’re the best ones, but I hope they can help a collective effort, such as the one John Elkington is leading to consider what’s next. In the meantime I’d like to share a few principles that I believe should be at the heart of the new sandbox:

- It should be both radical and practical – one without the other is useless.

- KISS (Keep It Simple, Stupid) should be a guiding design principle.

- The 2015 Paris Agreement’s goal will become a benchmark, articulating what ‘good enough’ is. It needs to be implemented on a corporate level according to a science-based timeframe and be enforced by regulation (think GDPR) and stakeholder activism.

- The ‘how’ is Simon Sinek’s golden circle is the missing part – we have a pretty clear idea about the ‘when’, ‘why’ and ‘what’. How we do it? That’s what we need to focus on.

- Innovation is critical. At the same time it needs to be humane and responsible, or else it will destroy more value than it can create.

- Cities will play an important role in shaping business thinking.

- This is a culture war. We can win it.

The sustainability-as-usual sandbox was created with the best intentions in mind to create a new and better operating system. However, with all the progress companies have made within it, this sandbox is just not good enough to steer the plane away from the mountain, and therefore we need to eliminate it before it destroys any chance we have for a brighter future.

Think Differently: The Shifting Landscape of Value for Emerging Brands and Successful ICOs

By ICO Impact Group

We’ve seen a massive shift towards values-based leadership over the last several years, particularly within the ranks of established corporate leadership teams.

But what role do values and operationalizing the creation of shared value play for the emerging entrepreneur, for whom it can be a matter of business life-or-death if funds aren’t quickly raised and partners don’t come alongside to support their urgent growth? Is there a role for social impact as an entrepreneur or ICO leader?

At the Women in Media LA 2018 event, hosted by World Forum Disrupt on July 26, 2018, leaders from across the spectrum of publishing, media, and communications helped consider the shifting business landscape. They shared stories of experience and influence, and talked about what it means to strategically operate in a world being continuously re-shaped and re-formed by high-profile movements including #MeToo and #blacklivesmatter.

How should CEO’s and Founders engage in conversations that are so vital and critical, yet at the same time, can be perceived as difficult, political, or even polarizing?

“We’ve seen increasing demand for social impact advice over the last 3 to 5 years, in particular, from both established brands and emerging companies. They’re seeing it’s no longer a separation. Social impact and impact storytelling lie at the heart of modern business strategy,” said Laura Plato, COO of Causecastand President of its recently launched +IMPACT Media Division, a team made up of influencers, social strategists, and filmmakers who work at the intersection of celebrity, technology, and nonprofit causes. Plato also serves as EVP for ICO Impact Group’s client AKoin, where she’s supporting a team of global partners ramping up a new cryptocurrency project designed to fuel youth entrepreneurship in Africa and the world. “AKoin -- and the way the founding partners there are galvanizing an entire group of entrepreneurs and ICOs around the ecosystem -- this is a great example of how people are awake to the fact that it’s time to do more than just go through the motions. It’s time to make movements.”

Still, while much has been written about the expectations Millennial and Gen Z consumers place on the brands they do business with, some leaders and companies remain reluctant to embrace social causes. And such reluctance can come at a real cost to a brand’s ability to grow and engage.

“The fear that advertisers and brands have of embracing irreverent, political content is holding them back from younger audiences who actually expect the content creators that they trust to have opinions and stances on a political and or social issues,” said Ana Kasparian, Host of The Young Turks. “We have to do whatever we can to encourage these brands to embrace diversified, irreverent content because they essentially will shield themselves from new people who would be interested in their products because they are afraid to try something different.”

So, do busy leaders really need to keep their values and often deeply personal desire for social change top of mind when movements can be made around and outside them? As social media movements continue to prove a juggernaut in the world of digital content, it can be tempting to simply sit to the side as a leader and wait it out.

Again, this reluctance to engage can lead to missed opportunities. Kendra Bracken-Ferguson, Chief Digital Officer at CAA – GBG, and Founder of Braintrust, points out: “Every single brand has a responsibility to be part of a conversation that affects this country because brands control the money and the advertising. They control the narratives that people see. I think it is the responsibility for brands to figure out what their social impact story and mission.”

And for leaders and entrepreneurs who do keep social impact more top of mind or have built into the core of the work they’re doing, it’s also often a matter of a bit of persistence and courage.

“You will earn a moment when people are ready to listen to you,” said Mina Seetharaman, SVP Global Managing Director, Marketing Solutions at The Economist Group. “Be ready to make the most of that moment.”

Photo: ICO Impact Group

Elon Musk's Painful Twitter Lesson: Image is Built on Words, Not Actions

Whew. What a week. Elon Musk’s Twitter tirade last week in which he publicly lambasted coordinators of a rescue mission in Thailand for not accepting his aid in the rescue and called one diver “Pedo guy” seemed to capture a salient message of our times: That hot-collar moments and social media don’t mix – even if you think you are on solid ground. No matter the technical expertise or genius of the tweeter, it’s reputation (and stock profiles) that are often meted out when it comes to performance on today’s online podium.

Musk’s irritation stemmed from the fact that the dive team that was coordinating the long-awaited rescue of 12 Thai children from an underground cave wouldn't use his mini-submarine to bring the kids out. Being told that his submarine design “wouldn’t work” apparently irked Musk.

But it was being told by Vern Unsworth, an experienced cave diver, that the submarine was really just a "PR stunt" -- that was the culminating force that drove Musk to fire back. Even though he did delete his tweet later, his comments are now immortalized in Twitter recaps.

And yes, Unsworth is now considering legal action against Musk.

In a week that saw the President of the United States once again use hearsay to impugn the reputation of those who criticize him and by extension, elevate his own public credibility, Musk’s actions are a megaphone for what happens when one’s assumption about reputation is used to score a point.

The fallout from Musk’s actions were immediate. His company, Tesla Motors, saw its stock value shed $295 million in value. Shareholders expressed their alarm and the managing partner at Loup Ventures, Gene Munster, urged Musk to "consider taking a Twitter sabbatical."

“Your behavior is fueling an unhelpful perception of your leadership -- thin-skinned and short-tempered," Munster told Musk in an open letter, noting that while Musk's track record is "visionary and unprecedented, [the] exchange with Vern Unsworth crossed the line."

That isn't to say that being Musk, the brains behind one of the world's most successful private space transportation companies and the first (money-making) electric car company isn't tough. Musk has plenty of detractors who feels his legacy is built on tall tales and lofty aims. And he has many who are willing to fund his success.

So, on Wednesday, two days after the exchange, he took Munster's advice and made a public apology, stating that the "fault is mine and mine alone" for the heated exchange.

Unfortunately, the timing of his apology couldn’t have been worse: It dovetailed with another apology of sorts for what has now gone down in history as an egregious act: the President’s public address in Helsinki along side Russian President Vladamir Putin.

Would Musk's apology have been better heard if it hadn’t had to compete for air time with Trump’s own public crisis? It’s doubtful. The American public, weary of debates over truth and un-truths, researched facts and false news, seems to be losing patience with heartfelt apologies that fall just short of heartless mistakes.

Perhaps the greatest lesson to learn from Elon Musk's (temporary) fall from grace is that in today’s arena, thought leadership isn’t a 40-hour work week. Its credibility is cultivated as much by what’s seen online as at work, and the damage control from hurtful actions can be prohibitively expensive: especially for a multi-billionaire whose innovative success and dreams depend on whether people believe what he says.

Flickr image: JD Lasica

Struggling With CSR Stories? Remember, an Old Tale May Be Peachy

I’ve been asked many times at conferences, media trips, on social media and by email this timeless question - how can a company make its corporate social responsibility (CSR) stories stand out?

There’s no easy answer. Part of the challenge is in the statistics: estimates have suggested that there are now far more public relations reps than journalists and freelance writers than ever before. Earlier this decade, research suggested that ratio was three to one. A 2014 article in Guardian suggested it had risen to almost to almost five to one. A year later, another article suggested that ratio was pushing six to one.

Breaking through is a Herculean task with those odds; let’s also add the fact that many companies are so frenzied trying to churn out an annual report with a forest of data that those individual trees (as in stories) often get lost or overlooked.

Having an all-hands-on-deck-meeting in a conference room trying to dream up a CSR project that can earn press attention is also fraught with risk. You just cannot brainstorm an initiative on the fly and expect quick (media) results. I know. I’ve been stuck in such meetings.

But perhaps your company has been working on something related to the environment, supply chain, or community that may seem routine and par for the course at a quick glance, but really is a fantastic story after all.

One example is a peachy Campbell’s Soup Company salsa project that recently was showcased on Forbes and scored its fair share of buzz on social media.

The story is a classic one. Growers have been sending fruit to landfill because the crop’s appearance doesn’t meet typical consumers’ standards for aesthetics. Campbell’s partners with a local food bank, which agrees to buy those peaches for pennies on the dollar - a far better prospect for peach producers than paying to have all that fruit buried in a landfill. The company also donates the manufacturing and packaging expenses, while its employees volunteer to pack the jars so that they can be distributed and sold. Proceeds from this product’s sales end up helping food insecure families in New Jersey, where Campbell’s is based.

Here’s the thing about Campbell’s Just Peachy Salsa - this is not a new initiative - it has been around since at least 2012. I was one of many who were apparently not aware of this, and I’ve written about Campbell’s off and on for years. Yet the timing of the Forbes piece was perfect. After all, it’s summer; food insecurity is a big problem despite the booming economy; and more companies are trying to show that they are vested in the communities in which they work.

Let’s also remember how we position these stories. When a company rolls out their latest CSR report, the gut (and understandable) reaction is to blast out that summary of the report to 50 different news and trade outlets.

It could be the case, however, that instead of sending the summary of that CSR report out 50 times, within that report, there may just be 50 different stories worth sending out to 50 different writers, based on their interests. Sure, that means more work; but there is also the chance of more reward.

In any event, that CSR or sustainability program that has been humming along may just deserve a fresh look. If your company has numbers, statistics, the reputation, proven impact and most of all, a story, it does not matter how “old” this project is. What does matter is how that story fits within today’s context.

Image credit: Campbell’s

Want More Smart Buildings? Amp Up the Collaboration

By Bert Valdman

“Smart technologies are defined by their interconnectedness,” points out a recent American Council for an Energy-Efficient Economy (ACEEE) report on smart building markets. The companies that buy and sell them, however, are defined by their disconnectedness.

Intelligent buildings have been a concept for decades (a quick search turns up a research report from 1991). Sustainability thinkers have been advocating them for years, and they’re a hot topic in building trade publications. So why is it that the brightest thing about most buildings remains their always-on lights?

There are many answers to that question: misaligned incentives, lack of accountability for energy costs, the fact that some professionals in the building maintenance sector see standardization and automation as threats to their livelihoods. Those are all topics of discussion, if not sufficient action. But there’s another core issue that’s been largely overlooked: every actor in the smart buildings universe is an island. Here are some of the culprits:

- Corporations looking to control their energy destiny and improve sustainability often aren’t structured to drive action across the enterprise. Energy-related decision making is decentralized, and local purchasers typically lack the time and expertise needed to make sense of an onslaught of new technologies.

- Emerging companies in smart building and energy technologies burn through precious capital waiting out the resultant long purchasing cycles and building large sales and business development teams to reach the many levels of decision makers.

- These teams all target the same commercial and industrial customers with siloed solutions.

- Established energy service and building technology conglomerates know customers want integrated, comprehensive solutions, but they’re structured to market individual portfolio company products and often hesitate to cross organizational boundaries.

What does collaboration look like?

A shared services organization that is customer focused and solutions oriented, and that receives active support from commercial customers seeking integrated solutions and willing to provide needed data, could be the answer. This model would enable emerging companies to go to market more efficiently and could incorporate a vetting component that makes technology capabilities and comparisons transparent for corporate buyers.We can take a cue from the food world, where various forms of pre-competitive collaboration are increasingly common. Industry organizations in coffee, chocolate, seafood and other sectors bring together key players in the supply chain—importers, processors and retailers, say—to support projects that ensure a sustainable, high-quality supply chain that benefits all participants. (See “It’s all hands on deck to save seafood supply chains” for a few examples.) Smart building owners and vendors can achieve similar results by working together as an ecosystem.

Many of the products and solutions that smart building technology companies offer are complementary. These companies spend a considerable amount of time and money on marketing and sales, going after the same customers at the same companies. A highly skilled and trusted shared services organization that marketed members’ products in a fair way would get technologies and services to market more efficiently.

It would also address barriers that prevent large corporations from moving forward on energy initiatives: complexity, a lack of familiarity with the technology, and trust. A shared services organization could develop a checklist of everything in a building that uses energy or water; technologies and practices that will make building systems maximally efficient; and specification, purchasing and use guidelines.

In concert with this planning and education tool, the organization could present integrated solutions that meet an enterprise customer’s particular financial, operational, and sustainability goals—for example, a suite of lighting, HVAC optimization, and demand management technologies that shrink the electric load; distributed renewable energy resources that reduce each facility’s dependence on the electric grid along with its carbon footprint; and a control dashboard that orchestrates the whole thing while providing business intelligence.

Who should lead this effort, or something like it? The utility industry is ideally positioned to take this on (and I say this as a former utility executive): they run the backbone energy systems and they have relationships with technology providers and commercial users. Enterprises could also lead by actively seeking integrated solutions, encouraging collaboration among technology companies and service providers, and materially supporting a collaborative approach.

Think forward, not backward

It’s easy to come up with reasons a collaborative approach wouldn’t work, but they’re all based on a status quo mindset positing that something can’t happen because it hasn’t already. The model could take off if we start with an initial commitment to not waste time creating elaborate contractual structures focused on “what if it doesn’t work?” We can find ways to maintain each participant’s intellectual property. If we don’t bog it down from the beginning with nuclear disarmament–level negotiations, we can create a collaborative structure that benefits emerging technology companies, energy conglomerates, corporate enterprises, and the world at large.A collaborative effort can scale faster, deploy technology faster, and drive innovation into the DNA of an organization faster. If we are willing to work together, we can create the intelligent buildings we’ve all been seeking, but somehow always remain in the future. We just have to care enough to invest the effort.

Contact me if you want to talk about it.

Bert Valdman is a board member and former CEO of Optimum Energy, a Seattle-based software and engineering firm that optimizes HVAC systems. He was senior vice president of strategy at Edison International and chief operating officer of Puget Sound Energy.

Image credit of Seattle at night: IIP Photo Archive/Flickr

“Mythical barriers fall when moral, technological, and financial imperatives are stacked”

Celebrating excellence in sustainable energy innovation around the world, the Ashden Awards 2018, now in its 18th year, continues to uncover sustainable energy heroes championing a brave new low-carbon world. Keynote at the awards ceremony was the well-known hero of the climate movement Christiana Figueres, whose unstoppable energy led to one of the most important climate deals of our time - the COP21 Paris Agreement.

Former Executive Secretary of the UN Framework Convention on Climate Change, Christiana explains that the once long- held mythical barriers to climate action are now collapsing. The carbon constraints of 2 degrees are no longer the limitation but now the huge impetus necessary for growth. Figueres reminded the attendees that old excuses such as “There is no solution!”, “It’s too complex!”, “It’s too expensive!” or “It’s already too late!” are no longer acceptable and the Ashden Awards is playing a key role in moving climate action forward.

Christiana pointed out that it becomes a “no-brainer” to take action when there is a such a compelling stack of moral, technological and financial imperatives. She said: “How blessed are we to be alive in this moment of the evolution of humankind when we can do the moral and right thing, the financially profitable thing, the technological advanced thing and be able to be put it together in coherent packages that is addressing climate change. That is a privilege”

Christiana reminded us that just a few short years ago, climate change had always been about doom and gloom. However, bottom-up innovations are appearing across all levels, and with this, we are shifting the narrative from the tragedy of the commons to the opportunity of the locals.

This year’s Ashden Award winners were described as ‘stubborn optimists’. She said: “To punch through the mythical barriers around climate change and work towards the common good it is necessary to be stubborn, optimistically stubborn. All of these fantastic winners have faced challenges, but their stubborn optimism in pursuing their goals is helping with the biggest challenge of all and that is climate change.”

The awards are the culmination of a rigorous judging process - involving a panel of industry experts and technical assessments. There were 10 awards across many areas, from a floor insulation robot to an off-grid clean energy pay-as-you-go solution.

One area of significant transformation is the transport and mobility sector; as Christiana declared, “Tonight we are all going to the inauguration of the Museum of Internal Combustion Engine.”

This is exemplified by winner of the UK Ashden Award for Clean Air in Towns and Cities, Chargemaster, the UK’s largest network of charging points. These are critical to powering electric motoring and encouraging the future uptake of EVs. Demonstrating that the Ashden judges had their fingers on the pulse, Chargemaster were bought by BP for £130m just after the awards.

Shuttl are worthy winners of the International Ashden Award for Sustainable Mobility as they are already taking 10,000 cars off the road each day in some of India’s busiest cities, and are rapidly scaling. The Shuttl app creates rush hour bus routes by responding to the demand from commuters. This provides affordable transportation on private, air-conditioned buses where seats are guaranteed, and safe for women to use. The Ashden judging panel said: “It is very rare indeed that sustainable transport interventions produce as many benefits as Shuttl, starting with the reduction in car trips which is a huge contribution to reducing congestion, pollution and improving roadsafety.”

Christiana’s keynote is a great rallying call for us to keep up the urgency needed for climate change action. Ashden Founder Director, Sarah Butler-Sloss concluded the event saying, “The winners of our Ashden Awards never fail to amaze and inspire our panel of judges, and the 2018 line-up is certainly no exception. The solutions, ideas and innovations that our winners have developed are already making a crucial difference in terms of creating access to energy, lowering carbon emissions, developing clean, sustainable solutions for cities and providing vital health and economic benefits. It is absolutely necessary for us to work together to achieve the objectives of the Paris Agreement and the UN’s 2030 Sustainable Development Goals and every one of our 2018 winners is playing a key role in moving climate change action forward.”

The International Ashden Award winners 2018 are Angaza, Chhattisgarh State Renewable Energy Development Agency (CREDA), Ecozen Solutions, Lumos Global, Shuttl, and MASS Design Group.

The UK Award winners are Q-Bot, Chargemaster,Upside Energy, and Energy Local CIC.

Single-Use Plastic: Are Paper Straws Really the 'Eco-Friendly' Answer?

After a month of relative silence over the challenges of workplace bias training, Starbucks was back in the news last week. This time it wasn’t to talk about its human resources policies or its laudable efforts to encourage Americans to open up about racial perceptions. It was to challenge the menace of a world-wide foe.

Single-use plastic. The lowly plastic straw, to be precise.

Starbucks’ announcement that it would be nixing plastic straws from its products by 2020 was only the latest indication that companies across the globe are now marshaling efforts to stop the use of materials that can’t be funneled into dedicated recycle streams.

But is it enough?

So far, Pernod Ricard, MacDonald’s, IKEA and other companies have come forward to suggest that their products will soon be sold without straws. A few companies are attempting to develop their own innovative solutions. But few, other than Starbucks and Pernod Ricard, which has partnered with a company that produces edible, bioplastic straws, have been willing to say just what that will look like.

In addition to the paper straws Starbucks says it will have on hand for cold drinks, it’s designed a new, sleek lid to go with its Nitro Cold Brew. It may not be as sexy as the iconic plastic straw, but it does offer a nostalgic reminder of an icy milkshake (or in this case, the iced coffee) you could slurp just like a kid.

The question that remains though, is just how other brands will be able to reshape their presentation. So far most are relying on paper – what straws were first made of when they were invented by the Sumerians for beer some 7,000 years ago, and later redesigned in the 1800s.

But that switch comes with a price for companies: paper straws are about two- to three-times more expensive than plastic. Some companies estimate it costs about 3 cents a product to furnish a paper straw with a drink. That may not sound like much, but it can make an impact on the bottom line for a franchise that sells hundreds of drinks a day.

And as some disability rights groups note, the new product sourcing come with challenges for mobility-impaired individuals who need straws to eat and drink. What works for the average able-bodied consumer may not work for individuals who have other functional demands and have a high choking risk.

Still, to return to the original question that fueled this movement: Will dumping plastic straws for plastic lids and a tsunami-level demand for paper straws make our drinks more eco-sustainable?

As of 2014, reports the website, TheWorldCounts, at least a quarter of the waste shipped to landfills comprised paper; a third of urban waste came from paper products, substances that are historically a huge drain on dwindling fresh water resources.

Will businesses recycle their used straws or send them to the garbage can? According to Aardvark Straws, it’s unlikely that the millions of paper straws destined to enter the restaurant supply chains will end up in recycling depots.

“Even though our straws are made out of paper, most recyclers will not accept food contaminated paper products. So depending on your recycling facility, they may be, but most likely not. That is why we suggest composting our straws instead,” the company said on its website.

A bright side the company offers is that paper breaks down much faster in water and in soil than other materials. Paper straws take 1-2 months to compost, and only about 6 months to break down in salt water.

That’s good. Because as the present time, the demand for paper straws appear to have outpaced our ability to create dependable recycling stream mechanisms that will keep them out of landfills and ocean gyres.

Which seems to bring the topic back to a broader issue: single-use products – and specifically, products that haven’t been accounted for with a dedicated recycle stream – that fulfill a narrow purpose.

Perhaps the broader challenge at this point isn’t to find new sources with which to manufacture old standby products as we seem to be increasingly doing, but develop alongside those products, new, reliable ways to ensure they make it into the recycle stream.

Takers, anyone?

Flickr image: Marco Verch

U.S. Energy Dept. Still Pursuing Low Cost Wind Power, With Bat-Friendly Twist

President* Trump built his 2016 campaign on a pledge to bring back coal jobs. That promise has yet to materialize in force, primarily due to competition from natural gas, wind power and solar power. To make matters worse for coal communities, ever since Inauguration Day the President's own Department of Energy (DOE) has been vigorously pursuing policies that help drive down the cost of renewable energy.

In the latest development, DOE is launching a new round of $6 million in funding for research that helps lower the cost of wind power while also avoiding impacts on wildlife, particularly bats and whales.

The road to bat-friendly wind power (and whales, too)

Triple Pundit has previously taken note of the disconnect between the President's coal friendly rhetoric and the wind-friendly actions of his own Department of Energy.The new $6 million initiative falls neatly into that frame. It comes from from the Wind Energy Technologies Office (WETO), which is tasked with investing in projects that "lower wind energy costs, increase capacity, accelerate reliable and safe energy production, and address environmental and human use considerations."

The new initiative seeks proposals in three areas, each of which will get a $2 million share of the $6 million pot.

The first area is aimed at fine tuning wind farms to operate more efficiently without increasing the impact on bat species.

Many wind farms already practice such "curtailment regimes," but the new generation of taller, bigger wind turbines presents some efficiency challenges. On the plus side, the larger turbines enable wind farms to be built in areas with less-than-ideal wind speeds. The tradeoff, though, is that curtailment regimes will have an outsized effect on power production, making those wind farms less efficient.

WETO anticipates that new "smart" technology will make it more economical to locate wind farms in low-speed areas.

In a related effort, the second area addresses some shortcomings in previous attempts to reduce bat impacts. WETO is looking for proposals that develop early-stage research to the next level, or that provide design solutions to resolve performance gaps that it has identified.

The third area drifts off the bat topic to provide more insights into the impacts of offshore wind farms, particularly impacts that may affect Northern Atlantic right whales. This area seeks to improve monitoring at offshore sites, which present a suite of challenges:

...the lack of fixed platforms, increased difficulties associated with survivability offshore, access for maintenance or data downloading, and availability of electric power all make required studies more difficult and more expensive.

Another focus of this area is to create new tools for reducing noise at offshore construction sites.

If all goes according to plan, the new research will lead to improvements in site selection and construction methods, promoting more efficiency in the environmental review process.

Vigorous support for wind power, from the Trump administration?

All else being equal, anticipating and resolving impacts on aquatic life will help accelerate offshore wind development in the US.

That's not exactly a reassuring thought for the U.S. coal industry.

Also not helping matters is DOE's insistence on maintaining a robust web page for climate change, which clearly identifies power production and fossil fuels as the main drivers.

It's not hard to find. Just go to the top of the energy.gov home page, click on "Science & Innovation" (right next to the big green "ENERGY.GOV" block), and go to Climate Change in the dropdown menu.

The page leads off with a mission statement that places climate change in the context of other responsibilities maintained by the sprawling agency:

Addressing the effects of climate change is a top priority of the Energy Department.

The page also forcefully affirms the scientific consensus on climate change, with the help of a user-friendly "Climate Change IQ" quiz.

Take the quiz (spoiler alert!) to see where the US coal industry fits in:

Electricity production generates the largest share of U.S. greenhouse gas emissions. About 66 percent of our nation's electricity comes from burning fossil fuels, mostly coal and natural gas. Renewable energy sources provide 13 percent of U.S. electricity, while nuclear power provides about 20 percent...

Although U.S. Energy Secretary Rick Perry has regularly accommodated White House efforts to support the coal industry, so far he has failed to produce any concrete results.

That seems to be a purposeful outcome. Last year's notorious "grid study," for example, failed to convince the federal rate-making body, FERC, to prop up aging coal power plants with an unusual new rate structure.

Adding insult to injury, the grid study actually made a better case for wind power -- and it did nothing to hamper Perry's ongoing promotion of the U.S. wind industry.

The White House followed up last April with an order for DOE to invoke its emergency authority to prop up coal power plants. As with the grid study, Perry supported the order in public, but probably nothing will come of it.

So far, Perry has slow-walked the advance work needed to act on the directive.

That's probably a good strategy. By June, FERC officials were already shooting down the idea that the recent rash of coal power plant closures justifies emergency action.

Photo: U.S. National Parks Service.

CSR Matters: How To Win Your First 100 Days In a New CSR Job

Congratulations! You landed the corporate social responsibility (CSR) role you’ve always wanted, and you can’t wait to get started.

Monday morning finally rolls around — it’s your first day. You make the rounds with human resources through the office, meet your new coworkers, and attend orientation meetings. You head to lunch with the boss and set up coffee meetings for that afternoon and the remainder of the week.

You know your first 100 days are critical to making a strong first impression and building a new foundation for CSR at the company, but that afternoon, you’re thrown some curveballs. You learn that your hiring caught many of your new coworkers off guard and that no plans had been made to transition you into the position. In your meetings, colleagues share their concerns about the security of their futures at the company, difficulties communicating between divisions, and uncertainty of how CSR even fits into the business.

What should you do?

To help me answer this question, I reached out to some of America’s leading CSR practitioners to weigh in with their top recommendations (slightly edited for length). Success leaves clues, and their perspectives are worth reading from top to bottom.

I’d be remiss if I didn’t also include a few insights of my own.

To win the first 100 days in a new CSR job, understand that you have more than 100 days to win in a new CSR job! Take the time to define success with your boss, establish trust and rapport with colleagues, and identify new ways to add value. Avoid the temptation to rush in and attempt doing too much too soon. Focus instead on learning, listening, and the "low-hanging fruit."

Doug Marshall @DeloitteUS, Corporate Citizenship Managing Director, Deloitte Services LP: “An organization’s ability to do good is increasingly important to its bottom line. It is important to align your social impact strategy to support and amplify the overall business strategy, values, and purpose of your organization. To that end, understand who your key stakeholders are and their expectations from the investments and activities you influence: what are the social and business outcomes that matter? Build your plan around achieving those outcomes, with an initial focus on 3–5 strategic initiatives to drive impact.”

Dave Stangis (@DaveStangis), Vice President, Corporate Responsibility and Chief Sustainability Officer, Campbell Soup Company: “The first 100 days can be the most important in any new role. I always recommend taking on a strong bias of listening, testing hypotheses and completing an inventory of current activities within scope. You want to complete that 100 days with a clear vision of what internal and external stakeholders expect from you and your position. Doing this right not only builds enlistment to the correct strategy, it also helps ensure the work you take on will truly drive results for the enterprise.”

Danielle Tergis (@dtergis), Founder, The Tergis Group: “Immerse yourself in the organization its strategic plan and the goals for all the departments and align your plans to support them. Get to know the key players on your team and the folks you’ll be working with the most. Also, read everything you can get your hands on — including industry trades, blogs, and mainstream media — about the issues your organization cares most about.”

Leon Kaye (@LeonKaye), Director of Social Media and Engagement at 3BL Media: “I think it’s a mistake to go in ‘doing’ and not listening . . . We may feel the issues are burning, but remember the concept of CSR or sustainability still may be new to many of your colleagues. Spend those first 100 days listening to key stakeholders at the company, from the people in the C-suite to the summer intern — and use this time wisely to build alliances and get buy-in for your agenda.”

John Friedman (@JohnFriedman), Sustainability Manager, WGL: “Learn the industry and the specific business first. Find out what matters to the c-suite and look to implement CSR programs that have an impact on those. I like to start with the 5 or 10-year strategy — most companies have one that sets things like financial, sales, operational and cultural objectives. It’s not about showing them how they can support CSR, but rather how CSR can help facilitate the things that they have already identified as priorities. Start helping them achieve those, and they’ll eagerly want to know what else you can do.”

Graham McLaughlin, Managing Director, Social Impact at UnitedHealth Group: “In the first 100 days, I’d work to ensure a clear, aligned strategy with a framework that staff and the company will rally around and executives will value through their words and actions. I’d also locate champions in positions across the organization who feel bought into your strategy because they were part of crafting it, and will be part of the team implementing it. Your power in a CSR program comes from being able to build a movement, so in the first 100 days, establish an infrastructure that allows you to do this effectively.”

Julie Hootkin (@jhootkin), Partner, Global Strategy Group: “First up, listen and learn. Kick off the 100 days with a full audit of all existing assets and communications.

“Identify key metrics, and measure against them.

- Measure the things that matter, not just the things that are easiest to measure. That could mean visibility, impact, recruitment and retention of talent, social media engagement or more.

- Be realistic about what you can accomplish and when.

- Share your progress.

“Don’t do anything drastic. Take the time to get a complete understanding before making decisions about what to keep, cut or create.”

Do you agree or disagree with these suggestions? What would you do differently? What strategies have you found to be the most successful? What should people avoid?

Ryan Rudominer's passion is connecting people to causes that impact the world. I blog about emerging trends & priorities in corporate social responsibility & social impact. Follow him on Twitter.Compassionate Capitalism and a Story of Coffee

Part 1: What quality is, luxury is not

Classic syllogistic logic: all things of luxury have quality. Therefore, all things of quality are a luxury. This may be a valid argument, but it is built on a false premise.

Many things of quality are not a luxury, and what we often think of as a luxury has little or only transitory quality. This confusion arises from the systemic market failure of externalities and linear economics.

Does the luxury of shelling out the cash for an iPhone X, for instance, necessarily translate into quality? (or a Galaxy, I play no favorites here). Not so much, I argue. Even at a cool grand, the price of an iPhone X doesn’t reflect the full or real cost of getting one in my hand — economically, socially, or environmentally. The quality inevitably, even intentionally, degrades; whatever value there was is lost, no longer in the value stream.

What does any of this have to do with coffee?

After all, the global coffee industry operates within the same "logical" economic argument as any other consumer product, presumably based on the same false premise: maximize productivity and profits, minimize costs, keep your margins - and consumer demand - high. In this scenario, shouldn't coffee work like any other world commodity, producing a similar result? In this case, we are left with lots of bad or poorly-sourced coffee.

Certainly, manufacturing iPhones is a world away from producing coffee, but there are many lessons to find in a cup of coffee. Like the cherry from which our morning brew derives, the story of coffee peels back in many layers until at last there is the bean. Therein lies the nut of the matter, what coffee is and why it’s so important to us in so many different ways.

One layer in coffee’s story hints at this distinction between buying quality and simply acquiring luxury, no matter what the cost.

Fair Trade is a great start to the story. It is a well-recognized and effective process that can help level the market, especially for tropical agro-forestry commodities like coffee, where as much as 82 percent of the global supply is grown by smallholder farmers. Fair Trade helps shed light on an otherwise opaque value chain.

But is there more to the story, or the way we tell it?

Betting the farm

Nearly all of the world's specialty coffee is grown in the "bean belt," a mountainous, tropical band encircling the planet between the Tropic of Cancer and Tropic of Capricorn. Even under the best of circumstances, and even commanding premium prices on the Fair Trade and organic market, these family farms struggle to make a living and support their families. Every day, every season, every year, they literally "bet the farm.”

They bet that a sudden rain squall won’t ruin a drying crop, that the price offered for their crop won’t collapse due to a glut of industrial coffee on the market, that the dreaded La Roya coffee leave rust won’t decimate their entire crop - “dead on the vine.”

Smaller producing countries like Peru are increasingly focused on providing specialty-grade coffee to a growing market demand. Farmers hedge their bets through consistent dedication to quality. Averaging only 3 hectares (about 7.5 acres), the typical Peruvian coffee farm produces shade-grown, hand-picked, sun-dried beans, using natural fertilizer to maintain a density of about 2000 plants per hectare at an elevation of between 1000 and 1800 meters (3200 - 5900 ft.)

These are the conditions that lead to certified specialty coffee, but they don't guarantee it. The beans must be properly dried, cupped, Q-graded, and assigned nothing less than an 80 on the Q system developed by the Coffee Quality Institute. Q grading coffee is an exacting and serious business.

Done consistently by dedicated farmers, the process of producing high-quality, organic or specialty grade coffee can be the model of quality we seek. The result is a transparent process that allows all stakeholders to understand the best possible outcomes up and down the supply chain, from the producer to the consumer.

Quality, therefore, flows back in a circular value chain to the smallholder farmer, devoted to the stewardship of his small plot and the quality it produces.

The stories we tell over coffee

“Don’t talk to me, I haven’t had my coffee.”

Substitute any other beverage in that statement, and you’d just be rude. But warning people away until you’ve had those first few sips of your morning coffee is considered a courtesy - or at least a good defense.

Offering a cup of coffee is an act of compassion.

Migrating down off the high plateaus of Ethiopia some 1,000 or more years ago, coffee settles into the Fertile Crescent and along the trade routes across Arabia and the Mediterranean, Europe, the Americas.

As coffee spread, so did new ideas, as they circulated across the proliferation of coffee houses across the old and new world.

From the morning sludge we consume at the office, purchased in bulk at Costco, to the finely tuned aromatic brew shared with a friend at a trendy coffee shop, coffee runs through the veins of our social interactions.

Arguably, the human cultivation of coffee, in turn, helped cultivate civilization A vigorous debate continues to this day about its origin story, but coffee cuts through human history like the legends of kings and long-forgotten civilizations.

Coffee merges elements of old and new; tradition and ritual; innovation and inspiration. Entire worldviews can be built around a simple bean.

True quality is rooted in compassion

With this overview, let's go on a trip!

In our next article, Triple Pundit travels to the highlands of Peru. There, we'll meet the farmers, explore the land, and yes, drink the coffee. More to the point, we'll see how Chameleon Cold Brew, a small (but thriving) Austin-based roaster is moving beyond Fair Trade, forging direct partnerships with their producers in Peru, Myanmar, Guatemala, and Columbia. For CEO and co-founder Chris Campbell and his team, the story of coffee starts with a keen eye on quality.

"True quality is rooted in compassion"

It's a valid argument based on a true premise. People are betting the farm on it.

Photos by Mikesh Kaos on Unsplash (Creative Commons); Courtesy Chameleon Cold Brew (Used with Permission, All Rights Reserved)