SEPD project restores natural beauty

Over 3km of overhead power lines, pylons and wooden electricity poles will be removed from Thursley Common as part of a major £400,000 project by Southern Electric Power Distribution (SEPD) to restore views over the Surrey nature reserve.

Under the watching brief of Natural England, engineers have started work to bury replacement power cables carefully under the reserve. The site, which also includes part of Ockley Common, was identified by the Surrey Hills Area of Outstanding Natural Beauty (AONB) team as a priority for power line removal to restore the traditional heathland landscape. Eleven pylons dating back to the 1960s, which carry a 33,000 volt overhead power line will be dismantled, along with 22 wooden poles carrying a 11,000 volt line. Both lines will be replaced by new underground circuits.

Engineers have started work on the first phase of the project to prepare trenches for the new underground cables. To minimise impact on the landscape, this is taking place alongside existing footpaths on the southern side of the common. In other parts of the reserve, a 'mole plough' will also be used to lay cable. This specialised piece of equipment causes minimal environmental disruption, but can bury cable at nine times the speed of conventional trenching.

Once this initial work is finished, the new underground cables will be powered up and the old overhead lines, pylons and wooden poles can then be taken down in the reserve. This second part of the project is due to be completed during the autumn, weather and ground conditions allowing.

Project manager Greg Moore from SEPD said: "This is a beautiful part of Surrey, enjoyed by lots of locals and visitors, and so we will be making sure access across the common is maintained throughout the project. We've carried out a detailed planning exercise prior to the work starting, as we'll be working in a sensitive landscape that has a whole range of dry and boggy terrains, and we'll be doing everything we can to return the area back to its original, natural glory as quickly as possible."

Thursley National Nature Reserve boasts extensive areas of open dry heathland, peat bogs, ponds, pine and deciduous woodlands and is home to a thriving and varied amount of wildlife and flora. Dartford warblers, stonechats, silver studded blue butterflies and marsh orchids are common sights in the area, which is popular with walkers, cyclists and horse riders.

Landowners Natural England and the Defence Infrastructure Organisation (DIO) - the Ministry of Defence's property and services provider - have been working closely with SEPD on the project. The work is being funded by a special allowance, granted to SEPD by industry regulator Ofgem, to invest in projects to underground power lines in AONBs and National Parks in central southern England.

James Giles, Natural England's Reserve Manager, said: "This important partnership project is a great opportunity to enhance the natural beauty of Thursley National Nature Reserve. We've worked closely with the contractors to ensure that the operations avoid areas used by rare nesting birds, such as woodlark and Dartford warblers, and every step is being taken to protect the Reserve's varied habitats. The pylons will be removed during the autumn when the terrain is drier and the nesting season is over. The end result will be a much improved and revitalised landscape, adding to the wilderness feel of this already incredible and special site."

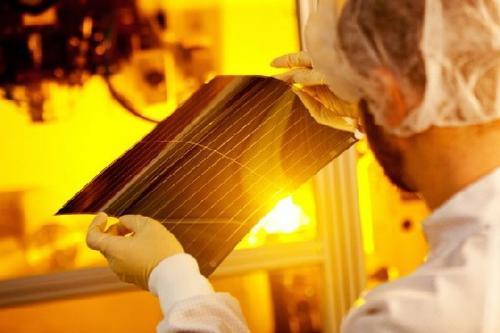

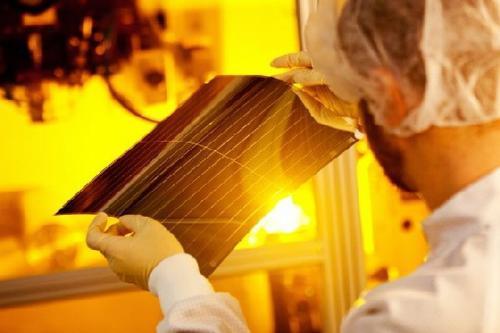

Transparent Panels Signal the Future of the Solar Industry

Imagine a world where every glass surface produces solar power. You'd wake up to the alarm on your fully-charged smartphone, pluck it off the windowsill and hop into a hot shower -- courtesy of a solar water heating system powered by your enclosed patio. You stroll out to your electric vehicle and flip on the radio, powered by your sun roof, and head off to your net-zero office building -- which skirts the grid thanks to its majestic floor-to-ceiling windows.

This scenario may sound like science fiction, but recent developments in solar technology suggest that it barely scratches the surface of where the industry may be headed in the coming decade. Earlier this week, German solar company Heliatek unveiled a 40 percent transparent organic solar cell that's ideal for generating energy from windows, façades and glass car roofs.

The development holds potentially groundbreaking implications for the new generation of net-zero smart buildings, as well as the alleviation of electric vehicle range anxiety. The possibilities are diverse, but it may be a while before we see transparent cells in use on a large scale. Heliatek has achieved 7 percent efficiency on its latest cell. This is respectable compared to its world-leading 12 percent efficiency for opaque organic cells but still a far cry from the 44.7 percent efficiency achieved by the top-performing standard photovoltaic (PV) cell -- made by fellow German manufacturer Fraunhofer.

Unlike standard solar cells, which are typically made from silicon, the production of Heliatek's organic film is based on small molecules (oligomers) developed and synthesized at its lab in Ulm, Germany. Oligomers are deposited at low temperatures in a roll-to-roll vacuum process, and their selective absorption of the solar spectrum targets different colors and transparency to convert sunlight into electricity. This may prove to be a breadwinning technology in the long-run, but for now higher costs keep it in the "niche" category.

While producing more efficient transparent cells, especially organic ones, may prove challenging, Dresden-based Heliatek sees promise in its latest development. The company has been open about its strategy to supply its transparent solar film to glass manufacturers for both building integration (BIPV) and car roofs. In a media release about this latest lab development, CEO Thibaud Le Séguillon went as far as to say that, "The transparency of our products is at the core of our market approach."

Le Séguillon isn't the only one who has this idea. Earlier this week, researchers from Singapore’s Nanyang Technological University debuted a new solar cell material that doubles as a touch screen for electronic devices, information kiosks and other displays. The integrated solar cell/touch screen concept parallels the emergence of building-integrated solar cells, as well as cells that can be incorporated into fabrics and other wearable or portable items.

In another attempt to bring a silicon-killer on the scene, the NTU cell is made from perovskite -- a relatively inexpensive mineral composed of calcium titanate (titanate is a salt composed of titanium and oxygen). But a group of MIT researchers took things one step further, devising a way to manipulate E. coli bacteria to create self-repairing solar cells. Inspired by natural materials such as bone, the researchers coaxed bacterial cells to produce biofilms that can incorporate nonliving materials, such as gold nanoparticles and quantum dots. The addition of inorganic nanoparticles, particularly gold, made the bacteria conductive to electricity. This potentially paves the way for self-repairing, and even self-assembling, solar cells and batteries.

"It shows that indeed you can make cells that talk to each other and they can change the composition of the material over time,” says Timothy Lu, an assistant professor of electrical engineering and biological engineering at MIT and the senior author of a paper describing the discovery in the March 23 issue of Nature Materials. “Ultimately, we hope to emulate how natural systems, like bone, form. No one tells bone what to do, but it generates a material in response to environmental signals.”

While none of these developments are likely to revolutionize the solar industry in the short-term, they pull back the veil and give us a peek at what is sure to be a promising future; a future that's likely inconceivable to us now. One thing is certain: The industry is already on the rise, with a 15 percent growth rate in the global solar PV market last year, and other savvy (though decidedly less sexy) developments in areas like smart energy storage are paving the way for what could be a whole new power source. There's no telling what the future holds, but we'll be watching.

Images courtesy of Heliatek GmbH

Based in Philadelphia, Mary Mazzoni is an editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared on the Huffington Post, Sustainable Brands, Earth911 and The Daily Meal. You can follow her on Twitter @mary_mazzoni.

Towns Impacted by Dan River Coal Ash Spill Continue to Struggle

As North Carolina regulators press to have Duke Energy stripped of protections that would have limited the company’s liability for cleanup of coal ash spills in two regional rivers, communities downstream are struggling to come to terms with the continuing impact of the cleanup and stigma from the pollution.

Danville, Va. is just miles downstream from where a pipe connected to a coal ash pond owned by Duke Energy failed and spewed toxic sludge into the Dan River in February. The city of 43,000 has been working hard in recent years to revitalize its image and its future. A former tobacco and textiles town, its growth has depended on this waterway, which served at times not only as a resource for drinking water, but as a disposal site for nearby industrial waste and rinse water. It’s a history that Danville has gradually been moving away from.

These days, the Dan River fulfills another, more elegant purpose as one of Virginia’s state-designated Scenic Rivers. Approved last October, the designation encompasses a 15-mile stretch in the vicinity of Danville. The scenic recognition is expected to draw in much-needed tourism dollars from travelers interested in seeing Virginia’s rural beauty. Danville’s economic development, and its transition away from an industry that once painted the river currents in color, is now dependent upon that designation -- and the tourism that is meant to follow.

In February, staff from Virginia’s Department of Conservation and Recreation told GoDanRiver.com that the river wasn’t currently in danger of losing its Scenic River status just because a spill had occurred. Turbidity was to be expected. But long-term pollution or the prevalence of factors that indicated pollution was another thing. A review has been put off until later this spring in order to gauge whether there has actually been damage to this coveted 15-mile stretch of river.

But local concern over the river’s status is only a reflection of a more insidious impact of this spill: Danville’s reputation as a place for new businesses to invest and thrive.

These days, business development is a make-or-break factor for small cities, especially cities that have an eye on tourism development as a way to transition away from industries that are no longer financially viable, or that pose environmental challenges. Danville’s historic legacy, its parks and scenic beauty rely not just on the vibrancy of the river, but also the investment of businesses that see its promotion and use as a sort of economic and sustainable partnership: The ecology of the river flourishes from protective, concerted investments of time and resources, and so do the businesses, the city and the residents that rely upon its health.

City officials have gone on record to assure residents that its water treatment plant, located in Danville, is able to filter out all of the toxins and sediment from the spill. City Manager Joe King appeared in a YouTube video designed to bolster confidence in the city’s water treatment. Gov. Terry McAuliffe even paid a visit to inspect the treatment plant and assured the 18,000 residents who depend on the plant for their drinking water that it was safe. Up until now, the reputation of Danville’s plant is as one of the top water treatment facilities in the state and one of the oldest in the country.

Still, the question on the minds of many right now doesn’t have to do with the efficient operation of the plant, or even the technology it employs, but the impact that pollution, which may take years to clean up, will have on the city’s ability to woo businesses from both within, and outside the area. And as other environmental spills have demonstrated in the past, that’s an answer that only the river knows.

Images courtesy of Aaron Headly

Housing the Homeless Saves Taxpayers Money, (Another) Study Shows

A new analysis from Charlotte, N.C. once again shows what we've learned from many other case studies: It costs taxpayers less money to house the homeless than it does to leave them to the elements.

Researchers at the University of North Carolina examined Moore Place, a housing complex with 85 units, constructed in 2012 specifically to meet the needs of homeless individuals in the Charlotte area. Moore Place requires residents to pay 30 percent of their income (which includes things like veterans and disability benefits) toward the cost of rent. The remaining housing cost per person, per year is about $14,000 -- which Moore Place pays for through Federal and local grants.

If that $14,000 seems like somebody is soaking the system, keep in mind it costs about $30,000 per year or more to imprison somebody. Sometimes a lot more. Which is one important reason that giving the homeless a place to live can save taxpayers money. The population at Moore Place saw a 78 percent drop in arrests and 84 percent fewer days in jail compared to living on the streets. That's fewer people in expensive prisons, less police work, a reduction of caseload for the courts, and the aversion of a whole range of taxpayer costs that occur when people run afoul of the law. More savings come from fewer emergency room visits. Residents of Moore Place also collectively made 447 fewer emergency room visits and spent 372 fewer nights in the hospital than they would have otherwise. The emergency room tends to be the go-to source for medical attention for homeless populations -- a very pricey medical option.

Turns out that having a place to stay reduces the likelihood that a person will find themselves sustaining injury or illness and getting into trouble with the law.

All told the researchers at the University of North Carolina found a $1.8 million taxpayer savings. That almost 2 million bucks taxpayers don't need to shell out, potentially safer streets, maybe less waiting at the emergency room, and more human dignity -- for a single 85-unit building. The initiative was such a success that the city council of Charlotte approved $1 million in funding to increase Moore Place to 120 units.

Similar initiatives around the country are following the same principle. Colorado turned the Fort Lyon Correctional Facility into housing for the homeless. It's estimated that each homeless person on the street costs taxpayers $43,240. By contrast it costs just $16,813, on average, to house that same person.

I had the honor of visiting Braddock, Penn. and meeting Mayor John Fetterman and other community leaders of the beleaguered city. Braddock lost 90 percent of its population and 90 percent of its businesses over the course of 20 years, leaving the town destitute and empty. It had a high homeless population and a high crime rate, including homicide. One of the solutions was to renovate some of the numerous empty homes and use them for low-cost housing for the homeless.

Unfortunately, while practical solutions like this save communities and taxpayers tons of money while creating safer streets, there are those who find these common-sense solutions distasteful simply on principle. But leaving the homeless on the streets, in addition to being a failure of compassion, is demonstrably penny wise and pound foolish.

Image Source: Waferboard - Link

The Quick & Dirty: A Tale Of Two Cities -- Rankings, Awards and Other Popular Myths

"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way."

Wow... And I thought this was the opening paragraph of "A Tale Of Two Cities." Maybe it was, but it best describes how I feel about rankings, ratings, awards and everything else the experts do when they try to tell us which company just passed sliced bread as the best sustainable thing ever. Better than the real thing. Better than all the rest. Simply the best.

This time it wasn't the usual daily-inbox-flooding set of Top 100 or Best Of or Greenest or Most Loved lists that got me going. This time it was one of my favorite morning reads, the Consumerist -- usually the place I go for a quick chuckle about who got into what trouble while I was sleeping. But this time it got me a bit worked up because it is the start of their 2014 Worst Company In America competition.

There were a few names on there that I don't like and would put on my personal list, too. But the thought that hit me first when I read the list was the Twitter joke #firstworldproblems. Do they really think Yahoo or eBay or Microsoft or CVS should be on that list compared to cigarette-makers or companies that spill chemicals into waterways or oil into neighborhoods or employ illegal workers on farms and factories and pay them next to nothing in slave labor conditions? Really? You think the things you identified make a company the worst company in the USA? Really?

Of course they don't. They are just making a list of companies who annoyed them and their readers in the last year or so. No real substance behind the list -- just a "I had a bad experience and will now take it out on you for revenge." No substance, no science and no credibility. And it wasted a precious 3 minutes of my commuting and reading time.

Make no mistake, those many awards and rankings and ratings and numerous lists that sustainability experts push out every day aren't much better. It is all in the eye of the beholder. How else can you have such huge differences between CR's 100 Best Corporate Citizens compared to Corporate Knights Global 100? Throw in Best Global Green Brands, and you are ranked No. 1 on the Most Confused Sustainability Expert With A South African Accent list.

How do you get a cigarette company to be listed as a better corporate citizen than Nike or Starbucks? You know the end product kills, right? You can make a Fair Trade certified cigarette, but it will still have the same outcome. How do four car companies make it into the top five of greenest companies? You know that no matter how fuel efficient their cars are, they are still made with metal and (mostly) burn fossil fuels, right? So how did they get there ahead of a Johnson & Johnson or IBM? How do two oil companies get listed in the top 10 global companies above a Unilever and Natura? You know they are oil companies, right?

I'm not climbing into any of the companies listed higher than others. That's not their fault. Heck, I drive a SUV. A small one but not a hybrid. My problem lies with the people making up the list. They are just making it up as they go along this merry sustainability road.

Each one will decide their own criteria according to what they believe should be the right way to make a judgment on who their research shows is the best. Some of them are pretty honest and list who are clients or who are members. But most of them just develop criteria, and we are told that these are the right criteria to assess whether this company is sustainable or not.

Lies, damn lies and statistics.

The criteria used is just an opinion. Sustainability is more complex than a simple ticking of boxes. A Timberland cannot be judged in the same way a BP is judged. They are only similar in that they are both called and defined as "a business." But they are apples and oranges. Yes, apples and oranges are both fruits, but we won't mix them up when making a list of what is best. That will come down to the criteria we create and our personal choice.

But don't blame companies. They all want their products to be seen as sustainable. They all want to win the race. The reality is that this is simply not possible. Not all products are equal when it comes to sustainability. Not all products are sustainable. They simply cannot all be sustainable. We wouldn't be in this amount of trouble if they all were as good as the lists told us they were. Remember, how a product is made is only half of the story -- the other half is the impact of the product itself. A Fair Trade cigarette? A responsibly mined piece of coal? A humanely slaughtered whale? Remember the end product. It's too complex to simply make up a bunch of criteria based on GRI or whatever gets you going in the morning.

So stop making up lists of the good or the bad as it all just turns into the ugly. None of these lists or awards are sustainable. Or be honest about the severe limitations of facts, figures, criteria and those damn statistics. Nothing wrong with an opinion (I just gave you one), but don't mask it with faux science and a list or ranking that give it some flavor of science. An apple a day keeps the doctor away and an orange is more than just a pretty color. But they aren't the same -- no matter what your opinion might be.

Remember that opening paragraph of "A Tale Of Two Cities." Right now we are starting to look like we are living in the age of foolishness and not wisdom. These lists are more the epoch of incredulity than belief. It creates more Darkness than Light. It brings me despair not hope...

I leave you with my favorite lines from "A Tale Of Two Cities" that reminds me of these lists and rankings and awards:

"What did you make of it, Tom?" "Nothing at all, Joe." "That's a coincidence, too, for I made the same of it myself."

Image credit: A portion of the Consumerist's 2014 Worst Company in America bracket

-

A series of quick & dirty opinion pieces by Henk Campher. Senior Vice President, Business + Social Purpose and Managing Director of Sustainability at Edelman out in the Wild West of San Francisco. Disrupter of purpose. Engineer of big ideas. Slayer of myths. Social media junkie - @angryafrican. He never wears ties. Ever. But always wears an accent with a strategy and opinion in his back pocket. Please note this series will not focus on individual companies and any reference is purely to provide color commentary.

Follow Henk Campher on Twitter.

Nest 'Protect' Raises the Bar on Smoke Alarms

Last month, Google paid $3.2 billion to acquire Nest Labs, Inc., the maker of upscale home gadgets with high-tech interfaces, most notably the Nest Learning Thermostat (NLT). Most observers feel the acquisition was to help Google participate in the home energy management market, which is becoming increasingly connected to the “Internet of things, which Cisco estimates to be worth some $14.4 trillion over the next decade.”

Nest had only recently announced it’s take on the smoke alarm, the Nest Protect, which is a combination smoke and carbon monoxide (CO) detector, done-up with the same kind of panache that made their thermostat stand out from the crowd.

The Nest Protect has a variety of features, providing the kind of performance that you might expect from a “smarter” smoke alarm.

Starting with the same kind of elegant styling as its thermostatic cousin, as well a similarly premium price ($129), it’s clearly aimed at a discriminating market. Here’s what your investment will get you.

The smoke alarms are all connected to the Internet via Wi-Fi, which not only allows you to check them with a smartphone app, as you could with the NLT (using the same app), but it also allows them to talk with each other. That means that when there is smoke or carbon monoxide being detected, the alarm will sound not only in the room where the smoke is, but in all the other rooms, too. That improves the chance that you will hear it, which is, after all, the point.

Human factors were clearly given a good deal of consideration. There are two levels of hazard detection with corresponding levels of response. The first is called a “heads up,” which means a small amount of smoke or CO has been noticed. This results in a yellow light and a mild chirp, notifying you not to get too excited, but perhaps you might want to take a look. If the smoke or CO continues, you get the full-blown loud alarm and a red light. The talking detectors will tell you which room the smoke is coming from.

Another great feature is the Nest Wave. Once the alarm comes on, and you’ve gotten the message, whether it’s a false alarm or not, you can easily silence it with a wave of your hand. It might take a couple of waves (the algorithm needs to be sure you really mean it), but as long as you are within 2 to 8 feet of the device, it will shut off. This is important, because annoying false alarms that are difficult to shut off often lead to people disabling their smoke alarms -- which, in turn, sometimes leads to very unfortunate outcomes.

The device comes in either a hard-wired or battery-operated version. The battery version requires six lithium-ion batteries, which Nest claims will last several years. Speaking of batteries, another nice feature is the Nightly Promise. What is being promised here is that the device will not awaken you in the middle of the night asking for new batteries. Once the lights go out, the device gives you a reassuring green wink if everything is a-okay, or a yellow frown if it's not. So you might need to change the battery at that point, but it’s better than waking up several hours later to do it.

The Protect contains an impressive variety of sensors including:

- Photoelectric smoke sensor

- Carbon monoxide sensor

- Heat sensor

- Three activity sensors

- Ambient light sensor

- Humidity sensor

All of this means that the device really wants you to calibrate it once a week, though I doubt that’s going to happen in most homes.

Reviews for the most part have been favorable. Some have balked at the price and wondered if it was really worth the money. Consumer Reports said it performed well, though it was not the safest product of its kind on the market. It gave that honor to a $30 Kidde device. Why? The Kidde uses both photo-electric and ionizing smoke sensors. This allows it to sense a wider range of fire types. The photo-electric sensor used by Nest does respond to smoky-type fires, meaning that it is what it says it is: a smoke detector.

Still, CR felt that for that price, and its claim to be the Cadillac of smoke alarms, the company should have included both types of smoke sensors. The CR reviewer also complained loudly about the difficulty of setting up the Wi-Fi, suggesting that it was not for the uninitiated.

I reviewed the Nest Learning Thermostat back in 2011. At the time I connected with Ted Kidd, a home energy expert, who felt that the premise on which programmable thermostats like the Nest were based on -- that setting back the temperature for a few hours each day would save energy -- was not necessarily true. “Big savings are not achieved by temporary temperature reductions of the home,” he said. “In fact, reducing air temperature in the home means high mass items like couches and beds get cold and stay cold.”

That means more energy will be required at the other end, to heat all that mass up again. So the question of savings is a little more complicated than one might expect.

In the case of the smoke alarm, Nest engineers have certainly pushed the envelope and advanced the state-of-the-art with a very thoughtful design. A number of these features are truly valuable.

As to whether they have truly designed the ultimate smoke alarm, I think maybe not.

As we look into the future, home automation will continue to progress, and I think we will begin to see smoke detectors coupled with ventilation systems -- combined under the heading of indoor air quality and smart ventilation. That way the smoke is not only detected, but it can be actively removed as well. Given that most fire-related deaths are due to smoke inhalation, this could be a very important development.

Still, in the near-term, the Nest Protect is an option well worth checking out, especially for gadget lovers.

Image courtesy of Nest

RP Siegel, PE, is an inventor, consultant and author. He writes for numerous publications including Justmeans, ThomasNet, Huffington Post, and Energy Viewpoints. He co-wrote the eco-thriller Vapor Trails, the first in a series covering the human side of various sustainability issues including energy, food, and water in an exciting and entertaining romp that is currently being adapted for the big screen. Now available on Kindle.

Follow RP Siegel on Twitter.

Women in CSR: Suzanne Apple, World Wildlife Fund

Welcome to our series of interviews with leading female CSR practitioners where we are learning about what inspires these women and how they found their way to careers in sustainability. Read the rest of the series here.

TriplePundit: Briefly describe your role and responsibilities, and how many years you have been in the business.

Suzanne Apple: I am Senior Vice President of Private Sector Engagement at World Wildlife Fund (WWF), the world’s leading conservation organization. I lead our corporate engagement with major U.S.-based companies and their supply chains to ensure that the natural resources and ecosystems which are essential to their operations are managed sustainably.

I joined WWF almost 11 years ago following more than 10 years at The Home Depot as Vice President of Community Affairs and Environmental Programs where I oversaw the company’s CSR and sustainability initiatives.

3p: How has the sustainability program evolved at your organization?

SA: I think what has been most satisfying in my career is to have seen the conversation about sustainability evolve from the right thing to do, to a business imperative. Sustainability is now front and center on many boardroom agendas, becoming integrated into companies’ core business strategies. Previously, many companies saw the environment as something separate from their business, but they are beginning to see the bigger picture and now understand that responsible environmental practices are essential to the long-term viability of business and the license to operate.

I saw this firsthand at The Home Depot. In the early 90s, we began to take a close look at our sustainability strategy and one of the first steps we took was to better understand the company’s impact on the environment, looking across all categories of our business. I was proud to be part of the company’s announcement in 1999 of the first comprehensive wood purchasing policy in the North American home improvement sector, which was a huge first step towards supporting responsible forestry throughout the world. We were really ahead of the game, because even in the early 2000s, sustainability was in its infancy in most companies and sectors.

When I first came to WWF in 2003, I had an opportunity to continue that work as more and more companies were embarking on their own sustainability journeys to better understand their environmental impact. Since 2003, the value that our partner companies place on sustainability has grown exponentially. In 2005, Walmart announced its sustainability goals which had a catalytic effect in advancing sustainability across the corporate sector and raised awareness of the role of the supply chain.

Working together with companies to jointly develop solutions to minimize their environmental impact while also improving their business practices—and hopefully strengthening their business’ profitability — and achieving WWF’s goals through this work has been one of the most rewarding elements of my work at WWF.

In fact, one of the proudest moments of my career was to see WWF recently named as the most influential NGO partner by the Green Biz Intelligence Panel. This recognition from more than 3,200 executives and thought leaders in the area of corporate environmental strategy and performance demonstrates that WWF’s approach to corporate engagement drives results for people, nature and business.

3p: Tell us about someone (mentor, sponsor, friend, hero) who affected your sustainability journey, and how.

SA: Arthur Blank, co-founder and former CEO of The Home Depot, had a significant impact on my career and personal view of sustainability as he pushed us, as a company, to assess our environmental impact and look at innovative ways for us to be more sustainable. I had the privilege of reporting to Arthur when I worked at The Home Depot and found him very inspiring, both personally and professionally.

Another source of inspiration is Ray Anderson, CEO of Interface, one of the largest carpeting manufacturers and noted author on sustainable enterprises. Ray was a true sustainability pioneer and was a leader with a courageous and ambitious environmental vision.

Both Ray Anderson and Arthur Blank have shown me the powerful role that CEOs can have in defining their company’s sustainability legacy.

3p: What is the best advice you have ever received?

SA: The best pieces of advice I have received have been about risk taking and thinking outside the box.

First, if you aren’t making mistakes, then you aren’t taking enough risks. I’ve found that the most innovative solutions often come from outside your own comfort zone.

Second, to move to the next level, think and act like you’re already there. Think ahead, think broadly and don’t be limited by your position or title.

3p: Can you share a recent accomplishment you are especially proud of?

SA: One of my most important accomplishments was launching WWF’s transformational partnership with The Coca-Cola Company to help conserve the world’s freshwater resources. Expanding this focus and building on our progress, we recently renewed our collaboration through 2020 to achieve even greater impact by helping address the natural resource challenges that impact fresh water. This partnership has had significant impact around the world and is unique in its focus on building a sustainable value chain for the 21st century and beyond. It has been an exceptional experience to see our two organizations (WWF and The Coca-Cola Company) work so closely together – it’s a true partnership and definitely not your typical NGO-corporate collaboration.

3p: If you had the power to make one major change at your organization or in your industry, what would it be?

SA: I think that at every organization there is an ongoing opportunity to empower people to be innovative risk takers. In the realm of corporate sustainability, I think there is momentum at some companies to approach sustainability from an entrepreneurial perspective; to look at it through the innovation lens. I’d like to see this continue as it not only makes for a more stimulating work environment, but it also can inspire terrific results and outcomes.

3p: Describe your perfect day.

SA: My perfect day begins sitting on a screened-in porch in Louisiana with a steaming cup of café au lait and ends with a sunset cruise on the Bayou.

Sustainability is Important to Most American Food Shoppers, Survey Finds

A new survey of American consumers provides some potentially surprising findings that indicate American food shoppers are very mindful about what they place into their shopping carts, and it's not just about price and taste.

While food commercials on television constantly bombard Americans with offerings that focus on price-point and convenience, a 2014 survey by Cone Communications found that people care about where their food comes from and how it is produced. In a poll of more than 1,000 people from a broad cross-section of the shopping public, 77 percent of respondents said sustainability was an important factor in deciding what to buy, while 74 percent said buying locally was a significant factor.

Understandably, food safety is something that 93 percent of shoppers consider very, or somewhat, important when making food purchasing decisions, slightly outweighing concerns over nutritional value (92 percent). Interestingly, though, while 74 percent of consumers indicated buying locally is a consideration in making decisions, fewer, at 54 percent, said buying organic is a consideration. Evidently shoppers are prepared to spend extra dollars to support their "buy-local" sensibilities, with 66 percent of those surveyed saying they would pay more, and sacrifice variety, in order to purchase locally-produced foods. The top reason provided for buying locally is that people want to support local businesses and communities, which they deem more important than the potential environmental or health benefits of doing the same.

Another of the study's findings is that despite industry resistance to labeling genetically modified (GMO) foods, consumers want to see companies step up their level of transparency about how food is produced. Eighty-three percent of those surveyed said they wished companies would disclose information and educate consumers about GMOs in their products -- especially as 55 percent of people didn't know whether GMOs were good or bad for them, and 51 percent didn't understand what GMO food is.

Though sustainability is important for more than three-quarters of American shoppers, with 81 percent keen to see more food options that protect the environment, when those surveyed were asked to select their top concern in making purchasing decisions, sustainability didn't trump other priorities. Fifty-four percent picked family satisfaction -- that is, what products their family most enjoys eating -- as the most important thing; 41 percent picked health and nutrition, while sustainability was selected as the top concern by only 5 percent.

The Cone Communications study is available to download online, and it seems that there is a substantial opportunity here for advocates of sustainably-produced foods to tap into an underlying consumer concern about health and the environment in food production. Yet with only a few consumers placing sustainability as their top concern, coupled with a powerful agricultural and food industry lobby, how easy do you think it will be to make sure the sustainability preference is met?

Image Credit: Paulo Ordoveza

Follow me on Twitter: @PhilCovBlog

Carson City, Calif. Puts a Temporary Ban On Oil and Gas Drilling

The five members of the Carson City Council in California voted unanimously to put a 45-day ban on new oil and gas drilling. During that time, the city council will consider enacting a one-year ban. Occidental Petroleum would like to develop 200 wells in the Carson City area, located in Los Angeles County. Occidental reportedly said back in 2012, when it first proposed drilling the wells, that it plans to use hydraulic fracturing, better known as fracking. However, the company now says it no longer plans to use fracking.

The council is not taking the word of Occidental Petroleum. As one councilman, Albert Robles, told Reuters, "There are too many questions, too many unknowns and too many possible bad consequences that could result from the city engaging in this activity.” Robles added, “These questions significantly outweigh any possible benefit to the residents of Carson.”

Report links earthquakes and fracking

Other California towns have also banned fracking, including Santa Cruz last September and more recently Los Angeles. However, Carson City is the first California town to ban all new oil and gas drilling. Two days prior to the vote, a 4.4-magnitude earthquake hit the Los Angeles area. The earthquake has not been blamed on fracking, but its epicenter was only 8 miles from a fracking well. A recently released report linked fracking to earthquakes. The report, titled "On Shaky Ground: Fracking, Acidizing and Increased Earthquake Risk in California," found that the majority of California active oil and gas wastewater injection wells are close to faults.

Specifically, the report found that 54 percent of California’s 1,553 active and new wastewater injection wells are within 10 miles of a recently active fault; 23 percent are within 5 miles, and 6 percent are within 1 mile. Some of California’s major population centers, including Los Angeles, are located in regions where large amounts of wastewater injection wells operate close to active faults. Seven of the 10 U.S. metropolitan areas with the highest estimated yearly losses from earthquake damage are in California.

The report also found that there is inadequate research and monitoring, nor have there been any studies to evaluate the risk of induced earthquakes from California’s existing wastewater injection wells. Regulation does not protect California from the risk of induced earthquakes. “The best way to protect Californians is to halt hydraulic fracturing, acidizing, and other unconventional oil and gas recovery techniques,” the report states.

There is already fracking in California

There is much more fracking going on than the California Division of Oil, Gas and Geothermal Resources will admit to, according to a Environmental Working Group 2012 report. EWG researchers found documents that showed fracking has occurred in at least six California counties: Kern, Los Angeles, Monterey, Sacramento, Santa Barbara and Ventura. The researchers estimate that more than 750 California wells were fracked in 2009 alone -- which is “clearly an underestimate,” the researchers believe, because "only a subset of California wells are being counted.”

State regulation of fracking won't occur until 2015

California Gov. Jerry Brown signed a bill into law, which puts regulation of fracking into place, but not until 2015. That means, unregulated fracking can occur in California until 2015. Not everyone is happy with Brown for not banning fracking, including some within his own party. Nine Democratic lawmakers sent him a letter in January asking him to prohibit all fracking “until health and environmental concerns are addressed.”

Many Californians are not happy with fracking in their state. Less than a week before Carson City Council members voted on the ban, thousands of Californians held what some call the largest anti-fracking rally, called Don’t Frack California, ever held in the state.

Image credit: torbakhopperMaking the Food Trade Work for All

By Daniel Gonzales, Fundación AVINA

This Monday, March 31, we celebrate Cesar Chavez Day, and remember the challenges faced and battles fought by farm workers across the country. It’s also a time to discuss the fight that lives on today in the U.S. and abroad—a fight for fair wages and safe working conditions in an industry held up by a population of laborers whose rights are often difficult to protect.

In North America, most farm workers come from Latin America. The U.S. Department of Labor, for example, says that close to 90 percent of farm workers are Spanish-speakers, and more than half of immigrant farm workers nationwide do not have legal protection. More indigenous workers from rural Mexico and Central America are arriving, as well as guest workers from Asia. Although they pay payroll taxes and contribute anywhere from $6 billion to $7 billion in Social Security funds, migrant farm workers do not come to the United States to get welfare because of the simple fact that they are not eligible.

A global workforce

What this tells us is that the realities of agricultural labor in the U.S. are not confined within its borders. Whether it’s a coffee farm in Brazil, a pineapple farm in Costa Rica, or an apple farm in North America, farm workers can often find themselves a part of a globally marginalized, transient and largely invisible workforce that brings us our food each day. Just as the issues in our global food systems cannot be addressed by problem-solving in one region alone, restoring pride and dignity to the American farm worker also requires a far more global perspective and approach. It requires the equitable appreciation of all farm workers, wherever they may be. Their skills, dedication and sweat are all human.

Let’s take the case of Angela Mayor and her husband Pedro Peren, who own a small strawberry farm in Central America. Unfortunately, there is not enough work to support the whole family, which is why their son, Edmer Aroldo Peren, must leave home to find work. As the son of farmers, his skills best lend themselves to agricultural work, so he decides to travel to North America for harvest season each year.

Once there, a whole new wave of challenges can arise. He may find himself working with harmful agrochemicals, earning extremely low wages and laboring around the clock with no access to healthcare. A recent article by Aviva Shen points to a survey of farm workers in New Mexico, where managers threatened to fire workers if they refused to work in direct contact with dangerous, carcinogenic pesticides.

Quality, dignity, sustainability

These challenges, which are shared by many farm workers across the globe, encourage the question—how can we get quality food that upholds human dignity and enables sustainable livelihoods?

One solution could be expanding the scope of existing models, like Fair Trade for example. Fair Trade is a well-established and proven approach to supporting farmers and workers. It’s also an important way for consumers to identify products that were grown with care. Historically Fair Trade certification has only been available to farms in the developing world, meaning that a majority of the products in North American grocery stores (and the people behind them) have been outside its scope. According to the USDA, more than 80 percent of food consumed in the U.S. is produced domestically. Given the positive work the Fair Trade movement has been pursuing for decades in the developing world, it could also be very beneficial if applied in the global North.

Any farms that earn Fair Trade certification, wherever they may be, must meet and adhere to stringent social and environmental standards. These include: safe working conditions, regulated chemical use, restrictions on work hours, equal opportunity employment, freedom of association and recruitment best practices. They also earn community development premiums to invest in important projects like housing, education and healthcare.

It’s also possible that skills built on Fair Trade farms in the North will benefit that worker when he/she returns home, potentially creating new economic and leadership opportunities in both places.

Applying a proven model

Fair Trade USA is an example of one group that is working to apply this proven model to more farmers and workers. Due to their decades of experience, the group knows that farm work remains among the most dangerous and lowest paying occupations anywhere in the world, not just in the global South. This is why they've begun a partnership with a progressive farm in Canada, to learn everything they can about what Fair Trade might mean for more than 100 farm workers, most of whom migrate from Central America on a temporary work visa, and their families back home. Through the farm’s compliance with the Fair Trade standards, consumers will be able to know how, where and by whom their food was produced.

Though this journey is in its infancy, there have already been many benefits for the workforce thanks to the farm’s step forward with Fair Trade. When one Central American farm worker, Carlos Corona, was asked what he thought about Fair Trade’s restriction on excessive working hours, he stated, “[A] maximum is great. Money is nice…but we also need to take care of ourselves. We must watch our health, too.”

Supporting recruitment best practices (i.e. how workers actually get to the farms) is also important, to ensure that individuals don’t take on significant debt while pursuing job opportunities abroad:

“Getting reimbursed [for recruitment costs] is great because we have very scarce economic resources,” added Corona. “I worked six years in my home town, but we barely made ends meet. This money I get back definitely will go for my eldest daughter’s education, to pay for her school fees and materials.”

And for Edmer Aroldo Peren, the worker I mentioned previously whose parents own a strawberry farm, he was recently elected as the president of the Fair Trade committee, and will vote on how to use the first Fair Trade premiums to address the most pressing needs of the workers, their families and their communities.

With this innovation, Fair Trade USA is taking their existing standard, which has been in development and improved upon for decades, and making it more inclusive. They also want to create more opportunities for people to choose Fair Trade more often and enable retailers to sell Fair Trade produce throughout the year (without being limited by seasonality). These products would add to the still-growing Fair Trade market--with more than 12,000 products now in over 150,000 retail locations.

By having a predictable, safe and inclusive supply chain, everybody wins. And Avina, a Latin American foundation I represent, is proud to support Fair Trade USA’s progressive and leading role in shaping Fair Trade globally, this Cesar Chavez Day and beyond.

Image credit: James Rodríguez © 2013 Fair Trade USA

Daniel Gonzales directs Avina's international strategy and team for Migrations. He is also a member of WTT, Avina’s for-profit spinoff, combining state-of-the-art technology with high-impact business models. He has 13 years of experience investing in the development of businesses and public-private partnerships for sustainable development with the social, business and public sectors in over 25 countries. He is a Board member in 4 social enterprises and 2 venture capital funds. Daniel holds a double degree as a Global Executive MBA from Georgetown University (USA) and ESADE (Spain). He is a former professor from de Universidad de los Andes Business School; holding a degree in Industrial Engineering from the same University. He also holds several executive education diplomas, including one on building ventures from Harvard Business School. Daniel is based in Bogotá, Colombia.