Lawsuit: Silicon Valley Under Scrutiny for $9 Billion in Wage Theft Conspiracy

Ironically, the importance and tight demand for high-tech human resources may have lead Silicon Valley companies to engage in practices that actually reduced their wages.

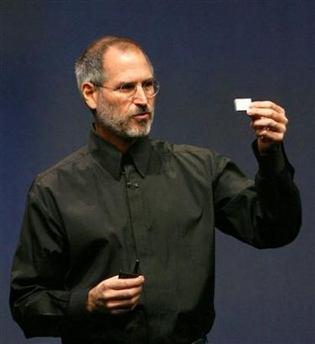

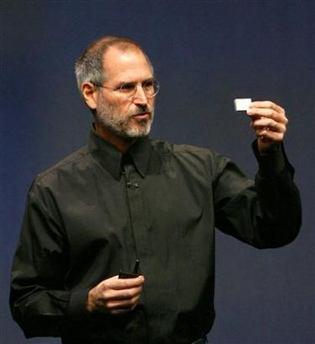

A class action wage theft lawsuit is implicating numerous tech companies in Silicon Valley for taking organized actions to suppress wages. In one instance, legal documents reveal that Steve Jobs threatened the CEO of Palm Inc. with legal harassment in an attempt to make a potentially illegal wage suppression deal. At issue, Mr. Jobs was annoyed with Edward Collagan of Palm for poaching workers from Apple and attempted to strike a deal where the two companies would agree not to hire each others employees. It's an agreement that amounts to wage suppression since employers can't use higher wages to hire employees away from another company.

Palm CEO, Edward Collagan, was one of the few prominent Silicon Valley heads to stand up for workers and against a possible wage suppression web that included high-profile tech companies, saying to Mr. Jobs:

"[Y]our proposal that we agree that neither company will hire the other’s employees, regardless of the individual’s desires, is not only wrong, it is likely illegal.

“…I can’t deny people who elect to pursue their livelihood at Palm the right to do so simply because they now work for Apple, and I wouldn’t want you to do that to current Palm employees.”

In turn, Jobs threatened to file costly, protracted lawsuits against Palm in retaliation, saying:

"This is not satisfactory to Apple…We must do whatever we can to stop this. I’m sure you realize the asymmetry in the financial resources of our respective companies when you say: ‘We will both just end up paying a lot of lawyers a lot of money.’… My advice is to take a look at our patent portfolio before you make a final decision..."

Basically, Jobs proposed an agreement detrimental to workers, Collagan said "No," Jobs threatened to engage Collagan in costly legal battles in retaliation and Collagan said "shove it."

This is part of a much broader issue as revealed by the wage theft lawsuit. Mr. Jobs may have also engaged in a secret pact with Google CEO Eric Schmidt to abstain from recruiting each other's employees. Yes, it's not just Steve Jobs. Two of America's most beloved tech companies may have engaged in business practices that directly contributed to wage suppression in the technology industry. Also implicated in the wage suppression lawsuit are Intel, Adobe, Intuit and Pixar.

These types of agreements became so pervasive during a period of tight demand for high-tech engineers that the U.S. Department of Justice began an antitrust investigation in 2010. That investigation formed the basis of a class action lawsuit on behalf of more than 100,000 Silicon Valley employees who claim wage suppression agreements robbed them of about $9 billion since 2000.

America idolizes many of these businesses and reveres Steve Jobs as one of our nation's visionaries and heroes. As a society we seem to idolize much of the toughness and shrewd business dealings, skirting the law at times. And they've definitely been powerhouses that have driven our society and our fortunes. We love those folks!

On the other hand, the fierce protectiveness each of these businesses has displayed for its high-tech humans resources shows an important story beyond the Individual Businessperson Hero narrative. It shows these businesses depend deeply, deeply on the skills and work and vision of the employees. And rather than rewarding these critical hands of an American technological revolution, these businesses may have in fact have taken money from them because of their importance.

That's irony. It's also, possibly, illegal.

Seattle Company Plans First Offshore Wind Farm on Pacific Coast

The nation’s first offshore wind farm on the Pacific Coast cleared a crucial federal hurdle after Seattle’s Principle Power received approval to move forward on a commercial lease for the proposed $200 million, 30-megawatt project.

Principle Power received the go-ahead this month from a Department of the Interior agency to lease 15 square miles of federal waters, 18 miles from Coos Bay, Ore. If the lease request gets final approval, the WindFloat Pacific project would anchor the first offshore turbines in federal waters on the West Coast. It also would be the first in the nation to use triangular floating platforms instead of single piles driven into the ocean floor.

At this stage of the complicated federal process, Principle’s plan is considered a demonstration project. DOI’s Bureau of Ocean Energy Management (BOEM) released a finding that there are “no competitive interests for the offshore area of Oregon” where the company has requested the commercial lease. That finding clears the way under BOEM’s non-competitive leasing process for Principle Power to submit an implementation plan for the project. WindFloat Pacific will demonstrate floating offshore wind technology; it is one of the Department of Energy’s (DOE) seven Offshore Wind Advanced Technology Demonstration Projects.

Principle Power has successfully operated a WindFloat prototype, WF1 offshore of Portugal, since 2011. To date it has delivered in excess of 8.4 gigawatt-hours of wind energy to the local grid.

Principle is a U.S. technology developer that is focused on the offshore wind energy market. Principle’s major product, the WindFloat, is a floating wind turbine support structure that enables the siting of offshore wind turbines in water depths greater than 40 meters/131 feet, thus capturing the world's windiest wind resources. The entire structure, from water surface to the end of the turbine blade, would rise about 600 feet. Offshore wind installations in these water depths have not been feasible to date, “due to economic and technological limitations,” according to BOEM.

The 2-megawatt WindFloat prototype currently operating off the Portugal coast is the first offshore wind turbine to be installed without the use of heavy lift equipment.

Under the Pacific Coast project, five 6-megawatt turbines and platforms would be assembled on Coos Bay harbor and then towed by tugboats approximately 17 miles out. They would be spaced about a mile apart and could begin generating a combined 30 megawatts of power by late 2017. That's enough to power 8,000 homes.

Ultimately, Principle hopes to deploy its platforms in Europe and in the Pacific along the West Coast, Hawaii and Japan.

But first the feds have to allow it to happen.

Image credit: WindFloat Pacific platform/turbine from Principle’s WindFloat Pacific website

Is the Sharing Economy Bad for the Real Estate Market?

If you want to start a debate, just mention rent control. But if you want to find yourself in a battle, throw in the sharing economy.

That was the lesson last week when a Slate writer penned an article about her town’s misfortunes due to the sharing economy. Rachel Monroe, resident of Marfa, Texas, explained why Airbnb and, by extension, the sharing economy began as a godsend for the small town of Marfa (population just under 2,000) but later became the possible “cause of Marfa’s housing shortage.”

A small tourist attraction off of busy Highway 10 at the foothills of Texas’ scenic Davis Mountains, Marfa’s sole claim to fame is its extraordinary collection of art galleries and al fresco art installations. With more than eight different art galleries and museums, Marfa’s downtown has more art investment than many mid-size cities have within their city limits. Ironically however, it has no significant industry outside of its popular exhibits and art events, most of which center their attention on artists outside of Marfa and rely on vacationing art aficionados for their tourism dollars.

Of course, Marfa is also known for its historically affordable real estate. And that’s part of the problem, said Monroe. Between 2000 and 2009 at the beginning of Airbnb’s rise to fame, and Marfa residents’ discovery of peer-to-peer rental opportunities, rents in Marfa rose more than 80 percent. Economic resources, such as job growth, however, didn’t keep pace, nor did the availability of accommodations for local residents.

“[More] than a third of the population still lives in a household earning less than $20,000 a year,” said Monroe.

And that rent spike, she contends, was helped along (if not created) by the sharing economy. With carefully researched statistics about rental conditions in major cities, she showed how the conundrums that Airbnb has experienced in large metropolises like New York City and Berlin are indicators that “peer-to-peer rentals were contributing to the problem and driving up costs for long-term residents.”

But as a number of commenters asked, is Marfa’s dilemma really the fault of Airbnb? Is it really fair to blame the whole sharing economy for the rental market of a small, residential town with an average property value of less than $90,000, unemployment of 11 percent, and a minimal infrastructure to promote job growth and real estate expansion?

Equally, is it really accurate to blame an enterprising business model for the rental woes of a city that is famous for its endemic rental problems? Isn’t more likely that unaffordable housing markets are what gave fuel to the creation of Airbnb, and the infectious enthusiasm of its supporters?

By comparison, Sandpoint, deep in the rural north of Idaho, has survived as an artist haven for more than a century. It is also on Airbnb, but with per-night rentals that are more consistent with the area’s motel rates and cost of living. Most of its more affluent mountain and lakeshore offerings don’t compare to Marfa’s wide spread of prices, which includes a $3,000 a night splurge that is out of sync with local property values. My guess is that Sandpoint has learned the value of eclectic but reliable commerce that promotes job growth and stimulates varied business investment. It's also found that a business community that is patronized by locals, as well as business and vacationing visitors is an added benefit to a community driven by tourism dollars.

But the stunning takeaway message of Monroe’s article was the response it received in the comment section. American readers are clearly not ready to surrender the sharing economy as a failed experiment. With more than 170 comments amassed in four days (most in favor of the virtues of a collaborative economy structure), Marfa's heart-wrenching story serves ironically, as an advocate for the diversity and entrepreneurial spirit that today's peer-to-peer supporters love most.

Companies like Airbnb, FlightCar, Lyft and the Australian concept WeTeachMe have survived not because cities like New York have defined their usefulness, but because the sharing economy supports business’s No. 1 motto: The customer always has the last say.

Image of Marfa: Daniel Schwen

Image of Prada Marfa Gallery: Andy Price

Why Family Businesses Have a Sustainability Head Start

By Anna Simpson

Nguyen Binh, a director and board member of one of Vietnam’s most successful enterprises, speaks with pride of his mother. She has held the titles of chairwoman and chief executive of Refrigeration Electrical Engineering (REE) for the past decade, having started her career with the company in the 1980s. For her son, Madam Nguyen is “a true pioneer … decisive and modern." When he accepted her invitation to join the firm, his motivation was not only “to bring the company to greater heights, continuing her legacy," he asserts: “I also wanted to help the REE Family grow from strength to strength."

Charles Tan–a second-generation employee of Sunray, one of the largest interior developers in Singapore–tells a similar story: “After my graduation from RMIT University, I returned to the family business. Topmost on my mind was the Chinese proverb […] that I am to remember my roots. Truly, I want to give back to the Sunray Family who supported me.”

Businesses can struggle to inspire such commitment among their employees, particularly as more people aspire to flexibility and variety in their working life. Strong values can make a difference to staff engagement and retention, but defining them is one thing–instilling them in the hearts and minds of the workforce another. In this, family businesses (defined as those in which at least two relatives are involved, through ownership and/or management) have a head start, thanks to their intergenerational approach.

For one, the next generation can be primed from a young age, witnessing their family’s values in action around them. Blood ties aside, family businesses often nurture relationships with employees, partners and suppliers over many years, building a culture of trust and loyalty. And, with an eye on the future, leaders start planning for succession well in advance of their exit, long before a typical three-month notice period.

What does this long-term approach mean for sustainability? It certainly doesn’t mean every family business is necessarily a leader, but it does mean they are primed to address some key challenges–from strong value chain management and resource stewardship to an appetite for innovation and a clear social purpose.

I met Jamie Lim, regional marketing director of the carpentry firm Scanteak, and the daughter of its founders, at the launch in Singapore of new research into succession issues within Asian business families, conducted by Singapore Management University’s (SMU) Business Family Institute (BFI) with a grant from Deloitte Southeast Asia. Lim’s slick and stylish garb is appropriately set off by her 10-month-old babe in arms.

“This could be something that she will like," Lim explains to me. “So we can start investing in her now. In family businesses, young talent can learn the soft skills that they would not learn in any business school. This helps us such a lot. My brother and I were exposed from a young age, going to meetings and so on: We made connections. Now we are connecting with our business partners’ kids, so the second or third generation can continue that network. Normally it would take a long time to build up that rapport with a business partner–but we know that our parents trust them, and we know that their parents trust them, and we probably even met them when we were young.”

This approach to relationships has ramifications throughout the supply chain, Lim claims, putting the emphasis on quality and longevity, above cost. “When my parents started they really had to find their sources; some of the suppliers have been with us for 15 to 20 years, and so it would take a lot more than a better price to convince us to make a transition.” It has also meant that Scanteak looks to the future of the stock: “We now only use plantation teak which means that for every tree cut down, they have to plant another”–a strategy which has been in place for over a decade.

When Lim joined the firm, she asked her father for permission to rebrand it for the next generation of consumers, moving away from the traditional aesthetics established through Indonesia’s long history of teak furniture production, and instead focusing on lifestyle. She came up with the concept for an award-winning television advert, which tells the story of a young boy caught doodling on a table by his father. “The angry father tells him off, only to find that he was scribbling the words "I love you Daddy." Fast-forward to the future, and the father gets the son a desk as a graduation present–with a message engraved on it.”

The theme of education is not accidental. “Business families understand that training and development needs are of paramount importance in ensuring success of the next generation,” says Tam Chee Chong, regional managing partner at Deloitte Southeast Asia. Anecdotes of inter-generational learning and mentoring recur, with the younger generation frequently reporting to long-serving employees to ensure their insights and techniques are passed on. Such is the secret behind the success of Singapore’s popular kaya toast (a traditional breakfast served with eggs) brand, Ya Kun. Its founder, Loi Ah Koon, grew up watching his father’s meticulous preparation of the toast, learning “to make sure it was crispy and good."

But does such an emphasis on tradition get in the way of innovation? Not necessarily, the BFI-Deloitte report indicates. In a survey of 83 business families, mostly from Southeast Asia, the research team found that 61 percent see research, development and innovation as one of their top three priorities for the next three to five years, alongside expanding into new markets and growing new lines of business.

“In order to maintain a family business, you must be very receptive to changes and you must be very fluid,” Neo Tiam Boon, the second-generation CEO and executive director of property and construction firm TA Corporation Group, told me at the launch event. “There’s no need [for my generation] to maintain the same business that our late father started [specializing in public housing in Singapore]. Innovation, for me, is continuously introducing new ideas into a business. If something has been there for 10 years, it can’t be left unchanged 10 years down the road. You have to be very creative in your designs.” and in meeting requirements.”

For Neo, planning his own exit and successor is the key to ensuring the business stays fresh and competitive. “As a CEO I’ve been there for eight years, and I’m not prepared to be there for too long – because sometimes we take things for granted. If we assume we are doing well, we are discouraging new blood and new ideas from coming in. I strongly believe that CEOs should not be at the helm of a company for too many years; maybe 10 years is good enough.”

Choosing a successor will only go so far towards ensuring innovation. “In the face of mounting resource and climate-related business challenges, there is a real opportunity right now to groom a pool of environmentally-aware next generation leaders, and equip them with the skills to shift their family business onto a more sustainable path,” says Jie Hui Kia, a futures advisor at Forum for the Future, Singapore.

If you really want to drive innovation, there’s also a need to invest in research and development. The long-term mindset of family business helps to foster longer-term investment strategies–argues Professor Annie Koh, vice president for business development and external relations at Singapore Management University, and academic director at BFI. “If you don’t have patient capital to wait for ideas to take on a life of their own, there will be no innovation.” Such capital is easier to set aside in family businesses, she notes, which are often privately held, and so experience less pressure to meet shareholder demands or targets set on a quarterly reporting basis.

For these reasons–their capacity to fund innovation and their emphasis on social capital–claims Koh, if any business can lead change in sustainable development, a family business can. Moreover, they have an added incentive, she says: “They have to live up to the name of the family in every product or service that bears their name.”

This incentive–the family name and its reputation as a brand–drives many family businesses to take both their environmental and social responsibilities seriously, through both corporate policies and philanthropy. “If we look around us, in any part of the world, most educational institutes and hospitals carry family names,” Koh observes.

Stephanie Draper, deputy chief executive at Forum for the Future, agrees that family businesses, such as Swire, YTL and Huntsman, have a sense of responsibility and reputation that makes them well placed to lead the charge on social and environmental issues. “At Forum for the Future, we are keen to see this go beyond traditional philanthropy and reach into the heart of the business,” she adds.

John Riady, the grandson of the founder of Lippo Group, a major Indonesian conglomerate established in 1950, illustrates the potential. “My father didn’t build all this for me. The word he uses is ‘stewardship,’ and this is the word I would also use. It means that the businesses you own, you don’t really own: You are its steward. You have a responsibility to grow it and to also use it responsibly. Hopefully, our businesses can be a blessing for the people of Indonesia.”

Riady’s interest in the future stretches well beyond the interests of his family: His personal ambition, he declares, is to train and educate the next generation of Indonesians. He is an associate professor and dean at the country’s leading private university, and oversees BeritaSatu, one of Indonesia’s largest multimedia organizations, owned by Lippo Group.

“It’s a country full of inequalities: many people do not have medication, many do not have access to health care,” he explains. “It’s a country without the infrastructure necessary to empower people to be able to do what they can do. I grew up during a time of transition; it was a time of political upheaval and social and sectarian violence. All these experiences have really shaped my views and why I am in business.”

Perhaps the most striking (and frequently cited) example of leadership in sustainability among family businesses is the Malaysian infrastructure conglomerate, YTL. The real leader on this front is Ruth Yeoh, who before the age of 30 was driving the environmental agenda within the business as executive director at YTL Singapore Pte Ltd and director at YTL-SV Carbon, an in-house carbon credit and clean development mechanism consultancy that she established to help companies within the group–and also across Malaysia–“go clean and green."

One year after Ruth Yeoh joined her father’s company, in 2005, YTL produced its first sustainability report–two years before the Malaysian stock exchange required any CSR disclosure. Ask Ruth about the roots of her environmentalism, and she points to her father, Tan Sri Francis Yeoh. “[He] played a big part in inspiring my passion for protecting the environment and growing my commitment to the cause," she told the publication Green Prospect Asia, recalling in particular the experience of planting trees with her father on the island of Pangkor Laut–one of her earliest memories, and “particularly influential in instilling such values within me.” She also remembers accompanying her father on business trips to New Zealand, where she remarked not only on the country’s natural beauty but also the active role of communities in protecting it.

Working to her vision and direction, YTL has set up systems to monitor energy, water, waste effluent, solid waste and consumables, across all its divisions–and targets to reduce its impact. One success story is a 10 percent reduction in carbon emissions at the YTL Power Seraya plant, through efficiency measures and a switch to less carbon-intensive fuels. Another is the installation of energy meters on the high-speed rail service KLIA Ekspres, which runs from KL International Airport to Kuala Lumpur and in which YTL is a major shareholder–resulting in a 5.3 percent reduction in energy cost per trip. Ruth’s talent and determination speak for themselves, but it’s difficult to tell whether these measures would have been implemented so rapidly were it not for her influential position in the family.

While non-family businesses may not be able to fast-track innovative policies, perhaps by overriding the hesitations of wider stakeholders in the way that a family business can, there are lessons they can learn. The value of nurturing relationships over generations, building both trust among employees and partners and commitment to the company’s social role is certainly one. As the Chinese proverb goes, “If you want one year of prosperity, grow grain. If you want 10 years of prosperity, grow trees. If you want 100 years of prosperity, grow people.”

Image credit: DenKuvaiev/iStockphoto/Thinkstock, A Journey Through Time V/YTL

Anna Simpson is an editor for Green Futures.

CSR and Financial Performance Linked, Moskowitz Prize-Winning Scholar Reveals

Winning the prestigious Moskowitz Prize—the only global award that recognizes outstanding quantitative research in socially responsible investing (SRI)—is no small feat. It recognizes scholars who are at the forefront of academic research on SRI, including such topics such as shareholder activism, socially responsible mutual funds and how SRI impacts financial performance.

Caroline Flammer, assistant professor in general management at Ivey Business School at Western University (London, Ontario), was recently named the 2013 Moskowitz Prize winner. Her paper, "Does Corporate Social Responsibility Lead to Superior Financial Performance? A Regression Discontinuity Approach," competed with a record number of 49 other submissions. Her complex research makes a bold and clear conclusion--that the adoption of corporate social responsibility (CSR) shareholder resolutions (e.g., which tackle environmental issues such as reduction of CO2 emissions or social issues such as the implementation of non-discrimination policies) leads to an increase in shareholder value and enhances long-term operating performance. We recently had the pleasure of speaking with Dr. Flammer on the implications of her work. The take-home messages, discussed in more detail below, include:

- There is empirical evidence to show that companies that adopt CSR proposals see financial benefits (0.92 percent increase in shareholder value, as measured by the stock market reaction on the day of the vote), supporting the conclusion that CSR initiatives lead to better financial performance.

- Pensions and SRI funds have the most success in getting resolutions approved (although a resolution provides positive financial performance regardless of who sponsored it).

- CSR programs improve operating performance (e.g., return on assets, net profit margin) as well as labor productivity and sales growth. This suggests that CSR programs improve employee satisfaction and boost productivity while helping companies cater to customers that are responsive to sustainable practices.

Lloyd Kurtz, chief investment officer at Nelson Capital Management, lecturer at Berkeley-Haas and faculty co-chair of the Moskowitz Prize, described Caroline’s work as "one of the most important studies of CSR because it makes the strongest argument for a causal relationship between CSR and financial outcomes that has ever been made.”

“It’s methodologically innovative and very, very good," he adds. Nadja Guenster (visiting professor at Berkeley-Haas, faculty co-chair of the Moskowitz Prize and former Moskowitz winner, herself), agrees. “Dr. Flammer's study is an outstanding and unique contribution to the large amount of literature on the link between CSR and financial performance,” explains Dr. Guenster.

The chicken and egg problem resolved: Shareholder value improves in wake of shareholder-sponsored CSR resolutions

Do companies that adopt CSR activities become richer, or it is that richer companies can afford to take on more CSR initiatives?

“It is very difficult to test the causal relationship between CSR and financial performance,” explains Dr. Flemmer when asked why there have been very few strong academic studies of CSR resolutions to date. According to her, it’s a “chicken and egg problem."

New CSR activities proposed by a firm’s shareholders are often put to a shareholder vote. Dr. Flammer looked at more than 2,500 CSR proposals in U.S. publicly traded companies between 1997 and 2012, covering both social responsibility and environmental performance. Environmental proposals request that a company issue a CSR report or adopt policies to minimize the company’s negative impact on the environment. Social proposals cover a range of issues, including animal rights, human health, labor conditions or discrimination.

In her winning paper, Dr. Flammer found that corporate financial performance improved sharply in the immediate wake of shareholder-sponsored CSR proposals that were “close calls”–those passing by a small margin of votes. Studying close-call proposals is appealing since the outcome of the vote is as good as randomized and cannot be anticipated prior to the vote. Specifically, Dr. Flammer’s results show that the stock market reacts positively to the passage of close-call CSR. Flammer further documents an increase in long-term financial performance based on various indicators. According to Dr. Flammer, “In the four years following the vote, the companies’ return on assets, net profit margin and firm value significantly increased” for companies that passed CSR resolutions.

What are the implications for shareholders?

As articulated in the study’s executive summary, “This study provides the first empirical evidence of a casual link between CSR and financial performance. The results indicate that implementing CSR leads to higher shareholder value, along with improved operating performance, happier employees and strengthened shareholder interest.” Should institutional investors be more “active owners," given these findings? Dr. Flammer’s findings suggest that the answer to this question is yes. “The findings suggest that there is some value of active ownership with respect to CSR.”

She points out three key implications for shareholders:

- CSR Programs Improve Operating Performance: One implication for managers, according to Dr. Flammer, is that “CSR is unlikely to be a cost, but rather a valuable resource. Accordingly, managers may find it worthwhile to invest in CSR programs.” Dr. Flammer found that increased shareholder value and operating performance happen because of improved labor productivity and sales growth.

- Resolution Sponsor: Two groups were most effective: public pension funds and SRI funds. However, if a resolution passes, “on average, financial performance goes up, regardless of who sponsors it.”

- CSR has Diminishing Marginal Returns: “If you have very few social initiatives, it is fairly easy to pick the low hanging fruits,” Flammer states. “However, once you have many more initiatives in place, it gets harder, more difficult, and probably more costly to implement even more. Therefore, we can expect that the financial return is lower (albeit still positive) the higher we get.”

Willmott Dixon to help build UK's first eco town

Willmott Dixon's credentials as one of the most prolific constructors of sustainable developments have been further strengthened with its appointment for the initial stage of the UK's first eco town, located in Bicester, Oxfordshire.

The company has won a £27m contract to build the first 94 of the planned 393 true zero carbon homes that will make up the initial phase of the North West Bicester (NW Bicester) eco-town.

The initial phase, known as The Exemplar, has already been awarded BioRegional's One Planet Living* status, making it just one of nine developments in the world to achieve this coveted mark of progress in sustainability.

NW Bicester aims to be a glimpse into the future of new residential developments that make minimal impact on the environment and promote sustainable lifestyles. This starts at the construction stage with zero waste going to landfill, using techniques and a supply chain that saw Willmott Dixon already achieve 95% waste division across all sites in 2013.

Further features that Willmott Dixon will deliver include achieving Code for Sustainable Homes Level 5, supported by PV solarpanels on every home (covering an average area of 34m2 per property), making it the UK's largest residential solar array and capable of generating power to supply 550 homes.

Climate change protesters gift 'survival kit' to UK environment chief

Representatives of flooded communities and climate change campaigners in the UK have delivered a ‘climate change survival kit’ consisting of wellington boots, a snorkel and flippers to the UK's Environment Secretary Owen Paterson.

Dressed in wetsuits, raincoats and wet-weather gear, the campaigners carried a banner bearing Mr Paterson’s own words: ‘Climate change? “We’re very good at adapting,”’.

During his tenure as Secretary of State, Owen Paterson has cut Defra’s climate change adaptation team from 38 staff to just 6, and slashed his department’s domestic climate change budget by 40%.

The campaigners also delivered a set of petitions in sandbags to 10 Downing Street. The petitions, collectively bearing the signatures of over 120,000 people, called for the Prime Minister to take action on flood defences, tackle climate change by setting tougher emissions targets and ending fossil fuel subsidies, and to sack Owen Paterson as Environment Secretary.

The Latest in Sustainable Textiles

We economize on our driving by using shared resources, or we bike to work, or walk to save on our carbon footprint. We reduce our energy usage where we can by buying appliances that conserve water and electricity and we lobby for energy-smart concepts like solar or wind energy production.

And yet, one of the world’s greatest culprits in environmental pollution is something we use every day and probably give the least consideration to its environmental impact: our clothes.

Conventional textile production is one of the most polluting industries on the planet. The World Bank estimates that the textile industry is responsible for as much as 20 percent of industrial pollution in our rivers and land.

Finding ways to curb the environmental pollution caused by textile production starts with finding new ways to produce fabrics that don’t require toxins and large amounts of water, and which minimize harm to local the ecology.

One company that has devoted its product line to sustainable clothing methods is California-based Synergy Clothing. Owners Henry Schwab and his wife, Kate Fisher have been working in the sustainable textile industry for more than 20 years. While most of Synergy’s products use organic cotton, the company is also known for its textile blends of cotton and bamboo or hemp. Their sustainable methods are also certified by Green America.

“We use low-impact dyes and we follow all fair-trade guidelines for our employees,” explains Schwab. That ethical criterion even extends to their supply chain. “We go out of our way to make sure that anyone who is connected with our company has fair working conditions and pays an above average wage.” Synergy also donates a portion of its proceeds to “nonprofits working on environmental or social justice and educational activities.”

The materials Synergy uses represents only a few of the sustainable textile choices on the market these days, although they are among the more favored by consumers. The following is a brief list to highlight some of the differences between sustainable and conventional textile production methods.

Organic Cotton

As the name implies, organic cotton is grown without chemical pesticides and fertilizers. Textiles made of organic cotton require less water to manufacture than conventional cotton textiles and are often more comfortable.

For the consumer, the advantages are obvious, says Schwab. “It is softer [and] it feels better on the skin. The skin is your largest organ, so you are not absorbing the chemicals.”

Organic cotton requires specialized equipment that allows the cotton to be harvested easily without conventional methods. Some fair trade cooperatives don’t advertise organic cotton, but still strive for a sustainable, humanely produced product. Still, the use of third-party certification, such as used by Mata Traders, that supports worker cooperatives and non-toxic dyes have their own sustainability value.

Silk

Silk is produced by moths, and conventional methods destroy the moth and cocoon in the process. Sustainable products, such as Ahimsa silk, use methods that don’t kill the moth pupa. Eco-friendly silk is produced primarily in India, North Asia and Africa.

Like organic cotton, “green” silk is often softer because it lacks the harsh dyes that are common in conventional silk production. There are a variety of types of sustainable silk, each with their own unique colors and characteristics. The most common is produced by a creamy white-colored silk worm that is found on the mulberry tree in India. The Ethical Silk Company, based out of Ireland, specializes in products made from this delicate weave. Tussur silk, also from India and Mopani silk, from Africa, are darker, rich-colored silks.

Hemp

Popular lore places this versatile plant in the category of marijuana. While it is technically a member of the cannabis family, its textile use is less controversial (and a lot less psychoactive). Its true benefits can be found in its durability and ruggedness, although as a fabric, hemp is surprisingly comfortable to wear. It also blends nicely with other lighter materials like cotton and silk. It is a fast-growing plant that is easily managed, can be grown organically and used for everything from clothing and nutritious food to paper and building materials.

Few textile companies use hemp right now, but that is likely to change with the passage of the latest Farm Bill, which contained a provision to legalize hemp farming. Nine states have already passed laws supporting its cultivation.

Bamboo

Bamboo is used quite differently today than in early Chinese culture, when it was used as a source for shoes and corsets. Today, weavers blend it with other fabrics through complex processes that soften the fabric.

There are two ways that bamboo can be used to produce fabric. The first involves pulverizing the woody fiber until it can be combed and spun into a yarn. It is a labor-intensive process that makes the end linen product more expensive.

The second way involves solvents that break down the fibers and create a viscose bamboo solution that is eventually hardened and spun into fibers. Techniques can vary, and not all manufacturers use sustainable methods to break down the fibers.

So why is bamboo considered a sustainable source for textiles? In a word: adaptability. It is an extremely fast growing plant that doesn’t need to be replanted each year, doesn’t require massive amounts of pesticides and is a great air cleaner for global warming concerns. As Schwab points out, the advent of cultivated bamboo plantations that negate the demand for clear-cut forest harvesting has made bamboo a worthwhile choice for some textiles.

Wool

The versatility and popularity of wool dates back thousands of years and can be found wherever sheep have been cultivated. It’s been used as a source for clothing in both cold and warm climates, although it gains its fame in part from its insulating properties in chilly, windy environment of the British Isles. Because of its natural ability to wick away moisture, it’s a favorite fabric during the winter. It is also used for summer throws and light blankets.

Sustainable wool is harvested from sheep that are raised in humane conditions. Research shows that adequate living conditions and reduced stress results in less disease and a better agricultural product. Organically raised sheep have been shown to have better immune systems that can withstand the parasites and diseases that commonly plague conventionally raised animals.

Wool is naturally hypoallergenic, and many people who have allergy sensitivities find that organic wool, which is void of chemical dyes, soaps and residues, are a comfortable fabric for year-round apparel.

The U.S.-based apparel company Appalatch specializes in unique organic wool products.

New Trends

Newer trends that present exciting opportunities for textiles, says Schwab, include ocean products like seaweed, which have so far only been used by those who can afford to invest and promote its textile production. Hemp blends are another area that has value, particularly if hemp production does take off in the U.S.

“I think there could be thousands of new materials that could come out in blends,” says Schwab, who admits that affordable production of hemp or seaweed needs larger companies to invest first, increase availability and “help bring the price down.” Doing so “makes it practical” for smaller manufacturers when there is increased demand and production. And it makes it affordable for the consumer to support sustainable products.

“If the mainstream companies would devote 1 percent to sustainability, we could change the whole industry,” says Schwab.

Images courtesy of Synergy Organic Clothing

Novo Nordisk Adds Environmental P&L to Their Sustainable Toolset

It's an old management truism that says you can't manage what you can't measure. Certainly if companies hope to manage their impact on the planet, then they'd best start measuring it. Novo Nordisk, the Danish pharmaceutical giant that was named the world's most sustainable company in Davos 2012, just announced another step in that direction, by publishing their first Environmental Profit & Loss (EP&L) account. This, for a company that has steadily been reducing their carbon footprint and water use, and who's CEO pay is already tied to sustainability indicators, further integrates sustainability into its core business practice.

Novo Nordisk, best known as suppliers of insulin, is the first pharmaceutical company to do this, the second major corporation, after Puma to take the step. Both companies worked with natural capital analyst Trucost to develop their EP&L accounting process.

What this means, in a nutshell, is that environmental impact, as defined by the process, will have equal footing with other business concerns, as a criteria for driving business decisions. It will help each company to focus their efforts on the biggest supply chain and operational risks and opportunities associated with environmental issues.

What the new accounting process found, when applied to the 2011 fiscal year, was that the total environmental impacts of Novo Nordisk’s business were valued at just over $300 million. Most of these impacts came from supply chain operations, particularly those responsible for growing corn to make glucose, the primary ingredient in insulin. Internal operations were responsible for roughly $40 million.

Susanne Stormer, Novo Nordisk's vice president for corporate sustainability said: “We have learned a lot from calculating the EP&L for Novo Nordisk. It has given the organisation valuable insights into the value of the externalities related to purchases in our supply chain and use at our production sites. We look forward to the continued deliberation on how the EP&L methodology can be used to inform decision-making."

The company's sustainability policy has long been triple-bottom-line-oriented, balancing social responsibility, financial responsibility and environmental responsibility with each other.

Commenting on their 2011 Annual Report, the website states, “Our annual reporting includes both non-financial and financial statements which provide detail on our efforts to have a net positive impact on society by reducing environmental impacts, increasing quality of life through better healthcare treatment, as well as providing an attractive return on investment for shareholders.”

By converting various environmental metrics, says Trucost, such as land use, which is generally measured in hectares (or acres), water use in cubic meters (or feet) and carbon emissions in tonnes (or tons), all into monetary terms, you now have “an overarching metric to assess risk and opportunity across operations, products and supply chains.”

Trucost calls it, “a proxy for nature's invoice.”

Puma has the following to say about their use of EP&L:

“While our corporate EP&L provided us with a strategic tool to measure and better manage environmental impacts across our operations and supply chain, and up to the point when our products are sold, the extension of our product EP&L analysis takes it one step further. It assesses the environmental impacts of a product at each stage of the product life cycle - from the generation of raw materials and production processes, all the way to the consumer phase.”

According to Richard Mattison, Trucost's CEO, “Novo Nordisk has shown that companies increasingly understand that creating long-term financial value depends on conserving and enhancing natural capital. Incorporating an EP&L into financial accounting provides a clear view of environmental risks and opportunities in a way that everyone in a company, from board members and financial managers to supply chain managers and product decision makers, can understand and act on.”

RP Siegel, PE, is an inventor, consultant and author. He co-wrote the eco-thriller Vapor Trails, the first in a series covering the human side of various sustainability issues including energy, food, and water in an exciting and entertaining format. Now available on Kindle.

Follow RP Siegel on Twitter.

Gap Raises Minimum Wage for US Employees

Gap, Inc. will increase the minimum hourly rate it pays American employees from $9 per hour in 2014 to $10 per hour in 2015. The 45-year-old company with six brands has 90,000 employees in the U.S. and operates in more than 50 countries with 137,000 employees worldwide. The company stated in a press release that increasing the minimum wage it pays employees is “not a political issue.” Instead, the decision to increase its minimum wage “will directly support our business, and is one that we expect to deliver a return many times over.”

A day before Gap’s announcement, the Congressional Budget Office (CBO) released a report on the effects of raising the federal minimum wage. The report concluded that raising it would increase the pay and family income for most minimum wage workers. The CBO estimated that increased earnings for minimum wage workers would be $31 billion, and move about 900,000 people above the poverty line. However, the CBO analysis pointed out that families whose income increases “tend to raise their consumption.” Clearly, that is something which Gap understands.

Other studies also find that the benefits of raising the minimum wage outweigh the costs. A 2013 study for Center for Economic and Policy Research by John Schmitt found that the the “relatively small cost to employers of modest increases in the minimum wages” is offset by “adjustment mechanisms...even for employers with a large share of low-wage workers.” Schmitt found that there are 11 possible adjustment mechanisms to minimum wage increases which "appear to be more than sufficient to avoid employment losses.”

Costco also pays a higher minimum wage

Other companies pay higher minimum wages, including Costco, which pays a minimum hourly wage of more than $11. Last year, Costco CEO and President Craig Jelinek spoke out in favor of a bill that would raise the federal minimum wage to $11.50 an hour. “At Costco, we know that paying employees good wages makes good sense for business,” CEO Craig Jelinek said in a statement. He added that an “important reason for the success of Costco’s business model is the attraction and retention of great employees.” The company chooses to “minimize employee turnover and maximize employee productivity, commitment and loyalty” by offering higher wages.

Jelinek is not the only one at Costco speaking out in favor of increasing the minimum wage. Costco founder, Jim Sinegal, spoke out in favor of increasing the minimum wage back in 2007. "The more people make, the better lives they're going to have and the better consumers they're going to be," Sinegal told the Washington Post. "It's going to provide better jobs and better wages.”

Costco’s commitment to paying employees higher wages gained the attention of President Barack Obama. During his State of the Union address, Obama called out Costco, stating: “Profitable corporations like Costco see higher wages as the smart way to boost productivity and reduce turnover.”

Perhaps Costco's success with paying higher wages has influenced Gap to do the same. Given Gap's size, it just might influence other companies to do the same in turn.

Image credit: Flickr/nffcnnr