SolarCity, Groupon Join to Launch Home Solar Promotional Campaign

Pioneering third-party solar leasing, as well as solar lease asset securitization, Elon Musk's SolarCity has been burning up the financial, solar and clean energy industry news networks for a while now.

Keen to add momentum to its rapidly expanding business, SolarCity today announced a partnership with another pioneering and fast-growing start-up, this one in the field of online advertising and promotions. Now the largest solar power provider in the U.S., SolarCity, and Groupon have launched “the first online offer of its kind for solar power systems.”

SolarCity-Groupon "deal of the day"

According to a joint press release, the two Nasdaq-listed companies will work together to offer deals on home solar photovoltaic (PV) power systems on Groupon's online marketplace. An initial, signature Groupon "deal of the day" carrot to entice online marketplace participants is already out there. “For a limited time, customers can benefit from additional savings with a deal from Groupon by paying $1 for $400 off” a residential solar power system leased and installed by SolarCity, according to the joint press release.

The nationwide marketing and promotional partnership with SolarCity is Groupon's first in the solar energy sector. Groupon's active subscriber base--or potential solar PV customers--stands at more than 51 million. More than 200,000 bargains are available at present, Chicago-based Groupon highlights.

Growing fast, SolarCity at present “serves thousands of communities and major metropolitan areas in 15 states.” The partnership with Groupon could prove a very productive, and rewarding, means for SolarCity to generate pre-qualified leads and close residential solar PV deals en masse.

Shelling out a buck and taking advantage of today's SolarCity promotion, Groupon subscribers will be contacted by SolarCity to schedule a consultation. From there, the companies explain:

“If the homeowner decides to move forward with solar service, the discount will be applied. Homeowners can install their solar system for free and pay only for the power.”

Interested? You can learn more about SolarCity's Groupon home solar promotional offer by clicking here.

Image credits: 1) Groupon; 2) SolarCity

Crowdsourcing and CSP Energy Storage Headline DOE Push to Achieve SunShot Goals

Last week was a busy and eventful one for the solar energy industry as market participants from across the U.S., and around the world, gathered in Anaheim, Calif. for the Department of Energy's (DOE) SunShot Grand Challenge Summit 2014. Among the highlights of the four-day summit: The DOE announced funding for six new concentrating solar power-thermochemical energy storage (TCES) R&D projects and launched SunShot Catalyst, a $1 million crowdsourcing contest that the Energy Department believes can accelerate the pace of solar energy innovation and cost reductions.

The SunShot Grand Challenge Summit 2014's event calendar was chock full of Obama administration and industry heavyweights and thought leaders, including ARPA-E's Dr. Cheryl Martin, the National Renewable Energy Laboratory's (NREL) Dan Arvizu, and the White House Office of Science and Technology Policy's Cristin Dorgelo.

Commenting on President Barack Obama's SunShot Initiative, the White House Domestic Policy Council's Ali Zaidi stated, “If moonshot was a race away from our planet, SunShot, in a way, is a race to save our planet.”

Crowdsourcing innovation to bring down solar energy soft costs

The overriding aim of the summit was to focus attention and rally industry participants and policy makers around making a concerted “push” to realize the 40 percent reduction in solar energy costs that would achieve the SunShot Initiative's goal: bringing the cost of solar energy down to 6 cents per kilowatt-hour (kWh), a levelized cost on par or below that of “other non-renewable sources of electricity generation.”

Providing impetus for the effort, the DOE announced the launch of the SunShot Catalyst Program. With the aim of accelerating breakthroughs capable of driving the "soft costs" of solar energy lower and thereby bringing the overall cost of solar energy down to the SunShot Initiative goal of 6 cents per kWh.

The DOE's SunShot Catalyst, through a series of prize challenges, “makes it faster and easier for American innovators to launch cutting-edge solar companies, while tackling time-sensitive market challenges.”

Consisting of four steps, SunShot Catalyst's winning contestants will receive awards totaling $1 million, including some $500,000 in cash prizes. Up to five winners in Step One, the “Ideation” stage, will take home $1,000 in cash each.

As many as 20, Step Two “Business Innovation” winners will receive $25,000 in services. Up to 20 finalists in the Step Three “Prototype” stage will advance to Step Four, the “Incubation” stage. As many as five Step Five winners will each earn a prize package valued at up to $100,000. The first cash prizes are to be announced on Feb. 9, 2015.

In addition to the cash prizes and packages, the DOE will provide unparalleled support to help assure SunShot Catalyst contestants succeed. All contestants, for instance, will gain access “to the vast array of tools, capabilities, data assets and additional resources” developed by the Energy Department and national labs. That includes tapping into “the nation's growing networks of technology mentors, incubators, and accelerators.” Check out the video for more:

$10 million SunShot funding for concentrating solar power-thermochemical energy storage

As 3p has been reporting, a new iteration of utility-scale concentrating solar power plants (CSP) capable of supplying clean, renewable electricity 24 hours a day, seven days a week is coming online. Integrating high-density thermochemical energy storage systems (TCES) with CSP plants, Energy Department funding and support has been pivotal in achieving this milestone.

As the Energy Department explains, its “CSP ELEMENTS”–Efficiently Leveraging Equilibrium Mechanisms for Engineering New Thermochemical nergy Storage (TCES)–funding program supports development of TCES systems “that can validate a cost of less than or equal to $15 per kilowatt-hour-thermal (kWht) and operate at temperatures greater than or equal to 650 degrees Celsius."

As the Energy Department explains,

“TCES presents opportunities for storing the sun's energy at high densities in the form of chemical bonds for use in utility-scale concentrating solar power (CSP) electricity generation.”

During last week's SunShot summit, the Energy Department announced $10 million in new CSP ELEMENTS funding for six R&D projects. From the DOE's CSP ELEMENTS website, here's the list of awardees and a brief description of their R&D projects:

- Colorado School of Mines, SunShot Award Amount: $1,008,511

- Pacific Northwest National Laboratory, SunShot Award Amount: $2,906,415

- Sandia National Laboratories, SunShot Award Amount: $3,450,000

- Southern Research Institute, SunShot Award Amount: $836,697

- University of Florida, SunShot Award Amount: $791,200

- University of California, Los Angeles, SunShot Award Amount: $1,182,788

Image courtesy of the SunShot Grand Challenge Summit

Regenerative Organic Farming Can Sequester Vast Amounts of Carbon

We are at a proverbial crossroads when it comes to climate change and avoiding its worst impacts. Total annual global greenhouse gas emissions need to drop to a net of 41 gigatons of carbon dioxide equivalent (GtCO2e) in order to have a chance of limiting warming to 1.5 degrees Celsius. Total annual global emissions of greenhouse gases (GHG) in 2012 were 52 GtCO2e.

Although the situation may seem dire, there is something that can help sequester vast amounts of carbon dioxide emissions, and it is called regenerative organic agriculture for soil-carbon sequestration. More than 100 percent of current annual carbon emissions could be sequestered by switching to regenerative organic agriculture, according to a new report from the organic farming nonprofit Rodale Institute.

Regenerative organic agriculture is a term coined by Robert Rodale, son of American organic pioneer and Rodale Institute founder J.I. Rodale. It is an organic farming system that does not use synthetic pesticides, which can do damage to the soil, or nitrogen fertilizer, which causes nitrous oxide, a GHG 300 times more potent than carbon dioxide. Nitrous oxide accounts for about 40 percent of all GHG emissions globally. Regenerative organic agriculture uses conservation tillage, cover crops, residue mulching, composting and crop rotation and can “easily” keep annual emissions within the desirable range of 41 to 47 GtCO2e by 2020, according to the report.

The most common agricultural practices today are doing the opposite of sequestering emissions: GHG emissions from the agriculture sector accounted for 9 percent of total GHG emissions, according to Environmental Protection Agency (EPA) estimates. GHG emissions from agriculture have increased by 19 percent since 1990.

The practices used in regenerative organic agriculture not only pose the best chance for sequestering vast amounts of carbon, but they are also good for the soil. They “minimize biota disturbance and erosion losses while incorporating carbon rich amendments and retaining the biomass of roots and shoots,” the reports authors wrote. All of those things contribute to carbon sequestration.

Take conservation tillage, which is not widely practiced in organic farming but is “integral to soil- carbon sequestration,” the report states. Switching to conservation tillage would improve soil structure plus reduce carbon emissions while contributing to increases in soil organic carbon. No-till farming systems are also a part of regenerative organic agriculture as they have the best chance of reversing the “trend of soil organic carbon losses in agriculture” when used with cover-cropping and enhanced crop rotations. No-till organic farming has been shown to increase soil organic carbon by 9 percent after two years and 21 percent after six years.

Conventional farming already uses cover crops. Travel to California’s San Joaquin Valley and you might see cover crops planted between vineyard rows. Cover crops are very good for the soil as they discourage wind and water erosion. They also increase soil carbon and reduce nitrogen leaching. The report cites other benefits of cover cropping, including reduced weed pressure, decreased water runoff, improved soil structure and water infiltration and reduced evaporation.

Image credit: Chesapeake Bay Program

Interview: Kevin McKnight, CSO, Alcoa

TriplePundit reported live from the Fortune Brainstorm Green 2014 conference in Laguna Niguel, CA. Follow along on this page for ongoing video interviews with sustainability thought leaders, corporate change agents and entrepreneurs who are leading the way to a more sustainable future.

In my second interview at Fortune Brainstorm Green last week I got to talk to Alcoa's Chief Sustainability Officer, Kevin McKnight. Alcoa is a well-regarded leader in sustainability, with some of its industry's most rigorous and long-standing sustainability initiatives. Kevin provides insight into Alcoa's leadership—both on how and what it makes. We also went into some of the details around Alcoa's recent success in the automotive industry helping make cars much lighter, and therefor more fuel efficient.

Unilever to develop new tea varieties to 'future proof' supply

PG Tips maker Unilever is embarking on a tea research and development programme aimed at 'future proofing' the supply of the world's most popular beverage.

Using advanced plant breeding methods and broadening the natural diversity of tea plants to enhance their productivity, quality and overall sustainability, the project will also help arrest any decline in tea crop diversity that could limit the crop’s ability to withstand drought, disease and pests in the future.

Clive Gristwood, senior vp, R&D refreshment at Unilever, commented: “This project is part of Unilever’s commitment to delivering real sustainability in the production and procurement of tea. It is critical that we act now in developing tea varieties that can thrive in the face of the challenges of tomorrow. Using cutting edge plant breeding we hope to naturally meet growing global demand whilst ensuring tea can continue to provide vital economic benefits to communities that rely on the crop for their income.

“The ability to grow more tea on less land, reduce further the need for agrochemicals while boosting tolerance to drought and climate change are integral to this project and in line with our sustainable sourcing aims under the Unilever Sustainable Living Plan."

The project, in partnership with Nature Source Genetics, will be initiated within Unilever’s tea gardens in Kenya, complementing the existing agronomy programme already housed there.

Consumers sceptical over online data privacy, says Accenture

The vast majority (80%) of consumers aged 20-40 in the US and the UK believe total privacy in the digital world is a thing of the past, a new study by management consultancy Accenture shows.

Indeed, the majority of respondents – 87% - believe adequate safeguards are not in place to protect their personal information and 64% are concerned about websites tracking their buying behaviour.

More than half (56%) say they are trying to safeguard their privacy by inputting their credit card information each time they make an online purchase rather than having that data stored for future use. And 70% believe businesses aren't transparent about how their information is being used, while 68% say there is not enough transparency around what is being done with their information.

“Since 51% of those surveyed said they would prefer for companies to stop tracking their shopping behaviour, companies must find ways to establish more trust with customers and an effective formula for reaching them without crossing a data privacy line. For consumers there's a direct correlation between privacy tolerance and value,” commented Glen Hartman, global managing director of Digital Transformation for Accenture Interactive.

Betfred pledges commitment to improve equality and diversity

The Equality and Human Rights Commission (EHRC) has entered into a formal agreement with Betfred, which aims to improve diversity and equality awareness among the high street bookmakers 5,000 employees.

The bookmaker has more than 1,350 betting shops in the UK and was contacted by the EHRC after an Employment Tribunal ruled against it in 2011 for failing to prevent the sexual harassment and subsequent victimisation of an employee.

Betfred has committed to a full review of its management practice in handling grievances and disciplinary proceedings; the rolling out of specific diversity training throughout its organisation, and a programme of activities designed to promote acceptance of a diverse workforce.

As part of the agreement the company will report to the EHRC in July on its progress to date in implementing these measures, the number of managers that have received diversity training, and its progress in revising the staff handbook.

It will provide a final report to the Commission in December 2014 updating that information and providing details of any discrimination cases in the previous months. It will also inform staff of the agreement through its intranet and newsletter.

Commission Chief Legal Officer, Rebecca Hilsenrath said: “Betfred will be working with us to make sure they are taking effective steps to improve the awareness among their workforce of how they need to treat customers and each other."

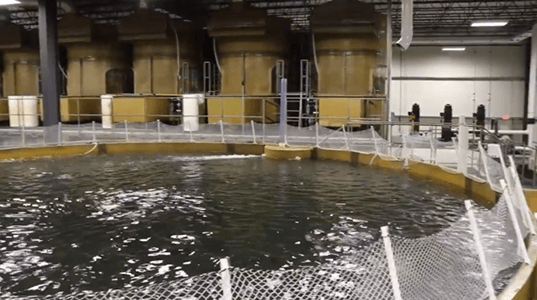

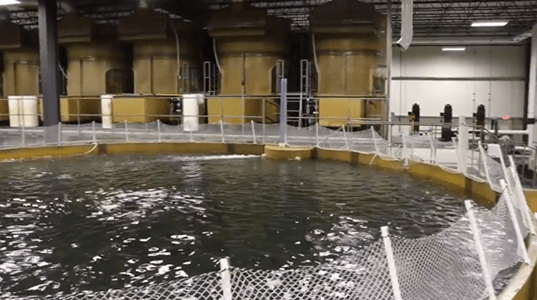

Inside Bell Aquaculture: A Holistic Approach to Sustainable Seafood

As TriplePundit founder Nick Aster and I drive to Redkey, Indiana to visit Bell Aquaculture's farm and facilities, it's hard not to let my mind wander as I stare out the window into the lush, rural countryside. Here in America's heartland, farmers grow everything from corn and soy to apples, oats and peppermint, to feed hungry mouths across the country. But as an ever-expanding list of studies show, it will prove more and more difficult to feed a growing population with the methods we now use.

As I gaze listlessly across the vast expanse of our nation's breadbasket, I can't help but wonder what will become of these peaceful prairies and quiet towns as populations boom and farmers struggle to keep up. These quasi-apocalyptic musings may seem like a bit of a downer on an otherwise warm and sunny morning, but my mind is put instantly at ease upon meeting Bell's CEO, Norman McCowan.

An unassuming man with a smooth Southern accent and warm, friendly eyes, McCowan takes the agricultural challenges of a resource constrained world not as a catastrophe, but as a challenge to create a better, stronger and more sustainable system. His company, Bell Aquaculture, is looking to redefine fish farming as an ecologically sound solution to humanity's growing demand for seafood--and protein in general, in a larger sense.

Nick and I were itching to see some fish, but our first stop was McCowan's own farm, a few miles away from Bell's facilities. As McCowan walked us through the grounds--from his strawberry greenhouse and grove of local pecan, maple and oak trees, to his fish pond and prized Purple Martins--I feel almost in awe of his passion.

His face lights up with excitement as he describes the different sights, sounds and ecosystems; like Bell's own operations, every detail of McCowan's farm is thought out and understood. Through the gentle sound of leaves rustling in the wind, McCowan's keen ear picks up a birdcall. "That's a pileated woodpecker!" he remarks excitedly, a wide grin spreading across his face. "See him up in those branches there?" It's impossible not to smile.

Although his duties at Bell surely keep him busy, McCowan still found time to construct nearly every inch of his farm himself--often with help from the Bell staff and their teenaged children, along with his own 10-year-old son and 13-year-old daughter.

The farm seems almost like an extension of Bell Aquaculture itself: McCowan gives his fish the same tailor-made feed Bell uses, and he fertilizes his crops with the company's signature fertilizer, FishRich, made from processing plant off-cuts. He even runs experiments on the farm, using FishRich for some crops and not others--although we can attest to the fact that the FishRich crops seem to grow much better.

Observing McCowan's connection to his land, it's easy to see where Bell's holistic approach to sustainability comes from. When we arrive at Bell's fish farm, I'm not surprised to meet one engaged, passionate staff member after another--each excited to tell the story of the company's fish.

They eagerly describe Bell's vertically oriented system: The company operates its own hatchery and optimizes the growing environment for its fish all the way through their lifecycle. Water is filtered in a closed-loop RAS system, which recovers around 99 percent of all water used. The remainder is sent to a fully-functioning wetlands out back, where it settles through the aquifer and then back into the system.

Rather than pumping fish full of antibiotics, Bell uses mostly sodium chloride (or salt, for us non-scientific types), as well as hydrogen peroxide for injured fish. In addition to farming three species of fish--yellow perch, rainbow trout and coho salmon--the company gains as much as 20 percent of its revenue from the sale of its FishRich fertilizer. Bell plans to use residual solids from the water filtration system--mainly fish waste--to produce high quality worm castings by the end of this year.

The company will also open its own feed mill this summer, producing as much as 2.2 million pounds of plant-based fish feed every month. Since the company only uses about 2.5 million pounds of feed annually, sales of the remaining feed--made mostly from locally-farmed ingredients--is expected to comprise another 20 percent of the company's revenue stream, if not more, predicts Becky Priebe, marketing director for Bell.

While many aquaculture ventures have tried and failed, Bell is projecting profitability this year, so there's obviously something different about McCowan's holistic, vertically-integrated approach.

Stay tuned for more coverage from our trip--including an inside look at Bell's fish farm--coming soon on TriplePundit.

GM’s 2013 Sustainability Report: Connecting to What’s Important

General Motors has been having a fairly tough time of it lately, with a record-setting number of recalls this year, due, in part, to the increased scrutiny the industry has been facing, as well as the increased complexity of today’s cars. Fortunately, the company has some good news in its 2013 sustainability report, which is called, “Connecting You to What is Important." As the name suggests, the report previews some of advantages of new, highly connected vehicles in terms of convenience, time and energy saved through optimal routing, and safety achieved by interactivity between vehicles.

I spoke with David Tulauskas, GM’s director of sustainability, about the report.

Triple Pundit: When we last spoke, you mentioned a goal of retiring 8 million metric tons of carbon emissions. How are you doing with respect to that goal?

Dave Tulauskas: We are now at 7.7 million metric tons committed, with 3.6 metric tons already retired. About six weeks ago, we announced another really exciting project within that initiative, a new VCS- approved methodology, dealing with university carbon reductions, either campus-wide, or on a LEED building basis.

3p: Great. So getting on to the report, I had a question about the supply chain, where you talk about lifecycle carbon footprint. In one section of the report it says “supplier parts account for 2 percent of our carbon footprint,” but later on it says that these parts represent 87 percent of the lifecycle carbon emissions. What am I missing here?

DT: That is a little confusing. When you look at the Scope 1,2 and 3 emissions, the use of our products make up nearly 96 percent of our total lifecycle carbon footprint. That really dwarfs all the other aspects of our carbon footprint. The manufacturing Scope 1 and 2 make up about 2 percent, and the other Scope 3 emissions, dealing with parts, make up that other 2 percent. But when you look at [the portion of the lifecycle that encompasses just] the mines to the manufacturing plant, including getting the iron ore out of the ground, vehicle parts make up 87 percent of that footprint.

3p: Thank you for that clarification. So tell me what’s in this report that you’re most excited about?

DT: One, this is our new CEO’s first participation. Mary Barr became CEO in January and spent quite a bit of time on that letter [which is excerpted below]. We’re really excited about her role and the way she is trying to change the culture.

“This customer focus underscores why sustainability is and will continue to be a core strategy for GM. Customers—and that includes everyone who might someday buy a GM product—expect us to be thoughtful, honorable and responsible in everything we do. In other words, they care about more than the cars. They care how we build them and how we engage with the world around us. This knowledge, and the discipline that flows from it, is transforming our approach to product design, manufacturing, safety, quality, the environment, customer care and a host of other areas, as you can read in this report.”

The CEO also highlighted a number of green accomplishments.

"A few statistics show just how comprehensive our approach is. For example, we are committed to reducing the average CO2 tailpipe emissions from our U.S. vehicle fleet 15 percent by 2017, while China will target a 28 percent reduction by 2020 and Europe a 27 percent reduction by 2021. The vehicles we design, build and sell tell these stories the best:DT: I’m also excited about expanding our product commitments, making progress towards those commitments and then adding the China market. I’m excited about adding our electrified fleet options, from the Spark EV to the Cadillac ELR. We’ve achieved some of our manufacturing commitments. We hit our goal on total waste reduction, seven years early, VOC reduction, seven years early, and landfill-free non-manufacturing facilities, we hit that goal early as well.

- Lightweighting our new four-wheel drive Chevrolet Silverado helped us increase city fuel economy by 16 percent and highway fuel economy by 11 percent, compared to the prior year’s model.

- Opel/Vauxhall introduced its all-new generation diesel engine, the 1.6 CDTI ECOTEC in the Zafira Tourer. With BlueInjection selective catalytic reduction technology, it already meets the strict Euro 6 emissions limits.

- The Sail EV from Shanghai General Motors is its first electric vehicle developed for the Chinese market.

"Of course, how we manufacture our vehicles is an equally important part of our sustainability strategy. For example, we added a net seven landfill-free sites in 2013 to bring our total to 111 worldwide. In addition, our facilities are also working toward a 20 percent reduction in energy and carbon intensity by 2020 from a baseline of 2010, while more than doubling renewable energy use globally."

We continue to be the industry leader in waste management, and we take the leadership seriously. We mentor other companies, share best practices, support EPA suppliers partnership. The weakest region in the U.S. is the Southeast, so we launched an initiative there earlier this year to support that. Finally, we are really excited about connectivity and the way that’s delivering benefits beyond what people imagined. This report is all about our approach to customer-driven sustainability, and connectivity is playing a huge role today and is going to play an even bigger role in transforming the industry going forward.

3p: Can you talk about ways that connectivity in cars is being used to help the environment?

DT: Sure, Reduced travel times, more efficient routes. Other apps, like the ones for the Volt which allow [users] to only charge when there are renewables on the grid. Our partnership with TimberRock and their solar [electric vehicle] charging systems, uses the connectivity of the Volt, so that when there’s high demand on a grid, that solar power can be redirected back into the grid to minimize peak demand.

3p: I’m assuming this is negotiated with the Volt owner.

DT: Yes. Absolutely.

3p: Very nice. So, you mentioned GM in China. What is your take on what’s happening there? Are people concerned about their carbon footprint? What kind of cars are they buying?

DT: China surpassed the U.S. in 2009 as the world’s largest auto market. Vehicle sales are strong, reinforcing some of your concerns, though there is some good news, too. For example, they have implemented some of the most stringent fuel efficiency requirements (Phase 4), and we outline their progress towards those fuel efficiency standards in the report. As Mary mentioned in her comments, we have committed to reduce GM China’s average fuel economy by 28 percent by 2020. We also talk about a partnership with the World Environment Center we’ve had going on in China since 2005, which works with our supply chain to reduce energy and emissions.

There’s no one in the leadership in China that doesn’t recognize the challenges they have in front of them from an environmental perspective. They are implementing stringent standards across all industries, though they still struggle with enforcement, especially at the provincial level. Local leaders don’t always share the same global perspective as the central government. China is where we first launched the EN-V networked vehicle. We've also been involved in the Sino-Singapore Tianjin Eco-City.

We also launched the Springo EV, produced by a joint venture over there. Frankly, it’s starting off slower than I would have anticipated, but they have an opportunity to leapfrog the technology and go forward with electrification. They are pursuing policies, incentives and regulations to help mainstream EVs as quickly as possible. It’s an exciting place, they are growing fast. They’re improving their efficiency. But the absolute targets given their size and their growth keep getting bigger and bigger.

3p: How do the cars you are selling in China compare with those you sell in the U.S. from a fuel efficiency perspective?

DT: We share power trains with them, but on average they have been using smaller displacement engines than we do. [Note: gasoline in China in currently around $4.80/gallon] On a model-to-model basis, they are roughly equivalent.

3p: Are they buying the bigger cars, the SUVs?

DT: We don’t sell the big Tahoes and Suburbans over there. Mostly they’re buying small to mid-size cars.

3p: That’s a relief. So, you mentioned autonomous vehicles, are they coming?

DT: The technology is here now, at least on the vehicle end. Nothing else needs to be invented. What’s lacking is the integration with legacy systems and overcoming public perception. And we need smarter infrastructure. We need smart stop signs and smart traffic lights

3p: Anything else you want to share?

DT: The last thing I want to highlight are the new partnerships we’ve gotten involved with. Mike Robinson, our VP of sustainability and global regulatory affairs, has a quote in the report about climate change, energy and congestion providing valuable disruptions to our industry. Our industry is not sustainable as we’re operating today. We’re all racing to figure out solutions. Since 2010, we’re a new company and we are committed to being part of the solution. Back in the days when we were selling the Hummer, people like Sierra Club, NRDC [and] Union of Concerned Scientists weren’t exactly looking for opportunities to collaborate with us. Now we’re talking to them all the time. That’s really an exciting sign of the times.

Image courtesy of GM.

RP Siegel, PE, is an inventor, consultant and author. He writes for numerous publications including Justmeans, ThomasNet, Huffington Post, and Energy Viewpoints. He and Roger Saillant co-wrote the eco-thriller Vapor Trails, the first in a series covering the human side of various sustainability issues including energy, food, and water in an exciting and entertaining romp. Now available on Kindle.

Follow RP Siegel on Twitter.

Does Women's Pay Inequity Really Matter?

Pay inequity issues are on our minds a lot these days. Recent showdowns between fast-food corporations and workers who must rely on food stamps and social assistance to pay their bills have been garnering most of the attention this month. After all, if we’re not filling the shoes of the average restaurant worker, we’re most likely making a stop at the drive-thru window in the evening, or purchasing something over the counter that is staffed by minimum-wage workers. The incongruity can’t help but touch us.

So why don't the recent stories of women’s pay inequity problems touch us the same way? The recent court battle by former Anheuser-Bush executive Francine Katz over alleged pay inequities was old news before it hit the Web. The fact that she lost the court case seems to give silent credence to the fact that it was an unnecessary battle. Yet hidden within the statements made about the pay structure of the company, readers can find evidence that there was more than one pay level and that Katz was determined by the management as being worthy of a pay grade almost one-fourth what her male predecessor had earned.

The story of Jill Abramson’s recent kafuffle at the New York Times is equally revealing. When an editor loses her footing, there’s no lack of experienced journalists to pounce on the story and–allegedly–get right to the facts. But even though Ken Auletta of the New Yorker was able to masterfully dig deep enough to explain New York Times Publisher Arthur O. Sulzberger's assertions that the firing had nothing to do with pay inequity, a key question could still be asked that gets to the heart of why women question pay structures.

“While Sulzberger and Thompson improved her compensation somewhat, the fact that she pressed the issue at all with a lawyer worsened the relationship considerably,” says Auletta in his column on the issue.

Why would questions about pay be an issue, especially if, as Sulzberger acknowledged, benefits and compensation were tailored according to Times' declining revenue? And wouldn’t a top editor use all the resources at hand, including a lawyer that knows state and federal laws? Wouldn’t Sulzberger?

Toppled editors are a dime a dozen in the newspaper business. But would a personality clash with an interviewee and the resulting fallout be enough to have the executive editor fired for cause in all circumstances? While you ponder that question, it may be worth noting that “fired for cause” is significant here, because it releases the paper of certain contractual obligations--and makes it harder for her to sue.

In regard to Katz, some critics have suggested that her court loss against Anheuser-Busch means there may be more problems ahead for equal pay proponents.

"In a high profile case like this, when an individual loses, it certainly can discourage others from bringing an action,” said attorney Jerry Dobson in an interview with St. Louis, Missouri television station KSDK-TV. And while Dobson discounted whether her particular case would discourage every woman from stepping forward to ask about pay equity, KSDK reporters Leisa Zigman and Stephanie Diffin note an interesting, though important, point about this case:

“Legal analysts also tell us they believe Katz faced a unique challenge because of her high level of pay. They say it's a challenge that generally does not come up in gender discrimination cases.”

Hmmm. Something like the challenges that a female editor may face when she discovers a discrepancy with that of her predecessor’s pay? As Auletta put it, “[she] thought she was gently pursuing her salary and pension case” with her boss.

The fact is, pay inequity isn’t a new subject. It may be new to the courts and legal venues for executives like Katz and Abramson, but it’s a topic that has been discussed, debated and deflocked for even longer than the topic of raising minimum wage rates to meet a wildly disproportionate cost of living.

“Pay secrecy fosters discrimination, and we should not tolerate it, not in federal contracting or anywhere else,” said President Barack Obama on April 8, which was recognized as Equal Pay Day for all members of the U.S. working force. Yet somehow, when women who have actually met their professional benchmark challenge the system, they may face “a unique challenge because of [the] high level of pay.”

It’s telling that analysts aren’t really sure how to explain women’s pay inequality problems. Explanations range from “suing is not a practical remedy” to “old stereotypes die hard.”

But the Center for American Progress gets closer, I think: “More than 40 percent of the gender wage gap is ‘unexplained,’ meaning that there is no obvious measurable reason for a difference in pay.” It can be overt discrimination or bias, say the authors, or as simple as the fact that the applicant is reluctant to put a job application on the line by asking for better, more equitable pay. And of course, in such circumstances, the hiring company may not do the right thing and offer more pay if it means it can save some money.

Either way, new studies are even more convincing that pay inequity exists. University of Miami researchers matched average men’s and women’s pay rates to grade-point averages and found that a woman with a flawless GPA is paid about the same as a man with a 2.0 GPA.

“The data indicate that overall high school GPA is significantly higher among women, but men have significantly higher annual earnings,” says the report summary.

But as researchers have pointed out previously, fixing the problem may not lie in understanding the statistics, but in a company’s effort to show it’s being transparent as well as fair in its hiring practices. And that, it seems, may take a bit more time and leadership for some companies to master.

Image credit: Pressers striking, between 1885-1980. Kheel Center