How You Can Be Part of the Fair Trade Difference

This piece was sponsored by Fair Trade USA and went through the normal editorial review process.

Fair Trade USA, a nonprofit organization and leading certifier of Fair Trade products, has released a powerful 5-minute documentary video to kick off its new Fair Trade Difference campaign and pledge drive. The purpose of the video and two-week campaign is to tell the story of Fair Trade in full color, and to inspire commitment to shopping Fair Trade by signing a pledge. As a whole, the Fair Trade Difference is an invitation to peer behind the seal; a guided tour into lives and communities across the world impacted by production and purchase of Fair Trade products; and a call to people to care about a simple way to make an immediate, long-lasting difference in the world.

The lifeblood of the Fair Trade movement is a spirit of curiosity. But when it comes to our most common questions—“Where do my products come from?” or “Why does Fair Trade matter?”—we at Fair Trade Certified can’t answer them alone.

That’s because Fair Trade-- which is part of a global movement-- is not a definition but a dialog. It’s is an ongoing, global narration of countless, deeply personal stories of farmers, workers, and fishermen who live its positive impact every single day. Fair Trade is about giving farmers and workers a voice in their community and around the world, and the Fair Trade Difference is about passing the microphone.

Specifically, the Fair Trade Difference zeroes in on a (if not the) self-defining aspect of the Fair Trade model, the Community Development Funds.

Community Development Funds

Many people understand that the Fair Trade Certified seal represents goods that were made responsibly, fairly, and sustainably, making it easier for people to choose products that align with their values. In addition, for every Fair Trade Certified product sold, the people who made it earn an additional amount of money called the Community Development Fund. From there, the community decides together how to spend the funds to improve their lives and meet their unique social, economic, and environmental needs. The Fair Trade Difference explores how different communities across the world are using those funds for good.

The film itself pulls back the curtain on the Fair Trade model to reveal a rich, nuanced narrative about the difference made possible through everyday purchases of Fair Trade products. It also shows how Fair Trade looks a little bit different everywhere you go, because every community has their own needs and priorities.

“In an ideal world, everyone could meet these farmers and workers for themselves, but the video allows the ability to start to bridge that connection between producer and product,” said Celina Plaza, senior manager of digital communications at Fair Trade USA.

With producer narration separated by striking aerial survey footage, the video documents a trip to three destinations around the globe—a coconut farming community in the Philippines, a textile factory in India, and a coffee farming community in Colombia—tracing the storied paths our products take before ultimately arriving on the shelf.

Sign the Fair Trade Difference pledge

The Fair Trade Difference asks you to follow through on your end of the deal by signing a pledge to choose Fair Trade Certified™ products when you shop, and in so doing, demonstrates the empowering force of Fair Trade for both producers and shoppers. We all have the power to make shared investment in the communities that provide for us, reverse the damaging effects of poverty and injustice, and turn every shopping trip into an opportunity to make an immediate and lasting difference in the world.

“So often, we deal with consumption by ignoring the other side of it,” said Dalia Burde, executive producer of the film. “You want to buy organic or Fair Trade—things that, to you, are just stickers on a product, without knowing that someone on the other side has had to work hard to make that product for you. To actually see every step of the process was eye-opening.”

Visit fairtradecertified.org/thedifference for more information and to sign the pledge.

Our friends at Avocados and Coconuts have shared beautiful behind-the-scenes journals and photos from each stop along the trip. Go to their website to read more about filming in the Philippines, Colombia, and India.

Image credit: Fair Trade USA

Transgender Scientist Sees Gender Discrimination from Both Sides

Imagine having the inside scoop on gender discrimination. Consider if you can, what it would be like to be a woman who was once a man who had unknowingly enjoyed perks like promotion, good pay and recognition -- only to find after transitioning to a woman, that there is indeed, a glass ceiling.

It's a reality that Dr. Vivienne Ming, a theoretical neuroscientist, considered "one of the top ten women to watch in tech" by Inc. Magazine, knows well. She's not only studied the difference between what men and women are required to fulfill to be "accredited" in their professions, but has lived it.

"There really is a monetary tax imposed on women," said Ming, whose most recent investigations involved the different processes that women and men must go through to remain upwardly mobile in their professions.

According to Ming's research, there's a distinct differences between what men and women need to go through to attain recognition in their respective goals and professions, right from the time they enroll in college. A woman "needs to go to more prominent schools for longer periods of time here in the States paying those extra tuitions [and] not earning salaries. They need to spend longer at lower-rank jobs" than men of the same age group and scholastic level.

What's more, Ming found when she was Evan Smith, a talented, aspiring male student who graduated with honors in his field from Carnegie Mellon University, people looked at her and judged her potential based on her sex: male at the time.

"What's interesting is how quickly people begin to presume you don't know the math behind your own work," Ming told BBC in an interview. As Evan Smith, her computations were considered unquestionable and landmark. As a woman, however, "overnight, people just stopped asking me math questions." Women in the same role were considered OK for leading research projects, but less likely to have the right scientific answers for a problem.

Nowadays, Ming's investigative work does hold a lot of weight in the scientific community. As the co-founder and managing partner of Socos, she works to improve educational opportunities for children by using technology and predictive analysis to address core problems.

"There is a disconnect between what is assessed in education and what is relevant throughout life," Ming states on her website. She's now using her own experiences with that disconnect to power innovation for other young achievers.

But it may be Ming's perceptive insights and experiences as a transgender woman that will really help illuminate the challenges that need to be addressed in education and the workplace. So often we hear messages better when there is a human voice, with a moving human experience attached to the technical data. As in Ming's case, the math behind the numbers back up the need for action, but it's the lived experiences she's shared that compel us to believe them.

Images: Courtesy of Socoslearning.com. Credit: Erik Jepsen/UC San Diego.

U.S. Pairs Up with Japan to Boost Hydrogen Fuel Cells

Back in 2010, the U.S. Department of Energy provided the $465 million loan that launched the Tesla electric vehicle phenomenon. Tesla repaid the loan early, and the company's runaway growth is a good indicator of the Energy Department's success in picking winners. With that in mind, it looks like hydrogen fuel vehicles could be the next breakout, zero emission cars to benefit from the agency's helping hand.

Yes, Hydrogen fuel cell vehicles are for real

Until recently, hydrogen fuel cell vehicles were something of a running joke among auto industry observers. Here's the joke:

Neophyte: They say hydrogen fuel cell vehicles are about to happen!

Auto journalist: Yes, and they've been saying that for the last 30 years!

Well, it looks like the joke is on the experts.

Virtually all major auto manufacturers are now developing fuel cell EVs. Toyota is probably the best known early adopter with its fuel cell Mirai sedan. Fuel cell vehicles also provide a mobility aspect for the company's broad "hydrogen society" vision, which will hopefully include a healthy dose renewable hydrogen.

In another standout example, GM recently made waves by introducing a new fuel cell EV platform aimed at replacing light duty diesel-powered military vehicles among others.

GM designed the platform to double as a stationary power source when parked. That's a significant development considering the growing interest in microgrids, including the use of microgrids for military use and emergency response.

Energy Dept. charts fuel cell growth

Although no single company has benefited from an Energy Department loan on the scale of $465 million, the Energy Department has been plowing millions into R&D projects aimed at bringing down the cost of fuel cells and related equipment and building up a network of hydrogen fuel stations.

Millions of taxpayer dollars are also going into solar-power water splitting and other renewable sources for hydrogen. That's a critical step, considering that the primary source for hydrogen is fossil natural gas.

Last week the agency recapped its efforts in a report timed to the observance of the third annual National Hydrogen and Fuel Cell Day (yes, there is a National Fuel Cell Day, and it's always on October 8 -- 1.008, get it?).

The full Fuel Cell Technologies Market Report is available as a free download. For those of you on the go, the major finding is that stationary power systems, including backup power, are among the largest markets for hydrogen fuel cell technology today. The report inlcudes fork lifts and other logistics equipment in that category, too.

The stationary and logistics market is still relatively small, with only 62,000 units shipped globally in 2016. However, the report notes that in terms of total megawatt capacity, the number has doubled in just two years, to 500 megawatts double the number just two years ago, in 2014.

More to the point, the report notes that on a capacity basis, the hydrogen fuel cell market for transportation -- aka fuel cell electric vehicles -- has tripled.

U.S. looks to Japan for Hydrogen fuel cell magic

Much of the rapid growth in hydrogen fuel cells for transportation is riding on the efforts of car makers in Japan and Korea. With that in mind, another recent announcement from the Energy Department is significant. Last week, the agency announced that its Fuel Cell Technologies Office will team up with NEDO, its Japanese counterpart, to accelerate the hydrogen and fuel cell trend.

The announcement was pretty low key, amounting to a total of just two paragraphs. Here's the second one:

DOE and NEDO will collaborate to collect and share data regarding early-stage R&D and safety of hydrogen and fuel cells, including data from hydrogen fueling stations and fundamental hydrogen research safety. The United States and Japan will work to apply that data for guiding future research and enabling the safe deployment of fuel cells and hydrogen infrastructure technologies. In addition, DOE’s Fuel Cell Technologies Office and NEDO plan to hold a joint workshop on hydrogen in the coming months.

That sounds like a lot of data-shuffling, but the new partnership will have a powerful impact on the hydrogen fuel cell market.

Aside from accelerating fuel cell R&D, the new partnership could also ramp up the transition out of fossil-sourced hydrogen. In a public-private partnership, Japan's Toyota is already experimenting with wind powered water-splitting in systems integrated with shipping and logistics, and the company recently announced a fuel cell initiative with 7-11 that could dovetail with rooftop solar power.

Toyota is also envisioning entire zero emission "hydrogen societies," and it recently announced a major R&D investment to back it up.

Meanwhile, over here in the U.S. it looks like things are already rolling. To cite just one big news item, last week GM unveiled a multi-use fuel cell vehicle platform that the company will leverage to reduce its fleet greenhouse gas emissions.

It's a good guess that Tesla's Elon Musk is not sweating, but as the saying goes: Don't look back. Something might be gaining on you.

Photo: via US Department of Energy.

Coal Is Going Down, Even Without the Clean Power Plan

By Elliott Negin

Last week, Environmental Protection Agency Administrator Scott Pruitt announced he will repeal the Obama administration’s regulation to curb power plant carbon emissions, telling coal miners in Kentucky that “the war on coal is over.” The next day he kept his promise, issuing a proposed rule to eliminate the Clean Power Plan.

It was hardly a surprise. After all, President Trump has called climate change a “hoax” and vowed during his campaign to bring back coal jobs, which is why Pruitt made his preliminary announcement in Kentucky, where workers have a direct economic stake.

Despite the rhetoric, however, Pruitt and Trump can’t alter the harsh reality of the U.S. coal industry: Terminating the Clean Power Plan isn’t going to bring coal back.

Consider the facts: As recently as 2008, coal-fired power plants generated half of all U.S. electricity. Since then, demand for coal has dropped steadily due to cheap natural gas, new wind and solar projects, energy efficiency initiatives, and bad investment decisions, forcing three of the four largest U.S. coal companies — and smaller ones as well — into bankruptcy. Today, coal accounts for about 30 percent of U.S. electricity generation.

As for jobs, mechanization displaced miners years ago. In 1980, more than 228,000 people worked in the coal industry. In July, according to the Bureau of Labor Statistics (BLS), the industry employed only 50,400. Employment is especially anemic in Kentucky, which supplies 7 percent of the nation’s coal, making it the third-largest coal-producing state. The coal industry employed just 5,600 people in Kentucky in July, according to the BLS, a mere 0.28 percent of the state’s nonfarm working population and 70 percent fewer than at the end of 2008.

Mining jobs aside, according to new Union of Concerned Scientists (UCS) analysis, the rapid transition away from coal-powered electricity is likely to continue no matter what the Trump administration does.

“A significant portion of today’s coal fleet can’t compete economically with cleaner energy options,” said Jeremy Richardson, a UCS senior energy analyst and the report’s lead author. “That’s particularly the case in the Southeast, where operational costs for coal units are considerably higher than what utilities would have to pay for natural gas or renewables.”

Coal plant retirements will continue

The numbers tell the story: Nine years ago, 1,256 turbine units at 526 coal-fired power plants had a generating capacity of nearly 357 gigawatts (GW). (One gigawatt can power some 700,000 average homes.) Now, 706 units at 329 coal-fired power plants have a capacity of 284 GW — 20 percent less. In the intervening years, utilities converted 98 units to burn natural gas and retired 452 others.

Of the remaining 706 units, utilities have already announced plans to either retire or convert 163 more by 2030, amounting to roughly 18 percent of total U.S. coal capacity. But even that does not provide the full picture: UCS identified another 122 units at 58 plants that are uneconomic compared with natural gas — an additional 20 percent of coal capacity that is ripe for retirement. Taken together, UCS analysis shows that U.S. coal-fired electricity capacity could drop by more than a third in the next 15 years.

This inevitable decline will affect some states far more than others. Ironically, the state that consumes the highest percentage of uneconomic coal-fired electricity is West Virginia, the second-largest U.S. coal-producing state. UCS found that 12 of the 19 coal-fired units currently operating in the state are ripe for retirement, accounting for some 57 percent of the state’s electricity. Four other states are generating more than 20 percent of their electricity from uneconomic coal-fired units: Georgia, Maryland, North Carolina and South Carolina.

Fewer coal plants, better health

Shutting down more old, inefficient coal units or converting them to run on natural gas will undoubtedly have a positive effect on public health. The data show that tighter pollution controls and closures already have dramatically reduced toxic coal plant pollutants linked to cancer and cardiovascular, respiratory and neurological diseases. Between 2004 and 2012, for example, sulfur dioxide and nitrogen oxide emissions — the main components of fine particulate pollution — dropped 68 percent and 55 percent, respectively, according to a 2015 Clean Air Task Force study. As a result, the study found, the number of asthma attacks attributable to coal plant pollution plunged 77 percent, heart attacks decreased 69 percent, hospital admissions plummeted 74 percent, and premature deaths declined 68 percent, from 23,600 to 7,500.

Food Waste: A New Investment Frontier

By Logan Yonavjak

If you haven’t heard the stats on food waste, they are staggering. According to a 2016 report by ReFED - a collaboration of over 30 businesses, nonprofit, foundation and government leaders focused on food waste - we collectively waste 40 percent of our food in the U.S. alone. On an annual basis, this equates to 400 pounds for every American, 1.3 percent of U.S. GDP, and $218 billion dollars. With a need to feed a growing population estimated to top 9 billion by 2050, reducing our food waste seems like a great place to start meeting this challenge.

Unlike many other societal issues, the need to solve the food waste issue seems pretty obvious. it’s a cause that people from all walks of life can get behind. And, the good news is, there are some feasible strategies to solve the issue. ReFED’s report presented a roadmap outlining cost-effective, scalable solutions to reduce US food waste by 20 percent in a decade, putting us on the path to achieve a national goal to cut food waste in half by 2030.

“If we can accomplish this goal, we will not only have reduced a tremendous amount of waste, we will also have an impact on all sorts of other problems - from food insecurity to climate change,” commented Chris Cochran, Executive Director of ReFED. “In many ways, food waste is an emerging industry, just like recycling was in the 1980s, or renewable energy in the early 2000s.”

So, how do we get there? The panelists at a SOCAP talk “Financing the Food Waste Free Future: Emerging Approaches to Funding Solutions” outlined one of the major actions needed to reach significant reductions in food waste, which is that we need to collectively galvanize hundreds of millions of dollars of new catalytic funding. It will take a spectrum of capital - from philanthropic to commercial - to get us here. An $18 billion dollar investment is what is estimated – and this equates to less than a tenth of a penny of investment per pound of food waste reduced.

The panel included representatives from the philanthropic, impact investment and innovation sectors to examine traditional and emerging approaches being used to fund solutions to reducing food waste. “$8 billion of government support, alongside $7 billion of market-rate private investments, and $3 billion of philanthropic grants will get us there,” says Cochran.

And the additional good news? This investment will yield an expected $100 billion in societal Economic Value over a decade. NRDC just published a report outlining key opportunities for investors on food waste reduction.

MissionPoint Capital Partners is an impact investment firm that supports clean energy and other environmental solutions. They have built out an entire fund model, called Fresh Fund, around the thesis of reducing food waste. The Fund aims to invest in de-risking innovations and unlocking key bottlenecks that currently prevent large scale food waste reduction in the U.S. The team is tracking hundreds of investment opportunities in the space, and Fresh Fund focuses on market-rate opportunities primarily in retail and recycling, with smaller opportunities in production and processing. The firm recently invested in a company called Spoiler Alert, a Boston-based technology startup helping the world’s largest food businesses manage unsold inventory more effectively.

Jesse Fink, the Founder of MissionPoint, was a co-founder of Priceline. “In many ways, what Priceline does is similar to what needs to be done for food recovery, even though airline seats are not a perishable good. The question is: how do we create supply and demand in a concentrated area?” posed Sarah Vared, a Principal at MissionPoint.

We still have a long way to go to reach our national goal of 50 percent food waste reduction by 2030. Let us remember what we all learned in Kindergarten: reduce, reuse, recycle. The first, and most important principle leads us to starting with a reduction in food waste. But, how do we move beyond investing in individual companies to create systems for food recovery and matchmaking?

Here are a few ideas:

- New packaging technologies - made from bio-based plastics, for instance, can help seal meat and other highly perishable foods more effectively.

- Meal kits - another systematic change example are companies like Blue Apron, who are helping reduce food waste upfront by doing portion control at a centralized location and then sending consumers only the ingredients they need for a particular meal.

- Government incentive programs - For example, the state of California has allocated $40 million in greenhouse gas reduction funds to CalRecycle for investments in waste diversion and greenhouse gas reduction - this includes investments in food waste reduction approaches.

Ultimately, solutions require action by many stakeholders - from food businesses, to recovery and recycling innovators, to capital providers. ReFED is facilitating collaboration among leaders in all of these sectors, convening a Funders Initiative designed to drive philanthropic investment in food waste solutions, developing action guides in partnership with major restaurant, foodservice, and grocery retailers, and maintaining an Innovator Database of for-profit and nonprofit purveyors of prevention, recovery, and recycling solutions.

ReFED’s Food Waste Policy Finder also provides a state-by-state overview of public policy designed to promote food waste reduction.

And, we could all stand to think more about food waste in our own homes - maybe there are ways we can start wasting less food starting right now. Together we can cut food waste in half by 2030.

Three quarters of companies worldwide yet to acknowledge climate change as a financial risk

California Passes First Cleaning Product Chemical Disclosure Law in U.S.

Cleaning product manufacturers that either do not make their products more sustainable and responsible will now be nudged to do so, or will have to disclose the exact chemicals used in their products by 2020 if their products will continue to be sold in California.

On Sunday, Governor Jerry Brown signed into law Senate Bill No. 258, otherwise known as the Cleaning Products Right to Know Act. The law's authors say its overarching goal is to give consumers the information they need so they can make informed purchasing decisions while reducing any impacts these products could have on public health. First, companies will have to disclose chemicals in their products online by 2020, and will then be required to list those chemicals on their products’ labels before 2021.

If this law is not overturned by a statewide ballot proposition or held up in courts, SB 258 could have ramifications nationwide. After all, most companies will find it too costly to print packaging to meet the laws of one U.S. state while having a separate set of packaging for other markets. Many cleaning product manufacturers may find that it will be more cost-effective in the long run to disclose those chemicals. And leading cleaning product makers may just find it will be easier to use more responsible ingredients in their surface cleaners and detergents.

These companies could also follow the lead of companies like SC Johnson and purchase “eco-friendly” cleaning products companies – though brands such as Ecover, Method and Seventh Generation will also have to disclose their ingredients in order to be compliant with the new California law.

With Gov. Brown’s signing of SB 258, California is now plunked in the middle of the debate over how much of a right to transparency consumers should have about potentially irritating, or harmful, chemicals and allergens that can be found in common cleansers, soaps and detergents.

According to State Senator Ricardo Lara of Bell Gardens, such disclosures are a no-brainer.

“People around the country and especially Californians are demanding more disclosure about the chemicals in products we use,” Senator Lara said in a public statement. “The science is clear, and we have seen the data about how cleaning product chemicals affect parents, children, people with pre-existing conditions, and workers who use these products all day, every day.”

Senator Lara also said he was motivated to submit this legislation after he heard stories from his mother, who for years was a domestic worker.

The bill had been amended several times over the past year, and faced opposition from many leading industry groups. One national trade group that represents fragrance manufacturers attacked the bill for its potential “negative impacts” that the law could have on its member companies.

“Requiring blanket fragrance formulation disclosure does not make products safer; it puts jobs at risk and increases the likelihood of dangerous counterfeit products entering the marketplace,” said Farah K. Ahmed, President and CEO of the International Fragrance Association North America in a statement issued earlier this year.

Nevertheless, many leading companies in the consumer packaged goods and cleaning products sectors came out in support of SB 258. Those manufacturers included California-based Honest Company (which last year confronted lawsuits and public skepticism over the safety of some of its ingredients) and WD-40. Nationwide, Seventh Generation, Procter & Gamble, SC Johnson, Reckitt Benckiser, Unilever, Eco Lab and fragrance maker Givaudan have also said they support the legislation.

In addition, the Consumer Specialty Products Association (CSPA), a trade group that represents major manufacturers, said yesterday it “applauds” SB 258. “The result is an ingredient communication proposal backed by both environmental advocates and name-brand consumer product companies, and which could potentially serve as a national model for other states and major retailers,” said CSPA’s CEO Steve Caldeira.

Image credit: Mike Mozart/Flickr

How the Trump Administration Hurts Economy, Environment with Clean Power Plan Repeal

By Bob Keefe

Last week the Trump administration announced plans to repeal the Clean Power Plan, the landmark policy designed to reduce carbon emissions from dirty power plants and put our country on track to addressing climate change.

This is good news for anybody who likes pollution, thinks we ought to hitch our economy to 19th century technology and doesn’t mind dealing with extreme weather disasters.

But it’s not good news for our economy — despite the falsehoods you’ll hear from President Trump, his surrogates and their fossil fuel industry backers.

Here’s why.

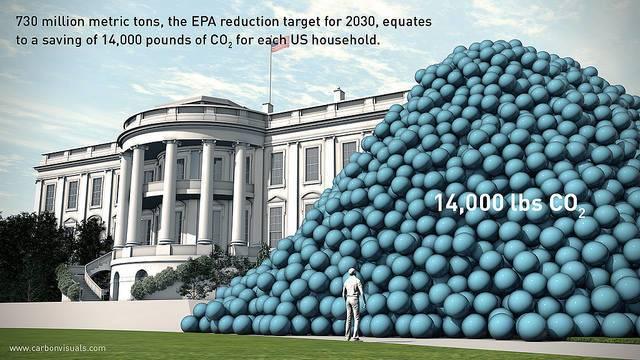

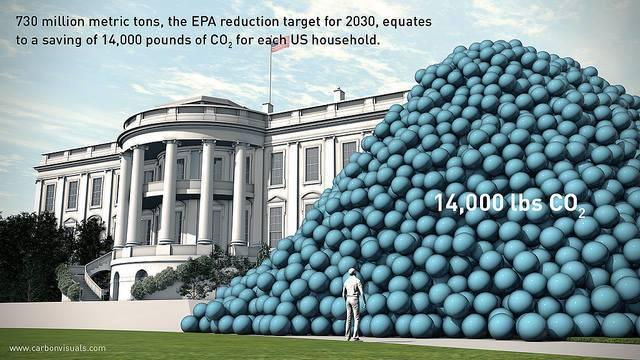

Under the Clean Power Plan, states are supposed to reduce their carbon emissions from existing power plants by about 30 percent.

To do that, states have a variety of good options. They can increase the availability of clean, renewable energy sources like solar and wind. That creates jobs and drives economic growth.

They can pass policies to make energy efficiency improvements in our schools, offices and homes — saving consumers and businesses money along the way. That creates jobs and drives economic growth.

They can clean up or replace outdated coal power plants, reducing their emissions while increasing their efficiency. Guess what? That creates jobs and drives economic growth.

In a recent analysis, E2 found that repealing the Clean Power Plan will sacrifice the chance to create 560,000 jobs and generate $52 billion in economic activity between now and 2030.

By rolling back the Clean Power Plan, President Trump also is rolling right over the more than 3 million Americans who already work in clean energy today (that’s about 12 times as many people who work in coal and gas, by the way).

He’s also sacrificing American competitiveness in the fastest-growing energy sector to China, Europe and other parts of the world, while simultaneously linking the United States with Syria as the only countries not willing to join the rest of the world in doing something about climate change.

Is this really how President Trump expects to become “the greatest jobs president that God ever created”?

We know that policies that advance clean energy create jobs and drive economic growth in every part of the country

In my home state of North Carolina — the only state in the Southeast that has a renewable energy standard — more than 34,000 people now work in clean energy. Amazingly, the state is now №2 for solar in the country.

In Colorado, a coal-and-gas state that has been pushing policies that increase energy efficiency and renewable energy while reducing pollution, more than 66,000 Coloradans now have good-paying jobs in clean energy. That’s about 2 ½ times as many who work in coal, oil and gas extraction.

And in California, the state with the country’s strongest clean energy policies also has the country’s strongest economy. Today, more than 519,000 Californians work in clean energy and more than $45 billion have been invested into the state’s economy thanks to California’s leading climate and clean energy policies.

By cutting pollution and replacing outdated energy sources with clean, renewable energy, the Clean Power Plan is simply good for our economy and our environment.

Pretending it isn’t is like pretending a border wall will stop immigration problems or that climate change is a hoax perpetuated by China.

It’s a con job, and Americans can’t afford be fooled again.

Bob Keefe is Executive Director of E2Image credits: Carbon visuals, E2

Business Owners Have the Last Say in Catalonia's Secession Bid

For the 2.6 million Catalonia residents who recently cast their votes for secession from Spain, independent self-rule is a dream that's remained unfulfilled for decades. For many of the businesses that make up the region’s bustling economy however, it’s been a textbook example of how not to declare statehood.

That’s because Barcelona, the region’s capital, is Spain’s economic engine. More than 20 percent of the country’s GDP comes from Barcelona, a magnet for global tourism and a powerhouse when it comes to technological innovation. As one of the country’s largest port cities, it also controls much of the country’s access to maritime commerce.

Book a luxury cruise of the Mediterranean and chances are you’ll be stopping in Barcelona for a night or three. Have business in Mallorca, Spain's island autonomous region? Most likely your ferry or ship will leave from Barcelona's state-of-the-art port. Tourism is the region's number-one industry, and has been for decades.

As a child I had the good fortune to spend a number of months on Catalonia's sunny coast while my family was in transit to a temporary home in England. Signs that Spain's tourism industry would soon explode were everywhere. And Catalonia, Spain's carefully controlled jewel, would become its seat.

The evidence that Barcelona, not capital-city Madrid, would eventually command the country's economic growth was evident in its cultural resurgence as well. This movement has not only given fertile ground to secession bids in both the Basque and Catalonia regions in recent decades, but helped Spain gradually recognize the benefit of acknowledging its multicultural roots. Jewish and Muslim cultural landmarks, once a carefully hidden facet of Spain's early history, are now highlighted in Spain's lucrative tourism sector. And Barcelona's century-old synagogues, mosques and museums have a role to play in that development as well.

But tourism isn't Barcelona's only economic generator. In recent years the area has become an inspiration for tech start-ups looking to capitalize from the region's global interface. Companies like Cisco, eDreams, and Mondo are just a few of the thousands fueled by foreign investment that have made a home on Spain's northeastern shores in recent decades. In 2015 foreign investment in Barcelona's booming tech sector and other industries was more than twice that of the rest of Spain.

In recent years though, that confidence has begun to bleed out. Businesses, shaken by the growing call for secession have discovered new homes in other parts of Spain. According to the Spanish publication, Expansion, more than 3,000 companies relocated out of the Catalonia region to other areas of the nation between 2008 and 2015. While many of these migrations weren't due to the current political situation, the publication notes, major companies like Grupo Agbar, which offers technological services in the management of water in the region have taken the call for independence as a signal of changing opportunities. Others like the telecom Cellnex and satellite broadband Eurona have announced their departure in recent months as well.

But it's the region's own banking institution, Caixabank, that may say the most about what local companies expect from a bid for independence. According to the bank's board, the "current political and social situation in Catalonia" has prompted the company to relocate away from Barcelona, where banking institutions, suddenly faced with the implications of a new, controversial and politically charged statehood, could find it more difficult to conduct business with European partners.

And therein lies Catalonia's greatest challenge. Popular support, as the movement's leaders are finding, is only half of the equation needed in statehood. As France24 writer Ségolène Allemandou puts it, Catalonia President Puigdemont "doesn’t worry too much about economic or social issues."

It's "independence, independence, independence" that drives Puigdemont and his supporters toward statehood, says Jose Antich, director of Catalonia's popular newspaper, El Nacional.

For Catalonia's remaining 7,000 foreign investors who are now weighing whether to stay in the Barcelona area, however, it won't be the dream of independence that will define Catalonia's success as an international powerhouse. It will be the question of whether its government and its future ambitions have the nation's businesses just as much in focus as their political dreams.

Flickr images: Jorge Franganillo; Yusuke Kawasaki; Maarten

$1 Billion In Credit Now Available for Sustainable Farming

Rabobank, the Netherlands banking giant and one of the world’s lenders to the global food and agriculture sector, today announced a $1 billion credit program that seeks to launch more land restoration and forest protection projects worldwide. The overarching goal, insists Rabobank, is to scale up more sustainable food and farming practices over the next three years.

The Netherlands-based bank currently claims it has over $109 billion outstanding in loans across the global food supply chain. “We also aim to strengthen food chains by optimization and financing, by taking part in initiatives for sustainable food security, by stimulating public debate and by contributing to the innovation financing that is necessary,” Rabobank states on its web site.

In addition, the bank says it employs at least 80 researchers who regularly report on trends across the global food industry.

The bank now wants to take its sustainable agriculture financing a step further with its “Kickstart Food” program. Partnering with UN Environment, Rabobank says its plan will focus on expanding finance options within four areas: food waste, soil restoration, resilient agriculture and nutrition.

One example of how Rabobank has already been turning such pledges into action is in Brazil. The bank has partnered with WWF’s Brazil chapter to finance and promote strategies so that agriculture can be used as a strategy to take on deforestation in the Amazon and other regions across the country.

The result has been an uptick in integrated crop-livestock-forest (ICLF) systems. The program pushes crop rotation even further by integrating livestock farming or forestry activities with the growth of crops such as soy. A joint study by Rabobank and WWF Brazil concluded that ICLF systems can result in requiring only one-sixth the amount of land needed for conventional agriculture.

Rabobank says such a focus on agriculture and food production is one way in which the bank can commit to the UN’s Sustainable Development Goals (SDGs). The long-term goal of Rabobank is to do its part to help increase global efforts to boost food production by 60 percent while reducing agriculture’s environmental footprint 50 percent by 2050.

To that end, Rabobank also insists that it is working to promote sustainability certification for its clients. The bank says it often advises them on the latest developments in sustainable production and soil management methods. Hence this bolstered credit facility, in tandem with UN Environment, can offer more grants, which in turn can allow companies to start much-needed land restoration and forest protection projects. In the end, the adoption of such tactics can reduce their exposure to risks, which means these companies can secure financing with ease in the future.

“Our global lead role in financing food production urges us to accelerate developments on the sustainable food issue,” said Wiebe Draijer, chair of Rabobank’s managing board, in an emailed statement to TriplePundit. “With our knowledge, networks and financial power, it is our natural role to further motivate and facilitate clients in adopting a more sustainable food production practice.”

Image credit: Rabobank