To Improve Employee Health, Start with Workplace Culture

Workplace wellness has been around for decades and its focus has been primarily on helping individual employees make lifestyle changes. This has been based on the belief that if a collective group of individuals change their bad habits, the health of the group as a whole will improve. While it’s true that personal choices affect how people perform at work and the level of health care services they need, the habits of individuals are greatly influenced by their surroundings. And, where do most adults spend the majority of their waking hours? At work.

Think your coworkers, your company culture or your larger environment don’t influence your health behaviors? Consider these facts.

- Studies have shown that a person is 57 percent more likely to become obese if a friend becomes obese. If that friend is a close friend, then that risk triples.

- A growing body of research indicates that the workplace itself is fueling poor health and well-being. According to the Willis Towers Watson “Stress in the Workplace” 2017 survey, work-related stress is the number one workforce health issue.

The upshot: To realize the benefits of a healthy workforce, companies must take a macro view of employee well-being.

When it comes to improving employee health and well-being – and perhaps making even a dent in health care costs – employers need to take a hard look at the conditions in the workplace itself that are giant contributors to poor individual health and well-being if they want to realize benefits, such as increased productivity, and reduced absenteeism and presenteeism.

How can we go about addressing these bigger issues? Here are six ways employers can make a difference:

- Reframe the conversation. It’s not uncommon to see workplace wellness messaging that goes something like this: “Better health begins with taking personal responsibility.” But that message might be better framed as, “Better health begins with changing our culture and environment so it’s easier for individuals to make healthy choices.” While the saying goes that we are “creatures of habit,” arguably, we are more “creatures of culture.” That is, most of us adapt to the culture and environment that surrounds us. Therefore, workplace wellness needs to begin first with addressing the larger culture before pushing individuals to “take responsibility.”

- Uncover the hidden factors. Addressing the culture begins with examining it. Very simply, is it a culture that is likely to support or undermine well-being at work? For example, are attempts to exercise or take mental breaks during the workday met with disapproval from supervisors and coworkers – or are these kinds of healthy behaviors readily embraced and normalized? On a broader scale, what is the level of “perceived organizational support,” or extent to which employees feel that their organization actually cares about them? These are big questions, but ones that impact people’s capacity to make healthy choices.

- Design “nudges” and “cues.” Building on the notion that we are more creatures of culture, we need to think about how we can optimize the environment and culture to support well-being. Every organization can literally design better health through healthy nudges and cues. Healthy nudges, or environmental prompts, make health and well-being easier. These includes things like signage, accessible stairs, subsidized healthy options in the cafeteria, and dedicated spaces for rest and recuperation. Healthy cues, or cultural prompts, make health and well-being “normal.” These include policies, rituals and regular practices that promote well-being at work.

- Enlist senior leaders. Clearly, senior leaders play a critical role in designing these nudges and cues. They set the tone, allocate resources and set policies that support well-being. Case in point, Microsoft recently enacted a family care leave policy, giving employees up to four weeks paid time off to care for an ailing family member. Research has shown that employers who provide flexibility and support for employees to balance work and home lives or personal passions with policies such as these see higher productivity and creativity.

- Activate managers. While senior leaders set the tone, managers effectively give permission. Moreover, every manager has the capacity to carve out a “micro-culture” of well-being within their team. These micro-cultures, or “pockets” of well-being, can spark a ripple effect throughout the entire organization. A manager who utilizes walking meetings or who takes time to show compassion for an employee who is experiencing a difficult time in their personal life fosters well-being within their team, and at the same time, enables their team members to do the same.

- Connect with the community. Thanks to the influx of community-minded millennials, mission-driven organizations have become the norm. Companies increasingly recognize the connection between profits, people and community. At Square, for example, teams of employees gather together on a weekly basis to clean up the neighboring streets. Efforts such as these are a great way to give back – and a positive way to connect internal, organizational wellness efforts with the larger task of creating a healthier society.

Image credit: Riley Kaminer/Flickr

5 Ways Your Company Can Be More Sustainable

Becoming a more sustainable operation is more than just a buzzword these days. It is becoming a way of life. Many older businesses, especially those that are based in older buildings or rely on outdated production methods, may find it more of a challenge to become a more sustainable operation than newer companies. If you're worried about making your business more environmentally friendly, here are a few steps that any business can take to become more responsible.

Go Paperless

We use paper every day without thinking about it - we print contracts, notes, instruction manuals and everything else under the sun. While it can be more convenient, most of the things that we do on paper can be done digitally without too much trouble. With the average U.S office worker using 10,000 sheets of paper annually, which equals 4 million tons of copy paper every year - doing what you can to encourage paperless offices can help to reduce your company's environmental impact.You don't need to stop using paper entirely, just reduce the amount of paper that you use and recycle or reuse waste paper.

Encourage Carpooling

This is much easier if you're based in a city or a significant population center but it can work for other business as well. Encourage your employees to carpool with one another, use public transportation, or even bike to work to reduce the amount of CO2 emissions being produced by their daily commute. In addition to lowering your global carbon footprint, it can save your employees money and even turn their commute into a useful tool for checking emails or talking about the upcoming workday.Rethink Your Building Heating

If your business is in an area that sees the temperature drop during the year, then keeping it warm during the colder winter months is a priority. Older building especially are likely equipped with inefficient or out of date oil burning furnaces. Modern furnaces can be more efficient and oil furnaces are more cost effective today than they have been in the past. Instead of gutting the whole system and replacing it with something new, why not upgrade your existing system to be more energy efficient and generate fewer emissions.Invest in Renewables

You don't necessarily have to rely on the local power grid to keep your lights on. Consider investing in clean energy sources like solar, wind, hydroelectric or geothermal. The exact options available to you will depend on where you are located, but chances are you can find at least one clean energy source in your area.Keep in mind that these will likely require a substantial initial investment, but once you have your new power grid set up, it will start to offset your monthly energy costs almost immediately.

Move Forward on Responsible Sourcing

If you rely on other businesses to supply you with the components for creating your products, make sure you're working with suppliers that source their raw material sustainably. This is especially important for things like wood, the harvesting of which can damage the environment or non-renewable resources like steel or plastic.It doesn't take much to make your business more responsible and sustainable. Even small steps, like choosing more responsible and sustainable suppliers and going paperless, can make a big difference in the long run.

Image credit: Pixabay

Iceland’s banned ad had the potential to democratise sustainability

The news that Iceland’s Christmas advert - with its powerful, consumer-friendly sustainability message - has been banned is a bad decision.

Iceland’s advert shows a brand that is trying to do good work in improving its impact on the world. Earlier this year, they became the first major supermarket to pledge to remove palm oil from their own brand products and so they are using their ad to campaign on an issue that is important and is actually credible for them to talk about with customers. Reducing usage of palm oil is a complex issue, and not everyone agrees with the action taken by the supermarket. However, it is such a shame this has been blocked as the traditional Christmas advert is a platform for brands to really connect with consumers, and the fact that Iceland chose to focus on sustainability is amazingly progressive.

It is also incredibly important for brands like Iceland to be making this stand as it democratises the idea of sustainability. The whole ‘brand purpose’ movement has for some time been in danger of becoming overly-directed towards a left-wing middle class audience who have the time, money and resources to be able to get involved (either by buying into a sustainable product at a higher price point or through making some form of compromise). Iceland has been broadening its base of shoppers over the last three years, but a large proportion of its customers are lower income families. Through the actions of the business, it is working to make sure it acts with purpose in the decisions it is making. Through this campaign, the brand is making sure that sustainability generally, and complex issues around the impact of products like palm oil, becomes more accessible

It is absolutely critical that big, mass-market brands are able to shout about the good work they are doing. If Iceland, and other brands like them, don’t have the opportunity to present and connect big social and environmental issues to less affluent audiences, sustainability and social responsibility will quickly become ’someone else's problem’.

Becky Willan is Managing Director at brand purpose consultancy Given London

5 Best Practices of Design Thinking Companies Can Use to Ensure Data Privacy

“Data is the new oil,” is a phrase attributed to Clive Humby, a data science innovator in the UK who coined the term in 2006. Since then, the concept has been adopted by both business and economics communities -- even making it to the cover story of a May 2017 issue of the Economist: “The world’s most valuable resource is no longer oil, but data.” As we become a more connected society, thanks in part to the internet, our individual data footprints are also growing. Rules and regulations around data privacy, however, have been loose, to say the least. That is until earlier this year when the General Data Protection Regulation (GDPR) was passed--a significant step forward for data privacy.

Over the last few years alone, we’ve seen a number of high-profile data breach stories: Facebook exposing the accounts of 50 million users; the Equifax data breach that may have affected 143 million in the U.S.; and one of the most significant breaches yet, the Yahoo data breach that is said to have affected 3 billion customers. These stories illustrate that data privacy is a major issue as tech companies go from startup to growing up in front of our eyes.

As online security and user experience simultaneously become two of the most important topics for modern companies, GDPR compliance by companies is a must. There is an art to creating a high-quality user experience while also adhering to this new regulation, and it begins with design thinking.

What is design thinking?

According to the Interaction Design Foundation, “Design thinking is an iterative process in which we seek to understand the user, challenge assumptions, and redefine problems in an attempt to identify alternative strategies and solutions that might not be instantly apparent with our initial level of understanding.”Ashley Graham, a design researcher at a Fortune 500 tech company, explains the process as she approaches it in her job as a user experience (UX) designer:

“Design thinking is a practice that helps us move through a design process. It’s user-centered, and it’s a way to frame your strategy, your design, and your development around that user. Design thinking is also a way of democratizing decision making, so it helps us to bring more diverse ideas to the table. In a traditional meeting only a few people are talking--those with the most power--but in using design thinking we’re not speaking, we’re writing on Post-its and putting our ideas on a wall. We’re releasing them. They aren’t our ideas, we don’t own them, so it helps teams to think less about who said an idea; the idea is for the end user.”While the two concepts might be seemingly unrelated, data privacy and design thinking both require a customer-first approach. “I think the mindset around both is really similar,” notes Graham, along with a few important questions that she believes companies working with data should be asking themselves, “How do we provide value to this person in a way that is good for them and not just good for our company? How do we only take the information that we need from them to serve them and help them to solve a need? And how do we let the rest of the data go?

5 Best Practices

Being on the front line of user experience, IT and engineering teams can create the infrastructure necessary to ensure that companies are meeting their court-mandated and ethical responsibilities. Here are five themes for engineers and designers to keep in mind. Here you’ll find five best practices that every company working with data should keep in mind.1. Only ask for the information that you need

Based on her experience, Graham notes that there is a temptation to ask for all the information that you could ever want. However, GDPR tells us no--only take the information that you need to create a quality experience for the user. 2. Make sure that the user knows what they are consenting to Some companies exist solely with the purpose of collecting and selling personal data. Therefore it’s more important now than ever before to be transparent with consumers on what they are agreeing to when signing up to use your product/service. 3. Use clear and concise language Another section of the regulation states that you must use clear terminology. “That’s design thinking 101 to create a good user experience,” says Graham. Everything you put in front of your user should be intuitive. “That includes whatever a person is consenting to in signing up for your product. Don’t use weird terminology, keep it simple. GDPR isn’t the first regulation to state this, however, because of its global implications, it’s helping us all to think about how to communicate more clearly to whoever we are designing for. “ 4. Education As with any new regulation that affects business, training and education are essential. It’s incredibly important for companies to train their staff and educate their consumers. “At my company, we went through hours of training on this. Companies need to be sure that their employees are informed,” says Graham. 5. Company Ethics Where does your company stand on data privacy? The implementation of GDPR creates the perfect opportunity to think through your company’s CSR strategy, and how it relates to data privacy. Work through the GDPR principles and see how you can integrate them into the ethics of your company.

What’s Next?

While data security feels like a buzz word at the moment, its effects will be felt over time as we continue to learn about the power of data and the internet. Trust is an element that every company needs to survive. Handling customer data with care, and empowering users through transparent practices helps to build that trust. Also, influence matters, so if your data practices are up-to-date and secure, you can demand that companies that you work with upgrade their data privacy capabilities as well. Consumer pressure can also move the needle. Graham puts it best, “Ultimately it’s the responsibility of the companies, but it’s also the responsibility of the public to hold the companies accountable.”Image: Unsplash/Rawpixels.

Waking Up to Unconscious Bias

That’s me in the photo above, engaging with an interactive, virtual reality (VR) installation on the “Check Your Blind Spots” unconscious bias training tour bus. In this VR experience, I’m invited into an encounter between two young black men, a suspicious elderly white neighbor, and a white policeman. The point is to immerse the viewer into an all-too-common situation that is loaded with potential for misunderstanding and conflict (fortunately, nothing violent took place in this instance). The title of this exercise, “Look Into Someone Else’s Reality,” is both a literal description of the VR experience and a larger, metaphorical call-to-consciousness about racial, ethnic, and gender stereotyping and resulting behavior.

This was one of several such interactive offerings designed to examine unconscious bias in everyday life presented in the custom-built bus, a project of the CEO Action for Diversity & Inclusion initiative. There’s a “Wake Up Call” audio experience that plays conversations between landlords and potential renters; a “Through a Different Lens” gamification quiz; a “Face Yourself, Face Reality” mirror booth; a “Check Yourself” how-diverse-is-your-world evaluation; an interactive LED touch curtain; a testimonial video-capture booth; touch screen media libraries; and an “I Act On” pledge sign-up section. The bus combines cutting-edge tech with hot-button pushing of dinosaur brain emotions to deliver its strong message: “To face unconscious bias, build inclusion, and broaden impact beyond the business community.” This $10 million “bias bus” is on a 100-stop tour to workplaces, universities, and communities across the country, with a goal of reaching 1 million people in person and online. Last week, it was parked outside New York City’s Jazz at Lincoln Center building where the second annual CEO Closed Door Session was taking place. Over 70 CEOs gathered to discuss the launch of the “Check Your Blind Spots” bus tour, the initiation of the “I Act On” pledge, and the upcoming “Day of Understanding” on December 7th, when nearly 150 CEO Action signatories will host conversations about race, gender, and other key D&I issues at their organizations. Readers of this newsletter know that I have regularly highlighted this coalition. Since its beginning last year, I have considered it to be one of the most effective private-sector efforts addressing the issues of diversity and inclusion. To date, CEO Action for D&I has collected 500+ signatories representing 85 industries and 12 million employees.Supported by research from Cone Communications that shows 78 percent of Americans want companies to address important social justice issues, and driven by the leadership of founder Tim Ryan, U.S. chairman and senior partner at PwC, CEO Action for D&I aims to double its number of signatories to 1,000 CEOs and add 100+ university leaders. The combination of its large scale and its top-down direction mark this coalition as one of the most significant civil rights initiatives of our time. One of the executives attending the meeting, John Miller, president and CEO of Denny’s, told me that the company signed up early on. “I was at an executive leadership conference a couple of years ago, and heard about the initiative there. We didn’t want to miss the opportunity so we sort of invited ourselves in and took the pledge. We were on the first list—which was all Fortune 500 companies except for us. We have 1,700 Denny’s but we’re just a billion dollar company.” Why was Miller so insistent on joining up? “Tim’s leadership was so inspiring. And there’s this: As a CEO, you can’t hide any more.” Denny’s diversity is reflected from top to bottom throughout the organization. Of nine board members, three are women, 50 percent are minority, an African American woman is the board chair, and 70 percent of the workforce is minority. “So, when we joined, we had a number of programs already, but that doesn’t mean they were good enough,” Miller explained. The big winner for Miller in CEO Action is the unconscious bias focus. “How do you get into the deeper nitty gritty? How do you get people comfortable in your environment? How does your culture prevail over these issues that follow us around in our nation? How do you really get inclusion and equality across all ranks? You start by being really committed from the top.” Then the issue is the training. “You can’t find the curriculum--it’s not taught in schools, it’s not in the restaurant industry.” So, Denny’s hired consulting firm Korn Ferry to provide unconscious bias training to the board, its franchisees, and all of its upper management. “They did a great job,” said Miller. “Here’s some things we do: We created work groups so people felt like they had access to places to talk about things; we talk about purpose and values all the time, opening and closing meetings with talk about them; we set goals and targets so people know they have the cover of leadership. And it works: Our company runs better. We’ve won a lot of awards for being a great place to work.” For Miller, D&I issues are straightforward: “You either care about people or you don’t.” That “people” focus is made concrete through monthly support-center community meetings held in the company’s auditorium that feature different groups such as veterans, women, the people with different abilities, and the LGBTQ community. “Everybody’s welcome, we respect everybody,” said Miller. “We bring members of the community on stage to talk about their struggles and challenges. The barriers melt away when people see the human in those who are different. The goal is to get people to look past their tribe and see the human in someone else.” Denny’s is not the first brand that comes to mind among the many brands taking stands—and that’s what makes the company’s commitment, as explained to me by Miller, so impressive. It’s focused on everyday work experiences that arise out of its diverse makeup, and workaday operations that organically raise D&I issues. “It’s a long, slow trail to make progress,” explained Miller, saying the company is always driven by two big goals: “Can we do better next year? Can we do better for the next generation?” Miller makes his down-to-earth descriptions of Denny’s D&I efforts sound downright exciting in their own way. Turning ideas into action at the “little” inflection points such as employee interaction makes Denny’s a model for the many companies that may be hesitant to push forward on difficult issues. That’s exactly what makes the Closed Door Session so valuable, Shannon Schuyler told me. She’s the principal, chief purpose officer, and responsible business leader at PwC, and president of PwC Charitable Foundation. “Getting CEOs together to learn from each other about how to have the difficult conversations is key to making real change,” she said. Being able to share when companies don’t always get it right is important, as is the sharing of best practices about the “…small things that make possible the bigger, more thoughtful decisions. Watching how CEOs reach out to each other in these meetings is amazing. We’ve now formed seven working groups organized around their interests.” It’s the emphasis on “action” by this CEO-driven coalition that marks it as a dynamic leadership initiative. Find out what members are doing and also how you as an individual can pledge and get in on the action. Stay up-to-date with the most current conversations around corporate responsibility with the Brands Taking Stands newsletter. Image credit: John Howell

PayPal Uses the Power of Giving to Create Social Impact

As the social consciousness of the average consumer continues to increase, large companies can no longer afford to sit on the sidelines and pretend it's business as usual. With a focus on social innovation, these global companies can become the triggers for social change, while still achieving business excellence and creating great shareholder value.

PayPal, which includes various payments platforms such as PayPal Credit, Braintree, Venmo and Xoom, has released its 2017 Global Impact Report, which highlights the company’s approach to social innovation. PayPal's efforts in this area are organized around three areas of focus: improving the financial health of individuals and businesses, powering charitable giving and strengthening communities.

Powering Giving

PayPal says it is using cutting-edge technology and scale to help nonprofits raise mission-critical funds. The company claims it is equipping nonprofits with digital solutions to help them engage with the communities – online, offline and via mobile – to boost funding.In 2017, over 49 million people across 200 markets contributed $8.5 billion to 640,000 charities via PayPal. In addition to supporting the fundraising efforts of nonprofits, the company provides its financial support, technical capabilities and expertise to the PayPal Giving Fund, a public charity that shares the company’s vision to make giving a part of daily life.

In 2017, more than one million donors contributed $105 million to the PayPal Giving Fund, which benefitted over 46,000 organizations. The contribution represents a jump of 150 percent over the previous year.

$1 Billion to Charities during 2017 Holiday Season

In 2017, PayPal partnered with 92nd Street Y– the founders of the global day of giving – to encourage people to give. The campaign involved people from 11 nations, and resulted in donations of $64 million through PayPal on Giving Tuesday.Overall, during the holiday season in 2017, nearly nine million people across 181 countries contributed $1.1 billion to charities via PayPal.

Funding for Disaster Relief

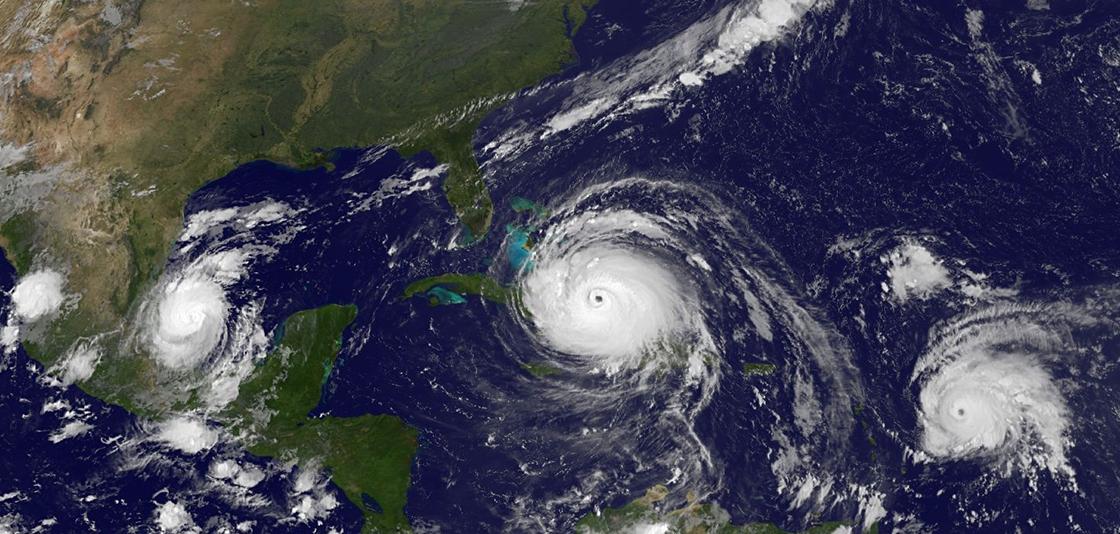

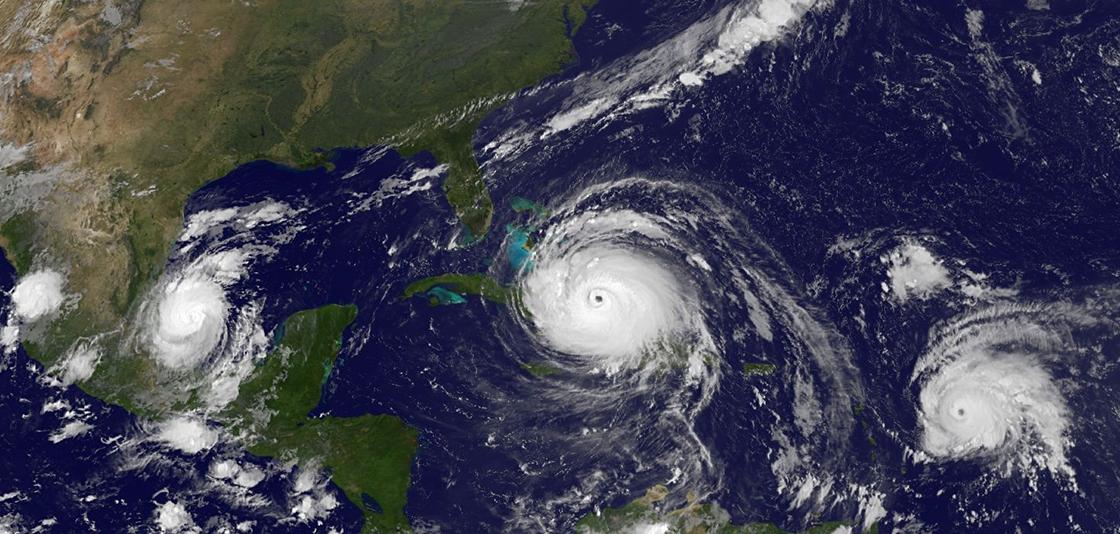

In 2017, hurricanes and wildfires in the U.S. and earthquakes in Mexico disrupted the lives of thousands of people.PayPal’s own community made monetary donations to global aid agencies, while the company also leveraged its platform to reach out to donors. PayPal says it helped raise $55 million for organizations engaged in relief work for the communities affected by these natural disasters.

Strengthening Communities through Giving

In this latest report, PayPal says it also makes philanthropic grants, organizes employee volunteer activities, facilitates fundraisers and supports other activities to strengthen local communities.The company encourages employee giving by matching charitable contributions up to $2,500 annually. And for every hour of employee volunteer service, PayPal donates $10 to a nonprofit of the employee’s choosing, up to $500.

In 2017, PayPal lowered its giving thresholds to make it easier for employees to receive matching gifts. During the year, the company gave about $1.7 million in matching gifts to nonprofits, while its employees contributed more than 20,000 hours of volunteering.

Through its grant-making efforts, PayPal gave more than $2 million to nonprofits. In total, PayPal says it gave over $11 million to organizations in 2017, including donations, matching gifts, grants and in-kind contributions.

Financial Exclusion Immersion Workshops

In 2017, PayPal’s employees in five countries took part in the Financial Exclusion Immersion Workshops. The goal of these workshops was to help employees empathize with the challenges that the financially underserved people face every day.According to the company, employees receive a first-hand experience through these workshops to connect with the company’s larger mission in a personal way, and come up with new ways to improve the financial health of the communities it serves.

In his letter to the stakeholders, Dan Schulman, President and CEO of PayPal Holdings, said: “Our business strategy and approach to delivering social impact are one and the same – together, they form a shared value model designed to deliver benefits for PayPal and our customers, investors, stakeholders and society at large.”

Image credit: PayPal

U.S. Climate Change Report Makes the Business Case for Action

The Trump administration released the latest National Climate Assessment last Friday, the day after Thanksgiving Day. This kind of timing is considered a fairly effective way to release bad news to the public, without attracting too much attention from the public. However, the opportunity for dissembling may prove illusory. The corporate social responsibility movement all but guarantees that the impacts of climate change will receive a vigorous airing over the weeks to come.

Or, will it? Friday news dump or not, The New York Times and other media propelled the new report into the headlines over the weekend. What's missing so far, though, is the response from leading U.S. business stakeholders.

The new climate change report

Before digging in, a bit of background is in order. The National Climate Assessment is a research and planning document mandated by the Global Change Research Act of 1990. It is issued to Congress and the President periodically. The new climate change report is the fourth such document and was issued under the auspices of NOAA, the National Oceanic and Atmospheric Administration.

The first part of the report -- Volume I -- actually appeared last year under the title, Climate Science Special Report. It didn't gain much traction, most likely because it focused on the data collection and foundational science mandated by the 1990 law.

The new report is different. As explained in NOAA's press release last Friday, it is a forward-looking document that deals with interpretation, analysis, and projections of trends:

Volume II focuses on the human welfare, societal, and environmental elements of climate change and variability...with particular attention paid to observed and projected risks, impacts, consideration of risk reduction, and implications under different mitigation pathways...

The press release elaborates:

Without substantial and sustained global efforts to reduce greenhouse gas emissions and regional initiatives to prepare for anticipated changes, climate change is expected to cause growing losses to American infrastructure and property and impede the rate of economic growth over this century.

In other words, the new report is a plain language document that directly addresses climate change issues of deep concern to the business community.

Where's the response?

To be fair, it would be difficult for most businesses to formulate a response over the weekend. The Trump Administration released the new National Climate Assessment with a double whammy in mind: it wasn't just any Friday, but the Friday after a national holiday, when many businesses are either closed or running with partial staff. Any real fireworks from the business community will play out over the days and weeks to come.

When the response does come, it may initially focus on the broad economic impacts underscored by the new report, where the media already set the table. Reuters lead off with this headline:

Clashing with Trump, U.S. government report says climate change will batter economyVox followed up with the subheading, "climate change is here, it’s expensive, and it’s deadly, according to a dire new report."

The Wall Street Journal also provides a representative sample of the media reaction:

The impact of global climate change is being felt across the country and, unchecked, could cause U.S. economic losses totaling hundreds of billions of dollars a year by the end of the century, says a new U.S. government report released Friday.

However, general economic impacts are only part of the report. Under its mandate, the National Climate Assessment also addresses a foundational underpinning of the corporate social responsibility movement, economic equality:

Future climate change is expected to further disrupt many areas of life, exacerbating existing challenges to prosperity posed by aging and deteriorating infrastructure, stressed ecosystems, and economic inequality.Economic inequality has been a key focus of corporate responsibility leaders like Levi-Strauss & Co., among others. Partly as a response to ethical supply chain management, leading companies have been moving beyond the traditional model of corporate charity to engage in community building and sustainable economic development, including water and natural resource conservation.

Climate change is already undermining that platform, and the new report makes the case that inaction will upend it completely:

People who are already vulnerable, including lower-income and other marginalized communities, have lower capacity to prepare for and cope with extreme weather and climate-related events and are expected to experience greater impacts.

In short, the new report invites U.S. businesses to respond within the full spectrum of corporate social responsibility concerns, in addition to their own bottom line issues.

U.S. businesses are already responding

So, why is it more likely than not that U.S. businesses will react strongly to the new report?

The obvious reason is that many leading companies are already well aware of the risks and impacts of climate change. They are already taking significant steps to transition to a low carbon economy, both within their own operations and in collaboration with their host communities, local governments and other stakeholders.

In addition to high profile actions like investing in clean energy and addressing lifecycle issues, businesses are also adjusting to new developments in insurance and risk management related to climate change. The financial community is also stepping in to ramp up low carbon investing.

Leading U.S. businesses have also recognized that environmental issues are important to consumers, and they are eager to promote their products in the context of sustainability. The consumer angle will grow in force as list of impacts grows. The California wildfires earlier this month are just the latest in a string of climate-linked extreme natural disasters in the U.S.

There is also a not-so-obvious reason, one that circles back around to the Friday news dump. President Trump was elected on a "Chinese hoax" platform of denying the scientific consensus on climate change, and as President he continues to undermine efforts to focus federal leadership on climate change.

By Saturday the White House was already undermining and dismissing the National Climate Assessment, but the report's authors are pushing back. The Hill caught this exchange on November 24:

White House spokeswoman Lindsay Walters said in a statement that the report is "largely based on the most extreme scenario, which contradicts long-established trends."Katherine Hayhoe, one of the authors of the report, pushed back on that statement, calling it "demonstrably false."

"I wrote the climate scenarios chapter myself so I can confirm it considers ALL scenarios, from those where we go carbon negative before end of century to those where carbon emissions continue to rise," she tweeted.

The takeaway from all this is that once again, the President has left the federal government rudderless while one of the most consequential issues confronting U.S. businesses unfolds.

As with gun control and other matters of national concern, the U.S. business community has little choice but to step up and take action -- and the National Climate Assessment has just handed companies a powerful platform for doing just that in this era of brands taking stands.

Image credit: NOAA

Colombia Embraces Sustainable Tourism

It’s rich in biodiversity, containing over 1,500 species of orchids that can’t be found anywhere else on the planet – and while we’re discussing nature, this country, almost twice as large as France, also hosts over 1,900 species of birds. This South American country’s biodiversity in part can be explained by its varied landscapes, from its vast Amazonian rainforests to small deserts and remote Caribbean islands.

That biodiversity is one reason why travelers are increasingly finding their way to Colombia, whether they seek to trek up one of the few glaciers in a tropical zone, visit the lush Pacific coast or explore the country’s mountainous Zona Cafetera.

And what these 3 million annual visitors (more than triple the amount of travelers from a decade ago) are discovering is a country home to 50 million people that by and large is very welcoming to visitors. That is, Colombians are especially gracious to guests if they can see the country for what it is and what it could become in the coming years – and not focus on the country’s past struggles. After all, Pablo Escobar has been dead for a quarter of a century, and while many Colombians have doubts about the country’s peace process, this is a country moving forward. Jokes about Escobar or the country’s illegal drug trade will earn an eye-roll at the very least or at most, a burst of exasperation. “Let’s not forget that Bolivia and Peru are doing very well with the drug trade, yet don’t have the reputation,” grumbled one guesthouse employee during my recent trip to Colombia.

“Now, let’s talk about this trek you’re going to do tomorrow,” said the same employee a few seconds later, as she was eager to pivot and explain what Colombia offers its guests who decide to visit the country. Colombia's security, not to mention its relative economic stability when compared to several of its neighbors, are among the reason why the nation's hospitality sector is enjoying robust growth. Medellín, Colombia’s second largest city, had only five hostels a little over a decade ago. Now it is home to a few hundred. And international chains, such as Hilton, are also bullish on Colombia’s growth potential.

While Colombia’s government certainly welcomes this economic boost, the country’s commerce, industry and tourism says it is determined to see that this increase in tourism is sustainable. Community-based tourism is one important part of this plan; earlier this year, the government added new towns to a list of what it describes as official “sustainable tourism destinations.” These communities have gained certifications verifying that their tourism infrastructures are not only environmentally and socially responsible, but are also generating wealth and opportunities for all citizens who want to participate in the local tourism sector.

And therein lies another reason why travel across Colombia can be a sustainable, responsible and local experience – while it is clear more gringos are traveling across the Atlantic and Caribbean to experience Colombia, visiting towns and cities like Salento, Filandia, Guatapé and Cartagena will likely be surrounded by hordes of tourists – the majority of which are Colombian. After all, the country’s natural, cultural and architectural riches have hardly been a secret to its own citizens.

More travel agencies have realized the potential that Colombia promises visitors and offer trips that promise a singular travel experience while ensuring that local culture is respected and preserved.

Medellín-based and British-run Amakuna, for example, plans itineraries that promise authentic experiences with local guides and stays at locally-run accommodations. Out in Colombia Travel, led by an American expat, organizes customized tours tailored for the LGBTQ community.

Leading international tour operators have been investing in Colombia’s potential. Canada-based G Adventures partners with a social enterprise to offer a Lost City Trek tour that takes visitors to Tayrona National Park in the northeastern section of the country. For the past three years, G Adventures and its nonprofit partner, the Planeterra Foundation, have worked with the indigenous Wiwa people to help visitors explore the Ciudad Perdida and experience what was once a completely isolated way of life. Projects included funding the construction of a community dining and handicraft sales center in the remote village of Gotsezhi, which employs some of Wiwa women who sell food and artisan crafts to travelers. “The goal of the project is sustainable employment and responsible development, which honor the Wiwa people’s ancient, sacred culture while also bringing income to their remote community and creating jobs for their young people,” said a G Adventures spokesperson in an email to TriplePundit.

In the next few weeks, we’ll take a closer look at how Colombia is becoming a focal point for travelers who are focused on more responsible travel – including the role coffee has in promoting ecotourism, a visit to one of the leading global “smart cities” and how one of the country’s leading brands is undergoing a sustainable makeover.

Image credits: Leon Kaye

Sustainable Transport Wins from New Ride-Hailing and Electric Scooters Innovations

The lines between car sharing and electric scooter firms are becoming increasingly blurred as they cross-fertilize expertise and innovation, making the big winner sustainable transport. That’s good news for business, transport users and the climate, with the transportation sector as the number one cause of carbon dioxide emissions in the U.S., according to the U.S. Environmental Protection Agency (EPA).

“Micro-mobility” in the form of electric scooters and electric bikes that are ideal for short trips, especially in traffic-dense urban areas, is the latest trend in sustainable transport. Everyone, it seems, wants to be part of it - even the companies that are traditionally tied to the automobile.

San Francisco-based electric scooter startup Lime recently announced it would make its operations in Seattle the largest free-floating car-sharing network in a U.S. city. And last month, a pair of Uber executives joined electric scooter startup Bird, citing the potential to take transportation to the next level by pioneering “Rideshare 2.0” technologies in order to solve ongoing transportation problems.

Uber, for its part, last month purchased Jump, a dockless electric bicycle sharing company, and is now using Jump to add electric scooter sharing to its portfolio of services. At TechCrunch Disrupt SF, Uber CEO Dara Khosrowshahi said that the company expects electric bicycles and scooters to become the future of urban transportation. He said a decade from now, ride-hailing will be less than 50 percent of all Uber’s business.

“Today, 40 percent of car trips are less than two miles long,” Bird Executive Travis VanderZanden told The Washington Post earlier this year. “Our goal is to replace as many of those trips as possible so we can get cars off the road and curb traffic and greenhouse gas emissions.”

A broad menu of transport options

Lime argues that its new car-sharing business is still very much rooted in its mission to reduce car use. There is evidence that car-sharing does reduce the number of cars on the road. A 2016 study by car-sharing firm Car2Go found that it led to a 6 to 16 percent drop in the number of miles the average household traveled by car. In Seattle, the report noted, each new Car2G0 vehicle added corresponded with a reduction of three to 10 private vehicles, either because people sold their cars or decided against buying them.Lime’s car-sharing business launched last week with 50 vehicles on city streets. By 2019, the company says it aims to have 1,500 cars in Seattle. Lime CEO Toby Sun told Bloomberg the primary reasons for the move into car-sharing are to serve “long-distance, higher terrain and bad weather.”

While Lyft and Uber are moving in the opposite direction—shifting from cars to now including bikes and scooters—the main impetus for all the companies is to offer users a full menu of transport options, which can only be good from a sustainable transport perspective.

Rise of scooters unprecedented

Judging from a recent nationwide survey, this is precisely what people want. The survey, “The Micromobility Revolution: The Introduction and Adoption of Electric Scooters in the United States,” found widespread support for the dockless electric scooters—70 percent of respondents like these new services—and evidence this new form of transportation can address transit equity issues.Polling 7,000 users across 11 U.S. cities, the study found that adoption was “accelerating faster than ever,” due to both the proliferation of smartphones and the general uptick in new mobility options.

In fact, the adoption rate is exponentially higher than other shared mobility options. In 2013, more than a dozen years after car-sharing services like Zipcar were first introduced, roughly 2 to 3 percent of the over-18 population had used such a service. In contrast, scooters, which have been active in the U.S. for less than a year, have already registered a 3.6 percent adoption rate, according to the study.

In addition to a growing adoption rate, electric scooters have also been embraced faster and more widely by populations not traditionally well-served by transit startups. The survey found a higher rate of adoption among lower-income groups compared to other micro-mobility services. Since dockless services require fewer infrastructure investments, they offer a more affordable way to expand transit access.

And transit firms are taking note, promoting their vehicles as means for cities to create more equitable public transportation systems. Bird, a scooter startup, recently announced a plan to subsidize rides for low-income users.

Steering innovation with the right regulation

These new modes of transport often outrun the ability of cities to study and regulate them, requiring better coordination between public and private sectors, as well as added incentives to steer riders towards shared systems. Regulating app-based mobility services was the focus of a recent roundtable held by the International Transport Forum, looking at congestion both on roads and the curb.“In order to create an ecosystem that can ensure the success of a virtuous cycle between these new modes and established public transit, government needs to lead,” wrote Gabe Klein, Co-Founder of CityFi, an urban change management firm, in Forbes. “City government should be at the forefront of shaping the rollout of these systems in collaborative, co-creative ways.”

As Klein sees it, “This is not an either/or choice between regulation or innovation. In truth, clear regulation can help scale up innovation.”

Image credit: Mike Licht/Flickr

Despite Trump, the Shift from Coal to Renewables Continues Unabated

If you were only paying attention to public statements coming from Washington D.C., you would likely think that in the almost two years since Donald Trump became President that coal has seen a magnificent revival. Trump has been consistently pro-coal and anti-climate, starting with his decision to remove the United States from the Paris Agreement. His proposal to replace President Barack Obama’s Clean Power Plan - with rules rolling back pollution controls to benefit coal generation - could kill as many as 1,400 additional people a year.

In reality, what’s happening outside the beltway is completely different. As it turns out, the markets and science matter more than Trump’s rhetoric, and energy companies across the country are continuing to shut down coal plants in favor of moving toward more renewables, just as they were before the 2016 election.

“Coal plants are retiring at the same rough rate under Trump that they were under Obama,” said Mary-Anne Hitt, director of Sierra Club’s Beyond Coal Campaign. “That’s because the decisions about individual coal plants and whether to retire them are not decisions that Donald Trump gets to make.”

This trend will only continue. In June 2018 a report from Bloomberg New Energy Finance predicted that coal’s share in the U.S. power mix will fall in half by 2040 and that almost two-thirds of the national fleet of coal-powered plants will be retired by that year, adding in a statement that “economic realities over the next two decades will not favor it in the power mix.” In a more recent update, they now predict that 2018 will be a record year for coal plant retirements domestically.

So what’s driving this? Two things, really. One is action at the state and local level, where policies like renewable energy standards, 100 percent clean energy commitments, and pollution regulations are pushing utilities to move away from coal. The most ambitious, and far reaching of these was a bill recently passed in California that mandates 100 percent clean electricity by 2045, meaning the country’s most populous state – and the world’s sixth largest economy – will be completely coal-free.

Another emerging trend is that renewables are becoming a viable alternative, and are sometimes cheaper electricity sources than fossil fuels. This is important, because for many years, it was natural gas that was replacing coal. While natural gas does have a lower carbon footprint in electricity generation (which could be negated by methane leakage at gas drilling or fracking sites), it’s still a fossil fuel and far dirtier than solar or wind. Now, clean energy is able to compete with not only coal, but gas as well.

“In just about every state in the country, when utilities go out and look for alternatives to coal plants, they are increasing finding that renewables are cheaper than running their existing coal plants,” said Hitt.

One example of this took place in Indiana – not far from coal country, where the utility NIPSCO has a tentative plan to replace all of its coal-fired plants within a decade, and according to Hitt, a study by the utility found that renewables would be the cheapest replacement.

Also important is the role of public-private commitments and partnerships like America’s Pledge, a network in which ”states, cities, businesses, universities, and citizens are taking action to fight climate change, grow the economy, and protect public health.” And, at the local level, climate is not a partisan issue as it in Washington. Take, for example, San Diego’s Republican mayor Kevin Faulconer, who pushed a 100 percent clean energy law that was the strongest in the country – even more so than cities with Democratic leadership.

This action is good. But increasingly, we’re being told by scientists that we’re not moving fast enough. We need to shift from coal and natural gas to clean energy even faster than we currently are. That’s why, in the end, while states, cities, and energy companies are still acting, the administration's efforts could have a negative impact in achieving broader climate action goals. Some planned effort could even make things worse – for example, the attempt to bailout of the coal industry, which was thankfully shelved, might have forced utilities to keep coal plants open in order to receive federal funding.

“These repeated attempts to bail out coal industry, or the rollbacks of our clean air, water, climate safeguards, are is a very real threat to this progress,” said Hitt. “We need to be fighting back against these rollbacks.”

This gets to a core problem – we already know that renewables can compete, and soon, will beat coal and other fossil fuels when the playing field is level. But the market isn’t fair, as we are still giving massive amounts of taxpayer money to the coal industry. These policies distort the market and make it harder to make the switch to clean energy we need in order to meet science-based climate change pollution reduction targets. And, as the recent report from the Intergovernmental Panel on Climate Change stated,

“That means we need to speed up our transition from coal by passing more laws like California, and less backward thinking regulations against the climate and environment like what’s been coming out of DC for the past few years. It’s time to ramp up the shift from coal to renewables. Not look to return to a dirty past.”Image credit: Greg Goebel/Flickr