Do we need more CR and sustainability mentors?

Claudine Blamey, chair of the Institute of Corporate Responsibility and Sustainability (ICRS) and head of stewardship at The Crown Estate, explains the institute's new mentoring scheme

The ICRS has launched a cross-sector mentoring programme to support all CRS professionals and to share learning across the profession.

According to the latest CR and Sustainability Salary Survey, exactly a third of CRS professionals work in teams of less than three people, and anecdotally we know that a large number work alone. Several companies only have a solitary CRS person. Working in isolation can be challenging at the best of times and impossible at the worst. Most people can’t reach their full potential without support, collaboration, cross-pollination of ideas, and learning from others.

The very nature of our work – often tackling complex environmental, social and ethical problems – requires people and organisations to work together.

Also, there are a large number of CRS professionals that don’t have a single person reporting into them – 45% according to the Salary Survey. Many of these individuals would like the opportunity to share their experiences with more junior employees.

We think there is a need, appetite, and huge potential in our sector for a sophisticated mentoring scheme which brings people together for shared learning. That is why the ICRS has set up the first formal mentoring programme for the profession. Mentoring can be powerful, rewarding, and fun for everybody involved. There is also evidence that mentoring creates – higher job satisfaction, higher retention, better performance, and even higher pay.

Our mentoring programme is bringing together people with complementing interests and experiences, to provide support, motivation, fresh ways of thinking, experience and knowledge sharing, and a sounding board to test ideas. There are a large number of people with a passion for helping others to be successful; we want to harness that passion.

It takes a flexible and light touch approach and our mentors or mentees will be supplied with a set of guidelines and resources to help them plan and make the most of their mentor-mentee relationship. Setting specific goals and objectives – and monitoring subsequent progress – are the responsibility of each mentor-mentee pair.

Each formal mentoring relationship will last 12 months, with a view to it continuing beyond this time on an informal basis.

The scheme formally launched on 13th November and is open to all ICRS members. Mentor-mentee matching will happen on a rolling basis as strong relationships are identified.

If you are keen to become a part of the community, why not consider joining us. ICRS membership will help you to develop your CRS career, give you recognition of your experience, and let you demonstrate your credentials to employers. It will also create a network for you to test ideas, make you part of a wider movement, and ensure that you stay on top of your game.

Joining the ICRS now gives you the opportunity to shape the organisation and set its direction of travel.

If you have any questions, feel free to get in touch with us at [email protected] or call us on 020 7839 019

Getting to grips with gambling controls

Leo Martin, director of responsible business advisers, GoodCorporation, asks if the gaming industry is doing enough to promote responsible gambling

According to the Gambling Commission, almost three quarters of the UK population participate in some form of gambling, up from just over two-thirds in 2007. While the vast majority of gamblers (92%) do so safely, without risk of developing a problem, the number of people in danger of becoming problem gamblers has reached almost a million. Worse still, the numbers with some form of gambling addiction have doubled over the last six years to almost 500,000, with the average debt standing at £17,500.

While the industry acknowledges that it must take a proactive approach to promoting responsible gambling, is it really doing enough?

The latest statistics from Gamcare reveal that the numbers receiving treatment through their organisation rose by 21% in 2012/3, with visitors to the site that year up by 100,000 and posts on the forum for problem gamblers up by 35%.

In an attempt to tackle the problem, the industry regulatory body, The Gambling Commission, is currently consulting on new licensing standards that could include a social responsibility code as well as advertising restrictions. Meanwhile, four of Britain’s biggest bookmakers have formed The Senet Group in a move to promote responsible gambling.

At this stage, their initiatives focus on advertising: removing adverts for touch-screen roulette machines from their windows and refraining from advertising sign-up offers on TV, such as “free bets” or “free money” until after the watershed. There is also a proposal to fund an educational advertising campaign on problem gambling and ensure that their own adverts carry more prominent messages about responsible gaming.

While advertising restraint and responsible gambling messages undoubtedly go some way to addressing the problem, it is really only the tip of the iceberg in terms of pro-actively preventing gamblers from developing a problem.

An initiative that involved intervening when problematic activity was identified; sharing information to exclude problem gamblers from sites or putting controls in place to prevent people from becoming addicted or spending money they can’t afford, would demonstrate a real commitment to tackling the problem.

Monitoring patterns

Regulators should be looking at a model that would require gaming companies to monitor gambling patterns and intervene at an early stage if indicators of problem behaviour are identified. For online gaming, such models already exist and some companies are using them.

The Cambridge Health Alliance, part of the Harvard Medical School, runs the Division on Addiction, which has been conducting studies on gaming behavior since 2005 in co-operation with bwin.party. The study uses accurate records from computer-based internet gaming to identify indicators of addictive behavior. This has enabled the Division on Addiction to develop an algorithm that would allow gaming companies to intervene and notify their customers if they suspected a problem.

In the UK, Featurespace, the corporate arm of a University of Cambridge engineering department project, is using machine-learning techniques to identify people that show patterns indicative of problem gambling. Once identified, they consult with psychologists on the best course of preventative action to take.

All on-line gaming sites will collect data on the betting patterns of their customers, including time of day, frequency, size of bets and the types of games played. Featurespace is able to analyse this information to build up a picture of what would be considered normal behaviour and conversely, what would constitute erratic or uncharacteristically risky behaviour that could indicate the onset of a problem.

On-line gaming companies could be required to contribute data to such studies in order to obtain the best possible picture of addictive behaviour and develop systems to intervene appropriately. The regulators should insist that on-line gaming companies actively exclude players who are showing signs of problem gaming. They should also insist on a common reporting format (like number of excluded players per total number of customers) and require all operators to report publicly. It would then be possible to identify which companies are serious about tackling problem gambling and which are not. The regulator should also be intervening to check that the on-line operators have proper systems in place not only to apply the Featurespace and Harvard type models, but also to ensure that consistent action is being taken on the basis of the findings.

For land-based operations, there is also a need to develop a mandatory requirement to intervene when people are gambling excessively. This is not easy, but with fixed odds betting machines described as the crack cocaine of the gambling industry, the need to moderate behaviour is clear. Just as bar staff can refuse to serve a customer who is drinking excessively, staff in betting shops need to intervene when people are betting out of control.

Both on-line and land based operators should also be required to share information about addicted customers. It is too easy for an individual who may have identified a gambling problem and self-excluded to walk into a competitor’s shop or go on-line and start playing elsewhere. The responsible approach would be to ask players, when they first sign up or when they first self-exclude, to agree to share their name with other responsible operators. This way protection can be increased significantly but with minimum cost.

Addiction modeling

This is not just a socially responsible approach to gaming, there is a strong business case for adopting such controls. As the world moves towards more licensing of gambling, companies that can proactively demonstrate the use of these models are much more likely to win licences and to obtain a favourable hearing from regulators. In contrast, the addiction modeling that is being developed will soon allow the regulator to take a harsh view of those that refuse to intervene.

In addition, there are brand reputation issues to consider. If the numbers with some form of gambling addiction continue to rise, it will only be a matter of time before gaming companies are pushed out of main stream advertising and promotion opportunities, for example on football shirts.

If government and regulators are serious about developing a responsible gaming industry, they need to ensure that the industry takes a proactive approach to responsible gambling. Governments and regulators should use these new techniques to push irresponsible gaming companies to adopt best practice or face sanctions. Companies should be required to share information, adopt models that monitor behaviour and intervene proactively to exclude and protect problem gamblers.

GoodCorporation has assessed and advised a number of the leading gaming operators on social responsibility over the last 14 years. Its work has included mystery customer testing of responsible gaming controls and evaluation of all social responsibility policies and systems within gaming companies.

With great power comes great accountability?

Do you remember when getting a fine was considered a bad thing? A sign that you’d flouted the law in some way? It was definitely something to be ashamed of at any rate. It doesn’t seem to be the same in the world of financial services. Banks simply set aside large amounts – of whose money I wonder? - to cover them.

The list of fines in recent times is staggering: Libor rigging, Forex rigging, sanction busting, mis-selling of faulty mortgage backed securities, gold price fixing, assisting tax evasion and mis-selling of personal insurance…

What is going on? If I operated in any of these ways and was found out, I’d soon be paying the price. Why are financial services operators any different? Indeed, a new report from Cass Business School and think tank New City agenda concludes that the ‘toxic’ and ‘aggressive’ culture inside British banks will take a generation to change.

The very recent RBS debacle over two senior executives’ ‘honest mistake’ while giving evidence to the Treasury Select Committee is a case in point. ‘Honest mistake’ or not, the only way banks will begin to get control of things is to make every director and every manager accountable for their actions. Let’s rewrite that famous Voltaire quote: With great power comes great…accountability.

Maybe we should take a leaf out of Iceland’s book. Former Landsbanki boss Sigurjon Arnason has recently been sentenced to 12 months in prison.

An Icelandic court found him guilty of market manipulation in the lead up to the 2008 financial crisis. And the former chief executives of Iceland’s two other big banks, Glitnir and Kaupthing, have already received jail sentences.

Hreidar Mar Sigurdsson, the former chief executive of Kaupthing - formerly Iceland’s largest bank - received a jail sentence of five and a half years - the heaviest sentence for financial fraud in Iceland’s history.

And real action does need to be taken. For while the most recent study from the Institute of Business Ethics (IBE) into the British public’s view of business behaviour shows that the public’s general opinion about ethical business behaviour remains the same as 2013 (and consistently leans more towards judging business as behaving ‘ethically’ than ‘not ethically’), it also shows that the British public seem to have become less ambivalent about business behaviour. In 2012, 15% expressed no opinion, but in 2014 only 2% do not have an opinion on business behaviour. So bad businesses beware! We are all getting more aware and sensitive to what you’re up to.

Philippa Foster Back CBE, IBE’s director, emphasizes that while business can take some heart in the report’s results that the British public’s opinion of business behaviour is improving, business is not out of the woods yet: “Business needs to listen to the public’s concerns about business behaviour and ensure that it addresses them, or they will lose the fragile trust that has been regained,” she said. “Consideration must be made of the opinion of the younger generations and those of the working classes who are experiencing business behaviour differently to the general public.”

EPA Proposes to Tighten Ozone Emissions Standard

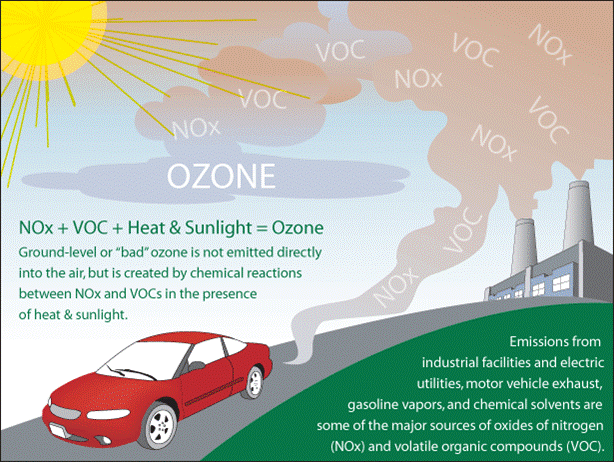

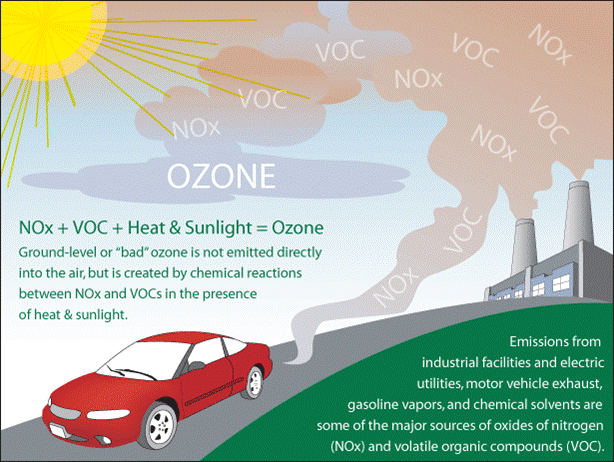

On Nov. 26, Environmental Protection Agency Administrator Gina McCarthy took another step forward in the federal government's three-plus decades long effort to improve air quality, and environmental and human health and safety, by driving further reductions in air pollution across the U.S.

Responding to “extensive recent scientific evidence about the harmful effects of ground-level ozone," or smog, Ms. McCarthy announced: “EPA is proposing to strengthen air quality standards to within a range of 65 to 70 parts per billion (ppb) to better protect Americans' health and the environment.” In addition, EPA said it is taking comments on tightening ozone emissions standards further, to 60 ppb.

“So, 60 is on the table for comment as well as consideration,” McCarthy stated in a conference call. “Now this is a proposal, so taking comments on a range of different outcomes is exactly how we're supposed to do it, and I'm excited to get moving with the comment process because the conversation isn't over. This is an opportunity for us to look at all of the science together.”

Tightening up on smog control

EPA is required to review ozone emissions standards every five years as per the Clean Air Act. Its last review was in 2008, when EPA set a national ozone emissions standard of 75 ppb.

Designed to be open and transparent, the review process entails taking comprehensive account of the latest scientific research on the topic and considering counsel of a panel of independent experts.

"Bringing ozone pollution standards in line with the latest science will clean up our air, improve access to crucial air quality information, and protect those most at-risk. It empowers the American people with updated air quality information to protect our loved ones -- because whether we work or play outdoors – we deserve to know the air we breathe is safe,” McCarthy was quoted in an EPA press release.

“Fulfilling the promise of the Clean Air Act has always been EPA’s responsibility. Our health protections have endured because they’re engineered to evolve, so that’s why we’re using the latest science to update air quality standards – to fulfill the law’s promise, and defend each and every person’s right to clean air.”

Political reactions

In an audio report, C-Span highlighted reactions via Twitter to the EPA's proposed stricter standards for ozone emissions. House Majority Leader Kevin McCarthy tweeted, “EPA's latest ozone regulation kicks the ladder out from underneath us.” Sen. Dianne Feinstein of California takes an opposing view: “Today, EPA took a key step to curb smog in our atmosphere. Future generations will benefit greatly as a result."

The Sierra Club came out strongly in favor of the EPA's action:

“We applaud the EPA proposal to lower the existing standard, and strongly encourage the agency to limit this pollution to 60 ppb when they finalize the exact standard in October of 2015. A 60 ppb standard will be a breath of fresh air for thousands of Americans who suffer needlessly with asthma attacks, nervous system disorders and heart ailments when exposed to smog pollution.

“The EPA has raised the mantle of putting people before polluters and holding negligent companies accountable for what they expose our communities to. Choosing to lower the standard from 75 ppb is a tremendous step toward putting the health of children above polluters, and we hope the EPA takes another one and places the final standard at 60 ppb come October of 2015.

“The EPA’s decision to side with children’s health contributes greatly to the integrity of the agency’s efforts towards transparency. From coast to coast, newspapers, school boards, and community organizations depend on the EPA to provide them with the most accurate measurements of air pollution available and the new proposal does just that.”

Senate Republican Party Committee Chair John Barrasso said, "EPA's ozone rule is more proof the Obama administration is turning a deaf ear to Americans, who want Washington to focus on jobs.” Of course, complying with the EPA's proposed ozone emissions standards will mean a wide range of sources – power plants, oil refineries, petrochemical plant operators and auto manufacturers -- will have to invest capital and create work if the new standard is enacted, and that's likely to create jobs.

*Image credits: 1), 3) US EPA; 2) Union of Concerned Scientists

Komaza Plants Sustainable Microforestry in Kenya

Sometimes, what we don’t know can set us free. Visiting a foreign nation -- and seeing local people struggle to eke out a living on arid and unforgiving land -- can certainly move and inspire a bright young man, who has never heard “all the reasons things cannot change here,” to come up with a clever plan that may or may not work.

One need look no further than the example of the renowned economist Jeffrey Sachs (whose biography I recently finished) to see both sides of that story. Sachs had an ambitious plan to eradicate extreme poverty in Africa, which he threw himself into with all the considerable passion, talent and fundraising he could muster. And while his Millennium Villages Project did improve the lives of numerous families, it ultimately fell short of its ambitious goals for a number of reasons. Most notably it lacked a sustainable business model.

Tevis Howard traveled to Kenya and saw what Sachs saw, and he too became determined to do something about it. After coming up with numerous business plans, Howard settled on the idea of planting trees and founded Komaza, a Swahili word that means “to encourage growth.” This was a fortunate choice, likely inspired by Wangari Maathai, the founder of the Green Belt movement and recipient of the Nobel Peace Prize. Maathai championed for human rights, democracy and conservation, all organized around the planting of trees.

Maathai’s work was also echoed in the Great Green Wall initiative -- an effort on the part of 11 countries to erect a wall of trees, 10 miles wide and 5,000 miles long, across the entire continent, to keep the Sahara desert from advancing southward.

Trees are inherently more resilient than field crops. Howard, who graduated from Brown with a neuroscience degree, chose to use drought-resistant eucalyptus, an astute choice. These trees provide marketable commodities, which can allow the farmers to participate in the cash economy. Planting them also helps to reverse the rampant deforestation which has been taking place as poor people cut down trees for firewood. Since 1963, forest cover in Kenya has declined from 10 percent to 1.7 percent of the total land area.

Here’s how Komaza’s nonprofit business model works. Farmers are recruited, told that they can make money planting trees. Then they are given training and inputs, in the form of seedlings and fertilizer, and tools. It takes several years for the trees to mature, but Komaza waits for the farmer to repay the initial outlay. In 6-10 years, seedlings that cost $1 each can be sold for $30. Komaza helps connect the farmers to the marketplace where the wood can be sold as charcoal, poles & posts, sawn lumber, manufactured boards, biomass energy, and more

This microforestry approach has provided a threefold increase in income among participating farmers. This has lead to widespread improvements in quality of life, from education, to health care, and access to improved infrastructure. The project also hopes to improve environmental conditions, with a target of 20 million trees planted by 2020. To date they have planted 1.5 million.

The project is organized in a pyramidal structure called the Field Extension Network consisting of multiple cells. Each cell contains a central office and a tree processing facility sufficient to serve 9,000 farmers. Field Directors, manage multiple Field Managers, who manage multiple Field Officers, who manage Facilitators. This allows for a high level of interaction while creating 125 jobs for the team.

Like the trees the enterprise depends on, this whole endeavor, which started in 2008, will take a while to come to fruition. In the meantime, as the roots deepen, the hopes continue to rise. And while Howard's aspirations may not be as lofty as those of Sachs, he is making a difference that is growing every day.

Image courtesy of Komaza.

RP Siegel, PE, is an author, inventor and consultant. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand. He recently traveled to Kenya to cover a water purification initiative byVestergaard.

Follow RP Siegel on Twitter.

Climate Financing Drops in 2013, Driven Mainly By Falling Solar Costs

Annual global climate flows last year decreased from 2012, according to a new report from the Climate Policy Initiative. The report, titled The Global Landscape of Climate Finance 2014, found that annual global climate finance flows in 2013 totaled $331 billion, $28 billion less than 2012. However, public actors and intermediaries contributed $137 billion, almost unchanged from 2012.

It is not necessarily a bad thing that global climate finance flows decreased. The report cites the falling price of some renewable energy technologies, namely solar photovoltaics (PV), as the the main reason. Or as the report put it, “These cost savings mean that in some cases more renewable energy is actually being deployed for less investment.”

It cost $40 billion less in 2013 to achieve the same level of solar deployment than it did in 2012. About 80 percent of the decrease in private investment came from the falling prices of renewable technologies, particularly solar PV. If investment costs of solar PV had stayed the same in 2013 as they were in 2012, then the global climate finance flows total would have increased by $12 billion, according to the report.

“Our analysis shows that global investment in a cleaner more resilient economy are decreasing and the gap between finance needed and actually delivered is growing,” said Barbara Buchner, senior director of the Climate Policy Initiative and lead author of the study. “Our numbers demonstrate that most investment is happening at the national level with investors favoring familiar environments they perceive to be less risky. This implies that domestic policy frameworks and appropriate risk coverage are critical to encourage investment.”

The report does have some bad news about renewable energy deployment: According to International Energy Agency estimates, an additional $1.1 trillion in low-carbon investments is needed every year on average between 2011 and 2050 -- in just the energy sector -- to keep global temperature rise below 2 degrees Celsius. An important part of limiting climate change to below 2 degrees Celsius is for climate finance investment to not only grow but also displace fossil fuels investment. The opposite is occurring. The IEA reported this year that investments in oil, gas and coal more than doubled since 2000, reaching $950 billion in 2013. Some experts are concerned that a 3 to 4 degrees Celsius temperature rise is more likely.

Public investment in climate finance totaled $193 billion, a decrease of $31 billion or 14 percent from 2012. While climate finance flows were split almost equally between developed and developing countries, the amount flowing from developed to developing countries decreased by $8 billion from 2012. Private investment decreased by $2 million. Almost three-quarters of total flows were invested in their country of origin, with 90 percent of private actors’ investment staying in their country of origin. What that indicates is that domestic policy frameworks are important for “unlocking scaled up climate finance flows,” the report's authors wrote.

Image credit: Chandra Marsono

Public opinion of business improving, but trust remains fragile

Tax avoidance and executive pay are still firmly on the agenda as issues the British public thinks business needs to address, according to the latest survey of public opinion about business behaviour conducted for the Institute of Business Ethics.

The survey shows that the public’s general opinion about ethical business behaviour remains the same as 2013. Since the survey began in 2003, the British public’s opinion consistently leans more towards judging business as behaving ‘ethically’ than ‘not ethically’.

Asked whether business generally behaves ethically, 58% of respondents said it did. However, over the past two years, the British public seems to have become less ambivalent about business behaviour. In 2012, 15% expressed no opinion, but in 2014 only 2% do not have an opinion on business behaviour.

For the full story see the December issue of Ethical Performance out next week!

Hyundai and Kia Promise to Triple Number of Green Cars by 2020

Hyundai and Kia recently pledged to increase their models of more fuel-efficient cars threefold by 2020. The announcement by the South Korean automakers comes on the heels of a massive settlement to which both companies entered into an agreement with the U.S. Environmental Protection Agency (EPA) after they were accused of underestimating greenhouse gas emissions of over a million vehicles. Together the companies will pay $350 million in civil penalties to the U.S. government. A week later, both Kia and Hyundai said they would offer more green cars by the end of this decade.

According to Reuters, both companies will also increase their total of fuel efficient cars to a minimum of 22 cars before 2020. That boost is in part due to investors complaining not only about the huge fine paid to the EPA, but also because of Hyundai’s most recent Genesis and Kia’s Soul offering a lower fuel mileage than previous models.

Both companies have lagged with their hybrid and electric vehicle models compared to their international competitors. The latest Kia Optima Hybrid, for example, has received disappointing reviews for its power train, braking and steering. The EV Soul, which was released in the U.S. for the first time this year, fared better in reviews, but Car and Driver still ranked it behind the Chevy Spark, Volkswagen e-Golf and Ford Focus Electric.

Hyundai’s Sonata Hybrid, meanwhile, also has scored middle-of-the-road reviews. While drivers generally praise the car’s aesthetics, they also note that its competitors’ vehicles in the same class have better gas mileage. The company is hoping to make a splash with its Tucson Fuel Cell, but reviews have also been tepid. Hyundai’s promise of free fuel for the car while it is under lease falls rather flat considering there are only nine stations open to the public in California; and eight of them are in the Los Angeles area.

Both companies have a lot of catching up to do on the EV front. Both Kia and Hyundai have promised to increase the variety of fuel-efficient vehicles to include both smaller automobiles as well as sport utility vehicles. A total of six plug-in hybrid cars are also supposed to be part of both companies’ future models. Five years is not a lot of time to make good on these promises in lieu of this public relations fiasco, and after years of steady growth, the Korean companies’ market share in the U.S. has been flat and even in decline this decade. But considering how far cars from South Korea have come in a generation, don’t be surprised if future models turn heads: After all, gasoline may be cheap now, but hybrids, plug-ins and EVs are not going away anytime soon.

Image credit: Hyundai USA

Leon Kaye is based in California and most recently worked for a renewable energy investment company in the Middle East. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

Mercedes Conceptualizes Solar Paint

By Roselin Dey

One of the first car brands that comes to mind when we think of luxury and style is Mercedes. In fact, so much has the brand’s popularity grown over the past few years, that it overtook BMW with the sales crown in the luxury auto segment in 2013.

And now, Mercedes might just bring about the next revolution in sustainable mobility.

Imagine a car with an innovative paint job that can enable it to run on solar as well as wind energy. Well, this could possibly come true with the latest concept car by Mercedes, unveiled in Beijing earlier this month at the opening of a new research and development center.

This innovative concept car, Mercedes Vision G Code, boasts a conventional electric motor (powering the back wheel), as well as a hydrogen combustion engine (powering the front wheel). The electric motor powering the back wheel can be charged by kinetic generators in the brakes and shock absorbers, while the hydrogen motor produces only water in the name of emissions. The water generated as a byproduct can be close-looped back to create more hydrogen, and the oxygen gas created can be pumped inside the car for the passengers to freshen the interiors.

But the feather in the cap is that the hydrogen fuel need not be bought at through-the-roof prices but instead can be created by the unique multi-voltaic paint job of the car.

Now consider this: When the car brakes to a halt, the shock absorbers and the brakes charge the batteries in the rear wheel; and the multi-voltaic paint helps capture electrostatic wind power for hydrogen generation (in the front wheel). And all the while -- whether moving or stationary -- the paint is utilizing the abundantly available solar power.

Increasing the cool visual quotient is the fact that the prominently visible front display glows blue when the car is stationary, red in sports mode and purple during relaxed driving.

As the number of conscious consumers is growing worldwide, more and more leading auto brands have been offering variants for green cars -- either manufactured with fewer materials or smarter engines with lower emissions (and hence smaller environmental footprint) or electrically charged (hence using less or no direct fossil fuels).

A quick peek at the U.S. EPA website shows that approximately $11.4 billion has been saved so far by consumers who have already purchased new vehicles under the fuel economy and greenhouse gas standards.

Although it is yet to be seen whether such a revolutionary concept car would actually hit the roads, it is heartening that leading automakers are spending millions on such forward-thinking research and technology. The hope is that some of these ideas are applied in the years to come to roll out the next generation of smart cars.

https://www.youtube.com/watch?v=6BrFD8KQ750

Do you own a environment friendly car? What has been your experience?

Image credit: Mercedes Benz

Roselin Dey works as a sustainability consultant in the Market Access and Insights Team of a strategic management and consulting firm in India. She specializes in research and analysis, strategic consulting, program management and communication in the area of corporate sustainability. She loves discussing the sustainability vision and innovative strategies of businesses and is passionate about writing on corporate sustainability issues.

Video: Jacques-Philippe Piverger of MPOWERD Talks Diversity at Net Impact '14

"The topic of diversity is thrown around quite a bit. I think oftentimes we don't fully appreciate or understand what it's really about," Jacques-Philippe Piverger, co-founder and CEO of MPOWERD, said at the 2014 Net Impact conference last month.

"Diversity comes down to the core topic of appreciation and love, and fully accepting all people for all that they are and the way that they operate," he continued. "Whether it's about your personal relationships or a business that one creates, I don't think it can reach its full potential unless we're really open and accepting of others."

As part of our Talking Diversity video series, Piverger goes on to make the business case for diversity and explain why it matters to MPOWERD, a New York City-based company providing solar solutions to customers on and off the grid, in this two-minute clip.

Jacques-Philippe Piverger is a social entrepreneur who draws on his business and philanthropic experience to create positive change for humanity across the globe. As Chief Executive Officer and Co-founder, Jacques-Philippe is deeply involved in all aspects of MPOWERD’s business and tirelessly works to bring innovative solar lighting solutions to the developed and developing world.

In addition to honing his business acumen as a Director at PineBridge Investments participating in over $10 billion of private equity, hedge and real estate transactions globally, Jacques-Philippe also worked at AIG Investments, Friedman Billings Ramsey and Barclays Capital. He founded The Soleil Group, a strategic marketing firm with a diverse portfolio of clients such as Western Union, Universal Music, New York Public Library, Glaceau Vitamin Water, BMG and Motorola. Jacques-Philippe is also Chairman of Regenerer Haiti, a 2500-acre quadruple bottom line sustainably designed community which takes into account people, planet, profit and society. He founded and is Chairman Emeritus of Soleil Global, a nonprofit organization dedicated to using renewable energy solutions to empower people in developing countries. Jacques-Philippe co-founded and is on the board of The Council of Urban Professionals and he is a Term Member of The Council on Foreign Relations, a Young Global Leader (as designated by The World Economic Forum) and an Advisory Board Member of George Clooney’s Hope for Haiti Now Fund. An avid speaker on leadership, impact investing and being a sound global citizen, Jacques-Philippe holds a Bachelor’s degree from Georgetown University and a MBA from the Tuck School of Business at Dartmouth where he was a Private Equity Research Fellow.