Nature: A Better, Faster, Cost-Effective Answer for Climate Resilience?

By Lynn Scarlett

As sea-levels rise and weather-related threats continue to increase, opportunities emerge for people and local governments to build “living shorelines.” These natural or nature-based structures are designed to reduce risk to communities and infrastructure from flooding and storm surge, while often providing the ecosystem benefits of habitat.

The U.S. Army Corps of Engineers proposed a new category in its nationwide permitting process that would allow speedier approval of living shorelines such as wetlands with sea and marsh grasses, sand dunes, mangroves and coral reefs. The category is now open for comment, reports Scientific American. Under the guidance of the Clean Water Act, permits are required for essentially all construction activities that occur in the nation's waters, including wetlands.

Currently, it’s much faster for property owners in many parts of the country to get a permit for sea walls, bulkheads and other so-called gray infrastructure than it is to get a permit for the construction of nature-based systems since there is an existing nationwide permit that covers some of those activities. If the Army Corps moves forward with the new category, though, permits to build living shorelines could be issued in a quarter of the time it takes under the current model.

Turning to nature to reduce the impact of severe weather

This proposal comes as data continues to highlight the financial and physical impacts of climate change and severe weather. Since 2005, five major hurricanes have caused a total of more than 2,200 deaths and some $230 billion in damages in the U.S. In the past 5 years, the Mississippi and the U.S. coasts have repeatedly experienced historic flooding -- damaging crops, businesses and communities.

The economic implications of extreme weather events are felt across the country. Ninety-six percent of the total U.S. population lives in counties where federally declared weather-related disasters have occurred since 2010. Meanwhile, average flood losses in the U.S. have increased steadily to nearly $10 billion annually, driving the National Flood Insurance Program $24 billion into debt.

To counter these risks and rising costs, we need solutions that are better, cheaper, and smarter. Notably, some of our best solutions are also greener. Nations, communities, and businesses are re-examining natural systems and their potential to meet economic, environmental, and safety needs. We are asking, increasingly: How can we tap nature’s solutions to secure and sustain safe, prosperous coastal communities and healthy ecosystems?

Living shorelines utilize a combination of structural and natural materials such as wetlands, marshes, sand dunes, mangroves, or coral reefs combined with coir fiber logs, sand fill and stone. They can reduce wave intensity, prevent erosion, and provide a host of other economic and environmental benefits.

Natural coastline protection and climate resilience

The move toward more natural coastline protection comes as federal agencies, state and local governments, and business leaders focus increasingly on the concept of resilience as they plan for how communities will adapt to climate change.

Earlier this month, I was a featured speaker at a forum on the State of Resilience hosted by the National Academy of Sciences. In the panel’s closing remarks, Lt. Gen. Thomas Bostick, who retired last week as chief of the Army Corps of Engineers, spotlighted living shorelines as a “natural way that we can reclaim some of our land and take the focus off of expensive infrastructure.”

Quantifying the benefits of natural systems

As the world begins to recognize the many services that natural systems provide to people, communities and economies, decision-makers are increasingly looking to quantify and secure those benefits.

To invest in living shorelines, governments and businesses need to know just how much contribution these ecosystem services provide. They need to better understand the contexts within which natural systems support these services and how they might vary over space and time. They need to better understand the costs of losing these services as well as the costs of protecting or restoring them. And they must understand who could benefit from these services and, potentially, pay for the costs of maintaining them. In short, to advance investment in these ecosystem services, there are many needs and players to engage at multiple scales.

The Nature Conservancy and other partners are already trying to answer these questions. A joint report with the Natural Capital Project suggests that 16 percent of the near-shore coastline in the United States is classified as high-hazard. Reducing risks to these communities involves rethinking the role of nature itself.

Though we need more data and knowledge-building, the potential risk-reducing benefits of nature’s assets are not hypothetical. A 2011 analysis examined coastal marshes and their protective role. Across all studies, the scientists found that salt marsh vegetation significantly reduced wave strength and helped stabilize shorelines.

Best-practice examples emerging across the U.S.

Already, across the U.S., some communities are tapping these benefits. In North Carolina’s Albemarle Sound, the Conservancy is expanding oyster reefs, sustaining and protecting coastal lands.

In Alabama, we helped build more than 1.5 miles of oyster reef with NOAA, other partners, and other funding. Data from two oyster reef restoration projects in Mobile Bay, Alabama, show an estimated 51 to 90 percent reduction in wave height and 76 to 99 percent reduction in wave energy at the shore from reef restoration. This restoration carries with it other benefits, including enhanced fish and crab catch.

The Conservancy is not alone in drawing from nature’s solutions along coasts. A variety of “living shoreline” initiatives elsewhere are emerging. They include oyster reef enhancement, tidal marsh creation, beach nourishment and dune restoration, riparian vegetation management, and “living” breakwaters. There is no one-size-fits-all approach to harnessing the value of nature to enhance coastal protection and provide other ecosystem services.

Some of the biggest challenges in addressing resilience may be those of governance and finance. Ecosystem services often are meaningful at scales that transcend the jurisdictional boundaries of political institutions and individual land owners. High-intensity storms along the Gulf of Mexico, for example, affect multiple communities, even multiple nations. Degradation in the Chesapeake Bay results from actions that extend from land to sea and among multiple U.S. states and many communities. These and other challenges unfold at landscape and seascape scales.

The bottom line

Fundamentally, communities and governments face the challenge of how to achieve a decision scale “big enough to surround the problem, but small enough to tailor the solution,” as scholars at the Lincoln Institute of Land Policy have observed.

We know there is no one simple set of policy and financing tools to drive action, but ideas are emerging. In some cases, creation of “conservation banks” may fulfill the role of achieving scale. Incentives for “living shoreline” easements present a different tool to bring about aggregation of action across multiple properties.

All of these ideas, including those being floated by the Army Corp of Engineers, are not to suggest that nature-based solutions are an “either-or” approach. We can achieve comprehensive risk reduction when these solutions are planned and implemented together with a portfolio of other approaches. We need governance to facilitate regional, landscape-scale, or watershed-level actions and enhance coordination across jurisdictional boundaries. We need tools that focus on outcomes rather than prescriptions, and we need incentives that align with ecosystem services investments. Working towards “living shorelines” helps combine many of these criteria so that we might have healthy lands and waters, thriving communities, and dynamic economies.

Image credits: 1) © Erika Nortemann/TNC; 2) © Andrew Kornylak

Lynn Scarlett, Global Managing Director for Public Policy at The Nature Conservancy. In this role, she directs policy in the United States and the 35 countries in which the Conservancy operates with a focus on climate and nature- based solutions. Most recently, she was the Deputy Secretary and Chief Operating Officer of the U.S. Department of the Interior, Lynn also served at Interior as the Acting Secretary of the Interior in 2006.

10 Reasons to Travel the World – While in High School

By Matthew Redman

I’ll bet most people don’t think of world travel as a way to help to solve the world’s conflicts. But being a citizen diplomat is the No. 1 reason to travel for me.

1. Being a citizen diplomat

Traveling the world is part of my job. Every day I help students fulfill their dreams of global travel.

I started traveling internationally in my teens. I’d suggest every individual start their global travels as soon as they are ready for an adventure past their state line. Study abroad is no longer just for college students. It’s growing more popular for younger teens. Research indicates these experiences help students to be more successful in college and life.

I see firsthand the exciting transformations in students who have the world as their classroom in CIEE High School Abroad programs. By living with host families in the country, they immerse themselves in another culture and language. They gain understanding and respect for that culture. It’s a two-way street. By sharing a home, people share cultures and defeat stereotypes.

2. Develop as a person

When you study abroad in another country, you push your personal boundaries to grow as an individual. You often deal with a different language, different customs and different means of transportation. Away from familiar support networks, you take on more responsibility, independence and learn resiliency. Students say study abroad helps develop self-confidence.

3. Prepare for a global future

The book "Educating for Global Competence: Preparing Our Youth to Engage the World," the Asia Society observes:

“Young people need to understand the worldwide circulation of ideas, products, fashions, media, ideologies, and human beings. These phenomena are real, powerful, ubiquitous. By the same token, those growing up in the world of today— and tomorrow! —need preparation to tackle the range of pervasive problems: human conflict, climate change, poverty, the spread of disease, the control of nuclear energy.”

By seeing the world, you have the opportunity to understand perspectives on issues that may similar to your own or may be very different.

4. Acquire global competencies

In addition to having a global, more compassionate perspective, you build skills to make you more attractive to future employers. Employers seek out individuals who are comfortable working in a diverse environment and able to incorporate different viewpoints.

5. Increase maturity

Students often use summer study abroad for independent exploration. This period away from the classroom and routine activities allows students time to reflect and grow. Parents report a dramatic transformation during these short-term programs as their children return stronger and more independent.

6. Gap to grow

Take a time-out like presidential daughter Malia Obama with a gap year between high school and college. This pause between high school and college allows students to get off the high-achievement merry-go-round and have time for themselves.

Many say it’s the first opportunity they’ve had to discover who they are as a person and what they want out of life. A gap year doesn’t have to occur far from home, but has added advantages when a different culture is added into the mix.

7. Sharpen focus

Study abroad allows time for renewal. For example, the majority of students who take a planned, structured gap year return to college within six months with a reignited passion for learning and the ability to contextualize formal education using their "real-world” experiences. Many colleges recognize the benefits of a gap year.

8. Increase readiness for college

Students who take a gap year are more likely to finish college in four years than those who enroll directly after high school. They also have higher GPAs and tend to be more focused. A study by Karl Haigler and Rae Nelson, authors of "The Gap Year Advantage," found that 60 percent of gap year participants said the experience influenced or confirmed their choice of major.

9. New perspective on home

You don’t know what you’ve got till it’s gone, the song says. Students who study internationally see their hometowns differently when they return. Their experiences abroad cause them to see controversial issues at home like immigration in a new light. Many students say it inspired them to volunteer in their local community.

10. Make lifelong friends and memories

The friendships formed can last a lifetime. I know. I went on my first international trip right after high school.

How can you make study abroad travel happen, especially at a younger age? It starts with you. The best resource is real life. Ask friends and family about their international travel experiences, how they made intercultural experiences a reality, and what they learned from unexpected experiences. Students, their families and school counselors should consider the student’s goals and desired experiences for the year.

The keys to a successful study abroad experience in high school is to identify a program meets those goals and to set up a structure to keep things on track. Look carefully into study abroad programs to find high-quality offerings that provide the desired cultural and learning experiences. Check out what others who have attended the program are saying. For example, CIEE gap year students blog about their experiences while studying abroad. You can also see ideas from the American Gap Association.

Image courtesy of CIEE

Matthew Redman is CIEE Vice President for Global High School and Teach Abroad.

Making Golf 'Greener' in the 21st Century

By Travis Lesser

Golf is an ancient game, and the legend of its origin is debated. One theory suggests the game was started by Scottish shepherds hitting rocks around a field with sticks. Their objective, of course, was to get the rock into a hole in the ground in as few attempts as possible. Regardless of how golf actually got its start, the reason the sport is alive after all of these years is clear: The game is a great way to spend the day.

Fast forward to the modern game here in the United States. Every April, the hallowed grounds of Augusta National Golf Club are pumped into our living rooms showing us The Masters. The emerald green fairways and stark white bunkers. The limited advertisements and exclusivity. Other than the advent of high-definition telecasts and extended coverage, little has changed over the years.

This is many Americans’ perception of golf. It is an old sport with dated practices and traditions. This notion is prevalent on many levels throughout the game -- none more so than the industry’s attempts to be a good environmental steward.

This is not to say the industry hasn’t taken some steps in the right direction. A recent Golf Course Superintendents Association of America (GCSAA) study shows significant reduction in nitrogen, potassium and potash use across the industry over the past 10 years. Additionally, superintendents are finding ways to reduce water usage, especially in places like California where drought conditions prevail.

But these positive actions are not enough. It is clear that more needs to be done in the area of environmental stewardship across the industry -- notably in the areas of water conservation, fertilizer and pesticide use, and waste management.

To get insight into just how far golf is lagging behind, we should look at how it compares to other sports. To do so, you need only to look back to late June in Houston, Texas. The Green Sports Alliance (GSA) conducted its sixth annual GSA Summit at Minute Maid Park, home to the Houston Astros. Several sports were featured, and lauded, for their contributions to the environmental sports movement.

Most notably, facilities, ownership and players for Major League Baseball, the National Basketball Association and the National Hockey League were prominently featured throughout the program as leaders in this movement. Taking steps in advocacy, stadium lighting efficiency, food waste reduction, and recycling program adoption were some attributes of these successful programs.

In past years, golf had been noticeably absent from the Summit, and for the most part other GSA endeavors as well. But this year’s program included people with ties to golf in two separate panel discussions. One was entitled "Going Global: An International Sports & Sustainability Fireside Chat," and included Golf Environment Organization Chief Executive Jonathan Smith. Smith's message was clear that golf wants to play its part in the green sports movement. The closing panel topic “Chatting with the Champs," included former LPGA Tour player Anya Alvarez, who offered the player’s prospective.

In addition, one panel discussion was solely dedicated to golf for the first time in the Summit's history, entitled “Golf’s Sustainability Agenda: The Power of Collaboration." The experts included executives from industry associations such as the GCSAA, the Club Managers Association of America and the Colorado Section of the PGA. They discussed steps being taken within the industry, such as the first corporate social responsibility report dedicated to a golf course, as well as considerations for future endeavors.

It was a great starting point and good to see leaders in our industry on the same page. However, as noted during the golf panel discussion, there were several people absent who could have offered even greater insight into the pain points that the industry faces. Much value could have been added by including representatives from the United States Golf Association, the PGA Tour, and professionals from the industry who are already putting environmentally-sound principles into practice. Having these additional people in the room will lead to a deeper discussion on how to improve and implement better processes throughout the industry.

I am more convinced than ever that we are all merely scratching the surface of what is going to be a large, global effort. It is my belief that golf’s environmental and social responsibility movement is about to reach a tipping point. And doing so will also carry with it other benefits. By communicating that golf is becoming more progressive as an industry, it is possible that we can open the door to a new segment of clientele. With an industry desperately looking for ways to jumpstart stagnant growth in participation, it is time to look for other solutions. Simply stating “the game is too expensive” and that it “takes too long” is not solving anything.

In order to encourage this drive, it is imperative that golf have a larger presence in the green sports movement going forward. By bringing together leaders in golf with leaders in the greening of sports, we will encourage informed, open-minded conversations. These types of talks can lead to positive steps not only on an industry level, but on a global level as well.

Attending the Summit showed me just how far we as an industry have lagged behind. While we are late to the party, my hope is that golf has a bigger presence at next year’s Summit. I know I will be there, and I encourage all of my fellow colleagues to join me. More panel discussions and a larger golf presence at the 2017 GSA Summit in Sacramento in June could go a long way to ensuring this great game will still be around for future generations to come.

And the good news is, by taking on a leadership role and moving to the forefront of the green sports movement, we will ensure a legacy of which we can be proud.

Image credits: 1) Pixabay; 2) Courtesy of the author

Travis Lesser is the Owner and Founder of Spring Mil Solutions, LLC, a consulting practice devoted to working with golf courses to implement zero waste programs. He earned his B.S. in Business Administration with a concentration in Professional Golf Management. He then spent eleven years in the golf industry, working at places such as Philadelphia Country Club, the International Junior Golf Tour, and the United States Golf Association, before returning to school to complete his M.B.A. at Penn State. Travis has also worked on projects concentrating on zero waste and recycling programs.

Business & Climate Summit: inspiring a social movement

The Business & Climate Summit 2016 held in London is a leading annual forum for businesses, investors and policymakers on climate action. One of the attendees was Charles Perry, a leader in sustainability, energy and climate change for 20 years, who is a non-exec director of no less than five sustainability organisations and who founded, ran and sold the highly respected Second Nature consultancy. Charles attended the conference and this article is based on an interview with him about the event—Adam Woodhall

Why did you choose to attend this conference?

This was a follow-up to COP21 Paris Conference, attracting people from all over the world, and after realising the high profile nature of these participants, I thought, “It’s about how businesses help drive both adaptation and mitigation on climate change” with speakers such as Stuart Gulliver, CEO of HSBC and Paul Polman, CEO of Unilever. I also saw that there were various dignitaries from government and public sector as well, such as Ségolène Royal, the French Minister of Environment who was also and President of COP21; Christiana Figueres, Executive Secretary of the UNFCCC and I thought this would be one not to miss.

It was a great collection of passionate and extremely knowledgeable people trying to work on how do we drive this agenda forwards with urgency. Because, if you remember from the Paris agreement, the big outcome was 175 countries signing up to keep climate change below two degrees’ increase, and in fact aiming for 1.5 degrees. And that’s really challenging to achieve. So we’ve all got to get a lot more serious about how we’re going to do this.

Who stood out to you from the speakers?

Someone who really impressed me was Laurence Tubiana, who is from the French government, she’s an economist and diplomat who was appointed the ambassador for the international negotiations for COP21. In her talk she described where we’ve got to and then what’s going to happen next with the handing of the baton to Morocco, the hosts for COP22 next year. She was really calling for a whole gear change and paradigm shift because it was generally agreed that we’re not on track at all. In fact, at the moment, we’re heading for more likes of three and a half to four degrees’ centigrade increase.

Was there anybody taking that pace up and following her urging?

I think the We Mean Business Coalition is a very good and positive group of very progressive businesses, that includes Marks & Spencer and Unilever and Ikea and others. They’ve come together to drive this change, so they’ve also formed RE (Renewable Energy) Hundred, committing to a 100% renewable energy generation. They also launched at the summit the The Business End of Climate Change report. This coalition is supported by Steve Howard, who is the Chief Sustainability Officer of Ikea. He came across very impressively and he’s made great progress in the way he’s corralled people of great influence around the world to drive things forward. Nigel Topping CEO of We Mean Business also spoke very well on this agenda.

That sounds very positive, what was the general mood of the conference?

Well, that’s a very different question because the mood was quite bleak, given that the Brexit vote had happened only 4 days before and just about every speaker talked about Brexit. This is a group of passionate people around sustainability, environment, climate change and 99% of them were supporting remain. So it was difficult to concentrate on the whole COP process of international negotiations when the whole world has been thrown into a period of uncertainty and instability.

Do you see any connections between what the Remain Campaign is now doing, post-Brexit, how things can be done going forward with climate change?

Yeah, absolutely. I think it’s all about mobilization and social movements. People like to think of the whole climate change thing as an environmental movement, I prefer to think of it as a social movement. So even though I’d call myself an environmentalist first and foremost, I actually believe what we need here is a social movement to readdress our way of life.

How would you summarise the conference?

I’ll tell you exactly how I’d summarize it; as individuals all these people are very knowledgeable, experienced with multiple qualifications, and it’s like “Wow, this is a group of incredibly impressive people”. That inspires me and as I’m a people person and a huge extrovert I get my energy from people. So the question for me is, how do you actually work with these individuals as an individual? Take organizations out of this, as individuals how do we work together to drive the necessary change? And that’s why I go back to the answer; that this is a social movement. Because as soon as realize it’s a social movement then it’s not about “I work for M&S and we do X”, or “I work for BP and we can’t do Y”, it’s about working together to deliver transformational change.

Thank you, Charles. It sounds like an excellent conference, and we look forward to the 2017 edition, when hopefully, we can report on considerable progress over the last 12 months.

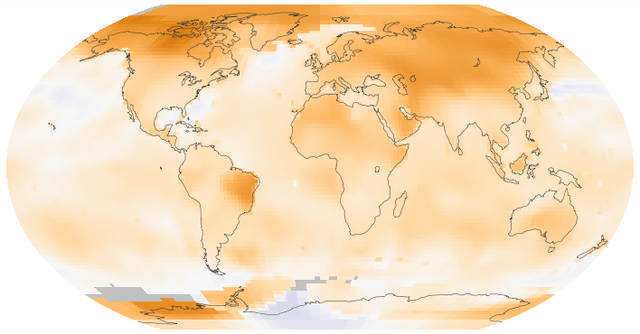

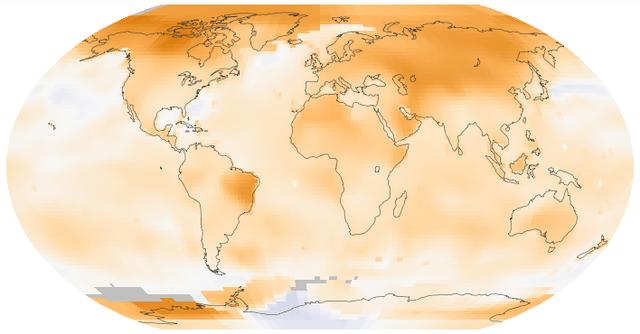

Warmer Temperatures Are Impacting Fish in North American Waters

It hasn't been a good year for the world's oceans. The plastic pollution problem is getting worse. We're seeing the biggest coral bleaching event in recent history. And now, there's growing evidence that even the small warming we've experienced due to climate change is having significant impacts on how fish reproduce, grow and even where they live.

This comes from a series of studies released by the United States Geological Survey (USGS), which, in turn, synthesize data from 31 other studies conducted across North America. It is one of the most comprehensive looks at how climate change is impacting fisheries. There is a caveat, of course, that even this is just a tiny piece of the puzzle, as there are thousands of different marine species in our waters, and only a tiny percentage of them were analyzed closely by scientists.

Some of the findings are quite worrisome: Scientists found new fish hybrids, a result of species that migrate at different times and now come into contact; altered prey-predator dynamics that could impact the food chain; and well-documented shifts in abundance of numerous inland fishes, including sockeye salmon.

While some species will benefit, others will not. And due to the complexities of ocean ecosystems, figuring out the long-term impacts will be a major challenge.

All hope is not lost, of course. With increased knowledge, fisheries managers can build responses that help build resiliency and also protect highly vulnerable fish species and their precious habitats.

“Even though climate change can seem overwhelming, fisheries managers have the tools to develop adaptation strategies to conserve and maintain fish populations,” said Craig Paukert, a lead author and fisheries scientist at the USGS Missouri Cooperative Fish and Wildlife Research Unit at the University of Missouri, in a press statement.

Key to that will be more research -- and increased knowledge. The climate is, as we know, incredibly complex. And we need to invest far greater resources in understanding the scientific impacts in order to create strategies to solve the problem. What we do know is worrying enough.

“The current state of the science shows that climate change is impacting fish in lakes, rivers, and streams, but knowing that is just the first step in effectively addressing the changes to these important natural resources and the communities which depend upon them,” said Abigail Lynch, a lead author and fisheries biologist with the USGS National Climate Change and Wildlife Science Center, in a press statement.

There is a strong financial component, too. Recreational fishing is a $25 billion industry, and coastal fisheries contribute almost $700 million in revenue to state agencies. There is a strong role that companies who sell fishing equipment, boats and other gear can play in both helping fund research and ensuring that our fisheries stay strong in the face of what is inevitable increased warming.

Together, we can protect our fish from climate change – but only if we take strong, science-based action soon.

Photo Credit: via Wikimedia Commons.

Is the Hydrogen-Fueled Toyota Mirai a Disruptive Technology?

Toyota branded the Mirai hydrogen-fueled car as a technology turning point. And for good reason. The Mirai is a technology wonder. This article profiles my test-drive of a car that stunned me with its speed and handling.

But does the Mirai represent a disruptive technology? Will it win the emerging market share war between electric cars and today’s gasoline cars? Or will the real disruptive technology be autonomous vehicles?

My test-drive of the Toyota Mirai

I was not prepared to like the Mirai so much during my test-drive at Sustainable Brands 2016. It looks a lot like a Prius. And that is not a bad thing. I own a Prius C. The Prius C is a surprisingly great car in terms of fuel efficiency, handling and comfort. But the Prius C’s weak point is its acceleration. It is just not exciting.

Accelerating the Mirai is great fun. Stomping down on the fuel pedal will drive you back into your seat. This is a car that can compete with gasoline-powered vehicles up the highway ramp.

The Mirai also handles like a sports car. It has a suspension that makes twisty roads a fun experience. And it delivers this fun with a luxury-like smooth ride.

The following is a 90-second video of my test-drive experience. In a word: The Mirai is a turning point in how I think about hydrogen cars.

https://www.youtube.com/embed/V4l_yut4q2M

The hydrogen question

I had the honor of leading the team that developed the first hydrogen-fueled Prius. The South Coast Air Quality District took delivery of these cars to conduct field testing. Their real-world experience on city streets demonstrated that hydrogen-fueled cars could deliver on performance with zero tailpipe emissions.

What stopped this technology’s commercialization was the challenge of sourcing hydrogen in quantity, at competitive prices, with a lower-than-gasoline emissions footprint. Here’s what my analysis found on sourcing hydrogen:

- Reforming natural gas. This is the commercial path most likely to deliver hydrogen today. The question is: Why take natural gas and refine it further to source hydrogen? Doing so adds costs and emissions. Why not just burn the natural gas because it has a higher energy content than hydrogen?

- Landfill methane. Landfills create methane (natural gas). This more sustainable source of methane can then be reformed to create hydrogen. But the question is whether this use of landfill methane is its best and highest-value use. The alternative is to use landfill methane to generate electricity, bypassing the hydrogen production and reforming process.

- Solar electrolysis. This is the Holy Grail that uses solar energy to split water modules to create hydrogen. It is a renewable technology path for sustained production of hydrogen with zero emissions. But existing technology is horribly inefficient. It takes about 10 units of solar energy to produce one unit of hydrogen energy.

- Nuclear power. Nuclear power plants can produce huge quantities of hydrogen at competitive marginal costs. Rather than generating electricity, these power plants could use their energy to create hydrogen by splitting water modules. While the marginal costs appears competitive, there are significant challenges tied to nuclear’s huge capital cost requirements plus the cost of long-term safe disposal of nuclear waste that has a 10,000-year half life.

Why I wish the Mirai could succeed

I truly wished the Miria could be a commercial success. It is fun to drive. It provides a 300-mile range between refillings. Refueling can be done in about five minutes. The car’s approximately 67 miles per gallon fuel efficiency exceeds our nation’s 2025 fuel standards. It’s zero tailpipe emissions is a solution to global warming.

There are incentives that make buying a Mirai attractive. The car's base price is $57,500. The federal government offers a tax credit that works out to be about $8,000. California offers its citizens a $5,000 cash rebate. Toyota is offering a $7,500 price discount for a limited time period. All of these incentives drops the Mirai’s price point to around $37,000.

But for the Mirai to succeed, the challenge of fuel supply has to be figured out. The closest hydrogen refueling station to my Oceanside California home is a 20- to 30-minute drive. Who wants to commute to fill up?

The bottom line is that the Mirai is a great piece of technology seeking a fuel solution. For it to be a disruptive technology, there needs to be an affordable, clean and convenient supply of hydrogen. Achieving that milestone would truly be disruptive.

Image courtesy of the author

Editor's Note: This post was updated on July 20, 2016, to correct terminology related to natural gas reforming. For more on this method of hydrogen production, check out Energy.gov.

Herbalife Agrees to $200M Settlement with FTC Over Pyramid Scheme Allegations

You've probably heard of the nutritional supplement company Herbalife. Heck, the chances are high that half of your Instagram followers are pitching the company’s suite of products.

For years, Herbalife was a towering example of multi-level marketing (MLM) -- or, to those who say they were burned by the company’s business model, a pyramid scheme. The company retorts that its weight-loss products helped people live far more healthier lives and inspired social value by corralling people into what the company described as “nutrition clubs.” To that end, Herbalife vigorously denies that it is a pyramid scheme and says it is a legitimate MLM.

The company’s slick marketing collateral, along with its stately headquarters in Los Angeles’ Century City business district, impart a legitimate business with $3.8 billion in annual revenues. But many former “distributors” allege it is not.

For years, people complained that the supposed $59 start-up fee can actually spike to as much as $4,000 to launch that coveted home-based business. Many claimed that only a few distributors could make money, and they did so by recruiting other sales reps, to whom they would sell Herbalife products and therefore score commissions.

The complaints snowballed to the point that the Federal Trade Commission (FTC) launched an investigation, which concluded last Friday.

Under an agreement reached in a California federal court, Herbalife will pay $200 million to people who say they were victimized by the company’s moneymaking marketing campaigns. And in Illinois, the company acquiesced to a $3 million settlement with the state’s Attorney General Lisa Madigan. That separate agreement will compensate Illinois residents who say they were misled into taking part in Herbalife’s expensive multi-level marketing scheme.

In addition to reimbursing consumers who say they suffered financially from participating in the company’s sales programs, Herbalife also agreed to revamp its business model. Sales reps who pitch the company’s products will no longer be rewarded based on how many people they recruit. Instead, they will be incentivized based on how many products they actually sell. Herbalife’s tactics and promises of living are what infuriated many former sales reps and sullied the company’s reputation for years.

“The inconvenient little secret about Herbalife,” wrote FTC attorney Lesley Fair in a blog post, “[is] the small number of distributors who actually made money made it not by selling products to people who wanted the company’s powders, pills, and potions, but rather by recruiting others to serve as distributors.”

What the settlements with the FTC and Illinois Attorney General’s office did not accomplish, however, is to label Herbalife a “pyramid scheme.” And that omission is what sparked Herbalife to crow victory in a press release shortly after both decisions were reached last Friday.

The company insisted that the FTC’s allegations were “factually incorrect,” and said it only agreed to the settlement because of the negative press and litigation costs that resulted from the investigations. In addition to paying financial damages and changing its incentive programs, Herbalife said it would improve its product and sales training, reclassify its employees, and extend the time during which a new distributor can return its introductory membership pack.

The settlement, in which the FTC appeared to describe Herbalife as a pyramid scheme without using that dirty word, exasperated many analysts. One of them, Matt Levine of Bloomberg, noted that the agency shut down another MLM, Vemma, which had an operation similar to that of Herbalife’s.

In addition to Herbalife, the company’s lobbyists, which Politico says include Oglivy and Democratic lobbyist Heather Podesta, can also consider themselves winners. So can the MLM industry at large, which critics say targets vulnerable consumers who are looking for gainful employment but see few options — which is also why organizations from Uber to Trump University have found lucrative opportunities by taking the advantage of desperation.

Owners of the company’s stock can also consider themselves victors. Herbalife shares, despite a recent stretch of stagnant performance, are on an overall upward trend this year. After the FTC announced the settlement, the company’s stock price soared 8 percent on Friday.

One of the biggest losers in the wake of the settlements is hedge fund manager Bill Ackerman, whose campaign against the company has long been a thorn in Herbalife’s side. In 2012, he released a presentation that attacked the the company’s business practices and shorted approximately $1 billion worth of the company's stock. Ackerman highlighted what he called Herbalife’s duping of consumers into falling for its alleged get-rich-quick scheme. And it brought even more negative attention to the company.

As the company disclosed it had overestimated its new member growth figures, Ackerman continued his four-year attack against Herbalife. On a CNBC panel in May, he offered this advice to the company’s employees: “I’d go find another job.” Despite Friday's announcement, Ackerman’s Pershing Square Holdings is still defiant, and issued a statement predicting that Herbalife’s restructuring “will cause the pyramid to collapse.”

That could happen as the terms of the FTC settlement involve more than issuing refunds to disgruntled former employees or, in technical terms, independent contractors. Over the next several years, 80 percent of the company’s sales have to be to new customers, and Herbalife also agreed to be audited to ensure the new compensation plan is actually followed. Based on how the company generated sales in the past, it is in for a tough slog for the rest of this decade.

Image credit: Philafrenzy/Wiki Commons

On Algae Bloom, Obama Tells Florida: You Figure It Out

Florida’s Treasure Coast has become inundated with algae blooms. The problem festered from time to time in recent years but has become even worse this summer. One could blame poor infrastructure, agriculture runoff or climate change. But whatever the problems may be, the green slime is wreaking havoc on the local environment and is harming local businesses.

Nevertheless, Florida must solve the problem on its own, as the federal government has so far refused to offer financial or logistical assistance.

The headlines aren't as dramatic as the “Ford to New York: Drop Dead” headlines during the 1970s, but the message from the Feds is clear: It is your mess, so you fix it. Over 40 years ago, President Gerald Ford refused to consider any federal bailout of New York City (although Ford never said the words “drop dead” himself). The Obama administration's response to the Sunshine State is eerily similar: This mess is yours, you’ve resisted federal regulations that could have helped with this problem, so don’t let the door hit you on the way out.

According environmental watchdog groups including Earthjustice, the algae bloom, as others before it, originated in Lake Okeechobee, about 65 miles from West Palm Beach. Nitrates and other pollutants from surrounding sugarcane fields, dairies and farms have leached into the lake, the shores of which are secured by a dike that is old and is need of further repairs. The U.S. Army Corps of Engineers often lower the lake’s levels in advance of the annual hurricane season, and that water in part flows into the St. Lucie River, which flows into the Atlantic.

The result is an environmental disaster along the Atlantic coast that has scared off tourists and hurt the local economy.

The solution, says Sen. Marco Rubio of Florida, is to secure the water in Lake Okeechobee no matter how high it may raise, or have it flow “in in a different direction.” But as Alan Farago, president of Friends of the Everglades, points out, Rubio has a long history of siding with Florida’s “Big Sugar” industry. Environmentalists, including Farago, have long accused the state’s sugar companies of putting the kibosh on any legislation perceived to tighten environmental rules that would hold those companies more accountable for their operations’ impact on local waterways.

Criticism is also mounting against the state’s governor, Rick Scott, who is scheduled to speak at the Republican National Convention tomorrow night in Cleveland.

Scott blames the Obama administration for what he says is its failure to act on this issue. But columnist Fred Grimm of the Miami Herald says the governor has long resisted more stringent water standards in deference to the state’s powerful agriculture lobby. Scott activated an emergency state loan program to assist small businesses owners suffering from the algae bloom. But at this point it is unlikely that the federal government, specifically the Federal Emergency Management Agency (FEMA), will be moved to take action.

It is ironic that two of Florida’s most powerful politicians -- who have either denied or dodged the issue of climate change, while local officials clamor that it is having an impact on the state’s fragile ecosystem -- are now suddenly looking to the federal government for a solution.

Two years ago, Florida’s residents voted to support an initiative to earmark hundreds of millions in state funds to purchase land around Lake Okeechobee. The plan was to add wetlands to remediate polluted water before it ended up south in the Everglades or east in the Atlantic. But that money went elsewhere, so the algae blooms keep coming and increasing in size.

It looks like Scott and Rubio, who have long insisted that the federal government cannot solve all of our problems, will have to accept their own advice on this issue.

Image credit: Florida Sea Grant/Flickr

Video: Heal the Planet with Climate Reality Leader Dr. Susan Pacheco

https://www.youtube.com/watch?v=BNfFG9qfzuE

By The Climate Reality Project

Ten years ago, when Susan Pacheco sat down to help her children with their homework, she wasn’t thinking about changing the course of her life. She was thinking about getting them to finish their assignments, getting dinner ready, and getting through a long list of patients at her university’s clinic the next day.

As it happened, her oldest son, Gabriel, was learning about climate change in his science class. Dr. Pacheco, a pediatrician and professor in Houston, had never really thought about the issue. But there a movie called "An Inconvenient Truth" was playing in theaters and getting people talking about the climate in a way she’d never seen before. So she packed up all three kids and her husband, and they went to see it as a family.

What happened next will sound familiar to almost anyone who’s seen the film. Sitting in the dark theater after the credits rolled, she recalls being thunderstruck.

“I watched in awe, and at the end of the documentary I just sat there in shock, the theater empty, the kids pulling on me to go,” she said. “It was like a storm in my mind. It wouldn’t rest and couldn’t calm down. I started reading and reading and applied to the training with Al Gore.”

The training she applied to was the second Climate Reality Leadership Corps event led by former Vice President Al Gore and held in Nashville in 2006. Gore’s premise was simple. He’d been giving the slideshow presentation on climate change featured at the heart of "An Inconvenient Truth" for years. If a movie version could get millions talking about the issue while most politicians were simply ignoring it, why not train regular people eager to give the same presentation themselves and get their friends, family members, colleagues and everyone else talking too?

The idea certainly appealed to Dr. Pacheco. But what she did with her training went far beyond the slideshow. After all, the more she learned about climate change, the more she saw what it meant. It was right there in her clinic’s waiting room every day: in the increasing number of anxious mothers’ faces, worried about their child’s asthma; in the hacking coughs of more and more kids fighting allergies; in the patients with heat intolerance forced to stay inside when the temperature climbs or wear cooling vests when venturing outdoors. And on and on.

With her medical and educational training, she knew she could teach her students how to treat these patients. And with her training as a Climate Reality Leader, she could talk to her peers throughout the medical community about what was happening. As an associate professor at the University of Texas Health Science Center, Dr. Pacheco specializes in pediatric asthma, allergies and immunology. And since training in Nashville, she’s used that position to educate her students, the broader Houston community and medical professionals throughout the United States about the threats to human health associated with climate change.

How? For starters, Dr. Pacheco founded the Texas Coalition for Climate Change Awareness, a network of individuals from diverse backgrounds united around the common goal of educating themselves and their Texas communities about climate change in the state. She’s been working with the American Academy of Pediatrics’ Council on Environmental Health to publish a policy statement and technical report on the importance of climate change in pediatric health. She published two op-eds in the Houston Chronicle and one in popular Hispanic paper La Opinion about the importance of the Clean Power Plan and EPA regulations for ozone.

And perhaps most importantly, she’s working to educate doctors just beginning their careers by bringing the impacts of climate change on public health into the medical school curriculum, starting with her own students at the University of Texas McGovern Medical School. She hopes to continue the trainings with medical schools throughout the country.

If it sounds like she is not-so-quietly revolutionizing the health care field in Texas, it’s because she has. It’s not just her patients and peers who’ve noticed, either. In 2013, President Barack Obama recognized Dr. Pacheco with the honor of being a White House Champion of Change for her work.

It hasn’t always been easy, though. In fact, when she first began her crusade, her own father was skeptical.

“He said to me: You’re a very passionate person, such a good pediatrician. This would be a waste to spend so much energy on climate change,” Pacheco recalled. “But I said: 'My planet is sick. If I’m committed to the health of my patients, I have to care about the health of my planet.'”

Luckily for all of us, she did. And when Vice President Gore visits Houston from August 16 to 18 to train the next generation of Climate Reality Leaders, Dr. Pacheco will be there too, sharing her story and mentoring a new group of regular people who decided to care about the health of our planet and helping them make a difference too.

About The Climate Reality Project

The Future of Packaging is Under the Sea

By Melissa Lang

Have a think about how much packaging you waste each year. Many of us attempt to reduce our waste through recycling. And in a survey by Cone Communications, more than 9 in 10 millennials said they would switch brands to one associated with a good cause, such as sustainability. But after Amazon came under fire for frustrating customers with over-packaged products, it still seems that retailers and packaging companies add extra materials without consideration.

It is time businesses started to think about how they can be kinder to the environment with their packaging. But how? Let’s have a look at an innovative packaging design that turned heads at Lexus Design Award 2016.

Eco-friendly packaging

Nowadays most businesses are making efforts toward eco-friendly packaging. Many companies use corrugated cardboard boxes, which are made of biodegradable material, and this is great. It is important for businesses to adapt an environmentally friendly packaging. This sends out a message to their consumers that they do care about the planet and not just about making money.Many customers become frustrated with the more packaging you give them. But it is also important to keep items safe during transit. Remember the more packaging you give your customer, the more effort they will need to put into disposing the rubbish. Separating it into different recycling bins isn't always an option either.

Lexus Design Award 2016

At this year’s Lexus Design Award, designers thought outside the box and dove straight into… the sea? Lexus was impressed by a prototype packaging product made with seaweed. This was created as an alternative to plastic and took the award for emerging designers.The design is called Agar Plasticity, and it displays the possible usefulness of agar for packaging design. The winning team is made up of three Japanese designers together known as AMAM. These designers have even been mentored by the designer Max Lamb – who is also renowned for his experimental work with materials.

What is agar?

AMAM firstly wanted to create a concept that used mouldable agar material as it could create a packaging form that would be environmentally friendly. As well as being biodegradable, agar is a sustainable raw material.The AMAM prototype substitutes plastic for agar as packaging. Agar can be found in multiple types of marine algae. The team used red seaweed (above), which is abundant in source and can be collected easily. Agar-based material dissolves in boiling water, leaving no residue.

In the future agar, is set to replace traditional disposable plastic material such as shopping bags. Unlike glass and paper, plastic simply cannot be recycled infinitely. Plastic has an estimated life cycle of between 500 and 1,000 years, a vast comparison to agar’s dissolvable quality; this is why agar is so appealing.

The designers were short-listed in November, and have been pushing the boundaries ever since. The group even sent an agar box which contained a perfume bottle from Tokyo to Milan.

The packaging prototype

AMAM's clever invention which was showcased at the Lexus Design Award exhibition in Milan and displays how the raw seaweed is could act as a functioning packaging material.This prestigious award by Lexus aims support young talent internationally. AMAM wants to promote recycled packaging and said this at the awards:

"We want to completely replace plastic products. But in the timeframe we had, we couldn't really industrialize the material," the AMAM team told Deezen. We hope that the backing of the Grand Prix winner of the Lexus Design Award will help us to get some contacts from the industry."The designers are keen to test the material for industrial purposes. Max Lamb was inspired by the idea and its problem solving abilities and was delighted to work with the team.

"It is probably the most pragmatic project there was," the team told the magazine. "It was the one that had the most genuine ambitions, and the most genuine desire to solve a problem – and that is the over-consumption and the over disposal of non-biodegradable synthetic materials."

AMAM’s goal is to completely substitute plastic packaging products with recyclable material to help eliminate unnecessary waste in the world's oceans

Lexus Design Award juror Alice Rawsthorn said the standard of each of the final projects – which included a shape-shifting dress and a magnetic lamp – was high.

The future of eco-packaging

The judges were inspired by the avant-garde ideas represented at the awards. One of the judges said:"One of the things that has been very interesting about judging the awards is that it’s almost like an annual barometer of young designers' preoccupations. Predictably, as a result, over the years more and more designers have focused on social, economic and humanitarian issues."

Utilizing these future-forward materials may not be possible for your brand right now. But sustainable products are available in the short term, such as committing to use recyclable inflatable bottle packing in the food and drink industry, or committing to only purchasing recycled cardboard for your warehouse storage needs. An advantage of purchasing only recycled products is that these products tend to often be cheaper than virgin alternatives.

Whether you believe that the future is buried deep in the sea or not, have a think about how your business can tackle over-packaging. Take inspiration by noticing how competitors are packing. What can you do to make your business packaging the best it can be? This will not only benefit the environment but will also provide great customer satisfaction as consumer mindsets shift toward sustainable living.

Image credit: 1) Pixabay 2) Michael Fagioli

Melissa Lang is freelance writer from Glasgow, Scotland. Melissa has a keen eye for all things design and in the past has consulted on business branding and marketing.