Report Reveals Startling Differences in GDP and Inclusive Wealth

Economic theory supports the allocation of capital and investments throughout the U.S. $17-trillion -- and global $75-trillion -- economy. Conventional economic theory is rife with assumptions that not only paint a narrow, inaccurate and vastly oversimplified view of the future prospects and actual overall impacts of investment decisions, but also justify investments that, over the long-term, can drive societies over the proverbial cliff.

Efforts to move beyond narrowly defined conventional economic theory -- and measures such as GDP -- stretch back decades. On Dec. 10, a globe-spanning initiative on the part of United Nations agencies, universities and research institutes released the 2014 Inclusive Wealth Report.

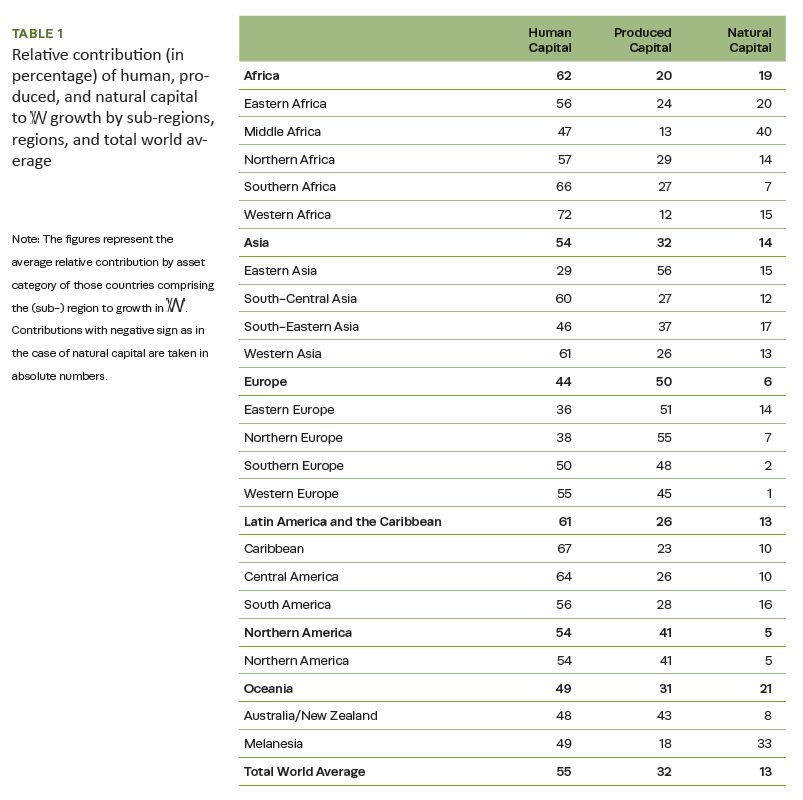

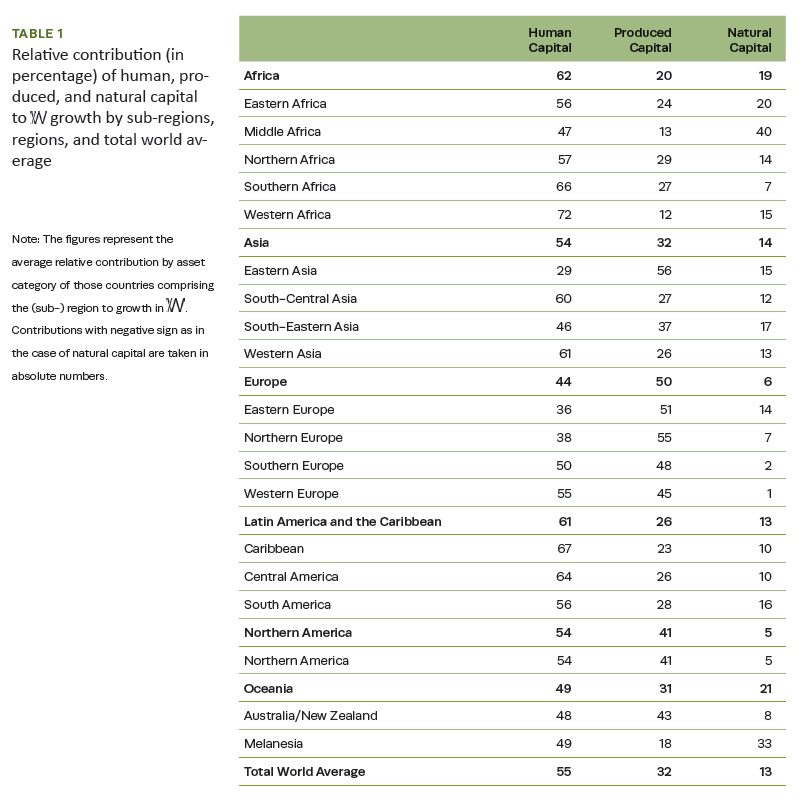

Measuring human and natural as well as produced capital, the Inclusive Wealth Index (IWI) offers a broader, more comprehensive -- and hence more useful more perspective than GDP -- regarding the economic performance of 140 nations. Moreover, comparisons of national economic performance from 1990 to 2010 as measured by Inclusive Wealth contrast starkly with those based on GDP.

A more inclusive measure of national wealth and well-being

Introduced in 2012, development of the Inclusive Wealth Index and production of biennial Inclusive Wealth Reports coincides with development of the U.N. Sustainable Development Goals (SDGs). The U.N. SDGs are to serve as the strategic blueprint that will guide policy and decision making across the U.N. organization in the post-Millennium Development Goals (MDGs) era.

Authored by 22 leading authorities from some of the world's most highly regarded universities and research organizations, IWI and IWR provide “an innovative yardstick [that] offers 140 countries a new perspective on their economic performance in recent decades, one that extends beyond Gross Domestic Product to help reflect sustainable development,” the IWI Project states in a press release.

Adding human and natural capital into the GDP equation

In addition to measuring produced capital, as is done in calculations of GDP, the Inclusive Wealth Report factors in measures of human and natural capital. As the IWI Project explains, human capital is measured in levels of education, skills and abilities.

The IWI Project's pioneering work reveals that human capital is the main source of worldwide wealth and accounts for 57 percent of total Inclusive Wealth. Natural capital seeks to measure the extent, health and integrity of “forests, sub-soil resources and other ecosystems.” Natural capital, according to the 2014 report, represents 23 percent of total Inclusive Wealth.

This year's second biennial global report highlights dramatic differences in economic performance for 140 nations over the 19-year period from 1992 to 2010, as measured by IWI and GDP. Whereas worldwide GDP rose 50 percent from 1992 to 2010, IWI rose a comparatively “anemic” 6 percent.

Small increases in human capital and “vast losses in natural capital largely explain the anemic overall growth in Inclusive Wealth worldwide despite enormous gains in produced capital,” Dr. Partha Dasgupta, chair of the 2014 report's science advisory group and professor emeritus of economics at the University of Cambridge, was quoted as saying.

"This report on changes recorded in three key types of wealth-related capital challenges the narrow perspective presented by GDP. And it underscores the need for integrating sustainability into economic evaluation and policy planning.

"Looking beyond GDP and adopting an Inclusive Wealth Index internationally is central to the post-2015 sustainable development agenda being negotiated within the UN Sustainable Development Goals."

Comparing national economic performance across three of the world's largest economies, the 2014 report project team determined that GDP in China, India and the U.S. increased 523 percent, 155 percent and 33 percent respectively from 1990 to 2010. Adding human and natural capital into the equation, Inclusive Wealth rose 47 percent for China, 16 percent for India and 13 percent for the U.S.

More startling differences between GDP and Inclusive Wealth are apparent in other countries, the IWI Project highlights:

- Ecuador: 37 percent GDP vs. -17 percent IW

- Guyana: 97 percent GDP vs. -2 percent IW

- Qatar: 85 percent GDP vs. -53 percent IW

- Tanzania: 67 percent GDP vs. -37 percent IW

- Uganda: 95 percent GDP vs. -6 percent IW.

Data and charts of Inclusive Wealth spanning all 140 nations covered in the 2014 IWR are available here.

Published by Cambridge University Press, the full 2014 IWR is available here.

*Image credits: Inclusive Wealth Project

Why Uber is Not Part of the Sharing Economy

Last week Uber raised $1.2 billion in its latest round of funding, bringing the company's value to about $40 billion. The headline on TheStreet was: “Uber's $40 Billion Valuation Nears Facebook Territory as Sharing Economy Continues to Soar.”

I find this headline quite accurate except for one thing – Uber is not part of the sharing economy.

I know that it might sound a bit strange, as Uber is one of the more common examples of the sharing economy. But bear with me for a minute while I try to make the case as to why Uber, despite being a business success story, still shouldn’t be considered as part of the sharing economy.

Looking at definitions of the sharing economy, one might actually think there’s no problem with addressing Uber as part of it. For example, in a 2013 report prepared for the European Commission, The Sharing Economy Accessibility Based Business Models for Peer-to-Peer Markets, the authors define the sharing economy as a space including “companies that deploy accessibility-based business models for peer-to-peer markets and its user communities.” Another definition comes from Adam Werbach, co-founder of Yerdle: “With sharing economy there are activities that take underutilized resources bringing them to use through the application of technology and community.”

Both of these definitions could fit Uber, especially with regards to its UberX service, in which ‘regular’ drivers use their own cars to provide customers with rides.

However, I believe that there’s more to the sharing economy than just creating peer-to-peer marketplaces and making a better use of underutilized resources. Take for example the framework Rachel Botsman, the co-author of “What Mine is Yours,” offers. She describes the core values of the sharing economy (or the collaborative economy as she refers to this space) as empowerment, collaboration, openness and humanness. “In terms of the underlying philosophy, it’s about putting these values above the end goal of profit maximization,” she writes.

Now, this might sounds like a narrative taken from a hippie lexicon, but to me it puts the finger right on the spot. The economic viability of the sharing economy is important, but so are the human values it promotes. After all, the hope (at least mine) is that the sharing economy will provide us with the much-needed vision of how a more sustainable future or a more humanized way of living would look.

To me, enhancing humanness through the sharing economy is not limited to the interactions between the service provider and the user, where we learn to trust strangers or redefine our sense of community. It is also about the values the organizations involved in the sharing economy stand for – we can’t hope to create the change we want to see in the economic system and humanize it if the new players have the same values the the old ones have. Would it really make a difference, for example, if Lending Club will replace Bank of America as America’s top lender -- but will have the same values?

And this is where Uber fails.

While the company puts a lot of effort in the interactions between customers and drivers, creating seamless and frictionless user experiences, it seems to be failing time and again when it comes to ethics, governance and embedding human-based values into its core business. Recent examples include using aggressive, questionable tactics to undermine Lyft and other competitors, allegations of privacy violations of customer data, and the revelations that Senior Vice President Emil Michael suggested the company should consider investigating the private lives of journalists critical of Uber.

After looking at these examples I thought no story about Uber could surprise me, but one I read last week actually did: Profs. Zeynep Tufekci and Brayden King wrote in a New York Times Op-Ed about “a 2012 post on the company’s blog that boasted of how Uber had tracked the rides of users who went somewhere other than home on Friday or Saturday nights, and left from the same address the next morning. It identified these “rides of glory” as potential one-night stands. (The blog post was later removed.)”

While these stories didn’t seem to undermine investors’ trust in the future of Uber, the media seemed to explode with explanations on what’s wrong with the company. PayPal co-founder Peter Thiel, who is also an investor in Lyft, called Uber "the most ethically challenged company in Silicon Valley." Prof. Arun Sundararajan compared Uber to Airbnb, explaining why the latter lacks the right “platform culture.” Robert Cyran suggested on DealBook that “Uber is one startup that needs to grow up fast.”

My two cents are that what we see is the result of a missing ingredient, humanness, which is required in every sharing economy recipe. Again, this is much more than just creating great interactions between service providers and users. It is best described by Nobel peace laureate Desmond Tutu, explaining the meaning of ubuntu -- the essence of being human:

“Ubuntu is very difficult to render into a Western language. It speaks to the very essence of being human. When you want to give high praise to someone we say, “Yu, u nobuntu”; he or she has ubuntu. This means that they are generous, hospitable, friendly, caring and compassionate. They share what they have. It also means that my humanity is caught up, is inextricably bound up, in theirs. We belong in a bundle of Life. We say, “a person is a person through other people”. […] I am human because I belong, I participate, I share.”

So, while Uber’s recipe seems to include many right ingredients I believe it still needs to find the way to add a lot of humanness into it. Only when we could say on Uber “Yu, u nobuntu,” it will be rightfully considered part of the sharing economy. Until then it’s just a successful car service business.

Image credit: Adam Fagen, Flickr Creative Commons

Raz Godelnik is an Assistant Professor of Strategic Design and Management in the School of Design Strategies at Parsons The New School for Design.

Are Cities the New Cigarettes?

By Jona Jone

We are living in a crucial time in Earth’s history — a time in which over half of the world’s population is now living in cities. This number is continuously rising, and with it comes the rise of pollution. Reports indicate that half of the world’s biggest cities are severely polluted, and the forthcoming setting for each of these places is looking grim.

Pollution comes in many forms, all of which capable of causing serious damages to our health. However, there is one form of pollution that harms us the most, simply because it is in the air we breathe. Humans are constantly breathing, and it is only logical that the more polluted the air we breathe, the more damage it causes our lungs. According to the World Health Organization (WHO), air pollution is responsible for more than 6 million deaths per year. In fact, air pollution is even causing more deaths than AIDS and malaria combined.

A study released by the United Nations in 2011 examined outdoor air pollution in almost 1,600 cities in 91 countries. The study, which used fine particulate matter as a measure of the severity of air pollution, notes that half of the world’s urban population are living in cities that have 2.5 times more of the recommended levels of fine particulate matter indicated by the World Health Organization (WHO) Air Quality Guidelines.

It is said that the current cities of the world are slowly killing us. Recent studies reveal exactly why.

The current cities, the future cigarettes

Smoking, the ultimate precursor of lung-related diseases around the world, is an old habit most people find very difficult to quit. They are paying the price for this dangerous vice, and it is for them to deal with — or so you think. These days, even a non-smoker is unknowingly smoking several cigarettes a week. How is this possible?

Experts have done the math: A day in some of the world’s most polluted cities is tantamount to smoking various amounts of cigarettes, depending on how much particulate matter is present.

Take, for example, the city of Beijing. It has been computed that, on an average day in this city, an average adult inhales a total of 1.8 milligrams of PM2.5 particles from air pollution, which is a sixth of that found in an average cigarette. This means that the mere act of walking around this city is forcing you to smoke. The most pressing concern here is that this severity of air pollution has been linked to an increased risk of lung and bladder cancers. In fact, it is the leading environmental cause of cancer deaths. This further justifies the claim that air pollution is continuously increasing death rates around the world.

This applies to numerous cities across various countries. A 2014 study conducted by the WHO even lists the 10 most air-polluted cities in the world, most of which are in India and Pakistan. Your city may not be on this list, but it is better to not be complacent. There are still multiple ways in which you can prevent converting your city into a giant cigarette.

Green living: The world’s most powerful cigarette filter

The sudden rise in urbanity has indeed caused a spike in air pollution levels around the world. It is a good thing though, that we are seeing substantial effort to combat and prevent air pollution. Green living, green architectural designs, and numerous other green innovations are setting the standard for future city trends. With energy-efficient home designs becoming one of the most proactive efforts, even condos buildings in key cities are now geared towards sustainability.

Calling the world’s cities “the new cigarettes” may be a loaded claim, but it really is not. The air we breathe has been polluted with a mixture of toxins and cancer-causing substances—which are the main ingredients of actual cigarettes. But hope is seen in many urban cities around the globe—and as mentioned earlier, people are gearing to more sustainable ways of living, and it is evident in the way they choose to build their homes.

Since construction holds the largest single share in the consumption of our global resources, it is also one of the main contributors to air pollution. This being said, it is only logical that to start rehabilitating our cities, we look at the very core of urbanity—which is the industrialized city setting. Charging the urban scene with green innovations may be just the filter we need for all these growing “cigarette cities.”

Image credits: 1) Flickr/Safia Osman 2) Flickr/hazara

Jona Jone has been a mortgage originator in Philadelphia, PA. She is also a Business and Property Specialist. She has been writing articles about real estate investment, business, parenting and living.

Republican Congressman to Introduce Climate Change Bill

Eventually the truth, like cream, rises to the top, though it sometimes takes a long time. Perhaps it’s because we live in a world with so much technological capability that allows us to merely think of something and it becomes true -- which has led us to believe whatever we wish to be true is true. In other words, some of us appear to have lost the distinction between fact and fantasy.

Sadly, there are a number of things out there that, no matter how hard we might wish it otherwise, are facts. Death and taxes are two (though if you have enough money you might be able to avoid the second one). The fact that the massive amount of combustion products we’ve emitted over time has substantially altered our planetary climatic system is a third. It seems that the facts are on one side, while the money is on the other, which might explain the standoff we’ve been seeing in Washington.

There is a young man in Congress, a Republican named Chris Gibson, who has announced his intention to put forth a resolution that will help others “recognize the reality” of the situation. Gibson, who represents the 19th district in New York (Hudson Valley), is basing the move on what he has observed:

"My district has been hit with three 500-year floods in the last several years, so either you believe that we had a 1 in over 100 million probability that occurred, or you believe as I do that there's a new normal; and we have changing weather patterns, and we have climate change. This is the science."

Gibson, who was just re-elected in November, does not have a particularly strong environmental record. The League of Conservation Voters (LCV) gave him a rating of 43 percent this year, though it has improved steadily since his 17 percent rating in 2011, which suggests that his position is evolving. Last year he voted against fracking, though he also voted to prioritize oil drilling on public lands. This year he voted against undermining the EPA and the ability to use sound science, while at the same time, voting for the Keystone XL pipeline.

Gibson stands in marked relief from fellow Republicans like Sen. James Inhofe, who are outright deniers. Gibson understands which side the facts are on.

"I hope that my party — that we will come to be comfortable with this, because we have to operate in the realm of knowledge and science, and I still think we can bring forward conservative solutions to this, absolutely. But we have to recognize the reality."

Gibson hopes the bill will, "harken us to our best sense, our ability to overcome hard challenges."

Specifics of the bill are not yet clear. Gibson acknowledges signing the Koch brothers pledge, but denies that the pledge was to “do nothing” about the problem. Instead, as he points out on his website, he merely pledged to “oppose any legislation relating to climate change that includes a net increase in government revenue."

That sounds like a matter of semantics, though it does leave open the idea of a carbon tax in which the funds collected are redistributed back to consumers, a popular option. As to why he felt the need to sign the Koch brothers pledge is another question, though it could have something to do with financial support. He claims it’s because he opposes raising energy prices.

Still, Gibson has voted in support of renewables and against subsidies for fossil fuels, making him a true rarity among Republicans. What remains to be seen is what kind of support he can garner among his Republican colleagues. Perhaps the time has come for a meaningful first step.

Image compilation by RP Siegel

Largest School District In the U.S. Will Serve Antibiotic-Free Chicken

Children attending schools within the Los Angeles Unified School District (LAUSD), the largest school district in the nation, will soon be eating better meat. The LAUSD’s Board of Education recently approved the 2014 Good Food Procurement Resolution which calls for food procurement guidelines to include antibiotic- and hormone-free standards. The LAUSD is the largest food purchaser in Los Angeles, the second most populous city in the U.S., serving 650,000 meals a day.

The Resolution is part of the Good Food Purchasing Pledge. Developed by the LA Food Policy Council (LAFPC), it has been described as being Leadership in Energy and Environmental Design (LEED) type standards for food. In October 2012, the City of Los Angeles signed the Good Food Purchasing Pledge, and few weeks later the LAUSD signed it. It consists of five key values: local economies, environmental sustainability, valued workforce, animal welfare and nutrition. It includes a tiered, points-based scoring system. It also features a baseline commitment: To be a Good Food Purchaser, a baseline for each value is required to be met.

"The passing of the resolution shows the bold steps school districts are taking to ensure the health and wellness of students," said Laura Benavidez, deputy food services director for LAUSD. "Providing the best possible, highest quality food for students shouldn't be a privilege, it should be a standard."

The Urban School Food Alliance focuses on improving chicken served at cafeterias

The Urban School Food Alliance, a coalition of the nation’s largest school districts, which includes LAUSD, announced an antibiotic-free standard that companies can implement when supplying chicken products to schools. The alliance focuses on chicken because it is one of the most popular food dishes served at cafeterias.

The standard requires the following:

- Chickens must not be given any antibiotics, ever

- No animal by-products in the feed

- Chickens must be raised on an all-vegetarian diet

- Chickens must be humanely raised as outlined in the National Chicken Council Animal Welfare Guidelines

The alliance formed almost two years ago with the aim to use joint purchasing power and influence to bring costs down while setting better standards for the food served in member schools. Alliance members procure over $550 million in food and supplies a year, serving over 2.9 million students daily.

Why antibiotic free chicken is important

The majority of antibiotics sold in the U.S. (about 80 percent) are used on farm animals, including chickens, according to the Natural Resources Defense Council (NRDC). And most of the antibiotics given to farm animals are given routinely, mixing them daily into food and water, which contributes to antibiotic resistance in humans.

The Centers for Disease Control and Prevention (CDC) estimates that more than 2 million people in the U.S. become sick every year with antibiotic-resistance infections. At least 23,000 die as a result. The CDC states in a 2013 report that “up to half of antibiotic use in humans and much of antibiotic use in animals is unnecessary and inappropriate and makes everyone less safe.” The World Health Organization (WHO) cites the “inappropriate use of antimicrobial drugs, including in animal husbandry” as a factor in the rise of antibiotic resistance.

Image credit: DC Central Kitchen

Telecoms giant teams with Unicef to champion online safety

Millicom and Unicef have agreed to a three-year alliance to improve respect for children’s rights in the telecommunications sector.

The telecoms giant and the international children's charity plan to create standards for good practice in the telecommunication sector that protect children online and respect their right to privacy, freedom of thought, opinion, culture and safety.

The alliance will develop and promote industry-specific guidance on how the telecommunication sector can improve respect for children’s rights, specifically through implementing the Children’s Rights and Business Principles.

The two organisations have been in discussions since 2012, when Millicom provided feedback on Unicef’s Children’s Rights and Business Principles tools for implementation. Millicom then piloted Unicef’s Children’s Rights Checklist at its operations in the Democratic Republic of Congo.

Millicom’s executive vp of Strategic Operations and Partnerships, Rachel Samrén commented: “Companies have many strategic and direct ways to influence children’s lives positively, beyond charity work or fighting child labour. At Millicom, we always ‘demand more’ and so we are proud to be at the forefront of putting into action the great work with UNICEF that takes a wider perspective on business responsibility and children.”

"Unicef is committed to working with business to identify the shared value that can be created when improving child rights within each industry,” added Gérard Bocquenet, Unicef's director of Private Fundraising and Partnerships. “We are proud to join Millicom in identifying how children can be better protected online in this growing virtual world. It is truly an important issue that is increasingly relevant to children everywhere."

And I would walk 500 miles… actually make that 39,397!

The Proclaimers don't know the half of it! When posed with the challenge – can you walk to Seoul, South Korea in 14 weeks? Over one hundred staff at Kia Motors UK head office immediately said yes! Armed with pedometers every step was counted in the walk to Seoul.

As a further incentive the company agreed to pay £1 for every mile walked in those 14 weeks. In total 39,397 miles – that’s 79,618,377 steps - were counted, which resulted in Kia donating £40,000 to its local charity – Walton Charity.

Since partnering with Walton Charity, staff at Kia Motors have helped in numerous ways – from spending time painting offices for local companies that were flooded at the start of the year, through to digging local allotments and donating food and toys for the Walton food banks and Burwood playgroup charity.

Jackie Lodge, chief executive at Walton Charity said of the support form Kia “The time that staff at Kia have committed to helping us in the last year has been such a positive experience for all involved. The Walton area is seen as an affluent area but there are many members of the community both young and old that need our help

“The £40,000 raised means that we can now combine this with the monies received from our recent merger with Thames Homeless Project to fund buying a residence for supported housing for people in difficulties. The additional £40,000 will buy us an extra bedroom, which in the long term will assist more homeless people in the borough.”

Gary Tomlinson, head of HR and facilities at Kia Motors who helped co-ordinated the Walk to Seoul added: “We never expected so many members of staff to take up the challenge – the levels of competitiveness shown has been a great surprise – the number of staff who would just get up and walk about just to get their steps up was a real incentive for everyone to get moving. The knowledge that we were all raising money for Walton Charity made everyone want to walk more”

“No TTIP” Christmas card submitted by singing Santas

This week a group of campaigners dressed as Santa Claus presented an over-sized Christmas card to the Department for Business, Industry and Skills (BIS) on behalf of the million people across Europe who had signed a petition calling for the end of controversial trade deals being pushed through between the EU and North America.

Over the course of 2014 the trade deals have become increasingly contested, with a wide array of politicians, trade unions and civil society groups articulating the threat that the trade deals would pose to vital public services. Critics have also pointed out that the trade deals would give more powers to multinational corporations to sue governments in secret courts for introducing legislation designed to benefit citizens, that might be harmful to the corporations’ profits.

Over a million people across Europe signed the petition calling for TTIP and CETA to be scrapped in the space of just two months.

Polly Jones, the head of campaigns and policy at the World Development Movement who attended the protest said: “More than a million people across Europe have voiced their opposition to TTIP because of the threat that it poses to vital public services and to legislation designed to protect labour and environmental standards. These secretive trade deals would deliver an unprecedented amount of power to corporate interests at the expense of taxpayers and of democratic process and they must be stopped.”

The event in London mirrored a parallel event in Brussels on the same day where around 100 campaigners in Brussels from the Stop TTIP coalition submitted a birthday card to Commission president Jean-Claude Juncker on the occasion of his 60th birthday, which again symbolically represented the more than a million people across Europe who had signed the #noTTIP petition.

SABMiller Makes the Case for Confronting Water Scarcity at Lima Climate Conference

Latin America is relatively water rich compared to other regions in the world. But there are still plenty of areas in Central and South America feeling the effects of climate change, generally because the precipitation is occurring where there is low population density. For example, Lima, the host of this week's United Nations Climate Change Conference and home to 8.5 million people, only receives about 6.4 millimeters (0.30 inches) of rain annually.

Ironically for beverage companies, they are often expanding their businesses into areas that are already struggling with water scarcity. To that end, one large global brewer, SABMiller, says businesses need to make the business case for addressing water stress and climate change throughout Latin America.

As with the case of many beverage companies and brewers, Latin America is a growth market as more citizens enter the middle class and can now easily afford a beer or two. The problem, however, is that new breweries are often opening in municipalities that are already coping with water stress. To address the issue, SABMiller, which has concentrated its business in Colombia, Ecuador, El Salvador, Honduras, Panama and Peru, has partnered with other organizations on water conservation and treatment programs for several years. One of them, the Water Futures Partnership, works with the World Wildlife Fund and the German development organization GIZ on recharging aquifers while reducing dependence on groundwater. According to SABMiller, such programs not only address water stress, but can also benefit businesses that invest in water security within Latin America in the long run.

SABMiller aims to set an example with its new sustainable development strategy, which the company calls “Prosper.” Among the company’s updated goals it seeks to achieve by 2020 include:

- Reduce the water-to-beer production to 3:1. Globally, the amount of water the company consumes to make one liter of beer is about 3.5:1, and has gone down incrementally over the past several years. The company says its current mark has been reached a year early.

- Reduce its carbon footprint within its value chain by 25 percent per liter of beer.

- “Secure the water supplies we share with local communities through partnerships to tackle shared water risks.”

- Establish programs to mitigate water risks for the key crops important within its supply chain.

Whether anything comes from the announcement of these goals at the Lima Climate Change Conference remains to be seen, but SABMiller has been one of the more proactive beverage companies. The company has concentrated a lot of its water stewardship work in Peru. The country of 30 million will be Exhibit A of how well the company performs: Fifteen percent of Lima’s population, for example, has no access to municipal water, and the country is still reeling from a drought earlier this year that led to water rationing. The city also suffers from a faulty infrastructure: As much as 38 percent of Lima’s water supply is wasted due to leakage and illegal tapping of pipes. Such challenges are a perfect opportunity for SABMiller and its competitors to show they are willing to solve some of the pressing problems related to clean and safe water in the coming years.

After a year in the Middle East and Latin America, Leon Kaye is based in California again. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

Image credit: SABMiller

Move Over Lithium-Ion: Vanadium-Flow Batteries Gain Commercial Traction

Early this year, California became the first state in the U.S. to start making use of advanced, distributed energy storage systems. The list of factors motivating the passage of California's energy storage mandate – AB2514 – is substantial. It encompasses integrating the fast-growing amount of renewable energy generation capacity coming online, enhancing grid reliability and resiliency, neutralizing the high and volatile costs of fossil fuels, and addressing the growing costs of climate change adaptation and degradation of ecosystems and natural resources.

Making billion-dollar investments in solar photovoltaic (PV) and lithium-ion (Li-ion) battery manufacturing, Elon Musk-led SolarCity and Tesla are gambling on their ability to dramatically lower the costs of solar PV and Li-ion battery storage technologies to cover all these bases. On Nov. 5, Southern California Edison (SCE) made its own foray into advanced energy storage, making U.S. power industry history when it awarded local capacity procurement contracts for over 260 megawatts of storage capacity across its Western Los Angeles Basin service territory.

Li-ion batteries lie at the core of most of these planned energy storage investments and deployments. But there are other alternatives that may be better suited when it comes to building an economically and environmentally sustainable energy infrastructure for the 21st century. Having closed its first sales contracts here in the U.S., Imergy Power Systems' vanadium-flow battery systems offer distinct advantages as compared to their Li-ion counterparts, company President Tim Hennessy told 3p. For those unfamiliar with vanadium, it is a soft element, found in about 65 different minerals, that naturally resists corrosion.

Putting flow into the battery storage landscape

Some 200 of Imergy's vanadium-flow batteries are up and running in countries around the world, storing energy for home and property owners; remote, off-grid commercial users; and across institutional microgrids. The majority are operating in India, where Imergy anticipates having 100 units installed by the end of 2014. The Fremont, California-based company's vanadium-flow batteries are also up and running in Kenya, Nigeria and South Africa, as well as in Europe (Slovenia).

On Nov. 5, Imergy announced its first sales in the U.S.: a purchase order for four of its 5-kilowatt/30-kilowatt-hour ESP5 vanadium-flow battery systems by Hawaii's Energy Research Systems.

Two of the ESP5s will be used by residential customers in Hawaii who intend to install the vanadium-flow batteries in conjunction with off-grid solar power systems. Another will be used to assess a variety of clean energy technologies, such as solar, hydrogen production and advanced energy storage, as elements of a microgrid.

The fourth installation in Hawaii will involve installing an Imergy ESP5 vanadium-flow battery in conjunction with a solar PV system at a technical school's science center. Having already earned LEED Platinum and Living Building Challenge certifications, the undisclosed technical school science center aims to take its entire campus off-grid using renewable energy and energy storage technologies.

On Dec. 1, Imergy announced it had won a second order for its vanadium-flow batteries here in the U.S. Three Imergy ESP30 vanadium-flow batteries are to be installed as part of a Smart Microgrid Project sponsored by the California Energy Commission and hosted by the U.S. Navy at its Mobile Utilities Support Equipment facility at Port Hueneme.

Sponsored by the California Energy Commission (CEC), Imergy's vanadium-flow batteries will serve as a core element of a smart microgrid test and evaluation. The Smart Microgrid project will focus on developing applications and use-case scenarios to optimize power consumption at military bases, college campuses, industrial parks and other institutions, according to the companies.

With Foresight Renewable Solutions the lead project developer, a 100kW/400kWh instance of Imergy's vanadium-flow battery technology will be put through its paces. The system will be rigorously assessed from summer 2015 to the end of the year in concert with up to 150-kW of solar PV capacity and the GELI (Growing Energy Labs, Inc.) Energy Operating System (EOS).

Four attributes will serve as the criteria for evaluation of the CEC-Navy smart microgrid's performance:

- Demand charge management: The project will demonstrate how well the system can release short bursts of energy when demand peaks occur, enabling users to reduce their electricity bills by lowering their utility demand charges;

- Load shifting: The project will prove how well the system can shift load from higher-cost times of day to lower cost times of day, enabling users to reduce their electricity bills by shifting load to times when electricity prices are lower;

- Solar firming and ramp rate control: The project will show how well batteries can smooth out the jagged nature of solar power production, helping solar power systems provide more consistent power throughout the day;

- Island mode: The project will demonstrate how well a photovoltaic solar system and battery storage, disconnected from the grid, can provide energy for a user’s critical loads during a given time period. This has potential to enable secure deployment of similar systems at remote, mission-critical facilities.

The unique chemistry of vanadium-flow batteries

Imergy's ability to take full advantage of vanadium's chemical properties makes its ESP series unique in the world of battery storage and ideally suited across the full range of advanced energy storage applications and project scales, CEO Tim Hennessy told 3p in an interview.

The batteries can can ramp up or down and pass through full charge/discharge cycles in a matter of milliseconds as compared to minutes for natural gas “peaker” plants. This enables the batteries to deliver electricity at utility-scale over periods of four, six and even eight hours. Rapid response and smooth ramp-up and ramp-down translate into a more efficient delivery of electricity at lower cost.

That also makes them very well-suited – and better matched than Li-ion battery storage systems – when it comes to integrating solar, wind and other intermittent renewable energy resources into power grids. These attributes are also of critical importance when it comes to recovering from grid outages and failures, which enhances the resiliency and reliability of electricity supply, Hennessy contends.

Longer discharge duration and greater scalability are other key differentiating factors of vanadium-flow batteries, Hennessy continued, making Imergy's ESP30s better suited for grid-scale applications. Furthermore, the electrolytes used never need to be replaced, they're nontoxic and non-flammable.

The key to success for advanced energy storage solutions is duration, Hennessy said. “You need storage that's low in cost on a levelized basis, over the entire lifecycle. [Battery storage] won't work if the batteries will only last for 300 or 400 charge/discharge cycles. You need something that lasts the equivalent of 15 to 20 years – the average life of PV systems.”

Imergy's vanadim-flow batteries fit the bill, Hennessy continued. Separating the energy conversion from energy storage elements of battery storage, “you only need to add more electrolyte[s] to add more hours of storage capacity. The incremetal cost of that is very low. Besides which, our vanadium-flow batteries are basically 'plug-and-play' with PV and even micro-wind systems."

The environmental benefits of energy storage

Whether vanadium-flow, Li-ion, pumped hydro, thermal, compressed air or flywheel, today's advanced energy storage solutions offer a big advantage to conventional use of fossil fuel-based grid storage and distribution assets: zero, or near-zero, greenhouse gas emissions and small environmental footprints.

Imergy uses recycled vanadium from environmental waste in manufacturing its advanced battery storage systems, adding to the CEC-Navy smart microgrid's advantages as compared to conventional alternatives.

Lower energy costs

Deploying solar PV and other renewable energy resources in combination with vanadium-flow batteries makes eminent sense in places where grid power has proven uneconomic or otherwise inaccessible.

Imergy's vanadium-flow batteries are already lowering energy costs, greenhouse gas emissions and environmental pollution in places like India, Kenya, Nigeria and South Africa. Imergy sees loads of prospects – pardon the pun – across the Caribbean, Central and South America, as well as Hawaii, California, New York and other U.S. states.

“Anywhere where diesel is being used to generate electricity, consumers are going to be paying anywhere from 40 to 80 cents/kWh for that energy,” Hennessy said. “If you correctly include a flow battery, you can improve operational and maintenance costs. And if you add solar, you can bring costs down to the 30- to 25-cent range. That sort of spread is obviously significant per kWh, and there's your payback.”

*Image credits: 1) Eos Energy Storage; 2), 3) Imergy Power Systems