Speaking Up and Standing Ground: CSR as an Employee Recruitment and Retention Tool

Employee engagement was on the main stage at this week's Commit!Forum. Despite vastly different industries, both MGM Resorts International and 84 Lumber share a commitment to engaging employees as a means to attract and retain top talent.

Phyllis A. James, executive VP and chief diversity & corporate responsibility officer for MGM Resorts International emphasized the importance of diversity and inclusion in every aspect of the organization’s workforce, dating back to founder Kirk Kerkorian, son of Armenian immigrants.

“To achieve true employee engagement, all employees must feel included and valued,” James said. When employees feel valued, they are more likely to share ideas and participate in dialogue on issues both internal and external.

She went on to cite studies showing that companies with diversity across all levels of employment are more productive and competitive.

84 Lumber was looking to recruit a diverse, talented pool of new employees when it aired its now-famous commercial during the 2017 Super Bowl. The commercial was produced by Brunner and Steve Radick, the firm's director of public relations, spoke about the strategy behind the spot.

The commercial followed a mother and daughter on their journey to the U.S. border. The televised portion of the story ends midway, directing viewers to continue the story online. The online portion shows the mother-daughter duo encountering a border wall - presumably between the U.S. and Mexico - and seeing a door to welcome them in.

“The ad showed the doors of 84 Lumber were open to anyone who wanted to work hard and make a living,” said Radick, noting 84 Lumber wanted to attract diverse job applicants skilled in construction and building.

Radick said one of the most amazing outcomes of the commercial was the reaction of current 84 Lumber employees, who, for the most part “rallied around the ad.” He heard numerous stories of 84 Lumber employees saying they were proud to wear their company logo-branded polo shirts in public, proud to represent a company willing to take a stand. Many employees started getting involved in other company-led CSR initiatives, as well, inspired by the public response of the commercial.

Research from Cone Communications supports what 84 Lumber and MGM Resorts have discovered: CSR can empower not only employee recruitment, but also retention. Seventy-six percent of millennials will research a potential employer’s environmental and social initiatives before deciding to work for them. Sixty-four percent won’t work for a company that doesn’t share their values. Whitney Dailey, Cone’s director of marketing, shared these numbers and more during a COMMIT!Forum panel on “Business Drivers Behind Brands Taking Stands.”

“[The impact on] recruitment and retention make the CSR investment worth it,” she said.

Image credit: Karen Sayre

Corporate Reputation Management in the 21st Century

By Debra Belluomini

A CEO’s decision to engage in corporate citizenship inevitably revolves around the question of ROI and the development and execution of a plan that will have impact. For some organizations the “why” may be easier to grasp. The “how,” on the other hand, is a challenge that can derail even the most well intentioned CSR staff.

The good news: There are well-defined steps that CEOs and CSR practitioners can take to create their organization’s corporate citizenship roadmap, according to co-authors Dave Stangis, vice president, Corporate Responsibility and chief sustainability officer of Campbell Soup Company, and Katherine Smith, executive director of the Boston College Center for Corporate Citizenship. They shared highlights of their new book, The Executive’s Guide to 21st Century Corporate Citizenship: How Your Company Can Win the Battle for Reputation and Impact, as speakers at the 2017 Commit!Forum.

The Executive’s Guide can be described as a best-practices handbook for integrating sustainability practices in an organization. It identifies, step-by-step, the strategies and tools needed to create and execute a high-performance corporate citizenship plan.

On store shelves among many corporate citizenship books, Smith and Stangis said their collaborative publication effort is unique because it presents a practical approach to a complex and difficult undertaking. Defining – and viscerally describing – clear expectations of the organization’s future is a first step in developing a solid corporate citizenship goal and strategy that can differentiate it in a crowded field of competitors.

“Work for corporate citizenship is harder and more demanding than ever before,” said Smith. “You really have to start with the core purpose of the company and think about what it is you deliver better than any other company in the world, and peel back the layers of the onion.”

Stangis described the approach outlined in the book as a set of inquiry where every facet of a company is examined and dismantled. “You start to connect the dots of something that’s very unique,” he said. “That’s what companies are competing against.”

He described the process as both visual and sensory. “Oftentimes [organizations] talk about activities. We talk about what we’re doing in the community, but we’re not able to paint a clear picture of what the future looks like for that company,” Smith said. “So, what does it look like if all of this [corporate citizenship] is true for the employee? What does it feel like for the employee? What does it look like to the investor, or to the customer, or to the consumer?”

Smith and Stangis assert that to succeed, a company must approach the process as an organization-wide effort. “Corporate citizenship means leadership from every seat,” Smith said. “It’s not only looking to the CEO to deliver the vision, it’s also helping the CEO develop the vision, making it real and tangible and helping people understand what that alternative future really looks like and feels like.”

The ultimate goal of The Executive’s Guide, Smith said to CSR professionals in attendance, was creating clarity about a subject that is gaining ground in an increasingly competitive landscape. “We just both felt it (corporate citizenship) shouldn’t be as hard to do the work as it sometimes is. There are lots of books out there that tell stories of success, but very few of them actually reveal the secret sauce.”

All proceeds from the book will go toward the Boston College Center for Corporate Citizenship.

GM's $2.5 Billion Hydrogen Fuel Cell EV Gamble About to Pay Off

General Motors turned heads last week when it announced big plans to expand its electric vehicle fleet, with hydrogen fuel cell EVs playing a strong role. The big question is, where does GM expect to find customers for hydrogen fuel cell EVs, when hydrogen fueling stations are so few and far between? That's a key question, considering that the company's fuel cell investment has added up to more than $2.5 billion since the 1990's.

The answer is right in front of you, especially if you've ever passed an Army convoy on the Interstate. With its own fuel stations and the potential for manufacturing its own renewable hydrogen fuel, the U.S. Army could prove to be the "stealth" customer that introduces fuel cell EVs into the mass market.

A hydrogen fuel cell EV in every pot...or not

For those of you new to the topic, fuel cell EVs are electric drive vehicles, just like their battery-operated cousins. The main difference is that battery vehicles take time to charge up, while fuel cell EVs can be fueled up in a matter of minutes, just like a gas-powered car.

Until battery technology improves, fuel cell EVs also benefit from longer range and more power, which explains why some manufacturers are focusing on the SUV and long distance truck markets for fuel cell EVs.

Of course, there's a catch. Just a few years ago, it was difficult to find public charging stations to recharge battery EVs. Likewise, public hydrogen fueling stations are practically non-existent outside of California and a few other states.

Hydrogen fuel stations are expensive, and it's difficult to convince investors to foot the bill unless they're confident that people will use them. However, very few people will buy fuel cell EVs until they are confident that they can refuel conveniently.

Hydrogen fuel cell EVs for the U.S. Army

Into this classic chicken-and-egg dilemma steps the U.S. Army. The Army's TARDEC vehicle research center has been working with GM to test a small fleet of fuel cell EVs in Hawaii, and on a new fuel cell SUV based on its Colorado model, called the ZH2.

In the latest development, last week GM unveiled something it calls the Silent Utility Rover Universal Superstructure (SURUS), which is designed to be the platform for a variety of different models.

Though the design is aimed at the commercial market, the Army is low-hanging fruit. If you caught that thing about "silent" in the name, that's an important tactical advantage that EVs have over conventional vehicles.

Along with silent running, a low heat signature is also an important tactical plus for EVs.

Another important feature of SURUS is its autonomous capabilities. The Army is already experimenting with semi-autonomous convoys, and SURUS would slide right into that concept.

Here's the rundown from GM, and you'll notice a subtle pitch to the Army in there:

SURUS leverages GM’s newest Hydrotec fuel cell system, autonomous capability and truck chassis components to deliver high-performance, zero-emission propulsion to minimize logistical burdens and reduce human exposure to harm. Benefits include quiet and odor-free operation, off-road mobility, field configuration, instantaneous high torque, exportable power generation, water generation and quick refueling times.

That "exportable power generation" angle is a significant one. It means that you could silently drive your SURUS to a site, and then just as silently use it to power other electrical equipment at the site -- a critical need for today's geared-up soldiers.

How serious is GM about fuel cell EVs?

So far, GM's SURUS announcement hasn't gotten nearly as much attention as its broader EV fleet announcement, but the company has made it clear that hydrogen will play a big role in its future:

Fuel cell technology represents a key piece of General Motors’ zero emission strategy. It offers a solution that can scale to larger vehicles with large payload requirements and operate over longer distances...The SURUS platform is equally well-suited for adaptation to military environments where users can take advantage of flexible energy resources, field configurability and improved logistical characteristics.

There's that pitch to the Army again, but evidently GM already has its eye on the consumer market as well, and it has been laying plans to roll out a significant number of fuel cell EVs. Last year the company announced $85 million in financing to build a fuel cell manufacturing plant in Michigan, as part of an ongoing fuel cell collaboration with Honda that launched in 2013.

GM's fuel cell technology is still in the evaluation stage at TARDEC. That includes stationary fuel cell generators, which share the same advantages of low noise, low odor and low heat for military applications. TARDEC expects to wrap up its testing early next year so stay tuned for more developments.

How serious is DoD about fuel cell EVs?

Interestingly, GM is also working with the US Navy to develop a small, unmanned fuel cell-powered submarine.

That's more bad news for fossil fuel fans. DoD is already front and center in the war against coal, and it has been developing a keen interest in both battery and fuel cell EVs.

If and when the Department of Defense adopts more EVs on a large scale, the national security factor will come into play, and you can expect more federal dollars aimed at growing the nation's network of battery EV charging stations and hydrogen fuel stations, too.

As for renewable hydrogen fuel, DoD is already on that, too. Last summer, for example, U.S. Army researchers joined the "water-splitting" club with a new method for generating renewable hydrogen from water.

Numerous research teams in the U.S. and globally are working on similar water-splitting technology, which can be powered by electricity sourced from sunlight.

With its growing number of on site solar arrays, DoD already has the solar power base covered, too.

Photo (cropped): via GM.

Resilience and Responsibility: Addressing Inequality

By Jeff Senne

Psychologists have identified a number of characteristics that define resilient people. They are optimistic and altruistic, have a mission or find meaning in life, are guided by role models and have social supports. They face their fears and possess a strong moral compass. Resilient individuals recognize their strengths and develop active coping skills. It makes sense that many of these same traits may also define resilient communities: the skills, attitudes, and support systems that enable communities to endure and thrive, even in the face of change, adversity, or disadvantage.

Why should business leaders strive to understand these characteristics and concern themselves with the development of resilient communities? Because businesses do not exist in a vacuum. They exist in, and depend on, the world around them. For businesses to endure and thrive, communities must not fail. Communities must be resilient—adaptable, flexible, and vigorous. They need social supports, access, and opportunities. They must capitalize on their distinct and diverse strengths and continue to evolve new skills for coping and addressing the multiple challenges facing them today and in the future.

Perhaps the greatest threat to resiliency in our country is inequality. And because the U.S. exhibits wider disparities in access and opportunity across communities than most major developed nations, inequality also puts our nation’s overall economic growth at risk. Creating a strategy for business success that simultaneously delivers societal impact is not merely a good thing for businesses to do, it's fundamental. Whatever you choose to call such a strategy —at PwC we embrace the concept of Responsible Business Leadership (RBL)—engaging multiple stakeholders (business leaders, shareholders, employees, clients and customers, nonprofit organizations, local governments, and members of local communities) will be critical for moving forward toward real, positive change. Not surprisingly, psychologists tell us that close relationships with trusted people and organizations are essential for developing resiliency. To advance RBL initiatives, business leaders must inspire trust through empathy, transparency, credibility, and reliability.

We had the opportunity recently to share our perspective on the relationship between responsibility (RBL) and resiliency on local and global levels with thought leaders from across sectors at Verge 2017, an annual global conference that considers solutions at the intersection of technology and sustainability. Equality, as a part of a holistic resilience strategy, was a theme we heard echoed again and again throughout the event. We were pleased to learn about practical approaches with attainable goals to address different issues, such as equitable access to affordable energy and increasing housing in underrepresented communities.

At PwC, we are also developing programs with specific solutions to address foundational issues in our communities, including financial literacy and development of a technology-savvy workforce. Among them, Access Your Potential™ (AYP), a $320M, five-year commitment with a laser sharp focus on underserved communities with programs of training, mentoring, and access to resources to enable students to develop financial capability and learn the technology skills that are fast becoming essential life skills. AYP is Responsible Business Leadership in action, leveraging our firm’s purpose—to build trust in society and solve important problems—history of altruism, and our values, assets, and strengths to help build systemic change and support the development of resilient communities.

Community resilience is a complex challenge with unique local differences and significant global implications. Psychologists tell us that developing resilience comes from a focused effort—systematic and disciplined activity—attitude, and having contact with others who can be trusted. To create resilient communities, businesses must become trusted partners whose objectives and strategies represent a win-win for every stakeholder. Business strategies designed to close the gaps in access and opportunity are a necessary and responsible way to enhance resilience.

Image credit: Pixabay / maxlbt

Excessive Vitamin Supplements Can Cause Cancer, Study Shows

My dad, who was a clinical nutritionist, had a mantra that ruled his life. And to the best of his ability, he made sure it ruled his kids’, too:

You get out of life what you put into it.

It ruled his work as a researcher, as well. He was known to grumble about short-term controlled experiments that claimed that a particular substance or chemical if consumed, would cause cancer.

“Anything taken in excess can cause problems,” he told me once. At the time, he was referring to clinical studies that suggested cyclamates, an artificial sweetener, would cause cancer. It was yanked from sugar-free foods in the United States as a result of a 2study that reported that mice fed cyclamates in very large amounts contracted cancer. It wasn't that he objected to the substance being regulated, but the way the research was done.

So I find myself wondering what my dad would think if he were here today and had read the new research on vitamins B6 and B12.

For years, getting enough B12 was considered a challenge for vegetarians and vegans, who often unknowingly were at risk for vitamin deficiencies. Invariably, my discussions with my dad about my own dietary preferences seemed to lead to this point: The very best sources of the elusive vitamin B12, my dad would insist, was red meat. The dedicated and well-educated vegetarian, he would gently nudge, could get enough B12 from vegetable, egg and milk sources, but it was difficult. "Fortunately," he would always remind me, "you need very, very little B12 in your diet." The average adult needs 2.4 mcg of vitamin B12 and between 1.3 and 1.7 mg. of Vitamin B6.

Today, however, accessing enough of those two vitamins clearly isn't such a problem. Thanks to modern food engineering, we have a panoply of vitamin and mineral supplements that can meet the needs of just about every dietary habit and health challenge. Ironically, it can also meet just about any medical premise that comes up -- Including the idea that taking more than the RDA (required daily amount) of Vitamin B6 and Vitamin B12 are actually not only OK, but good for the average person. That may be in part because until recently, hard-core quantitative data about the health risks of taking too much vitamins B6 and B12 has been hard to come buy.

But a new study published in September suggested that there is a backside to our new technological know-how: Toxic consumption. Vitamin and mineral supplements are some of the few "consumables" that the Food and Drug Administration doesn't regulate. It doesn't regulate availability and it doesn't set limits on dosages or a company's ability to state that a given amount will actually benefit the consumer. When it comes to some supplements, like your garden-variety fruit-flavored vitamin C, that's not generally a problem (unless, as the Mayo Clinic points out, you're into consuming mega doses of the vitamin, which can cause intestinal upset and other problems). There's been a load of research that (so far) has shown that the body discharges excessive amounts of vitamin C. It's been shown to help boost immunity, but excessive amounts aren't retained in the body. But that's not the case for B6 and B12, scientists tell us. According to research published jointly by investigators at the Ohio State University College of Medicine (Columbus, OH), Fred Hutchinson Cancer Research Center (Seattle, Wash.) and College of Public Health and College of Medicine, National Taiwan University, (Taipei, Taiwan), taking excessive amounts of these two vitamins raises the risk of lung cancer significantly in men. What is impressive about this particular research, and what makes its findings compelling is the way it was done. In 2000, researchers began following a broad cross-section of 77,000 individuals (ages 50-70) in the state of Washington to determine the effect of excessive intake of certain vitamins. Theodore M. Brasky and his team (Emily White and Chi-Ling Chen) already had reason to suspect that there was a possible link between intake and lung cancer from a previous small study. But they wanted a long-term, definitive view of just what kind of risk a high-intake of these two elusive nutrients really posed. What they have found so far, is that although women don't appear to be at increased risk for lung cancer when taking high amounts of either vitamin, men's chances of developing the disease more than doubles with very large dosages. And men who smoke face a 3 to 4-fold risk of cancer. The research is still ongoing, but one of the takeaways from these findings is the health implications of having no federal regulation. The 1994 Dietary Supplement Health and Education Act pretty much defers supplement regulation to the industry. The FDA has been known to put out warnings and restrict access when there's been a safety problem with a specific product, but it permits self-regulation. And as the researchers point out, the average consumer has access to dosages that are often dozens to thousands of times higher than the FDA's recommended limit for that vitamin or mineral. In other words, a company can promote 6 daily dosages of 1 mg of B12 by spray, or a fruit-flavored supplement that gives you more than 16,000 times the RDA of that vitamin based on its own research. As far as selling it to the consumer, the company only needs to back up its assertions with research that defends its claim. And this is where my dad's motto seems so worthwhile about getting exactly what you put into it. The researchers followed participants for more than a decade -- a significant investment when it comes to career and time -- building a case not from marketability but hard-core (and hard-to-come-by) results, the kind of thing that consumers often expect from the FDA's own assessments and regulation. What hasn't been discussed a great deal, either in the synopsis of Brasky and his team's findings or in the media's coverage of this, is that deficiencies of these two vitamins are also linked to health problems, and in some limited situations, cancer. Patients with Celiac disease are often deficient in these two vitamins and pose a higher risk for cancer from inability to absorb nutrients correctly. Vitamin deficiencies can be a real challenge for individuals who have health or diet concerns. So access to vitamin supplements doesn't just amount to an arbitrary decision of lifestyle. Still, this study proves better than most that both the manufacturing industry and the FDA have a role to play when it comes to ensuring that consumers get what they expect from supplements: better health. Flickr images: Neeta Lind; Colin DunnAfter Irma's Destruction, Global Links Ships Surplus Medical Equipment to Cuba

As Cuba continues to recover from Hurricane Irma's destruction, one NGO is stepping up to help the island's 11.5 million people recover by donating medical equipment - while helping waste diversion efforts here in the U.S.

Global Links is one of the few U.S. non-profits the U.S. Department of Commerce has licensed to work in Cuba, and by most accounts is the largest donor of medical assistance and supplies to Cuba from the U.S.

Now the organization is working with the Pan American Health Organization, World Health Organization (PAHO/WHO) and other international agencies to assess Cuba's healthcare sector in order to gauge what is most needed by Cuba's citizens in the wake of last month's hurricane. According to Global Links, equipment that is likely to be most requested and shipped to Cuba in the coming months include wheelchairs, hospital beds, mattresses, gurneys, scrubs and linens. Medical and laboratory supplies such as disinfectants, exam and surgical gloves, syringes and catheters are also in demand.

The island's strained medical system and loss of power throughout Cuba is hampering local efforts to ensure citizens have access to healthcare. Problems that have stemmed from Irma's aftermath, including high water levels, present additional health risks.

Meeting such needs is nothing new to Global Links, which first started partnering with the PAHO and WHO in 1994. The Pittsburgh-based group has coordinated with hospitals and clinics in the greater Pittsburgh area, as well as across the wider mid-Atlantic region, to source unwanted surplus medical equipment and supplies. As a result, Global Links says that volunteers working with Global Links have prevented over 300 tons of healthcare equipment and materials from ending up in landfills annually. Those supplies, which have been valued at a total of $190 million over the years, have long helped save lives across Cuba.

Now the group is accelerating efforts to source medical products in order to help Cuba's healthcare system recover from Irma's damage, which included the loss of many medical facilities and the supplies housed in them. Volunteers are currently cleaning and repairing gently used and unwanted equipment. In the meantime, Global Links has launched a fundraising drive in order to bolster its support for Cuba's medical professionals, hospitals and clinics. Such efforts are also designed to strengthen Cuba's public health system and ensure its long-term viability.

This disaster relief is especially necessary as Cuba faces a difficult tourism season, which in the year after year has been critical to the island's economy. In addition to the hit the country's travel sector faces, the country's electricity grid and agricultural sector also suffered from heavy damage.

“Global Links has been involved with disaster recovery in Cuba after many serious hurricanes over the last 23 years, but the damage from Irma is the most serious and far-reaching. Recovery from a disaster of this magnitude will take years,” said Global Links Executive Director and Co-Founder Kathleen Hower in an emailed statement to TriplePundit. “Because Pittsburgh regional hospitals and health systems are both generous and committed to taking the extra steps of directing their surplus to us year-round rather than sending it to landfills, we are well supplied to respond to this crisis."

Image credit: Global Links

Moving Beyond VC: New Investment Structures for Impact

By Logan Yonavjak

Research shows that the majority of venture capital (VC) investments go bust. The model itself is centered around selecting unicorns that will achieve a home run and can cover the costs of other investments in a portfolio that fail. Much has been written about the failures of the VC approach as of late.

The SOCAP panel “Looking Beyond Venture Capital: Understanding the Need for Alternative Deal Structures,” explored other types of capital that could be more appropriate for social enterprises beyond VC or straight debt.

Especially for companies looking to achieve positive impact alongside financial return, it can be incompatible for companies to chase an explosive growth model as they optimize for impact. From the investor side, a VC lens means aiming for investments that can justify the fees and profit-sharing of the fund, and not necessarily optimizing for impact.

VC funding is arguably one of the main reasons that Clean Tech 1.0 got a bad rap. VC firms spent over $25 billion funding clean energy technology (cleantech) start-ups from 2006 and 2011, and lost over half their money. Most of the companies simply weren’t ready for prime time. Unfortunately, the impact community is still feeling the ripple effects of this bust.

It’s time to take a look at other approaches. “As investors, we put too much pressure on entrepreneurs to constantly innovate. The irony is that investors are some of the least innovative in the impact field,” commented panelist Victora Fram of Village Capital, a global early-stage impact venture incubator and VC investor.

We also have to ask the question of who is getting funded in the VC world - to-date it’s been primarily men. It’s a well-documented fact that women entrepreneurs receive drastically less funding than their male counterparts. In fact, in 2016, companies run by men got funding 16 times more than companies led by women.

This bias doesn’t end with entrepreneurs, those that are investing the VC also tend to be men, and primarily elite men. This has significant ramifications for the distribution of wealth. If traditional VC financing is being deployed, the very structure tends to prevent wealth from being distributed more equally. Think aggressive returns, extreme pressure to grow, and lots of equity gains for a small few (and less for founders, employees and even other investor groups).

For all of these reasons, several investors are taking a different approach.

Village Capital already has already developed a unique approach to having entrepreneurs in their incubator engage in a peer-review process to source and diligence additional deals. Now, they are also expanding how they think about their return expectations. So far, they have only made a few investments in an alternative manner, but they see this opportunity growing over time.

Recently, Village Capital created a revenue-sharing agreement with a company with a time-bound grace period. They allowed for single-digit revenue-sharing returns until the company grew to a certain level, and expected a 2-3x multiple.

Candide Group is an advisor exploring yet another approach. Aner Ben-Ami, a Managing Director at the firm, works on behalf of two families who are taking a full portfolio approach to impact investing. Because they are taking a comprehensive approach, this means they can invest across different parts of the portfolio and are not constrained to one investment tool.

Last but not least, Astrid Scholz, CEO of Sphaera, a platform provider for the social change industry, realized during her capital raise process that not only was it more difficult to raise as a woman CEO, but that what she really needed was a flexible line of credit. As a result, she helped launch the XXcelerate Fund to fill this gap in the system. Through this fund, not only can women access lines of capital, but they also participate in an educational program that helps them bolster their financial literacy and connect with other female entrepreneurs.

Lingering challenges remain. The majority of the alternative investment approaches discussed are still quite small in the grand scheme of VC investments. To provide some perspective, the average size of a traditional VC investment was $10.9 million in 2016. Village Capital’s example investment was less than $100k, although they are looking into raising the amount to around $250k.

Revenue-sharing models with early stage companies can be difficult, so there’s an important balancing act for investors who are seeking greater than concessionary returns.

Entrepreneurs can also be concerned about deviating from the traditional VC financing approach. Some are genuinely concerned about their ability to find additional capital later down the line. Therefore, finding entrepreneurs who see value in the short-term cost of some upfront revenue sharing versus the long-term benefit of not diluting their equity will need to happen through improved education.

The truth is, entrepreneurs are often perceived to have less power in funding negotiations and will often defer to the investment community. “If anything, it’s the more experienced entrepreneurs that have been through the process of VC funding that get this need and are more cautious about getting involved with VCs,” commented Scholz.

Astrid Scholz, also spoke to how Sphaera is working to build a community around Zebra Entrepreneurs - mutualistic companies that are profitable and improve society. Eventually, Scholz hopes to get this community together to learn and iterate around new financing models. This could turn into a backbone organization or investment vehicle later down the line.

Another suggestion centered around creating opportunities to scale these new financing models so as not to perpetuate a bunch of one-off approaches. A project called the Impact Terms Project allows investors to upload alternative term sheets into a web-based repository.

“We need to create a movement that puts a positive spin around alternative investment approaches to VC,” says Ben-Ami, “instead of saying ‘these are not venture-backable,’ we should be making this into a positive thing to align incentives more closely to create the positive impacts we’re looking for.” This involves educating business students, organizations that support entrepreneurs, and also fund managers.

As impact investing reaches a greater portion of the investment community, it’s time for the investors to start innovating - the question is are they ready to be as innovative as the entrepreneurs they’re investing in?

Exclusive: 38% of Fortune 50 Publicly Support the Sustainable Development Goals

At the 2017 Commit!Forum, Megan DeYoung from Corporate Citizenship took to the stage with John Friedman for WGL to share some exciting findings about everyone's favorite topic: Sustainable Development Goals (SDGs).

The chatter among sustainability practitioners is that everyone is figuring out how to align with the global goals for social and environmental wellness. The 17 goals are specific enough to be tangible and broad enough to be aspirational.

Corporate Citizenship, a global management consultancy specializing in sustainability and corporate responsibility, recently conducted a survey on the Fortune 50's published commitments to the sustainable development goals. Corporate Citizenship's team analyzed corporate mentions of the SDGs to better understand how companies are engaging with the sustainable development goals.

An impressive 38 percent of the F50 have made a public commitment to support the SDGs. This public alignment -- a mention on a web page -- was significant for Corporate Citizenship. "Not only are they thinking about [alignment], but know that it’s something they need to be paying attention to," DeYoung explained to TriplePundit in an interview.

Admittedly, it's easy enough to slap a mention on a website, but DeYoung was adamant that these mentions are actually significant. In a public corporation, every published piece of material is fair game for regulators and investors. Indeed, a public commitment indicates a true internal commitment. Beyond simply mentioning the SDGs, many companies are doing more. Corporate Citizenship further analyzed the data to gain insight into how deeply companies are aligning. Four buckets emerged:

Think: Assess connection to SDGs and develop strategy for alignment Act: Change how company acts internally and/or externally Measure: Set targets and show impact Engage: Develop internal and external programs

"Over a third of companies are looking at SDGs not as philanthropy, but as a business strategy," John Friedman explained.

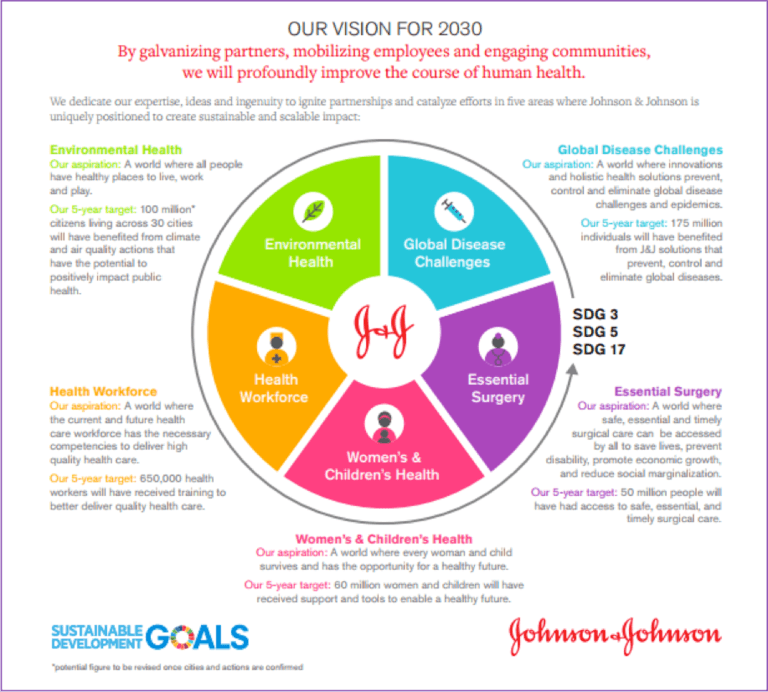

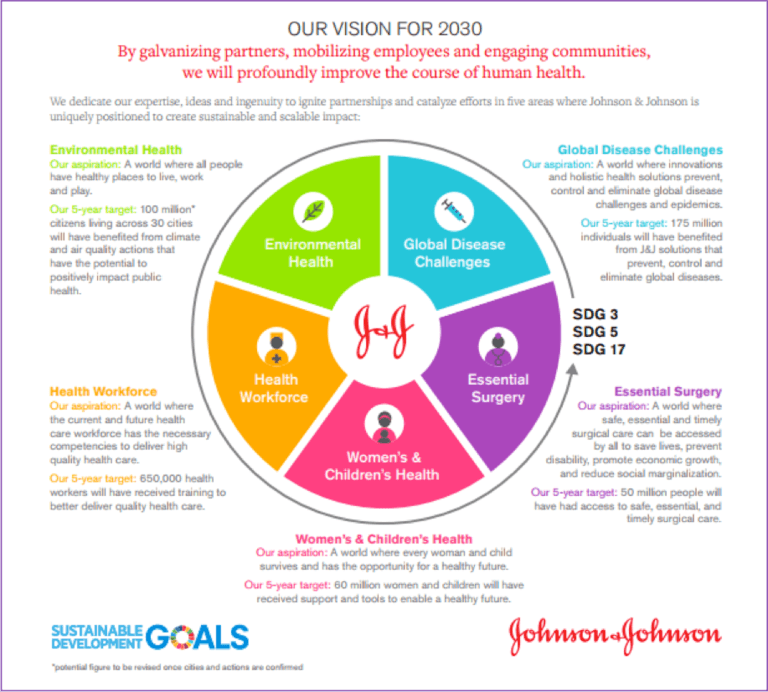

These levels are not meant to be sequential, DeYoung explained. "Sometimes they happen simultaneously." Indeed a company can change their internal actions (act) by developing programs to address the SDGs (engage). A great example of a forward-thinking organization comes from Johnson & Johnson who are strategically mapping their performance on social and environmental issues TO the SDGs. Corporate Citizenship gave them a "measure" credit for the way they set goals aligned to the SDGs on the slide below:

Johnson & Johnson does a good job aligning with goals that are material to the company's operations:

- SDG 3 Ensure healthy lives and promote wellbeing for all at all ages

- SDG 5 Achieve gender equality and empower all women and girls

- SDG 17 Strengthen the means of implementation and revitalize the global partnership for sustainable development

As a healthcare product and equipment provider, Johnson & Johnson is focusing on the areas where it can provide value to its constituents, committing to effect change in those areas where it operates, just as we love to see.

Most companies in Corporate Citizenship's study were not so bold. Most of the advanced engagement came through company's foundations or philanthropic giving, as opposed to being aligned with a company's core business-generating activities.

"When companies were doing something on act/measure/think, we saw more examples around community." DeYoung explained. With mapping tied to materiality, like J&J did above, sustainability people can align relatively easily, but it's more difficult for a single department to make quick changes. "In community foundations it’s easier to effect change," she said.

When asked why companies should care about the SDGs, DeYoung explained, "They are a roadmap to the future. It's the closest thing we have to a crystal ball showing the topics that will be facing business." Businesses need to address these issues in order to be successful in the years to come, and they might as well start now.

For Dove, a Botched Apology is Worse than a ‘Racist’ Ad

For Dove and its parent company, Unilever, the past weekend has demolished the personal care products brand’s reputation after 13 years of success celebrating, and garnering much praise, for its “Real Beauty” campaigns.

As many of us now know, a brief ad on Facebook showed a black woman taking off her top to reveal a white woman. The white woman then removed her top to reveal a Latina woman.

Unfortunately for Dove, few viewers could get past the frames devoted to the young white woman. Considering Dove’s history of showcasing women of all backgrounds, shapes and skin hues, for some observers, it is difficult to fathom that Dove’s marketers and social media team were truly driven by racist intent.

Then again, Dove had run similar poorly-conceived ads in the past. A 2011 print campaign clumsily put a black woman in a “before” and a white woman in an “after” pane in an attempt to tout the product line’s qualities (the woman in the “after” pane, many pointed out, was also thinner.) A couple years later, Dove marketed a body lotion that was supposedly formulated for “normal to dark skin.”

Hence the skepticism, and then fury, when Dove tweeted a couple milquetoast apologies as the weekend dragged on. Saturday, the brand said it had “missed the mark in representing women of color thoughtfully.” Yesterday, the company issued a longer apology, and said it was “re-evaluating our internal processes” to prevent the company from making similar mistakes in the future. Unfortunately for Dove, many were not buying into those explanations.

“I’m not sure why these people think that we are all stupid,” wrote D. Watkins on Salon. “We know ads send multiple types of messages, especially in a soundless GIF where all you can see is a black woman turning white.”

This year has been brutal for some of the most widely known brands. United was nailed after the violent removal of a passenger from one of its planes made endless rounds on social media. Uber found itself in the public’s cross-hairs for many reasons, including its clumsy maneuvers during the first round of the Trump Administration’s travel ban. PepsiCo had to wipe more than egg off its face after an absurd Kylie Jenner advertisement went viral.

But as is the case with many of these social media and advertising fiascos, the pallid apologies make a terrible situation far worse. And for a brand that has been determined to celebrate the “ordinary woman” – even though some ideas, such as various curvy-shaped bottles, thankfully never got past the whiteboards in a conference room – the fact no one within Dove or its external advisors stopped to think that the ad could be taken the wrong way raises plenty of questions.

“Maybe they should have 'real people' create the ads rather than just starring in them,” said Chris Allieri, the principal of a New York-based branding and marketing agency, in an interview with Business Insider yesterday.

Meanwhile, Unilever, owner of the Dove brand, has shown that it has refused to take on this crisis. As of press time, the company has not issued any statement on its web site’s media relations section. Spokespersons for the company have also not replied to TriplePundit’s request for their take on the controversy.

Even though the graveyard of failed social media campaigns gone awry is becoming filled to capacity – Starbucks, McDonald’s and KitchenAid are just a few examples – Dove’s headache shows that the surge of social media is more than about allowing for communication between companies and their customers to no longer be a one-way messaging street. But caution is needed before such conversations are launched in the first place.

Brands cannot just assume their social media conversations need as much care as their traditional print and media campaigns. In fact, the argument should be that social campaigns need to be even more carefully conceptualized and executed. Otherwise, a misstep can become a catastrophe for a company, and the resulting firestorm will become even more difficult to extinguish.

Image credit: Screenshot

Google Posts Sustainability Update, Yet Lacks Frankness on Russia Ads

This week, Google released its sustainability report for 2016, which the company described as a “landmark year” due to its progress on environmental goals. The Silicon Valley giant touts its technology solutions as providing high-speed data solutions that are “less energy intensive” than other offerings in the marketplace. Google’s various cloud platforms are also billed as a way in which users can learn new technologies, share ideas and connect their way to new economic opportunities.

But to those who want information on how Google is approaching risks such as the Russia ad buys during the 2016 U.S. presidential election, the company so far has been silent on how it plans on addressing this problem and similar challenges that could occur in the future. Just as Facebook and Twitter have come under scrutiny for their roles – or lack of oversight – in the dodgy advertising tactics that occurred during last year’s campaign, now Google is in the spotlight as several news sources have revealed Russian-bought ads were placed on Gmail, YouTube and other platforms the company supports.

The problem Google faces is that no matter how a company packages their corporate responsibility programs – whether they are packaged as “sustainability,” “purpose” or corporate citizenship, the fact is that more stakeholders are overlooking the semantics. Customers increasingly want to know what companies are doing not only on environmental issues, but they also seek more transparency on a company’s social and governance performance.

Google has reportedly launched an investigation of the ad buy, which could have been purchased by a Russian “troll farm” seeking to influence last year’s election. Nevertheless, the revelation of another ad campaign funneled through a huge technology firm shows that Russian efforts to disseminate misinformation was far more invasive than Silicon Valley companies led the public to believe. It now behooves Google to start having a more frank and transparent conversation with its stakeholders and the general public than it has in the recent past.

After all, it was only a month ago when a Google spokesperson told the Washington Post that the company had “always monitoring for abuse or violations of our policies and we've seen no evidence this type of ad campaign was run on our platforms."

Meanwhile, various press reports suggest Google is on track to become this year’s largest corporate lobbying spender in the U.S., displacing the usual suspects such as energy companies, banks and military contractors. Its peers such as Facebook have adopted the same tactic as they aim to dodge potential antitrust legislation and avoid regulations. In the case of Google, new federal laws could allow the company to be treated as a media, transportation or even – or as well as - a medical company. For a company that claimed it went public over a decade ago with the mantra, “don’t be evil,” Google is starting to come across as an all-powerful hydra – and in the process has put its brand reputation at risk.

The role Google played in last year’s presidential campaign, along with the attention focused on its aggressive lobbying efforts, for now are eclipsing its environmental accomplishments. On one hand, this week’s news developments are a disappointment for the company. After all, its investments in renewables and energy efficient technologies have allowed the company to be carbon-neutral for a decade. Its global operations are now running 100 percent on clean energy. And its Earth Outreach programs make it easier to track just about everything from air pollution levels to preserving wildlife to even stopping deforestation.

But until Google comes clean with how it could have allowed its technology to risk chipping away at its home country’s democratic institutions, those environmental efforts for now are a sideshow.

Image credit: Shawn Collins/Flickr