April Means Earth Day and Twitter Chat Month at 3p

It's hard to believe that advocacy for environmental sustainability through the celebration of Earth Day began 45 years ago. In 2012, a documented 1 billion people participated in Earth Day celebrations across 192 countries, and in 2015, the issues are more pressing than ever.

As part of TriplePundit's observance of Earth Month, we're sharing with you no less than five unique Twitter Chats. The purpose of these online events is to talk about the challenges, successes and goals of our guests, as well as to hear your insight into various sustainability topics. Through these conversations, it's quick and easy to glean best practices and lessons learned from some of today's most esteemed corporate responsibility leaders.

New to Twitter Chats? Don’t worry! Read this.

Here is the line-up for April's events, with featured companies and guest speakers. Please mark your calendars and be sure to check back to this page for more details.

SAP: #SAPYouthChat on April 14 at 8 a.m. PT / 11 a.m. ET

This panel of leading innovators will share their expertise on empowering youth and developing the future IT workforce through science, technology, engineering and math (STEM) education.

- Alicia Lenze (@alicialenze), Global Head of Corporate Social Responsibility at SAP

- Simone Sneed (@catchbrilliance), Chief Relationship Officer at YesWeCode

- Hoa Tu (@BtechSchool), Principal of BTECH

- Sarah Austin (@sarahaustin), former SAP Hacker of the Year, Forbes 30 Under 30

HP: #LivingProgress on April 21 at 8 a.m. PT / 11 a.m. ET

On the eve of Earth Day 2015, HP Chief Progress Officer Gabi Zedlmayer joins us for a candid chat about the challenges climate change is posing to people, the economy and the environment.

- Gabi Zedlmayer (@GabiZed), Chief Progress Officer at HP

Kimberly-Clark and WWF: #RespFibers on April 24 at 9 a.m. PT / Noon ET

This Twitter Chat will showcase how Kimberly-Clark and WWF have worked together to create thought leadership in responsible fiber sourcing.

- Linda Walker (@BalanceWWF), Director, Global Forest & Trade Network-North America Program, World Wildlife Fund

- Iris Schumacher (@KCPNorthAmerica), North America Sustainability Marketing Leader for Kimberly-Clark Professional

Yum! Brands: #3pYumChat on April 28 at 9 a.m. PT / Noon ET

This chat will be hosted in honor of the Yum! Brands sustainability report launch, discussing themes from the most recent report, particularly the company's environmental goals.

- Laurie Schalow (@YumBrands), VP of corporate social responsibility at Yum! Brands

- Roger McClendon (@YumBrands), Chief Sustainability Officer at Yum! Brands

Anheuser-Busch InBev: #ABInBevBetterWorld on May 5th at 9 a.m. PT / Noon ET

AB InBev will share progress made in 2014 on its Global Citizenship efforts, particularly the achievement of meeting or exceeding its six company-wide Global Responsible Drinking Goals.

Tweeting from AB InBev (@ABInBevNews):

- Ricardo Rolim, VP, Global Sustainability

- Hugh (Bert) Share, Senior Global Director, Beer & Better World

- Rainer Meyrer, Global Director, Beer & Better World

- John Rogers, Global Director, Agricultural Development

Don’t worry, the chats don’t stop here, either. Stay tuned for upcoming Twitter Chats later this spring and summer with Hormel Foods on its CSR progress and MGM Grand on Women in Leadership, as well as continued STEM conversations with SAP.

Ikea Partners with the UN to Provide Pop-up Shelters for Refugees

Every year, millions of people are forced to flee their homes due to war, famine or natural disasters. In search of safety, shelter, food and clean water, many seek refuge in humanitarian camps. Some stay for years, others for generations. For many children, these camps are the only home they’ve ever known.

The camps are dark, cramped and chaotic places. There is no electricity or running water. The tents do not provide adequate shelter from rain, wind or extreme temperatures. Without privacy, proper sanitation or a sense of security, many refugees are in dire need of safety, dignity and a better place to call home, however humble that home may be.

In an effort to provide better, safer and more durable homes for refugee children and their families, the Ikea Foundation in collaboration with the United Nations High Commissioner for Refugees (UNHCR) launched Better Shelter, a social enterprise committed to developing innovative housing solutions for people displaced by conflict and natural disasters. The UNHCR has recently placed an order for 10,000 flat-pack shelters from Ikea to improve the lives of thousands of refugee families around the world. The shelters are durable, affordable, sustainable, easy to transport and can be built on-site without any additional tools. On a mission to revolutionize the refugee camp, Better Shelter uses design, technology and social innovation to create a better home away from home for millions of displaced people.

The innovative Better Shelter structures represent a major milestone in humanitarian, human-centered design. A weatherproof and social temporary shelter, they offer a more dignified home for displaced people and a more cost-effective solution for humanitarian organizations. Like much of Ikea’s furniture products, the structures are flat-packed into cardboard boxes for easy shipping. They are logistically friendly and easy to build. They can be assembled in four hours and include solar panels that provide enough energy to power a light or charge a mobile phone.

The homes were designed with and for the refugees. “Putting refugee families and their needs at the heart of this project is a great example of how democratic design can be used for humanitarian value,” said Jonathan Spampinato, head of strategic planning and communications at the Ikea Foundation. “We’re incredibly proud that the Better Shelter is now available, so refugee families and children can have a safer place to call home.”

The Better Shelter modular refugee housing unit received an honorary award at the Swedish Design Awards last year. One of the judges, design critic Alice Rawsthorn, described the project as "an unusually sensitive and intelligent response that not only promises to provide sorely needed shelter for people in desperate circumstances, but also a robust and congenial place for them to live, possibly for several years, before moving on to permanent homes.” This housing unit offers the millions of children and families forced to flee their homes every year an alternative to traditional canvas ridge tents or more modern hoop tents, neither of which provide proper insulation or last more than a few months.

"Many of the current shelters used in refugee camps have a life span of approximately six months before the impact of sun, rain and wind means it needs to be replaced. Yet long-term refugee situations mean that, on average, refugees stay in camps for 12 years," according to Ikea. Designed to last up to three years, the Better Shelter is a shed-like structure made of lightweight polymer panels, laminated with thermal insulation, which clip onto a steel frame. And, unlike a sturdy-but-claustrophobic cargo container shelter, each Better Shelter unit includes windows, ventilation and “a door that actually locks” as Gizmodo noted.

This project is an example of how technology, collaboration and practical application can fuel social innovation. "The realization that the people who need design ingenuity the most, the poorest 90 percent of the global population, have historically been deprived of it, and the determination to address that, have been one of the most important design developments of the past decade," Rawsthorne said. Driven by the belief that sustainable design can make a difference to the humanitarian world, Better Shelter started as a small design and innovation project in the woods of Sweden before evolving into a groundbreaking collaboration with the UNHCR and the Ikea foundation. The ideas were transformed into prototypes, which were then tested and further developed together with refugees in Ethiopia and Iraq.

Better Shelter offers an innovative approach to an old problem, providing a better home away from home for millions of displaced people. As reported by IRIN news, the first of the 10,000 units ordered by the U.N. will be sent to house some of the 2.5 million people in Iraq who have been displaced over the past year.

The shelters which are currently being manufactured for summer 2015 dispersal, represent an exciting new development in humanitarian aid, and one that will greatly improve the lives of people living in crisis all over the world.

Photo Credits: 1) R. Cox 2) & 3) Better Shelter

Yum! Brands Commits to 100 Percent Responsible Palm Oil

Fresh off yet another report that showed large companies have a long way to go before ensuring the global palm oil industry is more responsible and sustainable, Yum! Brands released a new palm oil policy. The purveyor of KFC, Pizza Hut and Taco Bell claimed it sought to remove palm oil for cooking in its restaurants by 2017. Now, the company says it will enact a plan to ensure its suppliers meet guidelines set by the Roundtable on Sustainable Palm Oil (RSPO).

Yum! Brands' policy is a step forward for the fast food industry, albeit a small one. According to the Union of Concerned Scientists (UCS), the United States’ fast food industry is lagging on palm oil sourcing and transparency. While Dunkin’ Brands has committed to a more robust palm oil supply chain program, other fast food companies are either vague about their commitments or have not disclosed a palm oil policy at all. A commitment from the likes of Yum! Brands would encourage its competitors to follow suit, therefore ending the environmental degradation and human rights violations that have marred the industry behind the world’s most consumed plant-based oil.

According to Yum! Brands, the company will draft a set of guidelines its suppliers must follow within two years. First, suppliers may not source palm oil from areas of high conservation value landscapes or high carbon stock forests — most of which are peatlands and swampy regions that serve as carbon sinks and release destructive amounts of greenhouse gas emissions when turned into palm oil plantations. Companies must also set traceability standards that go back as far as the oil extraction mill and include the validation of fresh fruit branches. Land rights must not be violated, and suppliers must also verify that they are following local laws and regulations.

UCS responded to Yum! Brands’ shift in policy with guarded optimism, praising the company for applying its new palm oil policy to all of its outlets across the world. One of the nonprofit’s analysts, however, noted that the company’s policy does not cover baked goods and sauces, which its various fast food chains purchase through a third-party vendor. UCS also urged Yum! Brands to be more transparent about the quantities of palm oil the company uses, as well as outline the steps it has taken toward implementing this new policy.

Anywhere from 80 to 90 percent of the world’s palm oil is sourced from Indonesia and Malaysia, which of course have borne most of the environmental destruction and social ills related to this industry. Rainforest Action Network estimates that at one point the amount of land converted from rain forest to palm oil plantations was equivalent to 300 soccer fields an hour. By 2025, 26 million hectares (over 100,000 square miles) in Indonesia could become palm oil plantations; currently that figure stands at 10 million hectares. In 1985, only 600,000 hectares (2,300 square miles) were devoted to the crop — demonstrating the explosive growth the palm industry has experienced in a generation.

As is the case with other high value, coveted crops — coffee, chocolate and even almonds — if these industries do not do a better job at self-regulation, they could face consumer backlash or fade away in another generation.

Image credit: Wagino 20100516

Climate Change -- Just a Data Problem?

By Jason Trager

Data and statistics, when used properly, can provide key insights to help companies make sense of a complicated competitive landscape.

Unfortunately, statistics are often misused. This is, in part, the lamentable result of leaders either improperly selecting or simply fabricating statistics to justify a foregone conclusion. At best, this tends to result in gross mischaracterizations of critical trends and, at worst, flat-out falsehoods.

Take for example, the bold statement made by Ted Cruz, a Republican junior Senator from Texas and U.S. presidential hopeful: “The satellite data demonstrate that there has been no significant warming whatsoever for 17 years. Now that's a real problem for the global warming alarmists. Because all those computer models on which this whole issue is based predicted significant warming, and yet the satellite data show it ain't happening.”

Cruz’s refusal to accept climate change as a highly reproducible scientific result is based on his particular statistical interpretation of the data. And, unfortunately, his nonprofessional interpretation leads to a false conclusion, that “it ain’t happening.” Just as a taster to illustrate how much expertise is required to correctly interpret this type of data, I highly recommend reading this article from the Washington Post.

In order to avoid politically fractious and polarizing opinions on key topics like climate change and energy efficiency, we need to dig deeper into the definition and interpretation of data and statistics.

“Data” is not the same as “statistics”

Data are representations of real-world phenomena. We can use these representations to learn about the world around us and identify a particular trend or event hidden in the data. These representations are deciphered with statistics.Statistics is the study of collecting, analyzing, interpreting, presenting and organizing data. Before using large quantities of data for practical applications, such as enabling and implementing positive environmental remedies, useful statistics must first be gathered that inform our understanding of the data.

The importance of choosing the appropriate statistical metric can be illustrated by a simple example with temperature data. First, consider a single-year average of global temperatures, which does in fact show several years over the last decade during which time global surface air temperatures declined.

This could potentially be useful, as it provides a somewhat focused summary of trends over a large geography and variability in global temperatures from year to year. However, the story changes quite a bit if instead we choose 10-year averages for our statistic. Looking at temperatures in this way shows a clear upward trend.

This upward trend is manifestly clear despite the short-term cooling or warming drifts that have occurred between recent individual years. This applies both temporally and geographically: Average temperatures globally are rising, but there’s snow in Washington, D.C. These are not conflicting pieces of information. We cannot learn about long-term or global trends with short-term or local statistics.

In other words, data represents events that occur in the world, and statistics provide meaningful insight about these events. However, fully understanding and implementing lessons learned from large datasets requires well-considered statistics. By using the wrong statistics we are answering the wrong questions. This means we might be missing or misrepresenting the story that the data tells.

Unfortunately, the statistics we use to understand global climate phenomena are telling a tragic tale, and we must find a way to change these trends. I believe that a large part of the solution to this process involves using mass production methodologies to roll out efficiency at a rapid and global scale. This methodology will be covered in my next post.

Image credit: Craig Mayhew and Robert Simmon, NASA GSFC

Jason Trager is CEO and co-founder of Persistent Efficiency, maker of the stick-on energy sensor. He is an energy scientist and sustainability engineer with a PhD in Mechanical Engineering from UC Berkeley. An experienced team leader, project coordinator, and fundraiser, Jason founded the Art Rosenfeld fellowship for energy efficiency at UC Berkeley for which his team raised over $600,000 in endowment funding. In addition to the fellowship program, Jason has created several full-time, recurring job positions at UC Berkeley for undergraduates through his Sustainability Champions Internship program and works with energy companies as a consultant.

Etsy Takes Its Social Mission to Wall Street

Since Etsy followed up on its ambition to go public by registering with the U.S. Securities and Exchange Commission, online commentators have expressed various levels of concern, anticipation, and extensive financial analysis and speculation.

As a certified B Corporation, Etsy's social and environmental performance should remain a designated priority. As a public company, it will have to answer to its shareholders and periodically meet SEC requirements, while maintaining its social mission. Will Etsy be able to win over Wall Street -- and as a result add a little handcrafted and sustainable flavor to the stock-trading game?

Recent changes in Etsy's Board of Directors may be seen as significant and supportive of its goals. In December 2014, Michele Burns was added to the board just before longtime board member and Chairwoman Caterina Fake stepped down to pursue other interests. Etsy's CEO, Chad Dickerson, described Burns as a "strong female leader who understands our passion to build a people-powered economy that fosters small business growth and entrepreneurship." He also mentioned that she identifies with Etsy's mission of economic empowerment within an online marketplace where the majority of its sellers are women. Burns is ascribed a sense for both traditional and emerging innovative commerce models, of which Etsy, naturally, considers itself the latter.

As of April, another new board member is welcomed into the Etsy family: Melissa Reiff. Her company, the Container Store, is built on pillars of the conscious capitalism movement -- with principles for conducting business that are akin to Etsy's philosophy of community-steered and values-driven initiatives. Dickerson's optimism for Etsy's future as a public company, while staying true to its social mission, is reinforced by human capital strategies. The first rung of the triple bottom line, so to speak.

When it comes to the triple bottom line, profit isn't listed after people and planet for no good reason. Profit, in some circles, still bears the weight of negative connotation. Many Etsy sellers, as well as buyers, are drawn to the artisanal-for-vintage marketplace because it offers them an opportunity to be themselves in creative, artistic ways and to trade in an environment shaped to focus on the finer things in life. It marks one's lifestyle rather than labels one as an average consumer or businessperson. There's room for all kinds of arts and crafts, global and local exchange, and free choice to keep transactions strictly business or allow for friendships to bud and prosper. Profit next to acknowledgment and appreciation for one's artistic talents or good taste seems just one of the perks in this community-based economy model.

Etsy is best known as a small-scale business. Its community likes independence. It craves and seeks authenticity. In other words: Etsy's community of buyers and sellers is not really concerned with the bigger picture and the lure of capitalizing on Wall Street. Some fear a change in the fees and rating system, much to the sellers' disadvantage. Others made attempts to translate IPO complexities into plain English for their fellow Etsy storekeepers, offering a friendly invitation to delve into the business side of selling on Etsy in order to gain more insight and, ultimately, deepen one's skills as a marketplace entrepreneur.

Whatever the future may bring, for a certified B Corp of this size to go public, it could create a precedent and draw attention to strike more business alliances for making a better world when making money. Or making money to make a better world.

Etsy will offer around 16.7 million shares at a price in between $14 and $16 per share.

Image credit: Flickr/jpellgen

How Government Subsidies Drive Deforestation and Inequality

Government subsidies remain a fundamental factor driving deforestation around the world, particularly in countries where export-driven natural resource extraction plays a big role in the economy. Unfortunately these habitats often include environmentally-critical tropical forests.

These subsidies represent a perverse economic incentive that poses a major obstacle in the international drive to reduce greenhouse gas emissions, combat climate change and forge pathways toward sustainable development.

Governments subsidized resource extraction and consumption (including water, energy and food) to the tune of up to $1.1 trillion per year in 2011, according to a McKinsey Global Institute study. “By reducing the price of a natural resource below the marginal cost to society, subsidies can have far-reaching impacts (positive or negative) on both investment and consumption,” U.K. think tank ODI (Overseas Development Institute) highlighted in a recently released research report.

In eating up a nation's natural capital, destructive forestry and natural resource extraction policies are also linked to land grabs, as well as ongoing marginalization and disenfranchisement of indigenous people and forest communities. Such practices greatly diminish efforts to forge more open, inclusive democratic governments and market economies.

Government subsidies driving deforestation

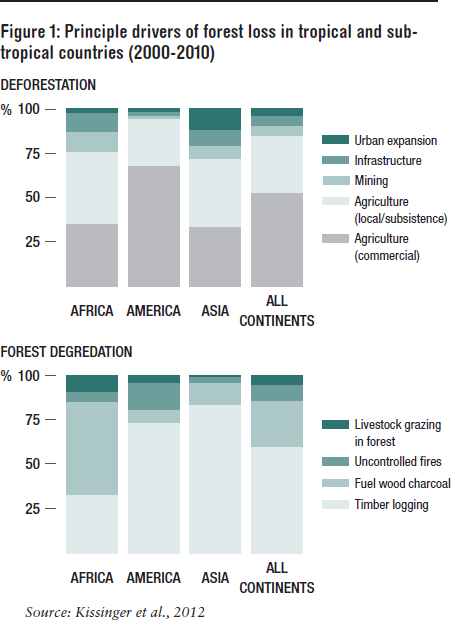

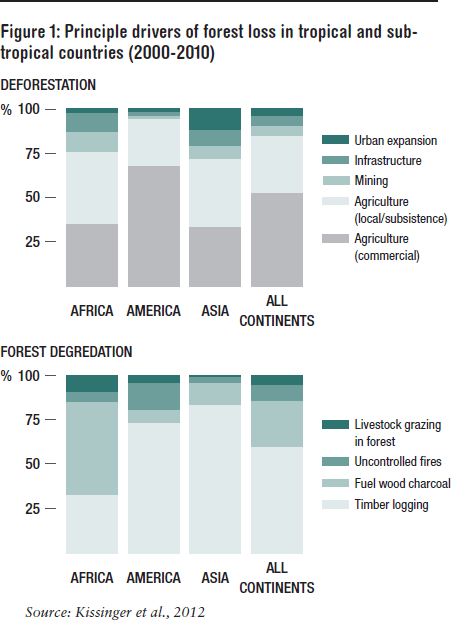

Timber and agricultural commodity production for global markets is a large contributor to global trade and national GDP. Deforestation accounted for 61 percent and 28 percent of Indonesia's and Brazil's respective greenhouse gas emissions, according to the ODI report. Subsidies that incentivize soy and beef production play leading roles in nations, such as Brazil, Congo and Indonesia, where large areas of intact tropical forest remain. These subsidies, moreover, pose substantial obstacles to instituting international, as well as national, agreements on climate change and sustainable development.

Estimates from a 2011 study from the Global Canopy Program pegged annual producer values for beef and soy globally at $14 billion and $47 billion, respectively. Those for palm oil totaled $31 billion, and the global export value of timber, pulp and paper was estimated to be $233 billion, WRI (World Resources Institute) reported in November 2014.

On the other hand, agricultural development as currently practiced is linked to 80 percent of forest loss globally, ODI pointed out in its report.

“Subsidies can accelerate environmental degradation through resource inefficiency, overcapitalization, overconsumption and by depriving the state of resources to support sustainable management,” ODI stated.

In addition to agricultural development, commercial timber extraction is another key driver of deforestation, “accounting for over 70 percent of forest degradation in Latin America and Asia,” ODI highlighted. ODI continued by citing the role mining, infrastructure development, urban expansion, uncontrolled fire, fuel wood collection and charcoal production play in tropical and subtropical deforestation. “In addition, it is estimated that between 2001 and 2012, $61 billion per year of the trade in commodities from Brazil and Indonesia (including beef, leather, soy, palm oil and timber products) was based on illegal conversion of tropical forests,” ODI said.

The OECD estimated that agricultural subsidies across 47 countries were worth $486 billion in 2012. As the World Resources Institute points out, these aren't evenly distributed. Between 2010 and 2012, researchers found that agricultural subsidies were highest in China ($160 billion), the U.S. ($145 billion), Europe ($121 billion) and Japan ($69 billion). Adjusted for GDP, subsidies were highest in Indonesia at more than 3 percent.

Forestry and agriculture experts from around the world continue to contribute to the United Nations' efforts to promote REDD+ (Reducing Emissions from Deforestation and Forest Degradation) as means of financing organizations that seek to carry out projects to reduce and minimize deforestation, if not eliminate it completely.

Deforestation, development and human rights

Government policies and subsidies that encourage natural resource extraction at the expense of ecological and socioeconomic considerations do not only run contrary to any notion of sustainable development. They also contradict and diminish the concepts of universal human rights and governments' obligation to develop “human capital” on an inclusive and equitable basis.

According to a detailed assessment of nine country cases produced by more than 60 indigenous forest communities from Africa, Asia and Latin America: “The global forest crisis is worsening and infringements of the rights of indigenous peoples and forest-dependent communities are rising.”

Convening in Kalimantan, Indonesia, a center point of deforestation and international efforts to reduce it, representatives from these indigenous forest communities spoke out regarding “the direct and indirect drivers of forest loss and shared their own assessments of the grave human rights violations and atrocities facing their communities and lands today,” Forest Peoples Program recounts.

By the end of the conference, they had completed work on and issued the Palangka Raya Declaration on the Rights of Indigenous Peoples. As Forest Peoples explained, the declaration makes the following demands for governments, international agencies and the international community:

- Halt the production, trade and consumption of commodities derived from deforestation;

- Stop the invasion of forest peoples' lands and forests by logging and other timber extraction, agribusiness, extractive industries, energy and conservation projects that deny fundamental human rights; and

- Take immediate and concrete actions to uphold forest peoples' rights at all levels (including the right to land, territories and the right to self-determined development).

An area three times the size of Germany – over 104 million hectares (~257 million acres) of the world's remaining intact forest landscapes -- were degraded from 2000 to 2013, according to a new analysis of maps released by the World Resources Institute, which worked with the Greenpeace GIS Laboratory, University of Maryland, Transparent World and WWF-Russia to produce them.

“Governments must take urgent action to stop IFL degradation by creating more protected areas, strengthening the rights of forest communities and other measures that protect intact forests for their economic, social and conservation values,” Dr. Christoph Thies, senior forest campaigner for Greenpeace International, was quoted as saying.

“The UN, donor countries and development banks also need to support developing countries to protect their IFLs. Finally, voluntary private sector initiatives such as the Forest Stewardship Council (FSC) and various roundtables on palm oil, soy and beef, can ensure that their standards for timber and agricultural commodities avoid IFL degradation.”

*Image credits: 1), 3) ODI; 2) Global Canopy Program

3p Weekend: 5 Signs American Food is Changing For the Better

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email thread and spend five minutes catching up on the latest trends in sustainability and business.

American eating habits have been the joke of the world for years. The fat, lazy American filling up on junk food and soda proved to be both a punchline and an unfortunate reality. But if recent trends are any indication, the American food industry may be changing for the better.

As consumers become more conscious about calories and wary of mysterious ingredients, food and beverage companies are forced to take notice -- and take notice they have: in the form of healthier options and expanded corporate social responsibility (CSR) programs. So, are Americans really ready for a turnaround when it comes to food? These five signs point to yes.

1. Old favorites feel the pinch

Long gone are the days of Americans chowing down on double cheeseburgers and extra-large sodas in their SUVs. Sure, drive-thru joints are still popular with some, but fast food and soda companies are seeing sales drop in the U.S., leaving them scrambling to regain market share.

Case in point: Each American consumed roughly 56 gallons of soda -- the equivalent of 1.3 oil barrels -- every year in 1998, Bloomberg Businessweek reported. In contrast, Americans now drink around 450 cans of soda annually (roughly 42 gallons), the same as they did in 1986. Likewise, fast food chains like McDonald's are seeing sales plummet, worrying executives and shareholders alike.

In an attempt to win back favor with consumers, fast food and beverage companies are rolling out more health-conscious options -- from Coke and Pepsi's stevia line to McDonald's 'artisanal' buns. But the question here is: Will it be enough?

2. CSR leaders take first place

While companies once synonymous with American eating habits -- like Coca-Cola and McDonald's -- take sales hits, modern and progressive alternatives are stepping into first place. Often cited for its industry-leading minimum wage of $10.50 an hour, In-N-Out Burger has one of the highest per-store sales in the business. And while the company doesn't franchise, leading to fewer stores and more modest systemwide sales, many investors admire its slow, steady expansion.

Likewise, Chipotle -- the fast-casual Mexican chain that's taken the lead on everything from local ingredients sourcing to supply chain transparency -- has seen sales surge: The company raked in more than 4.1 billion last year, compared to 3.2 billion in 2013, which amounts to a 27 percent increase. Comparatively, McDonald's saw its U.S. sales drop 4 percent in February alone.

3. Transparency becomes a must-have

As American diners become more conscious about what's on their plates, transparency is no longer optional for food and beverage giants. In response, we're seeing companies roll out sustainable sourcing policies for ingredients like seafood and palm oil.

Beyond that: More than two-thirds of supply chain executives surveyed in PwC’s 2013 Global Supply Chain Survey said sustainability will play an important role in managing supply chains through 2015 due to the potential to improve resilience, reduce costs and support growth. In an op-ed on TriplePundit, PwC's Shannon Schuyler predicted that this year "investors can expect to see increased collaboration at the supply chain level, leading the way for more sustainable sourcing."

4. Brands get real about controversial ingredients

From a Change.org petition targeting ingredients in sports drinks to Subway's "yoga mat chemical" debacle, it's clear that American customers are starting to give a hoot about what's hiding in their favorite foods and beverages. While some companies turn a deaf ear to mounting pressure to ditch controversial ingredients, a growing number are heeding the call -- and reaping the rewards in the form of higher sales and accolades from consumers.

5. Animal welfare initiatives gain traction

Chipotle made headlines earlier this year for removing pork from hundreds of restaurant menus after discovering a supplier had violated its standards. As Co-Chairman and Co-CEO Steve Ells put it in a February earnings call: "We could have chosen to replace this supply with pork from conventionally-raised pigs, [but] we decided not to because most conventionally-raised pigs are subjected to conditions that we find unacceptable.”

Its move was surely big news, but it came as no huge surprise to those in the CSR community, as Chipotle is a known leader in sustainable sourcing. But other brands seem to be taking notice of customers' mounting concern over animal welfare as well: Last month Costco, which sells 80 million rotisserie chickens a year, announced it will stop selling chicken and other meats treated with antibiotics. Other food giants -- from Starbucks and Panera Bread to Nestle, Chick-fil-A and even McDonald's -- have also adopted new animal welfare standards in the face of consumer pressure.

--

So, have Americans finally turned the corner when it comes to their eating habits? Only time will tell, but it sure looks promising.

Image credit: Flickr/badlyricpolice

McDonald's Needs More Than a Pay Raise to Win Over Millennials

You’ve probably heard the good news, and if you didn’t let me repeat it: McDonald’s will raise wages by more than 10 percent and offer new benefits to 90,000 employees working in the 1,500 U.S. restaurants it operates.

You might think this is good news for McDonald’s. It’s true that $9.90 per hour, the new average salary (as of July 2015), is still far from the $15 per hour fast food workers demand (and the reason some see this raise as a cynical move), not to mention that the increase doesn’t apply to 750,000 employees working in about 12,500 McDonald’s franchises. Yet, you could still see it as a step in the right direction that will help the company in its efforts to “get the turnaround going.”

Well, that might be the case for the paid employees, but not so much for McDonald’s.

Here’s the reason: McDonald’s main problem these days is with millennials, who seem to prefer fast-casual restaurants like Chipotle, Five Guys and Shake Shack to McDonald’s, or as a McDonald's memo bluntly describes: "McDonald's is currently not in the top 10 of millennials' (customers primarily ages 18-32) favorite restaurants." If McDonald’s can’t solve this problem, its future is at risk.

However, rather than taking a more holistic approach to solve this problem, McDonald’s seems to be taking random steps that are supposed to get it on the millennials’ radar, including “plans to offer breakfast all day and to retool a grilled chicken sandwich to use an 'artisan' bun and remove ingredients like maltodextrin.” The raise in the pay is just another one of these random steps, and therefore I doubt if it’s going to help McDonald’s solve its problem.

My argument is based on an up-to-date design-intelligence framework (think of it as design thinking version 2.0), which is user-centered but at the same time is also grounded in the context in which the corporation operates.

Using this approach McDonald’s would start with need-finding of the customers it wants to attract (what’s the job to be done?) as well as need-defending of the business (what should we really be about?). Only when it has a clear understanding of both elements could it synthesize them together and move on to the next step, which will be about idea generation (how to address the job-to-be- done?) and contextualization (does it make us more resilient? does it work for our stakeholders?).

Let me start with the need-defining. Here I’d like to use a quote from Karen King, senior VP and chief people officer in McDonald’s United States division: “What we’re doing is just one of many actions we have underway,” she told the New York Times. “We are and will be a modern, progressive burger restaurant, and this is just one step toward that goal.”

With all due respect to Ms. King, modern and progressive burger restaurant is not the first thing that comes into mind when thinking about McDonald’s. I bet that if you ask 100 people on the street what burger place is ‘progressive and modern,' most of them will think of high-end hamburger chains like Shake Shack or Five Guys and only one or two will think of McDonald’s.

However, it sounds very reasonable that “modern and progressive burger restaurant” is what McDonald’s wants to become. It’s important for McDonald’s not just to define very clearly what it wants to be about, but also to be honest about the journey it has to take to get there.

You can learn about the length of this journey from what Steve Ells, the CEO and founder of Chipotle, another fast food chain that could be described as progressive and modern, has to say about the differences between Chipotle and McDonald’s:

“What we found at the end of the day was that culturally we're very different. There are two big things that we do differently. One is the way we approach food, and the other is the way we approach our people culture. It's the combination of those things that I think make us successful.”

Again, this step (need-defining) requires honest reflection and clear vision: What does it actually mean to be modern and progressive? What values does it reflect? If McDonald’s wants to solve its problem it has to do it right.

The other part of the first step is need-finding. McDonald’s has to figure out what is the job-to-be-done that millennials hire places like Chipotle or Shake Shack to do. Is it about consuming quality fast food? Is it about going out with friends and having a good time in a cool place? Is it about the ability to see how your food is been cooked and customize your order? Is it about the customer service? Is it about the overall user experience?

I’m not sure McDonald’s actually figured this part out. So, when I read McDonald’s new CEO Steve Easterbrook explaining to the Wall Street Journal that the reason for the raise is that “motivated teams deliver better customer service,” and "delivering better customer service in our restaurants is clearly going to be a vital part of our turnaround,” I’m not sure if this would actually make a difference. If millennials seek, for example, a cool place to hang out with fast food that is not junk food at a reasonable price, would better customer service make any difference?

McDonald’s has a choice to make between taking a more holistic design-intelligence based approach and a more random, piecemeal approach. If it really wants to win over the millennials, it should know there’s a very small chance the latter one would work, with or without raising its employees’ pay.

Image credit: Roadsidepictures, Flickr Creative Commons

Is the Protest Against Nestlé Bottled Water in California on Point?

Agriculture may consume 80 percent of the water in California, and almond growers are alleged to use as much water as the Los Angeles and San Diego regions combined, but the state is still pressuring residents to cut back on their water usage. Meanwhile, more residents are questioning why beverage companies, especially Nestlé Waters, are allowed to pump water out of aquifers for pennies on the dollar during the ongoing drought and then sell it back to consumers as bottled water at a huge profit. Now the pressure is on in Sacramento, where activists say the companies are draining local aquifers of as much as 80 million gallons annually. They even formed a human barricade late last month, shutting down Nestlé’s local plant for the day.

The coalition, the “crunchnestle alliance,” complains that Sacramento Mayor Kevin Johnson and the city of Sacramento have allowed Nestlé to “drain” the city of precious groundwater with no oversight, no accountability and limits on what the company can sell back to consumers. Nestlé has responded with data suggesting the bottling plant only uses less than two-thousandths of one percent (0.0016%) of the city’s total water demand. Even if that figure were doubled, and then if the company included the amount of water used for the company’s local operations, Nestlé has a point when it states its water consumption is a relative drop compared to the total amount of water needed in Sacramento.

Like much of the ongoing debate over water in California, the arguments are over optics, not data.

Part of the reason why Nestlé has been criticized repeatedly is because of the company’s overall global reputation. Opponents of the company are quick to point out flaws in the company’s social and environmental record, and Nestlé’s responses on the public relations front are hardly helpful. Bland reminders that the company has partnered with Oxfam and is on the Dow Jones Sustainability Index, along with Nestlé’s reminders that it is a leader in “healthy hydration,” frequently come across as condescending. Such platitudes also do not answer the question whether the company is genuinely transparent about its operations in Sacramento, the High Desert, or other regions where it churns tap water into a “healthy alternative to other beverages.”

But at the same time, allegations about paramilitary death squads in Colombia murdering Nestlé trade unionists do not build or destroy the case whether Nestlé is running a responsible water bottling plant in California’s state capital.

True, anyone who knows how to use a calculator and is conscious about waste can make the statement buying bottled water is little better than throwing your money in the trash can—and the vast majority of those plastic bottles thrown away end up in landfills, not recycled or upcycled into cool sports gear. And yes, Nestlé, we know bottled water is a safe means of hydration during a natural disaster or humanitarian crisis, but we are discussing California, not Haiti.

So where should the angst over California’s water crisis be focused?

Despite all that water used to keep crops growing on California’s farms, agriculture comprises only two percent of the state’s economic output. While some local water districts have seen their water allotments slashed, the stubborn fact remains that water is still currently priced far too low considering its value. Furthermore, Governor Jerry Brown’s executive order—some analysts say in part his actions are because of the mess his father made when governor a half-century ago—relies too much on even more residential water restrictions. Telling Californians they need to conserve water even more to solve this crisis is akin to sending someone into an Uzi fight armed with a sling shot.

The Uzi fight, in this case, involve the large agribusiness interests that have said “NO” repeatedly to any more water price increases or a reduction in water allotments. Indeed, farmers in the San Joaquin Valley have made their case when they post signs saying “Food Grows Where Water Flows.” But the question that Californians need to ask is: what if a disproportionate of water flows to cultivate crops such as almonds—70 to 80 percent of which are exported and feeding people abroad? There are larger battles than Nestlé in what is becoming an increasingly bitter water war.

Image credit: Leon Kaye

Who Owns Private Prisons? Most Likely, You!

By Amy Orr

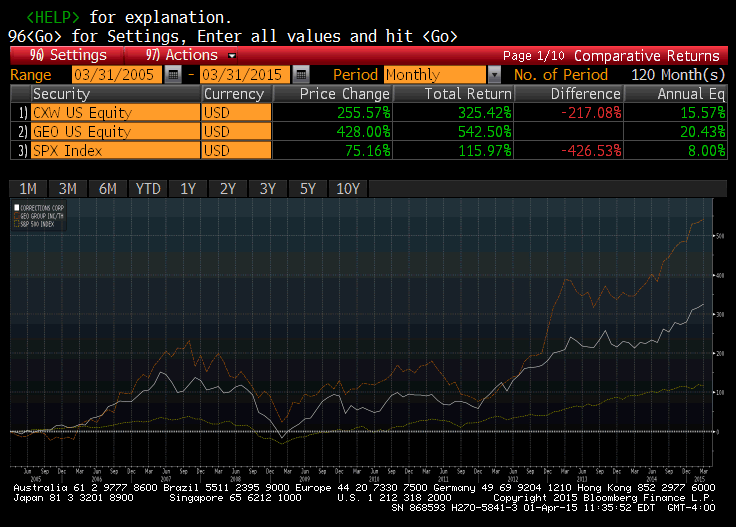

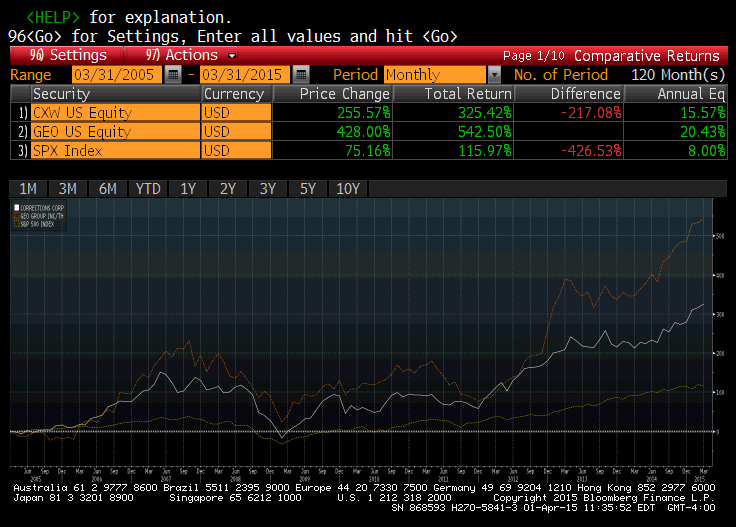

The Bill and Melinda Gates Foundation has been on the receiving end of public scrutiny for its controversial holdings in America’s two largest private prison companies – the Corrections Corporation of America (CCA) and the GEO Group (GEO). Why the controversy? Because CCA and GEO are notorious for their aggressive drive toward profit maximization at all costs – even in ways that exacerbate the social inequities that the Gates Foundation is supposedly organized to fix.

Before jumping on the bandwagon of criticizing Gates’ Foundation investments, we at the FB Heron Foundation decided to take a look at our own portfolio. We learned that Heron is also passively invested in GEO and CCA. In fact, anyone with broad passive exposure to the U.S. equity market through his or her pension or 401(k) plan is likely to have ownership of both companies. Surprise! Gates isn’t the only one.

Like many private foundations, Gates invests its Asset Trust with one objective: to maximize financial return on investments in order to grow capital to support the foundation’s philanthropic efforts. As a result, investment goals are considered separately from grant-making objectives. Considering this frame, private prisons are indeed an attractive investment that have the potential to yield stable financial return to an investor.

The demand for prison space is higher today than it has ever been and private detention facilities have grown to meet this demand. The federal private inmate population has increased by nearly 80 percent in the past decade, more than four times the growth rate of the total prison population (18 percent). Private prison companies have capital to invest in building and real estate, and in turn, benefit from stable revenues through subsidies and multi-year government contracts. They also have the ability to cut costs in ways that public prison systems cannot – via slashing healthcare and workforce reintegration costs. The business case has paid off to investors, as GEO and CCA stock prices have yielded annualized 10-year returns of 20.43 percent and 15.57 percent, respectively.

The reality is that very few of us — foundations or individuals — understand how externalized costs are fueling such strong investment returns, because most of the investment vehicles available to us are lacking in transparency. Those that do make the effort to look under the hood quickly find that data sources are deceiving. For example, private prisons are classified as Real Estate Investment Trusts (REITs), making it difficult for investors to know where to look for such investments. Private prisons could also mistakenly be flagged through data screens as “job creators” but it is unclear in annual reports how much of the workforce is comprised of inmates required by law to work and paid between 23 cents and $1.15 per hour for their labor.

Investors don’t have the tools they need to see how externalized costs are shouldered by inmates, their families, communities and ultimately taxpayers due to higher rates of assault and rape that occur in private prisons; cuts in health care spending and lack of resources to address PTSD and other mental illnesses commonly diagnosed in inmates; and the general lack of programming aimed at helping re-integrate inmates into society, find gainful employment and avoid re-arrest.

The FB Heron Foundation has embarked on the path of understanding the externalities (positive and negative) of our investments, and looking beyond the financial return to an investor to understand how such externalities are contributing to or detracting from our mission. Although we still have small investments in CCA and GEO today, we plan to divest from these and other enterprises that we consider to be net extractors. We consider ourselves legally obliged to make this change given our fiduciary duties as a tax-privileged organization (see Investment Policy Statement).

We encourage others to invest with the same premise but understand that the system itself is as much to blame as any individual investor. Ultimately, as investors and members of society we must demand a level of transparency in our investment portfolios that allows us to invest in enterprises that support a thriving society.

Image credits: 1) Courtesy of Bloomberg 2) The Prison Index

Amy Orr is the Director of Capital Deployment for the FB Heron Foundation.