“Reinvented” Toilets Saving Lives Could Also Reap Billions in Revenues by 2030

Sanitation is “the business of the decade,” Cheryl Hicks, chief executive of the Toilet Board Coalition, said last week on World Toilet Day. “Half the world needs toilets. They don’t have them because the infrastructure is too expensive for governments.”

United Nations and World Health Organization figures show that 4.5 billion people globally lack basic sanitation facilities, and 2.1 billion citizens do not have any safe and secure access to toilets. In addition, at least 1.8 billion people use a source of drinking water that is fecally contaminated. Unsafe sanitation causes diseases like diarrhea, cholera, and typhoid, which combined kill half a million children under the age of five every year. 80 percent of the wastewater generated by humans flows back into the ecosystem without being treated or reused.

This colossal global sanitation issue costs the economy $233 billion annually in health care costs, decreased income and productivity - and is most severe in the poorest and most populated regions of Africa and Asia.

The result is an enormous market potential for new products that can safely address this universal human need for sanitation, benefitting both business and society. Governments, investors and the private sector are already working together to “reinvent” toilets by using disruptive sanitation technologies that can destroy germs and process human waste into by-products like electricity, potable water, and fertilizer; and the most innovative ones are off-grid, i.e., without being connected to sewer pipes or water lines.

The reinvented toilet market is conservatively estimated to become a $6 billion global annual revenue opportunity by 2030, with more business opportunities across the sanitation value chain, according to a recent Boston Consulting Group analysis. A 2014 WHO study concluded that every dollar invested in sanitation provides an average economic return of $4.30.

A key player in this space has been the Gates Foundation, which since 2011 has invested over $200 million in research to develop next-generation sanitation solutions. During the recent Reinvented Toilet Expo held in Beijing, Bill Gates committed another $200 million to the cause. So far, 20 reinvented toilet and omni-processor technologies (small scale waste treatment plants) and products in the Foundation’s portfolio are ready for production and commercial licensing.

The Reinvented Toilet Expo showcased many such market-ready toilets and omni-processor technologies from companies in India, China, Thailand, and the United States. Also at the Expo, the Japanese company LIXIL announced plans to launch a reinvented toilet prototype for household use.

The host of the Reinvented Toilet Expo, China, is one of 193 countries working towards achieving the Sustainable Development Goal 6 (SDG 6) for water and sanitation, the goals of which include for everyone to have access to adequate sanitation and to end open defecation by 2030. China, with the world’s largest population at over 1.3 billion, is home to 57 million households that do not have their own sanitary toilet - and over 20 million people practice open defecation. In 2015, China’s President Xi JinPing launched China’s Toilet Revolution with the goal of expanding access to clean toilets to everyone.

India, the second most populous country in the world, also is coping with a huge sanitation crisis. The $20 billion "Swachh Bharat Mission – Clean India Campaign,” launched by Prime Minister Narendra Modi in 2014, aims to provide universal access to toilets to all Indians by 2019, eliminate open defecation and build 111 million toilets.

“It’s no longer a question of if we can reinvent the toilet . . . It’s a question of how quickly this new category of off-grid solutions will scale,” Bill Gates said during the Reinvented Toilet Expo. Reinvented toilets now even have their own ISO technical standard, which was introduced last month.

Businesses have an important role in addressing the sanitation crisis. The development of the emerging “Sanitation Economy” is a one way to tackle this problem, as it urges businesses to invest in providing toilet products and service innovation (toilet economy), reducing costs and recycling toilet waste into resources (circular economy), and optimizing data for operating efficiencies, maintenance, and health insights (smart sanitation economy). Hence companies looking for new market opportunities and those determined to align with the SDGs must realize that sanitation is central to the larger sustainability development agenda.

Image credit: WorldToiletDay.info

World Central Kitchen Is Making Thanksgiving Possible for Californians Devastated by This Month’s Wildfires

Upon returning home from a trip earlier this week on a short flight from San Francisco to my town, I, along with other passengers on the plane, were struck by what California looked like from 30,000 feet above ground. This month’s wildfires, notably the Woolsey Fire and Camp Fire, had left a thick brown haze across the Golden State. Many passengers on my flight could not help but stare at the land below us in complete disbelief as views of the Coastal Ranges and Sierra Nevada mountains were covered by smoke.

And now, although the rain falling this evening will help clear the air, the rainfall will make recovery efforts in the regions surrounding those fires even more difficult.

To be clear, those of us on that early morning flight were among the lucky ones. The Camp Fire in Butte County had become the deadliest and most devastating in California’s history, while in Los Angeles and Ventura counties, the Woolsey Fire forced the evacuation of approximately 300,000 people.

Meanwhile, tales of what life is like in the temporary camps that have sprung up in towns like Chico are heartbreaking. And the future of Paradise, the Sierra Nevada foothills town once home to 27,000 people, is uncertain after the community was destroyed on November 8. For too many Californians, this year’s Thanksgiving will be a grim reminder of what they have lost.

One nonprofit, however, is doing what it can to offer a glimmer of light, hope and comfort for tomorrow’s holiday.

World Central Kitchen, the nonprofit founded by celebrity chef José Andrés, is going beyond the call of duty to provide Thanksgiving meals for citizens displaced by the wildfires, first responders and firefighters.

To date, World Central Kitchen’s chefs and support staff have cooked 130,000 meals between its Camp Fire and Woolsey Fire emergency kitchens. The group is now gearing up to prepare 15,000 Thanksgiving meals for the town of Paradise, as well as surrounding shelters and informal camps that have emerged across the upper Sacramento Valley.

For World Central Kitchen, its mission, which is to use the power of food to empower food and strengthen economies, the work continues since first serving meals in Haiti after that country’s catastrophic earthquake in 2010. Its relief efforts have expanded worldwide, including across Brazil, Cambodia, Cuba, Dominican Republic, Haiti, Nicaragua, Zambia, and the United States.

Last year, Andrés and World Central Kitchen led disaster relief efforts in Puerto Rico after Hurricane Maria killed approximately 3,000 people and wiped out the island’s infrastructure. It was that work that inspired this organization to name Andrés the ‘Brands Taking Stands’ Humanitarian of the Year award last month at 3BL Forum.

Over the past year, World Central Kitchen has served 4.8 million meals to people who have suffered from environmental and natural disasters worldwide. Its mission will continue here in California - and could start anew anywhere on Earth at any moment. You or your company can learn about its work and donate here.

Happy Thanksgiving to everyone at World Central Kitchen; and thank you for your compassion and all the hard work you are doing across the Golden State and beyond.

Image credits: Gaspar Dietrich/World Central Kitchen

Businesses Find Innovation and Profit in Tackling Food Waste

The American Thanksgiving table laden with food is a stark contrast to the massive problem of food waste in the U.S. Americans tossed out the equivalent of 6 million turkeys — worth about $293 million — over Thanksgiving last year, according to environmental group Natural Resources Defense Council. And food waste is not just a holiday problem.

On average, 52 million tons of food ends up in U.S. landfills each year and another 10 million tons is discarded at the farm, according to ReFED, a national nonprofit committed to reducing food waste. That means American consumers, farms and businesses spend $218 billion annually to grow, process and then dispose of food that is never eaten (up to 40 percent of food produced). Meanwhile, one in eight Americans struggle to put enough food on the table.

Creating value, not waste

The good news is, seriously tackling America’s food waste may finally be having its moment, not least because solving the problem translates into significant economic gains for society. In its recent report, U.S. Food Waste Investment Report, ReFED claims that an $18 billion investment into 27 solutions can yield $100 billion in societal economic value. This has attracted the interest of big business, investors, innovators and philanthropists.“This is an incredibly disruptive time for food businesses,” Chris Cochran, executive director of ReFED told TriplePundit. “We are at the point of the biggest innovative changes of the last 50 years.”

The innovation has been born of necessity, he argues. “We have an overabundance of food at the same time that many Americans are food insecure, we have scarce natural resources, a global climate crisis and need more economic growth in local communities. Food waste in our culture has been previously unexamined, seen as a cost of doing business, or a built-in household cost.”

It’s time to open our eyes, he says and investors are among the first to do so. ReFED’s research notes that more than $125 million of venture capital and private equity funding has been invested in food waste startups—a sign, Cochran says, that investors have identified “a hotbed for innovation.”

AT&T partners with Grind2Energy

Often larger businesses join forces with the smaller innovators in the food waste challenge and that has been the case for technology and engineering firm Emerson which turned to AT&T’s Internet of Things (IoT) solutions to advance its Grind2Energy food waste recycling system.The Grind2Energy system creates an industrial food grinder that helps address the costs and environmental impacts of food waste disposal from grocery stores, restaurants and stadiums. This equipment turns food waste from commercial kitchens into a nutrient-rich slurry that anaerobic digesters can turn into biogas — methane obtained from biological resources that can be turned into electricity or heat — and fertilizer, instead of being taken to a landfill where it decomposes and emits methane, a potent greenhouse gas.

AT&T’s integration of IoT enables continuous data to optimize operations, increase scalability and increase the market competitiveness of the system, Doug Brokaw, director of sales for Grind2Energy told TriplePundit.

“We’re among the first on the market with IoT integration. For us, it’s been a game changer, not only internally, but with customers,” Brokaw says.

Changing wasteful behavior

“At AT&T, we’re seeing an explosion for IoT applications in unexpected places, and this is one of them,” John Schulz, AT&T’s director of sustainability integration, told TriplePundit. “You’re taking a food waste product and turning it into something productive and beneficial. I’m also struck by what a clean system it is.”Brokaw says that the real power of the IoT technology has been for its multi-unit customers, which now have an up-to-the-minute overview of the waste they produce. “What we’ve seen over time is that customer diversion rates improve, and less goes through our system as people become better stewards. Sometimes it’s just asking a simple question, ‘Why are we throwing this away?’”

One grocery chain, Brokaw says, was generating eight 30-yard compactors of food material a month, and within a couple of months of using Grind2Energy, “they were able to knock that down to one compactor a month. That more than offset the cost of the system.”

For AT&T, Schulz says, its involvement in Grind2Energy helps the company meet its 10x carbon reduction goal to enable carbon savings 10x the footprint of its operations by the end of 2025.

Tackling waste as financial priority

These partnerships around innovation are indicative of what is happening at a wider scale across industry, the investment community and entrepreneurs, says ReFED’s Cochran, who was previously Senior Manager of Sustainability at Walmart.ReFED has outlined a roadmap to cut U.S. waste by 20 percent—13 million tons annually—while generating $100 billion of economic value over the next decade and creating 15,000 new jobs.

“I see food waste moving from a sustainability priority to a CFO priority,” Cochran says. He points to Kroger’s Zero Hunger Zero Waste $10 million innovation fund to end hunger in its communities and eliminate waste in the company by 2025 as well as IKEA’s ambition to cut food waste in its business in half by 2020.

“This is a very financial material issue for the food business,” Cochran says. “I don’t think there is another topic out there that has such clear financial and societal value at stake, creating numerous benefits: increasing economic growth, addressing food security, and protecting the environment.”

Image credit: Emerson

Electric Aviation May Slash Emissions by Early 2020s

The winds seem to be shifting in favor of electric aviation as a viable solution to airplane carbon pollution, with major airlines and newer players touting electric flights as more than a pie-in-the-sky dream. Some proponents claim that take off is just around the corner, by the early 2020s.

Aviation is one of the fastest-growing sources of greenhouse gas emissions, with direct emissions accounting for about 3 percent of the European Union's total greenhouse gas emissions and more than 2 percent of global emissions. If commercial aviation were considered a country, it would rank seventh after Germany in terms of carbon emissions. Aircraft emissions are expected to grow by 50% by 2050 as demand for air travel increases.

Electric flights could put a substantial bite into growing emissions and help the world meet global climate goals. The electric aviation industry believes the technology is ready to meet the challenge. Earlier this month Air New Zealand announced it was working with European planemaker ATR on hybrid electric aircraft. Other major airlines like JetBlue and UK budget carrier EasyJet are backing electric aircraft start-ups.

Democratizing access to travel

US-based electric aviation company Zunum Aero expects to be among the first on the runway, with its first hybrid electric regional aircraft in the air by the early 2020s, according to Matt Knapp, Zunum Aero Chief Engineer. The benefits, he told TriplePundit, are huge—for the industry, passengers and, importantly, the environment. Electric propulsion cuts community and cabin noise by 75 percent and emissions by 80 percent, he says.“Our vision is to democratize access to high-speed travel by serving thousands of communities across the US that don’t currently have access to high-speed travel,” Knapp told TriplePundit.

Fleets currently flying the short-haul flights under a thousand miles comprise 40 percent of all commercial aviation emissions, Knapp explains. These fleets are aging and due to be replaced – according to an Embry-Riddle study, 8,000 regional aircraft are due to be replaced by 2030.

This means, Knapp says, that “by the 2030s we can eliminate 40 percent of all commercial aviation emissions.”

Air New Zealand eyes carbon neutral growth

Air New Zealand sees the same potential in their move towards hybrid electric aircraft. Under the agreement, the partners will investigate the development of these new solutions and the required systems to support them such as airport and regulatory infrastructure, maintenance, ground and flight operations."Our regional fleet accounts for approximately 40 percent of our domestic emissions so there's an enormous opportunity for carbon savings. It could be a significant contributor to us reaching our twin goals of carbon neutral growth from 2020 and reducing emissions to 50 percent of 2005 levels by 2050," stated Air New Zealand chief executive Christopher Luxon.

Luxon said hybrid aircraft are expected to enter the market in the “next decade or so.”

The electric aviation space is getting crowded. The list of players keeps growing: Airbus E-Fan X is being developed with Rolls-Royce and Siemens as a hybrid-electric airline demonstrator. Eviation Alice is an Israel aircraft being developed by Eviation Aircraft. Wright Electric is a startup with a goal of creating a commercial airliner that runs on batteries and for distances of less than 300 miles and is backed by EasyJet.

Zunum ready to push ahead

But some experts see Zunum as ahead of the pack, according to the Robb Report. Zunum has the backing of Boeing, JetBlue Technology Ventures and the Department of Commerce Clean Energy Fund. Charter provider JetSuite has already signed up to buy up to 100 of their aircraft.Zunum Aero last month selected France’s Safran Helicopter Engines to build engine turbines for its aircraft. The Safran Ardiden 3Z 500 kW turbo-generator is a “significant component of our ability to deliver 80 percent reduction in operating costs and emissions,” Knapp says.

Debate over battery technology

Some observers are skeptical that today’s electric battery technology is anywhere near ready for electric flight. In Wired, Eric Adams reports that the age of electric aviation is still 30 years away. “For all the hype electric aviation gets, the concepts put forth by aerospace companies and startups are just this side of impossible…The problem is, batteries simply do not offer the power-to-weight ratio or cost needed to be feasible, and will not for some time,” Adams wrote.Knapp would strongly disagree.

“We’ve actually designed our planes to be viable using battery technology that is available today by carefully sizing the generation and battery masses for minimum total operating cost at target range,” he told TriplePundit. “The infrastructure we require is pretty straightforward – we need space at airports to store and change batteries, and then a little room to charge them.”

He explains that Zunum’s aircraft is designed to be agnostic to the source that powers its propulsion. “So it can be configured easily to rely on battery plus gas turbine, which is the most common configuration initially, and switch over easily to battery only. It’s also agnostic to battery chemistry type – so we can take advantage of whatever the best technology happens to be. Either way, our propulsion is fully electric.”

Whether it’s within a few years or a few decades, the momentum for electric flight seems unstoppable. And pressure is on the aviation industry to come up with solutions to meet the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) scheme to push for a goal of carbon-neutral growth and complement the aims of the Paris Agreement.

To get there, Knapp says, “electric aviation is really the primary solution.”

Image credit: Zunum Aero

The Solar Home Energy Storage Revolution Has Just Begun

Energy storage, rooftop solar panels and LEED construction used to be expensive, customized options for wealthier homeowners, but they are rapidly going mainstream. The combination of experience, economies of scale and advanced technology is making it possible for more home buyers -- and renters -- to live a low-carbon life. A case in point is a new Google Home-enabled partnership between two leading companies in the sustainability field, the global cutting edge energy storage company sonnen and the U.S. builder Pearl Homes.

So, what comes next? The new partnership demonstrates what can happen when developers look beyond the benefits to individual home buyers, and design properties with an eye on the connected, distributed energy landscape of the future.

Public policy and sustainable building

Before getting into the details of the new partnership, it's important to take note of the public policy context.

Pearl and sonnen are pairing up to build a residential development called Hunters Point in Manatee County, Florida.

The name Hunters Point is strictly neutral, but there is no mistaking the sustainability mission. Hunters Point is being billed as a "Net-Zero-Plus and Climate-Positive' community."

That kind of climate action pitch might not touch a particular chord among prospective buyers in some areas. It will, however, resonate in Manatee County.

Manatee County hosts the Florida west coast city of Bradenton, and is also close to Sarasota, Tampa and St. Petersburg. The county of 385,000 people has a clearly defined sustainability policy:

Being sustainable remains in the forefront of decision making for Manatee County as leaders balance the environment, the economy, and the human/social needs of our community. As science, technology, and information change on the issues of sustainability, we adjust our path but consistently take steps toward this goal.

The Hunters Point developers leverage the Manatee County mission to flesh out their pitch:

The network of homes...is the first community implemented by the sonnen-Pearl Homes partnership, one designed to help decarbonize Manatee County and surrounding regions of Florida by making green living affordable to a broader market.

The appeal is very similar to the ways in which auto manufacturers promote electric vehicles to the driving public. The Hunters Point website expands on the appeal of clean technology:

...You’re saying you’re ready to be a part of the future of homebuilding. You’re ready to live in a community that is its own power grid. You’re a forward-thinking person who cares about legacy you’ll leave for future generations. Hunters Point will be a community of like-minded individuals that share your values—people who aren’t afraid to be early adopters when they see the future being built before their eyes...

The takeaway here is that local governments with a strong sustainability mission can provide marketing support for the real estate industry as it pivots to meet the demand for more sustainable housing.

In the case of Hunter's Point, the sustainability message will be amplified by hundreds of residents. In addition to the 148 homes planned for Hunters Point, there will be a total of 720 rental apartments.

Energy storage and climate positivity

As for the climate positivity angle, that's where experience and advanced technology come in.

Pearl Homes launched in 2015 with a splash when it broke ground on Mirabella, an award winning 158-home development of LEED Platinum homes in Bradenton. According to Pearl, economies of scale helped to bring its LEED costs down to within 5 percent of a conventional single family home.

The U.S. Green Building Council gave Pearl its Power Builder of the Year award in 2017 for Mirabella, citing the company's unique "new paradigm" of mass-producing LEED Platinum (USGBC manages the LEED sustainability certification program for buildings, with Platinum being the highest level):

...From highly insulated walls and roofs, to high-efficiency HVAC and irrigation systems, to interior air quality, Mirabella offers sustainability and savings that few single-family home developments can deliver.

The Hunter's Point homes will have rooftop solar panels, a "smart" thermostat and an EV charging station. The energy storage and energy management angles are handled by sonnen.

Home energy storage is a major expense, but the online solar marketplace EnergySage points out the obvious: batteries that store solar power can be an economical investment over the long term because they shave down utility bills.

The sonnen energy storage system also provides homeowners with emergency power backup, an important consideration in today's era of climate change and extreme weather.

The combination of energy storage with LEED Platinum energy efficiency leads to a scenario in which Hunters Point homes could contribute more solar power to the grid than they consume -- in other words, a climate-positive scenario.

Google Home and microgrids

The climate-positive angle is maximized by the use of Google Home and its Nest smart thermostat technology.

With Google Home on board, the developers can coordinate energy use, production, and storage across the whole community. All together, Hunters Point will account for 9 megawatt-hours of storage capacity and 7.2 megawatts of power.

In conventional construction, a sizable new development could have a significant impact on the overall grid. With solar plus storage, Hunters Point can act as a "virtual power plant" that can contribute electricity to the grid when conditions are right. Sharing solar energy within the community also helps to minimize if not eliminate carbon impacts.

All of this activity intersects with the trend away from central power plants and toward a more resilient power supply based on microgrids and distributed energy resources. Cloud-based software, the Internet of Things, automation and artificial intelligence all come into play in this arena.

The full potential of microgrids has yet to be realized, but that could happen sooner rather than later. Nest, for one, has been working with software management companies to develop a distributed energy resource management platform (aka DERMS), which could become a significant means of accelerating clean power in the U.S.

In the meantime, it's worth emphasizing that sonnen and Pearl Homes understand that the future of home ownership looks very much like the electric vehicle (EV) revolution.

EV's are still pricey relative to gas-powered automobiles, but up-front costs are rapidly coming down, lifecycle costs are already competitive in some cases, public policy is supporting the technology transition, and consumers are beginning to grasp both the individual and the communal benefits of switching over to a low carbon lifestyle.

Image credit (screenshot): Hunters Point Pearl Homes & Marina.

Blockchain - When We Are All Responsible

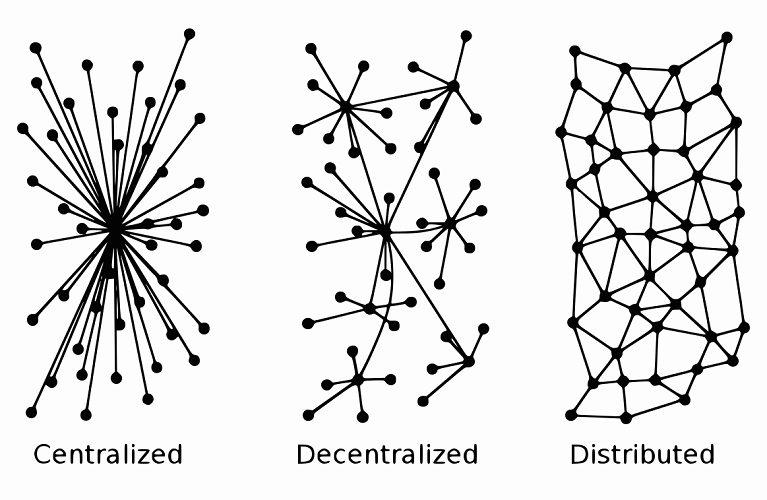

I have to thank Dr. Wayne Visser* for once again inspiring an article. In this case, it was this graphic that he shared and a short post about how this shows the promise of blockchain to potentially change governance structures, organizations and ways of working from centralized to distributed.

It graphically illustrates a model in which we are all be accountable to - and responsible for - each other.

Think about this as “self-policing” actions that are close to you; it becomes easier to see how this can and should work. There are no single "integral" links - scary for traditional managers, I know. But just as a bridge is built with redundant struts, this also means that if one were to fail, through anything from a simple mistake to deliberate malfeasance, there are others to compensate.

Think about the team approach to safety, as an example. If everyone is looking out for the other person, knowing that several others are looking out for them, a safety culture is born. And incentives at the team or group level further reinforce this shared accountability, without turning the culture into one of suspicion or finger pointing.

The same thing can apply to almost any other dimension of environmental, social or governance. And it can transcend organizational structures and boundaries, so that suppliers, customers and those within the community are all engaged. This may be somewhat idealistic, but the promise of blockchain - even as I cannot begin to explain the underlying technology - is that this level of transparency makes it easy for “error checking” and “self correction” in real-time.

Some companies will leverage this for storytelling; others will be able to show purchasers the source and supply chain in order to show and tell a compelling story. But for me, the far greater implications, and importance, rely in facilitating responsible and sustainable business processes.

For example, I have heard of examples where items can be traced back to their source in minutes rather than days or weeks. Think about the implications for a product that is, for the sake of argument, found to be out of specifications and therefore potentially dangerous. This digital “network” of accountability can not only determine the source, but where the products ended up, resulting in removing the questionable items faster while not limiting distribution of those that are good. Faster, more effective and complete and without causing any unnecessary interruptions or distress - or, of course, wasting things that are perfectly good because we cannot be sure.

The "secret sauce" of the technology is the way it fixes and time-stamps blocks of data by consensus and records any changes by adding new blocks in the chain. This promotes transparency and trust.Is this theoretical? Perhaps. But this is the coming promise and it will be a reality one day soon. I reached out to Dr. Visser to ask if he wanted to comment further and he offered this reflection:- Dr. Wayne Visser

"Blockchain is still massively over-hyped (many think it is the solution to everything, which it is not). Yet the potential for disrupting traditional ways of working and organizing is profound. By moving from hierarchical to distributed decision making, it can cut out managerial bottlenecks, and by moving from hierarchical to distributed (and encrypted) information storage, it can make our knowledge more secure. The "secret sauce" of the technology is the way it fixes and time-stamps blocks of data by consensus and records any changes by adding new blocks in the chain. This promotes transparency and trust. Companies like Provenance are already using blockchain to validate sustainable supply chains, linked to supportive micro-finance for producers. In the future, such traceable value chains will become standard practice - and also assist with our move to a circular economy."*Dr.Wayne Visser is Professor of Integrated Value and holds the Chair in Sustainable Transformation at Antwerp Management School, supported by BASF, Port of Antwerp and Randstad.

Companies Leading on Disability Inclusion Outperform Peers

Like many parents, I often think about what my young son will be when he grows up. As a person with disabilities, he faces unique challenges, but also brings unique strengths to everything he does. More employers, luckily, are beginning to realize the cultural and financial opportunities that disability inclusion can bring to the workplace.

Accenture, in partnership with Disability:IN and the American Association of People with Disabilities (AAPD), has released “Getting to Equal: The Disability Inclusion Advantage.” This report looks at both the disability practices and financial performance of 140 companies over the past four years.

One of the most significant findings in the report: Companies that “embrace best practices for employing and supporting more people with disabilities in their workforces” are several times more likely to outperform their peers financially.

The reality of employment for the 15.1 million Americans with disabilities

As of July 2018, only 29 percent of working age (16 to 64) Americans with disabilities were employed. Compare this with the 75 percent of Americans the same ages without disabilities who are working. Simply put – employers are missing out on an untapped talent pool of more than 10 million people.In 2017, the unemployment rate for people with disabilities (9.2 percent) was more than double that for people without a disability (4.2 percent), according to the Bureau of Labor Statistics.

Accenture’s analysis reports that the U.S. GDP could get up to a $25 billion boost if just 1 percent more people with disabilities join the workforce.

The business case for inclusion

“Persons with disabilities present business and industry with unique opportunities in labor-force diversity and corporate culture, and they’re a large consumer market eager to know which businesses authentically support their goals and dreams. Leading companies are accelerating disability inclusion as the next frontier of corporate social responsibility and mission-driven investing,” said Ted Kennedy, Jr. - disability rights attorney, Connecticut state senator and chairman of the AAPD board.The 140 companies analyzed in “Getting to Equal” have all participated in the Disability Equality Index(DEI) — a benchmarking tool that gives U.S. businesses an objective score on their disability inclusion policies and practices — over the past four years. Forty-five of the companies were identified as “Champions” for their leadership in disability inclusion and employment. Compared with the other companies in the study, the Champions had on average over the past four years:

- 28 percent higher revenue

- double the net income

- 30 percent higher economic profit margins.

- twice the likelihood of financially outperforming their peers.

The Four E’s: Steps to improve disability inclusion

“Getting to Equal” found four key actions that organizations can take to attract, hire, retain and advance the hiring of people with disabilities:- Employ: Companies must ensure that people with disabilities are represented, encouraged, and supported in the workplace.

- Enable: Leadership must provide employees with disabilities with tools, technology and accommodations to increase accessibility.

- Engage: Companies must generate awareness building through recruitment, disability education programs, and grassroots-led efforts like employee resource groups.

- Empower: Employers must create empowering environments through mentoring and coaching initiatives and skilling/re-skilling programs to ensure employees with disabilities continue to advance and thrive.

Image credit: StockSnap / Pixabay

Best Practices for Employee Data Protection

Data privacy is a primary concern for companies today, but that attention is often focused on customers. Yet they are not the only people whose data companies store. They also maintain information on their employees. And employees are apparently not all that confident that employers are doing a good job of protecting their personal data at the workplace.

Sixty-four percent of all Americans have experienced a breach in their personal data, according to a study conducted by the Pew Research Center, and about half of Americans feel that employee privacy is less secure now than it has been in years past.

This is not how it should be, says Gerard Chan, head of the global privacy office for Symantec. Privacy and the protection of personal data should be an integral part of the corporate culture and core values of every organization, he says.

“When it comes to privacy, companies need to remember that employees are just as important stakeholders as their customers,” Chan says. “Employees should feel their data has been protected by the company with no less of a standard than they would use to protect third-party data.”

As competition for top talent heats up, employee engagement is a top priority, and many companies use employee engagement software solutions to gather feedback from their teams. This information can be helpful to companies as they seek to improve their employee engagement, but it’s also highly sensitive and vulnerable to theft and breaches, Chan says.

Protecting employee data

Employers need to process and maintain a broad range of personal data for employees and they do so through the entire life cycle of the employment if not beyond, for example, during recruitment and onboarding process, during the course of the employment relationship, and even after it ends.

In addition to the personal data that is traditionally expected to be processed in the employer-employee relationship, such as contact details, right-to-work, and bank account information, employers will also process data about the employees as part of their day-to-day working lives. This could include data on their physical movements (CCTV and badges), data on their devices and corporate laptops, as well as data about their health and wellbeing, not to mention, in many cases, data about their families.

“Processing this vast amount of data brings with it a responsibility to ensure that employers both protect employees’ data and provide them with a level of privacy,” says Chan.

A global approach to employee data

Employee data is covered under the European Union’s recent General Data Protection Regulation (GDPR) and may very well be included in forthcoming data privacy legislation in the U.S. and elsewhere around the world. But not all companies have processes in place to properly manage employee data under the GDPR.

“International employers can stay ahead of the curve by adopting a global approach to how they maintain and process employee personal data that is mirrored on the GDPR. This will ensure that employees feel a sense of trust with their employer and engage employees to take personal data and privacy rights as a core value for their employer regardless of the local legal requirements,” Chan says.

Transparency is paramount

According to Chan, the GDPR provides data subjects, including employees, with increased transparency about how their data is managed and processed by their employers as well as bolstered data subject rights.

As he points out, employers must ensure that they have clear and easy-to-understand privacy notices for their employees, and those privacy notices should cover the broad spectrum of personal-data-processing activities that the employer will undertake during the course of the relationship.

“An area that most corporate organization struggle with is data retention,” Chan says. “Employers need to ensure that they have operationalized data retention and destruction process and policy in place. This will ensure that employers meet both the requirements of the GDPR from a storage limitation perspective, but also to minimize the time and resources needed when dealing with an employee data subject access request.”

Protecting sensitive information

In addition to all the other information companies traditionally collect and process about their employees, employee engagement solutions have become more prevalent. Such software has proven to be a successful way for companies to receive frank and honest feedback from employees while endeavoring to ensure that processes or technology are in place to ensure anonymity. What was once an annual online form or paper survey is now more often a real-time employee engagement solution that gathers regular feedback from employees.

Based on the feedback, companies develop metrics that they can use to measure the effectiveness of their culture, team building, and recruitment efforts. This is especially useful during changes in the organization.

But employee engagement software may also tap into highly sensitive information, even if not intentionally, Chan points out. Employees have the right to either opt in or out from sharing their feedback, and can choose to do so anonymously or not, but once they do participate, the data becomes the responsibility of the company. And more often than not, feedback that seems to be anonymous may be relatively easy to attribute to a particular employee because of the context in which it was given, the subject it relates to, or the view it expresses. Therefore, as with all information “this is susceptible to breach,” he says.

Prioritizing due diligence

Companies are keen to understand how to use employee engagement products while ensuring protection of employee data and compliance with legislation. The key, says Chan, is proper due diligence.

“Employers need to ensure that they conduct adequate due diligence on the solutions, and work with their security teams to ensure all applications are vetted and approved,” he advises. “Additionally, ensuring data is securely deleted and destroyed when it is no longer required is fundamental for ongoing compliance and reduction of risk of exposure.”

Employee engagement solutions experts also recommend that employers understand how cloud data is managed by the employee engagement vendor, and that they have a secure sign-on system for those using the employee engagement and feedback products.

Showing leadership in employee data protection

There are many ways that companies can demonstrate leadership in making sure employees understand that they care about protecting personal data. In addition to making it part of the corporate culture, privacy of personal data should be among the values “embedded across the organization from grass roots to executive level,” Chan says.

Privacy initiatives and training should be a regular part of the employees work life, he adds. “Leadership needs to take an active part in privacy initiatives.”

Many companies take the opportunity to engage employees on privacy issues on International Privacy Day.

“At Symantec we have put a lot of thought and planning into our operating model and this is now the backbone of our own privacy program, which we are very proud of,” Chan says.

Image: Rawpixel

Starbucks Aligns with New Circular Economy Roadmap

Last year’s shakeup in the global recycling market left cities across the U.S. scrambling for alternatives, and now it looks like the answer is at hand. The National League of Cities has just released a new recycling guide that comes down firmly on the side of the circular economy, and suggests a localized approach to recycling and waste recovery.

Benefits of a circular economy

The new guide recognizes that the solid waste problem cannot be solved by the global commodities market. Companies — like Starbucks — that contribute single use items to the waste stream need to step up and help cities promote more sustainable alternatives.Called Recycling Reimagined, the new guide incorporates recycling into the broader context of zero waste and the circular economy.

In a conventional economy, expediency and financial considerations drive waste handling. As a result, much of the trash generated by a community is gone forever — either incinerated or sent to a landfill.

A circular economy prioritizes the best use of materials and resources. With zero waste the ultimate goal, circular economies combine reuse, regeneration and recycling.

According to the new guide, cities could realize the benefits of a circular economy even before the zero waste goal is met:

“The benefits are manifold. A 75 percent diversion rate by 2030 could produce 1.1 million new jobs and reduce carbon dioxide by 276 million tons, as well as save billions of dollars.”

Optimism on zero waste

So, how realistic is the zero waste goal? Recycling Reimagined rests its case on the idea that recycling has been an overwhelming success in the U.S.That description may seem a little too rosy for some critics, considering that the overall recycling and composting rate in the U.S. was only 34 percent as of 2015.

Nevertheless, the numbers back it up. The guide notes that the composting and recycling rate was only 6.4 percent in 1960. Now, they can play a key role in public and environmental health for cities:

“In 2017, the U.S. recycling and reuse industry accounted for:

534,000 stable jobs

$30.6 billion in wages

$117 billion in economic activity and

$8.2 billion in state, local and federal tax revenues.”

In that context, the amount of non-recycled waste represents an opportunity and a challenge.

According to the guide, as of 2014 the U.S. generated 136 million tons of non-recycled waste, which ended up costing $6.8 billion to dispose.

Food waste alone accounts for a significant, recoverable resource. According to the guide, as of 2014 the U.S. generated 39 million tons of food waste, and the recovery composting rate was just 5.3 percent.

So, how can we make this work?

To achieve a waste diversion rate of 75 percent, the U.S. would have to double its 2015 recycling and composting rate.Using case studies from several U.S. cities as well as Copenhagen, Denmark and Vancouver, Canada, the guide focuses on concrete actions that yield quick results.

The case studies reveal common denominators that simply make plain common sense.

A successful zero waste program sets fact-based goals, engages the public continuously, and leverages municipal purchasing to promote the desired products and markets:

“Minimize single-use products and embrace single-material products that are most easily recyclable and compostable. Many cleaning products such as soaps and detergents are available in natural and biodegradable formulas that have minimal impact on municipal drinking water quality and treatment.”

Streamlining regulations, finding innovative ways to finance infrastructure and technology improvements, building partnerships and engaging regional support are among the other key elements.

One recommendation that may spark some controversy is a reliance on incineration as an alternative to landfilling.

That’s not an optimal solution, but it does provide for at least some degree of waste recovery in the form of energy generation.

In addition, a properly designed waste-to-energy facility can provide for the post-incineration recovery of metals and other materials.

Stimulating economic activity, zero waste style

Of all the guide’s recommendations, forming partnerships may provide the greatest long term results.The report’s case study for Phoenix, Arizona demonstrates the potential for enlisting entrepreneurs and stimulating economic activity within a few short years.

The city embarked on its zero waste journey in 2014, when the recycling and rate was just 20 percent. In addition, compostable material accounted for almost half of the entire waste stream.

Phoenix partnered with Arizona State University to launch an R&D center called the Resource Innovation and Solutions Network, which in turn hosts an eco-industrial incubator for zero waste businesses called the Research Innovation Campus.

The first tenant at the campus is a company that will tackle a significant local waste problem — palm fronds — by converting them to livestock feed.

That company sets the tone for taking on other challenges in the waste stream, including carpeting, foam, latex paint and treated wood.

As for Starbucks, the company is among those recognizing that the circular economy is inevitable. If they don’t take the lead, somewhere down the line they will have to deal with government regulations.

Image credit: National League of Cities

Top 3 Clean Energy Trends to Watch in 2019

Ethan Zindler is Head of Americas at Bloomberg New Energy Finance (BNEF), the definitive source of insight, data and news on the transformation of the energy economy. Zindler manages the company’s analyst and commercial teams in New York, Washington, San Francisco and Sao Paulo, Brazil.

Ahead of his speaker appearance at GLOBE Capital 2019, Zindler shares his insights on the future of clean energy, including the top three trends to watch out for in 2019.

The shift to low-carbon energy sources is happening, regardless of policy

Ethan Zindler: At BNEF, our view is that a fundamental shift toward lower-carbon technologies will continue. This shift will take place regardless of how much additional policy support is provided. Having said that, a concerted effort to achieve the goals of the Paris Agreement in the form of specific national, state or even municipal-level policies would certainly speed things up.By 2050, we estimate over $11 trillion will be invested in energy power generation and power storage assets, and around 85 percent of that investment will go to zero-carbon generation. This represents a very sizable potential opportunity. The estimate is based on our long-term New Energy Outlook, which is a projection established on the trajectories we’ve seen in the learning curves of relevant technologies, as well as the progress we’ve seen over the last 10 to 15 years. It is not founded on assumptions about relevant new policies.

The clean energy landscape has evolved

EZ: This is an interesting time for the clean energy sector. BNEF has been around for 15 years, and for the first 10 years, the best way to conduct market analysis was to simply look at which countries introduced generous subsidies. Where subsidies were created, large volumes of capital would flow very soon after. As soon as the subsidy spigot was turned off, private capital would stop flowing, and markets would dry up very quickly. During this time, you could argue we were as much policy analysts as market analysts.We’re now in a much more interesting period in which we see legitimate cost competition between zero-carbon sources of energy and incumbent fossil generation, and that’s exciting. It’s game on in terms of competition between technologies, and that competition can take place on an entirely unsubsidized basis.

The question is: When will we reach the point where this is no longer a competition, and clean energy technologies are the clear-cut winners and the cheapest in the market? We predict it will start to take place sometime between the middle and the end of the next decade.

Top 3 clean energy trends to watch out for in 2019

1. Batteries will continue to play a key role.

EZ: Not everyone thinks batteries are exciting, but I think they are. Batteries are an important instrument for enabling true clean power generation. Put simply, they allow us to use wind power when the wind is not blowing and solar power when the sun isn’t shining. We’re seeing incredible progress in terms of battery prices coming down, and around the world we’re starting to see projects that combine renewables and batteries to undercut fossil generation.2. Economies will grow without growing the demand for electricity.

EZ: We are seeing a general trend whereby the world’s wealthiest economies can grow their economies without growing the demand for electricity, and in some cases without growing their demand for energy overall. This is important because it means there is the potential to keep carbon emissions in check, at least in the power sector.3. Basic energy needs will be met with existing technology.

EZ: Around 1.5 billion people around the world have no meaningful access to energy. What’s exciting is that basic energy needs, such as running a lantern or a fan, can be served with existing technologies. The challenge we face is no longer cost, but the logistics of implementing these technologies.As this group of people moves beyond basic energy access, the potential is there to do it cleanly, as solar, wind, microgrids, and other technologies render the concept of a hub-and-spoke grid outdated. The potential for addressing energy access issues—and addressing it without contributing to climate change—is very exciting.

Previously posted on GLOBE Series.

Image credit: Sweet Ice Cream Photography via Unsplash