Inclusive or Exclusive Approach to SRI: Which Is Right for You?

By Brendan Erne

Socially responsible investing isn’t new by any means, but it is enjoying a surge in popularity. Whether it’s driven by the increasing awareness of environmental issues, workplace inequalities, or other social issues, there’s a palpable urgency to do better by both our fellow humans and the environment. Investing is also reflecting this trend.

In 2018, socially responsible investing accounted for more than $6.5 trillion of professionally managed assets, and some of the world’s biggest brands are jumping on board. Ford, for example, announced last year that its Ford Foundation would commit $1 billion toward socially responsible investments.

Ford isn’t the only company applying pressure to prioritize social responsibility. Larry Fink of BlackRock has spent years advocating for stronger management from global CEOs on social responsibility. The company plans to use its voting rights as the largest asset manager in the world to guide companies toward social responsibility. State governments are also displaying a certain sense of responsibility by placing mandates on utility firms with incentives to increase their production of renewable energy.

Inclusive vs. Exclusive

There are two main approaches to socially responsible investing: exclusive and inclusive. Exclusionary investing is the most common, and it simply involves leaving certain companies, sectors, or industries out of a portfolio — examples might include the tobacco industry or certain companies that produce firearms. This type of investing has been around for ages, and we’ve offered it at Personal Capital since our launch in 2011.

While exclusionary investing is certainly a step in the right direction, inclusive investing is a much more robust approach. It is the process of identifying and investing in firms doing a better job managing and promoting social and environmental issues. The newest form of this approach is known as ESG, or environmental, social, and governance. These represent the categories used in the evaluation process. Environmental includes areas such as renewable energy projects and carbon emissions; social includes policies around safe working conditions and employee diversity; and governance covers areas such as executive compensation and board independence.

A global standard for evaluating these metrics has yet to be introduced, but some third-party firms have established comprehensive research and methodologies for ranking. Investors can look to these organizations to validate their investment strategies and help ensure the companies they own are properly managing around ESG metrics.

But socially responsible investing wouldn’t do much good for your long-term retirement goals if it came at the cost of financial gain. The following tips are aimed at helping the socially conscious investor maximize social impact as well as financial gain:

1. Find a strategy that resonates with your values.

After all, this is a value-based approach to investing. Just be careful in the socially responsible filters that you apply. You want to align your investments to your values in a way that doesn't risk your retirement. The narrower the focus, the greater the risk of material performance deviations.

2. Use both inclusive and exclusive filters.

To achieve the greatest impact, consider incorporating both inclusive and exclusive filters into your strategy. In order to do this, you will most likely need a portfolio that includes individual stocks, as you can’t customize an exchange-traded fund or mutual fund. This is still a relatively new industry, so if you do actually use ETFs or mutual funds, be mindful of fees and liquidity.

Investors can use these filters to go much further in their application of socially responsible investing. Rather than just excluding companies they don’t want to own, investors can look for companies doing a good job managing social, governance, and environmental issues.

3. Maintain maximum diversification.

This is one of the most important considerations. As mentioned above, narrowly focusing on a specific socially responsible filter can result in heavy sector skews or category concentrations. These leave you open to greater financial loss when those categories turn south. Instead, choose a well-diversified strategy that at least loosely tracks a broad market index.

Moreover, you should continue to incorporate all of the major liquid asset classes. It’s possible there may not be any socially responsible options in a specific asset class, but that absolutely doesn’t mean you should weaken your portfolio by completely abandoning that asset class. Continue to incorporate both domestic and international equities; domestic and international bonds; alternatives; and cash. Diversification is critical to avoid materially impacting long-term returns.

Socially responsible investing is about recognizing that we’re all small parts of something larger, whether it’s the environment, the human race, or something else we hold dear. Whatever your motivations for joining the movement, you too can cast your vote for social responsibility every time you allocate your investment dollars.

Brendan Erne serves as the director of portfolio implementation at Personal Capital. He joined the firm just before its official launch in 2011, and he’s played a critical role constructing and managing the investment portfolios as well as building out the broader research team. Prior to Personal Capital, Brendan spent several years at Fisher Investments as an equity analyst covering the technology and telecommunications sectors. He also co-authored "Fisher Investments on Technology," published by John Wiley & Sons. Brendan is a CFA charterholder.

Photo: Ford Foundation

The information on this website is for informational purposes only and does not constitute a complete description of our investment services or performance. No part of this site nor the links contained therein is a solicitation or offer to sell securities or investment advisory services, except where applicable in states where we are registered, or where an exemption or exclusion from such registration exists. Third party data is obtained from sources believed to be reliable. However, PCAC cannot guarantee that data's currency, accuracy, timeliness, completeness or fitness for any particular purpose. Certain sections of this commentary may contain forward-looking statements that are based on our reasonable expectations, estimate, projections and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not a guarantee of future return, nor is it necessarily indicative of future performance. Keep in mind investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Transwestern and Caesars on Climate Action in Supply Chains - Webinar

For the majority of businesses, the supply chain is where they can have the largest impacts on climate change and greatest risks to business occur. But how do you build climate resilience and move to a low carbon supply chain?

To help you build resilience and transition to the low carbon economy, 3 senior leaders are ready to share their experiences and strategies via an interactive webinar debate. Join us August 7th at 9am PST [11am CST, 12pm EST] for our free online webinar with:

- John Gledhill, Senior Vice President, Transwestern

- Jessica Rossman, Vice President of Procurement, Caesars Entertainment

- Andrew Behar, CEO, As You Sow

In this 1-hour webinar, you will learn how innovative businesses are demonstrating their progress on ambitious targets through SDG focused disclosures.

- Set Science-Based Targets to deliver reduced resource use, prove energy efficiency and accelerate the migration to renewables

- Engage with suppliers to cascade responsibilities and actions

- Collaborate across industries to accelerate impacts

- Source technology that helps identify areas of your supply chain that are at the greatest risk to climate impacts

Can’t join? Sign up anyway to receive the full post-webinar recordings: https://events.ethicalcorp.com/rbs-west/webinar/

Media Contact:

Ed Long

Project Director

Ethical Corporation

+44 (0) 207 375 7188

Live Twitter Chat Tomorrow: #YumRecipeforGood, July 31, Noon ET/9:00am PT

Can a restaurant operator with over 45,000 locations worldwide (17,000-plus locations in emerging markets alone) be truly responsible and sustainable? Yum! Brands believes it already is on that path, and says it is striving to become even more responsible in the coming years. We invite you tomorrow, at Noon ET, to join us on social media to learn the company's accomplishments over the past year, and it what it has in store moving forward.

So please join us for this live 1-hour Twitter chat with Yum! Brands as the company discusses its 2017 sustainability strategy, which showcases the company’s progress and describes the efforts by KFC, Pizza Hut and Taco Bell to generate what the company says is impact in three areas of strategic focus: food, planet and people.

We last hosted a Twitter chat with the company two years ago; since then the fast food giant has embarked on a bevy of corporate responsibility initiatives, including boosting engagement with the communities in which Yum! Brands operates worldwide.

To get an idea of what Yum! Brands is up to on the sustainability front, take a look at the infographic below. We also encourage you to read up on the company's most recent corporate responsibility initiatives so you can gain ideas of what kind of questions you would like to ask Yum! Brands' panelists. You are certainly welcome to ask questions before the chat if you cannot make it at Noon EDT tomorrow; as with all of our Twitter chats, be sure you are seen by including your questions and comments with tomorrow's featured hashtag, #YumRecipeforGood.

Featured panelists include:

- Tracy Skeans – Yum! Brands Chief Transformation & People Officer

- Jon Hixson – Yum! Brands Vice President, Government Relations and Global Citizenship & Sustainability

- Jerilan Greene - Yum! Brands Global Chief Communications Officer

- Clive Newton – Yum! Brands Chief Food Safety Officer

- Liz Matthews – Taco Bell Global Chief Food Innovation Officer

Where: On Twitter, follow with the hashtag #YumRecipeforGood

Tips to get the most out of the #YumRecipeforGood Twitter Chat:

- Follow the main participants and #YumRecipeforGood hashtag

- Submit questions before the event to promote a more dynamic discussion

- Use the # YumRecipeforGood hashtag on comments that you want to share with the community

- Share tweets you think your followers will appreciate

- Follow Yum! Brands during and after the chat

New to our Twitter chats? Don’t worry! Read this.

RAICES Rejects Salesforce's Donation Amid Immigration Row

Tech companies that specialize in surveillance and cloud-based services are discovering an uncomfortable truth about this century’s new economy: Today’s skilled workers aren’t afraid to speak up, and speak up loudly if they feel their employer isn’t living up to its ethical potential.

In the past few months, a growing number of companies have found themselves in a ticklish situation when they have signed service or product agreements with the federal government. The leadership at Microsoft, Google, Amazon and most recently Salesforce have all received letters from their employees questioning the companies’ decisions to enter into contracts that provide services to federal agencies such as Immigration and Customs Enforcement (ICE) and the Department of Defense (DOD).

After the American Civil Liberties Union published information that Amazon's Rekognition facial software was being used by the federal government to track civilians including alleged illegal immigrants at the border, Amazon employees calling for the company to cancel the contract. Civil rights organizations followed suit, demanding that CEO Jeff Bezos "stop powering government surveillance infrastructure." The appeal doesn't seem to have slowed Amazon's enthusiasm for cloud software. The company reported last week that its revenue from Amazon Web Services (AWS), which includes the Rekognition software, has jumped 49 percent. Google, faced with resignations and outrage from employees about its contract to sell artificial intelligence software to the federal government, is one of the only companies that has agreed to implement new guidelines restricting the use of its products. In June the company said it would phase out the contract that nets Google more than $130 million and allows the government to use its program, Project Maven, to analyze footage in search for military targets. But questions about whether the program is also being used to track civilians in non-battle settings have forced it to reconsider the lucrative contract with the Department of Defense.And earlier this month, Salesforce found itself in the news as well. In June, some 650 employees signed an open letter to the CEO Marc Benioff calling on him to reconsider allowing Customs and Border Patrol (CBP) to use the company's cloud software in hiring processes. While the company declined to say at the time whether it would cancel the contract, it did take what some might consider innovative steps to dispel the controversy, by donating a quarter-million dollars to Raices.

The small Texas-based nonprofit gained attention earlier this year for raising funds to cover the legal costs of Latino families that had been separated by ICE at the border. The fact that the Trump administration says it is no longer separating children from incarcerated parents doesn't seem to have slowed the outpouring of donations from Americans who say they are enraged at the Trump administration for its handling of immigration issues. To date, Raices, which means "roots" in Spanish, has raised more than $20 million toward protecting immigrant rights.

But it's taken a very public stand toward Salesforce's oddly timed donation of $250,000. The offer arrived at the NGO's doorstep shortly after Salesforce's employees appealed to Benioff to "reexamine" the company's stance on potentially aiding CBP and ICE with software that can be used for surveillance of immigrants. “We cannot cede responsibility for the use of the technology we create,” Salesforce employees wrote last June, “particularly when we have reason to believe that it is being used to aid practices so irreconcilable to our values.” For its part, Salesforce says it is not "working with CBP regarding the separation of families at the border," nor is it "aware of any Salesforce services being used for this purpose." According to a Facebook post by Raices, the nonprofit declined a $250,000 donation from the company last week. In an open letter to Salesforce, it said the company's cloud software is the "operational backbone of the agency and thus does support CBP in implementing its inhumane and immoral practices." The organization said it would accept the donation only if Salesforce "would commit to ending [its] contract with [CBP]," which Salesforce has since said it will not do. Tech companies are now faced with difficult, ethical decisions about what limits that should be imposed when it comes to using a cutting edge product with moral and ethical implications. Is it enough for companies to say they aren't "aware" when critics charge a product is being used inappropriately? Do they have a responsibility to know, and to set contractual limits to its use? The questions that lie ahead will no doubt be a test for today's tech companies that also strive to be stewards of corporate social responsibility. Image credits: Molly Adams (Flickr); Wes Schaeffer/Salesforce)Join Us to Empower 1.6 Million Women Workers through HERproject by 2022

By Christine Svarer, Director, HERproject, BSR

The products and services that keep our societies advancing depend on interconnected economies and global supply chains. Often, if you follow these chains to their very end, you will find women in factories or on farms: Approximately 200 million women work in global supply chains. From Bangladesh and China to Kenya and Ethiopia, women are at the heart of the production of many of the clothes we wear and much of the food we consume.

Yet these women face specific systemic discrimination and inequality that make their lives harder—and that weakens the supply chain. This inequality exists both inside and outside the workplace. For example, a man with the same experience and educational background can expect to make 41 percent more than his female counterparts in the garment industry in Bangladesh. Meanwhile, women in MENA and South Asian countries do 80-90 percent of the total unpaid care work.

BSR's HERproject is based on the belief that women can be powerful agents of change to address these inequalities. When low-income working women are empowered to make and act on choices they value, they can change their workplaces, communities, and societies for the better.

Through discussions with our global brands and partners, we have developed a new vision and model for empowering women in global supply chains. The aim of our new HERproject strategy is ambitious: With our partners, we will double our impact and improve the well-being, confidence, and economic potential of 1.6 million women workers by 2022.

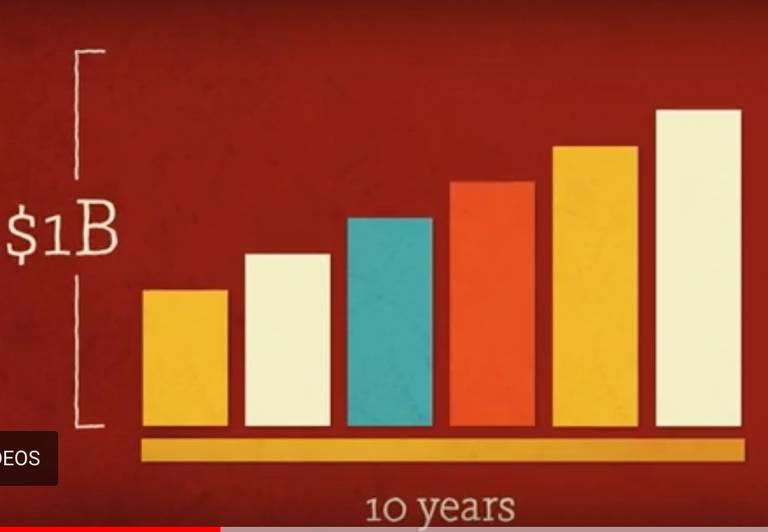

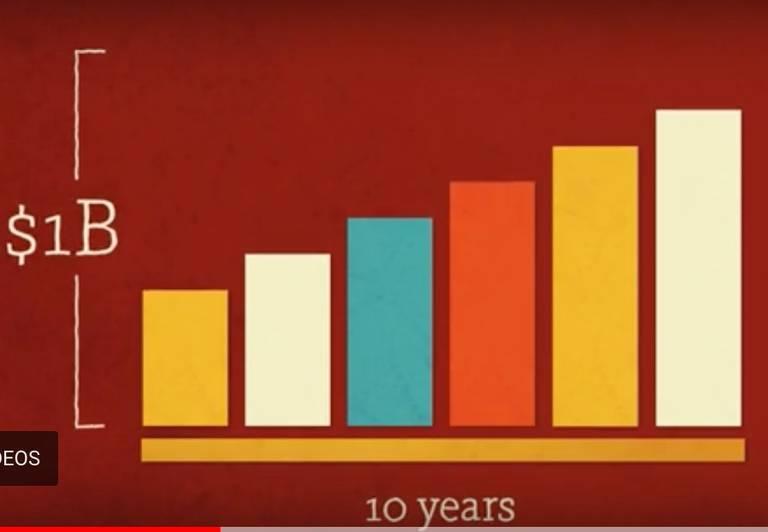

Over the last 10 years, we have brought together global brands, their suppliers, and local NGOs to deliver workplace-based interventions on health, financial inclusion, and gender equality. Having worked with over 60 brands in 14 countries to empower over 800,000 women, HERproject has become the largest workplace program devoted to unlocking the potential of women workers in global supply chains.

We are proud to have stood with inspirational—and powerful—women around the globe as they drive major change in their own lives as well as in the lives of their colleagues, families, and communities.

But we don’t believe in standing still. The supply chains we work in are constantly evolving; the lives and conditions of women are not static, and neither is HERproject.

To implement our strategy, we are asking brands to make a major commitment to women’s empowerment. Through HERproject, we would like to work with our partners and help them to:

- Integrate women’s empowerment into their sourcing practices;

- Support and recognize suppliers to make progress on women’s empowerment;

- Work toward a greater level of integration and buy-in at the supplier level; and

- Collaborate with peers and key stakeholders to set the agenda for improved outcomes for women in global supply chains.

We would also like committed brands to work with us to enhance the visibility of women workers in global supply chains through their collective reach and influence. We commit to help brands speak up, louder and more frequently, for the rights and welfare of these women in global policy debates.

It’s time for all of us to up our game and aim higher. For genuine change for women in supply chains, we need to commit and collaborate. Our new strategy outlines a pathway for us to achieve our vision together: empowered women, dignified work, better business.

We look forward to deepening our engagement with our existing partners and to welcoming new partners to these efforts. To learn more about these possibilities and to discuss your involvement with HERproject, please contact us.

Is Sustainable Development Still Sustainable?

In many international circles, it will sound like heresy. But now it must be asked:

Is sustainable development still sustainable?

And the corollary question:

If it proves viable, how will sustainable development look in the coming decades?

The questions are prompted by the current upheaval in global society. We now face a fierce storm of headwinds and centrifugal forces threatening the global harmony that is vital for sustainable development success.

In his new book, Us Vs. Them international analyst Ian Bremmer spells out the seriousness of this societal infection.

Here’s the money quote from his introduction:

“This book is about ongoing political, economic, and technological changes around the world and the widening divisions they will create between the next waves of winners and losers.

“It’s about the ways in which people will define these threats as fights for survival that pit various versions of ‘us’ and various forms of ‘them’.

“It’s about the walls governments will build to protect insiders from outsiders and the state from its people.”

More specifically on the roiling global forces impeding further sustainable development we see:

- Attacks on globalization via tariffs, economic walls, protectionism and xenophobic, populist nationalism

At the heart of such attacks: authoritarianism vs. liberal democracy and its institutions. Autocratic national governments are increasingly undermining liberal institutions such as the free press, law and order and diversity.

This concentration of recalcitrant power sucks out the social oxygen needed for sharing new ideas, as well as for the cooperation and innovation needed for sustainable development growth and success.

- The international refugees dilemma

A historic high of some 65 million people around the world are now displaced from their homes due to extended wars and a lack of immigration solutions. The tragic consequences: vast, complex humanitarian issues and a plague of the "Us Vs.Them" virus. Much of this turmoil is the result of divisive myths about migrants spread for political gain.

- New species of companies generating new kinds of macro social issues

Consider two relatively new company species:

- Digital behemoths such as Google, Facebook and Twitter represent a new stage of business evolution now generating or magnifying existential issues such as personal privacy, truth vs. “fake news” and the subtle, addictive psychological effects on users of their products.

- The coming wave of companies developing and/or applying artificial intelligence (AI) causing job displacements, vast economic and safety issues and potential use in anti-social applications such as weaponry.

What are the social responsibilities of these companies? How are they being met? What does a company owe to its country – and society?

The case for optimism

There does appear to be a strong case for optimism. Here's the evidence:

Responsive initiatives by the “new species” companies

The new-age, unprecedented socio/economic power and influence of these companies – Google, Facebook, Twitter, etc. -- prompts the question: What socially-oriented investments and commitments should they make, even with the possibility of sacrifice of some profit?

These digital communications behemoths – and other nascent high-tech companies -- are recognizing, and beginning to address their unique social responsibilities (sometimes under regulatory duress or pressure from employees, investors or customers).

A long-term global program for addressing pressing social issues – The United Nations Sustainable Development Goals – is now well underway.

The World Bank’s just-issued “2018 Atlas of Sustainable Development Goals” is a guide to the impressive progress already made to achieve these goals. Not incidentally, many of the involved companies are actually developing new businesses to benefit from the transformational opportunities inherent in the SDGs.

Principles of Responsible Management Education

This is the Global Compact–affiliated network of several hundred colleges and universities around the world preparing the next generation of business and institutional leaders for application of sustainable development commitments in their careers.

A new study reported by Bloomberg: “Younger millionaires feel a much stronger sense of personal responsibility to use fortunes to benefit broader society than do their older peers.”

The International Integrated Reporting Council recently produced a framework for “integrated thinking and reporting” - how an organization creates long term value in the context of its external environment. Networks of companies in a dozen countries around the world are applying the Council’s principles to their planning and reporting.

Ian Bremmer concludes his book – and perhaps provides us with an appropriate summation – with these hopeful sentiments:

“Human beings use their natural ingenuity to create the tools they need to survive. In this case survival requires that we invent new ways to live together.

“Necessity must again become the mother of invention.”

______

Adapted from “Innovation, Integration Driving Business Evolution Toward Sustainability”, Sherpa Institute 20018 Virtual Global Conference, June 20, 2018

Image credit: Flo Maderebner/Pexels

CSR Now Drives Business as Usual

Back in the day, corporate strategy meant defining a business mission and describing how those goals were to be reached through business practices. Today, setting a viable strategy means including many factors once considered outside the scope of traditional business planning. Brands are taking stands on multiple issues, from public, cultural questions (climate change, immigration, gun violence) to internal issues (diversity, ethics, harassment, gender pay gap).

Consider the new rules:

- Brand reputation is now susceptible to social trends, as extra-business entities from activists to consumers form movements to push their ideas into business practices.

- Governance now involves a large measure of risk management of external policy issues, from environmental regulations to discrimination and harassment laws.

- Employees increasingly demand a say in a company’s direction and practices

- Diversity and inclusion rule in today’s workplace and with them come a panoply of more complex management and communication approaches.

- Employee engagement is becoming embedded as part of many companies’ everyday culture, not a bolt-on activity.

- Supply chains have gone global and complex, with many moving parts to be monitored for such issues as workplace conditions, human rights, and sustainable practices.

- Markets segmentation can change radically with quickly shifting cultural tastes and social trends. Large corporations struggle to keep up with nimble, innovative start-ups.

- Investors demand more transparency and more data in sustainability reporting, and are increasingly integrating formerly qualitative, ESG factors into materiality via quantification—i.e., they’re in the bottom line.

- And not least, business strategy as it has traditionally been understood and practiced is coming up against opposing the Trump administration’s disruptive economic policy, resulting in unprecedented uncertainty in the marketplace.

In the past, “The CEO rule was basically keep your head down, stay out of complicated issues, because there were opinions on both sides of any issue,” Lawrence Parnell, program director at the Strategic Public Relations Program at George Washington University told the Wall Street Journal. “It’s no longer a question of if, but where, when and how to engage on these issues and what type of topics to engage on. These are new challenges and things CEOs and boards never had to deal with before, so they are struggling.”

In sum, corporate responsibility is now becoming a mainstream activity embedded throughout every department of a company, from HR to IR, from corporate affairs to procurement. The bottom line is straightforward: evaluation of a company’s value now depends more than ever on its values being active and visible across all areas.

So here’s the new bottom line: businesses and organizations must adopt the largest perspective possible when planning for future growth.

Originally published on Brands Taking Stands

CSR Now Drives Business as Usual

Back in the day, corporate strategy meant defining a business mission and describing how those goals were to be reached through business practices. Today, setting a viable strategy means including many factors once considered outside the scope of traditional business planning. Brands are taking stands on multiple issues, from public, cultural questions (climate change, immigration, gun violence) to internal issues (diversity, ethics, harassment, gender pay gap).

Consider the new rules:

- Brand reputation is now susceptible to social trends, as extra-business entities from activists to consumers form movements to push their ideas into business practices.

- Governance now involves a large measure of risk management of external policy issues, from environmental regulations to discrimination and harassment laws.

- Employees increasingly demand a say in a company’s direction and practices

- Diversity and inclusion rule in today’s workplace and with them come a panoply of more complex management and communication approaches.

- Employee engagement is becoming embedded as part of many companies’ everyday culture, not a bolt-on activity.

- Supply chains have gone global and complex, with many moving parts to be monitored for such issues as workplace conditions, human rights, and sustainable practices.

- Markets segmentation can change radically with quickly shifting cultural tastes and social trends. Large corporations struggle to keep up with nimble, innovative start-ups.

- Investors demand more transparency and more data in sustainability reporting, and are increasingly integrating formerly qualitative, ESG factors into materiality via quantification—i.e., they’re in the bottom line.

- And not least, business strategy as it has traditionally been understood and practiced is coming up against opposing the Trump administration's disruptive economic policy, resulting in unprecedented uncertainty in the marketplace.

In the past, “The CEO rule was basically keep your head down, stay out of complicated issues, because there were opinions on both sides of any issue,” Lawrence Parnell, program director at the Strategic Public Relations Program at George Washington University told the Wall Street Journal. “It’s no longer a question of if, but where, when and how to engage on these issues and what type of topics to engage on. These are new challenges and things CEOs and boards never had to deal with before, so they are struggling.”

In sum, corporate responsibility is now becoming a mainstream activity embedded throughout every department of a company, from HR to IR, from corporate affairs to procurement. The bottom line is straightforward: evaluation of a company’s value now depends more than ever on its values being active and visible across all areas.

So here’s the new bottom line: businesses and organizations must adopt the largest perspective possible when planning for future growth.

Originally published on Brands Taking Stands

"Mythical Barriers Fall When Moral, Technological, and Financial Imperatives are Stacked"

Christiana Figueres, former Executive Secretary of the UN Framework Convention on Climate Change

By Woon Tan and Adam Woodhall

Celebrating excellence in sustainable energy innovation around the world, the Ashden Awards 2018, now in its 18th year, continues to uncover sustainable energy heroes championing a brave new low-carbon world. Keynote at the awards ceremony was the well-known hero of the climate movement Christiana Figueres, whose unstoppable energy led to one of the most important climate deals of our time - the COP21 Paris Agreement.

Former Executive Secretary of the UN Framework Convention on Climate Change, Christiana explains that the once long- held mythical barriers to climate action are now collapsing. The carbon constraints of 2 degrees are no longer the limitation but now the huge impetus necessary for growth. Figueres reminded the attendees that old excuses such as “There is no solution!”, “It’s too complex!”, “It’s too expensive!” or “It’s already too late!” are no longer acceptable and the Ashden Awards is playing a key role in moving climate action forward.

Christiana pointed out that it becomes a “no-brainer” to take action when there is a such a compelling stack of moral, technological and financial imperatives. She said: “How blessed are we to be alive in this moment of the evolution of humankind when we can do the moral and right thing, the financially profitable thing, the technological advanced thing and be able to be put it together in coherent packages that is addressing climate change. That is a privilege”

Christiana reminded us that just a few short years ago, climate change had always been about doom and gloom. However, bottom-up innovations are appearing across all levels, and with this, we are shifting the narrative from the tragedy of the commons to the opportunity of the locals.

This year’s Ashden Award winners were described as ‘stubborn optimists’. She said: “To punch through the mythical barriers around climate change and work towards the common good it is necessary to be stubborn, optimistically stubborn. All of these fantastic winners have faced challenges, but their stubborn optimism in pursuing their goals is helping with the biggest challenge of all and that is climate change.”

The awards are the culmination of a rigorous judging process - involving a panel of industry experts and technical assessments. There were 10 awards across many areas, from a floor insulation robot to an off-grid clean energy pay-as-you-go solution.

One area of significant transformation is the transport and mobility sector; as Christiana declared, “Tonight we are all going to the inauguration of the Museum of Internal Combustion Engine.”

This is exemplified by winner of the UK Ashden Award for Clean Air in Towns and Cities, Chargemaster, the UK’s largest network of charging points. These are critical to powering electric motoring and encouraging the future uptake of EVs. Demonstrating that the Ashden judges had their fingers on the pulse, Chargemaster were bought by BP for £130m just after the awards.

Shuttl are worthy winners of the International Ashden Award for Sustainable Mobility as they are already taking 10,000 cars off the road each day in some of India’s busiest cities, and are rapidly scaling. The Shuttl app creates rush hour bus routes by responding to the demand from commuters. This provides affordable transportation on private, air-conditioned buses where seats are guaranteed, and safe for women to use. The Ashden judging panel said: “It is very rare indeed that sustainable transport interventions produce as many benefits as Shuttl, starting with the reduction in car trips which is a huge contribution to reducing congestion, pollution and improving roadsafety.”

Christiana’s keynote is a great rallying call for us to keep up the urgency needed for climate change action. Ashden Founder Director, Sarah Butler-Sloss concluded the event saying, “The winners of our Ashden Awards never fail to amaze and inspire our panel of judges, and the 2018 line-up is certainly no exception. The solutions, ideas and innovations that our winners have developed are already making a crucial difference in terms of creating access to energy, lowering carbon emissions, developing clean, sustainable solutions for cities and providing vital health and economic benefits. It is absolutely necessary for us to work together to achieve the objectives of the Paris Agreement and the UN’s 2030 Sustainable Development Goals and every one of our 2018 winners is playing a key role in moving climate change action forward.”

The International Ashden Award winners 2018 are Angaza, Chhattisgarh State Renewable Energy Development Agency (CREDA), Ecozen Solutions, Lumos Global, Shuttl, and MASS Design Group.

The UK Award winners are Q-Bot, Chargemaster,Upside Energy, and Energy Local CIC.

Originally published on Ethical Performance.

Taking a Bite Out of Student Loan Debt

To get a good job and earn a good salary: stay in school, go to college, and get a degree. So goes the conventional wisdom, and the research bears this out. Countless studies have shown that individuals with college degrees will earn more money over the course of their careers than those without a degree.

But the numbers also show that for many, the degree comes with a mountain of student loan debt that will take a good portion of their careers to pay off.

From the Class of 2017, some 70 percent graduated with student loan debt, and the average debt per graduate was $37,000. In total, some 44 million Americans are carrying nearly $1.5 trillion in student loan debt, which is more than all outstanding credit card debt and second only to mortgage debt.

While this mountain of debt seems insurmountable, a growing number of companies are starting to help by offering student loan repayment assistance to their employees.

These programs typically work like 401(k) retirement plans where the employer will match the employee’s payment toward the loan up to a certain limit. One of the pioneers in this area has been Aetna, which began offering this benefit at the start of 2017.

At the time, Aetna already had a well-established financial wellness program that had been in place for about ten years, according to Kay Mooney, VP of Workforce Well-being and Inclusion at Aetna.

Through this program, Aetna offers several vital resources to employees including free financial counseling with an unbiased certified financial planner, webinars and in-person seminars, and an online financial wellness assessment to help employees understand where they are in their journey.

Based on feedback from this program, as well as the increasing number of stories in the news, Mooney said, “we realized that student loan debt had become a problem not only for the economy in general but also for our employees.”

At this point, adding the Student Loan Repayment Program made sense. One of their existing benefits vendors was able to provide all administrative support for the plan, making it easier to roll out once they had decided to jump in, said Mooney.

Through Aetna’s Student Loan Repayment Program, the company will match qualifying student loan payments for eligible, active employees. To qualify, employees must be in good job standing, according to their last performance review, and must have earned the degree within three years of applying for the assistance program.

For full-time employees, the matching loan payments are up to $2,000 per year, with a lifetime maximum of $10,000. For part-time employees, Aetna matches up to $1,000 per year with a lifetime maximum of $5,000.

Not surprisingly, the program has been well received, with about 1,000 employees now participating. Mooney said it’s been effective for both attracting new candidates to the company, including college interns, as well as retaining existing staff.

“We’re seeing this as a recruiting as well as a retention tool for Aetna. Our recruiters and university relations partners were thrilled to hear about our plans to launch this benefit,” she said.

It has also allowed many employees to focus on other aspects of their financial health. “We hear from employees that their student loan debt has made it hard for them to even think about saving for retirement. In helping to reduce their debt, they can see the light at the end of the tunnel and in turn their focus to their 401(k) and Health Savings Account savings.”

For employees who don’t qualify, Aetna offers other forms of assistance. “Employees who are not eligible for the Student Loan Repayment Program can still take advantage of free advising sessions to help them develop strategies for paying down their balances in the most efficient way or to assess whether refinancing their loans would be appropriate,” said Mooney.

It’s still the early days for these student loan assistance plans. Only about 5 percent of companies currently offer such a benefit, according to estimates from the Society for Human Resource Management.

But there is certainly strong demand among job seekers, especially among millennials who now make up the largest portion of the workforce. In a survey by the American Student Assistance, three-quarters of respondents said that if a prospective employer offered a student loan repayment benefit, it would be a deciding or contributing factor to accept the job.

Where these plans differ from a 401(k) is in the tax implications. For the employee, matching payments made by the employer toward the student loan are considered taxable income. For the employer, these payments are not considered pre-tax deductible.

That could change pending legislation currently in Congress. The Employer Participation in Student Loan Assistance Act (H.R. 795) was introduced in February 2017 by a bipartisan Congressional group and now has 50 co-sponsors.

Under this bill, an employee could receive up to $5,250 per year in employer student loan assistance tax-free, which is how employer tuition assistance payments are now treated. As of July 2018, this bill is still with the House Committee on Ways and Means.

In the meantime, Aetna will continue to offer this assistance to its employees, and the company is anticipating roughly a 10 percent increase in participation this year, as word of the benefit continues to spread, according to Mooney.

Employees who are still early in their careers as well as those pursuing additional educational goals while at Aetna have been really excited about the program, said Mooney. "They felt that Aetna was deepening its commitment to their financial well-being and investing in their career growth by helping to reduce their debt and allowing them to make other financial decisions that they’d been putting on hold."

Image courtesy of Aetna.