Good News: Greenwashing Isn’t So Prevalent After All

What do you do if a company wants you to help with greenwashing?

The recurrence of this question indicates to me that while greenwashing may seem like a somewhat tired conversation to those of us who follow sustainability closely, it’s still a big concern to the thinking public.

Academic researchers affiliated with the Ray C. Anderson Center for Sustainable Business at Georgia Tech may have closed the book on at least one question regarding the prevalence of greenwashing in industry. (Disclosure: The Ray C. Anderson Center is a client of my firm, New Growth Communications.) Manpreet Hora and Ravi Subramanian, both associate professors of operations management, analyzed whether or not companies that voluntarily published information about their environmental intentions or achievements actually performed better or worse than their more reticent peers.

They found companies making positive discretionary disclosures in the press significantly reduced their overall releases of pollutants—as measured by the U.S. EPA’s Toxics Release Inventory (TRI)—compared to similar firms that did not.

“The research suggests that at least one form of greenwashing isn’t prevalent,” said Manpreet Hora. “We designed the study to test whether or not there was a so-called ‘hidden trade-off,’ meaning that one set of positive environmental outcomes was emphasized while other negative and potentially more serious outcomes were overlooked. Fortunately, that didn’t seem to be the case.”

The full study, “Relationship between Positive Environmental Disclosures in Press Announcements and Environmental Performance,” has been accepted for future publication in the Journal of Industrial Ecology. However, the Ray C. Anderson Center just published a research brief on the study in its new Sustainable Business Insights series for practitioners.

The study built on a data set previously used by Subramanian and another researcher at the Center to study how positive environmental disclosures did or didn’t affect shareholder value (Jacobs et al, 2010). But instead of correlating the disclosures to stock prices, Hora and Subramanian correlated the disclosures to environmental performance scores, which they devised from aggregating comprehensive TRI data about chemical releases across company facilities after weighting the releases for varying levels of toxicity. Then they compared the scores to a control group of companies that did not “toot their own horns,” so to speak.

“The overall environmental performance of the 200 firms that made press announcements was better than that of the control firms that shared similar characteristics such as size, industry, and prior environmental performance,” Hora said. “This should be good news to both stakeholders and activists.”

However, Hora pointed out the lack of greenwashing could be the result of external watchdog pressure. Hora and Subramanian’s paper cites an earlier study published in the Journal of Economics and Management Strategy (Lyon and Maxwell 2011) that observed a phenomenon I’ve experienced in which firms with good environmental performance and nothing to hide are hesitant to talk about themselves for fear of drawing more intense scrutiny.

Hora and Subramanian also analyzed their findings to compare the measured environmental improvements of companies in industries categorized as clean or dirty, and to compare the performance of companies that announced environmental intentions against those that announced environmental achievements. Interestingly, the firms in dirty industries had stronger improvements in environmental performance than those in non-dirty industries. And improvements were statistically the same for companies that announced environmental intentions compared to those that announced achievements.

It’s important to note EPA’s TRI doesn’t track carbon dioxide, so this study doesn’t apply to corporate claims about fighting climate change. Additionally, it doesn’t address political greenwashing, a pressing concern that some companies talk a good game publicly while quietly lobbying lawmakers behind the scenes to uphold or institute damaging environmental policies.

Nonetheless, I recommend the research brief to any practitioner who has three minutes to spare and an interest in understanding greenwashing better. If you’re really curious, the paper will be a good entry point to the academic research on the topic, with interesting citations to discussions on institutional theory and legitimacy gaps.

Image credit: Neep/Wiki Commons

As UNGA and Climate Week NYC Launch, de Blasio Urges Cities to Lead Fight vs Climate Change

Need to mail a letter this week in midtown Manhattan? Forget it.

Mailboxes are sealed up tight, traffic is gridlocked and thousands of NYPD officers are pulling in overtime as the United Nations General Assembly (UNGA) and Climate Week NYC gets underway.

New York City Mayor Bill de Blasio used the occasion to implore cities to make the fight against climate change a priority despite White House support of the fossil fuel economy.

Recalling the deaths of 44 people in New York City and billions of dollars in property and infrastructure damage as a result of Hurricane Sandy in 2012, de Blasio touted cooperation with London to accelerate fossil divestment, “even when nations falter.” More recent environmental catastrophes -- including hurricanes in Texas, Puerto Rico and North Carolina, and California wildfires – make it an imperative.

“Put your money in the technologies that will save us all,” the Democratic mayor told attendees at the World Economic Forum’s (WEF) Sustainable Development Impact Summit, adding that New York City pension funds are now investing 2 percent of assets, more than $4 billion, in renewable energy and other climate change mitigation strategies. “Fossil fuel investments are not just toxic for our planet, they are toxic for our economy as well.”

Indeed, asset managers were among the 800 attending the WEF event.

Barbara Novick, vice-chairman of BlackRock, the world’s largest asset manager with $6.5 trillion under management, said 100 new mutual funds tied to sustainability were created between 2015 and 2018. In the past year, there was a 30 percent increase in assets allocated to the environmental, social and governance (ESG) sector, she said.

But radical systemic change in investing in a zero carbon economy globally is hampered when governments and credit rating agencies favor the status quo. Additional disclosure is also needed, she said.

But Novick expressed concern about an “alphabet soup” of competing standards, and "survey fatigue" by corporations asked to provide ESG (environmental, social and governance) data, and called for governments to work with the private sector and civil society to unify some of these reporting frameworks.

Without mentioning President Donald Trump by name, the CEO of the largest U.S. private company used the WEF stage to call out politicians who disrupt the flow of food to consumers over border disputes and tariffs. Achieving zero hunger by 2030 is the second of 17 Sustainable Development Goals (SDGs) adopted by the UN in 2015.

“Trade is under attack… we have to have open borders to do it,” Cargill chief David MacLennan told WEF attendees, adding that Brazil is in a good position to supply China with soybeans, though the South American nation’s highway infrastructure needs upgrading to get commodities to shipping ports.

Cargill, like many private companies, has benefited from a focus on sustainability that allows the food giant to sink 80 percent of its profits back into the company rather than paying shareholder dividends.

“I don’t have to go every quarter and talk to the analysts about our earnings. We can take a longer view,” said MacLennan.

Image credits: The Climate Group (Facebook); Dave ArmonObservations on the Latest Shifts in Sustainable Investing

After spearheading the Sustainable Investing initiative for a large wealth management wirehouse for several years, I found myself in transition this summer – and spent much of that time catching up with old and new friends across the ESG (environmental, social and governance) and impact investing ecosystem. This time has given me the opportunity to reflect on the state of the industry and the challenges it faces.

ESG investing is not a monolith

With the number of ESG investing conferences growing year after year, it is striking how frequently the impression can emerge that different investors are doing similar things. In reality, even if one leaves aside traditional exclusionary screening (stay out of alcohol, tobacco, firearms etc.) ESG investing consists of a variety of different approaches and styles. Wealth and asset management firms would be well advised to create more transparency around the investment approaches they take or promote.

For example, the vast majority of assets that are reported in industry trends reports such as US SIF’s feature some form of ESG integration, whereby ESG aspects are incorporated into the investment process. This happens with varying degrees of discipline and weight placed on ESG, is usually implemented firm wide or at least on multiple strategies at once, and is often accompanied by some increased focus on shareholder engagement with respect to ESG topics. This trend is being driven by the need to comply with commitments made by signatories to the U.N. Principles for Responsible Investment (PRI) and/or to satisfy demands from institutional asset owners.

This is quite distinct from more dedicated ESG strategies, that are often labeled and marketed as such. Examples in equities include, in particular, positively screened ESG strategies (minimum level of ESG performance required for inclusion); ESG-tilted strategies (which seek to increase the portfolio’s ESG score while controlling other characteristics); sustainability-themed strategies (often with minimum revenue required from solutions-oriented activities); or a strong focus on driving positive change through shareholder engagement (often combined with one of the strategies above). Making such distinctions matters for wealth and asset management firms.

How to talk to wealth management clients

While individual investors are growing fonder of ESG investing, they are usually still early on their learning curve and their financial advisors (FAs) are often not well-versed enough to avoid some confusion. There is a certain tension between the need for FAs to understand their clients’ needs and preferences with respect to sustainability and social impact and the lack of customization that arises from a monolithic perspective on ESG. Embracing some form of investment classification is a useful first step to ensure better communication with clients and better satisfaction in the long run.

What is also striking is that many individuals with a preference for sustainability do not find ESG integration strategies compelling, in contrast with dedicated ESG strategies. The reason is that an investment process that takes ESG aspects into account (along with traditional financial considerations) but without imposing any minimum standards is very likely to generate portfolios that include ESG laggards. This can be at odds with what individuals expect from an ESG portfolio.

Decision tree for asset management newbies

For asset management firms who are looking to develop their business strategy around ESG, two distinct decisions must be taken.

The first is whether to implement some for of ESG integration across the firm’s investment processes. This is increasingly demanded by a subset of institutional asset owners and also serves to fulfill commitments incurred by the PRI signatories.

The second is whether to launch dedicated ESG strategies, or in some cases reposition existing strategies. I would argue that this is necessary to capture a portion of the growing wealth management demand for ESG, as well as to serve the needs of the most dedicated institutional investors. Note that both approaches can be taken in parallel and are likely complementary in terms of the skills and resources involved.

United Nations SDGs: moving beyond mapping

2018 is clearly the year the investment community started truly embracing the UN’s Sustainable Development Goals (SDGs). I am thrilled by that move but would caution that this is just the beginning of a long journey until 2030. Today, investment managers are by and large merely mapping their investments to the 17 SDGs or, in some cases, to the 169 underlying targets.

Over time, some goals and targets will be better funded than others, and achievement gaps will diverge substantially across both indicators and countries. Any SDG-focused investment framework developed today should incorporate achievement gaps in order to remain relevant as 2030 approaches. Tools such as the SDSN or Bertelsmann SDG Dashboards (www.sdgindex.org) are a useful resource to this effect.

Image credit: Luke Fritz/Flickr

AMD Puts People First in its Commitment to Be a Responsible Corporate Citizen

When a company has a deep-rooted culture to put people first, profits follow. Corporate responsibility in these companies means generating shared value with their customers, suppliers, investors, employees and communities.

On that point, AMD has published its 23rd annual corporate responsibility update, which highlights the company’s continued commitment to enable a better world by being an employer of choice. AMD says it is working to strengthen its communities and make an impact on the planet through its motivated, innovative and fully engaged workforce.

Health and Safety

The Silicon Valley-based semiconductor company has increased its focus on training and timely reporting of injury and illnesses, which according to AMD has resulted in a significantly lower workforce injury and illness case rate than the industry average. The company’s worldwide case rate was 0.05 per 100 workers in 2017 compared to OSHA’s private industry case rate of 3.0.AMD says it has also established best-in-class health and safety goals for its wafer foundry suppliers to outperform the industry average across various safety parameters. In the report, the company describes how it goes beyond the conventional standards in areas such as prevention of injury and illness, emergency preparedness and response, ergonomics, safety, and employee well-being.

Investing in Talent Management

Apart from providing its employees with competitive compensation, AMD supports them with employee assistance programs, health and wellness initiatives, and tuition reimbursements. It provides an array of technical, leadership and management training programs to promote career development of its employees.AMD insists that it rewards not just the top performers, but also those who demonstrate a commitment to improve their capabilities. The company periodically surveys its employees worldwide to assess their satisfaction levels and their views on the company’s corporate responsibility programs. According to the survey results in 2017, nearly 8 in 10 employees said that they are proud of the company’s involvement in community and social causes.

Finally, AMD claims that the company encourages a work culture where employees feel safe to voice dissenting opinions, challenge the status quo, and take calculated risks.

Engagement through Employee Resource Groups

AMD has formed Employee Resource Groups (ERGs) to promote a highly engaged workforce. Some of the notable ERGs include:AMD Go Green: the group includes AMD Green Teams at various locations that work to inspire and educate company employees worldwide to conserve resources and save the environment.

AMD Pride: the mission of the LGBTQ and Allies of AMD Pride is to foster an inclusive work environment, irrespective of gender identity or sexual orientation, through networking, education and workplace collaboration.

AMD Women’s Forum: this group aims to foster innovation across the organization through the contributions and collaboration of women.

uAMD: This is a virtual learning and development community for all employees to gain and share knowledge and expertise in areas of research, industry practices, and everyday tasks.

AMD Caregivers: This group’s mission is to ensure that every needful individual has the necessary tools to alleviate the challenges of caring for loved ones and pets.

Global Inclusion

AMD says it believes innovation and creativity receive a boost when diverse teams operate in a culture of inclusion. Diversity promotes productivity, improves problem solving, and ultimately drives business performance and profits. This approach, according to the company, has helped AMD become a place where all voices are heard, and all perspectives are embraced.The company maintains its strength lies in consciously building a diverse talent pipeline, increasing inclusion of under-represented groups, and encouraging a culture of respect and belonging.

“Our employees are highly engaged and proud to work at AMD, with a strong belief in our products and mission and an understanding that each person has an important role in our success,” said Dr. Lisa Su, President and CEO, in her letter to the shareholders. “Each year, thousands of AMDers roll up their sleeves to make a difference where we live and work.”

Be sure to talk a look at the services ReportAlert offers.

Image credit: AMD

Here’s What the Last 5 Years of Corporate Sustainability in China has Looked Like. What’s Next?

As a kid, one of my favorite things was a Moon Cake, which I'd get to eat during the Mid-Autumn Festival in China (taking place next week). It's a day of celebrating family reunion and harvest, where the entire country throws parties, comes together and gives homage to the full moon. I’ll always jump at the opportunity to eat a Moon Cake, but this time there’s something else worth celebrating this year: the progress being made on corporate sustainability in China.

This year marks the 5th year anniversary of expanding EDF Climate Corps into China. What started as 6 fellows in 5 companies, has grown to nearly 60 fellows into over 20 companies. With that we’ve seen tens of millions of dollars in potential savings from energy efficiency improvements. But before I jump into how corporate sustainability in China has advanced, let me tell you why we made the decision to expand there.

EDF Climate Corps: Welcome to China

As the world’s two largest greenhouse gas emitters, China and the U.S. are receiving increased attention on their cooperative efforts to save energy and curtail climate pollution. EDF has set a goal to help China with its rising CO2 emissions. So we thought: what better way to do this than enlisting the help of bright, young, talented graduate students?

In the five years since we first brought EDF Climate Corps to China, I’ve watched as the scope and breadth of projects – by both multinational and Chinese-owned companies – has evolved alongside the nation’s sustainability efforts. I’ll show you how.

The evolution of corporate sustainability in China

In our first year, the companies we worked with were for the most part after one thing: energy audit projects in factory settings. It was about plucking the low-hanging energy fruit at one specific site (upgrading lighting or air compressor systems, etc.). And I should note, it was only multinational companies we were working with – headquartered in the U.S., with factories overseas.

Fast forward to today, while factory-based energy efficiency projects are still in our pipeline, they’re no longer the main focus. More companies are making larger sustainability goals, looking to pursue projects beyond energy efficiency.

I’ve identified a few trends in China’s corporate sustainability landscape:

- Improving energy efficiency and scaling solutions. Energy efficiency remains and important and effective way to reduce carbon footprints. But instead of one-off projects, it’s about scaling opportunities both across portfolios of factories and sharing with other companies in similar industries. The results bring enormous ROI, and give a competitive advantage to companies. Pacific Market International (PMI) hired an EDF Climate Corps fellow to improve the energy efficiency of one of its glass suppliers. The fellow developed an energy management strategy, which included recommendations to reduce energy use, such as optimizing washing and dying processes, that can be scaled across the entire manufacturing industry.

- Setting ambitious targets. More companies are concentrating their efforts around data collection, analysis, verification, and reporting. More data is critical for identifying reduction opportunities, managing suppliers and communicating sustainability efforts. This year, MAHLE hired an EDF Climate Corps fellow to build the framework for its first-ever sustainability report, which included specific energy reduction goals, covering categories such as: product innovation and development, energy saving and green production, employee care, and social responsibility.

- Complying with China’s environmental policies. In recent years, China’s political landscape around climate has become much more stringent, giving companies a choice: work with it, or be fined. Working with policies can reduce costs, avoid risk, demonstrate leadership, and attract stakeholders. This year, an EDF Climate Corps fellow recommended an environmental engagement plan for IKEA’s suppliers to mitigate regulatory risk – mainly around areas such as coal burning, GHG emissions, wastewater treatment, and solid waste – across its entire supply chain in China. We also hosted two webinars on environmental law interpretations and corporate compliance that garnered a lot of interest from our hosts (a recording for this year’s webinar can be found here for those that are interested in learning more).

- Adopting green supply chain initiatives. Companies are looking to reduce the emissions of their global supply chains, and they’re working with their suppliers to do so. This is true for both small and medium-sized manufactures, as well as multinationals. As part of its Project Gigaton (reducing GHG emissions in its supply chain by one gigaton), Walmart enlisted two EDF Climate Corps fellows in its Global Sourcing division to identify products that have the potential to reduce significant GHGs. Walmart now has a better understanding of what products need to be upgraded, how to reach its reduction goals and how to incentive more suppliers to participate in the effort.

As I enjoy my Moon Cake next week for this year's Mid-Autumn Festival, I'll be celebrating the long way we've come in corporate sustainability over these past five years. But, I'll also be thinking about the long road ahead of us.

This article was previously posted on the EDF+Business Blog and 3BL Media news.

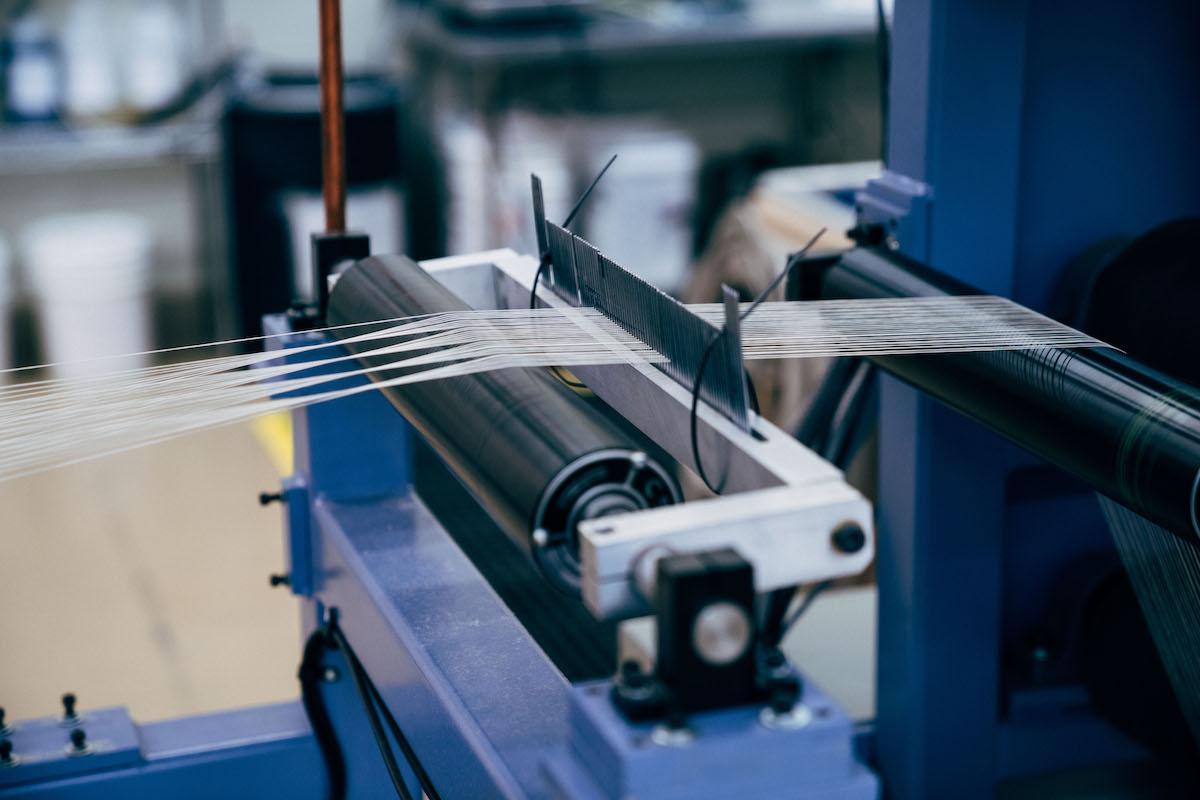

Wrangler Adopts the Denim Industry’s First ‘Dry-Dyeing’ Process

It takes a whole lot of water to make a pair of jeans. In 2007 and again in 2015, denim giant Levi Strauss set out to quantify just how much water went into making its iconic 501 jeans. The company discovered that each pair of 501's uses around 3,800 gallons of water during its full life cycle—70 percent of which is used for cotton growing and another 9 percent consumed during manufacturing.

This week another storied American denim company announced it will cut its manufacturing usage down to size by bringing a brand new dyeing technology to the industry.

On Tuesday, Wrangler confirmed an agreement to implement a new foam-dyeing process to give its jeans the same classic blue color without the water waste. The company will be the first to use the technology, which it says can eliminate 99 percent of the water typically used in the dyeing process.

Researchers at Texas Tech University developed the new dyeing system thanks to early-stage funding from Wrangler and the Walmart Foundation. Tejidos Royo, a Spanish fabric mill with a reputation for prioritizing environmental performance, will be the first to integrate the process, which it calls Dry Indigo.

“We invested in the development of this innovation, because we believe it can drastically change the denim industry for the better,” Tom Waldron, president of Wrangler, said in a statement. “We’re grateful to have an industry-leading partner in Royo, with whom we are taking this revolutionary step toward more sustainable denim.”

Wrangler will leverage a full line of jeans to showcase the foam-dyed denim in 2019. “We’re excited Wrangler is dedicating an entire line of jeans to this innovation,” Jose Royo, sales director of the Tejidos Royo fabric mill, said in a statement. “Our Dry Indigo process nearly erases the environmental impact of denim dyeing and represents the next generation of denim production.”

The manufacturing upgrade is part of Wrangler’s broader goal to save 5.5 billion liters—or around 1.5 billion gallons—of water by 2020. The company has already recycled 3 billion liters of water over the past 10 years, but it will need to step it up in order to meet its goal—and new innovations like this can help, Waldron said.

“While we have been able to reduce 3 billion liters of water in product finishing during the past 10 years, we know that more needs to be done across the entire supply chain,” he explained in a statement. “Foam technology reduces water consumption and pollution further upstream, helping our fabric suppliers to dramatically minimize the impacts of making denim fabric blue.”

If Wrangler dyed all of its denim with this new process, it would save enough water for 150,000 people to use in their homes for an entire year, the company said. For perspective, that’s roughly equivalent to the entire population of Savannah, Georgia, or Hartford, Connecticut.

Wrangler is also looking to move away from the petroleum-derived synthetic indigo dye used by most denim manufacturers. The company began sourcing natural indigo from a handful of farmers last fall, including the Tennessee-based Stony Creek Colors, and hopes to ramp up natural indigo purchasing in the coming years.

Even further down the supply chain, Wrangler continues to work with cotton farmers on more sustainable agricultural practices. The company introduced a soil health program last year to boost the sustainable cotton supply, engaging farmers from Tennessee, Alabama, Georgia, North Carolina and Texas, Environmental Leader reported.

The denim icon also plans to power all owned and operated facilities with 100 percent renewable energy by 2025, among other sustainability initiatives.

Wrangler’s parent company, VF Corporation, is no stranger to sustainability either. The apparel giant that also includes labels like Vans, Timberland and the North Face cut carbon emissions by 12 percent from 2009 to 2015 while growing the business—among a number of impressive social and environmental achievements.

The Made for Change strategy, launched at the end of last year, further embedded sustainability into day-to-day operations at VF. “Made for Change was designed as a long-term strategy for the business—not just a sustainability strategy—so it had to create value,” Letitia Webster, global vice president of corporate sustainability for VF, told Conscious Company. “If we want the plan to generate value in the form of revenue, reputation, brand relevancy and growth, it must be embedded in the business.”

As it moves forward with its company-wide goals, Webster said VF will lean on brands with more experience in sustainability, such as Wrangler, the North Face and Timberland, to lead the way. “We’ve been at it for a long time, and we’ve been able to show some wins and highlight some success stories from brands across the company,” Webster told the magazine. “Those bright spots put momentum behind us, and people start to wonder, ‘If that team can do it, why can’t I?’”

Image credits: Wrangler

Carlsberg’s Snap Packs are Latest Example of Sustainable Packaging for Beer Industry

Danish brewer Carlsberg’s latest packaging innovation is almost invisible, and that’s exactly the point.

Gone are the days of plastic wrap, rings or caps holding together multi-packs of beer. Instead, the cans in Carlsberg’s new Snap Packs are held together by glue.

“You can’t actually see the packaging. It’s almost not there, and that is what is extremely exciting from a sustainability perspective,” said Simon Boas Hoffmeyer, head of sustainability at Carlsberg, in an interview with The Guardian.

The Snap Packs, which will debut in the United Kingdom, were three years in the making. The hardest part of the development process? Making glue dots strong enough to keep the packs together during shipping and on store shelves, while easy enough for consumers to break when they want a single can.

Carlsberg estimates the switch to glued cans will reduce plastic waste by 1,200 metric tons (1,323 tons) a year – the equivalent of 60 million plastic bags.

The World Wildlife Foundation has already given its support to the new packaging design. Said Bo Øksnebjerg, Secretary General in WWF Denmark:

Our wildlife is drowning in plastic – and the problem is unfortunately growing considerable. We therefore need to act now. We need less plastic to end up in nature. That is why we consider it huge progress that Carlsberg is now launching solutions that significantly reduce the amount of plastic in its packaging. With these new solutions, Carlsberg has taken the first big steps on the journey toward a more clean and green future.To celebrate the release of the new Snap Packs, Carlsberg recruited one of Denmark’s biggest celebrities – The Little Mermaid. Earlier this month, Carlsberg debuted a replica of Copenhagen’s famous Little Mermaid statue. Only this version was made with, you guessed it, glued-together Snap Pack cans. The rising “tide” on the statue is made of 302 lbs. (137 kg) of plastic, representing the amount of plastic eliminated every hour by the absence of plastic on the new Carlsberg multipacks.

The Snap Pack is not the first green packaging initiative from Carlsberg. In September 2016, the brewing company unveiled designs for its Green Fiber Bottle, made from sustainably sourced wood fiber.

Carlsberg’s shift is among other eco-friendly packaging innovations that have been brewing across the international beer industry in recent years:

- Saltwater Brewery of Delray Beach, Florida, was the first brewery to offer the E6PR (Eco Six Pack Ring). These rings are made from compostable organic materials that are not harmful to wildlife if accidentally ingested. The E6PR has now expanded to four breweries in the U.S., along with breweries in Australia and South Africa.

- SAS Green Gen Technologies of France is finalizing development on a bottle made of flax fibers. The lightweight, biodegradable bottle can handle beverages with an alcohol content of up to 60 percent ABV, making it a suitable container for not only beer, but also wine and liquor. Within the next two years, SAS Green Gen Technologies expects to expand to include beverage containers made of bamboo, sugar cane, and hemp.

- Scottish brewing company Jaw Brew is working with biotech firm Cuantech to create can connectors made from shellfish. Chitin is a substance extracted from prawn shells. If successful, these six-pack connectors would reduce both plastic and aquaculture waste.

The North Face Expands Range of Sustainably Produced Wool Clothing

In 2016, the consulting firm McKinsey said one of the keys to succeeding in tomorrow's fashion market would be sustainability, asserting that consumers will “expect ecologically unobjectionable fabrics, a conservation-minded use of resources, reduced emission of pollutants, and greater social commitment.”

As Huffington Post has reported, sustainability has become the next fashionable trend, but despite growing interest from consumers, the industry still has a long way to go. Sustainable Brands reported earlier this year that the apparel industry has one of the largest carbon footprints globally. More companies, however, are stepping up their game.

For example, the outdoor clothing and equipment brand The North Face hopes its commitment to expanding the range of the label’s Cali Wool collection this year “will help raise awareness of how consumers can support climate action by purchasing products made with regenerative methods.” Cali Wool is sustainably produced wool that the company introduced last year.

In order to produce this range of clothing, The North Face has partnered with Bare Ranch in California, whose regenerative agricultural practices are expected to sequester 4,000 metric tons of carbon a year, or the equivalent of removing 800 cars per year from the roads. Bare Ranch in turn has worked with Fibershed, a non-profit that “develops regional and regenerative fiber systems on behalf of independent working producers.”

The basis of this system is carbon farming, the process by which carbon is sequestered back into the soil. This system uses techniques such as composting, planting cover crops and trees and restoring creeks on ranch land. As a result, while sheep graze on the land, overall soil health is improved, and the result is what Bare Ranch calls “Climate Beneficial” wool.

Sustainable ranching is one benefit of producing this line of clothing, while another feature is to produce a completely regional product - further limiting this apparel’s carbon impact. Instead of shipping the fibers off to an overseas location like China, The North Face’s Cali Wool products are manufactured in the USA.

This line of apparel is not a low cost leader, but as The North Face told TriplePundit via email, “the price of the Cali Wool collection - beanie, scarf and jacket - reflects the high-quality, premium USA Rambouillet wool and local manufacturing. All three Cali Wool products are made in the USA and the fabric for the jacket, in particular, is woven at American Woolen Company, a Connecticut-based fabric mill that makes specialty, high-quality fabric.”

This year’s Cali Wool range expands upon its first item, the beanie, which The North Face launched in 2017. By expanding the product range this year, The North Face is purchasing five times as much Climate Beneficial wool by volume compared to last year.

The product retails at a slightly higher price than those made from conventionally sourced fibers. As the aforementioned McKinsey report concluded, while consumers are demanding products that are sustainably sourced, “only the fewest customers are willing to pay more for these greener products.” So, will this be a problem for The North Face?

It appears not. The Cali Wool beanie is ten dollars more expensive than a similar merino wool product on the company’s website, but so the brand's customers are prepared to pay the price premium. The North Face told us via email that the Cali Wool product range for this year was expanded in part because of consumer demand, having sold out twice through their online store already.

It is encouraging to see responsibly sourced natural fibers finding their way back into the apparel market. From the startup footwear company using wool and tree fibers 3p covered last month, to large established companies like The North Face, moving away from synthetic materials will help provide consumers with more choices of responsibly- and sustainably-made apparel.

Image credit:/The North Face

Onward! Resilience Takeaways from the Global Climate Action Summit

In some ways, it’s surprising how little the 2018 Global Climate Action Summit focused on climate adaptation. Only two the 500 official announcements emanating from the annual event, which concluded last Friday, relate to adaptation.

And though The Exponential Climate Action Roadmap, published on the CGAS opening day by its leadership, explained that “the roadmap outlines the global economic transformation required by 2030 to meet the Paris Agreement on climate,” it asserted that the Paris Agreement’s goal to reduce the risk of dangerous climate change “can be achieved if greenhouse gas emissions peak by 2020, halve by 2030 and then halve again by 2040 and 2050.”

Actually, this isn’t quite right. The Paris accord has goals – plural. In addition to the above objective, the Paris Agreement covers global approval for adaptation, resilience and reduced vulnerability. It requires signatory nations to plan and apply adaptation, report adaptation efforts and needs, and – every five years – measure adequacy, effectiveness and progress. Indeed half of the Paris Climate Agreement is about adaptation. (For those of you who keep score, adaptation is mentioned 47 times in the agreement while mitigation only 23. Check it out.)

So while the climate media and GCAS may be distorting the Agreement’s reality, the resilience initiatives featured at the Summit and affiliated events are awesome and deserve to be encouraged and supported in their own right.

Here is my roundup of a baker’s dozen of highlights that deserve our attention and promotion as we fuel ambition for adaptation:

- James Lee Witt, former director of the Federal Emergency Management Authority at the Summit representing the National Association of Counties and discussing Community Readiness boldly pointed out that to break the damage/repair/damage/repair cycle in certain cases, we must "make climate action happen by migrating households out of harm’s way.”

- Sanjay Wagle, Managing Director of the Lightsmith Group, launched a resilience finance technical facility for lower income and small island nations, based on the progress of the firm’s award-winning Climate Resilience and Adaptation Finance and Technology-transfer facility (CRAFT).

- Emilie Mazzacurati, founder and CEO of Four Twenty Seven Inc., introduced the firm’s latest innovation, a project to identify and calculate the macroeconomic risks of climate change for every country and ensure that governments can access its data.

- Tom Steyer (At the Cities4Climate Event hosted by C40), who is a hedge fund manager, philanthropist, activist and the money and brains behind Risky Business, gave credit for California’s progress on climate action to community activists. He contended that California’s climate progress “is due to the leadership of the environmental justice movement – they are the high water mark in terms of morality. They make climate change a kitchen table issue.”

- The Natural Resources Defense Council (NRDC), is working on the biggest climate change killer out there, heat stress, by helping Indian states adopt heat action plans with public awareness campaigns, better identification of vulnerable populations and expanded use of reflective surfaces.

- C40 for its Deadline 2020 initiative – a commitment from 73 cities, representing over 425 million citizens, to develop inclusive climate action plans to strengthen resilience and address adaptation along with mitigation in their work.

- ICF’s Robert Kay, who foresaw that GCAS would be a key set of dialogues and initiated plans for the robust affiliate event, “Building Resilience Today for a Sustainable Tomorrow,” that brought together the Global Resilience Partnership with BSR and the United Nations initiative, Anticipate, Absorb, Reshape.

- Global Real Estate Sustainability Benchmark (GRESB) hosted a Climate and Resilience Preview where real estate investors waded into the deep of both reporting the climate risk embedded in their holdings and working to mitigate it. It included Romilly Madew, CEO of Australia’s Green Building Council, who has mainstreamed real estate climate change risk assessment among her members.

- The Pacific Coast Collaborative led by Governors Jerry Brown (CA) and Jay Inslee (WA), who launched a new effort to strengthen climate resilience through collaboration that results in climate resilience for local communities and infrastructure.

- Global Adaptation and Resilience Investment (GARI) work group and Willis Towers Watson’s Carlos Sanches, who together are promoting the development of financial tools and instruments for the management of portfolio exposure to climate risks.

- Connecticut Governor Dannell P. Malloy led with his proudest climate action: Creating resilience through traditional finance by applying state bond proceeds to neighborhood microgrids. This occurred after the state was pummeled by extreme snow events that cut power for days.

- BSR provided leadership from Samantha Harris with its new Climate-Resilient Value Chains Leaders Platform. Launched with climate resilience leaders Mars Inc. and Coca Cola, the initiative focuess on long-term models for corporate buying that require resilience.

- Mayor Lionell Johnson Jr. of St. Gabriel, Louisiana, (population: 6,677),who launched the Mississippi River Investment Coalition to grow local financing of resilient infrastructure “because the heart of America is experiencing climate change every day, affecting our economies and our workforce.”

Meanwhile, the high-level “Summit Champions” responsible for making GCAS 2018 more than just another meeting by fueling ambition for climate action, are encouraged to think twice about the Paris Climate Agreement – specifically, No. 1, mitigation and No. 2, adaptation.

And act with urgency on both.

Image credit: Global Climate Action Summit

Global Fossil Fuel Demand Could Peak In Only Five Years, Studies Find

Fossil fuel demand could peak as early as 2023, according to a pair of studies released this month. The shift has the potential to put “trillions at risk for unsavvy investors oblivious to the speed of the unfolding energy transition,” Carbon Tracker, a nonprofit think tank that studies the impact of climate change on financial markets, predicted in a report last week.

Demand for coal, oil and gas is “stalling” as the costs of clean energy and battery storage fall and governments shift away from fossil fuels in pursuit of their pledges under the Paris climate agreement, the London-based think tank found. Moreover, it describes an “emerging market leapfrog,” in which developing countries move directly to renewables and bypass costly fossil fuel projects.

“The motor of change now lies in the emerging markets, which is where all the growth in energy demand lies,” the report reads. “They have less fossil fuel legacy infrastructure, rising energy dependency, and are anxious to seize the opportunities of the renewables age. We believe it highly likely therefore that emerging markets will increasingly source their energy demand growth from renewable sources, not from fossil fuels.”

Overall, Carbon Tracker expects a 1 to 1.5 percent annual growth rate in global energy demand over the next decade, while the global deployment of wind and solar power increases by 15 to 20 percent each year. If that happens, “fossil fuel demand will peak between 2020 and 2027, most likely 2023,” according to the study.

“Fossil fuel demand has been growing for 200 years, but is about to enter structural decline,” Kingsmill Bond, new energy strategist for Carbon Tracker and author of the report, said in a statement. “Entire sectors will struggle to make this transition. They can expect price declines, greater competition, restructuring, stranded assets and market derating.”

The fossil fuel sector has invested an estimated $25 trillion in infrastructure, much of which could be put at risk if demand begins to fall, and energy firms are far from the only ones in the danger zone. The energy transition will directly affect sectors that compose up to a quarter of equity indexes and debt markets, ranging from banking and capital goods to transport and automotive, according to Carbon Tracker.

Bond and his team also warned that fossil fuel exporting countries will suffer potentially destabilizing shake-ups in the wake of a transition, as fossil fuel leases account for 10 percent or more of GDP in 12 countries, including Russia and Saudi Arabia.

A second report released by DNV GL came to a similar conclusion. The Norwegian risk-management company predicted that global energy demand will decline from 2035 onward, hastening the shift away from fossil fuels. Fossil fuel spending will drop by around a third by 2050, as investment in renewable energy triples, according to DNV estimates.

“Fossil fuels will play an important if reduced role in our energy future with its share of the energy mix set to drop from around 80 percent today to 50 percent by the middle of the century, with the other half provided by renewables,” Peter Lovegrove, media relations and video production manager for DNV, wrote on the company’s blog.

DNV expects oil to peak in 2023 and natural gas to become the single largest energy source by 2026, with wind and solar “set to meet the majority of new electricity demand.” Coal is already on the decline, having reached its peak in 2014. “The transition is undeniable,” Remi Eriksen, group president and CEO of DNV, said in a statement. “Last year, more gigawatts of renewable energy were added than those from fossil fuels.”

These peak projections differ substantially from what the fossil fuel industry expects. Shell says it could peak in the late 2020s only under the “most aggressive” and unlikely scenario for electric car growth, the Times U.K. reported. ExxonMobil projects growth to 2040 as sectors like shipping and aviation continue to depend on oil, reports the Guardian.

With these numbers in mind, it’s no surprise that some in the industry are unconvinced by the recent studies. In a Fortune op/ed published this week, the CEO of one of America’s largest privately-owned oilfield services companies said the 2023 peak forecasts “should be viewed with caution.”

“The energy transition will happen over the coming decades, but an array of political, economic and social considerations will determine how long it actually takes to ‘de-carbonize’ the entire global energy system, if ever,” Canary CEO Dan Eberhart wrote in Fortune.

Even as countries switch away from fossil fuels for their energy needs and electric vehicles continue to take hold in the transportation market, oil demand is expected grow in other sectors, including trucking, aviation and petrochemicals, Eberhart argued. He also pointed out that most oil companies sit on vast natural gas reserves that will keep them relevant and competitive for decades to come.

Still, Eberhart’s argument that full-fledged decarbonization is necessary to reach peak oil remains in dispute. “Even though complete decarbonization is far off into the future, the peak occurs early on in the transition,” energy reporter Nick Cunningham wrote on Yahoo Finance. “Once the peak is hit, the troubles start to accelerate. Demand starts to fall, so fossil fuel companies face lower prices for their products, lower valuations and ultimately stranded assets.”

Notably, demand often peaks when up-and-coming competitors still represent less than 10 percent of total sales in a sector, said Bond and his team at Carbon Tracker. They used Europe’s thermal energy sector as an example. There, demand for thermal energy peaked in 2007 when renewables made up just 3 percent of total energy supply. As demand fell following the financial crisis and renewables continued to grow, the thermal industry was forced to write down $150 billion in assets.

“We have seen a similar pattern in many energy transitions, from electricity, coal and cars in recent years to horses and gaslights in the past,” Bond argued. “Demand for incumbents peaks early, and investors in incumbents lose money early on.”

Carbon Tracker predicts that the tipping point for fossil fuel demand will come when solar and wind power make up around 6 percent of total energy supply—far below levels of penetration in many European countries. But these forecasts are far from certain, especially if more countries follow the United States’ lead and drop out of the Paris agreement or weaken their commitments. In Brazil, presidential candidate Jair Bolsonaro has already pledged to pull his country out of the agreement if elected.

“If more and more countries start to take Paris less seriously, that will have some effect on how quickly the energy transition happens,” Sebastian Ljungwaldh, an energy analyst at Carbon Tracker, told the Guardian.

While the exact timing remains to be seen, the potential risks for investors and industries tied to fossil fuels are undeniable—and those folks are likely paying attention, even if the fossil fuel sector is not. “Investors anticipate, so they will typically react even before companies see peak demand,” said Bond of Carbon Tracker. “This is what happened recently in the coal and European electricity sector transitions. We believe that investors will start to react faster as the energy transition works its way through the world’s capital markets. As each sector is impacted, it becomes easier for the market to anticipate something similar happening to the next sector.”

Image credit: Flickr/Walter