How Saipem Creates Value While Supporting SDG8

This article series is sponsored by Saipem and went through our normal editorial review process.

Many companies talk about their plans to support the UN’s Sustainable Development Goal 8 (SDG8), meant to promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all.

But Saipem, a global leader in drilling services, engineering, procurement, construction, and installation of pipelines and complex projects, onshore and offshore, does more than just talk. Based on documentation the company has released over the past few years, Saipem appears to be truly “walking the talk.”

As an international industrial group operating in 67 countries around the world, Saipem has built its SDG8 initiatives around the concepts of “local value creation” and “shared value,” terms the company uses to sum up how it creates employment, develops local skills and capacity, transfers know-how, collaborates with local suppliers and subcontractors, and enhances local entrepreneurship with its operations. That means most of Saipem’s SDG8 initiatives are directed towards:

- Promoting local employment. By creating job opportunities at the local level, Saipem expands the diversity of its workforce while providing young talent the opportunity to grow professionally. Promoting local employment also strengthens Saipem’s presence in the local market, reduces internal costs and ensures critical professional skills for future projects.

- Developing the local supply chain. Saipem continually works to develop multi-year cooperative efforts with local vendors. How? By contributing to vendor growth (in terms of technical competence, HSE, and human rights). Partnering with local vendors contributes to local social stability and economic growth, while also helping Saipem mitigate risk, cut costs and nurture its reputation. In 2017, 64 percent of the company’s project-based order value was placed with local vendors.

Over the years, this local value creation approach has become a long-term strategy for a mutually beneficial engagement between Saipem and its local stakeholders—and the results are impressive.

For instance, Saipem contributed 1.73 billion pesos to the Mexican GDP, where the company has implemented the El Encino Topolobampo project, an onshore natural gas pipeline project. To measure this contribution, Saipem developed a methodology aimed at quantifying the socio-economic externalities associated with its local value creation approach. More details on the methodology are available here.

Saipem also recently enhanced its systems and processes to ensure the respect for Human and Labor Rights and to prevent modern slavery and human trafficking in its business and supply chain. As outlined in the Saipem Modern Slavery Statement 2017, the company’s Code of Ethics states the rejection of any form of discrimination, corruption, forced or child labor and the promotion of human rights. All employees and vendors must comply, and in 2017, the company implemented several initiatives to promote the respect for internationally recognized human rights.

Saipem management maintains that the company’s business model has not been limited to only meeting the expectations of stakeholders; it has also been designed to prepare Saipem for the competitive global marketplace of the coming decades. Saipem’s vision for sustainability, combined with its know-how and technology, allow the company to fully create value in all of the countries where it operates.

IMAGE courtesy of Saipem.

IBM-Bechtel Partnership Applies SDGs to Help Puerto Rico's Schools Post-Maria

Hurricane Maria swept through Puerto Rico in a matter of days, but the lives of the island’s people were changed forever as they now continue to rebuild amidst another hurricane season. The U.S. territory was partially underwater and completely without power following the storm -- and the island’s schools were no different.

Recognizing just how important education and schools are to a community, IBM and Bechtel came together to aid the Puerto Rico Department of Education (PRDE) in its recovery. But before anything could be done, IBM, Bechtel and the PRDE first needed to come up with a plan.

By harnessing expertise in planning, technology and development, IBM and Bechtel helped to do just that -- mapping their work to SDG 11 along the way to craft an emergency management and resilience plan that fit the PRDE’s specific needs.

Speaking during a 3BL webinar titled “Responding to Disaster: IBM and Bechtel Partner to Address Resiliency,”Julia Keleher, secretary of the PRDE, and corporate citizenship leaders from IBM and Bechtel explained how the three organizations helped Puerto Rico’s schools to get back on their feet.

“Having help to navigate a path forward was critically helpful because we had a lot of people, even our own employees, who were displaced; and food, water and medical supplies were unavailable,” Keleher said. “What is largely traumatic for everyone is that the hurricane season is upon us again, and we’re not where we were on Sept. 19 [when] that infrastructure wasn’t even great to begin with.”

To come up with the best strategy, IBM and Bechtel first turned to the U.N. Disaster Resilience Scorecard, a list of 10 essential steps that should be followed to effectively assess a city’s resiliency. To better fit the needs of the PRDE, IBM adapted the 10 steps to work with education departments rather than municipalities.

The results led to a “roadmap” tailored to the PRDE with ten “wins” that could be achieved in order to begin recovery in conjunction with the Scorecard, explained Jurij Paraszczak, director of IBM Industry Solutions and leader of the Global Research Smarter Cities program.

As a method of prioritizing actions and sequencing them, IBM, Bechtel and the PRDE created an executive grid to weigh a priority’s “impact/benefits” with its “difficulty.” When put into practice, an issue with low difficulty and a high impact would receive priority over one with a high impact but high difficulty.

“One of the things that struck me and my colleagues as we drove around on mountain roads was the emotional power of people who wanted to get things done,” Paraszczak said. “That was a strength in itself, but it was also something that caused a weakness resulting from the fact that the organizational structure was built in such a way that a lot of groups trying to fix things on the ground were not connected in a strategic way up to the top.”

The road to recovery is a long one for Puerto Rico, but the process becomes easier with the help of solution-driven companies like IBM and Bechtel combining resources for the common good. As the two continue to contribute to disaster relief, the hope is the benefits of comprehensive planning will not only help areas susceptible to natural disasters today -- but also prepare them for the future.

Rebecca Curzon, senior program manager of Global Citizenship Initiatives for IBM Corporate Citizenship, explained that resiliency goes beyond natural disaster preparation. Rather, it is a way of bringing people and communities together by fostering a feeling of “opportunity” and “empowerment to act.”

“Something as fundamental as standard operating procedures, even in a desperate situation, provide something to do and a way to do it that has been proven, documented and agreed to, so at least there’s a sense of forward progress that can be made,” Curzon explained. “I have faith that that will happen here [in Puerto Rico].”

Photo: 3BL Media

Lucile Packard Children's Hospital Expansion Scores Platinum LEED Certification

In April, the new 521,000-square-foot expansion at Stanford’s Lucile Packard Children’s Hospital earned Platinum LEED certification. Designed by architectural firm Perkins+Will, the facility incorporates “biophilic” design concepts that not only make the building resource efficient, but helps ease the trauma and stress of visitors, patients, and hospital staff. Not an easy thing to do for a hospital. The facility is the fifth hospital - and only the second children’s hospital in the U.S. - to achieve LEED Platinum status.

One reason for this, says Breeze Glazer, who worked as Sustainable Healthcare Leader for Perkins+Will during the project, is that “historically” hospitals are considered a “nightmare for sustainability.” There is no “down” time, he says, and running a hospital is a very resource-intensive operation, especially for energy and water.

For example, Glazer told Triple Pundit that an average “Packard-sized” hospital consumes as much energy in any given year as 3500 homes. Water use has “similar impacts,” says Glazer.

The life-and-death nature of a hospital also brings with it the challenges not typically required of a school or office, such as infection control or human well-being. Arguably, these issues with considerations beyond the scope of typical resource efficiency.

The demands of healthcare stretch the concept of sustainability, and that’s a good thing. Stretching creates new thinking.

“Once you get into it,” says, Glazer, “you see many areas that actually represent an opportunity.”

So . . . let’s get into it.

A tour with the architect

On assignment for Triple Pundit, I recently met with Communications Manager Cora Palmer and Senior Project Architect Megan Koehler for an on-site tour of the newly finished expansion (some construction was still happening in exterior areas).

Walking from an older section of the hospital to the new main lobby I experienced in real-time the holistic transition of the building design. Even as a “disinterested” visitor, the biophilic aspect of the design had an impact. Making my way through the hospital to the new main lobby, the openness and natural light created in me a mild sense of serenity, as if I weren’t in a hospital at all.

During our tour, Koehler emphasized the importance of designing a healing environment guided by a biophilic philosophy. While not every aspect of human-centered design leads to energy efficiency, many do. Chief among them is daylighting and ventilation.

Daylighting is prodigious throughout the facility, starting with the vast 20-foot-high glass-walled lobby. Throughout the hospital, it seems like you’re never far away from natural light. Even in the pre-op section of surgical suites, there are skylights to help reduce both energy consumption and human angst.

Lucile-Packard is the first hospital in the United States to use displacement ventilation. Integrated into the building's design, the underfloor ventilation system is more energy efficient and improves air quality, filtration, and exchange rates as well as patient comfort. Pillars in the lobby mask ventilation outlets within the bottom six feet of each column. In hospital rooms, the system distributes ventilation at the foot of the patient’s bed.

Other LEED-worthy details

Among the many and diverse elements that go into any LEED-certified building, the following are some of the more notable aspects of the design.

Pedestrian traffic

Designed around the operational efficiency of a stacked rectangular grid, the building's layout streamlines how doctors, nurses, and staff deliver care and services. Juxtaposed with this angular logic is more free-flowing design elements, this design is meant to suggest a connection to nature while serving as navigational aids within the building for visitors and patients.

Water conservation, greywater recycling

A 110,000-gallon underground cistern collects, filters, and stores rainwater. In addition, a mechanical system condensates, and even provides water used in hemodialysis. Combined with ultra-low-flow fixtures, the building's water consumption is 40 percent lower than required by code.

The 3.5 acres of added landscaped and open space includes a vegetated roof and many outdoor gardens. Irrigation is minimal due to all native or adapted plants. What little irrigation required comes from the harvested water stored in the cistern.

Biophilic design

I stress this point. Biophilic design implies a more thorough cost-benefit analysis of sustainable design. Designing the built environment with an appreciation for the human connection with the natural environment is the only path to long-term sustainability.

As designers increasingly innovate around biophilic design principles, the economic efficacy of such design will become harder to deny and embraced by more people.

The challenge is the opportunity

For a firm like Perkins+Will, Stanford’s Lucile Packard Children’s Hospital was an “ideal” client, Breeze Glazer explains. The association with Stanford research combined with the Packard Foundation’s recognition from “way back when” of the “intrinsic link between a sustainable, healthy planet, healthy living, and the power of the environment to help heal” oriented all stakeholders to stay on course throughout the ten-year project.

“They were more than just curious or interested,” says Glazer, “but pushed us in terms of sustainability and what can be achieved on the project as well in that.”

“They had a really great foundation to begin,” Koehler adds, “this 'garden hospital' element where every single patient had visual access or physical access to, to some sort of garden space, in the existing hospital.

"Recognizing that this connection was essential to the healing process really helped to lay a foundation as to what needed to be involved in, in the new project.”

Going to the hospital is never fun. It’s a place for care and healing. Nevertheless, the Lucile Packard Children’s Hospital at Stanford is an excellent example not only of a resource-efficient building but also how LEED can foster biophilic design in the built environment.

Images by the author, all rights reserved

How to Improve Access to Education Around the World

Unicef tells us that 101 million children worldwide don’t regularly attend school. High costs, lack of local availability, lack of uniforms and school supplies, disability and competing family priorities are among the many reasons for this devastating statistic.

Each of those children may grow up without the basic communication, math and reasoning skills that can help them earn a living wage to support their family and build their communities. And so the cycle of poverty continues.

Many students also face barriers to accessing higher education, which has long-term implications on their ability to find good jobs and improve their situation in life. Sixty-five percent of all jobs in the U.S. economy will require postsecondary education and training beyond high school by 2020. At the same time, 40 percent of students in four-year public universities do not complete their courses on time, and many of these do not complete their degree at all.

Low-income students, rural students, first-generation college students, students who don’t speak the area’s most widely used language, people with disabilities, underrepresented minorities and those facing other personal constraints are particularly vulnerable.

One company changing this global paradigm is Pearson, best known in the United States for its K-12, higher education, and professional products and services that are used in schools and private settings across the country. In the U.S., Pearson offers products like MyLab Foundational Skills which helps learners overcome challenges and gain the skills they need to continue their learning journey; the Q-interactive assessment app, which streamlines student assessments; and Smarthinking, which provides online tutoring access for more than 25 professional university and college-level topics.

America's Promise: Higher graduation rates

Every year in America, more than 1.2 million students drop out of high school. DoSomething.org says 7,000 students drop out of American high schools a day. And about 25 percent of high school freshmen don’t graduation on time.

For the last several years Pearson has partnered with America's Promise Alliance, a network of national, state, community organizations and individuals dedicated to creating better educational opportunities in the U.S. In this case, the goal was to find solutions for the economic and social issues that kept kids from graduating from U.S. high schools. The educational publisher provided funding for the project and America's Promise collaborated with experts to find the data and the answers.

"We partnered with America's Promise to do two things," said Shilpi Niyogi, Senior Vice President for Strategy at Pearson. The first was "to create a series of seed grants for very particular states to scale up innovative practices." She said America's Promise had "done great local work and they had a terrific fully focused national alliance." Where they needed assistance was in expanding their efforts in particular states that could benefit from their expertise.

Another goal was to create a national learning community in which public and private educational institutions could network.

The two-year commitment not only strengthened programs and alliances at America's Promise, but leveraged partners, something that Pearson has learned is critical to breaking down the barriers of illiteracy, both at home and across the globe.

Advancing education for rural students in India

In 2012, Pearson launched its ambitious Affordable Learning Fund (PALF) to make minority investments in low-cost private education in the developing world. It made an early investment in Avanti Learning Centers, a college test preparatory company in Mumbai, India with a mission of improving access of high potential, low-income students in India to higher education to top Indian universities.

Rural high school students in India are seven times less likely to get into college or university than urban students. Researchers found it wasn't just the economic challenges of attending school that kept rural, working kids from going on to college, it was a vacuum of talented teachers in rural India.

Approach, said Niyogi, was a large component of their success. "Thinking globally, but acting locally" allowed Avanti to target a diverse student base and tailor the education to fit the needs of the local populace. Avanti developed a blended curriculum allowing for both home and classroom study and combined it with high-quality mentoring, rigorous tutoring and a peer-to-peer learning. Their unique model allowed them to help decrease that rural-to-urban ratio, in an affordable way.

Since that time, Avanti and Pearson have gone on to pioneer other programs that have helped make it easier for students in India to reach and pass college exams. Success stories include one student who, with PALF and Avanti's support, went on to study at the Massachusetts Institute of Technology (MIT).

Reducing accessibility barriers inspires learning

Building global accessibility to education also means exploring new tools, and as the National Science Foundation recently reported, new advancements in educational technology are making it possible for people with disabilities to attain the skills they need to go on to higher education.

Pearson has a global commitment to supporting learners with disabilities and special needs. In 2016 the company announced a target to ensure that 100 percent of their digital products are accessible to people with disabilities by 2020. This commitment includes fully accounting for accessibility throughout product development, testing, marketing, and distribution processes. This is just one initiative aimed at addressing a large and complex problem. For one student, those technological advancements not only gave her the ability to complete her lessons more easily, but gave her a whole new educational passion.

In 2015 Pearson sent a group of experts to Texas to speak with visually impaired students about the challenges they faced learning math. They learned that often the true barrier was communication. In one student's case, completing the math problems wasn't the challenge. It was finding an easy way to communicate about assignments with her teachers, who often didn't know Braille.

With the students' assistance, the team designed an Accessible Education Editor, software and hardware that would do the translation to and from Braille and English automatically. It was a hallmark for Pearson, and an inspiration for the student, who told the developers that the process simplified her homework to such a degree that she found she actually liked studying math.

"Accessible design is just good design," Niyogi said.

Niyogi added that the lesson that Pearson has learned over the years from developing projects like the Accessible Education Editor is diligence. "We evaluate everything we do [as to] whether or not it advances our mission to be brave, creative and advance people's goals." And it's that deep analytical approach and it ability to harness the benefits of unique partnerships she said, that is key to Pearson's success in education.

Innovating to reach underserved groups

Today, many education products and services do not reach the more than 4 billion low-income and emerging middle-class consumers across the globe – a rapidly growing market segment estimated to be worth more than $5 trillion.

Pearson launched the Tomorrow’s Markets Incubator in 2016 to innovate new products and services that help meet the need for access to high-quality education and learning in low-income and underserved communities. The response far exceeded expectations. A total of 167 teams of Pearson employees submitted an original idea for a new product or service. Seventeen teams were picked to receive product development funding and coaching and present their business ideas to senior leadership.

Tackling illiteracy through partnerships

One recent Pearson initiative is a literacy accelerator called the Project Literacy Lab, which the company launched in partnership with Unreasonable Group in 2016. The Project Literacy Lab, (which is part of the wider Project Literacy Campaign) is Pearson's and Unreasonable Group's challenge to start-ups. The accelerator offers new opportunities for addressing some of the core challenges faced today when it comes to global illiteracy: language skills, math competency, vision and disability challenges, and educational and socioeconomic limitations.

According to Niyogi, the accelerator has also helped build a consortium of expertise from a wide range of backgrounds that in turn has helped craft a broader ability to "chip away" from the core barriers to learning in underserved communities.

The first phase of this accelerator brought together 16 ventures from five different continents. Their focus was as wide-ranging as the challenges and barriers faced in illiteracy today. Innovative solutions included a new app that would cut the cost of language learning to under $10 per person, inclusive technology for individuals with disabilities, a personalized literacy platform, and new approaches to illiteracy in Brazil's impoverished communities. Planning for a new accelerator is already in the works.

Through programs like these, Pearson demonstrates that providing access, helping prospective customers overcome barriers to participation, can be good business. Hopefully other companies will follow in their footsteps.

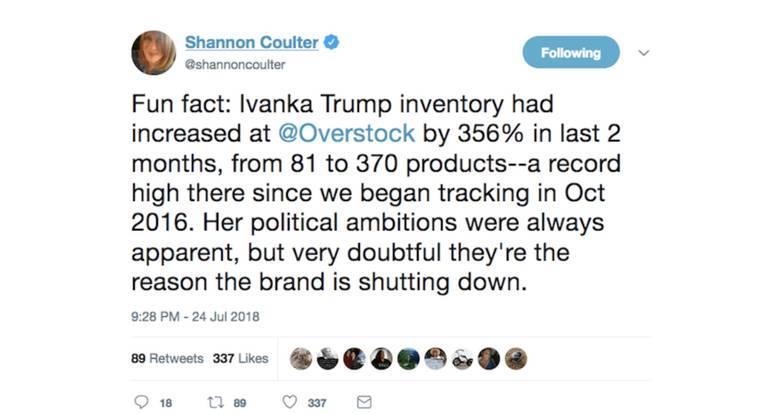

Ivanka Trump and the Consequence of Brands (Not) Taking Stands

We'll never know what President* Donald Trump promised his adult daughter Ivanka when he officially hit the campaign trail in 2016. Based on his rhetoric leading up to Election Day, one likely promise was that a Trump Presidency would be good for business.

If that's the case, then it should be no surprise that the First Daughter's eponymous fashion line, Ivanka, shuttered its doors earlier this week. According to one tally, the President has broken every single one of his economic populist promises, and with his new tariffs he is well on his way to harming business owners, too.

When Boycotts Work

Ivanka explained herself in an email to CNBC on July 24:

"When we first started this brand, no one could have predicted the success that we would achieve," Ivanka said in an emailed statement to CNBC. "After 17 months in Washington, I do not know when or if I will ever return to the business, but I do know that my focus for the foreseeable future will be the work I am doing here in Washington, so making this decision now is the only fair outcome for my team and partners."

However, CNBC and other news organizations also took note of the #grabyourwallet boycott campaign organized by Shannon Coulter during the runup to Election Day 2016.

The campaign urged shoppers to avoid stores selling items under the Trump brand, including the President's family. Participants in the campaign were also encouraged to contact stores and explain why they were shopping elsewhere.

CNBC observed (without naming #grabyourwallet):

But with President Donald Trump in the White House, critics of her father's politics have put Ivanka's brand at the center of boycotts and other protests. The brand was notably pulled from Nordstrom and Hudson's Bay in recent months, with those department store chains citing poor sales performance.

Elle Magazine's Megan Friedman was more forceful. In an article dated July 24 -- the day of Ivanka's announcement -- she began with a direct linkage between #grabyourwallet and the failure of the Ivanka brand:

On October 11, 2016, Shannon Coulter and Sue Atencio announced a campaign to boycott companies that sold Trump products in response to Donald Trump’s infamous Access Hollywood tape. #GrabYourWallet quickly went viral.Today, 651 days later: Ivanka Trump has decided to shut down her eponymous fashion and shoe line.

Why Boycotts Work

Shortly after the #grabyourwallet effort launched, Triple Pundit began exploring why some boycotts work and others don't.

The answer is complicated on a case-by-case basis, but in general it boils down to simple common sense: brands that have already suffered reputational loss are more vulnerable to a successful boycott. In addition, boycotts are more powerful when they go beyond the consumer level to influence decisions at the business-to-business level.

It's also worth noting that boycotts do not necessarily aim at putting a company out of business. Often, behavior change is the goal.

That's why Coulter's decision to have participants boycott entire stores was significant. When #grabyourwallet launched, the Ivanka brand was already highly vulnerable to reputational loss due to then-candidate Trump's apparent admission of a series of sexual assaults, later confirmed by multiple victims. By focusing attention on the stores carrying Ivanka products, Coulter involved them deeply in Ivanka's brewing sea of troubles.

The Ivanka Trump brand reputation took concrete shape after Election Day, when the true nature of the Trump presidency became apparent. Some stores reacted more quickly than others, with Nordstrom's being among the first major retailers to publicly shed the Ivanka brand last year. One last major holdout was Canada-based Hudson's Bay, which only recently announced that it would drop the Ivanka brand.

The timing is interesting in that regard. According to Friedman's information, Hudson's Bay privately informed the company of its decision as early as last fall, when Trump's tariff policy first began taking shape.

Within recent weeks, the full force of that policy has been hitting Canada among other countries, and Canadians have responded in kind. Earlier this month, news organizations reported that Trump's tariffs resulted in a noticeable increase in pressure on Hudson's Bay to drop the Ivanka line.

By July 13, Business Insider reported that Ivanka-branded products had disappeared from the Hudson's Bay website, and the rest is history.

Brands (Not) Taking Stands

As for Ivanka Trump's personal reputation, that has also taken a beating.

When Trump took office, he established Ms. Trump as an official presidential advisor.

Ms. Trump had already established herself as a career woman and mother through the Ivanka brand. Her new position provided her with a uniquely powerful opportunity to transfer the "brands taking stands" concept into national policy.

As described by Triple Pundit parent company 3BL Media, major brands are increasingly willing to take decisive, public positions on divisive, hot-button issues.

In some cases, for example as with gun control, that willingness to speak beyond the bottom line is the direct result of a policy vacuum at the federal level.

Ms. Trump could have had some powerful backers in the business community to help her make a forceful case for socially responsible policy, but so far she has failed to have any noticeable impact on the Trump presidency.

In fact, her most visible accomplishments have to do with increasing her personal wealth, if not outright self-dealing. In one recent example, the Ivanka brand escaped unscathed from the latest round of tariffs against China, where the bulk of its manufacturing takes place.

It's possible that a solid CSR strategy could have provided the Ivanka brand with a modicum of protection, but the absence of any social responsibility cushion at the brand level was only compounded by Ms. Trump's refusal to act on social issues as a top presidential advisor.

When Ms. Trump says that "my focus for the foreseeable future will be the work I am doing here in Washington,"it's not too clear what she hopes to accomplish.

Image (screenshot): via Twitter.

Land O’Lakes Implements ‘Insights Engine’ to Demystify Food Labels, Better Convey Farmer Sustainability

Matt Carstens, senior vice president for Land O’Lakes SUSTAIN, would like to apologize.

Not for something he did, but for the breakdown of communication between farmer and consumer that has been going on across the food and agriculture industries for far too long.

“When you go to the grocery store, you’re going to see tons of absence claims with perceived health benefits that aren’t really there,” Carstens said. “That’s the challenge, and I blame agriculture and companies like ourselves for not telling that story prior to now.”

These absence claims, claims about what the product does not contain, like “organic,” “non-GMO” and “antibiotic-free,” have contributed to a muddled marketplace, where products advertising perceived benefits can beat the better product. Just think, have you ever been in a situation where you opted for one product over the other simply because it was labeled as organic?

This is just one of many scenarios Americans must deal with when shopping in a grocery store. It’s also where Carstens sees data-based storytelling about the products we buy as a way to better engage consumers about production and sustainability practices going on at today’s farms.

“We’re trying to figure out the best way to tell that story that is not absence claim-based, but more, ‘Here’s what you need to know about how this product was raised and produced, does this resonate?’” Carstens said. “In a lot of ways, that’s going to be centered around the environment. That’s going to be a successful path forward for those companies that figure it out.”

The farmer perspective

For Cassidy Johnston, a New Mexico cattle rancher and sustainability officer for the United States Farmers and Ranchers Alliance, being sustainable is not a marketing ploy – it is a necessity to ensure the resources needed to raise her cattle are available for years to come.

“I really just want food to become more of a mainstream concern, not in the negative way it is now, but where we ask ourselves what we all can do about food,” Johnston said. “We all eat it, it’s not just about the farmers, the producers, the packers, the feedlots or the retailers, it’s about all of us.”

Today’s developments in key areas like genetics, traceability of food produced and transparency with consumers, Johnston explained, are all exciting and necessary to ensure farmers have a prosperous future.

Just like in the grocery store, though, she sees consumers needing to make a crucial decision.

“At some point, we are going to have decide whether efficiency and sustainability are always the same thing because when it comes to animal welfare, that’s a qualitative idea,” she said.

With the world’s population on pace to reach nearly 10 billion people by the year 2050, farmers need to continue to improve upon existing sustainability and efficiency practices. This poses a dilemma for consumers as claims such as “grass-fed beef” and “non-GMO” have become selling points for major restaurant and grocery chains. Simply put, the idea of eating a burger that originated from a cow freely grazing a field is a pleasant idea -- but not efficient enough to cater to a growing, hungry population.

Enter today’s feedlots and genetically-modified crops, two efficient growing practices that are negatively perceived by consumers today.

Johnston is hoping to see farmers learn to tell the stories about how they grow their food “effectively and excessively enough” to get consumers “invested” in the agricultural process.

Letting numbers tell the story

Drawing from his Iowan farming roots, Carstens sees farmers as the “original conservationists” as they seek new and innovative ways to ensure the lands they live and work on can be used by future generations.

“The more that they can take these new technologies, products and practices to put them into motion in a way that is good for them, they’re going to rally around that, which is why we’ve made some of the strong progress that we have in such short order,” Carstens said.

This is where the work of Land O’Lakes SUSTAIN is most vital.

Operating as a co-op, Land O’Lakes has worked to form a relationship with its network of farmers and companies to further achieve sustainability goals and maximize the effects of implementing efficient, environmentally-friendly technology and production practices.

In order to quantify the impact its farmers have made, Land O’Lakes SUSTAIN is currently beta testing a tool it is calling an “Insights Engine.” The company believes this will provide farmers a method of gathering data on their operations to help better understand how management and conservation practices are working and can be improved.

Once fully operational, Carstens sees the data collected by the Insights Engine serving as an important bridge to the consumer -- allowing for authentic, palatable storytelling to better convey the complexities of agriculture. As farming continues to look to a future where output far exceeds input, the hope is Land O'Lakes’ tool can debunk the supermarket myths that are misleading today’s consumers.

“This data has been something that has been part of our heritage of really strong collection for 10 years,” Carstens explained. “We’re now just looking at it through the lens of sustainability and not only trying to keep that good work that has been going on at farms but using it in a way to help message a more authentic story to the consumer through the value chain.”

Photo: Land O’Lakes SUSTAIN

Shortlist Announced! Ethical Corporation Responsible Business Awards

The shortlist for Ethical Corporation's 9th Annual Responsible Business Awards has been announced. The winners will be revealed and celebrated at a glamorous Awards Dinner ceremony on 9th October in central London

Kingfisher, Novartis, EDF Energy, Merck, Thai Union, Unilever, Kimberly-Clark, Co-Op, Google, ING, GSK, ABN AMRO, Vancity, Ocado, Carlsberg, AstraZeneca, IBM and Tesco are among the nominees being shortlisted for this year’s The Responsible Business Awards

Click here to view the full shortlist

Ethical Corporation would like to thank everyone that entered for all their hard work and efforts spent in the submissions. Please keep up your great work!

Media Contact:

Ed Long

Project Director

Ethical Corporation

+44 (0) 207 375 7188

Advancing Education for Sustainable Development Goals through Regional Centers of Expertise (RCE)

By Meghna Tare

Sustainability Education, also known as Education for Sustainable Development (ESD), has been recognized as a critical tool for the transition to sustainable development particularly since the United Nations Conference on Environment and Development (UNCED) in 1992, where Agenda 21, a framework for action, was agreed by 178 member states.

In 2002, 191 member states got together in Johannesburg in South Africa to assess the progress of the outcomes based on Agenda 21 at the World Summit on Sustainable Development (WSSD). They also reviewed Agenda 21 and renewed member states' commitments in the Johannesburg Plan of Implementation. UN General Assembly also adopted a resolution announcing the Decade of Education for Sustainable Development (UNDESD, 2005-2014) with the initiative of the Japanese government, and the United Nations Scientific and Cultural Organization (UNESCO) was assigned as the lead agency for accelerating the efforts of member states toward ESD.

In 2003, in response to the UN resolution on the UNDESD, the United Nations University Institute for the Advanced Study of Sustainability (UNU-IAS) launched the ESD project, including a global multi-stakeholder network of the Regional Centers of Expertise on ESD (RCEs). An RCE is an existing formal, non-formal and informal organization that facilitates learning towards sustainable development in local and regional communities. As of December 2017, 154 RCEs have officially been acknowledged by the United Nations University worldwide, and there have been various collaborative projects implemented by them.

After the UNDESD ended in 2014, member states have agreed to advance commitments toward ESD through the Roadmap for Implementing the Global Action Programme (GAP) on ESD with five priority areas of action: advancing policy by mainstreaming ESD, transforming learning and training environments using the whole-institution approach, building capacities of educators and trainers, empowering and mobilizing youth, and finally accelerating sustainable solutions at the local level. At all levels of society, RCEs play a crucial role in implementing these goals using their local knowledge and global network. Many RCE members are assigned as the Partner Network agencies by UNESCO to lead the world's efforts toward GAP.

ESD is also recognized as a key element of the 2030 Agenda for Sustainable Development. It is mentioned in the Sustainable Development Goal on education (SDG 4) under Target 4.7 and is considered a very important driver for the achievements of all other SDGs.

ESD aims to bring behavior changes to promote sustainability and it is critical to protect natural resources of the planet for future generations. There are cities and regions promoting sustainability throughout the United States, and there are various sustainability initiatives and projects implemented by the city government, NGOs, private sectors and individuals. An RCE can connect all these actors and accelerate collective impacts over the region, and also provides opportunities to impact the global policies such as GAP on ESD and SDGs through the UN platforms provided by the headquarter of RCEs, UNU. It can also connect the region with other 154 RCEs worldwideto work together and share experiences and challenges of projects on biodiversity, sustainable consumption and production, climate change, engaging youth, promoting higher education, etc. It is valuable to analyze the needs and benefits for establishing an RCE by scaling up local efforts to promote sustainability, increase awareness of ESD, and accelerate collaboration and collective impact.

The genesis of the RCE is a realization by the Institutions of Higher Education that, after implementing sustainability programs on their own campuses, the time is right to bring their knowledge and expertise outside their campus gates and partner at a broader regional scale for a multi-sector approach to education for sustainable development. It also engenders a culture of learning and continuous improvement, providing opportunities for students of all ages to contribute to these efforts and shape new ones.

George Bernard Shaw once said, “If you have an apple and I have an apple and we exchange these apples, then you and I will still each have one apple. But if you have an idea and I have an idea and we exchange these ideas, then each of us will have two ideas.” Sharing ideas and best practices and educating through the RCE gives everyone a chance to gain from the process. RCEs have the potential to tie together economic, environmental and social aspects that reflect the complexity of the pressing issues faced by a region. It also draws people together: The success of sustainability initiatives requires engagement, participation, and collaboration at all levels of the university, across campus and beyond. Working together is vital in any successful endeavor, and sharing ideas is especially important in education.

About the Author: Meghna is the Executive Director, Institute for Sustainability and Global Impact at the University of Texas at Arlington. She is a TEDx UTA speaker, was featured as Women in CSR by TriplePundit, received Woman of the Decade In CSR award by the Women Economic Forum, and graduated with an MBA in Sustainable Management. You can connect with her on LinkedIn www.linkedin.com/in/meghnatare/ or follow her on twitter @meghnatare

The Future of CSR is Corporate Activism

by Dr. Ximena Hartsock and Jeb Ory

Most corporations donate to nonprofits, organize volunteer days, and evolve their practices in the name of corporate social responsibility (CSR). We should applaud such actions while recognizing that conventional CSR is now expected rather than celebrated. Today, companies renowned for CSR practice a bold new style of corporate activism.

Why did this change come about?

Until recently, geography constrained our choice of brands. In one city or town, there were a limited number of businesses that a person could reach.

The Internet blew up geography. Consumers could purchase goods online from vendors without the constraints of location. Moreover, consumers could investigate brands (i.e., Google them) and choose based on their social track records.

This freedom of location and a new awareness of brands changed buying patterns. A recent Cone Communications study found that 87 percent of consumers would purchase a product because a company advocated for an issue they cared about. Conversely, 76 percent of consumers said they would not buy from a company upon learning that it acted contrary to their personal beliefs. A similar study from Edelman found that “62% [of respondents] will not buy if a brand fails to meet its obligations to consumers, the community, and society at large.”

The notion that a for-profit business is accountable solely to shareholders is dead. Businesses that want to be profitable must meet ethical standards set by their employees and customers first.

How do brands take on this responsibility and perform activism in a genuine way? As the co-founders of a company that provides grassroots activism software, we work behind the scenes of these campaigns. Being agnostic towards activism technology, we’d like to share the common principles behind the best campaigns.

- Respond in the moment

Brands that embrace activism start with issues they are known to support, and they rev up action when it matters most. For example, Patagonia (one of our clients) has a long track record of supporting environmental causes. Their employees and customers support protection of the public lands.

In April 2017, when President Donald Trump asked the Department of the Interior to review and potentially revoke National Monument designations, Patagonia organically launched an activism campaign designed to flood decision-makers with pushback. They generated some 200,000 public comments on Regulations.gov, 70,000 tweets to politicians, and 5,800 phone calls to lawmakers. Patagonia’s reputation as an environmental steward and good timing made the campaign effective.

- Create a ladder of engagement

Meet customers and employees where they are. Notice that in the campaign results from Patagonia, a small proportion of participants was willing to make phone calls. Many more people were willing to tweet, and most chose to submit public comments to Regulations.gov, the website where federal agenciessolicit feedback on proposed regulations.

When you provide multiple options, your constituents are more likely to act. Raising a voice in social causes will be a new experience for most of your customers. Welcome them toadvocate from their comfort zone.

- Treat activism and commerce like church and state

If you have a physical store, create educational displays and dedicated tablet kiosks where visitors can message a lawmaker. If you operate in multiple channels or strictly online, create an entirely separate landing page for your activism efforts, built around the ladder of engagement we described above.

The kiosks and landing pages distinguish between activism and business. Without a clear divide, visitors may think that you’re exploiting social issues for profit. Both your intention and implementation must create a strict, church-and-state divide between cause and commerce. If someone shares an email address for your environmental campaign, do not add it to a marketing email list. Likewise, don’t throw product deals and purchase links into activism emails.

The voice of a democratic society

Corporate activism is not traditional CSR, nor is it cause marketing that sells goods by partnering with a nonprofit cause. Activism is how brands tell the world where they stand – and help employees and customers do the same. Activism builds community outside the scope of a seller-buyer relationship.

Will activism benefit the business? It might, and as long as profit is not the goal, it’s ok. Some companies find that 30 percent of the people participating in their activism campaigns have never bought anything from them. The ROI is not the eventual sale or passage of a bill in Congress; it’s the fact that someone acted and wouldn’t have without your brand’s support. That fact can have a halo effect for your business.

Corporate activism recognizes that how we spend money is an ethical statement. The brands we choose signal our identity and values. Don’t be afraid to show yourcorporate soul.

Dr. Ximena Hartsock and Jeb Ory are co-founders of Phone2Action.

Photo: Patagonia

Three Key Steps: Grow Your Business, Not Your Footprint

As we approach this inflection point, it’s our responsibility as brands to help preserve our planet for generations to come. At HP, we continue to deliver on our mission to create technology that makes life better for everyone, everywhere. Nearly half of our carbon footprint lies across our supply chain, and we are focused on innovating to minimize our impact. In 2017 we helped suppliers avoid more than 1.05 million tonnes carbon dioxide equivalent (CO2e), getting us more than half way to our goal to help suppliers cut 2 million tonnes CO2e between 2010 and 2025.

Reinventing the supply chain footprint can’t be done alone. To drive sustainable impact across our industry, brands need to work together, sharing best practices and learnings to build a strong foundation for the future.

With the recent launch of our 2017 Sustainable Impact report, we reflect on how we are contributing to a more efficient, circular, and low-carbon economy and how we can continue to strengthen our business in 2018 and for the long-term. Here are three top learnings from our progress:

- Reimagine materials: As we innovate products, we need to identify new uses for existing materials and drive responsible consumption and production in support of UN Sustainable Development Goal (SDG) 12. The traditional, linear production model of “take, make, dispose” is no longer viable, and a fundamental shift is needed. We are committed to supporting the development of recovered materials markets through the use of recycled content in new HP products. Working closely with our recycling partners, we manufactured over 3.8 billion HP ink and toner cartridges using more than a cumulative 99,000 tonnes of recycled plastic through 2017. This has kept 784 million HP cartridges, an estimated 86 million apparel hangers and 4 billion post consumer plastic bottles out of landfills, instead upcycling these materials for continued use. More than 80% of our Original HP ink cartridges and 100% of Original HP toner cartridges contain consumer or post-industrial recycled content. Further, we’re innovating on how we design and manufacture our products with 3D printing to further help decrease GHG emissions and reduce resource consumption.

- Build innovative partnerships: Building a sustainable supply chain also entails making a positive impact on the people in that supply chain and in the communities where they work and live. In alignment with SDG 13 and 17, we’ve built partnerships that both support our local communities and minimize our impact on the planet. Last year, HP introduced the first Original HP ink cartridges made with plastic bottles recycled in Haiti. Through March 2018, HP sourced more than 170 tonnes of plastic (over 8.3 million plastic bottles) from Haiti—plastic that might otherwise have washed into waterways and oceans. Together with our partners in the First Mile Coalition, we have provided 50 children with educational opportunities as well as food and medical assistance, while enabling greater local economic opportunity.

- Engage your channel: Channel partners play a critical role in growing our business—and have also helped minimize our footprint. We worked with Best Buy to create a program in which customers would receive 15% off an HP inkjet printer when they bring any used printer into a Best Buy store for recycling. This provides customers with an easy way to recycle older printers and drives increased printer sales for Best Buy. In turn, it enables HP to recapture products at end of life and reclaim that plastic for use in new printers—further supporting SDG 12—and reduces our supply chain costs.

Nate Hurst is Chief Sustainability and Social Impact Officer, HP

Originally published on LinkedIn and distributed by 3BL Media.

Photo: HP