Monsanto Shareholders Defeat Resolutions for More Transparency

Monsanto continues to stand its ground against disclosing information about the costs associated with the genetically modified crop (GMO) industry. On Jan. 28, Monsanto shareholders, at the urging of the company’s board, overwhelmingly defeated two resolutions that would have increased transparency about Monsanto products.

One resolution, re-filed by Harrington Investments Inc., called for the board to issue a report detailing the financial risks and operational impacts related to certain GMO production. The issues included the costs of “seed contamination of non-GMO crops” and “damage to farmers’ reputations, livelihood and standing in the community” resulting from lawsuits that have ensued with neighboring farmers.

John Harrington, CEO and president of Harrington Investments, charged that the board “increasingly keeps stakeholders in the dark, about the true financial risks of GMOs … The corporation spends an incredible amount of shareholder money to prevent American consumers from knowing the extent to which it controls our national food supply.”

More than 60 countries around the world ban GMO-grown food. Others have taken actions to limit Monsanto's investments, such as in Malvinas Argentinas in northern Argentina, where a labor appeals court just ruled that the construction of a Monsanto plant was unconstitutional. Harrington said that wheat shipments to Japan were refused at one point after inspectors found a rogue GMO-infected grain in the shipment.

Recent polls in the U.S. show that as much as 90 percent of Americans want GMO foods identified and to have “the option to consume non-GMO products.”

Backing up Harrington’s statement was a petition signed by more than 160,000 people calling for more transparency about Monsanto’s procedures.

The other resolution called for Monsanto to work with federal regulators to establish GMO labeling standards.

The resolution calling for a risk report received 6.51 percent of the vote, while the resolution calling for the company to work with federal regulators received 4.16 percent of the vote.

Despite the defeat of both resolutions, Monsanto CEO Hugh Grant conceded that, “There is a recognition that we need to do more.” Whether that means that the company will actually work with the federal government to establish guidelines for GMO food labeling is yet to be seen. If Grant’s comments on the matter are anything to go by, it isn’t likely however. While the company supports voluntarily labeling, he said, it was Monsanto’s position that GMO labels could confuse consumers.

The company and those who have invested their money in Monsanto’s future are becoming increasingly aware, however, that consumers want more transparency and more ability to decide whether to buy GMO products.

“The momentum is clearly turning against Monsanto, and I think the company owes the shareholders a detailed explanation of what this is really costing the bottom line,” said Harrington.

Image credits: Alexis Baden-Mayer

Integrating Women in Business: Becoming a Modern Day 'Branch' Rickey

Sports are very much a part of my fabric. My father played college football at the University of Southern California, and my grandfather played and coached football in the National Football League. I have been active in sports since the age of five, both as an athlete and coach. I worked for a youth sports education nonprofit called Positive Coaching Alliance for my MBA summer internship and am currently working part-time for the NFL’s Oakland Raiders with hopes of parlaying the position into a full-time role with the Raiders or another professional sports organization after graduating with my MBA.

Because sports are such a big part of my life, I often draw upon business and leadership examples from the sports world. Therefore, you can expect no different from me when articulating how my approach to supporting women in business and leadership has changed over the past semester, largely motivated by my involvement in Professor Kellie McElhaney’s Women in Business class at the Haas School of Business.

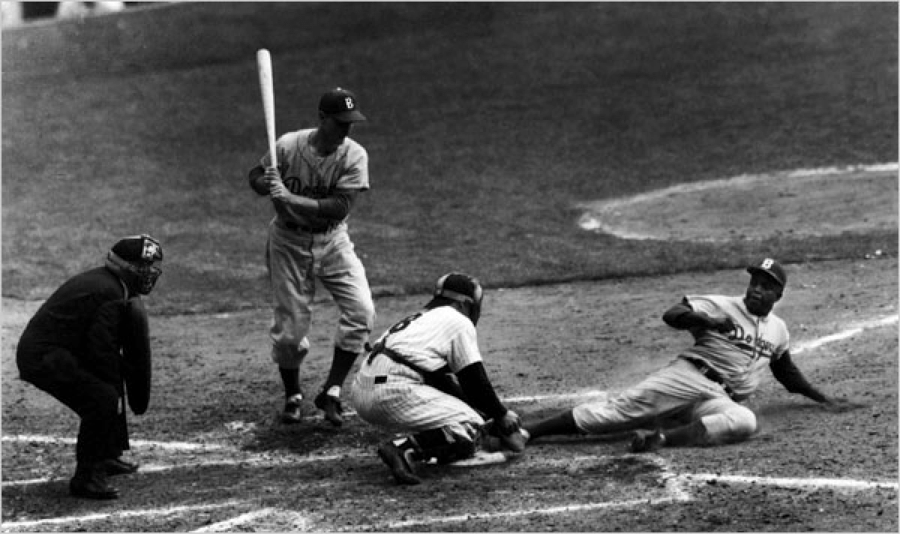

I have been familiar with the story of Jackie Robinson for a long time, but it was not until I recently watched Warner Brothers’ "42," a cinematic portrayal of Robinson’s story, that I realized how much this film resonates with me in terms of my approach to supporting women in business and leadership.

Wesley “Branch” Rickey, played by Harrison Ford in "42," was an innovative professional sports executive, best known for breaking Major League Baseball’s color barrier by signing African American player Jackie Robinson in 1947.

There was no statute officially banning African Americans from Major League Baseball, only a universally recognized and unwritten rule that no club owner had dared break. This rule was perpetuated by culturally entrenched racism and a desire by club owners to be perceived as representing the values and beliefs of the everyday, American, white male.

Similarly, although there is no rule or law that women should not serve as CEOs, board members or senior-level managers of large corporations, culturally entrenched sexism exists and inhibits a woman’s ability to climb the corporate ladder.

Rickey’s determination to desegregate Major League Baseball was born out of a unique combination of idealism and keen business sense. His idealism was derived from an incident involving a team for which Rickey worked early in his career. While he was managing at Ohio Wesleyan University, African American player Charles Thomas was refused accommodation at the team hotel because of his race. Though an infuriated Rickey managed to get him into the hotel for the night, he never forgot the incident and later said, “I may not be able to do something about racism in every field, but I can sure do something about it in baseball.”

The business element was based on the fact that the Negro Leagues had numerous star athletes, and logically, the first Major League Baseball team to sign them would get first pick of the players at an attractive price.

When battling a culturally entrenched ideal, one approach is to tug at the heartstrings of your "opponent" with an ethically-based argument; however, we all differ in some way on our approach(es) to such issues. Ultimately, everyone speaks green (money, that is)–and to me it is far easier to make the case when an issue clearly affects the bottom line.

Branch Rickey embraced his idealism and ethics in supporting a controversial issue; however, he also made the business case for his decisions. His success as an innovative professional sports executive is especially motivating to me given my career goals and aspirations.

Throughout my Women in Business class, I was consistently presented with the benefits of investing in women, all of which are clearly supported by data. In addition, our class final project required me to create a personalized approach to supporting women in business and leadership through combining my life experiences, information covered in the class and examples of those who have come before me.

Inspired by the real-life examples of Branch Rickey and the Brooklyn Dodgers depicted in "42," I established five guiding principles as they pertain to how I will support the continued integration of women in business. These principles are vital to keeping me grounded and focused on my values as I pursue a career in the male-dominated confines of the National Football League, especially in light of its recent C+ grade in gender hiring practices and continued struggles in the area of gender equity.

The Five Guiding Principles of Integrating Women in Business are as follows:

- Go “On the Record”: Let others know where you stand.

- Walk the Talk: Practice what you preach.

- Foster Unit Cohesion: Surround yourself with talented individuals who share your vision and ideals.

- Be a Mentor: Offer your experience, network and support to those who seek it. Don’t just hold the door open for others; pull them through with you.

- Stick to Your Guns: Once you’ve gone on the record, don’t ever back down.

Amid both positive and negative fanfare, Jackie Robinson debuted, and turned out to be a huge success. Robinson was baseball’s first African American Rookie of the Year, and while opposing baseball players, managers and fans often harassed him, he became extremely popular with the American public at large.

Robinson’s success became the crowning achievement of Branch Rickey’s illustrious career. It also set a standard and opened the door for other leaders like Bill Veeck of the Cleveland Indians, who integrated the American League later that year.

In order to achieve success similar to that of Rickey’s, I must also be true to my values and always make the business case when it comes to supporting women in business and leadership, utilizing these five guiding principles to keep my path lit.

Image credit: Robinson in Game 1 of the 1955 World Series (Source: NYT)

Brandon Doll is an MBA student at the Haas School of Business at the University of California, Berkeley (class of 2014).

A version of this piece was originally published on the Redefining Business blog, a Haas School of Business publication.

Obama Increases Fuel Efficiency Standards for Heavy-Duty Vehicles

President Barack Obama is moving ahead to increase fuel efficiency standards. While speaking at a Safeway distribution center in Maryland this week, President Obama cited the advantages of the fuel efficiency standards he put in place for both cars and light-duty vehicles, as well as heavy-duty vehicles.

Obama said that he is directing the Environmental Protection Agency (EPA) and Department of Transportation (DOT) to set the next phase of fuel efficiency standards for medium- and heavy-duty trucks by March 2016. In 2011, the Obama administration set the first new standards for medium- and heavy-duty trucks which take effect this year and last until 2018.

The standards require combination tractors to achieve a 20 percent reduction in fuel consumption and greenhouse gas (GHG) emissions by 2018, and require heavy-duty pickup trucks, vans and vocational vehicles to achieve a 15 percent reduction in fuel consumption and GHG emissions by 2018.

Obama pointed out that although heavy-duty trucks only account for 4 percent of all the vehicles on the highway, they are responsible for about 20 percent of the carbon emissions from the transportation sector. They are also responsible for about 20 percent of on-road fuel consumption and haul about 70 percent of all domestic freight. The first phase of standards saves an estimated $50 billion in fuel costs and reduces American oil use by 530 million barrels of oil, or more oil than the U.S. imports from Saudi Arabia in a year. They will also reduce carbon emissions by about 270 million metric tons, or the equivalent of removing 56 million passenger vehicles from the road for a year, and improve air quality by reducing particulate matter and ozone, which will result in health benefits from about $1.3 billion to $4.2 billion in 2030.

“And that’s why, after taking office, my administration worked with automakers, autoworkers, environmental advocates and states across the country, and we set in motion the first-ever national policy aimed at both increasing gas mileage and decreasing greenhouse gas pollution for all new cars and trucks sold in the United States,” Obama said. “And as our automakers retooled and prepared to start making the world’s best cars again, we aimed to raise fuel economy standards to 35.5 miles per gallon for a new vehicle by 2016.”

In 2009, the Obama administration set fuel efficiency standards for cars and light-duty trucks for 2011 to 2016 models, requiring vehicles for those model years to achieve 35.5 miles per gallon.

The first phase of the standard amounts to an eight miles-per-gallon increase over what cars had averaged in the past, and has saved almost a billion gallons of fuel while avoiding more than 10 million tons of carbon emissions.

Three years later, Obama issued a second phase of fuel efficiency standards, requiring cars and light-duty trucks to achieve 54.5 mpg by 2025, which will double the distance “cars and light trucks can go on a gallon of gas by 2025,” Obama said. The second phase also saves consumers more than $1.7 trillion, or $8,000 for a typical family, and reduces U.S. oil consumption by 12 billion barrels. It will reduce GHG emissions by 6 billion metric tons over the life of the vehicles.

Image credit: DiamondBack Truck

Pioneering Women at the Forefront of an Authentic Organic Beauty Revolution

By Tara Gould

When Spiezia Organics founder Amanda Barlow stood in front of a conference hall full of skincare industry delegates and ate a mouthful of one of her own beauty creams, it was to make a salient point: If what you put on your skin is not clean and natural enough to eat, then you shouldn’t be putting it on your skin--the body’s largest organ.

When you consider that propolene glycol is commonly used in a plethora of beauty products found on the shelves of the biggest supermarkets, her point hits home even more powerfully. Propylene glycol is used as an anti-freeze in helicopters, is banned in France, has provoked serious allergic reactions to people with eczema and can cause liver and kidney damage.

The good, the bad and the ugly of the beauty industry

Spiezia was set up 14 years ago, and they were the first U.K. company to receive Soil Association organic certification across the board. The regulations that govern organic standards for food in the U.K. are not the same as those that govern the health, beauty and textile sectors. For food to be labelled as organic it must, by law, go through a stringent, two-year accreditation process and be certified by one of several certification bodies, the Soil Association being one of them.

In contrast, lax EU regulations make it possible for beauty, skincare and cosmetics companies to brand their products "organic," "natural" and "pure" with as little as 1 percent organic ingredients, even if they also have anti-freeze, engine oil, formaldehyde and other petrochemicals lurking in those innocent-looking bottles.

Speizia Organics has won awards for sustainability. There is nothing harmful in its products or supply chain. It never tests on animals; uses traditional processes such as maceration and cold-pressing to distill herbs and flowers; packaging is sustainable; and they go local and carbon neutral in every way possible--even making sure products are made on-site in their Health and Wellbeing Innovation Centre.

A drive to nurture and protect

Alongside other certified organic U.K. brands, such as Essential Care and Green People, Spiezia is one of a handful of beauty companies that can be relied upon to deliver what it promises in its branding messages. What’s more, all of these companies are run by women. It makes sense: Throughout history women have used herbs, flowers and handmade concoctions--handed down through mothers and grandmothers--to heal and protect their families by tapping into the curative and therapeutic powers of nature. Thinking about it in this way, any company trying to market a face cream, or children’s shampoo laced with toxins, whatever the clever branding may tell us, is not driven by the same intention.

I asked Barlow how she felt, given that Spiezia put so much love, effort, commitment and energy into being organic and earth friendly every step of the way, when other unethical brands are getting away with deceitful greenwashing.

“It pisses me off,” she told me, unapologetically. “I know how much companies have to go through to get organic Soil Association accreditation. It takes a lot of effort, a lot of time and a lot of money.”

Barlow is not a maverick or eco warrior. She lives in Cornwall, England, with her family and is a dedicated woman who cares very deeply about what she does. Integrity is the driving force behind her philosophy for life and work.

“Authenticity underpins everything we do at Spiezia. Any business driven purely by commercial gain is not sustainable.”

Altruistic enterprise

"Imagine if companies started thinking about the social impact they wanted to create in the world and tied it to bottom-line performance. The potential impact could be incredible." So says Phillip Haid, CEO of Public Inc., an agency that creates scalable social impact campaigns that profit by doing good. Even Richard Branson has been recently extolling the virtues of altruistic business.

Unfortunately, in the same way that it’s easy for beauty brands to say they’re organic when they’re not, many businesses now use the "ethical" label as a way to garner respect and increase business without really looking at what the word means. But Spiezia goes the extra mile:

“I have a belief that you get out what you put into it. It’s not about paying lip service.” Barlow says.

That’s why Spiezia established the Made for Life Foundation supporting people diagnosed with cancer.

Spiezia products and ingredients are good for even extremely sensitive skin, even for those people going through chemo or radio therapy. Spiezia offers "organic days," where cancer patients can enjoy holistic treatments, organic makeovers, nutritional advice and lots of warmth and support.

In the last year, more than 600 people have come through their doors, and Barlow says that through working with people going through the cancer journey, she became even more aware of the problems associated with the lack of strict EU regulation:

“I even spoke to my local MP about it. I said please can you raise this at government level, there’s a lot of confusion.”

She explained how consultants often advise patients to eat and use organic as much as they can. So people pick up skincare and beauty products that say they’re organic when they may not be good for them at all.

Uncompromising quality control

Abi Weeds, director of the organic beauty company Essential Care is equally dismayed by the current loophole which allows "fake" organic brands to proliferate:

“This yawning gap in regulation has created a very uneven commercial playing field and is something we’ve struggled with throughout our 10-year history.”

Essential Care refuse to compromise the quality and effectiveness of any of their products to cut costs. All of the products are handmade by Margaret, Weeds' mum and Essential Care founder.

For Margaret, it was a long but worthwhile journey to arrive at where they are now. She began researching the formulations back in the 1980s, after studying aromatherapy and herbal medicine. There was a lack of suitable products for her own and her family's very sensitive and eczema-prone skin. Margaret set about creating effective formulations, using only organic herbs, plant oils and natural, active ingredients.

The efforts they needed to go to in order to source organic ingredients at the beginning set them on a steep learning curve. The record-keeping and paper trail that was required in order to satisfy the standards for Soil Association certification was vast. But this established a doctrine of "Good Manufacturing Practice" which means, in their own words:

"Exacting traceability systems, label accuracy and quality control. We can literally trace all the [of] ingredients of our skincare back to the field they were grown in.”

Keen for green

Like Margaret, Charlotte Vøhtz, founder of Green People and author of Naturally Gorgeous, was motivated by a desire to create a product for ultra-sensitive skin. As a small child, her daughter suffered from eczema and allergies. and she wanted to treat them herself. Charlotte spent 11 years in the pharmaceutical industry gaining knowledge in the fields of chemistry and pharmacology and then went on to the College of Practitioners of Phytotherapy in order to gain knowledge in herbal medicine.

Green People operates a strict cruelty-free policy and uses no animal-derived ingredients in its certified organic, synthetic free beauty products. The business has seen massive growth since its modest beginnings more than 17 years ago, when it was run from Vøhtz's kitchen in Sussex, England. More than 100 of their products are certified organic by the Soil Association or EcoCert.

Charlotte is passionately committed to natural and organic ingredients, and to creating a sea change in the beauty industry:

“I see this as a ‘mission.' I am meant to be doing this. It is so satisfying to be sent testimonials telling us how we have helped transform a customer’s skin problem–and the buzz we get from knowing we can make a difference makes it all worthwhile.”

Label savvy

One might question why the laws set up around certification for beauty and skincare are so sloppy when those for food are stringent and reliable. It’s not easy to find answers. Big beauty brands have considerable lobbying power with governments to whom they pay substantial tax dividends. In the end, it usually comes down to money. But we can keep the power in our own hands by making informed choices.

If you really want to be sure you are not helping to support companies that pollute and deceive then look for these certifications on your products:

- Soil Association: A U.K.-based charity founded in 1946, Soil Association certification requires a product contain at least 95 percent organic ingredients, or more than 70 percent with amounts clearly stated on the bottle.

- EcoCert: Founded in France, EcoCert conducts inspections in more than 80 countires. At least 95 percent of the plant ingredients and total content must be certified organic and of natural origin.

- USDA: Products must contain 95 percent minimum organically produced ingredients.

- CosmeBio, also known as the Professional Association for Natural, Ecological and Organic cosmetics: Certification criteria demands that 95 percent of the vegetable ingredients result from organic agriculture and the ingredients must be of natural origin.

Image credit: Spiezia Organics

Tara Gould is a writer and senior editorial consultant at Ethical SEO (www.ethical-seo.eu). She writes about all aspects of sustainable and ethical business, design and culture. She lives in Lewes, UK with her family.

Research: Crime Stats, Staffing Problems Plague Walmart

Walmart’s grip on the retail market may be slipping these days. Three unrelated reports just released suggest that America’s box store giant has some improvements to make both inside and outside of its stores.

Last week equity researchers at Wolfe Research (WR) in New York downchecked the superstore from a "market perform" to an “underperform” rating for its current staffing and stocking practices.

According to WR, several visits by researchers to the store “show a repeating pattern of stocking issues in many departments in the store.” It isn’t clear which outlets the research firm visited or how many locations it included in its report. While not all analysts agreed with last week’s assessment, it reflects a concern by some that Walmart may be outgrowing its image as America’s most popular department store.

According to Belus Capital Advisors analyst Brian Sozzi, Walmart’s disappointing fourth-quarter earnings in 2013 point to a need to make some significant changes in its stores, and not just in terms of stock availability. The superstore has blamed its slow Christmas sales on weather and an ill-timed decision by the federal government to slash food stamps. However, Sozzi suggests that the problem may well be related to operational procedures and a lack of perception about the country’s changing market trends. Walmart needs to make tough decisions about those stores that consistently underperform, and look at cutting some of its floor space, he says, if the retailer wants to avoid future losses. Sozzi also noted that Walmart’s size–at 4,177 stores across the nation–is adding to its difficulties during tough times, and that the company needs to trim back now.

And while it’s making changes to its décor, it may soon find itself under pressure to address some exterior concerns as well. According to a white paper just released by criminology researchers at University of South Carolina, and Sam Houston State University, in some locations the retail giant’s presence not only saw a rollback in prices for local communities, it witnessed a stall in crime rate reduction.

USC Assistant Professor Scott Wolfe (no known relation to Wolfe Reports owner Edward M. Wolfe) and SHSU Assistant Professor David Pyrooz tracked crime rates in 3,109 counties during the 1990s, and compared those where Walmart had stores with those that didn’t. The 1990s were characterized by a dramatic drop in crime rates across the nation. It was also a period of vibrant growth for Walmart, so it made sense for the researchers to concentrate on that economic period.

“The crime decline was stunted in counties where Walmart expanded in the 1990s,” Wolfe says. “If the corporation built a new store, there were 17 additional property crimes and two additional violent crimes for every 10,000 persons in a county.”

What is even more interesting, say the researchers, is that the already prevalent crime rate in a given community didn’t appear to deter the company from building there. Instead, results of the study suggest that Walmart may have actually sought out communities that showed certain sociological trends.

“Counties with more social capital--citizens able and willing to speak up about the best interests of the community--tend to have lower crime rates,” Pyrooz says. "Counties with more crime may have less social capital and, therefore, less ability to prevent Walmart from building.”

The “Walmart Effect,” say the researchers, points toward socioeconomic conditions that seem to typify the areas the company moves into. And contrary to what may be expected by increased growth and jobs, those problems--poverty, crime and depressed economy--don’t appear to always improve after the company has moved in. It's worth noting, however, that it is unclear whether the company continued those assumed building practices, or what (if any) steps the company has taken to improve or advocate for improvements in crime rates since the 1990s.

Each one of these studies, however, suggest that the labor and operational practices that virtually built Walmart’s concept of the self-serve superstore outlet in the 1990s may well be heading for a revamp. And so do new forecasts about the retail market in general, says Sozzi. Last Christmas season’s depressed sales suggest that we may be heading for across-the-board store closures in stores in all parts of the retail sector, and a focus on smaller, leaner stores with less floor space and a smaller inventory. The analyst is predicting a “tsunami of store closures” to herald this change.

It will be interesting to watch how Walmart addresses all of these impacts, and whether it can meet the needs of a changing retail market, the call for better wages for its workers and the scrutiny of local community improvement efforts, all of which stand in opposition to the practices that built its retail success.

Image credit: Nicholas Eckhart

Obama Pushes $1 Billion Climate Change ‘Resilience Fund’

Speaking against the backdrop of one of the worst droughts in California history, President Barack Obama on Friday announced plans to pitch to Congress a $1 billion climate change resilience fund intended to help communities facing climate change-induced negative weather.

The proposed fund is separate from Obama’s wider climate action plan and will be included in his 2015 budget, set to be released next month. This means the fund must be authorized by Congress and will not rely solely on executive authority. According to the White House, the fund would finance research on the projected impacts of climate change, help communities prepare for its effects, and fund “breakthrough technologies and resilient infrastructure.”

Last week, the Assistant to the President on Science and Technology, John Holdren, said without any doubt, the severe drought afflicting California and several other states across the country is tied to climate change.

“We really understand a number of the reasons that global climate change is increasing the intensity and the frequency and the life of drought in drought-prone regions,” Holdren said. “This is one of the better-understood dimensions of the relationship between global climate change and extreme weather in particular regions.”

Holdren said these effects include more rainfall that occurs in heavy downpours, meaning less is absorbed into the earth and more becomes runoff; more rain and less snowfall in the mountains, which means less melting snow to feed rivers in the spring and summer; and higher temperatures causing more evaporation.

“Recent events have reinforced our knowledge that our communities and economy remain vulnerable to extreme weather and natural hazards,” the administration said in a statement released last week.

From Hurricane Sandy in 2012, to this year’s record-low temperatures in the Midwest, to the California drought, the evidence of climate change is everywhere. And it’s costing us.

A 2013 report by Ceres found that extreme weather events cost the United States $100 billion in 2012. Most of this went towards federal crop, flood, wildfire and disaster relief. Only 50 percent of the damages in the United States caused by extreme weather events are privately insured, which means the federal and state governments are left to pick up the remaining tab.

But rather than encourage behavior that reduces risks from extreme weather events, public disaster relief and recovery programs tend to promote behavior that increases these risks–such as agricultural practices that increase vulnerability to drought and new development in hurricane- and wildfire-prone areas.

In September, a coalition of leading scientists from around the world, the Intergovernmental Panel on Climate Change (IPCC) announced it is 95 percent confident that human influence is the dominant cause of global warming. Translation: The debate is over–climate change is caused by human action.

With Congressional Republicans clinging to fiscal austerity, it seems likely the president will face opposition to the $1 billion measure. But climate change is becoming less of a partisan issue as its effects become more and more difficult to ignore. Some 80 percent of Republicans and Republican-leaning Independents now support increasing renewable energy use and more than 60 percent believe the United States should take action to address climate change, according to a Yale-George Mason University study. Only a third of Republican respondents said they agree with the GOP’s position on climate change, which has changed dramatically since 2008.

Photo Credit: Flickr Bert Kaufmann

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)

Coca-Cola and Green Mountain Coffee Roasters Challenge SodaStream

In a move that some might find surprising, Green Mountain Coffee Roasters (GMCR) and The Coca-Cola Co. announced a major strategic partnership last week. According to the announcement, the “companies have signed a 10-year agreement to collaborate on the development and introduction of The Coca-Cola Co.'s global brand portfolio for use in GMCR's forthcoming Keurig Cold at-home beverage system. Under the global strategic agreement, GMCR and The Coca-Cola Co. will cooperate to bring the Keurig Cold beverage system to consumers around the world.”

The two companies certainly come from opposite ends of the business spectrum: GMCR, with its humble Vermont origins and Ben & Jerry's-like commitment to sustainable practices and Coke, being the oft-criticized old school corporate behemoth.

Yet, in some ways, you could say the two have been moving closer towards each other. Coke, under the leadership of Muhtar Kent, who, in 2010, won Corporate Responsibility (CR) Magazine’s “Responsible CEO of the Year” in the Large Market category, has begun taking seriously the criticisms the company has received and trying to address them. At the same time, GMCR has been getting a lot bigger, in the wake of the enormous success of the Keurig line of coffee makers. The fact that GMCR saw net sales of $4.36 billion last year, up 65 percent over the previous two years, underscores the point in its 2013 Annual Report, that, “Our values reflect our belief that a strong business is in fact, a pre-requisite for contributing to social good.”

Under the terms of the agreement, Coke will acquire approximately a 10 percent ownership in GMCR in exchange for $1.25 billion. This is clearly a big deal.

I don't think the move by Coke to partner with GMCR is as much an effort to burnish its reputation as it is to fend off the penetration of a new at-home soda brewing business model entering the market, led by Sodastream. For GMCR, it's clear that aligning with the world's No. 1 brand will be a tremendous boon for sales.

Coca-Cola is still not out of the woods yet as far as their reputation is concerned. Despite the sincere efforts it has been making, particularly in the area of water stewardship, it was still a nominee for Corporate Accountability International's 2013 Hall of Shame for obstructing national park efforts to go bottled-water- free and lobbying against anti-obesity laws in several states ranging from New York to Texas.

Company backgrounds aside, let's take a look at what they are proposing to do here. GMCR's new Keurig Cold will come out as a direct challenge to upstart Sodastream, backed with genuine Coca-Cola flavors, as well as their enormous manufacturing and distribution infrastructure. That's great for the company's business, but what does it mean for the planet?

I've had mixed feelings about Keurig ever since the first time I saw it. While tremendously convenient, and much neater to use, what about all that packaging? If you buy a pound of coffee, either whole bean or ground, that is one package. Now, you get a whole bunch of individual, single-serving size packages that get thrown in the trash after being used. Yes, I know there is a reusable option, but I don't know what percentage of usage that represents.

Admittedly, I have not seen a lifecycle analysis (LCA) of this yet, so I cannot quantify Keurig's impact. GMCR has promised that it will provide a LCA on the new Keurig Cold, and when it does I will post the results. My expectation is that it will look very good, far better than the coffee version, for one very important reason.

When you buy coffee, unless you buy pre-brewed iced coffee in bottles or cans, you are essentially buying the main flavor as a dry ingredient and nothing else. You add the water, as well as sugar, milk or whatever else you like to put in your coffee, at home. Imagine if you bought all your coffee pre-brewed in bottles or cans to heat up at home. Think about how much water would have to be shipped long distances to make that possible. Think about what the carbon footprint of that would be, never mind the expense.

Yet, that is exactly what we do with soda, which is, after all, mostly water. The amount of water being shipped in soda bottles from bottling plant, to distribution center, to store, to home is enormous.

So, moving a large portion of soda consumption over to the coffee consumption model, which is essentially what this does, will substantially reduce the carbon footprint of this business. It also has the added benefit of significantly reducing the amount of water that companies like Coca-Cola will need to withdraw from the communities surrounding their bottling plants, something that has gotten them into trouble in many localities.

This will represent a big change for Coke, which has, whether it or anyone else realized it or not, has been primarily in the business of selling water all these years. They will still be doing a lot of that, of course, but perhaps, if this new model really catches on, there will be a significant shift to the point where their business will become more focused on the core value-add that they bring to the party, which is, after all, the flavors, and the formula that turns a glass of water into a glass of Coke.

This kind of refocusing of businesses and business models onto the unique value-adds that they bring to the market, through their innovative designs and formulations, will, I think, in a world where 3-D printers now allow consumers to produce their own products at home, prove to be an essential step in the journey to a sustainable future.

Ed note: The lifecycle assessment for GMCR's Keurig K-Cup Hot Brewing System can be found here.

RP Siegel, PE, is an inventor, consultant and author. He co-wrote the eco-thriller Vapor Trails, the first in a series covering the human side of various sustainability issues including energy, food, and water in an exciting and entertaining format. Now available on Kindle.

Follow RP Siegel on Twitter.

Solar Desalination Gives California Water District More Freshwater

California is experiencing a third year of drought. Researchers studying tree rings found that the last time California experienced a drought this severe was 500 years ago.

California is a leading agriculture producer, and much of that farming takes place in the San Joaquin Valley. Farming and ranching in the San Joaquin Valley requires much irrigation, and irrigation water deliveries are expected to be reduced by 50 percent or more this year. About 2 million acres in the San Joaquin Valley are expected to not receive any water this year under contracts with the State Department of Water Resources or federal Bureau of Reclamation.

The California coastline hugs a huge body of water, the Pacific Ocean, but it is too salty to be used for drinking water or irrigation. Desalination can take that salty water and produce drinking water, but traditional desalination technology is costly and produces large amounts of harmful emissions.

One company just might make desalination less costly to both the bottom line and the environment. The Panoche Water District, a privately held company in the San Joaquin Valley, and WaterFX teamed up to create a solar desalination facility in Firebaugh, Calif. The desalination technology is WaterFX's Aqua4 technology. The 6,500-square-foot facility in Firebaugh is powered by solar energy and produces up to eight gallons of water per minute from salty water. Plans are underway to increase the facility’s production to 2,200 acre-feet a year.

Firebaugh is located in the western part of Fresno County, an area long plagued with irrigation problems. The Panoche Water District and Drainage District serves over 44,000 acres of the Valley in and around Firebaugh, which includes farms growing almonds, tomatoes, melons, asparagus, pistachios and alfalfa. Panoche gets water from the Bureau of Reclamation out of Shasta Dam in Northern California which travels through the Sacramento River to the Delta region and is pumped into the Central Valley Project delivery system in Tracy, Calif. It then travels about 45 miles to the San Luis Reservoir. There is saline in the irrigated water, and lack of drainage in that part of Fresno County causes a major problem. The saline levels in some of the water have a content greater than seawater.

WaterFX’s Aqua4 system is different from traditional seawater desalination, which is done with reverse-osmosis (RO) process and requires a great deal of electricity. The Aqua4 system uses advanced solar absorption technology and produces more than 200 acre-feet of freshwater per acre of solar collection area. RO needs high pressure to push freshwater through a membrane, and water recovery rate is 50 percent. For every 100 gallons of water processed with RO, 50 gallons of freshwater are recovered and 50 gallons of brine are disposed (causes environmental problems). Aqua4 recovers 93 percent of freshwater. For every 100 gallons treated, only seven gallons of brine are produced.

The brine that is produced has a high concentration of salt (20 percent salt by weight) and using salt separators, solids can be produced from the solution. That is something which is not economically feasible with RO because of the vast amounts of brine. Phase 2 of the Panoche project, expected to be completed by September 2014, will show the types of solid byproducts that can be produced and sold through the Aqua4 desalination system without causing environmental damage. Gypsum, a calcium based salt used to make drywall and plaster, is one example of a byproduct. Another example is magnesium salts, which are in the drainage water and magnesium sulfate is used in the medical industry to treat pain and complications during pregnancy.

Photo: WaterFX

Proposed California Bill Goes After Sugary Drink Makers

If a California state senator has his way, sugary drinks will eventually be treated the same way that regulatory agencies treat cigarettes: as a health risk.

Sen. Bill Monning of Carmel, Calif., has introduced a bill to the state Senate that calls for warning labels to be placed on all sugary drinks. That includes drinks sold in vending machines and distributed in school cafeterias.

The new bill, which proposes to add an article to the state’s Health and Safety Code called the Sugar-Sweetened Beverage Safety Act, would be California’s latest attempt to regulate food and drug merchandizing. The Sherman Food, Drug and Cosmetic Law of 2008 (which regulates the branding of food among other items) and the Pupil Nutrition, Health and Achievement Act of 2001 both preempt federal food and drug laws and control what food manufacturers do to market items in the state. The two acts also make businesses that sell those products (either across the counter or in a vending machine) responsible for knowing what is being sold on their premises.

The proposed bill, which went into circulation last week, has already caused a fair amount of controversy. That may be in part because of Monning’s 2013 attempt to impose a tax on sugary drink sales, which proposed a 1-cent tax on each ounce of highly sugar-sweetened drinks. The monies collected would have gone to a fund to support nutrition education and research, which supporters said would help combat the epidemic of obesity and health problems now plaguing many communities. Unfortunately, the bill died in the Senate Appropriations Committee 11 months after being proposed because of lack of votes to carry it forward.

The topic of this bill, however, promises to elicit a much more visceral reaction from consumers and parents who oppose the high number of sugar-sweetened drinks on the market, and who are concerned about the nutritional options at schools. It is co-sponsored by Senate President Pro Tempore Darrell Steinberg and draws its strengths from the federal Food and Drug and Cosmetic Act, which makes it illegal to misbrand food (as well as regulates the percentage of actual juice that must be in a drink to be called "juice"), and the two state acts, which were put in place as a buttress against abuses that California lawmakers felt weren’t being addressed by Washington.

The Sugar-Sweetened Beverage Safety Act does have some hurdles to overcome, however. Store owners will probably not be enamored by the extra paperwork it creates, which requires vendors to keep records “including legible invoices and purchase orders, to determine the quantity and type of sugar-sweetened beverages distributed, purchased or sold” for a period of two years after the sale.

And manufacturers of sugar-sweetened drinks who don’t like the proposed legislation won’t have far to look for support in the food industry, since legislation that highlights the detrimental consequences of sugar aren’t always popular conversation-makers. Will products like ready-to-prepare corned beef, mustard, jams, bread, French fries and Cheerios be next to receive a warning label?

If the Monning-Steinberg doesn’t make it into law this time, perhaps the senators will turn their attention toward ensuring that supermarkets and other third-party vendors don’t call sugared juice drinks “juice” in their store advertisements. As California has proven in the past, its groundbreaking legislation sometimes has a tendency to influence federal laws as well. Ensuring that stores stay true to the limitations imposed on manufacturers is a healthy step toward ensuring that consumers stay informed.

Image of orange soda: Moneyblognewz

Image of grape and cranberry juice drink cocktails: Jmawork

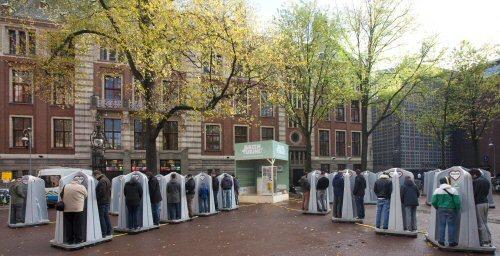

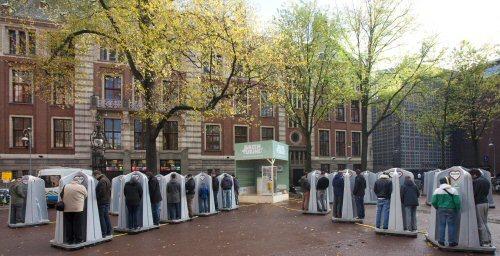

Urine-to-Fertilizer Campaign Launches in Amsterdam

Sewage is rarely thought of as a valuable resource, but the Green Urine campaign aims to change that--by utilizing urine for phosphate fertilizer and raising awareness of its benefits. The phosphates from urine will be extracted and turned into struvite, an agricultural fertilizer.

The campaign uses highly visible outdoor urinals in Amsterdam's La Place de la Bourse as collection sites and introduces the question: Is our wastewater actually a goldmine?

Urine was collected by the city's water company, Waternet, then upcycled to fertilize green roofs as part of International Water Week, which aims to create "integrated solutions for a green economy." This event aims to raise awareness about water issues and explore solutions, such as industrial and municipal water reuse and technology for optimizing the water cycle. Although publicly collecting urine may seem comical, it was a serious campaign aimed at raising awareness about waste reduction and the possibility of using urine as a source of phosphates for agricultural use.

Waternet is rising to the challange by constructing a facility that will make 1,000 tons of fertilizer from the wastewater of 1 million people. The facility is expected to open later this year.

Concern of phosphorus shortage could impact agriculture

Farmers largely use mined phosphorus to fertilize crops, previously using compost and manure to provide this vital nutrient. Unfortunately phosphorus fertilizer ends up in our waterways, where it produces algal blooms that suck up oxygen and create dead zones. Some scientists are concerned that phosphorus resources used for making fertilizer will run out in the next 50 to 100 years. They expect peak phosphorus in 2030, creating soaring food prices, while undermining our ability to grow food. Although this concern of peak phosphorus is debatable, if nothing else, using urine in fertilizer could hedge against rising fertilizer prices and produce a new revenue stream for Amsterdam and beyond.

Urine to the Rescue

Urine can be used directly on plants when diluted with water, providing nitrogen, phosphorus and potassium--the main nutrients plants need to thrive. Because urine is sterile, it doesn't pose a microbiological risk. The use of urine as a fertilizer has been described as an "age-old tradition" in Nepal. Hari Krishna Upreti, senior scientist at the Nepal Agricultural Research Council's Botany Division, recommends using urine and compost together for the best results.

The cross-contamination with feces, however, can create sanitation problems--as feces needs further processing, particularly before being used on food. It is recommended to separate urine from feces to ensure sanitation. Ecosan toilets help make the process both simple and sanitary, while saving water. The technology enables human waste to be used safely as fertilizer, mitigating reliance on chemical fertilizers.

If you consider the volume we're talking about on a global scale, the potential is huge. "A person urinates an average of 550 liters per year," says Upreti. "So this produces some four kilograms of nitrogen, which is equivalent to eight kilograms of nitrogen-rich urea."

The concept of using human waste as fertilizer is still taboo in many parts of the world, making the highly visible outdoor urinal display in Amsterdam intriguing, as it pushes the envelope. Creating more sustainable systems will sometimes require questioning our norms and creating new ways of doing things...gee whiz!

Image credit: Chris Toala Olivares via AGV.nl

Sarah Lozanova is a regular contributor to environmental and energy publications and websites, including Mother Earth Living, Green Building & Design, Triple Pundit, Urban Farm, and Solar Today. Her experience includes work with small-scale solar energy installations and utility-scale wind farms. She earned an MBA in sustainable management from the Presidio Graduate School and she resides in Belfast Cohousing & Ecovillage in Midcoast Maine with her husband and two children.