What Skills Do Young People Need to Succeed?

Many businesses face a common challenge these days: Finding enough qualified workers for an increasingly technical workplace. According to Code.org, by 2020 there will be as many as 1 million more computer jobs available than there will be skilled applicants.

And it’s a problem that isn’t just limited to computer coding jobs, either. The manufacturing sector, long the go-to resource for on-the-job training, is facing a dearth of applicants. So are university-skilled professions like medical, dental and teaching positions.

According to a report by the Society of Human Resource Management, HR specialists were already seeing a looming shortage in skill-ready applicants in a number of sectors by 2016. More than 65 percent of professionals across the markets confirmed recruiting enough applicants was becoming challenging.

The problem, say experts, isn’t just the new technical skills that may be required, but what analysts call a “skills perception gap” between what employers want and what the applicant perceives is needed for the job.

On the applicant’s side, more than half who responded to a survey by AfterCollege stated that college didn’t prepare them adequately for the skills they would need in their career.

Bridging that gap between the employer’s perception and that of a prospective applicant starts at the educational institution, says Lydia Liu, Senior Research Director, Academic to Career Research Center at Educational Testing Service (ETS). Liu oversees research that helps ETS develop appropriate testing modules for higher education graduates and innovative science assessment mechanisms for grades K-12. Her research team is responsible for helping to design new student learning outcome assessments for today’s workplace applicants.

Liu said it isn’t enough for the applicant to be able to demonstrate that they are trained in their specialty. These days employers need to know that the new hire will be able adapt to an ever-changing work environment. They’ll look for a bevy of competencies, such as critical thinking and communication skills that complement today’s global work settings and diverse workforce.

And to determine if the applicant has the resilience and capability to work in an environment that is subject to change, the employer may want to test for social emotional skills to see how the new trainee works in teams or collaborative settings – environments that are often part of today’s evolving work setting.

“So nowadays the job candidates really need to have a wide range of skills for them for function effectively in the workforce,” said Liu.

To complement those needs, ETS has been developing a new set of testing modules that help employers ensure that the applicant they are looking at hiring not only has the domain-specific skills, like biology, physics or computer coding, but has the “transferable” skills that would allow an employee to successfully transition into a new job as the employment landscape changes, or advancement becomes available.

That’s because employers have learned in recent years to harness the skills and talents they have on board, said Dan Hawthorne, Lead I/O Solutions Engineer at ETS’ Strategic Business Unit. A low unemployment rate has helped to create an “employee’s market” and encouraged employers to look for personality and social traits that they feel give workers the ability to work well in teams as well as demonstrate ingenuity.

“These days, Hawthorne said, “people [are often] working in very matrix teams and positions that they may not have necessarily been hired for. So they are having to move around a lot.”

He said the feedback from businesses is that “grit” or resilience and flexibility are now highly preferred skills.

Liu said ETS’ new program, HEIghten, tests for five generic core strengths that help illumine those attributes and are now considered beneficial in most workplace settings: critical thinking, intercultural communication and diversity, quantitative literacy, civic competency and engagement and written communication.

And she admitted that the knowledge points for scholastic tests are definitely different than they were for previous generations of workers.

“If we look at the skills and knowledge the competencies required 20 year ago, a lot of them are pretty different from the expectations from the workforce today,” said Liu. “So it is really important for both the education sector and the employers to anticipate what changes are taking place.

“[It] is not enough for [educational institutions] to teach the domain-specific knowledge. They will need to find ways to help promote the social-emotional skills … and also more transferable skills, such as intercultural competency and diversity,” which ETS describes as “the ability to communicate effectively and appropriately in intercultural situations based on one's intercultural knowledge, skills and attitudes.”

Oftentimes higher education institutions have a greater role than teaching the specialized knowledge that students are looking for,” Liu added. And to the prospective job applicant, they can make the difference when it comes to transitioning to today’s workplace, where skill sets are changing.

“We understand that for higher institutions, helping students find a job is not the only purpose or objective of higher education. But for many families that have to shoulder the financial burden and time investment, finding a good job is a priority. So connecting the higher ed and workforce should become a priority,” she said.

A survey by the Association of American Colleges and Universities (AACU) corroborated this finding. The AACU found in 2015 that graduates believed they were well-prepared for the workforce when they left college or university, whereas employers found their skills were often lacking.

Liu said to address this problem, ETS researchers reached out to university and college administrators to find out what it was that they needed tests to address.

“We actually reached out to over 200 higher education institutions and interviewed their vice provosts or vice presidents for academic affairs to understand their assessment priorities.” ETS then developed the five modules based on what interviewers heard from scholastic institutions – and then took a step further to develop modules that would help instructors bring students up to the level that employers expect.

“[We] also realize it is not enough to just tell people, OK, 80 percent of your students are at the developing level. Naturally the next question would be then how can I help my students improve, and we believe it is also important to start working on training or learning materials that students can use to improve those skills,” Liu said.

An important component of ETS’ testing programs is addressing the worker whose job is slated to be phased out or blended with another. When it comes to evaluating learners, Hawthorne said, it’s the well-trained, long-term employee that nowadays has to be considered.

“One of the things we have been looking at is how to identify that intersection between existing jobs that may be declining and new jobs that are coming up.” said Hawthorne. Figuring out how to test transitioning workers to not only help the employer fill challenging, new job positions but aid the employee in determining a new career paths is one of ETS’ current goals.

Liu and Hawthorne said there were steps that employers, educational institutions and prospective applicants could take to make the process of filling jobs more successful.

To the prospective applicant Liu had this advice: Increase awareness of what’s expected to apply for a particular job and be well-rounded in knowledge. Hone their generic and transferable skills. “Because whether they can function effectively in their intercultural team, whether they can handle conflict resolution, whether they can communicate effectively verbally and in writing is critically important,” Liu said.

Businesses and educators will both want to reach out to each other’s venues to test and ensure their expectations are being met, said Hawthorne. To businesses: “Communicate out to educators and try to deliver the message of what you really need or what you see as challenges. There has been quite a bit of research showing that there are gaps between what students are coming out of schools with and what businesses expect.”

Image credit: Pixabay

Ørsted, GRI & CDSB on the TCFDs

Ethical Corporation has just published a new briefing that delves into the role of the TCFDs in sustainability reporting and I wanted to send this across to you - you can access the report here.

There’s 9 pages of expert response and analysis to provide comprehensive insight into the climate-related financial disclosures, including:

- Pricing climate change correctly and integrating into wider business processes

- Overcoming the concept of scenario analysis

- Ensuring those at the top are versed on climate risk and opportunity

- Insight from CDP, GRI, Ørsted, Carbon Credentials and CDSB

- And more…

Download your complimentary TCFD briefing here

Media Contact:

Ed Long

Project Director

Ethical Corporation

+44 (0) 207 375 7188

When a Brand Takes a Stand by Severing Ties to Its Founder

There is a long history of companies that when push came to shove, they finally bucked up and got rid of a wayward founder. Uber eventually had to relegate Travis Kalanick to only a seat on its board after months of scandals that painted the ridesharing company as all that is wrong with Silicon Valley. American Apparel endured years of controversy from its founder, Dov Charney, until his company, and the hedge fund he handpicked to help him keep control of the clothing manufacturer and retailer, finally cut ties to him in 2014. There are exceptions: for decades, investors were so disenchanted with Armand Hammer’s shenanigans and stewardship of Occidental that the company stock actually increased after his death in 1990.

Now, we have the tale of John Schnatter, whose various remarks over the past year in part helped punch down Papa John’s stock to a long and painful downward trajectory. Although he was replaced by his chief operating office at the beginning of this year, Schnatter’s image was still prominently displayed on the company’s marketing collateral, web site and pizza boxes.

But in case you missed it over the weekend, accusations of racism finally spurred Papa John’s board to sever even more his ties to the company. It was not enough for Schnatter to resign his chairmanship after last week’s controversy; the company’s board of directors evicted him from his office at Papa John’s headquarters in Louisville, Kentucky.

Schnatter is now backtracking on his promise to hand over control of his company (and claims he was baited by his ad agency’s suggestion of Kanye West for a marketing campaign), but Papa John’s ordeal has become a case study for companies in this era of brands taking stands: a polarizing CEO’s behavior can demolish a company’s reputation in a only a nano-fraction of the time needed to build that company’s prominence in the market place.

There is a corporate governance lesson here as well. No matter how charismatic a founder/CEO may be, and however compelling one’s life story appears (Schnatter’s life journey could have been great fodder for a movie before last week’s controversy), boards need to be proactive when it comes to monitoring the public behavior – and subsequent reactions - of a company’s chief executive, as well as that of the rest of the C-suite. The all-too-rapid impact from the likes of those including Schnatter, Kalanick or Charney can too quickly bruise and batter a company, from its brand reputation to stock price, and can result in having a harmful effect on far too many people.

If they are not already, the days of a board acquiescing to a company’s founder are done.

As the Financial Times’ Brooke Masters wrote on Monday, “Without a board willing to say no, a founder who is losing touch can easily stray into trouble, either through poor strategic decisions or personal behavior that angers employees and investors.”

Watch for more decisive action in the coming months as companies increasingly take the long view, taking seriously the short-term volatility that occurs when corporate leaders humiliate themselves – and their companies – in both traditional and of course, social media. Case in point: Elon Musk’s vicious salvos lobbed at one of the Wild Boars’ cave rescuer will not be forgotten if Twitter continues to get the billionaire visionary in trouble – even if it appears Tesla is close to overcoming its Model 3 “production hell.”

Image credit: Mr. Blue/Flickr

Insurance Companies Calculate the Cost of Climate Change

Homeowners may be facing new insurance requirements in the coming years, thanks to climate change.

In Canada, where some provincial governments require flood zones to be clearly identified for insurance purposes, prospective homeowners must now consider whether they will need "overland flood insurance" to offset the cost of inundated streets or property that is not in a designated flood zone.

Overland flooding is water that accumulates above ground and seeps through openings like windows, doors and other openings. It is the latest designation for flooding that may come from climate impacts, where the weather conditions leads to too much water on the property.

Last year's catastrophic flooding of Houston, Texas is an example of chronic overland flooding made worse by climate impacts, in this case a tropical storm.

Canada and the U.S. aren't the only countries to be faced with the implications of this type of flooding. But the increase in destructive storms in recent years has prompted insurance experts in both nations to call for homeowners to beef up their insurance coverage.

And this has led to British Columbia, Canada's most-western province, to claim a new caveat to disaster assistance: homeowners who live in areas that are eligible for overland flooding insurance and are uninsured may not be eligible for disaster assistance, either.

The reason, say experts, is that disaster assistance in Canada is meant to support those who were powerless to prevent the damage. Homeowners in areas where the rider is sold are required to have the new coverage.

"[Insurance] companies do not offer flood insurance in high-risk locations because the premiums would be prohibitively expensive," explains the province's emergency management agency (EMBC). It isn't clear what geographic areas of British Columbia would be exempt from having overland flood insurance.

Homeowners aren't the only ones wrestling with the prospect of increased risk from climate change. According to research conducted by Insurance Business Magazine last year, the cost of payouts for climate-related damages is putting a strain on many small insurance agencies.

In the U.S., climate change is being blamed for the number of repeat payouts due to flooding. According to the National Flood Insurance Program, the number of properties that have reported second-loss claims has increased by more than 60 percent.

In fact, as Robert Muir-Wood, chief scientist for Risk Management Solutions (RMS) explained in a recent interview with Smithsonian Magazine, analysts no longer find it feasible to forecast weather patterns based on the past 100 year-average. RMS provides data software for insurance companies and is often credited with companies' ability to calculate adverse weather risk.

"Our business depends on us being neutral," Muir-Wood told Smithsonian in 2013, a year that saw catastrophic flooding in many areas of the U.S. and Canada.

“In the past, when making these assessments, we looked to history. But in fact, we’ve now realized that that’s no longer a safe assumption—we can see, with certain phenomena in certain parts of the world, that the activity today is not simply the average of history.”

In fact, when it comes to sizing up the potential for Atlantic hurricanes, which cost the insurance industry more than $150 billion in 2017, RMS says it has thrown out the rule book and "no longer uses its historical 100 year old database of Atlantic hurricanes as a valid predictor of future risk.” Instead, the new model predicts a “heightened hurricane activity and correspondingly modeled loss.”

But hurricanes aren't the only risk factor that has an impact on how we live and insure our homes and businesses.

A study reported by Nature Climate Change found that this decade, the global economic price tag for heat island effect could be almost triple what was originally anticipated.

According to the Environmental Management and Policy Research Institute, that rise in atmospheric heat can present risks for regional fires. There is not enough data yet, however, to suggest whether insurance rates will be affected.

But like rising sea levels, those risks are likely to be reflected in new city building codes and environmental policies in the near future. The county of Santa Cruz, long known for its summer beaches and occasional stormy winter weather, is already considering the changes that may be needed to future building codes as California's Monterey Bay area faces more adverse storms, hotter summers and more scrutiny from insurance carriers over the risks that are carried by climate change.

Image credit: DVIDSHUB/Flickr

Molson Coors Pushes Forward on Science-Based Targets

Molson Coors recently issued its annual corporate responsibility report. The brewing giant, which boasts venerable beer brands such as Blue Moon, Miller, and of course, Coors and Molson Canadian, says its long-term targets rest on three pillars: the promotion of responsible consumption; having a brewing process as efficient as possible from grain to glass; and supporting people and the communities in which they live and work.

Part of this strategy includes what Molson Coors says its decision this month to join the group of 430 companies worldwide that are committed to science-based targets. The company says its 2025 goals seek to reduce its carbon emissions by 50 percent within its own operations and by 20 percent across its entire value chain. In halving its carbon emissions throughout the company’s operations, Molson Coors says it strives to decrease its energy consumption, is working on purchasing all of its electricity needs from renewables, seeks CO2 self-sufficiency at all of its sites, and continues to assess options for cleaner and more sustainable fuels.

“Our efforts have already helped us make great strides toward our ambitions,” said a Molson Coors representative in an emailed statement to Triple Pundit. “In 2017, we reduced absolute carbon emission from our direct operations by 15 percent, and achieved an absolute carbon emissions reduction of 6.2 percent across our value chain.”

According to Molson Coors, the largest challenge to reaching these science-based targets is the same one faced by every industry that embarks upon such a plan: influencing change across the organization. Empowering these employees is one way in which the company says its determined to meet such goals over the next seven years. For example, Molson Coors recently rolled out an energy management software platform that provides greater accountability and visibility of energy use across its various locations. The platform offers employees tools to act with more autonomy to solve problems along with the agility to harness any new opportunities to conserve energy.

Conserving water is also high on the brewer’s priority list. The company has long worked on reducing that pesky water-to-beer ratio across its operations. Molson Coors says it is well aware that its operations include a large presence in water-stressed states, including California, Texas and Colorado. During 2017, the company said it had restored approximately 460 million gallons of water to various watersheds in those states.

When it comes to the company’s sustainability performance, one of the areas Molson Coors insists it has had significant impact is within its agricultural supply chain. According to Kim Marotta, the company’s global senior director of corporate responsibility, Molson Coors’ work with barley farmers in particular stands out. Nearly a decade ago, the company started with one barley farmer, John Stevenson, and one farm. Marotta explained how Stevenson and his family sought positive change, and that he was willing to take risks while implementing more sustainable farming practices. From there, this once-nascent pilot program expanded to ten farms, then eventually fifty farms - and now, to nearly all of the company’s barley growers in the U.S.

Currently, Molson Coors says it works with approximately 860 growers as part of the company’s Grower Direct program. These farmers supply up to 80 percent of all the barley it purchases. Farmers can access what Molson Coors calls its Grower Direct Portal, a digital platform that collects data from agricultural best management practices at the field level. This portal allows the company to track its barley growers’ sustainability efforts – and last year, the company said it achieved 100 percent participation by its barley farmers.

On another participation front: like brewing companies, Molson Coors has been open about ensuring that its products are safely consumed. But the company insists that its role is broader than merely “promoting responsible consumption.” Molson Coors says it works with governments worldwide to establish a legal drinking age, set what the company views as reasonable excise taxes, and ensure the enforcement of illegal blood alcohol limits. The company also has programs with retailers to make sure that these stores restrict sales to minors while educating consumers about viable alternatives to return home safely after a night of imbibing. Molson Coors claims that these efforts are helping to reduce harmful alcohol use and promote responsible consumption.

“The one thing that makes me the most proud is the people - from our leadership team, to our employees and to our farmers in the fields,” Marotta told 3p. “We are a collective group of passionate people who desire to make the communities and the places where we work better places to live.”

Image credit: Molson Coors

New Ethical Corporation Report – The Future of Digital on Reputation

In today’s world of cybersecurity, automation and data the resulting disruption for business is ballooning. Companies need to adhere to higher ethical standards to ensure social purpose and reputation stays intact.

Ethical Corporation has just released a new in-depth report on the future of digital on reputation tackling the most pressing issues and opportunities that digital business brings to society.

Key topics include how business needs to prioritise privacy to using data ethically and the impact of customer trust and reputation. The report features insight and case studies of the likes of; Accenture, Black Rifle Coffee, Digital Ranking Rights project.

Ethics and responsibility is an absolute must to guarantee long term success for business.

Click here to download a copy of the whitepaper briefing that tackle ethics, data and more

Media Contact:

Ed Long

Project Director

Ethical Corporation

+44 (0) 207 375 7188

Integrating a CR Report to Your Company’s Overall Strategy? Start, Don’t End, with the Board

Communicating a company’s corporate responsibility performance to all stakeholders is certainly a pesky task. There are all the various factors that merit reporting, including human rights, energy efficiency, employee satisfaction, volunteer hours, funds spent on lobbying and diversity, just to start. Then you’ve got the reporting standards. True, GRI has become the standard, but let’s not forget reporting to CDP, the UN Global Compact, SASB, IIRC, MCSI and DJSI, among others.

Furthermore, reporting on a company’s sustainability performance is becoming increasingly important to the people who are considering investing (or divesting from) in your company. “Investors need standardized, high quality information on material factors that can affect price or value,” Tim Mohin and Jean Rogers wrote in GreenBiz last year.

It sounds simple, but the corporate reporting journey often becomes complicated. Or, maybe companies are just making this process too complicated. The conventional wisdom is conducting that material assessment, (after ensuring that you have scored buy-in from the C-suite that a report should be done) . . . then have the board of directors sign off on the report.

But during a recent interview I had with Helle Bank Jorgensen, CEO of B. Accountability and President of the Global Compact Network Canada, it became clear that many companies may need to rethink their plan of attack when it comes to sustainability reporting.

Jorgensen certainly has the credentials when it comes to advising companies on taking a step back and giving a fresh look at their sustainability reporting processes. In addition to working on what were the first integrated report and first responsible supply chain programs, she has worked with hundreds of companies, including Ikea, Nike, Unilever, Shell, Novo Nordisk, Maersk, Pfizer, Monsanto and Lego during her tenure as a partner with PwC in Europe and the U.S.

As Jorgensen, and additional thought leaders such as GRI’s Tim Mohin have explained, there is no absolute rule that a company’s sustainability report be released on an annual basis. But because many countries, including the U.S., have long mandated that financial reports be issued on a regular basis, it was intuitive to assume the same should be done for that annual sustainability report.

The problem, however, is that sustainability reporting teams must deal with copious amounts of data through which they must parse. Therefore, you have scenarios of companies that find themselves generating financial reports, social reports, environmental reports and even intellectual capital reports. Naturally, the conclusion that comes about is all of this must be all integrated. But so much “what” goes into a sustainability report, it is easy for a company to forget the “why” they are doing such an exercise in the first place.

The task at hand is to ensure all this information resonates. “I still think some companies are missing the point of these reports: they need to show the value; yes, the numbers may be there, but what about the value?” asked Jorgensen.

One could just say that these reports are full of so much "what" . . . what is missing, is a clear understanding of the "why."

Unfortunately, the value of the company’s work too often becomes lost in translation. “That comes to the fact that they are spending much time putting all of these reporting data points in their report . . . rather than gaining value out of what they are doing.”

One challenge companies face is that despite all this talk about integration and collaboration, many companies still find they are working in silos. Jorgensen recounted a story of two different reports a company had issued. One report stated that the company’s employees were its most important asset; but another report disclosed that the same company had struggled with retaining employees. Naturally, stakeholders, including investors, were left scratching their heads.

As Jorgensen put it, “There must be a way for some companies to step back, and ask: what are we producing; and what does success actually look like? Are we focusing on the right stakeholders? Are we focusing on not only making the report, but getting value out of it?”

In the case of the aforementioned company that valued its employees (while those same workers were apparently quick to make an exit), it was clear that two different departments were writing their own report. “That comes from the tone at the top,” explained Jorgensen.

And therein lies for making the case that instead of signing off on sustainability reports, board of directors should sign on and be proactive when it comes to the process. This is especially important at a time when more corporate governance experts are calling for improved communication between investors, the C-suite and boards.

“The board needs an understanding of the goals of sustainability reporting,” said Jorgensen. “There are a lot of board of directors that only get the sustainability report to review and sign off on it. Meanwhile, they are responsible for the financials--but why not the sustainability report?”

What any board needs to understand, according to Jorgensen, is the reason why the so-called non-financials are important. Board members unfamiliar with the factors driving sustainability reporting may at first be averse to disclosing information about sensitive topics such as human rights or employee retention.

But boards need to understand that there are more customers insisting that if they can’t trust where a company stands on issues such as human rights or the environment, they will shop elsewhere. And at a time when supply chain is on everyone’s mind, it is also important to remind boards that if it is not clear where a company procures its parts or raw materials, those same customers move on to another competitor.

At a time when more brands are taking stands and companies are stepping out of their comfort zone to not just take on environmental and social responsibility, but also volatile political issues, it may just be time to give another look at the annual corporate responsibility report, with the emphasis on the “annual.” And the fact that so much of this data is difficult to obtain should send a message to companies that the mad rush to push out that annual report means less time spent on doing good – instead the emphasis is reporting the “good.”

“[Sustainability report] should not be a yearly project--it’s a process,” said Jorgensen as we wrapped up our talk.

And that process should showcase how the company is providing value to employees, and communities worldwide – even if it means reevaluating whether the annual report is the best way to communicate this progress in the first place.

Image credit: Jeffrey Zeldman/Flickr

Companies Push Back as Trade Wars Roil Markets

The global trade wars have begun, despite a rising drumbeat of concern from companies and trade associations.

From General Motors and Harley Davidson, large corporations to mid-sized and small businesses, companies have voiced their opposition. Trade groups have sounded the alarm: “The administration is threatening to undermine the economic progress it worked so hard to achieve,” said Tom Donohue, president of the US Chamber of Commerce, a longtime supporter of Republican economic policies in announcing a campaign to oppose the administration’s tariffs.

Ironically, this rupture between the private and public sectors comes under an administration and Congress controlled by Republicans—historically, the pro-business party. “This isn’t the natural order of history that large business groups oppose a Republican president, said Nancy Koehn, a business historian at Harvard.

“This is a genuine effort to take a wrecking ball to the whole international system of trade agreements,” Rufus Yerxa, a former US trade official who now leads the National Foreign Trade Council told Politico. “I think that’s something that’s causing a serious re-examination by business. You’re seeing industry after industry coming out and saying, ‘We don’t think that’s the way to do this, it will have very bad effects for us."

What’s worse, it’s a trade policy business did not ask for. “Unlike most trade policy fights where the US government is working to advance the industries—the specific interests of a specific US industry or two—in this case, it’s very difficult sometimes to find a US industry or a US constituency for these trade actions,” said David French, senior vice president at the National Retail Federation, which opposes heavy tariffs on imports from China.

So how does a brand take a stand against unsought-for economic policies proposed by government?

Taking some basic steps could make a difference:

- make a statement—the media notices and support is attracted

- seek out allies and partner up — join with sector peers and trade groups to share ideas for campaigns and initiatives

- start serious “scenario planning” to game-out strategies for future solutions—don’t wait for any downturns

- review and re-affirm internal policies that align corporate and social values—such as diversity, sustainable supply chains, governance, and employee engagement

- step up HR and leadership programs to counter the turbulence

- look for unthought-of opportunities in changing markets

- lobby Congress—the legislative branch may yet respond to pressure to support businesses hurt by tariffs

One thing is clear in this muddle: the upheaval of the current world economic order has made it impossible for business to avoid taking positions on these trade issues, especially as they are driven by politics, not economics. Corporations of all sizes and from all sectors now find themselves where the worlds of long-time global trade practices and new nationalist trade strategy collide. Managing the fallout will be key to future success.

Originally published in the Brands Taking Stands Newsletter.

Why Many Homes Are Turning Toward Energy-Efficient Landscaping

A lot of thought goes into a home to make it look beautiful and fit the needs of the people who live inside it. Landscaping takes a different level of thought than other parts of the home because you must consider what plants would do well in specific areas of your yard. What many homeowners don’t originally consider is how their landscaping affects their energy and natural resource usage. Now that people are more inclined to learn about going green, it’s affecting how landscaping is done before shovels hit the soil.

If you haven’t thought about energy-efficient landscaping, now’s the time. Your yard can be transformed into a more environmentally friendly place even if you’ve already had landscaping done in the past. Read on for more information about why homeowners want this new kind of landscaping and how it could help you in the long run. Anything that saves you money and helps the earth is worth a little time and effort.

Climate Can Save Money

When people think about what plants they want to put in their yard, they weigh the plant type and its needs against the type of climate they live in. This same climate can help you save money with a few landscaping tricks. Think about how the weather is where you live and let that determine your choices.

Hot weather regions make it hard to grow some plants, but other plants can be used to keep your money in your wallet. Heat radiates off cement and pavement, which creates hot air that hovers above places like driveways and sidewalks. While you might not think this would affect your life inside your house, breezes will catch this hot air and push it inside, making your air conditioning unit run into overdrive. Plant tall trees around your driveway that have thick foliage to shade these areas and keep the air around your home from getting any hotter.

Think about what happens with the rainwater in your yard after a storm. It collects all the chemicals in your lawn and takes them to natural streams, where it contaminates the drinking water for animals. It even damages homes, like in Maryland where rainwater runoff made 149 to 159 homes uninhabitable. You can keep your landscaping from contributing to this by cutting down on fertilizer use or planting more foliage to soak up the extra water if you live in a rainy area.

Water Waste Is Dangerous

People talk about cutting back on water, but at the same time they let their sink run when they’re not actually using it or when they do multiple loads of laundry. It might not seem like saving water could help the Earth, but it can. A World Health Organization study showed that 3,900 children die of waterborne illnesses every day. Cutting back on water waste will keep contaminated water out of places where it can’t be filtered or cleaned.

Strategically plan when you’re going to water your plants and how long you’ll let that water run. Ditch the idea of installing a sprinkler system so you can monitor your water usage by turning a hose on and off. You can also replace any existing plants with ones that will require less water, like succulents or other desert plants.

People Want Smaller Carbon Footprints

Everything now is about going green, so turning landscaping into an Earth-friendly project is the natural next step for homeowners to cut down on their carbon footprints. It’s something more people want with each passing day. There are so many ways everyone can contribute, but changing your landscaping will help you make a bigger impact on pollution. See what you can do based on the climate in your area and how you want your yard to look. It’ll give you more peace of mind when it’s time to sit back, relax and enjoy the view of your new yard.

Calor Gas strategy supports SDGs, triple bottom line

Calor Gas, which provides bottled propane and butane to four million UK homes and businesses, aims to recruit half its staff into community volunteering this year and to place all employees in the scheme by 2020.

The ambitious scheme is one of the targets in the company’s three-year responsible business plan.

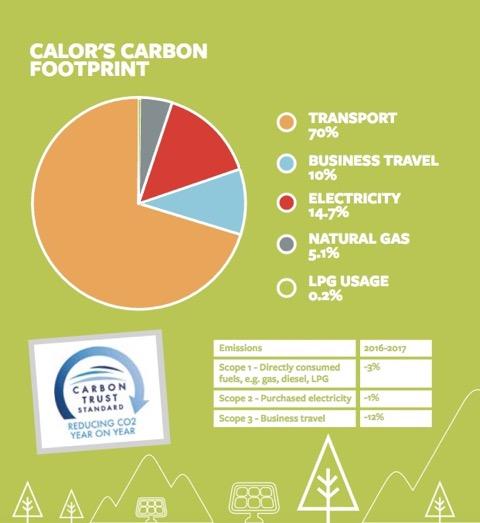

The company’s main environmental target will be to reduce its carbon dioxide emissions, partly by increasing sales of BioLPG into the UK market.

In March Calor became the first UK energy company to supply BioLPG, a type of liquid petroleum gas produced from wastes, residues and vegetable oils.

LPG has a lower carbon dioxide emissions level than other fossil fuels, but BioLPG cuts the carbon dioxide pollution even further, enabling environmentally responsible consumers to minimize their carbon footprint.

Calor’s introduction of BioLPG is part of the carbon dioxide emissions commitment of its parent group, the multinational power supplier SHV Energy, headquartered in the Netherlands. SHV, which has 30 million customers on three continents, has the ambition to create all its energy products from renewable sources by 2040.

The BioLPG innovation is described by Calor as “a new approach to wellbeing”.

The company committed itself to bringing “clean, efficient and modern energy solutions to homes and businesses across Great Britain” when it was formed in 1935.

Today it claims to consider the social, environmental and economic impacts of its activities alongside its long-term profitability.

In line with these objectives Calor says its three-year plan supports the UN’s Sustainable Development Goals and is based on three pillars – Our People, Our Business, Our Planet.