Haribo Gummy Bears Accused of Cruelty to Humans and Animals

Sure, many of us love the thought of driving a Beamer or Benz, but the most beloved products coming out of Germany are arguably those happy, jewel-colored Haribo gummy bears.

Unfortunately for the candy maker Haribo's reputation and public relations department, it turns out that the sourcing of ingredients for this almost 100-year-old treat is allegedly far from a happy experience for humans in Brazil and animals in Germany. Earlier this month, the German broadcaster ARD broadcast an investigative report that claimed two ingredients are tied to animal cruelty and gross violations of human rights.

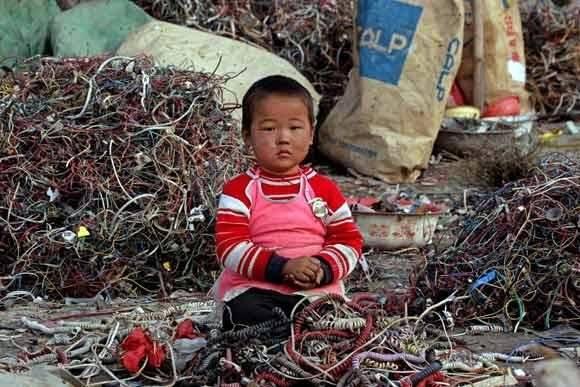

The first ingredient in question, carnauba wax (also known as Brazil wax or palm wax), has been linked to plantations in Brazil where workers are reportedly paid as low as 40 Real ($12.50) day. ARD journalists said they witnessed workers on plantations forced to sleep outside after long days cutting removing leaves from palm trees by way of blades attached to long poles. The network also revealed that in additions to discovery of child labor, many workers often had no access to clean water and were denied the use of toilets.

Furthermore, in footage filmed closer to Haribo's headquarters in Bonn, ARD revealed pigs raised by one of the company's suppliers were repeatedly subjected to cruelty before they were eventually churned into another ingredient used in gummy bears and other Haribo candies. Scenes showed pigs in filthy conditions covered in their own excrement and lacking water; many had open sores, infected boils and appeared to be in terrible health. Others were shown stepping over dead animals. Some pigs were unable to open their eyes due to infections. For animal rights activists, the film is a grim reminder that skin and bones from pigs is made into gelatin, the ingredient that gives gummy bears their translucence and consistency.

Although Haribo to date has no public policy on how it manages animal welfare across its supply chain, various divisions of the company, such as one in the United Kingdom, claim that they strive to be compliant with local laws applying to human trafficking and slavery. To date, the company has only issued a vague statement on the approach it takes to sourcing various ingredients. That may soon, change, however, unless the company wishes to follow in the footsteps of companies such as Scharffen Berger, Hershey and Nestlé, all of which have confronted accusations of lax oversight of their supply chains.

A petition urging Haribo to improve its animal welfare standards and ensure human rights across its supply chain is close to reaching its goal of 50,000 signatures.

In a statement issued to several German media outlets including Deutsche Welle, the company claimed it was unaware of any violations of its supply chain guidelines, but that it would pursue the issue with its suppliers.

If ARD's allegations are indeed verified, it behooves Haribo to move quickly to fix these problems and eliminate cruelty to humans and animals within its supplier base. Otherwise, the company risks becoming known the confectionery making kids happy with animal-shaped candy - ironically, at the expense of humans and animals linked to the making of these products.

Image credit: Toms Baugis/Flickr

When Green Became Mainstream in Consumer Products

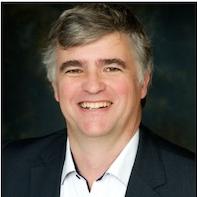

By Al Iannuzzi

The following excerpt is from Greener Products: The Making and Marketing of Sustainable Brands, Second Edition, released this year.

Things will never be the same regarding greener products; the world truly does need more sustainable brands. The stresses on the earth’s systems are very evident and are growing with the expanding global middle class; people are becoming more aware of this fact. There is an increased concern about the amount of pollutants that are found in our food and even in our bloodstreams. The global demand for natural or organic products is growing and doesn’t seem to be stopping.

Natural products like Method and Seventh Generation that once were considered fringe, and sold in health food stores only, are now sought after in mainstream supermarkets. The old stereotype of green products having sub-par performance has been shattered, particularly with game-changers like Green Works®, proving that large multi-nationals can develop and win in the marketplace with a naturals-based product platform.

The pull for sustainably minded products is not limited to consumer marketing. We have seen business-to-business marketing of greener products picking up pace. When chemical companies are making it a point to differentiate their products based on eco-innovation, it’s time to realize that there is something here to pay attention to. Companies are seeing, through life-cycle assessments, that in many cases their biggest environmental impacts come from the acquisition of raw materials, product use, or its end of life. This new knowledge is causing a shift toward greening up products in non-traditional ways. Over recent years, sustainable innovations included cold water laundry detergents, bio-based plastics, take-back programs, and sustainably sourced raw materials, to name a few.

Making products greener is becoming mainstream and moving toward being a requirement alongside efficacy and quality. Reduced environmental impact is being viewed as an “and.” There are some exceptions, but greener products will not command a higher price; customers want to have a product that works and is greener too, but not pay more for it. This customer requirement has spanned all types of businesses; numerous examples have been discussed in this book covering a host of product categories—apparel, chemicals, building products, paper products, food, medical equipment, and packaging.

Building an eco-innovative product requires a team effort and signals from the field must be gathered to gauge customers’ needs. R&D, procurement, operations, and product stewardship groups need to collaborate to build in the desired attributes. A balanced, clear communications program must be melded together by marketing and delivered by sales groups.

Care must be taken when communicating about greener products. First there must be a real authentic science-based story to be told and the message must be simple and transparent to demonstrate how the product or service helps customers with their sustainability needs.

Both customers and companies can make a difference by what they purchase and sell. Fewer resources can be used, good causes are supported, and costs are reduced. When you hit this sweet spot, of having a truly greener product that is communicated in an appropriate way, everyone wins. Customers' needs are met and brand loyalty is built.

The focus on greener products and sustainable brands is here to stay. We can expect that in the coming years that there will be a steady demand for eco-innovative products. The companies that provide these products without increasing costs will be the big winners.

Al Iannuzzi, PhD, is senior director in the Worldwide Environment, Health, Safety & Sustainability (EHS&S) Department at Johnson & Johnson. He leads the Global Product Stewardship program, and is a member of the Worldwide EHS&S Leadership Team. He has over 30 years’ experience in the EHS field and has developed and directs Johnson & Johnson’s Earthwards® greener product design process. Prior to J&J, Al worked for the NJ Department of Environmental Protection and at an environmental consulting firm. Al received his PhD in Environmental Policy from the Union Institute & University in Cincinnati, Ohio, where he researched EHS self-regulation programs. He is the author of the books, Greener Products: The Making &Marketing of Sustainable Brands (CRC Press, 2011) and Industry Self-Regulation and Voluntary Environmental Compliance (CRC Press, 2002) and has written numerous articles and blogs on product stewardship and environmental compliance. Al is an adjunct professor at Indiana University where he teaches on product improvement and sustainability. He has maintained the certification as a qualified environmental professional since 1996 and speaks regularly at sustainability conferences and universities.

Image credits:

Cleaning supplies: Pixabay / Stevepb

Book cover: Taylor & Francis Group, LLC

Offshore Wind Giant Vestas Aims to Catapult U.S. Into Global Renewables Leadership

South Carolina seems an unlikely spot for the global offshore wind industry to gain a showcase foothold in the U.S. After all, the state is among several Atlantic coast states that have been dragging their feet on offshore wind development. However, South Carolina's Clemson University happens to be the home of a self-described state-of-the-art wind turbine test bed, and Vestas has just announced that its V164-9.5 MW offshore wind turbine will get a test run there.

Despite its long coastlines, the U.S. has been lagging behind other nations when it comes to offshore wind development. However, the sleeping giant is beginning to awake, and Vestas is already claiming that its turbine will nail down the business for major U.S. offshore wind development projects to come.

Vestas keen on U.S. wind market

The new Vestas wind announcement is a big one. It's not just a one-off run through the test bed. The company is devoting $35 million to the test program overall, with up to $23 million going to Clemson over a five-year period.A joint press release with Clemson University lays out the mission:

The testing allows MHI Vestas to gain a better understanding of how the 9.5 MW gearbox and bearings will react over the course of a 20+ year lifecycle. Through the utilization of big data from the test results, MHI Vestas can optimize the service strategy for the turbine to ensure optimum reliability and minimize the fatigue on components.

Considering the global leadership position of Vestas, the new program also makes the U.S. -- and South Carolina -- into an instant global hotspot for wind energy development:

The deal with Clemson University marks MHI Vestas Offshore Wind’s first major investment in the United States, catapulting the U.S. into a leadership position in offshore wind as the country will now be testing the world’s most powerful wind turbine. It is anticipated that visitors from around the world will come to Clemson to see the test setup.

The new partnership with Vestas all but guarantees that South Carolina -- and the U.S. -- will also be a global centerpiece of cutting edge wind energy research:

“Clemson’s facilities are second-to-none and will enable MHI Vestas to accelerate their technology to the market and usher in a new source of renewable energy vital to our energy future,” said Randy Collins, the university’s associate vice president in Charleston. “Not only will this work advance wind turbine technology, it will propagate over into the education of our students and advancement of scientific knowledge. It is a true win-win for our respective institutions.”

Adding even more luster to South Carolina's new green sheen, last year Vestas joined a public-private collaboration with the U.S. Energy Department and other leading wind turbine manufacturers, aimed at developing a mammoth, cutting edge 50-megawatt turbine.

Vestas also recently stepped up its activism on behalf of clean energy by signing on to The Climate Group and the RE100 Campaign:

“Vestas is already using 100% renewable electricity across its own operations to create wind power infrastructure,” says Sam Kimmins, Head of RE100, The Climate Group. “Now the company is furthering that leadership by joining RE100, and calling for important policy changes that will enable more companies to plug into renewables too.”

Irony alert: anti-wind state provides the key to major U.S. offshore wind development

For those of you new to the offshore wind topic, a brief recap is in order. Despite certain technical obstacles, the strong, steady winds of the open ocean are idea for wind farm development. The U.S. is sitting on a veritable gold mine of offshore wind on the Atlantic coast, where the Continental Shelf has created wide swaths of relatively shallow water.

In 2010, the Obama administration laid the groundwork for streamlining Atlantic wind development by organizing the state-level Atlantic Coast Offshore Wind Energy Consortium. Ideally all coastal states would have signed on, but several -- concentrated mainly in the south -- opted to sit out.

South Carolina was among the group that refused to sign on, though it agreed to engage with the plan as an observer.

The state's refusal may have been more political window-dressing than a determined attempt to forestall offshore wind development. Local stakeholders are well aware that the South Carolina coast is ripe for development, and in 2008 the state legislature voiced its commitment to offshore development.

In addition, under the 2009 Recovery Act, South Carolina's Clemson University won $45 million in federal funding to construct and operate a mammoth wind turbine test bed, to be shared across the industry.

To put the award in context, it was the Department of Energy's single largest grant for wind power. Here's the rundown from Clemson:

At more than three-stories tall, the 15-megawatt wind testing dynamometer is the centerpiece of Clemson University’s SCE&G Energy Innovation Center. Made of steel and concrete, the behemoth measures more than 20 feet wide at its center, its circle shape resembling a digital giant’s eye set inside a massive base.Twenty-four red valves – each twice the size of a basketball – encircle the hub, where companies will attach their largest and most expensive wind turbine prototypes to be put to the test.

Nevertheless, political window dressing can be a force all its own. The $45 million nudge from the Energy Department failed to convince former Governor Nikki Haley (now the Trump administration's ambassador to the UN) and other policy makers to push South Carolina into the vanguard. That honor went to tiny Rhode Island, which recently laid claim to the title of first ever offshore wind farm in the U.S. The states of New York and Virginia are close on its heels.

Like Haley, current South Carolina Henry McMaster is an ally of President Trump, and Trump is no fan of wind energy. So, although the Clemson test bed is a powerful enabler of future wind energy development in the US, it looks like other Atlantic coast states will reap the benefits before South Carolina gets around to it.

Photo: via Vestas.

Five steps to choosing the right telecoms for your business

Leading companies strengthen sustainability reporting

After Months of Alleged Discrimination, NAACP Issues Travel Advisory Against American Airlines

Apparently, some players in the aviation industry have not learned from the public relations fiasco through which United Airlines suffered earlier this year after the violent removal of a customer who refused to give up his seat on an overbooked flight. The passenger was an Asian-American doctor, and the company went through the wringer on social media platforms such as Twitter.

The NAACP felt it necessary to issue a travel advisory warning for African-Americans over their “safety and well being” in the event they travel aboard American Airlines.

The NAACP said it had been monitoring a pattern of what the civil rights group described as repeated incidents of discrimination from the airline as reported by black customers. Until further notice, customers are warned that they should “exercise caution, in that booking and boarding flights on American Airlines could subject them disrespectful, discriminatory or unsafe conditions.”

The incidents include an African-American man who was forced to give up his seat on a flight out of Washington, D.C. after he responded to discriminatory comments lobbed at him from two white passengers; an African-American woman who was switched to an economy class seat even though she purchased a first-class ticket while her white traveling companion was able to keep her seat in the premium-level cabin; an African-American woman flying out of New York was kicked off a flight by a pilot after she claimed that her seat assignment was changed without her consent; another African-American woman was removed from a flight after she requested the stroller for her child be retrieved before disembarking the plane.

“We are aware of these incidents only because the passengers involved knew their rights, knew to speak up and exercised the courage to do so promptly,” the NAACP said in a public statement.

In a press release, Fort Worth-based American Airlines said it was “disappointed” to learn about the NAACP’s travel advisory. In a message to company employees, the company’s CEO, Doug Parker, said, “As we work through this in concert with the NAACP, please keep doing the great and noble work you always do: Treat our customers and each other with respect.”

Parker also said that the airline had reached out to the NAACP and said it would meet with the organization in order to listen to its concerns.

According to the Washington Post, the NAACP’s travel advisory is a “wake-up call” to American companies. The group’s former CEO, Ben Jealous, told reporter Tracy Jan that the strategy of travel advisories was more effective than expensive litigation. As research organizations such as Nielsen issue data showing that black Americans are increasingly a group of consumers that should not ignored, the NAACP figures that calling out brands can nudge companies to change their culture can pay dividends, as in equal and respectful treatment – especially as younger African-Americans are wielding their influence via social media. Airbnb is one example of a travel company that was forced to revamp its policies after a similar backlash against discriminatory practices festered on Twitter last year.

Earlier this summer, the NAACP issued a similar advisory directed at the state of Missouri after the organization said a pattern of racially charged incidents made the move necessary in order to ensure the safety of black travelers. The August advisory was widely reported as one of the first such advisories targeting a specific U.S. state.

In the meantime, the NAACP is encouraging travelers to share similar experiences they have endured when flying American or other air carriers.

Image credit: Ian Gratton/Wiki Commons

Education for Sustainable Development

It’s been two years since the UN introduced the Sustainable Development Goals (SDGs), a call to action embodied in 17 specific goals to tackle global issues like poverty, access to education, gender inequality, and climate change.

Since that time, the business community has become highly engaged in addressing the SDGs by aligning their own sustainability targets with one or more of the 17 goals. And this call to action is also reaching every level of the educational system, as schools around the world teach lessons related to sustainable development and otherwise incorporate sustainable development into learning.

Take for instance, the Argyle Primary School in London where for today’s geography lesson, the students are studying deforestation and discussing how their actions impact the problem. In history class, they are researching the lives of significant people who have championed human rights. Later, in science class, the students are working in teams designing “floating” gardens to teach them how farmers in developing countries adapt to changing climate patterns.

The Global Learning Programme (GLP), a government-funded initiative, provides these educational resources for free and funds training by working with several partners. In England, around 7,000 schools are registered, representing nearly a third of the eligible state-funded schools in the country. These schools can now embed these lessons about the SDGs throughout their curricula.

The lessons offer content but also focus on teaching specific skills – like systems thinking and collaborative problem solving – that are recognized as key to solving complex global problems.

“It’s a shift in mindset,” said one of the Argyle teachers describing their global learning curriculum. “Every time you are teaching the kids about something, it’s encouraging them to ask, ‘why are things like that, what have we done to make it like that, and what can we do to make a difference in the future?’”

Programs like the GLP, that combine content plus emphasize new skills and attitudes, are now more common as demand is growing worldwide for these types of courses.

For example, the World’s Largest Lesson, that has been supported by companies like Pearson, provides lesson plans and other educational material related to the SDGs to any school anywhere in the world. Materials are available in ten languages, are segmented by age group (from age four to 18), and range from short presentations that can be offered at a school assembly to complete lesson plans.

Its website also offers a Student Action section with suggestions for how students can put what they learn into action on solving problems like hunger, inequality, and poverty.

At the college level, demand for courses related to sustainability is also strong according to a 2016 survey co-sponsored by the organization Principles for Responsible Management Education (PRME).

The survey, conducted among students in college-level business programs around the world, found that 75 percent or more believed strongly that the curriculum should include coursework on environmental sustainability, business ethics, and the SDGs.

To meet this demand, colleges and universities are taking different approaches, according to Julian Dautremont-Smith, the Director of Programs at the Association for the Advancement of Sustainability in Higher Education (AASHE).

One approach is to create standalone programs devoted exclusively to sustainability or some specialized version of it in specific disciplines like management (think green MBAs). “But at the same time, there’s a parallel movement to integrate sustainability content into traditional programs and coursework – like the sciences, liberal arts, and engineering – because sustainability as a concept should be interdisciplinary,” said Dautremont-Smith. The latter approach ensures that students of all disciplines are exposed to crucial lessons of sustainability.

Jonas Haertle, the Head of PRME, has observed a similar shift. “We see that overall trends point to much deeper integration of sustainability and ethics teaching and research throughout entire curricula,” said Haertle, adding, “even in disciplines where sustainability has never been a traditionally central concept, we see this taking place.”

He cited the example of the London College of Fashion, a PRME signatory, that is reporting widespread integration of ethics and social issues in their courses as sustainability becomes a guiding principle throughout the school.

Andrew Bernier, who holds a PhD in Sustainability Education and is currently a Postdoctoral Research Fellow at Arizona State University’s Walton Sustainability Solutions Initiatives, believes that standalone sustainability programs could eventually be phased out as schools become better at embedding sustainability concepts into every department.

He also believes you can’t teach the topic using traditional methods and expect to develop learners who can create sustainable outcomes. “Sustainability is an action-oriented discipline,” he said, “so to simply fill the student’s bucket with a lot of information on the subject essentially does an injustice to the field of sustainability.”

Instead, to develop “change agents” he advocates teaching a set of specific skills. First, teachers should foster attitude changes among students to create more resilient individuals who are better able to change and adapt themselves.

“Sustainability is the capacity to endure, so for a professional individual to endure they need to have the skills to bounce back, to be resilient and respond to how the world is constantly changing around them. If we can’t produce a sustainable individual, we are not going to produce a sustainable society.”

Next, it’s about systems thinking, “how well do they connect the dots and understand the relationships between concepts as opposed to concepts in singularity,” said Bernier.

And it’s about engaging with the local community so students can put into action what they’ve learned. “Being disconnected from the community makes it really difficult to foster their community connections and to do localized sustainability projects,” he said, “so it’s the idea of taking students out of the classroom but also bringing speakers and community members in.”

The notion that integrating sustainable development issues into teaching and learning is not new. The idea was first formalized by the UN, in its Agenda 21 published in 1992. But since then, and especially with the call-to-action embedded in the SDGs, these efforts have blossomed, taking many different forms and emphasizing new skills, new attitudes, and a cross-disciplinary approach.

In fact, education for sustainable development is explicitly recognized in SDG#4.7 on education, which calls for all learners to “acquire the knowledge and skills needed to promote sustainable development.” After all, tomorrow’s sustainability leaders are in school today.

Fairphone Takes the Prize in Greenpeace's Guide to Greener Electronics

For years, it's been a neck-and-neck race: Samsung, Apple, Sony, and a myriad of other electronics manufacturers have all lauded their ability to reduce their environmental impacts better than the next guy. Whether it's recycling hard-to-get materials and components, or developing new technology that is kinder to the atmosphere, its clear that big tech companies understand that consumers want them to use greener manufacturing processes.

Well, thanks to Greenpeace, consumers can now get the latest skinny on tech manufacturers online. Just in time for Christmas, the 2017 Green Guide to Electronics provides a comprehensive look at 17 electronics companies and their demonstrated commitment to renewable energy, addressing climate change, toxic chemical use and smart product design.

And yes, there are some surprises.

The highest-scoring company is a relatively new arrival: Fairphone, which was launched in 2013 with a mission to be more environmentally sustainable. The fact that it scores high on sustainable design and resource reduction isn't that surprising, since that's part of what has given it commercial traction against the big guys. And according to Greenpeace's assessments, it shows a respectable commitment to reducing hazardous materials in the electronics supply chain and products. But it also has a strong history of providing transparency in its manufacturing cycles, an issue that the researchers feel is very important when claiming kudos for green manufacturing. Where it loses points is in its transparency concerning hazardous materials. It was down-checked not because it doesn't promote transparency, Greenpeace says, but because it doesn't go as far as many of its competitors.

Apple follows in a close second. What's interesting is that the iPhone maker would probably be at the top of the list in accomplishments if it weren't for the grade it received for sustainable design and resource reduction. As far as advocacy goes, says Greenpeace, "Apple has emerged as one of the companies leading the opposition to “Right to Repair” legislation in several U.S. states." They assert it's also helped block environmental standards that would facilitate device designs that would make recycling, repair and upgrades easier.

Where it really excels, says Greenpeace, is in demonstrating its commitment to renewable energy and climate change. It does great at shining a light on its energy usage and performance and displays solid commitment to addressing climate change. But it, too, needs to go further in its reporting standards.

It's worth noting that none of the companies mentioned in the review received an 'A' in all three categories. And with the exception of Fairphone and Apple, all of the electronics companies received mediocre grades ... or worse. The surprising find for me, was HP, which received a C+ for its overall efforts. The company that has opened doors to education for underserved communities around the world and spoken out on the need to "go green" got dinged (it received a C) for its apparent lack of commitment to sustainable design, resource reduction and how it handles its supply chain. But it did great, in the researchers' eyes, when it came to product life extension.

And Greenpeace doesn't fail to underscore the importance of transparency and advocacy here, either. HP's habit of furnishing repair manuals with its products and its efforts to "'promote regulatory frameworks that support efforts to extend our products’ lives through repair and reuse' saved HP from a lower score." Still, the message was clear with HP's C-grade for Advocacy.

The takeaway from Greenpeace's report card isn't just that tech manufacturers can do more, and better to change their manufacturing processes (and priorities). It also illustrates that in a large way, companies are pretty much like humans: they all have their strengths and their weaknesses, and if desired, they can all learn from the other guy's innovative accomplishments.

Flickr image: Anna

Climate Volatility Pushes Global Wine Production to a 50-Year Low

Wine has become the beverage of choice for more and more consumers, especially millennials, who by some accounts have been drinking half of all the wine imbibed in the U.S. In California alone, the industry scored a record last year with 238 million cases of wine sold at a value of over $34 billion.

But according to the International Organization of Vine and Wine (OIV), an industry group that supports research and development of wine and other grape-based products, 2017 will prove to be a rough year for vinters worldwide. The worst harvest since 1961, largely due to extremes in hot and cold temperatures in leading wine-producing countries such as France and Italy, have led to lower yields at harvest time. Global production of wine is forecast at 246.7 hectoliters, a drop of over 8 percent (1 hectoliter = 26.4 U.S. gallons, or 133 standard bottles of wine).

Other European wine producers, such as Spain and Germany, also hit historic lows this year. Meanwhile, wine production has generally stabilized or even increased, including in the U.S., despite climate-related disasters such as the fires that devastated California's wine country earlier this month.

Nevertheless, the OIV's number crunching reveals that there will almost be 3 billion less bottles of wine corked this year. And the OIV's report only includes data up to August, before the fires that destroyed tens of thousands of acres across Napa, Sonoma and Mendocino counties.

"If you haven't got a wine cellar, it's time to get one and start stockpiling," said Zoe Wood of the Guardian.

Analysts in recent years have anticipated a drastic shift in the nature of the global wine industry due to climate change. Last year, an article in the scientific journal Nature suggested that warmer climates in the long run could actually benefit France's wine sector. But it turns out that many French wine grape growers struggled with extreme forms of weather, from unexpected frost to low levels of rainfall.

Most observers offer the standard explanation that climate change will create both winners and losers in the wine industry. And the evidence suggests there are strategies vineyard owners can deploy, including canopy management, growing different varietals of grapes or moving vines to higher or lower elevations depending on how microclimates change.

But based on the OIV's conclusions, 2017 will see a lot of losers all the way around - from wine makers and merchants who will see lower sales figures, to consumers who can expect to pay higher prices in the coming months.

Image credit: Yves Cosentino/Flickr

This NY LEED Platinum Hotel Showcases Adaptive Reuse

In case you have not checked your favorite travel web site lately, hotels are becoming far more expensive. Yet there is a growing demand, and profit to be made, by hospitality companies willing to offer accommodation at a middle-market rate. At the same time, consumers are increasingly wanting to stay in unique properties that are sustainable and have character.

Hotel Skyler in Syracuse, NY, checks off all those boxes for those who are keen on sustainable travel. The Skyler is relatively affordable for those who are in town to visit a student studying up the hill at Syracuse University; the hotel is certified as LEED Platinum; and the property is definitely memorable, as it was once a synagogue that closed in the 1980s, found a second life as a theater and is now on its third act.

The Skyler made waves several years ago when it was one of the first hotels in the country, and the first in Syracuse, to achieve LEED platinum certification. Energy efficiency was the key to scoring that designation from the U.S. Green Building Council. A geothermal heating and cooling system keeps guests comfortable during western New York’s humid summers and harsh winters. Sixteen wells, each almost 500 feet deep were bored near the hotel. In turn, 68 water-to-air pumps allow cool and warm air to flow when needed, drastically reducing the property’s utility bills.

The hotel also scores green building points for relying on locally made goods. Those pumps previously mentioned were manufactured locally. Aesthetic features that make the Skyler stand out were also sourced from across western New York. Salvaged stained-glass doors from a church in nearby Oswego that greet visitors when they check in, as well as repurposed lumber and woodwork that blanket the Skyler with a warm, cozy feel. In addition, the Skylar’s owners claim over 20 percent of the products used in the hotel are recycled content, and more than 75 percent of the materials removed during the hotel’s construction were recycled.

The walls of the synagogue and bones of the original structure have been preserved. Some of the more eclectic rooms showcase exposed beams, crown molding and other architectural elements that comprise the temple’s vestibule or adjacent school. One of the hotel’s employees who gave a tour of the property earlier this week noted that former members of congregation occasionally stop by to share memorabilia or stories about their experience growing up with the temple.

For the Skyler’s owners, aligning with Hilton’s latest hotel line, Tapestry Collection by Hilton, is a smart business proposition. Hilton no longer owns any properties; this collection of hotels, branded and launched earlier this year, seeks unique upscale properties desired by travelers who seek and value that independent hotel experience. Yet the Skylar’s owners benefit from buying supplies, from towels to toiletries, at a cost-effective price made possible by Hilton’s purchasing power. The Skyler also has access to Hilton’s reservation system; guest in turns can score Hilton Honors points. Hilton’s branding is also kept to a minimum – most guests would not know this property was affiliated with Hilton until they see the small plaque at the entrance or the small signs at the check-in desk. A family long established in Syracuse owns the Skyler.

Staying in this 94-year-old building is a needed break from the pallid cookie-cutter experience most business travelers have as they travel across the U.S. Yet the hotel also offers the amenities, such as wireless internet and strong coffee, travelers seek as they try to catch up on work while attending meetings or conferences. And they can do so knowing that at least their environmental impact from being on the road is mitigated by the steps taken to make this property more sustainable and responsible than other options in the area.

Image credits: Leon Kaye

Travel and accommodations were provided by Hilton; neither the author nor TriplePundit were required to write about this experience.