Starbucks Updates Animal Welfare Standards

Starbucks recently updated its animal welfare standards. They include phasing out sow gestation crates and cages for chickens, eliminating the use of artificial growth hormones, and eliminating the use of fast growing practices for poultry. The standards will aso address concerns related to dehorning, tail docking, and castration, and supporting the responsible use of antibiotics. The updated standards are a continuation of the buying preference in North America the company established in 2009 to use best industry practices for dairy, egg and meat production.

Starbucks stated on its website that its priority is “ensure we offer food made with ingredients such as cage-free eggs, gestation crate-free pork, and poultry processed through more humane systems such as CAK [controlled atmosphere killing].” The company has yet to create timeframes but is working to create them. Despite the lack of timeframes for each issue, the Humane Society of the U.S. (HSUS) said in a statement that “this may be the most comprehensive animal welfare policy of any national restaurant chain, because this announcement includes both shell and liquid eggs (which are used for its pastries, which it sells in such volume).”

Starbucks updated standards come just in time. Several laws concerning egg-laying hens will go into effect in California on January 1, 2015. In 2008, California voters passed the ballot measure Proposition 2 that requires egg-laying hens to be able to stand up, lie down, turn around and fully extend their wings. In 2010, California lawmakers passed legislation that requires shell eggs sold in California comply with Proposition 2. In other words, all shell eggs sold in the golden state must come from cage-free hens.

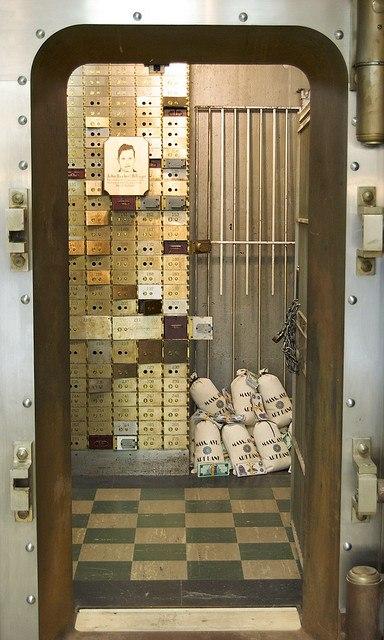

The cruelty of confinement and phasing it out of supply chains

Most egg-laying hens in the U.S. are kept in battery cages that give them, on average, 67 square inches of space. That is less than one sheet of letter-sized paper. The hens are not able to spread their wings in such a small space. Being in such a confined place means that caged hens can’t engage in natural behaviors like nesting, perching and dustbathing. Sow gestation crates are just as small and cruel as battery cages. The majority of breeding pigs in the U.S. are housed in gestation crates that are about two feet wide. They are so small that the pigs can’t turn around or take more than one step.

Many companies over the last few years have committed to eliminating battery cages and sow gestation crates from their supply chains. Fast food chains like McDonald’s, Arby’s, and Burger King have committed to phasing out gestation crates. So have supermarket chains like Kroger’s and Safeway. It’s a good thing for both the animals and the bottom line of the companies shifting away from cruel confinement systems. The fact remains that consumers want humanely produced food. The 2014 Cone Communications Food Issues Trend Tracker found that 69 percent respondents said they prioritize animal welfare when buying meat. A recent poll by HSUS of Californians found that most support Proposition 2.

Image credit: Compassion in World Farming

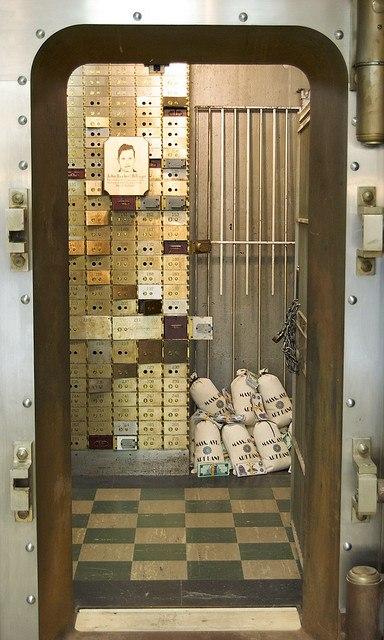

The Avian Flu: The Low-Down for the New Year

Revelations that two strains of avian flu were detected last week in Oregon and Washington has poultry farmers and some nations around the world on edge. The U.S. Department of Agriculture says the virus poses little risk to human populations. But what does it mean for the chicken and turkey industry, and how does it affect the average consumer? Here's what is known so far:

Two strains, likely one source

H5N8 (detected in British Columbia, Canada in early December) and H5N2 (found in Oregon and Washington state in late December) are believed to be mutated strains of an avian influenza that emerged in Asia in the late 20th century. The infections are believed to be carried by waterfowl that have migrated between continents over the years.They can have varying impact on domestic and commercial flocks depending on the strain and the affected species, with some H5N2 carriers showing no symptoms in waterfowl. It's often more pathogenic to commercial poultry, however.

Climate change spreads avian flu

Scientists figured out as early as 2009 that climate change would force birds to change their migration patterns. In so doing, said Dr. Marius Gilbert et al, the migrations heightened the chance for avian influenza strains to spread and mutate.

"[It] is thought that the biggest change in AI epidemiology resulting from climate change will be brought about by changes in the distribution, composition and migration behaviour of wild bird populations," the team said.

Brazil, which lies south of the common flyways of migrating waterfowl, has managed to escape H5N1 infections. As a result of this, some analysts suggest that Brazil might gain economically as it strengthens its poultry export markets. It's been taking steps since 2013 to bolster its protections against imported products that may carry the virus, as well.

The impact on the poultry industry

Western Canada lost significantly this month when H5N2 was detected in three of its Fraser Valley poultry farms. By the time the Canadian Inspection Agency had cordoned of the affected area, more than 11 commercial farms had been affected, leading to the destruction of hundreds of thousands of chickens and turkeys right before Christmas.

Fortunately for U.S. farmers, infections have only been found in backyard flocks in Oregon and one duck in Washington state. But the impact is still being felt by the U.S. poultry market, which has all or portions of its commerce banned by at least seven nations.

What does it mean for U.S. consumers?

The USDA states there is little risk to consumers from well-cooked meat, since the heat is believed to kill the pathogens. Cooking guidelines have been the gold-standard for avoiding food-borne illnesses for years and are being stressed here. It is yet to be seen whether U.S. consumers will gain comfort from that reassurance, but judging from the fact that the poultry industry is expecting a slump in sales, the fallout for the industry is still not known.

One thing for sure is that avian influenza isn't going away any time too soon. State agencies in Alaska and Delaware have issued statements to reassure and advise residents of any potential risks. Delaware's Department of Agriculture is cautioning poultry farmers to "be vigilant" and use biosecurity procedures that would limit any unexpected infections. Alaska has taken steps to reassure hunters that there is minimal chance of the infections reaching Alaska waterfowl -- and its popular waterfowl hunting season, which has just opened.

"While no public health concerns have been associated with either H5N2 or H5N8 avian influenza strains, these cases serve as reminders that wildlife can carry pathogens of many kinds," Alaska Department of Fish and Game has advised.

If there is a silver lining associated with these events, say researchers, it is that while climate change may affect bird migration patterns -- and by extension the global agriculture markets -- it isn't thought to create new strains or virulent outbreaks of H5N1.

"[These] observations support the idea that climate change will have very little effect on HPAI epidemiology," said Gilbert.

That's awfully good to know.

Image credit: Pandiyan V

Good and Bad News For Climate Change Performance

Looking at the 10th edition of the Climate Change Performance Index, there is good and bad news. The index, which compares the 58 top carbon-emitting nations, reveals that global carbon emissions reached a new peak. However, the index found that recent developments indicate countries have a new readiness to take action on climate change.

The first three places in the list are unoccupied to remind countries of how much still needs to be accomplished to prevent the worst climate change impacts. The first two occupied spots are taken by Scandinavian countries. Denmark tops the list at No. 4 and Sweden ranks No. 5. Denmark tops the list because of its renewable energy and emissions reductions policies. “Even though emission levels are still relatively high, the country sets an example in how industrialized countries can not only promise, but also implement effective climate protection policies,” the index, published by Germanwatch and CAN Europe, stated.

Clearly, Sweden and Denmark really do show developed countries that emissions reductions are possible. Denmark’s emissions have continued to decline since 1997. Over the last five years, the country’s emissions reductions have increased rapidly by about 19 percent. Sweden’s emissions have declined by about 70 percent over the last five years. The country has also improved its score in the renewables sector, moving up 19 places in that category.

"We see global trends, indicating promising shifts in some of the most relevant sectors for climate protection," said Jan Burck of Germanwatch, author of the Index, in a statement. "The rise of emissions has slowed down, and renewables are rapidly growing due to declining costs and massive investments."

Hope for the world’s top two carbon emitters

In China, the world’s biggest emitter, there have been improvements in efficiency and large investments in renewables. Recent developments point to China’s coal boom coming to an end. About a third of Chinese provinces agreed to implement restriction measures for coal plants. In November, China and the U.S., the second biggest emitter, agreed to name a date for an emissions peak. The U.S. government has given signals that it has adopted a “restrictive coal policy, both internally and externally,” the report stated.

Things are staying the same in Canada and getting worse in Australia

Things have remained the same in Canada, which ranked 58 on the list. Nothing is going forward at the state level, and the country is set to miss its 2020 emissions reduction target by about 20 percent. “The only effective policies in place are provincial initiatives,” the report concludes.

The new Australian government reversed the previous climate change policies, and as a result the country fell 21 positions in the policy evaluation compared to last year. Australia replaced Canada as the worst performing industrial country.

Morocco hits the top 10

Morocco continued to improve this year, as it did last year. The country climbed up six positions this year and ranks in the top 10 for the first time. “This is by far the best result for a developing country in the actual ranking,” the index declares. Morocco has adopted ambitious renewable energy targets and cut gasoline and fuel oil subsidies. It is building the world’s largest (500 megawatt) concentrated solar power plant in Ouarzazate.

Image credit: Wigwam Jones

Apply for NREL's Renewable Energy Leadership Academy

The Department of Energy's National Renewable Energy Laboratory in Golden, Colorado, is currently accepting applications for its 2015 National Executive Energy Leadership Academy.

NREL is the only campus in the DOE research network devoted just to renewable research. And its national outreach program, called "Energy Execs," offers in-depth training on renewable energy to leaders in the private and public sectors, as well as nonprofits and community groups.

There are two NREL Energy Execs programs: the Leadership Program, which is one weekend a month for five months, and the Leadership Institute, a one-week intensive program. The goal of these outreach programs is to immerse decision-makers in the opportunities offered by renewable energy and energy efficiency: technologies, market assessments, and financial and analytical tools. The sample syllabus is here (including field trips.)

Applications online are due by Jan. 16. The five-month program runs from May to September 2015, and the institute will be held April 14-17, 2015.

There is no fee for the Renewable Energy Leadership Academy, but applicants pay for travel to and lodging in Golden (about a half an hour outside Denver). Alumni include representatives from city and state governments, construction and building, telecom, real estate, military, Congressional offices, and more. More than 200 business, government and nonprofit leaders have taken the courses since 2007.

"Industry, academia and government rely on leaders with vision and drive to make the transition to a sustainable, secure, energy future," said NREL Director Dan Arvizu. "NREL's Energy Execs programs play an important role in bringing those leaders together to learn about what is possible and to strategize about market-viable solutions."

More about NREL: The 327-acre NREL campus in Golden houses several research labs, including three national centers located within NREL: the National Center for Photovoltaics, the National Bioenergy Center and the National Wind Technology Center. NREL has an additional 13 analysis projects, including grid and interconnection, vehicles, geothermal, buildings, weatherization and intergovernmental programs, and Department of Defense energy programs.

For more information and to apply, click here.

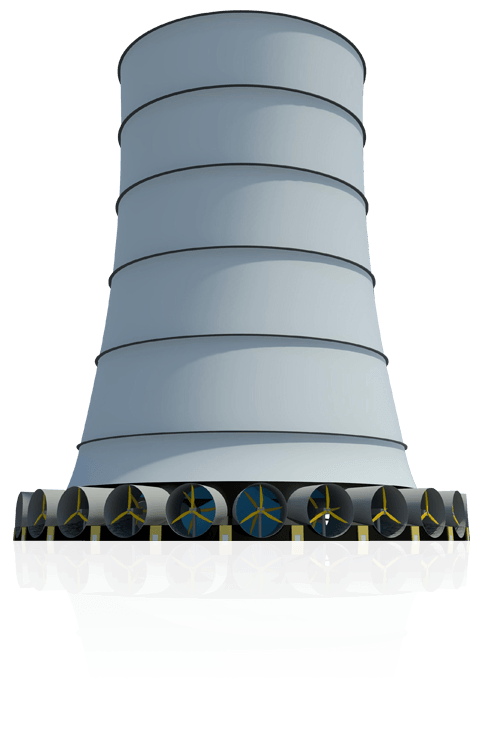

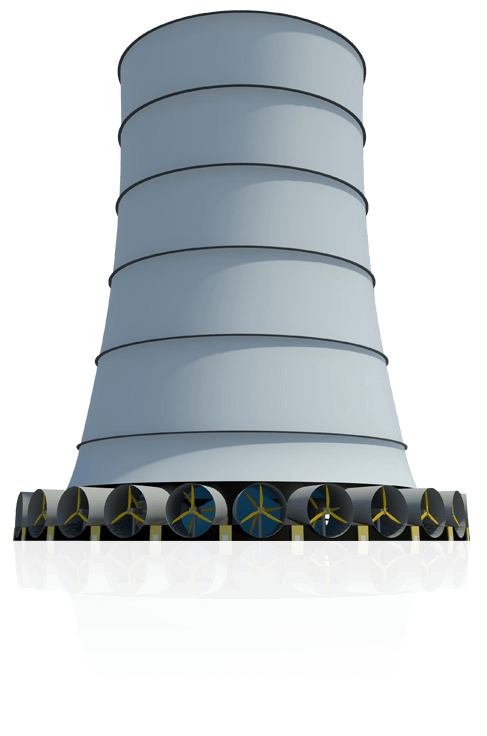

Will Energy Skyscrapers Someday Dot the Southwestern Desert?

Sometimes you have to think big. That’s certainly what Dr. Phillip Carlson would say. He’s the guy that invented the “energy skyscraper” back in the '70s. It was a colossal tower that would reach up into the sky to create what you might call artificial weather, which would deliver consistent 50 miles-per-hour winds to the base where an array of wind turbines would convert that wind into electricity.

The principle is basically the same as the chimney effect in which hot air rises and cool air descends. In order for the effect be sufficient to produce significant amount of power, you need a very tall chimney. Spraying water enhances the effect, especially if the air coming up is hot and dry.

Carlson was clearly ahead of his time. After the Arab oil embargo of 1973 came and went, interest in energy went back to sleep as oil had become abundant once again. But the idea was picked up by Technion, the Israel Institute of Technology. They proposed construction of a full scale version in the Southern Arava Desert that would be close to 4,000 feet tall and 2,000 feet in diameter. It’s worth noting that the tallest building in the world today, the Burj Khalifa, in Dubai, is 2,700 feet tall. Needless, to say, the cost of constructing such an engineering marvel would be prohibitive, which is why the Technion project did not proceed.

But now, an American company called, Solar Wind Energy Tower (SWET) is moving forward with plans to build one of these in Southwest Arizona, outside the town of San Luis, Arizona, and another one across the border in San Luis Rio Colorado, Mexico. Their design is only 2,250 feet tall, practically a miniature version of the original. The company has purchased land and received approval from the city council for the Arizona project. The town has also agreed to provide the water necessary to run the tower for 50 years.

The SWET tower, as designed, is expected to produce some 4 million MW-hours per year; that’s more than the Hoover Dam. If this seems unbelievable, it’s not. The underlying science is sound. That doesn’t mean there won’t be unanticipated problems with these if they ever get built. (See Video below.)

In the meantime, there are some significant hurdles to be overcome to get to that point. First, there is the cost. One tower is estimated to cost $1.5 billion. While the company has signed an agreement for preliminary financing, they have yet to write any Power Purchase Agreements (PPA) which is how the tower will eventually pay for itself.

Another big problem is water. Even though much of the water will be recirculated, some 8,000 acre-feet will be lost to evaporation each year. That’s enough to irrigate a 1,000 acre farm. That’s an inherent conundrum with this technology. It depends on using water in places where it is very dry. If there were a source of sea water nearby, the project could be self-sufficient, using excess power to pump and desalinate water. Failing that, the operators would be looking for some other way to trade electricity for water, I’m not aware of one other than pumping it from the nearest source.

A third problem is access. This tower will provide huge amounts of power in the middle of nowhere, which is probably the only place you could built a 2,000 foot tall tower. That means long distance power lines, running at very high voltage to minimize the inevitable losses.

None of these problems are insurmountable, and, in fact, the company plans to begin construction by 2018. On their side are lower costs than other large scale solar and wind projects, and a considerably smaller land footprint. Another plus-- unlike other wind farms, this provides consistent, steady wind.

It remains to be seen, whether this will be happen. The road to a renewable future will have a number of twists and turns in it, as well as numerous forks. One of those forks is between centralized utility scale projects, versus small decentralized rooftop systems. There will be room for both, but the current trend seems to favor the smaller systems for any number of reasons including resiliency, storage requirements, and transmission losses. But that also represents a departure from today’s utility business model, which won’t go away without a fight. The exceptionally low oil prices are also not helping.

As for those, even though lots of people are rushing out to buy monster SUVs, I don’t expect these low prices to be around for long.

Image courtesy of Solar Wind Energy Tower, Inc.

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.

A Comprehensive Standard For the Aluminum Industry

There are many uses for aluminum: It is used in consumers goods, for transportation and even for door knobs. Given the popularity of aluminum, it makes sense to have a comprehensive standard. That is exactly what the Aluminum Stewardship Initiative (ASI) created. The goal of the ASI Performance Standard is to improve the industry’s performance through its value chain, including reducing greenhouse gas emissions.

It took a year to develop the standards, which will be implemented through a third-party certification system. It focuses on 11 key issues: business integrity, policy and management, transparency, material stewardship, greenhouse gas emissions, emissions, effluents and waste, water, biodiversity, human rights, labor rights, and occupational health and safety. Certain end-users of aluminum, such as Audi, BMW Group, Jaguar Land Rover and Nestlé Nespresso SA, said they would purchase certified aluminum.

There are 28 organizations that worked to define the criteria in the sustainability issues relevant to the aluminum value chain. The organizations include BMW Group, Hydro, Nestlé Nespresso SA and Rio Tinto Alcan, Fauna & Flora International, Forest Peoples Programme, IndustriALL Global Union and the International Union of Conservation and Nature (IUCN).

Emissions reductions

Companies that produce aluminum are required to commit to reducing their greenhouse emissions under the criteria for GHG emissions. They will also commit to designing and achieving a roadmap to reduce their emissions. One example is that smelters will have to demonstrate the level of direct and indirect GHG emissions from aluminum production is below a set level by 2030.

Companies must account for -- and publicly disclose -- their GHG emissions and energy use by source every year. In addition, they must publish emissions reduction targets and implement a plan to meet those targets.

Managing waste

Under the criteria for material stewardship, consumer goods companies will be required to focus on resource efficiency, design for the environment and develop recycling timelines and targets for end-of-life of products containing aluminum. Companies must come up with a waste management strategy and publicly disclose every year the amount of hazardous and non-hazardous waste it created and how it disposed of that waste. Specifically, companies have to prevent the release of residual bauxite, an aluminum ore, to the environment. They are required to create a timeline and roadmap for eliminating bauxite residue lagooning, in which bauxite residue is pumped into a pond.

Respecting human labor rights

Companies are required to agree to uphold the United Nations human rights declaration at all stages of their operations. They must establish and implement a human rights policy that is in line with the U.N. Guiding Principles on Business and Human Rights. Women’s rights and the rights of indigenous peoples are to be protected as part of the human rights criteria.

Within labor rights falls bans on child labor and forced or compulsory labor. Companies are required to respect the right of workers to collective bargaining. Workers must be allowed to “associate freely, join or not join labour unions, seek representation and join workers’ councils,” according to the standard.

Image credit: roadsidepictures

Could 3-D Printing Bring the World Closer to the Circular Economy?

By Simon Fischweicher

The movie "Wall-E" portrays a dystopian future in which humanity has abandoned an Earth covered in skyscrapers of waste.

Sci-Fi cartoon? Yes. A plausible vision of the future? Maybe.

Society’s waste puts our planet’s ecosystems and natural cycles at risk. Plastic waste is especially bad as it can take up to 1,000 years to decompose. Less than 10 percent is recycled. Creating new, raw plastic is fossil fuel intensive and environmentally taxing. Is the only answer to abandon the planet to Wall-E?

Maybe not. 3-D printing could offer a dual solution, allowing transformation of plastic waste into new plastic products.

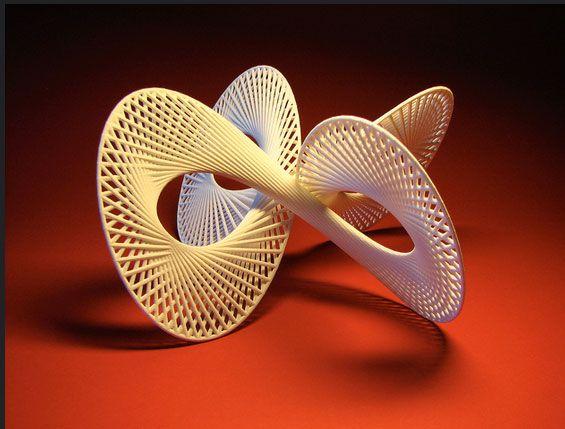

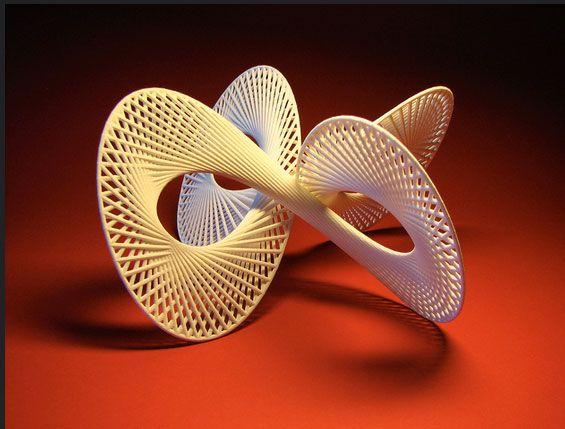

3-D printing can revolutionize where products are produced and how they look. It could lead to more local production and greater efficiency of design. Designers can scan a person’s jaw or use computer software to design a chair using the biological structure of a leaf. They hit go and their item is “printed” into existence. 3-D printers generate less waste since they use additive manufacturing rather than injection-molding — or milling, where products are cut away from larger pieces.

3-D printing is nota green panacea, as a study by the University of California, Berkeley’s mechanical engineering department found. It is still limited in capability, it’s costly and most 3-D printers are more energy intensive than other manufacturing methods. Furthermore, certain 3-D printers and filaments — the thermoplastic polymers melted into form by the printer — create significant waste, as well as toxic fumes. Inkjet 3-D printers, which use deposits of hot liquid material to bind a bed of powder, create a significant amount waste. Additionally, scientists from the Illinois Institute of Technology and the National Institute of Applied Sciences in France studied emissions and toxicity of 3-D printing materials: They found that certain materials like Acrylonitrile butadiene styrene (ABS) filament, resulted in toxic fumes dangerous to humans.

Appropriately employed, however, 3-D printing plastic waste could help create more sustainable manufacturing. Answers to the challenges are emerging: 3-D printers that utilize Fused Deposition Modeling or FDM methods — imagine shapes formed by hot glue gun that deposits layers of liquid plastic — do not create waste. Methods using Polylactic Acid (PLA) filaments were nontoxic and had no health risks. 3-D printing still has limitations, but, using FDM printers and PLA filaments, waste and toxicity can be eliminated.

Nowhere is this more evident than in the developing world: It is estimated that there are around 15 million waste pickers globally. These individuals collect, sort and sell recyclables to make a living. In India, the social enterprise Protoprint is empowering urban waste pickers to produce 3-D printer filament themselves from the plastic waste they collect. Protoprint collects the filament and sells it to customers, who are glad to purchase a recycled substitute to new plastic filament.

Other 3-D printing enthusiasts have gone a step further, creating small-scale 3-D printers that can actually melt plastic waste and print it into products like water collectors, plastic tools and small rafts. Researchers at Michigan Technological University created the Recyclebot, which uses the RepRap self-replicating 3-D printer to turn plastic waste into plastic filament and then directly into the end product. Combine this innovation with a portable, solar-powered 3-D printer, also tested at Michigan Tech, and you’ve got a self-sufficient production tool that could generate economic prosperity throughout the developing world.

Application of these practices will not be limited to waste pickers in the developing world, however. Plastic waste, unemployment and demand for goods are important issues in the developed world as well. Local recycling and waste centers could purchase 3-D printers and double as production hubs. Imagine a one-stop shop where you can drop off recycling and design and print a new iPhone case. 3D Systems, a publicly-traded company, has already released personal, high-quality 3-D printers like the Cube 3 that use 25 percent recycled plastic filament. At present, you purchase the filament from the company. However, as the technology improves, 3-D printers should allow users to use their own plastic waste to make new water bottles, containers, toys, tools and parts at home or in the office.

In the not distant future, imagine a world where nothing is wasted: Excess food is composted or fed to livestock; metal parts are smelted and reused; paper, glass and plastic are recycled. And, any additional plastic waste is sold to local 3-D printing shops or used in personal 3-D printers at home or in the office to make new containers, tools, parts, furniture or whatever is needed. It’s not too late to save the planet from becoming Wall-E’s graveyard of wasted plastic.

Image credit: Flickr user fdecomite

Leon Kaye: What I Learned 1,000 Articles Later on TriplePundit

A lot has happened in the world of sustainability since I wrote my first article here almost five years ago about a bicycle courier service in Paris (which no longer exists). It is hard to believe this is my 1000th article on TriplePundit, which says a lot about my own OCD, loyalty to this fine group who have built one of the best sustainable business news sites on the planet — or a little bit of both. I have to say the best perk from being a writer is what I’ve learned from all the business leaders, activists and government officials I have met in person and spoken with over the phone since I started here in early 2010.

I have written a lot about corporate social responsibility, social enterprise, clean energy, and architecture and design here — so while I would like to think I have gained a vast body of knowledge miles long, it's really only a half an inch or so thick. A lot has changed in this space in five years — much of it encouraging, some of it exasperating. So, what has stuck in my brain 1,000 posts later? Here is a sampling:

Business can be a force for good. In a past life I sold business services to Fortune 1000 companies and their corporate law firms, so I gained a very healthy skepticism about how companies conduct themselves on social and environmental issues. After all, the point of a public company is to maximize value for shareholders (I think I learned that in one of my business school classes), while the point of a privately-owned company is to disclose as little as necessary so the business can grow with as few impediments as possible. Yes, that is a jaded view, but things have changed. Businesses can be force for doing good, from skills training to opening new economic opportunities for some of the world’s poorest people.

As an American, I find it embarrassing my government ranks alongside Turkey and Brazil when it comes to listing the most polarized countries on earth. The halcyon days of the first President George Bush working with Democrats to pass legislation to stop acid rain seem like decades ago. Heck, Nixon’s presidency, which saw the Clean Water Act, Clean Air Act and the launch of the EPA, is akin to the Revolutionary War era to me. I share many others’ views that our government is not working for us.

But business can, will and should make progress while government does little except be less than useless. I see more business leaders talking about the need to be resource efficient in a world where we are consuming more than we can replenish. Despite the future of clean energy incentives largely in doubt, more companies are investing in renewables because it is a hedge against volatile energy prices and shows a commitment to reducing carbon emissions. Most of the sustainability work going on in the business world is hardly done for altruistic reasons, but I don’t care as the ends more than justify the means.

We have the power to hold businesses accountable. At the same time, we have to keep a wary eye on how businesses conduct themselves. So thank goodness for social media. One trend I have noticed at TriplePundit is that we write a lot less about “greenwashing” than we did when I started here — back then it was quite the regular topic. But social media is a great tool to hold businesses accountable. Hell hath no fury like stakeholders scorned when a corporation eats it due to some poorly thought-out decisions: Uber, McDonald’s, Starbucks and Safeway are just a few examples of companies that have seen their messages thrown awry thanks to Facebook and Twitter. We no longer have to put up with corporations’ one-way marketing and public relations messaging — now the only choice businesses have is to have a conversation with their customers and shareholders.

Youth is making a difference. I have never had the patience for the “kids these days” argument, especially now. If anything, young professionals (I refuse to use the term “millennials”), are doing more in the nonprofit and social enterprise sector than ever before. Part of it is because more workers want to make a difference with their skills and experience. Plus even if one wants to climb the corporate ladder, few are able to anyway because of companies’ proclivities to downsize as soon as Wall Street rattles their cage over a disappointing quarter. The financial crisis of 2007-2009 also put a wrench into many graduates’ hopes worldwide, forcing them to become more entrepreneurial. Not every social enterprise out there will survive, but that is just as true of startups. And the lessons learned from such failure — a very underrated human experience, in my opinion — will carry over to new ideas.

But let’s include our seasoned professionals as well. At the same time, too many businesses that are quick to tout their employee engagement programs are ridding themselves of older workers in the name of cutting costs. Too many of my peers over the age of 40 are always worried about being let go during the next down cycle.

The knee-jerk reaction to hire younger workers because they are “more hungry” (clearly, they are paid less) ends up hurting these businesses in the long run. Plus, we can all benefit from the perspective of professionals who remember when no one thought about environmental protection, working conditions overseas or the effects of living in a wasteful society. With all the endless banter over “diversity,” we have to remember that “pre-millennials” bring a lot to the table, too.

The momentum is shifting our way. Five years ago few of us could have predicted the rapid drop in solar costs, improvements in electric vehicle technologies and increased transparency in global supply chains. Of course we have a long way to go and there is plenty of room for improvement. Some fear the current drop in oil prices will hurt the sustainability movement, but past experience proves these cheap gasoline prices will not last for long.

More businesses know they are held accountable for their actions, more consumers want to know what exactly they are buying, and the younger generations are teaching the older generations about the virtue of caring about the planet and people — and vice versa. In the end, there is a lot more awareness than five years ago, so I am more confident and hopeful long term change for the better is on the way.

After a year in the Middle East and Latin America, Leon Kaye is based in California again. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

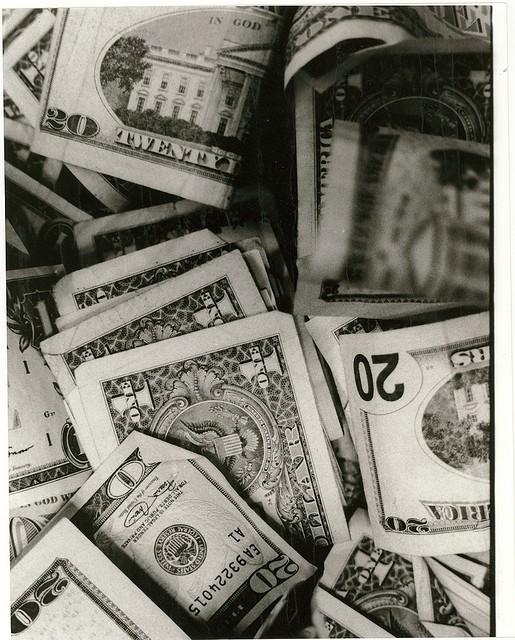

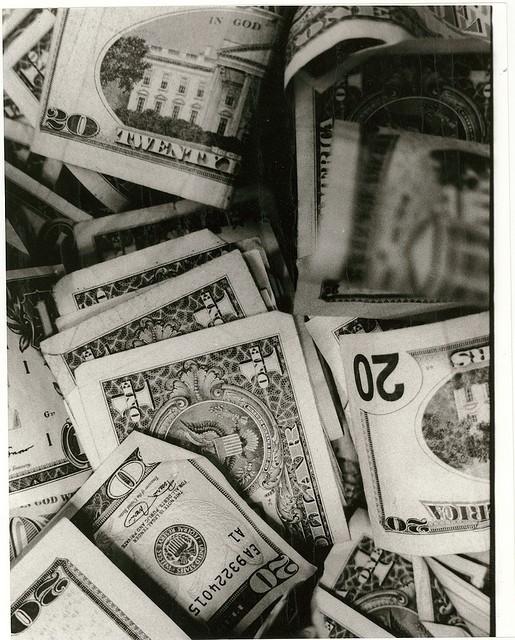

New Study Shows Record-Setting Wealth Gap

The Holidays! Food! Fun! Festivities! Gifts! Oh man ... oh so many gifts for the little ones and the family, cookies for neighbors, charity just a bit, traditional foods. Oof. For many Americans, mixed in with the fun is maybe just a twinge of another reminder of how broke we are despite a rising economy. A Pew Research Center survey of consumer finances shows a story of stagnating wealth for most Americans, while only high-income Americans are seeing gains.

With the Great Recession of 2007-2009 falling in the rear view mirror, American families have yet to recover the wealth they had just 10 years ago. Everybody across the board lost wealth from that crap storm. During the recession, lower-income families lost 41 percent of their wealth, middle-income families lost about 39 percent of their wealth, and upper-income families lost 17 percent of their wealth.

Since then almost nobody regained their lost wealth. In fact, post recession, most American families are in about the same place they were over 20 years ago wealth-wise, the study found. The lowest income families have actually lost ground from the early 1990s.

The one exception to this, of course, are the higher-income families who have begun to recover their lost wealth. Unlike everybody else, they've seen their wealth double from $318,100 in 1983 to $639,400 in 2013.

With higher-income families gaining wealth, and everybody else staying static since the recession, we've hit a record high in wealth disparity between the upper-income families and all other families in the United States. 2013, the latest year on record since the Federal Reserve started tracking consumer finance data, shows that the wealth of upper-income families ($639,400) is nearly seven times the wealth of middle-income families ($96,500). It's the highest gap recorded.

And if that weren't enough, wealth for the higher-income families is nearly 70 times the wealth of lower-income families ($9,300). Keep in mind we're not talking about income here. We're talking about wealth.

So, what does this mean? The act of pointing out the wealth gap is festooned with fun political hot-buttons we can all push in the comment threads ... all of which comfortably avoid a serious national conversation of why most of us are stuck in the mud. We can decry Obama, we can decry Bush, we can drag it all back to Reagan or even FDR for the sake of spirited political puffery. We can preemptively assume such a conversation is just a pretense for redistributing wealth and ignore the data, or even suggest that redistribution is a solution.

Ultimately, though, these are just data points showing very real stagnation for most Americans since the Great Recession. And it raises the question: Why is one segment of the population regaining its wealth while an overwhelming majority of the population is not?

It's no wonder Americans aren't particularly enthusiastic about the economic "recovery." We haven't felt it at all.

Image credit: Daniel Borman: Source

Dutch Bankers Now Asked to Take an Oath of Ethics

So, now after some 10,000 years or so of human civilization, what have we actually learned? One thing that seems clear is that greed has been an effective motivating force to get people to use their imaginations to improve their lot in life, often by improving the lots of others with useful products and services. This led to what we call progress -- all the wonderful conveniences that make the many aspects of our lives easier and safer, while providing the means to accomplish far more than any individual could have dreamed of in years past.

At the same time, it has produced a society with a high degree of social and economic inequality, a society that does not seem to have progressed very far at all in this regard since feudal times. There are still the haves and the have-nots with a vast chasm of entitlement and privilege dividing the two.

The question of how to bring these two opposing facets of our chosen course into some kind of balance has bred a couple of different approaches that seem to be in contention.

One, government oversight, has been used quite effectively at times, though it also goes in and out of vogue depending on the prevailing political philosophy. Today, in the post-Citizens United era, it seems likely that weakened oversight and regulation will remain the norm -- as long as those business interests with money to contribute to political candidates now get to erase those pesky regulations that dampen profits with the swipe of a credit card. Just this week, Dodd-Frank was further weakened in the latest budget bill, another thank-you gift to Wall Street campaign contributors from both sides of the aisle.

The other approach seems to be the installation of conscience into companies, via the move towards increased transparency, sustainability and the growing corporate social responsibility (CSR) movement. Mission-driven companies and companies that truly care are no longer merely hypothetical. This development seems to be consistent with the flourishing vision that is becoming popular, fueled largely by a sense of personal commitment on the part of individual employees.

It is in this latter camp that a recent announcement by the Dutch Banking Association falls. The group disclosed that it will now require bankers to sign a Hippocratic Oath, similar to the one used by doctors where they promise to do no harm.

Among other things, the Banker's Oath asserts that the oath-taker will exercise his "function properly and carefully," "weigh all the interests involved in the enterprise," including, "the society in which the enterprise is active," acting “in accordance with the laws, regulations and codes of conduct,” and that he will not abuse his knowledge, while maintaining “an open and verifiable attitude ... [with] responsibility towards society.”

So, the question is: Are they just words, or will they make a difference?

Kara Tan Bhala, founder of the nonprofit Seven Pillars Institute, which focuses on ethics in finance, told The Atlantic that, “Bankers are human and affected by symbolism and purpose.” This again anticipates a wave of flourishing consciousness to be realized. Otherwise, we’ll be forever stuck with regulation, though as Bhala points out, “There cannot be a rule for every possible wrongful act in banking.”

John Boatright, a professor of business ethics at Loyola University Chicago, is more in the other camp. He says that "oaths won’t work … until bankers can sense the threats of significant prison sentences or fines in response to unsavory conduct.”

The dream of internally committed, well-intentioned businesses -- financial and otherwise -- committed to always do the right thing seems somewhat utopian, while the insistence on regulation is more hard-nosed and down to earth. Yet, the self-regulation of businesses has long been the dream of conservatives who have traditionally considered themselves more down to earth than the liberals that they like to characterize as dreamers. Yet it is the liberals that generally push for stricter regulations. That’s likely because of who each chooses to distrust. With the liberals it’s businesses; with conservatives it’s government.

For me, I like the idea of the oath, because it shows a growing awareness of the necessity of ethical behavior in these institutions that hold so much sway over the destiny of nations and the people that live in those nations. But let there be meaningful consequences for those that violate that oath, and some objective means by which to assess whether or not a violation has been committed. In today’s world, those are called regulations, perhaps at some point in the future; they will go by another name.

Image credit: Greg Wagoner: Flickr Creative Commons

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.