San Francisco: No-Go to Sharing Economy Parking App

Has the sharing economy concept gone to far?

This week San Francisco City Attorney Dennis Herrera issued a cease-and-desist demand to the mobile-to-mobile bidding app that’s been gaining a popular footing in the parking-poor Bay Area, MonkeyParking. The service, which is currently used on iOS devices, allows drivers to auction off their public parking places. As of this week, it was still available on the Apple Store, with the tagline that the app “lets you make money every time that you are about to leave your on-street parking spot.”

And that, says the city, doesn’t fly.

Herrera has apparently sent a letter to one of the CEOs of the Rome, Italy-based startup, Paolo Dobrowolny, to let him know that there is “a key provision of San Francisco's Police Code that specifically prohibits individuals and companies from buying, selling or leasing public on-street parking.” And, the letter says: “Police Code section 63(c) further provides that scofflaws – including drivers who 'enter into a lease, rental agreement or contract of any kind' for public parking spots – face administrative penalties of up to $300 for each violation. Because MonkeyParking’s business model is wholly premised on illegal transactions, the letter contends that the company would be subject to civil penalties of up to $2,500 per violation under California's tough Unfair Competition Law were the city to sue from buying, selling or leasing public on-street parking.”

Oops.

Reading city bylaws is always a good thing to do before launching a locally-based startup (this appears to have been one of the worst cities to choose for a hang-loose premise like auctioning public property use). But it also looks like the enthusiasm for sharing-economy startups may be wearing just a bit thin in SF. Only last year, the city launched a suit against another three-member partnership, FlightCar for its airport drop-off-and-share concept. It seems the service overlooked the sizable revenue that the city gets from traditional car rental companies that operate at the airport.

FlightCar's growing popularity has highlighted consumers' frustrations with airport parking costs, but it also dug into the revenue that the city uses to cover airport operating costs. San Francisco's suit against the startup, which launched last year, is still ongoing and, not surprisingly, could ultimately have an impact on the rights and responsibilities of similar car-sharing programs in San Francisco.

Still, can you really blame three up-and-coming entrepreneurs for trying to solve city parking woes? The city has been struggling with parking issues for more than 40 years (I speak as a former Bay Area native) and get-ahead tactics like an online auction platform seem like a natural, if not extreme, outgrowth of the problem.

But what MonkeyParking and the city’s struggle really highlights – unfortunately – is where the sharing economy seems to be going. Remember the days when people shared because they could help, or because they valued the exchange it fostered? In this case, I think it's a fair bet that few, if any, of the drivers who swap parking places via MonkeyParking ever exchange glances, a smile or a casual word. Sharing, in this case, is a major misnomer.

The question at hand may not be how the city addresses a sharing economy startup that it feels encroaches on public-run property or city bylaws, but what it is going to do to replace the incentive by residents and ticked-off tourists who hate searching for parking places.

I can’t help but wonder what would happen if the city were to sit down with six (or more) new entrepreneurs from FlightCar, MonkeyParking, Lyft, Uber and other sharing-economy initiatives and pick their brains for alternative, city-friendly ways to solve parking, traffic and consumer woes. (And yes, I'd love to be a fly on the wall with that one.)

As the city no doubt noticed last year, NerdWallet's 2013 list of the 10 best cities for entrepreneurs --which looked at things like funding availability, cost of living and networking/collaboration options -- was missing a key mention: San Francisco. That should be a wake-up call to a city that has made its reputation from innovative approaches. It just might find that smart, edgy professionals that have the moxie and the brains to find out-of-the-box solutions for city growth problems (especially those that aren't the city's favorite concepts) might have something unexpected to offer. The outcome, however awkward that first brainstorm might be, just might offer the next evolution to the sharing economy.

Image of parking meter: Jason Tester Guerrilla Futures

Bill's Passage Boosts California Distributed Energy and Storage

California Gov. Jerry Brown signed a wide-ranging Public/Natural Resources trailer bill into law this past weekend. Among a host of significant new measures and amendments, Senate Bill 861 (SB 861) adds impetus to the California state government's pioneering energy storage initiatives, which extend down from utility-scale energy storage mandates to incentives for small- and medium-sized companies to deploy intelligent solutions.

More specifically, enactment of SB 861 maintains annual funding of $83 million of California's Self-Generation Incentive Program (SGIP), allocating a total $415 million in state funds to assure its operation through 2019. Run by the California Public Utilities Commission (CPUC), SGIP provides “rebates for qualifying distributed energy systems installed on the customer-side of the utility meter.”

In addition to wind turbines, waste heat-to-power systems, pressure reduction turbines, internal combustion engines, micro turbines and fuel cells, qualifying SGIP technologies also include advanced energy storage systems, which are poised to play a significant role in the emergence of a clean energy ecosystem in California.

Building a distributed, clean energy ecosystem

Fostering adoption of intelligent energy storage solutions among small- to medium-sized commercial, industrial and residential utility customers, SGIP now plays a key role in realizing the goals set out in California's Assembly Bill 2514 (AB 2514), “landmark legislation that will create a smarter, cleaner electric grid, increase the use of renewable energy, save Californians money by avoiding costly new power plants, and reduce greenhouse gas emissions and other harmful air pollutants through the use of energy storage technologies by utility companies.”

Whereas AB 2514 focuses on the energy storage at utility scale, SGIP is focused on fostering adoption of distributed energy systems, including intelligent energy storage solutions, “behind the meter” among utility customers. As explained in Section 156 of SB 861:

“It is the intent of the Legislature that the self-generation incentive program increase deployment of distributed generation and energy storage systems to facilitate the integration of those resources into the electrical grid, improve efficiency and reliability of the distribution and transmission system, and reduce emissions of greenhouse gases, peak demand, and ratepayer costs. It is the further intent of the Legislature that the commission, in future proceedings, provide for an equitable distribution of the costs and benefits of the program.”

Energy storage, demand response, load shifting and frequency regulation

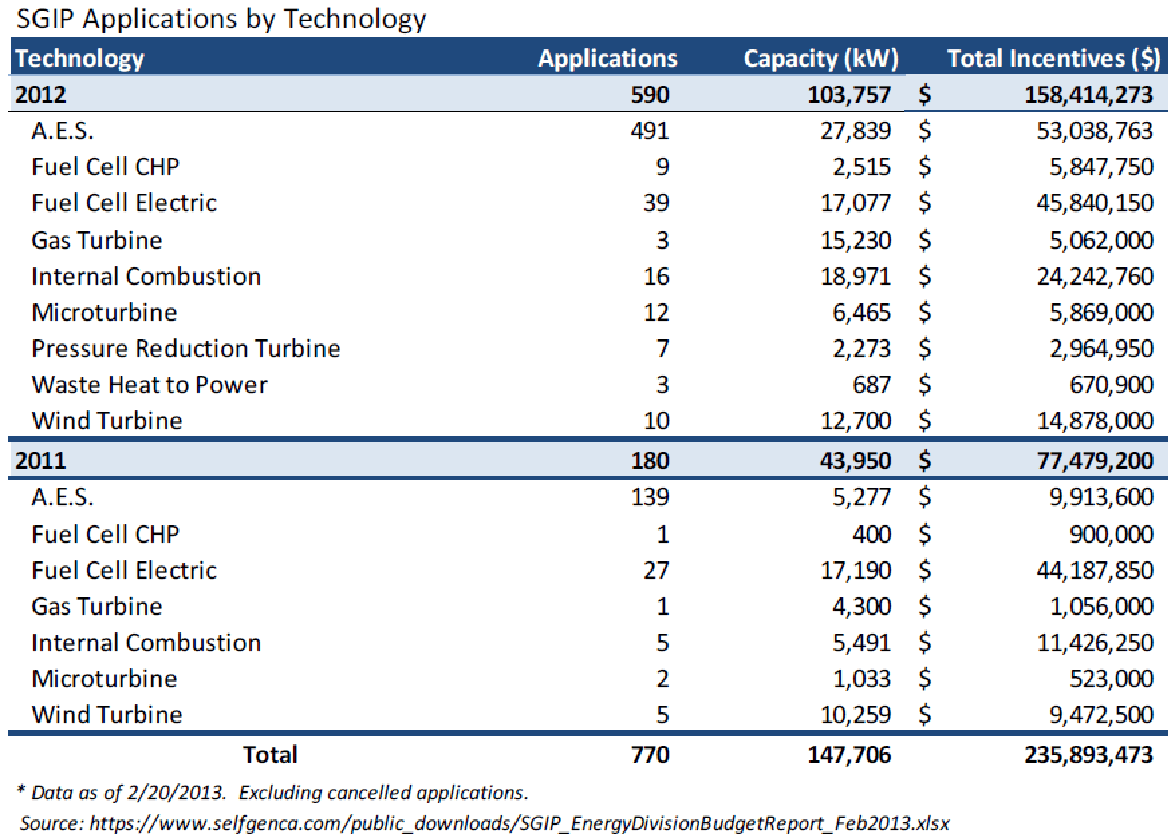

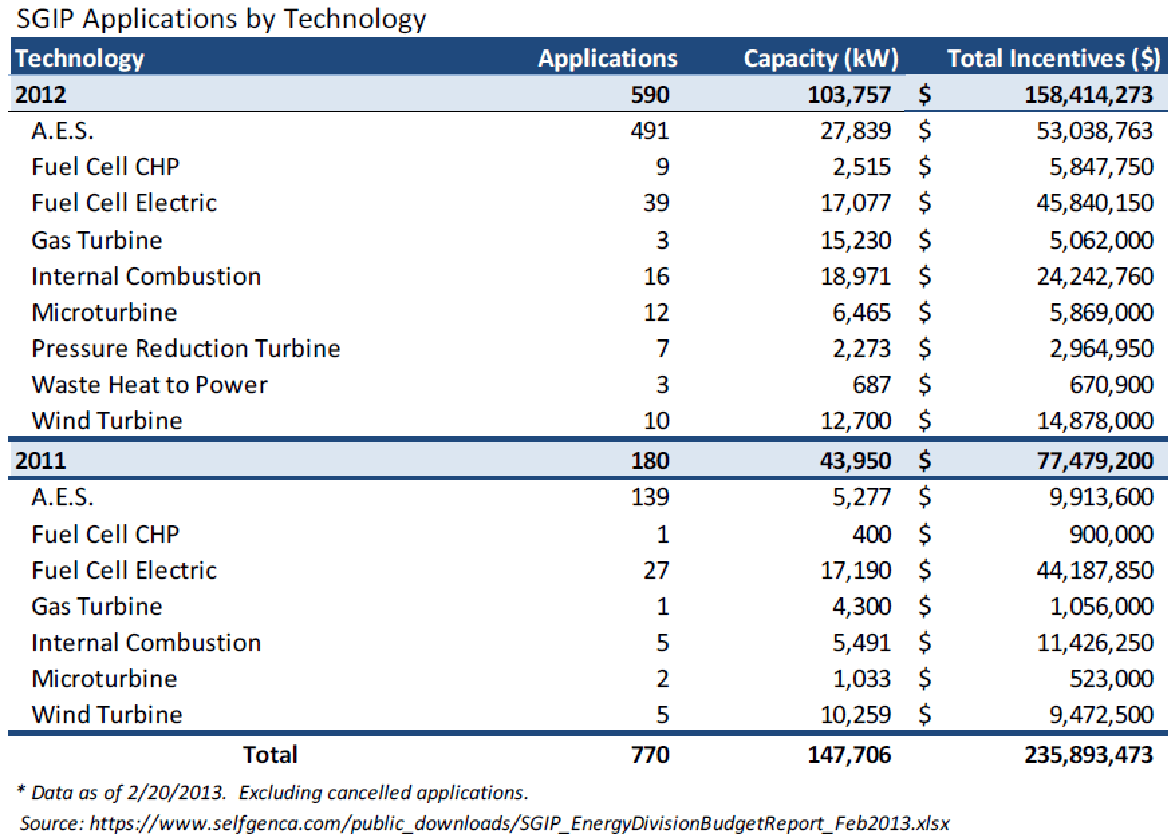

SGIP received more rebate requests for energy storage systems ($53 million or 34 percent of the total) than any other eligible distributed energy technology over the course of 2012, according to CPUC's latest, publicly released SGIP Budget Review. SGIP requests for combined heat-and-power (CHP) fuel cells followed a close second with $52 million (33 percent of total SGIP requests).

While the majority of SGIP energy storage applications were submitted by “just a handful of developers,” the variety of applications ranged from peak load shifting and demand reduction to back-up power generation and electric vehicle (EV) charging.

The average storage size of SGIP advanced energy storage rebate requests ranged between 5 to 25 kilowatts (kW), which, SGIP notes, “is relatively small compared to the average size of other participating SGIP technologies.” As a result, SGIP energy storage requests accounted for just 27 percent of overall funding from 2011 through 2012 but over 80 percent of SGIP application volume.

The California Energy Storage Alliance

Janice Lin, chair of Energy Storage North America (ESNA) and co-founder of the Global Energy Storage Alliance (GESA) and California Energy Storage Alliance (CESA), has played a central, pivotal role in California's groundbreaking energy storage initiatives.

Solar energy captured Lin's attention back in the mid-1990s, when she left management consultants Booz, Allen to join Power Light, which evolved and is now known as SunPower Corp., a leading U.S. provider of high-efficiency silicon solar photovoltaic (PV) products and solutions.

Lin's involvement in helping promote and foster development of advanced energy storage systems started gaining momentum post-2005, following her co-founding Stratagen Consulting LLC, a strategic clean energy consulting company.

At that early stage, Lin told 3p in an interview, “there really was no organized advocacy work related to advanced energy storage being done anywhere in the world.” Today, they are cropping up around the world, including in China, Germany, Japan and Ontario, as well as elsewhere in the U.S., in states such as Hawaii and New York, Lin noted with some sense of pride.

Teaming up with Douglass & Liddell principal Don Liddell, Lin in 2009 co-founded CESA. Since then, she and CESA have been working to organize support and help craft California's pioneering advanced energy storage initiatives, including expanding the SGIP to include energy storage systems as qualifying technologies.

California's Self-Generation Incentive Program

Some six years and three bills later, “Storage is now solidly in the [SGIP] program and is absolutely strategic, not only behind the meter, but as the primary vehicle via which investor-owned utilities (IOUs) meet their customer-sited procurement targets for energy storage in California,” Lin explained.

Encouraging investment in advanced energy storage deployment and projects is “really the only way to sort out how to incorporate storage on the grid,” she continued. “You learn by doing. To a utility, storage devices can look like load or they can look like supply.”

Streamlining and how best to carry out the interconnection process and local permitting are among the issues CESA and Stratagen Consulting are focused on at present. “We're helping build the 'ecosystem,'” Lin said.

California AB 2514 set an overall energy storage procurement target of 1.3 gigawatts (GW) by 2020. This will be broken out across three tranches: one for distributed interconnection; a second for transmission interconnected; and a third, totaling 200 megawatts (MW), for customer-sited deployments in which SGIP plays a key role as a provider of incentives.

“We're moving up the energy storage learning curve through SGIP,” Lin elaborated. “Energy storage systems are flexible assets; they can look like load or generation. Many of the behind-the-meter systems today are being used to reduce customers' peak demand and peak demand charges. They're also being used to support the grid, participating in CAISO's (California Independent System Operator) frequency regulation market.

“This [the SGIP] program serves a very important role in encouraging technological innovation for behind-the-meter systems in terms of both generation and storage. All these distributed storage technologies are a tremendous resource for the grid; they can provide services back to the grid.”

Through CESA, Lin and Stratagen Consulting are now looking to fine-tune the energy storage aspects of SGIP. “One of the things we have realized in implementing SGIP projects is that, though small, these behind-the-meter energy storage systems are acting like a wholesale asset.”

The problem is that commercial, industrial and municipal organizations making use of energy storage systems to help balance grid supply and demand, and earn extra revenue in the process, are often buying electricity at retail rates and then selling into CISO's frequency regulation market at wholesale rates.

CESA is looking to level the playing field by enabling those using advanced energy storage systems in the frequency regulation market to be charged and sell at wholesale rates.

Image credits: 1) PNM Prosperity Energy Storage Project; 2) OSI; 3) DOE Global Energy Storage Database; 4) California SGIP Budget Report 2013

Prudential reaffirms commitment to impact investment

Prudential Financial, Inc. is to build a $1bn impact investment portfolio by 2020 in its continuing effort to direct investments to companies, projects and funds that create positive social change and help individuals and communities achieve economic success.

Prudential made the announcement at the White House during a meeting of the US Advisory Board of the G7’s Social Impact Investing Taskforce, which presented its recommendations on how policymakers can spur more impact investments.

“Impact investing enables us, as a company, to make a deeper and more sustainable commitment in a way that has enduring impact,” said Lata Reddy, vice president of Corporate Social Responsibility at Prudential. “These investments are part of our broader strategy to eliminate the barriers that prevent individuals and communities from achieving financial and social mobility.”

Impact investing is the deployment of capital with the intention to generate a positive, measurable social or environmental impact in addition to a financial return.

“With this commitment, we are building on Prudential’s long history of using our resources to generate more than just a financial return,” said Ommeed Sathe, vice president of Impact Investments at Prudential. “For decades, we have strived to find innovative approaches that reach communities and individuals whose needs are underserved by traditional capital markets.”

Prudential formalized its impact investing program in 1976. Since then, the group has invested nearly $2 billion, including $300 million deployed in the company’s hometown of Newark, New Jersey.

The group invests in three core areas: social purpose enterprises, financial intermediaries that redeploy capital to individuals and organizations, and real assets, like affordable housing, that improve lives and communities.

"Prudential has been a leader in the impact investment arena for decades,” said Jean Case, ceo of the Case Foundation. "We have witnessed how instrumental impact investing can be, and it is encouraging that such a large private sector corporation understands the importance of using its capital to address complex social challenges." The Case Foundation is recognized for its efforts to increase giving and catalyze civic and business participation, as well as promote innovation, collaboration and leadership in the nonprofit sector.

Picture credit: © Dana Rothstein | Dreamstime Stock Photos

Symantec Bets on Next Generation of Cyber Security Workers

Cyber security sounds awfully complicated, and, well, dashing, doesn't it? The type of thing a hacker-meets-James-Bond fellow might do during the day to cover expenses while he builds the next BitCoin at night?

Symantec wants you -- and the young people of America -- to know that not only is this career path well-paying and approachable, but also, in many cases, it doesn't even require a college degree.

The security software giant isn't just getting the word out, it's launching an initiative to educate young people and train them for the field. The Symantec Cyber Career Connection (SC3) launched yesterday to address the global workforce gap in cyber security positions.A pilot of the program will start in August in New York City, Baltimore and the San Francisco Bay Area and will be implemented through a network of partners, including Year Up, NPower and LifeJourney, working in conjunction with the Symantec Foundation.

Cecily Joseph, vice president of Corporate Responsibility at Symantec Corporation, told me that the cyber security field is facing an unprecedented skills gap: 300,000 cyber security jobs are currently unfilled. Sixty thousand could be filled by those who don’t have a college degree. "The goal with SC3 is to fill that gap over the next five years," she said.

These positions exist in every large company and do everything from help desk support through keeping networks free from spam and hackers. You've probably had help at one point or another from a cyber security professional; when they start, they have job titles like Help Desk Administrator. Motivated employees can move up along a compelling career path with average salaries in the $60,000 to $70,000 range. At the top of the field, Network Defense Technicians and Computer Crime Investigators can earn up to $120,000, according to Symantec. Despite the compelling salary and career path, young people in the 18- to 29-year-old range are underrepresented in this industry, as are women and people of color.

The pilot SC3 program will start off modestly, serving approximately 50 students, in order to work the kinks out of the partnerships and curriculum. Students will earn an IT certificate with a specialization in cyber security. While the programs developed by the nonprofits vary in length, they all focus on both technical skills and soft skills -- giving students resume and interview training alongside the computer skills they will need to succeed. Said Joseph, "This is high-touch training that can’t be completed online." Following their training, students will be placed in cybersecurity internships to learn how to utilize their classroom skills on the job. Symantec will help program graduates seek jobs through its network of customers and partners, namely in the financial and government sectors.

While the company has a robust corporate responsibility program and has always encouraged employees to volunteer in their communities, leaders at Symantec wanted a new corporate responsibility initiative that would be more impactful and in line with their core competence in STEM (science, technology, engineering and math). Symantec turned to the Shared Value Initiative and FSG to find the right path. Says Joseph, "The Board of Directors challenged us to look for a larger societal impact than we could have with the traditional philanthropic approach." The Shared Value Initiative gave them that dual impact. Companies that utilize shared impact use their core competence to benefit society, creating a win-win. Nevertheless, Joseph had her work cut out for her getting buy-ins for the shared-value approach.

"When we first started, people asked: 'Is this altruistic enough?' People asked if we should be planting gardens instead. We still have programs in diversity and environment and will continue to support those types of things. However, if we’re really going to have an impact, we need to focus on those areas where we can add value and address a need at the same time. In addition to educating tomorrow's workforce, this initiative provides a business opportunity by serving our customers."

SC3 allows Symantec will help its customers stay secure and, at the same time, provide job training in a lucrative field to underserved populations. Sounds like a win-win-win to me.

Image credit: Element5 Digital/Unsplash

Climate Change Isn't Man Made? Prove It for $10,000

Naysayers, you’re on. If you’re convinced that climate change isn't man-made, a physicist in Texas wants to hear from you. Bring your virtual chalk, polish up your math, hone your argument and prove your point. Your time won’t be misspent: If you can irrefutably prove your hypothesis, he’ll pay you $10,000.

Dr. Christopher Keating, author of "Undeniable: Dialogues on Global Warming," has offered the challenge to anyone who can “prove, via the scientific method, that man-made global climate change is not occurring.” Keating, who is well versed in climate change research, has taught at the U.S. Naval Academy and the U.S. Coast Guard Academy.

He’ll also pay $1,000 “to the first person to show there is any scientific evidence that refutes the conclusion of man made climate change.”

He posted the first submission to the two challenges this week on his blog, Dialogues on Global Warming. The competition entry, which was posted initially as a comment by an anonymous poster, received a full-page analysis by Keating – and an in-depth explanation (which must have been excruciating for the candidate) for why it didn’t pass muster for either category.

In two words: “cherry-picking.”

“Cherry-picking is invalid science,” Keating explains, “no matter which way you go. I cannot do it any more than Mr. Anonymous can. It is still invalid and only serves to provide someone with a false argument.”

Ouch.

It isn’t hard to see that the submissions Keating receives serve more purpose than to prove his premise that man-made climate change is indeed true. In the process of analyzing each submission, he’s teaching his readers how to analyze scientific data, and hopefully, to be discerning of what’s true and what’s not (in other words: real science).

And those who feel they do indeed have a chance to prove climate change and global warming are not man-made will be happy to hear the qualifications for entering this competition are fairly simple and straightforward.

“If it is so easy, just cut and paste the proof from somewhere. Provide the scientific evidence and prove your point, and the $10,000 is yours!” says Keating.

But he says he is sure that will never happen “because it can’t be proven. The scientific evidence for global warming is overwhelming and no one can prove otherwise.”

But, alas, where does this monetary challenge leave those who already have a strong, steady conviction that man-made climate change really does exist? Are there no opportunities for proving your point (or at least ones where you can be monetarily compensated)?

Fear not!

The Ultimate Global Warming Challenge takes the cake when it comes to earning potential – if you can meet the criteria of the judge(s), that is. Keating says he’s already entered the challenge and lost. The competition offers a $500,000 award for anyone that can “prove, in a scientific manner, that humans are causing harmful global warming.” The argument will be required to reject two hypotheses cited by UGWC.

Before you start making a list of all of your irrefutable sources and mapping out your award-winning argument, you may wish to take note of No. 2 and No. 4 of the competition rules, which specify that, “Entrants acknowledge that the concepts and terms mentioned and referred to in the UGWC hypotheses are inherently and necessarily vague, and involve subjective judgment,” and that the website has the sole discretion to determine “the meaning and application of such concepts and terms in order to facilitate the purpose of the contest.” It also admits that there’s no guarantee that the $500,000 will ever be awarded.

The competition began in 2007. That alone may suggest that the judge is a hard audience to impress (Keating asserts that it is only one person judging the entries). It also highlights the fact that there is still a wide breadth in opinion when it comes to just how important science is in defining climate change, as well as our role in global stewardship.

Image of Earth: Nasa Goddard Space Flight Center

Image of pollinating bee: Michael Gil

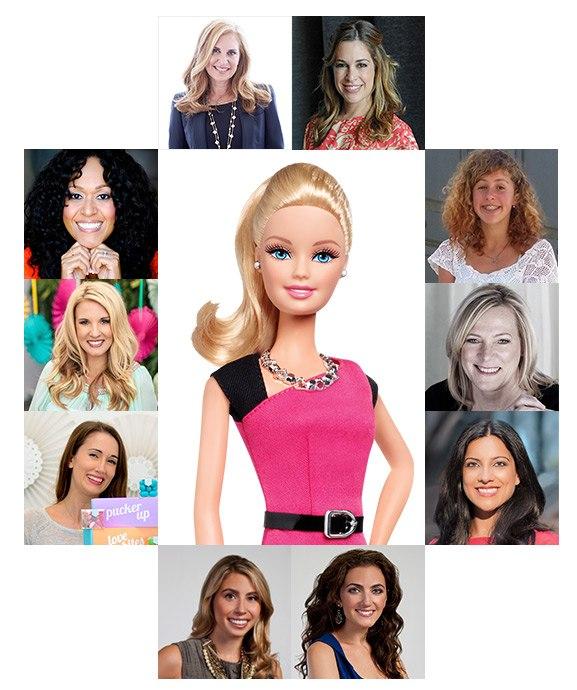

Here Comes Entrepreneur Barbie: Will Women Buy It?

She’s been around for over a half century, has aged less than the late Dick Clark, and has been in high demand by countless girls (and some boys)—while suffering criticism by many others. But Barbie is still proving that life in plastic is fantastic—even at age 55, for which now she can score some senior citizen discounts.

Now Barbie is going full-on MBA with the launch of Entrepreneur Barbie, available online or at a toy store near you. Based on what I can see, she is the combination of a business leader, diplomat and of course, entrepreneur—as in part Sheryl Sandberg, part Hillary Clinton, but mostly Kim Kardashian.

Going entrepreneurial is a hugely positive step for Barbie during her (what some would say is too long of a) life. After all, she suffered through a 45 year relationship with Ken, only to have no children—though the fault was clearly Ken’s. She has had a love-hate relationship with her owners, even suffering “maiming and decapitation,” as a leading British study revealed. On the sustainability front, she has even been accused of causing deforestation in Indonesia. And of course, there is the long standing criticism that she sends mixed messages to women, from past dieting tips including “Don’t Eat!” to bathroom scales maxing out at 120 pounds (54.5 kilos).

This is also a move in the right direction for her parent company, Mattel, which has enjoyed success due to Barbie and, in fairness, has given Barbie many glass ceiling-breaking jobs: astronaut, surgeon, Marine Corps officer and firefighter. At this same time, this is a company that also eaten it with other versions of Barbie. Among them, there was the passport-carrying Mexican Barbie, which looked like an anorexic piñata; Teen Talk Barbie, some of which blurted out “Math class is tough!”; and in one of the most poorly thought out co-marketing campaigns ever, the company rolled out an Oreo Barbie. (Check out this slideshow of Barbie misfires that were truly gifts that keep on giving.)

To show this is no ordinary vapid Barbie Doll, Mattel has enlisted the support of a posse of impressive entrepreneurs, including the founders of Girls Who Code and Plum Alley. The campaign will include articles from this group of 10 women as well as an aggressive social media push. In a response to the ongoing standard criticisms that Barbie is still a pallid high heels-wearing doll shrouded in pink fabric, Mattel has defined this Barbie as a smart, sophisticated professional: with, of course, the glam necklace and cool clutch. There’s one caveat, however: we do not know exactly what kind of business she’s in. It’s doubtful Barbie even knows: Mattel has given her at least 150 jobs over the years. Who wouldn’t be confused?

As with just about every other Barbie iteration, the debate will rage on: is Barbie still sending unattainable messages about women’s body images or will this resin skeleton deliver inspiration and empowerment to girls? Is there a middle ground, as Claire Cohen of the Telegraph believes—can a woman can wear high heels, pink viscose and take the business world by storm?

To the dismay of Barbie haters, it does not really matter to Mattel. Barbie will march on, even using the hashtag #unapologetic to get their new Barbie messaging out. But in the end this new Barbie is about business: as demographics and attitudes about gender roles continue to shift, Barbie will find herself more culturally challenged. Sales have dipped the last few years, and that is bad news for Mattel as she has long raked in a massive chunk of revenues for the company. Barbie will have to change with the times, as she always has, if she is going to survive in the long run. And hence the challenge for Mattel—rather than reacting to consumers, the company has to find a way to get ahead of the curve to inspire girls and their parents jaded by Barbie’s message—and resuscitate its sales in the meantime. Discussion aside, women will be less inclined to plunk down $12.99 for her.

Leon Kaye currently lives in the United Arab Emirates, where he works for the Abu Dhabi office of APCO, a communications consultancy. Follow him on Instagram and Twitter.

Image credit: Mattel

Food Companies Rally to Protect Bees, While Pesticide Giants Dispute the Evidence

U.S. honey bee colonies are declining by an annual rate of 30 percent.

Experts believe pesticides, parasites and habitat loss are likely culprits. Since bees and other pollinators are needed for more than two-thirds of all crop species, the lives of bees and humans are intricately connected. In fact, even cheese, milk and butter depend on bees. They are even essential to the reproduction of clover and alfalfa -- staples in the diet of grazing animals.

"Honey bee pollination supports an estimated $15 billion worth of agricultural production, including more than 130 fruits and vegetables that are the foundation of a nutritious diet," says Agriculture Secretary Tom Vilsack. "The future security of America's food supply depends on healthy honey bees."

The bee crisis is already impacting some types of crop production, including almonds. Large orchards in California bring in numerous bee colonies to pollinate the flowers.

“Other crops don’t need as many bees as the California almond orchards do, so shortages are not yet apparent, but if trends continue, there will be,” said Tim Tucker, vice president of the American Beekeeping Federation. "Current [bee] losses are not sustainable. The trend is down, as is the quality of bees. In the long run, if we don’t find some answers, and the vigor continues to decline, we could lose a lot of bees.”

Many companies are showing their support by partnering with the Xerces Society, a nonprofit organization that protects pollinators and their habitat. Whole Foods, General Mills, Burt's Bees, Boiron, Annie's, Cascadian Farm, Celestial Seasonings and Talenti are among the long list of supporters, having donated more than $100,000 to the Xerces Society. Whole Foods stores are also hosting “Human Bee-In” events and “Give Bees A Chance” promotions. The White House even announced the creation of a Pollinator Health Task Force, a multi-departmental effort for "understanding, preventing, and recovering from" the rapid declines in the U.S. honeybee population.

While some companies are launching campaigns to protect pollinators, Monsanto, Bayer and Syngenta are trying to draw attention away from the link between neurotoxic pesticides (neonics) and the bee crisis. These pesticides have been shown to kill a variety of species, including bats, ladybugs, dragonflies and lacewings. Neonics are typically applied to the surface of plants and found in the nectar and pollen. They are widely used on corn, soy, wheat and canola seeds. As a result, the European Commission implemented a two-year continental ban on the three most common neonics -- imidacloprid, clothianidin and thiamethoxam.

"These industry public relations strategies come straight from the tobacco industry’s playbook, and were used for years to mislead the public about the danger of their products by manufacturing and magnifying uncertainty about the cancer risk of cigarettes," according to a recent report by Friends of the Earth. "Coincidentally, neonicotinoids are synthetic derivatives of nicotine, a toxin produced by the tobacco plant."

Despite dozens of peer-reviewed scientific studies linking bee collapse to pesticide use, Syngenta's website states: "Since we do not believe pesticides cause bee losses, banning them will not make any difference to bee health. This is also the view of the Swiss and other governments ... Banning neonicotinoids might remove one of the possible causes of bee losses in the sense that accidental misuse by farmers of neonicotinoids-based seed treatments could not then occur if the product was not available."

It is completely logical that food companies are launching campaigns to save pollinators, while pesticide companies dispute evidence. Each is acting in their own best interest. Perhaps Monsanto, Bayer and Syngenta even have something to gain from food scarcity.

https://www.youtube.com/watch?v=hdJNWjeyuBQ

Image credit: Whole Foods

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Building & Design, Triple Pundit, Urban Farm, and Solar Today. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Cohousing & Ecovillage in Midcoast Maine with her husband and two children.

New CSR Report Shows Ford Takes Climate Change Seriously

Ford's latest corporate social responsibility (CSR) report really caught my attention.

I read at least two or three CSR reports a month. When you read as many as I do, one that devotes a lengthy section to climate change stands out. In most reports, climate change is a sub-section tucked within the section on environment. It may get a few paragraphs, or maybe even a whole page. But Ford devoted an entire section to “Climate Change and the Environment.” Clearly, Ford takes climate change seriously.

Ford’s position on climate change is that reducing emissions “calls for an integrated approach -- a partnership of all stakeholders, including the automotive industry, the fuel industry, government and consumers.” The company states that reducing emissions can “only be achieved by significantly and continuously reducing greenhouse gas (GHG) emissions over a period of decades in all sectors of the economy.” For the transportation sector, that requires improving vehicle economy, developing lower carbon fuels, and working with the government on measures to encourage consumers to buy more fuel efficient vehicles and lower carbon fuels, according to the report.

Ford even has a long-term climate strategy to contribute to climate stabilization specifically, the strategy consists of the following:

- Continuously reducing GHG emissions and energy use of its operations

- Developing the flexibility and capability to market lower GHG emission products

- Working with industry partners, energy companies, consumer groups and policy makers to establish an effective and predictable market, policy and technological framework for reducing GHG emissions

Ford supports the Obama administration’s efforts to regulate of GHG emissions and fuel economy standards. However, the company believes that focusing on only one sector of the economy “will not enable us to achieve the necessary level of GHG reductions.” What Ford thinks is needed is an “economy-wide program” that allows “market mechanisms to determine where GHG reductions can be achieved at the lowest cost.”

Ford’s climate strategy is worked out through specific goals, and the vehicle manufacturer is on track to meet its environmental goals, including reducing carbon dioxide emissions by 30 percent per vehicle by 2025 compared to a 2010 baseline. The company already achieved a 31 percent reduction from 2000 to 2010, and its efforts to reduce carbon emissions per vehicle have been recognized. In 2012, Ford received a Goal-Setting Certificate at the Environmental Protection Agency’s Climate Leadership Awards Ceremony and Conference for its carbon dioxide strategy.

Ford has also reduced waste, improved fuel economy, and increased EcoBoost engines. From 2012 to 2013, Ford reduced waste sent to landfill by 14 percent per vehicle, and implemented a plan to reduce waste to sent to landfill by 40 percent per vehicle from 2011 to 2016. The company improved the fleet-average fuel economy of its U.S. car fleet by two percent and U.S. truck fleet by three percent from 2012 to 2013. By 2013, Ford surpassed its goal of producing 1.5 million EcoBoost engines globally by producing over two million.

Ford is proving to be a car company that has an eye on the environment. It will be interesting to see where its climate change strategy takes the company that sends American made vehicles down the highway.

Image courtesy of Ford Motor Co.

Joule Assets Targets First $90 Million for Energy Efficiency Contractors

Joule Assets on June 18 announced that it is targeting an initial $90 million of an anticipated $270 million in funding for 10 U.S. energy efficiency and demand response contracting companies.

Opening up the mid-tier energy efficiency and demand response markets to accredited investors across the U.S., co-founders Mike Gordon and Dennis Quinn launched Joule Assets' Energy Reduction Assets (ERA) Fund in late January. The fund enables investors to earn a share of the returns generated by energy efficiency and demand response projects carried out among U.S. small- and medium-sized businesses (SMBs).

“In a given year, a typical energy efficiency contractor may see $2 million to $3 million worth of projects stall due to a customer's budget constraints for upgrades. The lines of credit from Joule Assets enable those small-to-mid-sized contractors to offer financing options, radically shortening sales cycles and extending their project pipelines,” Joule Assets stated in a press release.

Boosting energy efficiency among SMBs

With Joule Assets' funding, energy and facilities information management systems and services provider NorthWrite expects to finance 50 to100 energy efficiency projects across “a spectrum of small commercial buildings, including schools, restaurants, national chains and offices” over the next 12 months, Joule Assets highlights. Said NorthWrite founder and CEO Patrick O'Neill:

“Joule Assets’ ability to offer conditional cash flows for projects is what sets it apart from standard financing options. In true partner fashion, the team at Joule helped us envision, create and work through the different financing scenarios available to us. They have a level of domain knowledge around conditional cash flows that others deeply discount or won’t even consider, which is what makes these projects possible.”

Added Joule Assets CEO Mike Gordon: “Our model, which places financing decisions in the hands of the vendors, not only empowers the small-to-midsized contractors, but it accelerates the adoption of energy reductions assets as a whole by reducing overall due diligence and transaction costs. We’re pleased to provide contractors with investment dollars that will enable them to significantly increase their deal closure rate and scale rapidly.”

Investing in "negawatts"

Apparently there is a good amount to go around by investing in energy efficiency and demand response projects and services. By monetizing the energy savings realized through contractors energy efficiency and demand response work, Joule Assets expects investors in its ERA Fund will realize investment returns of 6 to 10 percent.

Then there are additional “mezzanine returns of 5 to 15 percent and potential equity participation, totaling estimated average targeted returns of 18 percent.”

Those are some very attractive rates of return, particularly since these investments are considered relatively low risk. That may beg the question: Why aren't banks all over this?

Nevertheless, by investing in Joule Assets' ERA Fund, there's a big bonus: You'd be putting investment capital to work to boost energy efficiency, reduce greenhouse gas emissions and the threats and costs of climate change at the same time.

Image credits: 1) Verrazano Narrows Bridge by Ecofriend; 2) Arrowhead Electric Cooperative

How Much Energy Will the 2014 World Cup Consume?

Editor's Note: This post originally appeared on Oilprice.com.

By Nick Cunningham and James Stafford

Along with 3 billion other viewers around the world, I plan to tune in for the month-long World Cup to see whether the 22-year-old Neymar can withstand the colossal pressure that has been put upon his shoulders to deliver a win for team Brazil.

Every time I turn on my television set, I’m using World Cup-related energy. And that’s just the start. Flying in teams, trainers, equipment, World Cup personnel and the estimated 500,000-plus fans will use enormous volumes of jet fuel.

Add to that powering the stadiums on game days, moving millions of spectators around host-country Brazil, and transmitting the event to billions of viewers worldwide, and you end up with millions of tons of carbon dioxide added to the atmosphere.

So while the 2014 World Cup is going to be bigger than ever -- it’s shaping up to be the most watched,most lucrative and expensive tournament in soccer history -- it’s also going to be one of the biggest energy-consuming, greenhouse gas-spewing World Cups in history.

Think about this as the music blasts through the stadium and the fans cheer and scream and the players race up and down the field chasing the ball: The 2014 World Cup tournament will burn through enough energy before it’s over to fuel almost every one of the 260 million cars and trucks in the United States for an entire day, or the equivalent of what 560,000 cars use in a year.

Estimating the total energy required to mount such a massive operation with any precision is a fool’s errand, but let’s take a look at some numbers to get a sense of scale.

FIFA did its own fascinating study of the carbon footprint that will be created by setting up and running its broadcast television operation. It found that the biggest contributor – 60 percent – is international flights for staff members. The other 40 percent comes from all the trucks needed to transport cables, cameras and furniture, and the energy required to operate all of the electronics.

All told, FIFA’s TV operations will contribute 24,670 tons of CO2 to the atmosphere – the same impact of burning 2.8 million gallons of gas, or 13,250 tons of coal.

FIFA also tried to estimate its carbon footprint for staging the tournament’s matches, which wraps in the electricity needed for stadiums, fan festivals, banquets, concession stands, training sites, travel for ticket holders, and team hotels. That number came to 2.72 million tons of CO2 equivalent. That’s like using up306 million gallons of gasoline or burning 1.46 million tons of coal.

What’s the point of the study? FIFA says to figure out where it can do better next time. Just a 10 percent decline in international staff, for example, reduces the carbon footprint by 6 percent.

TVs and Tea Kettles

None of these numbers include other sources of Cup-related energy use, like building new transportation infrastructure and stadiums.

And speaking of stadiums, while everyone would probably love to attend the final match in Rio de Janeiro’s famous Maracana stadium, the vast majority of us will be watching at home. Which means we’re contributing to the Cup’s carbon footprint, too.

A spike in energy use is likely to occur in places when millions of people turn on their TVs at the same time to watch a match. For example, in the United Kingdom, the record for an energy surge during a TV program occurred during the 1990 World Cup, when England went to a shootout against West Germany in the semi-final. (Incidentally, West Germany prevailed and went on to win the trophy. West Germany’s title run was led by Jurgen Klinsmann, who is now coaching the U.S. national team.)

During that match, the UK National Grid experienced a spike of 2,800 megawatts of demand, as people across England tuned in to watch the game’s climax. Other significant power surges in the UK occurred during England’s 2002 quarter-final match against Brazil (2,570 MW surge), and the 2011 royal weddingof Prince William and Kate Middleton (2,400 MW surge).

In fact, it’s relatively common for the UK to experience a spike in power demand during big soccer matches. National Grid operators have become accustomed to forecasting higher electricity demand during games, according to its operations manager, Jon Fenn. Not only does electricity consumption spike from millions of TV sets, a surge is felt most acutely during halftime or just after the final whistle, when everyone heads to the kitchen to turn on electric tea kettles or grab a snack from the fridge.

“It must be one of the few jobs where watching World Cup matches is essential to your work rather than a distraction, because we need to know to the second when half time and full time occur to be ready for the surges in demand,” Fenn told The Telegraph in an interview before the 2010 World Cup.

The 2014 World Cup will be transmitted to every country in the world and could potentially be the most watched sporting event in history.

Now we know it could set new records in terms of greenhouse gas emissions, too.

Image credit: Flickr/taigray

Graphic courtesy of Oilprice.com