Apple's New Headquarters Missing a Major Green Point

A version of this post originally appeared in Metro Magazine.

By Tom Fairchild

As an avid iPhone user, I have bought into the sense that Apple could literally peer into the future and deliver me technology I never realized I would so desperately need.

For years, Steve Jobs and company seem to have been our reliable guides to a better tomorrow. For new technology, Apple’s vision towards the future seems nearly flawless. But for corporate responsibility? Well, that’s a different story.

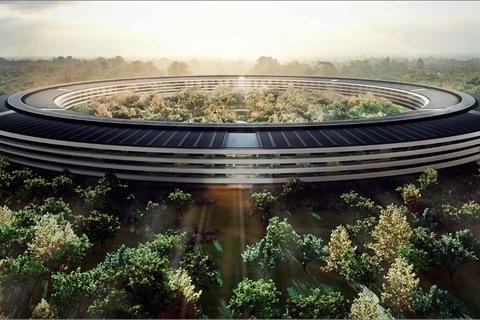

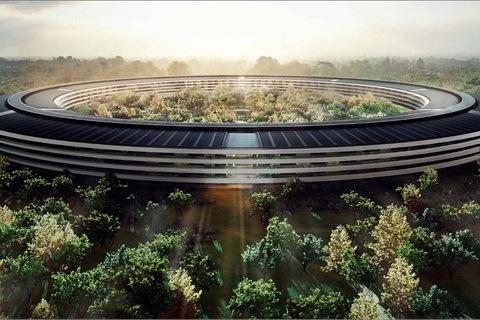

Apple’s decision to build a mammoth new headquarters in Cupertino, Calif. — miles from public transportation and adequate housing — amounts to a corporate denunciation of sustainability and a giant corporate shrug to Mother Earth.

Leadership for the tech giant maintains that the new campus will offer "a serene environment reflecting Apple's values of innovation, ease of use and beauty." However, the simple facts show that many of Apple’s 13,000 employees will now be commuting to an isolated location 45 miles south of San Francisco.

This reality seems a world apart from Apple’s corporate communications, which state:

“Our commute programs reduce traffic, smog, and GHG emissions by providing incentives for biking, using public transportation and reducing the use of single-occupancy vehicles.”

How exactly is this possible when the new headquarters is being built on a location without any existing public transportation options?

It does sound nice that Apple is funding a $35 million transportation demand management (TDM) program encouraging employees to use corporate shuttles and carpools. However, even with these efforts in place, Apple predicts at least 9,000 employees will drive alone to the new headquarters — resulting in a huge increase in emissions and clogged roadways.

Although TDM can mitigate the worst outcomes, even the best program cannot make up for a disastrous location. It’s commendable that Apple has a TDM program at all and fits their vision since TDM is designed to be forward thinking. But having a TDM at this facility is like Exxon having a program to wipe down baby seals after a spill.

Apple would have done well to have followed the White House directive that establishes:

“an integrated strategy toward sustainability in the federal government, including efforts to operate high performance sustainable buildings in sustainable locations and to strengthen the vitality and livability of the communities for federal agencies.”

That Executive Order further directs agencies to:

“advance regional and local integrated planning by ... participating in regional transportation planning and recognizing existing community transportation infrastructure; ensuring that planning for new federal facilities or new leases includes consideration of sites that are pedestrian friendly, near existing employment centers, and accessible to public transit, and; emphasizes existing central cities and (rural) town centers."

Soon the Federal Bureau of Investigation (FBI) will select a site for its new headquarters in the Washington, D.C. region. The selection is narrowing to two locations that are both adjacent to Metrorail stations. Whether the FBI will beat Apple’s drive-alone rate to its new campus is yet to be seen. Nonetheless, by locating adjacent to existing transportation infrastructure, the FBI will make a statement about its desire to create a sustainable work environment.

Successful TDM programs around the world make great contributions by encouraging better use of sustainable transportation options, such as walking, biking, public transportation, carpooling and vanpooling. Regrettably, even with a best-case TDM program for shifting employee commuting patterns, Apple’s isolated location will result in a commuting nightmare for its employees with consequences for the entire San Francisco Bay Area.

Image by Flickr user Chris

Apple Headquarters rendering by the City of Cupertino

Tom Fairchild is the Director of Mobility Lab.

Volkswagen Biodiversity Initiative To Establish Nature Corridor in Mexico

On April 8 Volkswagen (VW), the owner-operator of the largest auto manufacturing plant in North America in Puebla, Mexico, launched an ambitious, pioneering biodiversity and ecological sustainability initiative to help establish a protected biological corridor that will assure local wildlife has the habitat and migratory paths required for their survival. The program also aims to instill a healthy environmental ethic in Mexico's youth and communities.

With its “Think Blue” strategy, VW has sought to firmly ingrain and establish ecological, as well as economic and social, sustainability principles in its core organizational values, operating policies and procedures. The results of this effort are evident in the company's “green” manufacturing facility outside Chattanooga, Tenn.

VW is taking that a step further with the “Think Blue. Nature.” program. The world's third-largest auto manufacturer, VW, is allocating an initial €260,000 (~$358,800) as the first private sponsor of the Corredor Ecologico Sierra Madre Oriental (CESMO) (Eastern Sierra Madre Ecological Corridor), a 4 million-hectare area spanning five Mexican states that provides habitat for some 650 endangered species.

Auto manufacturing and ecological sustainability

Along with its commitment to help establish CESMO, VW is also pledging resources to launch “Eco Chavos,” a youth conservation project that aims to train 300 young people as environmental ambassadors. The 300 will carry on to recruit another 10,000 young people in their communities to raise ecological sustainability awareness and knowledge, and take part in nature conservation activities in one of seven nature conservation areas with the CESMO corridor.

The Eco Chavos project's goal is to plant 100,000 trees and clean 100 kilometers (62.5 miles) of water courses, VW explains in a “Think Blue. Nature.” press release.

VW, through its Mexico subsidiary Volkswagen de Mexico, is the largest private sponsor of environmental protection measures in the country, activities that the company will be pooling under the “Think Blue. Nature.” umbrella in future.

VW & "Por Amor al Planeta"

Speaking amidst government officials, project partners, employees and public participants at the “Think Blue. Nature.” program launch event at the VW plant in Puebla, VW Group Officer for the Environment, Energy and New Business Areas Wolfram Thomas stated:

"Volkswagen has declared the conservation of nature to be a corporate objective and is committed to the conservation of resources, biodiversity and the linking of habitats for plants and animals throughout the world. The Group's activities here in Mexico are a perfect example of this commitment."

“Think Blue. Nature.” also includes support for “Por Amor al Planeta” (“For the Love of the Planet”), a reforestation and youth education program in a national park home to the Iztaccihuatl and Popocatepeti volcanoes. Through “Por Amor al Planeta,” VW of Mexico, in cooperation with 40 partners, has enabled the planting of some 490,000 spruce trees in the national park since 2008.

The reforestation effort yields real, substantial benefits to VW's manufacturing operations, as well as to local communities and ecosystems across the area, not the least of which is helping stabilize the water table in the Puebla region. As VW states:

“Thanks to the improved seepage of rainwater, an additional water volume of up to four million cubic meters per year is available. 158,000 indigenous trees are being planted in a similar project in Sierra de Lobos, Guanajuato.”

Dedicated to research into and protection of biodiversity in Mexico, “Por Amor al Planeta” also made its eighth environmental conservation award at the “Think Blue. Nature.” launch in Puebla. The latest “Por Amor al Planeta” award, which includes a cash prize of some €30,000 (~$41,400), went to the University of Guadalajara Prof. Enrique Jardel Pelaez for recognition of his achievements “in the area of the preservation of forests and research into innovative methods for fighting forest fires.”

All images credit Volkswagen AG

Global Companies Call On Governments to Cap Carbon Emissions

More than 70 global companies signed the Trillion Tonne Communiqué, coordinated by The Prince of Wales’s Corporate Leaders Group, to limit cumulative carbon emissions to 1 trillion metric tons. That’s the emissions threshold needed to avoid more than 2 degrees Celsius of warming, according to the new IPCC report. We are already halfway to that limit as cumulative carbon emissions are around 579 billion tons. The 1 trillion limit is expected to be reached in 2040. Companies that signed the Communiqué include major multinationals such as Acciona, Adidas, CalSTRS, EDF Energy, ING, Mars, Shell, TetraPak and Unilever. The signatories have a collective turnover of about $900 billion.

The Communiqué, the seventh in a series coordinated by the Corporate Leaders Group, calls for a “'rapid and focused response' to the threat posed by rising global carbon emissions and the 'disruptive climate impacts' inevitably associated with them.” It specifically calls on governments to set a timeline for achieving net zero emissions before the end of the century, design a strategy to transform the energy system, and create a plan to manage reliance on fossil fuels, particularly coal.

“This communiqué sends a clear message from business at a critical time, when events in the Ukraine have refocused global attention on energy security, and just as the scientific consensus reminds us all of the imperative of collective action,” said Eliot Whittington, deputy director of The Prince of Wales’s Corporate Leaders Group.

It is only natural that businesses take the lead in addressing climate change. A report last year by Climate Accountability Institute links most human induced climate change to 90 companies, the majority of which are oil, natural gas, coal and cement producers. Fortunately, businesses are taking the lead. The Communiqué is not the only call by business for governments to address climate change. More than 750 companies have signed the Climate Declaration by Business for Innovative Climate and Energy Policy (BICEP), which urges the U.S. to take action to address climate change. The Climate Declaration states that what is needed is a "coordinated effort to combat climate change" with the U.S. taking the lead. Last month, over a dozen major California-based businesses signed the Climate Declaration, including Apple, SolarCity, San Diego International Airport and Sungevity.

The impacts of climate change are already being felt

The new IPCC report details the impacts of climate change, including those already being felt, which include:- Changing rainfall or melting snow and ice, which affect water resources

- Glaciers shrinking almost worldwide

- Permafrost warming and thawing in high-latitude and high-elevation regions

- Species shifting their geographic ranges, seasonal activities, migration patterns, abundances, and species interactions

- Wheat and maize yields for many regions are being negatively affected

- Weather extremes such as heat waves, droughts, floods, cyclones, and wildfires

The IPCC report makes it clear that we can reduce the risks of climate change impacts "by limiting the rate and magnitude of climate change.” Or as Johan Karlström, CEO of Skanska AB, one of the signatories of the Communiqué, said: “The threat of climate change is real and urgent. To curb emissions we need to work together." In other words, businesses and government must work together to tackle climate change.

Image credit: Glamhag

REI Commits to Solar Energy to Reduce Climate Impact

REI, the $2 billion national outdoor retailer, is committed to renewable energy. The company has 26 locations with solar power systems in eight states (Arizona, California, Colorado, Maryland, Massachusetts, New Jersey, Pennsylvania and Georgia). The locations with solar rooftop power systems include retail stores and a distribution center in Bedford, Penn. REI began installing solar panels on certain stores in 2008 after Davis, Calif.-based Blue Oak Energy conducted a three-year feasibility survey that found solar rooftop panels can provide 10 to 100 percent of a store’s electricity.

Sharon Im-Lee, energy manager at REI, Seattle, told Interiors & Sources that stores with high energy costs were a good fit for solar, including those located in California, which has higher energy rates. “Here in Seattle, our electricity costs are only 5 to 6 cents per kilowatt-hour; in California, we’re seeing upwards of 17 to 20 cents per kilowatt-hour, so what you’re offsetting is dramatically more in California,” said Im-Lee.

REI also buys renewable energy certificates (RECs). The REC purchases are equal to powering more than 130 stores, two distribution centers and its headquarters. Its annual purchase of RECs are equivalent to removing almost 8,000 cars from the road or switching over 990,000 incandescent bulbs to compact fluorescents. REI purchases RECs from San Francisco-based 3Degrees, which was named Best Trading Company for RECs in North America by Environmental Finance in its 14th annual market rankings.

“We intend to generate enough local renewable energy for our total electricity needs, but until then, RECs will be an important part of our energy strategy,” stated Kirk Myers, corporate social responsibility manager at REI, in a news release.

REI’s goal is to become climate neutral in its operations by 2020. Since energy is a big part of the company’s greenhouse gas (GHG) emissions, energy reduction is part of its energy strategy, which includes efficiency projects like lighting retrofits. The company is on its way to meeting its goal. Despite growing almost 6 percent in 2013 over 2012, its energy consumption only increased by 0.1 percent. REI also reduced GHG emissions by 39.5 percent.

In January, REI was listed as No. 16 on EPA Green Power Partnership’s Top 30 Retail, for obtaining 16 percent of its total energy from renewables. The companies listed represent the largest green power purchasers in the U.S. The combined green power use of the listed companies is 5.6 billion kilowatt-hours a year, which is equivalent to avoiding the carbon emissions from the electricity use of almost 600,000 average American homes every year.

Image credit: Chris Phan

Beyond Sustainable: A Call for Transparency

By David L. Phillips

When the numbers seem stacked against you, stay positive.

Statistics can be ugly – only 50 percent of firms survive their first five years and up to 95 percent of new products fail in their first year.

Green numbers tell a different story about consumer and investor choices:

- 65 percent of shoppers feel a sense of responsibility to purchase products that are good for the environment.

- Greener industries grow faster than the overall economy.

- The green building segment grows even during periods when the overall U.S. construction industry shrinks.

- Sustainable and socially responsible companies are more profitable.

Several reports, including "The Big Green Opportunity," show a steady rise in sustainable products compared to traditional. Along with the demand for more green goods and services comes a shift in consumer awareness that will extend to every industry.

Business strategist Jeffrey Hollender calls this Radical Transparency and explains how it can be used as a powerful tool to transform ordinary businesses into responsible and profitable entities. Transparency can take several forms.

Publicly sharing activities preempts critics; more eyes on company activities yields more supporters. Radical transparency leads to partnerships that may be a step toward overcoming deficiencies. Green companies do not “go it alone." Companies that execute real transparency have advocates like the Clean Technology Trade Alliance. CTTA forges partnerships among select member companies who share values and share customers seeking sustainable solutions.

Radical transparency can increase employee morale and productivity. At ReWall, we encourage employee participation in all areas of the business. The benefits are evident. Our latest product, EssentialBoard+, was developed by our Facility Manager who transformed a problem into an advantage. He saw an opportunity in a truckload of recycled input material that contained a different plastic content than our usual mix. Today we have a new product with an even higher moisture resistance.

Healthy building materials are a hot topic. It is frustrating when the government enacts regulations to limit exposure to certain chemicals but there is resistance in the marketplace -- even with safe, affordable alternatives. Even the best small companies don't have the marketing budgets to go up against industry giants who have been selling the same products to the same installers for years. Today, thanks to Internet searches and consumer disposition, the new kid with a great product can get the message in the hands of a discriminating consumer.

According to the Center for Association Leadership, demanding consumers have now gotten downright nosy.... Soothing language in marketing materials no longer cuts it. Details, people. We want details about our stuff and your stuff. This consumer expectation is way beyond buying "green" or Fair-Trade certified. We demand meaningful interaction with our professional advisors, our children's schools, our food suppliers and our building materials vendors.

Stop telling your customers and prospects how great you are.

Show them what you are made of.

This is radical transparency.

Image credit: Flickr/likeablerodent

David L. Phillips is the CEO of The ReWall Company, the first and only US company to recycle milk and juice cartons into a durable, mold resistant, and healthy substitute for drywall, plywood, and other components of our built environment. He works his butt off at the factory bringing a sustainable solution to two industries. When he gets home he is happy being merely comfortably sustainable.

Is 'Made in the USA' Always the Most Sustainable Choice?

This is a question many of us have wondered about. Seeing how the local movement is so closely associated with sustainability, at least when it comes to food, does that same closer-is-better reasoning hold when it comes to other products, such as clothing?

For starters, Steve Sexton challenged the local food argument in Freakonomics, in a post that has drawn a lot of criticism from locavores, including this smart piece by Tom Philpott. But still, he lands a number of valid points including the economies of scale argument and the fact that some places are better for growing potatoes than others. But probably the most important point he makes is that there are other considerations besides how far a product is shipped when determining how sustainable it is.

When it comes to clothing, there are other considerations to keep in mind. For example, how long an item of clothing will last determines how many times it will need to be replaced in a person’s lifetime.

This is the argument made by a companies like Appalatch and Osmium, which puts a high emphasis on the craftsmanship in their goods and their resulting durability. Companies like Darn Tough are now selling socks with a lifetime guarantee. The company even has a sign on its factory that says, “Nobody ever outsourced anything for quality.”

Pride aside, it’s certainly not out of the question that quality goods can come from many places. Even China. Thanks to the International Standards Organization, which provides operating practices and principles for manufacturing quality in the form of standards, quality is on the rise. Because a number of major multinational companies will not buy from suppliers unless they meet ISO standards, that puts pressure on companies to clean up their act. Fine, you say, if you’re selling nuts and bolts to Boeing, but we’re talking about clothing here. Yes, and some clothing makers have done just that. High-end Spanish clothing manufacturer Roberto Verino adopted the ISO 9001 quality standard back in 1997.

Quality aside, perhaps more prominent are concerns about labor practices. How can we buy clothing overseas, when so much of it is made in sweatshops? Organizations like the Clean Clothes Campaign, which is active in 16 European countries, focus on workers rights in the clothing industry. They are fighting for a living wage for workers and are seeking compensation for victims of the Rana Plaza disaster in Bangladesh. Child labor is a major issue, with the number of children (age 5 to 14) exploited in this manner numbering in the hundreds of millions. The Asia-Pacific region has the most, followed by sub-Saharan Africa, Latin America and the Caribbean

One Green Planet has a guide for purchasing sustainable clothing, which contains a list of 34 manufacturers that are at least somewhat sustainable with indications as to whether they are U.S.-based, organic, fair trade and animal friendly. Only 11 of them make their clothing entirely in the US. The list is not entirely comprehensive.

Among the environmental concerns associated with the clothing and textile industry are:

- Pesticides used to protect textiles can harm wildlife, contaminate water supplies and get into the air and the food we eat. Cotton is the most pesticide intensive crop in the world

- Chemicals that are used to bleach and dye textiles are often toxic.

- Discarded clothing fills up landfills. Americans generate 12.4 million tons of textile waste annually. That means that, on average, every American throws out roughly the equivalent of their own body weight in clothing every year.

- Textile machinery causes noise, sound and air pollution.

- Over-usage of natural resources like plants and water depletes or disturbs ecological balance. Most of this usage is in the agricultural phase, with lesser amounts in the production phase and consumption phase for laundering.

These concerns can occur anywhere, though some countries have stronger environmental regulations than others.

Longshot Apparel of Seattle, which makes clothing for tall men, chose to make all of their product here in the U.S. for reasons of quality and efficiency. The company's founders, who came from places such as Nike, Adidas and Nordstrom, were tired of long lead times, unfathomable minimums, long flights and generally lower quality products.

But the fact is, roughly 60 percent of everything we buy comes from China. That number grows to 98 percent when we look at clothes. The low cost of labor is irresistible to most companies, especially the large ones with their large overheads and larger bonus plans. Workers are paid $14 a day in China versus $88 a day in the U.S.

Bob Bland is a New York-based fashion designer and entrepreneur who is trying to change all that. Her Manufacture New York campaign wants to bring textile manufacturing back to Brooklyn. She decided to make the move after visiting clothing factories in China.

“The fact that [workers] were making clothes for us that were beautiful, really high-quality pieces, while at the same time wearing discarded samples, was just unsettling for me. Being a part of that made me want to level the playing field for everyone.”

Her Brooklyn Royalty clothing label will occupy 20,000 feet in Brooklyn, half for design and half for manufacturing. For the names of other clothing manufacturers still producing goods in New York City's famous Garment District, check out this story.

Another reason that making more clothes here than overseas would be more sustainable has to do with the economy. Even though it’s true that making clothes abroad allows companies to sell them at lower prices, there is a race-to-the-bottom mentality at the heart of that. Why? The reason why lower prices are so important to retailers like Wal-Mart is because people can’t afford to pay higher prices because they don’t have jobs. Henry Ford understood that paying his workers a decent wage would create a larger market for his cars. He was right. But today’s industry leaders are doing just the opposite, by cutting wages, busting unions and sending so many jobs overseas. Along with other distortions in the American economy that favor the wealthy over the rest, the once-thriving middle class is disappearing and, along with it, a large chunk of the market for consumer products.

I think it’s pretty clear that in an ideal world, making clothes, at least for the American market, over here would be more sustainable than importing them from overseas. This is especially true when the countries we import from have lax standards for worker and environmental protection. But this is far from an ideal world, which means that until corporate leaders recognize that their lowest-prices-at all-costs journey has been a dead end that has put our economy on life support, that will not change.

Yes, there will be a small but growing segment of domestic producers, selling to those who are willing and able to pay a little extra for domestically produced goods.

Until wages start going back up, the domestic market will be too small to allow for manufacturers to bring those jobs back home. So it's kind of a Catch-22.

Keep in mind, though, that at the end of the day, these big multinational corporations work for us, in the sense that they can only stay in business if we continue buying what they are selling. So here is yet another opportunity to vote with your dollar. The top brands all have teams of MBAs watching the market like hawks, and if they see demand for made-in-USA products going up, you can be sure they’ll begin offering that too.

Image credit: Cindy Shebley/Flickr

Seafood Traceability: The Business Case for Better Data

By Cheryl Dahle

Exposés of deception and abuse in food supply chains have become disturbingly routine. Whether we’re hearing about pink slime or horsemeat passed off as beef, the news is consistently unsettling: We can’t trust what we’re eating.

Seafood is no exception to this pattern. More than one-third of our seafood is mislabeled in North America. And upwards of 24 million tons of seafood is caught and sold illegally every year. A just-published report from University of British Columbia estimates that up to 26 percent of all wild seafood imports to the U.S. is so-called pirate fish!

Beyond what that deception may mean for your health, it is also a window to other more systemic challenges, including pirate fishing, human trafficking, and widespread fraud and corruption. While news stories easily generate outrage for the more personal aspect of these offenses, cultivating the attention span and call-to-action that targets change at the deeper, underlying problems is understandably harder.

These problems can’t be fixed simply by the decision of a few consumers to “eat local.” We need to rebuild the systems and behaviors of the global interconnected brokers, corporations and governments that touch your food before it hits your plate. Pulling that off will require better data.

What do we mean by better data? Better data means going beyond murky definitions of traceability systems to verified data. This is not a foreign idea to supply chains: Couple product data with time and location stamps, and an auditable trail of information is produced -- one that could be demonstrably free of illegal fish, for example. Here’s a look at the benefits better data could make possible, for businesses and for fish.

Better data means better ways to fight pirate fishing

We need some data about fish before it’s landed. Much of illegal fishing happens in international waters in vast areas that are impossible to police and monitor by boat. New technology allows remote surveillance by integrating satellite data with boat transponders to spot suspicious activity.

Windward, a technology company that develops unique algorithms to scan for these suspicious patterns, has been able to catch legal vessels pulling alongside pirate boats while at sea to offload illegal fish. That kind of data, coupled with widespread endorsement of the Port State Measures Agreement, which the U.S. ratified last week, would give ports the ability to refuse docking privileges to any boat flagged for pirate behavior. A better way to spot illegal fish in the supply chain is to make sure it doesn’t get into legitimate channels in the first place.

Better data is better for business

One of the entrepreneurs Future of Fish supports, Tom Kraft of Norpac, has found that implementing systems to track fish better also helped him track his business better. As a result of traceability data that connects to his core operating systems, he’s been able to reduce overtime costs by 80 percent, decrease his cost of goods by 2 percent, and use data-driven management to assist with purchasing decisions and increasing efficiency. Meanwhile, his customers get greater transparency and longer product shelf life.

While the return on investment in these systems will vary, the core reason to choose them is not merely to comply with tracking requests for environmental reasons, but because these systems provide clear business wins.

Not just certification; verified data

Certification systems are a great start. They can assure the sustainability of fish, and they typically develop separate chain of custody programs that claim to offer reliable tracking and labeling. But these chain of custody programs reside within an industry that delivers a dismal track record of one-third mislabeling, and these programs touch just a small percentage of fish. That leaves the bulk of the world’s fish as “mystery fish.” That low-data standard doesn’t filter out the 25 percent of illegal fish, nor draw meaningful distinctions between local fish, which might not be certified but could be more responsible than fish shipped in from a farm in China.

Moreover, the whole trick of setting market-driven change in motion is to align better behavior in the supply chain with better margin. Certified fish doesn’t consistently drive that alignment because consumers care about more than just science and harvesting gear. They want “local,” “fresh,” “convenient” and “healthy,” as well -- data not comprised by most certification definitions. Better data allows these other value points to be seen, rewarded and ideally used as additional enticements to buy responsibly harvested fish.

Many supply chains relying on sensitive natural resources (such as timber) are recognizing that the supply chain itself must take greater responsibility for broader implementation of better information practices. It’s time for the seafood industry to join that list.

What’s your role?

What can you do? Well, if you’re a company that buys or sells fish, or a technology company that serves the seafood industry, you can apply to join Future of Fish’s Technology for Transparency pod. We’re hosting several collaborations over the next 18 months aimed at making the purchase and implementation of better data systems easier.

If you’re a consumer, pay attention to the names of retailers who made Greenpeace’s list of best practices in seafood sourcing. And if you’re an IT professional, perhaps consider turning your talents to help end marine extinction in your lifetime. The ocean needs you.

Image credit: Flickr/Garry Knight

Cheryl Dahle is a journalist and entrepreneur who has worked at the intersection of business and social transformation for more than a decade, Cheryl conceived and co-led the effort to found Future of Fish.

Greenpeace Slams Amazon on Dirty Energy Use

A Greenpeace scorecard on green internet companies cites Amazon Web Services as one of the worst dirty energy transgressors.

The 84-page report released this month, “Clicking Clean: How Companies are Creating the Green Internet,” notes that AWS “provides the infrastructure for a significant part of the Internet.” But it is “among the dirtiest and least transparent companies in the sector, far behind its major competitors, with zero reporting of its energy or environmental footprint to any source or stakeholder.” Twitter is also a culprit in many of the same areas, the report continues.

Amazon gets failing grades from Greenpeace on energy transparency; renewable energy commitment and siting policy; and renewable energy deployment and advocacy. The company also received a “D” on energy efficiency and mitigation. Amazon Web Services relies heavily on nuclear and coal energy to run data-guzzling services like Netflix, Spotify, Tumblr and Yelp, the report states.

Twitter weighs in with three “fails” and a “D” – the latter in renewable energy commitment and siting policy.

Apple scored high marks because it uses only renewable energy for its iCloud and iTunes services.

Greenpeace reports some overall progress: Six major cloud brands – Apple, Box, Facebook, Google, Rackspace and Salesforce – “have committed to a goal of powering data centers with 100 percent renewable energy and are providing the early signs of the promise and potential impact of a renewably powered internet.”

Also, a number of leading brands, notably Apple and Facebook , have made “significant improvements in their energy transparency, discarding the previous dogma within the sector of withholding energy data due to competitiveness concerns.” However, transparency remains weak among many brands, especially co-location providers.

Other findings from the report:

- As a result of pressure from Apple, Facebook and Google, which are located in North Carolina, Duke Energy, the largest utility in the U.S., adopted a Green Source Rider, opening the market to renewable electricity purchases for large customers in North Carolina.

- Google is maintaining its leadership in building a renewably powered Internet, as it significantly expands its renewable energy purchasing and investment both independently and through collaboration with its utility vendors.

- Facebook continues to prove its commitment to build a green Internet, with its decision to locate a data center in Iowa driving the largest purchase of wind turbines in the world.

- Apple “is the most improved company” since the last Greenpeace report, and “has shown itself to be the most innovative and most aggressive in pursuing its commitment to be 100 percent renewably powered.”

This is serious business because, as the report says: “The rapid growth of the cloud and our use of the internet have produced a collective electricity demand that would currently rank in the top six if compared alongside countries; that electricity demand is expected to increase by 60 percent or more by 2020 as the online population and our reliance on the internet steadily increase.”

And while the shift to an online model can create significant gains in energy efficiency for businesses, “the energy appetite of the Internet continues to outstrip those gains” due to its dramatic growth.

Another problem is that the Internet’s growing energy footprint so far is mostly concentrated in places where energy is the dirtiest. So, “despite the leadership and innovation demonstrated by green internet pioneers, other companies lag far behind, with little sense of urgency, choosing to paper over their growing dirty energy footprints with status quo solutions such as renewable energy credits and carbon offsets while rapidly expanding their infrastructure.”

Amazon and other companies power their infrastructure “based solely on lowest electricity prices, without consideration to the impact their growing electricity footprints have on human health or the environment.”

The Internet isn’t going away; we won’t get to a renewable energy economy and society very quickly or efficiently unless the Internet becomes a platform that leads the way to a clean energy future, rather than leaning on the dirty energy past. Shame on you, Amazon!

Image: Greenpeace Clicking Clean report cover

German Renewable Electricity Consumption Hits Record High 25.4 Percent in 2013

European economic and fiscal woes, push-back from utilities and the influx of cheap imports from China have created stiff headwinds for Germany's homegrown renewable energy sector in recent years. Nonetheless, renewable energy reached a record 25.4 percent of Germany's total electricity consumption in 2014, according to the latest annual statistics from the Working Group on Renewable Energy Statistics (AGEE-Stat), an increase of nearly 2 percent from 2012.

Totaling 53,400 million kilowatt-hours (kWh) and up 5.1 percent year-over-year, onshore and offshore wind energy, at 34.4 percent, accounted for the greatest percentage of renewable electricity consumption in Germany. Despite a sharp scaling down in feed-in tariff (FiT) rates for residential solar photovoltaic (PV) installations, a total 30 million kWh of solar PV was consumed, up 13.7 percent from 26.38 million kWh in 2012.

As the German Embassy noted in a recent news item, “Solar energy implementation has been extremely successful in Germany over the past decade. Solar farms in the south broke records in 2013 for energy production and have continued to produce high levels over the winter."

Solar is no longer a luxury item

Solar PV accounted for 19.7 percent of German renewable electricity and 9.7 percent of overall renewable energy supply in 2013. The German Embassy went on to note that the Photovoltaic Grid Parity Monitor ranked Germany's solar PV market is one of the most competitive and profitable in Europe, with Germany, Italy and Mexico considered to have the best economic framework and infrastructure for solar energy.

As stated in a March 26 article in the Germany.info news service:

“In Germany, solar energy is no longer luxury item; in fact, the latest edition of the study noted that the cost of solar energy and other energy sources are about equal.”

Germany's growing, diversified mix of renewable energy resources

Overall for 2013, Germany's growing, diversified mix of renewable energy resources – wind (onshore and offshore), solar, hydro, biomass and geothermal – contributed a record 152.6 billion kilowatt-hours (kW) to the nation's electricity supply last year. That equates to a total 318.0 billion kWh when energy consumption in the form of heat and motor fuels are included.

The supply of renewable electricity from biomass – a mix of biogas, biogenic solid and liquid fuels, fraction of waste, and sewage and landfill gas – rose 7.3 percent to 47.9 billion kWh, 31.4 percent of the renewable electricity supply mix.

Biomass and other renewable energy sources are also supplying more of Germany's heating needs. Though down from 9.3 percent in 2012, biomass sources accounted for 9 percent of energy consumption for heat in 2013.

Hydroelectric power supply totaled 21.22 billion kWh last year, down 2.45 percent from 21.755 billion in 2012, though up 20 percent from 17.671 billion kWh in 2011.

The extraordinary pace of renewable electricity and overall energy development in Germany becomes clearer when viewed from a longer term perspective. Renewable electricity generation capacity totaled 84.3 million kW, up from just 4.7 million in 1990, 12.3 million in 2000 and 77.1 million in 2012.

Motor fuel supply and consumption remains the weak link in the renewable energy industrial ecosystem. Taken together, biodiesel, vegetable oil, bioethanol and biomethane supplied 5.3 percent, the equivalent of 32,613 kWh, of Germany's motor fuel supply in 2013 -- down from 36,130 kWh and 5.9 percent in 2012.

Still, progress on the renewable motor fuel front is noticeable over the longer term as well. From a standing start in 1990, the percentage of Germany's motor fuel supply coming from renewable energy sources rose to 6.3 percent in 2006 and 7.4 percent in 2007 before slipping in the years since, according to AGEE-Stat's data.

Image credit: ANR2008/Flickr

Graphs credit: AGEE-Stat

SolarCoin: Digital Money Backed by Solar Power

By Sam Bliss

Back in 2011, Nick Gogerty and Joseph Zitoli of the Thoughtful Capital Group wrote a proposal to back national currencies with electric power. They argued that electricity provides benefits to society, unlike gold, and retains monetary value better than government debt or mortgage-backed securities -- the assets the U.S. Federal Reserve Bank currently holds against dollars in circulation.

Naturally, central bankers and policymakers around the world ignored the academic paper. It’s difficult to convince large institutions to transform a system that seems to be working just fine -- and most of the world’s major currencies are relatively stable.

So this year, Gogerty and an online volunteer community created an electricity-backed digital currency, in the vein of Bitcoin, to incentivize solar energy generation. If we show a little faith in the value of sun power, this new online monetary system will increase the rate of investment in solar electricity.

SolarCoin is a decentralized digital currency that we can trade person-to-person, with no need for a bank or other intermediary. Launched in 2014, it is not affiliated with a specific country.

Proof of computer work

SolarCoin is backed by two "proofs of work." The first is called a cryptographic proof of work, basically a math problem that’s difficult for computers to solve but easy to check that they got it right.

I don’t pretend to fully understand digital cryptocurrencies, but the possible positive impact of SolarCoin shines brightly with or without computer science knowledge. All we need to know is that a database called a block chain acts as a public ledger, holding a record of every SolarCoin transaction.

This innovation prevents anyone from trying to spend the same SolarCoins twice. More generally, the invention of the block chain marks the first time in human history that we have achieved decentralized trust.

Because of this new technology, it is no longer necessary to rely on a central authority to assure shared trust in agreements -- a reality that could radically transform banking by reducing or eliminating legal fees and other transaction costs. Yet the block chain has potential applications well beyond the sphere of money (check out ProofOfExistence, a service that provides evidence of ownership of a specific file at a specific time).

Proof of solar work

What makes this currency a potential game-changer in the electric power sector is its second proof of work: authentication of solar electricity production through a third party-verified meter reading. One megawatt-hour (MWh) of generation earns one SolarCoin (SLR).

The SolarCoin Foundation created 98 billion SolarCoins to match the amount of solar electricity that the International Energy Agency predicts will be generated over the next 40 years. All but 0.5 percent of these SolarCoins will go to energy producers; the remaining 500 million will compensate the computer geeks and other volunteers who build and support the infrastructure behind the currency.

The peer-to-peer network of SolarCoin holders will build the currency’s transactional value upon the belief that solar-powered electricity is worth more to the world than its value in traditional energy markets. Ideally, it will work like electronic cash.

Get SolarCoins

Up until Saturday, March 8, all the virtual money was held in reserve. That day marked the first SolarCoin pilot grant, in which Arizonan Lisa Shock received 23.4 SolarCoins by providing verification of the 23.4 MWh her rooftop installation generated between 2011 and 2013.

The pilot program represents the first steps toward developing a global system for verifying electricity generation and granting SolarCoins in a communally transparent way that still respects individual privacy. Residential solar system owners and investors in larger projects can participate in the grant program and start receiving SolarCoins for their power production.

First, you need a receiving address for your e-money. Download a SolarCoin QT wallet at SolarCoin’s website to join the solar-backed currency community.

Then head here to claim your coins. You’ll need a scan or photo of two documents: a Proof of Use that contains the physical address and nameplate capacity of the generation facility; and a Proof of Work that verifies solar electricity generated and time period from the meter.

The power generated by solar projects at a residential dwelling can earn SolarCoins for the resident, whereas the SolarCoins for large installations’ production can be claimed by the owner of the facility. This structure incentivizes the primary consumers of the electricity from rooftop solar arrays -- the residents -- even if the system is leased or financed.

In addition, granting SolarCoins to residents grows the SolarCoin community larger than dispersing all the rewards to a few solar leasing firms. Even better, the currency's worth increases for everyone using it as it finds its way into more people's digital wallets, because the value of SolarCoin is directly proportional to the number of people holding the currency.

You can also get small quantities of the currency absolutely free at a charitable faucet like this one. These faucets are third-party websites that give away SolarCoins in order to grow the economy of SolarCoin users. SolarCoins' value as a means of exchange grows as more people hold them.

In addition, you can obtain SolarCoins on a currency exchange. Click here for a list of online sites where you can trade dollars, Bitcoins, and other currencies for SolarCoin, once you have downloaded your digital wallet.

But wait. Why would anyone want SolarCoins? Are they really worth anything?

Trust me, they're valuable. Actually, trust SolarCoins -- currencies are all about trust.

The next post in the series will explore why SolarCoins have value and how their purchasing power will increase over time. Stay tuned!

Image credit: SolarCoin.org

Sam is an aspiring economist and writer. You can read his work at theblisspoint.org