Add These Sustainability and CSR Webinars to Your Calendar This Week

(Mr. Whiskers is sick of boring webinars too, but we've got you both covered.)

Having trouble sifting through all of those webinars? Boy, do we hear you. We're all for the chance to connect from afar and learn about important topics at a time when it's especially crucial to educate ourselves, but the daily invites, updates and reminders can easily become overwhelming. Of the dozens we've received for this week alone, these stood out most to us — and each are worth a bookmark if you're looking to fill a few holes in your calendar (you're welcome).

The Global Boardroom: Shaping Policy, Business and Finance in a Time of Crisis

Hosted by: The Financial Times and The Next Web

When: All day May 12-14, starting at 11:50 a.m. BST/6:50 a.m. EDT

What: This three-day web event brings senior decision-makers in policy, business, tech, and finance together with FT journalists to discuss the COVID-19 pandemic and its impact on people and economies. Leaders from multilateral groups such as the World Health Organization and International Monetary Fund — along with companies like Volvo, Mastercard and Ikea — will touch on how the public and private sectors can work together to ensure a just response and recovery.

Masterclass: Business and Gender Equality and Challenges for Women in Supply Chains

Hosted by: Business Call to Action and Oxfam

When: May 12 (Business and Gender Equality) and May 14 (Women in Supply Chains), both at 8 a.m. EDT

What: Learn about some of the most pressing gender issues in this pair of webinars hosted by the charitable organization Oxfam and Business Call to Action, a private-sector coalition focused on advancing the U.N. Sustainable Development Goals (SDGs).

On May 12, the groups unpack the business case for pursuing gender equality at major multinational companies, with a focus on recommendations for firms looking to improve. On May 14, they'll zoom in on gender and human rights issues within global supply chains, specifically the barriers faced by low-income women workers and producers.

Register for Masterclass on Gender Equality (free) here

Register for Masterclass on Challenges for Women in Supply Chains (free) here

Leading With Humanity

Hosted by: MIT Sloan Management Review

When: May 13 at 11 a.m. EDT

What: As we've seen time and again during this crisis, those who lead with empathy are most successful at protecting their teams and directing their businesses from response to recovery. Paul Michelman, editor-in-chief of MIT's Sloan Management Review, will join Morela Hernandez from the University of Virginia's Darden School of Business to discuss it means to embrace your duty to others, how to check your personal privileges and biases, and how to leverage your expertise to serve your teams. The format is workshop-style with no slide presentations (cue sigh of relief).

Ceres 2020: Going Digital

Hosted by: Ceres

When: Select dates in May and June (events this week on May 12 and May 14)

What: The investor-focused sustainability nonprofit Ceres has moved its 2020 conference online. With an agenda spread through May and June, topics vary from decarbonizing industries and engaging investors to the Build Back Better initiative surrounding a green and equitable recovery from COVID-19. Events are free for those previously registered for Ceres 2020. Others can register for a fee.

View the agenda and register here

Best Practice Supplier Engagement

Hosted by: Ethical Corporation and Reuters Events

When: May 13 at 10 a.m. EDT

What: Moderator Ellen Grieseme of Future500 will speak with representatives from PepsiCo, Cathay Pacific Airways, and CDP about how to engage with suppliers to ensure transparency, worker rights and environmental sustainability. The conversation will range from environmental strategies that decarbonize supply chains to supporting suppliers as they deal with the effects of COVID-19.

Learn from Home: Corporate Citizenship and Reputation

Hosted by: 3BL Media

When: May 13 at 1 p.m. EDT

What: TriplePundit's parent company 3BL Media will sit down with Dave Stangis, a longtime sustainability executive who did stints at both Campbell Soup Company and Intel. Anyone who knows Stangis knows he's all about lifting others up — and his social media pages are often full of shared job openings for people in his network looking for work. In this free webinar, he'll share his insights into how sustainability provides business value and ways companies can support their stakeholders during the COVID-19 crisis.

Mayors of 10 U.S. Cities Look to Sustainable Recovery After COVID-19

The mayors of 10 U.S. cities have joined two dozen city leaders from around the world in signing a statement of principles endorsing guidelines for a healthy, equitable and sustainable economic recovery from the COVID-19 pandemic. The C40 group of cities, representing more than 750 civic leaders worldwide, warn that recovery from COVID-19 “should not be a return to ‘business as usual,’ because that is a world on track for 3 degrees Celsius or more of over-heating.”

The principles in the statement include an adherence to public health and scientific expertise, a commitment to address issues of equity that have been made evident during the pandemic, and investment in city and community resilience to protect against future threats, including climate change.

Two American cities in particular stand out as being on the frontline of both this pandemic and the climate crisis: Houston and New Orleans. Both cities’ mayors have signed the statement of principles. Both have much experience to share and a long road ahead.

The impact of COVID-19 on NOLA and Houston

Both Houston and New Orleans (pictured above) have borne the brunt of their states’ pandemic impacts. Both cities also have diverse populations. Houston’s population is about a quarter African American and has the third largest Hispanic population in the U.S. Further, an estimated 400,000 undocumented immigrants live in the Texas’s largest city. More than 20 percent of the people in the city live at or below the poverty line. Farther east in Louisiana, the population of New Orleans is about 60 percent African American, and an estimated 35,000 undocumented immigrants live in the city. Further, about 25 percent of the population lives at or below the poverty level.

All of this matters, because communities of color and low-income communities have been the hardest hit by the pandemic. Significantly more African Americans and Latinx patients are hospitalized or die from the virus than white patients. Many in these communities and in immigrant communities are doing much of the essential work, putting them at further risk. The pandemic adds insult to injury, as these communities have long been on the front lines of the climate crisis due to poor air and water quality and generations of environmental injustice.

Resilience in NOLA and Houston

New Orleans and Houston are in the climate crosshairs. Hurricanes Katrina and Harvey are the first and second most costly hurricanes in recorded history, each totaling over $100 billion in damages. The 2020 hurricane season starts June 1, and so far evidence suggests that this season will be an above-normal year. Neither city can ever rest on its laurels when hurricanes churn in the Gulf of Mexico. Studies conducted after each storm bore out the evidence of what the news told us: African American communities and low-income communities bore the brunt of the hurricane-induced flooding. In addition to the inequity, this puts added pressure on public health responses when such disasters occur.

Rebuilding from a natural disaster like a hurricane is a complicated business, but it is relatively localized compared to the rebuilding that will be required when this pandemic finally ends. Investments in public health systems are critical, but so are investments in communities. Post-hurricane, resilience must be built into recovery efforts — and pandemic recovery must also include resilience.

The aftermath of COVID-19 will require a close examination of public and private health systems, and part of that will be to address the inequity in our current economic system, from who is considered essential to how to protect the most vulnerable. This pandemic, like past extreme weather events, is not the last public health challenge cities will face. Businesses in both of these cities also face countless challenges as state and local governments give conflicting signals about how and when they will reopen — and for companies to thrive, they’ll need healthy employees who feel safe and secure about a return to work.

Image credit: João Francisco/Unsplash

Worker Safety Is Central to the Economic Case for Keeping Public Transportation Running

As the world socially distances to protect the most vulnerable from the new coronavirus, many activities and public services have quieted. One such service is public transportation. Over the past two months, public transportation channels across the world have seen significant declines in ridership.

That slump could at first be a relief for the essential workers who keep those systems running, but it also comes at a cost. First and foremost, at least in the United States, public transit workers have not been adequately protected. City officials across the U.S. have been slow to implement safety measures on buses and trains. Transit workers have been getting sick, and over 100 have died from coronavirus-related complications around the country.

A reduction in ridership, ironically, has led to overcrowded bus lines in some areas. As ridership decreases and many bus and train operators choose not to work due to unsafe conditions, people are relying on reduced service. In some cases, this means buses are more crowded than they were three months ago.

In Tampa, Florida, for example, service on the busiest routes has decreased from running every 15 minutes to every hour. “I absolutely don’t feel safe,” Vera Johnson, a Tampa bus driver, told the local television news channel WTSP-TV.

Transportation funding is a huge challenge

From a financial perspective, a decrease in ridership also means that cities won't see the same flow of revenue from fares — and cash-strapped City Halls are finding it difficult to sustain current transportation needs. In some cases, the future viability of public transportation itself has been brought into question.

Some support comes in the form of the federal coronavirus aid package passed in late March, which allocated $25 billion to public transit agencies.

The funds come as a relief to cities like San Francisco that rely significantly on fare revenue for operation. Bay Area Rapid Transit (BART) is losing an estimated $37 million per month due to loss of ridership. Fares represent 60 percent of the system’s operating budget. “For BART, these emergency funds can be the difference between needing to shut down when our reserves run out and maintaining service to keep the San Francisco Bay Area moving,” BART general manager, Bob Powers, told Mass Transit Magazine.

The New York Metropolitan Transit Authority (MTA) has received $3.8 billion from the relief bill, but it’s asking for double that amount. Without additional support, MTA Chairman and CEO Patrick Foye told Fortune Magazine, “The present and future of the MTA are in serious jeopardy.”

Even if cities receive adequate funds to keep moving, there remains an innovation gap. Cities need to keep transit workers and riders safe and comfortable. Business-as-usual is not cutting it — and the businesses that rely on their employees to get to and from work could suffer in the long run, too.

The economic impact of public transportation

It should come as no surprise that letting public transportation decay during months of city-wide shutdowns does not benefit people or local economies. For one, public transportation is providing means for many essential workers to keep the U.S. running.

And a study from 2013 found that the hidden value of public transportation to any city is between $1.5 million to $1.8 billion a year, depending on its size. Public transportation nurtures agglomeration — a technical term for the clustering of people that brings economic productivity.

Transforming transportation for the good of drivers, riders and the economy

Some cities are already seeing a phased reopening of activities. As activity resumes, protecting transit workers should be of utmost priority. To accomplish a reopening of normal transit operations that protect all, the World Resources Institute (WRI) offers five principles for city leaders that can guide investment and growth.

Ensure stability through revenue support to transit operations: As the country reopens, fare revenue will likely remain low as people fear bus crowding. Cities should explore alternative financing options — congestion pricing and parking management are two options.

Create high-quality bus and transit infrastructure: Washington, D.C. is already taking advantage of a 95 percent decrease in ridership to conduct summer maintenance on much of its Metrorail system. The WRI recommends using this time to create dedicated bus lanes to improve transit reliability and comfort.

Modernize and electrify bus fleets: Cities have a chance to use stimulus funds to modernize their fleets — an opportunity that doesn’t come around often. If a complete overhaul isn’t possible, cities should invest in incremental upgrades, the WRI suggests. Digitization can improve service quality and thus increase ridership.

Invest in cycling and walking: The WRI points to a study that shows every $1 million invested in cycling creates up to 11 jobs. Milan is looking to cycling and walking as it emerges from its coronavirus crisis by permanently opening 22 miles of streets to bikes and pedestrians.

Get governance right: Cities should not work alone, the group concludes. Coordination, especially when it comes to transportation, is essential. By working together, cities can ensure that they don’t just survive the pandemic, but rebuild to be greener, safer and more productive.

The WRI makes it clear that investing intelligently in public transportation systems during and after the coronavirus pandemic will aid economic recovery. These are large-scale interventions.

On a more human scale, policymakers around the wold have employed temporary interventions to protect operators and riders, including signage to remind rides about social distancing, deploying larger vehicles and having riders enter from a bus’s back door. The Massachusetts Bay Transportation Authority is providing bus drivers with a button to push if their buses become over-crowded — a manager can then send more vehicles onto the route.

There’s no question that reaping the economic benefits of a healthy public transportation system requires a healthy and happy workforce. Letting public transit workers fend for themselves as ridership increases just isn’t ethical.

As Ronald Spring, a New York bus operator, said at a March 5 meeting with New York’s MTA: “We are supposed to have systems in place for this. We are supposed to have equipment for us to go out and serve the public even in a crisis. But we didn’t see any of that happening like it should have.”

Another driver, Daniel Cruz, who tested positive for coronavirus, told the New York Times that even though he loves his job, he is not looking forward to going back. “I feel like we’ve been left to defend ourselves,” he said.

If driver shortages of more than 90 percent in places like Detroit should communicate anything to city officials, it’s that public transportation investments and improvements must put frontline employees first.

Image credit: Matthew Henry/Unsplash

At a Time of Loss, the CEO of JetBlue Showed His Humanity

It’s easy to criticize politicians, business leaders and, okay, even our neighbors for how some of them have conducted themselves during this pandemic. And trust us, here on TriplePundit, we have not held back in calling companies accountable for actions that in the very least are tone-deaf to at most, egregious (and that’s being tactful). But in fairness, none of us has ever experienced a time like this, so all of us are learning as we continue on through this crisis. One CEO who could teach his peers how to show compassion and empathy is JetBlue CEO Robin Hayes.

Last week, it was up to Hayes to participate in JetBlue’s obligatory quarterly conference call to announce the company’s latest financial results. But instead of doling out the usual corporate speak, Hayes paid tribute to the six JetBlue employees who passed away from COVID-19, the disease caused by the new coronavirus:

“We are deeply saddened to have lost six crew members to the coronavirus, including a pilot, two members of our in-flight community, one support center colleague, and two airport crew members. Ralph Gismondi, Charles "Chuck" Lewis, Jared Lovos, Kevin McAdoo, Ray Pabon, and Nikki Thorne were valued and amazing members of our JetBlue team, each with a special and unique story.”

Hayes continued with an anecdote about each employee. One was a former New York City firefighter who showed up for duty at Ground Zero on 9/11. Another was retired from the U.S. Air Force. He then asked the earnings call attendees to pause for a moment to remember these JetBlue employees in silence.

Contrast that with the usual opening statements from the CEOs of public companies, who typically launch into “thoughts on our most recent quarterly performance” and “our strategic priorities going forward.”

Even today, the tone hasn’t changed much. CEOs generally start off these calls with expressions hoping everyone is “healthy and safe” or an update of COVID-19 “activities.” One could counter that this is a call for investors, so any additional pleasantries aren’t necessary. The counter-argument is that at a time when we have seen no empathy from the nation’s top leadership, business executives can step in and let people know that, at a minimum, this crisis is weighing on them, too.

As Dawn Gilbertson of USA Today noted in her reporting on JetBlue's earnings call: “Every airline and travel company has been thanking workers profusely this earnings season given the industry's dire straits and prospects of layoffs, but Hayes went beyond that.”

Bottom line: These aren’t normal times. People are scared. We’re all seeking some comfort where we can find it. So, taking a few moments to acknowledge the gravity of the situation in which we’re mired can bring you goodwill — and you’ll be remembered long after the rest of us emerge from COVID-19.

Image credit: Nel Botha/Pixabay

Solar Sees Opportunities in this Major Oil-Exporting Nation

In the U.S., the coronavirus pandemic is highlighting inequalities as it disproportionately affects people of color and low-income communities. Across the globe, healthcare systems are being pushed to their limits, and energy systems are stretched thin as people stay shuttered inside their homes. While every country is facing an unprecedented health and economic crisis, some are harder hit than others. Innovative solar technologies could help take on some of these problems.

Essential energy during the pandemic

A new report from the International Energy Agency (IEA) found that electricity use worldwide is down, but a study of residential use in Austin, Texas, found that residential use was up about 20 percent as people are working and schooling from home. Electricity powers healthcare facilities, wastewater treatment and clean water distribution, and it enables all of our communications and internet services. But in parts of the world, reliable electricity was not a given before the pandemic, and much less now.

In sub-Saharan Africa, for example, only 28 percent of healthcare facilities can rely on regular electricity service. Only 43 percent of the population is electrified. Further, less than a quarter of schools in sub-Saharan Africa are electrified, widening the technical gap between the haves and have-nots. Distance learning is just a distant dream for most students.

The majority of countries in this region face economic contraction during the pandemic, but for oil-exporting nations like Nigeria and Angola, the hardship is compounded by falling oil prices. African utilities, already under financial strain, may find providing basic services especially difficult. So, some companies are looking to help by developing a resource that has been growing for the past few years in the region: solar energy.

Solar in West Africa

Nigeria is Africa’s largest oil producer, with oil and gas providing about 10 percent of its gross domestic product. Like Texas in the U.S., government officials, who have long relied on oil for wealth and power, have a history of resisting full-scale solar deployment. But as with Texas, Nigerian energy developers see an opportunity to build the industry and help the vulnerable during the pandemic.

Late last year, the World Bank awarded Lumos, a Netherlands-based solar developer with projects already underway in Nigeria, part of a $75 million grant to electrify Nigerian homes. When the pandemic hit, the company received a share of an emergency grant from the off-grid energy impact investing company All-On, set up by Shell. With emergency funding, Lumos will provide reliable solar power to healthcare organizations fighting COVID-19 to power health centers and rapid response teams. The company is also participating in the new ‘Work from Home’ initiative, which will provide Nigerian businesses with domestic portable solar systems to enable their employees to work from home.

“COVID-19 is an unprecedented crisis, putting millions of lives at risk. Reliable, affordable and clean electricity is vital to running life-saving equipment in hospitals and training essential workers," said Adepeju Adebajo, CEO of Lumos Nigeria. "The All-On fund is enabling us to react exceptionally quickly. Lumos has the products and the trained staff on the ground to install solar systems, which will allow key workers to test and treat patients with the virus and save lives.”

Ingenuity in a pandemic

Solar developers have long seen the opportunity in sub-Saharan Africa to provide a better quality of life through more reliable, clean energy. Shifting to more solar will also ease some pressure on stressed water systems, as solar photovoltaic (PV) installations use little to no water, as opposed to traditional sources of energy.

The incredible ingenuity and entrepreneurship in many countries in the region, already often reliant on decentralized systems run through cell phone networks, could be enhanced with the increased deployment of solar to power essential services and a shifting employment model. The region has been primed to leapfrog a lot of the technologies that other countries have muddled through and go straight to a decentralized, off-the-grid system to empower distributed healthcare services, education, and employment opportunities.

The way we do business in the world will likely change when the peak of the pandemic has passed — and countries like Nigeria could be at the forefront of ensuring that shift is toward a greener, cleaner future, if done right.

Image credit: Lumos Nigeria/Facebook

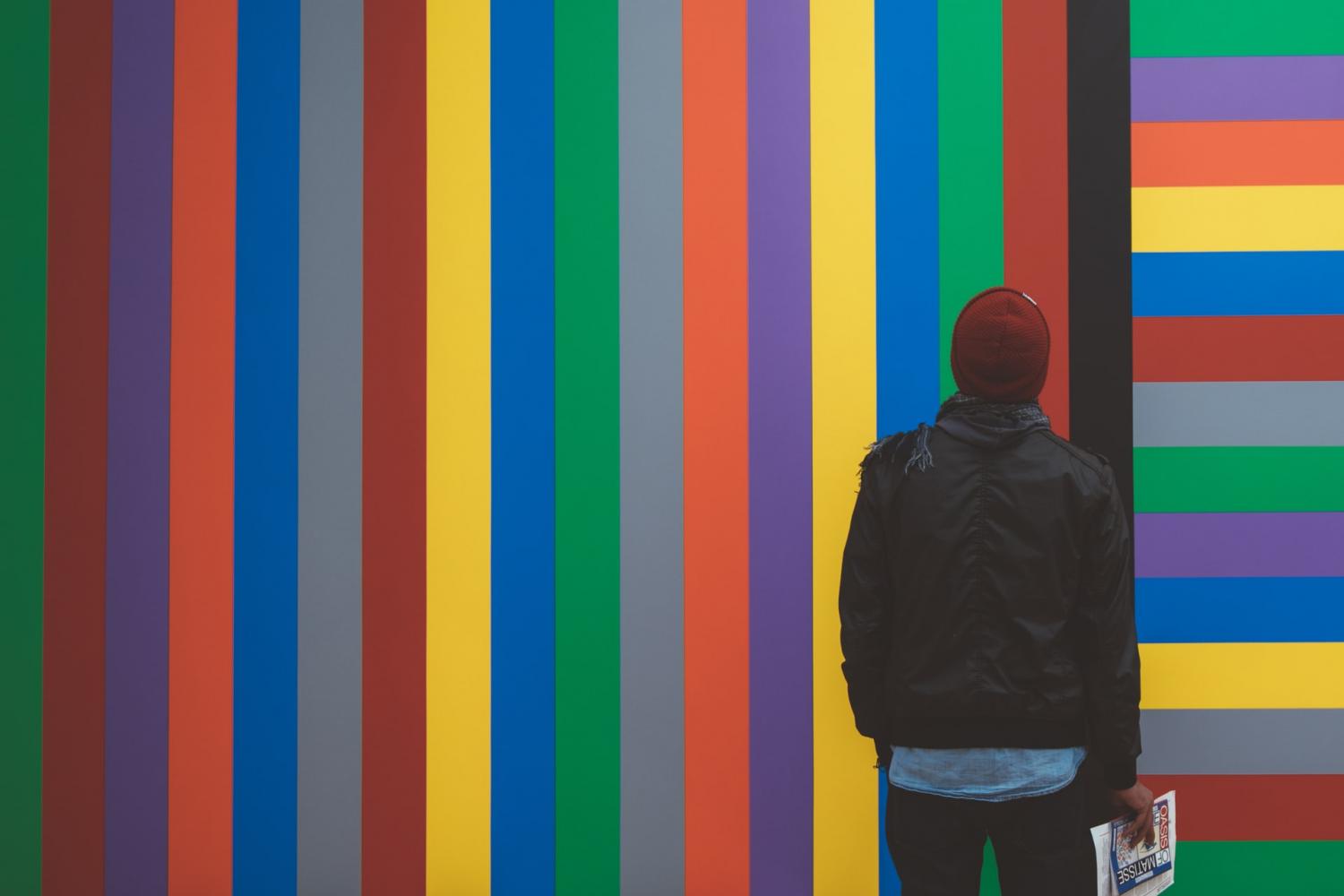

In America’s Philanthropy Community, Giving Out Green is Far Too White

As we settle into this very uncomfortable new normal of coping with COVID-19’s impact on how we live, work and learn, companies and the communication professionals promoting them are now quick to showcase how generous they are. And considering the federal government’s bumbling while local governments are close to the brink, every dollar counts. But there’s a problem: A group of researchers crunched the numbers and concluded that in the world of philanthropy, white nonprofit leaders have been disproportionately benefitting from all this largess.

It’s discouraging enough that philanthropic giving is largely driving down the route Hollywood has paved with movies such as Green Book, which infer, “I’m white, I know better and I’m here to help.” But at a time when racial and ethnic minorities are disproportionately bearing the brunt of suffering and death from COVID-19 while they are largely the “warriors” who are fighting this fight, those Americans who feel as if they’ve been thrown under the bus have every right to feel concerned over how – or in reality, if - they will recover in the long term. Philanthropy will have to step in. The challenge is to ensure the communities that need help the most will receive it.

A joint study by the Bridgespan Group and Echoing Green makes a pointed conclusion: If philanthropic foundations want to succeed in enacting social change, they need to tap into the communities they say they wish to make stronger. From the point of view of this study’s authors, two obstacles are in the way of philanthropy’s push to make society better. First, philanthropic leaders need to understand the role that race plays when it comes to the problem these foundations are keen on solving. In addition, race has been a factor in how many philanthropists have recognized leaders and identify solutions.

Bridgespan Group and Echoing Green acknowledge that the quest to do social good comes from a good place. “However, what is often missing from philanthropy’s discussions about achieving results is how much successfully changing the world depends on bringing an intentional, explicit, and sustained focus to addressing racial disparities across the problems we are trying to solve.”

And therein lies the rub: Ensuring that nonprofit leaders of color receive the funding they need is critical, as many of them can empathize with the stubborn problems that their communities confront day after day. Hence this disconnect is seen in how black-led organizations struggle with a lack of funding. Compared to white-led nonprofits, the black-led organizations this study analyzed had revenues 24 percent smaller. And when it comes to unrestricted funding – i.e. funding and grants that come with no strings attached – black-led organizations’ funding streams are 76 percent smaller.

According to the Bridgespan Group’s analysis, nonprofit leaders of color face four major barriers within the philanthropy sector. First, they lack the access to networks, and therefore connections, that are so important in this space. Interpersonal bias that often leads to misunderstanding also comprises a problem. Funders frequently rely on standard forms of evaluation that don’t take into account the needs of foundations that are led by, and work with, people and communities of color. Finally, the study’s authors are frank in their assessment that the sustaining of such relationships does not come easy in a world where “white-centric” views reign supreme.

The researchers at Bridgespan Group and Echoing Green acknowledge that some foundations are now taking racial equity into account when they proceed through the grantmaking cycle. Their study mentions Borealis Philanthropy, The Charter School Growth Fund, Chicago Community Foundation, Ford Foundation, San Francisco Foundation and Weingart Foundation as organizations that have changed how they evaluate grant proposals.

“Population-level impact in the issues donors care about cannot happen without funding more leaders of color and funding them more deeply,” concludes the study. “The question now becomes what philanthropists are going to do about that.”

At a higher level, the authors make it clear: The first three steps philanthropy leaders should take are to get proximate, get reflective and get accountable. And those are lessons that companies can apply internally as they take a close look at both their corporate giving and diversity programs.

Image credit: Mario Goph/Unsplash

Millennials Will Force an ESG Revolution

It falls to the youth to build a better world – and now, they finally have both the money and motivation to do so.

Today’s millennials are at a pivotal point. They stand at the threshold of their peak saving years and maintain a strong belief that the companies in which they invest should go beyond money-making to become part of the solution. In a recent global survey conducted by the deVere Group, a remarkable 77 percent of millennial investors said that environmental, social and governance (ESG) issues are their top priority when assessing investment opportunities.

Millennials’ growing investment influence is difficult to deny; as of 2019, those between the ages of 23 and 38 accounted for over a third of the global population. They are also in the process of undergoing a massive, multi-trillion-dollar wealth transfer as baby boomers pass on their resources to upcoming generations. These funds, in addition to millennials’ own burgeoning savings potential, have given younger investors considerable power in the investment sector – and their focus has rested firmly on sustainable investing.

Driven in part by millennial activism, sustainable investing has become a significant trend in recent years. The term refers to any investment process that incorporates ESG factors into investment decisions, but is made up of two distinct activities. First, following the United Nations-backed Principles for Responsible Investment, it refers to the integration of ESG considerations into the analysis and valuation of investments, along with engagement with investee companies on those same issues to improve their ESG performance. Analysts who ignore material ESG factors risk underperformance as they will be missing important risk and return inputs to their financial models. Second, it refers to the screening of companies based on moral, ethical or social responsibility concerns: an alignment of an investor’s values with the portfolio holdings.

When sustainability-minded investors put money toward a chosen company or organization, they do so in the hopes that their investment will not only provide a financial return but also drive measurable social and environmental change. Particular areas of focus may include climate change, renewable energy, healthcare, working conditions and community development.

The market for values-driven sustainable investing is, in a word, enormous. According to reporting from Morningstar, flows into U.S.-accessible, open-ended and exchange-traded funds identified explicitly as “sustainable” topped $13.5 billion in 2019. This achievement was a remarkable leap from even a year before, when, as the Morningstar reporter notes, “flows had never topped $2 billion in any quarter, and the calendar-year record, set in 2018, was just $5.5 billion.” Sustainable investment is on a meteoric rise – and the generational force that propels it is apparent.

Millennials think about investments differently than their predecessors. The most significant shift is their tendency to be hands-on; millennials tend to take more of an active role in determining their investments than baby boomers or Gen X investors.

As Greg Cobb, the Director of Fixed Income for Boyd Watterson Asset Management recently shared for an EY report on millennials’ presence in the sustainable investing sector, “The industry is moving from a passive investor population, which is dependent on the income from defined benefit and pension plans to a population that is self-funding via their defined contribution plans. These millennials will demand more active involvement in their own investments as they wish to be more actively involved in controlling their own destiny. Along with this more active approach will come more activist tendencies.”

Millennials want to invest in companies that resonate with their values – but that doesn’t mean that they don’t care about portfolio diversification and long-term performance. Instead, they want their investment managers to ask tough questions of potential investees and actively work to improve behaviour and performance. In 2018, the Allianz ESG Investor Sentiment Study Report noted that 89 percent of surveyed millennial investors expected their financial advisors to thoroughly assess a company’s ESG factors and track record before recommending it as a potential investment. Moreover, 57 percent of millennial investors have divested from or turned down an investment opportunity because the company harmed consumers’ health and well-being.

These findings demonstrate that in the future, investment firms and companies will need to adjust their strategies to take the priorities of socially minded millennial investors into account. Millennials have only just begun to command attention in the investment space; as they continue to move towards the peak of their savings potential, their influence will continue to grow. It seems reasonable to assume that interest in socially responsible investing is neither a fad nor a short-term trend; rather, attention to ESG issues will likely increase as younger investors grow more secure in their finances.

It is worth noting that millennial investment preferences aren’t the only reason to make socially responsible changes. In one recent study, researchers at Morgan Stanley assessed the performance of over 10,000 funds and managed accounts and found a positive correlation between sustainable strategies and high performance. The writers noted that “investing in sustainability has usually met, and often exceeded, the performance of comparable traditional investments.” These findings were consistent across asset classes and over time.

Moreover, companies that demonstrate good corporate social responsibility are more likely to command premium prices for their products, services and share prices. In 2015, the Nielsen Global Corporate Sustainability Report found that two-thirds of global consumers are willing to pay more for sustainable brands – and 73 percent of millennials worldwide will pay a higher price for sustainable products or services.

The metrics for both investment performance and the pricing of companies’ products are compelling and should prompt all companies and investment firms to consider actions they can take now.

There is no quick fix that companies can apply to appeal to millennial investors and their focus on ESG issues. Rather, organizations will need to employ a multifaceted approach to demonstrate their support for environmental and social causes – and dedicate considerable time, effort and resources to the process. These efforts must be transparent and authentic, as both investors, analysts and employees can see through PR stunts and greenwashing.

The steps that organizations choose to take will vary. Investment companies might opt to hire sustainability professionals who can lead sustainability initiatives with genuine buy-in from internal and external stakeholders. Investment management firms might look for analysts and portfolio managers who have in-depth understanding of ESG issues in addition to skills in more traditional financial analysis. They may also choose to train advisors on how to evaluate and communicate with millennial investors the investment options that can both provide above-par financial performance and meet emerging expectations for sustainability.

Regardless of strategy, however, one point is clear: millennials are changing the investment landscape. Sustainable investing is no longer a niche; it has become a central platform for investment. Whether based on the valuation of stocks using ESG integration, or on the values-based preferences for investments or products – or both – the sustainability of companies is a central focus of a new generation of investors. Companies and investment firms alike will need to get on board – or else be left chasing the millennial rush.

The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice to be relied on without an individual first consulting with their financial advisor to ensure the information is appropriate for their individual circumstances. The opinions expressed in this article are of its author only and do not reflect the opinion of Odlum Brown Limited. Member-Canadian Investor Protection Fund.

Image credit: Mikaala Shackelford/Unsplash

A Longstanding Pandemic Response Team Helped Intel Act Swiftly in the Wake of COVID-19

Companies around the world have collectively committed billions of dollars to help communities and health organizations combat the new coronavirus, but the pandemic is uncharted territory for most business leaders. And while the scope and scale of the coronavirus threat is unlike any we've seen before, global technology firm Intel was perhaps more prepared than most, thanks to a forward-thinking decision made nearly 20 years ago and investment that's continued to this day.

The tech giant created an in-house Pandemic Response Team amidst the outbreak of severe acute respiratory syndrome (SARS) in China in 2002, which ultimately sickened more than 8,000 people across 26 countries, according to the World Health Organization (WHO). The response team began as an informal group of executives, who coordinated efforts to protect employees and customers while supporting health agencies in the fight against SARS, but it soon evolved into a standing team within the company.

This group went on to lead Intel's response to other pandemics including the Avian Flu, Ebola and, now, the new coronavirus and the disease it causes, COVID-19. "When all this started happening, we were really able to activate that group and activate the learnings from past pandemics," said Suzanne Fallender, Intel's director of corporate responsibility.

During a webcast this week hosted by Susan McPherson of the corporate responsibility consultancy McPherson Strategies, Fallender went on to explain Intel's response and what can be learned from it.

Intel's Pandemic Response Team was ready when it mattered most

Intel's Pandemic Response Team is tasked with a multifaceted approach to guide the company during global or regional health crises. This includes standardized health and safety practices to protect workers, business continuity planning, and the development of staggered deployment strategies based on risk and need.

The group has longstanding partnerships with local governments and public health organizations such as the WHO and the U.S. Centers for Disease Control and Prevention (CDC), which they lean on for advice in developing response plans when needed.

In the case of the new coronavirus — which, unlike SARS before it, spread quickly to nearly every country around the world — Intel's response extended to its more than 100,000 employees across 60 countries, as well as supply-chain partners on nearly every continent. "We work with such large global supply chains, so we've connected with our suppliers from the beginning to help them protect their employees and also make sure that we could help when they needed support," Fallender said.

The Pandemic Response Team also worked with Intel's existing community partners to deploy $10 million in immediate funding for food security, housing and small business relief. And it collected 1 million pieces of protective equipment, including masks and gloves, from its own factory and emergency supplies for donation to frontline healthcare workers.

"We have a history of partnering with local communities already through the Intel Foundation and through corporate programs, so we worked with those community partners" on the initial response, Fallender said. "Then we took a step back. We’re going to continue to support these communities, but where can Intel have a real impact in this moving forward? It really came down to technology."

(Image: Healthcare providers at Houston Methodist Hospital can monitor multiple patients in real time with the help of technology provided by Medical Informatics Corp. in partnership with Intel.)

(Image: Healthcare providers at Houston Methodist Hospital can monitor multiple patients in real time with the help of technology provided by Medical Informatics Corp. in partnership with Intel.)

Leveraging technology expertise to scale impact

Intel created a pandemic response technology initiative to help essential organizations complete their work and aid individuals facing a new normal. "We were seeing healthcare workers and hospitals struggle to have the technology they needed, researchers trying to quickly work on this, and all the students who could not continue to learn online because they didn't have access to technology," Fallender said.

Of the $50 million committed to the initiative, the bulk will leverage advanced technologies like artificial intelligence (AI) and high-performance computing to advance diagnosis, treatment and vaccine development, according to Intel. This includes getting technology into hospitals faster for testing and treatment of COVID-19. The funds will also support education-focused nonprofits and public school districts as they work to get technology into the hands of students suddenly learning from home.

A dedicated innovation fund of $10 million will back partner- and employee-led projects to assist their own communities, including an expanded testing program in India, a ventilator initiative in the U.K., and a "virtual ICU" system that allows U.S. health workers to monitor COVID-19 patients from a distance, reducing their risk of exposure and expanding their care capacity.

"We hope that by sharing our expertise, resources and technology, we can help to accelerate work that saves lives and expands access to critical services around the world during this challenging time,” Intel CEO Bob Swan said in a statement announcing the initiative.

Knowing they'll be cared for, Intel employees take it on themselves to serve their communities

On top of more than $60 million in cash and products donated to fight COVID-19, Intel has committed more than $100 million in additional benefits and compensation for its employees on the front lines. While the majority of Intel's staff can work from home, the company also relies on on-site employees in manufacturing plants and labs to power its technology response initiative.

"First and foremost, we've been focused on the health and safety of our employees, particularly those who continue to work onsite in our factories and our labs," Fallender said. "Intel technology is in over 95 percent of the world's internet communications and government infrastructure, so we've really worked hard to make sure we can safely continue to operate and to provide that essential technology that's used in hospitals and in supporting the economy."

Knowing they have the support they need, including benefits, protective equipment and safety practices that ensure social distancing, Intel employees have responded in kind. "It's been one of the hardest times I've ever worked at Intel, but it's also been one of the most special times, particularly because of what some of these employees have been doing," Fallender told attendees during McPherson's webcast. "People have, on top of doing their jobs and homeschooling their kids, jumped in to bring others together."

This includes a group of Arizona employees who are 3D-printing face shields for first responders and vulnerable communities, including the local Navajo Nation which has been especially hard hit by the pandemic. After hearing that senior neighbors weren't able to connect with their families during Passover because they didn't understand video conferencing technologies, another team in Israel created a one-click conferencing system to bring families together around the table. Fallender herself is sewing face masks in her spare time.

Overall, Intel's top corporate responsibility executive said she is encouraged by the leadership she's seeing, both within Intel and more broadly, in the face of the pandemic. "It’s shown organizations can come together in this crisis and in urgency around an issue — and there are many other urgent issues that we face, so I am more hopeful in that standpoint," she said. "Some companies are going to be challenged to be able to do things, but I think there are many others that can continue to look at how to really engage."

Image credits: Julian Wan/Unsplash, Tandem X Visuals/Unsplash and Houston Methodist Hospital, courtesy of Intel

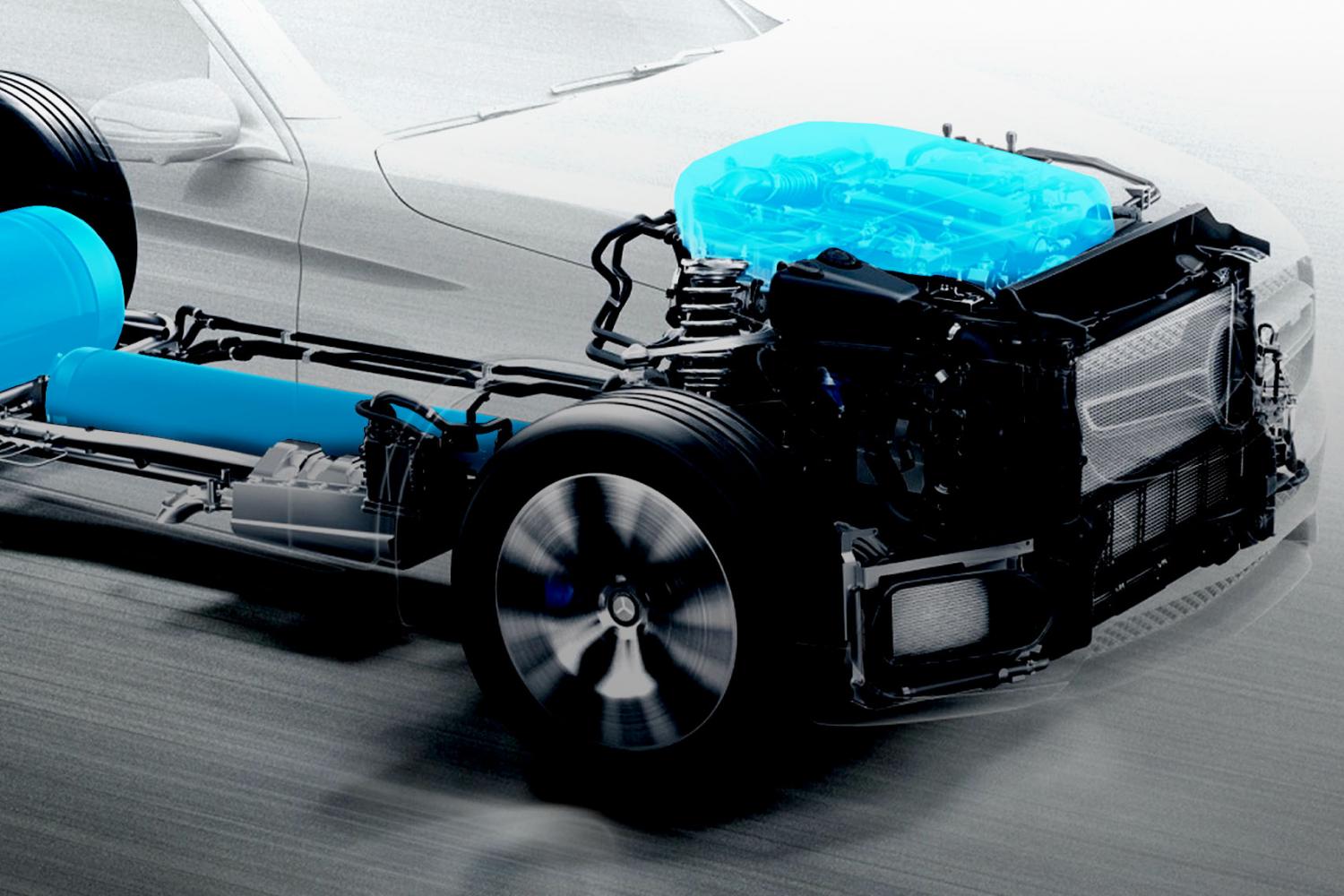

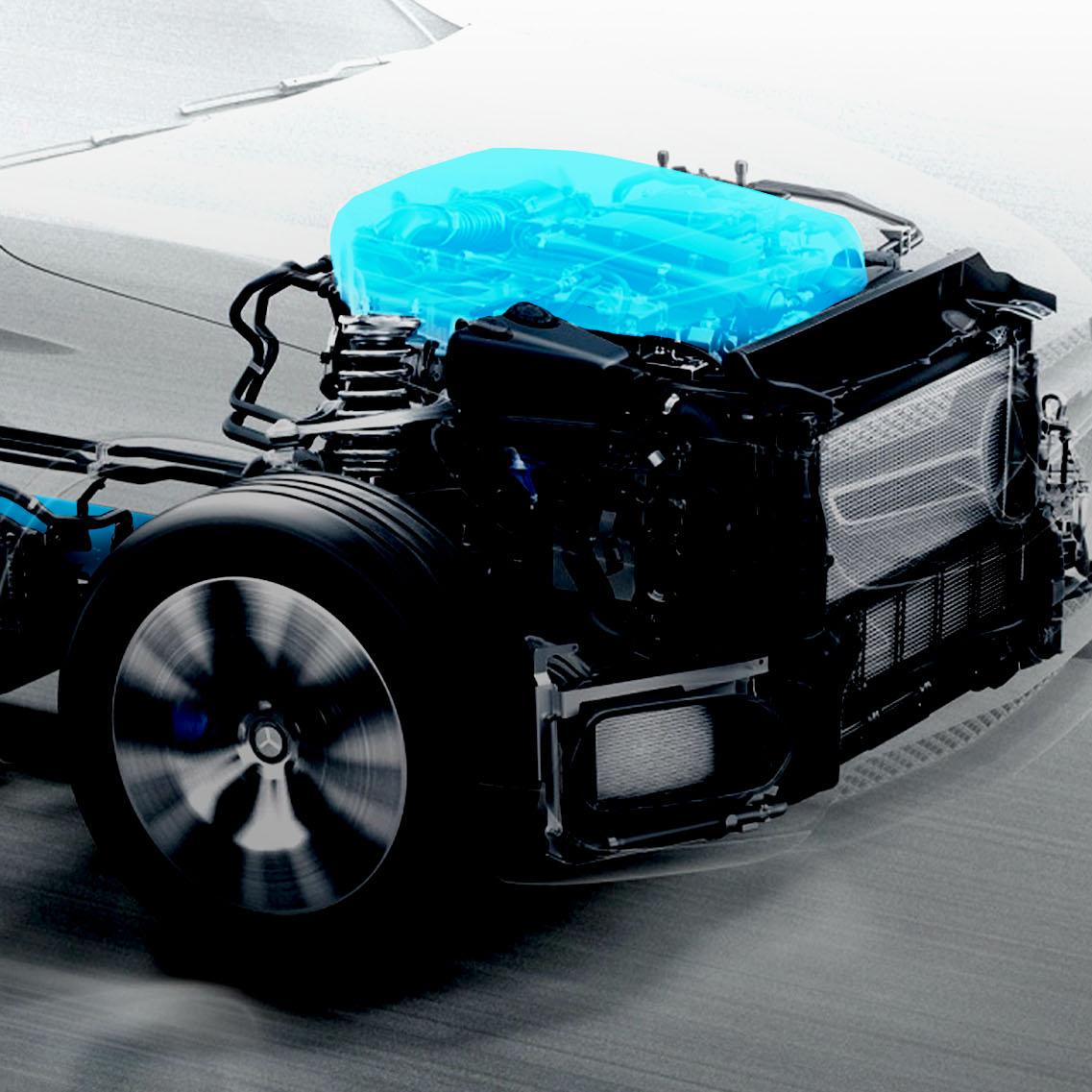

Oil Glut or Not, More Automakers Pivot to Hydrogen and EVs

The world is awash in oil as a consequence of the COVID-19 crisis and global economic crash. The ripple effect is seen in lower prices for gasoline, which could dampen enthusiasm for electric vehicles. That may be so temporarily. However, the auto industry is still barreling towards an electric future. In the latest development, a new joint venture between Volvo Group and Daimler Truck AG indicates that hydrogen fuel cell vehicles could play a larger role than previously thought.

The long road to hydrogen fuel cell vehicles

Auto makers have struggled with hydrogen fuel cell technology for decades. GE first applied a fuel cell to a car in the 1950’s, but it wasn’t until 2013 that Hyundai introduced the first mass-produced, commercially available fuel cell car.

Multiple other companies soon followed suit with versions of their own, but hydrogen-powered cars have yet to gain traction with the motoring public.

One problem is the fuel itself. Fuel cell cars are zero-emission vehicles that produce electricity from hydrogen through a chemical reaction. That sounds green enough, but the primary source for hydrogen today is fossil natural gas. That’s a turn-off for drivers and fleet managers who prioritize sustainability and renewable energy.

The hydrogen fuel cell truck solution

Fortunately, the sustainability issue is beginning to resolve itself. The hydrogen supply chain is gradually transitioning to green hydrogen from water, produced with renewable energy.

That still leaves two challenges: high up-front costs and a shortage of fueling stations.

Those factors can discourage individual consumers. However, fleet managers have a different perspective. As a counterbalance to higher costs, fuel cell trucks have two major logistical advantages over battery trucks. They can pack longer range into a smaller, lighter space, and they fuel up just as quickly as petroleum-powered vehicles.

Because of their longer range, fuel cell trucks also do not require a high degree of penetration for fueling stations. Fleet managers can plan routes and schedules around the few stations that are available. Plans are under way to build out the fueling network in the European Union, the U.S. and other key regions.

A giant step for fuel cell vehicles

Interest in fuel cell trucks and other heavy-duty vehicles has been ticking up in recent years. Last week’s move by Volvo and Daimler picked up the pace significantly.

On April 21, the two companies announced a new joint venture to develop a line of heavy-duty fuel vehicles. Volvo is putting up cash for a 50 percent stake in the new company, which will consolidate all of Daimler’s existing fuel cell activities. That includes 20 years of experience through the company’s Mercedes-Benz unit.

“For trucks to cope with heavy loads and long distances, fuel cells are one important answer,” explained Daimler Board Chairman Martin Daum.

Volvo President and CEO Martin Lundstedt emphasized that the business will pivot on the use of hydrogen from renewable resources or “green electricity,” in accord with efforts to achieve a carbon neutral economy.

The two companies anticipate that the new joint venture will begin mass producing long-haul fuel cell trucks and buses within about five or six years.

Other types of vehicles may also be added to the plan.

Batteries versus fuel cells

The formation of the new joint venture indicates that fuel cells and batteries are not necessarily competing technologies. Auto makers that deploy both technologies strategically may be in a stronger position to broaden their customer base, embrace more use cases, and accelerate the zero-emission transportation trend.

As if to underscore that point, Volvo also recently passed an important milestone in its battery electric vehicle program.

On March 5, the Volvo officially commissioned its new battery assembly line in Ghent, Belgium, putting the company on track to begin building its first 100 percent battery electric car this year.

Another example of this strategic approach to electrification is the U.S. startup Nikola. The company first launched with a focus on long haul fuel cell trucks. Last fall, it added new battery technology for lighter vehicles, too.

Image credit: Mercedes-Benz

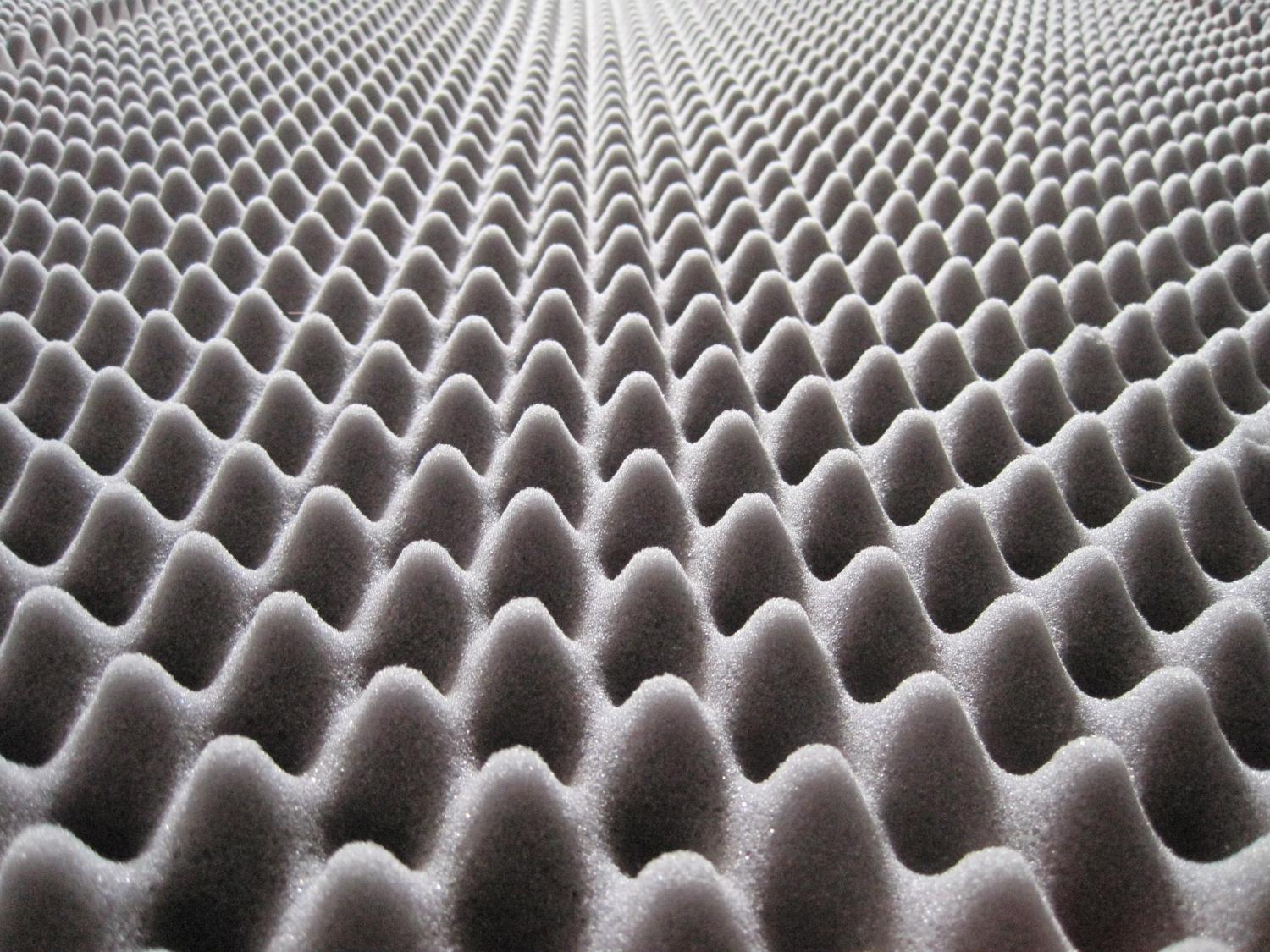

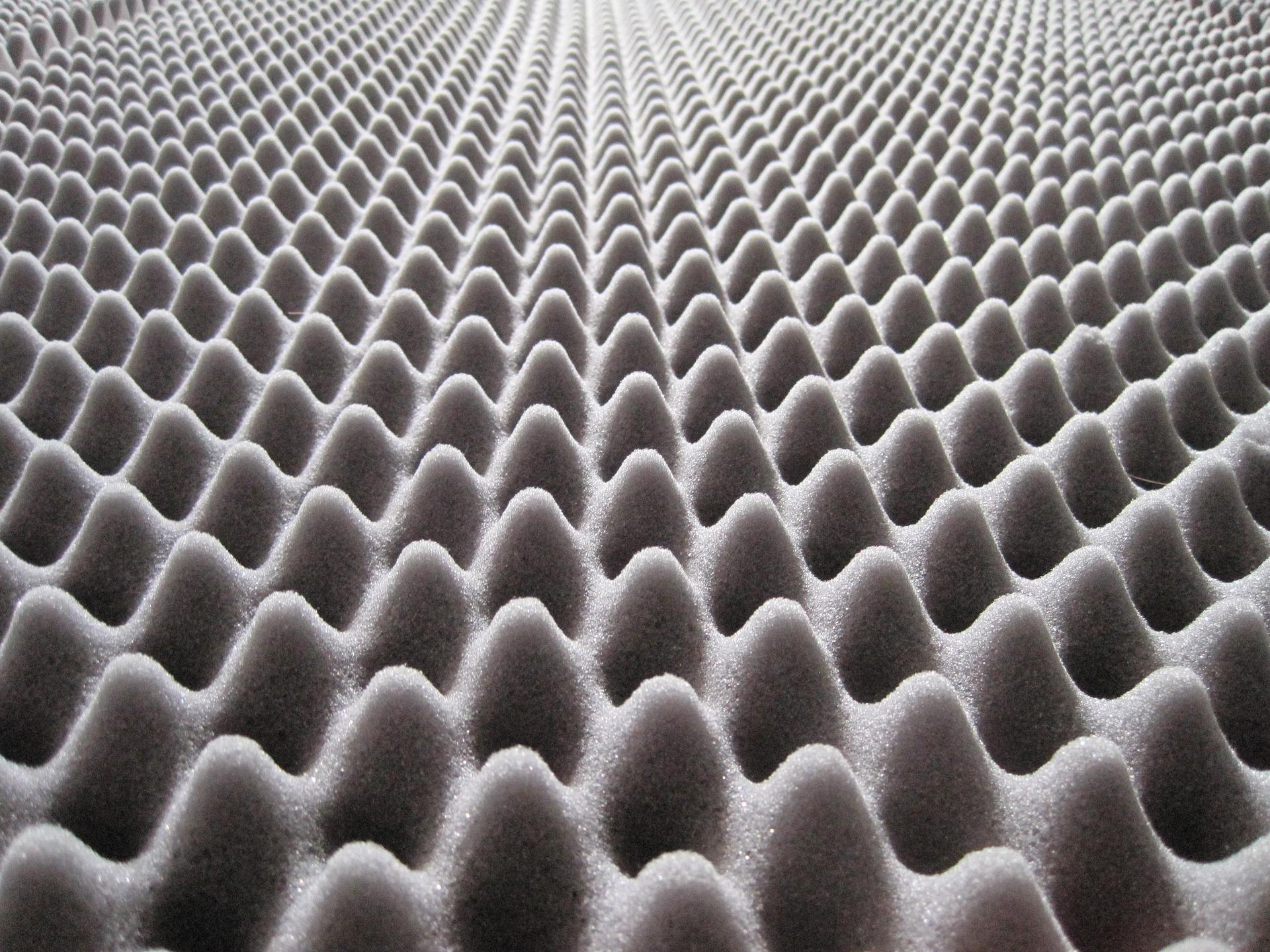

Beyond Ocean Plastic: Recycling Tackles the Polyurethane Foam Problem

The ocean plastic issue has caught its share of media attention, and rightfully so. However, there are other pressing issues related to the overflow of petrochemical-derived waste. One of them is how to recycle the mountains of polyurethane foam that are burned or disposed in landfills every year.

The polyurethane foam recycling challenge

Sheer bulk is one part of the problem. In its flexible form, polyurethane foam is commonly used in large-scale applications including automobile interiors, carpet underlay, mattresses, acoustic foam and many other types of cushions. Rigid forms of the foam are also popular in the construction industry, with building insulation a primary use.

Though many of these items are long-lasting, eventually the foam becomes waste. As of 2012, the U.S. alone generated an estimated 1.3 million tons of polyurethane foam waste.

Unfortunately, so far foam has resisted recycling efforts. Polyurethane foam is made from crude oil, like other plastics. However, it is produced through a cross-chemistry process that makes it resistant to melting and reformation.

For the most part, recycling options are limited to shredding. The primary use for recycled polyurethane fiber today is in carpeting.

Otherwise, the only other options are to downcycle it and burn it as fuel or dispose it in a landfill.

A new approach to recycling foam

If foam could be upcycled into higher value products, that would provide a financial basis for recovering and recycling more foam waste.

The key technology challenge for expanding the range of applications for recycled foam is dealing with the air trapped within its structure, and a team of researchers at Northwestern University in Illinois may have discovered an economical solution.

Their approach is similar to pushing a large sponge through a Play-Doh extruder. It can be done, but first the nature of the sponge needs to change.

One method would be to compress or slice the sponge, but the result would be a brittle material that is difficult to mold into new shapes without further treatment.

The process that Northwestern developed resolves those problems with a two-step system. First, the foam is softened with a commonly used catalyst called dibutyltin dilaurate, a colorless, oily liquid that is sometimes added to animal feed as a treatment for worms and other parasites.

The catalyst reduces the foam to a less spongy consistency. Then it can be extruded through a specially designed device. Two rotating, intermeshing screws in the device remove the air while improving the consistency of the reduced foam.

The result is a new material that can be upcycled to various forms including hard plastic and flexible film.

Northwestern cites shoe cushions, accessories (watch bands, for example), hard wheels (as in skateboards and shopping carts) and auto parts as potential uses.

More trouble ahead for the petrochemical industry

The Northwestern recycling research is one part of the effort to reduce the use of virgin crude oil in plastic products.

Another approach is to reduce the use of crude oil in making the foam itself.

Researchers are experimenting with various sustainable alternatives including walnut shells, fossilized algae, and even sugar to achieve an alternative material that meets the performance standards of conventional foam.

Meanwhile, interest in reclaiming and recovering plastic waste from the ocean has continued to grow, despite the global economic crisis touched off by the COVID-19 crisis.

One recent example is last month’s ocean plastic announcement from Japan-based JSP. The company has introduced a new product called Apro 35, made with 15 percent maritime waste, from recovered fishing nets and other gear.

Recycling also provides a financial incentive for keeping maritime waste out of the ocean in the first place. In one significant development, last month the third-party certification firm UL validated recycled content for five resins used by HP, ranging from 5 percent to 99 percent “ocean-bound” plastic.

The “bound” refers to plastic at risk of entering the ocean. This is the first time that UL has provided validation through an upgraded recycling standard that includes measuring the impact of collecting recycled materials on local economies. Now that HP is on board, other major resin users may strive to achieve validation as well.

At the smaller end of the scale, last month a startup called Bureo was also featured in the Guardian for its work in making skateboards and other items from recycled fishing nets in Chile.

As the world recovers from the COVID-19 crisis, companies like these are laying the groundwork for an economic recovery that finds solutions to environmental problems instead of causing them.

Image credit: Pixabay