Campaign Underway to Send U.S. Power Soccer Team to the White House

By Eric Smith, Senda Athletics

In 2011, the United States Power Wheelchair Soccer team won its second consecutive World Cup title, making them the only U.S. soccer team in history to win back-to-back World Cups. Despite this momentous achievement, the team has not yet been invited to the White House to be honored by President Barack Obama. I truly believe that it is time for the White House to take the initiative in celebrating the dedication and achievements of athletes of all abilities representing the U.S.A.

This April, the U.S. Men’s National Soccer Team will visit the White House on their way to the 2014 World Cup in Brazil. The goal of this campaign is to seek an invitation for the U.S. Power Soccer Team to join the U.S. Men’s National Team in their visit. This is a unique opportunity for President Obama to honor both teams' achievements together, on the world stage. Thus far, the change.org campaign to make this happen has reached nearly 1,000 supporters, and word is being spread through all of the major social media channels.

The United States won the first Power Soccer World Cup in Tokyo in 2007, defeating Belgium, England, Denmark, Japan and Portugal before beating France in a penalty shoot-out in the finals to win the cup. The team then made history when it defended its title in Paris four years later, defeating England 3-0 in the final becoming the first American soccer team to defend their title as world champions.

“Each year, winning teams in major sports in the U.S. spend time with the President; it is an honor athletes who reach the highest of milestones enjoy,” said Chris Finn, Head Coach of the U.S. team. “Considering we are the only team in U.S. history to win TWO world cups, I think it is prudent for our team to visit with the President and introduce him to our growing global sport.”

Power Soccer is the fastest growing sport for power wheelchair users. Players use these power wheelchairs to pass, defend and spin-kick a large 13-inch soccer ball in a skilled and challenging game similar to traditional soccer. Teams of four athletes compete on a regulation-sized basketball court, under rules established by the governing body of power soccer, the Federation Internationale de Powerchair Football Association (FIFPA). This sport provides an unparalleled opportunity for everyone to be able to experience the magic of soccer.

As believer in sports as a tool to bring people together, I know that with the help of the White House, the U.S. Power Soccer Team can inspire millions with their accomplishments, and that President Obama has an incredible opportunity to honor this inspiring group of players.

To achieve this goal, USPSA and Senda Athletics are launching a Change.org campaign to gather 1,000 signatures of support, generate awareness for this cause and send the two-time defending World Cup champions to the White House.

For those of you on Twitter, we have created a web page that allows you to send a tweet to the people at the White House and U.S. Soccer that can make this happen.

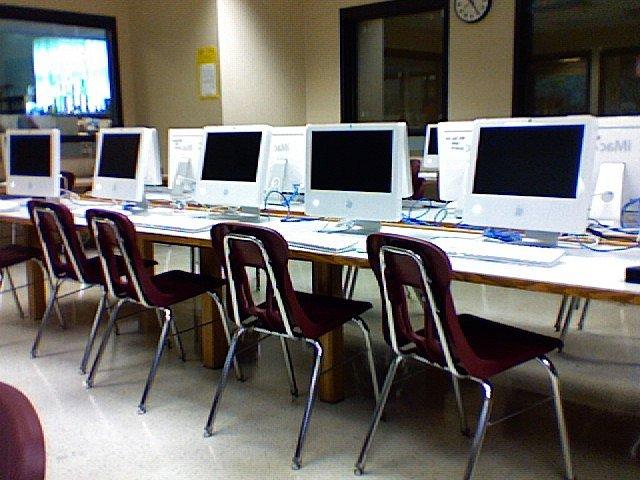

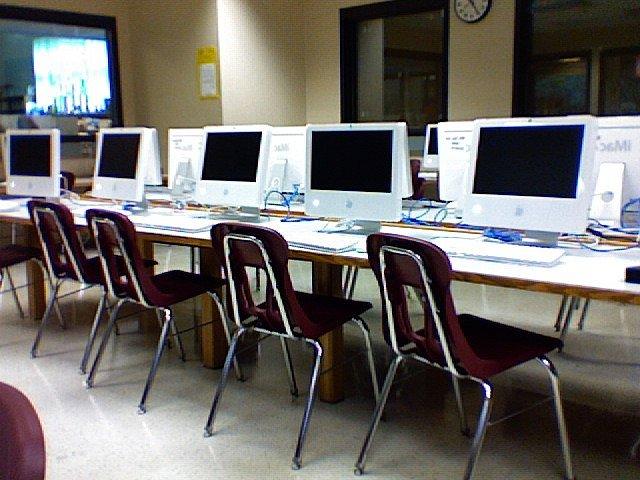

Tech Networks of Boston Puts Sustainability at the Core of Business

Tech Networks of Boston (TNB), is a 47-person professional information services company. It delivers help desk, remote monitoring and maintenance, staff augmentation, onsite support, training and project IT services to nonprofits and businesses in the greater Boston area. TNB, founded in 1994, has incorporated the principles of sustainable business from its inception. The company has steadily expanded its sustainability initiatives enabling the firm to broaden the range of services it provides.

Susan Labandibar, founder, president and chief mission officer of Tech Networks Boston, converted her environmental activist career into an earth-steward, job creation role with the launch of TNB. At its inception, TNB saved computers from heading to the landfill by refurbishing them and giving them a second life. The company evolved to bringing energy efficient computers and servers to the market. The company’s Earth-PC and Earth-servers used 25 percent less energy than well-known commercial computing devices. At the time, energy efficient computing devices was a groundbreaking, novel idea that has since taken hold of the entire computer industry.

TNB’s mission has evolved from salvaging and repurposing old computers to building energy efficient models. The firm now provides a suite of technology-related services aimed at significantly reducing the resource consumption of its clients. The suite of services includes training customers to optimize computer technology and software; properly manage, store and back-up information; and use IT tools to serve business needs. Through proper use, firms can maximize the return on their technology investments without wasting compute cycles, energy or money by purchasing more equipment than needed.

TNB has successfully integrated the financial, environmental and social elements of sustainable practices into its own business as well as its clients’ businesses, building a resilient company that has prospered for 20 years, establishing a strong competitive position in its local market.

Remote IT management, the genesis of cloud computing, is designed to reduce, and in some cases eliminate, intensive capital equipment requirements. TNB launched with the development of energy efficient compute devices; it has evolved to a managed services provider. Along the way, the firm adopted a range of sustainable business initiatives for itself.

TNB opened its original store on a subway portal. This location enables its customers and prospective customers to visit the shop without having to drive private vehicles. This simple site selection has saved thousands of driving miles.

As the company added employees, the location enabled the firm to actively promote its core values through the subsidization of transit passes. Three-quarters of the employees take advantage of the pass, removing more than 35 cars from day-to-day commuting. Using EPA-based measures of 5.1 tons of CO2 per year, per vehicle, TNB prevents over 178 tons of carbon dioxide from being released into the atmosphere annually. Employees who need to visit customer sites have TNB’s electric vehicle available for use.

Office waste management is an operational cost where TNB has applied disciplined handling. The company has implemented aggressive recycling and composting initiatives. These initiatives have reduced its waste from operations significantly. The City of Boston provides recycle services and TNB uses a third party for compostable pickup services. The firm has eliminated its landfill-destined waste by more than 50 pounds each month.

One of TNB’s most successful sustainability initiatives is the greening of its office. The site is a repurposed building in a neighborhood undergoing revitalization. TNB is working on upgrading its older inefficient florescent lighting to new, fifth-generation fluorescent lights. The new lights use the existing fixtures and infrastructure which represent up to 80 percent of a lighting upgrade cost. The new lighting technology enables a faster, more cost effective lighting upgrade; and eliminates adding functional fixtures to the landfill. This change is expected to have a dramatic impact, reducing the firm’s energy costs by more than 20-percent, or approximately $75 per month. TNB recognized the electric waste of having a hot water heater at its first facility and removed it.

In 2013 TNB pursued B-Corporation status, increasingly thought of as representing the ultimate commitment to sustainability by small business leaders. It took three months to accomplish this goal. Along the way to becoming a B-Corp, the company learned it was an industry thought leader on many corporate practices; however, the firm needed to put a stronger emphasis on establishing and tracking metrics for energy, waste, and their ecological footprint.

The B-Corp status was important to Labandibar and the firm because it identifies TNB as an earth-friendly, mission-based company. The status certifies TNB as an accredited, mission driven organization focused on its own environmental impact as well as its role in driving sustainability within the community.

Image credit: Flickr/izzymunchted

Recycling remains challenge for many domestic households

Scepticism is still rife among French and UK households when it comes to where their recycling lands up and the aesthetics of recycling bins also leave a lot to be desired.

These are just two of the ongoing barriers to better levels of household recycling revealed in a new study commissioned by Coca-Cola Enterprises (CCE) in partnership with the University of Exeter.

As a result CCE has launched a recycling challenge to co-create solutions to help improve at-home recycling habits, in partnership with open innovation platform, OpenIDEO.com.

The 11-week challenge will draw on the platform’s 60,000 members from across the globe as part of CCE’s Recycle for the Future campaign.

Joe Franses, corporate responsibility and sustainability director, Coca-Cola Enterprises, explained: “Recycling is something in which we all have a role to play, and as one of the world’s largest independent Coca-Cola bottlers we recognise we have a responsibility to address today’s social and environmental challenges.

“While we can leverage our experience and expertise to educate and inspire consumers to recycle more often, we recognise we don’t have all the answers. So, we are collaborating with other thought leaders, and the best creative minds in the OpenIDEO global community, to help generate ideas that could deliver real change in at-home recycling habits.”

To find out more, or to get involved, see here and follow #recyclechallenge on Twitter for updates on the challenge.

New round of bankers’ bonuses draws more anger

Banks have drawn more criticism with their new round of large salary and bonus announcements.

Much of the anger results from Barclays’ revelation that the number of its staff on £1m ($1.66m, €1.2m) rose last year by more than 12% from 428 to 481. Half the recipients worked in the US and a quarter in the UK.

Those paid more than £5m rose from five to eight. They all worked outside the UK. One unidentified employee received a £3m pay-off.

Barclays was criticised earlier for swelling its investment bank bonus pool by £200m to £1.6bn despite a £37% slide in profits.

Chief executive Antony Jenkins himself, who refused his 2013 bonus, is nevertheless receiving shares worth £1m.

Jenkins gave the usual explanation that inducements were necessary to retain staff and business: “People are less attracted to come to you, both clients and employees. You get into something of a death spiral. Your brand deteriorates, and you can move very quickly from being a first-tier player to one in the second or third tier if you don’t protect the franchise.”

He reported that hundreds of key staff had already left Barclays’ US investment bank.

Lloyds Banking Group, 32.7% of which is government-owned, announced it paid 27 staff more than €1m ($1.39m, £836,000) last year.

Chief executive António Horta-Osório received a £1.7m bonus in addition to his £1m salary, and Juan Colombás, the head of risk, was paid £3.1m.

HSBC, the world’s largest bank in asset terms, revealed it paid more than €1m to 330 staff, and that 192 key staff received on average $1.5m (£903,000, €1.08m).

The pay and bonuses deal given to group chief executive Stuart Gulliver last year was £8m, up from £6.3m in 2012. Gulliver will also receive £1.7m in shares annually. The deal offered to chairman Douglas Flint could almost double his potential remuneration from £2.4m to £4.6m.

Emolument, the salary data specialist, has reported that the 2014 median bonus in UK investment bank trading divisions will be 52% higher than last year’s. The median bonus for directors was put at £200,000, compared with £106,000 last year.

Some bonuses, however, could be under threat. The Bank of England is consulting on proposals for clawing back bonuses in cases of misconduct or material error by individuals or a company’s financial downturn or risk management failure. The rules would be applied from 1 January, 2015.

The payments have upset even the Institute of Directors, which attacked Barclays for paying too much to senior staff and too little to shareholders.

The Trades Union Congress, the unions’ umbrella group, accused Barclays of “sticking two fingers” up to the public, and condemned HSBC for “soaraway boardroom greed”.

General secretary Frances O’Grady said: “It would be great if banks put the same effort into lending to small businesses as they do to getting round EU rules on boardroom bonuses.”

H&M signs up to BCtA as unions push for Rana Plaza fund donations

The Swedish multinational clothes retailer H&M has reinforced its campaign for improvements in Bangladesh’s garment industry by joining the UN-based Business Call to Action (BCtA).

Its objective in Bangladesh is to ensure better work conditions in the industry, skills and development training, social dialogue and opportunities for women.

With BCtA’s help H&M intends to create a skills centre in Bangladesh to raise vocational training standards, increase productivity and ensure the long-term employability of garment workers.

The company hopes later to establish a formal system for the training and support of skilled employees in Bangladesh. It expects the skills programme to benefit 5,000 workers by 2016.

The campaign is a “win-win for all”, said Sabha Sobhani, programme manager at BCtA, which aims to persuade companies that realising workers’ potential also brings commercial success.

More than 70 labour rights groups and trade unions are now urging clothing brands to contribute to the Rana Plaza Donor Trust Fund for the families and victims of the factory building collapse that killed 1,138 Bangladeshi garment workers and injured more than 2,000 a year ago.

The fund target is $40m (£24m, €28.7m), the amount needed to cover medical expenses and loss of income.

The pressure group includes more than 30 Bangladeshi bodies, 21 Canadian groups, trade union federations in Asia, Europe and the US, and the Amsterdam-based Clean Clothes Campaign, which is dedicated to improving conditions in the garment industry.

Seven brands have so far promised contributions, including Bonmarché and Mango.

* The Bangladesh Accord Foundation has recently completed its first reports detailing the results of factory inspections in Bangladesh and find that there are no current issues of a similar magnitude to those which caused the collapse of the Rana Plaza building in April 2013. They do identify a number of issues to be addressed and explain the steps to be taken to resolve them.

Commenting on the reports publication, Alan Roberts, the Bangladesh Accord Foundation’s executive director said: “The publication of these reports is an important milestone in the Accord’s progress and a demonstration of our commitment to transparency but it is only really the beginning of our work. There is a big task ahead of the inspection teams and the Accord will be working hard with brands, unions, workers and the factory owners themselves to see that the actions the inspections identify are undertaken.”

China’s austerity regime sets way for new business model

China’s new era of austerity could lead to a new way of global corporate governance, a Beijing forum has been told. Its still-growing economy will set the tone for a new world way of doing things, as the west continues to contract under its own debt-reduction programme.

The forum, organised by the British Chamber of Commerce, and the China-Britain Business Council heard from leading CSR speakers, including Wang Liwei, editor of Charitarian magazine, Sammy Feng, head of CSR at DLA Piper and Carma Eliott from the British Council.

Eighteen months since China’s new leadership of President Xi Jinping and Premier Li Keqiang took power, the new business landscape is becoming much clearer.

Firstly, there has been the clampdown on corruption, with a pledge that no matter how senior a figure is politically or commercially, they will all be targeted as “tigers and flies” in Xi’s own words.

Following corruption, extravagance is also now a no-no, with lavish banquets and the giving of luxury items banned.

Wang especially says this means the end of a grey area for foreign firms, including the high-profile bribery case of UK pharma giant, GSK, wherein the line now stands in doing business.

“In the past there was probably a breakdown in communications between foreign managers and their Chinese managers over ways of doing things. That is over now, “ he said.

Sammy Feng added: “What Xi has done has a major impact on big companies, especially in terms of government procurement in areas such as the telecoms and construction sectors, and of course the impact is felt in the hospitality industry.”

The strength of the crackdown has taken many people by surprise.

Figures presented to China’s parliament early in March showed that last year, 51,306 officials and 37,551 cases were investigated for work-related crimes including bribery and embezzlement - figures representing an 8.4% increase in the number of officials and 9.4% in cases - according to the work report of China’s top procuratorate, according to China Daily.

But that’s also good news for the future.

“It means a much more level playing field for everyone, domestic and foreign firms, a new era of transparency,” said Feng.

And as China’s economy grows to become the world’s number one, it will set a benchmark for the future way of doing business.

“Clearly what that means is that companies will need to follow the rules of doing business in China, globally,” he added.

Responsible sourcing unearths unseen benefits

By Jon Woodhead, Head of UK Sustainability, DNV GL – Business Assurance

As expectations grow on companies to take responsibility for sustainability-related issues beyond that of their immediate operations, responsible sourcing has become a prominent issue across many industry sectors. It’s a significant challenge, particularly where there are vast and complex supply chains producing products that are very much in the front of mind for consumers and therefore subject to increased scrutiny. Last year’s horsemeat scandal goes only to show how quick and extensive a problem can become.

There is no one single definition for responsible sourcing, but essentially it comes down to one fundamental aim: satisfaction that the products you source and the suppliers you use, meet or exceed your sustainability expectations. To do this, you need visibility and a collaborative approach.

M&S, for example, believes that 80% of its impacts are within its global supply chain. Part of Plan A includes a £50m fund to help suppliers find new ways of working.

How you ensure visibility and ultimately manage your supply chain impacts, from environmental impacts to quality and safety, is critical. It’s no longer acceptable to only manage and report the impacts within a company’s immediate operational boundaries.

Managing supply chain responsibility is often talked about as a requirement to monitor performance. This is only part of the picture. A successful approach goes one step further, identifying areas where improvements can be made and building capacity through supporting suppliers.

Whilst we see a wide variance in performance, through our research in the Tomorrows Value Rating, our team has observed that, in the food and beverage sector, almost all rated companies have some degree of management system in place, whether a policy statement, framework agreement or supplier code of conduct. The few companies that go beyond minimal compliance describe systems of independent audit and certification, and report on the results.

A number of good examples stand out; Unilever’s Cool Farm tool helps farmers calculate and reduce their carbon emissions. In the interests of promoting best practice across the agricultural sector, Unilever has made the tool available to other companies free of charge. Twenty companies are now using it. Coca-Cola is developing a human rights metric to add to its supplier performance scorecard.

Barriers in addressing responsible sourcing naturally increase with supply chain complexity. Smaller companies often face a lack of resources which, in turn, affects the companies they supply, who can’t meet their sustainability commitments without the support of their suppliers. Take water footprinting: when you are a small-scale producer, supplying a large global corporate, this could be a task outside the skills and resources that you have available. DNV GL has been working with UNIDO to address this, creating an easy-to-use water footprint tool that is accessible to SMEs, reducing the burden on them to comply with their customers’ requests.

Responsible sourcing makes business sense. It promotes closer collaboration with suppliers, unearthing benefits you may not have previously been able to identify, and spotting opportunities to collaborate with suppliers. Importantly, it almost certainly offers huge scope for improving your overall sustainability performance too.

Why women’s work for equality is far from done

On becoming a parent one of the vows I made was to never, ever tell my kids off for ‘showing off’. Growing up, I found being told to ‘stop showing off’ hugely embarrassing. For even if I was ‘showing off’, being told off for it felt utterly horrible. Being shown up for showing off, I guess.

Parenthood these days is strewn with semantic hazards. The latest is a Ban Bossy crusade that urges everyone to ban the term ‘bossy’ when referring to a girl’s behaviour.

The campaign was instigated by the chief operating officer at Facebook, Sheryl Sandberg, and the Girl Scouts movement in the US. It all came about following a study by the Girl Scout Research Institute which found that girls are twice as likely as boys to worry that leadership roles would make them seem bossy. This fear then puts girls off going after such roles. I’m not so sure. Bossy people aren’t usually people you want to follow, are they? Leaders, on the other hand, are inspirational, people you definitely do want to follow.

The Ban Bossy campaign was given a kick start with a slick YouTube video featuring a wealth of famous faces including Condoleezza Rice, Glee actress Jane Lynch and pop superstar Beyoncé, all urging us to support the movement. Beyoncé’s closing remark, together with perfect hair, skin and lipgloss aplenty is: “I’m not bossy. I’m the boss”. Now what does that glib comment add to the whole equality debate? Indeed, gyrate on a stage and call it ‘girl power’ or gyrate on a stage and put women’s rights back hundreds of years? Who gets the balance right?

Coinciding with International Women’s Day last month, Kellogg’s Special K announced a new strategic partnership in Europe with Chime for Change, another Beyoncé backed initiative and a global campaign to raise funds and awareness for girls’ and women’s empowerment.

Peter Soer, vp marketing at Kellogg Cereals Europe and a new member of the Chime for Change Advisory Board, commented: “We are thrilled to join so many other voices helping girls and women to shine and be the best they can be, which is what Kellogg’s Special K is all about. Large brands like ours can use our scale and reach to help make a positive impact on the world by driving awareness, inspiring action and ultimately helping to make change happen”.

The brand says it will help drive the campaign forward with a “25/25/25” commitment, which aims to share the Chime for Change message with 25m households in Europe; inspire 250,000 voices to “chime in” and join the movement; and help improve the lives of 25,000 girls and women around the world through education, health, and justice. Quite a tall order for breakfast cereal wouldn’t you say? Especially as I grew up thinking of Special K as a diet aid rather than the healthy diet choice into which it has evolved.

And it certainly has a job on its hands: an opinion poll carried out for the brand recently revealed that most women believe true equality – equal opportunities in every field from work to education to health – will not be a reality until 2030. Furthermore, 32% believe gender equality will never exist.

Food glorious food?

So how much has food security improved since Romanian horse meat was found in beef ready meals, prompting financial and reputational damage across the food industry? Miranda Ingram reports

Mozzarella that is only 50% cheese, prawns that are 80% water and ham that is either poultry dyed pink or “meat emulsion”.

On the anniversary of the horse meat scandal, West Yorkshire trading standards, with their superior laboratory, tested 900 food samples and found that over a third were not what they purported to be.

“We are facing a food adultery crisis,” said Labour’s Baroness Crawley, President of the Trading Standards Institute, addressing the House of Lords last month. “Call me old fashioned but I want fruit juice to be just that and not laced with vegetable oil that is used in flame retardants.”

The Labour peer went on to criticise cutbacks in the Trading Standards budget, pointing out that since 2009 testing is down 26% while food fraud is up 66%.

So how much has food security improved since Romanian horse meat was found in our beef ready meals, prompting financial and reputational damage across the food industry? Not much, according to Adrian Chamberlain, ceo of the global supply chain risk management company, Achilles. He believes that we are sleepwalking our way into another horse meat scandal since a survey commissioned by Achilles and carried out by the independent consultancy IFF last November showed that 82% of food and drinks manufacturers said the horse meat scandal has not affected the way they manage information about their suppliers.

Forty percent have never ‘mapped out’ their entire supply chain to find out who all their suppliers are and only 24% said they were ‘very confident’ that suppliers in emerging markets would continue to adhere to health and safety responsibilities.

“We were very surprised to see that manufacturers had not made changes to the management of supplier information, given the loss of public trust caused by the horse meat scandal,” says Chamberlain.

“Supply chains are becoming increasingly complex and globalised, with manufacturers seeking suppliers from all over the world. What this research shows is that even by the second tier of the supply chain, buyers begin to get hazy about the operations and risk profile of their suppliers. This is particularly concerning, given that recent scandals have involved suppliers deep down within supply chains.

“We are likely to see another scandal because of complacency about risks within the supply chain,” he told Ethical Performance.

There are two issues at stake when talking about food security: safety and fraud. It doesn’t matter how clean the East European dairy is or how good the UK storage facilities if the haulier uses insufficiently refrigerated trucks, the product will be rendered unsafe for human consumption.

Food fraud = food crime

Food fraud, on the other hand, involves deliberately substituting one food for another so that the product being sold is not what it says on the label. This latter, food fraud – or, as he calls it, food crime – is the biggest risk facing Britain today, according to Chris Elliott, professor at the Queen’s Institute for Global Food Security in Belfast and who published his interim report on the horse meat scandal at the end of last year.

“I have been persuaded by the evidence I have collected that food crime already is or has the potential to become serious organised crime,” he says. Although there is nowhere near enough data to put a cost on food crime, with the UK food and drink industry worth an annual £188bn, the profits from criminal behaviour could be substantial, he adds.

Elliott’s final report will be published in June but he has already called for the creation of a food crime unit within the FSA. “Our focus now urgently needs to turn to tackling food crime.”

Both food safety and food crime depend on the security of the supply chain which is itself subject to myriad pressures. Do you know your suppliers? Your suppliers’ suppliers? Their suppliers? Set questions like these against a rapidly changing global market in which traditional suppliers, such as China and Asia, are becoming consumers and emerging countries are joining the supply chain and the enormity of the task of monitoring supply chains becomes clear.

On top of this, consumers are constantly demanding innovative products – a mind-boggling 8,000 new food and drink products are launched in Britain annually according to the Food and Drink Federation – which requires a constant stream of new suppliers.

Clearly sustainability has a big impact on security here. Knowing your suppliers, your suppliers’ suppliers etc., talking to them, investing in them and understanding their problems while explaining your needs, builds an atmosphere of trust. Sharing the risks and rewards that follow goes some way towards avoiding corner-cutting and fraud.

However, there are more steps that could be taken. Achillles’ Adrian Chamberlain is among those calling for retailers to work collaboratively and create some sort of accreditation system for suppliers.

The idea is that two or three leading food manufacturers set the ball rolling by getting together and mapping out their entire supply chains, right down to source, during which process they will probably find they have suppliers in common.

They could then work together towards introducing industry certified standards for suppliers worldwide, creating an accurate, centralised database which would allow retailers to check suppliers’ credentials in all operational areas.

This would save retailers time and money as they would not have to keep carrying out their own audits whilst also giving certified suppliers a shop window to promote their products as well as an incentive to maintain standards in order to retain their certification.

This approach, however, necessitates leading retailers being transparent about their existing supply chains which they are remarkably reluctant to do. When Oxfam was trying to collate information for its Behind the Brands sustainability scorecard last year the charity was frustrated by ‘a lack of transparency within the sector’.

“All ten firms examined were overly secretive about their agricultural supply chains, making their claims of sustainability and social responsibility difficult to verify”, said a statement which prompted industry investors including F&C Asset Management, BNP Paribas Investment Partners and Aviva Investors to join the call for more supply chain transparency.

This assessment of supply chain security makes it clear that Britain needs robust testing in place. So is this the case?

Testing food is the responsibility of local authorities and their trading standards departments but as their budgets have been cut many councils have reduced checks or stopped collecting samples altogether.

Department for Environment, Food and Rural Affairs Minister Lord de Mauley, responding to the Yorkshire findings, told the Lords that the testing carried out by West Yorkshire Trading Standards demonstrates the action being taken by local authorities across the United Kingdom to tackle known problem areas and added “ there were 86,000 food safety composition and authenticity tests during 2012-13” and the Food Standards Agency has increased the funding it provides to support testing to £2.2m this year.

Overall, however, the number of samples taken to test whether food being sold matched what was claimed fell nationally by nearly 7% between 2012 and 2013, and had fallen by over 18% in the year before that.

About 10% of local authorities did no compositional sampling at all last year, according to the consumer watchdog Which?

Huge risk potential

Worryingly, West Yorkshire’s public analyst, Dr Duncan Campbell, believes the problems uncovered in his area are representative of the picture in the country as a whole and adds: “We are routinely finding problems with more than a third of samples, which is disturbing at a time when the budget for food standards inspection and analysis is being cut.”

Horse meat report author Elliott also blames the fragmenting of the responsibilities of the FSA between different bodies. There are, indeed, a bewildering number of organisations concerned with food safety and Elliott is calling for closer working between government departments and a “more robust” FSA as well for a supra-national system of standardised laboratory testing.

“I believe criminal networks have begun to see the potential for huge profits and low risks in this area. The food industry and thus consumers are currently vulnerable. A food supply system which is much more difficult for criminals to operate in is urgently required,” he writes in his interim report, recalling an incident when a supplier told him that a retailer had asked for a “4oz gourmet burger” to be brought in at 30p, a feat that would only be possible, according to the supplier, by using non-EU approved meat, offal and mechanically-recovered meat.

Investment in soft commodity trading ‘problematic’ says report

The most recent quarterly ‘Amity Insight’ report from Ecclesiastical Investment Management, which has been at the forefront of socially responsible ethical investments since 1988, argues that investment in soft commodity trading is “problematic” owing to a “fundamental model that disconnects the raw material from the wider beneficiary - growers and customers.”

The 16-page report titled ‘The Hard Truth About Soft Commodities’ contends it is “beneficial to closely scrutinise companies’ supply chain and better business practices before committing to financial investment.”

Soft commodities, which include coffee, cocoa, palm oil and sugar, represent one of the key components of the global economy. And, while such commodities dominate global trade today - accounting for around 25% of all trade and 65% of global traffic - Ecclesiastical notes that commodity trading “remains opaque and elusive.”

Neville White, Senior Socially Responsible Investment Analyst at Ecclesiastical in London, commenting says: “Criticism of trading companies is not just about their size or lack of transparency. Most have been dogged by charges of poor environmental management, pollution, deforestation, and complicity in human rights violations as a result of their high impact. In particular, traders tend, by their nature, to do business in countries with very poor human rights records.”

The majority of commodities trading is controlled by a handful of giant global companies wielding great power. For example, Vitol Group, a Swiss-based, Dutch-owned private energy and commodity trading company, produced 2012 revenues of $303 billion (bn) surpassing Malaysia’s gross domestic product (GDP) of $300.6bn.

And, Cargill, a private U.S. company that would rank ninth in the Fortune 500 if listed, generated revenues of $136.7bn in 2013 - a figure exceeding Hungary’s GDP.

White noted: “Many of these companies are unlisted and therefore not subject to normal corporate transparency, which means that trading can be highly speculative and potentially manipulative given the lack of regulatory oversight.” Indeed, of the top 20 global players in the sector today eleven are unlisted.

A further issue is the “complex and extensive” commodity supply chains, which put a barrier between the grower and customer. That said, the report remarked that manufacturers are beginning to address this issue by taking more control and buying direct.

Coffee, for instance, has one of the “most complex” supply chains of any commodity. Around 90% of coffee production is in the developing world and grown largely by small farmers, where “labour practices may be poor and poverty remains an issue” according to White. Typically the supply chain here involves producers, middlemen, exporters, importers, roasters and retailers. Green coffee is purchased by importers from exporters, 75% of which is handled from Switzerland, a jurisdiction with a favourable tax regime. Roasters like Nestlé rely on importers holding

large inventories, ‘drizzling’ the commodity into the market to maintain the price.

Sugar, which trades in contract sizes of 50 long tonnes (112,000lbs) and faces enormous competition from synthetic and artificial sweeteners like corn syrup, is labelled in the report as “one of three agricultural commodities most responsible for driving competition for land in developing countries” and blamed by Oxfam for ‘land grabs’.

White points out that: “Ecclesiastical Investment Management would always look to engage with industries to encourage greater transparency over practices and to make investing in this area easier for the ethical investor.”

Ecclesiastical offers eight investment funds including their Amity range of six ethically screened funds. None of the Amity funds are invested in any listed commodity traders.