Sedex and Verité tackle supply chain slavery risk

Sedex Global has partnered with the training, consulting and research NGO, Verité, to publish a new briefing tackling modern day slavery risks in global supply chains.

The Modern Day Slavery Briefing presents latest thinking on the risks and manifestations of human trafficking and other forms of forced labour in the supply chains of multinational enterprises. It includes insights from Verité and Sedex on the root causes, how workers are affected, and indicators of forced labour in factories and on farms.

The briefing also includes recommendations to help buyers and suppliers tackle modern slavery. These cover key areas such as such raising awareness of the issue, establishing appropriate policies, supply chain mapping, assessing impact and reviewing progress, supplier accountability and collaboration.

Marianne Voss, report co-author and Stakeholder Engagement Lead for Sedex in North America, commented: “With surging news coverage highlighting cases of slavery, focus and scrutiny on global supply chains is increasing. We hope this new guidance helps more global businesses to play their part in contributing to the eradication of modern day slavery within their supply chains through commitment, transparency and collaboration."

Dan Viederman, ceo at Verité, added: “Let us not ignore the continuing and largely hidden tragedy faced by millions of workers who are forced to work in appalling conditions: because they owe money to their recruiter; because their passports have been confiscated by their employers; or because their visa ties them to their job. Despite their severity these are solvable problems."

You can download the briefing here.

Picture credit: © Freds | Dreamstime Stock Photos

3p Weekend: 10 Clever (and Conscious) Ad Campaigns That Won the Internet

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every FridayTriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads, and spend five minutes catching up on the latest trends in sustainability and business.

It's tough to deliver a truly great ad campaign these days. The good news is that despite an an ever-expanding sea of competition, ads that appeal to social consciousness are cutting through the crowd. With that in mind, this week we're featuring 10 clever and socially conscious ad campaigns that won the Internet.

1. U.N. Women's Autocomplete campaign

Released late last year, this ad campaign rocked the Web by featuring portraits of women with discriminatory Google autocomplete results covering their mouths. The campaign, developed as a creative idea for U.N. Women by Memac Ogilvy and Mather Dubai, features portraits of women with autocomplete results for search terms like “women should” and “women shouldn't” covering their mouths. The results were disturbing, with responses like women should "be in the kitchen" and women shouldn't "have rights."2. Pantene "Labels Against Women"

https://www.youtube.com/watch?v=kOjNcZvwjxI

This campaign made waves around the Web by pairing powerful women in management positions alongside men. The 60-second ad initially focuses on a male manger leading his team, with an appropriate caption of "boss." The shot then flashes to a female manager in the same position. Adding one letter that makes a big difference; the caption reads "bossy." Similar captions describe a working father as "dedicated," while those under a working mother read "selfish." Calling for a defiance of stereotypes, the campaign received more than 46 million views on YouTube.

3. Honey Maid’s “This Is Wholesome” follow-up

https://www.youtube.com/watch?v=cBC-pRFt9OM

In early March, Honey Maid launched its “This Is Wholesome” ad campaign featuring several “unconventional” families – a family with two dads, a mixed-race family, a “rocker” family, a military family and a single dad and his son. After the ad drew criticism from religious and anti-gay circles over the family with two gay dads portrayed in the commercial, the company released a follow-up video on social media addressing both the negative and positive comments it received. Seriously, this ad about graham crackers is so powerful it may bring you to tears, which is pretty impressive.

4. Dove "Real Beauty Sketches"

https://www.youtube.com/watch?v=XpaOjMXyJGk Dove made a smart, conscious and decidedly business savvy choice by cutting directly to a societal issue that impacts its consumers -- pervasive body image issues among women. By pairing real women alongside their perceived notions of themselves, the brand garnered nearly 30 million views on its campaign in only 10 days.

5. Chipotle, "The Scarecrow"

https://www.youtube.com/watch?v=lUtnas5ScSE

Another tear-jerker, this ad is the companion film to Chipotle's app-based game that calls on consumers to join the quest for wholesome, sustainable food.

6. GoldieBlox & Rube Goldberg "Princess Machine"

https://www.youtube.com/watch?v=IIGyVa5Xftw

This visually captivating campaign gives young girls a clear message: There's a world beyond pink and princesses. Founder Debbie Sterling sees Goldie Blox, which is billed as an engineering toy for girls, as way more than a toy. It's the beginning of a movement to give girls new role models, a reason to become interested in STEM careers and new challenges to keep them engaged as they grow.

7. Coca-Cola, "It's Beautiful"

https://www.youtube.com/watch?v=443Vy3I0gJs Coca-Cola found itself embroiled in controversy earlier this year after the beverage giant’s “It’s Beautiful” Superbowl ad intimated that individuals of different ethnicities and cultures and a family with two dads were all-American. But its message also drew an overwhelming positive response, as well as more than 11 million views on YouTube.

8. Patagonia, "Worn Wear"

https://www.youtube.com/watch?v=z20CjCim8DM

Back in 2011, Patagonia turned heads on Black Friday by encouraging less consumption with an ad campaign boldly entitled "Don't Buy This Jacket." Last year, it kept the alternative holiday shopping trend going with its "Worn Wear" campaign, which called on consumers to repair rather than replace.

9. Panera Bread, “Live Consciously. Eat Deliciously.”

https://www.youtube.com/watch?feature=player_embedded&v=b7nIkuR9cMM

In another campaign featuring a Rube Goldberg machine, this ad from Panera Bread puts social consciousness front and center. The ad showcases both its commitment to wholesome food (like antibiotic-free chicken) and its dedication to feeding the hungry with nightly donations.

10. Woodgreen Community Service, “Homeward Bound”

Created by Woodgreen Community Service, a Toronto-based organization that helps the underprivileged and elderly, this ad campaign challenges viewers to care as much about those living in poverty as they do about celebrities. Despite a small budget, news of the campaign traveled fast earlier this year after it was featured on BuzzFeed.

Based in Philadelphia, Mary Mazzoni is an editor at TriplePundit. She is also a freelance journalist who frequently writes about sustainability, corporate social responsibility and clean tech. Her work has appeared on the Huffington Post, Sustainable Brands, Earth911 and The Daily Meal. You can follow her on Twitter @mary_mazzoni.

Can Corporate Sustainability & Economic Growth Coexist? A Twitter Chat With SAP, BSR and CDP

Join TriplePundit and CSRwire at #SustyBiz TODAY at 8am PT/11am ET live on this page or on Twitter.

What does it mean for a technology company to lead with sustainability? How can technology companies leverage their expertise and scale to make exponential social and environmental impact? Moreover, how do you sustain your impact while growing your business? In its second SAP Integrated Report , SAP announced “plans to power all its data centers and facilities globally with 100 percent renewable electricity” as well as a shift to a cloud business model, which it predicts will also help “eliminate carbon emissions caused by its customers' systems by moving them into SAP’s green cloud.

The “green cloud” might sound geeky and industrial to many – especially when companies like Intel are busy making extraordinary commitments to reduce their footprint – but it does address the sustainability conundrum many corporations face on its head: how do you wrap your consumer into your sustainability strategy and attempt to minimize their footprint as well?

The answer isn’t simple, even for a company like SAP that has lead with sustainability for years by committing to ambitious goals and transparently reporting against them via an interactive sustainability platform and early adoption of integrated reporting.

FOLLOW ALONG LIVE HERE

To tackle the question among others, join us on April 11, 2014 at 8am PT / 11am ET, for a conversation with SAP’s Chief Sustainability Officer Peter Graf, along with sustainability influencers BSR President and CEO Aron Cramer and CDP’s Executive Director Nigel Topping.

Moderated by CSRwire's Editorial Director, Aman Singh, and TriplePundit's Founder and Publisher, Nick Aster, the discussion will explore several subthemes including:

- How do you continue to scale sustainability initiatives while growing your business?

- How does Integrated Reporting both exemplify and lend itself to SAP’s sustainability thinking?

- As we return to economic growth globally, how are sustainability programs getting affected?

- What about the “social” in ESG? Will a return to economic growth impact corporate attention to social investments?

- How do companies keep their sustainability and business goals aligned?

Here’s what you need to know to join us:

- Date: April 11, 2014

- Time: 8am PT/11am ET

- Hashtag: #SustyBiz

To register, send out the following tweet: I will join @PeterGGraf @AronCramer @TopNigel @AmanSinghCSR & @NickAster to discuss the challenges of growing a #SustyBiz on 04/11 8am PT.

Got a question for our panel? Send them to [email protected].

TerraCycle Wants to Help Businesses Go Zero Waste

TerraCycle is known for collecting materials that can’t be recycled through traditional curbside recycling programs – like chip bags, water filters and cigarette butts – and turning them into innovative, affordable products. Now with the launch of its Zero Waste Box program, the New Jersey-based company wants to make it easier for businesses to dramatically reduce their waste stream.

Unlike TerraCycle’s recycling Brigades program where participants can often recycle a product from only one company, the Zero Waste initiative allows customers to mix products from different companies in the same box. For example, you can order a Zero Waste Box to collect baby food pouches made by any company, but you would have to sign up for one Brigade to recycle Earth’s Best pouches and a separate one for Ella’s Kitchen. Some of TerraCycle’s Brigades let participants recycle products from different companies together like its cell phone Brigade, but all of TerraCycle’s Zero Waste Boxes are product-based, rather than company-based.

Why are many of TerraCycle’s recycling Brigades focused on a product from one company? TerraCycle frequently collaborates with a company to pay for the cost of shipping its products to TerraCycle for recycling; for example, TerraCycle partners with Brita to recycle its notoriously difficult-to-recycle water filters. This sponsorship allows the Brigade collection program to be free for consumers and is another difference between the upcycling company’s Zero Waste Box and Brigade programs: Most Brigades are free of charge, while businesses must pay a fee to order a Zero Waste Box. The box’s price varies, depending on size and the waste stream, and covers the box, shipping and recycling costs.

Businesses can also buy a special No Separation Zero Waste Box, where, much like a single-stream recycling cart, they can place all non-hazardous, non-organic waste that can’t be recycled through their curbside program. TerraCycle will then sort the materials for the customer and recycle everything inside. Just like single-stream recycling, these no-separation boxes can save companies staff time sorting out recyclables and prevent contamination from the wrong material. But this convenience comes at a price: Fees for the No Separation Zero Waste Box are more expensive than the standard Zero Waste Boxes, costing $48 for the smallest box and $177 for the largest. To save money and still reduce their waste stream, businesses can opt for the Zero Waste Boxes that collect materials separately and have their employees do the sorting.

But will businesses sign up for TerraCycle’s Zero Waste Box program – especially when they have to pay to do the right thing? While businesses are accustomed to spending money on legally-required, proper disposal of hazardous wastes, will they shell out money to recycle items they could simply throw in the landfill for a lower fee? TerraCycle’s CEO Tom Szaky thinks some businesses will, motivated by the opportunity to promote their companies’ zero waste programs and attract new customers.

“Participation in TerraCycle’s Zero Waste Box program can be a marketable, differentiating element in a crowded marketplace,” Szaky told Consumers Goods Technology. “With consumers starting to expect environmental responsibility at every phase of their favorite product’s lifecycle, it just makes sense.”

The Zero Waste Box program is geared towards businesses, but anyone can order a box to recycle unusual waste materials from his or her home, nonprofit or business, said Albe Zakes, TerraCycle’s vice president of media relations.

While, of course, the true definition of zero waste does not simply mean 100 percent recycling, TerraCycle’s new program goes a long way in addressing traditionally difficult-to-recycle materials, while we wait on companies to take a more sustainable approach: designing their products to be easily and efficiently recycled at the end of their useful life.

Image credit: TerraCycle

Passionate about both writing and sustainability, Alexis Petru is freelance journalist based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

The Return of the Pink-Mustached Jedi: Lyft Raises $250 Million

A few months back, I wrote about Uber’s efforts to level Lyft by leveraging its hefty $258 million in new funding from Google Ventures and TPG Capital. Shortly after, Uber attempted to stifle Lyft’s launches in St. Paul, Phoenix and Indianapolis by offering free rides in these cities. Since then, it has gone on much like this: Lyft expands to new cities, and Uber comes up with ever-more-crafty ways to steal the limelight. Not even kittens are safe.

For the longest time, Uber has been the well-heeled Galactic Empire, and Lyft the scrappy but stalwart Rebel Alliance. Uber respects markets; Lyft values people. But no matter how hard Uber has tried to squash its competitor with silly marketing schemes, attack ads and even lowering rates, Lyft continues to not only survive – but thrive.

And then last week happened. Lyft closed a $250 million Series D round, bringing its total funding up to $332 million – several million above Uber’s $307 million (although some reports claim Uber has actually raised between $361 million and $405 million).

It’s the return of the Jedi, baby. And this one wears a pink mustache.

The new funds are more than double what Lyft and its original parent company Zimride had raised to date. In the past year alone, the company has used its $80 million in venture capital to expand from two cities to 30. This money was sorely needed to continue to compete with Uber, as well as sparring with government regulators, offering enough drivers to meet customer demand and eventually expanding abroad.

Lyft likely will also use the new funds to shore up its safety and security infrastructure. The nature of the business means that the company will inevitably face disastrous accidents, personal injuries, assaults or death incidents involving its drivers. The company already has acted to expand its insurance policy to cover drivers when they are between rides but logged in to the app.

In the wake of Lyft’s recent victory, Uber executives must be feeling a lot like the Empire after Luke Skywalker blows up the first Death Star. Uber’s financial advantage allowed the company to lower rates in several key markets, which should have spelled Lyft’s doom, according to the rules of the market.

Lyft has succeeded not because it always offers the cheapest rides (it doesn’t), but because it offers something more than just a ride. Uber’s failure to crush its competition stems from a fundamental misunderstanding of the sharing economy.

Case in point: In January Uber began running a Facebook ad that depicts a middle-aged man and woman bumping fists – Lyft’s signature – with the copy, "Don't pay a premium to fist bump."

I recently wrote that transportation network companies (TNCs) such as Lyft and Uber “aren’t just about logistics – getting from Point A to Point B – but about bringing communities together, so that we can move forward.”

Despite the fact that people today are more connected to one another than ever before in human history, thanks to Internet-based social networking sites and text messaging, they also are more lonely and distant from one another in their unplugged lives, according to MIT social psychologist Sherry Turkle, PhD. This is not only changing the way we interact online, but also straining our personal relationships.

Lyft is building its business on the idea that at the end of the day, we all seek community.

In a recent blog post, Lyft wrote:

“In just the last week, a Lyft driver travelled to Africa to shoot photos of budding musicians because of a ride he gave to the executive director of PeaceTones, a nonprofit empowering Kenyan musicians. Another driver witnessed an elderly woman having car trouble and dropped everything to help get her home, while in Los Angeles a group of passengers invited their Lyft driver to lunch after their ride.”

Maybe I got a little carried away with my Star Wars metaphor. Uber is not a malevolent company led by an evil emperor and fallen Jedi who killed younglings (some may disagree). Nor is Lyft without its faults.

But Uber continues to operate under the false notion that the sharing economy is a zero-sum game. It’s them, or Lyft. This is why Uber spends millions trying to tear down the competition. Now that Uber has lost its monetary advantage, it would do well to take a look in the proverbial mirror. Lyft isn’t going anywhere, and you know why?

Sometimes people just want to fist bump.

Image Credit: starwars.wikia.com

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)

IKEA Invests In 98 Megawatt Wind Farm In Illinois

IKEA US announced its investment in a 98 megawatt wind farm in Hoopeston, Illinois. The wind farm, called Hoopeston Wind, is the largest single IKEA Group investment in renewable energy globally. The project is being built by Apex Clean Energy and expected to be in operation by 2015. IKEA Group will own Hoopeston Wind and Apex Clean Energy will manage its operations. Rob Olson, Chief Financial Officer of IKEA US made the announcement at an business executive briefing by companies who have signed the Climate Declaration, which calls on the government to take action on climate change, for members of the Congressional Bi-Cameral Task Force on Climate Change.

“We are committed to renewable energy and to running our business in a way that minimizes our carbon emissions, not only because of the environmental impact, but also because it makes good financial sense,” said Olson. “We invest in our own renewable energy sources so that we can control our exposure to fluctuating electricity costs and continue providing great value to our customers.

Hoopeston Wind will generate enough electricity to power almost 39,000 average Illinois homes, or 18 percent of the electricity used by IKEA Group worldwide. The carbon emissions reduction of the wind farm equals taking 55,000 cars off the road. The wind farm will consist of 49 wind turbines installed near Hoopeston in Vermillion County, Illinois, about 110 miles south of Chicago. Illinois is a great place for a wind farm as the state ranks fourth in the U.S. for total megawatts of wind energy installed, fourth in the number of utility scale turbines installed, and fourth for number of wind-related jobs.

Hoopeston Wind will bring economic benefits to Vermillion County, which include:

- $11.3 million in new tax revenue for schools, roads and services, over the life of the wind farm

- $10 million into the local economy through direct landowner payments, over the life of the wind farm

- $17.8 million into the local economy through purchasing of good and services for construction of the wind farm

- $3 million a year ($75 million over the life of the wind farm) from purchasing of goods and services within the state for operations

- 36 local jobs in Vermillion County for construction of the wind farms

- 61 full time jobs through supply chain impacts and multiplier effects, during construction

- Five long term local jobs to operate the wind farm

IKEA is committed to renewable energy investment

IKEA Group’s goal is to generate as much renewable energy as the total energy it consumes by 2020, as stated in its 2013 sustainability report. For that reason, the company is investing in renewable energy, including wind and solar. The IKEA group produced 1,425 gigawatt hours of energy from renewable energy, equal to 37 percent of the total energy it uses globally. IKEA Group owns 206 wind turbines globally, including Canada, where the company is now the largest retail wind energy investor. The company also has installed 550,000 solar panels on IKEA buildings in nine countries. IKEA has installed solar power on 90 percent of IKEA locations in 20 states in the U.S. with a total of 165,000 solar panels providing 38 MW, making it one of the largest private owners of solar power generation in the country. It’s an investment of over $150 million.

Photo: Idaho National Laboratory

Clean Solar Initiative II To Add 100 MW of Solar Power on Long Island

Residents of New York's Long Island (2010 estimated population 7.568 million) will be getting more of their electricity from clean, renewable solar energy as the Long Island Power Authority (LIPA) and PSEG Long Island move forward with the second-round Clean Solar Initiative (CSI-2). Following a four-month application period that ended Jan. 31, the Long Island electric utility on April 2 announced that it had chosen 76 projects out of a prospective 178 CSI-2 proposals in a bid to bring an additional 100 megawatts (MW) of solar power online -- enough to power some 13,000 homes.

PSEG Long Island conducted a clearing auction to determine a final bid price of $0.1688 per kilowatt-hour (kWh) for the second-round solar energy feed-in tariff (FiT). That's the fixed rate the utility will pay to project developers over the life of their 20-year power purchase agreements (PPAs) with the utility.

CSI-2's final bid price is almost 25 percent lower than the prices being paid for solar energy generation via CSI-1, LIPA and PSEG Long Island's first solar feed-in tariff (FiT) -- an annual savings of $8.1 million, PSEG Long Island director of Energy Efficiency and Renewables stated in a press release.

Clean, local energy benefits

PSEG attributed the decline in CSI-2 solar energy bid prices to several key factors:

- Increased consumer awareness, understanding, availability and demand for solar energy

- Competition among a growing solar industry on Long Island

- Ongoing decline in costs of manufacturing and installing solar

- Federal, state and local tax incentives

Commenting on the results of the CSI-2 bidding process, executive director of the nonprofit Renewable Energy Long Island Gordian Raacke stated:

“This is yet another major milestone in Long Island’s solar energy history. When completed, Long Island will have a distributed solar power plant which will generate reliable and clean electricity for decades to come, using our abundant sunshine instead of fossil fuels. Solar electric systems are a proven technology not only for individual rooftop installations but also for larger, utility-scale applications.”

“The expansion of Clean Solar Initiative is yet another signal that clean local energy benefits both consumers and utilities,” added executive director of the Clean Coalition Craig Lewis.

“Furthermore, LIPA’s recognition that distributed solar provides at least 7 cents per kilowatt-hour in avoided transmission and central generation costs makes clear to the rest of the country that the locational value of wholesale distributed generation is undeniable and significant.”

Stable, local, cost-effective and clean

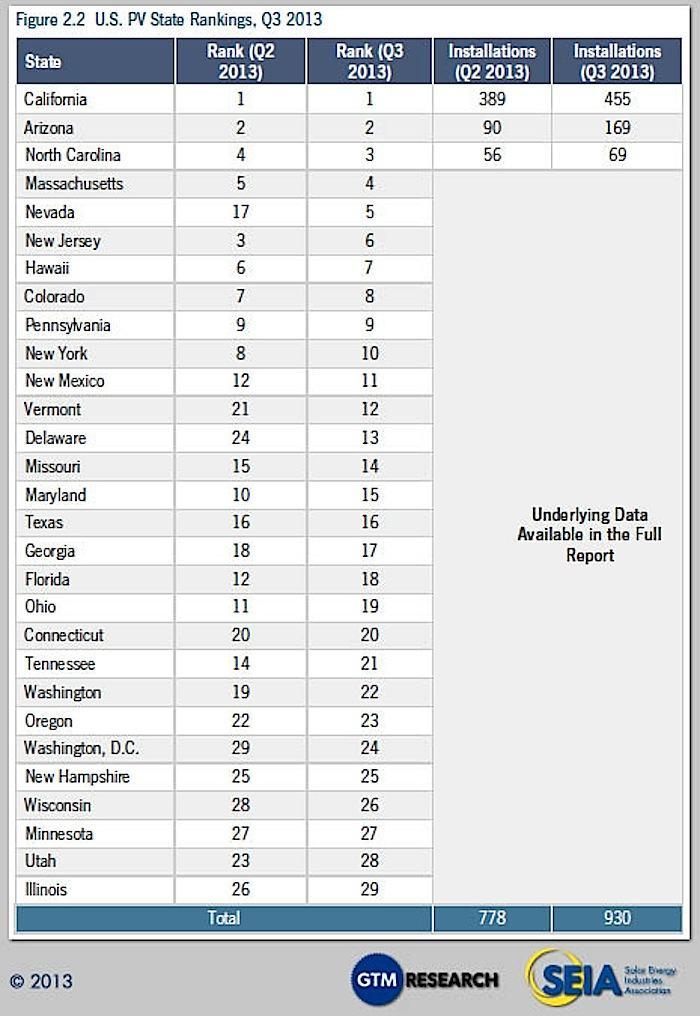

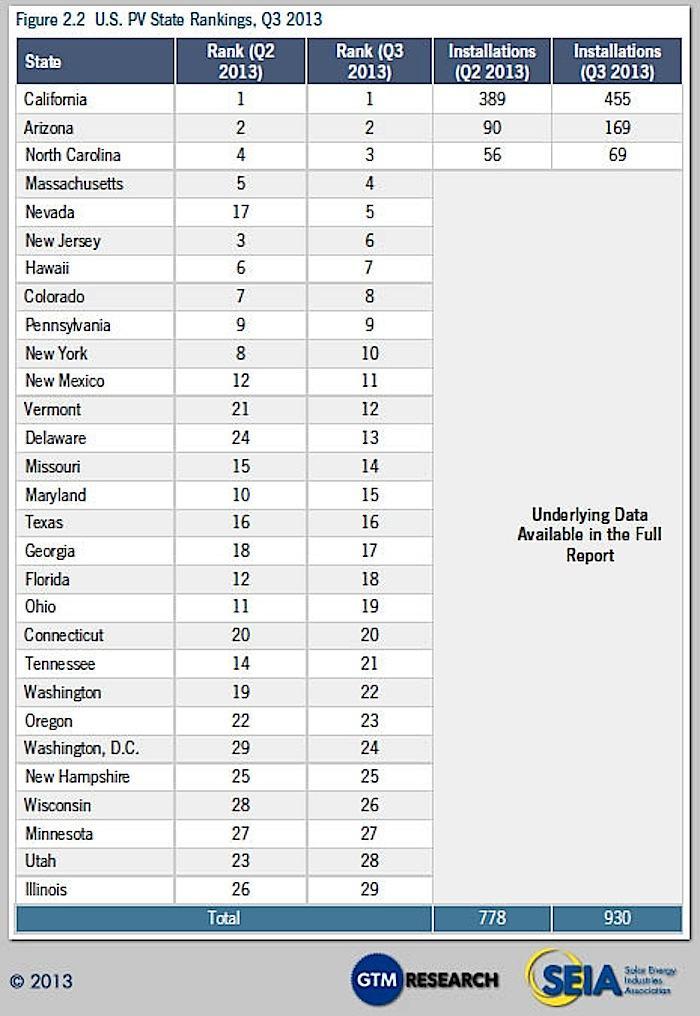

A mix of supportive government policy measures and industry advances are contributing to raise solar energy's place in New York's power mix. More than $343 million was invested in residential and commercial solar photovoltaic (PV) installations in New York in 2013, a 12 percent year-over-year increase, with installed prices falling 4 percent.

With the installation of an additional 69 MW of solar energy capacity in 2013, New York ranked ninth among U.S. states, according to the New York Solar Energy Industries Association (NYSEIA). With a cumulative 247 MW, New York also ranked ninth in total installed solar electric capacity.

LIPA views solar and other renewable energy sources as cost-effective, flexible and environmentally friendly means of reliably meeting energy demand across its service territory, including insulating the utility and its customers from swings in fossil fuel prices.

Long Island residents have been hit hard recently by rising electricity costs. According to a Dec. 30, 2013 Newsday news report:

“'Average residential customers will see a $16.91 increase in their bills next month because of an anticipated jump in natural gas pricing, and a backlog of unpaid fuel costs from November,' LIPA said.”

In order to better meet load constraints in specific areas, as much as 40 of CSI-2's 100 MW is to be installed on the South Fork of Long Island's East End, LIPA explains. PSEG offered an additional incentive of approximately 7 cents-per-kWh for CSI-2 projects situated within the designated area.

“Reducing the load constraint in this area will help defer, reduce or eliminate the need to invest hundreds of millions of dollars in building new generation, infrastructure, and transmission and distribution lines.”

Solar green job creation

Supporting solar energy is also seen as a way to boost local job creation. There are more than 414 solar businesses employing some 5,000 people across the value chain in New York state, according to NYSEIA. Building out CSI-2's 76 solar power projects on Long Island is expected to create hundreds of construction jobs. As PSEG Long Island states in its press release:

“It is also significant that all 100 MW will be generated on Long Island, further advancing the development of solar energy and the growth of clean energy jobs.”

Looking ahead, LIPA intends to expand its efforts to foster renewable energy growth and reductions in greenhouse gas emissions and environmental pollution.

In order to fill an additional 20 MW of renewable energy, LIPA is developing another clean energy FiT for wind energy, fuel cells and other renewable resources. It is also preparing a Request for Proposals (RFP) for as much as 280 MW of additional renewable power. Both initiatives are expected to be ready before year-end.

A non-profit municipal electric utility, LIPA owns the retail electric transmission and distribution system on Long Island, which provides electric service to more than 1.1 million customers in Nassau and Suffolk counties and the Rockaway Peninsula in Queens.

PSEG Long Island manages LIPA's electric grid per the terms of a 12-year contract awarded in December 2011.

LIPA is the second largest municipal electric utility in the nation in terms of electric revenues, third largest in terms of customers served, and the seventh largest in terms of electricity delivered. As LIPA highlights, in 2011 it “outperformed all other overhead electric utilities in New York State for frequency and duration of service interruptions.”

Image credit: Brookhaven National Lab/Flickr

Water-Energy Nexus: Utah Approves Largest Solar Power Park

Scatec Solar on April 1 received final approvals from the Utah Public Service Commission and Iron County Community Development and Renewal Agency to start building what will be Utah's largest solar energy facility.

Under the terms of a 20-year Power Purchase Agreement (PPA) with PacifiCorp, the 80-megawatt (MW) AC Utah Red Hills Renewable Energy Park will supply clean, renewable electricity to residents in far-off Idaho and Wyoming, as well as Utah, through Rocky Mountain Power.

The project highlights the social and environmental, as well as economic, benefits and advantages to deploying solar and other renewable energy sources as opposed to conventional fossil fuels. Those aren't limited to green job creation and reducing carbon emissions, but extend to the conservation of increasingly precious freshwater resources.

Solar's triple bottom line benefits

Pointing out the triple bottom line benefits to building what will be Utah's largest solar energy facility, Gov. Gary R. Herbert stated in a Scatec press release:

"Energy development is one of Utah's four cornerstones to continue to strengthen our economy. By supporting projects like the Red Hills Renewable Energy Park and other utility-scale renewable energy facilities, Utah will remain a premier destination for business, jobs, and an enviable quality of life for our residents."

With construction on approximately 650 acres of privately-owned land slated to begin in this year's third quarter, building and operating the solar power facility will produce revenue to landowners and the state, as well as create hundreds of green jobs. Project investment and incomes will flow through through the local economy and beyond as spending.

Expected to generate enough clean, renewable electricity for around 18,500 homes (some 210 million kilowatt-hours (kWh) in its first full year of operation), the solar energy project will avoid an estimated 150,000 tons of carbon dioxide (CO2) annually, the equivalent of taking nearly 28,000 cars off Utah's roads over the PPAs life, Scatec notes.

Solar energy and water conservation

And in a drought-plagued, water-stressed U.S. West, the Utah Red Hills Renewable Energy Park highlights another glaring advantage and benefit of deploying and other renewable energy sources, such as wind energy, as opposed to coal, oil and natural gas. Whether on the utility, commerical or residential scales, solar PV doesn't use up any increasingly precious freshwater supplies.

In building out the project, the U.S. subsidiary of Norway's Scatec will deploy some 325,000 solar PV modules on a single-axis tracking system on-site. An interconnection will be built to PacifiCorp's 138 kilo volt (kV) line in the nearby Parowan Valley Substation. Commented Scatec Solar North America managing director Luigi Resta,

"The Red Hills Renewable Energy Park represents a major step forward in providing Rocky Mountain Power access to the superb solar power potential available in Utah.

Added Utah Red Hills Renewable Energy Park president and CEO Richard Walje, "Our contract with the Red Hills Renewable Energy Park is one big step of many to come to bring renewable energy opportunities while maintaining reasonable prices for customers."

Image credit: University of Utah

Graph credit: SEIA

Climate Change Getting You Down? Just Follow the Butterfly

The polar bears are doing it. The birds are doing it; even the trees are doing it. And now, according to research by several biologists, the butterfly has given us the best example so far of how nature, confronted with shifting parameters, is hurrying to adapt to climate change.

As early as 2005, scientists found evidence that animal and plant species were making migratory changes to offset dwindling food supplies or intolerable temperature changes. Species ranging from the Canadian red squirrels to rock barnacles apparently already knew something we found very contentious: that adaptation was going to be necessary.

More recently, researchers at the American Museum of Natural History in New York conducted studies that showed that the polar bear was finding ways to adapt to the loss of sea ice during winter. Polar bears are spending more time on land, and as a result, their diets were migrating to more land-based food sources in an effort to adapt.

And changes in tropical zones, like Costa Rica, where there is a variation in elevation that allows for climate adaptation, biologists have found that trees were actually “changing” the zone where they thrived best, by proliferating at higher elevations than before. The same changes were also seen in the Andes, in South America, where significant elevation changes allow for migration out of elevating temperature zones.

This year’s find however, has been the lonely quino checkerspot butterfly, an endangered species in California. Once one of the most common butterflies to be found in Southern California, it had all but disappeared due to diminishing habitat. But according to Camille Parmesan, a professor at the Marine Sciences Institute at Plymouth University, the quino checkerspot has done something most biologists never expected: it has survived extinction.

“Every butterfly biologist who knew anything about the quino in the mid-1990s thought it would be extinct by now, including me,” Parmesan said in a Reuters article. According to the Center for Biological Diversity, the species was recently described as “four engines out and about 10 seconds to impact.” But by gradually migrating to cooler elevations, it has been able to improve its foraging and escape punishing climate changes.

Just as surprising has been the migration of the Comma butterfly in the England, which has learned that moving its base of operations toward cooler climes in Scotland gives it an edge on climate change as well. That change amounts to more than 100 miles over the past 40 years.

But many species are going to have a harder time adapting, scientists say. Where some species have adapted, others have died out. And still others will continue to be at risk at higher elevations if protective strategies aren’t put in place to ensure that further development such as roads, land clearing and human expansion – the things that have so far contributed to species endangerment – don’t deplete new homelands as life forms find ways to adapt to new environments.

“We have to give these species the space to adapt,” explained Parmesan, which is why some scientists are calling for conservation corridors to be established and maintained as species gradually find a new toehold in an ever fractious and changing climate.

At this point however, it’s clear that while humans have had a hand in creating environments that have perpetuated global warming, we are far from the most knowledgeable on the planet in understanding what adaptation really means. The quino checkerspot butterfly has proven that when dealing with climate change, extinction just like survival, is not necessarily a sure thing.

Comma butterfly: PMatthews123

Quino Checkerspot butterfly: USFWS

Why Did Indiana Kill Its Successful Energy Efficiency Bill?

There was some strange news out of Indiana recently. A piece of legislation designed to dismantle the state’s energy efficiency law made its way to the desk of Gov. Mike Pence. The governor neither vetoed nor signed the bill, thus allowing it to become law by default.

The governor defended his action, or inaction, as follows:

“I could not sign this bill because it does away with a worthwhile energy efficiency program. I could not veto this bill because doing so would increase the cost of utilities for Hoosier ratepayers and make Indiana less competitive by denying relief to large electricity consumers, including our state’s manufacturing base.”

This seems a bit odd at a time when most states are taking action to reduce energy consumption, encourage the adoption of renewables, and enable technologies such as storage systems to facilitate the rapid integration of renewables into their utility grid.

In fact most of Indiana’s neighbors continue to move forward on efficiency.

- Illinois utilities are set to reduce annual electricity demand by 1.5 million MWh over the next three years. ComEd has saved its customers more than $700 million through energy efficiency.

- Michigan utilities are reducing their electricity usage by more than 1 percent per year through energy efficiency. These utilities saved a net of $800 million in the first three years of their programs.

- A group of manufacturers in Ohio including Honda, Honeywell and Whirlpool recently wrote a letter to the state legislature urging them to keep the energy efficiency standards in place.

- Minnesota, Iowa, Missouri and Wisconsin are all using energy efficiency as a resource and capturing the benefits for their customers.

Why did Indiana let this happen? Was it simply a matter of politics?

The original bill, which was called the Energizing Indiana Program, was launched two years ago by former Gov. Mitch Daniels, who has gone on to become the President of Purdue University. The bill added a small monthly surcharge, an average of $2 per month, to ratepayers. The money was used to pay for energy audits, weatherization programs and rebates on energy-saving appliances. The bill made Indiana the 26th state to have such a program. The program was successful in meeting its objectives, saving enough energy to power nearly 78,000 homes, and was on track to save 1,800 megawatts of peak demand by 2022, according to a study conducted by Purdue University’s State Utility Forecasting Group. Sounds pretty good, doesn’t it?

But there were issues, apparently. A bill, introduced in the state Senate by Jim Merritt, amended the Energizing Indiana bill so as to let industries using more than 1 megawatt opt-out of the program. This was considered a tweak, to fix the bill to more closely reflect the original intent.

Merritt’s bill was then further amended in the House by fellow Republican Heath VanNatter to prohibit the Indiana Utility Regulatory Commission (IURC) from extending or entering into new contracts for the program after Dec. 31, 2014. This effectively kills the program.

The bill passed both houses by a wide margin, making Indiana the first state to back away from efforts to improve energy efficiency.

The move was greeted by this comment by Jodi Perra, Indiana Representative of Sierra Club’s Beyond Coal program:

“Today’s decision makes Indiana the first state in the nation to roll back its energy savings goals. There’s no denying that hundreds of energy efficiency workers will be out of a job next January when utilities cancel or scale back home energy audits, appliance rebates, and low-income home weatherization programs. We will now work with our coalition partners to make sure Indiana electric utilities will be required to replace what they’ve destroyed, despite their historic failure to reduce energy demand for the benefit of their customers.”

So the question is, why?

Clearly, the law was opposed by the utilities.

Edwin Simcox, speaking for the Indiana Energy Association, a utility group, said Energizing Indiana has cost ratepayers $500 million so far and would cost almost $1.2 billion by 2019. Proponents of the program dispute those numbers, and say no hard evidence for the figures has been presented. They point to a June 2013 evaluation that showed $2 savings for every dollar spent on efficiency. This is actually a little low. A study by the Southeast Energy Efficiency Alliance found a average return of 3.87-to-one, though two-to-one is still respectable. Perhaps if their efforts were more effective in producing savings, large consumers with the most to gain wouldn't be complaining so much.

Perhaps it’s a matter of who those savings go to. In almost all cases, efficiency efforts, by keeping demand low, save utilities the expense of adding new capacity by constructing new plants that can be incredibly expensive. But reduced demand can also reduce revenues.

It makes sense that if your business depends on getting your customers to buy a certain product, you could be excused for being less than enthusiastic about programs that encourage your customers to buy less of that product. But there is a way around that problem.

According to the American Council for an Energy Efficient Economy, in their paper “Making the Business Case for Energy Efficiency:”

“Utilities have faced financial disincentives for customer energy efficiency programs since their advent in the 1970s and 1980s due to the structure of utility rates and the processes used to determine them. When these disincentives are not addressed, utilities investing in energy efficiency work against their shareholders’ financial interest. These disincentives are as follows:

1. The costs of customer energy efficiency programs constitute financial losses to utilities absent cost recovery allowed through utility rates or fees.

2. Reducing energy use reduces utility revenues, but it does not reduce the short-term fixed costs of providing service. This is known as the throughput incentive.

3. Money invested by utilities in energy efficiency programs defers or avoids the need for investments in utility assets that provide financial returns allowed by traditional rate regulation.”

The report goes on to say that, “Regulators, utilities, and stakeholders can overcome these barriers by implementing well-tested policy solutions to align regulation with energy efficiency. Program cost recovery is generally not a major barrier, as regulators recognize this need and readily approve such recovery via rates or fees.”

They are referring to the practice of decoupling revenues from energy consumption -- something that Indiana has not yet done. States with decoupling, of which there are now 17, allow their utilities to raise rates to help recoup revenues lost by lower consumption. Neighboring Minnesota’s largest utility, Excel Energy, just asked their state regulators to allow them to decouple.

So there is a solution if Indiana really wants one.

What the legislators said, though, was that it was the consumers that were complaining, not the utilities. According to ACEEE, a number of large-scale customers including Honeywell, General Electric, Siemens, JACO, the Alliance for Industrial Efficiency, the Indiana Distributed Energy Alliance, and the Air Conditioning, Heating and Refrigeration Institute came out in opposition to the bill.

Checking out the campaign contributions to VanNatter and Merritt, we find American Electric Power was one of VanNatter’s top contributors in 2012 and Duke Energy contributed to Merritt’s 2006 and 2008 campaigns. Just saying…

One other thing: According to the National Mining Association, Indiana is the second largest consumer of coal in the U.S. behind only Texas. Last year they burned more than 54 million short tons, making them the seventh largest emitter of greenhouse gases, despite being the 15th largest state in terms of population. Indiana is also the seventh largest producer of coal in the nation, producing roughly 3.6 percent of the national total.

A large-scale effort to reduce consumption would not be at all welcomed by an already-beleaguered coal industry that is well-known for taking matters in their own hands when things are not going the way they want them to.

In 2013, coal-fired plants accounted for 84 percent of Indiana’s electricity. The fact that so much of Indiana’s electricity comes from coal makes it all the more important to aggressively pursue measures to improve efficiency. That’s important to all of us, whether we live in Indiana or not. But based on the experiences of all their neighbors and people all over the world, once they begin this important work, they’ll be glad they did. They’ll be glad for lower electric bills, better air quality, more jobs, and the satisfaction of knowing that they are doing their share in the fight against a global problem.

Image credit: Library of Congress: Flickr Creative Commons

RP Siegel, PE, is an inventor, consultant and author. He writes for numerous publications including Justmeans, ThomasNet, Huffington Post, and Energy Viewpoints. He co-wrote the eco-thriller Vapor Trails, the first in a series covering the human side of various sustainability issues including energy, food, and water in an exciting and entertaining romp that is currently being adapted for the big screen. Now available on Kindle.

Follow RP Siegel on Twitter.