The Life of a Straw – A Harrowing Narrative to Support #TheFutureDoesntSuck

Bacardi, the world’s largest privately held spirits company, has been teaming up with venues and organizations worldwide to ban single-use plastic straws. The initiative, #TheFutureDoesntSuck, was launched in July and aims to remove one billion single-use plastic straws by 2020. The mainstreaming efforts have been catching fire as companies including Cachet Hotels and Resorts have joined the movement.

“Every day we have an army of people walking in to bars and restaurants around the world,” said John Burke, chief marketing officer for Bacardi. “We share this campaign with our partners and people working the front-line, those who want to make their voice and support for eliminating single-use plastics heard.”

Bacardi chose to focus on straws because they are non-recyclable, oftentimes end up in the oceans and become eaten by marine life.

Perhaps the organization also heard of the tragic tale of Polly – the polypropylene plastic straw whose vision for a great life was never realized thanks to her single-use material. Enjoy the narrative below:

“Today’s the day!” I excitedly, and too loudly, shouted to my old best friend, Slurp. The two of us, along with 200,000 of our assembly-line counterparts had been through a lot together; we had been burned, morphed, snipped and packaged together. And now we were being shipped together. Our destination was unknown.

“Today’s our only day, Polly…” Slurp grunted back. Slurp was wise beyond his minutes – he understood what the world was really like out there for us. He knew we’d likely suffer the same fate as our ancestors – we’d be chewed up, tossed to the bottom of a trashcan and eventually find ourselves piled up in a trash gyre in the middle of the ocean. After all, the life of a straw is bleak to say the least.

But things would be different for me. I’m going to bask in an ice-cold McDonald’s Coca-Cola, soak up an elementary student’s 2% chocolate milk or suck out the delicious flavor of a tall, non-fat latte with caramel drizzle at Starbucks (Slurp says Starbucks doesn’t use straws anymore – but don’t all coffee shops need straws?)

A slender, freckly man carefully extended his arm to pick up the box Slurp, 498 strangers and I had been living in for the past 10 minutes. He tossed us on top of four other boxes he was balancing and cautiously tiptoed to the back of a mini tractor-trailer, wobbling back and forth as he certainly exceeded his box-carrying limit. He was relieved to finally reach the foot of the truck and wasted no time unloading us, tossing us high into the air as if our sad, single-use life meant absolutely nothing to him.

I forgave him quickly, though, as his next words would almost surely seal my fate and reverse Slurp’s pessimistic outlook for our future. As if in one fluid motion, the slender man closed the gate to the trailer, banged the side of the truck three times and belted out to the driver “Sheeeee’s reaaaaady – next stop: Jay’s Sports Bar.”

Jay’s Sports Bar? Theeeee Jay Sport’s Bar – is that what he said? It’s the number one college bar in the tri-county area and all of the straws were lining up to plunge into a rail drink there. They even have daily specials and alliterative theme nights – Margarita Monday, Taco Tuesday, Wine-o Wednesdays and Thursday Trivia. Oh, how I hope to be unwrapped on Trivia night – I know all of the state capitals and two-thirds of the Greek Gods. The emcee had better not ask me about Dionysus.

Brrrrrap Brap Brap Brapppppp. The sound and smell of the diesel was unmistakable. The truck driver adjusted his cap, switched his gears and we were off. While the other 499 straws in my box – yes, Slurp included – were bumping wrappers trying to search for their nonexistent personal space, I was content and ecstatic about going Jay’s. The future doesn’t suck.

The drive from the factory to Jay’s, though long, was about as smooth as it gets. We passed countless average, non-Jay’s bars along the way. I felt bad for the straws that ended up in hole-in-the-wall joints like these.

We approached our destination and were immediately offloaded and taken through the bar to the stockroom. The bar smelled horrible, like last night’s wild college night had gone completely ignored. Puddles of beer settled overnight and made the floor audibly sticky. It was everything I had hoped for.

My anticipation was ripe. I had gotten a good night sleep and several of my fellow straws had already made their way from the stockroom to the floor. Happy hour was coming and I knew the restaurant would need upwards of 1,000, no, 2,000 straws to satisfy the thirsty college students who just endured a grueling syllabus week full of awkward icebreakers. My moment was coming.

And sure enough, it did. In a matter of three minutes, I went from anxiously waiting in the stockroom to proudly standing front and center, unwrapped and ready for use, in a black bucket next to the bartender. Each drink order begged the chance of me getting selected. I hope my customer was well mannered and not a “you kiss your mother with that mouth?” smart aleck.

“Two gin and tonics and one plain Coca-Cola please,” a young man no older than 21 said to the bartender. The bartender nodded her head and proceeded to fill the drinks. She reached down for three straws and pinched the top of my head – I was one of them! My body was numb with excitement and nervousness. I didn’t want to be in a gin and tonic – that sounded scary. What in the world is tonic?

As destiny would have it, I was plopped into the gin and tonic. I was giddy when I realized I hadn’t immediately blown up when entering the tonic. The young man who ordered the drinks left a sizable tip and reached down to test the potentness of one of the beverages. He opted for the other gin and tonic and seemed pleased with his first few gulps.

Instead of asking one of his friends whom he had ordered for to help transport the drinks from the bar to the cocktail table they had been sitting at, the young man decided to be a hero and take all three cups to the table himself. His hands proving too small and the drinks proving too slippery, the young man dramatically spilled all three drinks almost immediately upon lifting them off of the bar.

I lay sprawled out on the bar, defeated. The bartender shrugged it off and quickly refilled the young hero’s drinks. My hopes and dreams were quickly dashed when the bartender reached into the same tub I used to reside to grab three fresh straws. I was a single-use straw and wasn’t even used once.

I thought my life was over – but it had really just begun.

The bartender nonchalantly picked me and the other two straws up and threw us into a wet, smelly trash bag. The bag became more and more crowded as the party music grew quieter and quieter as the trash piled on. Soon, a bearded man stood over us and tied the bag, fully erasing any of the light that once seeped into the can.

The same bearded man took us on a somewhat fun and somewhat nauseating ride, swinging us around in our bags until we reached an even smellier and more disgusting destination: the dumpster.

Our time in the dumpster seemed endless. Was it two hours? Two weeks? Two years? I really couldn’t tell you. But me and the countless other straws, plastics and food scraps were enthralled to hear the loud beeping of a truck hitting reverse. Our messiah came in the form of a garbage truck, which swiftly lifted the dumpster and thrust the 20 or so black garbage bags on top of 100 or so other reeking garbage bags.

The situation certainly wasn’t better than the dumpster but I held out hope that our misery was temporary and the messiah would soon deliver us to the land of milk and honey. Instead, it delivered us to a different land: the landfill. I was officially just a statistic now; one of 500 million straws discarded by Americans each year; another feather added to the 254 million tons of garbage that annually makes its way to one of the 2,000 landfills in the United States.

I missed the factory. I missed Slurp. I wonder what happened to Slurp – maybe he ended up in the ocean. I hated Slurp. He knew we’d lead miserable lives. But there was one thing he didn’t know – he thought the day we were created, packaged and shipped would be our only day. We’d be chewed up, thrown out and poof, gone. If only. He didn’t realize we’d live in a pit with other non-compostable trash or float in the ocean and end up in the stomachs of turtles or seagulls. He thought we’d live for one day. He was off by a couple thousand years. You see the truth is, we’ll never fully die.

Image credit: Lonely Whale

Resilient Golden Arches – Structurally and Sustainably

Those golden arches of McDonald’s, among the most recognized logos in the word, are actually a catenary arch, a super strong architectural feature that has helped ensure resilience buildings for centuries. So, does the ubiquitous yellow pair that graces roughly 37,000 McDonald’s worldwide represent a company resilient to current and future changes?

At last week’s Global Climate Action Summit, I sat down with Keith Kenny, McDonald’s Global Vice President of Sustainability to learn about the company’s resilience story. He asserted that climate resilience is both an environmental and economic imperative for the company.

“Farmer livelihoods and related thriving rural communities are important to us because our restaurants are in those communities,” he explained. “That gets forgotten when we speak about sustainable agriculture. Farmers need to be able to reinvest in their business. Just as we invest in them.”

That belief proved to be McDonald’s inspiration for its Flagship Farmers Program, which connects farmers interested in continuous improvement and sustainable practices. Its platform notes that climate change is affecting agriculture, causing droughts, floods, more storms and heat waves. The program encourages farmers “to adapt and develop our farming systems to be more resilient to these changing environmental conditions.”

Publicly recognizing these hazards caused by changes in climate – and predicted to grow over time – offers a good start on the path to making climate resilience a key feature of the business.

Keith pointed out that McDonald’s invests in supply chain projects with a 20-30 year payback, which makes them both climate change sensitive and focused on resilience to ensure year-over-year payback. Unlike other retailers with tens of thousands of items on their shelves, “15-to-20 items represent 70 percent of what we sell,” he said. “We have long-term relationships with our suppliers. Most of them have grown their business as we have grown ours.”

This is key, for instance, for beef consistency – patty to patty – throughout the world and also for long oblong potato varietals conducive to harvest times, storage and its fries.

This is a significant improvement from McDonald’s supply chain response of about five years ago. Then, under different leadership, its response to a question of what McDonald’s was doing to adapt its supply chain to climate change was to exclaim, “We’ll just tell Canada to get ready to grow canola if it gets to hot and dry to grow it in the lower 48.”

Its fresh approach may bring McDonald’s more into the climate-resilient supply chain vanguard with such companies as Mars Inc. and Coca Cola that have collaborated with the nonprofit Business for Social Responsibility to launch a Climate-Resilient Value Chains Leaders Platform announced at last week’s Summit.

Though McDonald’s has yet to officially join that initiative, it is among a group of food companies including Keurig Green Mountain, Heinz and Chipotle making initial strides on climate resilience. And, like other big companies, climate action to reduce greenhouse gasses is becoming more of a priority. Last year, McDonald’s announced it was partnering with franchisees and suppliers to reduce greenhouse gas emissions related to its restaurants and offices by 36 percent by 2030 from a 2015 base year in a new strategy to address climate change. It also committed to a 31 percent decrease in emissions intensity per metric ton of food and packaging across its supply chain by 2030 from 2015 levels, and the combined target has been approved by the Science Based Targets initiative.

Keith said innovation is key to McDonald’s resilience and sees soil health as a “huge opportunity” that the company is exploring with such partners as the World Wildlife Fund and the University of Arizona. In addition, he enumerated the many collateral benefits of pursuing adaptive multi-habitat grazing – moving cow herds from paddock to paddock – that allows soil to regenerate by giving native plants a chance to establish deeper roots. This enhances carbon sequestration and water retention and filtration while increasing productivity with more animals grazed on the same land.

Keith also offered another example of how its thinking about climate change and resilience has changed, and it reflects that McDonald’s is a surf-and-turf restaurant. Cod fished from the North Atlantic were a key element of McDonald’s filet-o-fish sandwich until environmental organization Greenpeace brought McDonald’s and others to task for fishing in a warming ocean where melting ice flows are exposing previously frozen areas. Keith was invited by Greenpeace to journey on its Arctic Sunrise ship to see firsthand “what the fish are up to” in a climate-changed world.

In May 2016, McDonald’s and more than a dozen other seafood industry giants joined forces to protect a large area of the Arctic from increased fishing. The voluntary agreement commits the companies from expanding cod fishing into a previously ice-covered portion of the Northern Barents Sea in the Arctic.

Image credit: McDonald's

Is Campbell Finished With Health-Focused Foods?

After years of building its product portfolio through mergers and acquisitions, Campbell Soup Co. is looking to return to its roots. In a surprise announcement at the end of last month, executives laid out plans to sell off the company’s international and fresh food businesses—including recently acquired brands like Bolthouse Farms and Garden Fresh Gourmet

The decision came after a months-long operational review the company began in May in the wake of slumping sales, falling stock prices and a reportedly rocky integration of pretzel-maker Snyder's Lance—which Campbell acquired for $6.1 billion last year, CNN Money reported.

After shedding fresh food labels, as well as international brands like Australian biscuits company Arnott’s, Campbell will refocus efforts on its North American snack, meal and beverage categories—which include Pepperidge Farm cookies, Prego sauces and, of course, Campbell’s condensed soups. “Our plan will build upon our existing strengths,” interim President and CEO Keith McLoughlin said in a statement.

McLoughlin stepped in after the sudden and unexpected retirement of former CEO Denise Morrison, who held the top spot at Campbell for seven years. Her departure left an even smaller group of women at the helm of America’s largest companies—only 25 women serve as CEOs of Fortune 500 firms, a number that will decline again this year as longtime CEO Indra Nooyi leaves PepsiCo.

When she reflected on her career in an interview with the New York Times, Morrison said she “wanted to break the glass ceiling” for future women executives. “It wasn’t only about me,” she told the paper. “It was about the next generation of women coming behind me.”

During her tenure, Morrison oversaw a vast expansion into fresh, organic and health-focused foods in response to what she called a “seismic shift” in eating habits. But, as Philadelphia Magazine’s Fabiola Cineas put it, “The fresh-foods business plan backfired.”

Sales numbers indicate Campbell may have been ill prepared to enter the crowded category. Its fresh-food unit posted an operating loss of $7 million this quarter, and McLoughlin said the company overextended itself in its rush to diversify and enter this growing segment.

“We aggressively pursued the important consumer mega trend of health and well-being without having clarity on our source of uniqueness or whether we brought a competitive advantage to the space,” he said in an analyst call last month, as quoted by Philadelphia Magazine—which operates across the Delaware River from Campbell’s headquarters in Camden, New Jersey. “We depended too much on [mergers and acquisitions] to shape our business strategy.”

Even as the company plans to leave fresh foods behind, some health-focused acquisitions first championed by Morrison will remain in the portfolio—and they may be integral to the company’s success.

In particular, Campbell’s soup sales would have dropped 14 percent over the past year if not for Pacific Foods, which Campbell bought for $700 million in July 2017.

The products on offer from Pacific, which also has strong roots in environmental and social sustainability, clearly overlap with Campbell’s legacy business model, as well as its potential future. The Oregon-based company’s signature products are shelf-stable soups and broths, which feature organic and sustainable ingredients and continue to be a hit among millennials and other conscious consumers. The company also gives Campbell penetration in decidedly more modern food segments, such as plant-based milks and meat substitutes.

As Morrison put it after the purchase last year, “The acquisition allows us to expand into faster-growing spaces such as organic and functional food.” Though her broader vision of an ever-expanding Campbell that can nimbly navigate fluctuating demands in both the fresh and packaged foods segments may prove short-lived, the company isn’t leaving the entire plan behind. It identified Pacific as one of 10 brands it hopes to grow in order to boost sales.

Ironically, Pacific was among the least expensive in a string of high-profile acquisitions that reportedly left Campbell mired in debt. Bolthouse Farms, which makes fresh juices, shelf-stable salad dressings and plant-based milks, cost the company $1.55 billion back in 2012. The $6 billion Snyder's Lance purchase last year further complicated Campbell’s balance sheet.

Of course, Campbell is far from the only company to catch flak for over-diversifying in an attempt to keep pace with shifting consumer and market trends. After decades of dividend aristocracy, General Electric halved its quarterly dividend payments to shareholders at the end of last year. Insiders said the breadth of its business played a key role in the cash crunch that fomented the dividend cut, only GE’s second since the Great Depression.

But where Campbell opted to double down on its legacy businesses and leave new acquisitions behind, GE took the opposite approach. The $20 billion worth of brands GE plans to sell come almost entirely from legacy categories—including its century-old railroad business, its former flagship light bulb business, and its well-known dishwasher and appliance business. Instead, GE will “focus on being a modern industrial company that sells things like jet engines, power plants and MRI machines,” Matt Egan of CNNMoney reported last year.

For its part, Campbell is far from out of the woods when it comes to managerial drama. Even as it moves away from fresh foods and toward health-focused options that are perhaps a more seamless fit for its business, the company remains under increasing pressure from activist investor Third Point. The hedge fund recently disclosed a 5.65 percent stake in Campbell and called an outright sale the "only justifiable outcome" of its operational review, CNBC reports.

McLoughlin noted that Campbell’s board “remains open and committed to evaluating all strategic options to enhance value in the future,” leaving the door open for a potential sale. Without one, Third Point and its billionaire founder Dan Loeb may push for a full turnover of Campbell’s board, all of whom come up for re-election this year, Lauren Hirsch of CNBC predicted.

The ongoing shake-up at Campbell is only the latest in a string of signals indicating a food industry in flux, as consumers continue to gravitate toward more healthy and sustainable food choices. US packaged food companies have shuffled chief executives 15 times since the start of 2016, the same number as in the previous seven years, according to an investor note from JPMorgan, as cited by the New York Times.

Image credit: Bolthouse Farms via PRNewswire

How Saipem’s Initiatives on Human Rights and Ethical Supply Chain Create a Healthy, Vibrant Business

Saipem and the United Nations Global Compact Nigeria in a joint effort for the dissemination of a culture of ethics and business integrity

This article series is sponsored by Saipem and went through our normal editorial review process.

For any company that relies on a network of suppliers and subcontractors, maintaining an ethical supply chain -- one that protects human rights and promotes fair labor practices and a safe work environment -- is hard work. But the challenge is multiplied when you work globally in over 60 countries across five continents, like Saipem, the Italian energy services giant.

The company specialises in the engineering, procurement, construction and installation of pipelines and complex projects, and also offers onshore and offshore drilling services.

Saipem works with more than 26,000 first-tier vendors. This huge number represents a significant challenge when setting up a system that ensures alignment between Saipem’s standards and those adopted by its vendors, according to Raffaella Bersani, Saipem’s manager for sustainability stakeholder engagement, corporate value, and human rights.

A further difficulty arises, she said, when dealing with so many companies “with different cultures, ways of operating, and technical and managerial capabilities.” To tackle this challenge, the company has implemented several noteworthy initiatives to engage with its vendors, as well as internally with its own management employees.

To begin with, the company set up a rigorous assessment process for vendors operating in countries considered high-risk for human and labor rights abuses. This process includes examination of documents and third-party information, on-site verifications and a feedback system to assess vendor behaviour and abilities. A comprehensive training program on human and labour rights topics was also set up for Saipem employees that have recurring relations with vendors.

In addition, Saipem regularly conducts seminars and forums in countries like Nigeria, Saudi Arabia, and Indonesia to educate vendors on health and safety practices and how to set up internal risk assessment and management systems to protect their workers.

Another initiative, the HOPE (Human OPerational Environment) Training Programme, was designed to translate the commitment to human rights into practice. It combines theoretical and practical training for management personnel on key human rights risks and issues particular to the oil and gas industry.

HOPE is specifically targeted at Saipem employees in managerial positions at the local leve,l and also involves client representatives, main business partners, and contractors.

What makes HOPE unique is that it is “based on an on-the-ground approach and tailored to the local context,” said Bersani. “It identifies appropriate solutions for human rights issues that can emerge in day-to-day activities with local stakeholders, which are mainly suppliers and local community members.”

A noteworthy initiative recently conducted in Nigeria is the “Leading by Ethics” campaign. It was targeted both at Saipem employees and suppliers, with the aim of improving awareness of ethics and integrity in business. Fifty Nigerian suppliers were involved. (You can view the training video here.)

The success of the HOPE initiative was recognized by the UN Global Compact Network Nigeria when it was presented during a UNGC Workshop on Ethics and Compliance to representatives of companies and NGOs.

Saipem published its first Sustainability Report back in 2006, but the company’s attention to the supply chain started even earlier, said Bersani, with an initial focus on the protection of workers in terms of health and safety. “Later on, the approach became more comprehensive, including all aspects of the human and labour rights concept.”

In 2016, Saipem officially joined the United Nations Global Compact, after a long period of compliance with UNGC principles as part of its former parent company, the Eni group.

The UNGC is a voluntary initiative based on a company’s commitment to implement universal sustainability principles and to take steps to support the Sustainable Development Goals (SDGs). According to Bersani, Saipem specifically focuses on those SDGs that relate directly to its core business and its ability to create value in the areas where it operates.

With regard to an ethical supply chain, the initiatives carried out by Saipem, as described above, focus on contributing to gender equality (SDG5), decent work and economic growth (SDG8), reducing inequalities (SDG10), promoting peace, justice and strong institutions (SDG16), and enhancing partnership to achieve goals (SDG17).

While protecting human rights and supporting sustainability principles is important, maintaining an ethical supply chain is also good for business, acknowledges Bersani. “We believe that an unethical supplier represents a risk for us not only in terms of reputation but also at operational level, since we can be more exposed to risks of accidents, higher personnel turnover (which means losing skills and competencies), and underperformance in terms of managerial and quality standards overall,” she said.

She also recognizes that building and maintaining an ethical supply chain is not a static process, but an ongoing commitment to learning and refinement. “We are aware that it is a long and continuous process that needs to be monitored constantly in order to be kept vibrant.”

Image courtesy of Saipem.

Weathering the Storm: Real Estate Resilience to Climate Change (Finally) Gets Attention

“It blows my mind that this is coming up now: Real estate risk from the physical impacts of climate change.”

That’s how Neil Pegram, Director of Americas with GRESB, a global investor-driven benchmark organization that tracks real estate portfolios’ environmental, social and governance performance, welcomed attendees at GRESB’s affiliate event at last week’s Global Climate Action Summit.

Pegram was noting how slow the real estate industry has been in turning its attention to the impact of climate change on real assets, even though climate resistance has become an investment imperative in a sector where such investments often are held for a decade or longer.

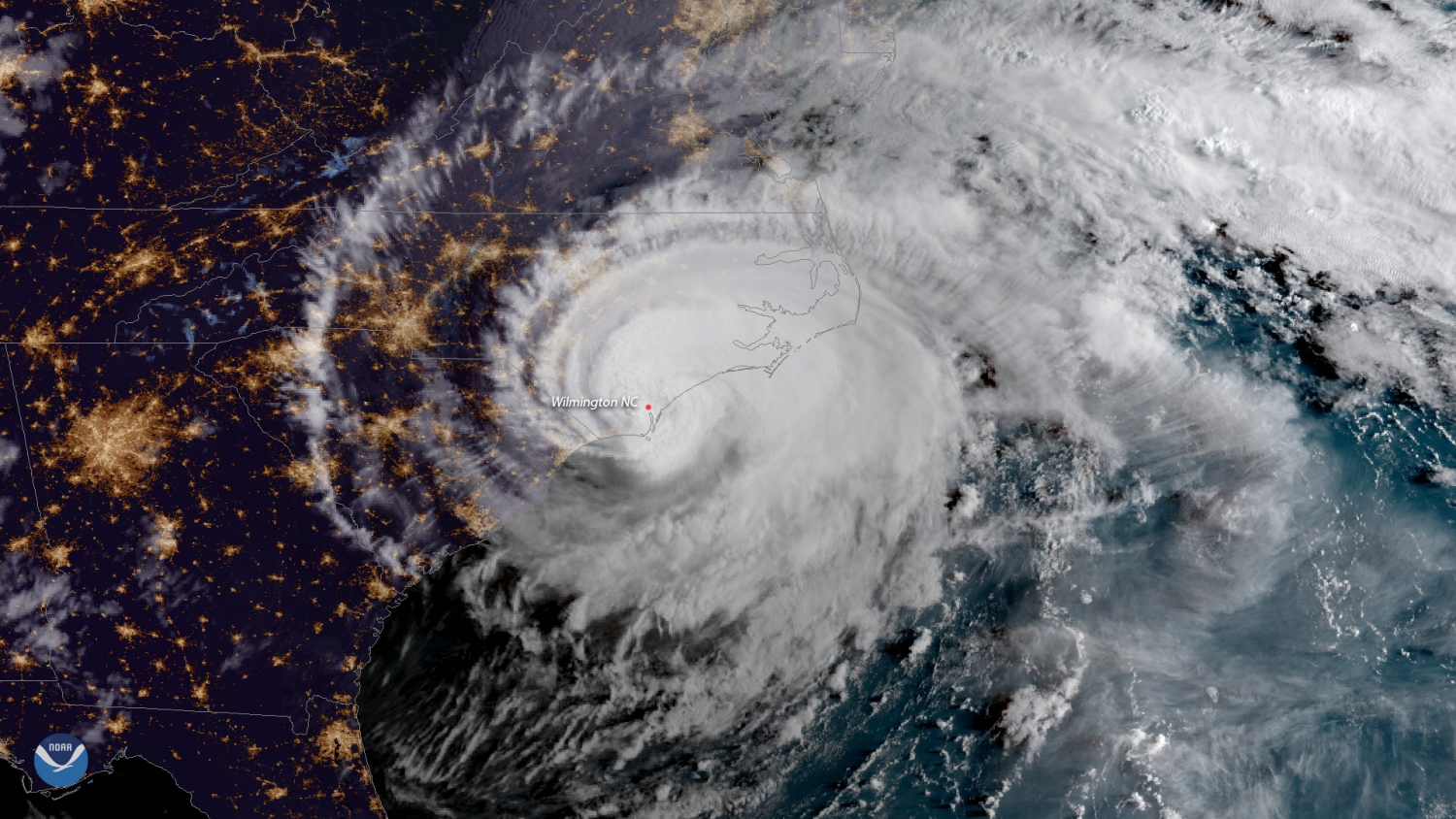

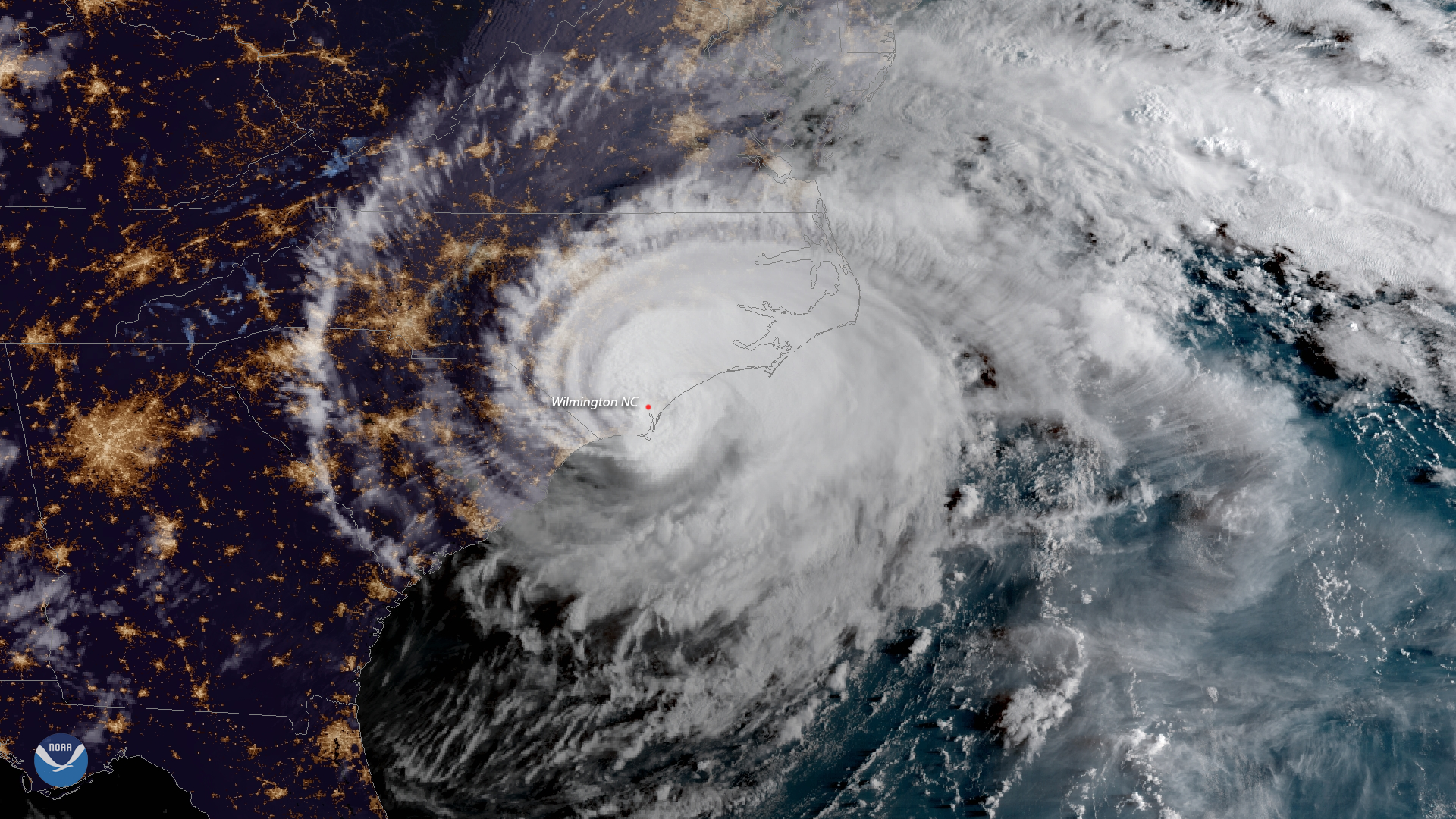

It seemed apropos that the GRESB event was taking place as the East Coast prepared for Hurricane Florence’s anticipated wrath and as the real estate industry absorbs the news that 2017’s natural disasters caused an estimated $220 billion in property and infrastructure damage – two-thirds of the $330 billion in global economic losses, figures Munich RE.

In March, GRESB released a new resilience module, an optional supplement to the GRESB Real Estate and Infrastructure Assessments. It is a significant improvement over the paltry resilience checkbox that GRESB included in prior benchmark frameworks.

GRESB leaders acknowledged it was the Financial Stability Board’s Task Force for Climate-related Financial Disclosure (TCFD) recommendation that information related to governance, risk management, strategy, and performance metrics be disclosed that caused them to fortify the resilience benchmark.

Several real estate investors in attendance described their portfolio’s resilience – and they reinforced the view that an industry awakening has begun. Nina James, General Manager, Corporate Sustainability, for Investa said that resilience generally is considered a “mega trend” and investors place it in the category of a “taking a long-term bet.” Like technology, climate change is viewed as a disruption that influences thinking and begs questions about what effective asset stewardship should look like.

Martin Kholmatov, Senior Responsible Investment Specialist at AIMCo, acknowledged that a new set of stresses and shocks exists. “They make us wonder, how is the business model going to evolve.” He said, adding that he and others think that “a proxy for good management is looking at ESG [Environment, Social and Governance] issues.”

Romilly Madew, representing Australia’s Green Building Council, noted that a growing number of investors ask about resilience. “We tell our members to deal with resilience now and be prepared because investors are going to ask,” she explained.

And Michelle Bachir of Deloitte pointed out that the firm’s advisory clients “are wondering what to put out there to make it decision useful for investors. Our clients want to portray their leadership in the space. This is an exciting time.”

But GRESB’s data don’t completely confirm this positive tone. Only 13 percent of Real Estate Assessment GRESB responders – just over 100 firms – submitted information for the resilience module. The vast majority reported on only 20 percent of the resilience module, a poor showing indeed.

Adam Kirkman, Head of ESG at AMP Capital struck a conservative note by asking, “Where is the right time to pull the lever to future proof an asset based on risks down the track….What is the financial engineering resilience required?” He also pointed out that benchmarking is for the current real estate portfolio, while resilience decision-making needs to be built into new assets, too.

Ari Frankel, Sustainability & High-Performance Buildings, Alexandria Real Estate Equities, Inc. put a fine point on the challenge beyond GRESB. Unlike other reporting frameworks such as GRI that requires quantification of progress and check boxes relating past information, TCFD is “transformative, because you are asking investors to look at forward-looking, qualitative and scenario-based uncertainty.”

Let’s hope these real estate mavens attended the actual Global Climate Action Summit. They would have heard from leaders as varied as James Lee Witt, former FEMA director and current advisor to Fortune 500 companies; Lionel Johnson Jr., mayor of St. Gabriel, La.; former U.S. Vice President Al Gore; Henk Ovink, Special Envoy for International Water Affairs for the Kingdom of the Netherlands; and Johan Rockström, executive director of the Stockholm Resilience Centre. They warned that the real estate sector’s ongoing drive for coastal development was on a collision course with climate risk, imperiling real estate assets and humans.

The UNFCCC’s 3rd Biennial Assessment and Overview of Climate Finance Flows released in April -- a month after GRESB’s resilience module – calculates that real estate assets at risk in 2070 will be $35 trillion (total value). Now that’s mind-blowing.

Image credit: NOAA Environmental Visualization Laboratory

New Startup Aims to Revolutionize Supply Chains Using Blockchain

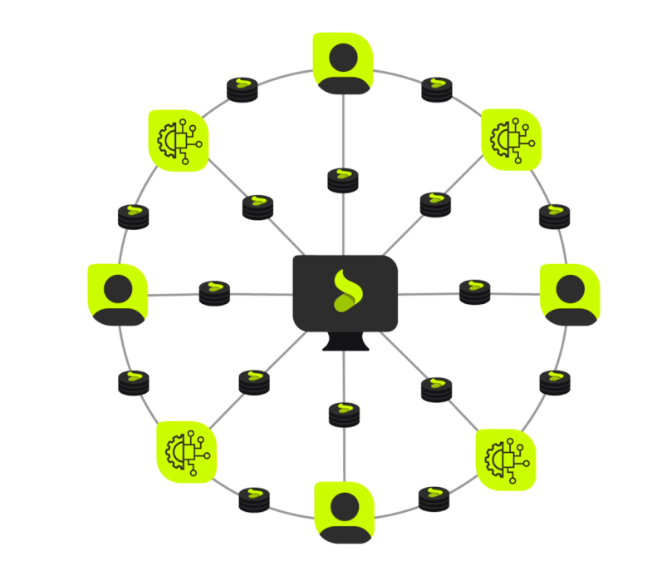

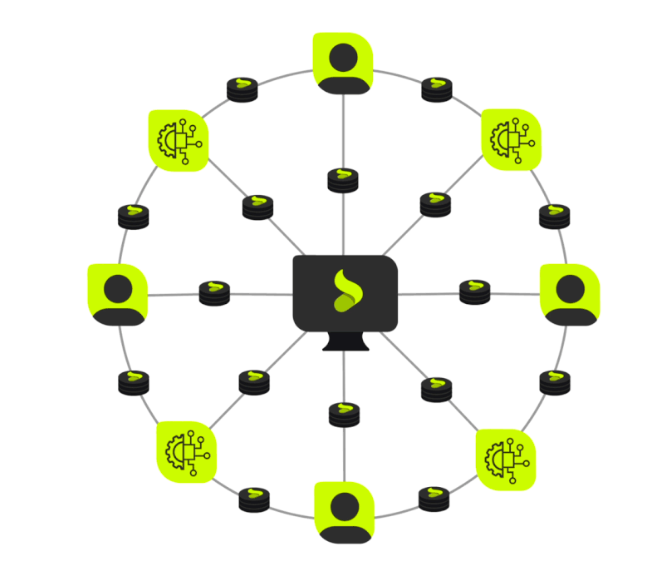

A new startup company, Citizens Reserve, announced earlier this month that it will launch an industry-agnostic supply chain solution using a blockchain-based platform, aimed at tackling the issues of transparency, efficiency, and product visibility that existing legacy supply chain systems struggle to address.

According to the company’s press release, its “SUKU” platform will be a decentralized supply chain as a service platform which will span across industries, enabling trading partners to interact in a way that has been all but impossible up to now.

We spoke with CEO Eric Piscini of Citizens Reserve this week to find out more about it, and while there is much potential for blockchain solutions to revolutionize industry in general, we wanted to discuss what the true value-add of their platform could mean to business partners in this application.

First, a brief primer on blockchain. It was originally developed as the underlying technology to allow online transaction of cryptocurrencies such as Bitcoin. The imperative for transacting cryptocurrencies in the virtual world is to be able to do so without the oversight of a trusted central authority, such as a bank.

To facilitate this process, the concept of the “immutable distributed ledger” was conceived to create what is known as a “trustless” system. In extremely simplistic terms, each time there is a transaction, a ledger is updated with the new transaction, while also bringing forward an encrypted history of all prior transactions in the chain. Since this ledger is distributed across the entire network, instead of needing to trust a central authority - you have a system of full transparency.

If you replace a cryptocurrency with any digital asset, you still have the essence of a blockchain; a decentralized system with no central point of control, which offers all parties on the network full and immediate transparency.

This operating principle is what underpins Citizens Reserve’s SUKU platform. Using underlying blockchain technology ensuring that immutable records of supply chain transactions are decentralized, the platform is then augmented with several layers of functionality.

The “SUKU core” layer offers supply chain as a service features such as visibility of products, access to capital and engagement between stakeholders. And on top of this is what the company calls an ecosystem layer, whereby technology and trading partners can build “apps” and get paid when entities use them - for example, there might be apps for inventory or warehouse management systems.

Similar to “miners” in cryptocurrency blockchain networks - who are entities incentivized by a system of reward to participate in verifying blockchain transactions - SUKU provides an incentive for participation in the supply chain system, too, though on a different basis.

To help generate engagement, the company has created the “SUKU token,” which operates like a virtual currency within the ecosystem. Technology and trading partners will be awarded tokens for building apps and for using SUKU. The tokens themselves can then be used, for example, to pay for transaction fees. In addition, the more tokens an entity gains, the greater access they would have to premium services, as well as having greater voting rights in guiding new iterations for platform improvements, for example.

Piscini says “the token is a demonstration that you have a decentralized business organization” adding that this is a goal of their SUKU system. But as he indicated, many large companies that might claim to be setting up blockchain systems for managing supply chains are in fact more likely just sharing their own centralized database. Piscini stresses in contrast, “Citizens Reserve does not want control of it.”

Still, they have a business to run, and so the company plans to generate revenue by selling tokens as well as by gathering transaction fees from users of the system. And as it is a business-to-business platform, revenue will also be generated from consulting fees. For example, the company expects to provide consulting services to help businesses integrate their general ledgers into the SUKU platform.

Once on the SUKU platform, what advantage might the blockchain powered supply chain solution bring to bear?

In general, there is the potential for increased access to a network of business partners, enabling new opportunities for businesses, while opening up new decentralized marketplaces.

Piscini offered the hypothetical example of a container of soybeans shipped from a certain point of origin. Effectively, at the time of shipping, the end customer of the commodity might not yet be known because the container of soybeans might be traded multiple times in transit before it reaches an eventual final customer.

The SUKU platform would help facilitate these multiple trades, providing both transparency to the availability of the commodity to trade, and keeping accurate and immutable records of each transaction. In this way, while facilitating supply chain visibility, it also potentially opens up an efficient marketplace.

Another opportunity is providing certification for proof of origin for responsibly sourced commodities. Buyers want to ensure that what they have bought is what they will have delivered. SUKU will be able to track responsibly sourced commodities from origin throughout the supply chain; again, especially important if the commodity is traded multiple times in transit.

Still, Piscini recognizes that blockchain cannot be “all things to everything” and concedes “the challenge is how to connect the physical world and the digital world in the right way,” which is where the services of trusted trading partners can be integrated into the system too. For example, if you have bought a consignment of organic produce, you might still need an entity to verify and certify that organic produce is what is loaded into a container, otherwise the blockchain could simply transfer incorrect information. SUKU can integrate such value added real-world services partnerships to augment the digital technology.

But still, even with the challenges, or opportunities, of integrating the physical and virtual worlds, Piscini says blockchain will no doubt help facilitate improvements over current supply chain systems that exist in a fragmented form today. He also believes that creating a decentralized platform is easier to do as a startup than as an established company.

Piscini sees SUKU as one of a progression of decentralized business models powered by blockchain that we’ll increasingly see in the future and expects their supply chain solution to begin operation towards the end of this year or early next year.

Does Your Business Pass the Waffle House Test: Hurricane Florence Edition

With Hurricane Florence all but certain to carve a path of destruction through part of the US southeast, the media -- from CNN to Fortune Magazine and everything in between -- is taking note that Georgia-based Waffle House has activated its Storm Center. That may seem like an odd bit of trivia to focus on, but in fact Waffle House's emergency preparedness strategy has enabled it to bounce back from disasters that could cripple many other businesses.

TriplePundit took a look at the Waffle House disaster management strategy back in 2011 and pulled out some lessons learned, so let's revisit the topic for an update.

The "Hidden" Part of the Waffle House Index

The reason for all the media attention is something called the "Waffle House Index."

That term was coined by former FEMA director W. Craig Fugate in 2011 as an indicator of how badly a storm had an impact on local communities.

The system is simple: green means a Waffle House location is open, which indicates the community is faring well. Yellow means the store is open but with a limited menu, indicating there are some serious issues in the aftermath of the disaster. Red means something unusually serious is going on.

As for how the Waffle House earned this distinction, the company is fiercely dedicated to its 24/7 business model, so closing a location in advance of a storm -- or failing to open it quickly afterwards -- indicates a community in a dire situation.

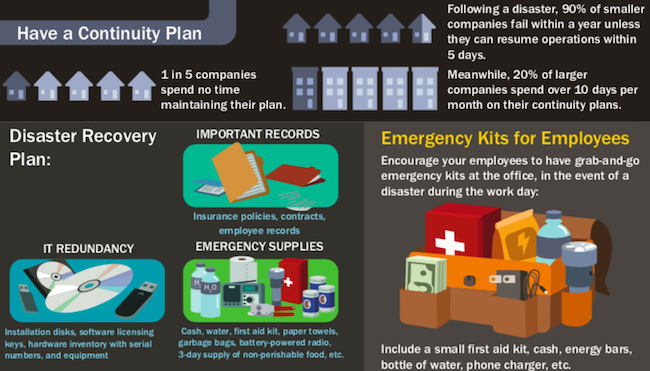

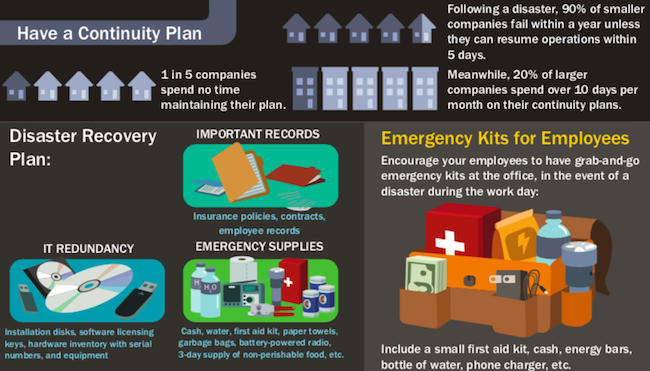

That rapid response takes a sophisticated level of advance planning, and the payoff is clear in terms of bottom line benefits. According to information compiled by the data recovery company Invenio, 33 percent of businesses fail to plan adequately for a disaster, and 90 percent of businesses without a recovery plan will fail after a disaster. Overall, FEMA estimates that up to 60 percent of businesses fail to recover after a disaster.

Efficient planning can also yield more intangible benefits, in terms of a company's reputation in its community.

In particular, restaurants and other retail food stores can have a significant impact on community resilience in the aftermath of a disaster.

Emergency responders need food -- and hot coffee -- on the go, and for various reasons people may be unable to cook at home.

Restaurants and food stores can also pick up the slack when additional emergency responders and volunteers are called in from outside of the community.

The Waffle House Secret

FEMA actually still refers to the Waffle House Index as a model for risk management. In a 2012 article the agency summarized the importance of the Waffle House approach for community resilience:

...the Waffle House test doesn’t just tell us how quickly a business might rebound – it also tells us how the larger community is faring. The sooner restaurants, grocery and corner stores, or banks can re-open, the sooner local economies will start generating revenue again – signaling a stronger recovery for that community. The success of the private sector in preparing for and weathering disasters is essential to a community’s ability to recover in the long run.

Credit for "discovering" the Waffle House secret is due to the emergency management publication EHS Today, which noted two key aspects of the company's emergency strategy.

One is a strong focus on employees -- both those who are able to put in extra hours during emergencies, and those who are needed at home:

...Waffle House has been known to reach out to employees with four-wheel drive vehicles to help ferry supplies, and it brings in employees from outside the disaster area so local employees can take care of their families and property. The lesson here is to make sure you know what your employees can do in an emergency – and make sure they are motivated to do it.[snip]

...Waffle House waitresses have been known to show up for work even when local public safety officials can’t make it, so if your local Waffle House can’t open then you know things are pretty bad out there.

The other factor is a laser-like focus on supply chain management. That includes being prepared to open at less than full capacity:

Waffle House will open with a limited menu when necessary, and that actually forms the basis of the “Waffle House Index.” If a community hit by disaster has a Waffle House open with a full menu, the index is green. Open with a limited menu means yellow, and closure means red, indicating that the community is in serious trouble.

Planning Ahead Is Not A Secret

None of this is actually "secret." FEMA maintains a robust preparedness website specifically for business, ready.gov/business, including toolkits for hurricanes, earthquakes, flooding, widespread power outages and other disasters.

Businesses that plan ahead have more to gain than bottom line benefits. They can also earn priceless good will in their communities as they become a vital part of local emergency response planning.

As the impacts of climate change come into sharper focus, the bottom line benefits of disaster planning are also becoming more clear -- and so are the reputational benefits that resilient businesses can earn.

Aflac Shows Being a Good Corporate Citizen Is More Than a Promise

Many global companies now recognize that true business success is not just measured in dollar terms. It is also weighted by the societal impact a company makes through its business philosophy and actions.

Aflac has published its 2017 CSR Report: More than a Promise, which reflects on the company’s 63-year promise to “be there” when it is needed the most. Among other CSR accomplishments that the report highlights, what stands out is Aflac’s commitment to give back to the community.

Supporting Childhood Cancer Treatment

Aflac has stood by the childhood cancer cause for over two decades. By 2017, the company had donated over $123 million to promote research and treatment of childhood cancer. Every month, as many as 17,000 independent sales associates of Aflac contribute over $500,000 from their commissions to the Aflac Cancer Center. In addition, Aflac has taken on projects such as:My Special Aflac Duck: In 2017, Aflac came up with a way to support kids and families on their childhood cancer journey. The company partnered with a design firm to create “My Special Aflac Duck,” a fine robotic imitation of the company’s mascot.

The company plans to distribute My Special Aflac Duck to all newly diagnosed children between 3 and 13 years in 2018, at no charge to the recipients.

CureFest: For the second year, in 2017, Aflac sponsored CureFest, an event aimed at making childhood cancer a federal funding priority. The purpose of CureFest is to create a platform that will unite the childhood cancer community, researchers, doctors, elected leaders and the general public to press for the cause of prioritizing childhood cancer funding.

Duckprints: Through its Duckprints initiative, Aflac is taking its support of childhood cancer beyond the Aflac Cancer Center in Atlanta. Duckprints is a traveling and digital endeavor to spread awareness. In 2017, four Duckprints events were held in four different states to celebrate cancer-fighting heroes.

Community Engagement

While Aflac's support of families affected by childhood cancer is remarkable, it is also important to point out other examples of community work that the company has taken on in recent years.:

Habitat for Humanity: For over 13 years, Aflac has been running this program as part of its mission to give back to the community. The program allows the Aflac employees to join hands as a team to help others in need. This year, 300 Aflac employees built a home in Phoenix City, Alabama – in just five weeks. As a company, Aflac made a donation of $75,000 to the cause.

Operation Backpack: In 2014, a small community engagement project for one of the Aflac teams was launched. It has now evolved into a major back-to-school drive for homeless students in New York City. The program, called Operation Backpack, provides backpacks stocked with school supplies for less privileged kids. Employees at Aflac Global investments donate these backpacks.

Hoops for Youth: Aflac’s Federal Relations office is premier sponsor of the Hoops for Youth Foundation. Each year, the foundation hosts a coaching clinic, giving at-risk youth in Washington, D.C. an opportunity to practice basketball skills with some of the area’s best high school and college coaches.

March of Dimes: In 2017, Aflac supported the March of Dimes Gourmet Gala. March of Dimes focuses on research, education and community services to improve the health of premature babies. The Gourmet Gala invites celebrity chefs who are also members of Congress. This year’s gala played host to 50 members, had over 750 attendees, and raised $1.2 million.

“Society evolves with time, but what hasn’t changed – and never will – is Aflac’s core values that embody our promise to helping customers in need while serving the community,” said Dan Amos, Chairman and CEO, Aflac, Inc., in his recent letter to shareholders. “We are committed to doing business the right way, which, in large part, is why we continue to lead our industry today.”

Image credit: Aflac

Integrating Renewables in the Grid: A Snapshot of Progress

Renewable energy has achieved a level of integration in the U.S. power grid that would have been unthinkable 10 years ago. Two recent milestones illustrate how this progress came about.

[Get the 2018 Electric Report]

The first occurred on April 28, 2018, when use of renewable energy on California’s power grid reached 73 percent of demand. Many factors had to fall into place to achieve this degree of penetration: it happened in the spring when wind, hydro and solar output were all high; it was in a state with energy policies that strongly encourage renewables; and it lasted only for an hour or so. But it shows what is possible: that renewables can occupy more than a token spot on the power grid and can even play a leading role.

The second milestone happened in Colorado, where Xcel Energy announced that it had received bids from energy developers to supply solar and wind-generated electricity — with battery storage included — at a lower cost than conventional generation. While Colorado’s supportive regulatory environment helped make this a reality, the major takeaway is that in 2018, renewable energy at utility scale can not only be price-competitive with fossil fuels, but it can even cost less.

U.S. Power Grid More Renewable Ready Than Many Thought

Just a few years ago, there were predictions that 30 percent of power from renewables was all the grid could easily handle and that anything more would have significant consequences. However, recent events have shown that it is possible to integrate much higher levels of renewable energy without large negative effects. Part of the reason is that the growth has been incremental, typically a few percentage points a year, allowing grid planners to adjust as needed. It’s also because of the emergence of technologies and techniques that help incorporate fluctuating power from renewables into the grid.

With the right tools and guidance, utilities can manage that variability successfully, even on a massive scale.

Facing Down Today's Regulatory, Economic Barriers

Many technical challenges (such as forecasting) associated with integrating renewable energy into the grid have been addressed. In addition, prices have dropped sharply — a trend that continues. The result is a different set of challenges than a few years ago, when there was more uncertainty over whether these projects could work, along with concerns over their financial toll.

Every state has a unique set of resources, market structures, energy priorities and policies that affect the economics of a project. Project developers must evaluate this landscape of factors and choose a strategy that makes business sense.

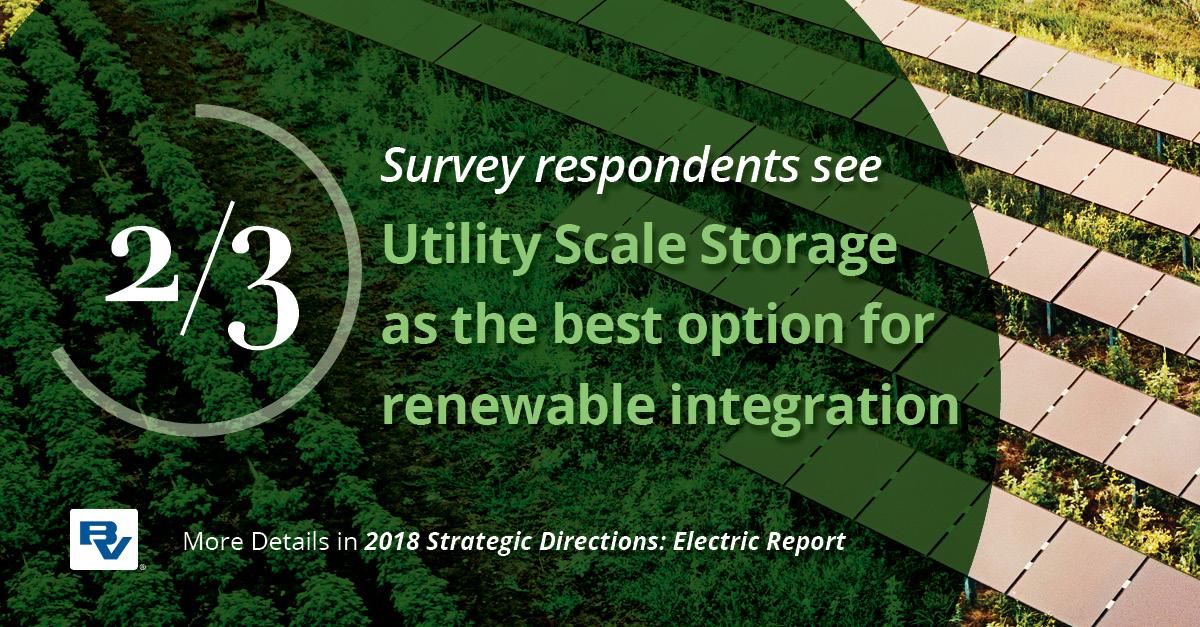

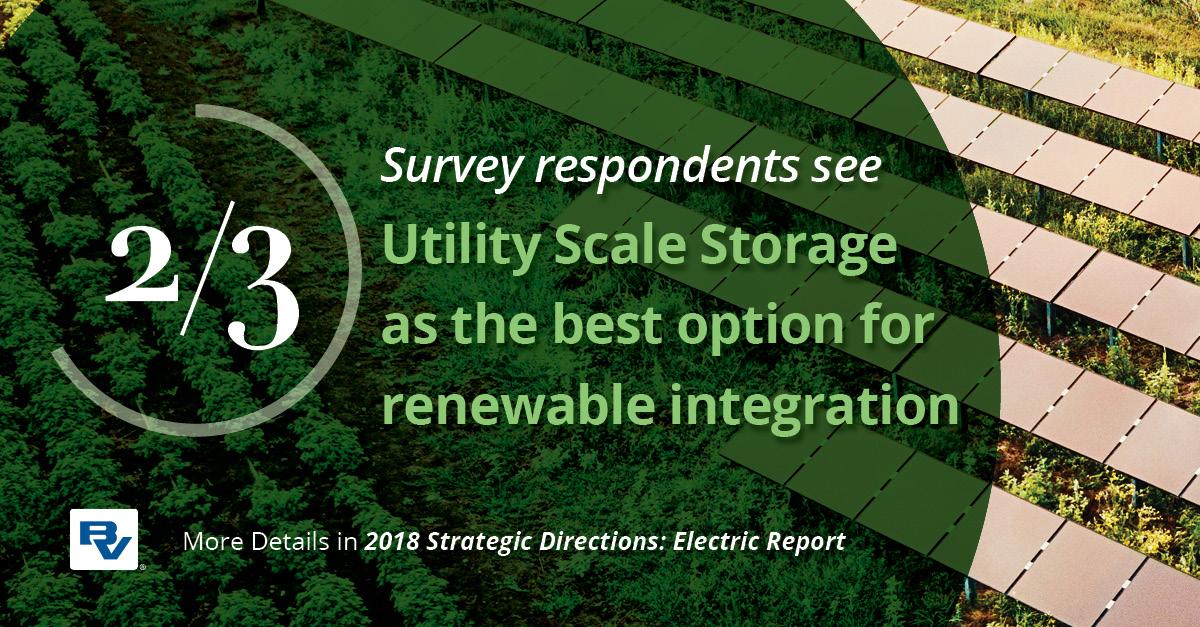

Findings from the 2018 Strategic Directions: Electric Report survey reveal what energy professionals are thinking as they plan and build their renewables projects. When asked to choose the best options for renewable integration, utility-scale energy storage was the preferred choice at 66 percent, with grid improvements a distant second at 41 percent (Figure 1).

The dropping cost of storage technology is good news for utilities because high prices long have been a challenge to integration efforts. Today’s lower costs are enabling much more competitive offerings, as seen in the Colorado example.

It should be noted that there are ways to address intermittency that do not require lots of new equipment, transmission lines or capital. For example, rather than balancing supply and demand hourly, doing it every five minutes or less could be considered. More accurate forecasting of wind and solar output is another option, as is changing the way power producers are penalized or incentivized for over- or under-generation.

While these are admittedly partial measures, changes in rules or polices can help grid operators respond to output fluctuations with minimal investment.

Respondents also were asked what system improvements they recommend. A variety of tools are available to help utilities deal with the variability of renewables, including demand management, storage management, real-time monitoring and rapid cutover solutions to meet a sudden drop in output.

The most popular choice was quick response resources, selected by 56 percent of survey participants, followed closely by load control devices (51 percent) and advanced system control devices (48 percent) (Figure 2).

Utilities typically use a combination of the resources listed. The fact that survey participants are aware of these capabilities is encouraging, suggesting at least basic knowledge of practical details required to make the integration work.

More Progress to Come

Technology is available that allows large-scale renewables to better integrate into the existing grid while accommodating for the inherent variability. Financial viability is determined on a case-by-case basis by weighing regulations, weather patterns and competition and doing what makes economic sense. Considering the previous uncertainty over whether this integration was even possible, this marks major progress.

More dramatic changes are on the horizon. Some utilities have started long-range planning for 100 percent renewables, looking ahead at what changes will be necessary in 10 or 20 years. To get there, they will have to address a new class of challenges for generating, storing, distributing and managing power without falling back on fossil fuels.

Image credit: Black and Veatch

Previously posted on 3BL Media news.

Five Adaptation Finance Tips That Can Help Build Resilience Worldwide

Extreme weather events and long-term climatic changes are having an impact on economies everywhere, and leaders are grappling with action to adapt and build the resilience of communities, ecosystems, and economies alongside action to reduce greenhouse gas emissions and limit global warming.

Hence the rise of adaptation finance, which World Resources Institute has said is necessary as “poor rural areas are frequently the most in need of financial support to strengthen their resilience to climate change, yet they often have the fewest financial resources available.”

To that end, a key question was asked at “Resilience Day” during this week’s Global Climate Action Summit: how do we scale finance for adaptation?”

The question and responses are critically important because, as noted by Barbara Buchner, executive director of the Climate Policy Initiative, finance for climate adaptation in 2017 amounted to just $22 billion vs. $382 billion for climate mitigation.

Here are five answers based on input from several players in the adaptation investment field. These leaders include Sanjay Wagle, managing director of the private socially driven equity investment firm The Lightsmith Group; Dr. Buchner and Kirsten Dunlop, CEO of the European Union’s Climate-KIC; Kathy Baughman-McLeod, senior vice president of Global Environmental & Social Risk, Bank of America; and Mari Yoshitaka, chief consultant for the Clean Energy Finance Division of Mitsubishi UFJ Morgan Stanley Securities. For adaptation finance to work and ensure resilience, the following must occur:

- Get the adaptation-related policies right. Regulatory uncertainties hinder investors. Especially since finance flow is mostly domestic, investors care about predictability. Nonprofits, bilateral agencies and academic institutions can assist sovereigns with regulatory improvements.

- Borrow innovative finance solutions from other sectors, including the vanilla approach of ensuring all government investments are adaptive to climate risk, as well as insurance-linked securities, green bonds and other scalable and replicable means.The International Finance Corporation and other multilateral investment banks can further this work, increasing their emphasis on adaptation from a historic emphasis on mitigation.

- Move toward a globally accepted standard for resilience finance including language on the use of proceeds so the market grows with each investment. Commercial and investment banks should be part of this standard-setting, with engagement from the Financial Stability Board and others.

- Create facilities, starting in markets easy for investors’ participation, where a blend of philanthropy, impact capital, development finance and regular market capital invests in products and where projects can be wrapped and warehoused for their marketability. Focus especially on multiplying the scant grant resources in ways that inspire more adaptation finance, not just one improved project. Philanthropies, development banks and green investment banks are part of this solution.

- Make the existing knowledge about profitable adaptation solutions much more widely known, since investors remain unaware of opportunities in this space. All adaptation thought leaders need to make this a priority, turning risks into investment opportunities.

Image credit: United Nations/Flickr