Women in CSR: Kathleen Tullie, Reebok International & BOKS

Welcome to our series of interviews with leading female CSR practitioners where we are learning about what inspires these women and how they found their way to careers in sustainability. Read the rest of the series here.

TriplePundit: Briefly describe your role and responsibilities, and how many years you have been in the business.

Kathleen Tullie: I am Director of Social Responsibility at Reebok International and Co-Founder and Executive Director of BOKS (Build Our Kids’ Success). BOKS is a free, before-school physical activity program that aims to help improve kids’ academic performance and overall health by promoting physical activity and nutritional knowledge as a way to jumpstart children’s brains and better equip them for learning. The program is run by moms, dads, teachers and volunteers, two-to-three days a week before or during school.

Following my departure from the world of corporate finance, my attempt to be a “stay at home mom” was short-lived. I had this desire to engage with the community and leave an impact on children. It was the book Spark, by Dr. John Ratey from Harvard Medical School, which supported my belief that there is a strong positive correlation between exercise and learning.

I began the before-school activity program for kids in October 2009 at a school in Natick, Mass. With support from the school faculty, and my team of mom volunteers, we were able to start a program that focuses on the importance of building both healthy bodies and minds in youth.

Based on the success of the first school, myself, Cheri Levitz and Jen Lawrence created a non-profit corporation and approached Reebok International for T-shirts. At that initial meeting, senior executives at Reebok were inspired by our program and did not hesitate to ask us to become part of The Reebok Foundation and provide access to physical activity for kids around the world. The timing was right – Reebok has the mission to change the current culture of spectators to a culture of participants and there is no better way to start than with our youth. In 2010, BOKS became a signature initiative of The Reebok Foundation, which has played a key role in helping the program expand to almost 900 schools worldwide and reach as many children as possible. It’s been wonderful to see the impact the program has had in schools nationwide, as well as through important alliances with organizations like Let’s Move Active Schools, ChildObesity180, local YMCA's, Alliance for a Healthier Generation, Partnership for Healthier America, and American Alliance for Health, Physical Education, Recreation and Dance.

3p: How has social responsibility evolved at your company?

KT: The Reebok Foundation is investing to ensure that people all over the world are able to live active, healthy and happy lives. Reebok’s mission is to “Empower people to be fit for life” and through their support of BOKS, they have enabled us to reach more schools and more children. We want to go beyond generating awareness of the critical need for movement and exercise. We are working with schools, communities and children every day to build lifelong habits that will change the culture of sedentary lifestyles to one of active, healthy and happy lifestyles.

3p: Tell us about someone (mentor, sponsor, friend, hero) who affected your journey, and how.

KT: I believe everyone in my life has had an effect on my journey. We are creatures of influence and it is up to us to determine how to use those influences – in a positive or negative way. My parents always empowered me to be independent and resilient. Positive parents have a significant influence on children. I believe a father’s relationship and belief in his daughter(s) have a lasting impact. My dad has always said that I could accomplish anything I put my mind to. My oldest sister and my friends have also played a critical role in my love of fitness and the power of communities. Also, I’ve been fortunate to have a few mentors in the corporate world who have given me opportunities to excel. Most importantly, I feel blessed with a husband and children that are real rock stars and make my life complete and keep me motivated every day.

3p: What is the best advice you have ever received?

KT: Every obstacle is an opportunity.

3p: Can you share a recent accomplishment you are especially proud of?

KT: It was a huge accomplishment for the BOKS team to share the stage with First Lady Michelle Obama to promote the benefits of being active. First Lady Obama has played a pivotal role in raising a healthier generation through nutrition and fitness, and we were thrilled to be recognized for the commitment to get kids moving.

3p: If you had the power to make one major change at your company or in your industry, what would it be?

KT: I’d be thrilled to see every kid in America be more active before school. With less access to physical activity, it’s imperative that we take the steps needed to get kids more active – both to create healthy habits, and to help them perform better in school. We hope the BOKS tools and resources will help spur even more parents, teachers and volunteers nationwide to become advocates in their communities and work with their local schools to set up and implement BOKS. If everyone in the kids sporting industry took on the responsibility of bringing BOKS to their local school (before or during school) imagine how many kids we would have moving, and the precedent we would set showcasing the power of collaboration.

3p: Describe your perfect day.

KT: An early start with my family (including Bella, our golden retriever) full of outside activities (hiking, biking, skiing) ending with a delicious, healthy dinner, a fire, a family board game (and some ice cream), and then early to bed!

Students Design Edible, Plastic-Free Water Bottle

In an ideal, eco-friendly world, disposable plastic water bottles wouldn't exist; everyone would drink their water from a reusable cup or bottle. But in reality, Americans drink more than 73 billion half-liter water bottles each year, according to the nonprofit Environmental Working Group – enough to circle the planet more than 370 times.

While single-use plastic water bottles may just be too convenient for our rushed, on-the-go culture to give up entirely, three industrial design students have come up with an innovative, alternative packaging for water that is so biodegradable you can even eat it when you’re done drinking. The “Ooho” water container doesn't look like your typical water bottle; it more closely resembles a water droplet – one of nature’s most simple and beautiful forms, designer Rodrigo García González wrote on Designboom.

To make the Ooho, García and his fellow designers Pierre Paslier and Guillaume Couche used a process called spherification, which was developed in 1946 to shape liquids into spheres that are similar to caviar in both appearance and texture. In the 1990s, spherification became a popular culinary technique within the molecular gastronomy movement, after Spanish chef Ferrán Adria introduced the process at his restaurant elBulli.

The London-based students mixed together brown algae and calcium chloride to create a gelatinous, double membrane around the water – much like how the thin membrane of an egg yolk maintains it shape. The Ooho’s double membrane also keeps the water inside clean and safe for drinking. During the spherification process, the designers freeze the water into ice, so they can produce larger spheres and prevent the membrane’s ingredients from leaching into the water, FastCompany reported.

Because the Ooho is made from natural ingredients, the water sphere is completely biodegradable – or edible – after its useful life. The Ooho water container was one of the 12 winners of this year’s Lexus Design Award and will be on display during Milan Design Week, according to FastCompany.

Will this unique waste-free packaging catch on with bottled water manufacturers? Plastic water bottles are not cheap to make: In fact, about 90 percent of the price a consumer pays for bottled water is for the bottling, packaging, shipping and marketing – not the water itself, according to the Natural Resources Defense Council. But the Ooho costs just two cents to make and its double-membrane structure is the perfect spot for a company to place a label between its two layers without an adhesive, García told FastCompany.

The Ooho actually seems to live up to its claims of 100 percent biodegradability, unlike other “biodegradable” plastic water bottles on the market that critics say neither degrade in the landfill nor can be recycled with conventional plastic bottles.

But this quirky globe of water has a few conundrums to sort out before it hits the marketplace: Can you transport the Ooho in your bag or backpack without piercing its membrane and spilling water? Is there a way to drink from the Ooho without water trickling out onto your clothes and body, like the woman in the video experiences? Can companies produce a water sphere large enough to compete with those super-sized plastic bottles?

In the mean time, the Ooho team hopes their design will inspire people to test out a spherification recipe and make their own water containers at home.

"Anyone can make them in their kitchen, modifying and innovating the recipe," García told FastCompany. "It's not DIY but CIY – cook it yourself."

Image credit: Toyota Motor Sales

Passionate about both writing and sustainability, Alexis Petru is freelance journalist based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

A 3p Chat w/ David Gottfried; Founder, USGBC & World Green Building Council

Every Wednesday, TriplePundit takes 30 minutes or so to chat with an interesting leader in the sustainable business movement. These chats are broadcast on our Google+ channel and embedded via YouTube right here on 3p.

David Gottfried is a catalyst for transformation. His work has impacted the global building industry more than almost any other, having founded both the U.S. Green Building Council and World Green Building Council, with GBCs in 100 countries.

In our Google Chat series this week, TriplePundit's Founder and Publisher, Nick Aster, interviewed David Gottfried about the LEED accreditation program and the state of the global green building movement.

If you missed the conversation, you can watch it right here or on our YouTube channel.

About David Gottfried:

David Gottfried is best known as the father of the global green building movement, having founded both the U.S. Green Building Council and the World Green Building Council (with GBCs in 100 countries). He’s a catalyst for transformational green start-ups, collaboration and inspiration. Gottfried is an entrepreneur, author, keynote speaker and modern art painter. Gottfried’s organizational innovations have led to the greatest transformation of the world’s largest industry and perhaps the world. David's recent release of Explosion Green was reviewed by President Bill Clinton, who stated: "Our future depends on sustainability... David Gottfried's pioneering work is proof that we can do it, and Explosion Green tells us how."

Supply Chain Worker Rights: From Good Intentions to Implementation

Not that long ago worker rights were a given, labor unions were strong and powerful, as was the American middle class where a large part of the work and the need to enhance and protect workplace rights, benefits and progress was most in evidence.

Sure, it was a simpler time. Today’s globalized economy and its extended supply chains, rising income inequality, and stagnant economic and trade conditions makes the preservation of worker rights more problematic and difficult. This is especially true for supply chains in manufacturing and retail apparel sectors.

Today, worker rights might even be considered an oxymoron. But it’s a struggle well worth engaging as both a holding action and in efforts to bring workers across the globe living wages, safe working conditions and better standards of living.

Driven by globalization, supply chains are rapidly evolving across every industry sector, and the vendors in those supply chains are often a moving target as multinational corporations search for the lowest cost suppliers. Another unfortunate result of globalization is a race to the bottom by resource-poor, developing nations that are eager to secure sourcing contracts from wealthier countries. Concerns also center on how labor standards can best be monitored and enforced throughout these evolving organizational structures.

The University of Washington last year explored this topic during a conference on “The Transformation of Supply Chains” featuring academic experts and leaders from several labor rights organizations, including Central General Trabajadores, Worker Rights Consortium and the Fair Labor Association (FLA). The focus was on these issues: how supply chains have changed over the years; pressures to evolve; and how — if at all — workers have benefited from these transformations. The gist of their findings was that a collaborative approach will bring continued improvement among multinational corporations, and that better alignment is needed among all the players – from governments and corporations, to the brands and companies ordering the products, to factory owners, management and workers on the factory floor.

FLA President Auret van Heerden addressed the improvement of labor standards by the Chinese government and its efforts to create high value-added supply chains. He said China’s low value-added systems — for example in the garment industry — did not create the type of high-wage, high-skilled jobs that China was seeking. But van Heerden added that China has begun to raise its standards to create better jobs and greater value in its supply chains, including developing labor law provisions and increasing factory wages.

The problem is that for every laudable step forward there are countries, such as Bangladesh, that lower their labor standards in order to compete with China.

NGOs could also take a larger and more collaborative role by working with factory owners to improve labor conditions, rather than policing the supply chain through frequent auditing. Nike Inc. picked up on this idea, saying it is “evolving its mindset and its field operations away from a compliance auditing model towards a coaching model for factory partners focusing on continuing improvement in sustainability.” Nike adds, “We are looking forward to continued partnership with FLA in the development of industry-wide tools to build sustainable supply chains in the footwear and apparel industry.”

Ceres and Sustainalytics recently analyzed 600 major U.S. companies as part of a "Road to 2020" report on corporate sustainability. While 43 percent of the firms surveyed have supplier codes of conduct, according to the report only 25 percent perform even minimal monitoring to determine if suppliers are abiding by those codes, and only 10 percent have codes that reference International Labor Organization conventions.

Levi Strauss & Co. was one of the first companies to adopt a supplier code of conduct more than 20 years ago. After a recent Ceres-led dialogue with labor and human rights groups, NGOs, suppliers and other companies, Levi Strauss released a blueprint for supply chain engagement that promises “deeper efforts to improve the lives and well-being of its supply chain workers, and challenges and inspires other companies to do the same.” The blueprint, "Improving Worker’s Well-Being: A New Approach to Supply Chain Engagement," signals a shift away from the compliance-driven model in which companies periodically police supplier factories to see if they are complying with minimal standards. As with Nike, this effort is more inclusive -- involving workers, suppliers and companies as active partners in efforts to improve child and maternal health, promote gender equality and empower women, combat disease, strengthen local communities and protect the environment wherever they do business.

It sounds like some progress is occurring, but — and there is always a but when it comes to worker rights — note this from a 2013 report (“Labour Rights in Unilever’s Supply Chain: From Compliance Towards Good Practice”) from Oxfam: “Working conditions remain poor for many workers in the value chains of multinational companies around the world, despite the often good intentions of senior management.”

Low wages, long hours, weak systems of industrial relations and job insecurity “combine to leave many of the world’s poorest people in a precarious situation and undermines their efforts to work their way out of poverty,” the report continues. “As the U.N. Framework on Business and Human Rights makes clear, companies have a responsibility to respect the human rights, including labor rights, of all people involved in or affected by their business.”

Case study: Unilever

The Oxfam report focuses on Unilever’s Vienam operations; Unilever Viet Nam (UVN) directly employs about 1,500 people producing home, personal care and food products. Among the report’s findings:

- Unilever has made a commitment to social responsibility by adopting the U.N. Guiding Principles on Business and Human Rights. It also has a Code of Business Principles (CoBP); a Respect, Dignity and Fair Treatment policy; and a Supplier Code, all publicly stated.

- Despite this, human and labor rights are conspicuously absent from the Unilever Sustainable Living Plan. “Social targets focus on the well-being of consumers and smallholders, but there are no targets for labor rights.”

- Unilever management in Vietnam lacked “the capacity and knowledge to ensure the company’s operations comply with international standards, nor did they have the authority to support suppliers to do so.”

- Many suppliers in Vietnam were unclear about Unilever’s expectations and how best to realize labor rights in practice.

- Some Unilever sourcing practices were found to contribute to “excessive working hours and precarious work in the supply chain.”

- There are no tracking or internal reporting mechanisms that cover Unilever’s effectiveness in dealing with labor issues, and grievance mechanisms are ineffective because workers lack the confidence to use them.

- Unilever shows a good level of transparency and “actively engages with stakeholders at the global level.” But in Vietnam this is still at an early stage.

Regarding freedom of association and collective bargaining, Oxfam concluded that Unilever corporate policy appears to provide “a good overall framework” for these rights. “The challenges arise when it comes to implementation, since the industrial relations policy of Unilever (and potentially other multinational corporations) may be country-specific and locally determined.”

Case study: Target

Consider Target. America’s third-largest retailer has a somewhat complicated and double-edged record concerning domestic and international worker rights. In the U.S., it is staunchly anti-union despite recent violations of labor law because of its activities; it remains so today as this recent video amply illustrates.

On the other hand there is progress of sorts on the international scene, if forming a top-level committee is considered progress, that is. Last month Harrington Investments, a socially responsible investment advisory firm, convinced Target to step up its human rights oversight. After several weeks of dialogue with Harrington, Target’s legal staff recommended that Target’s Board of Directors “expressly oversee” human rights issues through its Corporate Responsibility Committee. And in a legal opinion, Target acknowledged that such a commitment to human rights oversight is a fiduciary obligation of directors pursuant to Minnesota state law.

“Until now, there has been no explicit board oversight for human rights issues at Target,” Harrington said. “It is almost unheard of for a large retail company, with 1,200 employees working in its supply chain and sourcing material from more than 50 countries, to not have board oversight in human rights compliance.”

Harrington had filed a shareholder resolution that targeted Target, calling for a human rights committee based on previous settlements for human rights abuses, including the multi-corporation $20 million settlement for sweatshop conditions in factories in the early 2000s. The firm also cited the human rights compliance issues in the company’s own, internally produced reports. “By Target’s own account, wage and safety violations have been increasing since they began keeping track in 2010,” CEO and Chairman John Harrington said.

According to Target’s most recent Corporate Responsibility Report, 40 percent of its supplier factories were found to have unacceptable human rights compliance practices, and critical violations were found in 20 percent of the factories. In China alone, working conditions in 50 percent of supplier factories were found unacceptable.

As reported by Harrington, Target officials will recommend to the board specific language to make human rights oversight an explicit responsibility of the company’s Corporate Responsibility Committee. Oversight will also include, in addition to human rights, matters relating to health and safety, diversity and equal opportunity. “This is a wonderful success, not just for Target shareholders, but for employees, customers and all stakeholders,” Harrington said. The Harrington shareholder resolution was withdrawn following the agreement with Target.

Target is a founding member of the Sustainable Apparel Coalition and the Alliance for Bangladesh Worker Safety, which states that addressing human rights issues in its international supply chain is a “business imperative and opportunity” requiring leadership, resources and funding. Since 2011, Target was featured in two high-profile reports and media campaigns alleging factory worker beatings, death threats, and sexual abuse of young women in supply chains in Bangladesh and Jordan. So it’s good of Target to finally get around to kicking the issue up to board-level review. It’s only in recent weeks that this movement by Target’s board is evident — will it walk the talk?

Restless at the end of the supply chain

Last November, hundreds of truckers in Los Angeles took part in what was described as the first strike by independent contractors in decades. The truckers at Green Fleet Systems, American Logistics International and Pac 9, all of which deliver goods for retail giants like Walmart and Forever 21, were protesting unfair labor practices.

Robert Pollin, professor of economics at the University of Massachusetts and the founding co-director of the Political Economy Research Institute (PERI), was at the scene. In an in interview with The Real News.com he said:

“I think it's very important that we're seeing the Walmart workers, retail workers, we're seeing fast food workers, and now we're seeing truckers going out on short-term strikes because…their conditions have deteriorated. Union strength is weak, so without the formal role of the union behind them, their bargaining power has worsened … The point is that working people do deserve better conditions. It's important that they fight for their rights, because otherwise they're getting kicked around by both parties.”

Hyper-transparency

Sean Ansett, founder of London-based At Stake Advisors, a supply chain sustainability and strategy consulting group, says in an article for Shift that while supply chain human rights issues continue to make the headlines, “even in industries like apparel, it seems we are far from solutions despite significant investments to address systemic supply chain human rights issues since the 1990s.”

Technological trends, he continues, suggest that in the next several years “we will enter an age of ‘hyper-transparency’ in upstream and downstream supply chains with lower cost technologies like smartphones creating new communication platforms for workers and communities in the global South.”

This new world is empowering to some stakeholders and creates needed transparency and thus accountability. “However, it may be of concern to others. New engagement processes will be required as information loops exponentially pick up pace and brands lose control of their message and engagement strategies.”

Ansett says the solution to supply chain human rights issues will be “multifaceted and require brands to look into the mirror to assess how their own purchasing practices may be a part of the problem.” The U.N. Guiding Principles, he notes, require that a company look at how its activities may contribute to human rights impacts as a result of its business relationships.

“Brands should therefore determine if their own purchasing practices are undermining the monitoring efforts of their internal compliance teams or their external auditors.”

Ansett underscores this ambiguity, along with the complexity and the difficulty that companies — and worker rights -- face. Is it possible to be committed to the success of a brand (i.e., profits and shareholder happiness) and at the same time be fully engaged on worker rights along the supply chain?

In a 24/7 news-cycle world with smartphones rampant, it’s also much harder to mask or ignore worker rights abuses wherever and whenever they occur. Companies today have to at least appear as if they are paying serious attention. Commitments, committees, board-level reviews and evolving mindsets are fine – but clear thinking and ethical implementation practices are what is really needed.

Image credit: International Labor Organization (ILO) in Asia and the Pacific via Flickr

Can Technology End Overfishing?

Back in 2002, Thomas Kraft, managing director of Norpac Fisheries Export, came up with the idea to electronically track each fish the company captures and sells. Soon after Norpac’s electronic monitoring system was up and running two years later, Kraft realized that the technology was not only an effective management tool, but it could also help the company trace fish through the supply chain and guarantee its products were not caught using illegal, unreported and unregulated (IUU) fishing practices.

In fact, the nonprofit Future of Fish identifies tracing fish through the supply chain as one of the best ways to curb overfishing – one of the greatest threats to our oceans, where 85 percent of global fish stocks are fully or over-exploited, according to the organization. And now companies like Norpac are turning to technology to make fish traceability more efficient and accurate.

At Norpac, fish are monitored from the time the ship hits the dock, Kraft says. While offloading their boats, fishermen tag each fish with a barcode and record pertinent information about their catch, including vessel information, species, weight, and time and location of the catch. Some of Norpac’s boats are equipped with radio-frequency identification (RFID) tags; fishermen on these ships wrap a Velcro strap with a RFID chip around each fish’s tail. The company’s RFID reader is then tied to a vessel monitoring system, allowing the company to validate, within a few hours of capture, that fish were caught in legal fishing areas, Kraft says. When a boat lands, government observers make a note of each fish caught and compare their records against the vessel’s log books, further verifying the ship’s catch.

As fish move into the processing stage and are broken into their component parts, processors issue barcodes for each part of the fish and connect the new codes back to the original barcode. For example, each of the four loins of a tuna will have a separate barcode, Kraft explains.

“If you have a piece of fish in a box in the back room at a supermarket or restaurant with our barcode information on the package, we can determine exactly which fish, which vessel [it came from], which day [it was caught] – the entire logistics chain,” he says.

Kraft, a former certified public accountant, says Norpac’s system essentially creates a reliable audit trail, and the company works with third-party auditors FishWise and MRAG Americas to verify its data.

Michael Carroll, vice president of the fisheries and aquaculture division at environmental consulting firm Vertex, is also developing technology to follow fish through the supply chain. When the environmental economist assisted a client in implementing a traceability system several years ago, he found that currently available databases couldn’t corroborate information the company inputted against fishery data reported to the government. Meanwhile, Carroll’s former classmate and colleague Mark Soboil was working in New Zealand, helping the country’s largest fishing company set up a fishery management database that also traced its fish through the supply chain and verified supply chain data against government records. The pair teamed up to spin off a new company from Vertex, BackTracker, to bring the technology system created in New Zealand to other companies worldwide.

One of the most important features of the BackTracker system is data validation; authenticating data in the system with ground-level information already filed with the government gives certainty to a fish’s traceability, Carroll says -- and helps combat overfishing. In most modern fishing countries, fishermen are required to report landings data, Carroll says, including vessel permit number, weight of fish captured, location of capture and type of gear used. BackTracker uses this landings data to verify the records a company enters into the system.

But fishermen are often reluctant to release their landings data, Carroll explains, because it reveals their trade secrets: how and where they fish. BackTracker overcomes fishermen’s privacy concerns with sharing their intellectual property by applying algorithms and data tailoring tools to the landings data.

“We use aggregate tools or data tailoring to manipulate the data slightly, so that it’s not so sensitive, and [so that data takes a form] that [fishermen are] comfortable sharing, but is valuable in the market and to the next person in the supply chain,” Carroll says. “BackTracker allows fisherman and supply chain participants to retain full control over their data, but offers them tools to share information with the market.”

But is the rest of the fishing industry ready to embrace the kind of traceability technology employed by BackTracker and Norpac to make a dent in the overfishing problem?

Carroll is currently in talks with several U.S. and European companies about implementing the BackTracker system, as well as discussing with government agencies the possibility of adopting BackTracker industry-wide and incorporating a third-party accreditation process.

Krafts says that the seafood sector – like most industries – readily adapts technology when it results in quick efficiencies, such as new refrigeration equipment to preserve a product’s shelf life. And while Norpac’s electronic tracking system has saved the company both time and money, traceability’s benefits are not as immediate as and require more work than quick fixes, Krafts says, so it may take the industry longer to get on board. But, he thinks that more companies will implement electronic traceability programs if consumers increasingly demand fish that is certified to be caught responsibly and become more disapproving of fishermen engaging in illegal fishing practices.

Image credit: Norpac Fisheries Export via Facebook and Pexels

Record Number of Non-U.S. Firms Make ‘World’s Most Ethical’ List

A record number of companies based outside the U.S., including H&M, Marks & Spencer, L'OREAL and 35 others from 21 countries and five continents, have made Ethisphere’s 2014 World’s Most Ethical Companies list released late last month.

The list honors a total of 144 organizations representing 41 industries such as automotive, apparel, consumer products and electronics, among others.

Other companies named to the list include GE, Microsoft, eBay, Mattel, Visa, Pepsi, International Paper, Johnson Controls, 3M, Marriott, Safeway and UPS. Notably, Starbucks and Gap, Inc. made the list for the eighth consecutive year.

Ethisphere says the “The World’s Most Ethical Company” designation recognizes companies that go beyond making statements about doing business ethically and translate those words into action. These companies not only promote ethical business standards and practices internally, but also embed the theory of "conscious capitalism" into everything they do, every employee they hire and every partner they bring into their network to ensure they deliver long-term value to key stakeholders including customers, suppliers, regulators and investors.

To determine honorees, Ethisphere says it uses its Ethics Quotient framework, developed over several years to assess an organization’s performance in an objective, consistent and standardized way. Rather than measuring all aspects of corporate governance, risk, sustainability, compliance and ethics, Ethisphere collects a comprehensive sampling of definitive data in core competencies. Scores are generated in five key categories: ethics and compliance program (25 percent); reputation, leadership and innovation (20 percent); governance (10 percent); corporate citizenship and responsibility (25 percent); and culture of ethics (20 percent).

Some might question apparent inconsistencies in the way Ethisphere describes its methodology. It is interesting that the organization admits that it does not measure "all aspects of corporate governance, risk, sustainability, compliance and ethics" when vetting honorees. This might make it difficult to back up a blanket statement that these firms are ethical in all aspects of their business. Granted, no awards scheme or ranking is perfect.

“In today’s complex global economy, it can be increasingly challenging for companies to meet performance expectations, while addressing the varying regulatory, compliance and sustainability needs across geographies and cultures,” said Tim Erblich, CEO of the Ethisphere Institute. “Global economic and social challenges from anti-corruption to security and privacy are accelerating the need for companies and organizations to embrace ethics and governance as critical business imperatives.”

“These organizations have taken this challenge head on and recognize that leading ethical business practices present an unprecedented opportunity to deliver significant tangible and intangible organizational benefits. This year’s honorees from all countries and industries understand that outstanding compliance programs, investment in a corporate culture of integrity, and sound business ethics have key roles in attracting and retaining talent, expanding business globally and driving financial performance,” Erblich added.

This year, four more companies made the list than last year’s total of 138, but still one fewer company made the list than the 145 companies named in 2012.

Last month, B Lab released its "B Corp Best for the World" list, which recognizes 92 companies from 15 countries and 31 industries for creating the most positive, overall social and environmental impact. The list includes businesses that earned an overall score in the top 10 percent of all Certified B Corporations on the B Impact Assessment, a rigorous and comprehensive assessment of a company's impact on its workers, community and the environment. Honorees were recognized among micro, small and mid-sized businesses.

Image Credit: Ethisphere

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)

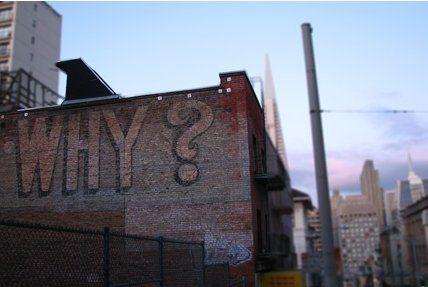

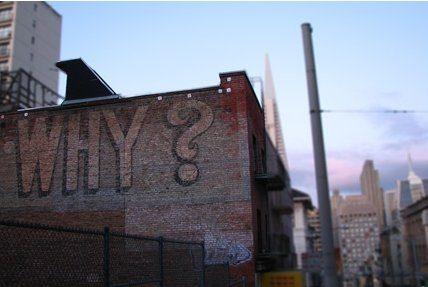

Meet Me at the Corner of 'And' and 'Why'

Recently the University of Washington Milgard School of Business Center for Leadership and Social Responsibility convened a summit for thought leaders in corporate social responsibility (CSR) and sustainability leadership to discuss the role of “and” and “why” in CSR and how these two important concepts intersect. The conversations were invigorating, varied and challenged organizations to create positive change. The themes that emerged from the day were two simple but profound, short words; one a conjunction and the other an adverb.

The conjunction “AND” emerged strongly in all of the talks. Joe Whinney of Theo Chocolate spoke of a new kind of company focused on profits and making a difference in cocoa growing regions of the world by paying fair wages to farmers. Peggy Willett from Getty Images spoke about protecting intellectual rights and creating a new system (announced that day) that allows individual non-commercial users to embed Getty images without risk of stealing photographers’ rights. Jackie Drumheller of Alaska Airlines talked in detail about how the airline is working hard to make its fleet the most fuel efficient fleet it can, minimizing costs for the company and helping the environment.

The tired old argument that business can either make a profit or be socially responsible and sustainable just doesn’t resonate within the context of a multi-stakeholder view of enterprise. In the words of former REI CEO and current Secretary of the Interior, Sally Jewell: “Companies that fail to do this are really putting their overall businesses at risk, because it is not going to be too long from now that doing ‘less bad’ isn’t going to be good enough in the minds of our customers, employees and regulators. They expect us to do ‘more good’ with our business.”

Profit and purpose, sales and sustainability – this is the new, much more challenging and invigorating business model. The "or" model has caused a lot of problems, and has gotten us into a position that is, frankly, unsustainable. It is a lazy view of business that doesn’t capitalize on our creative potential to build and grow without taking and destructing, and that model no longer holds water with a new workforce that is demanding we do things differently…they are demanding “AND."

The other word that emerged from the day of discussions was the adverb “WHY." It was discussed in many different contexts, but the emerging question for many organizations is, “Why are we here, and what is our mission?” This has been a question historically reserved for the not-for-profit sector where mission-based organizations do good things for the community and the world. But should their tax status and their organizational structure give that sector exclusive ownership of "why?" It is a valuable question, and often there are equally valuable answers. If the NGO sector can make an impact on society by asking (and answering) this question, wouldn’t it be reasonable to assume that the exponentially larger business sector could make an exponentially larger impact by unleashing the power of "why?"

Throughout the day we heard company after company talk about why they protect consumers, why they ensure their supply chain is ethical, why they conserve energy, why they design safe environments and many more “why” questions. They didn’t always have the answer, but the power isn’t always in the answer as much as the engagement of employees, suppliers, owners, communities, regulators and all stakeholders in exploring the possibilities. Asking “why” and listening to the answers -- exploring the possibilities -- is the future of sustainable business. It is also the hallmark of great leaders.

The theme of our conference on corporate social responsibility was “Leadership and CSR,” and we explored the many ways that these two issues intersect. It was clear throughout the day that we weren’t just talking about leadership within businesses; instead, we were discussing how business can illuminate a path forward and lead the way. Business has to take back the leadership role in creating a more sustainable and just world. However, it must be business and government and NGOs making the changes. As I listened to the speakers talk about their companies, I heard the intersection of leadership and CSR at the corner of “and” and “why."

Joe Lawless is the Executive Director for the Center for Leadership & Social Responsibility at Milgard School of Business – University of Washington Tacoma.

Creating New, Sustainable Jobs? Rural Communities Are Eating It Up

By Leah B. Thibault

For a time in 2011, an enormous, 327.58-gallon smoothie, flavored with maple syrup and apples from local Vermont farms and mixed with about 200 gallons of Greek-style yogurt from Ehrmann Commonwealth Dairy in Brattleboro, Vt. held the Guinness World Record for Largest Yogurt Smoothie. It’s still a point of pride for the farming community.

Ehrmann Commonwealth Dairy holds another important distinction – it is cornerstone to a fast-growth, job-creating and sustainable food enterprise.

Greek-style, or strained yogurt, has a long global history, but only recently became popular in the U.S. Regardless of its relative newcomer status on American supermarket shelves, Greek-style yogurt now accounts for more than $2 billion of the $6 billion yogurt market. In 2010 New England-based entrepreneurs Thomas Moffit and Benjamin Johnson saw an opportunity to capture a share of this growing market and founded Commonwealth Dairy.

While the pair explored options to set up a manufacturing plant in New York, Connecticut and Massachusetts, it ultimately selected the southern Vermont community of Brattleboro because of the region’s strong background in the dairy industry and its proximity to grocery distributors. The project had the potential to be a boon to the region’s dairy industry, which had been struggling economically due to volatility in milk pricing for small family farmers. Indeed in the two decades between 1990 and 2009, more than 2,100 dairy farms were shuttered.

This clear potential for the project to provide important benefits to an economically distressed community allowed Commonwealth Dairy to receive state and federal tax incentives, including funding via the federal New Markets Tax Credit program by locating in the area. The New Markets Tax Credit program was established by Congress in 2000 with the goal of spurring new or increased private investments into businesses located in low-income communities, by offering private investors a credit off their federal tax liability worth 39 percent of an investment made in a low-income community. As a result, the borrowing businesses typically receive financing that involves more favorable terms and conditions than those the market typically offers.

Commonwealth Dairy found a partner in Ehrmann AG, a $1 billion family-run company, with more than 1,500 employees in four countries, including its home base in Germany. Ehrmann provided Commonwealth Dairy with capital, as well their yogurt-making expertise, and together they created Ehrmann Commonwealth Dairy.

The Brattleboro plant was designed for an annual yogurt production capacity of 32,000 tons and quickly reached this production target, creating 108 new full-time production jobs to date, and increasing demand for high-quality local milk by 100 million pounds per year. These results are well beyond the company’s and the community’s original expectations, which estimated 24 full-time employees in the first three years, with an expansion to 50 within five.

Due to the growth in the U.S. yogurt market and the success of the Brattleboro facility, further investment was warranted and Ehrmann USA and Commonwealth Dairy expanded the Vermont facility and broke ground on a second U.S. dairy plant in Casa Grande, Ariz. in August 2012. The second plant is expected to employ about 110 workers in its first year and 250 by 2015.

Yogurt is not the only dairy category to utilize the New Markets Tax Credit program to build capacity and create jobs.

World Cheese Award Medal-winning Roth Grand CruOriginal and Roth Grand Cru Reserve are the latest entrants to a highly competitive arena, that would not have been possible but for a Wisconsin-based manufacturing plant financed through New Markets Tax Credits.

Emmi of Switzerland, its home country’s largest milk processor, already counts the U.S. as the largest foreign market for its cheese and fondue products. However, U.S. sales were largely driven by exports of their Swiss-produced cheeses. Through their Emmi Roth USA subsidiary, the company made a $44 million investment in a new 77,000-square-foot manufacturing facility in Platteville, Wis. – the company’s largest single investment to date.

During its first phase, the company is expected to produce about 6 million pounds of cheese per year. When the plant is expanded, the production is expected to increase to about 20 million pounds annually. This should result in 30 jobs in the first year of production, with a possible expansion to as many as 60 full-time positions. The addition of federal New Markets Tax Credits to the financing package allowed Emmi Roth USA to double the project scale from original plans -- meaning 50 percent greater production capability and a third more jobs than would have otherwise been available.

As with Ehrmann Commonwealth Dairy, the Emmi Roth facility not only benefits those directly employed at the plant, but also improves the long-term economic outlook for local dairy farmers, who will supply 80 percent of the milk needed for processing. The demand from the Emmi Roth facility is also expected to increase the base price for that local milk by 2.7 percent, which is a significant change in pricing paid to farmers in the commodity-based milk market.

In addition to new jobs and profitable business plans, the Emmi and Ehrmann Commonwealth Dairy plants were each built to the latest sustainability standards, adding the third tenet in a triple bottom line pursuit in projects that would not have gone ahead but for attracting outside capital.

Leah B. Thibault is Director of Operations at CEI Capital Management LLC.

The Stories in Your Closet: What Do Your Clothes Say About You?

By Mor Aframian, co-founder of Redress

During my first semester in undergrad, a friend introduced me to the concept of thrifting for the very first time -- and it was love at first sight. I walked into a store filled with vintage garments that lived unknown, unimaginable lives in the closets and social circles of women I’ve never met, but knew I’d get along with based on their fashion sense. Aisle upon aisle showered me with the opportunity to shop for vintage pieces and spoke to the old soul within me.

Have you ever thought about the stories the garments in your closet have to tell? Or the stories they will tell long after you’ve let them go? Which moments of your time together will stand out?

In saying all of this, there’s an assumption that you -- the reader -- already have a relationship with the items in your closet. There’s an assumption that you intimately know every detail about some of your favorite garments, can recall when and where you got them, how much you paid for them, and you take extra care of them. When your favorite garments are "hurt" you’re quick to take them to the tailor or a friend with great sewing skills, and while these garments are getting fixed, you find yourself missing their presence in your closet.

There’s an assumption that you’re emotionally invested in the well-being of your favorite garments because they play a role in the daily, non-verbal expression of who you are and your sense of style. This emotional investment goes beyond your garments and to the rest of the items that adorn your body: your jewelry, shoes, handbags, neckties, hats, and so on. There’s an assumption that everything you put on your body has a meaning and story to tell; a story that will be told for generations to come; a story that will be passed down to a family member or a stranger you may never encounter.

But, are these assumptions coming from an ideal and naive perspective that you have a relationship with the items in your closet? Is it too much to assume that you are intentional and calculated about your fashion purchases? Is the assumption that you’re not one to buy disposable clothing that lacks an authentic story making you uncomfortable?

Imagine if we lived in a world where all people have meaningful relationships with the items in their closets and treated those items with the love and respect they deserve. Imagine a world where all people have a deep understanding of the process and craftsmanship required to produce a quality item capable of living many lives and telling many stories. Imagine a world where all people are committed to purchase new items from conscious designers and makers who seek to continuously reduce the environmental and social impact of their products. Imagine a fashion industry utopia.

http://www.youtube.com/watch?v=P3CyR7a5qIE

Utopia is up to us to make, and though it’s possible you and I will never live to see this utopian world, it’s up to me and you to trailblaze the path for it. It takes people

like Darcy Cropp, a loyal customer and friend of Jamie Powell, Raleigh-based designer of Seven Sages and co-founder of Redress. “I love Jamie’s clothes for a lot of reasons. One is the quality of fabrics she uses. They are soft, comfortable, and wear well. Two is because the cuts fit myself and the rest of my family well. We are all different shapes and sizes but her clothes work well for my sister, mom, sister-in-law, and myself! Lastly, I know I am supporting someone who has created a unique design that makes me and my family look and feel good," says Cropp.

The residents of Raleigh, N.C. are spoiled with the number of talented eco-friendly designers who make their products readily available at local boutiques and marketplaces that happen throughout the year. Likely, you also have access to sustainable designers in your area -- or to a consignment shop, thrift store or craft market that features fashion designers. If you have a solid connection to the Internet then you have access to hundreds of designers who produce eco-conscious products -- you just need to take the time to find the ones that tell the stories that align with you.

Next time you find yourself shopping for new clothes, jewelry, shoes, etc. ask yourself, “What is the story of this product, and is it one I want to share with others?”

Mor Aframian is the co-founder and Creative Director of Redress, a company that connects and champions eco-conscious designers and companies through event planning and marketing. Aframian loves to work with designers on their new concepts and designs. She also teaches Fashion Design at Youth Digital Studio.

How Mindfulness Inspires 360-Degree Social Responsibility

“One way to read the injunction for Right Conduct, an essential part of the Eightfold Path, is to see it as calling us—as citizens—to translate the dharma into specific acts of social responsibility.” - Buddhist author and professor, Charles Johnson, writing in the Tricycle magazine.

Mindfulness

Mindfulness has been in the news a lot lately, in part due to its infiltration of the board room, and the list of high-level executives and thought leaders who practice mindfulness exercises such as meditation is long. To those of us who meditate, this is not really a surprise (in light of meditation’s myriad benefits), and though the co-opting of an ancient Buddhist practice for profit is slightly disturbing, as the renowned Mindfulness master, Thich Nhat Hahn, recently put it: With mindfulness, the means and the ends are one in the same.

But what is mindfulness? Technically, it is the nonjudgmental observation of the present moment, no matter what that moment may entail, and it is arguably the paramount Buddhist instruction. The essence of mindfulness, though, is simply “paying attention," the natural byproduct of which is heightened compassion and consideration of the impact of one's actions on others. Some real-world examples of mindful behavior might include: pausing to think before habitually reacting; choosing to recycle, rather than to litter; or choosing to eat humanely raised chicken, rather than broiler chicken from a factory farm. Put another way, mindful behavior is behavior that is socially responsible.

Mindfulness, corporations and "360-Degree Social Responsibility"

From a corporate standpoint, then, mindfulness could manifest either externally or internally. Corporate policies that are externally mindful (or “externally socially responsible”) would be those that concern how the corporation interacts with the outside world. The type of conduct typically associated with classic corporate social responsibility (CSR) endeavors, in other words. Does the corporation minimize its impact on the environment? Does it incorporate human rights into its day-to-day operations? Does it do diligence on its supply chain?

Internal mindfulness (or “internal social responsibility”), on the other hand, would refer to employee well-being. If a company is being internally socially responsible, it is paying attention to the way it treats its own people. Does it pay an adequate wage? Does it give its employees reasonable maternity and paternity leave? Or, is the corporation mindful of the impact of the job on the individual? The most well-known example of a company taking internal social responsibility seriously (though not referring to it as such) is Google. Famous for its napping pods, yoga classes and community gardens, the company even offers a class on the practice of mindfulness itself. “Search Inside Yourself,” as the course is called (pun intended, I imagine), is one of the company’s most popular offerings. (Perhaps this wasn’t so far off, after all.)

We could therefore call a company “360-Degree Socially Responsible” if it is mindful of the way it treats both its own employees as well as the larger, external world. Yet, companies rarely -- if ever -- use sustainability or CSR language to talk about (what I’m referring to as) their internal social responsibility efforts. Why does a company’s CSR or sustainability report not have a section on employee satisfaction or a company's wellness programs? To behave mindfully is really to act socially responsible, and from a corporate standpoint the 360-degree view ought to concern both those within the company's walls as well as those without.

The point isn’t to redirect the focus of CSR/sustainability from how companies are warming the planet and abusing human rights to how they are are overworking their employees and ignoring the very clear data about happiness and productivity. Rather, it is to stress that any external CSR program without a corresponding internal dimension -- and vice versa -- is an exercise in hypocrisy.

Changing the way we talk about social responsibility

Even Google, a company that is arguably getting this whole sustainability/social responsibility thing right, is not talking about it in the right way. When the company discusses what it is doing “on its own turf,” it focuses entirely on its “Google Green” initiatives, and there is no internal discussion on its separate CSR page. In other words, it chooses to ignore the incredible things it is doing for its own people unless these “perks” also relate to its external environmental sustainability measures. In part, that is because Google, like many companies, misguidedly uses sustainability language exclusively when talking about the environment; relegates its “other” CSR efforts to a separate, less flashy Web page; and ignores the fact that all of these efforts -- be they human rights protections, green initiatives, or workplace benefits -- are really part of the same operating philosophy.

While it would be great if more companies followed Google’s lead and literally offered training in mindfulness practices, the real point is that CSR is about more than just whether a company is moving toward renewable energy and considering its impact on local communities. It is just as much about how companies treat their own, and without this 360-degree approach, businesses are really only going part of the way.

(For more information on the Buddhist practice of mindfulness, check out Thich Nhat Hahn’s “The Miracle of Mindfulness” or Jon Kabat-Zinn’s “Wherever You Go, There You Are.”)