How Energy Impacts Water Supplies

Water and energy intersect in more ways than many of us realize. Extracting water takes energy. Up to 13 percent of the energy used in the U.S. relates to the pumping, treating or distribution of water, according to a report by the National Association for Environmental Management (NAEM). In California alone, up to 19 percent of electricity is used for water extraction, purification and wastewater disposal. Energy is used to pump water from the ground, or from bodies of water such as lakes and rivers. Energy is also used to purify water from pollutants and salt, and pump water through pipelines to deliver it to homes and businesses. Water is necessary for extracting fossil fuels, including mining for coal, drilling for oil and fracking for natural gas.

There are 7 billion people on the planet, and 2.8 billion of them live in water-stressed areas. Energy consumption will increase by 35 percent by 2035, and that will increase water consumption by the energy sector by 85 percent. Groundwater supplies are drying up around the world due to droughts and increased consumption. “Climate change has the potential to further reduce freshwater supply even more,” the NAEM report, the first in a series on emerging issues, states. This can happen several ways. As temperatures increase and ice and snow cover melt, that freshwater will turn saline as it melts into the ocean. Changing weather patterns is another way that freshwater supply can be reduced by climate change.

Aging infrastructure can cause water to be lost through leakage and inefficient distribution networks. In the U.S., energy and water infrastructures are four decades old. In the past, water infrastructure investments focused on dams, reservoirs and improving water availability to some arid regions, but few surface water reservoirs have been built since 1980. This is particularly important for certain western states, including California, that are arid. All of California is currently in a drought, and farmers across the state are having to farm with less water available.

The world population is expected to reach 9 billion by 2050. There will need to be increases in both energy and water to produce, process and distribute enough food to feed that many people. Agriculture accounts for 71 percent of water withdrawals globally. The demand for energy- and water-intensive foods, such as meats and grains, will increase by as much as 50 percent by 2025. “Having sufficient energy and freshwater supplies to produce enough food to meet the nutrition needs of a growing population and changing diets will be one of the most complex challenges of our future,” the report points out

Investors and companies are recognizing and dealing with water scarcity risks

Investors are starting to recognize the risks associated with water scarcity. The Dow Jones Sustainability Index has included water in its assessment criteria since 2010. CDP recently launched the CDP Water Disclosure to help institutional investors understand business risks and opportunities associated with water scarcity. Investors are not the only ones recognizing the risks of water scarcity. Companies are increasingly understanding that conserving water is important. That includes utilities, and some of them are reducing their water use by using less water-intensive cooling towers which reduces their reliance on a water source. Other companies are realizing the importance of working with the agricultural sector. Nestle and General Mills work with farmers to help them irrigate more efficiently.

One of the best ways companies can both prepare for and deal with the risks associated with water scarcity is by switching to one of the renewable energies that does not use freshwater. Certain renewable energy technologies do not need freshwater to operate, including wind, solar photovoltaics, solar dish-engine, geothermal, hydroelectric and ocean energy systems.

Image credit: mlhradio

Astellas backs new women’s health programme in Kenya

The European arm of Japanese pharma giant Astellas is backing a new health programme in Kenya which aims to transform the lives of more than 1,200 women living with obstetric fistula.

Action on Fistula is a three-year initiative led by the charity Fistula Foundation and funded by Astellas Pharma Europe Ltd. (APEL).

Funding of €1.5 million will provide support to increase the number of fistula surgeons trained utilising the International Federation of Gynaecology and Obstetrics (FIGO) Competency Based Training Programme in Kenya by 100% and significantly boost the number of surgeries that take place.

A Fistula Treatment Network across Kenya will also be created and a major outreach programme funded with community workers identifying and encouraging patients to access available treatment.

An obstetric fistula is a hole between the vagina and rectum or bladder that is caused by prolonged obstructed labour when emergency care is unavailable, causing either fecal or urinary incontinence or both conditions. Whilst virtually eradicated in developed countries, the United Nations Population Fund (UNFPA) estimates 3,000 new cases of obstetric fistula occur annually in Kenya, with approximately one to two fistulas for every 1,000 deliveries.

Obstetric fistula sufferers are too often subject to severe social stigma due to odour which is constant and humiliating, often driving the patients' family, friends and neighbours away. Stigmatised, these women are also often denied access to education and employment and left to live lives of isolation and poverty. Untreated, fistula can lead to chronic medical problems including ulcerations, kidney disease and nerve damage in the legs.

Ken Jones, president & ceo of APEL, commented: “Action on Fistula tackles a significant unmet need for treatment in urology, where we have a strong heritage. Critically, the programme will build capacity through surgical training so that even more women can be treated in the future.”

New Syngas Production Partnership Coming for Western Canada

What do you get when you combine the resources of a forward-thinking Canadian petroleum company and an innovative American syngas company? More opportunities for biofuels expansion, of course.

The Ontario-based Biogas Association estimates that 68 percent of Canada’s biogas industry could potentially be fueled by agricultural resources. That percentage is no surprise considering Western Canada’s prolific agricultural industry and its increasing focus on natural gas. But the ag biogas business could be stronger, according to the association’s 2013 biogas study, which notes that syngas production could not only increase job growth in rural areas (an endemic challenge in many rural sectors), but also provide energy generation at the designated farming facility, as well as contribute better fertilizer and carbon to the soil.

Getting funding for such operations is often difficult however, especially considering that overhead costs often can’t compete with coal or hydropower production, both of which exist in Canada’s western provinces.

So a recent agreement between Petrostar Petroleum in Nanton, Alberta and Maverick Synfuels of Research Triangle Park, North Carolina, offers new possibilities for synthetic fuel production in Canada’s methane-rich prairie provinces.

Under the terms of the memorandum of understanding that was signed by the two companies last Thursday, Petrostar will retain 60 percent of the ownership, while Maverick will maintain 40 percent.

“The plants will utilise and promote technology that converts a methane-rich feedstock into high-quality methanol,” Petrostar outlined in its May 15 press release. “Maverick Synfuels, formally known as Maverick Biofuels, is proposed to commit exclusive licensing to Western Canada with Petrostar committing various petroleum and natural gas properties to the joint venture entity.”

“We are very pleased with opportunity to co-develop and operate a joint venture entity with the guys from Maverick,” Petrostar CEO Mackenzie Loree said. “This transaction will begin a new era for Petrostar and its shareholders.”

Maverick has also contracted with Plant Process Equipment (League City, Texas) to manufacture and sell small-scale gas-to-liquids plants (GTL). These modular plants are mounted on skids and can be quickly transported and installed remotely, even in difficult-to-access terrain. According to Maverick, they can produce up to 10,000 gallons a day of syngas from methane-rich waste gas, or natural gas sources.

“Now, for the first time, waste gas producers have a financially attractive alternative to flaring or generating electricity,” Maverick said in a May 10 press release. “Waste gas sites are abundant worldwide as a source of low-cost methane, albeit in locations remote from markets or pipelines. Only a small percentage of these sites use the methane or biogas to produce energy. Despite government subsidies, economics of electricity production at these locations remain challenging.”

Methane-rich gas streams can come from several different sources, such as anaerobic digesters (what is found on rural farms or land fills) and natural gas reserves that are economically too remote or impractical to extract. According to Maverick, it uses a “spoke and hub” system, in which the fuel is processed at the smaller modular GTL plant, and then shipped to a hub location for further conversion. According to the syngas manufacturer, the two-step process cuts down the costs associated with production.

Image of Maverick's "spoke and hub" conversion of feedstocks to products courtesy of Maverick Synfuels

Image of an anaerobic digester on a dairy farm courtesy of the USDA

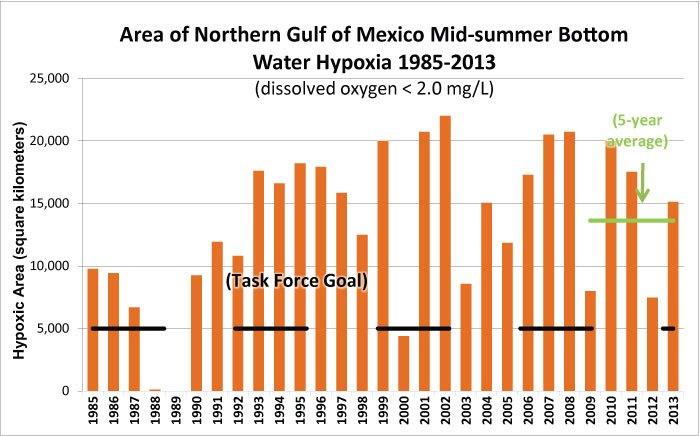

New 12-State Task Force Aims to Shrink Gulf of Mexico 'Dead Zone' Down to Size

The northern Gulf of Mexico has long served as an illustration of the dangers and economic costs associated with marine hypoxia. Also called "dead zones," marine hypoxia is a shortage of oxygen in ocean waters due to terrestrial run-off of nitrogen, phosphorous and pollutants from cities, farms, oil refineries and industrial plants. Not limited to the Gulf of Mexico, marine “dead zones” have been identified around the world--suffocating marine life, snuffing out ecosystems and biodiversity, and ruining once-thriving fisheries and communities.

Looking to restore the northern Gulf of Mexico-Mississippi River Basin to something approaching its former glory, the Mississippi River/Gulf of Mexico Watershed Nutrient Task Force yesterday announced a groundbreaking partnership made up of land grant universities, federal agencies and other stakeholder organizations across the 12-state basin.

Bringing life back to the Gulf of Mexico "dead zone"

Dubbed the “Hypoxia Task Force,” five federal agencies, indigenous tribes, and environmental quality, agricultural and conservation agencies from 12 states will partner with land grant universities in an effort to reduce nutrient pollution and shrink the northern Gulf dead zone down to size.

Given the scale, scope and complexity of the problem of marine hypoxia in the northern Gulf of Mexico, wholesale and wide-scale changes to current practices and attitudes in agriculture, energy, industry and urban lifestyles are likely to be required if the Hypoxia Task Force is to succeed.

As the U.S. Environmental Protection Agency (EPA), one of the task force's five participating federal agencies, elaborates in its news release:

“Nutrient pollution is one of America's most widespread, costly and challenging environmental problems, and is caused by excess nitrogen and phosphorus in the air and water. The impacts of nutrient pollution are found in all types of water bodies.

“More than 100,000 miles of rivers and streams, close to 2.5 million acres of lakes, reservoirs and ponds, and more than 800 square miles of bays and estuaries in the United States have poor water quality because of nutrient pollution.”

The "Hypoxia Task Force"

The EPA notes that a lot of research and groundwork on marine hypoxia and interrelated problems has already been done in individual Gulf of Mexico-Mississippi River Basin states. “Individual states are already collaborating with their respective land grant universities on local water quality research and agricultural programs,” according to the news release.

What's been lacking, EPA adds, is a specific focus on the issue of marine hypoxia or an institutionalized process for sharing university research and ideas among the 12 states that will participate in the Hypoxia Task Force.

Likewise, universities across the Gulf of Mexico-Mississippi River Basin states now party to the task force have been conducting research on issues interrelated with the marine dead zone in the northern Gulf, such as soil conservation, water quality, and the pathways agricultural nutrients like nitrogen and phosphorous take through water bodies.

The new network established by the Hypoxia Task Force, the EPA says, “will bring additional expertise to help reduce nutrient runoff and advise the task force and other national policy makers.”

Check out the EPA's “Nutrient Pollution Policy and Data” website for more on what the EPA, the federal government and other stakeholders are doing to reduce nutrient pollution and shrink marine and aquatic dead zones down to size.

*Image credits: 1) OceanDoctor.org; 2 & 3) U.S. EPA

Women in CSR: Leah Seligmann, NRG Energy

Welcome to our series of interviews with leading female CSR practitioners where we are learning about what inspires these women and how they found their way to careers in sustainability. Read the rest of the series here.

TriplePundit: Briefly describe your role and responsibilities, and how many years you have been in the business.

Leah Seligmann: I am the Director of Sustainability at NRG Energy. I joined NRG to create a sustainability strategy to support David Crane’s vision for the business. This is characterized by three components:

- Develop our strategy (and engage everyone who is needed to deliver on it),

- Activate programs that will improve our footprint and social performance, and

- Perhaps most importantly—since we cannot do it alone—to identify partners that will join us as first movers in transitioning to a clean energy economy.

While I have only been with NRG for a year, I was raised living and breathing sustainability and have been fortunate to find work that perfectly aligns with my interests.

3p: How has the sustainability program evolved at your company?

LS: Our program grew out of our commitment to the environment and society from a compliance perspective, but it didn’t take us long to realize that the true value in sustainability is when you move beyond compliance into innovation. For NRG, sustainability means growing our business in a way that aligns with our values, and experience shows that this alignment results in cost savings, revenue opportunities, brand value, talent acquisition, and many other benefits. That is why we shifted our approach to action, investing billions of dollars to clean up our fleet and grow our clean energy offerings all the while ensuring that we keep our customers lights on.

Over the last year, we have elevated sustainability as a business priority and put into place a number of structures to deliver on our vision. Two important advancements include:

- Strong governance: The development of our sustainability steering committee, a group of twelve senior leaders from across the organization including our CEO, responsible for and committed to integrating sustainability into the nature of our everyday work;

- Data driven strategy: A 360 degree assessment we conducted on our strategy and opportunities including a LCA of our business, third party materiality assessment and hundreds of interviews. We believe a fact-based approach to sustainability is critical to achieve the best outcomes.

LS: I’d like to tell you about the three people that have affected my sustainability journey in profound and meaningful ways.

- First and foremost, my father, Peter Seligmann. As the founder and CEO of Conservation International, my father encouraged me to engage with some of the biggest thinkers in the area of sustainability from a very young age. His passion for this work inspired me and shaped the way I approach sustainability.

- Jib Ellison, founder of Blu Skye consulting and my former boss. Jib showed me how to create impact within large organizations and the importance of engaging the entire system in the solution.

- Finally, David Crane. I first met David on a river trip in northern California. It was the first time I had ever heard a CEO of a major energy company speaking so passionately and knowledgeably about climate change. His interest was authentic, and I considered his perspectives to be game-changing. Immediately after the trip I started pestering him to give me a job with NRG so I could help make his vision a reality, and as luck would have it, he agreed.

LS: Take advantage of the years you have when you are unjaded because a time will come when you get mired in the reality of a situation to push through and overcome.

3p: Can you share a recent accomplishment you are especially proud of?

LS: I am particularly proud of NRG’s recent announcement of our strategic partnership with Unilever to help them become powered by 100 percent renewable energy. This partnership is an incredible opportunity for two companies that are leaders in their fields to come together to combat climate change and has the potential to change how companies buy, sell and use renewable energy. When the leaders of both organizations met, it was an obvious match. Now, this alliance will enable us both to push the envelope and drive change that is bigger and better than what either organization could do alone.

3p: If you had the power to make one major change at your company or in your industry, what would it be?

LS: I’d like to move even faster. The time for action was yesterday, so we need big changes to happen quickly.

3p: Describe your perfect day.

LS: Professionally, my perfect day would find everybody working to execute our mission, while my perfect day outside the office would include a hike with my sweetie and of course my dog, Phyllis.

Op-Ed: Heineken CEO Jean-François van Boxmeer on Growing Agriculture in Africa

Ed Note: A version of this post originally appeared on the World Economic Forum blog.

By Jean-François van Boxmeer

Sustainable commercial agricultural production is vital to the health and well-being of Africa’s economy and people. Smallholder farming accounts for the majority of African agricultural production, and subsistence agriculture--where farmers focus on producing what is needed to feed their families–is still widespread. In Uganda, for example, 86 percent of the population live in rural areas and rely on subsistence agriculture. Low inputs and low productivity result in stagnation, and stagnation in the developing world is equivalent to poverty, hunger and malnutrition.

As leader of a company that has been involved in Africa for more than 100 years, I see enormous potential to more rapidly develop this area together with regional partners. There is a need for more partnerships between farmers, government, NGOs, local business and multinational corporations to accelerate Africa’s commercial agricultural growth. This will not only help thousands of farmers escape the subsistence trap but also offer benefits to all partners.

According to the Food and Agriculture Organization of the United Nations, the global demand for food is expected to increase by 60 percent by 2050. Smallholder farmers will need to play a key role in meeting the growing need. Africa’s food and beverage markets are to reach a threefold increase by 2030, the World Bank estimated in 2013, bringing more jobs, greater prosperity, less hunger and significantly more opportunity for farmers to compete globally.

There are, however, numerous challenges that subsistence farmers are faced with and that inhibit potential growth. These include limited access to infrastructure, to productivity-enhancing technologies and to education–issues that require substantial investment and long-term partnership of local business, farmers, corporations, governments and NGOs.

Two critical challenges are the inability to compete with low-priced international products–it is virtually impossible to compete with imported rice from Vietnam, for example–and the lack of access to a strong commercial market. These cause farmers to maintain production at levels merely enough to provide for their family, providing little or no incentive to invest in improved crops and fertilizers, or access to these products. As with cash crops such as cotton, coffee and tobacco, markets are most likely to be built on demand for the product and accelerated by large multinational corporations. Multinational companies such as Heineken can play a significant role in creating this demand, partnering with farmers, government and NGOs to help African agriculture gain a larger share of the world’s commercial market. Local sourcing creates shared value.

Heineken currently produces from 56 plants in 23 African countries and has made a Clinton Global Initiative commitment in 2011 to source 60 percent of its agricultural raw materials used in Africa within the continent by 2020. This is also part of the commitments we made under our Brewing a Better Future program, Heineken’s approach to sustainability and one of our key business priorities. Together with the European Cooperative for Rural Development (EUCORD) and the Dutch Ministry of Foreign Affairs, we recently invested in three Public Private Partnership projects in Ethiopia, Rwanda and Sierra Leone and we appointed a local sourcing director to increase the focus on and coordination of these projects.

In the Democratic Republic of Congo, our commitment to train farmers to produce consistent volumes of high-quality rice has seen their average annual production increase by 62 percent between 2009 and 2012. We have committed to invest more than $4 million by 2017 to accelerate our sourcing initiatives in the region, which will reduce the number of crops imported from other countries, educate local farmers through support and training, and improve income for thousands of farmers and their families.

Through partnerships with government and international NGOs such as EUCORD, Heineken seeks to use its commitment to actively improve agricultural productivity in the countries in which we operate. Working together with NGOs, Heineken is using its agricultural experience and capacity to train and organize smallholder farmers to integrate as many rural families in their supply chain as possible. Our objective is to make the agricultural sector more competitive in order to lower the costs of local grains – both as a source for the agro-processing industry as well as for local food consumption.

For farmers, the benefits include improved agricultural knowledge, increased productivity and profitability, better food security and an improved overall livelihood. Governments will see improved employment, economic development and a growing international trading position. And for commercial corporations–whether local businesses or multinationals – the long-term benefits are significant as well. For Heineken, these include securing a long-term sustainable source of raw materials, reduced exposure to unavailability or potential volatile prices, reduced transport costs; and a smaller carbon footprint.

We believe in Africa and can see the immense opportunity it offers. We also realize it is our obligation to partner with the continent to stimulate sustained and sustainable growth. We are encouraged by the results of our partnerships and want to engage in dialogue with other multinationals, local business, farmers, NGOs and governments about successful partnering for shared supply chain value. Together, we will be able to stimulate the growth of a sustainable and commercial agricultural sector for Africa and take an important next step to increase the global food supply.

Image: A worker picks tea at a plantation near Kasese town, 497km (309 miles) west of Uganda capital Kampala January 29, 2013. REUTERS/James Akena

Jean-François van Boxmeer is Chairman of the Executive Board & CEO, Heineken. He is a co-chair of the World Economic Forum on Africa 2014.

World's Largest Single-Axis Solar PV Plant Goes Live in Southern California

Last week, Spanish sustainable energy multinational Abengoa gained environmental approval in Chile to build what is expected to be the world's first utility-scale concentrating solar power plant (CSP) capable of supplying electricity to the grid 24/7. Following up on this success, the company announced yesterday that it has completed construction of the world's largest single-axis solar photovoltaic (PV) power plant in California.

Built for project owner Silver Ridge Power, one of the largest PV plant operators in the world, the 206-megawatt (MW) Mount Signal Solar PV facility in the southeastern California city of Calexico spans 801 hectares (~1,980 acres). More than 3 million PV modules have been installed on-site, each rotating on a north-south axis as they track the sun's path--enabling Mount Signal Solar to supply clean, renewable electricity to 72,000 in households in the San Diego area.

Harnessing solar energy rather than burning fossil fuels to produce electricity, Mount Signal Solar will prevent some 356,000 tons of carbon dioxide (CO2) emissions from entering the atmosphere each year, Abengoa explains in a press release.

Mount Signal Solar: Clean, renewable energy for San Diego

In addition to the clean, renewable energy and avoided CO2 emissions resulting from the Mount Signal Solar PV facility, Abengoa worked with a variety of local businesses in the region. More than 700 direct jobs were created in building Mount Signal Solar, which was completed in a record 16 months. Most, Abengoa highlights, were filled by local residents.

The U.S. solar and sustainable energy market now represents 28 percent of Abengoa's overall business, management notes. In early October 2013, Abengoa Solar announced it had completed construction of the massive 280-MW Solana CSP plant in Arizona.

Besides being the largest CSP plant to employ parabolic solar troughs to generate renewable electricity, Solana's molten-salts thermal energy storage system is capable of storing around six hours' worth of energy production--enabling it to deliver electricity night and day.

Abengoa's yieldco & growing U.S. presence

Raising its profile among U.S. clean energy investors, Abengoa is among a growing number of energy companies to raise capital by spinning off some of its solar, wind and clean energy assets and selling shares in a yield-company, or “yieldco,” to the public.

Joining the likes of NRG, which raised $431 million in its NRG Yield Inc. IPO last July, Abengoa on April 1 filed an amendment to its SEC registration statement seeking approval for an initial public offering (IPO) of shares in Abengoa Yield Plc on the Nasdaq stock exchange.

Abengoa is looking to raise as much as $600 million of capital through the yieldco IPO, which management anticipates will be “its main vehicle for owning, managing and acquiring renewable energy projects, conventional power plants and transmission lines,” according to a Bloomberg News report.

*Image credits: 1) & 2) Abengoa, Mount Signal Solar; 3) Findata

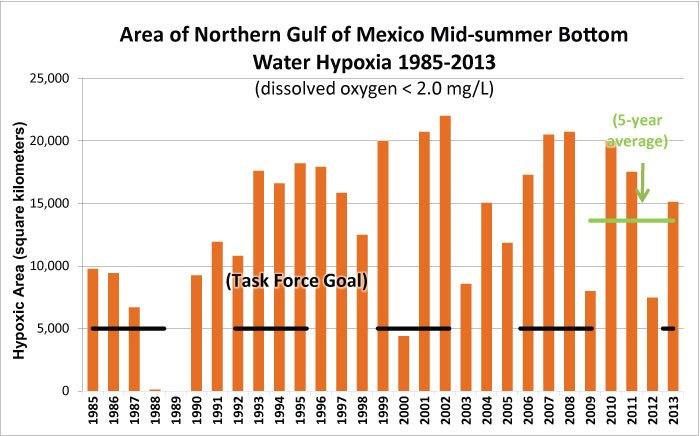

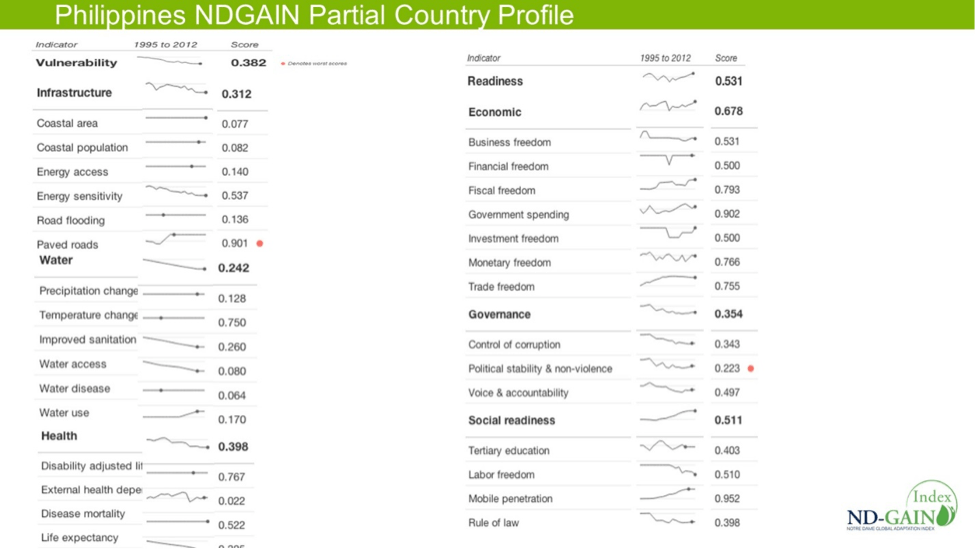

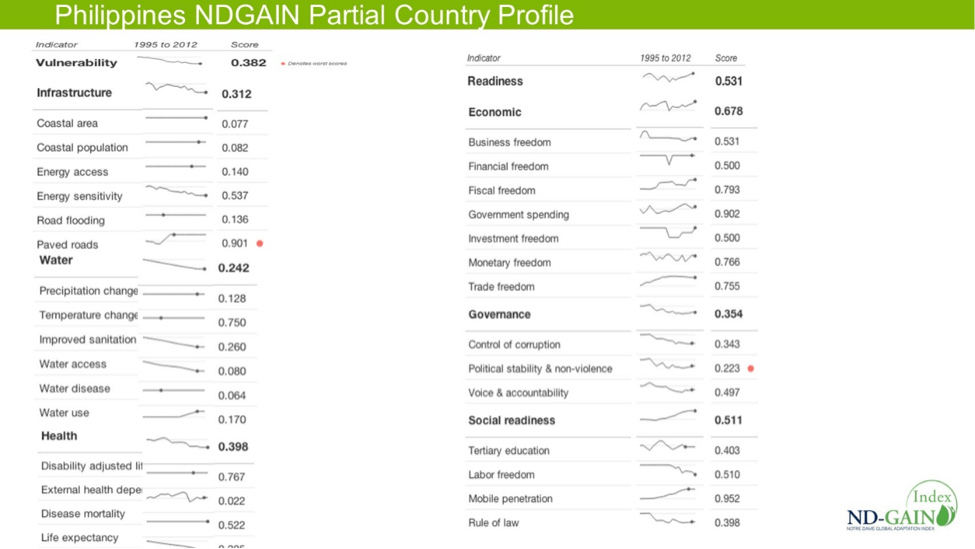

Bridging the Climate Adaptation Gap: Relative Risks of Geographies in Supply Chains

Editor’s note: This is the second post in an ongoing biweekly series on the climate adaptation gap. Stay tuned for future installments here on TriplePundit! In case you missed it, you can read the first post here.

Previously, exploring the chasm between the need by corporations to adapt to climate change and the apparent absence of leadership to do so, I addressed a five-part plan for companies to become climate adaptation leaders. Let’s delve into the first two, offering suggestions to ensure corporate resiliency in a climate-altered world.

Why does this matter? For the past several years, the CDP’s supply-chain survey has revealed that more than 70 percent of corporate respondents envisioned risks to their supply chain from climate disruption. Indeed, these risks are appearing. Thailand’s unprecedented 2011 flooding alone caused $20 billion in economic losses. Honda’s losses alone totaled more than $250 million when flood waters inundated an auto assembly plant. In another climate-related disruption in Mexico, General Motors calculated that a one-month disruption at one of its production facilities there hard hit by drought could spark a $27 million loss in profits.

The secret involves knowing first where your supply chain starts. That’s another kind of gap for many corporations–and one that myriad sustainability surveys and shareholder proxy fights face. But let’s presume that, like a majority of global corporations, you are getting a handle on your supply-chain geography to examine both risks and opportunities for your bottom line.

That’s the first step of addressing your climate adaptation gap: Examine the relative risks of geographies in your supply chains.

Many tools are available for corporate and development decision makers to help plan and devise their business strategies. Corporate leaders tell me they use the Consumer Confidence Index, Corruption Perceptions Index and Human Development Index, among other well-regarded tools, to help relay complex information quickly to their boards of directors and C-suite peers.

Some global corporations maintain tools themselves. MWH Global, an early employer of mine and a leader in hydropower development worldwide, including in the least-developed countries, developed an internal risk-management schema that helped it consider the hardship to employees working in less-stable countries.

The ND-Global Adaptation Index, or ND-GAIN, is another business barometer that provides quick insights into a country’s climate vulnerability and readiness to adapt. And since risk experts rank climate change among the principal threats to business, the tool serves as a timely resource for strategic planning.

Free and open-source, ND-GAIN illuminates the countries best prepared to deal with global changes sparked by overcrowding, resource constraints and climate disruption. This index uses 17 years of data to rank over 175 countries annually against 50 variables, based on how vulnerable they are to droughts, super-storms and other natural disasters and, uniquely, how ready they are to employ adaptation solutions.

To generate actionable information about country-level vulnerabilities from climate change and the readiness of countries to absorb and use new investments, you can examine a cross-section of the data most germane to your supply chain by looking at three things:

- The ND-GAIN ranking (pictured right and above), which orders every country by aggregating all measured factors into a single score. It allows a quick look at combined vulnerability and readiness. View the full rankings to find your countries within the index and compare their ND-GAIN ranking with one another.

Using ND-GAIN’s Matrix, you can draw lessons from existing disruptions to your supply chain due to extreme events or predict future problems. Assessing the realities of climate change on your supply chain, you can look at the relative vulnerability by country of origin of your major suppliers – Taking, for instance, four countries important for the auto industry: China Japan, Korea and Mexico. As of 2011, Japan and Korea possessed a similar level of readiness, and Mexico and Japan’s vulnerability matched, but China was the least prepared and most vulnerable of all of them. (Check out the vulnerability/readiness matrix here to compare countries.)

- The ND-GAIN Country Profiles (pictured right) provide all of the data and their sources, organized by specific vulnerability and readiness measures such as water availability, food security and education level. These country profiles for the 175 countries in the index help you to identify relevant vulnerabilities in geographies where you maintain significant human and capital assets.

What’s vital about these country profiles is that they give the private sector the means to gauge adaptation-related opportunities and risks in developing countries. With this ability, the private sector can address the critical needs of vulnerable populations (and identify new markets well-suited to their business model, products or services and investment-risk profiles).

The profiles also help policymakers identify the easiest-to-achieve avenues – that proverbial low-hanging fruit – for improving rapidly a country’s investment attractiveness to the private sector as well as to motivate and create incentives to employ the best public policies.

Graphics courtesy of the ND-Global Adaptation Index

Read more in the Climate Adaptation Gap series:

- Bridging the Climate Adaptation Gap: From Recognition to Action

- Bridging the Climate Adaptation Gap: Relative Risks of Geographies in Supply Chains

- The Climate Adaptation Gap: How to Create a Climate Adaptation Plan

British business continues to fail women in the workplace

Over 40% of women say their gender has hindered their career… or will, finds a new survey from coaching consultancy Talking Talent.

The research, conducted among over a thousand professional women and working mothers, found more than seven in ten women rated their employer positively for retaining and progressing female talent, and yet 36% said they had experienced prejudice because of their gender. Indeed, 12% maintained that they had been passed over for promotion because of their gender.

This contradiction suggests many professional women do not feel comfortable voicing concerns over a lack of support or behaviour that can negatively impact their careers.

Talking Talent says that some sectors are much better for women than others however. Accountancy is the best sector for working women, with the highest scores for more positive indicators than any other profession.

At the other end of the scale, women in advertising, marketing and media rate their industry as worst for progressing female talent and a majority have faced prejudice and discrimination (51%).

Women in engineering and manufacturing are least likely to say they feel supported and least positive about their employer’s ability to retain female talent (11%). They are most likely to say their gender has hindered their career progress, with the majority citing a male dominated environment as a key reason.

Chris Parke, ceo of Talking Talent commented: “While some sectors are doing better than others, it is clear that UK employers need to do more to ensure strategies to support women are being properly accepted and implemented at the operational level. At the same time, employers need to promote a culture where professional women are comfortable voicing concerns about barriers to their careers. The level of prejudice and discrimination towards women and working mothers, and the fact such a large proportion have been passed over for promotion due to their gender is shocking.

“If employers fail to stamp this out and to introduce measures to support women particularly through maternity, employers will miss out on a huge section of their top talent – something they can ill-afford to do in today’s competitive economy.”

Picture credit: © Galina Barskaya | Dreamstime Stock Photos

Seafood Fraud Meets Tech-Driven Traceability

If something smells fishy the next time you step up to the seafood counter or sit down for sushi, it may not be the catch of the day. An estimated 33 percent of seafood sold in the United States is incorrectly labeled by type of fish, catch method or provenance, according to a recent report by conservation group Oceana. So that ahi tuna roll you ordered might actually be escolar, a cheaper substitute known as the ‘ex-lax fish’ for its digestive effects, and the wild-caught shrimp at the grocery store could have in fact been farm-raised in Thailand.

This is not a new problem—there have been documented cases going back to at least the 1930s when canneries tried to pass off mackerel for pricier salmon. But now, with the falling price of computing power and tech-enabled tracking devices starting to change traceability methods, technology is fast-becoming an unlikely hero in the traditional world of seafood.

The seafood industry’s notoriously opaque supply chains mean that exactly how, and how often, fish mislabeling occurs is not precisely known. In Oceana’s two-year test of 1,200 fish samples in 21 states, one-third were found to be fraudently labeled. While the organization admits the report was never meant to be a scientific survey and the actual scale of the problem is not perfectly understood, it is clear that there are plenty of opportunities for mislabeling to occur on seafood’s journey from the water to your plate.

“There are 101 different root causes for this,” said Gib Brogan, fisheries campaign manager at Oceana, and no one is sure which parts of the supply chain are the most likely points for mislabeling to occur. “But what it comes down to is trying to find value for the fish,” he said. Distributors, fishmongers or others that handle the fish along the supply chain might be trying to get a higher price for a low-valued fish, sell an overfished species or sell one that is out of season.

Besides ripping off consumers, seafood fraud has serious implications for fisheries conservation. In an ideal world, “Fisheries management accounts for all the fish that come out of the ocean to make sure that we are not going over the quotas and not overfishing,” said Brogan. “If we can’t ensure that fish is honestly labeled, then the foundation of fisheries management is threatened.”

Brogan calls traceability—the ability to accurately track any piece of seafood back to its point of catch—an “essential element” of fisheries management today. He emphasizes that traceability advocates are not asking fishermen to collect any new information. Regulators already require any seafood caught or sold in the U.S. to provide documentation of where, when and how it was caught. But that information is still often filed on paper forms, and there is no way of knowing if it will follow the right piece of seafood through the supply chain. “It’s more of a data management and handling issue,” said Brogan.

That’s the problem Canadian-based Ecotrust, a conservation nonprofit, set out to solve in 2009 when it was approached by a group of Vancouver Island fishermen to develop a traceability mechanism for their haul. Part of their motivation was to more easily meet international regulations. Even though British Columbia has some of the strictest catch regulations (some fishermen even have video cameras on board to verify catch methods), there was no way to accurately and easily track their fish once it left the dock. But the fishermen also wanted to start treating their catch less like a commodity and more like a branded product that they could actively market.

ThisFish is the organization born out of that collaboration. Along with Gulf Seafood Trace—funded by disaster recovery grants in the wake of the BP Gulf oil spill—Red’s Best in Boston, and others, the organization is part of a growing trend of tech-based approaches to solving seafood traceability.

ThisFish works by allowing seafood harvesters use an online platform to upload similar information required by regulators (species and location of catch), along with their own personal story and photos. Each catch gets a unique code, which can either be placed on the box of each shipment of fish, or physically attached to each animal. Lobsters, for example, get an individual tag on their claws; some products receive a scannable QR code. The code follows the product through all touchpoints in the supply chain, and finally reaches the consumer, who can either scan or enter the code online to get the story behind the fish and even connect directly with individual fish harvesters.

The physical tag and the simple coding system help prevent mislabeling and create trust and transparency along the supply chain. Fishermen can see a financial payback as well. ThisFish has seen anecdotal evidence that consumers are willing to pay a small premium for the assurance of knowing where their fish came from and who caught it.

Eric Enno Tamm, team leader at ThisFish, also approaches the issue from a consumer standpoint. “If you can trace your FedEx package, if you can trace your merino wool, your coffee, your chocolate,” he asks, “then why can’t you trace your seafood?”

While the company, which charges fishermen a fee for the service, got its start working with small, artisanal fishermen, it does not exclusively host seafood that has high sustainability marks (though it does provide sustainability ratings to users). Instead, it focuses on empowering consumers with information. It designed its platform to be flexible and scalable to work with any kind of fishermen, from the small to the industrial level.

“The real philosophy of ThisFish is that we want to help consumers make more informed decisions about what to buy,” says Tamm. “We don’t want to tell consumers what to buy, we just want to provide credible information in a clear, visual way.”

ThisFish has found that while there is often a strong focus on the sustainability rating of a fish, “buy local” may be just as strong a rallying cry for consumers. In a survey of 300 ThisFish users, 89 percent said they were motivated to trace their fish because they wanted to know where it was caught. By comparison, checking eco-certification and sustainability ratings was cited by about 25 percent of respondents.

For Tamm, the real power of traceability is that it can address any type of consumer concern: “Traceability is not just a one-trick pony. It’s not just about sustainability, it’s not just about local, it’s not just about the quality of your food.” Traceability can help improve all of these things, he says.

While Tamm sees transparency-focused entrepreneurs entering the seafood industry as a promising force for change, consumer demand will also play a big role. “Over time consumer expectations will start to rise,” he says, “and people will...just have the expectation that ‘if I'm going to buy this product, I deserve to know how and where it was produced.’”

For now, a little extra effort at the restaurant or grocery store can help protect you against seafood fraud. Gib Brogan of Oceana advises consumers to buy from places they trust and ask questions about the species type and where and when it was caught. Anyone selling seafood should at least know those basics, he says. Above all, use a shopper's common sense: "If a deal is too good to be true, it probably is."

Image courtesy of ThisFish