Companies Sign on to Report on Climate Change

As we’ve observed in several posts this week, one of the really beneficial outcomes of the increased focus on the United Nations summit on climate change, which launches today, has been the groundswell of companies that have been willing to publicly step up or announce their efforts to offset global warming.

The Climate Disclosure Standards Board and its consortium of signatories has actually been in place since 2007, but its most recent statement is an example of the kind of momentum that is continuing to gain speed from the private sector.

Members of the CDSB have agreed to "to report and make use of climate change information in mainstream corporate reports (such as an Annual Report) to support the U.N. climate change negotiations," Michael Zimonyi, a Project Officer with the CDSB Secretariat, said in an email.

CDSB offers a suggested Climate Change Reporting Framework that will allow shareholders to have a better sense of how their investments impact or are impacted by climate change, but signatories are not required to use this framework. The CDSB signatories, says the announcement, “believe shareholders and plan beneficiaries have an inherent interest in the completeness and comparability of climate-related information available in annual and other mainstream corporate reports.” The reporting framework also has the support of the U.N. Environment Program.

The group includes a broad membership of 43 companies such as Honda, Kirin and Novo Nordisk; 24 investment firms such as Amundi, Trillium and Green Century Funds; and is backed by the Investor Network on Climate Risk, a consortium of 100 institutional investors representing $11 trillion in assets and focused on sustainable business practices.

CDSB created a reporting framework in 2010 to offer guidelines on reporting fiduciary responsibility when it comes to carbon risk. The framework is an effort to correct inherent failures in current reporting processes when it comes to gauging climate change impact.

“[Markets] do not yet take sufficient account of climate-related corporate performance, risks and opportunities relevant to future shareholder value because of a lack of comprehensive and comparable information in ‘mainstream’ corporate reports for the investment community,” said the CDSB. “This information gap undermines the efficiency by which markets are able to allocate capital to its most productive uses over the medium to long term — a crucial enabler of strong and sustainable economic growth.”

Members are encouraged to set up their own framework, “whether or not required by current regulation” that informs stakeholders more fully of the relationship of investments and company performance to climate change issues.

“CDSB’s Reporting Framework connects financial and climate change-related information and sets out an approach for those interested in incorporating the financial-decision-making the crucial role of a healthy climate and environment in protecting economic growth and financial stability,” said Christina Figueres, Executive Secretary of the U.N. Framework Convention on Climate Change.

The CDSB is calling on companies and investors to join the call for better reporting methods that take into consideration implications to climate change.

“[The] release of the statement on climate change disclosure and fiduciary duty today creates a parallel focus on a “positive agenda” of multi-stakeholder actions that accelerate changes in economic and financial market activity, building critical private sector leadership to strengthen the efficiency and resilience of financial markets in the 21st century,” said Richard Samans, CDSB’s chair.

It is yet too early to know how this reporting framework will truly inspire investors to support corporate social responsibility when it comes to potential investments. But one thing is certain: A new reporting system that allows investors to be informed of the relationship between their money and environmental changes can’t help but increase global understanding of our individual roles in climate change.

Ed note: This article has been changed since it was first published to reflect the fact that the reporting framework was created in 2010 and signatories are not required to use it to report.

Image of Monopoly game: Philip Taylor

CGI Annual Meeting: When Confronting Climate Change is Good Economics

Addressing climate change comes down to simply implementing good business sense and long-term thinking about how we invest, build and support business growth around the globe. The Confronting Climate Change is Good Economics plenary session, presented at the Clinton Global Initiative (CGI) Annual Meeting this week, drew consensus among notable panelists. They spoke to the changing values of companies and cities as it relates to planning effectively to leverage solutions that bridge both capital and climate change alleviation.

Highly appropriate after coming off a high from the People’s Climate March on Sunday, which drew an estimated 400,000 people from all over the world, this panel discussion accurately assessed the need for government, business and citizens to address greenhouse gas emissions and quality of life by aligning our actions to our most pressing issues.

Helle Thorning-Schmidt, Prime Minister of Denmark, had this to say:

“There are two facets of increasing environmental solutions. First, we must set the target and incorporate stakeholders. Second, we need to create a long-term, stable framework.”

That framework, according to Prime Minister Thorning-Schmidt, incorporates the need for breaking down systematic solutions that will allow cities and business leaders to adopt green technologies, produce prosperity through job creation and find ways to use our energy more efficiently.

Echoing her statements, panelist Henry, M. Paulson Jr., chairman of think-and-do tank the Paulson Institute, spoke up for the perils of “short-termism” behaviors.

“Businesses need to incorporate the environmental analysis into their decision making. If they don’t make the investment properly, there will be a huge cost that they and their shareholders will pay.”

Paulson also rebutted the notion that upfront investment in the long-term will be strenuous to investors and government policy changes. He cited the same apprehension to the Clean Air Act when it was first introduced in 1963. “The only way to get there [long-term economic prosperity] is by putting a price on carbon.”

Stay tuned for more coverage of the Clinton Global Initiative annual meeting this week on Triple Pundit!

Image Source: Clinton Global Initiative/Flickr

Sherrell Dorsey is a writer, social entrepreneur and advocate for environmental, social and economic equity in underserved communities. When she's not obsessively learning how to decrease her carbon footprint, Sherrell contributes frequently on green design, sustainable architecture and environmental policy at Inhabitat.com. A featured safe cosmetics expert on Fox News, her work has also covered the pages of Black Enterprise and Organic Spa Magazine. Follow Sherrell on twitter @sherrell_dorsey.

Volvo Introduces High-Performance Hybrid-Electric Bus

It’s common knowledge that getting people to use public transportation instead of driving cars will reduce carbon emissions. According to Transportation Nation, transit riders last year saved 4.7 billion gallons of gasoline. That adds up to 37 million metric tons of CO2 or 10 pounds of CO2 per ride.

Intercity buses, which are gaining in popularity, can potentially save even more. Using figures provided by Megabus, a completely full bus, which holds 77 passengers, emits 14 times less pollution per passenger than a typical automobile. Using those numbers, any bus with four or more passengers in it will emit less per passenger than a car.

The numbers for city transit buses, which are less efficient and are constantly starting and stopping, are not as good. According to the Department of Energy, city buses achieve an average of 31 passenger miles per gallon, which is less than a typical car carrying 1.55 passengers, and thereby achieving 39 passenger miles per gallon. That is, in part, due to the fact that a typical city bus is less than 25 percent full.

Clearly, getting more people to ride the bus regularly instead of driving cars is one way to curb carbon emissions. Another way is to make buses more efficient. On that note, there is some very good news to report.

Volvo just announced that its new 7900 Hybrid Electric Bus will be launched at the International IAA Commercial Vehicles show next week. The bus which, utilizes a 201 HP electric motor in conjunction with a lithium-ion battery, could be a game-changer. Because the bus can be run in silent, emission-free, all-electric mode for up to 4.3 miles at a time, that means the bus can be used indoors and out. This can positively impact air quality in bus stations and shelters which has been observed to be a problem, not to mention the air quality inside the buses themselves.

Three of these buses have successfully completed field tests in Gothenburg, Sweden over the past year, and eight more will be deployed in Stockholm this fall. Analysis of the routes shows that the buses will be able to run in all-electric mode 70 percent of the time. This results in the following performance milestones:

- 75 percent fuel saving

- 60 percent energy reduction

- 75 percent CO2 reduction

The bus can recharge its battery in only six minutes using an overhead power connector.

These buses should compare favorably with the Daimler buses, manufactured by Orion of Mississauga, Ontario, that have already become widespread across North America, with over 4,000 vehicles on the road. They claim a 30 percent improvement in fuel economy compared to conventional diesel buses. New York City, which at one point had 850 hybrid buses, has stopped purchasing them and has even retrofit some back to conventional diesel, citing high maintenance costs associated with the electric motors burning out. Hopefully, Volvo’s technology will be able to overcome that issue.

Hybrid-electric technology is well suited to applications like buses and garbage trucks that stop frequently, both because of the relatively high torque that electric motors provide at low speed and the regenerative braking that captures energy that would otherwise be lost as heat every time the vehicle stops.

Even though the new Volvo buses are small, with only 32 seats each, they don’t have to be full to be economical. The energy and fuel reductions mean that these buses can be expected to achieve far higher passenger miles per gallon than even high mileage hybrid cars, effectively raising the bar for fuel-efficient urban transportation. They will also help to improve air quality and reduce noise levels. If you want to be greener than riding this bus, you just might have to walk or ride a bike.

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand.

Follow RP Siegel on Twitter.

Study: Enormous Gains to Be Had From Sustainable Urban Transport

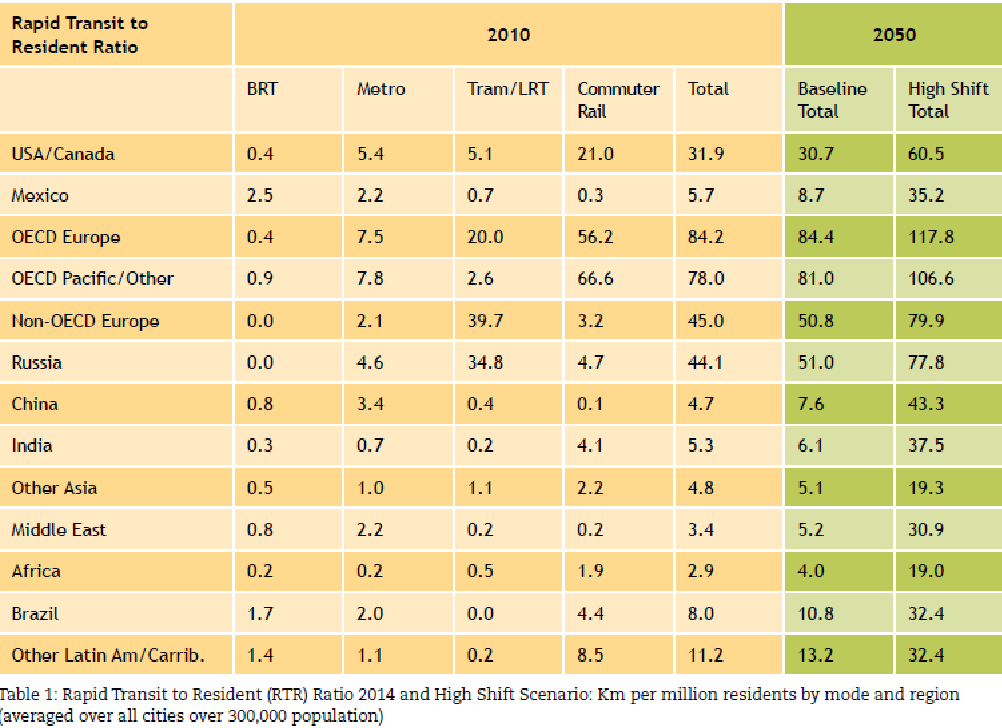

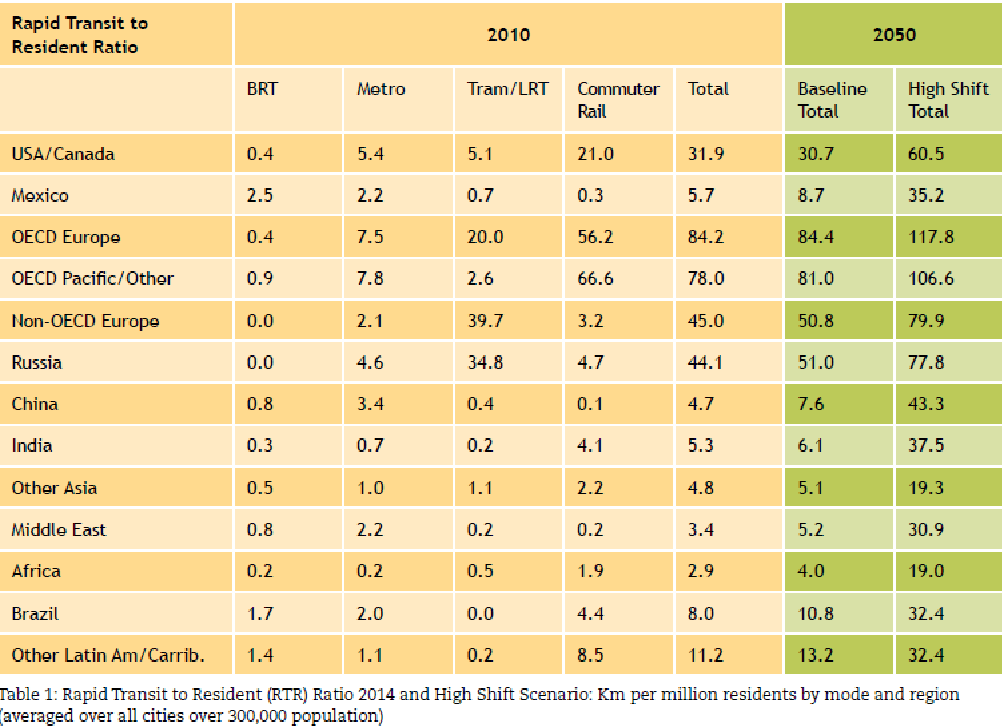

Carbon dioxide emissions from urban transportation could be reduced by 40 percent by 2050 – eliminating an estimated 1,700 megatons of CO2 emissions per year – by expanding public transportation, cycling and walking in cities, according a report from the Institute for Transportation and Development Policy (ITDP) and the University of California, Davis. There's much more to be gained, however.

At a time when public services are being cut, expanding public transportation, cycling and walking in cities could save over $100 trillion in cumulative public and private spending. In addition, an estimated 1.4 million early deaths per year could be avoided by 2050 “if governments require the strongest vehicle pollution controls and ultra-low sulfur fuels," according to a related analysis by the International Council on Clean Transportation (ICCT).

Greening urban transportation

Launched in advance of the U.N. Climate Summit in New York City on Sept. 22, the report – A Global High Shift Scenario – highlights that the findings are relevant to three concurrent policy issues societies and leaders worldwide are grappling with: how best to promote and invest in climate change action; how to advance equitable, environmentally sustainable economic and social development; and how to cope with unprecedented urbanization.

According to the report's producers, the study is the first to investigate “how major changes in transport infrastructure and transit system investments worldwide would affect urban passenger transport emissions as well as mobility by different income groups.”

ITDP founder and Managing Director Michael Replogle noted that, driven by rapid growth in the use of cars, transportation has been the fastest growing source of CO2 emissions worldwide.

Transportation in urban areas accounted for about 2,300 megatons of CO2 in 2010 – nearly 25 percent of carbon emissions from the transportation sector overall. With rapid urbanization and an ongoing growth in the use of fossil-fueled vehicles, it's forecast that CO2 emissions from transportation will nearly double by 2050 “absent changes in investments and policy.” CO2 emissions increases from urban transportation will be fastest in the world's rapidly industrializing countries, such as China, India and Brazil, which have been struggling to cope with the rapid urbanization for decades.

Expanding investments, infrastructure and programs that promote public mass transit, cycling and walking would be a direct means of addressing the impacts of rising CO2 pollution from urban transport, according to the ITDP-UC Davis report.

Elaborating, Lew Fulton, report co-author and co-director of the NextSTEPS Program at the Institute of Transportation Studies at UC Davis, stated:

“The analysis shows that getting away from car-centric development will cut urban CO2 dramatically and also reduce costs, especially in rapidly expanding economies,” added “It is also critical to reduce the energy use and carbon emissions of all vehicles.”

"Business as usual" vs. "High-Shift" scenario analysis

For the study, CO2 emissions in 2050 were calculated for two scenarios: a “business-as-usual” and a “High Shift” scenario. In the second, “governments significantly increased rail and clean bus transport, especially bus rapid transit (BRT), and helped urban areas provide infrastructure to ensure safe walking, bicycling and other active forms of transportation,” the report authors explain. The research team's scenario analyses also included shifting investments “away from road construction, parking garages and other ways that encourage car ownership.”

In addition to a sharp, steep drop in urban transportation CO2 emissions, the net financial impact would yield “enormous savings” in public- and private-sector investment over the next 35 years, ITDP and UC Davis highlight.

“A Global High Shift Scenario” was released at the U.N. Habitat III Preparatory Meeting in New York on Sept. 17 in advance of U.N. Secretary General Ban ki-Moon's global climate summit. Aiming to catalyze stronger actions to mitigate and adapt to climate change on the part of governments and businesses worldwide, the Secretary-General is calling on world leaders to make strong and definitive voluntary commitments to reduce greenhouse gas emissions. That includes new efforts to promote sustainable transportation.

“This timely study is a significant contribution to the evidence base showing that public transport should play central role in visions for the city of tomorrow” Alain Flausch, secretary general of the International Association of Public Transport, and member of U.N. Secretary General’s Advisory Group on Sustainable Transport, commented.

*Images credit: ITDP, UC Davis, "A Global High-Shift Scenario"

Barclays receives record fine over client assets breach

Barclays Bank Plc has been fined £37,745,000 by the Financial Conduct Authority (FCA) for failing to properly protect clients’ custody assets worth £16.5 billion. As a result clients risked incurring extra costs, lengthy delays or losing their assets if Barclays had become insolvent.

This is the highest fine ever imposed by the FCA or its predecessor the FSA for client assets breaches, reflecting ‘significant weaknesses’ in the systems and controls in Barclays’ Investment Banking Division between November 2007 and January 2012 and the number of affected accounts.

David Lawton, FCA director of markets, said: "Safeguarding client assets is key to maintaining market confidence if firms fail - Barclays lack of focus on the rules was unacceptable. Our on-going scrutiny of firms’ compliance reflects the importance of the regime, which protects custody assets worth £10 trillion held in the UK."

A Barclays spokesperson said: "Barclays has subsequently enhanced its systems to resolve these issues and to ensure we have the requisite processes in place. No client has suffered any loss as a consequence of this weakness in our processes which existed prior to January 2012."

The fine comes three years after Barclays paid out £1.1m for a similar issue.

Tracey McDermott, FCA director of enforcement and financial crime, added: "Barclays failed to apply the lessons from our previous enforcement actions, numerous industry-wide warnings, and exposed its clients to unnecessary risk. All firms should be clear after Lehman that there is no excuse for failing to safeguard client assets."

Barclays agreed to settle at an early stage, qualifying for a 30% discount. Without this, the FCA would have imposed a penalty of £53,921,619.

Picture credit: © Basphoto | Dreamstime.com - Barclays Tower, Canary Wharf Photo

Does Your Company Inspire Others?

Submitted by Jeroen Geelhoed

by Jeroen Geelhoed

To get straight to the point, this blog is not about marketing. At any rate, not the traditional method of marketing. This is because organizations that create value for all stakeholders generally adopt a different approach to marketing. An approach that is far more effective. Raj Sisodia discovered organizations with a sizable marketing budget have a relatively low level of customer loyalty. On the other hand, he saw a lot of organizations that spend little on marketing have a relatively high level of customer loyalty and connection. Why is that?

Motivation versus inspiration

Why do all these people love these organizations? First of all these companies provide good service and products. They perform well. But it is much more then that: people are inspired by these companies. A major difference exists between inspiring and motivating. Motivating can be defined as stimulating, encouraging and urging people to take a specific action. You use motivation and marketing to try and focus attention on your company, the product or the service. And motivation helps you acquire customers.

But inspiration gives you ambassadors because it involves something entirely different. The original meaning of inspire is ‘to breathe life into’. The goal of inspiration is to bring something to life within other people. Inspiration wants to ensure that people desire something themselves and are enthusiastic about something. It is about kindling something new in the other. With inspiration you try not to focus attention primarily on your company, but rather on an issue, a challenge, a problem or an opportunity that requires a major mobilization of efforts. ‘Inspire Others’ is therefore completely different to motivating and traditional marketing. It is more about creating a movement with customer, employees, shareholders, suppliers and society.

Source: Creating Lasting Value (2014), pp. 194

But how to do that? Inspirational organisations succeed in putting their story across. They inspire others with the source of their passion: their vision. They don’t immediately try to convince people to buy their products or services. Instead, they fire people up with enthusiasm for what they want to realise in the world: their vision. And so you as a potential customer, employee, investor or ordinary member of the public feel invited to join in and make a contribution to this vision. People are willing to spread happiness. In other words, inspiring others is about showing and sharing the value you create.

Showing

When you have made progress it is important to show it to the world and to celebrate. They have to see and experience it! And it will inspire others to build a brighter future. There are several ways in showing your success and getting better by it:

- Rankings: participate actively in rankings and benchmarks (e.g. Great Place to Work). This disciplines the organization and the High scores in rankings will give credibility of the success. But it will also provide a sense of pride within the organization.

- Brand your success and track record by commercials, books, films, advertisements and the like. New potential customers will like you and want to connect to your organization. Ricardo Semler has done great work on this. I mean, look at his books Maverick and The Seven-Day Weekend advocating the totally different Semco management style.

- Be open and ask for feedback. Invite the outer world to have a look at your organization, for example by company visits, like Zappos does. Do not be afraid you will be copied. They can copy everything, but not the fundament of your success: the culture. Besides, feedback from the outer world will also provide you with new insights which might inspire you to start a new process of value creation.

- Stand up for your opinion in the outer world to be explicit about your opinion and statements about developments in the world. This is what Whole Foods CEO John Mackey and Paul Polman from Unilever does for example.

Sharing

Do well by doing good. So share your wealth, your knowledge and your culture with the world and foster connections with people who want to relate to your organization:

- Networks: create an expanding network of followers and connect with them. They will use your knowledge, wisdom and ideas. In the meantime, they will be your ambassadors and your teachers. Their feedback is very helpful.

- Contribute or give back to society, customers and employees. This does not mean another social responsibility program. It means sharing the elements you are most good at. The world needs your core qualities. This is what Rabobank is very good at.

- Co-creation: with the outside world you can create new opportunities together. This will open new ways of collaboration. Interface has done great work on this in co-creating with the Zoological Society.

This way of showing and sharing will not only inspire others, it will also inspire and discipline the organization in order to create even more value for their stakeholders.

Be inspired

Be that as it may, it brings us to an important precondition for putting ‘Inspire others’ into practice. And this precondition is just as simple as it is fundamental: to truly inspire others you have to be inspired yourself. It must be ‘real’ and authentic. This means that a sense of urgency and excitement exists within the organization. This also means there is a vision that is lived and inspires employees and managers in the organization. A vision that people truly support and that has AROMA for all employees. The outside world will know instantaneously whether or not this is real.

Ask yourself how you can inspire others if you are not personally inspired.

The first three comments on this blog will receive a free copy of Creating Lasting Value. Be sure to include an email address where we may contact you -- The Editor.

After March, 347 Institutional Investors Call for 'Meaningful' Carbon Pricing

A coalition of nearly 350 global institutional investors are calling on world leaders to institute “stable, reliable and economically meaningful carbon pricing." They elaborate by calling for carbon pricing "that helps redirect investment commensurate with the scale of climate change challenge, as well as develop plans to phase out subsidies for fossil fuels.”

The Institutional Investors Group on Climate Change (IIGCC) includes some of the world's largest and most prominent institutional investors, including Australian CFSGAM, BlackRock, Calpers, Cathay Financial Holdings, Deutsche, PensionDanmark and South African GEPF. Collectively, the 347 institutional investors manage over $24 trillion in assets.

IIGCC's call for meaningful carbon pricing and the elimination of fossil fuel subsidies comes as world leaders meet for the U.N. Climate Summit this week to hammer out details of a global climate treaty and successor to the Kyoto Protocol.

Making sure their presence is felt and their voices heard, over 300,000 people [ed. note: the crowd count has been raised to 400k] took part in the People's Climate March in Manhattan on Sunday. Organized by a group of environmental, social justice and public interest organizations, the march kicked off Climate Week NYC. A week-long series of events and demonstrations, Climate Week NYC organizers are likewise calling on government leaders to institute strong climate change action plans that are seen as a means of realizing other key U.N. goals, including alleviating poverty and growing socioeconomic inequality.

The need for stronger climate change action

The International Energy Agency (IEA) has estimated that at least $1 trillion or more per year needs to invested in clean energy by 2050 if the rise in global mean temperature is to be kept within the 2 degrees Celsius limit determined as a climate change tipping point by the U.N. Intergovernmental Panel on Climate Change (IPCC). Though it's been growing rapidly over the past decade, global investment in clean energy totaled just $254 billion in 2013.

In a statement the group of 347 institutional investors said:

"Gaps, weaknesses and delays in climate change and clean energy policies will increase the risks to our investments as a result of the physical impacts of climate change, and will increase the likelihood that more radical policy measures will be required to reduce greenhouse gas emissions," said the statement – the largest of its kind by global investors on climate change. Stronger political leadership and more ambitious policies are needed in order for us to scale up our investments."

Wielding financial clout for stronger climate change action

Managing more than $24 trillion in assets, it's clear that the group of 347 institutional investors wields a lot of financial clout. They themselves can take meaningful action, systematically boost clean energy investment, and decrease investments in fossil fuel companies and markets.

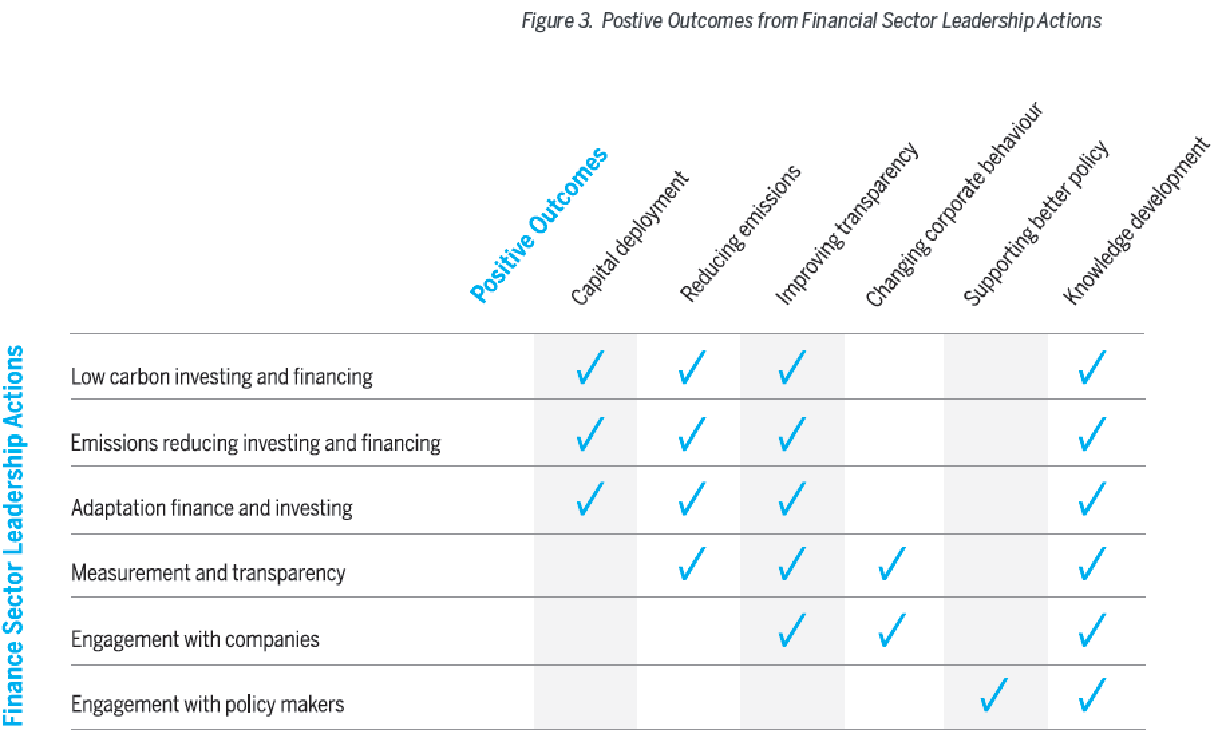

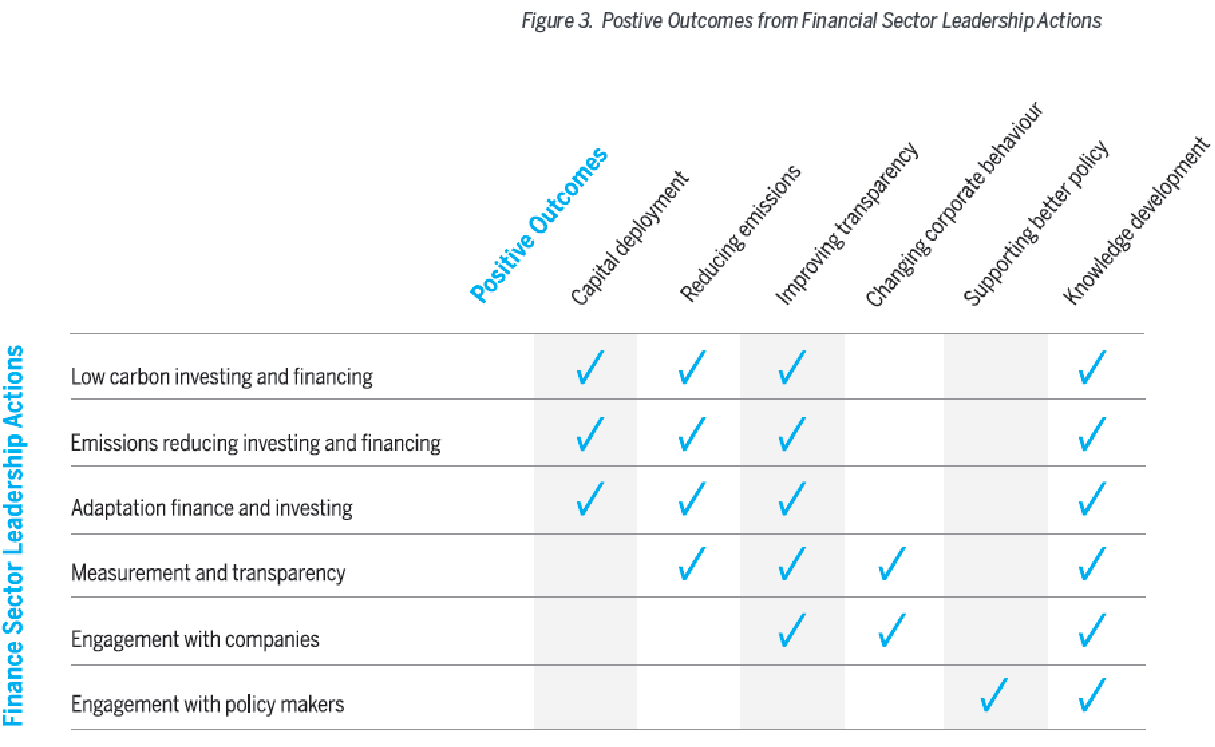

The institutional investors group also published a report illustrating the actions they are taking to “support a low-carbon, climate-resilient economy.” These include making direct investments in a wide range of low-carbon companies and projects, the creation of low-carbon investment funds, company engagement, and reducing exposure to fossil fuel and carbon-intensive companies.

The group's statement and report was coordinated by Ceres' Investor Network on Climate Risk (INCR) in the U.S.; the Institutional Investors Group on Climate Change in Australia and New Zealand (IIGCC); and the Asia Investor Group on Climate Change (AIGCC), along with the U.N. Environment Programme Finance Initiative (UNEP FI) and Principles for Responsible Investment (PRI).

Echoing and reinforcing calls by environmental, social justice and public interest groups, PRI Managing Director Fiona Reynolds stated:

"Stronger carbon and climate frameworks are needed to catalyze institutional investment. The time is now for national governments to overcome the political obstacles that prevent global carbon pricing and hinder long term capital flows into climate mitigation and adaption."

U.N. Under-Secretary-General and UNEP Executive Director Achim Steiner asserted that the dichotomy between taking strong climate change action and promoting economic growth and social development is a false one.

“The perception prevails that we need to choose between economic well-being or climate stability,” Steiner was quoted in a press release. “The truth is that we need both.

"What is needed is an unprecedented re-channeling of investment from today's economy into the low-carbon economy of tomorrow. Investors are owners of large segments of the global economy as well as custodians of citizens’ savings around the world. Having such a critical mass of them demand a transition to the low-carbon and green economy is exactly the signal governments need in order to move to ambitious action quickly.”

“It is significant that the largest institutional investors from around the world are in agreement that unmitigated climate change puts their investments at risk,” said Mindy Lubber, director of INCR and president of the U.S.-based nonprofit sustainability advocacy group, Ceres. “The financial community has a message for heads of state gathering at the United Nations next week: we can’t afford to wait any longer for a climate deal.”

*Image credits: Institutional Investors Group on Climate Change

University of California Commits $1 Billion to Climate Research

Yesterday’s People's Climate March was predicted to be a game-changer for climate policies across the globe. While nearly 400,000 attended to make their wishes known, unfortunately there can sometimes be a big divide between public demands and institutional action. One public entity in California is already making plans to dramatically increase its support for improved climate initiatives.

The University of California has announced that it will commit $1 billion to climate change research initiatives. And with a $91 billion portfolio behind it and some of the top researchers in climate technology on its payroll, the state university system is in a unique position to lend weight to this endeavor.

In a statement earlier this month, UC President Janet Napolitano stated that the UC system would start off by allocating $1 billion over the next five years to ways to address climate change. It wants to have the framework in place by the end of the year, and “integrate environmental, social and governance (ESG) factors as a core component of portfolio optimization and risk management.”

Earlier this year, the university system said it hadn’t committed to drop any of its substantial fossil fuel investments, but agreed it would “evaluate all strategies for achieving ESG goals as soon as practical, including whether to use divestment.” Its decision was clarified on Sept. 18 following the regent's vote, when the university announced it would not to drop its carbon-based investments, but look for other ways to increase its commitments to carbon neutrality.

Jagdeep Bachher, UC’s chief investment officer and vice president of investments for the president’s office, said that dropping the $10 billion divestment was not a practical option at this time.

“It is clear to me ... that these actions will have financial consequences on all of us and on our portfolios,” said Bachher, addressing divestment activists, who were hoping for a bolder climate change strategy by the university.

UC isn’t the only university to have rocked back on its heels in response to pressure to divest from oil and gas companies. Last year, Harvard University also resisted pressures to divest from fossil fuel industries stating that it did not feel its endowments should be governed by climate change.

Despite this sticky point, Napolitano says that UC will be the first public university in the U.S. to adhere to the United Nations’ principles for responsible investment (PRI). They are six broadly-written principles that endorse environmental and social responsibility.

UC’s commitment is evidence of a widening trend by public and private institutions across North America to support the U.N. PRI. Earlier this year, privately-owned Harvard University signed on to the PRI. There have also been a number of Canadian universities, such as Simon Fraser University in Burnaby, British Columbia, Canada, that endorsed the principles earlier this year.

Napolitano said the university will also be increasing its dependence on solar over the next 25 years as part of its goal of meeting its carbon-neutrality goals by 2025. This includes two solar arrays in rain-parched but sunny Fresno County developed by Frontier Renewables. The project will give the university the ability to pump 206,000 megawatt-hours back into California’s electrical grid. The university says the excess power will be the equivalent of what it would take to power 30,000 homes. Just as importantly, it will decrease the university’s carbon load by 88,000 metric tons per year.

Napolitano, well known for her support of environmental initiatives when she was governor of Arizona earlier this decade, has also established a global climate leadership council to bring together stakeholders from all sections of the university and greater community. Students, faculty, staff and authorities in climate change are taking part in the university’s strategy for combating climate change. The university has yet to announce, however, how it will attain carbon neutrality with more than 10 percent of its investments tied up in carbon-based industries.

Image credit: UC Berkeley: Charlie Nguyen via Flickr

The High and the Low: Climate Change Resiliency in NYC

Editor’s Note: This article is part of a short series on creating resilient cities, sponsored by Siemens. Please join us for a live Google Hangout with Siemens and Arup on October 1, where we’ll talk about this issue live! RSVP here.

As a coastal city with an inland water supply, New York City faces a unique set of challenges for climate change resiliency in a future marked by frequent, destructive coastal storms and rising sea levels.

In terms of clean water supply, New York has one advantage thanks to resiliency planning that dates back to the early 19th century. At that time, urban sprawl, commerce and industry quickly overwhelmed Manhattan's patchwork of privately-owned wells after the Revolutionary War.

Rather than continuing to dig wells within the city, planners developed a system of reservoirs far inland at higher elevations, some as far as 125 miles away, relying almost exclusively on gravity-powered aqueducts and water tunnels. The incorporation of Queens, the Bronx, Brooklyn and Staten Island into New York City was impelled partly by Manhattan's lock on reliable, expandable inland water resources, as groundwater in those boroughs proved inadequate to sustain population growth. Only one group of public wells continued to serve part of Queens until 2007, when they, too, were finally put out of service.

The city's wastewater resiliency, however, is a different story.

The wastewater treatment resiliency problem

New York's 14 wastewater treatment plants present two different kinds of problems for climate change resiliency.

The first problem is their vulnerable location: Unlike the city's reservoirs, they are located much closer to sea level, and they are all within the city's borders. In addition, as is is typical with wastewater treatment plants, they are also located alongside or very near the city's waterways, including rivers, creeks and bays.

One of the plants is even located entirely on a waterway. The North River treatment plant was built on a platform in the Hudson River, adjacent to the shoreline of upper Manhattan.

The second problem is mechanical: Again in contrast to the city's reservoir-based, gravity-powered water supply system, wastewater treatment plants are massive, energy-sucking machines characterized by enormous engines and pumps along with tanks, digesters and other infrastructure.

After Sandy: Climate change resiliency in New York City

Hurricane Sandy devastated parts of New York City in 2012, causing an estimated $100 million in damage to the the city's wastewater facilities. It affected 10 of the 14 treatment plants and 42 out of 96 wastewater pumping stations.

In the context of climate change resiliency, an analysis estimated that more than $1 billion in wastewater equipment and infrastructure would be at risk from future destructive storms.

With that in mind, the city's Department of Environmental Protection, which administers the water supply and wastewater systems, assessed the city's wastewater vulnerability and issued a series of recommendations in a 2013 report titled The NYC Wastewater Resiliency Plan.

Billed as "the nation’s most detailed and comprehensive assessment of the risk climate change poses to a wastewater collection and treatment system," the plan was actually initiated before Sandy, in 2011. It includes an analysis of 58 wastewater pumping stations along with all 14 treatment plants.

As a cost-based analysis, the report makes a clear case that potential damage to the city's wastewater assets could top $2 billion over the next 50 years from a series of coastal floods precipitated by rising sea levels, unless steps are taken to protect the facilities.

The report calculates an up-front investment of about $315 million in infrastructure upgrades with the aim of minimizing damage and preventing service disruptions during storms and coastal floods.

The upgrades consist of a variety of strategies, including elevating and waterproofing critical equipment and infrastructure, installing flood gates and dikes, and replacing conventional pumps with submersible pumps.

These infrastructure-centric mitigation measures also dovetail with the city's broader A Stronger, More Resilient New York initiative, which calls for restoring protective wetlands along with creating engineered barriers.

A toolkit for climate resiliency

The city's wastewater resiliency planning also dovetails with the resiliency report developed by Siemens.

As New York's experience with Sandy shows, every city faces a unique set of circumstances, but there are many areas of commonality.

Aptly titled Toolkit for Resilient Cities, the report covers systems for energy, transportation, water supply and buildings. As Siemens proposes, focusing on these critical systems ensures a firm platform for other services -- including public health related services such as sanitation, emergency response and food supply, as well as fuel supply.

As clearly stated in the Toolkit, Siemens recognizes the 'new normal' of climate change and its related impacts:

Resilience is the ability of people, organizations or systems to prepare for, respond, recover from and thrive in the face of hazards. The goal is to ensure the continuity and advancement of economic prosperity, business success, environmental quality and human well-being, despite external threats.

As a technology company, Siemens' emphasis is on the use of microgrids with updated monitoring and control features, to build more resilient IT systems and ensure that the widespread failures characteristic of today's storm-related impacts are a thing of the past.

Siemens makes clear, though, that IT is only part of the solution. Infrastructure actions like the NYC Wastewater Resiliency Plan are also critical.

Even more critical is a change in the nature of our civil discourse. While not necessarily referring to the anti-renewable energy, anti-Agenda 21 paranoia expressed by certain pundits and politicians, the Toolkit makes it clear that we can't simply engineer our way into a sustainable response to climate change:

Changing social, political and economic conventions is as fundamental to the success of city resilience initiatives as is upgrading physical assets. Implementation of technology solutions often requires a broader ‘enabling’ toolkit, which includes changes to urban planning, policy and regulation; governance; knowledge development; and financing models.

The good news is: The climate denial noise is finally being overwhelmed by a more reality-based approach, and we'll hear more about that as the United Nations General Assembly meets in New York City this week.

Image (cropped): Courtesy of NYC DEP

Money Talks: The Big Switch to Sustainable Palm Oil

When your pooled assets add up to more than $600 billion, people tend to pay attention when you write them a letter about sustainable palm oil. That seems to be the case in Friday's announcement by five major palm oil producers, which pledged to self-impose an immediate moratorium on clearing high carbon stock forests.

The announcement came a week after four of the companies received a letter from a group of investors spearheaded by Green Century Capital Management, with collective assets topping the aforementioned $600 billion. In addition to calling for the moratorium, the Green Century letter urged the producers to adopt more sustainable palm oil practices, in accordance with a growing number of industry stakeholders.

Unfortunately, that's where things could get sticky.

Green Century Capital Management writes a letter...

Green Century's sustainable palm oil letter, dated Sept. 8, was addressed to four of the five palm oil producers: Sime Darby, Asian Agri, IOI Corp. and Kuala Lumpur Kepong. (We'll get to the fifth, Musim Mas, in a minute.)

The letter cuts straight to the mustard: It starts off by noting that major stakeholders, including Wilmar, Golden Agri-Resources, Nestle and Unilever, have already pledged to establish traceable systems to ensure that their supply chain does not begin with the development of High Carbon Stock (HCS) or High Conservation Value (HCV) forests, as well as peatlands.

With the major suppliers Wilmar and Golden Agri-Resources already responding to increased demand for sustainable palm oil by staking out a "first mover" supply chain advantage, the holdouts risk losing a huge chunk of business.

The letter includes a list of actions for reducing environmental impacts and ending human rights abuses in conventional palm oil operations, specifically referencing Kuala Lumpur Kepong. It calls upon the producers to:

...adopt an immediate moratorium on clearance of any potential HCS areas and peat land areas, and to adopt a time-bound plan by which all palm oil supplied by KLK and its third-party contractors will be traceable back to plantations that meet the above criteria for protecting forests, peatlands, and human rights.

Notably, the letter points out that publicity over both environmental and human rights abuses in the palm oil industry have created "significant brand and reputational risks" for industry stakeholders and their shareholders.

Along with Unilever and Nestle, the letter also cites Procter & Gamble and Colgate-Palmolive for signing on to the sustainable palm oil movement.

...which gets results...sort of...

We're not saying there's a direct cause-and-effect here, but it is true that just a few business days after the letter was issued, all four of the recipients -- as well as a fifth producer, Musim Mas -- jointly announced that they would adopt an immediate moratorium on HCS clearing (a link to the copyrighted announcement is available on Sime Darby's website).

The moratorium will be in effect while a yearlong industry-funded study is underway, which aims to provide a standard of definition for HCS forests.

That's not quite as simple as it sounds. The sustainability risk analysis company Chain Reaction Research points out that the five growers were previously behind a somewhat notorious greenwashing exercise called the "Sustainable Palm Oil Manifesto," which allowed HCS clearing.

Chain Reaction also notes that the public statement issued by the group does not specify what the moratorium would actually cover, in terms of defining HCS areas until the study is concluded. The statement is also thin on compliance methodology -- although Asian Agri has stated that it will use the HCS developed by the Forest Trust, Golden AgriRsources and Greenpeace until the study is concluded.

Although cheered by the joint announcement, Green Century has also taken a we'll-believe-it-when-we-see-it-approach.

Momentum builds for sustainable palm oil

On the other hand, Green Century has a much stronger hand to deal compared to just a few months ago. On Dec. 13 of last year, Green Century issued a similar sustainable palm oil letter to leading palm oil producers and stakeholders when it only represented $270 billion in assets.

The recipients included Wilmar, which now appears to be firmly in the sustainable palm oil camp.

It certainly doesn't hurt that sales of sustainable palm oil are surging in response to increased demand. That includes new and recent pledges from major U.S. customers like Starbucks, Dr. Bronner's, Dunkin' Donuts and Mars among others.

It's also worth noting that palm oil is just one of Green Century's green initiatives, fracking disclosure being another topic of concern.

Like they say, money talks...

Image credit (cropped): Lip Kee via flickr.com, cc license