Standard Setters Unite to Streamline Corporate Reporting

Pity the corporate reporting team who has to choose between a dizzying array of sustainability, non-financial and integrated reporting standards to satisfy growing stakeholder and investor demands for clarity and comparability in reporting. It’s not an easy or straightforward task.

Enter the Corporate Reporting Dialogue, a coalition of major international corporate reporting standard-setters and framework providers. Earlier this month, they announced a groundbreaking, two-year project focused on driving better alignment in the corporate reporting landscape.

“Businesses are choking on the so-called ‘alphabet soup,'” Richard Howitt, CEO of the International Integrated Reporting Council (IIRC), which convened the Corporate Reporting Dialogue, wrote in Accounting Today.

Cutting the clutter

The International Trade Center identifies more than 230 corporate sustainability standards applicable to more than 80 sectors and 180 countries—all with an amazing variety of acronyms.The two-year project brings together financial reporting standard-setters (the International Accounting Standards Board and the Financial Accounting Standards Board) and the four most comprehensive and global of sustainability frameworks—the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Climate Disclosure Standards Board (CDSB) and CDP. They will work together on a quest for clarity, coherence, consistency and comparability between the different reporting frameworks.

“It is still a lot of acronyms, but one that holds out a real prospect that we can ‘cut the clutter’ in business reporting,” Howitt wrote.

Making reporting easier to navigate

Launched simultaneously at the Bloomberg Sustainable Business Summit in London and the World Congress of Accountants in Sydney, the announcement met a receptive audience.A poll of audience members at a World Congress panel on framework alignment demonstrated the need to bring the frameworks together. They were asked: "Do you find, either as a preparer or as a user of reports, the corporate reporting landscape easy to navigate?" Almost three-quarters of respondents—coming from a variety of nationalities and organizations, but all in professions related to accountancy—answered no.

“The market told us it wanted greater alignment between frameworks, and this project sends a clear reply that this message has been heard and is being acted on,” Howitt wrote in Accounting Today.

The clarity will be welcomed by companies, with an ever-growing number making the decision to do non-financial reporting. According to the Governance and Accountability Institute, 85 percent of the companies in the S&P 500 Index published sustainability or corporate responsibility reports in 2017.

An open, inclusive process

Participants in the project will undertake joint work to map and align their metrics. They're looking to identify how non-financial metrics relate to financial outcomes, with the ultimate aim for a paradigm shift toward the integration of financial and non-financial information. The first phase will include alignment to the Financial Stability Board's Task Force on Climate-related Financial Disclosures (TCFD) recommendations, but seek to go well beyond them.This will not be an internal technical exercise between the frameworks, Howitt promised, but an open process with structured communications, outreach, and stakeholder engagement “to seek to ensure the market is ready, excited and prepared to engage with the results,” he wrote.

An important aspect of the project is to achieve the ultimate aim of integrating financial and non-financial reporting. Today, 1,600 global companies have already adopted integrated reporting.

Image credit: Pixabay

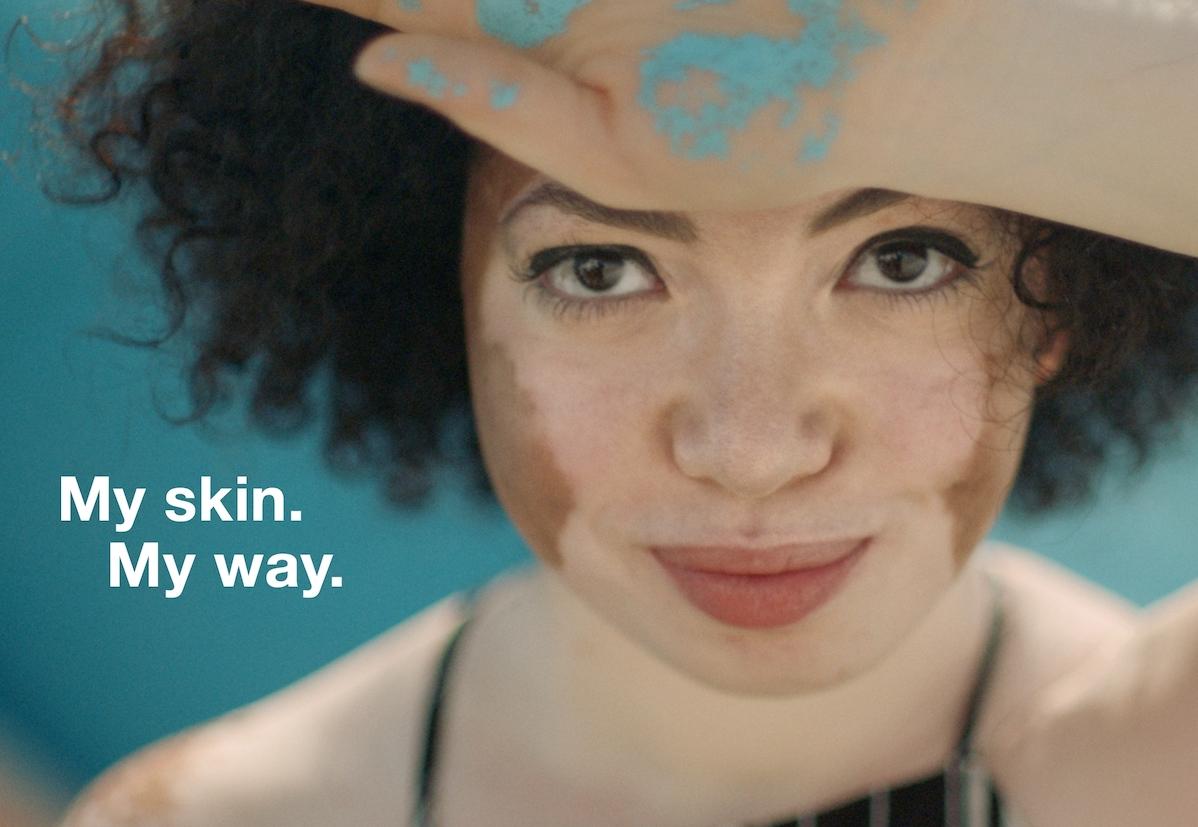

How P&G Prioritizes Diversity, Inclusion and Gender Equality to Create Global Impact

Companies with a global footprint have an opportunity to foster an environment where diversity, inclusion and gender equality can become the catalyst for building a better world.

Global packaged goods company Procter & Gamble published its 2018 Citizenship Report last week, which highlights its commitment to these priority areas. We took a look inside the report to find out what P&G is doing to promote diversity and equality around the world.

Diversity and inclusion

P&G’s global workforce is an amalgamation of people from over 145 nationalities. Upholding strong values of diversity within its own organization and driving action outside allows the company to win the hearts of consumers worldwide. Here are a few examples of P&G diversity initiatives that took off.

“The Talk” Sparks Conversation: In 2017, P&G created a short film focused on “the talk” that many black Americans have with their kids about racial bias in order to protect, prepare and encourage them. Since its launch last year, the film has generated intense dialogue on social media and millions of online views. The film also won 2018 Creative Arts Emmy and 2018 Cannes Grand Prix Lion awards.

Herbal Essences designs packaging for visually impaired: People with visual impairments find it difficult to differentiate shampoo from hair conditioner while in the shower. P&G's Herbal Essences brand will soon introduce a category-first “visual impairment aid” through raised indentations on every bottle, the company said.

Changes to the Flex@Work program: P&G's signature workplace flexibility program, Flex@Work, gives employees agency over their work days—including the ability to work from home, compress the work week, or work less than full time. The company plans to further modernize the program to accommodate employee needs such as single parenting, supporting a special needs child, caring for aging parents, or navigating same-sex parenting, according to its report.

Inclusive playgrounds from P&G Germany and REWE: P&G has teamed up with REWE, a large German grocery chain, to build inclusive playgrounds. The first such playground is now opened in Cologne, where children with and without disabilities can jointly experience new games and adventures every day, according to P&G's report.

P&G Latin America Hosts LGBT+ Conference: In 2018, P&G Brazil hosted the first P&G Latin America GABLE Conference to raise awareness about diversity and LGBT+ issues with a lens on business impact. More than 70 P&G employees from 10 countries, along with 40 invitees from local academia and business, attended the conference, according to the company.

Gender equality

P&G continues to invest time, money and human capital to promote equality for women and girls around the world. Here are a few highlights, as detailed in P&G's report.

Dispelling workplace myths: This year, P&G and Seneca Women presented a thought-provoking interactive exhibit, “Women at Work: Myth vs. Reality,” to bust false gender notions that become hurdles to women’s advancement in the workplace. The exhibit was first shown at the World Economic Forum in Davos, Switzerland, and is now appearing at events around the world to challenge outdated beliefs.

Fueling girls’ aspirations with Sesame Street characters: P&G partnered with Sesame Street Workshop to create TV shows that explore gender equity issues in child-relevant ways. The episodes will air around the world with a goal to set new expectations that value a girl’s education as much as a boy’s, P&G wrote in its report.

$100 million commitment to non-U.S. women-owned businesses P&G says it prioritizes women’s economic empowerment, and it created a program that supports women entrepreneurs across its supply chain in the U.S. Now, the company is extending this effort globally and committed to spend $100 million with women-owned businesses outside of the U.S. over a three-year period.

Generation of Firsts P&G’s Always brand launched a “Generation of Firsts” campaign earlier this year, which celebrates women achievers in Saudi Arabia. The film, produced with an all-female Saudi cast and crew, has generated a flurry on social media and garnered more than 1.5 million views.

“Our aspiration is clear. We want to be a force for good, a force for growth,” David S. Taylor, P&G’s president and CEO, wrote in his letter to the stakeholders. “We know that the more we integrate and build citizenship into how we do business, the bigger the impact we can have on the people we serve, the communities where we live and work, and the broader world that surrounds us."

Images courtesy of P&G and P&G Pakistan

New Study Finds Correlation Between Financial and Sustainability Performance

Is there a financial return on sustainability? Can a company improve its financial performance by increasing its focus on the environment, its employees and suppliers, and the communities in which it operates? Will producing comprehensive sustainability reports enhance these returns?

The answer to all of these questions is “yes,” according to a study released last week by the Centre for Sustainability and Excellence (CSE), a sustainability consulting and educational organization.

To complete the study, researchers looked at 642 sustainability reports published last year by private companies and other organizations in the U.S. and Canada. From this group, they examined financial results for the 50 companies with the highest environmental, social and governance (ESG) scores, and found that 73 percent of these companies recorded higher revenues in 2017 compared to 2016—indicating a "strong correlation between financial performance and sustainability performance."

To determine which companies had the highest ESG rankings, CSE relied on ESG scores developed by CSRHub, a sustainability benchmarking firm. CSRHub aggregates information on corporate sustainability performance from several different data sources and scores performance in four areas:

- Community: Community development and philanthropy; product; human rights and supply chain

- Employees: Compensation and benefits; diversity and labor rights; training; health and safety

- Environment: Energy and climate change; environmental policy and reporting; resource management

- Governance: Corporate board; leadership ethics; transparency and reporting

This is the third annual study from CSE examining corporate sustainability reports and the second that used this exact methodology. Last year’s report produced similar results, with two-thirds of companies with the highest ESG rankings showing better financial performance by revenue than companies with lower rankings during the period of 2014 to 2016.

Countless studies have been performed and reports written that support the business case for sustainability. What’s unique about CSE’s approach is that it’s the first to identify the possible links between having a sustainability strategy, goals and reports to the financial performance of companies and organizations.

“The unique element of our methodology is that we identify strong correlations between CSRHub top-rated companies that publish a sustainability report and their financial performance,” Nikos Avlonas, CSE’s founder and president, told TriplePundit.

Such consistent results should help dispel the notion that sustainability will be a burden on business by increasing communications and operations costs. In fact, Avlonas believes the opposite is true.

“Our research shows that increased attention to a sustainability strategy with comprehensive sustainability reporting influences profitability positively,” he told Forbes. “Transparency and comprehensive sustainability goals are great business enablers and support the success of corporate strategies. Stakeholders, including investors, shareholders and clients, see more opportunities and have more trust in these companies.”

Other findings in the report provide deeper insights into the correlation between top ESG performers and comprehensive sustainability reporting. For example, a third (32 percent) of the top 50 companies seek external assurance for their reports, a process that enhances the report’s credibility by having the reporting methodology validated by a third party. External assurance among the top ESG performers was about 6 percent higher than the average for all companies in the research.

Some 36 percent also integrate the United Nations Sustainable Development Goals (SDGs) into their reporting, which is 22 percent higher than the average and double the number from last year’s report. Some 44 percent report to CDP, which is 20 percent higher than the average in the research.

The Global Reporting Initiative (GRI) is clearly the reporting framework of choice, with 67 percent of the top 50 companies producing reports to this international standard.

You can download a summary of the report from the CSE website, which also includes an analysis of how artificial intelligence and blockchain technology will impact sustainability strategies and reporting in the future.

Image credit: RawPixel via Unsplash

Study: 'Meat Tax' Could Save 220,000 Lives Annually

Taxing red and processed meats could prevent more than 220,000 deaths globally each year while also saving $40 billion in associated healthcare costs, according to a study released last week.

The study, inspired by the World Health Organization’s 2015 report labeling red and processed meat as “carcinogenic,” calculated optimal tax levels for the 149 world regions studied based on consumption, health costs and non-communicable disease mortality.

The WHO’s International Agency for Research on Cancer found that red meat—beef, veal, pork and lamb—is “probably carcinogenic to humans,” meaning that its research found positive, but not definitive, associations between meat consumption and developing cancer. The organization’s findings on processed meats—such as hot dogs, ham, sausages, corned beef, beef jerky and canned meats—are more damning; these meats were categorized as a Group 1 carcinogen, putting them in the same tier as tobacco and asbestos.

“It all raises the question: Maybe we should regulate red and processed meat similar to other carcinogens like tobacco or asbestos, or some of the other foods that have demonstrable negative health impacts and that are increasingly regulated, like sugary drinks,” Marco Springmann, leader of the study and senior researcher at the Oxford Martin Program on the Future of Food, told Fast Company.

The study, conducted by researchers from Oxford Martin and the International Food Policy Research Institute, found that taxing red meat lowers consumption and thereby decreases the number of deaths attributed to red meat.

To appropriately measure the impact on a country-to-country basis, the researchers instituted a Pigouvian tax, a tax used to offset the unintended negative consequences to society of an economic activity. In this case, the tax would generate enough revenue to cover the negative health effects associated with red meat consumption.

The suggested taxes on red and processed meats in high-income countries, where these meats are most popular, averaged 21.36 percent for red meat and 111.17 percent for processed meat. This carries a noteworthy difference on the market—a $10 steak would bump to $12.13, while a pack of hot dogs previously running $3 would more than double to $6.33.

The suggested tax on processed meats reaches as high as 185.41 percent in Sweden, where Swedes would enjoy the once $3 pack of hot dogs for something closer to a ballpark rate of $8.56.

While the tax increase is staggering, the study shows it would have the intended result of significantly lowering consumption rates while also leveling out the burden of associated health costs. The decrease in red meat consumption would also limit meat’s extraordinary environmental footprint—the researchers estimate that the taxes would cut greenhouse gas emissions by close to 100 million metric tons.

“Nobody wants governments to tell people what they can and can’t eat,” Springmann told CNBC. “However, our findings make it clear that the consumption of red and processed meat has a cost, not just to people’s health and to the planet, but also to the healthcare systems and the economy.”

Despite the convincing evidence, governments would likely face a firestorm of opposition if they proposed a steep “meat tax.” Ryan Bourne of the Cato Institute argues that while the tax may steer people away from red and processed meats, it does not guarantee consumers would replace the food with healthier options. He quoted a 1937 George Orwell book to articulate his point that poor families would likely not splurge for the more expensive and nutritious replacement: “The less money you have, the less inclined you are to spend it on wholesome food....You want something ‘tasty.’”

Local governments are becoming increasingly familiar with the fight for taxes on food items and beverages, as a wave of American cities have recently campaigned for a sugary drink tax that increases the cost of soft drinks. Philadelphia, Seattle, San Francisco and Portland have all passed such taxes, and the results have been emblematic of what the researchers hope a meat tax would accomplish. According to a 2017 study, sales of sweetened beverages in Philadelphia, a city home to 1.5 million people, fell 57 percent after the city implemented a tax of 1.5 cents per ounce.

Worldwide, more than 30 countries have put taxes on sugary drinks.

Soda companies have taken notice. They supported a November ballot measure in Washington state that prevents cities and counties from passing new taxes on sugary drinks. The companies presented the initiative as a “Yes! To Affordable Groceries” campaign and claimed in ads that striking down the measure could make groceries unaffordable, especially to the elderly.

A similar campaign strategy failed in Oregon, where public health funding raised $3.4 million to combat a comparable initiative.

A ballot measure for meat taxes would almost surely be met with millions of dollars from lobbyists and farmers representing the meatpacking industry. After all, the meat industry, as reported by Quartz, has had its finger on dietary guidelines in the United States for several decades.

With that in mind, the U.S. is not likely to see any large-scale meat tax implemented any time soon, but it would be interesting to see it introduced on a local level. Aside from balancing out associated healthcare costs and potentially saving lives, the meat tax could subsidize fruits and vegetables—and assist in weaning farmers away from producing red meat.

Image credit: Lukas Budimaier via Unsplash

Can Making Cannabis Production More Sustainable Increase Profits?

The legal cannabis industry in the U.S. may grow to $50 billion by 2026, expanding to more than eight times its current size. In the recent midterm elections, Michigan joined nine other states and Washington, D.C. in legalizing recreational marijuana. Utah and Missouri joined the 22 states that already approved access to medical marijuana. Nationally, support for marijuana legalization is stronger than ever—62 percent of Americans say marijuana should be legalized.

This is great news for the cannabis industry and its investors, but is it good news for the environment? Growing cannabis for commercial production is associated with some pretty significant environmental impacts.

Cannabis is often grown indoors, requiring extensive use of grow lights and equipment powered by the electricity grid. In the U.S., 1 percent of all energy usage is attributed to indoor cannabis growing, and 4,600 kilograms of carbon is released into the atmosphere for every kilogram of marijuana produced. In California, indoor cannabis production represents 3 percent of energy usage, more than is produced in the Hoover Dam.

A 2016 report from New Frontier found that marijuana is the “most energy intensive agricultural crop produced in the U.S.” A report earlier this year from Colorado Public Radio showed that Denver’s marijuana industry accounts for nearly 4 percent of the city’s total electricity use.

Focus on energy efficiency

Regulatory requirements and an illegal growing mentality has led farmers to simply scale the indoor growth approach. But is there a better way? An increasing number of growers and cannabis companies are finding that they can reduce overhead and increase profits by making cannabis production more sustainable.

“You can’t downplay how much of an impact energy efficiency has and energy costs have for cannabis producers. It’s a significant factor,” John Downs of cannabis investing firm The Arcview Group told Big Buds, a website for marijuana growers.

Energy-related costs can account for as much as 50 percent of what it takes financially to run an indoor grow, according to the Southwest Energy Efficiency Project.

Canada’s Green Organic Dutchman, a research and development company for medical marijuana, struck a deal with a local energy provider and was able to reduce its energy expenses from the average 13 cents per kilowatt-hour to around 4 cents. That reduction in operating costs made the brand significantly more competitive in the cannabis market, Big Buds reported.

Taking advantage of incentive programs

Some indoor cannabis growers are taking advantage of incentive programs to stem their production costs. An Oregon company called Deschutes Growery created a method of growing recreational marijuana indoors that's rooted in energy efficiency, thanks in part to sustainable growing techniques the company developed over time and the energy-saving incentives it sought from the Energy Trust of Oregon.

Deschutes developed its own system of movable racks, LED lights, and programmable monitors to multiply growing space, cut utility costs and reduce the time its plants take to flower. The company mixes and recycles its own growing medium and uses biological pest control, including nematodes, predatory mites and natural oils, rather than chemical pesticides. The company, which claims to be the first solar-powered indoor cannabis farm in the state, set a goal to become carbon-neutral—offsetting the energy it consumes with conservation measures—in three years.

State-of-the-art growers are also using machine learning technology to determine the minimum amount of light needed to produce the largest yields. Smart-sensor systems can measure how much light each plant receives to help fine-tune lighting arrangements.

Tackling high water usage

Cannabis is also a high water-use plant—each plant consumes up to 23 liters of water per day. A company called GrowX found a way to conserve water by using a system called “aeroponics,” in which the marijuana plant is suspended by its roots in a moist environment. Water vapor keeps the plant hydrated. Not only does aeroponics require 95 percent less water than outdoor farming and 40 percent less water than indoor hydroponic farms, GrowX claims it can yield 300 percent more product than traditional yields.

Another firm, Aquatonix, uses a water treatment device to increase water absorption in cannabis, leading to an increase in the photosynthetic efficiency and crop yield while minimizing environmental impact. In recent trials in Humboldt County, California, growers using Aqutonix increased cannabis yield by 43 percent while decreasing their water usage

Outdoor growing has its challenges

Outdoor growing has its own set of environmental impacts. A study from Ithaca College found that planting cannabis in remote locations for commercial production is creating forest fragmentation, stream modification, soil erosion and landslides. Without land-use policies to limit its environmental footprint, the impacts of cannabis farming could get worse.

“Cannabis leaves a small spatial footprint but has potentially significant environmental impacts,” said co-author Jake Brenner, associate professor in the Department of Environmental Studies at Ithaca College. “To mitigate these impacts, policymakers and planners need to enact specific environmental and land-use regulations to control cannabis crop expansion during this early stage in its development.”

Pesticide use another concern

Use of pesticides in marijuana growing also has environmental advocates worried. “Until California gets serious about making clean water and our environment a priority over legalizing marijuana, pesticides will continue to be abused by growers regardless of the impact they have on our resources,” Stephen Frick, assistant special agent in charge of the Forest Service in California, told The Independent.

Frick said the state does not have the capability to monitor and enforce illegal chemical usage associated with the increased cultivation of cannabis.

Bodē Loebel, the founder of Bodē Wellness, a Colorado company that makes topicals and extracts infused with cannabidiol (CBD), the non-psychotropic cannabinoid compound derived from the hemp plant, told TriplePundit he would like to see statewide legislation that prohibits use of pesticides in growing cannabis.

Hemp is grown from the same plant genus, cannabis, but has only trace amounts (less than 0.3 percent), of tetrahydrocannabinol, THC, the chemical responsible for most of marijuana's psychological effects. Hemp, Loebel said, is “inherently sustainable. Growing hemp is an outdoor venture, grown without any need for pesticides.”

Investing now to weather the market

Making investments in more sustainable production is smart business, said Derek Smith, executive director of the Resource Innovation Institute, an organization that promotes sustainable practices in the cannabis industry. Energy, in the form of electricity and natural gas, ranks behind labor as an indoor grower’s greatest expense, he explained, and producers could be in a much better financial position going forward if they prioritized energy efficiency.

“To me, that is the holy grail of sustainability—when the economics of the investment start to make sense,” Loebel said.

While a number of companies are seizing advantages with sustainable production, and new solutions are coming on the market, many cannabis producers don’t seem concerned enough about energy use. Maximizing production now at the expense of the environment could end up being a short-sighted approach, experts say.

One sign of that is the market. While cannabis stocks have shown unprecedented growth over the past year, some analysts are calling the market over-hyped and warning that the boom could soon be over. Making efficiency improvements should help cannabis companies in it for the long haul to weather upheavals in the market and continue to deliver to the ever-growing American appetite for cannabis.

Image credit: Pixabay

Former Microsoft CEO Invests $59 Million in Education Project with Austin Tech Firm

The U.S. education system continues to lag behind other developed nations. Only two U.S. states have high-school graduation rates above 90 percent, and 15 states graduate less than 80 percent of their students. American kids are also more likely to be absent from school compared to their peers in other developed countries, with chronic absenteeism rates exceeding 30 percent in some cities.

These numbers caught the attention of billionaire businessman and philanthropist Steve Ballmer, who owns the Los Angeles Clippers basketball team and served as CEO of Microsoft from 2000 to 2014. Back in August, the Ballmer Group—the philanthropic organization co-founded by Ballmer and his wife, Connie—announced a five-year, $59 million commitment to Austin technology firm Social Solutions in order to improve educational outcomes for students across the country.

"After studying this space for the past couple years, we are making our largest commitment yet to improving data use for nonprofit, education and social services work, and we hope this acceleration of innovation will really help these organizations more effectively serve kids and their families," Ballmer said in a statement announcing the investment back in August.

Founded in 2000, Social Solutions provides performance management software to help government agencies and nonprofits maximize their impact by tracking the outcome of their programming.

The company works with over 18,000 nonprofit organizations, community groups and government agencies from all 50 U.S. states, as well as communities in Canada, Australia, the United Kingdom and Latin America. It offers two primary software products: Apricot for smaller organizations, such as Kansas City's Local Investment Commission (LINC), and Efforts to Outcomes (ETO) for larger nonprofits and government social service agencies, including a collaborative human service network in Boulder County, Colorado.

Clients use Social Solutions' software to combine data from local participating community programs, school districts and government entities and create actionable insights to better serve program participants. LINC, for example, uses Apricot software to share data between local schools and its after-school programs.

By trading paper records for data-sharing software, the organization can easily track critical indicators like attendance for over 7,000 students across five school districts in the region—allowing program managers to provide individualized attention to the students they serve, according to press information from the Ballmer Group. A broad range of other social service programs, including those focused on job placement, neighborhood improvement, family support and mentoring, can also use the software to share their data with groups like LINC.

The partnership with the Ballmer Group will fund expanded services and improved design on the Apricot and EOT platforms and help make them more readily available for organizations serving K-12 students. TriplePundit attended Social Solutions' annual Impact Summit in Austin last month, where we learned more about how this innovative partnership seeks to harness technology to serve students better.

Using data to improve student outcomes

One in five American families receive services from community organizations, government agencies or both, Alexis Zotalis, director of education solutions for Social Solutions, said at the Impact Summit in Austin. But most of the information these groups gather about program participants is latent—meaning other local nonprofits and government service agencies can't access it or use it to make informed decisions.

The Apricot platform puts this latent data to work. In the case of this latest project, it will serve to connect nonprofit data about K-12 students with education-based data from participating school districts. For example, LINC has data-sharing agreements with local school districts in Kansas City. If a student enters a LINC after-school program, volunteers can easily pull up information from the district's student information system (SIS)—such as grades and attendance—and use it to tailor their action plan. Likewise, the district can refer struggling students to groups like LINC in order to reduce their risk of failing classes or dropping out of school.

By pairing information together, nonprofits and school districts are able to see what type of programming has a measurable effect on an individual student’s performance at school. Additionally, a predictive analytics feature recommends specific actions to improve a student's chance of success, but it's ultimately up to nonprofits and school districts to chart their own paths forward using the available data. "This is a complimentary data system that's meant to arm [nonprofits and schools] with data to make a more informed approach," John Manganaro, VP of product for Social Solutions, said at the Summit.

The first iteration of the Ballmer-backed solution will be available to nonprofits in April. Social Solutions and the Ballmer Group will identify priority cities and geographies based on a number of factors—such as the percentage of students considered economically disadvantaged, as well as existing data-sharing partnerships between school districts and local groups, Zotalis said.

San Antonio, Kansas City and Seattle will be first to pilot the data-analytics dashboard—with two to five public school districts and a host of nonprofit groups participating in each city, Joel Martins, chief technology officer for Social Solutions, told TriplePundit. The company hopes to eventually roll out its data-analytics dashboard in “at least 20 cities,” CEO Kristin Nimsger told the Austin Business Journal.

Balancing student privacy with improved services

As Ade Adeniji of Inside Philanthropy recently reported, “efforts to use new technology to track and assess students haven't always worked out.” Adeniji cited the now-defunct InBloom, a $100 million student data project backed by the Gates Foundation, which “sparked strong resistance from educators and parents worried about student privacy.”For their part, the Ballmer Group and Social Solutions seem keenly aware of these concerns. "The risk is inherent," Martins said of storing and sharing student data. "That's something that both SIS systems providers and Social Solutions take extremely seriously. We're proud of our robust security standards and the certifications that we obtain to verify those standards."

Apricot's education data dashboard is compliant with the Family Educational Rights and Privacy Act (FERPA) and certified by the likes of Booz Allen Hamilton. All pilot participants already have data-sharing agreements in place, and future agreements will be made on a district-by-district basis, Martins said. Some districts are looking to require students or their parents to opt in to having SIS data shared with third parties, for example.

Other districts may choose to share only aggregate data that does not contain students' personal information, Manganaro said in Austin. "The data science models can still leverage that data," he explained. "It's still incredibly impactful to have aggregated data to say, for example, students that are 14 to 16 years old and live in these ZIP codes trend toward a certain behavioral pattern."

"Data security and privacy is something we've invested a lot of time and money in to make sure we get it right," Martins added. "I'm really confident not only in the security and privacy of our solution, but also in the work that communities can do with our technology to better their school districts and their communities."

The bottom line

The Ballmer Group's investment will be split in two—half will support research and development for the Apricot platform, and the other half will fund grants that allow nonprofits serving students to access the platform for a reduced cost. The philanthropic organization will obtain a financial interest in Social Solutions in connection with the partnership, which may return a profit if the company increases in value and is sold or goes public, the Ballmer Group said.

By testing its proof of concept, Social Solutions hopes to pave a way forward for greater data-driven collaboration around student success. "In addition to Social Solutions and the Ballmer Group, we view this as a public and private partnership," Zotalis said. "Having participation between nonprofit community organizations, school districts, and government agencies is what we believe it will take to drive progress and help increase the economic mobility of disadvantaged students."

Image credits: 1) NeONBRAND via Unsplash 2) and 3) Courtesy of Social Solutions

For This Young Professional, Junior Athletics Blossomed Into a CSR Career

In the U.S., 81 percent of Generation Z say they're looking for purpose in their work, according to a recent report from American Express. Many are finding that purpose in the corporate responsibility and sustainability fields. As this next generation enters the workforce, we wanted to find out what draws them to careers in this space, so we are publishing a series of personal essays from young professionals about what their new CSR or sustainability careers mean for them.

I first began to think about corporate social responsibility (CSR) more than 20 years ago when I played competitive junior tennis. The backstory of the athletic brands I wore always intrigued me. I remember asking where and how my Nike clothes were made—and by whom.

Little did I know that this curiosity would lead me to explore the topic of CSR in more than 25 countries, attend dozens of conferences, earn a Master’s degree in the field and, later, advise Fortune 500 companies on corporate citizenship and socially responsible investing.

In three years as an analyst at Corporate Insight, a private consulting and competitive intelligence research firm for Fortune 500 companies, I advised leading asset managers on the digital user experience across multiple channels. I discovered a range of industry best practices and trends through exposure to market events, product offerings, marketing and social media strategies, practice management, educational resources, and thought leadership. In blog posts for Corporate Insight, I wrote about how CSR, environmental, social and governance (ESG) factors, and sustainable investing are influencing and shaping the current asset management industry.

My Master’s degree work at the University of Victoria was dedicated to investigating female laborers working in contract apparel factories in the Maquiladoras by evaluating the efficiency and implementation of Nike’s CSR practices. This work led to a role as a CSR researcher at Global Affairs Canada, where I analyzed developments in the mining sector to assist clients with off-shore investments and created an online CSR course to train trade commissioners stationed abroad.

As a former nationally-ranked junior tennis player and an NCAA Division I athlete, I’m especially hyped about sports brands that incorporate CSR principles. After captaining the tennis team that made it to the NCAA tournament in my senior year at Niagara University, I worked with members of the Special Olympics team in Australia, travelled to remote parts of Asia, and did a charity hike in Africa that raised funds for Right to Play. These were all experiences that taught me the powerful role corporations can play in extending sports opportunities to children and adults globally when they espouse responsible business practices that carry far-reaching benefits to society.

This past summer, at the Green Sports Alliance Summit, I heard from panelists about sustainability lessons learned at the 2010 and 2016 Olympics in Vancouver and Rio, respectively. Held at North America’s first LEED Platinum certified stadium in Atlanta, the conference gathered various sports teams, athletes, leagues, media and corporations to advance sustainability in the sports industry. I ate with biodegradable forks, sought shelter beneath solar installations, and met young trailblazers Sam Gordon and Charlie Nyquist who are challenging the role of gender in sports. I spoke with Bina Indelicato, a sustainability consultant who advises the United States Tennis Association, and was blown away by Tom Jones’s account of Clemson University’s expansive football game-day recycling efforts.

It was encouraging to see Atlanta’s rapid adaptation of sustainable practices over the past few years that helped it earn a top spot in Bloomberg’s 2018 American Cities Climate Challenge.

This summer I also attended the CSR Investing Summit in New York City that brought together industry leaders to discuss, among several topics, the expanding role of data analytics in responsible investing. I heard panelists advocate for companies to absorb more ESG risks and boost reporting standards to drive overall business value. I also heard Kevin Mahn speak; he sees a future where CSR will become the bedrock of all corporations, eliminating the need for more conferences on the topic. I echo his aspiration and am looking to further explore the importance of data intelligence in smart business leadership.

My next step to bring together my interests and my work is a forthcoming series of interviews with leading experts in the corporate responsibility and sustainable investing sphere. The conversations will be inspired by my interactions with thought leaders at conferences such as Peter Bakker, who spoke on the importance of bottom line corporate accountability at the Future-Proofing Enterprise Risk Management workshop during September’s climate week in New York City.

Are you at or near the beginning of a career in CSR or sustainability? We’d like to hear your story: How you got started, your particular interests, and the steps you've taken to activate your passion. Contact [email protected].

Image credit: John Fornander via Unsplash

HP Turns More Than 550,000 Pounds of Ocean-Bound Plastic Into New Cartridges

Imagine the size of an adult humpback whale. Now imagine the whale relative to an empty plastic water bottle. No comparison, right? In fact, it would take about 12 million empty plastic bottles (that’s nearly one bottle for every person in the state of Ohio) to balance the scale against just seven adult humpback whales.

Today there are about 65,000 humpback whales in the world. Meanwhile, humans are producing about 20 million plastic bottles a second. The two facts shouldn’t be related, except a large portion of these bottles end up on shorelines and in waterways, contributing to the estimated 17.6 billion pounds (8 million tons) of plastic waste spilling into our oceans each year. In fact, research by the Ellen MacArthur Foundation estimates that by 2050, there will be more plastic, by weight, than fish in the ocean. And while humpback whales are mammals—not fish—protecting their ocean habitat is not only essential for all life below water, but it’s also vital for the sustainability of our planet and all people who live here.

The positive news is that ocean-bound plastic is a problem that can be solved. And I’m proud to say that HP is helping lead the way.

Building an ocean-bound plastics supply chain

Last month, HP announced that 12 million plastic bottles collected in Haiti are being upcycled into new Original HP ink cartridges—that’s more than 550,000 pounds (250 tons) of plastic material that won’t be spilling into the Caribbean Sea.

This milestone accomplishment comes just two years after we announced that we were joining the First Mile Coalition to clean up plastic waste and create economic opportunity for the people of Haiti. Haiti is the poorest country in the western hemisphere. It continues to recover from a catastrophic 7.0 earthquake that hit the country in 2010, as well as smaller quakes (including a 5.9 quake earlier this month) and several severe weather events. With limited access to clean water, Haitians rely on bottled water. Because proper disposal methods aren’t in place, plastic bottles litter the country’s land, canals and shoreline—eventually finding their way into the Caribbean Sea.

To help address this problem, HP partnered with Thread International and the First Mile Coalition on a program that turns plastic bottles collected in Haiti into recycled plastic that is used to produce Original HP ink cartridges. HP and our partners have built a fully functioning ocean-bound plastics supply chain with materials sourced from collectors in Haiti. Together with the First Mile Coalition, we’ve created more than 600 income opportunities for adults in the country.

HP has long been an industry leader in closed-loop recycling, combining material from products returned by our customers through the HP Planet Partners program with other post-consumer materials to create new Original HP cartridges. Through 2017, HP produced more than 3.8 billion Original HP ink and toner cartridges using recycled plastic from more than 784 million recovered cartridges, 86 million apparel hangers, and 4 billion plastic bottles. More than 80 percent of our ink cartridges now contain 45 to 70 percent recycled content, and 100 percent of HP toner cartridges (excluding toner bottles) now contain 5 to 38 percent recycled content.

Collaborating to end ocean-plastic pollution

We’ve made tremendous progress in Haiti and through our long-standing closed-loop recycling process. Yet we recognize that truly turning off the tap on plastics entering our oceans requires all of us working together toward this shared goal.

That’s why HP joined the NextWave Coalition, a consortium of worldwide businesses committed to scaling the use of ocean-bound plastics by developing a global network of ocean-bound plastics supply chains, at the end of last month. The addition of HP, along with new member Ikea, to the NextWave Coalition was formally announced at the fifth annual Our Ocean Conference in Bali, Indonesia.

Through our work and partnerships in Haiti, we’ve proven an ocean-bound plastics supply chain is feasible—and we’ve learned many lessons along the way. Joining the NextWave consortium is one way we can help other companies benefit from our experience, and to learn from others in return. This enables all of us to scale more quickly.

Our Chief Supply Chain Officer Stuart Pann describes it this way: “While HP has already demonstrated our commitment to sustainable impact by eliminating ocean-bound plastics and reusing them in our products, we firmly believe in the power of collaboration. We have a responsibility to take the critical steps necessary to reduce plastic pollution. Collaboration within and between industries is one of those critical steps.”

Solving ocean-bound plastic is fully within mankind’s control. By working together to create innovative new supply chain models, like the recycling program in Haiti, and openly sharing learnings and experience with others, both inside and beyond our industry, we can close the ocean-bound plastics tap for good.

You can watch our new film, Oceans of Plastic to learn more about HP Planet Partners and our plastic bottle recycling program in Haiti.

Previously posted on the HP blog and 3BL Media news.

Image courtesy of HP

Why Soil Health Matters for Food and Beverage Businesses

When I speak about our work in soil health, I will often see a head tilt with a questioning look. Why would a food company have any interest in soil? That’s when I take a step back and share that 99 percent of our food comes from the soil. Being a food company, the connection is instantaneously made.

We’re out to serve the world by making food people love. That means having a sustainable supply chain that can provide us with the best quality ingredients. Our business model, in short, is to take the output of Mother Nature and farming communities, transform it into products that are relevant for consumers to get the nutrition they need in the midst of their busy lives, and market it to them.

If Mother Nature and farming communities break down, our business model becomes much more expensive to operate and our ingredient supply at risk for being disrupted. There’s evidence that the agricultural portion of our business model is under a lot of pressure, whether it’s from climate change or operating cost pressure for farmers. So, we care a lot about ensuring Mother Nature can thrive today and for generations to come. And our consumers are caring about that more and more.

We have seen incredible benefits as we have worked on soil health over the last three years. It’s one of the few single levers in the supply chain that provides so many benefits. Whether it’s more resilient and profitable farms, carbon sequestration and lower greenhouse gas emissions, better water quality and quantity management on the farm, or more biodiversity on the landscape. We love all the positive outcomes that come with healthy soil.

At General Mills we are taking a holistic approach by investing across many categories and ingredients to advance our work. Some of our most impactful initiatives include:

- Investing more than $4 million in soil health initiatives in the last three years with NGOs including The Nature Conservancy, Soil Health Partnership and the Soil Health Institute; and academic research institutions including the University of Minnesota.

- Partnering with farmers to make products with single-origin ingredients grown using regenerative practices (Annie’s Soil Matters mini-documentary).

- Converting 34,000 acres of conventional farmland to certified organic, regeneratively managed farmland (Gunsmoke Farms announcement).

- Partnering with the Savory Institute to launch Land to Market – the first verification for regenerative supply chains (Ecological Outcome Verification seal).

- Working to commercialize Kernza (Cascadian Farm announcement), a perennial relative of annual wheat whose deep roots show promise to build soil health and ecosystem resilience.

- Supporting the work of the Noble Research Institute to develop an Ecosystem Services Market built on soil health.

There is a lot of work being done within our supply chain, by others across our industry, leading NGOs and non-profits to drive and foster action. We are all striving for many of the same results. We are so excited to see the momentum on this issue in the industry. But we recognize there is much more that needs to happen. We’re up for it because we are out to serve the world by making food people love. And great food starts with healthy soil.

Image: Pexels/Flambo

Google Employees Step Forward in the Brands Taking Stands Movement

When I began the Brands Taking Stands newsletter exactly one year ago, the inspiration came from the increasing CEO activism I saw taking place throughout the business community. I had been reporting on this movement for 3BL Media since its beginnings, in 2014, when Apple’s Tim Cook and Starbucks’ Howard Schultz spoke out on gay rights and race, respectively. From their positions at the top of highly profitable companies with large, loyal consumer bases, I thought their statements bold and welcome, although privileged and perhaps unique.

In 2015, the “bathroom” and “religious freedom” bills proposed in several states prompted oppositional statements from dozens of prominent CEOs from all sorts and sizes of companies—the rules of the game had clearly changed. Following the inauguration of the current administration in 2016, issues of immigration, gun control, climate change, and gender equity rose to the top of the agenda at many more companies. C-suite executives and boards began regularly commenting publicly on social and political issues. Since then, many hundreds of CEOs have signed on to one or more collective statements on these issues (notably, 550 chief executives are supporting CEO Action for Diversity and Inclusion).

Now, on the cusp of 2019, a second wave of disruption in business-as-usual has hit with full force: Employees taking stands. Earlier this month, 20,000 Google employees walked off their jobs in 50 offices around the world to protest revelations that the company had fired three senior executives over sexual misconduct, paying one of them a severance package of $90 million. The reveal came from an article in The New York Times, not from any internal Google announcement. The lack of transparency, on top of the original payoff, angered the company’s employees and ignited calls for collective employee action: A one-day “strike.” (The company subsequently informed its team that 48 employees had been fired over the past two years without severance packages for sexual misconduct reasons.)

Google employees were protesting their workplace culture, which they felt had protected sexual harassers if they were senior-level executives. From a company with the motto “Do No Evil” and a parent company, Alphabet, with the slogan “Do the Right Thing,” they expected much more. Their demands to the company were basic: Improve transparency in reporting on sexual conduct, end pay and opportunity inequity, and elevate the position and authority of the chief diversity officer.

“Employees are now a company’s most powerful interest group,” Alison Taylor, a managing director at Business for Social Responsibility (BSR), wrote in an article for the Harvard Business Review, entitled “When CEOs Should Speak Up on Polarizing Issues.” She explains that “workers are freely using the tools of this hyper-transparent era—including petitions and email leaks—to land punishing blows against corporate reputations and finances, in the process emerging as companies’ most powerful interest group. At a time when the U.S. economy seems to be approaching full employment, employees have more influence over whether and how their leaders speak out.”

There’s no doubt that Google employees are protesting from a privileged position. The company is “built on human capital and nothing else,” John Wilson, Cornerstone Capital Group’s head of research and corporate governance, is quoted as saying in the HBR article. “Google hires people who can work anywhere. So if employees don’t trust the company will have their backs, it will impact Google’s ability to attract, retain and motivate employees.”

It’s a major bottom-line issue. An Accenture study has calculated a perceived material loss of trust from stakeholders, including employees, had cost more than half of the 7,000 companies across 20 sectors analyzed as much as $180 billion in revenue. The study defined “trust” as encompassing consistency, integrity and transparency.

“This is part of a growing movement,” the organizers wrote in a news release, “not just in tech, but across the country, including teachers, fast-food workers and others who are using their strength in numbers to make real change.”

It’s déjà vu, all over again. A stand taken by some admittedly privileged employees at one admittedly unique company will inevitably spread throughout businesses of all types, in all sectors.

Values in the workplace are here to stay.

Image credit: Flickr/Shawn Collins