CCC questions fashion chain H&M’s living wage claims

As H&M launched its 2014 sustainability report, pressure group Clean Clothes Campaign (CCC) called on the Swedish fashion retailer to show evidence to back up the 'fair living wage' claims, the report highlights.

The clothing giant has committed to paying 850,000 textile workers a 'fair living wage' by 2018, but the latest sustainability report, contains no real figures to show progress towards this goal, CCC says.

Carin Leffler from the campaign said: “Despite announcing partnership projects with the ILO, education schemes alongside Swedish trade unions, and fair wage rhetoric aplenty, H&M has so far presented disappointingly few concrete results that show progress towards a living wage. H&M are working hard on gaining a reputation in sustainability, but the results for workers on the ground are yet to be seen.”

Athit Kong, vp of the Cambodian garment workers’ union C.CADWU commented: "H&M’s report does not accurately reflect the reality on the ground in Cambodia or Bangladesh and their PR rings hollow to workers who are struggling everyday to feed their families. A ‘sustainability’ model that is put forth and wholly controlled by H&M but is not founded in genuine respect for organized workers and trade unions on the ground is never going to result in real change for H&M production workers and only serves as a public relations façade to cover up systemic abuse.”

In the sustainability report, Karl-Johan Persson, H&M’s ceo, says that the company is “seeing positive developments on many fronts” in the living wage debate but does not give any exact figures.

“We started to test the so called Fair Wage Method, developed by the independent Fair Wage Network, in three role model factories, two in Bangladesh and one in Cambodia. These are factories where we have a five-year commitment and 100% of the capacity so we can have time to test this method and create best practice examples for our suppliers and our entire industry.

“Although it’s still early in the process, the initial results from the first factory that’s been evaluated are promising. Overtime has been reduced by over 40%, wages have increased, pay structures have improved just as the dialogue between the management and workers. At the same time productivity has also gone up,” he states.

Access H&M’s latest sustainability report here.

Picture credit: H&M

Barclays reviews MTR coal mining investment stance

Following years of pressure and protests from campaigners, Barclays has released a policy position statement on Mountain Top Removal (MTR) coal mining in which it states: “Provision of financial support to companies which are significant producers of MTR sourced coal will be agreed by exception only.”

MTR is a controversial form of coal mining in which entire mountain tops or ridgeways are destroyed, with enormous amounts of mining waste being dumped into nearby valleys, destroying waterways and communities. The practice has been particularly controversial in the Appalachia mountain region in the US.

According to research released in April 2014, Barclays was the lead international financier of coal companies practicing MTR, while between 2005 and 2014, Barclays was the fourth biggest financier of the coal sector as a whole, including coal mining and coal power companies.

Sam Lund-Harket, energy justice campaigner at Global Justice Now commented: “It’s significant that the bank that has been the most heavily involved in financing this destructive coal mining practice is now recognising the horrific impacts MTR continues to have on both communities and on vast swathes of mountain ecosystems.

"This is a victory for the account holders, civil society groups and Appalachian community organisers who have all put pressure on Barclays to stop financially enabling this particularly toxic practice, but there is still a long way to go.

"We need commitments from Barclays and other banks to stop bankrolling all fossil fuel companies.”

Yann Louvel, the Climate and Energy Campaign Coordinator for BankTrack added: "This positive move from Barclays will add pressure to other European banks that are still involved in MTR coal mining in the United States, like Deutsche Bank in Germany or Credit Agricole in France. They need to follow suit and stop financing MTR immediately."

Picture credit: © Alan Gignoux | Dreamstime.com

Unilever accelerates sustainable packaging target for 2015

Magnum and Walls ice cream maker Unilever has brought its sustainable paper and board packaging use target forward. The multinational FMCG giant will now source all of its paper and board packaging sustainably by the end of this year.

The new Wood Fibre Sourcing Policy will contribute to Unilever’s work to eliminate deforestation from supply chains and will also help to embed the Unilever Responsible Sourcing Policy, which supports Unilever's commitment to increase its positive social impact throughout the entire supply chain by improving the lives of workers and their communities.

Pier Luigi Sigismondi, Chief Supply Chain Officer commented: “The business case for doing this is clear. It helps us secure a sustainable supply of commodities into the future, and it is good news for forests and the people that live and depend on them. Action on forests can tackle emissions – at least 4.5bn tonnes of CO2 a year – while at the same time increasing food production sustainably and improving livelihoods.”

Greenpeace scales Arctic-bound Shell oil rig

Following six Greenpeace climbers intercepting an Arctic-bound Shell oil rig in the middle of the Pacific Ocean, and scaling the 38,000 tonne platform, Shell has taken out an injunction against Greenpeace USA.

Annie Leonard, Greenpeace USA executive director, said: “This injunction is Shell’s latest attempt to keep people from standing up for the Arctic. Shell thinks it can do whatever it wants, but there’s one thing the company still clearly fears--ordinary people standing up to save the Arctic.

“Shell wants activists off its rig. We want Shell out of the Arctic."

Last week, the United States Department of Interior approved Shell’s drilling lease for the Chukchi Sea in the Alaskan Arctic. This means that in 100 days, Shell could begin drilling in the Alaskan Arctic, maintains Greenpeace.

Picture credit: © Vincenzo Floramo / Greenpeace

How Can We Get More Women Involved in STEM Fields?

There is an economic recovery happening, though it isn’t happening everywhere. Some localities and some skills are seeing much higher levels of job growth than others. Careers in so-called STEM fields (science, technology, engineering and math) are among the best these days.

Jobs in STEM-related fields grew by 17 percent last year compared to almost 10 percent for non-STEM careers, according to the U.S Department of Commerce. Those are good jobs too, paying 26 percent more than their non-STEM counterparts.

But those jobs are primarily going to men. According to a study performed by the National Science Foundation, even though 57 percent of all bachelor’s degrees are going to women, only 18 to 19 percent of those receiving degrees in computer science, engineering, and physics were women. There are higher concentrations of women in certain STEM fields with 58 percent of social scientists and 48 percent of those in biological and medical science.

This has translated into the job market: While women comprise 47 percent of the job market, only 12 percent of civil engineers and 7 percent of mechanical engineers are women. More women are environmental scientists (28 percent) and chemists (39 percent), but even these figures are disproportionate.

Many efforts are now underway to address this disparity. Some are local efforts to provide “STEM equity” tours of manufacturing businesses to high school girls like this initiative in Simi Valley, California, or a girls-only STEM program at a high school in Summit County, Colorado. A number of colleges are creating special programs to lure women into programs like this computer science program at Harvey Mudd.

Then there are social media outreach efforts like a Foursquare check-in from outer space, the brain child of NASA's Stephanie Schierholz.

The American Association of University Women (AAUW) has made the construction of a STEM pipeline for girls and women a major pillar of its mission, which the organization pursues through research, creation of programs for girls, funding for female graduate students and lobbying their agenda at all levels of government.

The problem is apparently not only one of attracting women to STEM fields. Data from the Center for Talent and Innovation shows that in the U.S. women are 45 percent more likely than men to leave their STEM jobs within the first year. Among reasons given are: isolation, scarcity of sponsorship, inadequate feedback and hostile cultures.

Of course, there are many success stories as well. Sophie Vandebroek, Xerox chief technology officer, suggests: “Women should work in a company where they don’t need to be a trailblazer ... where other women have gone through a similar career path and the company supports work-life balance.”

She further advises: “Don’t be afraid to take on new opportunities, continuously educate yourself and work on challenging projects that make a difference to the world. Choose a project that you truly believe in so you love what you do.” This is the path that her daughter, an environmental engineer, has followed.

This April, the Institute of Electrical and Electronics Engineers will host the Women in Engineering International Leadership Conference in San Jose, California, which will focus on accelerating the careers of women already working in STEM fields to help them rise to higher levels. Vandebroek and numerous other high-ranking technical women and men will present.

Given the essential role that science and technology play in our society, it is critical that women’s voices be represented among those creating, directing and applying the advances that continue to come out of the laboratory. In many ways women are uniquely equipped to understand the implications of technology in society, and therefore no effort should be spared from including them in the process.

Additional resources: Women in Space database

Image credit: Rachel Haller: Flickr Creative Commons

Mining Companies Discover the Truth About CSR: It Pays

The history of the mining industry is filled with sagas of the old company town where workers not only received their pay, but also their food and their shelter -- where wages were low, work hours were long and options for advancement in standard of living were limited.

But there is another side to the story that in a strange way connects with the state of the mining towns of today.

As they invested in North America's industrial development, mining magnates learned that if they wanted to woo workers and maintain a stable workforce, they needed to be responsive to needs. They needed to provide housing, resources and, in some cases, health care. In short, they needed to ensure that the forbidding environment in which laborers were expected to work, live, sleep and raise their families supported the basic needs of its new inhabitants.

The mining industry of today faces similar challenges. I say similar because, in the end, its appeal to the towns and communities that have grown up around its mining claims, plants and developments have a bearing in its success, just like the marketing of its product. And perhaps more than in the 1800s and 1900s, a company's image is tied to its commercial success.

"When opposition to the mining industry materializes as social conflicts, then mining projects risk blockades, vandalism, and other acts of violence," points out Luis Garcia Westphalen, an intern at the Center for Mining Studies at the Fraser Institute in Vancouver, BC Canada.

Corporations have discovered in recent years that showing a vested interest in the community adjacent to their mining operations, or on whose land they may be operating, is one way of alleviating tensions with local residents and avoiding expensive conflicts. It not only demonstrates stewardship, but also recognizes the community's expectation that it will be, in some fashion, compensated for difficulties the mining operation may cause.

But this understanding hasn't always been the case. The watershed example is Chevron's recent settlement with an Ecuadorian community that sued the company for widespread pollution of its ancestral lands from 1964 to1992. The lawsuit took close to a decade and in 2011 yielded one of the largest financial settlements ($18 billion) in mining history. To date, Chevron remains embroiled in contentious litigation and expensive appeals. It has also impacted the corporation's global image and, indirectly, its dealings with communities in other regions of the world.

But ameliorating protests and negative press isn't the only reason that mining companies have become proactive in establishing corporate responsibility at worksite communities, these days.

Corporate social responsibility (CSR) "provides a way of responding to increasing consumer concern about how the products they buy are produced," writes the staff at MiningFacts.org. Extractive industries have discovered the added plus of transparency on their websites, in their press releases and in worksite communities. And "companies that are regarded as socially responsible may be more likely to be asked to do business with governments that are accountable to their citizens," a real plus for companies that have long-term operations in the country. In some cases, these initiatives receive government backing that helps defray cost.

When Rio Tinto provided a town in Ghana with clean water and education, it also led to a training initiative for 400 young individuals. The CSR program was underwritten by both Rio Tinto and the Canadian International Development Agency.

But the mining industry's increasing use of CSR as a means of avoiding social tensions isn't without its critics, said researchers Ralph Hamannn and Paul Kapelus. "In contrast to the business case argument for CSR, critical perspectives argue that CSR is primarily about greenwash," said the authors, in which the companies are accused of putting forth a concerned image "without significant change to socially or environmentally harmful business practices." In South Africa, these views have been reinforced by inconsistent efforts and lack of mandatory requirements that would ensure the community feels compensated for use and development of the property.

And that is, in part, because there are no legal requirements for a company to invest in such programs. "CSR is truly voluntary," Westphalen said. The corporation's decision to invest in a small-loan initiative to help community members start businesses or go to school helps the mining company as well as the community, but it isn't required by law.

International programs like the United Nations Global Impact and the Renewed EU Strategy 2011-14 for Corporate Social Responsibility have helped encourage and add framework for companies that see CSR as part of their social and business strategy.

Still, say Hamann and Kapelus, while"CSR-related claims, and particularly the reference to a business case for voluntary CSR, need to be treated with caution," CSR isn't greenwashing. It has a constructive purpose that benefits communities and when invested in wisely, can help reduce the impacts of an industry that increasingly is being seen for its detrimental environmental effects.

The question that other industries have had to address and seems equally current to the fossil fuel sector is how to migrate toward other investments while using CSR to minimize the impacts of extractive technology. Industries like waste management, which was at one time centered on carbon-expensive landfill operations, have found ways to use their technology to benefit communities, job growth, environmental preservation and, at the same time, migrate away from high carbon-based operations. Can the mining industry do the same?

Perhaps this will be the next question that the extractive industry needs to face. CSR initiatives like building schools, creating infrastructure and expanding diversified job growth are voluntary measures, but in today's commerce they are the essential tools to doing business. So is looking ahead toward the industrial and commercial changes that mandate a carbon-free future, and an enduring healthy environment.

Image of Red Ash Virginia, 1929: Jack Corn/National Archives

Mining protest: Keith Bacongco

Miner and daughter, 1974: Jack Corn/National Archives

Celebrating Previously Frozen Farmed Fish

Editor's Note: This post is an entry in the 5th Annual iPura Tweet & Blogfest at Seafood Expo 2015. It originally appeared on the Good Catch Blog. Read all of the Blogfest entries here.

By Ret Talbot

Well here’s a headline I never thought I’d write: “Celebrating Previously Frozen Farmed Fish.” But I just did, and now I need to explain myself.

I live in Maine, a state where it’s not infrequent to see the bumper sticker “Friends don’t let friends eat farmed salmon.” While I don’t take part in the categorical demonizing of the fish farming industry, I admit I personally tend to avoid farmed fish when presented with a choice. In part I don’t choose farmed fish because I live within a stone’s throw of the Gulf of Maine. I’m fortunate to have access to incredibly fresh seafood, the purchase of which puts money directly back into my community. For me, that’s an ethos that’s hard to beat.

What can I do for farmed fish?

After attending an aquaculture panel at the Seafood Expo North America (SENA15), however, I feel inspired to do more than simply pride myself on not demonizing farmed fish. In the same way Peter Tyedmers of the School for Resource and Environmental Studies at Dalhousie University and Michael Tlusty of the New England Aquarium inspired me last year at SENA14 to celebrate “previously frozen” fish, in the upcoming year, I am now feeling inspired to celebrate finfish aquaculture. In the coming months, I think I need to talk more about why aquaculture is essential to the seafood industry of the future, and I probably need to go so far as actually eating some (previously frozen) farmed fish!

“There has been a concerted campaign for many years to de-market farmed fish,” Neil Sims, co-founder and CEO of Kampachi Farms, said at the pane discussion at SENA15. “I think it’s time to undo it, and we need to consider how to do that.” The session was titled “2 Billion People are Coming to Dinner, Let’s Feed them Fish!” and was moderated by Scott Nichols, director of Verlasso Harmoniously Raised Fish. In addition to Sims, Josh Goldman, co-founder and CEO of Australis Aquacutlure, was also on the panel.

The science behind farmed fish

“There has been an accumulation over the last 10 years of some really compelling science that says that we need to be increasing the amount of aquaculture that we are doing in a significant manner,” Sims told the audience. Sims broke the science into three groups: consumer health, ocean health and global health.

When it comes to consumer health, Sims pointed to a 2006 paper by Mozaffarian and Rimm, which found that eating twice as much oily fish could lead to a 35 percent reduction in death secondary to heart disease in the U.S. Further, Sims said, “If Americans would double their consumption of oily fish, there would be a 17 percent reduction in overall mortality. That’s got to be up there with seat belts and smoking in terms of a public health initiative.” In short, as the U.S. Food and Drug Administration (FDA) recently advised, Americans should eat more seafood for its health benefits.

When it comes to ocean health, a significantly larger population eating significantly more fish presents a major problem. Sims cited Myers’ and Worm’s landmark 2003 analysis that concluded, “Large predatory fish biomass today is only about 10 percent of pre-industrial levels.” In addition, Sims cited Worm et al’s controversial 2006 paper that projected global fish stock collapse by 2048. Even if we take issue with the projections outlined in these two papers, there is still general consensus that we can’t significantly increase wild fish harvest as a means of meeting a growing global population. In other words, finding another source of fish -– “the best protein we can put into our bodies,” according to Ricard Stavis, president and CEO of Stavis Seafoods -– is essential for ocean health.

Of course these is still the question of whether or not aquaculture itself harms ocean health, but Sims pointed to two recent papers that show minimal to no negative effects when fish farming is done right (Price and Morris, 2013 and Rust et al, 2014). “Price and Morris concluded that if the water is at least twice as deep as your net pen, and you’re in at least a quarter of a knot of current, then you’re going to have no significant impact on the environment 30 meters or more away from your net pen,” said Sims. “Often they’ll be no measurable impact at all.”

Finally, in terms of global health, Sims directed us to the comprehensive analysis of the environmental impact of the world’s major aquaculture production systems and species released by WorldFish Center and Conservation International. “Aquaculture,” the 2012 report stated, “is the least impactful of all animal proteins.”

Very compelling

Wrapping it up, Sims said, “The science is very, very compelling. It’s indisputable. We should commit these references, these citations, to memory so that we can roll these out at every dinner party or every conversation that we have about why we need to be expanding aquaculture.”

Of course Sims works in aquaculture, so he has a vested interest in promoting it. Nonetheless the science is compelling. A lot has indeed changed since the early days of the “Friends don’t let friends eat farmed salmon” movement. The data increasingly support Sims’ narrative. Of course not all aquaculture is created equal, and outfits like Kampachi Farms, Verlasso Harmoniously Raised Fish and Australis Aquacutlure represent the gold standard and are not representative of aquaculture as a whole. Nonetheless, the fact that problems with aquaculture remain is not justification for categorically demonizing all farmed fish in the same way that the fact that there are problematic wild harvest fisheries doesn’t justify forsaking all wild fish.

There is much work to be done when it comes to both farmed and wild fishes, and I think the future will rely on a combination of the best of both worlds. I look forward to covering food fish aquaculture more in the coming year, and I’m also committing to supporting sustainable aquaculture with my own purchasing decisions.

Image credit: Kampachi Farms

Ret Talbot is an award-winning freelance science writer and photojournalist with nearly 20 years of experience covering stories from some of the more remote corners of the globe. From the icy summits of the Andes to the reefs of Papua New Guinea, his assignments have taken him off the beaten track and put his readers face-to-face with stories of adventure, new ideas and innovative approaches to commonplace issues. His current work focuses on the intersection of fisheries, science and sustainability.

Women and the Future of Investing

Editor's Note: This article originally appeared in the April 2015 issue of Green Money Journal on "Women and Investing." Read more excerpts here.

By Mellody Hobson

Discerning the ways in which women interact with and affect the investment sector has in the past been challenging, as very few serious discussions delved deeply into the subject. The most prominent conversations have tended to focus on the different approaches men and women take when it comes to investing, the disparities that exist when saving for retirement and wealth accrual, or similar comparisons. The more nuanced discussion regarding how women might shape the future of the financial services industry needs to be had.

As most know, women increasingly make up significant percentages of the total workforce in developing and emerging economies alike. In most Organization for Economic Co-operation and Development (rich industrialized) countries, women outpace their male counterparts in terms of college graduation rates. And the share of global wealth and earnings controlled by women is rising at a rapid rate. All of these factors make women the largest emerging market in the world – twice as big as India and China combined – with over $5 trillion in growth since 2009.

As a result, women are poised to have a massive impact on the investment and financial services spheres in the coming decades, and as such, conversations have moved away from stark gender comparisons toward discussions that focus on how the investing world must adapt and embrace women in their own right.

How far we have come – and where we are going

In order to understand the wave of change women will bring to the investment sector in the coming years, it is important to look at the evolution of women and wealth over the past few decades. Using 1980 as a base year for comparison, women comprised just 42.5 percent of the labor force in the United States. By 2012, women made up 49 percent – or half – of the U.S. workforce, with nearly 58 percent of adult women employed. Perhaps a clearer contrast: The number of women working has grown by 27 million in the last 35 years, while the number of men working has grown by just over 13 million. In the same time period, the wage gap has shrunk from 35 cents on the dollar to 18 cents – not the well-deserved parity that should exist, but progress nonetheless.

What does this progress mean for the current and future state of women in the economy, and in investing in particular? The fact is, these trends are only accelerating. For example, among households with at least $250,000 in bankable assets, women currently control a third of wealth in the U.S. and Canada. As such, of the top 25 percent of high-income American households, women already comprise one-third of the total wealth. Additionally, women already hold over half of all investable assets in the U.S., and that share is only expected to grow. Over the next two generations, women are projected to receive 70 percent of inherited wealth in the U.S. Finally, by 2028, the average American woman is projected to earn more than the average American man.

Viewed through this lens, we begin to see women will increasingly be the key growth market in terms of individual investors in our country. And the same is true globally. By 2018, working women will increase their earned income globally to $18.5 trillion, according to a 2014 report by the Transamerica Center for Retirement Studies. The global average of female earned income is expected to rise by about $8,000 by then. Currently, women control 27 percent of the world’s wealth, and women-controlled wealth is expected to grow at an average rate of 8 percent.

What are the ramifications?

Given the growing economic clout of women, there are a number of takeaways to be gleaned based on what we know about how women invest. Perhaps the biggest shift we can expect is an increased focus on socially responsible investing, as women are known to link their values with their investments.

Numerous surveys have born this out: High net-worth investors were asked how important social, political or environmental impacts were in evaluating investments. Of the women surveyed, 65 percent said these factors were “somewhat” or “extremely” important, while only 42 percent of men said the same. Another survey similarly found nearly 42 percent of the women questioned report they are “likely” or “very likely” to make environmentally responsible investments, compared with just 27 percent of men.

Interestingly, these views are also true for financial advisors. Female advisors report to be more interested than their male counterparts in using sustainable investing funds or strategies – that is, those that integrate environmental, social and governance (ESG) factors into the investment process – by a margin of 59 percent to 34 percent. As women invest more wealth, we are likely to see a much greater demand for socially responsible investment vehicles.

Which brings us to another expected trend: greater numbers of female financial advisors. The Certified Financial Planning Board of Standards is already trying to entice more women to consider the business of financial advice. Large financial advisory firms see the writing on the wall, and you can expect they will begin to place more emphasis on building their internal expertise on socially responsible investing. Hiring more women not only helps them do this, but it also allows them to better attract female clients. The beginning phases of this move have started to take place, as large firms such as BlackRock, Barclays and Bank of America begin to place greater emphasis on both impact investing and hiring more women.

Finally, I think the coming decade will see a surge in the number of publicly-traded companies with women in senior positions and on their boards. Catalyst, a U.S. nonprofit focused on expanding opportunities for women in business, continues to deliver research on the relationship between the representation of women on boards of directors and corporate performance. In its 2011 research, Catalyst found a 26 percent difference in return on invested capital (ROIC) between the top-quartile companies (with 19 to 44 percent women board representation) and bottom quartile companies (with zero woman directors).

Read Mellody's full article here.

Mellody Hobson is President of Ariel Investments and chairman of the board for DreamWorks Animation SKG, Inc.

Colorado's Solar-Friendly Communities Go National

The thousands of solar installers in Colorado – as in many other states – have a hard time developing energy regulation. As with most other green businesses, they are often small shops in a nascent industry.

Since the rules about rooftop solar are local (decided by towns or counties), more than half the cost of installation are now the “soft costs” of permitting and inspection, said Rebecca Cantwell, executive director of the Colorado Solar Energy Industries Association (COSEIA).

But COSEIA's Solar Communities program has made strides so far in streamlining the installation process, offering a $500 discount for customers of participating companies. The organization now hopes to expand its program to the rest of the country.

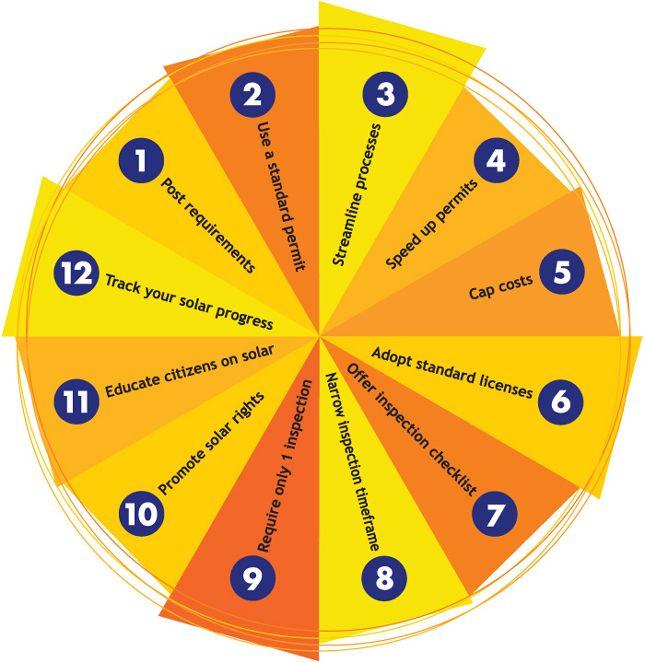

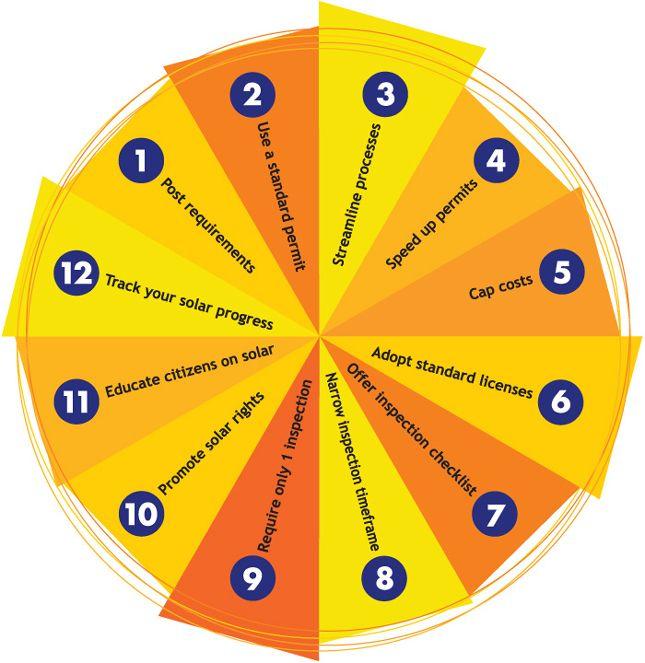

Solar Communities is a program sponsored by a Department of Energy grant through the Sunshot Initiative and managed by COSEIA, which works directly with local governments to help them implement 12 best practices for rooftop solar. So far, Solar Communities has certified 16 communities in Colorado as “solar-friendly” cities, ranging from Denver to Lyons. This covers over half the population of the state.

"Solar is growing incredibly fast," said Cantwell. "Cities might not have the resources to deal with them, and companies (working in different towns) might have to learn 50 different ways of doing business.

"Right now, putting solar panels on your roof is almost as complicated as a whole custom-home addition," she continued. "But it should be as easy as getting a new furnace. It should almost be plug and play."

COSEIA's staff has done a great deal of outreach to local governments in order to make this happen: In some cities, the city council took action, while some towns in Colorado learned about the program from each other. "In each case, it took a champion," she said.

The form is easy to look at online, and towns can start getting recognized by following the first three of the best practices the team developed.

COSEIA's 12 Best Practices for Local Governments (important enough to list all of them!)

- Provide a checklist of all requirements for rooftop solar photovoltaics and solar thermal permitting in a single online location

- Offer a standard permit form that is eligible for streamlined review for standard residential or small commercial rooftop flush-mounted systems

- Offer electronic or over-the-counter submittal and review options for standard systems

- Issue permits within a specified time frame

- Charge actual costs for permits and inspections with a cap on the total

- Replace community-specific solar licenses, if required, with standard certification for installers

- Provide inspection checklist that explains unique requirements beyond applicable codes

- Specify a narrow time window for system inspection

- For efficiency, require only one inspection for standard rooftop systems on existing homes or businesses

- Adopt ordinances that encourage distributed solar generation and protect solar rights and access including reasonable roof setback requirements

- Educate residents on solar energy by providing information on financing options and projected economic benefit

- Show your commitment to being a solar-friendly community by tracking community solar development and provide tools showing solar access in your community

Some of the best practices may not seem like a big deal (they wouldn't list fixing your website if there wasn't a need), but what they really affect is time. "For installers, time is money," as Cantwell said, but in this case, time is also the temperature of the planet.

Image credit: Colorado Solar Energy Industries Association

Finding the Value in Sustainable and Inclusive Business Activities

Editor's Note: This post originally appeared on the Business Fights Poverty blog.

By Kelly Liu

‘Potential cocoa shortage by 2020’ was an obvious business case for a company like Hershey to invest in being resilient to climate change in order to sustain long-term profits. Hershey has even surpassed its 2014 goals, announcing that 30 percent of its globally sourced cocoa is independently certified and verified. Cost reduction strategies by Pacific Rubiales Energy encouraged the development of a water treatment process that helped to avoid $400 million in spending over 15 years and simultaneously provided an estimated 2,000 local jobs, as well as water to irrigate crops in the water-scarce southeast plains of Colombia.

But how do sustainable business practices like these get initiated and valuated? Though materiality assessments continue to advance in sophistication, in order to initiate sustainable or inclusive business projects, managers must still demonstrate the business case, usually in the form of Profit = Revenue – Cost.

Achieving revenue growth in the name of sustainability is a difficult feat achieved by very few including Whole Foods, a large-scale U.S. grocery chain featuring natural and organic products. I’ve heard several industry practitioners complain that millennials have yet to walk the walk and actually pay more for sustainable products like they say they will, according to Nielsen’s data. However, other companies like Novartis have found the opportunity to add revenue streams and achieve top line growth through “inclusion.” Novartis targets lower-income or underserved populations in new or emerging markets through its Social Ventures program to expand access to healthcare.

The difficulty of measuring the performance of these activities and their ability to contribute to the top or bottom line is a hindrance to some companies, but not all. Just as the public relations industry struggled to confirm proof of concept in the early 1990s, the sustainability industry struggles to show proof of impact. Today, corporations understand the necessity of investing in PR as a risk mitigation strategy to avoid reputational damage. However, how much capital and billable man-hours must be injected into activities like these to achieve the desired outcome – or in the case of sustainable and inclusive business – the desired social, environmental and financial impact?

Sustainable and inclusive business projects are sometimes initiated at concessionary rates with the built-in expectation that they could perform below the cost of capital. Similar to pharmaceutical R&D, a portfolio approach allows some corporations to invest in some more risky projects to achieve overall balanced returns. Scorecards of many kinds, held proprietary by sustainability consultants, work to marry the qualitative and quantitative elements of measuring impacts such as supplier relationship satisfaction and product life cycle analysis. Corporations like Novartis that are reaching customers at the base of the pyramid receive small margins on a large consumer base, but they struggle to demonstrate impact on increased access to healthcare because so many other uncontrollable factors affect these consumers’ ability to achieve better health outcomes, such as poor living conditions and sanitation.

Despite the obvious hurdles of measuring performance per dollar invested, sustainable and inclusive business activities are still initiated top-down, bottom-up, and anywhere in between from within the multinational enterprise. So far, there is no unifying structure or one-size-fits-all approach to starting them; they can occur within compliance, quality assurance, procurement, and product innovation departments, to name a few initiation points. Providing data to prove the business case and developing actionable solutions to initiate sustainability efforts is difficult. However, managers of all levels still find ways to make impact as intrapreneurs.

I think these efforts to make an impact will not go unnoticed, even by the average consumer. Consumers are becoming more active in demanding transparent supply practices and can actively check where ingredients come from. Even the most watched event in America’s television history, this year’s Super Bowl, featured an ad promoting an “all natural burger” of grass-fed beef with no antibiotics, no added hormones and no steroids. Despite some skeptical response to the Nielsen data, maturing millennials with increasing purchasing power in the next 10 to 15 years could become key drivers of demand for more sustainable strategies. As employees, millennials have already moved the needle in demanding many corporations to act more responsibly, by exercising their choice to work at more socially responsible businesses.

As a research associate at the Institute for Business in the Global Context at Tufts University, I work to answer how businesses conduct sustainable and inclusive business activities and why they don’t invest enough. This collaborative program, funded by Citi Foundation, aims to build an empirical case for inclusive business, and strengthen the ecosystem for it to be more common for these developing profitable innovations with social impact to succeed with reliability at scale. By compiling data on how companies initiate and valuate these activities, we hope to share best practices with today’s practitioners in order to help them in their day-to-day challenges of managing sustainable and inclusive business initiatives.

Help us move the needle by telling us how you initiate and valuate the sustainable and inclusive business activities at your firm by taking our survey. Click here to take the survey.

Kelly Liu is a Research Associate at the Institute for Business in the Global Context at Tufts University.