Jaguar Land Rover Embraces Carbon Finance to Deliver Change

By Will Simpson

Can an auto manufacturer make a difference in millions of lives? That is the goal of U.K. manufacturer Jaguar Land Rover, which set an ambitious target to improve health, reduce poverty, and create new opportunities for employment and education for 12 million people around the world by the end of this decade.

It’s no pie-in-the-sky goal: The difference will be felt by people living in communities with particular development goals – such as the need for safe water. These are being identified in collaboration with ClimateCare, with the Busia region of Kenya first on the list (see box, ‘Water for Busia’). Consistent measurement frameworks are being agreed with the London Benchmarking Group to help report the impact consistently across a variety of projects and global locations.

The key to delivering change on such an immense scale? Carbon finance.

Traditionally , carbon finance is a method of offsetting emissions through investment in clean energy solutions. For ClimateCare, the climate and development organization which has worked with Jaguar Land Rover since 2007, it’s about going a step further and using this money to both cut carbon emissions and fund community development. “Really it’s bringing a new source of finance to projects that wouldn't otherwise happen without that revenue," explains Tom Morton, director of ClimateCare.

Through ClimateCare, Jaguar Land Rover has supported 50 climate and development projects in 17 countries around the world, cutting 10 million tons of carbon emissions and improving the lives of 2 million people. “We wanted to learn from our experience to date and set ourselves a challenge to do more,” explains Jonathan Garrett, director of corporate social responsibility at Jaguar Land Rover. He plans to make smart use of carbon finance to both cut carbon and as a cost effective means to deliver almost half the new target and create measurable opportunities for 5 million people by 2020. A further 5 million people will be engaged through humanitarian, conservation and environmental projects and 2 million through educational initiatives.

As well as delivering on the new target, this remains an important part of Jaguar Land Rover’s wider carbon reduction strategy.

Since 2007, the group has reduced CO2 emissions by 21 percent per vehicle produced, and cut waste-to-landfill by 75 percent per vehicle. While identifying ways to reduce the impact of production, the company continues to operate one of the world’s largest carbon offset programs covering the entire manufacturing assembly process.

“At the moment, 20 percent of the company’s total emissions can be traced to this production process," explains Garrett. “The remaining 80 percent occur in the use-phase of our vehicles. Obviously we are focused on trying to reduce these, and that’s where new stop-start technology, lightweight materials and more fuel efficient engines come in."

But reducing manufacturing emissions, particularly in older plants, takes time. “Although we work on reducing energy use in the first place, there is still a residual element of carbon-related emissions from the factory. So we created the offset program to help negate those emissions, by advancing low-carbon solutions in another part of the world.”

So this is how supporting climate and development projects fits into the carbon reduction strategy at Jaguar Land Rover, but how do you choose the smartest way to use your budget, with a specific focus on creating measurable new opportunities for people, as well as carbon reductions?

Water is an obvious area to make a big impact.

“If you want to do a hard-nosed, ‘best value for money’ life-improvement calculation, then water projects come out on top,” Garrett affirms. “It’s because there are a whole load of other benefits that flow on from access to water: including improved health and increased economic productivity. Clean water projects are very cost effective.”

For funders like Jaguar Land Rover, the business case for supporting integrated climate and development projects goes beyond mere brand development. “Some of the companies we work with measure value in other ways, including an increase in staff engagement and retention," says Robert Stevens of ClimateCare. “And because many of the projects are in developing countries, supporting them can help businesses make partnerships and demonstrate support for local communities. For instance, supermarket chains might want to support projects in regions that play a significant role in their supply chain. There is also an element of reassuring investors that a company is working responsibly and understands the risks associated with climate change.”

And of course, there is a simple value for money argument. Climate and development projects deliver multiple outcomes which helps companies streamline and focus activity and make it possible to demonstrate progress towards multiple targets through one activity.

“It’s a win-win,” explains Garrett. “It also fits with our new parent company Tata [Motors]: The Indian business model gives back to communities in a big way, so with the Tata group, 60 percent of the profits go back to community-related philanthropic projects.”

Jaguar Land Rover’s support for climate and development projects is an integrated part of a well-established corporate social responsibility program, which saw it awarded Responsible Business of the Year 2013 by Business in the Community.

Supporting the entire Busia area of the LifeStraw Carbon for Water project is Jaguar Land Rover’s largest carbon finance initiative to date, but only a first step in the expansion of its program.

“Our work with ClimateCare is going to teach us all some interesting lessons that will help us design and deliver the most effective climate and development projects,” says Garrett. “We aim to deliver bigger projects and also build on existing methodologies to measure positive impacts in communities. Hopefully”, he adds, “this will inspire other companies to do the same.”

Water for Busia

The largest carbon finance project that Jaguar Land Rover has supported so far is the Life Straw Carbon for Water project in Kenya. By purchasing all the carbon credits generated from the Busia region of the project, Jaguar Land Rover has supported provision of safe water to more than 700,000 people and funded a carbon reduction equivalent to that generated by U.K. manufacturing assembly for one year.

How does it work? Free LifeStraw Family water filters were distributed to households in the region by global health company, Vestergaard. These filters use no electricity and, crucially, mean that local people no longer have to collect firewood to boil their water, thereby reducing carbon emissions.

The project is monitored closely. Every householder that is given a water filter is logged by number and geographic location, and checked by a third party. The carbon reductions are independently verified by the Gold Standard Foundation, before being paid for by Jaguar Land Rover.

A report expected later this year, will detail some of the health benefits being delivered, but Morton has already seen the difference for himself: “You can go to any household and you will hear the same story again and again: Families are no longer getting diarrhea; they are not getting worms or diseases such as typhoid; [and] their babies are healthier.”

This project is proving transformative for the community, and the aspirations of people living there. “My children are now able to go to school when in good health," says local mother Sarah Abwire. “The money I used to spend in hospital I now use to pay their school fees. The remaining money I use for household needs, such as buying seeds for planting and washing soap for my family.”

Talk about value for money…

Image credit: Jaguar Land Rover

Will Simpson is a freelance writer specializing in environmental change.

ClimateCare is a Forum for the Future partner. www.climatecare.org Find out more at www.jaguarlandrover.com

How MBA Students Are Getting 'Out There' with Global Experiential Learning

By Erika Herz

Societal issues loom large, and MBA students don’t want to wait until the end of their programs to make a difference.

As Prof. Andrea Larson of the University of Virginia Darden School of Business shared in her October Triple Pundit article, students eagerly refine their abilities to lead in business with an eye toward sustainable innovation and social impact. An instrumental and increasingly popular means for doing so is global experiential learning. Working beyond domestic sustainability challenges gives these students the opportunity to tackle very complex business, political and cultural situations – all in one project.

Global company visits have long been prevalent as for-credit business school classes, offering plenty of opportunities for students to see firsthand the leadership challenges (and opportunities) they will encounter when working among those from different cultures. For learning on sustainability topics, these classes can be even more beneficial when a team of students completes an actual project for an organization involving a combination of preparatory classroom work and research in-country.

Several projects have been conducted at Darden this academic year, including those with mature organizations as well as brand new ventures. All are overseen by the Darden Center for Global Initiatives, led by Executive Director Marc Johnson, which builds the connections between Darden and top executives, organizations and business schools around the globe.

Darden School alumni in more than 90 countries and relationships with 25 partner schools outside the U.S. help ensure a meaningful opportunity for students to grapple with environmental and social challenges in real-time -- in the context of an unfamiliar culture. These four examples show how global experiential learning is helping MBA students tackle tomorrow's environmental and social problems today.

1. World Bicycle Relief in Zambia

World Bicycle Relief (WBR) alleviates poverty by providing local citizens with bicycles that enable children to go to school, parents to access health care for their families, and entrepreneurs to bring products to market. [Listen to a Darden GreenPod interview with the COO here – scroll to #19.]What students seek to address

The number of individuals who can benefit from the bicycles WBR offers is outstripping the organization’s capacity, as it often participates in large-scale disaster-recovery efforts. Students must address:

- How can the organization solve complex business challenges related to its technical and supply chain capabilities?

- How can it increase available capital in order to serve more people?

2. INASante in Tunisia

INASante is a newly-founded social enterprise, aiming to be the first healthcare services accreditation agency in Tunisia, with the ultimate intention of serving a wider African market.

What students seek to address

- What type of business model is needed for this organization to generate the first quality management process in the country’s healthcare industry?

- How can it promote the adoption of, and adherence to, standards that ensure effective and equitable treatment access for Tunisians?

Working jointly with fellow MBA students at the Mediterranean School of Business, the team creates financial models for the enterprise, conducts market research and develops systems for measuring impact.

3. Freeset Global in India

Freeset Global in Kolkata, India manufactures custom bags, shirts and other garments. By providing jobs for the women it employs, Freeset addresses the growing problem of human trafficking -- freeing the women from forced participation in the sex trade and providing a better life for them and their children.What students seek to address

Students generate a detailed analysis of the current Freeset business strategy, customer base and marketing strategy, and they envision a large-scale growth strategy that will provide an increasing number of women the economic alternative to indentured servitude. This includes identifying product diversification/positioning opportunities, new distribution partners and a communications plan.

4. Rotary Club of Calapan City and Baruyan in the Philippines

Rotary Clubs bring together business and professional leaders to serve and build their communities around the world.

What students seek to address

Working with community leaders in a rural Philippine village, students address:

- What would characterize an innovative and sustainable economic development plan for the area?

- How can natural resources be protected and cultural traditions honored while addressing high unemployment and poverty?

What skills are gained, and what more is needed?

Classroom learning on sustainability topics is critical. But learning in the field while aiding a valuable organization helps students develop into sustainability-savvy leaders who can:

- Successfully align multiple business functions (such as product development and supply chain management) to achieve sustainability aims and find competitive advantage.

- Take a system-wide view of both company and industry, creatively and diplomatically influencing key individuals and groups across that system to effect change.

- Engage in solution design with a wide variety of stakeholders, including employees, customers, local governments, and nonprofit partners.

It is a Herculean task to bring together all the right players to enable these projects to be beneficial for all involved, as my colleagues in the Darden Center for Global Initiatives and our faculty will attest. However, it is critical for business schools like Darden to invest expertise in developing an increasing number of these opportunities for students. Simultaneously, the organizations themselves must carve out the bandwidth – even when running on a shoestring budget -- to work with MBAs passionate about using their business skills to address the world’s most serious issues. Ultimately we all benefit from helping to create more MBA change agents intent on improving society.

Images courtesy of the Darden School of Business

Erika Herz is Associate Director of Sustainability Programs for the Darden School of Business and Managing Director of the Alliance for Research on Corporate Sustainability (ARCS).

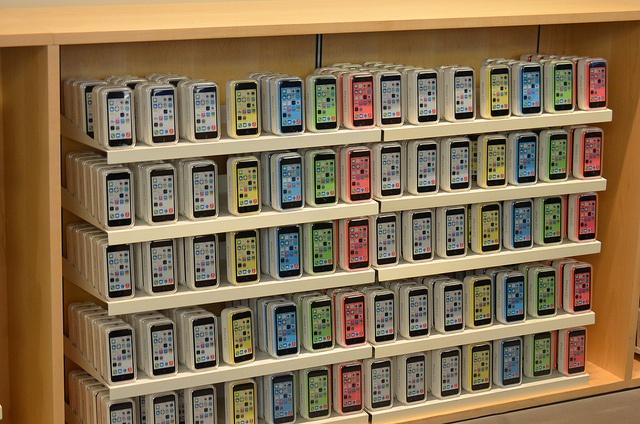

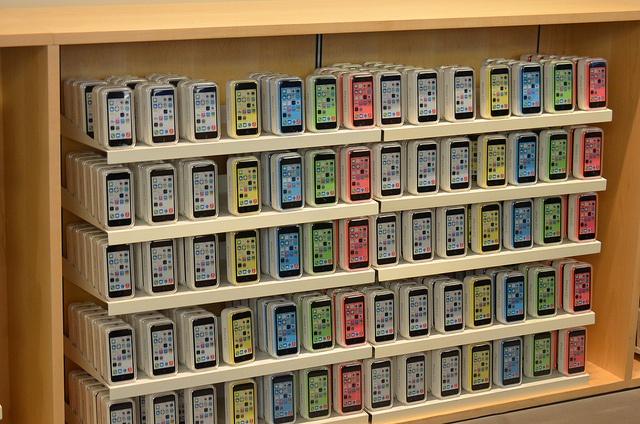

Buying Smartphones for Longevity: Are Manufacturers (and Consumers) Ready?

Here’s a quick question: What’s your smartphone upgrade cycle? Or in other words, what’s the frequency with which you replace your older smartphone in a newer one?

If you’re like the average American, it’s a little less than two years (22 months in 2012, according to Recon Analytics).

This aggressive upgrade cycle is no secret, and it helps the mobile industry grow and generate impressive profits. At the same time, we all know this trend is not sustainable and hurts our wallets. In addition, writes Farhad Manjoo in the New York Times: “Smartphones have crossed the threshold from amazing to boring. High-end phones seem to have hit an innovation plateau, with each new iPhone or Samsung Galaxy just incrementally better than the last.”

Given these circumstances Manjoo suggests it might not be so wild to imagine a world in which we “buy smartphones with an eye to longevity.” In this world, he writes, consumers use their smartphones for more than two years (ideally three); try to repair them instead of replacing them when possible; consider buying used phones instead of new ones; and trade their smartphones in where they’re done with them.

I like Manjoo’s vision. It’s practical and at the same time offers a real change. The only thing I would change about it is aiming somewhat higher with the upgrade cycle to at least twice what we have now – let’s say four to five years. But even without this revision, is it really possible for the mobile industry to become a (more) sustainable closed-loop system, or is it just another green fantasy?

From a rational standpoint, making Manjoo’s vision a reality shouldn’t be that hard. First, if the benefits we gain from buying a new smartphone actually diminish, then we should have less incentive to do it every two years. And indeed as the Wall Street Journal reported last July, “The rates at which American cellphone users have traded in their devices for more advanced models have declined over the last few years, according to analysts at UBS.” One of the reasons behind this trend according to the WSJ is indeed that fewer people feel they need to buy new phone as the pace of innovation slows down.

Second, buying a used phone instead of a new one and trading in your old phone make a lot of sense from a financial point of view. It’s no wonder that smartphone trade-in programs expand rapidly. Last September, CNNMoney reported that according to Bernstein Research, “Twelve percent of smartphone upgrades worldwide were a result of trade-ins, up from 4 percent three years ago,” and that used phones will cannibalize 8 percent of new smartphone sales by 2018, up from 3 percent in 2013.

Last but not least, making simple repairs of your smartphone or changing its battery isn’t such a big deal anymore with websites like iFixit offering repair tools and replacement parts -- from an iPhone 5 replacement battery kit to an iPhone 4 Display Assembly kit. And if you’re not a handyman, you can always call services like iCracked -- which will be happy to send you one of their “iTechs” to fix your phone at home (it’s $70-$100 for most iPhone repairs).

The problem is that these trends seem to be outweighed by powerful forces that might be less rational but are still very dominant. The first one is the business model of the mobile industry, which is contrary to everything Majoo’s vision stands for. A company like Apple, for example, “has long been aiming to get iPhones into the hands of more and more customers” and when it experiences a declining sales growth rate (in Apple’s case, 13 percent in 2013 compared to 46 percent in 2012) what it has in mind is not closed-loop systems but new phone models (a larger iPhone) or products (wearables) that will help the company reverse the trend and keep investors happy.

Yet, it’s not just the fix of the mobile manufacturers (and investors) on high growth rates that leads them to fulfill Brook Stevens’ 1950s vision of planned obsolescence – “We make good products, we induce people to buy them, and then the next year we deliberately introduce something else that will make those products old fashioned, out of date, obsolete.”

Consumers apparently have a fix of their own – a desire for novelty or new stuff, and as Prof. Tim Jackson puts it, “our own relentless search for novelty and social status locks us into an iron cage of consumerism." Now, add to it the fact that smartphones became status symbols (the latest trend are smartphones with cracked screens that have become “the gadget equivalent of ripped jeans for the tech generation”), and you can understand why we feel like we not only need, but really need to buy the newest smartphone.

It’s true that it’s not totally consumers’ fault – after all, we’re bombarded 24/7 with advertisements telling us that if we don’t buy the newest smartphone we’ll probably be less cool, less savvy and shouldn’t be surprised if our social status will fall. Yet, while it’s definitely not easy to overcome these perceived obsolesce tactics, let’s not forget that we’re still capable of making our own decisions and understanding what makes sense and what doesn’t.

Still, overall I believe that Manjoo’s vision depends mainly on the smartphone manufacturers. As long as their innovation process will stay focused on shortening the upgrade cycle or starting new upgrade cycles with similar products such as the “phablet” (phone plus tablet) or wearables, Manjoo’s vision will stay a far-fetched dream for now.

Things will change only if these companies will start focusing on new concepts that are economically viable but also sustainable such as phonebloks, or even smartphones with changeable design so we can stay with the old smartphone but it will look like the newest one. Maybe then Manjoo’s vision will come true, but I wouldn't bet my beautiful new smartphone on it.

Image credit: Steve Rhodes, Flickr Creative Commons

Raz Godelnik is an Assistant Professor of Strategic Design and Management at Parsons The New School of Design. You can follow Raz on Twitter.

A Fish with a Story Could Save Our Oceans ... and 200 Million Jobs

By Cheryl Dahle

The best fish story I ever heard was from Dune Lankard, a native Athabaskan fisher, who shared the tale of the salmon that those of us gathered in his home that evening were about to eat. His people, the Eyaks, have lived in the Copper River Delta region of Alaska for 3,500 years. For much of that history (before industry exploitation and disease decimated the population) their culture, diet and spirituality all centered on salmon.

Lankard narrated the journey of the salmon -- starting with its birth in the rich, silty river, following its trek out to sea and then, years later, its heroic return upstream, fighting currents to fulfill its destiny. He said we were privileged to eat this fish, which had been taken at the peak of its energy -- immersed in the struggle to reproduce and give its life to the future survival of its species. Instead, its energy would feed us. For that, we owed our thanks.

I’ve never eaten a meal with as much reverence as I did that night. That fish story connected me to riverbanks, pristine waters, and something bigger than my appetite or myself. I’ve not eaten a fish since without thinking about its journey.

The truth is that we rarely know the journey of a fish that has landed on our plate. And that missing story is more than a lost opportunity for reflection: It is the root of why we are overfishing our oceans with rapacious abandon.

Here are a few reasons why story matters if we want to ensure the survival of our own species, which depends on oceans for every other breath we take.

Story matters to the fish

Mislabeling (wrong species, wrong origin, or wrong harvest method) is rife in the seafood industry. About a third of our fish is mislabeled in North America. A whopping 74 percent of sushi venues are wrapping their fish in sweet lies.

While you might chafe at the deception of paying more for a cheaper fish, the bigger deal is how mislabeling disguises scarcity. Price and abundance are potential market signals that track back to the stock status of a fish in the water. If overfished stocks (like Red Snapper, which is only truly Red Snapper 13 percent of the time) appear abundant because we’re eating substitutions, our collective misperception that there are plenty of fish in the sea continues.

Story matters to you

It’s your health we’re talking about. The U.S. imports almost 90 percent of the seafood we consume. But the FDA inspects just 2.7 percent of it. If you don’t know where that fish came from, it most likely was imported.

According to a 2012 report from the Centers for Disease Control and Prevention, fish were the biggest culprit of food-borne illness among all types of imported food. Why? Well, even cursory research into international fish farming and processing practices uncovers unsavory stories of chilling fish with ice made from unpotable water or feeding farmed shrimp a diet of pig feces. How do you like your Mystery Fish now?

And then there’s the carbon footprint. Much of our frozen fish circumnavigates the globe twice before landing on our plates because it’s processed in China.

But before you give up and order lasagna, remember that jobs depend on fish: 200 million of them globally, directly or indirectly.

Story matters to the fishers

Right now on a floating processor vessel or commercial dragger, people are working as indentured servants because the supply chain can’t figure out a way to ensure that fish doesn’t come with a side of slavery.

In the developing world, fishers using responsible circle hooks that don’t snare and kill sea turtles are getting the same price for their fish as the longliners that kill tens of thousands of turtles in a year because grocery stores can’t find a way to distinguish these products on the shelf — and you don’t ask them to. Hence, the link between better margin and better behavior (the fundamental way markets drive change) remains broken.

In New England, fishers are losing their homes and livelihoods because we’re not interested in creating markets where local fish get preference over (and better price than) imported commodity fish. I sat with a fisher in Boston this week as he broke down in tears sharing his story:

“I’m the first generation of my family, but I loved the fishing life and that’s what led me to it. I was a little kid holding my dad’s hand; we’d go down to the dock and see the guys fishing, and I just loved it. I was able to do it for 50 years. And I thought my son could. But he can’t.”

It doesn’t have to be this way. You can make a difference. By asking for a story. By being willing to pay for it. Look for Community Supported Fishery programs or direct markets in your region. Patronize restaurants with responsible harvesting policies. Buy the right brands in retail locations or online.

We all know how to demand story with our food. (Or we can learn from episodes of Portlandia). It’s time to demand that every fish has a tale.

Image credit: Flickr/coda

Cheryl Dahle is a journalist and entrepreneur who has worked at the intersection of business and social transformation for more than a decade, Cheryl conceived and co-led the effort to found Future of Fish.

ExxonMobil to Report Publicly on Carbon Asset Risk

Finally, ExxonMobil is agreeing to publicize the risks that stricter carbon emissions rules and limits will have on its business.

In doing so, the largest publicly traded international oil and gas corporation in the world became the first such company to do this.

It seems like a huge deal for a several reasons: The oil major is publicly acknowledging the potential impact of carbon emissions limits on its business model and revealing how it assesses the “risk of stranded assets” from climate change, and it did so at the behest of two shareholder groups.

The landmark agreement with shareholders was disclosed—without comment from ExxonMobil—in a PR Newswire release from Arjuna Capital and As You Sow. Arjuna is the sustainable wealth management platform of Baldwin Brothers Inc., and As You Sow is a nonprofit that promotes environmental corporate responsibility.

There was a deal involved: Arjuna and As You Sow agreed to withdraw a shareholder resolution in exchange for ExxonMobil “providing information to shareholders on the risks that stranded assets pose to the company's business model, how the company is planning for a carbon constrained world, how climate risks affect capital expenditure plans, and other related issues.”

This is how Al Gore describes stranded assets: “A stranded asset is one that loses economic value well ahead of its anticipated useful life. Stranded carbon assets include fossil fuels, as well as those assets which, given their dependence on fossil fuels, are also CO2-emissions intensive. Not all carbon-intensive assets are created equal, and it is reasonable to assume that in carbon-constrained scenarios the projects with the highest break-even costs and emissions profile (e.g., tar sands and coal) will be stranded first.”

Natasha Lamb, director of equity research and shareholder engagement at Arjuna Capital, said: "We're gratified that ExxonMobil has agreed to drop their opposition to our proposal and address this very real risk. Shareholder value is at stake if companies are not prepared for a low-carbon scenario.” She added that: “More and more unconventional 'frontier' assets are being booked on the balance sheet, such as deep-water and tar sands. These reserves are not only the most carbon intensive, risky, and expensive to extract, but the most vulnerable to devaluation. As investors, we want to ensure our companies' capital will yield strong returns, and we are not throwing good money after bad."

ExxonMobil's agreement to report publicly on carbon asset risk is an important first step in addressing the likelihood that Exxon's reserves are at risk of devaluation in a carbon-constrained future, and how the company is responding to the long-term financial risks climate change poses to its business plans.

For example, oil reserves miles deep in the Gulf of Mexico are highly expensive to extract and become uneconomical if carbon emissions are reduced by as much as 80 percent -- which is a goal proposed by President Barack Obama.

So it becomes, at best, disingenuous and downright misleading for oil and gas companies to value those types of reserve assets in the same way that they count other assets, with no acknowledgment of the potential impacts on their business models and bottom lines.

As Lamb says: “Forward thinking companies need to re-assess how they allocate shareholder capital and act strategically to shift their business models. If Big Oil can't redirect capital to low carbon energy alternatives, investors will.”

And for ExxonMobil, it’s an admission at long last that changes are coming from climate change.

Image credit: Flickr/hythe-eye

How Walmart Is Empowering Women in Business

By Meghan Ennes

Believe it or not, Walmart is taking on big social issues to build a stronger business. Through the Empowering Women Together Initiative, launched in 2011, they’re making that strategy a reality.

“Walmart is using our size and scope to help women-owned businesses around the world succeed and grow,” says Andrea Thomas, SVP of Sustainability. Setting the precedent for similar social initiatives at Whole Foods and Starbucks, this strategy shift from America’s largest retailer could signal a “turning point in socially-conscious retail” (Forbes).

But Walmart’s strategy is attempting to go beyond social consciousness. They’re creating shared value by achieving business goals that help alleviate a societal problem. Beth Keck, senior director of women’s economic empowerment at Walmart, believes her company can give more women the opportunity for success through the shared value mindset. “All of these initiatives are improving our bottom line,” she says of the company’s sustainability efforts.

One of these goals is to give women in business access to Walmart’s huge customer base, and the company plans to source $20 billion from women-owned businesses across the world. For example, on Walmart’s main ecommerce website, you’ll find a dedicated women empowerment marketplace selling everything from personalized photo cards to jewelry – sourced from small businesses owned by women. This and other initiatives are powered by partnerships with nonprofits, like the Women's Bean Project which employs chronically impoverished women in a gourmet food or handcrafted jewelry position. These women benefit from a transitional job to help them with their next step, and Walmart benefits from the new products they’re able to sell.

Walmart has announced other goals to boost woman-powered business worldwide. The company plans to train 500,000 women in the agriculture value chain in emerging markets, which Keck says is now improving food availability in those areas. And with the help of partnerships in those markets, they’re promoting female entrepreneurs by giving them the training they need to boost their business. “The benefits of the program are 100 percent real,” says Leticia Hernandez of Guatemala, whose homemade fried plantains are now distributed worldwide in Walmart stores through the company's partnership with local social responsibility program A Hand to Grow.

In the second installment of our series, Leading Shared Value, Keck explains the strategic motivation behind Walmart's initiatives in-progress in the video below. (For our first interview, read “CEO of Japan’s Kirin Brewery on Creating Shared Value.”) Ms. Keck will also speak at the Shared Value Leadership Summit on successful cross-sector collaboration for both social good and business benefit.

Meghan Ennes is community coordinator for the Shared Value Initiative. Learn more about attending the Shared Value Leadership Summit.

Feds, State Investigate Duke Energy for Illegal Pumping of Coal Ash

A small handful of environmentalists that were expelled by police from boating on a local waterway in North Carolina are being hailed as national heroes this week. After members from Waterkeeper Alliance, who were trying to take water samples from a stream, were told by police on March 10 to leave an area bordering the Duke Energy Cape Fear River facility, they resorted to aerial surveillance of the area.

The following day they released photographs showing that Duke Energy has been pumping coal ash into a local tributary of the Cape Fear River, a local source for drinking water.

According to subsequent investigations by the North Carolina Department of Environment and Natural Resources, the company has been pumping the coal ash for months from two facilities without authorization or the proper safety measures in place to filter the contaminated water. DENR estimates that between September 2013 and early March, 61 million gallons were dispersed into the tributary.

Duke Energy states that it let DENR know last year that it would be conducting “routine maintenance,” the Raleigh News & Observer reports. DENR, however, says the volume of contaminated water that Duke Energy has pumped is not consistent with routine maintenance and denies giving the company authorization to pump the wastewater as it did.

The series of incidents are the latest problems for Duke Energy, which is now under both state and federal investigations for environmental pollution. In February, a coal ash containment pond at the North Carolina-Virginia border failed, spewing sludge that polluted some 70 miles of the Dan River. Virginia Gov. Terry McAuliffe has said that he expects Duke Energy to compensate the state for the cleanup of the river, which polluted containment ponds at the Danville, Va. treatment plant.

Last Thursday, the Southern Environmental Law Center filed motions on behalf of four environmental groups requesting that they be permitted to participate in the enforcement of the cleanup from the Dan River spill. The four organizations, the Waterkeeper Alliance, Dan River Basin Association, Roanoke River Basin Association and Southern Alliance for Clean Energy, say they want to ensure that the cleanup is done satisfactorily.

“The Dan River site is an ongoing disaster, with illegal discharges pouring out of the coal ash lagoons everywhere you look,” said Waterkeeper Alliance Staff Attorney Pete Harrison.

Environmental groups have also accused the DENR having “uncomfortable ties” with Duke Energy, which they feel has impeded oversight and enforcement of regulations at the coal ash sites. North Carolina Gov. Pat McCrory is a 28-year veteran of Duke Energy and has been accused of weakening state environmental laws that provide oversight of businesses like Duke Energy. The DENR is also under federal investigation concerning documents that suggest that the DENR may have consulted Duke Energy by email before excluding environmental lobbyists from meetings related to whether Duke Energy’s ponds were polluting groundwater. More recently, the state has been accused of preempting attempts by environmentalists to sue the company under the federal Clean Water Act.

Duke Energy has so far received eight violations relating to wastewater management issues. The most recent was issued last week after state regulators had paid a visit to the Cape Fear River facility and said they found the company illegally discharging waste into the stream. Two were issued Feb. 28 for the Dan River spill, and five more were issued on March 3 for operating five plants without stormwater permits.

According to the Associated Press, the DENR has acknowledged that the ponds have been lacking the permits since 2010. AP reported on March 20 that no action was taken by the state until three days after a Freedom of Information request had been filed by AP to examine stormwater permits at the company’s facilities.

The state’s new crackdown, and the increased attention by federal regulators, is good news for many environmentalists who have been lobbying the state to get Duke Energy to transfer its holding ponds to lined facilities that are less likely to crack or fail. But it comes with bittersweet results knowing that environmental cleanup of these two rivers will likely take years to address.

"Obviously the local community and conservationists can't count on DENR to do the right thing,” said SELC Senior Attorney Frank Holleman. “And so we want to be there to be sure that DENR does do the right thing—that their feet and Duke's feet are held to the fire.”

Image credit: USFWSSoutheast

'War on Coal' is Not the Real Reason Your Utility Rates Will Go Up

With new EPA regulations for coal-fired power plants looming ahead, the coal and utilities industries have issued sharp warnings about the impact of another "war on coal." The argument goes that the cost of installing pollution-scrubbing equipment, and/or shutting down outdated coal-fired power plants, is passed directly along to the consumer in the form of higher rates. The U.S. economy also feels the impact, so the argument goes, in terms of higher business costs, lost employment opportunities and a competitive advantage for coal-using companies overseas.

However, given the past record of accuracy for those warnings, it looks like a bad case of déjà vu all over again. According to a history of similar warnings about coal regulation compiled by the Center for American Progress (CAP), those predictions fail to account for the positive impact of innovation, as well as the economic counterbalance of improved public health.

Meanwhile, within the broader issue of U.S. infrastructure, CAP draws out an important point: In the coming years, the main driver of utility rates will not be the power plants or the fuel they use, it will be the urgent need to overhaul the nation's aging, badly outdated electricity distribution and transmission grid.

A history of the 'war on coal'

The CAP article, by Daniel J. Weiss Miranda Peterson, is well worth a read in full (here's that link again), but for those of you on-the-go, here is brief summary of the failed predictions they uncover through more than 40 years of the EPA's war on coal:

- 1970s: The war on coal set predicted that 1970 Clean Air Act regulations would spark "huge" utility rate hikes. By 1982, the Congressional Budget Office concluded that the impact was low.

- 1972: Similarly, a West Virginia environmental official testified that the Clean Air Act would result in costly compliance errors over a 25-year period, a prediction also later debunked by the Budget Office.

- 1977: Utilities and related industries predicted an "economic disaster" from new pollution scrubber regulations. By 1981, the National Commission on Air Quality determined that was wrong, and the bipartisan group had the figures to prove it. The estimated cost of installing new equipment was $16.6 billion in 1978, while the economic benefits of improved air quality ranged from $4.6 billion to $51.2 billion per year.

- 1989: In response to the acid rain bill, the lobbying group Edison Electric Institute (EEI) issued a detailed report predicting a dramatic rise in electricity rates over a 20-year period. CAP's own analysis of actual utility rates in 2009 -- 20 years later -- showed that the prediction was "flat-out wrong."

Innovation and the war on coal

Weiss and Peterson argue that the "war on coal" complaints go off-track because they fail to account for the ingenuity of the U.S. research and engineering sector:

The EEI study proved false because it ignored the innovation and savings that occur once managers and engineers have binding reduction targets with firm deadlines. In other words, EEI’s study could not predict nor account for future innovation. In reality, numerous studies found that regulation can stimulate creative invention. The EPA found that the Clean Air Act19 prompted the deployment of new technologies to reduce sulfur dioxide and nitrogen oxide emissions, which are ingredients in acid rain and smog.

That's not even counting more recent innovations, namely the emergence of utility-scale wind power and low-cost solar power, and the rise of the distributed electricity generation model -- along with the development of new energy storage technology.

As for the competitive advantage, as public awareness grows around the issue of global warming and other forms of fossil fuel pollution, the business sector has become more attracted to clean energy as an effective branding tool.

It's also worth noting the Chicago example, which illustrates that utility costs are only one factor in a strong local and regional economy, and the benefit of public health improvements may far outweigh the cost of paying a premium for clean, renewable energy over coal.

Image credit: Flickr/Yidjp_2b

AT&T, EDF Promote Conservation Toolkit In Water-Stressed U.S. Cities

"Conserving water conserves energy, and conserving energy conserves water," was a key message of 2014 World Water Day and the World Water Development Report. It's a message that business executives across the economy, not just those in the agricultural and industrial sectors, are increasingly taking to heart.

The search for ways to minimize waste and conserve water, other natural resources and energy is making for what may seem like strange bedfellows. Some of the world's largest corporations have been joining with leading environmental organizations to find what amount to triple bottom line solutions -- solutions that can turn business risks and threats into opportunities and benefits.

Working together at the water-energy nexus, AT&T and the Environmental Defense Fund (EDF) over the past few years have developed a set of tools to help businesses reduce water, and hence energy, use for cooling buildings. Setting a target of reducing their own annual water use by 5 percent (some 150 million gallons) and annual energy use by 400 million kilowatt-hours (enough for 35,000 U.S. households), the two unlikely partners are setting out to promote and foster adoption of their water-energy conservation toolkit in five water-stressed U.S. cities.

Business risks and threats at the water-energy nexus

It turns out that AT&T has very good reasons for being concerned about water and energy use. As EDF Project Manager Brendan FitzSimons notes in a blog post, “A quarter of AT&T’s top water-consuming facilities – a mix of offices and data centers – are in water-stressed regions, which poses a risk to its operations.” AT&T is not alone.

“Thirty-six states faced water shortages last summer, and the 2012 drought cost the U.S. an estimated $35 billion from crop losses and business interruptions,” FitzSimons points out. “U.S. water prices have doubled or even tripled over the past dozen years, and rates are expected to continue to climb.

Commercial and institutional (17 percent of publicly-supplied water use) and industry (5 percent), as well as U.S. households, are critically dependent on ample, affordable supplies of freshwater.

A similar situation exists when it comes to energy usage. The U.S. Energy Information Administration (EIA) estimates commercial and residential buildings accounted for nearly 40 percent of energy consumption across the country in 2012.

Compounding this, energy consumption among data center operators, such as AT&T, is growing a lot faster than average. Worldwide, data centers consume some 30 billion watts of electrical power -- equivalent to the output of 30 nuclear power plants, according to the results of a year-long investigation undertaken and published by The New York Times in 2012.

Moreover, the Times found, as much as 90 percent of that electrical power can be wasted, while reliance on diesel fuel for backup generators makes data centers some of the biggest sources of air pollution.

Then there's the linkage between water and energy use, a linkage that flows both ways. Here in the U.S., thermoelectric power generation is the largest user of freshwater supplies (41.5 percent), according to the U.S. Environmental Protection Agency (EPA). At 37 percent, irrigation is the second largest.

A water-energy conservation solution

All this makes the water-energy conservation partnership between AT&T and EDF important. The partners estimate that 28 billion gallons of water – enough to fill 400 million bathtubs year after year – could be saved by improving the efficiency of cooling towers in U.S. buildings.

As EDF's FitzSimons writes:

“Saving water creates a virtuous cycle: the more water we save means less energy is needed for supplying, treating and distributing water, and those energy savings translate into less water we need to use for developing and producing energy—the 'energy-water nexus.' Using water for cooling translates into lower costs for businesses as well — lower water/sewage charges and less energy and chemicals used for running building cooling systems — savings that add up.”

AT&T and EDF are promoting their water-energy efficiency toolkit to businesses in Dallas, Denver, Houston, Los Angeles and Phoenix – all water-stressed metropolitan areas. Evidence that water and energy aren't only on the minds of EDF and AT&T, other companies, including AT&T competitor Verizon, are taking the toolkit in-house and adapting it to meet their organizational needs.

Image courtesy of Y. Kanazawa/Flickr

Graphics courtesy of EPA WaterSense Partnership Program

First Interstate Water Credits Program Launched in the Ohio River Basin

The Electric Power Research Institute (EPRI) on March 11 officially launched the first water quality pilot trades in the Ohio River Basin. The pilot, which is the world’s only interstate water quality trading program, is part of a new initiative to test water quality improvement strategies. Duke Energy, American Electric Power and Hoosier Energy were the first buyers of the interstate water credits.

Water quality trading is a market-based approach that could enable facilities to meet permit limits using nutrient reduction credits from farmers who implement conservation practices, EPRI says.

Several parties, including industrial sources, farmers and the general public, contribute to nutrient loading -- which may lead to serious ecological problems. The transactions will produce cleaner watersheds, advance sustainability practices and test more cost-effective regulatory compliance options, according to EPRI.

The companies altogether purchased 9,000 stewardship credits, agreeing to retire the associated nutrient and ecosystem benefits, rather than apply them towards possible future permit requirements. The buyers can use the credits to meet corporate sustainability goals, and the credits may also be considered for future flexible permit compliance schedules by the participating states.

“These early credit transactions will immediately improve watershed and farm health, and will serve as a foundation for ongoing discussions on the potential for water quality trading to meet regulatory compliance obligations in the future,” said Jessica Fox, an EPRI technical executive and director of the water quality trading program.

Due to the fact that the affected watersheds cross state lines, working on an interstate basis is essential, according to EPRI. In August 2012, Indiana, Ky. and Ohio signed the first interstate trading plan where the states can operate under the same rules so that a water quality credit generated in one state can be applied in another. This framework set the stage for the pilot trades. At full-scale, the project could include up to eight states in the Ohio River Basin and potentially create credit markets for 46 power plants, thousands of wastewater facilities and other industries, and around 230,000 farmers.

Stewardship credit trades will continue through 2014 and 2015 to test critical programmatic features such as an online credit registry and live trading auction.

Water scarcity increasingly is becoming difficult to ignore, especially in California, which is facing one of the worst droughts in its history. Recognizing how climate change-related natural disasters such as droughts is crippling communities, President Barack Obama last month announced plans to pitch to Congress a $1 billion climate change resilience fund intended to help communities facing climate change-induced negative weather.

The global population will need 40 percent more water by 2030, according to a recent report by the U.N.’s World Water Assessment Program (U.N.-Water). The report highlights the threat to water supplies posed by the conflicting interests of a growing global population for energy and food, as well as water itself. The list is extensive and includes regulations and governance that lead to perverse outcomes, as well as threats from water contamination, pollution, climate change and the often profligate ways in which we use and manage freshwater resources.

Image Credit: Flickr dailyinvention

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)