Leveraging New Tech to Wean America Off Its Addiction to the Plastic Water Bottle

It’s finally clear—the single-use plastic water bottle is now the environmental cigarette, stigmatized as a mark of disgrace in a growing circle of consumers. The mega-trend away from single-use plastics is no longer deniable.

The statistics around single-use plastic water bottles are astounding:

- There are 50 billion water bottles consumed every year, about 30 billion of them in the US.

- Approximately 80 percent of single-use plastic water bottles don’t get recycled.

- Every square mile in the ocean has over 46,000 pieces of plastic floating in it, the biggest culprits of which are plastic bottles and bags.

- Over 90 percent of some of the most popular bottled waters brands contain micro-plastics.

- Plastic bottles are made from PET and often contain BPA and phthalates, both of which are endocrine disruptors harmful to health—both in drinking from them and by leeching into the environment through our aquatic system.

- By the year 2050, our oceans will contain more plastic (by weight) than fish.

As bad as this sounds, two simple question often get asked: “If the effects of plastic bottles are so devastating, why do so many people continue to drink bottled water?” And, “Why don’t they just drink tap water instead?”

The majority of American consumers (77 percent in one survey) either don’t like or trust tap water. So quite simply, many won’t drink it. And this is what’s created a big bottled water market with a destructive environmental impact. There are inherent issues with the U.S. tap water system: High lead levels are not just a Flint, Michigan problem, but far too prevalent throughout the U.S. Our millions of miles of aging infrastructure can contaminate even the cleanest source water. And at the source, tap water contains chlorine, fluoride, and now, studies show, trace amounts of pharmaceuticals, herbicides, pesticides, and inorganic solids.

Further, in many places throughout the U.S. tap water just doesn’t “taste right” to consumer palates. In some cases, it tastes downright awful. Often, this is due to high total dissolved solid content (TDS), which doesn’t get substantially removed in municipal water treatment facilities. Ultimately, much of our access to public-use tap water is via water fountains or water coolers that do nothing (or minimal at best) to filter out and remove these impurities, and the resultant taste of the tap water is unrefined and unchanged. The end result is that consumers behave as consumers do—they make decisions based on preference, and, when they prefer the taste of something over tap water, it’s created the new environmental cigarette problem: single use bottled water pollution

Unlike other plastic products like straws and bags, there aren’t readily available alternatives to plastic water bottles that can easily be adopted. The simple removal of straws still provides consumers a way to drink their beverage—by sipping, if nothing else, or the replacement of a plastic straw with a paper one. The same applies for plastic bags, where alternatives are readily available in the form of recyclable paper or reusable bags. Replacing plastic water bottles, a far larger environmental problem, requires a much higher degree of change in consumer behavior.

What will it take to wean America off of its addiction to the plastic water bottle?

One solution is to create a pathway for consumers to fall in love with tap water again—not by pushing them back to the tap itself but rather by transforming tap water and making it their preferred alternative to bottled water.

There are several ways to make this happen. Our approach has been the development of a product called the FloWater Refill Station, which has a new-tech purification system that not only purifies the water but enhances its benefits and taste.

The challenge is in educating the market about both the dynamics surrounding packaged water—and water itself. A substantial component to what FloWater is building is education around changing consumer behavior. It’s not with a message as simplified as ““bottled water is bad” but “you can actually have access to something that as a consumer you’ll love more than bottled water…and you can do something good for the environment as a result.”

Over the past three years, we have partnered with hotels, schools, corporations, and retail outlets in 42 states to deliver this different kind of plastic-free, drinking water experience for their employees and guests. We recently hit the 50-million mark in the number of plastic water bottles eliminated from the market, and we are on track to hit a billion by 2022.

As a growing number of consumers, businesses and municipalities turn away from single-use plastics like straws and grocery bags, developing alternatives to the plastic water bottle is a critical challenge. A major shift in how water is delivered and consumed is inevitable.

Image credit: Pixabay

What to Anticipate in ESG Reporting for 2019

Environmental, social, and governance reporting has become a mainstream feature of corporate America. In addition to responding to stakeholder concerns, ESG reporting can also inform decisions that lead to bottom line benefits — if companies are geared up to get the most out of their own internal assessment.

In a recent conversation with TriplePundit, Alyson Genovese, Head of Corporate and Stakeholder Relations in North America for the Global Reporting Initiative (GRI), underscored the significant difference between the corporate charitable giving of the past, and the ways in which companies can use ESG reporting to improve their operations:

“Companies are starting to realize that charity does not replace responsibility and good governance. It should reflect the values of the organization, not simply ‘give back.’

“Giving part of the profits to charity is admirable, but stakeholders are saying that they care about how those profits are made, too.”

In the area of sustainability, for example, corporate leaders generally accept that companies have the ability to take action on climate change.

“Companies are starting to realize there are risks and missed opportunities if they don’t understand their relationship to climate change,” said Genovese. “The challenge is that they need to take action before they see an immediate impact on the bottom line.”

Employee productivity is another area in which companies can benefit by being proactive on sustainability issues:

“When a company can track and measure impacts, it can make connections between seemingly disparate issues,” Genovese explained. “For example, a company can connect environmental issues to employee wellness, and use that information to foster a culture of health and wellness.”

The role of companies in creating change has also been developing. In the past, awareness was a deliberate, integrated strategy exemplified by companies like Kenneth Cole and Patagonia. Now “regular” companies are taking stands on issues, partly in response to employee concerns.

“There is also a greater understanding that, in the absence of government leadership, corporate leadership has a role to play,” Genovese explained.

According to Genovese, the next challenge is for companies to realize the value of ESG reporting, and reflect that value by assigning a full team to collect and disseminate information.

“Companies are beginning to see their sustainability directors as a strategic internal resource, but they are not necessarily getting the staffing,” she said. “Companies need to grow their sustainability teams as internal resources. They need to right-size their sustainability teams.”

Along with ramping up staffing, companies also need to meet the growing need for training and certification. Genovese explained:

“Ten years ago, sustainability reporting was not a profession. Now it is a professional role, and we are pivoting toward developing the skill set needed to implement GRI standards.”

In addition to direction from GRI, Genovese also noted that for most companies, the vast majority of impacts occur in their supply chains. That makes communication and knowledge-sharing between companies an essential part of the process.

Competition between companies can also motivate change:

“We are seeing companies respond to each other. They don’t act in isolation. They respond as competitors or as parts of each others’ supply chains. They are demanding information from each other, and they influence each other. When a major customer takes action, companies in the same field pay attention.”

As the uses and benefits of ESG reporting come into sharper focus, there will be increased demands on companies to assemble, analyze and disclose current, reliable data.

Genovese emphasized that having sufficient staff to meet the demand is only one part of the disclosure equation. The other part is timeliness. She made the case that annual ESG reports need to be released earlier:

“ESG reports are now being seen as reference documents to be shared with stakeholders inside and outside of the company. That means they have to be current and contextual.”

“Right now public companies have to have all hands on deck to deliver their annual reports by March, but their sustainability data might not come out until the fall. That sends the message that this information is less value and is not closely tied to the rest of the reporting.”

“That doesn’t necessarily mean it has to be integrated with the annual report. It’s a matter of getting decision-useful data into the hands of people who need it.”

ESG reporting has come a long way in a relatively short period of time, and Genovese foresees another wave of growth as companies grow their teams and develop an institutional base of knowledge and experience.

“For most companies, currently there is not sufficient expertise in-house,” she said, “That’s why it’s vital to have a certification process, to get the graduate schools involved, and to establish a career path.”

During the October 23-25 3BL Forum, Alyson Genovese of GRI will host a half-day workshop on October 23 that will focus on materiality assessment, valuable to both new and experienced ESG and sustainability reporting practitioners. Register now and save 25 percent with code GRI2018VIP.

Image credit: Adeolu Eletu/Unsplash

More Women Are Serving on Corporate Boards, But Parity is a Long Way Off

American companies are putting more women in leadership positions, but they still have a long way to go, according to recent research.

Within the Russell 3000, an equity index that tracks the 3,000 largest US-traded stocks, 82 percent of companies now have at least one woman on their board of directors—up from 77 percent in March of last year, according to financial data analysis firm FactSet. Less than half (47 percent) have boards comprised of less than 15 percent women, compared to 58 percent last year.

At the CEO level, only 151 companies within the Russell 3000—or roughly 5 percent of the index—are headed by women, but that still represents a marginal improvement over the 143 companies with female CEOs last year. These findings mirror recent analyses of the Fortune 500—in which only 24 companies are headed by women.

Though these firms are few and far between, companies with female CEOs are more likely to have women on their boards. “Of the 521 companies in the Russell 3000 that have zero female board members, only four have female CEOs,” Katherine Guerard, a training specialist with FactSet, wrote in a blog post announcing the findings. The inverse is also true—when a company’s board is comprised of 40 percent women or more, the likelihood that it will hire a female CEO increases by a third.

Gender equality in leadership by industry

Of the Russell 3000’s nine sectors, utility companies have the best record for female leadership, with women representing a little over 11 percent of CEOs and averaging 22 percent female board representation.While these numbers are promising, utilities comprise the smallest sector in the index by far, with only 99 companies, “so it’s difficult to draw meaningful conclusions,” Guerard of FactSet noted. However, the 420 companies representing the index’s third largest sector—consumer discretionary goods—are also boosting female representation in leadership. In this sector, 8.8 percent of CEO positions and 21.4 percent of board positions are now held by women.

The technology sector is among the worst performing when it comes to leading on gender diversity—which is no surprise given its prior track record. Although annual returns at highly gender-diverse tech companies are 5.4 percent higher on average, according to a 2017 report from Morgan Stanley, men still comprise over 75 percent of the tech workforce. Of the 339 technology companies listed in the Russell 3000, only eight have female CEOs—amounting to a measly 2.4 percent. “This sector also ranks near the bottom when it comes to female representation on boards of directors, with an average representation of 16.1 percent,” Guerard wrote.

Still, all is not lost for technology companies: Of all Russell 3000 firms, technology company Travelzoo has the highest female representation on its board, with 80 percent of board seats being occupied by women.

Gender equality is good for business, research shows

This latest report from FactSet comes after large asset managers like State Street Global Advisors, BlackRock and Vanguard called for improved gender diversity on corporate boards.“Gender diversity is one element of board composition that we will continue to focus on over the coming years,” Vanguard CEO William McNabb wrote in an open letter addressed to the directors of all public companies, as reported by MarketWatch. “We expect boards to focus on it as well, and their demonstration of meaningful progress over time will inform our engagement and voting going forward.”

Though women’s leadership is an increasingly hot topic, such strong words from fund managers like Vanguard aren’t just trend watching or altruism—they reflect definitive data that shows gender diversity is good both for corporate governance and for business.

Publicly-traded companies with gender diverse boards—defined as women occupying at least 40 percent of board seats—see an average 12 percent higher return on equity compared to the Russell 3000 overall, according to another FactSet analysis released in March. These companies also demonstrate greater return on invested capital and lower price volatility than their peers, especially those with exclusively male boards, FactSet found.

Bank of America Merrill Lynch Global Research came to a similar conclusion in a report released earlier this year. “We found that gender diversity amongst executives, board members and managers consistently suggested higher returns on equity . . . lowered price volatility and lower earnings risk,” Savita Subramanian, head of U.S. equity and quantitative strategy for BofA Merrill Lynch Global Research, said in a statement.

Findings like these appear to be top of mind for fund managers. "Irrespective of a company’s industry, location or size, we believe that a lack of diversity on the board undermines its ability to make effective strategic decisions," Michelle Edkins, global head of investment stewardship for BlackRock, wrote in a letter to the Russell 1000 last year, as reported by Bloomberg.

Parity is still a long way off

Though data clearly shows the benefits, it will be a while before corporate America reaches gender parity in the boardroom, experts say. Recruitment firm Heidrick & Struggles predicts that we won’t see an even split in board appointments for men and women until 2025—“and that’s just for new directors,” wrote Quartz editor Heather Landy.Note from the editor: In this week's Brands Taking Stands newsletter, we explore the potential impact from California's law mandating that women on serve on the boards of companies that are headquartered within the state.

Image credit: Dane Deaner via Unsplash

You’ve Set Your Sustainability Goals. Now What?

I’ve never run a marathon, but I imagine it would be a very praise-worthy experience.

First, you sign up, feeling that initial rush of “wow, I’m actually doing this” adrenaline. That's followed by everyone's favorite part: telling people. You’re instantly flooded with responses like “Good for you!” and “You’re such an inspiration!”. But then, the glory starts to fade and you realize it’s time for the hard work. Months of training, time and dedication (and probably pain) are needed before you can cross the finish line.

We’re seeing a similar process happening in corporate sustainability around setting climate goals. It’s inspiring work to see companies set targets. Take for example evian, which announced its ambition to be Carbon Neutral globally by 2020 during the Paris Climate Summit in 2015.

But getting kudos for setting a goal is just the beginning. The rest of the story, often the most important and tricky step is figuring out those middle miles – determining how exactly these goals can be met. As consumers, it’s the hard work being done to deliver on a goal that we should be celebrating even more.

This summer, I got a glimpse into what those middle miles look like – what it takes to get from goal setting to goal hitting.

One year later: where is evian® on its journey?

A lot goes into the manufacturing of a bottle of water and getting it to consumers. There’s the design, production, transport, and end use. And with that, there are greenhouse gas (GHG) emissions. That’s why evian is focusing on reducing the carbon footprint of the product’s lifecycle at every step of the way, including 100% renewable energy at its manufacturing facility and incorporating more recycled content into bottle design.

One big area of opportunity to make GHG reductions in evian’s supply chain is related to downstream logistics in the U.S – activities such as warehouse storage, or transportation from U.S. ports to other warehouses and distribution centers.

This summer, the company partnered with EDF Climate Corps, enlisting the help of Andrea Gomez Vesga. Andrea was challenged by the head of Danone Waters America Supply Chain with designing a GHG reduction plan, focusing on these downstream activities.

Andrea worked hand in hand with the Supply Chain team to compile data on the carbon footprint of each of the company’s lane and carriers. Per the team’s request, Andrea created a custom, user-friendly carbon calculator to make it simple for the transportation team to incorporate carbon into decision making. “evian has bold ambitions and now we can move from ambition to action here in the United States. By analyzing our existing data through a sustainability lens provided us with information that can help us take the actions necessary to reduce our emissions”, stated Aurelie Fonzes, Logistics Manager with Danone Waters.

To reduce transportation-related emissions, evian is converting to intermodal freight transport – the use of two modes of freight, such as truck and rail, to transport products – when possible. Supporting this strategy, Andrea analyzed the environmental performance of each carrier and ranked them accordingly. She determined that evian could make significant cuts in its footprint and recommended opening a strategically located new warehouse that would replace trucks with trains.

The supply chain team has already started the conversations with partners and the next steps is defining metrics, targets and goals that plan to be incorporated into the Supply Chain’s sustainability roadmap. And even better, the potential for scale is huge: This pioneering program in Danone Waters of America is being shared for learnings throughout the company’s other business units.

How we can learn from evian®

There’s a lot that can be learned from evian’s progress for those who are facing similar challenges in hitting their goals:

- If you set a goal, you need a plan to meet it. Although it takes a lot of work to set a goal, a goal is only impactful if it’s met. evian’s progress shows the impact of taking a systems approach to meeting a goal and the need for iterative roadmaps.

- You don’t have to do it alone. Partnerships can be a great, cost-effective option to meeting your goals. Andrea gave evian a dedicated pair of hands and fresh set of eyes needed to accelerate progress.

- One mile at a time. Meeting a goal can be overwhelming, but evian’s supply chain team shows how you can methodically address one piece at a time and build momentum.

- Meeting goals can provide new perspectives. By assessing various business units, you often uncover smarter business decisions that can save money, time and carbon emissions.

Here’s what making progress on sustainability goals looks like for evian. How about you?

Connect with Daniel Hill on LinkedIn

Previously published on EDF+Business and 3BL Media news.

The Allstate Foundation Encourages Youth Empowerment with Good Starts Young Program

Mary-Pat Hector was 13 years old when she decided she had to do something to stop the gun violence that was riddling her Atlanta, Georgia neighborhood.

“She was determined to generate awareness for the issue and caught the attention of supporters who enabled her to develop a billboard campaign in Atlanta to help spread the word about the violence epidemic,” said Laura Freveletti, senior program officer of The Allstate Foundation’s Good Starts Young program.

“I wanted to create billboards so people could see themselves, see it happening to them,” Hector said, who was able to erect 50 billboards across the city of Atlanta to not only shine a spotlight on the problem of gun violence, but encourage people to look at the issue with fresh eyes.

Now a sophomore in college, Hector has created a nonprofit to publicize the issue further. She also ran for local office, becoming one of the youngest candidates to run in Atlanta’s history. Although she didn’t win the election, Freveletti said, Hector hasn’t slowed down one bit.

“She continues her pursuit of raising awareness and encouraging others to speak out about violence and violence-reduction methods,” Freveletti said.

To help with her goal, The Allstate Foundation awarded Hector’s nonprofit $10,000 to continue her work – both in Atlanta and in other cities plagued by violence in the U.S.

“Her accomplishment as a teenager is a prime example of what can happen when youth are empowered to lead, are given tools and resources, and use their influence to make a positive difference in their communities,” said Freveletti. The goal of The Allstate Foundation’s Good Starts Young program is to inspire the next generation of leaders and develop their social and emotional learning skills, which are things like resilience and grit, self-awareness and self-management, and teamwork and conflict resolution.

Research shows that for a young person to succeed in life, social and emotional learning skills are as – if not even more important – than academic achievement. With these skills, youth are empowered to succeed and become our future leaders.

Freveletti says one of the reasons for the program’s ongoing success is its ability to network with organizations with similar goals. Organizations like WE Charity, which helps to empower youth through rallies, educational forums, and volunteerism have been instrumental in equipping kids with the learning tools that researchers have found are critical to their success.

“We underwrite rallies and educational forums to provide inspiration and instruction with a dose of fun for young people,” said Freveletti. The Allstate Foundation has found that storytelling can be a powerful vehicle for lifting spirits and building courage.

“We tell stories about youth who are challenging inequity and solving issues in their schools and communities across the country; stories about students who have stepped up to take part in rebuilding their community, and are addressing bullying, homelessness, and food scarcity. We try to amplify these stories to show the good work youth are doing in the world and inspire other young people to do that work as well,” said Freveletti.

In doing so, The Allstate Foundation and its partners are building a platform for service-learning and social and emotional learning skills. Programs like WE Volunteer Now teach kids the value of being part of, and making a positive impact on, their community while equipping them with skills to be successful in life.

The Allstate Foundation also partners with the Collaborative Academic Social Emotional Learning (CASEL), which is a resource for school districts, principals and administrators throughout the country to ensure that social and emotional learning is factored into curriculum guidelines, classroom activities and school culture.

“Research and best practice shows that the combination of volunteer service and development of social and emotional learning skills enhances the likelihood for youth to succeed in the future,” Freveletti said.

For high school graduation and entrance to college, many students need real volunteering experience. Volunteering allows young people to meet new people, experience new cultures, find new friends, make connections and build references, which is so important. We know that volunteering lets them gain new skills and build confidence. It allows them to stretch their current perspectives in new environments.”

Later this fall, The Allstate Foundation embarks on another phase of its work, said Freveletti, with a national campaign to highlight the importance of social and emotional learning for youth. They will be launching the campaign at the National Mall in Washington, D.C. “Our goal is to get families talking about the importance of these skills in helping youth realize their goals in life.”

Dovetailing with that effort will be CASEL’s first international conference on social and emotional learning in 2019, which The Allstate Foundation is helping to launch. “We are really excited about being the engine that allows this valuable information sharing and collaboration to take place and to get families and schools to start taking action to ensure youth build these life-enhancing skills,” said Freveletti.

“We set a goal to engage 25 percent of young people (ages 10-18) in The Allstate Foundation Good Starts Young-supported programs that develop social and emotional learning skills in the U.S.in the next few years,” she said. “We’d like to see schools and communities across the U.S. increase access to social and emotional learning resources before, during and after school.”

The Allstate Foundation hopes to meet that goal by 2021, eight short years since it launched the initiative.

Image of Mary-Pat Hector courtesy of The Allstate Foundation.

The Business and Societal Case for Privacy

This article series is sponsored by Symantec and produced by the TriplePundit editorial team.

American companies experienced nearly 500 data breaches in 2016 alone, and governments around the world are beginning to require more from private firms when it comes to protecting user data.

Most notably, the European Union’s General Data Protection Regulation (GDPR) became enforceable in May of this year. The new regulation requires companies to, among other things, receive consent from users in order to store their personal data—and it applies to all companies that serve European citizens, whether the company is based in Europe or not.

While compliance with a new regulation often seems burdensome to global firms, data shows that the type of privacy policies required under the GDPR echo a rising clarion call from consumers, who studies show are increasingly concerned about misuse of their data.

The nonprofit think tank Centre for International Governance Innovation (CIGI), in partnership with the Internet Society and the U.N. Conference on Trade and Development, has surveyed global Internet users about privacy and security since 2014. In its most recent survey of more than 25,000 Internet users from 25 countries, 52 percent of respondents said they’re more concerned about their online privacy than they were a year ago.

For 81 percent of these users, cybercriminals were the primary source of concern regarding online privacy. “Internet companies, such as Facebook, Twitter and Google, are a close second, with over 70 percent saying these businesses are a major source of concern over privacy,” Eric Jardine, a CIGI fellow who has worked on the survey since its inception, told TriplePundit.

A growing number of users are acting on their concerns: 12 percent reported making fewer online purchases in the past year, 10 percent have closed social media accounts, and 7 percent say they’re using the Internet less overall.

“The numbers indicate that despite how pervasive the Internet, social media and e-commerce have become, use of these technologies remains based upon trust,” Jardine told us. “When trust goes, the first and foremost reaction by users is to change how they behave. In the extreme, that means not using a service or using a service more selectively.”

Findings like these should make any company that handles user data stand up and take notice. We asked Jardine, who is also an assistant professor of political science at Virginia Tech and researches cybersecurity topics at CIGI, why companies should care about their customers’ views on data privacy and what they can do to re-establish consumer trust.

Data privacy is a competitive advantage

Research shows that robust and transparent data privacy policies can give companies a leg up on their competitors. When firms engage in consumer data protection and privacy efforts for less than one year, 66 percent report that they are effective in retaining customers, according to Boston College’s 2017 State of Corporate Citizenship Report. More than 80 percent say the same if they invest in data privacy efforts for more than four years.

A 2018 study from the U.K.-based Global Alliance of Data-Driven Marketing Associations (DMA) further underscores these findings. Nearly 90 percent of the global consumers DMA surveyed cited transparency as the key to trusting organizations. “Improving transparency and control for people will help companies be in a much stronger position to engage them within the data economy,” Chris Combemale, CEO of the DMA’s U.K. group, wrote in the report.

Helping people understand why and how their data is being used is even more important for Internet giants, e-commerce companies and other firms that do business online, Jardine told 3p.

“Building a brand that is privacy conscious would certainly help Internet companies keep and attract customers, especially since many of the large Internet platforms are U.S.-based but need to tap into global markets to ensure growth over time,” he explained. “If these companies cannot ensure that they will do their utmost to protect user data, global consumers will worry about the possibility of government surveillance or cybercriminals and choose to use an alternative service.”

Privacy demonstrates your values

Beyond the fear that customers may go elsewhere—and other risk-aversion considerations like regulatory compliance—safeguarding user privacy gives your company an opportunity to demonstrate that you care about your customers. “In the digital age, personal data is intrinsically linked to people’s private life and other human rights,” the nonprofit NGO Human Rights Watch concluded in a recent blog post. “Everything a person does leaves digital traces that can reveal intimate details of their thoughts, beliefs, movements, associates and activities.”

As companies collect more and more information about their customers—from identities and buying preferences to characteristics like race, sexual orientation and political affiliation—it grows harder for these firms to refer to themselves with words like “conscious” or “responsible” if they’re not doing all they can to prevent this deeply personal data from being misused. This social connection is core to any company looking to leverage business as a force for good, and it’s also a clear avenue through which to repair eroding consumer trust and put values front and center.

Such conclusions don’t appear to be lost on top global firms. Earlier this year, IBM surveyed 1,500 business leaders whose companies were deemed early adopters of the GDPR to better understand their motivations. A whopping 84 percent believe that proof of GDPR compliance will be seen as a positive differentiator to the public, and 76 percent said it will enable more trusted relationships with customers and business partners.

Trust is a two-way street

While regulations like the GDPR put the onus on the private sector to keep user data secure, Jardine told us that both companies and consumers will need to shift their mindsets in order to re-establish trust in an increasingly Internet-driven age.

“Users need to adjust their mental frames,” he explained. “Data stored online is not secure and always runs the risk of being compromised. It would be nice if it wasn't so, but perfect security is impossible to obtain while still having anything even remotely resembling a functioning, useful system.”

While consumers are concerned about data privacy, research shows they’re still willing to share their data with companies in exchange for enhanced services. DMA’s study found that roughly half of global Internet users are “data pragmatists” who decide whether to share their personal information with an organization on a case-by-case basis, dependent on the benefits.

Still, trust plays a key role: 51 percent of consumers surveyed by DMA put trust in their top three factors that make them happy to share personal information with a company—and companies will need a multilevel approach to build that trust, Jardine said.

“Companies can help retain user trust by, first, providing as much security and possible and, second, making the aftermath of a malicious cybersecurity event less acute,” he told us. “Financial service companies do this already. If your Visa card is stolen, which may invariably happen, the company does an investigation and then covers the losses and issues a new card. Users trust that Visa works to prevent card theft, but they also know the company will help to minimize the adverse effects of a malicious event.”

Of course, not all companies are in the position to take such direct action. But taking steps to prevent data misuse—and clearly communicating how the company will respond to a breach if one occurs—remains paramount, Jardine said. “This sort of thing is harder for content intermediaries, as you cannot simply change out your personal photos or identity with the same ease as a credit card number,” he explained. “Nevertheless, keeping this dual focus on prevention and remediation is the best approach to building a trust-infused product.”

The bottom line

In response to findings like these, nearly 60 percent of companies surveyed by IBM said they’re embracing the GDPR as a business opportunity rather than an impediment. Over the next few months, in partnership with Symantec, TriplePundit will dive into how leading companies plan to do this.

We’ll explore the different ways that companies interact with vulnerable personal data—from user experience to supply chain management—and what they can do to better ensure privacy and security. We’ll discuss how the growing push for greater transparency impacts different teams across your business and talk through how companies can continue to innovate while maintaining privacy. You can keep track of the series here.

Image credit: Robin Worrall via Unsplash

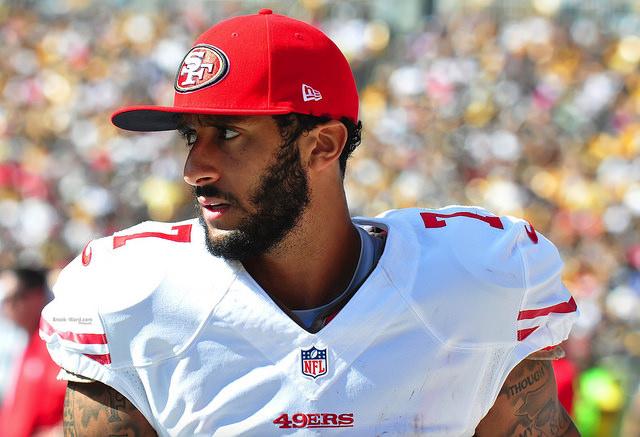

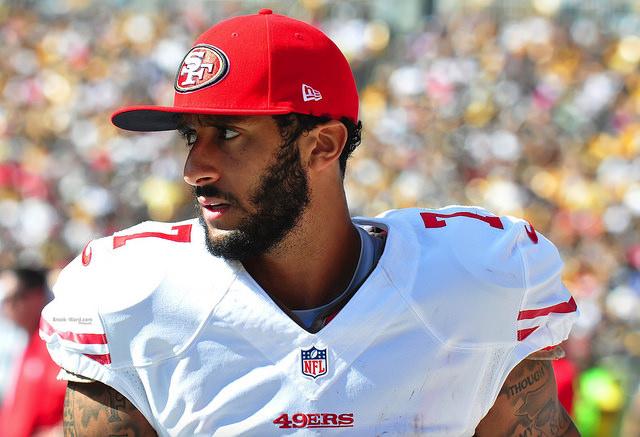

Taking a Stand In Controversy: Should Nike Just Do It?

The Colin Kaepernick campaign, which we first discussed yesterday, is high stakes for Nike because it is much, much bigger than the brand. Bigger than sport. The brand is engaging with a hugely complex issue. It is an issue that touches on American history as well as American values. It is not about institutional racism, freedom of speech, civil liberties. It is about all of that and more. So this is dangerous, but also, important territory. The campaign has polarised consumers, because the original issue polarised consumers. Many Americans feel that Kaepernick’s stand was unpatriotic, disrespectful and was anti-American rather than anti-racist.

There is also enormous risk in Nike taking on this issue and being found to be hypocritical. If people accused Nike of racism, sexism or showed the business to be unethical in the way it treats people, this could result in long-term damage to a company's reputation. Nike is a huge sprawling mass of individuals. It has enormous supply chains and operations that stretch the length and breadth of the planet. Across this business it is possible, actually it is highly probable, that there are individuals who do not behave in a way that is represented through the Nike brand. This again plays to the difference between a business taking up a cause and an individual doing the same.

There is also risk in overexposure - so far the campaign is estimated to have generated at least $43m worth of media coverage and the internet is awash with conversation about the ‘controversy’. The campaign has now generated so much noise that it is being hacked by people who see this as a platform to have some fun or are taking their own stand.

If the message becomes appropriated by a much larger audience, there is a risk that this could undermine, not just the intent of the Kaepernick campaign, but also that of the Just Do It celebration. We know the days where ‘no publicity is bad publicity’ are gone and the investment in a big idea, targeted at specific audiences can easily come undone. And brands are fair game when it comes to attempts to connect through challenging or innovative communications campaigns. We’ve seen the fall out from Gary Lineker Walkers crisps meme and of course Boaty McBoatface. If you search Nike ‘just do it’ today, you will see that the campaign has gained notoriety, acclaim, but also hundreds of thousands of new interpretations.

Just Do It…but do it strategically

Nike’s corporate activism risks alienating some audiences in the US who disagree with the message, but it will also have been a calculated risk. Nike has a track record of backing new talent, outsiders, and individuals who have polarized opinion. Nike will have done its homework on any potential damage that this campaign could cause.Ultimately, Nike has made a strategic decision about what matters to their core and future audience. As with any celebrity endorsement, it has aligned with an ambassador that represents its brand idea but critically connects that idea to its core target audience. Nike has made a decision about the relative value of the audiences that will take umbrage with the campaign, and those who will feel it connects with them. As well as adopting a position that highlights an important issue, it has made a bet on an audience.

Nike may well have taken into consideration the likelihood that the audience that disagrees with its message will be less likely to publicize their dissent. Those disagreeing may also be more likely to forgive and forget – and perhaps have changed their opinion as a result of the campaign.

Aside from audience split, they have certainly done their research. Last year Kaepernick’s football shirts were at number 39 in the NFLPA’s official NFL merchandise Top 50 list - and for a while in 2016, his jersey was the top seller. As well, the timing of the campaign suggests that this was a considered move from the brand, with the NFL’s new season about to begin and the long US Labour Day weekend on the horizon.

Overall the Nike campaign is a great move. It lights a fire under the brand, as well as the issue. It shows that brands can and should get involved in issues beyond their core business. It demonstrates the opportunity for brands to grow by doing good.

Image credit: Brook Ward/Flickr

Where Are the ‘Green Jobs’ in 2018? You May Be Surprised

In 2018 job seekers and employers continued to pursue “green jobs” in sectors like renewables and conservation. While growth occurred in many states, recent trends saw Texas leading the way in sectors like wind power, currently supporting over 24,000 such jobs backed with over $42 billion in capital. These jobs are just a small part of more than 10 million clean energy jobs worldwide in 2018.

Although the clean energy sector continues to be one of the highest growth industries in the U.S., many people are still unaware of the variety of opportunities available to them. Part of the reason is that while renewable energy is the most visible and substantial sector, opportunity is also divided along geographical lines, making it a difficult field to enter for people living in certain areas.

But renewable energy is only one portion of the professional ranks fighting for environmental causes. There are dozens of different career paths that job seekers should be aware of that contribute to the fight against climate change. To show students, jobseekers, and companies what opportunities are available, we published a recap listing the best climate change jobs. The list breaks down careers by four categories: field jobs, office jobs, high paying jobs, and entry-level jobs.

Using data from the Bureau of Labor Statistics’ Occupational Outlook Handbook (OOH), this resource includes the median pay, degree requirement, and projected growth of 18 different professions that the BLS predicts will experience steady growth over the next decade.

If you are interested in working in a job related to sustainability, the following fields could be of interest to you.

Entry-Level Jobs

You do not need a doctorate to have a meaningful impact in the fight against climate change. While scientists and engineers are among the most visible green jobs, there are many important careers that only require an associate's degree.For example, environmental engineering technicians make a median pay of $50,230 and have a projected growth rate of 13 percent over the next 10 years. They assist environmental engineers by collecting air and water samples to assess pollution. On the front lines in the fight against environmental contamination, environmental engineering technicians work both indoors and out in the field.

Social and community service organizers also play a critical role in the fight against climate change. The position usually requires an associates degree and has a projected growth rate of 18 percent. Organizers galvanize public support and educate their community about pressing local and global environmental issues.

High Paying Jobs

Green jobs are not only important for the future of the world, they can also be lucrative career choices. Educating the public and job seekers on career paths that anticipate a continued growing demand and pay high medium salary can convince more talented people to enter into such jobs to prevent climate change.Environmental engineers take home a median pay of $86,800 in a field that has an expected growth rate of 8 percent. Most environmental engineers hold a master’s degree and are skilled at preparing environmental investigation reports, designing projects that help protect the environment, and inspect industrial facilities to make sure they are up to code.

Office Jobs

Of course, there are jobs that function in a more traditional office environment, with regular hours and other regular functions for those who prefer to stay inside. Again, communicating the diversity of positions and structures of green jobs will convince more of the public to enter this growing sector.Sustainability specialists, who typically have a bachelor’s degree, make a median salary of $55,000 and can expect a 9% growth in job opportunities over the next ten years. Sustainability specialists tend to work in the private industry, helping businesses make cost-effective decisions that also promote environmentally friendly policies.

Image credit: Mario Caruso/Unsplash

Principles and Politics Collide Over Tariffs

The collision of principle and policy in current affairs has just ratcheted up several notches in intensity. The reason? The latest round of tariffs on Chinese goods imported into the U.S. that takes direct aim at profits at a number of the largest multinationals. After losing the lobbying battle to stave off this latest round, these companies are going public with their protests, hoping to encourage a rollback by taking a collective stand against a policy that hits their bottom line.

The issue in play revolves around the best way to deal with the numerous trade frictions with China. While supportive of addressing those complaints—such as the uncompensated use of proprietary intellectual property, and the requirements for U.S. businesses to have a Chinese partner whether wanted or not—American corporations are opposed to tariffs that force them to choose between cutting their profit margins or hiking prices to consumers.

First among the brands taking a stand at this intersection is Walmart. In a letter sent prior to the imposition of the latest tariffs imposed on $200 billion worth of Chinese goods, and then released publicly after their announcement, the company warned of adverse consequences: "Either consumers will pay more, suppliers will receive less, retail margins will be lower, or consumers will buy fewer products or forego purchases altogether.”

Other retailers echoing a similar position include Apple, Target, Fitbit, Hewlett Packard Enterprise, Home Depot, Dell Technologies, Intel, Newell Brands, Mattel, Whirlpool, and Carrier.

Target CEO Brian Cornell said "As a guest-focused retailer, we're concerned about tariffs because they would increase prices on everyday products for American families. In addition, a prolonged deterioration [in] global trade relationships could damage economic growth and vitality in the United States."

"Given these risks, we have been expressing our concerns to our leaders in Washington, both on our own and along with other retailers and trade association partners,” Cornell told The Motley Fool.

Organizations representing thousands of businesses have spoken out against the tariffs. The U.S. Chamber of Commerce, the Business Roundtable, the National Association of Manufacturers, the National Retail Federation, and the Koch Network are among the numerous top business groups that have stepped up their efforts to push back against the tariff policy. And new associations have been formed to double down on the stance, including Americans for Free Trade, which itself has been joined by other large trade associations such as the Consumer Technology Association, American Petroleum Institute, American Apparel and Footwear Association, Association of Equipment Manufacturers, Toy Association, and National Fisheries Institute.

Their complaints are addressed to the Trump administration, since the president is using a section of trade law that permits him to impose tariffs unilaterally by invoking national security. This circumvents the usual process for large policy shifts that would track through Congressional legislation, allowing for more extended, traditional lobbying. “The political calculus may lead the administration to think this is a winning hand,’’ Dean Garfield, chief executive of the Information Technology Industry Council, whose members include Apple, Alphabet/Google, and Microsoft, told Bloomberg. “But if we can change the realities on the ground, then the administration may recalibrate.’’ In a related development, nearly 150 companies have formed a coalition to encourage voter turnout. Among the members of Time to Vote are Levi Strauss, Southwest Airlines, the Gap, Kaiser Permanente, Lyft, Patagonia, and Walmart. While insisting that the effort is nonpartisan, it’s hard to avoid defining it as a political act in the broadest sense. “Getting out the vote should be a nonpartisan issue,” Aaron Chatterji, a professor at Duke University’s Fuqua School of Business, told the New York Times. “But in this day and age, it will inevitably be seen as political. So many of those companies have publicly tangled with the president on race issues, immigration and climate change.” Michael Bloomberg, founder, CEO, and owner of Bloomberg L.P. and former three-term Mayor of New York City, is thoroughly comfortable with the political dimensions of cause-related business. Through his Bloomberg Philanthropies and other grants, he has established a long list of financial support for controversial issues such as reproductive rights, education, public health, and especially, environmental issues—notably climate change. Now, the gun control group he founded, Everytown for Gun Safety, is promising a $5 million digital ad campaign explicitly targeting 15 House races in an overtly political effort to make change in suburban districts. The ads, part of the group’s “Not One More” campaign, feature news footage of the aftermath of mass shootings at schools. Finally, consider the stance taken by Cargill at the Sustainable Development Impact Summit, sponsored by the World Economic Forum during the opening of the UN’s General Assembly. Cargill CEO David MacLennan used the WEF stage “to call out politicians who disrupt the flow of food to consumers over border disputes and tariffs. “Trade is under attack… we have to have open borders to do it,” MacLennan told WEF attendees. As the largest private company in the U.S., Cargill, like many private companies, has benefited from a focus on sustainability that allows the food giant to sink 80 percent of its profits back into the company rather than paying shareholder dividends. “I don’t have to go every quarter and talk to the analysts about our earnings. We can take a longer view,” MacLennan told Triple Pundit. These latest exhibits of conflict between the private sector taking stands on the issues against current policies are a considerable addition to the growing body of evidence about an ongoing movement that is still gathering momentum. Image: Levi Strauss & Co. Be sure to subscribe to the Brands Taking Stands newsletter!

Diversity Improves on Corporate Boards

Board diversity policies have now been adopted by 98 per cent of FTSE 100 companies and 88 per cent of those in the FTSE 250 group, a government regulator has reported.

The figures represent a “considerable improvement” since 2012 when this requirement was included in the UK Corporate Governance Code, which establishes good conduct principles for London Stock Exchange companies.

The research was carried out by Exeter University business school for the Financial Reporting Council, the government regulator that promotes high-quality corporate governance and reporting in order to encourage investment.

The investigators observed that although most of the UK’s largest companies had adopted boardroom diversity policies aimed at making positions available to employees from both genders and from all ethnic and social backgrounds, their reporting to stakeholders was inadequate.

They regretted that only 15 per cent of FTSE 100 companies complied fully with the code’s diversity principles. Many failed to describe their diversity policy, their board appointments process, their objectives for implementing the policy, and progress on achieving them.

Among FTSE 250 companies the researchers found a minority regarded diversity as having strategic importance, but the vast majority appeared to treat reporting on it as a box-ticking exercise, betraying a lack of commitment.

The report could be a wake-up call for slacker companies. From January a revised version of the code will insist that annual board reports detail how companies have applied their diversity policies and how this influences progress towards corporate objectives.

The revised code encourages directors to ensure that appointment and succession planning promotes diversity more broadly. This means workforce-wide diversity giving employees of all backgrounds opportunities to become senior managers.

Another observation from the report is that many companies may need to formulate clearer policies on senior management diversity.

The advice to the not fully compliant 15 per cent is that they should describe the work of their nomination committees, including the board appointments process, and should explain the board diversity policy, what measurable objectives there are for implementing it, and what progress is being made.

Companies are told too that the appointment of chairmen or non-executive directors should be transparent and that they should state whether search consultancies, if used, have connections with them.

Tracy Vegro, the Financial Reporting Council’s executive director of strategy and resources, said: “There is almost universal acceptance that diversity contributes to more effective decision-making and mitigates the danger of group think.

“Some of the findings of this report are disappointing, and FTSE 350 companies should provide fuller disclosure on all diversity.

“We expected to see more of our largest companies providing information about their approach to boardroom diversity and insights on the actions they are taking to increase diversity at all levels, particularly those in the current UK Corporate Governance Code.

“To maintain a competitive edge and success over the long term, UK companies need to consider how diversity and inclusion are relevant to the markets in which they operate, all their stakeholders and the communities they serve.

“We are writing to companies to challenge them to take a more strategic approach to diversity and inclusion, and to consider their approach to reporting on it.”

Victoria Atkins, the Minister for Women, commented: “It is essential that we maximise the contribution that women make to our economy. If we want our organisations or projects to succeed, we had better include women.

“There are more women in work than ever before, more women-led businesses, more women on FTSE boards, and more female MPs than ever before.

“In 2017 we introduced ground-breaking regulations requiring large companies to publish their gender pay gaps. But only about a quarter of FTSE 350 board positions are occupied by women, with eight all-male boards still existing.

“We must continue to show that in today’s fast-paced competitive market we are driving towards diversity in boardrooms.”