Retailers Play Increased Role in Moving Markets Away from Toxic Chemicals

By Lindsay Dahl

Public awareness about toxic chemicals in consumer products and food has grown exponentially over the last decade. Major companies have taken action on removing individual toxic chemicals from their products, and food companies and fast-food chains like Panera Bread are moving away from questionable food additives. Consumers are clearly asking for more transparency and action on the things that go into their food and everyday products.

Consumer pressure warrants market and policy response

Public concern isn’t just a fad; it’s rooted in decades of scientific research showing links between chronic disease and toxic chemicals we often unknowingly come into contact with every day.

Consumer behavior is moving the market away from some toxic chemicals, albeit slowly. State and federal policy reforms have pushed the envelope and created an increased demand for a credible and meaningful regulatory framework on chemicals. And finally, the marketplace, most notably retailers, have started to create a more comprehensive and systematic shift away from these ingredients in their supply chains. These are all a reaction to our failed chemical policy in the United States.

The root of the problem lies in the flawed Toxic Substances Control Act of 1976 (TSCA), which hasn’t been updated since Gerald Ford was president. The Government Accountability Office has issued several reports showing the deep regulatory failure of TSCA. Everyone, including chemical manufacturers, agree TSCA needs to be reformed. A movement of individuals, health organizations, medical professionals and environmental organizations as seen in our robust coalition, Safer Chemicals, Healthy Families, have been pushing for meaningful reform of this failed and broken statute.

Enter new market campaigns

While progress on meaningful policy reform has been slower than we would like, last year we launched a new campaign called Mind the Store, which has the goal of working with leading retailers (10 in total) to remove and eliminate toxic chemicals from their supply chain. With our wealth of experts in the field, we pulled together the Hazardous 100+, a list of toxic chemicals identified by authoritative bodies that are of concern. This is a roadmap for where chemicals will be restricted at the state, federal and international level and creates a way for retailers to get ahead of the game.

Within the past year both Target and Walmart have come out with comprehensive policies on chemical ingredients, both of which take different approaches, and in some ways has been a game-changer. Both retailers have created lists of more than 1,000 chemicals of high concern, which includes our Hazardous 100+ list. Walmart, for example, is encouraging suppliers to reduce, restrict and eliminate these chemicals using informed substitution principles. They are also encouraging suppliers to disclose whether their products contain these chemicals on their websites, and starting January 2018 on the product label. For the first time, major retailers are showing a responsiveness to their customer base and tackling the problem at a much larger scale than simply responding to the “chemical of the week.”

Walgreens stays silent

Many other retailers are working on their own policies on how to address the use of chemicals in the supply chain. Unfortunately some retailers -- most notably Walgreens, despite being the largest pharmacy health chain in the country -- have been silent on this issue. After a year of friendly outreach to Walgreens, they have effectively blown us off. Even when concerned parents showed up at over 50 of their stores to return toxic products, they still haven’t responded.

What’s even more interesting about Walgreens is they recently bought 45 percent of Alliance Boots, a European drugstore chain that has a robust chemical policy. Walgreens has none. The merging of these two companies is expected to be complete in early 2015.

So as these two companies merge, doesn’t it make sense for them to align their sustainability practices and for Walgreens adopt Alliance Boots chemical policy? To give you an example, Boots has already phased out many of our Hazardous 100+ chemicals including: phthalates, PVC plastic, parabens and triclosan. If anything this shows us that a comprehensive chemical policy can not only be created but also successfully executed. If they’re doing it in Europe, they can do it here in the United States.

Thankfully, the radio silence from Walgreens is rare. Many of the leading retailers are working with us on how they can best address chemicals in their supply chain, knowing that tailored approaches are needed to meet each of their unique needs.

This problem won’t go away, public health campaigns like ours will only increase in size and breadth. Meanwhile the science around some chemical ingredients only creates more urgency for us to address the problem in a comprehensive manner.

Once people learn about this issue it’s hard to “unlearn”. And so the question remains: which retailers have the guts to respond to this concern in earnest with a sophisticated and robust chemical action plan?

Over the next few months, I am hopeful we’ll find out.

Lindsay Dahl is the Deputy Director of Safer Chemicals, Healthy Families where she directs the coalition grassroots and online organizing efforts. In her free time, Lindsay writes on a variety of topics on her blog at www.lindsaydahl.com.

Pay workers fairly or lose customers, warns KPMG

Consumers will change their buying habits and shop elsewhere if British businesses fail to pay staff a fair wage. According to a survey of more than 1,000 individuals across the UK, most people believe that the country's continued economic recovery demands a close examination of the UK's wage structure – and many think that the lowest paid workers should be the first to benefit.

The survey, conducted by Censuswide for KPMG, reveals that 52% are willing to pay higher prices if the money goes directly into employees' pockets. Four out of 10 respondents also claim they will not hesitate to shop elsewhere if their preferred store doesn't pay the Living Wage. Just 13% suggest they won't alter shopping habits, arguing that employers can pay what they want.

There is also a strong belief that UK productivity and performance will improve, if employers pay a Living Wage. For example, asked about the service level they expect to see, 61% suggest that if staff in a pub, restaurant or hotel were paid a Living, rather than Minimum, Wage there would be a visible improvement in customer care. Four out of five also argue that individuals shouldn't have to work more than 60 hours per week to earn enough to live on, believing that excessive hours adversely affect morale and output.

Mike Kelly, KPMG 's Head of Living Wage, says: “For the past six years employers have been able to hide behind the notion that a downtrodden economy has enforced a freeze on wages. However, with the IMF revising its forecasts upwards, there can be no more excuses to ignore the principle of fair pay. A year ago there were just over 200 accredited Living Wage Employers and with that number now rising to more than 750, it is clear many organisations realise the benefits of offering a salary on which direct, or third-party, employees can live.

The research was conducted during May 2014 and has been published ahead of the release of the Living Wage Commission's final report on low pay and the Living Wage, on 24 June 2014.

Picture credit: © Anizza | Dreamstime.com

Levi's: The Value of Jiu Jitsu Sustainability

Levi Strauss & Co. CEO Chip Bergh recently stirred up the airwaves when he announced that his Levi’s jeans hadn’t seen the inside of a washing machine for more than a year. His statement, which was made during a sustainability conference in California last month, had just the right effect: It reminded listeners that if there is one overriding hallmark associated with America’s iconic blue jeans, it's sustainability.

But his admission delivered another interesting impact as well: It jump-started a conversation on how easy it can be to live sustainably. Granted, not everyone seems to have bought the idea of freezing their favorite pair of denim in lieu of washing them. But the simple, almost incidental mention of this unorthodox technique jump-started a conversation that has inspired jean-lovers across the country to come clean with their best sustainability secrets, and why decreasing the use of water isn’t so hard after all.

Levi's + jiu jitsu + sustainability

Welcome to jiu jitsu sustainability. It’s a concept that speaks to the essence of what the company is all about these days, said Michael Kobori, Levi Strauss & Co.’s vice president of global sustainability: re-inventing the way companies and consumers think and talk about sustainable living and sustainable products.

Jiu jitsu, a form of Japanese martial arts, “is the art of a gentle way of using your opponent’s strength and turning it to the benefit of your own strength,” explained Kobori. Jiu means “supple, or yielding or gentle,” while jitsu refers to “technique."

“Basically it is leveraging [your opponent’s power]. Rather than taking your strength and push against them, it is taking theirs and flipping it around so that it becomes your strength."

So when Bergh initiated a conversation on unexpected ways to care for and preserve one of America’s best-loved forms of apparel, he did more than chat about the durability of Levi's. He rebranded the discussion on sustainability by getting people to engage in a brainstorm of why such practices were cool -- and good for the environment at the same time.

“I think that was the great thing I saw when his comments went viral, is that people were talking about it," Kobori said. "On Good Morning America, the Today’s Show, they were talking about it. Millions of Americans said: ‘Oh, I can wash my jeans less. It’s not going to impact their wearability or their style, or anything; in fact it’s probably better for the pants …Hmm … That’s an easy change in my behavior that I can make.' And thinking of millions of people doing that, it will add up to something.”

Leveraging the Sustainability Message

This lesson didn’t come instantly for Levi Strauss, however, Kobori said, but was forged out of many years of searching for the right medium.

“For many decades those of us in the sustainability movement have really tried to engage consumers by giving them more sustainably produced products or services.” Kobori said they have been fairly successful in telling consumers about the mechanics of sustainable purchasing, such as why it reduces the consumer’s foot print, and why it’s environmentally a great idea. “But we haven’t touched their hearts. We haven’t really touched their soul or gotten them emotionally involved in the products. It’s an ironic dilemma, he notes, because in truth, appealing to the consumer’s personal passion is what Levi’s does best.

“We’re best at engaging consumers emotionally with our products. They love Levi's.”

Figuring out how to inspire consumers to love Levi’s jeans that are more sustainable has become an important goal, said Kobori, because the more engaged consumers are in what they buy that is good for the environment, the more they will feel an affinity for products that are environmentally sustainable.

Engaging and fun count, too

But for some, the ‘fun factor’ is important as well. Research has shown that social media contests and other online interactions often speak to the very reason that people buy Levi’s: They are cool, and they are fun. Contests that encourage customers to commit to tracking and using less water at home and other online connections have helped teach consumers about the methods that go into making Levi’s Water<Less jeans. It also brings to light how Levi’s has been able to reduce water usage from 42 liters to one liter for every pair of Water<Less jeans produced. The reduction has not only revolutionized Levi’s production methods, but inspired dialogue with consumers about how they can reduce water usage at their end.

But just as different products appeal to different people, the concept of what it means to live sustainably can differ as well. A video featuring musician and actor Will.i.am and Levi’s Brand President JC Curleigh, which conveys the cool benefits of Ekocycle and Waste<Less jeans’ partnership in recycling plastic bottles, was able to connect with millions of viewers that were familiar with both Levi’s products and Will.i.am’s music. Meanwhile, another video put out by Dockers promoted the conscientious, practical accountability that goes into its Well Thread brand. But its real success, said Kobori, traded on the product’s high-quality appeal. “[The] emphasis really is on style and quality, [by saying] ‘Hey, these pants are stylish: They look good; they feel good; and they’re also better for the environment and for the people who are making them.’”

And Then, There's Scientific Analysis

But underlying each of these engaging messages, said Kobori, is always Levi’s focus on accuracy and validation. “It is super important, for us certainly as sustainability professionals, to make sure that we are absolutely able to substantiate through our scientific analysis and research all of these claims that we make as a company about using less water, using recycled soda bottles, and improving workers’ wellbeing.” He said Levi’s track record in workers rights abroad is as important to the company as its efforts in environmental conservation – and he knows consumers expect that.

“I think the consumer is very smart. And so even though we say, Yes, we want to make this fun and engaging, and we absolutely do, there are consumers out there that will watch and look for all of the data, the back up to understand, yes, these claims are true.”

And that, says Kobori is what Levi Strauss’ jiu jitsu sustainability effort is all about, because it means consumers are truly engaged.

Image credit: Varun Gaba/Unsplash

How International Paper Cuts Greenhouse Gas Emissions

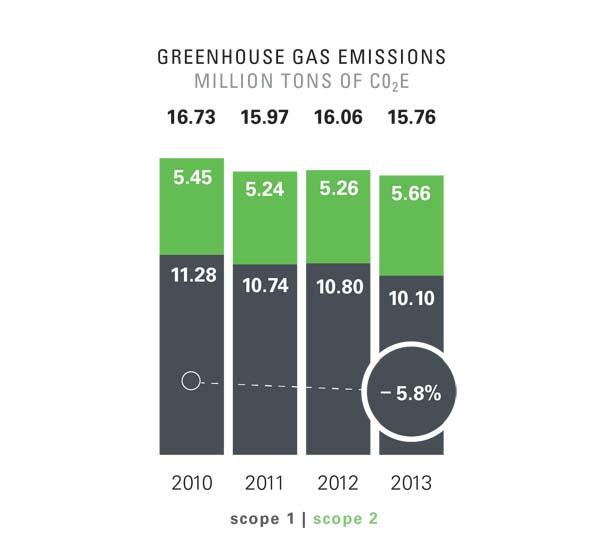

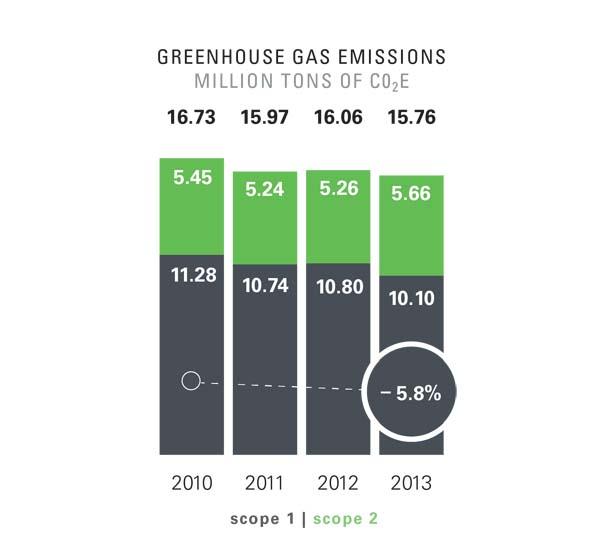

The American Forest and Paper Association (AF&PA) has set a goal to reduce greenhouse gas emissions from the forest products industry by 15 percent by 2020, but one of the association’s members, International Paper, is aiming for a more ambitious target: 20 percent by 2020. And the pulp and paper company is making progress towards its objective, cutting companywide emissions by 5.8 percent last year, according to International Paper’s recently released sustainability report.

The 5.8 percent figure is an aggregate of increases and drops in the company’s emissions in two different sectors: Emissions from burning fossil fuels to power the company’s mills fell 7 percent in 2013, while emissions from electricity purchased from utilities climbed 4 percent from the company’s 2010 baseline and 8 percent year-over-year.

The bulk of International Paper’s emissions reductions were achieved at the company’s 41 paper mills, which are responsible for more than 95 percent of the company’s total energy use and 90 percent of the company’s fossil fuel consumption, according to the sustainability report. But about 72 percent of the mills’ energy actually comes from a recovered waste product, rather than a fossil fuel. When a tree goes through the mills’ pulping process, its wood fibers are separated from the natural glues and sugars that previously held the tree together. The fibers will eventually be made into paper products, while the leftover glues and sugars become a biofuel that is burned to produce energy for the mill.

Using waste for biomass

Biomass is considered a renewable fuel because its energy came from the sun and it can be re-grown in a relatively short period of time, according to the Union of Concerned Scientists. Biomass proponents say that it is also a carbon-neutral fuel: Burning wood for energy releases stored carbon that trees would have eventually given off as part of their natural death and decaying process. In this vein, International Paper said it emitted approximately 34 million metric tons of carbon-neutral emissions from biomass in 2013.Biomass is a controversial energy source, however: Its critics charge that it competes for agricultural land with food production and argue that any fuel that generates pollution cannot be considered carbon neutral.

But International Paper is using a biomass derived from a waste product that would otherwise have been discarded – clearly a more sustainable solution than throwing the wood residue in the landfill or using crop land to grow fuel. And despite the debate on carbon neutrality, the fact remains that biomass is low-carbon and cleaner than fossil fuels. In fact, the Union of Concerned Scientists considers biomass from sustainably harvested wood and forest residues – like the kind International Paper uses – to be a “beneficial biomass” that can “reduce overall carbon emissions and provide other benefits.”

Since recovered biomass accounts for approximately 72 percent of the mills’ energy needs, the company purchases fuel and electricity to power the remaining 28 percent of the facilities’ energy demands. To achieve emissions reductions in this area, International Paper has improved energy efficiency and switched away from coal and fuel oil in its mills.

“Between 2010 and 2013, we invested about $380 million in energy efficiency and fuel flexibility,” said Paul Tucker, the company’s manager of energy and chemical recovery solutions.

Emissions reductions through thermal energy

To make the most dramatic emissions reductions in its mills, the company focused on its use and reuse of thermal energy, which accounts for more than 80 percent of a mill’s energy demand, Tucker said. The process to make pulp and paper requires a huge amount of thermal energy to heat and evaporate water, he said.

For example, International Paper’s Russian mill installed a 25-megawatt combined heat and power system – equipment that simultaneously generates electricity and process steam more efficiently than stand-alone power generation would. The new system produces more than 180 million kilowatt-hours of electricity annually – enough electricity to power 16,000 U.S. homes – as well as steam to fuel the facility’s manufacturing processes, the company said in its report.

At its mill in Maysville, Ky., International Paper set up a paper machine heat recovery system, which captures hot exhaust gas from the paper-drying process and uses it to heat water. The project will reduce the facility’s need for coal-powered steam by 12,000 tons of coal per year – the equivalent amount of coal needed to fuel 100 railcars annually, according to the report.

The paper and pulp company has also been replacing the coal and fuel oil used to produce its mills’ thermal energy with cleaner-burning energy sources, including natural gas and biomass. While natural gas is still a fossil fuel, the report noted, it releases half the amount of carbon dioxide emissions that coal does.

Natural gas may be a reliable energy source for some of International Paper’s U.S. mills, since natural gas is abundant and economical in many parts of the country, but it is not an option in some parts of the world, Tucker said. For example, purchasing natural gas was not feasible for the company’s mill in Brazil; there are not many natural gas reserves in Brazil, so most natural gas comes from other countries, Tucker said. The company’s mill already had a Eucalyptus plantation, so mill employees dedicated a portion of the plantation to grow biomass fuel. International Paper put in a new biomass boiler at the facility, which converted nearly 200,000 tons of fossil-fuel-based emissions into cleaner-burning biomass emissions.

Why chose biomass over other renewable energy sources like solar or wind? Those types of renewables are better suited for providing electricity, Tucker said; a paper mill requires vast supplies of thermal energy, and suitable sources of thermal energy include natural gas and biomass. International Paper is looking into opportunities for solar and wind projects to serve the electrical needs at its facilities and has just installed solar array at a bulk packaging plant in Exeter, Calif., that will produce about a megawatt of electricity, Tucker said.

In addition to decreasing the company’s carbon footprint, reducing the company’s demand for coal and oil led to a significant drop in its emissions of harmful air pollutants. Since 2010, International Paper has cut sulfur dioxide emissions by 25 percent and nitrogen oxides emissions by 10 percent – for an overall reduction of 14 percent in what the Environmental Protection Agency (EPA) refers to as the "criteria pollutants.”

How will International Paper achieve its ultimate goal?

International Paper – and the pulp and paper industry as a whole – faces many challenges as it strives to slash its carbon emissions further. One of these obstacles is an uncertain regulatory landscape, Tucker said: For example, the EPA keeps changing its “final” rules regulating industrial boilers – which makes it difficult to undertake the 2- to 3-year planning process of investing in new boiler equipment.

Paper and pulp makers – and all manufacturers – also must consider the long-term viability of their facilities -- another challenge when planning for energy efficiency and emissions reductions, Tucker said. It can be risky for a company to propose long-term investments in energy efficiency at a facility whose markets may shrink or change, he said.

There is also the simple fact that once a company makes initial, deep energy reductions at a facility, it becomes difficult to squeeze out any more energy savings, Tucker noted. But International Paper will continue its current course, Tucker continued, looking for more opportunities to improve its facilities’ energy efficiency and replace its coal and fuel oil with more sustainable energy sources.

“We’ll keep peeling back the layers of the proverbial onion in trying to make ourselves more efficient,” he said.

Image credit: International Paper

Passionate about both writing and sustainability, Alexis Petru is freelance journalist based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

The Race to Build a National Fleet of EV Charging Stations

Paralleling the historical development of a cross-country network of gasoline and diesel filling stations, a nationwide electric vehicle (EV) charging station network is beginning to emerge in the U.S. As with any technological advancement that breaks new ground and disrupts vested commercial and political interests, the U.S. fleet of EV charging stations is growing in fits and starts. There have been business casualties, scandals and fatalities, and there will be more. But real progress is being made, and the overall trend appears clear.

It took some 50 years from the time the first gas stations cropped up to the emergence of a nationwide network of gasoline and diesel filling stations. Given current conditions and progress to date, a nationwide EV-charging infrastructure is likely to emerge in far less time, perhaps as little as two decades.

Tesla's Supercharger network is the highest profile effort to date when it comes to building a cross-country network of EV charging stations. Tesla isn't alone by any means, however. Flying largely under the radar, Miami's CarCharging Group, Inc. has been on an acquisition spree, acquiring assets on the cheap and planting the seeds of what could turn out to be a national fleet of EV charging stations.

Having acquired four competitors in 2013, CarCharging is now the largest owner, operator and provider of EV charging stations and services in the nation. Scooping up distressed EV charging assets, the group acquired ECOtality's Blink Network for over $4 million in a bank auction last year. It also acquired 350Green, another failed EV charging venture.

Building up from the ashes

Looking to revive and expand the projects, revenue streams and good names of its business acquisitions is no easy task. Both 350Green and ECOtality took business partners, customers, and the Department of Energy (DOE) by surprise when they filed for bankruptcy protection -- leaving a host of federal, state and local government-backed projects unfinished.

Amid a rapidly evolving technological, economic and political backdrop, CarCharging management is focused on business integration and technological synthesis. Recent company news releases chart the business development pathways they are pursuing.

In a May 29 news release, CarCharging announced a partnership with privately-owned real estate developer Related Companies that will see SemaConnect Level 2 EV charging stations deployed at Related Midwest's 47-story, LEED Gold-certified “ultra-luxury” residential tower in Chicago. In addition to CarCharging EV charging stations, the 500 Lake Shore community has an on-site Zipcar facility, as well as “a resident-only bike share program,” the company highlights.

"In major metropolitan areas like Chicago, having public EV charging services available is vital for EV drivers," CarCharging Group CEO Michael D. Farkas was quoted as saying. "Given its prime location and residential profile, 500 Lake Shore Drive is a prime location for EV charging."

A May 26 TribLive article reports on a CarCharging Group project with the Pennsylvania Department of Environmental Protection (DEP). Each has contributed $1 million and the Pennsylvania Turnpike Commission another $500,000 to build out 17 self-serve EV charging station plazas along the state turnpike.

Level 2 EV chargers, which can fully charge an EV in six hours or less, have been installed at an initial four sites, according to TribLive's report. The next step for CarCharging is to install DC (Direct Current) Fast Chargers that can charge an EV in as little as 30 minutes, though this applies to only a “handful of models." While the equipment has cost less than expected, negotiating and making grid connections with various utility companies has proven slower and costlier than anticipated, leading CarCharging to seek additional funding from new sources.

Covering all the bases

Doing business amid rapid changes in technology and a volatile political market environment, CarCharging Group is trying to cover all the bases. The group is an EV charging station manufacturer in its own right, having acquired the assets of failed ECOtality.

ECOtality's bankruptcy declaration left projects in states including Pennsylvania and Washington unfinished. ECOtality was supposed to install 22 fast-charging Blink Network EV charging stations in the Seattle area from Everett to Olympia. Only half have been installed, and some of those weren't working as of a February 22 online news report from King 5.

For its part, CarCharging is working to get the EV charging network in the Seattle area up and running. It's in negotiations with the U.S. Department of Energy to unlock remaining federal funds and revive the unfinished project. Washington state's Department of Transportation has said it is prepared to allocate $1.2 million to the project. Another $5 million has been allocated in Washington state Gov. Jay Inslee's latest budget.

Adding a retail aspect to its business model, CarCharging on March 4 announced that it had resumed sales of the Blink Network HQ Level 2 residential EV charging station, which it sells directly via website to customers for just under $700.

Besides providing customer customized charging all models of EVs sold in the U.S., CarCharging is offering buyers a $100 bonus credit to join the Blink Network, which provides online search and discovery, as well as physical access, to all Blink EV charging stations.

Image credits: 1) Highway EV sign; 2) CarStations; 3) Car Charging Group

El Paso Electric to Be Coal-Free By 2016

With a robust solar energy and natural gas portfolio, El Paso Electric expects to wean itself from coal in 2 years, providing cleaner power to its 395,000 residential and commercial customers in Texas. By the end of the year, solar energy will represent 6 percent of EPE's generation sources, compared to 0.23 percent nationally.

EPE signed a 20-year power purchase agreement (PPA) with the Macho Springs solar plant in New Mexico, on 500-acres of State Trust Land in Luna County. The 50 megawatt project supplies enough power for 18,000 homes and will displace more than 40,000 metric tons of CO2. Macho Springs was touted as a super cost-effective solar energy development, at a mere 5.79 cents per kilowatt-hour, and will be the largest in New Mexico. This is significant because the project is selling solar energy for about half of what is typical for such a project and for nearly the price of coal power -- but with a 20-year purchase agreement.

In addition, EPE signed a 30-year power purchase agreement with Newman Solar to build a 10 megawatt solar plant in El Paso, which should be online at the end of 2014. The utility also has a PPA with the Camino Real Landfill Gas to Energy facility, which plans to increase capacity from 1.5 megawatts to 3 megawatts in 2015. EPE also plans to sells its 7 percent share (108 megawatts) in the coal-fired Four Corners Power Plant by its retirement date in 2016, making the utility coal-free.

"Our commitment to building a portfolio that includes renewable energy technologies in order to complement our local, clean burning natural gas units help make overall power in our region dependable, safe and cleaner," says Tom Shockley, CEO of EPE. "We continue to look for opportunities to add cost effective solar energy, such as the Newman Solar project, which in the long run helps reduce emissions and provide cleaner air. EPE is at the forefront in the solar energy industry, which is fitting given our location and abundance of the solar resources. We continue to look for the most cost-effective and reliable resources for our customers which today is led by natural gas resources that support and enable us to expand our solar portfolio."

In a move that EPE says will complement solar energy, it is building Montana Power Station, a four-unit natural-gas fired power plant in El Paso. It will be online to meet peak power demand in the summer of 2015. Natural gas and solar power plants work well together because natural gas power plants, unlike coal power plants, can ramp up and down relatively easily. Natural gas can thus ease some of the indeterminacy issues associated with solar power by providing electricity as it is needed.

EPE's move away from coal power will help it comply with proposed new rules set by the EPA to reduce carbon emissions from power plants by 30 percent. Under the new rule, coal will be disproportionately impacted -- due to its large carbon emissions. In 2013, coal generated 39 percent of the all U.S. electricity, with solar generating almost 0.25 percent. EPE is showing bold leadership as a low-carbon utility by its use of solar energy, coupled with phasing out coal power.

Given the solar energy potential of the region, finding cost-effective sources of solar energy with long PPAs provides certainly and reliability to its energy portfolio and hedges against potential price increases from future regulatory changes.

"Our west Texas and southern New Mexico region has the right kind of sun for optimal solar energy production, making this region the 'goldilocks' in terms of climate, humidity and heat characteristics that allow us to expand our renewable portfolio with cost-effective technologies and reliable energy resources," says Shockley. "With over 300 days of sunshine every year, we are in the perfect region for solar energy technologies, which in the long run reduces carbon emissions and provides cleaner air."

Image credit: Sun Edison

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Building & Design, Triple Pundit, Urban Farm, and Solar Today. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Ecovillage in Midcoast Maine with her husband and two children.

New Reports From Marks & Spencer Prove it is One Sustainable Retailer

Looking at the Plan A and Annual reports of the British department store chain Marks & Spencer (M&S), two things become clear: The company is a sustainable retailer and sustainability increases its bottom line.

M&S became the first retailer to achieve triple certification to the Carbon Trust’s Carbon, Waste and Water Standards, as the Plan A report shows. M&S achieved this while sales increased in the U.K. by 2.3 percent and 6.2 percent internationally.

The Plan A report details progress toward the company’s Plan A goals. In 2007, M&S launched Plan A as a “technical initiative,” as Mike Barry, director of Plan A stated in the report. During the first phase of Plan A, M&S made 100 commitments to reduce its social and environmental footprint. In the next phase, the company integrated Plan A into its management processes.

Now, M&S is focusing on engaging with its customers and employees to make Plan A part of how it does business. So far, M&S has achieved nine Plan A 2020 commitments. Eleven are not started, one is behind plan, and the rest are on plan. One of the nine commitments achieved is reducing business flights by 43 percent per full-time equivalent employee, exceeding its goal by 23 percent by increasing use of video conferencing and rail travel.

M&S has also achieved some of its Plan A goals for 2015. This year, 57 percent of the company’s products had at least one Plan A quality, beating its 2015 goal of 50 percent. The Plan A qualities include Fair Trade, organic, free range, cruelty-free, low alcohol, sustainably sourced materials, recycled content, healthy food, and made in a factory that best meets environmental or social practice standards.

Sustainability throughout the supply chain

M&S has big goals for its supply chain, including for all of its farmed fish and fish feed to come from the most responsible sources available by 2015. To meet that goal, M&S developed Select Farm Assurance codes of practice for salmon, shrimp and fish feed which includes welfare, social and ethical, quality and food safety developed with the support of World Wildlife Fund and industry experts. Other supply chain goals include palm oil, cotton and wood:

- All palm oil used in M&S products has Roundtable on Sustainable Palm Oil (RSPO) certification, with 63 percent coming from physically certified sources. The other 37 percent is covered by GreenPalm certificates to encourage transitioning to sustainable palm oil supplies.

- 96 percent of wood used in products comes from sustainable sources, including Forest Stewardship Council, and recycled material.

- 20 percent of the cotton used in products comes from sustainable sources, including the Better Cotton Initiative, Fair Trade, organic and recycled. The goal is for 25 percent of cotton to come from sustainable sources by 2015 and 50 percent by 2020.

One step further: Food standards

M&S has a goal of having all of its food suppliers implement a gold/silver/bronze sustainability benchmarking standard. The specific goal is that by 2015, 30 percent of product by volume will come from factories that have reached silver level, and 75 percent by 2020. The company is already on the way toward its goal; it more than doubled the amount of products from food suppliers that meet its silver standard for sustainable food factories from 8 percent in 2013 to 19 percent this year. Other progress by suppliers includes:

- 25 percent have improved energy efficiency by at least 20 percent

- 24 percent have reduced water usage against last year

- 41 percent send no waste to landfills

- 40 percent now have positivity scores of 65 percent or more in staff feedback surveys

The Plan A report also details waste and water reductions, and two projects stand out as examples of what the company has achieved. The first example has to do with waste reduction: By working with the Somerset County Council Waste Partnership, 14,600 tons of packaging was collected and recycled this year. Some of the materials collected are used to produce 13 types of M&S food packaging. The second has to do with water reduction. M&S introduced water-free packaging this year for bouquets of flowers purchased online. Flowers are sealed in an airtight bag instead of using water while being transported from a warehouse to the customer’s home. This method will save a half a million liters of water this year alone.

Image credit: Elliot Brown

"Stories & Beer" Chat with David Gottfried; Founder, USGBC & World GBC

It’s time for another Stories and Beer Fireside Chat on Thursday, June 19th at 6:30pm PST (9:30 EST) at the Impact HUB San Francisco – and online via web cam.

At this month's “Stories & Beer", TriplePundit’s Founder, Nick Aster, will be chatting with David Gottfried, Founder of the USGBC.

David’s work has impacted the global building industry more than almost any other individual, having founded both the U.S. Green Building Council and World Green Building Council, with GBCs in 100 countries.

TO WATCH , PLAY THE VIDEO BELOW.

Schedule

6:30 – 7:00 – beers and networking

7:00 – 8:00 – fireside chat and Q&A

8:00 – 8:30 – networking

About David Gottfried:

David Gottfried is best known as the father of the global green building movement, having founded both the U.S. Green Building Council and the World Green Building Council (with GBCs in 100 countries). He’s a catalyst for transformational green start-ups, collaboration and inspiration. Gottfried is an entrepreneur, author, keynote speaker and modern art painter. Gottfried’s organizational innovations have led to the greatest transformation of the world’s largest industry and perhaps the world. David’s recent release of Explosion Green was reviewed by President Bill Clinton, who stated: “Our future depends on sustainability… David Gottfried’s pioneering work is proof that we can do it, and Explosion Green tells us how.”

Chime in to the chat on Twitter, before and during the event, using #3pChat!

Do Nestlé's Sensuous Ice Cream Ads Comply with Their Ethics Test?

A version of this post was recently featured on the CSR Reporting Blog

An Israeli ice cream ad has folks riled up for its sensuous nature.

Joya ice cream is produced by Osem, which is 63.7 percent owned by Nestlé. Before I offer my thoughts, I have to let you judge for yourself. A screen shot from the ad is available to the right, and the ad itself -- proclaiming Joya ice cream the hottest ice cream around -- is below.

I have to wonder how this kind of marketing passes the ethics test at Nestlé.

http://youtu.be/7iCXk67TIB0

Beyond the fact that this ad serves only to make me personally resolved NOT to try Joya ice cream, I wonder why these companies need sex to sell dessert. Does fabricated sensuality really entice buyers? When corporate marketers air an ad featuring a voluptuous woman lustfully sucking on a phallus-shaped ice cream bar, to attract a man's attention, does that really move product?

I sought another opinion from a respected colleague who is an expert in corporate and business communications. This is what he said:

“I recall putting the issue of responsible marketing to the director of sustainability who was speaking at a conference one day while his company was running an ad featuring almost voyeuristic images of a woman’s body that bore no relation to the product being sold. His reply -- to the effect of 'It wouldn’t happen if I was in charge of marketing' -- spoke volumes about the lack of integration of sustainability into day-to-day practices, which is so often claimed by corporations. How companies approach marketing is emblematic of the way they understand consumers but so often merely seeks to plug into stereotypical, out-dated attitudes in order to grab (men’s) attention for the brand name." - James Osborne, Senior Partner, Lundquist

Nestlé's Consumer Communication Principles is a four page document that prescribes the way Nestlé companies should develop and air marketing content. It states: "The Nestlé Communication Principles have been defined as the highest standard on which all marketing and communication to consumers must be based." Here are some of the principles:

- The content of consumer communications must reflect good taste and social responsibility in accordance with each country’s laws and regulations and voluntary codes and standards. Although standards will vary from country to country, it must not display vulgarity, bad manners and offensive behavior and there must never be an intention to shock or offend.

- Advertising content must not depict attitudes that are discriminatory or offensive to religious, ethnic, political, cultural or social groups.

- Advertising should avoid exploiting media events that could be in bad taste.

Nestlé is no stranger to ethical problems. In fact, it's one of the corporations that exemplifies the most extreme levels of emotion, as, one the one hand, the most boycotted company in the UK, and on the other hand, the most admired for its' work in "creating shared value" and advancing global food science and technology for the benefit of everyone. A quick internet search brings up a host of ethical issues over the years related to different parts of the Nestlé business, including a recent $680,000 fine for anti-competitive marketing tactics in the coffee business.

In fairness, Nestlé claims to be addressing many of the concerns of stakeholders around the world with several supply chain assessments, and a host of other initiatives under the CSV banner, as you can read in the 2013 Nestle Shared Value Report. The company even made a bold commitment to no deforestation traceable palm oil, after the Greenpeace campaign disaster that had everyone associating Kit-Kats with bloody orang-utan fingers.It seems that as soon as one ethical problem dies down, another one crops up. This ice cream advertisement is, in my view, poor judgment and poor ethics. If the marketing is in bad taste, I wonder if the ice cream comes with a bad taste too.

Perhaps it's time to refresh that set of consumer communication principles and get the folks that market ice cream at Osem up to date with today's values and Nestlé's commitment.

Illegal fishing threatens tuna stocks in Mediterranean

Illegal fishing for Atlantic bluefin tuna in the Mediterranean Sea continues to threaten the recovery of the species, a new study reports.

At least 79 media accounts of bluefin tuna catches above the EU quota have been collected in the past 12 months – 73 in Italy, five in Spain and one in Tunisia – showing a tally of 186 tonnes.

The figures have been gathered by The Pew Charitable Trusts, a non-profit global research body based in Washington DC, and MedReAct.org, a group working for the preservation of the Mediterranean ecosystems, headquartered in Italy.

The Italian incidents include the impounding of more than 1.7 tonnes of bluefin tuna from a factory in Rossano, Calabria, because the company’s owner had no catch documents.

In Pescara, Abruzzo, port officials intercepted two vans carrying a tonne of the fish intended for sale in Rome, and in Salerno, near Naples, traffic police stopped a truck carrying 2.5 tonnes without catch documentation.

Another case featured 38 tonnes, worth €300,000 ($406,000, £240,000), suspected of being illegally traded in Italy and France during the year.

The future of the bluefin tuna is “highly uncertain”, says the International Commission for the Conservation of Atlantic Tunas. Those fears for the survival of the fish are shared by Amanda Nickson, of The Pew Charitable Trusts.

Nickson, who is director of global tuna conservation for the organisation, said: “Without doubt illegal fishing remains a significant threat to Atlantic bluefin tuna in the Mediterranean, and this population has a long way to go before it fully recovers from decades of unsustainable management.

“As the fishing season ends, we’re reminded that every fish caught illegally undermines the recovery of this population and the actions of legal fishers operating by the rules within the set quota.”

She welcomed the efforts to halt illegal fishing but, referring to the recorded instances, she warned: “These are just the cases we know about. By its very definition, illegal and unreported trade flies under the radar, which makes advances in reporting and technology even more integral to developing a transparent and sustainable trade.”

The study was published through SeafoodSource.com, a seafood industry information provider in Maine, New England.

Picture credit: © Marshall Turner | Dreamstime.com