On Earth Day, Leaders Call for Climate Finance as Part of COVID-19 Recovery

In 2009, developed countries agreed to reach $100 billion per year in climate finance by 2020 to help poorer nations reduce emissions and adapt to climate impacts. Tracking progress is notoriously difficult, primarily because world leaders never decided what type of funding counts toward the goal. But some advocacy groups insist existing climate finance committed for developing countries is far below what's needed to ensure their resilience to the threats ahead.

For example, in a 2019 report, the charitable organization Oxfam estimated that people living in the world’s poorest countries each receive around $3 per year — less than a penny per day — to protect themselves from the impacts of climate change.

Against the backdrop of a human health and economic crisis they call a "warning" for what's to come, financial thinkers and leaders say now is the time to push for change.

"What world leaders today have shown is that we have the money: World governments have already spent over US$6 trillion just to keep the business-as-usual economy open [during this crisis]," said Ingmar Rentzhog, who sat on the board of more than a half a dozen companies before founding the climate action network We Don't Have Time. "We are at a crossroad in humanity now: Either we spend this money to go back to business as usual, the unsustainable world that doesn't work, or we invest in all of the solutions we have out there. I think it's a really simple choice."

"We have a strategic responsibility to recover better"

In March of last year, a devastating cyclone hit the coastal city of Beira in central Mozambique. Months' worth of rain fell in a matter of hours, killing 600 people and leaving more than 1.8 million displaced. Mere weeks later, the city was hit again — this time by the most intense tropical cyclone ever known to have made landfall in this region of the country.

The damage was unprecedented. Catastrophic flooding left more than 2.6 million people in Mozambique, Zimbabwe and Malawi in need of aid. It caused US$3.2 billion worth of loss and damage in Mozambique alone, equivalent to 22 percent of the country’s GDP and half of its national budget, according to Oxfam. From a monetary perspective, this is roughly equivalent to 23 Hurricane Katrinas hitting the U.S. at once.

The United Nations called the cyclones “a wake-up call” for vulnerable countries “to build resistance" against climate change, but they are not isolated incidents. Further north, on the Horn of Africa, prolonged drought left more than 15 million people in need of humanitarian aid in Somalia, Ethiopia and Kenya last year. In its report, Oxfam detailed these stories as “a terrifying portent of things to come without urgent action from world leaders.”

Now, as the novel coronavirus creeps across the Southern Hemisphere — and the World Health Organization warns the number of cases in Africa could surpass 10 million in six months — some of these same nations are again among the most vulnerable. Mozambique, Somalia and Ethiopia all have less than one hospital bed per 1,000 people, compared to around three in the U.S. and eight in Germany, putting the former group's healthcare systems at high risk of becoming overwhelmed, all while continuing to cope with threats from climate change.

"In the words of U.N. Secretary General Antonio Guterres, 'We have a strategic responsibility now to recover better,'" Nick Robins, professor in practice for sustainable finance at the London School of Economics, said on Monday at a webcast hosted by We Don't Have Time.

Sounding the alarm for a commitment to climate finance

In his former role as head of the Climate Change Centre of Excellence at HSBC, Robins and his colleagues estimated that green stimulus programs amounted to just over 16 percent of the total public finance boost following the Great Recession of 2008. "Governments now must take a more comprehensive approach so that 100 percent of their COVID recovery plans are aligned with the Paris climate agreement, with a special focus on the needs of the most vulnerable, to deliver a just transition," he insisted.

But that's a far cry from where we are now. World governments back the fossil fuel industry to the tune of around $5 trillion a year in the form of subsidies and a failure to put a price on carbon, according to the International Monetary Fund.

"Let's be clear on the scale of the financial mismatch," Robins suggested. "On the one hand, we are making a perverse bet of well over 5 percent of global gross domestic product in supporting fossil fuels and carbon pollution. On the other hand, the investment required to save the climate has been estimated at about 1 percent of gross domestic product. This has never been about an issue of lack of money or finance, but about the rules that govern the allocation of that capital."

Here is where COVID-19 response and recovery plans provide opportunity. "COVID-19 is the world's largest cost-benefit analysis of precaution," said Paul Dickinson, executive chair of CDP. "Sadly, we were warned by health experts to prepare for pandemics, and in most cases governments did not heed the warning, and we see the results today."

"This is just a rehearsal for climate change," he continued. "We have learned that we are vulnerable. We have learned that we can — and sometimes we have to — change the whole economy to protect ourselves. We have to take action now on climate change, because this pandemic is just a warning of what happens when we ignore problems that we know can destroy us."

Governments consider green stimulus as part of COVID-19 recovery: Will climate finance be next?

Large financial institutions including the World Bank have similarly advocated for climate finance and other forms of green stimulus as part of COVID-19 recovery.

Last week, a French member of the European Parliament followed suit, launching the European Alliance for Green Recovery and calling for climate change to be central in post-COVID-19 plans. The CEOs from 37 major European businesses, as well as heads of state from across the bloc, have since signed on. Both China and South Korea have also noted capital allocation for sustainable infrastructure as part of their recovery plans.

As of now, these proposals primarily focus on building green infrastructure and lowering greenhouse gas emissions within each country's own borders. Whether capital will make its way to vulnerable countries is another matter entirely.

For their part, groups ranging from the World Resources Institute, to the Institute for Sustainable Communities, to the United Nations itself have laid out roadmaps for delivering climate finance to developing countries as the world recovers from COVID-19.

This work is far from over. But as Earth Day enters its 50th year, Robins reminds us that the sustainable finance space has already come a long way — including more than $80 trillion in investor assets and more than $47 trillion in banking assets now committed to integrate environmental, social and governance (ESG) factors into decision-making. "We don't have a lack of commitment or a lack of awareness. What we need now is acceleration and deepening of action to deliver the transformation and financial apprentices we need to see," Robins said.

"Special attention should be given to the needs of developing countries, where the coronavirus impacts are said to be the most severe and the capital for the transition is in shortest supply," he concluded. "In this way, we could meet and exceed the longstanding pledge for $100 billion in annual north-south flows in climate finance, and we could make COP26 in 2021 the place where sustainable recovery plans are shared, upgraded and coordinated."

Image credits: Lucas Marcomini/Unsplash

Food Waste Reduction Platform Retools to Help Retailers Track Demand Amidst COVID-19 Pandemic

New York City startup Crisp launched last fall with an AI-driven demand forecasting platform that helps retailers and their suppliers reduce overstocking and cut down on food waste. Around 30 beta customers in industries such as meat, dairy and produce have already seen promising results from the tool, including fewer short orders and an 80 percent reduction in scrapped inventory, according to the company.

With its breadth of experience in forecasting, Crisp was well positioned to retool its services to help retailers cope with shifting consumer demands in the wake of COVID-19.

In late March, the startup launched a modeling tool that allows retailers to look at point-of-sale data from a European grocer to more accurately forecast U.S. purchasing trends. "Europe is a few weeks ahead of us, from the U.S. perspective," which means purchasing data from European retailers is indicative of what's to come for stores in the U.S., said Trevor Hough, VP of product for Crisp.

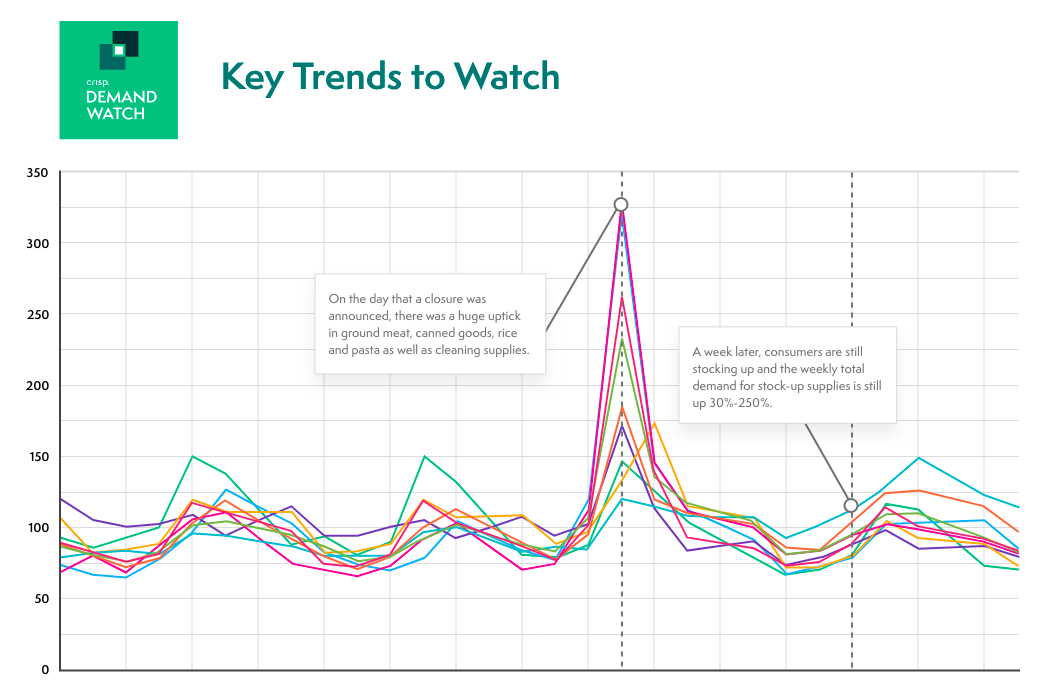

As you can see in the graph below, taken from Crisp's DemandWatch tool, purchasing surged in the days immediately following the announcement of Europe's stay-at-home orders. A week later, demand remained 30 to 250 percent higher than usual as people continued to stock up. "Then, for the most part, things went back to normal," Hough explained. "If you're a supplier, you can take a look at this and marry it with … your own data in order to be better prepared for either an influx or a drop in demand."

(Image: This chart shows demand for grocery essentials, such as cleaning supplies, canned goods, rice, pasta and ground meat, before, during and after the announcement of Europe's stay-at-home orders. Click to enlarge.)

Mitigating the 'bullwhip effect' in the wake of COVID-19

Crisp's food waste reduction tool largely centers on a supply chain theory known as the bullwhip effect. First identified by a trio of Stanford professors and published in MIT's Sloan Management Review in 1997, the theory likens inaccurate information passed through the supply chain to the flick of a bullwhip in a person's hand: A small movement at one end creates larger and larger ripples in the other direction.

When it comes to supply chains like the food system, the theory dictates that a small inaccuracy in consumer demand forecasting — plus or minus 5 percent — can result in companies further back in the chain thinking demand has increased or decreased by up to 40 percent. "A slight ripple on the consumer side — which is in the retailer — can create huge, cascading impacts at other areas in the supply chain," Hough told us.

Under normal circumstances, the result is food being left in the field to rot or companies carrying overstock that's ultimately scrapped, leading to roughly a third of the global food supply going to waste each year. But in extraordinary times such as these, the effects can be even more damaging.

"The retailer sees a huge spike and doesn’t know how long it will last, and they start to order thousands of cases of coffee or toilet paper or whatever the case is," Hough explained. "That then hits everyone else, and now all of a sudden all of these people are saying, 'I need thousands and thousands and thousands.'”

As suppliers dramatically over-order or over-produce in response to inaccurate forecasts, many will be left with stock they can't sell as demand returns to normal — leading to a massive financial hit and, particularly in the case of perishable goods, a whole lot of waste. Wasted food becomes particularly heartbreaking amidst the COVID-19 pandemic, as millions find themselves out of work and photos of miles-long food pantry lines go viral on social media.

Accurate data can push back against the problem and ultimately ensure food ends up where it's needed, Crisp's team says. "Global events like COVID-19 heighten the interconnectivity of our food supply chain," said Are Traasdahl, co-founder and CEO of Crisp. “Having this data available and knowing that U.S. behavior is following European behavior at a two- to four-week time span is critical for U.S. grocers and food manufacturers as they try to predict demand for categories of food and grocery products, restock shelves, and meet the needs of citizens.”

The consumer-to-supplier time lag can be up to four months, Hough explained further. "So, the demand spike we’re seeing won’t actually hit a supplier for 12 to 16 weeks, which is why this is so critical: The more advanced information you can give to a supplier, the more accurately they're able to respond to it."

Crisp's DemandWatch data model, which can be filtered by product category down to the store level, is updated in real time and is free to grocers, retailers, suppliers, brokers, distributors, CPG manufacturers and other organizations along the supply chain.

Image credits: Adrien Delforge/Unsplash and Crisp

Food Banks Are Overwhelmed. Here’s How Business Is Lending Them a Lifeline

By now you’ve seen the photos on newswires, including the heartbreaking sight of the line of cars outside the San Antonio Food Bank. Across the U.S., similar photos of lines outside food banks from San Jose to Chicago to New York show how the novel coronavirus has taken a devastating toll — a much higher one than the aftermath of the 2008-2009 global financial crisis and, earlier in that decade, the 9/11 tragedy.

For those of us who endured spells of unemployment after those crises and remember the friends and relatives asking us why we didn’t just "go out and get any job,” these photos taken at food banks sear into our consciousness the devastating impact the COVID-19 crisis is having on millions of families. Businesses have shuttered, and while some retailers including Walmart are on a hiring spree, paychecks have stopped coming for millions of people while the stimulus money can’t arrive fast enough, if private lenders don’t get their hands on it first.

Adding to this perfect, or should we say, horrific storm: As this study from ReFED sums up, the food supply chain in the U.S. couldn’t recalibrate in time. The spread of COVID-19 left no room to adjust as consumers emptied store shelves, forced businesses to close, and left many farmers who rely on foodservice distribution companies in the lurch. Food products such as fresh produce, dairy and meat that were meant for a large restaurant chain just can’t be suddenly repackaged on a dime and diverted to grocery stores. Remember, it’s called the food supply chain, not a food sling shot, for a reason. One kink in the chain, and the whole movement of goods can go awry.

And therein lies why many are confronting the threat of hunger, a shift that probably could have occurred over a few months couldn’t move fast enough in a few weeks, and now food banks find themselves inundated by families who only a month ago were able to get by. Sure, the commitment to food banks that Jeff Bezos made earlier this month certainly helps, yet demands on food banks will surge as spring turns into summer.

In the midst of this crisis, we have seen many companies step up. Here are a few:

Danone North America: This was one of the first companies to cut a check to food banks as the COVID-19 pandemic spread across the U.S. Last month, the dairy and plant-based foods company said it would donate $1.5 million, including $300,000 worth of food products, to food banks across 12 U.S. states.

Dole: The brand most associated with pineapple has been involved with several local hunger relief efforts. According to an emailed statement to TriplePundit, Dole has supported World Central Kitchen’s efforts in California, teamed up with Lyft to help deliver meals in Chicago and Seattle, and delivered treats such as smoothies and fruit cups to frontline healthcare workers at approximately 650 hospitals nationwide.

International Paper: You don’t have to be a food company or retailer to support the fight against hunger. This Memphis-based pulp and paper company recently donated thousands of boxes to food banks in southern California.

MetLife: Through its foundation, MetLife announced last month it would donate $1 million to food banks in cities where it has a “significant presence.”

Starbucks: The coffee giant is one example of a retailer that had to move fast and on the fly as it was forced to shift from becoming that “third place” other than home or office to hang out, and instead has become a drive-thru operation. The company said it has lent some of its trucking and logistics capacity to assist with local food banks. In addition, it has donated $1 million to Feeding America to support its COVID-19 response fund. And all that milk? Starbucks said at least 62,000 gallons of it, along with 700,000 meals, found their way to food banks across U.S. and Canadian communities.

Subaru of America: The automaker says it is working with two of its distributors, in partnership with the nonprofit Feeding America, to provide 50 million meals across the U.S. Subaru also said it would work with its 600-plus dealerships across the country to support local food banks with donations, food drives and volunteering campaigns.

Unilever: Another first-mover during this crisis, the CPG giant’s North America division announced a donation of over $8 million in products to food banks across the U.S. And as reported in USA Today, Unilever’s 14 U.S. factories will launch a “national day of service” on May 21, during which the company will manufacture and then deliver as much as $12 million worth of products.

To put all of these efforts in context, Maryland’s state government had to scramble fast to funnel $8 million into local food banks, as Gov. Larry Hogan explained during a recent interview with CNN.

The bottom line: Not only do food banks need more contributions like those we mentioned above, but food companies need to rethink their supply chains, and do so fast, to weed out inefficiencies, slash waste and help get available food to the people who need it most.

Image credit: Pixabay

Coal, Natural Gas Stakeholders Pivot to Renewable Hydrogen

Despite the ravages of COVID-19, the hydrogen economy continues to take shape. The latest development involves an interesting twist as it positions renewable hydrogen as a key pathway for weaning the global economy off of natural gas, in addition to coal. In other words, green hydrogen is pushing the global decarbonization envelope past the coal-to-gas transition, indicating that fossil-based natural gas is quickly losing its reputation as a “cleaner” alternative.

A plan for competitive renewable hydrogen

Hydrogen is a zero-emission fuel, but the primary source of hydrogen today is fossil-based natural gas. On the plus side, renewable hydrogen can be produced by electrolysis, which involves splitting water with an electrical current. To complete the green circle, the current can be sourced from renewable energy.

Until recent years, the hydrogen economy dream seemed far off in the future. Electrolysis is not a new technology, but scaling it up economically is a challenge. Furthermore, in past years wind and solar costs were prohibitively high.

Building new infrastructure for renewable hydrogen is another key challenge, and that is where the new twist comes in.

Conceived by Siemens’s Power and Gas division and the global energy company Uniper, the new plan aims to leverage both coal and natural gas infrastructure to help make renewable hydrogen competitive in the energy market, leading to a full-on commitment to the hydrogen economy.

“Power-to-X” and renewable hydrogen

“Our future lies in hydrogen,” is the way Jochen Eickholt, a member of Siemens‘ Energy executive board, summed it up in a press release announcing the new green hydrogen partnership between the two companies.

That statement is especially significant considering that both companies have been heavily invested in both the coal and natural gas areas.

Nevertheless, both have been making progress on decarbonization, and the new partnership will help accelerate their progress.

Called Power-to-X, the concept pivots on “sector coupling,” the idea that renewable hydrogen can enable a holistic approach to major economic sectors that were previously treated separately, including power generation, industry, and transportation.

“Sector coupling acts as a link between renewable energy sources such as wind, solar, biomass, waste, etc. and consumers such as industry, households, or use in other sectors,” Siemens explains.

As an energy carrier and storage medium, renewable hydrogen can act as the glue holding these various energy consumers together (as shown in the image above, courtesy Siemens).

Siemens makes it clear that the Power-to-X concept alone will not lead to 100 percent decarbonization. However, it does have the potential to play a significant role in a low-carbon economy.

According to Siemens, even if power demand grows 25 percent in the coming years, sector coupling with renewable hydrogen could halve the consumption of primary fossil energy (“primary” is a reference that avoids double-counting coke coal and other fossil fuel products).

The connection to brownfield sites

The real mystery is how to achieve cost-competitiveness in today’s energy market.

To that end, Siemens and Uniper plan to focus on repurposing existing fossil energy infrastructure, including the “brownfields” left behind when coal units are shuttered.

The plan will help Uniper follow through on its commitment to close its last coal power plants, while also reducing carbon emissions from its fossil gas operations.

Uniper already has a head start on zero emission energy through its hydropower and nuclear power plants in Germany and Sweden. Last year the company also proposed a new green hydrogen consortium in Germany, to build on its earlier initiatives on renewable hydrogen.

With the Siemens partnership, Uniper will investigate its existing fossil gas turbines and storage facilities for the potential to add renewable hydrogen, in addition to moving ahead with its plans for closing coal power plants.

Uniper anticipates that the cross-sector approach will make it possible to produce green hydrogen for the market in the “near future.”

That optimism represents a sea change in attitude compared to just a few years ago, when Toyota’s vision for a hydrogen economy was met with abundant skepticism.

With other leading supporters like Siemens and Uniper on board, it looks like the hydrogen economy doubters have some revising to do.

Image credit: Siemens

Coronabonds Boost, and Risk, EU Solidarity and Prosperity

Global cooperation is of paramount importance at a time when the world is united against a common enemy, the novel coronavirus. As a coalition of nations, the European Union is uniquely positioned to facilitate inter-nation support. Last month, a newly coined term, “coronabonds,” entered the scene to describe the concept of European nations pooling their collective debt in order to spread financial risk more equitably across the continent. Countries like Germany and the Netherlands would back this securitization plan as guarantors, making it easier for nations like Italy and Spain to acquire low-interest bonds.

Such a program could make a huge difference for companies hit hard by the coronavirus crisis. Italian Prime Minister Guiseppe Conte insisted over the weekend that coronabonds would not be about absolving Italy’s past debt burdens, but instead show the 19-nation currency bloc can commit to solving problems together. Businesses could also use a lifeline: Italy’s northern region, home to 40 percent of the country’s total industrial capacity, was one of the first industrial areas in Europe to be hit hard by this crisis.

Coronabonds: Who shoulders the burden?

Financial cooperation when it comes to taking on debt is not foreign to Europe, but the very idea of coronabonds faces backlash within some northern European countries. One fear is that co-signed debt would roll over into post-pandemic times. Residents of the Netherlands in particular are reportedly quite staunch in their position. Polling data suggests that many Germans are also wary of any aggressive bond programs.

French President Emmanuel Macron has been a champion of coronabonds, not only because of France’s current needs, but for the long-term future of the EU. Addressing the arguments southern European populists have long made about various EU policies and northern European countries, Macron said the following during an interview with the Financial Times:

“’They’re in favor of Europe when it means exporting to you the goods they produce. They’re for Europe when it means having your labor come over and produce the car parts we no longer make at home. But they’re not for Europe when it means sharing the burden.’”

On that point, Lucas Guttenberg, deputy director of the Jacques Delors Centre think tank in Berlin, recently told New York Magazine, “If some countries come out of this [pandemic] much stronger than others, that is going to politically undermine the European project as a whole.” Countries like Germany are already faring better than southern European counterparts like Italy, partly due to preexisting infrastructure, and will likely recover more quickly because of their wealth.

Will unity and solidarity persevere in the EU?

Ahead of further discussions about coronabonds, the EU’s finance ministers agreed on Thursday to a $590 billion package to support member state businesses and citizens during this recession. A day later, despite resistance from northern countries, the European Parliament passed a ”recovery bond” proposal by a significant majority. While the resolution isn’t binding, it’s a good sign that EU budget decisions will be cooperative with southern European needs.

“Recovery funds,” inspired by coronabonds, could be the topic of discussion during the Eurogroup’s follow-up meeting on April 23. These bonds aren’t exactly like coronabonds — instead of focusing on debt, they will support future investment like building sustainable and digital infrastructure.

After a rocky March, especially as the EU failed to support Italy at the beginning of the outbreak, European unity may be seeing a comeback. During a debate in the European Parliament on Thursday, EU Commissioner President Ursula von der Leyen said despite missteps and complacency early on, “Europe has now become the world’s beating heart of solidarity.”

“This Union of ours will get us through,” she said.

Not everyone has been sanguine about how the leading European powers managed this crisis. The Guardian was particularly pointed in its criticism of the continent’s COVID-19 response in an April 19 op-ed:

“Throughout, there has been a lack of co-ordination: Countries imposed their own restrictions, imposed their own border controls, and banned the export of much-needed medical supplies. Italy received speedier help from China than from its EU partners, and, not surprisingly, that has left a sour taste.”

Coronabonds for the good of the whole EU

Whether coronabonds or recovery bonds are on the table at this point, economists point to the fact that these bonds don’t need to cost wealthy countries much, if designed well. Further, they could actually benefit the entire EU. However, some observers recommend that the EU should take a larger and more federalist step into sharing the debt burden this pandemic will impose on the region.

France’s finance minister, Bruno Le Maire, has gone on the record saying the longstanding divisions within the EU, which involve dynamics between the north and the south as well as richer and poorer countries, needs to be cast aside. It will up to the wealthier nations, he said, to assist their less well-off neighbors that have been hit hard by the COVID-19 pandemic.

Outside of Europe, some leaders who were involved with rebuilding the global economy after the 2008-2009 global financial crisis have suggested bigger and bolder action is necessary.

During the 2008 recession in the United States, Neel Kashkari, then U.S. Assistant Secretary of the Treasury, supervised the bailout of banks and car companies. When speaking with NPR’s Planet Money last month, his advice for a swift economic recovery after the coronavirus pandemic was: Don’t be penny wise and pound foolish. Giving generously during a crisis pays off; being frugal leads to a long and arduous recovery.

A united EU, especially one that has learned from its early coronavirus mistakes, may just err on the side of generosity this time around.

Image credit: ML Watts/Wiki Commons

Energy Firms Score Another Free Pass as Texas Seeks to Duck More EPA Rules

In 2015, the U.S. Environmental Protection Agency issued the Startup, Shutdown and Malfunction Rule (SSM). The rule requires industrial facilities in Texas and 35 other states to follow specific air pollution guidelines when starting and shutting down plants or when a malfunction occurs. Previously, plants were able to leverage a loophole to release unlimited pollutants during startups, shutdowns and malfunctions without legal penalties under the Clean Air Act.

States had 18 months to submit their plans to comply with the SSM rule, but within that time period, Donald Trump became U.S. president, and some states — including Texas — still had not filed their plans. In January of this year, the U.S. EPA began a process to roll back the SSM rule for Texas. On April 7, the Sierra Club and several other advocacy groups filed litigation to stop the EPA from reopening the SSM loophole in Texas.

States including Texas, as well as industry groups, previously challenged the SSM rule. That case was headed for oral arguments in the D.C. Circuit Court in 2017 when the Trump administration asked for a stay so its attorneys could buy time to study the rule. Texas is the first state the EPA has carved out of the original SSM rule, said Andrea Issod, senior staff attorney with Sierra Club’s Environmental Law Program.

Why Texas?

There are a couple of things going on here: the rollback of environmental protections by the Trump administration and business-as-usual in Texas.

The current administration has rolled back several key environmental protections. These shifts in policy affected the Clean Power Plan to reduce emissions from the U.S. energy sector, as well as many others that addressed environmental issues including clean air, clean water and habitat restoration.

The SSM rule is another offensive against the Clean Air Act in a long line of this White House’s attacks. As with many of the Trump administration’s rollbacks, the arguments for rescinding these regulations are generally not clearly laid out and lack legal reasonableness.

Case in point: As of March 14, the administration has only won legal attempts at environmental rollbacks in a handful of cases. When compared with previous presidents, the success rate is abysmal: 5 percent during this administration compared to an overall 69 percent success rate of President Trump’s predecessors.

The Lone Star State continues to chip away at EPA rules

Further, fighting environmental regulation is par for the course in Texas. For over a decade, I worked in the state as an advocate for clean air, energy, and water policy. The only change we saw after November 2016 was that Texas would be on the same side as the decision-makers in Washington.

During the Barack Obama administration, Texas went on a lawsuit rampage, and 27 of the 49 cases focused on objections to environmental regulations. Texas won six of those 27 cases. Four of those wins were in the 5th Circuit Court of Appeals, a notoriously conservative court where Texas prefers to have its cases heard and where the state is hoping the SSM loophole case will be heard, as opposed to the D.C. Circuit, where environmental litigation stands a fairer chance, explained Issod of the Sierra Club.

Yes, we’re in the middle of a crisis, but lax EPA rules come at a bad time

The Trump administration has been on a roll rescinding environmental rules since coming into office. But the timing of the litigation and rule reversals are particularly cruel considering the climate risks U.S. citizens face. During extreme weather events, such as hurricanes and floods, industrial facilities often must be shut down.

But before the deployment of the SSM rule, the loophole allowed industrial facilities to release unlimited pollutants into the air. Typically those who live near such facilities already suffer from poor air quality, and levels of pollution could be 10 times the amount normally allowed. The Texas state government’s resistance to the SSM rule meant that vulnerable, low-income communities located near refineries in Houston were made more so in the aftermath of Hurricane Harvey, to use just one example.

Many people in those communities are already suffering from pollution-related illnesses, such as asthma, making them more at risk to complications from COVID-19. Allowing this loophole would exacerbate an already serious problem. Add that to the fact the hurricane season starts in little over a month, and meteorologists are predicting a more active than normal hurricane season this year. With no clear indication of how long the pandemic will last, a busy hurricane season need not be worsened by a loophole that allows more air pollution.

Image credit: David Mark/Pixabay

What COVID-19 Means for Philanthropy: Experts Weigh In

(Image: A woman has her temperature checked at a COVID-19 response center in Beijing.)

As governments grapple with the scope of need associated with the COVID-19 pandemic, philanthropists are challenged to step up and fill the gap — and many are responding in kind. By the start of this month, more than $4.3 billion in philanthropic commitments had been made around COVID-19, said Jennifer Alcorn, deputy director of philanthropic partnerships for the Bill and Melinda Gates Foundation.

During a recent webcast hosted by Stanford Social Innovation Review (SSIR), Alcorn and two other philanthropy professionals shared case studies in how the sector is responding and offered advice on how donors of any size can contribute. Read on for their insights.

In the U.S., the coronavirus relief bill provides incentive for charitable giving

"In the midst of this unprecedented crisis, there are so many different pressing needs that it's going to take everyone's collective resources to make a difference as quickly as possible," said Kim Laughton, president of Schwab Charitable.

Of course, at a time when more than 22 million people — or roughly 1 in 7 American workers — have filed for unemployment benefits in the past four weeks alone, not everyone has the ability to give. But for those who are fortunate enough to be less financially affected by the pandemic and related shutdowns, the coronavirus aid bill enacted on March 27 provides incentive to give more, Laughton explained during SSIR's webcast.

As most of us probably know, the bill provides a one-time payment of up to $1,200 per adult and $500 per child. "If you're one of the lucky ones who has a stable job, expects to remain employed, and you do not need this payment, you might consider giving all or part of it to charity," she said.

Additionally, donors at any level can deduct up to $300 in charitable contributions from their 2020 taxable income through a provision in the bill. Wealthier donors who itemize in their filings can typically deduct up to 60 percent of their taxable income by donating to charity. The relief bill increases this to 100 percent, excluding donor-advised funds and private foundations, and any excess can be rolled over for five years.

Schwab Charitable offers a list of nonprofits working on COVID-19 response and vetted by the Center for Disaster Philanthropy to guide individual donors.

Regional action plans put donations to work

In the U.S., some of the leading philanthropic organizations on the front lines of COVID-19 are the country's more than 700 community foundations. While the average community foundation serves around 180,000 people from a given city or county, the scale of coronavirus-related challenges has prompted many to come together in united regional action plans.

Cities along the U.S. West Coast, including Seattle, San Francisco and Portland, Oregon, were among the first hit by COVID-19, and case studies from this region shed light on how locally-based philanthropists can maximize their response.

In the Bay Area, for example, the Silicon Valley Community Foundation (SVCF) primarily serves San Mateo and Santa Clara counties, about an hour's drive south of San Francisco. Its initial COVID-19 fund, launched February, was aimed at serving these two counties, but "we quickly realized this had to be a regional response," said Nicole Taylor, president and CEO of the foundation.

It joined with the eight other community foundations serving all 10 counties across the Bay Area to establish a regional response fund. Working with dozens of nonprofits across the region, the fund channeled charitable donations to help affected residents pay rent, buy food and meet other basic needs in the wake of the pandemic. The group also launched a nonprofit emergency fund to help charitable organizations across the region weather the storm.

Still, the level of need is daunting. Last month, SVCF joined with the mayor of San Jose and others to raise $11 million for Santa Clara County residents through the local nonprofit Destination: Home. "They received 4,400 applications for financial assistance, and that $11 million was depleted in three days," Taylor said.

More than 7,000 individuals and families are now on the waitlist for assistance in Santa Clara County alone. "That is the level of need we're seeing right here in one of the wealthiest regions in our country," she continued. "The scale of job loss in just two weeks was on par with the first two years of the great recession back in 2008 and 2009."

The small businesses that employ roughly half of all California workers are also being hit hard. "Before the crisis, half of the country's small businesses only had 15 days of cash reserve, and almost overnight, so many of them had to close their doors or put their work on pause," Taylor said. The community foundation partners joined with California Gov. Gavin Newsom and the nonprofit microfinance lender Opportunity Fund on a separate regional relief fund to help small businesses stay afloat.

Overall, SVCF has seen giving increase by 30 percent compared to this time last year, and "community foundations across the country are doing very, very similar activities," Taylor said. Use this locator from the Council on Foundations to find and support community foundations near you.

More work is needed to fight the pandemic in the Southern Hemisphere

As healthcare systems are pushed to the brink even in the world's wealthiest countries, the number of confirmed coronavirus cases is growing exponentially across Africa and South Asia. This is what keeps Jennifer Alcorn and her team at the Bill and Melinda Gates Foundation up at night, she told attendees at the SSIR event.

"In the U.S., for the most part, social distancing will be effective, but in many other parts of the world where multiple generations live together, social distancing can be impossible," she explained. "It's critical that we expand enough capacity to ensure that diagnostic testing and results can be processed quickly and efficiently, particularly on the ground in low- and middle-income countries."

The foundation has already committed more than $250 million to support the development of testing, treatments and vaccines, fund centers for disease control in African and South Asia, and contribute to national and sub-national responses to the pandemic worldwide. Its Combating COVID-19 Fund has received donations as small as $10 and as large as $25 million, Alcorn said.

Meanwhile, with funds from large donors including the U.K. government, the Wellcome Trust, Mastercard and the Chan Zuckerberg Initiative, the foundation's COVID-19 Therapeutics Accelerator is looking to bring treatments, diagnostics and vaccines to market as quickly as possible. Last month, the accelerator announced grants of $20 million each to fund clinical trials at the University of Washington, University of Oxford and La Jolla Institute for Immunology.

"Our goal is to have something to market as early as the end of the year," Alcorn said. "We're moving fast, and our first clinical trials started last week. But we also know that developing and delivering diagnostics that can be used in low-resource settings is going to be a top priority."

The bottom line: Philanthropy professionals dig in for the long haul

The early response from philanthropic organizations and their donors is surely promising. All three experts on SSIR's panel reported increased giving to their respective organizations compared to this time last year, but each underscored that their sector's work is far from over.

"The urgency of need is critical, but we also have to understand that we are in this for the long haul," said Taylor of SVCF. "There are going to be waves of response that need to happen — not just now in response, but also in recovery."

Image: Kian Zhang and Liz Martin via Unsplash

Domestic Workers, the Unforgotten Casualty of This Pandemic

The roster of workers who are highly vulnerable to the ravages of the novel coronavirus pandemic is a long one, including retail employees, drivers working for public transit systems, farmworkers, meatpacking company employees, first responders and, of course, those on the front lines in hospitals. As they face more threats from hunger to eviction, domestic workers have largely been in the shadows as the work available to them has for the most part dried up.

We can shake our virtual fists at fast-food companies, grocery chains and online delivery services on social media. We can tout our own companies’ contributions in corporate blog posts or on these firms’ media relations pages. But for those of us who focus on social responsibility and corporate sustainability, no mechanism exists that forces us to ensure domestic workers are taken care of during this crisis.

One comment on a recent webinar sums up this problem succinctly. To paraphrase: Those who are saving money on daily expenses, such as cleaning bills, by working from home might consider passing these savings along to a charitable organization or small business, a webcast panelist said.

Here's our response: While we appreciate the sentiment of cutting a check for a nonprofit or ordering from a local business, if you know your job is secure, and you have had the means to hire domestic help, here’s a simple question. Why not continue to pay that person, even if she — face it, more than 90 percent of domestic workers go by “she” — is not able to clean your house or watch the children, as they did daily, weekly or twice a month as she could before?

Enter the lone voice for domestic workers

The National Domestic Workers Alliance is largely a lone voice doing what it can to shine light on the tragedy now confronting domestic workers. This coalition has tasked itself by doing what it can to slow the spread of COVID-19 by providing emergency assistance for domestic workers (as in house cleaners and childcare workers) during this crisis.

The alliance’s numbers starkly illustrate what these citizens now face. About three-quarters of domestic workers are making a living that had subjected them under the U.S. poverty line. Their median wage is just over $10 an hour, and almost half of these workers are paid an hourly wage that is below the minimum level necessary to support their families.

Furthermore, domestic workers aren’t in a position to make the decisions necessary to stop the spread of COVID-19 on their terms. According to the alliance’s survey, 94 percent of these workers reported that any cancellations were made by their clients, not by them. And 70 percent say they have no idea if they will return to those clients’ homes once this pandemic subsides.

Without any social safety, these workers on society’s margins are at huge risk

The rest of this story should be obvious: The vast majority of domestic workers are unable to pay the rent and buy food this month, and because of the nature of their work, many will not qualify for any benefits under the U.S. federal government’s coronavirus relief package.

Hence domestic workers were clearly among those citizens on Pope Francis’s mind when he suggested earlier this week that governments consider a universal basic income in order to support those who have been the hardest hit by this crisis. The National Domestic Workers Alliance’s executive director, Ai-jen Poo, echoed that sentiment in a recent public statement emailed to TriplePundit.

“All of us deserve to feel safe and secure in our lives and work. But for millions of working people, especially people like domestic workers who have lived and worked in the shadows, a lost paycheck could mean losing a roof over their heads or being unable to put food on the table for the families,” said Ms. Poo. “This crisis has heightened that reality and brought it into sharp relief. The inherent value of all work and all of humanity has been revealed through the crisis. Right now, we must respond by urgently providing assistance to all who need it. There is no other greater human imperative.”

Until a universal basic income becomes a reality, or when these essential workers also qualify for the same benefits as the rest of us do, it’s now up to us to speak up for domestic workers, who don’t belong to any “stakeholder group” about which many of us in this space discuss.

In the meantime, this video the National Domestic Workers Alliance released yesterday makes it clear what we can do right now. America’s companies, large and small, could help on this front to start by finding a way to send a gentle reminder to their employees: Be sure to take care of those who are closest to you.

Image credit: Clay Banks/Unsplash

As Coconut Products Gain Popularity, Certification is Essential for Sustainability

In the west, coconut-based products are booming in popularity. Coconut-based foods and personal care products that include oil, cream, water, and charcoal have all become a popular cooking and cosmetic choices, appearing on more and more shelves and ingredient labels across the country.

Here’s the problem: There remains no broad supply chain certification schemes for coconut-based products, meaning little traceability and a high likelihood that coconuts are being produced unsustainably, or with the use of unfair labor practices including child labor.

“The brands that were in the coconut space didn't really understand the sustainability issues that were facing their supply chains,” said Molly Renaldo, partnerships manager for Fair Trade USA, during a recent interview with TriplePundit. “Whereas, in coffee, cocoa and bananas, the market just knows that ‘hey, we don't want child labor.’”

The global coconut industry still lacks a unified certification process

In fact, nearly every other widely traded tropical commodity has a broad ethical sourcing scheme. Palm oil has the Roundtable on Sustainable Palm Oil (RSPO), cacao has the Cocoa and Forests Initiative, rubber has the Global Platform for Sustainable Natural Rubber and even soy now has the Roundtable on Responsible Soy.

This is worrying because the environmental and human rights concerns facing coconuts are real. There are widespread allegations of child labor on coconut farms, according to the United States Department of Labor. Moreover, low wages are persistent across this industry. Coconut farmers very often toil in terrible poverty — as high as 60 percent of them in the Philippines, the world’s top coconut producer. There, farmers I spoke with told me they often make as little as 12 cents per coconut. This adds up to less than $2 a day, according to Fair Trade USA.

The truth is, unless there is traceability — from consumer to farmer — it is nearly impossible to know whether or not your coconut oil, water, or cream is being sourced from an environmentally or socially irresponsible actor, or if any of the high prices you are paying are actually ending up in a farmer’s pocket. This is true for any supply chain: Opacity breeds abuses.

Fair trade is a path toward transparency and fairness for coconut farmers

Here’s the good news: Some nonprofits and corporations have started to address the need for traceability in the coconut industry. The leader is the fair trade movement, and the United States-based nonprofit Fair Trade USA, which launched a certification scheme for coconuts earlier this decade.

“When we first started, no one knew about any of the supply chain issues,” Renaldo said. “The beginning of the program was really just about educating brands.”

That’s because Fair Trade USA takes a market-based approach. Namely, it doesn’t seek to expand sourcing until it is certain it has enough buyers for a particular product. What it provides is complete traceability and transparency — and the opportunity for brands to know and work with farmers in Southeast Asia.

“We often take brands to go meet their farmers and see how things happen on the ground,” Renaldo explained. “It’s really incredible to be able to have brands see the work that the farmers are doing, and then have the farmers finally see someone valuing the work that they do.”

Another similar effort is the the Sustainable Certified Coconut Oil project led by the German development agency GIZ, the Rainforest Alliance and the agribusiness company Cargill, one of the world’s largest traders of tropical commodities.

“We have seen growing customer demand for sustainable certified oil,” said Vivien Nacion, a project manager at Cargill Philippines, during a recent talk with TriplePundit. “They want to make sure the product they consume comes from a farm that is not violating environmental standards.”

Cargill and GIZ have been training farmers on the southern Philippine island of Mindanao and the Indonesian island of Sulawesi, empowering them to improve farming practices in exchange for higher prices. In just a few years, they’ve helped thousands of farmers increase incomes by between 12 and 17 percent. Now, they need to find more brands looking to source sustainably.

With scale comes accountability

“We are looking into expanding the market demand for Rainforest Alliance certified coconut oil,” Christiane Hornikel, program manager for nuts and fruit juices at the Rainforest Alliance, told TriplePundit. “We are looking in the food sector, personal care products like shampoos, lotions, crème, as well other manufacturing products that use bio-based materials.”

This is the challenge. Right now, together, these projects are at a small scale, empowering a few thousand of the estimated 8 million coconut farmers in Southeast Asia. Brands need to source more sustainable coconut. Consumer demand, too, will be key in pushing brands so that these projects can grow just as similar efforts have in the oil palm, cocoa, and chocolate industries.

“We really have to focus on how we make sure consumers really understand coconut supply chains,” Renaldo said. Key to that, she adds, will be brands telling these stories to their customers.

Of the brands taking leadership when it comes to sourcing sustainable coconut, some of them are the usual suspects like Lush, Harmless Harvest, Nutiva and AlterEco. Others are surprising. Kroger, the country’s largest grocery chain and second largest retailer, has been sourcing fair trade coconut for its Simple Truth store label brand, showing that even low-cost food products can be produced with ethically sourced ingredients.

Public pressure has led brands to commit to traceability in industries where labor or environmental abuses are well known, such as the palm oil, garment and shoe supply chains. Coconuts have yet to receive the same level of attention or scrutiny. Smart brands know that’s no excuse to ignore their responsibility. Ensuring traceability and sustainability from the beginning is not only a smart way to avoid negative publicity, but to ensure a reliable supply of high-quality products for their business.

This story was supported by a grant from the Pulitzer Center.

Image credit: Pixabay

From Diagnostics to Masks: How a Cisco Global Problem Solver Challenge Winner Is Helping Front-line Health Workers

OmniVis developed a handheld, IoT device that detects cholera in water samples within 30 minutes of collection. Until now, that process took over a week. Shorter detection times can reduce illness and death from the disease. The biotechnology company was a second runner-up in the 2017 Cisco Global Problem Solver Challenge. The challenge recognizes entrepreneurs who are using technology to address a social or environmental problem.

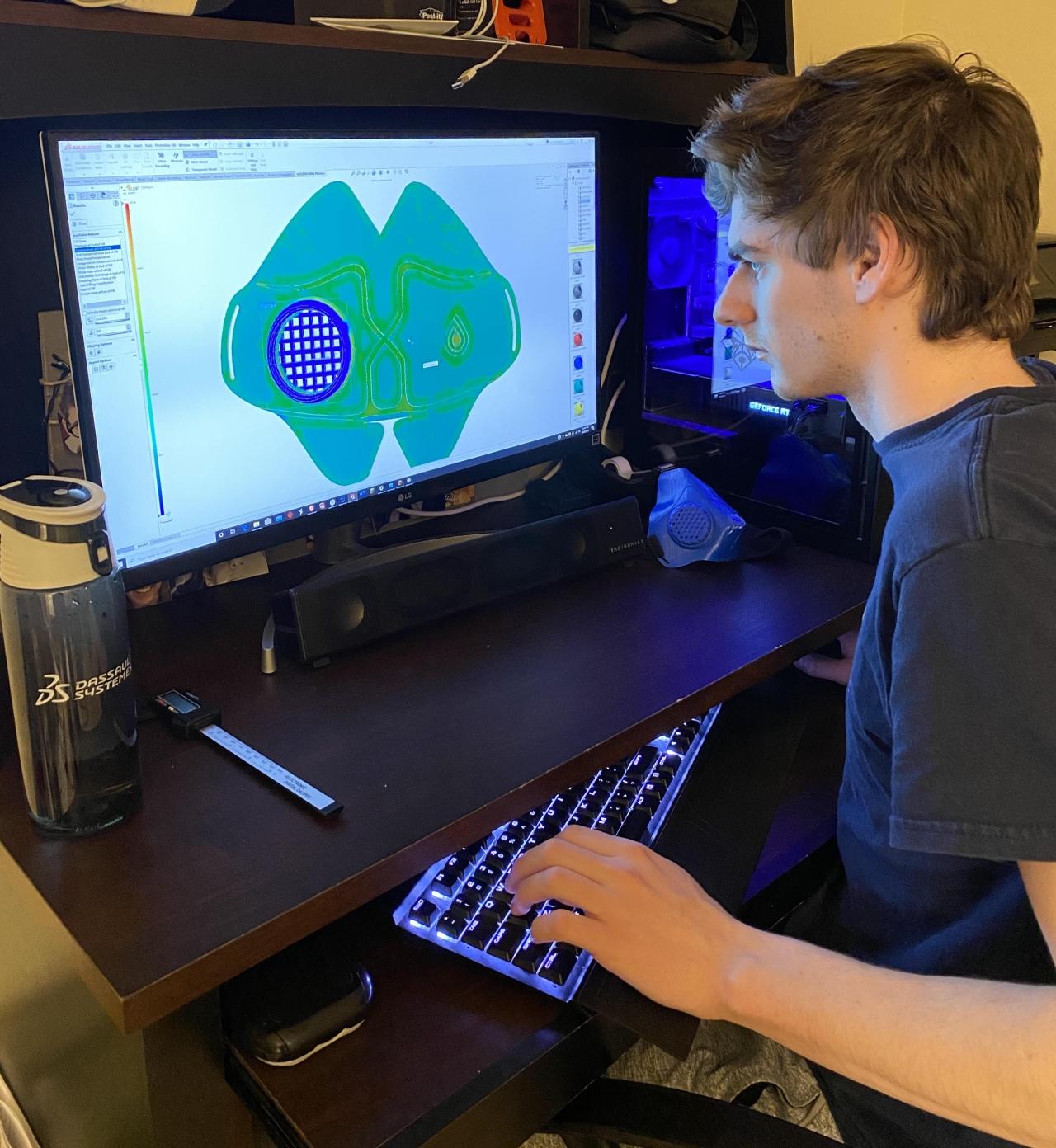

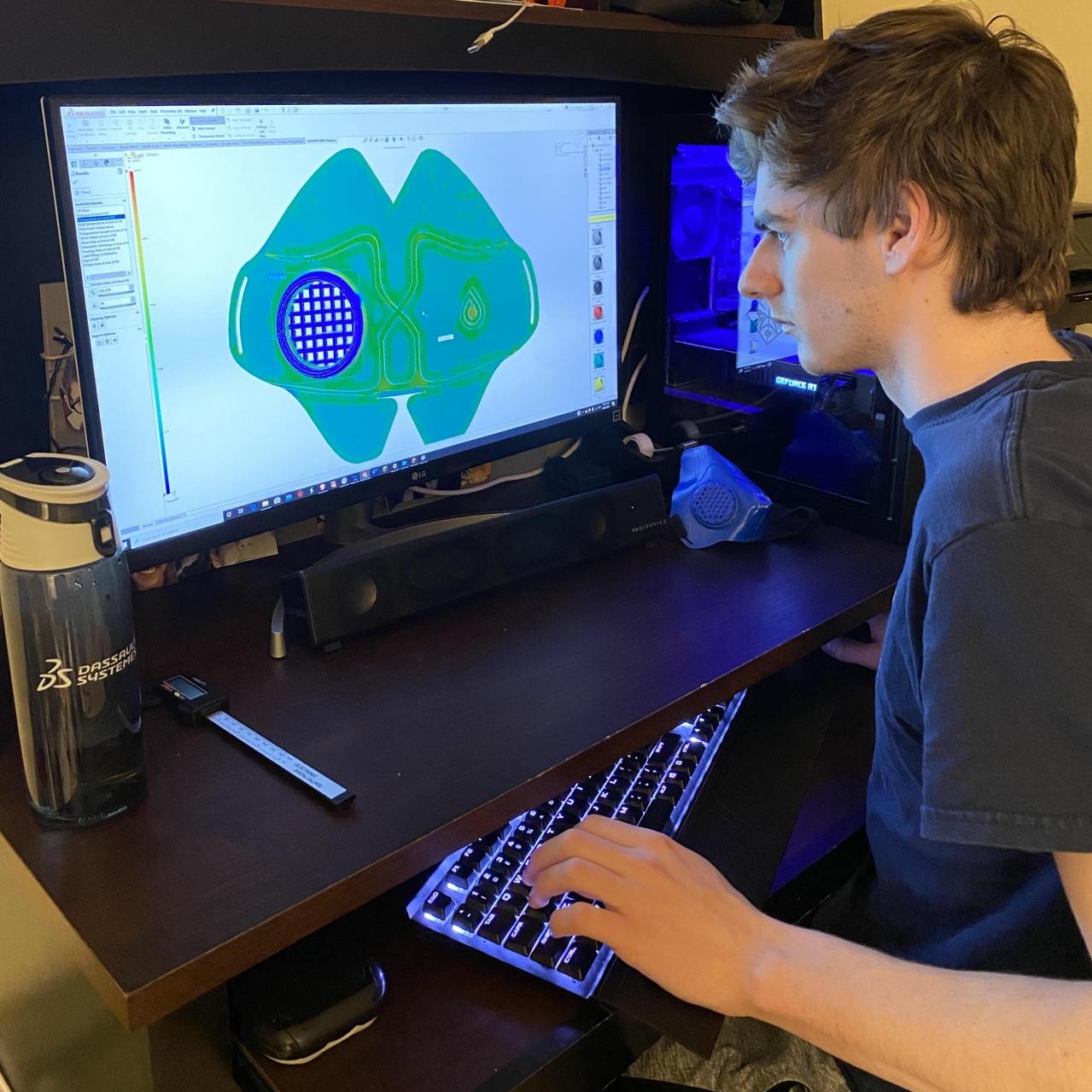

Now, the team behind OmniVis is using Solidworks to design the OmniMask, which is a tool that they typically use for designing their diagnostics device technology. OmniMask is a 3D-printed mask that was developed to protect front line health workers who don’t have access to enough personal protective equipment (PPE). OmniMask is unique because it is compatible with faces of various shapes and sizes. Using easily accessible materials, OmniMask was designed to be open-source for facilities with 3D printers.

The design and prototype process behind OmniMask

Jordan Florian, Global Health Engineer at OmniVis, and Michelle Florian, Finance and Grants Manager, teamed up to spearhead OmniMask. The married couple’s journey started on a Sunday morning at their home in Indianapolis, Indiana. After spending an entire week working from home, Michelle and Jordan felt there was more they could do to help health workers who were caring for patients with COVID-19.

“We have a lot of family and friends in healthcare and saw things on social media from people who didn’t have PPE. There were designs online for 3D- printed masks, but we could tell they were less than ideal,” said Jordan. The designs he found were very rigid around a user’s face, and there were a lot of gaps. Anyone with a face shape that deviated from the “norm” wouldn’t be able to wear the typical 3D mask.

Michelle and Jordan came up with an idea for a mask that would print completely flat and would form to the user’s face. According to Jordan, the first version was “pretty bad.” After trying it on, they started drawing on the mask, cutting it, and folding it back out. They analyzed the issues on a computer, so they knew what to change, which made the iteration process extremely fast compared to what they usually do with diagnostics.

Making sure OmniMask is accessible and fits everyone

Katherine Clayton, Co-Founder & CEO of OmniVis, suggested trying the mask on different faces. Michelle and Jordan took turns trying on masks and made a few more tweaks. The mask can be customized by applying heat, like from a hairdryer, while wearing the mask. This customized fit ensures there are no gaps or leaks, which is essential when designing a mask with a high-grade filter. Katherine also helped Jordan and Michelle scale down the mask for kids who may suffer from health issues that put them at higher risk of disease – adopting a user-centered design approach, so anyone can use the product.

After that, it was about finalizing the materials. They decided to use PLA filament, which is a pretty standard 3D printer material. “Instead of making customized material, we wanted to make it accessible. We respect those special design materials, but we need to make sure that things are easily sourced,” Michelle shared. Another unique aspect of their design is the filter, which needed to be up-to-par with the standard N95 filters. To make OmniMask accessible, they used hospital-grade furnace filters that they were able to source online. The filter blocks particulates of 0.3 microns or larger, the same as the N95. The filter is a little circle about 1.75 inches in diameter. Right now, they are sending about 10 to 20 filters with each mask. They recommend only 8 hours of use per each filter. You can wipe down the OmniMask after each use and put in a new filter.

Pivoting Operations from the Cholera Testing Kit to OmniMasks

When it came to pivoting their operations from the cholera testing kit to OmniMask, Katherine shared that it has been a balance. OmniVis will always focus on diagnostics because they believe in the importance of prevention and its ability to change the course of disease outbreaks. “Michelle and Jordan fit the cultural values that OmniVis has, making medical devices for good and helping to prevent the spread of disease,” Katherine said.

From a business perspective, as a for-profit company, OmniVis needs to be sustainable. But Katherine expressed that they believe charging for OmniMask is not right during a time of need. OmniMask is an open-source product, so someone else in another part of the world can make it. “Our overall vision is to prevent disease. The way we usually do that is by giving people a way to detect disease. In this case, what came to us is how the transmission of such a contagious virus can be stopped with the right type of mask. OmniMask is something we can do for the world, on our own time,” said Jordan.

With generous funding from Peace First, they are distributing OmniMask to health care workers and individuals who are at higher risk of infection on a local scale first, with 20 distributed so far and 25 orders pending. “We are hoping to find partners who can donate funds that we can use specifically to make and distribute the OmniMask. Our hope and intention are to reach as many people as we can with the partners that we gain,” Michelle shared. Katherine added that they are looking for partners to help them scientifically test the OmniMask and see how well it does at protecting individuals. The team is also hoping to find a partner to help them figure out the best way to make the filters, since not everyone has access to a laser cutter and the filters need to be cut into small circles.

Working together to design and deliver PPE

Katherine advised others who are interested in designing PPE to approach it from the perspective of working together, instead of the usual competitive mindset. Jordan has some additional advice: “It’s not about profiting from this. Unfortunately, we have seen that, and that is one of the big reasons we aren’t charging for OmniMask. You need to approach it with a global health-compassionate mindset, or you won’t have the right intentions when you make your product.”

If you are interested in learning more about OmniVis and their response to COVID-19, please visit their COVID-19 Response Center. OmniVis plans to make the OmniMask file available to the public, so anyone with a 3D printer can make one from home. OmniVis is looking to partner with third party testing facilities to determine mask efficacy and to find manufacturing partners for scale-up. If you are interested in a partnership or donating funds to help with the testing, manufacturing, or distribution of OmniMask, please contact the team directly.

Previously posted on the Cisco Corporate Social Responsibility News blog and the 3BL Media newsroom.

Image credit: Cisco