What Does It Take to Help Women of Color Build Successful Startups?

Kathryn Finney, founder of Digital Undivided (right).

Women of color are America’s fastest growing entrepreneurial population. More than 4.5 million black and Latina women now sit at the helm of their own companies, and women of color have started between 600 and 800 new businesses every day since 2007.

Even as more black and brown women become entrepreneurs, studies show that their companies tend to make less money than women-owned businesses overall—representing a substantial loss that goes beyond a select few founders. For example, if American firms owned by women of color generated the same revenue as those led by white women, they would add 4 million new jobs to the US economy, according to the 2018 State of Women-Owned Businesses Report, commissioned by American Express.

The Atlanta-based social enterprise DigitalUndivided (DID), which helps women of color build technology businesses, was among the first to assess how black and brown women fare in the high-growth space. Back in 2014, while putting together their lauded BIG Incubator program, the DID team went looking for data on the number of black and brown women who launched high-growth tech startups. Instead, they found a black hole. “There was no data,” founder Kathryn Finney told TriplePundit. “It was almost as if no one thought we were in high-growth.”

Uncovering the data on women founders of color

With scant information on the population she hoped to serve, Finney—who worked as an epidemiologist prior to launching DID—gathered a team to create it. Their findings were shocking: Though black women owned more than 1.5 million businesses, they received a mere 0.2 percent of all venture deals from 2012 to 2014.

“One of the most significant things we found was that people weren't asking the question of race and gender because they didn't want anyone to pay attention to the fact that the numbers were so bad,” Finney told us. “In the process of finishing our report, we realized the data was too stark to keep to ourselves. It told a bigger story about the systemic issues within the startup innovation space.”

DID made its findings public in a 2016 research study called Project Diane, which eventually prompted others to begin gathering data on women entrepreneurs of color. “The first Project Diane had a really big impact on the interest,” Finney told us. “We had no idea it was going to be as influential as it's become.”

Still, outside investment in women founders of color remains low: According to the most recent Project Diane data, released earlier this year, black women–led startups raised $289 million in venture and angel funding since 2009, over $200 million of which was raised last year. That represents an infinitesimal 0.0006 percent of total tech venture funding over that same period.

Those numbers are chilling, to say the least—and they no doubt play a role in the consistently lower revenues generated by women of color-owned firms—but Finney says funding is only the tip of the iceberg. “We know that funding continues to be an issue, but one of my concerns is that people tend to focus on the funding problem and not on the pipeline problem,” she told 3p. “Within a two-year time period, there's been a threefold increase in the number of black women who have raised over $1 million, but there hasn't necessarily been that big an increase in the number of black women-led startups—and that’s what we want.”

More than a “money problem”

While 34 black women founders crossed the $1 million venture threshold last year, the majority of black women–led startups don’t raise any money and remain underrepresented in the high-growth space. DID identified 8,000 women-led, high-growth-potential startups in its most recent analysis, but a mere 4 percent of those companies were led by black women. These numbers represent not only a lack of VC capital moving into black women-led startups, but also a lack of access to resources that form the building blocks of their companies, Finney said.

“This isn't necessarily a money problem,” she explained. “[VCs and funders] also need to open up their networks. They have to do some mentorship and make sure that founders are connected to the right people. All of these things are equally important to money when it comes to building a successful company.”

Since 2013, DID has made resources like these available to more than 2,000 high-potential black and Latina women entrepreneurs through its 26-week BIG Incubator program. Rather than focus on the elusive hunt for outside financing, the BIG model hinges on customer, product and company development—helping founders to understand their target market, create a product that market wants, and build a team that can deliver it.

“Some of the fears I had about talking about my business went away because... I knew I had a business,” Bryanda Law, a former cytogenetic technologist and founder of Quirktastic, a media tech company for “quirky” people of color, said of her experience with the BIG Incubator. “I can look at my unit economics and know what’s working. I can tell you my month-over-month growth rate. I can tell you my customer acquisition costs. That helped me become more confident within my business.”

Rethinking capital

BIG’s evidence-based model won the US Small Business Administration Growth Accelerator Competition for two consecutive years, and it now serves as a direct pipeline to the top accelerator programs in the world. Though the incubator helped founders raise $25 million in investment, Finney encourages BIG cohorts to look beyond venture capital to build their businesses.

“I would love it if our companies would never have to take investment, because when you take investment, you're adding a boss,” she explained. “We teach our founders that raising a lot of money doesn't mean you're necessarily building a successful company, because that's just the money raised. Measure success by revenue and—more importantly—by profit.”

Growth fueled solely by revenue is the holy grail, Finney told us. But vehicles like debt financing through Community Development Financial Institutions (CDFIs) may also prove more lucrative than VCs deals—which tend to be unfavorable toward women of color and command high equity stakes for low investments. “Rethinking capital is a conversation that most of us in this space are starting to have amongst each other: How do we think about capital differently? Are there other instruments that can be developed that would be more appropriate for our community?”

The bottom line

By almost every measure, these numbers simply don’t add up. Black and brown women are starting more businesses than any other demographic, yet the necessary resources don’t reach them and investors still aren’t paying attention. Powered only by bootstrap funding that averages less than $50,000, according to Project Diane data, women of color often don’t earn enough to build their companies, launch new products or hire more workers.

The fact that women entrepreneurs of color still struggle to earn revenues on par with their white counterparts is reflective of systemic issues that permeate every aspect of American life, Finney said. “Money, who gets it, and who can use it is a subject that is really fraught here in the United States, so the problem is not just about investment,” she argued. “It's literally about who we think deserves to innovate and create a company.”

Even as the definition of a startup founder expands slightly beyond the white guy in a hoodie—to, maybe, a white woman in a power suit—we’ll continue to lose out until decision-makers accept that anyone, of any background, has the potential to develop a profitable idea. That isn’t just conjecture—once again, it’s all about the data, and the numbers don’t lie: If their revenue reached parity with firms led by white women, women of color-owned companies would add $1.2 trillion to the US economy, according to the AMEX report.

“Until we have discussions around our beliefs about money and who should have it, it's going to continue to be an uphill battle for women of color founders,” Finney said. “We have to push past the funding part of it and think about what it takes to build a successful company and the resources that founders need to do so—then we have to get those resources to women of color and to anyone who wants to build a company.”

Image courtesy of DigitalUndivided/Facebook

When a Financial Institution Takes a Stand on Corporate Citizenship

The financial services industry is one in particular where a commitment to a triple bottom line is most critical. In leading up to 3BL Forum: Brands Taking Stands – The Long View later this month, TriplePundit sat down with Andrea Barrack, Vice President of Global Corporate Citizenship at TD Bank, to talk about the stand that TD has taken to be the best corporate citizen possible. Barrack shared the process of creating and implementing TD's sustainability platform and why a well thought out corporate strategy is no longer a nice to have, but a core business initiative.

After the financial crash of 2008, it’s no surprise that big banks lost the trust of many Americans. The millennial generation, the largest generation currently in the U.S. labor force, began to enter the workforce in droves in 2008. The economic state of the U.S. in the wake of the crash left a bad taste in many young citizens’ mouths as they began to search for their first jobs out of college. According to a recent Gallup Poll today in 2018, 10 years after the crash, only 27% of Americans trust big banks. Mistrust, coupled with rapidly changing digital trends and options for “investing” (as in cryptocurrency), is forcing large banks to prove that they care about and are working for the wellbeing of people everywhere - their customers, their employees, and the planet.

TD Bank is one company that says it has taken changing consumer expectations to heart and is addressing them through its Ready Commitment, an initiative designed to support a more inclusive tomorrow. The Toronto-based retail banker is investing CAD$1 billion (US$770 million) toward communities in four focus areas that support change, nurture progress and contribute to making the world a better more inclusive place.

Barrack, who's been at TD for about two years now - and who has a long history of steering philanthropic causes and organizations prior to joining the bank - has seen TD’s commitment grow and change before its launch in March. “TD views itself as purpose-driven, and that purpose is to enrich the lives of our customers, our colleagues, and our communities . . . the bottom line to our commitment is that we want the bank to have a positive impact on society,” she told 3p during an interview.

What’s most compelling about TD’s Ready Commitment is the process the bank used to design a platform that would be most impactful for its stakeholders. Barrack explained that the Ready Commitment was designed based on extensive external research highlighting the concerns of its communities and customers across North America. “There is a bit of trepidation about the future,” Barrack explained as she described the findings of the bank's research:

“People believe the world is changing very quickly, and people are worried that they won’t necessarily be able to keep up. The issue of inclusion (came up). A large sentiment of parents shared, ‘Are my kids going to be included in the economy.’ ‘Are they going to be out of a job’, ‘Are they going to be able to afford a house or even the rent for an apartment?’ We also heard the narrative, ‘My job is being automated, where does that leave me?’ ‘Am I actually going to be able to retire?’ What does this mean for me?’”

Not only did TD Bank survey its customers, but it used its yearly Pulse Survey to learn about employees’ concerns as well. Looking over all of the information gathered, Barrack shares that the question for her team became, “We’re a financial institution. What role can we play in having a positive influence on the future?” From that moment, the Ready Commitment was born, an all-encompassing vision based on what Barrack’s team had learned.

Breaking it down, the Ready Commitment has short-term, mid-term, and long-term strategies; Barrack shed light on what the bank learned and how TD hopes to implement these programs over time:

“As a bank, financial security is certainly the one driver that makes sense for us. It’s this idea of shared prosperity in the future. As a retail bank, we rely on a really strong middle class who can qualify for mortgages and car loans. We have both a business interest and a moral interest in making sure that people feel secure. In that, we take both the short-term and long-term view. The short-term includes financial education, as well as affordable housing. Over the medium-term, we are looking at income stability and how do we help people to better prepare for the changing nature of work and what that’s going to look like. Our longer-term is actually on early learning, as in what are the things that kids need to learn now so that they are prepared to be financially secure in the future.”

After all of the time and energy that has been invested in TD’s Ready Commitment, it is now a living, breathing platform with support at every level of the business. When asked how well received the Ready Commitment has been internally, Barrack shared that the bank had the majority of senior leaders participate in the working group to craft the strategy. “We had a presentation for our board and they are 100% behind it,” said Barrack. “Our CEO actually used the Ready Commitment in his address at our annual meeting of shareholders in March, which is probably the biggest commitment that we could've asked for - that he choose that venue to share the vision.”

In addition to senior leaders, rank-and-file TD employees have embraced the Ready Commitment as well. Barrack continued, “We put an internal announcement out on our intranet at the end of March before we went public with this, and in 24 hours, we broke the record for the most views and the most comments from employees at the company. They left comments about how proud they were to work at TD and wanted to know how they could help. Our biggest challenge, and opportunity, now is that people want to engage, and we want to be sure that they can.”

Why are the Ready Commitment and programs like it important for financial institutions and other public institutions? Barrack believes it has everything to do with changing customer expectations - and rightly so when here in the U.S.

Specifically, we’ve entered uncharted territory both politically and socially. Barrack explained, “There is rising consumer expectation that companies do the right thing. From that perspective, you can see a lot of consumer activism and people looking at the bank to do the right thing. This has both a positive and a negative side. If people think that we as a bank are doing something wrong, they are going to let us know. I think the shift in consumer expectations is really going to force companies to up their game regardless of where they are. We certainly look forward to that as a good challenge to have.”

Barrack also noted that investors are increasingly asking companies about ESG (environmental, social and governance issues). As it turns out, whether or not a company is socially responsible is beginning to persuade or dissuade investors. “Most of the shareholder proposals that are coming to annual meetings now are around ESG issues. I think that the number of investors that are asking companies to really demonstrate how we are having a positive influence (has increased).”

One of the largest investors in the world, Larry Fink, Founder and CEO of BlackRock agrees. In a January letter to the CEO’s of the largest companies in the world, Fink said, “To prosper over time, every company must not only deliver on financial performance but also show how it makes a positive impact on society”. The oft-debated letter signaled to big business that the days of profit-centered thinking will no longer work in the future.

Changing business trends continue to show us that brands who take a stand are out in front. This news isn’t new, but we are beginning to see more data supporting an uptick in profits for companies who have taken a stand on an issue. It’s not just about the environment; consumers are looking to brands to tackle issues most important to Americans, issues that also tend to be quite polarizing. (According to Edelman, Nike’s controversial new Dream Crazy campaign has sparked a 31% sales increase to date).

As Edelman's recently released 2018 Earned Brand survey revealed, a glaring statistic surfaced: “Nearly two-thirds of consumers now choose, switch to or boycott a brand based on its stand on societal issues, up from 51 percent in 2017."

While many of these brands who have taken very public stands for or against an issue are CPG companies, the same ethos is just as relevant and necessary, if not more so, across all industries - particularly the global financial services sector.

Image credit: Mike Mozart/Flickr

Andrea Barrack will be speaking on October 24 during 3BL Forum: Brands Taking Stands – The Long View. Receive a 25% discount using code PUNDIT2018VIP when you register here.

This Foundation Is Helping Grieving Students by Supporting Teacher Training and Grants

When tragedies like shootings, suicides or car accidents affect a school community, news reports often state, “Grief counselors will be on hand to help students." What happens in the following weeks and months, though, after cameras and reporters leave? Or what about an equally upsetting loss that didn’t get covered in the media – the death of a child’s relative due to illness, for example?

This week, the New York Life Foundation launched the Grief-Sensitive Schools Initiative (GSSI), a national program to help schools better support students in the aftermath of a loss.

“Although student tragedies and acts of violence strike our communities all too often, creating urgent concern around issues of death and grief at school, grief is an issue that educators encounter in the classroom every single day,” said Heather Nesle, president of the New York Life Foundation.

The reality of grief in the classroom

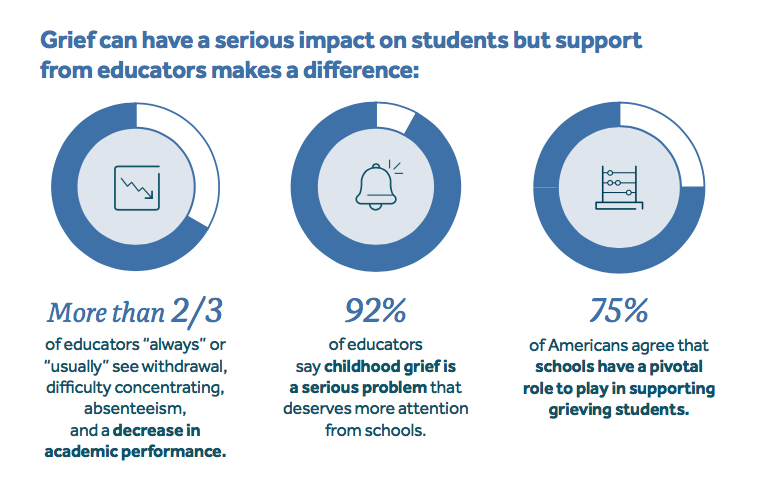

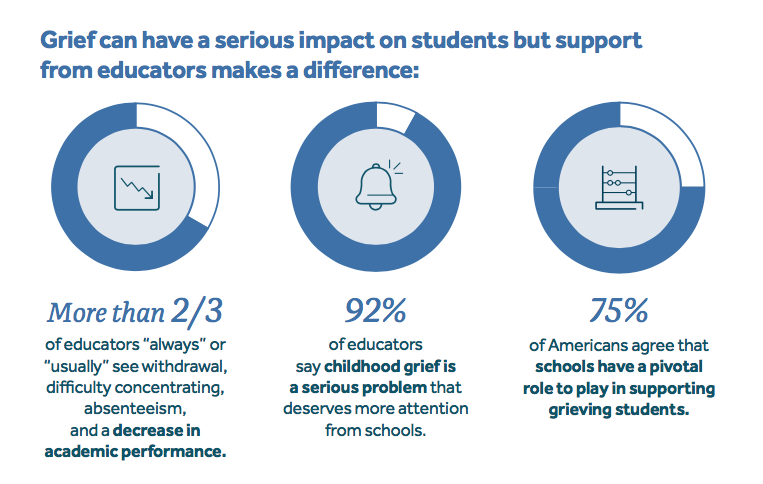

More than 1 in 15 children will lose a parent or sibling before the age of 18, totaling more than 4 million children nationwide. Add children who have lost a loved one outside of the immediate family, and the number of grieving students at any given time is staggering.Grief can have both short- and long-term consequences for students, including behavioral issues, difficulty concentrating, withdrawal, absenteeism and a decrease in academic performance:

But while 92 percent of educators say childhood grief is a “serious problem deserving more attention from schools," only 7 percent of teachers say they have had any type of bereavement training.

School is a critical place for children and teens to receive support and care, especially during a particularly vulnerable period in their lives. Teachers and school staff are often some of the most trusted and respected adults in students’ lives, so proper grief awareness training can make a significant difference.

How the Grief-Sensitive School Initiative works

The New York Life Foundation’s GSSI will provide assistance through two programs.Hundreds of trained New York Life employees have visited or will visit schools in their own communities to share best practices, free online resources, and other grief support tools with teachers and staff.

Once a school completes this training, schools can take the pledge to become a Grief-Sensitive School, making them eligible to receive a grant from the New York Life Foundation to further their grief awareness efforts. Elementary, middle and high schools are all eligible for these grants.

More than 400 schools throughout 30 states have already received “Grief-Sensitive Schools” designation and grants, since New York Life Foundation piloted the program in 2016. The Foundation expects to reach more than 1,000 schools by the end of the 2018-19 school year through this initiative, distributing more than half a million dollars in grants.

The next phase of the GSSI – set to occur over the next three years – will expand the training to the regional and national levels through a partnership with the National Center for School Crisis and Bereavement, directed by Dr. David Schonfeld.

“Our hope is to lay the groundwork for a significant shift in the level and quality of support grieving students receive at school,” said Dr. Schonfeld.

The issue of childhood grief: Aligning business objectives and social outreach

Through the Foundation’s focus on childhood bereavement, the New York Life organization has taken an often-overlooked issue directly related to the life insurance business and focused on the social aspects of families experiencing or preparing for major loss.“New York Life’s commitment to grieving children and their families is woven into the fabric of our company, reinforcing our mission to provide financial security and peace of mind,” said Nesle in an interview with TriplePundit. “The strong alignment of the Grief-Sensitive Schools Initiative with New York Life’s core values and day-to-day business has created particularly robust engagement around the program – a true ‘win-win’ for our workforce and their local school communities.”

Photo credit: Aaron Burden on Unsplash

Infographic credit: New York Life Foundation

Regulators Are Taking a Tougher Stance on ESG Disclosures, Report Finds

Regulators are taking a tougher stance on environmental, social and governance (ESG) disclosures, according to a study released this week.

Datamaran, a software as a service (SaaS) company with a focus on non-financial risk management, analyzed the growth of ESG regulations back to 2012. Researchers focused on three sectors—financial services, utilities and pharmaceuticals—across the United States, Canada and the United Kingdom. Their findings indicate an evolving regulatory landscape that increasingly favors more non-financial information from public companies.

In the last three years alone, ESG-related regulations grew by more than 100 percent across the U.S., Canada and the U.K., the study revealed. Regulators imposed new disclosure standards on topics like business ethics, energy use and product safety, a trend Datamaran researchers expect to continue.

“Business needs to be aware of emerging ESG regulation,” said Marjella Alma, co-founder and CEO of Datamaran. “The tougher stance taken by regulators means that companies who are not integrating ESG issues into their strategy and their risk analysis will have a harder time navigating the complex and evolving regulatory landscape.”

The sharp rise in ESG regulations over the past six years, together with a tougher hand from policymakers, should make business stand up and take notice, Alma said. “The message is clear,” she insisted, “non-financial issues are a ‘must have,’ not a ‘nice to have.’” Datamaran’s researchers expect business ethics, as well as supply chain management, to be a key focus for regulators moving forward.

As the regulatory landscape continues to tighten, institutional investors are also calling on companies to increase their non-financial disclosures. At the start of this year, the CEO of the world’s largest asset manager said he expects companies to demonstrate their long-term value to society, as well as healthy financials. “I want to reiterate our request, outlined in past letters, that you publicly articulate your company’s strategic framework for long-term value creation,” BlackRock CEO Larry Fink wrote in an open letter to the CEOs of all publicly-traded companies.

“Your company’s strategy must articulate a path to achieve financial performance. To sustain that performance, however, you must also understand the societal impact of your business as well as the ways that broad, structural trends—from slow wage growth to rising automation to climate change—affect your potential for growth.”

In other words: as issues like wealth disparity, resource scarcity and climate change continue to pose risk to the way companies do business, investors—as well as regulators—want assurance that these companies are planning ahead.

“Business has to think beyond the one- and two-year perspective to a much longer term as it evaluates the potential impacts of ESG risks,” advised Paul Sobel, chairman of the Committee of Sponsoring Organizations of the Treadway Commission (COSO), a multi-stakeholder risk management initiative. “These risks are mainstream, and they have to be part of the overall risk assessment and monitoring.”

European markets in particular are looking to tighten their ESG reporting standards. In May, the European Commission proposed a new regulation to clarify how how institutional investors—including pension funds and insurance companies—should integrate ESG into their investment decision-making.

In the U.S., however, it’s two steps forward and one step back. In April, the U.S. Department of Labor published a guidance cautioning financial managers that investments based on ESG issues may not always be a “prudent choice.” The guidance stands in stark contrast to best practices advised under the Barack Obama administration—which encouraged investors to consider ESG factors, Compliance Week reported.

Still, ESG regulations for the American pharmaceutical sector doubled over the past six years, according to the Datamaran study, while those impacting financial services companies increased by 87 percent since 2015. And, for their part, decision-makers seem unconvinced by the Labor guidance. "Markets are in no doubt of the materiality of ESG considerations," Fiona Reynolds, CEO of Principles for Responsible Investment, which represents investors with more than $70 trillion in assets, told Investment News.

Image credit: Rawpixel via Unsplash

Privacy: A Business Imperative and Pillar of Corporate Responsibility

All of us can see how technology can change and improve lives. Wearable devices can help better manage health, home sensors can reduce your energy use and costs, and STEM education can lead to an in-demand and fulfilling career. Working in Silicon Valley, I see leading technology companies all around me, pass self-driving cars on my daily commute, and have a love/hate relationship with the Symantec security robot that now patrols our corporate campus.

With these incredible opportunities and technological advancements comes the crucial responsibility to ensure companies like Symantec are assessing the use of their technology. In conducting our sixth materiality assessment as part of our recently released 2018 Corporate Responsibility (CR) Report we paid special attention to the evolving privacy landscape and also noted a new material issue: The social impact of technology.

Companies today do a lot in driving their sustainability agendas. At Symantec this year, we made incredible environmental progress, reducing greenhouse gas emissions by 15 percent in FY18 and reaching our 30 percent reduction target in just three years. We also increased employee volunteer hours by 28 percent and used our philanthropic dollars to help close the diversity and gender gaps in the tech workforce. While climate change, employee engagement, and diversity are all vital aspects of a company’s commitment to corporate responsibility one of the most important things we can do is to make sure our technology is being used responsibly.

At Symantec this means:

- Building internal policies and practices that ensure Symantec’s compliance with emerging privacy regulations

- Delivering products and services that enable consumers, businesses and governments to protect their personal information

- Engaging policy makers and other stakeholders on privacy related issues

- Managing our products responsibly to reduce the risk that they are being used to infringe upon privacy rights or freedom of expression

- Supporting global communities through our software product donations

Privacy and Corporate Responsibility

For software and technology companies, the link between data privacy and corporate responsibility is relatively straightforward. But should CR practitioners in non-tech industries focus on privacy? I think so, and here’s why:

First, no matter what industry you work in, more products are becoming connected products. Mattel released a WiFi-connected Hello Barbie in 2015 and researchers promptly uncovered several vulnerabilities that showed it could be hacked into a secret listening device.

Second, regardless of industry, companies process and store both customer and employee data that must be kept secure. Fast food chains like Wendy's and Chipotle, and health insurers like Anthem and Premera, have all been hacked, and retailers Macy’s and Adidas experienced customer data breaches in 2018.

In addition to increased risk, privacy regulation is also changing. This May companies across the globe were forced to increase their privacy efforts to comply with the European Union’s recent General Data Protection Regulation (GDPR). And Europe isn’t alone; data protection law continues to develop swiftly in other regions. Privacy regulations are changing in the Asia Pacific region and in the U.S. California’s governor recently signed the California Consumer Privacy Act of 2018.

Finally, data privacy must become a pillar of corporate responsibility programs because stakeholders are demanding it. People are concerned about the misuse of their data, investors are asking for increased corporate transparency, and NGOs continue to show us how privacy is a fundamental human right.

Like other tech companies, GDPR readiness was a critical initiative for Symantec and we took a number of steps to strengthen and enhance our privacy practices. We have internal policies and practices that ensure our own legal compliance with emerging privacy regulations and engage with policy makers and other stakeholders on privacy-related issues. We are also in a unique position as we offer products that help consumers and organizations secure and protect their important data as well as those that help companies stay compliant with evolving privacy regulations. And, as part of our commitment to delivering on our mission to make the world a better and safer place, we’re continuing to look for ways where we can do even more to help people protect their personal information.

The Social Impact of Technology

In addition to our focus on privacy, we have an obligation to ensure our products are distributed and managed responsibly, and we carefully monitor human rights risks associated with the use of our technologies in specific regions and by specific customers. Safeguards and controls include robust global trade compliance efforts, stringent contract provisions with partners and end users, and detailed processes for due diligence on orders of relevant products to countries of concern.

As an example, our Public Internet Access Policy aims to minimize the risk of our technology being used for inappropriate purposes. We track sales opportunities, hold orders deemed high-risk until we can collect more information on intended use, and reject orders found to pose a human rights risk. We follow all legal sanctions and do not sell to certain countries where our products could be used by governments against their people.

Managing the social impacts of our products also means making sure all people have the ability to keep their data secure and to protect themselves from cyber threats. Through a partnership with TechSoup, our products are distributed free of charge to nonprofits in need around the globe.

During FY18, we donated more than 440,000 licenses with a retail value of over US$19 million. Our donation program served over 22,000 organizations in 55 countries last year. These product donations keep confidential data safe, keep technical systems running virus-free, and put nonprofit partners' minds at ease to allow them to focus on what really matters.

For the Japan Association for Refugees, entrusting Symantec Endpoint Protection with keeping sensitive data secure, allows the organization to focus on advocating for the rights of refugees and asylum seekers. At Garden to Table Trust, keeping their systems running means they can teach children in New Zealand to grow, harvest, prepare, and share more fresh fruit and vegetables so they can live longer and healthier lives. And, at la Fundación Cristo Rey in Spain, our products help protect the identities and personal information of the 3,000 students and 50 nonprofit organizations that receive training services from the nonprofit.

These efforts are a start and we know we need to do more. Just as technologies are constantly changing and situations around the world evolve, we know we need to constantly revisit our responsibilities to ensure our products are being used responsibly.

As new research shows that data privacy goes directly to building trust with stakeholders, to providing companies with a competitive advantage, and to protecting human rights, I anticipate that we’ll see more and more companies embed privacy into their CR programs. Publishing our annual CR Report provides a time for reflection. I’m proud of the progress we’ve made, recommitted to the issues where we need to do better, and excited to see where a new year takes all of us.

Help us strengthen future reports by providing your feedback on Symantec’s 2018 CR Report via a brief survey.

Image credits: Symantec and Kevin Ku/Pexels

Nobel Prize Turns Spotlight on Climate Change as IPCC Warns Time is Running Out

The timing underscored the urgency—and the opportunity. The same day that Americans William D. Nordhaus and Paul Romer were awarded the 2018 Nobel Economics Prize on Monday for bringing long-term thinking on climate issues and technological innovation into the field of economics, the UN Intergovernmental Panel on Climate Change (IPCC) issued a dire warning that time is running out to address climate change.

Nordhaus, Professor of Economics at Yale University, was acknowledged by the Royal Swedish Academy of Sciences for integrating climate change into long-run macroeconomic analysis, while Romer, Professor of Economics at New York University, was singled out for integrating technological innovations into long-run macroeconomic analysis. Both are pioneers in adapting the western economic growth model to focus on environmental issues and sharing the benefits of technology.

The urgency of their work couldn’t be more timely. The landmark IPCC report warns that immediate consequences of climate change are worse than previously thought, with worsening food shortages and wildfires, and a mass die-off of coral reefs as soon as 2040. Avoiding the damage requires transforming the world economy at a speed and scale that has “no documented historic precedent,” says the UN’s scientific panel.

“One of the key messages that comes out very strongly from this report is that we are already seeing the consequences of 1°C of global warming through more extreme weather, rising sea levels and diminishing Arctic sea ice, among other changes,” said Panmao Zhai, Co-Chair of IPCC Working Group I.

The report was the first to be commissioned by world leaders under the Paris agreement, the 2015 pact by nations to fight global warming

The report “is quite a shock, and quite concerning,” Bill Hare, an author of previous IPCC reports and a physicist with Climate Analytics, a nonprofit organization told the New York Times. “We were not aware of this just a few years ago.”

Still time to act

Yet both the Nobel Prize winners and the IPCC report offer room for optimism—if the world is prepared to grasp the opportunity. Preventing an extra single degree of heat over the next few decades could make a life-or-death difference for millions of people and ecosystems on Earth, the IPCC report stated. A number of climate change impacts could be avoided by limiting global warming to 1.5ºC compared to 2ºC, or more. For instance, by 2100, global sea level rise would be 10 cm lower with global warming of 1.5°C compared with 2°C.“Every extra bit of warming matters, especially since warming of 1.5ºC or higher increases the risk associated with long-lasting or irreversible changes, such as the loss of some ecosystems,” said Hans-Otto Pörtner, Co-Chair of IPCC Working Group II.

According to the IPCC, the world has about a decade to cut carbon emissions in half before the lower goal slips away. Global net human-caused emissions of carbon dioxide (CO2) would need to fall by about 45 percent from 2010 levels by 2030, reaching ‘net zero’ around 2050

Reason for optimism

The Nobel Prize winners believe that solutions are at hand, if the world gets serious about seizing them.Nordhaus told Reuters that he was being honored for his work on carbon tax as a mechanism to reduce global warming. “It was for work on one of the most important problems the globe faces, which is climate change,” he said. “I’ve been working on that for almost 40 years, and the time’s ripe.”

"It's entirely possible for humans to reduce carbon emissions," Romer said at the press conference announcing the Nobel Prize. "There will be some trade-offs, but once we try we will find that it wasn't as hard as we thought it would be."

Growth at any cost?

It is this idea of trade-offs, however ,that has some economists objecting to the Academy’s choice. Both laureates’ work emphasize growth as the ultimate measure of an economy's success--an approach some economists argue has contributed to the climate crisis."I would say [this prize] is the last hurrah of a certain old guard of the economics profession that want to preserve the idea of growth at all costs," Julia Steinberger, an ecological economist at the University of Leeds in the United Kingdom, told Science Magazine.

Ecological economists argue that models focusing on economic growth as the measure of a policy's success leads to trade-offs to increase growth in the short term, on the assumption that it will make it easier to deal with the increased environmental damage in the long term.

The debate is valid, but the greatest risk is to do nothing and stay on the path of business-as-usual.

If, as the IPCC warns, limiting global warming to 1.5°C would require “rapid and far-reaching” transitions in land, energy, industry, buildings, transport, and cities, there is no time to waste.

This week’s Nobel Prize laureates and the IPCC report make that adamantly clear.

Image credit: Docent Joyce

The Good Life Goals - A Company’s Vision to Simplify the SDGs

With overwhelming goals like end poverty for all, achieve gender equality worldwide, feed an increasingly growing population and change the earth’s course on climate change, it’s easy to feel discouraged, and even a bit unimportant, as the world aims to achieve 17 Sustainable Development Goals by 2030.

It is difficult to view the SDGs as a collaborative effort when we zoom out and see that governments, private companies, nonprofits and intergovernmental organizations wield the most influence, power and fattest checkbooks.

But behind its newly launched “The Good Life Goals” initiative, Futerra, a global change agency, wants to zoom in and prove to individuals that their actions matter - that the SDGs will not be accomplished by solely the work of those with resources and power.

“The Global Goals have driven new action by policy-makers and corporations across the world, but what about the other billions of us?” Solitaire Townsend, co-founder of Futerra, said in a press release. “Sustainability isn’t just for institutions, it must also inspire individuals.”

The campaign breaks down each of the 17 SDGs and provides concrete and simple steps for how people can do their part toward accomplishing the bigger, overarching goals. A video also explains personal actions that people around the world can take to help support the SDGs.

Let’s look at SDG8 (Decent Work and Economic Growth) for example. While one of the SDGs targets inspires us to “take immediate and effective measures to eradicate forced labour, end modern slavery and human trafficking…” it seems more attainable at a personal level to “check no one was exploited to make what you buy,” as The Good Life Goals recommends.

Similarly with SDG3 (Good Health and Well-Being), targets like “achieve universal health coverage” or “end the epidemics of AIDS, tuberculosis, malaria” seem like they are better left to lawmakers, doctors or NGOs. But when it’s simplified to “value mental health and well-being” or “demand medical care and vaccinations for all” then it becomes clearer that individuals can truly play a role in creating a healthier future.

For each of the SDGs, Futerra provides five Good Life Goals to create a personal guide on how to chip away at the bigger vision. Most of the 17 animations preach the importance of learning and educating ourselves about the issues at hand, and advocating for the goal. Futerra understands that individuals may not be able to contribute to causes financially but they can contribute their voice and support.

The SDGs are the encore to the United Nations’ eight Millennium Development Goals, which from 2000 to 2015 ushered in worldwide improvements in reducing extreme poverty, unlocking educational opportunities for youth, promoting gender equality, and improving children and maternal health, despite missing most of its ambitious targets. The SDGs are a compilation of 17 goals to be met through 169 targets with the collaboration of 193 countries.

Starting in 2015 and ending in 2030, the SDGs aim to “free the human race from the tyranny of poverty and want and to heal and secure our planet.”

The Good Life Goals were created to bridge the gap between the SDGs and the sustainable lifestyles movement.

“Changing the world has never just been about policies or products, it always comes down to people,” Townsend said.

Image credits: Futerra

IPCC Report Reveals Urgent Need for CEOs to Act on Climate

The Intergovernmental Panel on Climate Change (IPCC) released a sobering report this week detailing the dramatic effects of climate change and the immediate steps we need to take to make significant progress on limiting warming in the future. The report makes it clear that apathy and inaction are no longer viable options. Unprecedented action is needed by both the public and private sector to transform our energy, transportation and other systems around the world.

Could this report finally be the clarion call to our nation’s business leaders to take responsibility for ensuring a prosperous and clean energy future for all?

There has been encouraging progress to date, but much more needs to be done. Businesses have an essential role to play in building political will for action, which may be the biggest challenge of all. Moreover, new research shows corporate stakeholders want – and expect – climate leadership, including policy advocacy.

Consumers want brands to take stands

Today, consumers expect to hear what CEOs and companies think about issues that affect all of society. In fact, 86 percent of consumers believe companies should take a stand for social issues and environmental causes, according to new research from the Shelton Group.

This year’s annual Edelman Trust Barometer found that 84 percent expect CEOs to inform conversations and policy debates on one or more issues, while 64 percent thought that CEOs should take the lead on change rather than waiting for government to impose it. In the report’s executive summary, Bank of America CEO Brian Moynihan summed up the role of a modern-day CEO by saying, “Our job as CEOs now includes driving what we think is right.”

Corporate CEOs have the clout and credibility to lead the charge for climate action while our federal government lags behind – America is hungry for passionate business leaders who want to drive innovation while safeguarding our planet.

A recent national study by the Pew Research Center found a majority of Americans feel the federal government is doing little to protect our water (69 percent) and air quality (64 percent). And more than three out of five Americans (67 percent) believe the government is not doing enough to reduce the effects of climate change.

"In a world where they no longer expect the government to fix things, people are turning to corporate America to step in and do some good," said Peter Horst, founder of marketing consultancy CMO. "Consumers increasingly want to engage with companies whose values match theirs."

Further, investors and stakeholders are increasingly scrutinizing companies’ engagement in public policy, and demanding consistency with their sustainability goals.

Corporate engagement on climate is on the rise

Thankfully, companies are beginning to stand up for the environment and climate policy, too. Recently, 21 business leaders at the Global Climate Action Summit announced the Step Up Declaration, an alliance to harness the power of new technologies to reduce greenhouse gas emissions. The declaration, developed by Salesforce and Mission 2020 with signatories including Bloomberg, Cisco and Uber, highlights a commitment to accelerate climate action not just within corporate boundaries but also with governments.

The Sustainable Food Policy Alliance is another promising step forward by four influential companies – Danone North America; Mars, Incorporated; Nestlé USA; and Unilever United States – that aims to leverage collaboration to inspire policy action that improves transparency for consumers, supports farm communities, and tackles climate change.

And when representative Carlos Curbelo (R-FL) introduced the MARKET CHOICE Act (H.R. 6463), a bill that would repeal fuel taxes and replace them with a carbon tax, 34 leading companies — including Campbell Soup Company, BP America, Shell, Dow Chemical Co., DuPont, National Grid, and General Motors — signed onto a letter thanking Rep. Curbelo for his leadership.

A step-change in business leadership is needed

True leadership requires courage and carries risk. However, staying quiet on an existential threat like climate change is far riskier. As the IPCC report makes clear, it is no longer enough for companies to tend their own sustainability gardens.

Businesses must work together to improve sustainability across their supply chains and to support public policies that ensure a thriving economy and a healthy planet. Climate change is the defining global challenge of our time. We know what we need to do to meet the challenge; all that’s missing is political will.

CEOs can and must change that, by making climate action a top priority in their policy advocacy in state capitals and in Washington, DC. Who will be first to truly lead on climate?

Previously published on EDF+Biz and 3BL Media News.

General Mills Works to Decouple Emissions from Business Growth

Agriculture accounts for around 9 percent of total greenhouse gas emissions in the United States, according to the U.S. Environmental Protection Agency. The global tally of agricultural emissions is even higher, with estimates ranging from 13 to 24 percent of total GHGs.

Meanwhile, “Climate change is becoming a source of significant additional risks for agriculture and food systems,” according to a 2015 report from the World Bank. The international finance institution predicts that shifting average growing conditions and increased climate and weather variability will present increasing risk to farmers and food companies in the coming decades.

As our warming climate poses greater and greater uncertainty for the food sector, leading companies are looking to shrink their own contributions to climate change and build resilience for the days to come.

Case in point: Global packaged foods company General Mills committed to a set of science-based emissions targets ahead of the COP21 climate talks in 2015, where world leaders drafted the landmark Paris Climate Agreement. The company was among the first to have its plan approved by the Science-Based Targets Initiative—indicating its goal to reduce value chain emissions by 28 percent by 2025 aligns with the global effort to limit temperature rise to “well below” 2 degrees Celsius.

In its 2018 Global Responsibility Report, released earlier this year, the company behind brands like Cheerios, Yoplait and Häagen-Dazs announced it’s making serious progress toward its GHG goals. Its greenhouse gas emissions footprint dropped by 11 percent in 2017, compared to a 2010 baseline, while the business grew by 6 percent over the same time period.

“It’s exciting to know that we've been able to grow our business from 2010 while reducing our impact on an absolute basis,” Jeff Hanratty, applied sustainability manager for General Mills, told TriplePundit. “When you set a goal like this, using science-based tools, you're establishing what Mother Nature needs of your company—not necessarily what the company can accomplish. It's promising to see that we've been able to move against that.”

We sat down with Hanratty to find out how General Mills managed to make such a significant dent in its footprint and learn more about the global food giant’s future plans as it seeks to continue growing the business while further reducing emissions.

Cutting costs, shrinking footprints

While naysayers often dismiss corporate sustainability as an unnecessary expense, many of General Mills’ GHG-reduction initiatives actually helped the company save money. “The main successes we've had along the way so far have been where we found cost savings,” Hanratty explained.

Energy efficiency and reduction projects, for example, helped General Mills save $2 million in the last fiscal year while avoiding nearly 15,000 metric tons of carbon-equivalent emissions.

In June 2017, General Mills signed a 15-year virtual power purchase agreement for 100 megawatts of the Cactus Flats wind project in Concho County, Texas. It will produce “the equivalent of up to a third of our electric consumption in the U.S.,” Hanratty said.

Still, Hanratty and his team know these cost-saving measures will run dry eventually—and likely far before General Mills reaches its goal to slash value chain emissions by 28 percent by 2025. Further moves will require the company to think outside the box, especially as it looks to expand while reducing emissions.

“Decoupling business growth and GHG emissions is a challenge,” Hanratty told us. “We're not going to be able to achieve our ambition by just working on the things that have been successful in the past, such as energy efficiency in our manufacturing plants. We're going to have to find it somewhere else.”

Looking to the future: Investing in sustainable agriculture

As General Mills looks toward 2025, its team identified sustainable agriculture as a key lever to drive down emissions across the value chain.

Such a move makes sense considering that growing and transporting crops and transforming them into food ingredients accounts for half of the company’s value chain emissions. “The ingredients themselves are half of our footprint,” Hanratty explained. “We have to mine that area for greenhouse gas reduction.”

To that end, General Mills has invested more than $3.25 million in soil health initiatives across the U.S. Its investments support on-farm research through supplier and grower partnerships such as the Soil Health Partnership and the Midwest Row Crop Collaborative. “We see [these investments] as a benefit for society and for agriculture, but there is also a huge potential to capture carbon in agriculture—which can help us with our science-based target,” Hanratty said.

Leading on commitment: Value chain reporting in the food sector

Experts consistently predict that the food sector will be among the first to experience disruptive impacts from climate change, and General Mills was one of the first companies to publicly attribute profit loss to our warming climate.

In a 2014 quarterly report, the company told investors it lost 62 days of production due to the extreme winter—a hit that impacted its production . The fact that the company is already seeing business suffer at the hand of weather extremes played a role in its decision to lead on climate action, Hanratty said.

“We see our climate change ambition and our activities around both climate change and water risk as a business resiliency play,” he told us. “We feel that we need to act because we could be affected the soonest. But we've realized since making these commitments that, because we're closest to the earth, we have a greater opportunity to act. Because we're buying food directly from the land, in agriculture particularly, we have an opportunity to cause change and use our scale for good—and that's what we're in the process of doing.”

Unlike most of its peers, General Mills reports on full value chain emissions—from farm to fork. Many top companies report only their direct emissions (Scope 1) and those from the generation of purchased electricity (Scope 2). But for several industries, including food products and agriculture, indirect supply chain emissions (Scope 3) account for the lion’s share of a company’s footprint.

“Our manufacturing footprint is 10 percent of our overall footprint,” Hanratty said. “If we need to reduce our emissions by 28 percent, we could eliminate our entire manufacturing operation and we wouldn't reach that goal, so we knew that we had to go elsewhere.”

Though value chain emissions assessment and mitigation is still a fairly nascent process, General Mills hopes its early success will attract attention from fellow food companies and their suppliers. “Our ambition is about getting better and bringing others along to do the same,” Hanratty said. “Now, some of our competitors, suppliers and customers also have science-based targets that span the value chain.”

The bottom line

Cutting emissions while growing the business is a huge achievement for any company, but we’ll need the private sector to do far more if we hope to cap global temperature rise at 2 degrees Celsius—which climate scientists deem essential if we are to avoid the worst impacts of climate change.

By themselves, national commitments associated with the Paris Agreement will only limit warming to 3.5 degrees Celsius this century, as Oscar-nominated filmmaker Josh Fox pointed out in a 2016 op-ed on TriplePundit, and business engagement is needed to fill the gap. For its part, General Mills isn’t pretending the process will be easy.

“We wanted to be leaders in this space, and it's scary,” Hanratty admitted. “We're feeling a little better because we've had some success and we have some ideas. But again, our plan is to grow the business and any growth we have, we have to abate.”

While the home stretch will be undoubtedly challenging, the company remains optimistic that it can lead its industry toward climate leadership. “We're on trajectory toward 2025,” Hanratty concluded. “We’re very positive that it's achievable.”

All images courtesy of General Mills.

Why Being a Social 'Edupreneur' is the Way to Go in Business Education Today

Business education has come under fire from different angles in recent years, leading some to even question whether B-Schools should not completely be overhauled. The criticism comprises a wide scale of arguments. There is condemnation about the sheer structure of many B-Schools’ operations, with deans placing excessive focus on acquiring major funds for the school at any expense, faculty being more concerned about maintaining their scholarly status than to properly facilitate their courses, and students treating their bachelor's degree or MBA as a negotiation tool, expecting top-grades for their tuition dollars. There is also major criticism about the training of business students into future executives who solely focus on the bottom-line (“homo economicus”), even if it requires immoral strategies. American B-Schools, in particular, are often accused of defending, teaching, and practicing hard core capitalism without any social emphasis, a trend that has proven destructive to the collective emotional wellbeing of society.

The call for “meaning” has emerged and surged, but has yet to find massive adoption in the ways B-Schools are run and how they structure their curricula. Fortunately, there are movements that have spawned rays of hopes. Workplace spirituality, leadership styles that emphasize broad stakeholder inclusion, emotional intelligence, business ethics, diversity management, and an energetic focus on social entrepreneurship and corporate social responsibility, are some of the avenues that several business faculty members have cultivated in recent years.

Yet, teaching these constructive topics is one thing. Making them appealing and compelling is another. Today’s student, business or non-business, needs more than a mere textbook and a series of bank-deposit resembling lectures to remain enticed. Today’s business students, with all distractions that surround and consume them, need an active and fertile environment to absorb the topics that will drive their behavior in the future of professional performance.

This is where the Edupreneur enters the business classroom. Edupreneurs are simply educators with an entrepreneurial mindset and approach. They can be found in all sectors of education, but are desperately needed in business schools. Why? Because they teach by example. Edupreneurs are not static educators, but remain on the move, and engage in a range of constructive outreach activities that enrich their insights and positively affect the quality they bring to the classroom. They may engage in external presentations to professional audiences, which enables them to extend their influence outside the classroom and establish useful connections. They may create or participate in constructive physical or virtual projects, inspired by a perceived need. They may write books and articles that reach practitioner audiences, or try to involve broader platforms in the teaching practice. The range of activities in which edupreneurs can engage is vast and fascinating. And, as we are now witnessing growing recognition and appreciation of social entrepreneurs – those who start ventures with a primary aim of solving social problems or instigating social change – so should we encourage the cultivation of social edupreneurs: educators who aim at positively altering the social landscape, and confront their students with the urgency to bring about responsible change in society.

In order to achieve the greatest impact, it is important to include action-based experiences, whereby students identify projects to which they can constructively contribute, because only when they have experienced the euphoria of actually alleviating a need in society, regardless how small, will they be encouraged to do it more often.

We must convince business professors about the importance of becoming social edupreneurs, and help them understand that this approach will not infringe, but rather strengthen their scholarship, while also enlarging their impact on society and their students. In doing so, we will have taken a major step toward constructively reinventing business education, while at the same time, initiating the much-needed change in the outdated narrative about the role of business in society.

Image credit: Woodbury University/Facebook