President Bans Oil and Gas Drilling in Bristol Bay Indefinitely

President Barack Obama took executive action yesterday evening, Dec. 16, to protect Alaska's Bristol Bay, instituting an indefinite ban on oil and gas drilling across some 5.6 million acres in what's known as the North Aleutian Basin Planning Area.

One of the world's most economically valuable fishing grounds, the waters of Bristol Bay yield up to $2 billion worth of wild-caught seafood every year. Visiting to partake of Bristol Bay's natural splendor, recreational fishing and tourism adds another $100 million a year to Alaska's economy and communities. Home to an American fishing fleet and community that supplies 40 percent of U.S. wild-caught seafood, one of the economic and social pillars of the community is Bristol Bay's salmon run – the world's largest – as well as a bevy of endangered marine and terrestrial species of plants and animals.

President Obama's latest executive action assures that the Bristol Bay ecosystem will not be threatened by oil and gas drilling. Further, it ensures local communities and businesses can continue to pursue eco-based livelihoods and lifestyles that reach back generations. Far above Bristol Bay, another environmental threat persists, however: the massive open-pit Pebble Mine project.

Why protect Bristol Bay from oil & gas drilling?

In text and stunning photos, White House correspondent Tanya Somanader clearly and succinctly lays out the economic, social and ecological attributes that make Bristol Bay and environs a national treasure and “one of Alaska's most powerful economic engines.” It's these attributes that led President Obama to take executive action.

In 2010, the George W. Bush administration set a new lease that would have opened up about a fifth of the North Aleutian Basin Planning Area that includes Bristol Bay – some 5.6 million acres – to oil and gas exploration and drilling. President Obama temporarily withdrew the lease offer in 2011.

With his Dec. 16 executive action he has extended that ban indefinitely. Upon signing the Presidential Memorandum, the president stated:

"These waters are too special and too valuable to auction off to the highest bidder."

The Pebble Mine

Another environmental threat lies up above in the headwaters that flow down into Bristol Bay. This past March, the EPA put a temporary halt to the U.S. Army Corps of Engineers approving permit that would have allowed the Pebble Limited Partnership to move ahead with its plans to develop the Pebble Mine.

The scope and scale of the Pebble Mine Partnership's development plan is humongous, as would be its effect on ecosystems across the area and far beyond. As is typical of such deposits, the actual copper, gold and molybdenum-bearing minerals are disseminated thinly throughout the vast area of bedrock. Northern Dynasty Minerals, now Pebble Mine Partnership's sole major partner, envisages a five-year construction phase followed by an initial 25 years of production. Three subsequent development phases of 20 years each remain a possibility.

The legal process is still being played out. On Dec. 4, a federal judge in Anchorage “ordered the Environmental Protection Agency (EPA) to cease all work pertaining to its investigation of whether to block development of Alaska's controversial Pebble Mine,” Tim Sohn reported in the Huffington Post.

Senior Judge for the U.S. District Court in Alaska, H. Russell Holland, deemed there was enough in the Pebble Limited Partnership's assertion that EPA employed “an anti-mine team of experts” to conduct its investigations to warrant upholding a preliminary injunction he had issued on Nov. 24.

Noting the injunction was preliminary, the EPA said it was complying, and it welcomed the establishment of “a swift schedule to move forward.” “We are confident in our case and look forward to a prompt resolution,” the EPA stated.

As Sohn pointed out: “While the injunction represents a rare win for Pebble, the mine’s future prospects remain murky." This past April, Northern Dynasty Minerals, the owner of the Pebble Mine project's mineral rights, lost the financial and technical support of multinational mining giant Rio Tinto, the Pebble Mine project's last remaining major backer.

Where we stand

3p is an Internet media organization, a collection of like-minded Web publishers, marketers, editors and writers that depend on the Internet and information and communications technology (ICT) for their livelihoods. Without metals such as the copper and gold that Pebble Mine owners propose to exploit, we would have to find other means of earning a living, or at least another means of doing what we do.

That said, 3p is all about helping identify and share means of doing business in ways that are sustainable – ecologically and socially as well as economically. In other words, businesses based on the triple bottom line. To further identify and align with these motivating and informing values, 3p's founders registered the business as a B Corporation (B Corp.).

We've been following developments at Bristol Bay and the Pebble Mine rather closely. While we are acutely aware of our and modern society's dependence on metals and mineral resources, we believe there are steps mining companies can and should take to minimize its negative environmental impacts and assure ecosystems are restored once mining operations cease.

Furthermore, mining companies can and should assure local people and communities participate in any and all decisions regarding mineral resource exploration and development, and that their health and livelihoods are protected and assured. We stand with those in Bristol Bay and the EPA that seek to assure that current and future generations can revel in and benefit from the natural wonders the Bristol Bay ecosystem and watershed affords.

*Image credits: 1) Alaska Conservation Foundation; 2) The White House; 3) EPA, Pebble Mine Bristol Bay Assessment; 4) PeriodicTable.com

Tom's of Maine Awards $510,000 to Nonprofits in All 50 States

The votes are in, and 51 nonprofits from across the country will be able to give back more in their communities as winners of the Tom’s of Maine 50 States for Good community giving program.

Now in its sixth year, the 50 States for Good program rewards grassroots nonprofits with a total of $500,000 in project funding. Back in August, the natural personal care brand asked the public to nominate their favorite nonprofit organizations on social media, and thousands of entries poured in.

This year, for the first time, the program features 51 winners, one from each state and the District of Columbia — bringing this year’s project funding total to $510,000, with each organization receiving a $10,000 donation. (Scroll down for the full list of winners.)

“For the first time, we’re awarding more than $500,000 to support organizations and volunteers on the front lines of making communities stronger across the country,” said Susan Dewhirst, goodness programs manager at Tom's of Maine. “Every community advocate we heard from – reflected in thousands of nominations – has a unique and special vision for bringing a lasting, positive impact to where they live.”

From children’s literacy programs and urban agriculture to veteran reintegration, the winning organizations share a mutual passion for improving lives in their communities with what Tom's of Maine calls "heart and sweat equity."

Nonprofits from each state were selected from a pool of nearly 3,000 nominations by a panel of judges representing a variety of unique perspectives on human, health and environmental goodness. (I had the opportunity to judge the competition myself this year, so I can attest to how tough the choices were!) To date, the 50 States for Good program has benefited more than 5 million people and hundreds of communities across the nation, the company said.

Scroll down to check out the winners and see if your favorite made the list. You can also learn more about the winners and what they're doing to benefit both people and planet at 50StatesforGood.com.

- Friends of Campbell Creek Science Center: Anchorage, Alaska

- Druid City Garden Project: Tuscaloosa, Ala.

- Lucie's Place: Little Rock, Ark.

- Treasures 4 Teachers: Tempe, Ariz.

- What's Mine is Yours: Concord, Calif.

- Phamaly Theatre Company: Aurora, Colo.

- hawkwing, Inc.: Glastonbury, Conn.

- Common Good City Farm: Washington, D.C.

- Healthy Foods for Healthy Kids: Hockessin, Del.

- In Jacob's Shoes: Pompano Beach, Fla.

- Books for Keeps: Athens, Ga.

- Giving Back Mentoring: Paia, Hawaii

- Young Women's Resource Center: Des Moines, Iowa

- Framing Our Community: Elk City, Idaho

- Safe Humane Chicago: Chicago, Ill.

- HearCare Connection: Fort Wayne, Ind.

- Kansas Consumer Advisory Council for Adult Mental Health, Inc.: Wichita, Kan.

- Grow Appalachia: Berea, Ky.

- lowernine.org: New Orleans, La.

- Found in Translation: Medford, Mass.

- Extra-Ordinary Birthdays: College Park, Md.

- My Place Teen Center: Westbrook, Maine

- Sweet Dreamzzz, Inc.: Farmington, Mich.

- Manna Market: Fridley, Minn.

- St. Louis HELP: St. Louis, Mo.

- Stewpot Community Services: Jackson, Miss.

- Red Lodge Area Community Foundation: Red Lodge, Mont.

- Mothers and Their Children, Inc.: Raleigh, N.C.

- Metigoshe Ministries: Bottineau, N.D.

- Cross Training Center: Omaha, Neb.

- Copper Cannon Camp: Franconia, N.H.

- Seer Farms: Jackson, N.J.

- Dental Care In Your Home, Inc.: Albuquerque, N.M.

- Goodie Two Shoes Foundation: Las Vegas, Nev.

- City Growers NYC: Long Island City, N.Y.

- Riders Unlimited: Oak Harbor, Ohio

- Full Circle Adult Day Center: Norman, Okla.

- Libraries of Eastern Oregon: Moro, Ore.

- ASAP - After School Activities Partnerships: Philadelphia, Pa.

- House of Hope Community Development Corporation: Warwick, R.I.

- Palmetto Project - Begin With Books program: Mount Pleasant, S.C.

- NAMI South Dakota: Sioux Falls, S.D.

- Strings for Hope: White Bluff, Tenn.

- Elves and More: Spring, Texas

- Karma Bike Shop: Magna, Utah

- Angel Wheels to Healing: Virginia Beach, Va.

- Vermont Woodlands Association: Rutland, Vt.

- Growing Veterans: Lynden, Wash.

- Faith, Hope, & Love, Inc.: Racine, Wis.

- Boys & Girls Club of The Eastern Panhandle- Morgan County Unit: Martinsburg, W.Va.

- Sheridan Angels: Sheridan, Wyo.

Based in Philadelphia, Mary Mazzoni is a senior editor at TriplePundit. She was also the judging panel for this year’s 50 States for Good. You can follow her on Twitter @mary_mazzoni.

Boeing and South African Airways Partner on Biofuel from Tobacco

It has been ages since you could light up on a flight, but there is a chance tobacco could become an aviation fuel of the future. Boeing and South African Airways (SAA) have announced that they are close to processing the first crop of tobacco plants for biofuel production. This pilot project, which both companies have publicly acknowledged for over a year, promises so much it almost sounds too good to be true.

This time the feedstock is Solaris, a nicotine-free tobacco plant developed and patented by the Italian biotech firm Sunchem. Instead of providing leaves for cigarette production, the Solaris plant offers flowers and seeds from which oil can be extracted for fuel production. Solaris is not genetically modified, it can grow on lands inhospitable to food crops, and its by-products are high in protein and can be used for animal protein. Its promoters say it will allow tobacco farmers to continue their lives’ work while supporting the national campaign to reduce smoking in South Africa.

Amsterdam-based SkyNRG will develop the test fuel. According to the company, 123 acres (50 hectares) of the Solaris tobacco will be available for harvest next year, with a test flight on SAA to be scheduled when feasible. Along with its other partners, SkyNRG is bullish about this tobacco plant as a future feedstock, promising thousands of jobs, new skills and technologies, energy security for South Africa, and reduced carbon emissions. So, is this really a renewable jet fuel for the future?

Clearly the aviation industry is making progress on biofuel technology. Airlines are under more pressure to reduce their carbon emissions, which is hardly an easy task considering how energy-intensive it is to haul passengers around the world. While airplanes and airlines keep improving with more carbon fiber in planes’ construction, better design and therefore increased energy efficiency, calling any airline “green” or “sustainable” now is a stretch. Several alternatives have been suggested to conventional fossil fuels. For example, garbage has been touted as feedstock for jet fuel, as well as algae and sugarcane. KLM has gone further than most airlines with its weekly transatlantic flights using a blend of kerosene and recycled cooking oil. Finally, it is important to remember these biofuels are blended with jet fuel — often a 40-60 biofuel-conventional blend, sometimes 50-50, but often much less.

The challenge for Boeing, SAA and their partners will be scalability. Assuming tobacco fuel takes off, can farmers really grow enough tobacco to help slowly wean the airline off fossil fuels? The biofuels industry also faces challenges from distribution and cost: Witness the promise of cassava as a cookstove in nearby Mozambique, only for the ambitious project to get cancelled two years later. Nevertheless, projects such as this tobacco-for-fuel venture have their purpose: continued innovation and experimentation that can help improve energy security while hedging against future climate change risks.

Image credit: Cone Communications

After a year in the Middle East and Latin America, Leon Kaye is based in California again. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

"Coal Means Death for Us": Big Coal and Forced Evictions in Colombia

Here’s a sad truth: The displacement of indigenous populations as a result of international corporate development projects is a relatively common practice. A mining or agricultural company needs land, so a deal is struck with a corrupt government providing land to the corporation, whether or not it is occupied. Those with the misfortune of living in the way of the project are forced to leave, under the threat of violence or an approaching bulldozer; development begins while insufficient attention is paid to environmental concerns, leading to the pollution of local water sources; people die, either from disease or violent clashes with security forces.

Sound familiar? It should, because in weakly-governed states in Africa, Asia and South America, where governments are more interested in attracting (and siphoning off) foreign investment than in protecting the land or the people, this happens every day.

The story of the Cerrejón mine in the the Guajira region in Colombia is one such story, and it carries a simple lesson: In La Guajira, Colombia, the resource beneath the ground is more valuable than the people who live above it.

The mine

In 1983, an Exxon (U.S.) subsidiary and the state-owned Carbocol company entered a joint venture (dubbed “Cerrejón”) to mine for coal in La Guajira, Colombia, and the world’s largest open-pit coal mine was born. By 2002, Exxon and Carbocol were out, and a consortium of BHP Billiton (Australia/U.K.), Anglo American (U.K.) and Glencore/Xstrata (Swiss/U.K.) subsidiaries were in. Today, the Cerrejón mine produces more than 32 million tons of coal each year -- 60 percent of which ends up powering Europe's coal-fired plants -- while using 61,000 tons of explosives and 57 million cubic meters of water, annually.

The Guajira region’s primary inhabitants are the Wayuu people -- Colombia’s largest indigenous population -- and Colombians of African descent who fled slavery on the coast. The Wayuu have lived in the area since well before Spanish conquest, and their fierce resistance of colonial rule lead to a series of violent uprisings in the 18th century.

To the international mining companies seeking to develop and expand the Cerrejón mine, the indigenous and African Colombian populations in the Guajira region are simply in the way. As it turns out, communities are no greater impediments to mining than are layers of rock. They just have to be removed, and so the Cerrejón companies set about removing them.

Demolitions, forced evictions and strangulation

According to a lawsuit filed in Colombia by La Guajira residents, between August 2001 and January 2002, the owners of the Cerrejón mine -- at that time, Exxon, Billiton, Anglo American and Glencore/Xstrata subsidiaries -- undertook a process of displacing the African Colombian population of Tabaco by destroying the local infrastructure. With the help of the Colombian military, local government and paramilitary groups, Cerrejón bulldozed houses, the local school, a clinic and the village communications center. The demolitions resulted in hundreds of families with no homes and no place to go. Other communities were forcibly evicted or subjected to such uninhabitable conditions that they ultimately had no choice but to vacate the land (what is referred to there as “estrangulacion”).

In all, 17 villages have been displaced by the Cerrejón mine.

As a result of the Tabaco lawsuit, the Colombian Supreme Court in August 2002 ordered the local government to find a new home for the displaced. Yet, according to a 2010 report by the Danish human rights group, DanWatch, that order remained unfulfilled eight years later. (A separate complaint submitted in 2007 to Australia’s OECD National Contact Point resulted in a monetary settlement for the population of Tabaco, but produced no resolution as to the other displaced communities.)

Some of those evicted from the Guajira region were offered nominal compensation for their removal; however, no provisions were made to replace the means by which the villagers -- many of whom were farmers -- had previously earned their livings. As DanWatch pointed out of one such farmer, “his means of subsistence have been taken away from him all at once. Gone are his farm, animals and possessions.”

In addition to losing their homes and livelihoods, the people of La Guajira have been subjected to mining-related pollution to the drinking water, causing significant health problems. Dust from coal mining operations, which became particularly problematic over the summer due to drought, is unsafe at any level of ingestion but is particularly damaging to the lungs and heart following prolonged exposure.

The struggle continues

In August 2011, the Cerrejón companies approved a $1.3 billion project to increase the mine's output by 25 percent, leading to further displacements. Al Jazeera documented some of the Guajira resident’s current hardships in a mini-documentary released last week. “Coal means death for us,” one villager said. “Just like it creates light there, here it generates darkness.” The short film features numerous interviews with Wayuu and African Colombian villagers who tell of sickness, environmental degradation and financial devastation.

Repeated pleas to the mining bosses have been ignored. During one taped meeting with Cerrejón executives, an African Colombian villager who speaks of his family’s violent removal by Cerrejón in 2001 receives little more than a shrug; the company has never been sanctioned and has invested far more in social responsibility than any other company in the country, the man is told. The Cerrejón representative then complains about the villagers’ failure to recognize the company’s humanitarian efforts.

Questions and solutions

In 2010, the Cerrejón companies responded to the DanWatch report. They claimed to be “proud of what [they] have achieved in the areas of health and safety, the environment and community relations,” and touted “The Cerrejón Way” -- their “corporate culture model” developed in 2009. At one point in the response, Cerrejón claims to be “facilitating the resettlement of approximately 920 persons from small rural villages and helping them to substantially improve their quality of life.” Yet, as one to-be-relocated villager observes in the Al Jazeera video, “They don’t consider the fact that in that mud house, people were guaranteed their three meals a day.”

The issues raised by the Cerrejón mine go beyond relocation and compensation schemes and transcend corruption, weak governance or even corporate social responsibility.

Why is forced relocation ever tolerated? Even the guidelines issued by the United Nations' Office of the High Commissioner for Human Rights (OHCHR) allow for forced evictions in certain cases, so long as they are “unavoidable” and made for the “general welfare.” One can imagine how the OHCHR’s definition of “unavoidable” and “general welfare” might differ from BHP Billiton’s.

When forced evictions do occur -- and are not covered up -- companies defend themselves with payouts and resettlement offers that supposedly improve the displaced persons’ lives. Enforcement of even the strongest international human rights standards against multinational corporations, in other words, just means forcing the corporations to pay. Yet, how many international mining concerns cannot afford a few million dollars here and there if it means continuing to discover and sell a valuable resource?

This calculus is crude and backward. Forced evictions should be per se unlawful, without exception. Without such a clear-cut rule, companies will continue a policy of "exploit now, pay later," and the world's poor will continue to be treated as less valuable than the corporations that drive them from their land, or the resources above which they happen to live.

Image credit: Flickr/tenenhaus

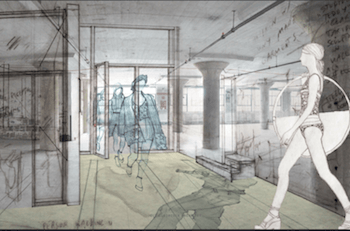

Manufacture NY: The New Model for Sustainable Innovation

New York City’s apparel manufacturing sector is about to get a makeover: To reignite local fashion manufacturing and spur economic development, the city recently announced it will invest $3.5 million to help launch the fashion incubator Manufacture New York, a co-location center with sustainability in its DNA.

Founded by Bob Bland, a Brooklyn-based fashion designer, entrepreneur and community organizer, Manufacture NY will be the country’s first fully-integrated facility with on-site, on-demand manufacturing – taking the term “Made in the USA” to the next level. Part production hub, part incubator, part learning lab, part R&D lab, the 160,000-square-foot Brooklyn facility will advance sustainably-minded research, design and manufacturing for emerging designers, manufacturers and entrepreneurs in apparel, textiles and wearable tech.

"Fashion is often viewed as innovative and forward looking, but when it comes to actual production in the U.S., it seems the sector has been slow to embrace new ideas or use sustainability as a driver for innovation,” said Patrick Duffy, Manufacture NY’s VP of sustainability and external affairs. “We’re trying to build a major center here and influence domestic manufacturing.”

The spirit of innovation certainly drives Manufacture NY’s unique model. Through its facility, local, independent designers and manufactures will have access to state-of-the-art equipment that will enable them to integrate zero-water and zero-waste elements, nontoxic dyes and ethically-derived textiles into their designs. With access to patented software tools, members will also be able to identify and source more sustainable materials, improve supply chain transparency, and monitor and report on the environmental footprint of their designs – all while decreasing production time and increasing production capacity. The facility itself will also boast high energy efficiency and indoor air quality standards.

Through Manufacture NY’s R&D center, independent fashion companies and manufacturers will also be able to explore the latest in nontoxic, natural and sustainable fibers and synthetic materials – such as bio-fabrics, bio-leathers and 3-D printed soft materials – to use in their apparel, textile and wearable tech designs.

"Technology and sustainability should not be at odds with each other, which they are often perceived to be. There are so many ways to develop technology that are more sustainable and more cost effective,” said Amanda Parkes, Manufacture NY’s chief of technology and research. “We want designers who would normally not be exposed, or have access, to this kind of innovation, because we believe that sustainability can be as core to making money as other important factors.”

Once a global fashion manufacturing hub, Manhattan’s Garment District looked a lot different than what Manufacture NY expects to build in the Big Apple. The organization’s Manufacturing Innovation Center aims to play a significant role in reawakening and rebuilding America’s fashion industry and retake the reins of homegrown apparel, textile and wearable tech manufacturing.

The site will open its doors by late 2015, and will begin bringing in manufacturers to the center in the spring.

Image courtesy of Manufacture NY

Utility-Scale Solar Photovoltaics Cheaper Than Fossil Fuels in Chile

With energy demand rising and energy imports meeting as much as 70 percent of its needs, Chile has put itself on the “fast track” when it comes to developing an abundance of clean, renewable energy resources. Recent changes in energy market regulations are proving to be keys to unlocking Chile's distributed renewable energy potential, and more broadly speaking, its sustainable development.

The same confluence of market regulatory changes, lower costs and technological advances is driving rapid renewable energy growth in the U.S. The birthplace of solar photovoltaic (PV) technology, U.S. solar energy technology and project developers are venturing overseas in efforts to expand their businesses. Given the changes recently made to the market regulations governing its energy sector, Chile has become a “hotspot” for solar and renewable energy project developers.

Case in point: SunEdison on Dec. 15 was awarded 15-year power purchase agreements to supply 570 gigawatt-hours of electricity to Chile's National Electricity Commission. Highlighting just how fast solar has become competitive with fossil-fuels in Chile, this solar energy will come at a lower cost than electricity generated by fossil-fuel combustion – and that's without subsidies or incentives.

A $700-million investment in Chilean solar PV

In a press release, SunEdison said it will invest a projected $700 million to develop 350-MW of utility-scale solar photovoltaic (PV) power plants across Chile in order to fulfill the contract's terms and conditions. SunEdison highlights just how affordable utility-scale solar PV has become in Chile:

“Electricity generated by SunEdison's solar photovoltaic (PV) power plants is now 10 to 25 percent lower cost – without subsidies or incentives of any kind – than electricity generated by fossil fuels in Chile,” the U.S.-based solar PV manufacturer and project developer states.

Recently instituted climate change and energy market regulatory changes supportive of developing distributed solar and renewable energy generation capacity are “turbocharging” Chile's energy sector. This trend is attracting long-term direct investment, creating well-paying “green” jobs and paving the pathway to sustainable development.

Last May, the Chilean Environmental Service's Evaluation and Review Committee unanimously approved construction of Cerro Dominador, a 110-MW concentrating solar power plant and energy storage system by Spain's Abengoa. Under construction in Chile's northern Atacama region, where much of the nation's mineral wealth is mined, Cerro Dominador will generate renewable electricity 24/7 thanks to a molten-salts energy storage system capable of storing the equivalent of 18 hours of electricity production.

Use of solar PV and other types of renewable energy technology “is poised to play a substantial role in fulfilling the need for increased power generation capacity” throughout the Latin America-Caribbean region, according to an NPD Solarbuzz market research report released Sept. 29.

Regulatory reform key to solar, renewable energy growth

Chile's parliament in late 2013 unanimously passed legislation raising the percentage of electricity generated from renewable energy resources nationwide from 10 percent to 20 percent by 2025. As defined in the bill, that excludes large hydropower plants with generation capacity over 40 MW. More than 3.1 gigawatts GWs of solar energy projects were approved in Chile from 2012 through November of this year. Another 908 MW were awaiting final approval.

In its press release, SunEdison emphasized the key role recent market regulatory changes are playing in fostering development of Chile's abundant renewable energy resources and enabling the Andean nation to enhance economic, social and environmental sustainability:

“The National Energy Commission in Chile recently changed the bidding process used to award electricity supply contracts for the regulated market to create a more level playing field across different kinds of energy. With these changes, SunEdison was able to bid on and win supply contracts for 570 gigawatt-hours of solar energy."

Added Jose Perez, president of SunEdison for Europe, Middle East, Africa and Latin America: "This project demonstrates SunEdison's ability to provide innovative energy solutions and compete on equal footing in the Chilean regulated market ...

“This bid represents a portfolio of strategic projects for SunEdison that will help diversify the energy mix of the Chilean grid and will help resolve the country's energy supply deficit using clean, sustainable renewable energy at competitive electricity prices."

U.S. investors will be able to participate in SunEdison's Chilean utility-scale PV projects and international expansion by buying shares in its its yield company, or “yieldco,” TerraForm Power. “The plants will be added to the call-right list of TerraForm Power, Inc., a global owner and operator renewable energy power plants,” SunEdison states.

Image credit: Intercambio Climatico

Your Investment Portfolio’s Naughty and Nice List for 2014

As most of us rush to get our holiday shopping done over the next week (or chose to do so while sitting with our tablets at the kitchen table), we'll be checking off our lists of who has been naughty or nice. You know who you are! One item to possibly check off your list is to figure out which companies in your portfolio are being naughty or nice.

SustainVest Management continues to monitor sustainability criteria for clients’ positions in their portfolios, keeping a keen eye on which companies are performing well and also the ones that are doing poorly. The below is referenced from a recent Consumer Reports list. After reading the info below, you can show off at your family holiday gatherings with some interesting information, both good and bad!

Enjoy…

THE NAUGHTY

[table id=4 /]

THE NICE

[table id=5 /]

Dale Wannen is President of Sustainvest Asset Management, an independent investment advisory firm that specializes in socially and environmentally responsible investing. He can be reached at [email protected].

Uber: Driving for Child Hunger and Gouging During a Crisis

In many ways, this is a great time for Uber. The carsharing service keeps expanding (210 cities worldwide) and has recently been valued at over $40 billion. But it also has taken a PR beating in past months, from reasons including thin-skinned executives threatening journalists to thuggish tactics in undermining its competitor, Lyft. Nevertheless, in many cities Uber has become the transport of choice. And it has tried to show a softer side, as in its current campaign to take action against childhood hunger. Fine, Uber is not donating the money, but the company is lending its technology to allow riders to kick in another $5 to their ride fares and help fund No Kid Hungry. Unfortunately for Uber, no one is talking about the rides-for-hunger campaign: the buzz is on the company’s surge pricing, or as some say, price gouging, during the tragic hostage crisis earlier this week in Sydney.

The outrage stems from Uber’s use of algorithms to set “surge pricing” into effect during rush hours, holidays, hectic Friday nights and bad weather. Uber users have long railed against this business practice, and in fairness much of that noise is an insufferable stream of whining—after all, some public transport systems like the Washington, DC Metro increase fares during peak commuting times while municipal taxi services boost fares late at night. Uber is a business, not an entitlement program for those who do not have a car.

What caused the outrage, however, was when Uber rides out of Sydney during that awful day increased as much as four-fold as the chaos in that downtown café unfolded.

Uber always responds that surge pricing is a way to motivate drivers to hit the road during times of high demand. But how Uber got egg on its face is from how it handled the situation. The company stated it was fully aware of the crisis, and according to Gawker, raised fares in order to push more drivers to head towards downtown Sydney. Most likely the snafu started because Uber’s surge pricing is an automated process, but poorly written social media messages and its already shady reputation hardly did the ridesharing service any favors. True, Uber reversed course, offered rides out of downtown Sydney for free, and said it would refund the fares, which reached as high as $200.

So once again, Uber comes across as the Freddy Krueger of the sharing economy. And the backlash is only increasing, kicking a company many see as arrogant when it is already down. Cities in the U.S. including Portland, San Francisco and Los Angeles have threatened legal action against Uber for a bevy of reasons. Spain has banned the service because of “unfair competition,” and New Delhi suspended the company’s operations after a suspected rape by one of the service’s drivers—followed shortly by Thailand. Then add the potential headache of Uber drivers unionizing and you have a company getting hit hard from all directions.

It did not have to be his way. AirBnb has had its share of challenges, but for the most part has given the impression it has learned from missteps and still enjoys a strong reputation. But perceptions of Uber are in tatters, and the company needs to stop hiding behind PR spin and show they are a partner, not a predator. A solid corporate social responsibility could help, but the childhood hunger campaign falls flat for several reasons: first, it is not original; second, it is not as if Uber is contributing its own money; and finally, the program has nothing to do with its core business. What Uber could do is look within: surely its innovative technology could find an application within the non-profit world. It could fund programs for its drivers, from scholarships to paying for more of their costs, just to show it can and will build goodwill.

These are just ideas: Uber executives and employees know their business better than anyone. But this latest fiasco in Sydney, fair or not, behooves Uber to become more serious about righting its ship—because in many ways, these sharing economy firms are like social media channels. Eventually users will get so disenchanted they will find an alternative, and despite Uber’s strength, surely there are entrepreneurs out there who have ideas on how to take on a company that to many offers more bullying than benefits.

After a year in the Middle East and Latin America, Leon Kaye is based in California again. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

Image credit: Wikipedia (Jason Tong)

Western New York: 2030

This post is an entry in the Masdar Engage Blogging Contest.

It used to be too cold up here in Western New York to ride a bike in early April, but winters have gotten shorter. I also have a lot more flexibility now than at my old job. I work at a freelance co-op where a bunch of us share office space and equipment. So, I’m out for a ride on a weekday morning.

I’m on what used to be the Inner Loop expressway. It was filled in 10 years ago and now there are trails, community gardens, playgrounds and other common spaces. One trail circles the city, while others form commuting corridors that connect a number of neighborhoods with a now-thriving downtown. Many people walk, bike or take electric buses, many from net-zero homes. There are tubes that shield intrepid bikers and walkers from the elements.

The city has grown a lot in the past decade. People are attracted by the moderate temperatures and abundant water supply. Plus, this has become a high-tech hub. Even though so much is done now using virtual worker networks and 3-D printing, the presence of major universities still attracts a skilled workforce. People have come to realize that there’s a limit to what virtual tools can provide and that there is no substitute for face-to-face interaction when important matters are at hand.

This is part of a trend emphasizing the human side of business: People are realizing that intangibles, like the richness of one’s social network, meaningful employment and the depth of sharing, are far stronger drivers of happiness and well-being than material wealth. That realization has been a key driver in our transition.

As for me, I probably wouldn’t be riding this bike if it weren’t for advances in health care. I have an arm band that transmits my vital signs to my regional health center. Early intervention made a big difference for me. Yes, the bike has an electric motor, powered by solar cells on my helmet, but I try not to use it. Bikes are safer now, too, thanks to lightweight and effective protective gear and electronic collision avoidance systems in cars.

Speaking of cars, a number of commuters use all-electrics. Most parking lots have charging stations that allow car batteries to feed the grid when demand is high. Otherwise, by charging, they store excess supply from the solar and wind installations found on many smart buildings downtown as well as the surrounding hills. Advanced hydropower systems pull base-load power from the flow of the river. Other vehicles use fuel cells, and some still use internal combustion engines, though those are mainly powered with biofuels now.

The city has also upgraded public spaces on the lakefront and the riverfront. On my left is a community garden. Some plots are allocated to people who used to be on food stamps and now grow their own food. On my right is a facility that takes organic waste from the gardens, in addition to offcuts from food processing facilities and residential yard waste, and converts it into animal feed, biofuels and compost. Everything is recycled now. The result is that we were able to close the county landfill. The sea change occurred when people who didn’t recycle began to be seen as foolish or uncool, just like people who smoked or didn’t wear seat belts did back in their time.

There has been a great resurgence of funding for schools, which now have incredible resources to engage students and prepare them for the dynamic challenges that await them. Such investment became possible with the “building from within” initiative, which coincided with a reduction in defense spending. As people began to recognize the fragility of our planet, they saw that not only nuclear war, but any kind of war was something the Earth could no longer withstand.

Yes, we have had terrible storms and droughts. Wildlife has suffered. And there are times when certain foods are impossible to obtain. But the fact that the entire world finally is pulling in the same direction, struggling to realize a shared vision of a flourishing future, makes 2030 the greatest time to be alive in all of history.

Image credit: John Grana: Flickr Creative Commons

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.

How the 2014 Oil Price Collapse Threatens Sustainability

1980 was the last time we had an oil price collapse. Americans buying fuel-efficient vehicles created the 1980 oil price collapse, just as they have contributed to today's oil price collapse. But what consumers did in response to lower pump prices during the 1980s does not bode well for today’s pursuit of sustainable solutions for our economy and climate change.

Will history repeat itself, where the 2014 oil price collapse undercuts our adoption of sustainable technologies?

1974 energy crisis sparks energy efficiency

America got acquainted with vehicle fuel efficiency in 1974, when the Organization of Petroleum Countries (OPEC) embargoed oil imports to the U.S. At the start of 1974, the U.S. was importing almost half of its oil supply. Overnight the price at the pump jumped to $1 per gallon. America’s gas pumps literally could not handle these higher prices. They were designed to record prices only up to 99 cents.

The 1974 oil embargo sparked an auto industry technology revolution in pursuit of vehicles that had both higher fuel efficiency and acceptable performance. Unfortunately, American manufacturers were unprepared to compete. U.S. auto companies launched some of the worst cars they ever produced including the Pinto, Vega and Gremlin. The technology leadership failure of American automakers opened the sales door to the Japanese auto industry selling cool and fuel-efficient cars like the Accord, Corolla and 280Z. The end results were:

- A government financial bail-out of the U.S. auto industry

- Explosive growth in Japan's economy

- A gradual fall in gas prices as more Americans began driving higher MPG vehicles.

1980 “Oil Glut” rekindled America’s love for big vehicles

America’s mass adoption of more fuel-efficient automobiles, combined with reduced economic growth caused by record high oil prices, resulted in a dramatic reduction in oil demand that cut U.S. oil imports in half. By the mid-1980s, the major news outlets were proclaiming an “oil glut” from oil supplies exceeding oil demand. In competitive response, the oil producers slashed the price of oil from $80 per barrel to below $30 per barrel to win market share. The result was a dramatic drop in pump prices.

Lower pump prices rekindled America’s love for bigger vehicles. Lower pump prices also enabled increased economic growth from increased consumer buying power. The boomer generation, enjoying more buying power plus the start of their families, began buying “mini-vans,” SUVs and full-size pick-up trucks. The government aided this shift to less fuel-efficient vehicles by applying a lower fuel milage requirement for “light trucks” that included SUVs, full-size pick-up trucks and mini-vans. By 1999, the sale of SUVs had jumped up 75 percent from 1994. The price of gasoline escalated with the increased sale of less fuel-efficient vehicles. Gas prices steadily rose from $1+ per gallon in the 1990s to a $3.50 to $4+ per gallon price range in the 2000s.

Will the U.S. repeat its mistakes?

The American consumer appears to be on the threshold of repeating their 1980s consumption mistakes in response to lower gasoline prices. Sales are soaring for full-size vehicles. The sales of fuel-efficient automobiles are lagging.

Today's CAFE vehicle fuel regulations might save America from Americans repeating their 1980s consumption of light-duty trucks that operate with lower fuel efficiency. CAFE regulations mandate a “fleet fuel efficiency” level for vehicle manufacturers. Today’s manufacturers have strong incentives to sell a fuel-efficient mix of vehicles compared to their 1980s unbridled ability to sell “light-duty” vehicles. But a potential emerging political threat to vehicle fuel efficiency is whether Americans will continue to support CAFE fuel standards in the face of lower pump prices.

Energy technology crossroads

The world faces an energy technology crossroads. The success of vehicle fuel efficiency achieved through technology leaps in engine and vehicle designs has delivered lower pump prices. Hybrid-electric and electric vehicles are now offered by Tesla, BMW, Porsche and Ferrari that deliver screaming performance and superior fuel efficiency. Achieving economies of scale is the path to reduced prices and mass-market adoption of hybrid-electric and electric vehicles. This is a path that offers sustained restoration of jobs, our economy and the environment.

California is now experiencing the economic and environmental benefits from achieving economies of scale in sustainable technologies. When I first began developing solar power in California, it was so costly that California taxpayers had to subsidize installation costs. With economies of scale, the industry no longer receives state subsidies. The cost of solar has fallen so much that California homeowners are buying rooftop solar systems to cut their electric bills by approximately 40 percent. In addition, an increasing number of rooftop solar homeowners are discovering that they can more than pay for the lease on an electric vehicle through gasoline cost savings achieved by fueling their electric cars from their home’s solar system. The net result for California is an increase in local jobs, a reduction in climate changing emissions and lower consumer costs.

America’s question is: Will it will repeat its mistakes from the 1980s? Right now it is not looking good, as consumers delight in buying less fuel-efficient, gasoline-powered vehicles now that pump prices have fallen. History has proven that this path will lead to higher pump prices from consumers reigniting oil demand. This path lays the seeds for another cyclical economic decline plus irreversible climate change.

History does not have to repeat itself. A path is in place for achieving economies of scale in technologies that can deliver a sustainable future generating local jobs, increased U.S. economic growth, sustained reduced consumer costs and a restored environment. It is now in the hands of the America consumer.

Image credit: Flickr/emdot

Bill Roth is an economist and the Founder of Earth 2017. He coaches business owners and leaders on proven best practices in pricing, marketing and operations that make money and create a positive difference. His book, The Secret Green Sauce, profiles business case studies of pioneering best practices that are proven to win customers and grow product revenues. Follow him on Twitter: @earth2017