What Will the Monsanto-Bayer Merger Mean to Us?

This week we saw big news in the world of Big Ag: The American GMO giant Monsanto agreed to be acquired by Bayer AG. The deal was variously reported as valued between $56 billion and $66 billion. So much has been written about these two companies that it’s hard to know where to begin in discussing the deal.

For starters, I think it’s safe to say that for a large number of people around the world, Monsanto would not be missed. While the company could be considered successful enough to be worth billions to a buyer, it also succeeded in becoming one of the most hated companies of all time. This is largely due to its penchant for producing dangerous and controversial substances, ranging from PCBs, to dioxin, Agent Orange, DDT, rBGH, polystyrene, aspartame, the glyphosate herbicide known commercially as Roundup, and the genetically-modified crops that were designed to increase its use.

Add the fact that the company made little distinction between marketing and bullying in its business practices, suing both critics and farmers in highly aggressive enforcement of its intellectual property and suppress criticism. The company also cut vast inroads into the federal government, placing its people in crucial oversight positions ranging from the FDA to the Supreme Court and leveraging those positions to strong-arm policies that were tailor-made to its liking.

Monsanto is not going away. It will simply be absorbed by Bayer, which will likely strengthen the biotechnology company. Details of the new company structure are not yet available

The buyer, Bayer AG, is a much larger and more diverse enterprise, perhaps best known for its over-the-counter healthcare products such as aspirin, Alka-Seltzer and One A Day vitamins. However, Bayer also has a sizable business in agricultural chemicals and is a huge supplier of commercial plastics. Its plastics division, Bayer Material Science (which was recently spun off and renamed Covestro), was a major supporter of the Solar Impulse program -- providing lightweight structural and insulating materials to enable the aircraft to reach its performance targets. The merger, if approved, would make the agricultural chemical division Bayer's largest.

Bayer is no stranger to controversy either. In its long history (the company was founded in 1863), it produced heroin in 1898, when it was still legal, and had strong and nefarious ties to the Nazi regime in WWII. (Its CEO publicly apologized to Elie Wiesel in 1995 for the company's involvement in the Holocaust.) Most recently, Bayer’s production of neonicotinoid pesticides -- which some linked to massive bee die-offs -- has come under fire. Not only has the company diverted attention by shifting blame to the varroa mite, which it claims is responsible for the bee deaths, but it also sued the watchdog group BUND, a German branch of Friends of the Earth, in an effort to silence criticism.

This proposed mega-deal could be the most controversial yet. Given the recent mergers between DuPont and Dow Chemical, and between Sygenta and the China National Chemical Corp., if approved the merger will reduce the number of companies controlling the inputs to the global food supply from seven down to four. This lack of diversity in seed stock will make the food system more vulnerable to diseases or other unforeseen events.

The combined Bayer-Monsanto company will own more than 30 percent of the global seed market. That means it would control, for example, the inputs for 70 percent of the U.S. cotton crop. Reduced competition will likely lead to higher prices, putting a strain on both consumers and farmers. Use of genetic engineering in foods and other crops will likely increase. Consumers will find less choices in the supermarket and innovation in areas other than those profitable to the company will likely be squashed.

Two former Justice Department officials, Maurice E. Stucke and Allen P. Grunes, claim the merger would violate anti-trust laws. Given their concerns, which mirror those cited above, the pair insists "the antitrust enforcers must not allow this merger to proceed."

More than 500,000 people already signed a petition to block the approval.

Speaking of all these proposed mergers, Food & Water Watch Executive Director Wenonah Hauter said: "The shocking consolidation in the biotech seed and agrochemical industry turns over the food system to a cabal of chemical companies that would make it even harder for farmers, consumers and communities to build a vibrant, sustainable food system."

The food industry, apparently in imitation of the banking industry, is approaching the too-big-to-fail point, when it will become too late for even the government to control their behavior, their risks, and their determination to shift the objective of the global food supply system from that of providing nutrition to that of maximizing profit. Does anyone out there, besides perhaps their major investors, actually think this will make the world a better place to live?

Image credit: Mike Mozart: Flickr Creative Commons

Is Airbnb's New Anti-Discrimination Policy Too Little, Too Late?

Airbnb has been plagued with accusations that African Americans attempting to book accommodations are met with discrimination. A lawsuit filed earlier this year alleges that 25-year-old Gregory Selden faced discrimination by an Airbnb host. And a study published in January found that requests for Airbnb lodging from people who have "distinctively African-American” names were about 16 percent less likely to be accepted than “identical guests with distinctively white names.”

Earlier this summer, Airbnb announced that it would review its anti-discrimination policies. The company brought on Laura Murphy, former head of the Washington, D.C. branch of the American Civil Liberties Union (ACLU), to write the new policy.

Airbnb released a report last week that details the policy. In the introduction, Murphy assured customers that Airbnb is “putting in place powerful systemic changes to greatly reduce the opportunity for hosts and guests to engage in conscious or unconscious discriminatory conduct.”

At the heart of the policy is the Airbnb Community Commitment. Starting on Nov. 1, everyone who uses Airbnb will be asked to uphold the following commitment: “We believe that no matter who you are, where you are from, or where you travel, you should be able to belong in the Airbnb community. By joining this community, you commit to treat all fellow members of this community, regardless of race, religion, national origin, disability, sex, gender identity, sexual orientation or age, with respect, and without judgment or bias.”

In addition to this commitment, the company put new rules in place that it claims are “stronger than what is required by law.” Here’s an overview:

- A permanent, full-time product team to fight bias made up of engineers, data scientists, researchers, and designers “whose sole purpose is to advance belonging and inclusion and to root out bias.”

- Encouraging the growth of instant book listings without prior approval by the host. The use of instant book listings will be accelerated with the goal of making 1 million listings bookable through instant book by January 2017.

- Going beyond photos in profiles. Airbnb’s new product team will “experiment with reducing the prominence of guest photos in the booking process.”

- Through the new open-doors policy, if a guest is unable to book a listing because of discrimination, Airbnb will “ensure the guest finds a place to stay.”

Is the new policy really effective?

So, how effective is the new policy? Ben Edelman, lead author of a Harvard Business School report on Airbnb’s problems with discrimination, told MIT Technology Review: “Airbnb’s proposed steps do not seem likely to succeed.” In June, Edelman wrote on his website about the steps Airbnb could take to prevent discrimination. None of them made it into the report.The “open-doors” policy in particular doesn’t seem to be very effective. As City Lab points out, “It doesn’t seem to do much to actually correct the racism.” It lacks a penalty for a host who discriminates, as well as "anything that disincentivizes discrimination to begin with,” wrote CityLab reporter Brentin Mock. The only thing Airbnb offers to do for a guest who experiences discrimination is to find them different accommodations. But as Mock put it, “Those guests would end up in a place that was not their preferred choice anyway.”

Joah Spearman, CEO and founder of travel startup Localeur, has the same criticism of “open doors.” It doesn’t “truly punish the potentially discriminating hosts, but instead forces the guests to wave a white flag and get Airbnb’s help to secure alternative lodging,” Spearman wrote in an open letter to Airbnb co-founder and CEO Brian Chesky.

And Spearman has more criticism for Airbnb’s new policy. The 32-page report wasn’t actually authored by Airbnb, and Spearman says: “This leads me to believe the fight against discrimination lacks internal, high-level ownership.” He personally experienced discrimination while trying to book accommodations on Airbnb “on a number of occasions.” And “at least one” of them took place through instant booking, “the very product initiative Airbnb touts as a potential anti-discrimination tool.” That isn’t exactly a vote of confidence for Airbnb’s new policy.

And what about how long it took Airbnb to address discrimination in the first place? Cheskey himself admitted the company is lagging in this area. He wrote in an email to Airbnb hosts and guests last week: “We have been slow to address these problems, and for this I am sorry.” He added that Airbnb “will not only make this right; we will work to set an example that other companies can follow.”

Based on the new policy, as outlined in the report crafted by Murphy, it seems unlikely Cheskey can make good on his promise. TriplePundit will continue to cover the story as it develops.

Image credit: Flickr/tommypjr

Henk Rogers of Tetris Wants Clean Energy Storage For All

Tetris fans know Henk Rogers as the man who took a risky trip into Soviet Russia 30 years ago. He sought to bring the iconic video game from behind the Iron Curtain to delight millions of people all over the world. Now, Rogers aims to break down another barrier. His company, Blue Planet Energy, just introduced Blue Ion -- an energy-storage solution that aims to enable homeowners to live the dream of an off-grid, clean-powered life.

From video games to energy storage

Given the rough-and-tumble world of today's distributed energy storage market, Blue Ion faces a tough row to hoe.

Rogers, though, is prepared to take on the heavy hitters, including Tesla's much-publicized Powerwall. He graciously took some time from a busy schedule last week to do a Skype interview with TriplePundit, and he explained how the hot competition for the rights to Tetris prepared him for the competition.

After all, this is the man who secured the rights to Tetris for Nintendo at the expense of Atari.

Here's his take on the adventure, which involved a flight deep into Soviet Russia and a meet-up with the game's inventor, Alexey Pajitnov:

"Nothing is going to stop me. I walked through a door that I was absolutely not allowed to walk through, and I did it anyway.

"The experts tell you why things can't be done. In my naivety, I'm going to do it anyway."

Energy storage for everyone

Rogers is a huge fan of Elon Musk and his Tesla electric vehicles, and claims to have owned every model Tesla has introduced so far.

However, that doesn't stop him from comparing the benefits of Blue Ion to Tesla's Powerwall.

One key item is Blue Planet's relationship with the design firm IDEO. Rather than simply marketing an energy-storage product based on efficiency, capacity and other numerical markers, Rogers wanted to leverage his own experiences with energy storage to create a product that is appealing on a more holistic basis to a wide range of homeowners.

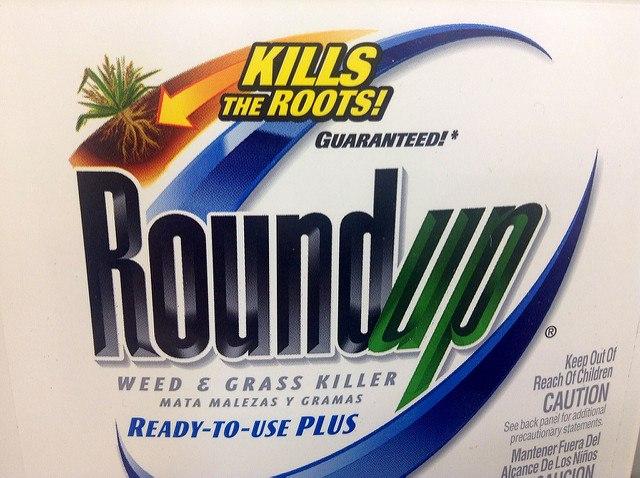

For Blue Ion, IDEO worked with focus groups to come up with a sleek, narrow energy-storage unit that includes the inverter unit. (Powerwall requires a separate inverter installation, Rogers points out.)

With the inverter positioned side-by-side with the battery units, Blue Ion has a low-key, horizontal aspect that contrasts with Powerwall's vertical alignment. (The Blue Ion units can also be stacked vertically if desired.)

Blue Ion's low-key footprint dovetails with IDEO's research, which revealed that many prospective energy-storage buyers prefer equipment that is more or less invisible, like any other household appliance.

On the other hand, if the buyer prefers to showcase their home energy-storage technology, Blue Ion's clean lines and deep color provide a striking focus point.

The unit's sleek design leads to another key advantage, which is the potential for keeping the installed cost of the unit down.

Rogers points out that Powerwall is designed to be literally hung on a wall. At 254 pounds per unit, that's a complicated operation. Between that requirement and the separate inverter, labor and installation costs mount up.

Blue Ion, on the other hand, is designed to put its weight on a floor, using an adjacent wall only for stability and support. That provides customers with more options for placement.

It also makes for a simple installation ,which Rogers estimates at a matter of minutes rather than hours. According to IDEO, that simplicity makes a huge difference to consumers, because it compares favorably with the kind of appliance installation with which they are already familiar.

Like the Powerwall, Blue Ion must be installed by certified professionals. But Rogers is already looking forward to developing a plug-and-play system.

How about a BatteryShot?

If this is beginning to sound like the energy-storage version of President Barack Obama's SunShot Initiative, that's what Rogers has in mind.

SunShot is an Energy Department program that looks at the cost of solar power from every angle, including obtaining permits, installing solar panels, making financing arrangements and other "soft" costs. The aim is to bring the total installed cost of solar power down to a level that meets -- or beats -- the cost of conventional fuels.

Blue Ion is the energy storage version of that theme. Rogers realized the need for a holistic product several years ago, when he experimented with a cutting-edge flow battery system at his own residence. He was not thrilled with the results. The lifespan proved to be far too short, and there was no lifecycle plan for dealing with the spent batteries and their toxic components.

Flow battery technology is improving rapidly, but Rogers needed a more reliable battery that is ready for today's mass consumer market.

He settled on a Sony lithium-ion battery based on the mineral olivine, with ferrous phosphate cathodes -- an interesting choice, considering that back in 2011 the Energy Department released the results of a comparative study that identified ferrous phosphate as the "cathode of choice" for electric vehicle batteries.

The agency cited several factors, including a high degree of stability, non-toxic characteristics, lower cost and better safety performance.

In our conversation, Rogers pointed out those same factors make the Sony battery ideal for home use.

Sony launched the first version of the battery in 2009 with this description:

The Olivine-type lithium iron phosphate used in this new battery is extremely suited for use as a cathode material due to its robust crystal structure and stable performance, even at high temperatures. By combining this new cathode material with Sony's proprietary particle design technology that minimizes electrical resistance to deliver high power output, and also leveraging the cell structure design technology Sony accrued developing its current "Fortelion series" lithium ion secondary battery line-up, Sony has realized a high power density of 1,800 watts per kilogram and extended life span of approximately 2,000 charge-discharge cycles.

Sony originally introduced the battery for use in power tools and other movable devices. In 2011 the company introduced it for stationary energy storage with a 10-year lifespan. The version used in Blue Ion has a 20-year lifespan with 8,000 charge-discharge cycles.

Rogers himself is living the dream. His home and ranch, both located in Hawaii, are fully off-grid using Sony batteries and solar power.

Image (screenshot): via Blue Planet.

Seafood Alternatives Could Help Relieve Pressure on the World’s Oceans

The world’s oceans, and their fish stocks, are under continued threats. Climate change has caused oceans to absorb more carbon, which in turn caused increased acidification -- harming some of the world’s most vibrant yet fragile ecosystems.

Demand for protein means many of the world’s most abundant fisheries are teetering toward collapse. In addition to overfishing, the seafood industry’s social impact shows an ugly side with the revelations of forced labor and even slavery that was most recently exposed in Hawaii. To make matters worse, there could be more plastic than fish in our oceans by 2050, a depressing fact organizations including the Monterey Bay Aquarium have put forth for years.

All things considered, a rethink of how we source seafood will be absolutely necessary if we hope to continue enjoying these foods that are both delicious and healthful.

Reducing the amount of trash we generate, starting with a ban on single-use plastic bags, is a start. Proposition 67, a bag ban on the California ballot this fall, is one tool in the fight to protect oceans. Aquaculture, which has become far more of a responsible industry, will also have to be part of the conversation.

But as is the case with fake meats such as substitutes for the “bloody burger” and chicken strips made from pea flower, it may just be time to start recreating seafood alternatives, otherwise known as “analogs.” Otherwise, mangroves will still be turned into shrimping ponds, and men from poor countries will work for pennies an hour in order to satisfy consumers’ insatiable demand for canned tuna or shrimp.

And we are not talking about foods like surimi, the pollock-based crab substitute that anchors many a California roll and has its own cyclical challenges. New products are emerging that are entirely plant-based, and taste like the real thing.

The foundation of such foods can be algae, one marine organism that is certainly not under any threat. Jonathan Wolfson, CEO of TerraVia, shared his thoughts on the future of algae as a way to feed the world. His company was formerly known as the algae biofuels company Solazyme until it started to shift away from fuel and more toward food.

“As time went on, we realized algae has this incredible place at the base of our food system,” Wolfson told an audience at the Sustainable Foods Institute earlier this week in Monterey. “The question was: How can we go out there and figure out a way to bring this to people?”

TerraVia is on that path. The company now primarily focuses on three core products. Algae-based omega-3s, particularly those produced at a massive plant in Brazil, show promise for aquaculture feed. Protein powders can replace animal proteins such as eggs and whey. And oils could show promise to replace products such as palm oil, which is flummoxing the world with unchecked environmental degradation that the industry is either unable or unwilling to stop. TerraVia claims its algae cooking oil beats competing products on both health benefits and with its smoking point. An alternative to shortening, says the company, can skirt the environmental impacts of palm oil and the health risks of ingesting hydrogenated oils.

The challenge is convincing consumers that algae belongs in the fridge and on the table. One startup taking on this task is New Wave Foods, a California-based company that delivers a shrimp alternative it says tastes just as good as the real thing. The company’s CEO, Dominique Barnes, who shared the stage with Wolfson at a Sustainable Foods Institute Panel, said her company’s product is close to commercial scale.

Barnes was in part motivated by her upbringing in Las Vegas. “All you could see were seafood buffets and 99-cent shrimp cocktails,” she told the audience. “But was is their true cost?” An expensive delicacy only a generation ago, massive shrimp farms overseas helped drive down prices, but then created huge environmental and social costs.

The biggest challenge, Barnes explained, was recreating that texture. Shrimp is slightly rubbery, but gives that satisfying pop at first bite. Her team researched countless varieties of shrimp, along with algae and other plant-based substitutes, which together could mimic shrimp’s fibrous texture. Developing this product involved science down to the molecular level, and the company had to account for ingredients that were both FDA-approved and sustainable. In addition, NewWave needed a unique environment in which to make these fake shrimp – this is not a product that can be made where crackers or candy bars are also manufactured.

The trick is scoring consumer acceptance of these products, and the holy grail is to be able to serve these foods at restaurants – which can move meat away from the center of the plate and ideally generate profits for the business.

Kasja Alger, executive chef at Mud Hen Tavern and Blue Window in the Melrose district of Los Angeles, offers ideas that other chefs who want to cook with a conscience should consider. Alger and her business partner, Susan Feniger, plan to close Mud Hen next month. But its take-out business, Blue Window, will remain. The pair also opened a Blue Window in Terminal 3 at Los Angeles International Airport.

The transition to a more plant-based menu takes time, Alger explained. The chef has long avoided eating meat, but taking those ethics and beliefs to a restaurant setting can be challenging. Alger started with condiments, and eventually incorporated more plant-based substitutes into the restaurant’s menu. Part of her goal was to avoid the unfair “vegan tax,” in which consumers are either charged more for a non-meat option or pay the same if that animal protein is removed from the dish.

And that vegetarian or vegan option does not have to be a copycat of animal protein, as not everyone wants that Gardein fake chicken patty or Morningstar soy burger. But what chefs can do is offer a similar taste, texture and experience. Maitake mushrooms can be fried and served as a reminder of chicken. A Korean wrap can include tofu. Marinated daikon can fill in for ahi in a mock Hawaiian poke bowl. And agar-agar, which can be made from algae and seaweed, can be used in place of gelatin boiled from animal bones. Once available, fake shrimp -- and perhaps other fake fish -- could eventually emerge on Alger’s menu.

A transition to algae-based foods, at home and in restaurants, will take time. Alger shared one story of how an algae substitute for eggs wreaked havoc because of its smell, which would spread out of the kitchen and into the dining area.

But the reality is that our long-term health -- and, of course, the health of the oceans -- will depend on this innovation. And if we are to feed 9 billion people by 2050, the science offered by TerraVia and NewWave Foods, along with the tinkering by chefs such as Alger, offer a chance to sustain humans and ease the pressure we impose on both land and sea.

Image credit: New Wave Foods

The Cherie Blair Foundation mentors women entrepreneurs through technology

Chevy Bolt’s 238-Mile Range Poses Huge Challenge for Tesla

Tesla was once the darling of the electric vehicle and clean-tech worlds. It has the fastest production car on the planet. Its cutting-edge vehicle design turns every head. And the company boldly re-thinks what electric cars can and should be today. But Tesla has gone from being an industry disruptor to one disrupted by doubts about its new business model and production shortfalls.

Now, the former golden child of Silicon Valley has another challenge on its hands: The all-electric Chevy Bolt, slated for release by the end of this year, has an EPA range exceeding that of Tesla’s Model 3.

With a purported range of 238 miles, the Bolt could drive about 10 percent farther than the mass-produced Model 3. The result is a huge challenge for Tesla, which carved out a niche as a visionary leader in this small but rapidly growing automobile market.

And the attention General Motors (GM) scored for this achievement shows the automakers are still guessing electric cars are the future, despite the two-year slump in petroleum prices. Add the fact that a once-pedestrian automaker could potentially cure the “range anxiety” that long had consumers skittish about EVs, and we have even more good news for this sector.

This week’s announcement is also a boon for GM, Chevy's parent company. The automaker had its own fair share of struggles this year, including a recent airbag recall that could affect up to 3.6 million vehicles. Many companies are good at over-promising and under-delivering on products. (Think: the latest device from Apple, or the latest and greatest meat alternative that promises to change the world but still tastes like shoe leather.) Just earlier this year, GM estimated the Bolt would have a range of 200 miles. To extend that distance by almost 20 percent is no small feat.

Of course, Tesla is far from crying “uncle.” As Fortune writer Kirsten Korosec pointed out this week, Tesla has a long track record of manufacturing EVs that offer a stellar driving experience. GM is the relative new kid on the block with the Bolt. True, GM has offered the Chevy Spark for a while, but other than its torque, driving a Spark is about as scintillating as driving a Toyota Echo or a Kia Rio.

Furthermore, Tesla promises a slightly lower price than the Bolt (if you can believe it). As of now GM, priced the Bolt at $37,500, while the Model 3 is targeted to cost slightly under $35,000. And Tesla offers incredible design flourishes, while the Bolt -- like many American cars -- has a more pallid look and feel inside and out.

Nevertheless, if GM can wow customers and meet demand, Tesla could have some serious catching up to do. The Model 3, set to release in 15 months, now has a waiting list so long that Bloomberg had some morbid fun speculating what would happen if someone on that list died before receiving his or her Tesla.

But as the cliché goes, competition is good for the marketplace. Depending on how the Bolt resonates with consumers, Tesla could always respond in kind. And do not expect folks on the Model 3 waiting list to flee to the Bolt just because they may be able to drive around in a competing EV sooner. It is important to remember the early adopters and tech types who fawn over Tesla and its 21st-century versions of muscle cars. The Model 3 promises a top speed of 125 to 130 miles per hour, even up to 155 mph if drivers opt for the “Ludicrous” mode (though, at those top speeds, say bye-bye to its range). Danielle Muoio of Business Insider reported that the Bolt will carry a top speed of, ahem, 91 miles per hour, which is a yawner for many consumers.

So, whether or not Tesla and GM end up in a rivalry once considered totally unimaginable, the stubborn fact is that electric cars are performing better, catching the eyes of more consumers and can offer us a hedge in the event that the low oil prices of now become, once again, a volatile cost of tomorrow.

Image credit: Chevrolet

Free TVs Can’t Mask Human Rights Violations in Uzbekistan Cotton Fields

Gather five tons of cotton and score a free television. That's the proposition a regional government gave families in eastern Uzbekistan last week. And the local press is buzzing. Families who can double their cotton haul could receive a free washing machine or refrigerator, while 15 tons can help them skirt the country’s long waiting list for a new car.

As the BBC reported this week, the car perk alone could be enough incentive for some people, as waits for a new Chevrolet can extend for as long as six months.

But what the BBC report barely touched upon is that Uzbekistan's annual cotton harvest brings out some of the worst human rights abuses on earth. An oppressive regime, until recently led by a family who reportedly hoarded billions of dollars while many citizens struggled, cashes in due to backbreaking work in a nation the World Bank says has a per capita income of just over $2,100.

This year's cotton harvest season in Uzbekistan comes at a time when the country’s leadership is mourning the passing of its president, Islam Karimov, who died on Sept. 2. Karimov led the country since it broke off from the Soviet Union in 1991 and became its first, and only, president until his death.

But Karimov was able to stay in power because of the stranglehold he had on his country and its economy, the third largest export of which is cotton. NGOs, including Anti-Slavery International, say this industry nets over a billion dollars annually for the nation’s coffers while forcing citizens to work long days in oppressive conditions.

Most of that money was reportedly funneled to the Karimov family over the years, including the late president’s older daughter, Gulnara. Gulnara Karimova was often seen as the softer face of her father’s regime, and her roles as a public figure alternated between pop icon, cultural ambassador and fashion designer. But according to Wikileaks and the Guardian, she was also a borderline mafia head who “bullied” her way into just about every profitable business in Uzbekistan.

And inside the famously opaque country home to 30 million people, Gularna was often described as its most hated person for using her father’s power to enrich herself while abuses in the cotton sector never relented. When human rights activists learned that she was presenting her clothing designs at New York Fashion Week in 2011, outrage over the Uzbek cotton industry’s ties to child labor, forced labor and even torture convinced the show’s organizers to cancel the rest of her events. Only after the outcry over a 2012 scandal, which involved a $300 million payment from a Swedish telecomms company to one of her businesses in order to enter the Uzbek market, did Gulnara fall out of favor with her father. Once viewed as her father’s successor, she was not seen at his funeral earlier this month.

But Gulnara’s fall from grace was a picnic compared to the suffering heaped on Uzbeks every autumn. EurasiaNet, one of the best sources of news on Central Asia, has long documented how citizens are rounded up to pick the country’s most lucrative cash crop.

In August, local and national officials begin to compile lists of citizens who they deem ready to work in the summer heat, which can soar up to 50 degrees Celsius (122 degrees Fahrenheit). No one is exempt, including teachers and medical professionals, but the more fortunate citizens can pay someone to take their place. Corruption is rampant, farmers are threatened with jail should they not meet their quotas (if they do not commit suicide), and as many as 1 in 5 Uzbek adults find their lives disrupted with forced labor on the country’s cotton fields.

Due to boycotts and a long-running awareness campaign, child labor in Uzbekistan is on the decline, but abuses are still found across the country. Most Western companies and governments prohibit the imports of Uzbek cotton. But the country avoids that ban by exporting to markets such as Bangladesh, China and Korea. Hence any apparel company that does not have rigorous audit controls in place can see its supply chain, and reputation, blow up at any time.

The likelihood of conditions improving in Uzbekistan at any point soon are remote. The country has become an economic basket case as years of mismanagement weakened an already fragile economy. Low energy prices have curbed Uzbekistan’s gas exports as the country’s guest workers in neighboring Russia and Kazakhstan are wiring less money home due to decreased job opportunities. Jobs are scarce, which means unrest could occur as citizens face further competition from former expats returning home. And Uzbekistan’s struggle with drought and pests means conditions on the nation’s cotton plantations could only become worse as the government becomes more desperate to gather more cash.

Fashion brands, including Gap Inc., H&M and Zara, have pledged to remove Uzbek cotton from their supply chains, though as win the case of many apparel companies, it took relentless pressure from NGOs in order to stop such sourcing practices. Consumers, in turn, need to be educated about cotton's social impacts, including what is going on with Central Asia’s cotton industry. And retailers need to educate everyone, from procurement officers to retail clerks on the shop floor, about one of the world’s most hideous travesties that still refuses to go away.

Image credit: David Stanley/Flickr

Wells Fargo Shows Why the Banking Sector Still Lacks Consumer Trust

The “sandbagging” scandal that slammed Wells Fargo this week harkens back to the financial sector’s behavior a decade ago. Back then, the big banks’ affinity for sub-prime loans and collateralized mortgage obligations (CBOs) catapulted the U.S., and much of the world, into the largest fiscal crisis since the Great Depression. The Wells Fargo episode, which reveals a rotten culture across the one of the largest banks in the U.S., leaves a huge stain on a company that manages almost $2 trillion in assets and generated over $86 billion in revenues last year.

Wells Fargo was left relatively unscathed during the 2008-2009 financial crisis, and in fact benefited as it swooped up now-defunct Wachovia. While its “big 4” banking rivals -- Citigroup, Bank of America and JPMorgan Chase -- still have their reputational struggles, Wells Fargo projected images of a squeaky-clean image with solid corporate governance. It even boasted a large portfolio of environmental and water investments.

But 2 million fake accounts later, its reputation is in tatters and is a poster child of why so many Americans do not trust our institutions, starting with the big banks.

So, what happened with Wells Fargo?

A week ago, the U.S. Consumer Financial Protection Bureau (CFPB) fined Wells Fargo $185 million, saying employees illegally opened bank and credit card accounts to pad sales figures. The widespread shenanigans are now well documented.

Employees, bearing the pressure of sales quotas, often felt desperate and employed a variety of tactics, the CFPB said. Accounts were opened without consumers’ consent, funds were transferred between accounts without customers knowing, and accounts were stealthily moved online. The bank also reportedly harangued customers' friends and family. (Full disclosure: I was hit up by someone on an online dating app a few years ago. The conversation died about five minutes later, when I was asked if I would open a Wells Fargo account at a Delano, California, branch. I responded with praise for my credit union.)

The $185 million fine is the largest penalty the CFPB has ever imposed. And thousands of hourly employees have lost their jobs as a result.

Los Angeles City Attorney Michael Feuer revealed other maneuvers that alternated between bold and crass, Matt Levine of Bloomberg reported last week. Consumers were told they could not get a service or product unless they signed up for an account, Feuer alleged. He also cited equally troubling incidents: In some cases, employees falsely claimed there would be no monthly fees for some new accounts, only to impose fees later. And, occasionally, new accounts would be held over until the next reporting period if a current sales quota wasn't reached. Most of these new phony accounts were opened on the down-low: Only about 14,000 of the 565,000 new credit card accounts incurred fees, as generally employees only wanted to meet internal sales goals and did not want to be caught.

As a result, over 5,300 Wells Fargo employees -- many of whom were coping the best they could in what has been often described as a hostile and toxic work environment where quotas were prioritized over ethics -- were thrown under the bus. But as been the case with the worst of the banking scandals here in the U.S., the Wells Fargo executive who was in charge of this operation was not only left unpunished, but generously rewarded. The bank’s former head of its consumer banking operations, Carrie Tolstedt, will walk away with a $124.6 million severance payment as part of her separation agreement. Furthermore, Wells Fargo confirmed that Tolstedt will not have to disgorge any of her previous salary despite the CFPB making it clear that she should be held responsible for her business unit’s actions.

The fallout

Wells Fargo says it is changing its business practices, starting with the elimination of sales goals for retail bankers and preventing its employees from cross-selling other banking products. But the company’s CEO, John Stumpf, refused to take any responsibility, even though he is scheduled to testify at congressional hearings next week in Washington, D.C.

“There was no incentive to do bad things,” Stumpt told the Wall Street Journal on Tuesday. He has has not yet explained how a work culture could be so oppressive that over 5,000 employees used such drastic means to meet quotas, or how they could escape undetected for so long.

For citizens still resentful over the global financial dumpster fire the banks started a decade ago, Wells Fargo is another case study of how those heading financial institutions not only escape any penalties for their behavior, but also profit. Just as no one responsible for the 2008 financial meltdown logged any jail time, it appears no individuals at Wells Fargo will pay any price – except those employees who only did what they did to enhance their meager salaries and help Wells Fargo appear stellar to its shareholders. Those shareholders (including the author), are not too happy now, as Wells Fargo’s stock price dipped 6 percent in value last week, although as of press time share prices have slowly begun to rebound.

The only winner coming out of this sordid tale appears to be credit unions. Bloomberg practically begged credit unions and community banks to capitalize on Wells Fargo’s behavior, though many consumers -- especially millennials -- don't need a story about 2 million fake accounts to change where they bank. Customers are flocking to credit unions, eschewing ATMs on every corner and high fees in exchange for better interest rates and less nickel-and-diming. Credit union bosses may want to include Mr. Stumpf on their Christmas card list this summer, as his flaccid response to Wells Fargo’s crisis gives these smaller banks gifts that will long keep on giving.

Image credit: Mike Mozart/Flickr

Largest Fund Manager Remains Resistant to Shareholder Action on Climate

According to a recent Stanford University study, temperature change from global warming could lower global GDP by about 23 percent per capita by 2100. That would mean a lot less money in the corporate coffer and the chance of stock prices dropping significantly in the decades to come. So, why isn’t big money joining in the fight against climate change?

As many of us know, Vanguard is a U.S.-based investment company that manages about $3.5 trillion. Yes, that's trillion with a T. It is the largest provider of mutual funds and the second largest provider of exchange traded funds (ETFs), holding about 10 percent of the value of the U.S. stock market. Investors in Vanguard funds own at least 5 percent of the stock in big companies like Nike and Starbucks. But as Barron's reported last month, Vanguard failed to support any of the approximate 200 climate-related shareholder proposals filed this year.

For those new to the world of shareholder proposals and proxy voting, every year shareholders present companies with certain proposals that are meant to bring awareness. The topics range from animal cruelty to CEO compensation to sustainable reporting. For example, in 2015 shareholders asked fumbling natural gas company Chesapeake Energy to publish a climate change report and how it could affect the revenue of the company. Considering Oklahoma just experienced a 5.8-magnitude earthquake this week near key fracking sites, one would think this should be on their radar. Vanguard voted against this proposal.

Since 2004, U.S. mutual fund companies have been required to publicly disclose how they cast their proxy votes. However, finding this data would certainly require a Ph.D in data mining. Recently launched, Fund Votes is an independent project that tracks mutual fund proxy voting in the U.S. and Canada. The website shows the percentage of support for shareholder proposals in each mutual fund company in the U.S. You can easily see that a mutual fund company like Green Century does a much better job voting its client’s shares than Wall Street darling JPMorgan.

The next logical question may be: Why is Vanguard not voting in favor of these proposals, considering there may be unforeseen costs involved with how companies address climate change?

Like any of the behemoth money-management firms out there, conflicts of interest may exist -- particularly because Vanguard manages money for companies via their 401(k) and retirement plans, posited Barron’s reporter Lewis Braham. Ask any friend or colleague, and most likely their 401(k) is managed by Vanguard or Fidelity. In return for managing these plans, companies collect many millions of dollars. If Vanguard were to vote for a shareholder proposal on one of its client’s proxies, this could lead to the “degradation” of such a relationship.

We shall see how this plays out in the years to come as investors demand that Vanguard vote its investment dollars and climate change becomes primary with metropolises like New York City, which is literally sinking into the ocean. By the time Generation Z or the appropriately named "iGeneration" hits retirement in 2100, Vanguard may have to put climate change shareholder proposals at the top of its priority list to simply exist as a business.

Image credit: Pexels

Dale Wannen is founder of Sustainvest Asset Management, a Petaluma, CA-based independent investment advisory firm focused on sustainable and responsible investing, shareholder activism and impact investing.

5 Ways Companies Can Save the Planet With Plastic Alternatives

By Ryan Williams

As anticipation for the Summer Olympics in Rio de Janeiro ramped up, the host city's environmental issues were just as hot a topic as who would medal in the games' marquee events. With rumors of unclean water and dangerous pollution, concerns for athlete welfare were at an all-time high. With the 2016 Games now complete, however, contaminated supplies are still an issue that affect many citizens.

Unfortunately, polluted water isn't an issue specific to the bays of Ipanema. An estimated 8 trillion metric tons of plastic enter ocean waters from land each year, polluting and harming as many as 100 million marine animals.

The Olympics Games are a massive stage for not only athletes, but also for awareness of global issues. But when it comes to saving our water from the daily crisis of plastic pollution, a massive spotlight shone from a worldwide event shouldn't kickstart a movement toward reform.

Businesses and consumers can do their part to attack the situation by increasing their own of use of non-virgin plastics, pursuing other alternatives, educating the public.

Do your part to clean up plastic

I work at a small and scrappy soap company, Method. We don't have delusions of cleaning up the ocean single-handedly. But we can raise awareness and use our platform to demonstrate smart ways of using and reusing the resources we already have — such as using post-consumer recycled plastic in our own products.

Every company, no matter how small, has a responsibility to make "green" mainstream. Here's what you can do:

1. Tell everyone. Awareness is everything as we try to defeat the problem of plastics, and your company can help. Promote consciousness of the issue by telling other companies how much you care about it.

Share articles with colleagues. During meetings and planning sessions, keep green practices top of mind.

Sunglass company Costa is baking environmental awareness into its brand. It teamed up with an agency to create animation illuminating Florida’s environmental problems. This simple investment of branding energy has initiated a wave of awareness, traveling out to all Costa’s customers and competitors.

2. Be choosey. It's imperative that companies develop products and services that are less disposable, but can easily be dispatched. Preferably, those outlets lead to sorting and recycling. Impacting pollution can be as simple as installing green options throughout your production chain. When possible, use PCR and other alternatives to virgin materials.

Utilize environmentally friendly cleaning products and packaging. It’s amazing what you can do by just making better choices.

3. Assemble a team. Many hands make light work. Carpet tile producer Interface beefed up its Net Effect carpet collection with Net-Works, a project designed to utilize discarded fish netting from the Philippines. The campaign weaves the recycled content into nylon that gets used in Interface's carpet samples.

That project is a sign of the times indicating that the next level of pollution-fighting is teaming up with a green partner. We set out to raise awareness by earth-conscious teammates, including local beach cleanup groups, volunteers, and organizations such as Sustainable Coastlines Hawaii, Hawaii Wildlife Fund and Surfrider Kauai. Together, we hand-collected several tons of plastic from the beaches of Hawaii.

4. Engage your supply chain. If you can go further in the fight against pollution, do it. Use your resources to push your products. Innovate solutions, explore recovered plastics, push your supply chain, and demand better alternatives to post-consumer recycled plastic. You may be surprised how willing your existing partners are to get involved.

Our recycling partner, Envision Plastics, was willing to push the boundaries of our capability. Together, we’ve discovered how to take plastic from the beach and turn it into bottles.

5. Educate your audience. Just like you, your customers also want to make a difference. Save the ocean, and help your customers play their part at the same time.

You can alert your audience by showing them how to recycle and reuse plastic and extend a product's life cycle. Connecting them to a resources like Recommunity should be the foundation of this education.

Use your influence to bring awareness, your resources to do your part, and your voice to educate others. Your company can help make the Olympic-size plastics problem a thing of the past.

Image credit: Flickr/Edward Conde

Ryan Williams holds a Ph.D. in environmental toxicology and has more than 15 years of experience assessing ingredients for human health and environmental impacts, applying this knowledge to bring sustainable product innovation to the Method business. Ryan collaborates with global authorities in government, industry, NGOs, and universities to identify emerging topics and sustainable technologies in chemical ingredients to ensure that Method maintains its industry leading Dirty Ingredient List.