The Long Road to True Innovation

By Dr. J. Michael McQuade

The most powerful innovations are those that change people’s perception of what is possible. In today’s world, “innovation” is often synonymous with “fast.” New social media and game apps, for example, can come to life within a matter of days. When the stakes are high, the mission is critical, and failure is not an option, the reality is innovation can take time – but that doesn’t mean the outcome is any less disruptive.

Take the Pratt & Whitney PurePower engine with Geared Turbofan technology, which is revolutionizing air travel. Simply put, this engineering marvel introduces a gear into the engine, enabling the large fan to turn at its optimum speed (slow) and the rest of the engine parts to move at their optimum speed (fast). This technology allows jet engines to be quieter and much more efficient – benefitting airline operators, people on the ground, and passengers in the sky.

The concept of using a geared engine had been around for decades before Pratt & Whitney started researching the technology in the mid-1980s. Despite this, the technology proved tremendously difficult to implement – and it was long accepted to be an impossible feat. Pratt & Whitney and its parent company, United Technologies, ignored the naysayers and went on to invest more than $10 billion and 20 years to prove the concept worked, perform the extensive testing needed to ensure safety, and turn it into a commercial product.

“While in theory a geared engine had the potential to achieve significant efficiency gains and noise reduction, many within the engineering community thought the idea of perfecting the geared engine for practical use was nothing more than a pipe dream,” said Dr. Alan Epstein, Pratt & Whitney’s vice president of technology and environment. “As we have done for 90 years, Pratt & Whitney advanced materials, processes and manufacturing technologies because we understood the enormous impact this innovation would have on our business, the environment and the aerospace industry.”

Ultimately, United Technologies’ determination to push science, technology and ingenuity to the limit made the impossible, possible. The Geared Turbofan engine is in service with three airlines on two continents – and engine orders from operators worldwide surpass 7,000*.

This breakthrough engine is cleaner, greener and quieter than any previous jet engine. Over the next 10 years, the Geared Turbofan engine – which burns 16 percent less fuel than other prior-generation jet engines – will enable airlines to avoid releasing some 160 million tons of greenhouse gas emissions into the atmosphere, and save approximately 15 billion gallons of fuel valued at about $40 billion (at current prices).

In addition, the Geared Turbofan engine reduces noise footprint by 75 percent on the ground, potentially allowing carriers to fly over some areas where they were previously not permitted due to noise regulations. And, with significantly fewer parts, the Geared Turbofan engine will also increase engine reliability, substantially reducing the cost of aircraft maintenance. Thanks to a sustained growth path for the engine, future versions will offer even greater efficiency.

This week, as tens of thousands of aviation and aerospace professionals come together for the Farnborough International Airshow, companies from around the world will showcase an astonishing array of innovations. Pratt & Whitney’s PurePower engine with Geared Turbofan technology will be among them. More than a story of purposeful innovation, this engine serves as a powerful testament to investing in technology for the long term. The Geared Turbofan engine did not happen overnight. Instead, like other game-changing innovations, it is the result of a determination to solve engineering challenges in the face of past failures, the courage to take risks on innovation, and the willingness to put in the hard work to turn a vision into reality.

* Including options and unannounced orders.

Dr. J. Michael McQuade is Senior Vice President for Science and Technology

at United Technologies Corp.

Image courtesy of Pratt & Whitney

JetBlue's Purpose-Driven Campaigns Spark Conversation

During a divisive time, how can a company inspire people to lay aside personal opinions and do something for the greater good? JetBlue has an answer.

Imagine you’re relaxing in an airplane seat. The plane is headed from Boston (in a politically blue state) to Phoenix (in a traditionally red state). Everyone onboard is politically divided; they’re digging in and holding their ground. Super Tuesday is right around the corner. Suddenly, an announcement comes over the intercom.

The announcer states that everyone on the airplane has a chance to win a round-trip ticket to anywhere. But here’s the catch: All 150 random strangers must unanimously agree on that destination. And round and round we go. Domestic versus international. Costa Rica versus Turks and Caicos. The plane is now divided on more than politics. Fortunately, it’s a five-hour flight, so there’s plenty of time to talk to your neighbors and listen to their reasons for traveling to a particular destination.

But here’s the difference: When it comes to travel, everyone realizes they all benefit more by giving in a little. In the end, everyone agrees on Costa Rica, and all the passengers cheer and give each other high-fives. Most people hadn’t originally chosen Costa Rica out of all the options, and so most passengers had given up their ideal solution for the greater good.

“So, what did we learn?" asks the announcer. "When people compromise and work together, all parties can win.”

That's the concept behind an ad spot JetBlue ran earlier this year. And it isn’t the airline's first purpose-driven campaign. Tamara Young, manager of corporate communications for JetBlue, described other piece of content at the 2016 Sustainable Brands Conference.

During the last presidential campaign between Barack Obama and Mitt Romney, the country again was divided. Some people threatened to leave the country if their candidate lost: “If Obama wins I’m moving to Canada,” some said. And vice versa.

JetBlue is a nonpartisan company, and it wanted to turn the negative dialogue into a positive one. So it created the Election Protection campaign, a landing page that prompted people to select their preferred candidate and the destination they wanted to go if their candidate wasn’t elected. After the election, there were a few lucky winners. JetBlue was nice and made the tickets round-trip, not just one way, so the person wasn’t stranded in another country. The campaign was able to turn negativity into something positive in hopes that people would become more optimistic.

https://youtu.be/EPurzKVTlU4

Since JetBlue’s campaigns are all about bringing people together (both physically via flying and emotionally), the company tackles other topics beside politics. For example, it decided to create dialogue around another polarizing topic: babies on airplanes.

This Mother’s Day, JetBlue turned crying babies on airplanes into a perk. Parents find it more stressful to fly with a baby. They cross their fingers that the toddler doesn’t have a meltdown or squirm too much.

On one Mother's Day flight, JetBlue announced it was the first time a crying baby is a good thing. Every time a baby cried, all passengers received 25 percent off their next flight. In other words, four crying babies were equivalent to a free round-trip ticket. Every time a baby cried, people smiled and a few clapped. By the end of the flight, everyone had won a free round-trip flight. “Thanks to all the moms and babies on board today for making the flight so special,” the flight announcer said.

The hope was that the campaign would start positive conversations and create empathy and compassion. The ideal result is to create a welcoming atmosphere for parents traveling with children. (Disclaimer: The crying baby discount was for this one flight only and is not a new policy, just in case you were getting ready to suggest your friend with a fussy baby take a flight with you.)

https://youtu.be/xQyfu1LrOSM

Jet Blue’s purpose-driven campaigns have been highly successful and received billions of media impressions. But Young says it’s not about advertising. Instead, it’s about “inspiring humanity.”

The content connects with people, she says. They feel confided in and see themselves as part of the mission. Creating thought-provoking experiences opens up one-on-one dialogues with customers, and JetBlue receives important feedback.

The main lesson that can be learned from Jet Blue is that brands shouldn’t be afraid to talk about taboo and divisive topics. When brands authentically spark dialogue and engage people in conversations, they form deep relationships with customers. And that depth is something customers crave.

Image credit: JetBlue

North Carolina Eases Coal Ash Cleanup Laws as New Leak is Discovered

North Carolina legislators celebrated a victory this month: For the first time in years, they came up with a constructive strategy for dealing with Duke Energy coal ash dumps. Or, to put it more accurately, they came up with a strategy that is likely to make it past the governor's office.

The question is: Does the strategy prevent future coal ash spills? And will it ensure more oversight?

The answer to those questions fueled a call for third-party oversight of Duke Energy's coal ash sites. Legislation proposed last spring sought to create a new commission to oversee the closure of 14 Duke sites. As drafted, the bill would also provide new water systems for families living near existing coal ash ponds on Duke Energy's dime.

North Carolina Gov. Pat McCroy, a former Duke Energy employee, quickly vetoed the bill -- continuing a years-long fight against oversight by a third-party commission. In 2014, the governor sued the state and successfully argued that the installation of a separate agency to govern coal ash sites was in violation of the state constitution. The subsequent June 1 veto and the lack of third-party oversight forced the legislature to rewrite some of the requirements imposed on Duke Energy. In doing so, they shifted control back to the Department of Environmental Quality (DEQ), which is overseen by Gov. McCrory.

The coal ash leak lawsuit

But back to the original questions: Will the state's new concept protect homeowners and drinking water systems from any further leaks? And will it ensure the coal ash sites, which Duke Energy agrees must be closed, are taken out of commission?

The answer, some would say, can be found in a new lawsuit. The Southern Environmental Law Center (SELC) filed suit against Duke Energy on June 13, alleging that local water resources and recreational areas around Mayo Lake were being polluted by the company's adjacent coal ash site. SELC estimates that 6.9 million tons of coal ash have seeped out of an unlined containment area in the North Carolina site. But the real issue, says SELC, which filed the suit on behalf of the Roanoke River Basin Association, is that news of the leak went unheeded by Duke and both state and federal agencies.

"EPA and DEQ have not commenced and are not diligently prosecuting a civil or criminal action to redress the violations asserted in this citizen enforcement action," SELC and other environmental organizations allege in their complaint.

This is the second spill that the Roanoke River basin has faced in as many years. In 2014, Waterkeeper Alliance (a national advocacy group that includes the Roanoke River Basin Association) was able to prove that Duke Energy illegally pumped coal ash into the river to relieve a failing containment system. Some 300,000 tons of ash laced with heavy metals flowed downstream, polluting drinking water, wetlands and miles of a scenic river area.

Coal ash toxicity: Old data sources?

But the most recent problem, notes SELC, has nothing to do with failed piping. It has to do with Duke Energy's method of managing coal ash.

"In the nearly 40 years Duke Energy has stored coal ash at Mayo, it has never obtained a permit for discharges into Crutchfield Branch, for discharges into Mayo Lake by way of hydrologically-connected groundwater, or for disposing of pollutants in the state’s groundwater," SELC argues in its suit.

And that's where Duke Energy's interpretation of coal ash, heavy metal toxicity and federal requirements get sticky. According to the company's website, coal ash isn't really hazardous, because in small amounts it isn't really toxic.

"The U.S. Environmental Protection Agency has evaluated coal ash extensively and has repeatedly determined that it is not a hazardous waste," Duke Energy says in its handout, Coal Ash and Toxicity. Besides. "The trace elements in ash are measured in very small units."

But the reason it is measured in very small quantities is precisely because of its toxicity. According to the Physicians for Social Responsibility (PSR), the EPA has already begun to revise its statement on coal ash danger. In 2014, the federal agency took the first steps toward limiting the release of heavy metals from coal ash deposits (also called coal combustion residuals, CCRs). In 2015, it issued final guidelines for proper disposal (or recycling) of CCRs. The motivation for those new regulations, says the EPA, is that heavy metals "can pollute waterways, ground water, drinking water, and the air."

"The need for federal action to help ensure protective coal ash disposal was highlighted by large spills near Kingston, Tennessee, and Eden, North Carolina, which caused widespread environmental and economic damage to nearby waterways and properties."

Coal ash cleanup by 2028

But federal mandates like environmental limits on heavy metals don't mean that state legislatures will follow suit, especially when a governor's veto hangs in the balance. North Carolina Bill 630 does little, if anything, to back up EPA regulations. Instead, it does away with the rating system which determined that Mayo Power Plant's coal ash site (also known as the Roxboro Steam Electric Plant) was considered an intermediate-level threat to waterways and drinking resources.

While the bill expedites the cleanup of four "high-risk" coal ash sites, it extends the deadline for cleaning out others (like the Mayo Power Plant) until 2024.

It's a timeline that may make sense for North Carolina's biggest power company, inundated by the cost of revamping its coal ash system. But will it prove to be the best protection for North Carolina's homeowners, businesses and state tourism infrastructure? Time will undoubtedly tell.

Flickr/USFS Southeast Region

Phillip Morris Loses Lawsuit Against Uruguay on Tough Tobacco Rules

An international trade court ruled against Philip Morris International (PMI) in the company’s lawsuit against the government of Uruguay over tobacco-labeling rules. The International Center for Settlement of Investment Disputes' (ICSID) decision to side with Uruguay, a country with a GDP of $53 billion, and not with PMI and its annual revenues of $80 billion sends a signal: Small countries can implement public health policies however they want without the interference of multinational corporations backed by huge lobbying and legal budgets.

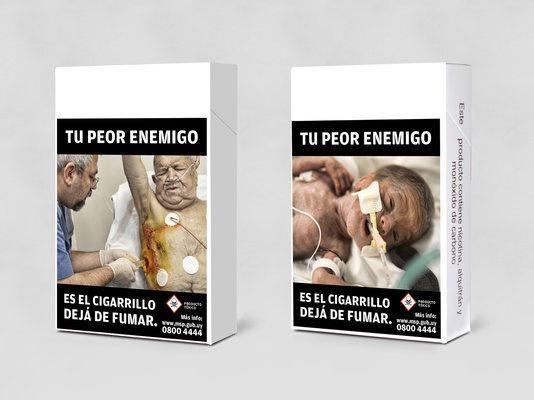

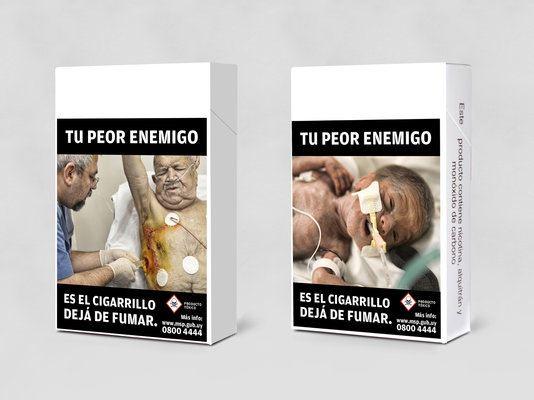

For a decade, Uruguay has been home to some of the toughest anti-tobacco laws in the world. Smoking is banned in all indoor public spaces and in outdoor areas adjacent to education and healthcare facilities. Tobacco taxes are high within this country of 3 million, and graphic warnings about health risks from smoking must cover at least 80 percent of the front and back of a pack of cigarettes. Cigarette makers are also prohibited from labeling their products as “light” or “low,” as public health policy makers argue that such labels deceive consumers about tobacco’s health risks.

PMI did not take kindly to Uruguay’s laws, and filed a lawsuit in 2010. The company cited an alleged violation of a 1988 trade agreement between Switzerland (PMI’s current base) and the tiny South American country.

Last year, the litigation finally found its way into ICSID’s docket, with arbitrators reaching their final decision on Friday. PMI sought $25 million in damages over what the company called a “decision to disregard its commitment to investors.” But instead, the ICSID ruled that Philip Morris had to pay Uruguay’s government $7 million in damages, along with all fees and expenses related to the litigation.

Reaction to the ICSID’s decision was swift. Former New York City Mayor Mike Bloomberg, now a leading anti-tobacco crusader who offered the Uruguayan government financial support in order to defray costs related to the litigation, celebrated Uruguay's legal victory.

“It shows countries everywhere that they can stand up to tobacco companies and win,” Bloomberg said in an emailed statement to TriplePundit. “Governments should always be able to protect people's health and safety, and we're committed to helping them when tobacco companies try to stand in the way.”

Action on Smoking & Health (ASH), which describes itself as the oldest anti-tobacco organization in the U.S., also applauded the decision. ASH praised Uruguay and President Tabaré Vázquez, who spearheaded the laws during his previous term in office, for “prioritizing the health of his people and standing up to the bullying tactics of the tobacco industry.”

Victory aside, ASH’s executive director, Laurent Huber, warned that this would not be the last time tobacco companies would use an investor-state dispute settlement (ISDS) within a trade agreement in an attempt to influence government policy. “The global community needs to look in the mirror and ask itself: Why do we give tobacco multinationals special rules and special courts to sue governments?” Huber said in a press statement.

ASH has long hailed Uruguay’s laws as a leading case study in restrictive tobacco regulations, which the organization says are necessary in addition to taxation in order to decrease the consumption of tobacco and raise public awareness of smoking’s health risks.

On Friday, PMI said it would respect the ICSID panel’s decision. In an interview with the Associated Press, the company’s general counsel said the litigation was less about compliance and more about “clarification under international law.” In other words, look for small countries to remain spooked about enacting any aggressive public health laws designed to curb tobacco use. And the world’s largest tobacco companies will still find ways to sell cigarettes in the countries that can least afford to pay the healthcare costs that can result from smoking.

Image credit: Municipal Government of Montevideo

AmeriCorps to Shut Down Health Program After Abortion Controversy

AmeriCorps, the federal public service program with more than 75,000 volunteers, is discontinuing its popular healthcare program after criticism about members providing emotional support to women seeking abortions. The Community HealthCorps program, run by the National Association of Community Health Centers (NACHC), promotes healthcare for America's underserved while helping to develop tomorrow's healthcare workforce. The program has trained 7,300 members in over 200 healthcare clinics across the country over its 21-year history.

The controversy arose because six AmeriCorps volunteers offered emotional support for women seeking abortions. Although the volunteers did not perform abortions, their actions were found to have broken federal law, according to the Corporation for National and Community Service (CNCS) agency’s Office of the Inspector General. Federal law states that AmeriCorps resources cannot “provid[e] abortion services or referrals for receipt of such services.”

The CNCS manages AmeriCorps and has an annual budget of $1.1 billion. It created its own restrictions, which prohibit “providing or promoting abortions” and “providing a direct referral for an abortion.” A direct referral would involve giving out the name, address and contact information for a clinic that provides abortions. But the CNCS guidelines do not specifically prohibit providing emotional support services.

Six volunteers in New York were the only ones found to have offered abortion-related services out of 1,600 that served the NACHC during the grant cycle, said Samantha Jo Warfield, a spokeswoman for CNCS.

As a result of the abortion controversy, the Community HealthCorps will shut down. The NACHC failed to receive its grant of $30 million, which it received for the past five years. The 400 actively-serving Community HealthCorps volunteers can finish their clinic assignments.

Republican lawmakers appear intent on finding organizations that receive public funding and have ties to abortion services, and AmeriCorps is its latest a target. Despite the ruckus the program created due to the abortion controversy, the closure of the Community HealthCorps program has been relatively discreet and with little media attention.

Community HealthCorps volunteers provide important services, including childhood obesity prevention, HIV/AIDS awareness and diabetes education, in areas where people lack access to necessary healthcare services. Volunteers raise awareness of potential health issues, ultimately preventing more costly and severe issues in the future.

Because Community HealthCorps benefits low-income people in underserved areas, some of the most vulnerable populations will be most severely impacted by the end of the Community HealthCorps. Singling out the actions of a few volunteers in what appear to be relatively isolated incidents doesn't look at the big picture. It is ultimately the health needs of the underserved that will suffer the most here, due simply to differing ideological views.

Image Credit: Steven Depolo, Flickr

Elon Musk and Tesla Twitter Outbursts Smack of a Cover-Up

In the worlds of politics and business, when it comes to a crisis, the cover-up is always worse than the crime.

Richard Nixon and Bill Clinton can attest to that. Cover-ups ended one presidency, while another became a hopeless media circus. The tobacco industry’s suppression of its own research is well-known. And Exxon-Mobil’s quashing of its scientists’ research on climate change became the subject of several investigations. Johnson & Johnson’s reaction to the 1982 deaths from cyanide-laced Tylenol has long been hailed as a leading example of crisis management. But this year, the company was nailed for being too slow to warn the public about the risks related to its Pinnacle hip implants.

Now Tesla and its co-founder, Elon Musk, are facing similar problems. And the way they managed the fallout from the death of Joshua Brown, a former Navy SEAL and technology-lover who died while using the autopilot feature in his Tesla Model S, is creating more problems for the company than solutions.

Indeed, much of the media reaction bordered on the absurd, as Nick Bilton showcased last week in Vanity Fair. Approximately 33,000 Americans die from traffic fatalities annually, largely because of human error. And the numbers worldwide are a disturbing 1.3 million a year, according to one road-safety advocacy group. The hysteria over driverless cars, and suggestions that this tragedy serves as a “wake-up” call, is shortsighted when considering the rather dreary 100-year history of human drivers.

Nevertheless, for many consumers, autonomous cars are still a nascent technology. And the reactions of Musk and Tesla, on both blogs and social media channels such as Twitter, came across as self-serving, defensive, tone-deaf and lacking any compassion.

The accident happened in May, and immediately, Tesla notified the National Highway Traffic Safety Administration. But it did not announce the death to its shareholders until almost two months later. In the meantime, Tesla and Musk combined to sell over $2 billion worth of stock, without any mention of the accident within its securities filings.

When Fortune editor Alan Murray questioned the timing, Musk was not having any of it:

https://twitter.com/elonmusk/status/750350191044259840

The spit-spat with Fortune continued, with Tesla slamming Fortune’s continued coverage of the stock sale and accident. In the meantime, Musk continued to tout the Model S’s “lowest probability of injury” for any car tested by the NHTSA. This could be statistically true, but it's still dismissive of any concerns the public, or regulators, may have about Tesla’s products in the wake of the May accident. And let’s face it: The bottom line is that investors have a right to be concerned — Tesla is still losing money, and has fallen short of its most recent production goals.

For autonomous car experts and those deeply vested in this young industry, one death in 130 million miles driven may not seem to be material when it comes to disclosing such information to investors. But to much of the public, including those who are considering the purchase of Tesla stock, such disclosure is important — not necessarily because of the statistical significance, but what it says about how the company will respond to adversity in the long run.

And the stubborn fact remains that no matter how well a company is run, how fantastic the products are, and how brilliant and visionary a firm’s executives may be, all companies will confront huge challenges. The way in which a company responds is about more than “optics.” It's about the agility of an organization during a time of hardship. Taking a defensive tone, as Tesla and Musk have done, heightens more suspicion instead of silencing it.

Meanwhile, Musk made it clear that “comments, suggestions and criticisms” of Tesla’s products are welcome but criticism of him, or the company, is not. Musk’s rules also apply, apparently, to any environmental concerns, as evident in his response to a recent Bloomberg article that suggested the demand for rare minerals such as lithium could have an impact on wildlife:

[embed]https://twitter.com/elonmusk/status/750446098020503552[/embed]

The reality is that all companies are under a microscope. And while publications such as Wired, Gizmodo and TriplePundit are often advocates and even celebratory of companies in the mold of Tesla, other publications, such as vanguards of yesterday’s industries such as Forbes and Fortune, often have a completely different take. That does not mean Musk and Tesla should take the bait. Instead of picking a fight, Tesla and its co-founder need to communicate transparency and cooperation in the face of a crisis.

Picking a fight with the media won’t make the problem go away. If anything, as Nixon learned, it will only encourage the skeptics. And these days, there will be more than a Carl Bernstein or Bob Woodward on a company’s tail. Anyone with a smartphone and a reasonably high IQ can call a company out on its “BS.” Musk, Tesla and the future of transportation would be better served by showing more grace, and developing a far thicker skin.

Image credit: Martin Gillet/Flickr

B-Lister’s Memoir of ‘Gap Year’ in Africa Makes the Case Against Voluntourism

In the old days of the entertainment industry, an up-and-coming actor would find celebrity by entering into a sham marriage or, in the more recent era of reality TV, making a scandalous sex tape that somehow “leaked” to the Internet. Of course these days, celebrities are “multiplying like head lice.” And actress Louise Linton, known mostly for her roles in the comedy film "She Wants Me" and the Lifetime movie "William & Kate," took a different approach. Presumptively to boost her profile, Linton recently decided to reminisce about her “gap year” spent on a voluntourism stint in Zambia during 1999.

Unfortunately for Linton's career prospects, the reception of her self-published book, "In Congo’s Shadow," did not go very well. Either Linton conveniently forgot many details from that episode in her life 17 years ago, or she is remarkably ignorant about Zambia and the rest of sub-Saharan Africa in general.

Despite the challenges endemic across the globe, African countries continue to rank amongst the world’s most rapidly growing nations, depending on the source cited. Sub-Saharan Africa has become a hub for clean energy innovation, a magnet for multinationals looking for that last new market and further experimentation in social enterprise. Even conventional media companies such as CNN, which long portrayed Africa in a negative light, have acknowledged the emerging technology and business centers in cities as diverse as Addis Ababa, Cape Town and Nairobi.

But Linton chose to hold on to old assumptions about Africa in her memoir, which is a gift that keeps on giving and hardly in a good way as she veers between neocolonialism and overt racism. The Amazon.com description, in which Linton describes herself as having “long angel hair” and the establishment of a school “under the Mukusi tree,” presented enough red flags.

But then the British daily The Telegraph published excerpts of Linton’s story last month, which read as a contrived tearjerker of a war memoir as Linton describes how she uprooted herself from a life of prestigious schools and a secret garden, only to find herself confronting every fair-skinned maiden's worst nightmare in Africa:

“The dense jungle canopy above me had eliminated what little moonlight there was and plunged me into inky blackness deep in the Zambian bush. I lay very still, listening for the armed rebels and wondering how long it was until daybreak, not knowing if I’d survive to see it.” – An excerpt from "In Congo’s Shadow," published in The Telegraph.

Linton survived to tell her story. But it is not clear if her career will survive the social media backlash, much of which is from Zambians who dispute her description of their country. The hashtag #LintonLies slathered across Twitter as Zambians took issue with everything from her accounts of being in the middle of the Hutu-Tutsi conflict to nursing a child stricken with HIV with a Coca-Cola. Even a softball piece in her hometown newspaper did not do Linton any favors. The paper raised its brows at her alleged encounter with “smirking men with deadened eyes [who] would brutalize me before casting me aside like a rag doll,” only to make a narrow escape and, eventually, become a dining companion of Donald Trump.

Critics -- often mocking, but usually with fury -- were beside themselves with other details, such as machete-wielding child soldiers or Zambia’s 12-inch spiders. So over the past week, Linton applied a virtual machete to her book in order to salvage her reputation as she halted its sale, deleted her Twitter account and turned her initial dismay over the furor into an apology. In a cruel twist of irony, any references to the book are nonexistent on her website, with the first magazine cover displayed in her press section bearing the title, “Top Scottish jokers of all time." To many observers, "In Congo’s Shadow" was so outrageous that it appears to mimic the parody Instagram account Barbie Savior, which had this to say about the controversy:

[embed]https://www.instagram.com/p/BHfD5Q5DJLr/?taken-by=barbiesavior[/embed]

Voluntourism has long been criticized by Africans as a self-serving exercise by privileged outsiders who seek personal redemption or more bullet points on a graduate school application. But Linton's melodramatic and clichéd account of her time in Zambia is insulting to anyone who actually invests resources in this region because they see themselves as equal partners, not saviors. Whether the efforts involve opening a restaurant in Ethiopia or funding technical training programs in South Africa, these individuals and organizations succeed not out of condescension or a literal self-image as a white knight helping victims, but because they work with locals as equals.

As the creators of Barbie Savior have explained, good work overseas is accomplished by understanding the challenges on the ground where one wants to truly “help,” not by making a pilgrimage to fulfill a narcissistic quest to find self fulfillment.

Image credit: Matthew Grollnek/Wiki Commons

What Nature Teaches Us About Design and Leadership

“A sustainable world already exists. And we need to access that wisdom, that knowledge, those design blueprints, those chemical recipes, those ecosystem strategies, and even that purpose,” Janine Benyus, co-founder of the Biomimicry Institute, said at the 2016 Sustainable Brands Conference.

“Biomimicry is the conscious emulation of 3.8 billion years of time-tested wisdom,” Benyus continued. It doesn’t mean extracting, domesticating or harvesting organisms. It means learning from nature.

Clients approach Benyus with design problems and ask: How would nature solve this? Does the natural lend a solution that will let us leapfrog to the answer?

Some of the design questions and answers go like this:

Q: How does nature create the color white without pigment, without chlorine? A: We whiten our paper with chlorine. But polar bears, moths and beetles create the color white by using structures that scatter light.

Q: How does nature capture pollutants from a moving stream of fluid? A: Mangroves pull out sediments to make land. Their root columns are in very specific locations. This insight helped a waste energy company get lead and cadmium particulates out of the flow going up smoke stacks.

Q: How can we repel bacteria without harsh cleansers and antibiotics? A: A shark does it with diamond-shaped bumps on its skin. Now, a company called Sharklet Technologies is using the design to prevent bacteria pathogens from taking root in hospitals and bathrooms.

Q: How does nature preserve? A: Tartigrades are an animal that can survive extreme heat and nearly freezing temperatures. Vaccines are now being wrapped up using the same process so they don’t need refrigeration.

Q: How does nature manufacture without heat, beat and treat? A: If you’re a spider and you need to make fiber in or near your own body, you don’t use harsh chemicals or high temperatures.

The questions are endless. For more examples, you can watch Benyus’s recorded session on the Sustainable Brands Conference website.

At the conference, KoAnn Vikoren Skrzyniarz, the founder of Sustainable Brands, asked Benyus: “What does nature teach us about leadership?”

The answer to this question is long but easy to understand. When figuring out how to lead a social group toward a worthy goal, Benyus said we should examine herds of zebras and flocks of geese. “Leadership for collective action is distributed, shared and purposeful,” she explained. In these situations there isn’t just one leader. There are multiple leaders who take turns so the leadership is distributed. The leaders are subject-matter experts who set the direction for the rest of the group to follow. And they all share one purpose: to continue life.

The rules for this type of collective pursuit are simple: Avoid colliding with teammates; align your direction and speed; stay in group formation; and, every once in awhile, randomly dart out to find good food somewhere.

So, how does this play out in real life? Cities and brands should be generous and produce ecosystem services which should be measured. For example, cities should produce as many ecosystem services as the wild land. There should be ecological performance standards for carbon sequestration, pollination, erosion control, air filtration, water purity, and water and carbon storage. They should meet or exceed the level of ecosystem services provided by the native ecosystem and there should be per acre metrics. Such requirements would mean the leadership is distributed, shared and purposeful.

Some buildings are already starting to function this way. One building Benyus cited releases three times cleaner air than the air that goes into it. A factory is trying to turn itself into a forest, a river flat Eucalypt forest to be precise. Another company is imitating a coral reef by taking CO2 from smokestacks and shooting it through brine or seawater to precipitate limestone.

“This is how we get to become a welcome species on the planet,” Benyus said. “I have great hopes that our purpose is turning toward, Elon Musk forgive me, not going to Mars but actually staying on this home which is ours but not ours alone.”

Image credit: Maarten van den Heuvel via Unsplash

Investors Can’t Ignore the Human Capital Challenge for Social Enterprises

By Sal Giambanco

We at Omidyar Network have invested close to $1 billion in social enterprises. And like any investor, we want the companies in our portfolio to meet their scale, return and impact goals. While it is commonly understood that funding is a big issue facing entrepreneurs as they grow their businesses, we have found that our investees are often equally starved for talent — a perspective validated by newly released research.

While hiring, developing and retaining the best people is challenging for nearly every business in every market, it is particularly difficult in emerging markets, where the talent gap is stifling social enterprises’ ability to scale. Fundraising may get all the attention, but while that gets easier for later-stage startups, human capital challenges grow tougher. The Human Capital Crisis: How Social Enterprises Can Find the Talent to Scale surveyed 628 social entrepreneurs in 59 countries, and the percentage of entrepreneurs ranking talent as “very challenging” increases from 25 percent to 45 percent as companies mature.

The research was conducted by one of our investees, RippleWorks, with analytical support from McKinsey & Co. The research confirms what we hear from entrepreneurs from India to South Africa to Brazil: Local talent is in short supply, and seasoned senior talent is expensive and often beyond startup budgets. The top-ranked challenge — by nearly 40 percent of entrepreneurs — was not having the funds they needed to hire. While we know this to be true, we believe there are things that can be done to overcome these challenges.

It takes more than a CEO

Having data on the state of human capital in emerging markets validates our experience and can help entrepreneurs and investors prioritize the talent that we think is so critical to the success of social enterprises.

When we meet with founders, we usually end up advising them to make recruiting a higher priority. It always takes longer than founders think to bring on the senior leaders needed to scale their company, and it takes personal involvement from the CEO to attract and select the right people.

CEOs who prioritize recruiting as a crucial part of their role are more successful at hiring the talent they need to scale. Fred Swaniker, founder of African Leadership Academy and African Leadership University, has built strong teams and talent pipelines for all of his organizations. Swaniker devotes half of his time to recruiting, noting: “A huge part of the recruiting for an organization like mine is the vision of what we are building. Whoever joins my team needs to be sold on that vision. Who better to hear that from than me?”

Just as CEOs need to hone their pitch to investors, they also need to articulate a winning argument for why a qualified candidate should join their team. An effective value proposition should emphasize mission-driven and challenging work, a healthy and inspiring company culture, and professional development opportunities. We have found that when our portfolio companies are able to clearly articulate a strong employee value proposition, they are able to overcome market challenges, and hire and retain incredible talent.

Investors need to step up

We hear time and again that human capital support is one of the most valued ways we support investees. And yet we also hear that in many cases entrepreneurs are reticent to share human capital challenges with investors. The research underscores that the best mentoring is founded on trusting and deep working relationships. As investors, we need to strive to be more effective mentors, to create the space for open conversations about human capital needs, and to be part of the solution. We have the opportunity to help founders focus on the right things, like prioritizing recruiting and developing high potential employees. We can also make connections and provide funding to enable startups to invest in relevant training and development.

Our founder, Pierre Omidyar, is an entrepreneur. He knows the value of investors who provide mentoring alongside funding. As a result, we have a human capital team dedicated to helping our portfolio organizations address talent challenges. We focus primarily on recruiting and leadership development, but also extend additional support through making connections to relevant specialists and industry experts. We have also made investments in organizations like Endeavor and RippleWorks to strengthen entrepreneurial ecosystems. These organizations have different but complementary models for providing the type of relevant and specialized mentoring that this research found to be most helpful for scaling companies.

The talent challenge in emerging markets is well-known, but this new research shows us how significant it is for social enterprises in particular — and how important it is for startups to invest early in talent in order to scale successfully. This report makes entrepreneur needs clear, and we hope it helps both entrepreneurs and investors to prioritize talent and work together to overcome these challenges to more effectively reach scale.

Image credit: Taylor Nicole via Unsplash

Sal Giambanco leads human capital at Omidyar Network, where he helps develop and scale the talent at the philanthropic investment firm and its portfolio organizations. Follow him on Twitter @onsal.

3p Weekend: These Cradle-to-Cradle Innovations Stop Waste in Its Tracks

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads and spend five minutes catching up on the latest trends in sustainability and business.

“Designers have a pivotal role to play in driving long-term solutions that circumvent the concept of waste in favor of materials that can remain in a perpetual cycle of use and reuse," Lewis Perkins, president of the Cradle to Cradle Products Institute, wrote in a prompt for its third design challenge.

Sponsored by the Institute and Autodesk, the Cradle to Cradle Product Design Challenge seeks to inspire up-and-coming designers to create products for the circular economy — highlighting safe materials that can be perpetually cycled.

A total of 138 design professionals and students in 19 countries worked as individuals or in teams to submit 79 entries for the contest. Participants were required to take a free two-hour, online course about designing for the circular economy, made possible by a partnership with the Alcoa Foundation, prior to entering the challenge. So, even those who don’t win will still walk away with an increased knowledge of cradle-to-cradle design.

"From retail packaging to human shelter, the Spring 2016 Challenge winners are outstanding examples of the way young designers and design professionals alike are stepping into the crux of this revolution, using Cradle to Cradle principles to pioneer ideas for innovative materials applications and, in turn, the circular economy,” Perkins said.

So, without further ado, here are the four winning designs from this year's challenge. Read on to be inspired -- and start reimagining what you consider waste.

MODS

Winner: Best Student ProjectMillions of pairs of shoes end up in landfills each year, where they can take 30 to 40 years to decompose. Quang Pham, a student at Virginia Tech, created a modular sneaker in response to this problem.

Made with bamboo, wool textiles and recycled PET fiber, MODS consist of five modular units that use the minimal amount of material needed for maximum comfort and security. Even better: The user retains full control of the shoe’s aesthetic and functionality. MODS shoes can be customized and updated to change up the style, as components begin to deteriorate, without using glue.

Because the shoe can be easily disassembled, cleaning is a breeze. In Pham's vision, component parts could be sent back to the manufacturer for recycling at end-of-life, in exchange for a discount on new parts.

Banana Stem Fiber Packaging

Winner: Best Professional ProjectColombian designers Brayan Stiven Pabón Gómez and Rafael Ricardo Moreno Boada wanted to transform a geographically abundant material into sustainable food packaging. The result is this compostable packaging concept made from banana stem fibers.

Bananas are farmed across several regions of Colombia, yet farmers perceive banana stem fiber (extracted as part of routine crop maintenance) as waste.

Drawing upon traditional food preparation methods, Banana Stem Fiber Packaging offers a sustainable alternative to plastic and paper food packaging, along with the potential to generate sustainable economic development in farming communities, the designers said.

Huba

Winner: Best Use of AluminumDeveloped by designers Malgorzata Blachnicka & Michal Holcer, Huba is a self-sufficient, compact mountain shelter that is able to generate its own energy. Huba also offers a potential solution for other housing applications, including helping homeless populations or the provision of emergency shelter, the designers said.

Huba’s design is based on traditional alpine architecture, with its small size and choice of materials aimed at minimizing its impact on the environment. Intended to be located above 3,200 feet, the shelter is equipped with an effective vertical wind turbine.

The energy produced by the generator is stored within a battery and is used to supply the building’s heating, lighting and water pump. Specially arranged roof tiles enable rainwater to easily be collected within the tank, which is then filtered and safe for drinking.

OLI

Winner: Best Use of Autodesk Fusion 360It seems Virginia Tech isn't messing around when it comes to educating designers about the circular economy. Another VTech student, Claire Davis, came away with the win for the best use of Autodesk’s Fusion 360 3-D printing technology.

Her design, the OLI, is a convenient, elegant and intelligent solution for food waste. The food scraps collection bin creates a pretty and elegant at-home composting experience. It's also made entirely from sustainable materials like coconut shells and recycled PET bottles. And it can be disassembled for easy cleaning, reuse and recycling of component parts.

Images courtesy of the Cradle to Cradle Products Innovation Institute