Seven Companies with the Most Unique Matching Gift Programs for Employees

By Adam Weinger

With competition for top employees at an all-time high, companies are looking for ways to stand out. Many have implemented corporate giving programs, such as matching gifts, which allow their employees to contribute to causes close to their hearts. Here are seven with unique matching gift programs.

BHP Billiton

BHP Billiton is the world's largest mining and petroleum company (based on 2011 revenues) headquartered in Melbourne, Australia, and employs more than 46,300 people.BHP's matching gift program is unique in that it's not only very generous (matching donations up to at a one-to-one ratio), but it offers fundraising matches, also. If you participate in a fundraising event (a walk, run, bike, etc.), BHP will match all donations that you personally collect. BHP will also match donations raised for events hosted exclusively by BHP employees.

In fiscal year 2013, BHP Billiton reported $7.5 million in contributions (including matching gifts) to more than 1,500 nonprofit organizations.

Dominion Resources

Dominion Resources (most often referred to as Dominion), a power and energy company headquartered in Richmond, Va., has 15,500 employees. In 2012, Dominion contributed more than $21 million in corporate giving.

Dominion's matching gift program is available to an array of people, including current full-time and part-time employees, as well as retired employees and current members of the Dominion Board of Directors. Donations are matched on a dollar-for-dollar basis up to $5,000 per calendar year.

Dominion also recognizes its employees who volunteer with nonprofit organizations, allowing them to request a grant once per calendar year up to $2,500 based on how many hours of volunteering were provided

General Electric

General Electric (GE) is an American conglomerate corporation headquartered in Fairfield, Conn., and employs 305,000 people. GE was ranked the 26th largest company in the United States by gross revenue in 2011.GE is unique in that it laid the foundation for corporate giving in 1954 by creating the very first matching gift program. In 2012 alone, the GE Foundation Matching Gifts Program matched gifts totaling almost $38 million.

GE has an incredibly robust matching gift program, matching donations up to $50,000 from employees and retirees (including surviving spouses of eligible GE retirees) to most American and U.K.-based nonprofit organizations.

Hewlett Packard

Hewlett-Packard Co. (often called HP) is an American information technology corporation that was founded in 1939 and is headquartered in Palo Alto, Calif. In 2012, it was the world's largest PC vendor by unit sales, and it employs more than 317,500 people.HP offers two kinds of matching gift programs. The first is called the HP Cash Matching Program, which provides a dollar-for-dollar match up to donations of $1,000 per employee every year.

The second program is called the HP Employee Product Giving Program, in which technological equipment is donated to eligible nonprofit organizations. An HP employee contributes 25 percent of the list price of the HP product, and HP will contribute the remaining 75 percent, up to $15,000 worth of technology. Full-time and part-time employees are eligible to participate in these programs, as are retirees.

HP has made monetary and technological donations to nonprofit organizations totaling $48 million since 2007, including $25 million worth of HP technology.

Johnson & Johnson

Johnson & Johnson is an American medical device, pharmaceutical and consumer packaged goods manufacturer that employs nearly 118,000 people. It was founded in 1886, and is headquartered in New Brunswick, N.J. From 1998 to 2005, it was ranked at the top of Harris Interactive's National Corporate Reputation Survey.Johnson & Johnson has a unique and generous matching gift program, providing matches to employee donations of up to $10,000 at a two-to-one ratio for current employees, and up to $10,000 at a one-to-one ratio for retirees. In 2012, Johnson & Johnson reported more than $131 million in cash giving.

Soros Fund Management

Soros Fund Management LLC is a private, American investment management firm located in New York City that was founded in 1969. SFM was reported in 2010 to be one of the most profitable firms in the hedge fund industry.

Despite employing fewer than 500 people, SFM has one of the most generous matching gift programs in existence. Soros will match employee donations of up to $100,000 at a three-to-one ratio to most eligible nonprofit organizations. Partner donations are matched at a two-to-one ratio. The maximum company contribution per calendar year is $300,000.

Soros Fund Management also provides grants to nonprofits where employees volunteer on a regular basis (at least 20 hours). From 20 to 39 hours, SFM will provide a $1,000 grant; 40 to 59 hours yields a $2,000 grant; 60 to 79 hours earns a $3,000 grant; and more than 80 volunteer hours yields a $4,000 grant to a nonprofit organization.

State Street Corporation

State Street Corp., more frequently called State Street, is an American financial services holding company that employs nearly 30,100 people. Founded in 1792, it the second oldest financial institution in the United States.State Street has two matching gift programs employees can participate in. The first, "GiveMore," matches employee donations at a one-to-one ratio to most eligible nonprofit organizations. The donation limits vary depending on the role of the employee: Board of Directors, CEO, President, and Vice Chairs have a limit of $35,000; Executive Vice Presidents have a $25,000 maximum; Senior Vice Presidents a $15,000 maximum; and all other employees have a $5,000 maximum donation match. Spouses of employees are eligible to have their donations matched if the donation is listed under both names.

The second program, "CollectMore," is State Street's matching gift program in which the company matches an employee's fulfilled fundraising pledges for nonprofit organizations.

In 2010, State Street employees contributed over $4 million to nonprofit organizations via GiveMore and CollectMore, and State Street contributed $4.2 million in donation matches.

Learn more about State Street's generous corporate giving program.

Read about four more unique corporate giving programs.

Image credit: Flickr/asenat29

Adam Weinger is the President of Double the Donation, a company focused on helping nonprofits increase the amount of money they raise from corporate matching gift and volunteer grant programs. Follow Double the Donation on Twitter or LinkedIn.

Fracking Boom: Some North Dakota Rentals Now More Pricey Than NYC

It’s a lesson that, not surprisingly, cuts across all segments of the oil industry these days and is as old as the Alaska pipeline: There’s always a price with fame, including fracking fame.

With a population that more than doubled since 2006 when the fracking fever gripped North Dakota, the town of Williston’s real estate prices have burst through the roof. Average monthly rents and leases now top those of New York City, making it the most expensive place to live in the country. An 800-square-foot, one-bedroom apartment will cost you somewhere in the range of $2,100 per month. A 1,400-square-foot plan, spacious in comparison, ranges around $3,500 a month. Add another $500-600 per month if you want it furnished.

For property owners, the influx of workers is a financial boon. Construction is zipping along, giving rise to apartment and condo communities that look more in keeping with a metropolitan center like Los Angeles or New York than an agricultural hub once made famous by a little brick railway station.

That’s not to say that personal safety and living conditions always keeps pace with progress. The influx of thousands of highly paid oil workers to Williston has been followed by increasing reports involving violence and alcohol. Rape stats have spiked more than 40 percent in North Dakota’s oil counties this year. Thefts and property crimes are up as well. Williston’s police department has been forced to reach out to other states in recent years to bolster its force.

For other communities around the country faced with hydraulic fracturing, Williston’s challenges have been a learning experience. Last year we reported a quiet Southern Illinois town that used Williston and Dickenson, N.D. as examples of what they didn’t want to happen to their town. Fairfield, Ill.’s unusual approach of banning nudity within the city has so far kept the couch dancing and “babes buses” off of its streets, but has it prepared its residents for other issues, like rising costs that affect more than the transient workers that will likely be gone in a few years’ time?

The news from Southern Illinois suggests not. As “laptop-toting” oil company representatives have descended on the small town, local residents have found it harder to resist the financial incentives of leasing their land to hydraulic fracturing companies. And that isn’t hard to understand. Since 2000, there has been more than a 200 percent increase in median household income in Williston–all due to the oil industry and the mom-and-pop businesses that have moved into to support its crew. In comparison, Fairfield’s current median income ($31,006) is only slightly better than Williston’s was in 2000. Unemployment in the agricultural hub of Fairfield was 8 percent in August 2013, offering optimum conditions for an industry that promises financial stability to towns that have historically suffered below the national average.

Fairfield may believe it has a finger on the pulse of the types of social “ills” not to import from oil patch counties, but is it prepared to pay the financial costs incurred by supporting an industry with a finite future? Time will tell. There are few trends as iconic to North America than the boom-town legacy that put towns like Williston and states like Alaska on the map. As American history has taught us through the centuries, whether it's launched by the discovery of gold, oil or natural gas, every boom-town phenomenon eventually runs its course.

Target Logistics innovative Bear Paw Lodge for oil workers - Williston, ND. Image courtesy of Target Logistics

ExxonMobil CEO Cites Fracking Concerns in Homeowner Suit

Maybe we should just file this one from the continuing fracking saga under the “just do as I say, not as I do” file.

But it’s still pretty delicious: According to various news reports, including the Wall Street Journal, Rex Tillerson, ExxonMobil’s chairman and CEO, is part of a lawsuit seeking to block construction of a 160-foot water tower adjacent to his and his wife’s Bartonville, Texas home. The tower will supply water to a nearby hydraulic fracturing site.

Tillerson and his neighbors contend the tower is illegal and will create "a noise nuisance and traffic hazards," in part because it will supply water that is needed for the fracking project. Fracking, which requires heavy trucks to haul and pump massive amounts of water, unlocks oil and gas from dense rock. It is widely cited as at least a mid-term answer to U.S. energy output needs, and one that’s supposedly less environmentally harsh than oil drilling and extraction.

Fracking also happens to be a core part of ExxonMobil’s core business these days.

But apparently the joys and benefits of fracking become another story entirely when the project is in your backyard or down the street: A story about property values, noise and traffic, even when you are the CEO of a company that is the biggest natural gas producer in the U.S.

After all, Tillerson’s $5 million property value might be harmed by the tower. Though his name is on the lawsuit, a lawyer representing him said in the WSJ article that Tillerson’s concern is about the devaluation of his property, not fracking specifically. Maybe there’s a distinction there somewhere.

As the ExxonMobil CEO, Tillerson has criticized fracking opponents and proponents of better fracking regulation. “This type of dysfunctional regulation is holding back the American economic recovery, growth, and global competitiveness,” he said in 2012. Natural gas production “is an old technology just being applied, integrated with some new technologies,” he said in another interview. “So the risks are very manageable.”

In fracking project areas, less wealthy residents have protested fracking developments that have much more impact than noise, including water contamination and cancer risk. Exxon’s oil and gas operations and the resulting oil spills not only hit property values, but also have leveled homes and caused long-term environmental damage.

The Bartonville water tower has been controversial and the subject of permit disputes for several years. Last November, Tillerson addressed the town’s council, telling officials that he and his wife, Renda, settled in Bartonville to enjoy a rural lifestyle and invested millions in their property after satisfying themselves that nothing would be built above their tree line, according to the council's audio recording of the meeting.

Allowing the tower in defiance of town ordinances could open the door to runaway development and might prompt him to leave town, he said. "I cannot stay in a place," he said, "where I do not know who to count on and who not to count on."

That sounds a little threatening, but why should we count on intellectual honesty from ExxonMobil’s head guy–isn’t consistency the hobgoblin of little minds?

Image: Rex Tillerson (Exxon Mobil) by energyPICs via Flickr cc

WegoWise Aims to Inspire Building Efficiency Improvments

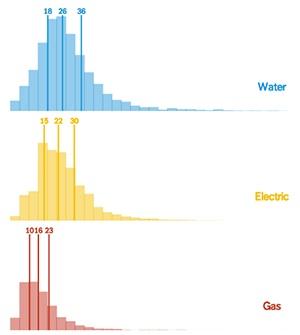

Earlier this month, the building analytics company WegoWise launched a blog that provides the public with useful nuggets of data about building efficiency and water use, gleaned from the staggering amount of information it collects from scores of utility companies around the country, among other sources. The new blog, data.wegowise.com, focuses on concisely presented, interactive images that enable readers to get a visual grasp-at-a-glance of the essential elements before delving into the details.

As a means of helping to convince property owners that energy efficiency improvements are an investment, not a cost, the new blog is especially timely for New York City. New regulations embodied in Local Law 84 require owners of thousands of buildings in New York to start recording and publicizing their energy and water consumption, and WegoWise has launched a new service designed to help them comply.

Getting a handle on building efficiency

As described by WegoWise co-founder and Chief Technology Officer Barun Singh, the company's mission literally is that knowledge is power. By providing customers with details about their utility bills, WegoWise also provides them with the motivation to act on improving building efficiency.

The new blog enables WegoWise to present that information in a visual format that enables customers, and the public at large, to see how the collected data adds up to reveal significant trends. As Singh describes it:

Data.wegowise.com builds on top of this expertise to demonstrate more macro-level trends. It allows the public to see how we can leverage millions of meter readings to better understand, and thus improve, the efficiency of the built environment.

The first five interactive images presented on the new blog are:

- Plotting water bills after a retrofit to demonstrate savings.

- Graphing seasonal changes in gas and electricity use as building tenants adjust for weather swings.

- Comparing the potential for water savings in different types of buildings.

- Tracking seasonal shifts in utility bills in New England.

- Comparing month-to-month utility bills in California and Massachusetts.

More data, more power

WegoWise also has another blog, blog.wegowise.com, that also offers up some data points along with other useful information.

Last week's entry was a list of top 15 statistics on energy and water use in buildings (here's that link again).

All 15 are significant, but three of them really stood out out.

One is a statistic from the federal EnergyStar program that, on average, 30 percent of energy in buildings is used inefficiently or unnecessarily.

That should be a wake-up call to every property owner, including those who have already made some efficiency improvements but have not gone to the extra step of benchmarking and tracking their energy use before and after the investments. Without that information in hand, the full relationship between their investment and their actual energy savings is not clear.

A second statistic underscores how the full value of the efficiency investment may not be realized, if a property owner does not have the information to target the most productive areas in which to invest efficiency dollars within a limited budget. Benchmarking information is critical, for example, when deciding on new insulation, new windows or new HVAC equipment.

The last one we'll highlight is a statistic on water loss in plumbing that underscores how small inefficiencies can add up throughout the year. Running toilets are a notorious water-wasters, at 200 gallons per day according to the U.S. EPA, but even a dripping faucet (one drip per second) can add up to 3,000 gallons per year.

The collection of statistics also draws attention to the role of consumer trends. Consumer electronics, for example, already account for 15 percent of residential electricity consumption globally. Without new advances in energy efficiency, energy use by those devices is expected to triple in about 15 years.

WegoWise and Green Button

WegoWise's contribution to public awareness about the potential for efficiency improvements is also significant in the context of the federal Green Button initiative. The idea behind Green Button is simple: require utilities to provide data to their customers in a standard, user-friendly online format.

That might seem like a no-brainer, but in the context of a large nation with no pre-existing national standards, the adoption of a uniform knowledge platform is significant.

When it joined, WegoWise had this to say about the Green Button initiative:

Green Button is about one thing: open standards. Standards are a set of rules that the individual players in an industry agree upon to allow the industry as a whole to flourish. One of the best examples of why standards are so necessary is the internet. Without formal, well-defined, open web standards, the internet wouldn’t be the innovative marvel it is today, and WegoWise almost certainly wouldn’t exist.

The utility industry was eager to sign on. Green Button launched in 2012 with half a dozen utility partners and other stakeholders, and quickly gathered steam. Within two months it doubled in size to cover about 27 million households, and even more utilities signed on to to Green Button later that spring.

The initiative was also expected to result in the startup and growth of the utility data services industry, and WegoWise is just such an example. When the company joined up with Green Button in May 2013, it had already created a name of itself in building analytics and it had begun importing data in the Green Button format.

Image: Building efficiency data courtesy of WegoWise

Interview: CEO of Japan's Kirin Brewery on Creating Shared Value

By Meghan Ennes

Kirin Co. faces an interesting challenge when it comes to creating social good. Among the assets in its large food and beverage business are two of Japan’s most popular beers: Kirin Lager and Ichiban Shibori. But how does a company that makes alcoholic beverages also address social needs, like drunk driving accidents, for example? The beginnings to that complicated answer, says President and CEO Yoshinori Isozaki, center around the concept of shared value–which has enabled the company to address the needs of society while still operating under its core business.

In the new series, “Leading Shared Value: Personal Reflections from Global Practitioners,” the Shared Value Initiative will speak with global leaders who are driving shared value strategy within their organizations. Today we interview Isozaki-san, who will also be speaking at the Shared Value Leadership Summit: Investing in Prosperity, May 13-14 in New York.

Shared Value Initiative: What does the success of shared value look like at your company? Tell us your favorite shared value story.

Yoshinori Isozaki: Drunk driving is strictly prohibited by law in Japan. As a company providing alcoholic beverages, we at Kirin believe it is our responsibility to eradicate drunk driving. So we developed the world’s first non-alcoholic beverage that tastes like beer, KIRIN FREE, in 2009.

Unlike other non-alcoholic beers in the world, KIRIN FREE is completely free of alcohol (0.00 percent ABV). Yet, due to our original brewing technology, we have succeeded in retaining the great taste of regular beer. Over the past 20 years, the number of annual accidental deaths in Japan caused by drunk driving decreased dramatically, around 63 percent.

We feel that KIRIN FREE has certainly contributed to this remarkable result. The beverage can also be enjoyed on a daily basis for sports, outdoor activities, lunch meetings, etc.–times when a person might want to taste beer but not feel intoxicated. KIRIN FREE has created more drinking opportunities for people who choose not to drink in a new non-alcoholic market in Japan.

SVI: Why is shared value one of your priorities as the leader of Kirin Co.?

YI: We believe that creating shared value can solve social issues and enhance corporate competitiveness simultaneously by creating value that can be shared with the society. Kirin Group has started its challenge to realize “KV2021,” our long-term business plan towards 2021, by setting shared value in the center of the management concept of Kirin Co. dealing with integrated beverage business in Japan.

SVI: What are the most innovative opportunities that you see for shared value in your region?

YI: A devastating earthquake struck northeast Japan in March 2011, and Kirin has launched the KIZUNA Relief-Support Project, providing 6 billion yen in three years to assist reconstruction of the affected areas. [Kizuna is the Japanese word for “bond.”] One example of our efforts is a launch of ready-to-drink Hyoketsu Wanashi in November 2013. This product uses the juice of pears produced in the Fukushima region, where agricultural products suffer from harmful rumors after the nuclear accident. We intended to introduce it as our shared value product and was highly acclaimed and supported by the customers.

SVI: What’s the biggest challenge that you’ve faced in adopting shared value?

YI: Our biggest challenge was to commit to shared value by launching a specific division carrying its name when the concept of shared value had not yet permeated in Japanese companies. I met Professor Michael Porter when he was visiting Japan and was encouraged by him in launching the division.

SVI: What does the future look like for Kirin, imagined through a shared value lens?

YI: [The] beverage business covers [a] long value chain from procurement to sales, and there are numerous chances to create values. KIRIN FREE and Hyoketsu Wanashi are good examples of shared value through our products and services. From the value chain perspective, reducing the packaging will decrease environmental load and modal shift will lead to CO2 reduction. As for the community, restoring agricultural and fishery industries through the KIZUNA project, co-existence of beer factory and local community, and other development programs can be expected.

To see Isozaki-san speak at the 2014 Shared Value Leadership Summit, request an invitation.

Meghan Ennes is the community coordinator of the Shared Value Initiative. You can learn more about the initiative and join the shared value community of practitioners at sharedvalue.org.

Asia Pulp and Paper: One Year After the Forest-Clearing Moratorium

Last fall we reported extensively on Asia Pulp and Paper (APP) and its Forest Conservation Policy (FCP), which since February 2013 placed a moratorium on any further clearing of natural forest across the company's 38 supplier concessions in Indonesia and subsequently put an end to the use of natural wood fibers in its paper mills.

In October, we also reported on Greenpeace's assessment of how APP's moratorium was holding up. In a comprehensive report published by the organization--who up until the implementation of FCP had been one of APP's harshest critics--its assessment was generally favorable. In essence, Greenpeace's position was that while some concerns remain, the company is doing what it said it would do.

Feb. 5 marked the anniversary of APP's announcement by company Chairman Teguh Ganda Wijaya that it had stopped the destruction of natural forest lands in Indonesia, and in marking this milestone, the company has announced further areas of focus going forward. APP also hosted a debate in Jakarta to discuss their progress to-date; the debate panel involving company officials, the NGOs assisting them in their FCP implementation, and importantly, members from both WWF and the Rainforest Action Network, who remain skeptical critics of APP. More on this later--but, first, a quick recap of what APP has been doing in the last 12 months.

As well as the cessation of bulldozing the rainforest, APP engaged with third-party organizations to carry out critical environmental assessments, utilizing both High Conservation Value (HCV) and High Carbon Stock (HCS) assessments to determine the environmental value of the concession lands. More details can be found in this prior post. Completion of these assessments is critical, because they will form the basis of recommendations to the company which will be used in its Integrated Sustainable Forest Management Plans (ISFMP) going forward.

By way of an update on both HCV and HCS, these will be completed by June of this year. In the case of HCS, this is a little later than initially forecasted, but the extension was necessary in order to gather more comprehensive field data to supplement satellite imaging.

Still, work done to date has provided sufficient feedback in order for APP to set four key priorities for 2014, which as stated by the company are as follows:

- Overlapping licenses: The issue of overlapping licenses needs to be resolved by all concerned parties if we are to develop a system for governing all concession holders in Indonesia.

- Community and land conflict issues: At times when the needs of communities are at odds with no-deforestation policies, an agreed and consistent way of managing the negotiation process should be developed.

- Landscape management: Landscape level conservation is vital to the preservation of peatland, the habitat of key species and protection against forest fires, all of which can span several concession areas of differing uses. A cross sector approach must therefore be developed to manage entire landscapes to ensure their long term viability.

- Market recognition: Policies that protect forests and peatland can only be economically viable if there is market recognition of their value. It is therefore important for the market to encourage companies to introduce and implement them.

A key learning underpinning these objectives appears to be that APP sees the need to increase cooperation with other organizations (business, government and civil society) in order to work together to resolve issues. In APP's press release, Aida Greenbury, managing director of sustainability and stakeholder engagement said--as part of a wider statement--that, "many opportunities and obstacles that we know cannot be realized or solved by a single company."

Take, for example, the problem of overlapping licenses granted to different entities to use the same area of land. In cases when this happens, it is not something that one entity can resolve alone, but can nonetheless impact the commitments APP makes if the overlapping licensees take contrary action.

That said, APP continues to take unilateral steps which address prior concerns. For example, though Greenpeace has acted as a partner over the last year, one of the key concerns in the organization's October report was how APP will properly manage peatlands on its concessions. When we last reported on this, APP was searching for peatland experts and, as of January of this year, has announced they will work with a team from Netherlands-based Wageningen University and Research Center--an organization with international peat management expertise that will help determine best-practices specific to APP's tropical rainforest environment.

During the last year APP has also entered into dialogue with the Forest Stewardship Council (FSC)--whose board of directors has publicly welcomed APP's Forest Conservation Policy--and though FSC has not yet granted re-association with the company, this is something APP has expressed an ambition to achieve.

Notable too is that APP engaged with the Rainforest Alliance as of Jan. 14 of this year. The alliance will serve as a third-party evaluator of APP's implementation of the Forest Conservation Policy and will be reporting their findings in the latter part of the year.

These are all positive moves by APP, and with every new commitment and engagement with third-party organizations, it binds the company more strongly to the promises it has made. Furthermore, it is keen to offer as much transparency as possible.

For instance, APP didn't shy away from bringing in staunch critics to the debate it hosted in Jakarta. The Rainforest Action Network (RAN) and WWF were both around the table--and both organizations continue to remain skeptical that APP has truly changed its ways. But even so, during the discussion both WWF and RAN congratulated APP on engaging with the Rainforest Alliance; both organizations see this as an important step in providing independent verification of company practices.

Both RAN and WWF remain concerned, however, that while the FCP commits APP to a cessation of deforestation for good, scant details are provided regarding setting right the legacy of prior deforestation. Additionally, concerns remain about proper peatland management.

Aida Greenbury, APP's managing director of sustainability and stakeholder engagement, asserted in response that the legacy of deforestation will be addressed upon the completion of the HCV assessments when recommendations will be made, and of course, since they have just engaged with peat experts--peatland best practices are still to be determined. That said, APP has a plan in place for the main areas of concern of both RAN and WWF, and time will tell if it proves to be satisfactory for these organizations.

Following my own visit to Indonesia to meet with APP last October, the announcements made this month seem evident that even in the last three months or so, APP's efforts to improve and address existing concerns have moved forward in a significant way. We'll keep you posted!

Photo of APP's paper mill taken by the author in October 2013

Follow me on Twitter: @PhilCovBlog

Investors Pressure Oil Companies to Disclose Carbon Asset Risk

The jury might still be out on when the world will run out of oil, but the rising human and economic costs associated with climate change, air pollution and overall environmental decline are accelerating the world towards a low-carbon economy. In recognition of this reality, a half-dozen investors recently filed shareholder resolutions with 10 fossil fuel companies, including Exxon Mobil and Chevron, seeking an explanation of their strategies for competing in a low-carbon global market.

Southern Company, Hess, Anadarko, Devon, Kinder Morgan, Peabody Energy, FirstEnergy and CONSOL Energy also received resolutions.

The resolutions focus on potential carbon asset risk, or the possibility that these companies’ present and future fossil fuel-related assets will lose value as various market factors—such as energy efficiency, renewable energy, fuel economy, fuel switching, carbon pollution standards, efforts to curb air pollution and climate policy—increasingly reduce demand for fossil fuels and related infrastructure.

According to the shareholders, fossil fuel companies are not sufficiently disclosing these risks, even after a coalition of investors managing more than $3 trillion in collective assets sent letters last fall to 45 of the world’s largest fossil fuel companies urging them to report on this very same concern. Resolution filers include the Connecticut State Treasurer’s Office, the New York State Comptroller’s Office, Arjuna Capital, As You Sow, First Affirmative Financial Network and the Unitarian Universalist Association.

Fossil fuel companies ought to be concerned--equity valuation of some oil producers could drop by 40 to 60 percent under a low-carbon scenario, according to an HSBC report cited by the investors.

“Climate-related trends such as carbon-reducing regulations and clean energy growth are a real threat to fossil fuel companies’ future profitability, but most firms have relegated it to the ‘someday’ pile when it comes to corporate priorities,” said Mindy Lubber, president of the sustainability advocacy group, Ceres, and director of the Investor Network on Climate Risk—which helped to coordinate the filing of these resolutions.

The letters and resolutions are part of the Carbon Asset Risk Initiative, coordinated by Ceres and Carbon Tracker, with support from the Global Investor Coalition on Climate Change. Through this program, investors are addressing the growing concern that demand for fossil fuels will be less in a low-carbon future and that no more than one-third of proven reserves of fossil fuels can be consumed prior to 2050 if the world is to achieve its goal of limiting average global temperature increases to 2°C, as outlined by the International Energy Agency.

As part of this initiative, investors have asked fossil fuel companies to assess—under both a business-as-usual scenario and a low-carbon scenario—the viability of capital expenditure plans, the risk of stranded assets, physical risk to operations from climate change impacts and the effect of these risks on the workforce.

But when it comes to voting on shareholder resolutions filed with companies on climate change business risks, many investors continue to disregard climate change as a material concern, according to a 2013 Ceres study. The study is an analysis of proxy votes cast in 2012 by 43 of the largest U.S. mutual fund companies. Among more than 40 large U.S. mutual fund families that were included in this study, only eight have an average support of more than 50 percent for climate-related shareholder resolutions. Of these eight fund families, only three supported the vast majority (more than 80 percent) of these climate-related shareholder resolutions–DWS, AllianceBernstein and Oppenheimer.

On a more positive note, investors have been much more vocal about climate change in recent years, achieving notable victories during the 2013 shareholder proxy season, with a near-record 110 shareholder resolutions filed with 94 U.S. companies on corporate sustainability challenges such as climate change, supply chain issues and water-related risks.

Image Credit: Flickr aoenday

Based in San Francisco, Mike Hower is a writer, thinker and strategic communicator that revels in driving the conversation at the intersection of sustainability, social entrepreneurship, tech, politics and law. He has cultivated diverse experience working for the United States Congress in Washington, D.C., helping Silicon Valley startups with strategic communications and teaching in South America. Connect with him on LinkedIn or follow him on Twitter (@mikehower)

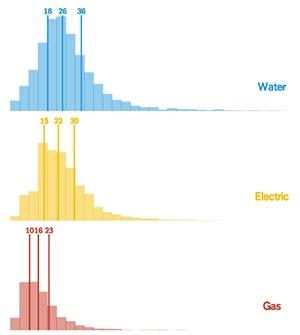

Will the New 'Food Porn Index' Get People to Upload More Photos of Healthy Food?

Are you into food porn? Well, you don’t have to admit right here right now, but given that there are more than 175 million food hashtags ond Twitter and Instagram, there’s a good chance you’re also part of this phenomenon.

For those of you who have no idea what I’m talking about, don’t worry--we’re not talking about porn that mixes sex with food, but about people sharing online photos of meals they’re about to eat at a restaurant or homemade food, from Krispy Kreme glazed donuts to peanut butter brownie pizza.

If you want to get a better idea about this phenomenon just go to Tumblr, Instagram or Twitter and search for #foodporn. What you’ll quickly notice is that most of the #foodporn photos on the various social media channels are of food that is not exactly the healthy type and include mostly fast food and fatty, sugary food.

Now, a new website wants to change that, one photo of kale at a time.

Welcome to FoodPornIndex.com, a new initiative of Bolthouse Farms, a manufacturer of juices, smoothies and other items, which is owned by the Campbell Soup Co. This new website is based on an algorithm tracking hashtags and mentions of 24 different food items on social media, where half are vegetables and fruits and half are mostly junk foods. Visitors can see the number of mentions for each item, as well as a tally for each group. As of last weekend, the unhealthy foods counted for 72.2 percent of the mentions online while the healthy foods counted for only 27.8 percent.

The website provides not just a constantly updated tally but also a visualized and fun experience–you can click on every food item and enter into a world of music and fun graphics. Click on "Snack" for example (14,060,297 mentions), and you will see a spiral of snacks zooming in with a warning window at the middle: “Warning: Your computer is being attacked by snacks.” At the bottom of the window there’s a “NOM” button that makes a funny NOM sound every time you click on it. If you click on "Mushroom" (4,098,039 mentions), you enter a sort of psychedelic experience with weird mushrooms floating around accompanied by music that could be part of the soundtrack of Zabriskie Point.

So why did Bolthouse Farms come up with this index? According to the website, the company believes that: “If we can change the way people think (and post) about fresh fruits and veggies, we’ll make the world a healthier place.” The goal, added Bolthouse executives on the New York Times, “is to remind consumers that a fresh strawberry is just as beautiful as those found in a dessert like a tart—and healthier.”

Is this a marketing gimmick of Bolthouse Farms or an honest effort to level the playing field in an effort to change the #foodporn imbalance? It’s probably a little bit of both--creating this unique index has definitely proved itself to be a smart marketing move, giving the company free publicity on the New York Times, Slate and other media outlets. In addition, leveling the #pornofood playing field also benefits Bolthouse Farms, as more photos of veggies and fruits certainly don’t hurt a company that sells products like fresh carrots and premium beverages and claims to “loudly and proudly celebrate fresh fruits and veggies.”

Still, even if the Food Porn Index is about helping the company sell more of its products, I believe we should applaud it because of the innovative approach it represents. It takes the decade-long fight to get people to eat healthier and reframes it as a fight over social media dominance instead of a fight over education and affordability. What’s behind it is the realization that social media had become an important part of the food culture as for many people. “Showing your food . . . is showing a little bit about your personality and who you are as an individual,” Brigham Young professor Ryan Elder explains.

The importance of this understanding is that the type of #foodporn photos uploaded on Tumblr, Twitter, Instagram and Pinterest is not just a reflection of what people eat but also a mechanism shaping the general public’s perception of food consumption. This is due to the principle of social proof, which means according to Prof. Robert Cialdini et al. that: “One way that individuals determine appropriate behavior for themselves in a situation is to examine the behavior of others there, especially similar others. It is through social comparison with referent others that people validate the correctness of their opinions and decisions. As a consequence, people tend to behave as their friends and peers have behaved.”

In other words, we like to follow the crowd, and when this crowd is posting (and eating) mainly junk food, there’s a good chance we’ll also be posting (and eating) junk food. As healthier food becomes less and less prevalent on #foodporn photos, there’s a greater chance that we wouldn’t feel very comfortable uploading a photo of a quinoa salad we made or the beautiful strawberries we just bought at the farmers market. After all, too many people might think it’s not that cool, at least not as much as pancakes with peanut butter and hot fudge, for example.

I’m not sure to what degree the Food Porn Index can change the balance of power between online photos of healthy and unhealthy food, but it is an effort worth pursuing given our tendency to feel that we can’t really enjoy food unless we take a picture of it and upload it to make sure the rest of the world sees it. If more people will remember that every #foodporn counts as the website puts it, when making a great looking salad or a mouth-watering broccoli dish, there’s still hope to change the landscape of #foodporn photos.

Image credit: Bolthouse Farms

Raz Godelnik is an Assistant Professor of Strategic Design and Management at Parsons The New School of Design. You can follow Raz on Twitter.

Shell Banks on Runaway Climate Change

Imagine a world where coalitions form to address climate change. Global alignment to reduce energy consumption and CO2 emissions slows the demand for coal, while boosting efficiency and clean energy investment and deployment. Carbon prices and cap-and-trade schemes enable investment in carbon capture technologies as the world shifts to low-carbon technologies. This proactive approach to climate change, entitled "Blueprints," was identified by Shell in 2008 as one of three possible scenarios.

Shell has used scenario planning as a powerful business tool for making more strategic choices and being sensitive to uncertainties for 40 years. The "three hard truths" that were the foundation for the three scenarios in 2008 were that energy demand is surging, suppliers are struggling to keep up and stresses on our environment are increasing. The scenario entitled "Scramble" involves a lack of decisive action on climate change, thus coal and biofuels drive growth in developing countries, leading to rising food prices and air pollution, while the U.S. and Canada turn to "unconventional oil projects," such as Canada's tar sands.

In the past, Shell used scenario planning merely as a tool to gain insights but didn't advocate for any particular scenario. For the first time, Shell chose a scenario that it wants to manifest, and it says it chose the Blueprints scenario as being better for both the company and the world. The company announced this, and former Shell CEO Jeroen van der Veer even advocated for governments to impose a price for emissions.

Some large corporations, including the five biggest oil companies, Walmart and American Electric Power, including a price on carbon into their long-term financial plans. However, now years have passed without decisive action, and the Blueprints scenario hasn't been widely playing out. Governments haven't adopted strong climate policies, carbon emissions continue to mount, and climate change is a largely unpopular topic in the media. It appears that the Scramble scenario is actually playing out, not Blueprints, and Shell itself is leading the way.

Shell has invested $6 billion towards drilling in the Beaufort and Chukchi Seas in Arctic Alaska, but a recent court ruling by the 9th U.S. Circuit Court of Appeals threw offshore Arctic oil leases into question. Shell spent nearly $1 billion annually in Arctic drilling in the last few years, thus it was banking on the Scramble scenario and looking to capitalize off of this scenario. A coalition of native and environmental groups led a lawsuit that has halted Shell's plans to start drilling this summer, thus elements of the Blueprints scenario are manifesting.

Oil produced from Canadian tar sands are another example of Shell banking on the Scramble scenario. Because a lot of energy needs to be used to extract oil from this source, the greenhouse gas emissions are 23 percent higher than from conventional crude.

The proposed Keystone XL pipeline would help deliver hard-to-access Alberta tar sand oil to U.S. refineries. If the production, refining and combustion of 830,000 barrels per day of sands crude oil were actually met, the pipeline would contribute the climate-change equivalent of an additional 5.7 million cars on the road each year , according to a report by the State Department. Shell has invested millions in lobbying for this controversial project, furthering the push towards the Scramble scenario.

Although Shell has publicly stated that it supports the Blueprints scenario, its support of the Keystone XL pipeline, oil production from tar sands and Arctic drilling show otherwise. In the absence of decisive government action to curb climate change, Shell is scrambling to capitalize off of the current scenario.

"I will be one of those persons most cheering for an endless summer in Alaska," Peter E. Slaiby, vice president of Shell Alaska, said at the Arctic Imperative Summit.

Image credit: Shell (upper photo) and Greenpeace (lower image)

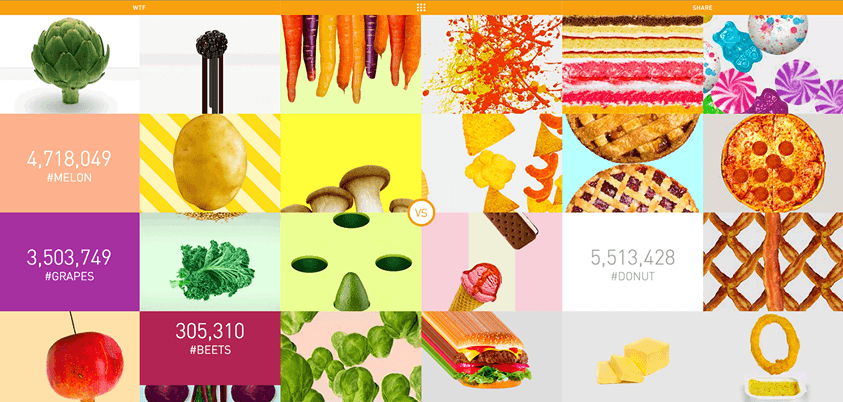

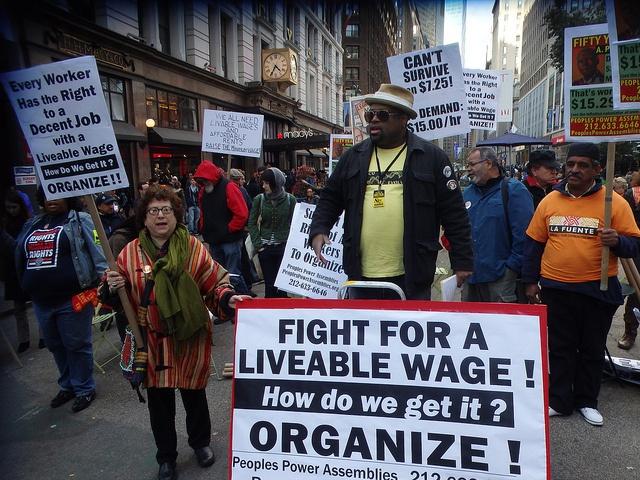

Raising Federal Minimum Wage Would Benefit Majority of Low-Wage Workers, CBO Finds

While many conservatives and conservative think tanks claim that raising the federal minimum wage would bring only negative consequences, an analysis by the Congressional Budget Office (CBO) shows otherwise.

The CBO, a non-partisan group that analyzes congressional bills, analyzed the effects of increasing the minimum wage and concluded that it would increase the pay and family income for most low-wage workers. The increased earnings for low-wage workers would be $31 billion, by CBO’s estimate.

Overall real income for all low-wage workers would increase by $2 billion, and real income would increase by $5 billion for workers whose income is below the poverty threshold. Raising the minimum wage would move about 900,000 people above the poverty line. The CBO also found that raising the federal minimum wage would slightly reduce employment by about 500,000 workers, or 0.3 percent. However, changes in the economy for goods and services might offset the employment decrease. As the CBO points out, “The families that experience increases in income tend to raise their consumption.”

During President Barack Obama’s State of the Union address last month, he promised to sign an executive order raising the minimum wage for federal contractors to $10.10 an hour from its current $7 an hour. A few weeks later, Obama made good on that promise and signed the executive order which affects about 100,000 workers. It will go into effect next January.

Obama is not satisfied with only raising the minimum wage for federal contractors. In both his State of the Union and his weekly address last week he has called on Congress to pass a bill that would raise the federal minimum wage to $10.10. Raising the minimum wage would “lift millions of Americans out of poverty, and help millions more work their way out of poverty–without requiring a single dollar in new taxes or spending,” Obama said during his Feb. 15 weekly address. He added that increasing the federal minimum wage would “give more businesses more customers with more money to spend–and that means growing the economy for everyone.”

An analysis in 2013 by the Economic Policy Institute (EPI) finds that raising the minimum wage would “help reverse the ongoing erosion of wages that has contributed significantly to growing income inequality” while providing a “modest stimulus to the entire economy.” Increasing the federal minimum wage to $10.10 by July 1, 2015 would raise the wage of about 30 million workers by about $32.6 billion and create about 140,000 new jobs over the phase in period.

Those who would see wage increases do not fit the stereotypes of minimum wage workers, as more than 88 percent are at least 20-years-old, about 44 percent have at least some college education, only 14.2 percent are part-time workers and more than half (54.5 percent) work full time (35 or more hours a week). And Obama is right in stating that women would be most affected, as the EPI found that women make up 56 percent of low-wage workers. The EPI states on its website that it is a nonprofit, non-partisan think tank created in 1986.

Many economists agree with the findings of the CBO and the EPI, as a 2013 survey of leading economists by University of Chicago’s Booth School of Business found. The economists surveyed agreed by almost a four-to-one margin that raising the minimum wage has more benefits than costs. Sen. Tom Harkin (D-Iowa), who introduced a bill to increase the federal minimum wage to $10.10, also agrees. On MSNBC's "Morning Joe" show, he said that it's "goofy stuff" to claim that increasing the federal minimum wage will cause workers' hours to be cut or reduce employment. Instead, he said that raising the minimum wage would help the overall economy because minimum wage workers "tend to spend their money."

Image credit: Flickr/The All-Nite Images