Video: Kathy Hopinkah Hannan of KPMG Talks Diversity at Net Impact '14

"I don't think you can have a discussion about sustainability without talking about talent," Kathy Hopinkah Hannan, national managing partner of diversity and corporate responsibility for KPMG, said at the 2014 Net Impact conference. "And given the shifting demographics we have to be looking at diversity in talent."

"When we bring together diverse perspectives, we will get the best innovation and best solutions for our customers."

As part of our Talking Diversity video series, Hannan goes on to describe why the business community should care about diversity and the reasons it's important to KPMG in this two-minute clip.

Kathy Hannan’s tenure in the accounting profession reflects close to 30 years of industry expertise and a series of leadership roles within KPMG. Admitted to the partnership in 1994, she served as the Midwest Partner in Charge of International Services, Partner in Charge of Chicago Metro-Tax Practice, Vice Chair of Human Resources, and Midwest Area Managing Partner of Tax Services prior to her appointment in 2009 as National Managing Partner, Diversity and Corporate Responsibility.

Her passion extends beyond KPMG through active involvement as an advisory board member of Catalyst, and board member for the Adler Planetarium, Metropolitan Planning Council, and is the national president and chair of the Girl Scouts of the USA. Kathy has been fortunate to receive recognition from Athena International, DiversityInc, Illinois CPA Society, and the Anti-Defamation League. In 2011, she was honored by the Illinois Women’s Conference with the Most Powerful and Influential Women award, the YWCA Outstanding Leader in Business award in 2012 and, most recently, was the recipient of Diversity Woman Magazine’s annual Mosaic Woman Leadership Award.

America is Aging: What More Do We Need to Know?

By Maura Dilley

“Aging is the adults version of the birds and the bees, we need to talk about it.” -- Rob Lowe

Rob Lowe, a seemly ageless Hollywood actor, was a keynote speaker at this year’s Social Innovation Summit in Silicon Valley. He was speaking (and sparkling) as a brand ambassador for Genworth, a leading provider of long-term care insurance, attempting to bring the subject of an aging America out of taboo and into the limelight. Rob wants you, me and Ann Perkins to get our house in order for retirement while we’re young and healthy. Good message, but what more needs to be said about aging, social innovation and the business of our near, gray future?

I caught up with Janice Luvera, global brand leader for Genworth, and Dr. Edward Schneider, dean emeritus and [rofessor at the University of Southern California's Leonard Davis School of Gerontology, to dig deeper.

Aging by the numbers

- 10,000 baby boomers will turn 65 every day between now and 2030 – nearly seven every minute.

- The Department of Health and Human Services projects that the U.S. population older than 85 will more than double by 2040.

- Americans older than 40 are more likely to plan for their death than plan for their long-term care needs. While two-thirds have discussed funeral arrangements with loved ones, fewer than half have talked about their preferences for the care they might need as they age.

Choose more now or choose less later

Looking 2o years in the future, Dr. Schneider sees a stark dichotomy between calamity and opportunity. A future with business-as-usual for elder care invites government services to be overwhelmed with care costs for the elderly; services will be delivered badly due to financial constraints and poor design begetting a social crisis where people young and old attempt to meet their needs in frustration with little maneuvering space.

On the flip, aging America could be seen as an opportunity: firstly to confront our fears and change our mindsets around aging, but also for innovation. It’s an opportunity to come up with products and services that perform better than what we have now, that deliver with dignity and with appropriate business models and that meet families where they are. Choosing to engage this opportunity now means a wide-open field for experimentation and improvement, as well as generating more choices for the future.

America requires disruptive, social innovation to age right

Despite these staggering facts and marketing stunts, critical thinking about aging was conspicuously absent from the conversation at the Social Innovation Summit. What will it mean for America, and American business, when the retirement and long-term care boom hits us in full?

Simply put, you and everyone you know will grow to a state where you are no longer able to care for yourself; your care by others will be expensive, and you have no more than four options for managing this inevitability.

- Invest in a long-term care policy;

- Self-finance your long term care – warning, nursing home care costs an average $87,000 per year;

- Beseech the support of a family member or friend who will care for you – warning, caregivers spend an average of $8,000 of their own money when providing care for their loved ones, or;

- Try Medicaid – hitch, you may need to run down your assets to the poverty line before you can qualify.

Which will you choose, which will your peers choose and how will those choices shape America? There are many theories as to why and how the subject of long-term care is so unimaginable and inert for the average American, but the impact on families will be huge without immediate evasive action.

And yet there is vast opportunity here. In the government sector, we need human-centric public services that are purpose-fit to meet real needs of the elderly and their families. For social innovation inspiration, we could look to the service design trend percolating in the U.K. -- redesigning government services. In the medical field, there is so much to be done from telemedicine to training – how do you attract talent to long-term elder care when your nursing home isn’t wage competitive with McDonald’s? And in design, what potential can be uncovered for increased wellbeing, mobility and independence as we age, with Google’s driverless car, interior design tweaked for cognitive impairment, and senior housing that supports continued social interaction of seniors with society at large. New products and services need to be investigated, prototyped and launched immediately, and the social innovation crowd should be leading this charge.

Image courtesy of Genworth

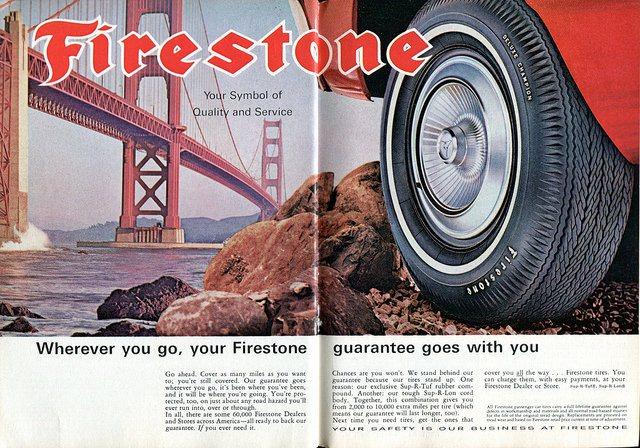

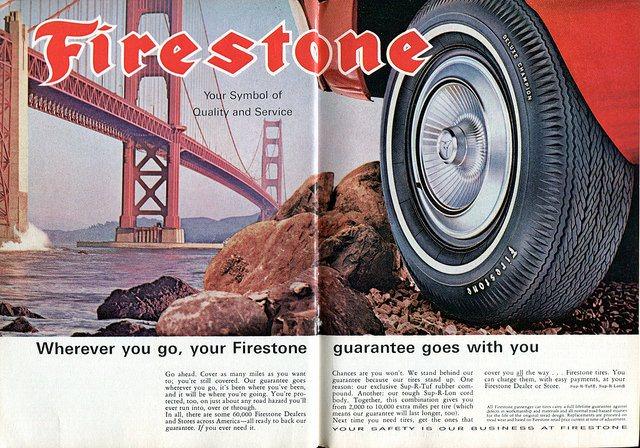

How Firestone Buoyed the Rise of Convicted War Criminal Charles Taylor

On Nov. 18, PBS aired “Firestone and the Warlord,” the result of a joint Frontline-ProPublica investigation into the relationship between the Firestone tire company and Liberia's former president and convicted war criminal, Charles Taylor. ProPublica also published a lengthy companion piece under the same title, drawing upon hundreds of interviews and scores of never-before-seen documents. The result is an exhaustively researched and fresh look at the vital role played by a major international corporation in supporting one of Africa’s most brutal dictators.

Firestone’s history in Liberia

Firestone first came to Liberia in the 1920s, seeking to exploit the country’s vast rubber resources. In 1926, it opened the rubber plantation that, 66 years later, would serve as Charles Taylor's base for directing his brutal assault on Monrovia, Liberia’s capital.

Firestone’s Liberian rubber plantation was considered to be the world’s largest and was a key asset for a company that, after being swallowed up by Bridgestone in 1988, began to experience cash-flow problems. So, despite generating just $16 million in revenue in 1989 (the year before the start of Liberia’s civil war), the plantation’s 15 percent profit margin represented a much-needed “bright spot on a corporate ledger drowning in red ink.” The plantation provided roughly 40 percent of the latex in America at the time.

Taylor arrives, Firestone flees

In the late 1980s, after escaping from a Massachusetts jail and making his way to a Moammar Gadhafii-sponsored military training camp in Libya, Charles Taylor established the National Patriotic Front of Liberia (NPFL). The NPFL’s stated goal was the overthrow of then-president Samuel Doe and the establishment of a Taylor government. Shortly thereafter, Taylor started Liberia’s civil war.

Taylor’s army first appeared at the Firestone plantation in June 1990. The head of the plantation at the time, Donald Ensminger, reported not being surprised by the NPFL's arrival; many of the Liberian workers even greeted the rebels with cheers, welcoming them as perceived liberators. (Doe was himself a brutal dictator.)

Of course, liberators they were not. Soon after showing up at Firestone, the NPFL began exacting revenge against members of tribes associated with the Doe regime. Government soldiers launched reprisal attacks, forcing the NPFL back into the jungle and searching the plantation’s company town for rebel collaborators. Terror descended upon the plantation, and Ensminger quietly plotted the expats’ escape. (When Liberian workers sought refuge at Ensminger's corporate mansion, where the expats had gathered for safety, the Liberian workers were turned away.) A U.S. Special Forces team soon escorted the Firestone expats to Monrovia and out of the country.

No sooner had Firestone left Liberia than executives at company headquarters in Akron, Ohio, were planning their return. According to Gerald Padmore, in-house counsel at Firestone, the company “knew there had been fighting, there had been killing, and there had been some ethnic reprisal killings,” but at the time, “Taylor did not appear to be conducting genocidal activities.” Ensminger disagrees with that account, telling ProPublica, “Firestone ... knew full well that atrocities and human rights violations were committed.”

It’s hard to buy Firestone’s alleged ignorance. Even putting aside Ensminger’s statement, there was significant contemporaneous documentation of widespread killing and torture already committed by Taylor’s army. In October 1990, Human Rights Watch warned that members of Doe’s tribe who remained in the country were “at risk of genocide.” A ProPublica analysis of data compiled by Liberia’s Truth and Reconciliation Commission suggests that, by December 1990, Taylor’s forces had committed “nearly 40,000 human rights violations, including more than 6,400 killings, 800 kidnappings and 600 rapes.”

Firestone returns

Yet, in June 1991, Firestone sent its head of HR, John Schremp, to Liberia to negotiate a return to the country. In July, Taylor summoned Schremp to a meeting and told him that, in order to return to Liberia, Firestone would have to deal exclusively with him and his regime. Two days later, Schremp communicated Firestone’s acquiescence. In December 1991, the Firestone board approved Taylor’s proposal and on Jan. 17, 1992, the two sides signed an official agreement to resume Firestone’s operations at the plantation.

In its World Report, published on Jan. 1, 1992, Human Rights Watch observed that “the human rights situation in Liberia continues to be marked by abuses ranging from extrajudicial killing and torture to restrictions on freedom of movement,” particularly “in the 90 percent of the country controlled by Charles Taylor's [NPFL].” The U.S. State Department’s 1992 human rights report found that between 20,000 and 30,000 Liberians had died over the course of the previous year; more than 600,000 had fled the violence -- spilling, like the war, into neighboring countries.

Nevertheless, according to Padmore, Firestone was not concerned. “The areas under Taylor’s control seemed to be relatively peaceful at that time,” he told ProPublica.

The root of all evil

ProPublica’s investigation turned up previously unreported Firestone records showing that, by the end of 1992, the company had paid Taylor more than $2.3 million -- $1 million of which was paid in rice, buildings and equipment. Firestone also spent over $35 million to rebuild the plantation between June 1990 and February 1993, and paid more than $12.3 million for “miscellaneous obligations and expenses.”

When presented with the documents, U.S. and Liberian officials who had worked in Liberia at the time expressed surprise at the payments. Former U.S. Chief of Mission, William Twaddell, called the heretofore unseen account statements "amazing" and questioned the purpose of some of the payments.

At one point, Taylor claimed the relationship with Firestone earned him between $1 million and $2 million every six months, calling it the "lifeblood" of his movement. The arrangement was clearly seen by Firestone as mutually beneficial. As a 1992 State Department cable observed, Firestone “has a huge investment to protect and ... seems to have concluded that to be successful they must deal with Charles Taylor now.”

Operation Octopus

By the summer of 1992, Firestone “knew that Taylor’s fighters were using the plantation as a [military] staging area.” Certain areas of the plantation were off-limits to Firestone employees. The plantation’s roads were marked with military checkpoints. Planes landed at a nearby airbase and sent cargo into the depths of the plantation on covered convoys. As one former Firestone employee put it to ProPublica, “You could tell they were planning to launch a full-scale war. There were weapons moving around.”

In October 1992, Taylor launched his brutal and erratic assault on Monrovia, dubbed Operation Octopus. Two attacks were staged from the Firestone plantation, aimed at seizing Monrovia’s suburbs and an airport. In response, West African bombers targeted the plantation, killing some 40 people — none of them combatants -- and injuring 200 more. The dead were buried among the plantation’s rubber trees. In November, Firestone would once again leave Liberia.

Amos Sawyer, Liberia’s interim president at the time, called the Firestone plantation Taylor’s “command post and nerve center” for Operation Octopus. ProPublica uncovered a previously unreported rebuttal to Sawyer, from Firestone, sent in July 1993. In the letter, signed by Schremp, Firestone acknowledged being in business with Taylor but claimed that there was no “practical alternative.”

Epilogue

Taylor’s campaign in Liberia soon spread to Guinea, Sierra Leone and Côte d’Ivoire, where his troops were notorious for indiscriminate killing, raping, and dismembering of men, women and children. Taylor was also a pioneer in the use of child soldiers. In 2003, Taylor stepped down as Liberia’s president and was indicted by the Special Court for Sierra Leone for war crimes and crimes against humanity. Taylor was taken into custody in 2006 and convicted in 2012, becoming the only former head of state since Nuremberg to be convicted for war crimes or crimes against humanity by an international tribunal. Nobody has ever been charged with crimes relating to the war in Liberia.

Firestone returned to Liberia in 1996. In 2005, a class action was brought against Firestone in California, alleging that Firestone’s labor practices at the Liberia plantation amounted to forced labor. The case was dismissed in 2011 on jurisdictional grounds. In 2009, an investigation by the Liberian government found that Firestone had polluted local water sources.

Image credit: Flickr/SenseiAlan

Video: Jose Corona of Inner City Advisors Talks Diversity at Net Impact '14

"... Where creativity and innovation really happens is by bringing together different people, different backgrounds and different approaches on how they think to come up with great ideas," Jose Corona, CEO Inner-City Advisors, said at the 2014 Net Impact Conference.

Based in Oakland, California, Corona's organization serves inner-city communities throughout the Bay Area. By and large, these are very diverse communities as far as race, ethnicity, sexual orientation, language and background, he said. But local companies have been "called out," as he put it, for lack of diversity -- particularly in Silicon Valley.

As part of our Talking Diversity video series, Corona goes on to describe why diversity matters to Inner City Advisors, as well as why it should matter for the greater Bay Area, in this two-minute clip.

Raised by a family of farming entrepreneurs in Watsonville, California, Jose Corona understands by way of practical experience how growing businesses have the power to transform communities. He has built a reputation as a leader with strong, innovative management and as a convener of public, private, and community leaders working toward fundamentally changing the way communities and all its residents benefit from economic development efforts. Corona led Inner City Advisor’s (ICA) launch of Fund Good Jobs, an investment fund focused on using capital to catalyze job creation, and its Talent Management Initiative, an innovative approach that is transforming the workforce development sector by influencing entrepreneurs to be strategic human capital leaders and managers to support the hiring, promoting, and transitioning of people.

Image courtesy of Inner City Ventures

Does a Company’s LGBT Policies Apply to Its Workers Abroad?

Most leading U.S. corporations now have LGBT nondiscrimination policies in place for their American gay and lesbian employees, according to Shelley Alpern, director of social research and shareholder advocacy at socially responsible investment firm, Clean Yield Asset Management. But it’s unclear if these policies extend to the companies’ employees in countries outside the U.S. – an issue that becomes particularly important in parts of the world that are culturally and legally hostile to LGBT individuals.

To open up a dialogue on this subject, Clean Yield and a group of other socially-minded investment firms sent letters last week to some of the country’s largest publicly-traded corporations, like Apple, Johnson & Johnson and Target, encouraging the businesses to make sure their LGBT employee protection policies apply abroad.

The investor group, which collectively owns or manages $210 billion in assets, wrote to approximately 70 companies in the S&P 100 that were identified by the Human Rights Campaign’s 2014 Corporate Equality Index as having strong nondiscrimination and equal benefits policies for their U.S. employees.

There is currently no federal law that shields gay, lesbian and transgender individuals from employment discrimination, including not being hired, fired or otherwise singled out because of their sexual orientation or gender identity. According to the Human Rights Campaign, 29 states lack regulations explicitly prohibiting discrimination based on sexual orientation, while 32 states have no such legislation regarding gender identity.

Because of the federal government’s inaction on this issue, many companies have stepped up to the plate and developed their own internal policies and practices that protect LGBT employees from discrimination and ensure they receive the same benefits that non-LGBT employees do. In fact, more than 175 companies made these commitments after encouragement from investors and shareholders, Alpern said.

Laws and cultural attitudes towards gays and lesbians across the globe is obviously varied, and Clean Yield and the other investors said they were especially concerned about LGBT workers who live in countries with little or no legal protections. Only 66 countries provide some legal assurances for LGBT individuals in the workplace; in 164 nations, discrimination based on sexual orientation or gender identify is either permitted, or the law is unclear, according to the group of investors. In 79 countries, consensual same-sex relationships are considered illegal; only 17 nations allow same-sex marriages, while 23 provide some recognition of LGBT partnerships.

Even more draconian, homosexuality or gender role non-conformance is punishable by death in a handful of countries, including Saudi Arabia, Nigeria and Somalia.

The private sector is increasingly viewing safeguarding the rights of gay, lesbian and transgender employees as a smart business decision – and not solely a moral obligation. A corporate culture that promotes diversity and inclusion enables companies to recruit, nurture and retain the best talent, said John Browne, the former BP CEO who was forced to resign when he was outed as gay by a British tabloid.

Clean Yield and the group of investors highlighted this business case for LGBT protection in last week’s letter about companies extending their nondiscrimination policies to foreign workers. They also pointed out that offering international assignments to U.S. employees – a career-advancing opportunity that can help keep top workers loyal – pose extra challenges for LGBT individuals. Can employees seek legal recourse if faced with discrimination or harassment in the country to which they’ve relocated? Will they be able to bring their same-sex partner abroad? According to the investors, 168 nations, including the U.S., do not allow individuals to legally bring their same-sex partner into the country.

Just as these corporations established their LGBT nondiscrimination policies in response to a lack of government action, it will be interesting to see if these same companies will do the same for their workers in countries also failing to protect gay and lesbian employees. And it’s just possible – because a group of socially-conscious investors previously influenced over 175 companies to enact their original LGBT policies – Clean Yield and the other investment firms will be successful in this current campaign for equality.

Image credit: Flickr/InSapphoWeTrust

Passionate about both writing and sustainability, Alexis Petru is freelance journalist and communications consultant based in the San Francisco Bay Area whose work has appeared on Earth911, Huffington Post and Patch.com. Prior to working as a writer, she coordinated environmental programs for Bay Area cities and counties. Connect with Alexis on Twitter at @alexispetru

Watch Fishing Vessels and Stamp Out Illegal Fishing

SkyTruth, Oceana and Google unveiled an easy-to-use online platform that will give citizens in countries the world over the ability “to visualize, track and share information about fishing activity worldwide.” Dubbed Global Fishing Watch, the three development partners introduced the online platform Nov. 14 at the 2014 IUCN World Parks Congress in Sydney, Australia.

Making use of satellite data and big-data analytics, Global Fishing Watch will give stakeholders and the public at-large unprecedented views of the location and activities of fishing vessels globally. This comes at a time when public interest in and support for sustainable seafood and fishing practices is strong and rising.

“So much of what happens out on the high seas is invisible, and that has been a huge barrier to understanding and showing the world what’s at stake for the ocean,” SkyTruth founder and president, John Amos, was quoted in a press release. “But now, satellite data is allowing us to make human interaction with the ocean more transparent than ever before.”

Global Fishing Watch

Global Fishing Watch collects and analyzes data points from the U.N. International Maritime Organization's Automatic Identification System (AIS) network. SkyTruth, Oceana and Google are tapping into AIS network data to raise public awareness and knowledge, as well as transparency and accountability of the global fishing industry participants.

The AIS network was originally developed and implemented as a maritime safety mechanism so that ships could avoid collisions while at sea. Data obtained from the AIS network includes the identity, speed and direction of broadcasting. As Global Fishing Watch's three development partners discovered, this data can be filtered and leveraged to give “an unprecedented view of human interaction with the ocean.”

“Global Fishing Watch is designed to empower all stakeholders, including governments, fishery managers, citizens and members of the fishing industry itself, so that together they may work to bring back a healthy, bio-diverse and maximally productive ocean,” Oceana CEO Andrew Sharpless explained.

“By engaging citizens to hold their elected officials accountable for managing fisheries sustainably and for enforcing fishing rules, Global Fishing Watch will help bring back the world’s fisheries, protecting and enhancing the livelihoods of the hundreds of millions of people who depend on ocean fisheries for food and income.”

Besides providing signals of activity that may be unsustainable or in contravention of national and international maritime regulations, fishing vessel operators and crews “can show how they are doing their part to fish sustainably,” the three partners highlight. “We can motivate citizens to watch the places they care about, and we can all work together to restore a thriving ocean.”

"While many of the environmental trends in the ocean can be sobering, the combination of cloud computing and massive data is enabling new tools to visualize, understand and potentially reverse these trends,” said Brian Sullivan, program manager of Google Ocean & Earth Outreach. “We are excited to contribute a Google-scale approach toward ocean sustainability and public awareness."

*Images credit: Global Fishing Watch

Unilever food hits certified palm oil target in Europe

Unilever has reached its certified palm oil target for its European food business. A new report published by the Anglo Dutch conglomerate/food brand maker shows that all palm oil directly sourced for its European foods business will be 100% traceable and certified sustainable by the end of this year.

Pier Luigi Sigismondi, Unilever Chief Supply Chain Officer, said: “2014 has been a defining year for our goal to create a more transparent palm oil industry. Knowing where it comes from is a critical step in the journey. The challenge is enormous and not easy to achieve but we are determined and can now report good progress. We want to share our learnings with the rest of the industry.”

Unilever now has visibility of around 1,800 crude palm oil mills, representing around two-thirds of all mills in the global palm oil industry and around 58% of its palm oil use is now traceable to known mills.

Sigismondi added: “This is about doing the right thing for our planet and our consumers because you cannot have a healthy business in an unhealthy world. We want to continue to meet our consumers’ every day needs in decades to come and this means sourcing in a fully sustainable way to future proof our supply chains. Halting deforestation is our end goal and this is what we work towards.”

Picture credit: ©   Ldambies  | Dreamstime com  - Oil Palm Fruits Photo

More support for farmers urged in renewable energy push

Farms could be a major player in the renewable energy market in the UK, according to a report issued by a new industry coalition, Farm Power.

According to its research, there is at least 10GW of untapped resource across UK farms – equivalent to more than three times the installed capacity of the proposed new nuclear power plant at Hinkley Point C.

The coalition is made up of farming bodies, such as the National Farmers Union, businesses and NGOs and led by sustainability non-profit Forum for the Future.

To enable farms to become significant contributors to the energy system, a number of obstacles need to be tackled, says the coalition and it needs the support of policymakers and other key stakeholders, such as supermarkets, to support its vision.

Obstacles highlighted by the coalition include getting reliable access to grid connections and supportive planning. Removing these barriers will require a system-wide approach and the support of key decision makers from central Government to Ofgem and the UK’s six distribution network operators.

Supermarkets also need to build on the work they are already doing with farmers by committing to buying home-grown energy, and in doing so, sending out a strong message of their backing for farm-based energy generation to policymakers, their customers and suppliers, and the energy industry.

Dr Jonathan Scurlock, Chief Adviser, Renewable Energy and Climate Change, National Farmers' Union, said: “The NFU strongly endorses farm diversification into renewable energy, for export as well as for self-supply, where it supports profitable farming and underpins traditional agricultural production. We recognise that low-carbon energy production can actually enhance our national food security for only a modest land take, and the additional returns from renewables make farm businesses more resilient and better able to manage volatility in both the weather and in farm prices”.

For more information or to pledge support, click here.

Picture credit: © Gbphotostock  | Dreamstime com  - Farm & Farm Buildings Near Wakefield Photo

IKEA makes largest wind farm investment to date

IKEA has purchased its second wind farm in the US. The site in Texas is the single largest renewable energy investment made by the Swedish furniture retailer to date.

The wind farm will contribute significantly to the IKEA Group 2020 goal of producing as much renewable energy as the total energy the company consumes globally. The new wind farm is expected to be fully operational in late 2015.

“IKEA believes that the climate challenge requires bold commitment and action,” says Rob Olson, IKEA US Acting President and CFO. “We invest in renewable energy to become more sustainable as a business and also because it makes good business sense. And as a home furnishings retailer with sustainability in our roots, we are committed to providing products and solutions that help our customers be more sustainable in their everyday lives.”

IKEA Group has now committed to own and operate 279 wind turbines in nine countries, and will invest a total of $1.9 billion in wind and solar power up to the end of 2015.

Picture credit: © Bahrialtay | Dreamstime.com - Wind Turbine Photo

New wind power body for shipping industry in full sail

An international association has been created to facilitate and promote wind propulsion for commercial shipping worldwide.

The International Windship Association (IWSA) will facilitate and promote the technology, applications and general concept of wind propulsion for the global commercial shipping industry and bring together all parties interested in catalysing the development and uptake of these technology solutions. It will also play a key role in acting on behalf of our members and supporters within this sector in order to shape industry, regulators’ and international bodies’ perception of the concept of wind propulsion.

Gavin Allwright, IWSA secretary, commented: “Our goal is to be an advocate for the development of wind propulsion solutions in the industry, whether retrofit, wind-assisted, new builds or wind as the primary propulsion source. We recognise and applaud the efforts of the industry to reduce emissions, the increased interest in renewable energy sources and the gradual changing perceptions about wind propulsion.”

Click here for more.