Renewable Energy: “Development as Freedom” in Haiti and Beyond

Rapid transition from centralized energy systems based on fossil fuels to those based on a mix of distributed, locally appropriate renewable energy resources is viewed by many as the most effective means of mitigating and adapting to climate change. That's just the “thin edge of the wedge” with regard to the advantages and benefits societies can realize by spurring development and adoption of distributed energy resources and technologies, however.

Economists and development experts such as Nobel Prize winner Amartya Sen have zoomed in on and elaborated the potential of distributed renewable energy resources and technologies to do much more than address climate change. Rather than focusing narrowly on climate change, Sen asserts in an August 2014 article in the New Republic, renewable energy proponents, and global society, would be better served if this perspective were to be broadened and refocused on the potential of distributed renewable energy resource development to alleviate poverty, enhance individual liberty and freedom, and hence foster development of more open, inclusive market-based economies and democratic forms of government.

An energy-and-development policy paper from the Worldwatch Institute invokes Sen's conceptualization of “Development as Freedom” as applied to Haiti, the most poverty-stricken nation in a region whose history is characterized largely by general poverty linked to political and economic repression and unsustainable extraction and exploitation of natural resources and ecosystems.

In its “Haiti Sustainable Energy Roadmap,” Worldwatch highlights that “tremendous opportunities and actionable solutions exist to build an electricity system that is economically, socially, and environmentally sustainable using the tremendous renewable energy and energy efficiency potentials of the country.”

Idyllic Caribbean vacations amid harsh realities

The idyllic Caribbean experiences sought so avidly by tourists and resort-goers the world over belie the harsh political and economic realities faced by citizens across the Caribbean-Latin America region.

“With their soft white sand and pristine ocean waters, their swaying coconut trees and bright blue skies, small islands in the Caribbean are often compared to paradise, René Jean-Jumeau, Ph.D., former Minister Delegate for Energy Security in Haiti, was quoted in a Worldwatch press release. “Yet they all struggle to attain the ideal supply of energy to serve their population. Availability of energy is…an absolute necessity for small developing countries, as a driver for their growth and contributor to social well-being.”

Petroleum imports account for 85 percent of Haiti's energy supplies, the Worldwatch report authors highlight, draining the economy and government of scarce capital and financial resources, as well as degrading ecosystems and natural resources upon which Haitians rely on for subsistence.

Despite siphoning off 7 percent of Haiti's GDP, only 25 percent of the Haitian population has regular access to electricity. The authors of “Haiti Sustainable Energy Roadmap” envision and lay out steps critical to developing, a mix of local, renewable energy resources that would enhance ecological and socioeconomic sustainability in Haiti.

Its study, Worldwatch explains, “compares the full economic and societal costs of Haiti’s current electricity sector and its business as usual development to that of alternative pathways.” The Institute's conclusion: “Haiti will benefit immensely if it relies more heavily on renewable energy sources and less on fossil fuels.

"There is hardly a place on Earth where the advantages of a distributed electricity system powered by domestic renewable sources are as evident as in Haiti,” Worldwatch Institute Climate and Energy Director Alexander Ochs writes of the study.

For example, the report authors highlight:

“Only 6 square kilometers of solar photovoltaic panels would be able to generate as much electricity as Haiti produced in 2011.Other key takeaways from Worldwatch's “Haiti Sustainable Energy Roadmap” report include:“In the absence of a national grid system, Haiti has an opportunity to leapfrog 20th century energy development, modeling a pathway to electrification and resilience that harnesses the enormous domestic energy resources the country has at hand and uses them locally and efficiently.”

- The highest renewable energy scenario shows savings of up to USD 5.84 billion by 2030;

- Up to 1,870 new jobs would be created, electricity access expanded, local air and water pollution reduced, and health and education improved;

- Ambitious policies towards these goals would position the country – which already suffers from the consequences of extreme weather conditions – as a leader in climate change mitigation and adaptation;

- Based on analysis of Haiti’s business environment, the roadmap suggests concrete regulatory, policy and institutional changes that will be necessary to attract new investments in clean energy solutions.

For Sen and others, an environmental, as well as socioeconomic, ethic that recognizes and values social and natural capital underlies and pervades public and private social and economic policy- and decision-making. Those same values support and inform Worldwatch's “Haiti Sustainable Energy Roadmap.”

Considered a classic work on political economy and development, Sen's “Development as Freedom” may be seen as anathema in societies where income, wealth and political power have been concentrated in plutocracies, oligopolies and monopolies. On the other hand, it rejects the premise that individual freedom and liberty need to be sacrificed so that progress and gains in living conditions and quality of life may be obtained.

This ecological ethic resonates across boundaries of political and economic philosophy, as well as geography. As such, the concepts set out in Sen and others' work can serve to bridge the divides of income, wealth, political representation, freedom and opportunity that have been polarizing and pressuring industrial and industrializing societies of all ideological stripes over the course of recent decades.

By providing access to affordable, environmentally sustainable energy resources, instituting policies and programs that foster widespread adoption of renewable energy technologies can serve as a keystone for development of more open, inclusive and equitable forms of capitalism and democratic forms of government. Blazing this path requires access to affordable, environmentally friendly energy resources and active participation, dialogue and a genuine commitment to social, political and environmental justice for all.

*Image credits: 1) BrightLeaf Power 2) Worldwatch Institute; 3) Amartya Sen, Amazon

The North Face Introduces Locally Grown Hoodie

When you hear the words “locally grown,” images of leafy-green-lined farmer’s markets, multi-colored CSA boxes, and interestingly odd-shaped heirloom tomatoes may come to mind – and not necessarily a piece of clothing. Borrowing a cue from the local food movement, The North Face has developed an all-cotton hoodie that was grown, designed, cut and sewn within 150 miles of its corporate headquarters in California. The Backyard Hoodie, as it’s called, is the first in The North Face’s Backyard Collection, a line of products manufactured in the United States using locally sourced materials and resources.

The limited-edition men's and women's sweatshirt represents the brand’s commitment to connect with its regional textile supply chain and build products with local roots that have a positive local impact – a significant feat not common within the global apparel industry. In collaboration with the organizations Fibershed, Foxfibre, and the Sustainable Cotton Project, The North Face sourced the cotton used to make the Backyard Hoodie from California farmers who implement biologically-based practices that protect land, air and water resources and result in improved water and air quality, healthier soil, and reduced chemical exposure for farm workers and rural communities.

Beyond the source material, the Backyard Hoodie’s design was also intentional: Motivated to reduce waste, designers accounted for excess fabric in the design process and consequently lowered the hoodie’s waste percentage below the apparel industry average. This type of apparel production gives a new meaning to conscious design. I spoke with Adam Mott, director of sustainability at The North Face, to hear more about the making of the product from seed to sweatshirt, and why a locally grown product like this matters.

TriplePundit: Why did you choose California as the source for the cotton in this product? Adam Mott: Our goal was to make a product locally from soil to skin within 150 miles of our headquarters in Alameda, Calif. We set out to support our local community. California has some of the highest quality cotton in the world and we were able to source from two different cotton farms within 150 miles. Sally Fox provided heirloom 'Buffalo' brown cotton from her farm in the Capay Valley and the Martin family provided Cleaner Cotton-certified through the Sustainable Cotton Project from their farm in the San Joaquin Valley.

3p: The original idea was to create a hoodie using materials and manufacturers within 150 miles of The North Face’s headquarters, but it wasn’t possible to do the sewing and spinning in California due to the lack of cotton mills in the state. Do you think a big apparel company like The North Face will ever be able to make a product within 150 miles of one place in the U.S.?

AM: The main limitation was the lack of spinning and knitting infrastructure in California. (Due to the decline of cotton mills in Northern California, the cotton spinning and knitting had to be completed in the Carolinas before the fabric was returned to a cutting facility in Oakland and a local sewer in San Leandro, California, who constructed the garments.)

The U.S. is bringing a lot of production back (in multiple industries) and, overall, consumers are becoming more interested in buying local. This movement will probably continue and therefore it's only a matter of time until entrepreneurs bring that type of knowledge and production back to California so it can be close to the cotton harvest.

3p: Most apparel (or most products, for that matter) are designed with only the consumer-use in mind, not with what resources are available to make that product. The Backyard Hoodie is an example of what can be created through conscious reverse design. Why did you decide to take that approach?

AM: It's really about bringing back an older form of design where available materials and resources dictated your design choices. We decided to take a bale of beautiful heirloom cotton and see what we could make with it. This created more collaborative, deeper connections with the artisans involved in the textile production and inspired us to think about reducing waste in the design process for this exclusive collection.

3p: What's your measure of success for the Backyard Hoodie?

AM: This was more about the process than the final product. We have several learnings that can carry through as inspiration for future products. For one thing, Backyard helped us understand more about sustainable cotton farming practices and connected us with local artisans and growers in our community. We also experienced what it was like to let materials further inform design. Rather than starting with the goal of a specific design, we asked ourselves how we could let materials be a visual cue and primary driver in the design process.

On sourcing, when we couldn’t source from within 150 miles, we looked to other U.S.-based vendors. Our teams did a lot of work to try to make that happen so now we have a base of American suppliers we know we can partner with in the future. The measure of success will be the extent to which we can apply these learnings to scale up in the future.

3p: How do you think The North Face consumer will respond to the way this hoodie was made?

AM: The typical The North Face consumer has an appreciation and respect for the environment and community. We hope the story of this product will resonate with them.

More and more, consumers want a deeper connection to and understanding of the products that they buy. We are evolving to higher expectations for products with which consumers have an intimate connection. The food industry is a good barometer for such interest in transparency, health and connection to the local community.

3p: How has designing this hoodie changed the way The North Face designers think about the design process?

AM: The true benefit of the Backyard Project was the inspiration it generated by taking a different approach to making a product and bringing it to market. Backyard is really about asking new questions and making deeper connections. The project inspired our teams to better understand local production, encouraged us to reduce waste in the design and manufacturing processes and allow unique materials and partners to tell a story through design.

In turn, this helped inform a whole series of products we are calling the Backyard Collection. We are digging deeper into the origins of our raw materials, making stronger connections with the partners that help us bring product to market and gaining a better understanding of the impacts we have as a business. People here at The North Face are thinking ‘what can we do next?’

Social Sustainability and Sport

Editor’s Note: This post is part of an ongoing student blogging series entitled The Business Of Sports & Sustainability. This “micro-blog” is the product of the nations first MBA/MPA certificate program dedicated to sustainability in the sports industry. You can follow the series here.

By Kathleen Hatch

As the sustainability movement in sport expands, it’s time to leverage the power of people and focus our attention on social responsibility and inclusion. Think about it – every athlete, team, and league sets out to succeed, from amateurs enjoying a recreational league to teams at an international competition. Success is measured in various ways, ranging from the win-loss record and TV and media market share, to ticket sales and fan engagement. Now, there is a newer metric focused on mitigating impacts to the environment and the preservation of natural resources. It's time to expand these more quantifiable metrics to include diversity and other hard-to-quantify measures of social sustainability.

The National Hockey League (NHL) led the way as the first major sports association to publicly report on its league-wide carbon footprint. The league recently released a comprehensive 2014 NHL sustainability report.

This first, path-breaking step required significant leadership from NHL Commissioner Gary Bettman. He recognized that sustainability isn’t only about doing right by the environment -- rather it can be a well-thought out, long range core strategy for league success. The NHL sustainability report provides great examples of broad goals for social sustainability, including preserving frozen ponds for aspiring hockey players.

Consumers are a vital component of the sports industry. They have an emotional connection to the competition of sports, action, and the larger sense of community that sports teams can mobilize. Data gathered by the NHL indicates that relative to the general population, sports fans disproportionately care more about the environment and expect greater stewardship from teams and leagues. This is not just relevant in professional sports but in collegiate athletics and recreation as well.

What if the same energy deployed to advance technology and development of innovative lighting and cooling systems, playing surfaces and training facilities, and renewable energy, were galvanized toward creating a more inclusive sports culture?

There are promising examples that show how being more inclusive and socially responsible resulted in a team advancing many valuable goals, including: widening its fan base, more innovative marketing efforts, building thriving and diverse communities, and strengthening the value of a team or venue’s brands. To name a few:

- WNBA was the first professional sports league to specifically reach out to LGBT fans;

- Michael Sam’s jersey was the number one pre-season seller after being drafted by the St. Louis Rams;

- NIKE #BETRUE retail line set record sales and strengthened the corporate value that everyone is an athlete

One important voice promoting inclusion and diversity is Billy Bean, appointed this July as Ambassador of Inclusion by Major League Baseball. Whether a response to the social revolution taking place in America or just the natural path of baseball leadership ready to act – it doesn’t matter – according to Bean, baseball will “lead with its social conscience and vision.”

Photo courtesy NIRSA: Leaders in Collegiate Recreation

Kathleen Hatch is currently working as a consultant and recently completed service as President of NIRSA: Leaders in Collegiate Recreation. Follow Kathleen on twitter @KathleenHatch1 or call 509.592.3596

Timberland Gives Tire Retreads Second Life as Shoes

Old, worn out tires will get a new life through a partnership between two companies: Outdoor clothing manufacturer Timberland and tire manufacturer Omni United recently announced their collaboration to create a line of tires. Called Timberland Tires, they will be the first tires ever designed to be recycled into Timberland boots and shoes when the tire treads are worn out. The tires were unveiled at the Specialty Equipment Market Association (SEMA) automotive trade show in Las Vegas.

Timberland Tires are something new on the market: They will have a tire-to-shoe lifecycle. They will be American made. Used tires will be set aside by retailers after consumers purchase new ones. Liberty Tire Recycling will collect the worn out Timberland Tires and ship them to a North American recycling plant. There they will be recycled into crumb rubber which will be processed into sheet rubber that will be shipped to Timberland outsole manufacturers.

"Our partnership with Omni United marks a new day for the tire and footwear industries," said Stewart Whitney, president of Timberland."Given the strength of the Timberland brand, and our target consumer's appreciation for sustainability, we see a huge opportunity to change the way people choose their tires,” said G.S. Sareen, president and CEO of Omni United. “With Timberland Tires, drivers can be confident that their tires will perform, while also making a statement that expresses their lifestyle and values."

Timberland parent company VF releases first ever corporate social responsibility report

Timberland is owned by VF, the owner of over 30 apparel and footwear brands, and a commitment to sustainability exists throughout the company. VF recently released its first corporate social responsibility report. The report highlights the company’s sustainability efforts, including environmental stewardship efforts. One of those efforts is reducing electricity use. Since 2009, VF reduced electricity use by 4.5 percent and natural gas use by 2.8 percent at its manufacturing sites. It achieved this reduction through the installation of efficient lighting and HVAC systems, lighting sensors, variable speed controllers and timers. It replaced older dryers with updated burner designs.

Green building is important to VF. The company has committed to pursuing certification by either the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) or the Building Research Establishment’s Building Research Establishment Environmental Assessment Methodology (BREEAM). Its new distribution center in Hackleburg, Alabama was certified LEED Gold this year. Distribution centers in Kunshan, China, Sint-Niklaas, Belgium, and Mexico City have either met or will meet LEED standards. VF has 12 LEED certified buildings and one BREEAM certified building.

Some of VF’s buildings feature renewable energy. Part of the power from its international headquarters in Stabio, Switzerland comes from solar photovoltaic (PV) panels which sit atop the roof. The company purchases the rest of the power needed from external renewable sources that include hydroelectric and wind turbines. Its Outdoor & Action Sports coalition headquarters in Alameda, California is powered 100 percent by renewable energy consisting of solar PV panels on the roof and parking cover panels and wind turbines.

Photo: Timberland Tires

Report: How Organizations Can Turn Slacktivism into Clicktivism

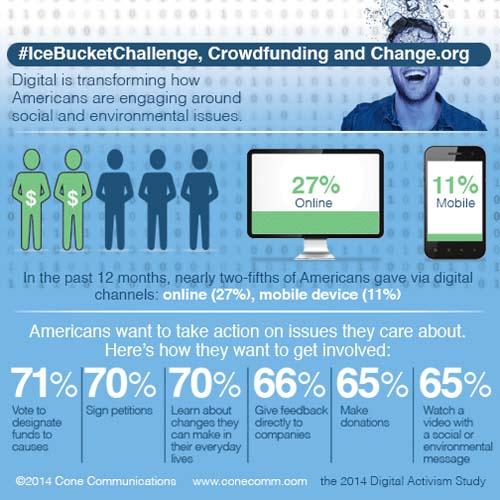

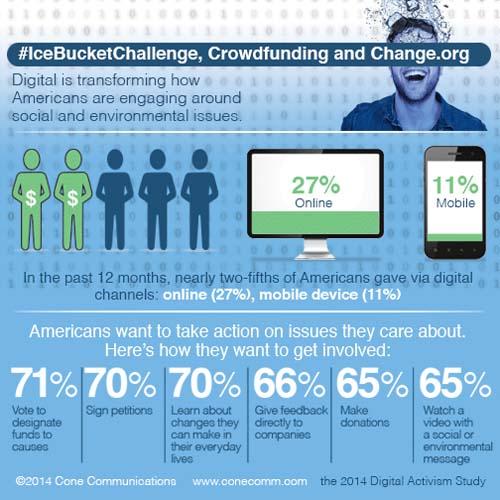

The term, “slacktivism” – defined as “informal actions performed via the Internet in support of a political or social cause but regarded as requiring little time or involvement” – has become so common in modern parlance that it was one of the runners-up for the Oxford English Dictionary’s Word of 2014. But the stereotype of a slacktivist tweeting outrage about the kidnapped Nigerian schoolgirls under the #BringBackOurGirls hashtag – and then not doing anything else about it – may have to change, according to a new report that examines the ways technology and social media are altering Americans’ engagement with social and environmental causes.

Prepared by public relations and marketing firm Cone Communications, the “2014 Cone Communications Digital Activism Study” found that when individuals educate themselves about social or environmental issues through online channels, they are more likely to take action. Close to two-thirds (64 percent) of Americans say that after “liking” or “following” a nonprofit or corporate social responsibility program (CSR) online, they are more inclined to support a cause by volunteering, donating and sharing information.

The study, which surveyed a demographically representative sample of 1,212 adults, also discovered that once individuals “like” or “follow” an organization online, they are also far less likely to disengage from the particular social or environmental issue. Sixty percent will continue to read content and engage with the organization, while only 12 percent will ignore content and 6 percent would “unlike” or “unfollow” the organization within the next 12 months.

Americans also turn to social media to discuss causes they care about, Cone Communications found. Over half of all individuals surveyed say they tweet about, post about or otherwise discuss important issues online, while nearly three-quarters of Millennials reported doing so.

But the report revealed a disparity between what people say they do and what they actually do. Sixty-five percent of Americans said, given the opportunity, they are willing to make an online contribution to a cause they are concerned about, but in the last 12 months, only 35 percent of them donated through the Internet. Similarly, 70 percent of survey respondents said they are likely to learn online about changes they can carry out in their everyday lives to make an impact on a social or environmental issue, but only 25 percent reported doing so in the last year.

But rather than view this inconsistency between intent and action as a reinforcement of the slacktivist stereotype, Cone Communications said this difference is “a prime opportunity” for nonprofits and CSR programs to get individuals more involved in their cause.

“It’s no surprise we’re seeing a gap between the actions Americans say they’d like to take online and what they’re actually doing, considering the bulk of online activities offered today are focused on more passive actions, such as watching a video or ‘liking’ a social page,” said Alison DaSilva, Cone Communications’ executive vice president, in a statement. “Organizations can better leverage digital touch points to help consumers make real impact on the issues they care about. The groundswell of support and action around the recent Ice Bucket Challenge demonstrates how Americans stand ready, willing and able to engage online in a variety of ways – if given the opportunity.”

Organizations should still continue to offer individuals more passive online actions, including “liking” and “sharing” content, but they should also suggest more action-oriented activities like giving feedback and committing to change their behavior, the “Digital Activism Study” recommended. The survey data demonstrates that most Americans want to do more to help their favorite causes, Cone Communications said, but they need organizations to channel this desire-to-help into specific actions that make an impact.

The report provides other recommendations to nonprofit organizations and CSR programs looking to better engage their online audience, including targeting specific populations like Millennials and Boomers on the online channels they prefer, as well as exploring new ways to get the message across, such as quizzes, videos and infographics.

Malcolm Gladwell might still be right, when he famously (and controversially) wrote that the revolution will not be tweeted: To effect real systemic change, individuals need to put down their smartphones and tablets and be willing to take on existing social and political structures. But, as Cone Communication’s new report shows, digital activism doesn’t just have to be a fruitless intellectual exercise; it can lead to worthwhile action, or “clicktivism.” And, since the study found that 58 percent of Americans think that tweeting or posting information about a cause online is an effective form of advocacy, nonprofits and CSR programs need to step up their game and make the most of this growing enthusiasm.

Image credit: Cone Communications

Passionate about both writing and sustainability, Alexis Petru is freelance journalist and communications consultant based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

Made to Last Promotes Local Products Proudly Made in Britain

No, they don’t have Thanksgiving in the United Kingdom. Maybe they should, since the Brits should feel thankful they rid themselves of the Puritans. One tradition that has creeped across the pond from the U.S., however, is Black Friday: a ritual some probably feel should stay out of Britain. It’s easy to feel exasperation over Black Friday’s emphasis on heavily discounted, shoddily manufactured goods when plenty of products made to last are on the market. Speaking of which, one online business, Made to Last, is connecting consumers to a bevy of manufacturers who craft their wares within the UK.

Calling out consumers to take into account durability, sustainability and the benefits of strengthening local industries, Made to Last is similar in concept to American web sites Locally.com and Etsy. Products are sold via a web site, but the emphasis on small manufacturers and artisans allow users to “buy local.” Made to Last only has a few rules in order for suppliers to sell on its site: products must come with a guarantee, they must be manufactured within the United Kingdom and finally, the products must have utility—no dancing flowers or pet rocks.

Vendors on Made to Last run are all over the map; clothing, furniture, electronics and home products are among the goodies on offer. The site is definitely not for those who have bought into the disposable society: toasters, for example, run about £200 ($313), but again, they come with a three year guarantee. Men’s fashion has some buys not out of range when compared to corporate retailers. T-shirts are priced decently, but the one beanie on offer goes for £75—though in fairness it is made from alpaca, not polyester. Nevertheless, in a society that overall values cheap over craftsmanship, Made to Last will have its challenges as it continues to grow and seek new suppliers.

At a time when too many cheaply made goods end up taking space on shelves or even worse, in landfills, the message Made to Last sends to suppliers and consumers is one we need to take more seriously. Made to Last insists its suppliers are held accountable for its products, therein requiring them to include a manufacturer’s guarantee on all products sold through its site. Furthermore, making a smarter and more responsible buying decision is more than about the quality and ethics of a product.

According to the UK’s Federation of Small Businesses (FSB), buying from small and local businesses has a large role in strengthening local economies. A report the FSB wrote last year claims for every £1 spent with a small- or medium-sized business, 63 pence returns to the local economy; contrast that to the 40 pence that is retained locally when purchasing from a large company. Hence the larger case about buying better, local products: they help build stronger communities and encourage more local entrepreneurs and designers. Sites such as Made to Last face strong headwinds in the retail sector, but offer a compelling long term alternative to the Amazons and Walmarts of the world.

Leon Kaye is based in California and most recently worked for a renewable energy investment company in the Middle East. Follow him on Instagram and Twitter. Other thoughts of his are on his site, greengopost.com.

Image credit: Made to Last

Working together towards an AIDS-free generation

This World AIDS Day, Dr Brian Brink, chief medical officer for Anglo American explains why it’s going to require teamwork, partnership and dedication to beat HIV/AIDS.

The world has made great progress in the battle against AIDS.

I marvel at the way in which access to affordable and effective treatment has transformed the epidemic. From a situation of fear, stigma, discrimination and despair, we can now face the future with the certain knowledge that HIV can be beaten.

The scientific advances that have made this possible, in a relatively short period of time, are nothing short of miraculous. Whilst we don’t yet have a cure, I am optimistic that we are getting closer to a long-term, sustainable solution.

The term AIDS today should be relegated to history. If we diagnose HIV infection early, and ensure access to timely and quality treatment, there should be no-one with HIV infection that progresses to AIDS.

Most people know of the populations that are particularly vulnerable to HIV infection and who are often marginalised with regard to the care, support and treatment they should be getting – these include sex workers and intravenous drug users.

We have to improve our HIV/AIDS response for these people. However, there’s also a particular demographic in sub-Saharan Africa where new cases of HIV infection are occurring far too frequently - young women and girls.

Women and girls at risk

The Gap Report from UNAIDS has revealed that there are about 380,000 new HIV infections among young women aged 15–24 every year. In 2013, almost 60% of all new HIV infections among young people occurred among adolescent girls and young women. The entrenchment of gender-based exploitation, abuse and violence against women is a significant factor in this worrying trend.

The disproportionate burden of HIV infection in young women and girls is something for which men need to take responsibility. Only when men begin to show understanding and respect for the sexual and reproductive rights and health of women and girls, will the world really make real progress towards eliminating HIV infection.

About 330,000 babies are born every year with HIV infection and that’s a burden of disease for life. We have the power to stop it. The fact is that the transmission of HIV from a mother to her child is entirely preventable.

We can get to a generation born HIV-free.

We also need to make sure that the mothers of these children don’t get sick and die. When that happens, the child not only loses a mother, but also his or her opportunities in life – the child loses everything.

Our role as a business

We at Anglo American understand the severity of what HIV/AIDS can mean for those infected and their families.

We also understand what can be done to prevent HIV infection or to mitigate the consequences for those infected. That’s why we run one of the largest corporate programmes to combat HIV/AIDS in the world and invest in numerous community partnerships.

It has been gratifying to see how many employers have responded to the AIDS epidemic by embracing the scientific advances, making the right investments to ensure the health of their workforces and extending these investments to the communities associated with their operations.

This is something to celebrate. It defines the concept of sustainable business and shared value with society.

We also understand that human rights must be the foundation of our HIV/AIDS response. Stigma and discrimination against people living with HIV have been the most hurtful societal responses to the AIDS epidemic. The world has sadly not made sufficient progress in protecting the human rights of those most vulnerable to HIV, including their right to health.

Fortunately there are civil society organisations that have had the courage to stand up for what is right in the response to HIV/AIDS and to never give up. NGOs have been pivotal in the success of the global response to the epidemic. Increased corporate social investment in support of human rights based NGO’s would help sustain the gains that they have achieved.

When governments, the private sector and civil society work together – reflecting a major theme for this year’s World AIDS Day: “Focus, partner, achieve: an AIDS free generation” – we can make a real difference.

Our success in fighting AIDS has shown that it is possible. We must go forward with the resolve to build on this success and progressively realise the right to health for all.

Corporate tax avoidance “morally wrong” says British public

More than four in five (85%) British adults say tax avoidance by large companies is morally wrong even if it’s legal, according to a new ComRes poll for Christian Aid and ActionAid.

The poll is published ahead of the government’s Autumn Statement, which is expected to include new measures against tax avoidance. The poll found that four in five Britons (80 per cent) agree that large companies in the UK can avoid tax too easily.

People are also worried about tax avoidance in the world’s poorer countries. Four out of five British adults (78%) say it’s important to them that large companies pay their fair share of tax in developing countries and three-quarters (73%) say the next UK government should legislate to discourage UK companies from avoiding tax in these countries.

Toby Quantrill, Principal Economic Justice Adviser at Christian Aid, said: “This poll clearly shows mass public opposition to tax avoidance by large companies, both in the UK and in developing countries. It doesn’t matter which political party people support – they all are saying the same thing: that politicians of all parties are still not doing enough to stop tax dodging.”

Patagonia Launches Black Friday Worn Wear Swap with Yerdle

Last year, amid the flurry and consumer buzz of Black Friday, Patagonia unveiled its Worn Wear program. On a day when most consumers were at the malls piling through racks of winter gear, new toys and the latest electronic releases, the company was celebrating Black Friday in a different way: It was urging its customers to give away the Patagonia gear they didn't need.

Patagonia knows it's the kind of appeal that resonates with its customers. Sharing the value they've enjoyed, from that over-used jacket or favorite top, with others who can turn those memories into usable, re-loved gear makes sense. It also feels good. And, as the U.K.-based group WRAP points out, it's the kind of strategy that works for the environment.

This year, Patagonia is going a step further with its Worn Wear initiative. Today, in eight locations across the U.S., it's holding Worn Wear Swaps, where customers can swap their used gear for another item off the Worn Wear rack.

For those who can't make it to one of the designated locations, Patagonia has another option: It has joined forces with the sharing economy app Yerdle to make its Worn Wear program accessible to those in the remotest of mobile locations. Customers who don't find something they want in exchange for their pre-loved item can swap for Yerdle credits.

Patagonia's $20 Million and Change investment fund is backing up the partnership, which the company says is designed "to help innovative, like-minded companies bring about solutions to the environmental crisis and other positive change through business."

The eight Worn Wear Swap locations for today are:

- Boston: 346 Newbury St.

- Cardiff, California: 2185 San Elijo Ave.

- Chicago, Lincoln Park: 1800 N. Clybourn Ave.

- Denver: 1431 15th St.

- New York City, Bowery: 313 Bowery

- Portland: 907 NW Irving St.

- San Francisco: 770 North Point

- Santa Monica: 1344 4th St.

Individuals who don't have gear to swap can still turn up. Patagonia is hosting refreshments, food and music. Not a bad way to spend a Black Friday.

Image credit: Patagonia

A Student Challenge Suggests Millennials Could Save Us from Black Friday

As retailers debate whether to jumpstart holiday shopping by opening on Thanksgiving, 44 of my students have a new perspective on consumption – they just completed their first “Buy Nothing New” challenge.

For 30 days, the students did not buy anything new other than food and absolute necessities. As their professor, my intention wasn’t to torture them but to give them an opportunity to explore alternatives to consumption -- hoping that through their experiences I would have a better sense about their generation’s (aka Gen Y, or Millennials) actual willingness to consider alternatives to traditional retail channels. In other words, the question I had in mind was: Can Millennials significantly integrate sustainable consumption into their lifestyles?

The opinions about it seem to be mixed. While Mary Meeker of Kleiner Perkins Venture Capital describes this generation as transitioning from asset-heavy lifestyles into asset-light lifestyles, a BCG study found out that Millennials “continue to place a high importance on brands. And they do the same for consumerism: majorities of those surveyed said that buying makes them happy and that spending is good for the economy and society.”

So, which one is it?

The beginning of the challenge wasn’t that easy for some students. One student wrote on the project’s blog: “I was initially very wary when I first heard about this project because I LOVE to shop.” Another student wrote: “When I first heard that we had to go an entire month without making new purchases I was mortified and slightly put off by the project. Shopping is one of my favorite things to do, and I hate buying secondhand. I love new things.”

This wasn’t necessarily an easy ride for the students, but the search for sustainable alternatives that would make sense for them took them to some interesting places. One of my favorite stories was of a student who walked through SoHo and saw a leather jacket that she really liked. She tried it and it fit perfectly, but then on the way to buy it she wondered if there wasn’t another way to meet her needs. She asked her roommate, who has a nice leather jacket, if she wanted to swap her leather coat for one of hers. The roommate said yes, and my student wrote: “I’m really excited to be wearing a new leather jacket this weekend and I do think it’s a great alternative to be switching with a roommate instead of buying something new.”

Other examples included borrowing magazines from a neighbor, preparing food instead of ordering takeout, reusing old candle jars as vases, using sharing economy services like Airbnb and Citibike, making your own costumes for Halloween, buying a second-hand radio on eBay, and even a DIY haircut (five minutes, no cost and it actually ended well).

Still, no matter how satisfactory the alternatives were, at the end of the challenge students still agreed that shopping for new things makes them happy, though far less than before the challenge started (90 percent dropped to 72 percent).

Was Mary Meeker right, or BCG? Both are somewhat right. Millennials seems to enjoy shopping as much as any other generation, and often see buying new stuff as the default option. But when asked to shift to a more thoughtful mode -- where they start asking themselves questions not just about their purchasing decisions, but also about their lifestyle overall -- something interesting happens. As one student described it: “I believe that this has been a month of rethinking my consumption behavior. I have been trying to shift my consuming behaviors toward more sustainable ones. I really think that as the weeks passed, I started to fully be aware and conscious of every purchase I made. Or at least I really thought to myself: Do I really need this? Or is there any other possible solution?”

And this is not just about some fuzzy feeling that there’s a better way to live your life – students reported significant savings in their monthly expenses, making better use of what they already have and feeling gratified about creating something rather than buying it.

In the end, more than 8 in 10 students defined “consuming better” as consuming only what I truly need and consuming products with better quality/durability. Interestingly, consuming less was almost at the bottom of the list with 40 percent.

Based on the challenge, Millennials seem ready to orient their lives in a much more sustainable way, shifting from a wasteful culture that puts a lot of value on shopping to one that is more focused on relationships, community and creativity -- the elements that make us happy.

But don’t expect Millennials to do it without a nudge. As one student wrote: “I have to be honest that I would probably not have done the challenge had it not been a requirement for class.” Therefore, this is our critical challenge -- if we can’t nudge the Millennials, we’ll have to wait for the next generation (Gen Z). Can we really afford that? I doubt it.

* I'd like to thank Mitch Baranowksi of BBMG for his insightful comments on an earlier version of this post.

Image credit: Paul Hocksenar, Flickr Creative Commons

Raz Godelnik is an Assistant Professor of Strategic Design and Management in the School of Design Strategies at Parsons The New School for Design.