Dynamic Governance: A New System for Better Decisions

Editor's Note: This is the first post in a three-part series on dynamic governance, a new operating system for both for-profit companies and nonprofit organizations.

During the financial crisis of 2008, Creative Urethanes, a plastics manufacturing company based in Virginia, saw business dry up overnight -- with sales down by 50 percent. CEO Richard Heitfield was shocked and immobilized by the situation, but the employees sprang into action, creating a plan that everyone could accept.

One of the company's product lines was wheels for skateboards and roller skates; they created an innovative design for them in the 1970s that helped the sports grow into multi-million dollar industries. Now they were reeling.

"All of a sudden, our business was way down," says Heitfield. "While that was going on, our management group was sitting down and making a plan. It was a very detailed and elaborate plan that happened spontaneously. Folks were comfortable enough with the process to put it on the table and get it into action. That's a direct result of using the sociocratic process. If these guys had not come to action and done the work, we would have folded."

Sociocracy -- also called dynamic governance -- is a non-authoritarian organizational operating system that empowers people to make policy within their established domains, fostering better and clearer decisions. The company culture that was built at Creative Urethanes through adoption of dynamic governance in the 1980s allowed leadership to spring up when it was most needed, enabling the business to stay afloat during a very difficult time.

In many organizations, decision makers under-utilize the knowledge, expertise and experience of lower-level employees when it's time to make decisions. Even in companies where the leadership wishes to create an open-door atmosphere, reality may be quite different. Policies get created with good intentions that breed ineffective results and even resentment. In dynamic governance, every voice is heard for creating policies -- and a management hierarchy exists for daily operations.

"In horizontal governance everyone has a voice in decisions; vertical governance is the traditional top-down hierarchy," explains Sheella Mierson, a consultant with the Sociocracy Consulting Group. "We usually think of those two as either-or, but the unique thing about dynamic governance is that it's both-and. Both the manager hierarchy stays in place and everybody has a voice that can't be ignored."

Dynamic governance often leads to higher morale, increased productivity and better decisions. "They were getting more good ideas for their decisions and people were really putting energy into carrying them out," explains Mierson about a school that implemented the method. "Adopting dynamic governance made for a very positive atmosphere. Some of the new teachers came from schools where their voices were not being heard, and they found having a voice tremendously validating and energizing."

In dynamic governance, authority is delegated to small groups called 'circles' with distinct aims and domains, so that responsibility and authority are clearly defined. Using a concept called 'double linking,' each circle is connected to the next higher circle by two people, an operational leader and a representative elected by the lower circle, who are full members of both circles. The circles choose people for roles using consent decision-making, which is different either from voting or from one person making an appointment; the result is to encourage leadership to sprout up throughout the organization.

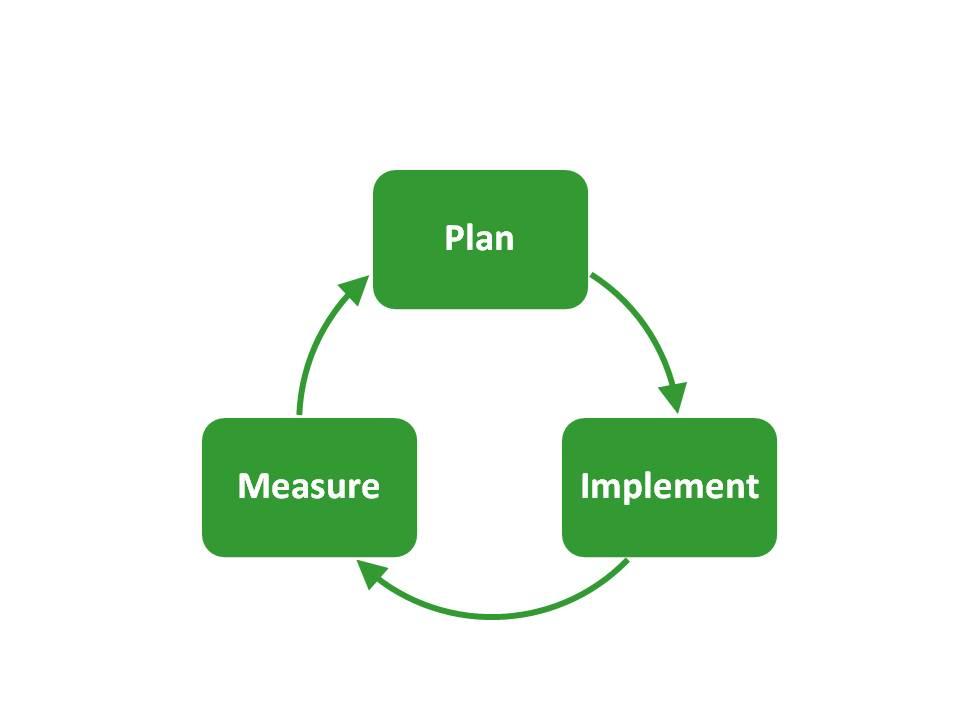

Information, policies, and meeting agendas and minutes are accessible to all circle members and openly shared among circles. The circles use consent decision-making, meaning that a proposal passes when there are no paramount objections. Each new policy incorporates a feedback loop involving a plan-implement-measure cycle.

"If there was a policy and someone is having a problem with it wherever they are in the structure, they go to the leader of the meeting to add it to the agenda and revisit it," explains Heitfield. "No decisions are set in concrete."

It seems logical that if every voice were heard, meetings would take longer, but Mierson says this isn't the case, especially once an organization becomes skilled in applying dynamic governance. Meetings become more effective, thus saving time and money.

"One reason dynamic governance makes companies more profitable is that they have the information they need from all over the organization," explains Mierson. "They are getting people's best thinking and they are getting buy-in to the decisions. Lack of buy-in and lack of information in top-down decision-making can really cause meetings to drag on and on. When they put a decision into place without the needed information that is already available within the organization, they are more likely to have to go back and revisit the decision. They end up spinning their wheels."

Training is typically needed for dynamic governance to thrive because the method involves quite different structures, processes, skills and mindsets than what we are used to. The Sociocracy Consulting Group helps chart an implementation path specific for a particular organization; adjust the organizational structure to ensure clear roles and accountabilities; establish aims and domains for committees, teams and boards; train the employees, with additional training and support for circle facilitators and circle memory keepers; and generally guide the whole process.

"Dynamic governance creates a radical change in the way organizations are run," says Heitfield, who initially implemented the method without a consultant, but later hired the Sociocracy Consulting Group. "I would absolutely recommend [using a consultant for implementing dynamic governance] rather than charting new territory each day."

Image credit: Haworth (upper image) and Sheella Mierson (lower image)

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Building & Design, Triple Pundit, Urban Farm, and Solar Today. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Cohousing & Ecovillage in Midcoast Maine with her husband and two children.

Natural Business and True Sustainability

By Giles Hutchins

Whereas once evolution was viewed as little more than a struggle for survival through dog-eat-dog competition, many now see nature through a more collaborative lens: networking, feedback loops, behavioral qualities and interdependencies within and throughout ecosystems.

Nature adapts within limits and creates conditions conducive to life. Likewise, in human systems, the old logic of Social Darwinism underpinning hyper-competitive business practices is giving way to a deeper understanding of what drives the individual, organization and ecosystem in its ability to sense, respond, adapt and evolve.

Yesterday’s logic is of top-down, hierarchic, command-and-control, risk-adverse, competition-oriented, control-based thinking. It is a mechanistic worldview based on reductionist logic that fragments reality into abstract definitions, silos and objects to be quantified, measured, controlled and then maximized, while largely overlooking the interrelated, fluid, connective, collaborative, participatory nature of Nature.

In drawing inspiration from nature, we may step beyond our narrowed-down view of life and recognize the intrinsic patterns and reciprocal relations in our midst. These patterns can often seem confusing or complex for our reductionist mind, yet for our intuitive logic they are quite natural to cohere with – we are, after all, expressions of nature. Such patterns and flows are, by their nature, regenerative and sustainable. In applying this inherent logic of life, we no longer need to superficially bolt-on sustainability initiatives to unsustainable modus operandi. In going with the flow of nature, we re-design for resilience, ensuing sustainability – in all sense of the word – is ingrained in how we operate and innovate.

Natural business creates the conditions conducive to collaboration, adaptability, creativity, local attunement, multi-functionality and responsiveness; hence, enhancing the evolution of organizations from rigid, tightly managed hierarchies to dynamic living organizations that thrive and flourish within ever-changing business, socio-economic and environmental conditions.

While, on the surface, diverse, interconnected, open, emergent organizations may appear more chaotic and difficult to manage. They are vibrant places for people to become self-empowered and to inspire others – self-managing through mutual understanding of correct behaviors rooted in core values and clarity of purpose. It is this shared value set of core ethics that ensures self-empowered diversity naturally emerges towards delivering the value creation goals of the organization, while maintaining flexibility, adaptability and sense of purpose.

Increasingly, as the organization is required to become more emergent, so leadership is more about empowering, empathizing and encouraging interconnections, innovation and an active network of feedback. As organizations and business ecosystems become more self-organizing and self-empowering, the working environment and culture becomes more emotionally and mentally healthy, where business goals are met without sacrificing personal values and integrity. Quite the contrary, in fact: Work acts to reinforce personal integrity in providing a rich emergent experience for individual and collective learning and ethical growth.

The role of leadership is to actively participate in enabling and facilitating local change, by encouraging effective communications through clarity of understanding of how to behave, act and interact. Each of us plays our part in leadership-of-the-future by helping others to co-create towards positive outcomes. Here, future outcomes are beyond pre-definition: It is the co-learning journey rather than the pre-defined destination that brings transformative value to the organization and wider ecosystem of partners involved; real benefits beyond ‘doing less bad.' This approach to business walks-its-own-talk by embracing a living, regenerative, empowering, co-creative, ecological way of being and doing which is aligned with our authentic human nature and deeper nature. After all, true sustainability means being in harmony with nature, anything less is, ultimately, unsustainable.

Giles Hutchins blogs at www.thenatureofbusiness.org and specialises in the transition to a new logic in business and beyond - a logic inspired by and in harmony with Nature.

Clean Tech Case Study: When Sustainability Means Big Savings

By Lacey Miller

Sustainability is more than just company operations. At the Doe Run Co., sustainability is also about “protecting our workforce and neighbors”… to the tune of $2 million in savings!

In 2013, Doe Run invested about $600,000 into the Herculaneum High School, part of the Dunklin R-V School District in Jefferson County, Missouri, paving the way for major upgrades to the inefficient campus. With the help of Microgrid Energy, which performed the energy audit that covered lighting, HVAC, water heating, plug loads and building envelopes, the final project included several energy conservation measures, set to save the school an estimated $2 million over the life of the project.

Project details that were verified in the Microgrid case study include:

- 75 kilowatts (kW) of solar capacity, including 25 kW rooftop arrays on the gymnasium and fine arts building, a 13 kW array with a battery storage component on the main building, and 6 kW solar canopies on the football stadium grandstand and cafeteria courtyard.

- Interior and exterior lighting upgrades to replace all T12 fluorescent lamps with new, energy-efficient T8 lamps, and the replacement of metal halide fixtures on the building walls and parking lots with new, high-efficiency LED fixtures.

- HVAC upgrades, including a new Variable Air Volume air handler in the D-Wing of the main building, and a new, high-efficiency boiler to heat the building.

Upon completion in 2014, the upgrades and financials were verified by Noesis Energy, proving out the savings at an estimated $44,000 a year. The energy savings equivalencies will equal nearly 4 million pounds of CO2 avoided over the equipment’s lifetime, which is equivalent to 3.75 million miles not driven, or the planting of 280 acres of trees.

In an industry that has major trust issues, it’s important to showcase successes like this one and to make sure the results can be trusted. Verified case studies allow businesses that sell products and services for energy efficiency to share the specifics about their successful projects, in a manner that is verified for accuracy. This helps product vendors, distributors, consultants, and building managers build confidence and trust around the energy savings business cases for their own projects, resulting in more projects getting done.

Image courtesy of Noesis Energy

Lacey Miller is the Digital Marketing Specialist for Noesis Energy, focused on bringing awareness to energy efficiency and the new avenues of financing available for projects.

Xeros Laundry System Saves Businesses Water and Money

Water is a precious commodity, and reducing water use is a goal every business should set.

A Sheffield, England-based company called Xeros has developed an innovative laundry system that makes it easy for companies to reduce water use by up to 80 percent. The system uses polymer bead technology that attracts dirt and absorbs it into the beads, which can then be reused for hundreds more washes before being recycled. Xeros launched its laundry system at the International Motel and Restaurant Show in November 2013, and received the Editor’s Choice Award for Best New Product for Hotel Operations.

The British company has since expanded in North America. Xeros recently announced that its plans to roll-out out the system to the hospitality industry is on track, and most of its laundry systems have been sold to the top five hotel groups in North America. Since hotels in the U.S. use about 2.3 billion gallons of water a month to wash linens, that is a good fit. A life cycle assessment (LCA) carried out by Sustain Ltd found that the Xeros system also reduces carbon footprint by 44 percent. The life cycle savings in carbon footprint and water use are equal to the emissions produced by watching a 32-inch LED TV for 32,000 hours or 10 years’ worth of direct water use by an average U.K. household.

The laundry system contains a special storage system for the beads to contain them between wash cycles, called wet sump housing, and allows the beads to be easily carried up into the drum during a wash. The sump also allows the beads to be cleaned after heavy use, which is necessary for commercial laundries that wash large amounts every day, such as a hotel. Each load saves energy, in addition to water, plus it reduces the need for detergent. That makes the system money saving. The system might also save time since Xeros claims it reduces the need for separating colors because the beads absorb stray dyes in the wash.

Xeros provides support for customers through its SbeadyCare program, which it describes as an “all-in-one support service providing customers with everything that they need to get the most out of the Xeros machine.” The company also has an Affirmation Program for customers that measures the utility consumption and other related costs of currently used washing machines and compares it to their system.

The system is a great one to be used by businesses in drought stricken California, where every part of the state is in drought conditions. The state is facing the worst drought in its recorded history. Some cities are asking businesses to reduce water use by 35 percent. The Capital Athletic Club in Sacramento, California, a fitness facility, reduced the water consumption of its laundry operations by using the Xeros machine by almost 50 percent.

Image credit: Xeros

How Little Steps Can Help Your Business Create Big Change for the Environment

By Dennis Hung

What does a business produce? The simple answer would be that every business produces a commodity of some kind, be it a product or a service. A more optimistic response might include the idea that a business should generate a profit. However, besides money and merchandise, there’s something else that every business produces: environmental damage.

In a 2010 study performed by the London-based firm Trucost, it was estimated that the 3,000 largest public companies in the world cause an annual estimated $2.2 trillion in environmental damage. And even though larger organizations may have a greater overall impact, smaller businesses can also cause significant damage when their leaders don’t take action to embrace a “green” corporate lifestyle.

But what can they do? It takes money to make the switch over to eco-friendly business, and given the current state of the world economy, many entrepreneurs and start-up businesses are barely managing to stay afloat as is. Well, there’s no need to give up hope; there are things that your business can do to help save the planet, without going bankrupt in the process. Here are a few tips on how you can go green, without having to spend all of your green.

1. Reduce paper use

Let’s just get something straight right off the bat: Paper is not an inherently environmentally-unfriendly substance. Paper is recyclable, clean, and most of it comes either from other recycled paper or from sustainable tree farms.

That having been said, every recycling program requires a significant amount of energy in order to convert used materials into usable material. As such, your company can help the environment by reducing its overall paper use where possible. One average, an office worker will use 10,000 sheets of copy paper every year, and the energy costs associated with using that paper often amount to more than the initial cost of the paper itself. Instead, rely on digital communication wherever possible, only using paper when absolutely necessary. You might even consider switching over to only accepting digital payments — such as credit card or bitcoin — in lieu of paper currency.

2. Save energy by switching bulbs

When the incandescent light bulb first made its debut in beginning of the 19th century, it forever changed the world. Of course, that was 200 years ago, and our technology has progressed since then.

Incandescent bulbs only use about 10 percent of their energy to produce visible light — the rest is bled off as unwanted heat, which makes them a costly, wasteful and inefficient design. Many businesses attempt to overcome this discrepancy by using florescent lighting, which is more efficient and lasts longer, but those who work under the green-tinted glare of a fluorescent tube often report health issues such as eyestrain and headaches, and the chemicals and gases used in fluorescents are often toxic, making environmentally-safe disposal difficult (and these issues apply to the smaller CFL bulbs as well). Instead, consider investing in LED lighting for your business. LEDs only use about a fifth of the energy of conventional bulbs, and can last upwards of 25 times as long.

3. Conserve water with low-flow fixtures

Depending on how old the toilets in your office are, you could be wasting upwards of seven gallons of water with every flush. Standard new models use substantially less (1.6 gallons per flush), but they still account for a substantial water use over time. You can save your company 20 to 60 percent on water utilities simply by investing in new low-flow fixtures. Also, make sure to have all of your plumbing fixtures checked for leaks and drips, as a drippy faucet or running toilet can end up costing you significantly over time.

4. Allow employees to telecommute

A vast majority, 86.1 percent, of Americans commute to work via personal automobile. At the same time, fossil fuel use accounts for 57 percent of global greenhouse gas emissions. Add these two facts together, and you have a smoking gun indicating that the average employee commute is doing serious damage to the planet. Now, consider for a moment just how many of your employees really need to come into work every day. We live in the age of communication, and a large percentage of the workforce could easily do their jobs from in front of their own home computer.

Nowadays employees can use cloud computing to access important files, oversee customer relationship management and contact management software systems, and even correspond with the rest of the company. This would reduce (or even eliminate) issues surrounding office energy, water, and paper use. It would also go a long way towards decreasing daily carbon emissions. Despite all of this, many employers still cling to the outdated practice of forcing their workers to come to the office every day. You can break the cycle and allow your employees to telecommute; it will save your office money, and will help the environment at the same time.

5. Promote green business practices to your colleagues

Once you’ve gotten your own organization as green as it can be, your next step is to promote green practices in the companies that you do business with. There’s no special formula here; just familiarize yourself with other companies, and only do business with those who are striving to meet green standards. As environmentally-unfriendly businesses start to see a drop in profits, they’ll have more incentive go green, and you’ll have made an even greater impact than you ever could alone.

Hey, your business can produce more than just profits, products, and environmental problems; with a bit of effort and a focus on the planet, you can turn your company into a well-oiled green machine, and if you end up saving a bit of money in the process, well, that doesn’t make it any less noble.

Dennis Hung is a freelance writer and business consultant. He's spent the last ten years of his career focusing on writing about businesses and their best practices.

Is LEED Becoming the New Normal?

The LEED certification program has its roots back in 1993, when David Gottfried and Mike Italiano founded the U.S. Green Building Council (USGBC). The aim was to promote sustainability throughout the building and construction industry, which naturally involves standard-setting, and so just a few years later, in 2000, about 60 private and nonprofit sector stakeholders gathered to launch LEED (Leadership in Energy and Environmental Design).

Since then, USGBC has grown to 76 chapters with 13,000 member companies and other stakeholders, along with a roster of more than 181,000 credentialed LEED professionals. According to USGBC, currently more than 4.5 billion square feet of construction space have gone through the LEED system.

Just by the numbers, LEED has clearly gone mainstream. Acceptance by leading global companies like Mariott is another mainstream marker. Even the U.S. Department of Defense has adopted LEED standards to help fulfill longstanding energy conservation mandates, despite opposition from the usual suspects (yes, Sen. Inhofe, we mean you).

This poses an interesting problem. If LEED certification is the new normal, how can it make your business stand out from the crowd?

LEED basics

For those of you who are unfamiliar with LEED, there are actually five LEED variants, each tailored to a different sector of the building industry: Building Design and Construction, Interior Design and Construction, Building Operations and Maintenance, Neighborhood Development, and Homes.

Depending on the sector, property owners can seek LEED certification for work on existing structures as well as new construction.

The system was designed for accessibility, so instead of establishing one blanket level of certification there is a basic "certified" category and three successive levels of higher achievement, the now-familiar Silver, Gold and Platinum certifications.

The level of certification is awarded through a point system, which is broken down into six categories. The Sustainable Sites, Water Efficiency, Energy and Atmosphere, Materials and Resources, and Indoor Environmental Quality categories are self-descriptive. The sixth category, Innovation in Design, serves as a catchall for measures that don't quite fit the other categories, which helps to keep the system flexible and open to new approaches.

Why choose LEED?

LEED, of course, is not merely window dressing for companies seeking to establish their green cred. The bottom line benefits are well documented in terms of operational costs and utility bills, and the point system is designed to enable construction costs at or below non-LEED standards. USGBC also points out some additional bottom line factors:

...Businesses and organizations across the globe use LEED to increase the efficiency of their buildings, freeing up valuable resources that can be used to create new jobs, attract and retain top talent, expand operations and invest in emerging technologies.LEED buildings have faster lease-up rates and may qualify for a host of incentives like tax rebates and zoning allowances. Not to mention they retain higher property values.

There is also a growing body of evidence to support these kinds of claims. A 2012 study of hundreds of PNC Bank branches, for example, found substantially higher revenue performance at LEED-certified branches, and LEED certification has also been linked to improved employee health.

On beyond LEED

The real beauty of LEED is that it provides a platform for leveraging a company's unique identity.

That's because while the LEED system sets goals, there is considerable flexibility in the strategies, products and materials that achieve those goals. Even if we're looking at a future where non-LEED is the exception and not the rule, there is still plenty of room for differentiation.

For example, just last month Triple Pundit profiled the family-owned Shore Hotel in Santa Monica, California, which is aiming for LEED Platinum certification. To earn LEED points, cement its cutting-edge image and satisfy growing customer demand for EV charging, the hotel features an advanced energy storage and EV charging platform from the company Green Charge Networks. To ice the cake, the storage system will cut the hotel's expensive utility "demand charge" usage by up to 50 percent.

Another example of a high-visibility LEED strategy is the U.S. Army Corps of Engineer's new billion-dollar LEED Gold office complex in Virginia. It includes a number of LEED-qualifying features designed to educate visitors and raise public awareness about sustainable design, such as a green-roofed visitors center as well as "green screens" for one of the parking lots, and landscaping designed for water conservation and natural stormwater management.

At the other end of the visibility spectrum, the iconic Empire State Building achieved LEED Gold certification through a series of energy efficiency upgrades that are all but invisible, in keeping with its historic status.

As for the Department of Defense, let's note for the record that it adopted LEED in 2010, only to see the Gold and Platinum aspects of the program restricted by Congress late in 2011. However, an independent 2013 LEED report provided substantial evidence of benefits to taxpayers for resuming Gold and Platinum. Unrestricted LEED goals were included in the National Defense Authorization Act for fiscal 2014, which President Barack Obama signed in January.

Image courtesy of UL Environment

Consumer Demand Could Turn the Tide on Sustainable Fishing

In 2006 Walmart sold fresh Atlantic salmon fillets in its stores for $4.84 per pound — an incredibly low price. Where did it all this cheap salmon come from? As it turns out, over the previous 10 years, fish farms had proliferated along the coast of Chile, a country far from the natural habitat of Atlantic salmon in the cold waters of the northern hemisphere.

Despite a lack of experience with fish farming, salmon became the second largest export of Chile, thanks in no small part to the huge market reach of the big-box retailer. As Charles Fishman documented in his 2006 book, "The Walmart Effect," Walmart bought all of its salmon from Chile, amounting to perhaps one-third of the country’s total exports.

Lax regulation and price-driven suppliers eager to meet Walmart’s demand led to exactly the kind of overcrowded, antibiotic-heavy, environmentally-destructive fish farms that environmentalists caution against. In 2007 an outbreak of an infectious disease led to a near-collapse of the salmon farming industry in Chile. Walmart, known for its ability to pressure suppliers to change their policies and decrease price, has since diversified its salmon purchasing. And Chile has started to improve its fish farm practices: In 2013 the country’s Verlasso farm became the first ocean salmon farm to receive a “good alternative” rating from the Monterey Bay Seafood Watch.

While Walmart is in a class of its own in terms of size, the point is that because of their massive purchasing power, large corporate grocery chains can wield incredible influence over product markets and even the policies of their suppliers. In the world of seafood, there are fairly immediate consequences — for better or worse — for the environment.

“Supermarkets are one of our strongest connections to the oceans,” reads the headline on Greenpeace’s latest annual report on the sustainable seafood policies of the country’s largest grocers. Indeed, large chain grocery stores are increasingly the source of consumer seafood purchases. Greenpeace’s latest Carting Away the Oceans (CATO) report, its eighth, showed some promising progress by large retailers, with Wegman’s rising up to become the fourth retailer to be awarded a “good” rating since the report began in 2008. Even Walmart was lauded for its efforts to introduce a private-label sustainable canned tuna product.

But the CATO report also cautions that human rights abuses regularly occur in the industry, along with dangerous levels of overfishing: The populations of top predators like tuna, swordfish and sharks have dropped by as much as 90 percent in the last 50 years. It calls for increased transparency from large retailers on their seafood purchasing policies.

According to Geoff Bolan, Commercial Director of the Americas for the Marine Stewardship Council (MSC), corporations have an “invaluable” role to play in taking care of the oceans:

“As large buyers of seafood, the rules they put in place through sustainable seafood policies and sourcing commitments translate into action through the supply chain back to the fisheries,” Bolan told Triple Pundit.

The MSC runs a fisheries certification and an eco-labeling program to encourage purchase of seafood produced using the most sustainable methods. The organization works with stakeholders across the seafood supply chain, from fishermen to grocery stores and was actually founded in part by Unilever as a response to declining fish stocks.

One thing is clear: Large and small companies are paying more and more attention to sustainability issues. Within MSC alone, the wholesale value of seafood products carrying the MSC eco-label rose 21 percent from 2013 to 2014. The increase in marketed sustainability products was driven by new and existing demand from producers, including Highliner Foods and Dr. Praeger’s, as well as new categories for sustainable fish like pet food and nutrition supplements.

“Corporations also need to figure out how sustainability fits into their own value proposition,” said Bolan. He says that whether companies pursue sustainable supplies because they want to hedge their risk against future seafood supply losses, or if they are looking to use sustainability to attract more customers, committing company resources is key. “[Sustainability] commitments without sufficient resources and empowered staff whose success is measured around these issues usually come up short,” Bolan said. He pointed to Loblaw Companies, Canada’s largest supermarket chain, as an example of leadeship at the top supported by strong team execution.

With increasingly visible campaigns by large grocers like Trader Joe’s, Whole Foods and even Walmart, it’s clear that sustainability is becoming more and more status quo, rather than a fringe niche. But Bolan points out that change at the corporate level is slow and there is constant room for improvement. What is needed to take corporate commitment to the next level?

According to Bolan, consumer demand will drive change at the organizational level.

“There’s no doubt that increased, quantifiable consumer demand would drive more action by large companies,” he said. And while government regulation may be helpful in other industries, the laws of supply and demand can go a long way in the world of seafood.

“When a major buyer transmits a message through its supply chain, that message is heard,” said Bolan. “When many large buyers transmit a similar message, there’s little room left for those who are not operating at such high standards.”

Image credit: Flickr/pedrosimoes

Risky Business: The Cost of Climate Change to the U.S. Economy

Editor's Note: Nik Steinberg contributed to this report.

In 2006, the British government released the world’s first and most comprehensive assessment of the economic impacts of climate change. The Stern Review on the Economics of Climate Change was instrumental in establishing unequivocally the link between physical impacts of climate change and economics. It helped dramatically shift the conversation on greenhouse gas mitigation.

Eight years later, the United States now has its own Stern Review.

Risky Business: The Economic Risks of Climate Change in the United States provides the most comprehensive assessment of the economic risks our nation faces from the changing climate. The report focuses on the clearest and most economically significant of these risks: Damage to coastal property and infrastructure from rising sea levels and increased storm surge, climate-driven changes in agricultural production and energy demand, and the impact of higher temperatures on labor productivity and public health.

Short-term costs in the billions

Let’s start with some of the short-term impacts; in climate-speak, short term is anytime between tomorrow and the next 15 years. The East Coast and the Gulf of Mexico will likely see an increase in the annual cost of coastal storms and hurricanes of $7.3 billion, bringing the total annual price tag to $35 billion on average. The agricultural sector in the Midwest and South may see decline in yields of more than 10 percent over the next 5 to 25 years if they don’t ‘adapt’ their crops and cultivation methods to the new climatic environment. Increases in temperature, heat waves and humidity will drive up demand for energy, calling for the equivalent of 200 new power plants across the country, which could cost up to $12 billion a year.

Long-term impacts significant threat to property and lives

As if this weren’t enough, the long-term projections present an even more dire outlook. In the Northeast, the projected costs of sea level rise are estimated at $9 billion in property loss each year, directly affecting 88 percent of the region’s population. In the Midwest, extreme heat is expected to last an additional two months by the end of the century, resulting in a 73 percent loss in crop yields. In the Southeast, extreme heat is expected to last an additional four months by the end of the century -- placing significant pressure on labor productivity, electricity costs and capacity -- and could lead to 11,000 to 36,000 additional deaths each year in the region.

The report also makes the important connection between financial capital and human capital, providing estimates on the changing patterns of labor productivity and human health as a result of climate change. To quantify the potential impacts on human health, the report utilizes the Humid Heat Stroke Index, or HHS, to measure the combined stress of heat and humidity on the human body. Findings show that in the Midwest HHS will reach dangerous levels at least two days in each year by the end of the century and by as much as 20 days each year by 2200, during which time it would be impossible to remain outdoors without putting one’s life at risk.

This chart from the report (right) offers a striking display of how average summer temperatures could increase if we don’t curb GHG emissions.

Similar if not more severe temperature predictions are reserved for the South and Southwest where labor productivity could drop by 3.2 percent in key sectors like mining, agriculture, construction, utilities, transportation and manufacturing. With a focus on average and extreme temperature increases, the report alludes to the challenges of switching from natural gas and oil-driven heating to electricity powered cooling.

With the exception of the Northwest, electricity demand and costs across the U.S. are expected to rise between 2 and 7 percent by mid-century. In somewhat uncertain terms, the report refers to greater pressure on the electrical grid system, along with local hospitals, banks and insurance companies.

Reducing emissions – and more

An immediate and obvious conclusion from the report is the need to ramp up our greenhouse gas (GHG) mitigation efforts. The report's authors administer a healthy dose of the precautionary principle, urging leaders in business, investment and the public sector to consider the potential material risks of climate change at the regional and national level. Acknowledging the urgency behind climate change and the ever-increasing rate of range, these sectors are urged to reallocate capital to strategic mitigation investments in the short-term.

In the absence of aggressive adaptation measures, the Intergovernmental Panel on Climate Change reports that the threshold for keeping planetary warming at a tolerable level could be as little as 15 years. The Risky Business report effectively conveys this message in business terms and presents the material risks of climate change by highlighting the severe impacts on the U.S. economy and our collective inability to ameliorate such risks in the near future.

Another important take-away is the need to start adapting to climate change – and fast! Even in the most optimistic scenario where the planet successfully contained GHG emissions, we are still bound to experience significant impacts from GHG already accumulated in the atmosphere. But while we have a pretty good sense of how to reduce our GHG emissions – the main hurdle is political, adaptation is a different story altogether.

Managing climate risks: What does it mean for businesses?

It’s one thing to be convinced we need to adapt, it’s another to understand and be able to quantify the many ways climate change may impact a business’s value chain. Climate change can impact businesses in their supply chain, their operations, their manufacturing or production processes, and their distribution network. It can affect the infrastructure businesses need to operate, shift consumer preferences or make products obsolete. The impacts of climate change can be gradual or abrupt, hit tomorrow or in 30 years.

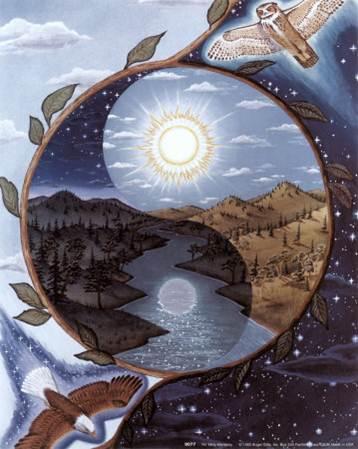

Businesses may at times forget how they depend on ecosystem services, even if they’re not sectors directly dependent on natural resources like agriculture or mining. At the end of the day, businesses (and the humans that run them) all depend on food, fresh water, fiber, fuels, and other biochemical products that nature provides. Certainly, not all sectors are born equal from that standpoint – but the most sophisticated tech products still need water and energy to be manufactured, and minerals to be processed.

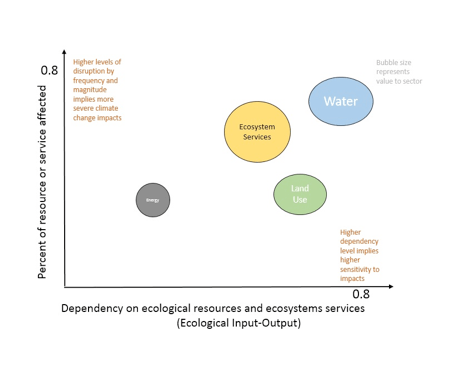

The chart at right, drawn from the Millennium Ecosystem Assessment Synthesis Report, illustrates the many ways ecosystems support human and economic activities.

And finally, not all companies are equipped to respond and rebound from this kind of disruptions. Any modern computers and servers and A/C and telecoms – all of which can be subject to disruption due to extreme weather events and costs increases over time. But some companies have business continuity plans and backup generators, and others may be put out of business by an extended power outage.

Taking action

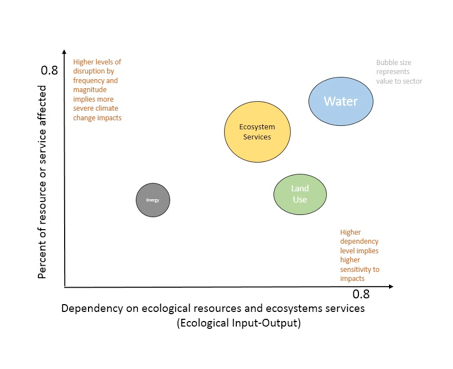

These differences can be analyzed, measured, and addressed. At Four Twenty Seven, we’ve developed a methodology to quantify the relative sensitivity of businesses to climate change that captures both their reliance on natural systems (ecological dependencies) and their exposure to weather variability, both in their operations and in their supply chain. We also have tools to assess an organization’s ability to respond to predictable and unpredictable changes.

This diagram illustrates how ecological dependency can vary by sector, hence creating different climate risk profiles for different companies (Source: Four Twenty Seven, Inc.).

There’s no silver bullet to climate adaptation. But there are practical tools and steps a business can take to understand its exposure to risk, estimate potential costs and develop effective adaptation measures. The Risky Business provides an important economic context for the nation – now it’s time for businesses to start looking at climate risks in their own operations, and focus on building resilience.

Image credits: Risky Business

This post was originally published on the 427 blog.

Emilie Mazzacurati is Founder and CEO and Nik Steinberg is a Climate Risk Specialist with Four Twenty Seven, Inc., Four Twenty Seven provides innovative tools and services to organizations seeking to understand climate impacts, assess risks to their operations or their stakeholders, and increase their resilience by developing and implementing climate adaptation measures. Contact us for a free preliminary assessments.

Solar Leases May Scare Off Potential Homebuyers

Imagine saving money on your electric bill and locking in today's price for your future bills with no money down. Solar leases have helped fuel the residential solar market boom, with installations increasing by 60 percent from 2012 to 2013. Now that some homeowners with solar leases are putting their homes on the market, the deal doesn't seem as sweet. Solar leases may scare off potential homebuyers, particularly if they don't understand them.

Some homebuyers are shying away from buying homes with solar leases, seeing them as liabilities instead of assets. The lease does require the homeowner to purchase solar electricity from the lessor, typically at a slightly lower rate than what's provided by the utility. Homeowners typically save money from day one -- while locking in the power purchase rate for years to come. SolarCity locks the electric rates for 20 years, thus serving as a hedge against rising energy costs.

Considering that home equity lines of credit have become more difficult to obtain and many homeowners can't pay the upfront cost of a solar system, a solar lease is an appealing option to utilize solar energy, reduce electric bills and mitigate the impact of rising electricity costs.

“They’re essentially moving into a home with a lower cost of ownership, a lower cost of energy, so a solar lease shouldn't make it harder to sell a house," said Jonathan Bass, a spokesman for SolarCity. “It becomes a selling point instead of a point of misunderstanding.”

Why are homebuyers shying away from leasing homes with solar systems?

Lack of understanding may deter buyers

In many cases where homes with leased solar systems are harder to sell, it is likely fear and lack of information that deters buyers. Certainly, saving old electric bills and contracts to prove how much energy the seller saves is prudent, as is hiring a realtor that understands solar leases.

Credit standards limit transfer of solar leases

The solar leasee usually requires the homebuyer (who will assume responsibility for the lease) to meet certain credit standards. In most cases, if someone qualifies for a mortgage, they will also meet the solar lease standards. In some cases, this can limit the pool of potential buyers, or require the seller to pay off the lease before selling the home. In such instances, the solar lease is truly a liability.

Foregoing tax credit and solar rebates

For home shoppers that wish to own a solar system outright, a solar lease is not usually a good deal. Although solar leases may shave a chunk off of monthly electric bills and be a good deal for homeowners that cannot afford the upfront cost of a solar system or cannot obtain financing for a reasonable rate -- leasing a system instead of buying a system does have its drawbacks.

A leasee does not receive the 30 percent federal tax credit or any local incentives that may exist. A $20,000 solar system for example (that is not leased) qualifies for a $6,000 federal tax credit. This reduces the value of taxes owed by $6,000 and is of greater value than a write-off. In addition, some states also offer rebates and other incentives for the purchase -- but not the lease of a solar system.

During a seller's market, the downsides of having a leased solar system may not be as pronounced. In a slow market, misunderstanding, credit standards, and foregoing incentives may scare off potential buyers. Unfortunately, sometimes going solar can have its drawbacks.

Image credit: Solar Service Inc. of Niles, IL

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Building & Design, Triple Pundit, Urban Farm, and Solar Today. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Cohousing & Ecovillage in Midcoast Maine with her husband and two children.

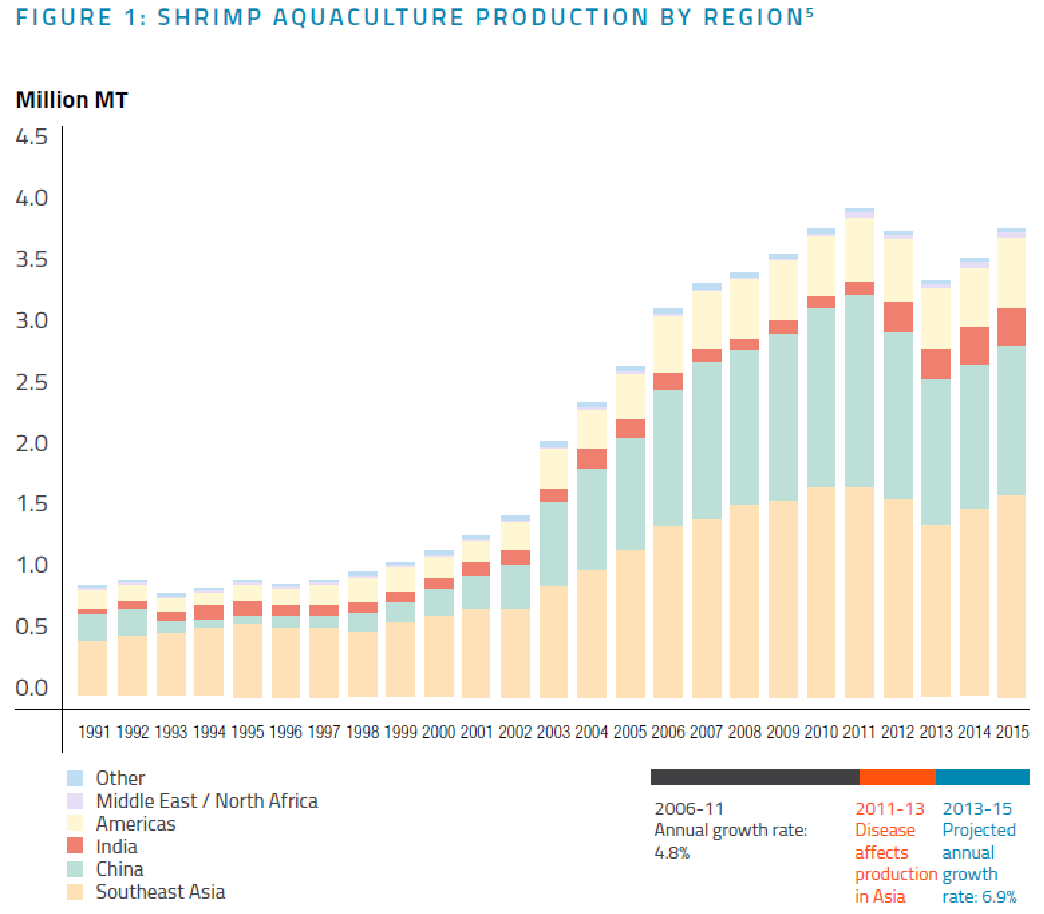

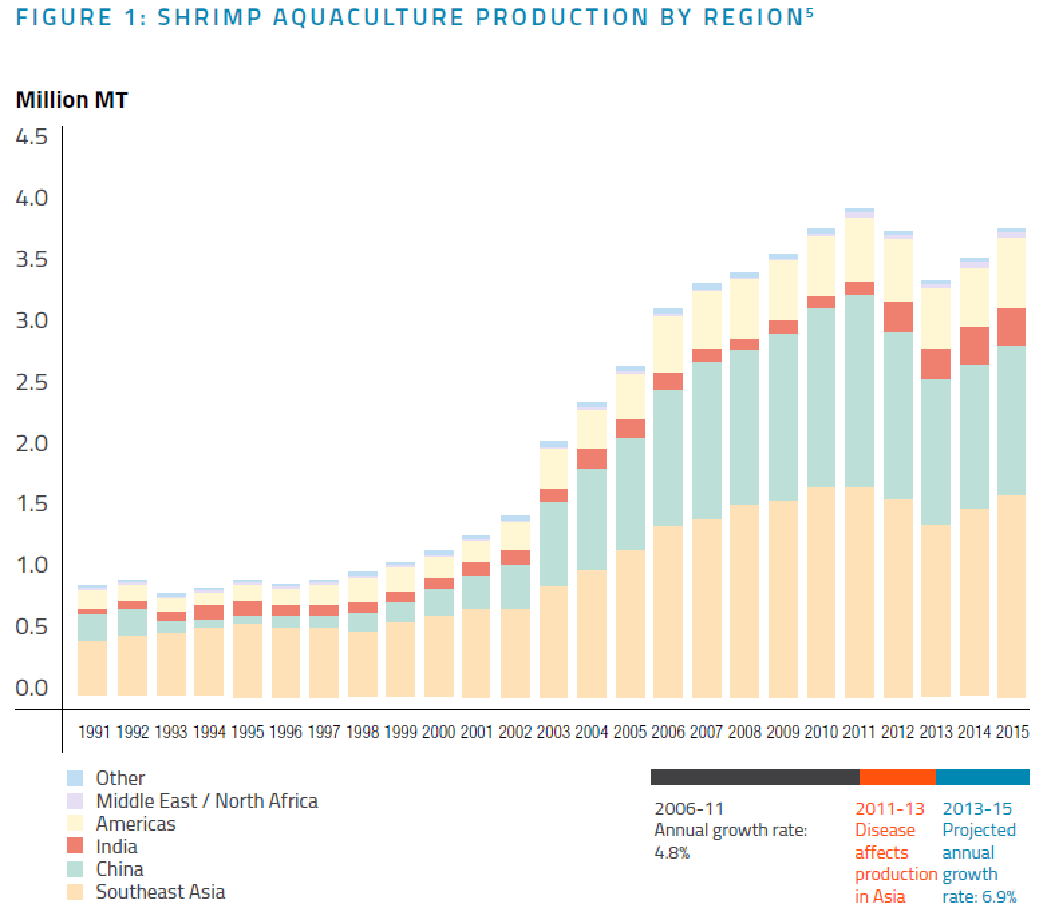

The High Cost of Cheap Shrimp

Thanks in large part to aquaculture, global shrimp production has increased by an average 13 percent per year since the 1980s. Prices have dropped nearly 30 percent. That's turned shrimp from a luxury food item into one of the most popular and affordable seafood products in the world -- and made shrimp aquaculture a lucrative and important industry in Asia and other developing regions.

While the benefits of lower prices and greater availability are clear for consumers to see, the social and environmental costs associated with shrimp aquaculture and fishing are often not. As a report from CSR Asia highlights, shrimp production as it's being practiced today is associated with environmental degradation, excessive use of antibiotics and chemicals, and land grabs -- not to mention scandals revolving around slavery and human trafficking.

In “Opportunities for Inclusive Business: A Case Study of the Shrimp Value Chain,” CSR Asia brings to light 10 key challenges facing the shrimp industry in three of the world's leading shrimp producing nations, then goes on to identify “possible entry points and interventions for inclusive business opportunities.”

Shrimp fisheries and sustainability

Shrimp is the world's most valuable seafood product, accounting for about 15 percent of the total value global fisheries products in 2010. Of the world total, 45 percent were wild-caught shrimp, which provided livelihoods for an estimated 900,000 fishers worldwide, CSR notes in its report.

The majority of shrimp are raised on small-scale, open-air farms, mostly in developing countries, where the costs of land and labor are relatively low. Falling shrimp prices have been raising the pressure on shrimp farmers, leading them to decrease already-low wages for the predominantly poor residents and migrants who work for them.

In its report, CSR Asia zooms in on the shrimp fishers, farmers, processors and processes in three leading shrimp-producing nations: Thailand, Vietnam and Indonesia, the world's second, third and fourth largest shrimp producing nations after China, the world's largest.

There are some important differences among these leading shrimp-producing nations, however. China's shrimp production is mostly consumed domestically. Most of the shrimp produced in Thailand, Vietnam and Indonesia, in contrast, is exported to major markets in the U.S., Japan and the European Union (EU). Thailand is the world's largest shrimp exporter.

10 critical challenges

Greater awareness of economic, social and environmental problems along the shrimp value chain has led to increased scrutiny by international NGOs and other public interest groups, which are exerting pressure on governments and multinational businesses to take actions that could resolve them.

The fact that the shrimp is industry is made up of many small enterprises with low revenues makes this all the more challenging, CSR Asia points out, but the seriousness of the problems merit prompt, concerted action.

“Whilst the complexity and limited transparency of the shrimp value chain may make it difficult for companies to take action, it is clear that ‘business as usual’ is neither sustainable nor consistent with increasing the incomes of poor people involved in shrimp fishing, farming and processing.”

CSR Asia identifies the following as the 10 critical challenges facing shrimp industry participants:

- Overfishing

- Fishing practices

- Mangrove destruction

- Pollution

- Ecosystem disruption from introduction of non-native species

- Disease

- Consumer health and food safety

- Human rights

- Child labor

- Land grabs

In turn, these ills bring along a host of associated business risks, CSR Asia notes. These include risks to reputation and the sustainability of supply and food security, the risk of embargoes and tariffs, volatility in prices and quality, the risk of worker protests, and the risks associated with ineffective implementation of industry standards.

Possible entry points for inclusive business

In its report, CSR Asia urges the entire spectrum of stakeholders to actively seek out “opportunities to develop much more inclusive value chains that can better involve the poor and increase benefits accruing to them.” As the report authors state:

“Businesses, consumers, NGOs,development organizations and local governments can work together to find solutions to problems through examination of new opportunities for inclusive business.”

CSR Asia defines inclusive business as “a sustainable business model that includes the poor in commercial value chains as producers, suppliers, distributors, employees, business owners and customers in ways that enhance the competitiveness of a company while simultaneously improving economic, environmental and social conditions in the communities in which it operates.”

An inclusive business strategy for the shrimp, or any, industry, CSR continues, requires “a package of interventions, including access to finance and capacity building for small fishers, farmers and processors.”

Leading companies along the shrimp industry value chain, CSR Asia asserts, “can help to increase the incomes of small producers and workers at the same time as modernizing the industry, ensuring improved labor practices, integrating sustainability factors and improving the traceability of products.”

So can other key stakeholders, including government, community leaders and NGOs. CSR Asia identifies 10 possible entry points that stakeholders can leverage in executing an inclusive business strategy.

*Image credits: CSR Asia