Experts call for new ministerial role to promote financial inclusion

An independent body of experts and parliamentarians have called for financial inclusion to be a high public policy priority, going as far as urging the appointment of a Minister for Financial Health.

The call comes in a new report from the UK Financial Inclusion Commission called “Financial Inclusion: Improving the Financial Health of the Nation”. The Commission, an independent body of experts and parliamentarians, also urged the Financial Conduct Authority to promote financial inclusion as one of its core objectives.

The Commission suggests that community lenders might become more sustainable by reaching a wider market, therefore making themselves more attractive to commercial lenders and social investors. This might be achieved through learning from good technology and marketing practices developed by others in the market.

More details on the Financial Inclusion Commission and its report are available here.

The Commission highlights that nearly 2m adults in the UK do not have a bank account and that financially excluded people pay a 'poverty premium' of £1,300 each year.

Picture credit: © Nchuprin | Dreamstime.com - Black Purse And Money Photo

Chemical giant Bayer loses libel action over pesticide harm claims

German chemical giant Bayer has failed in its attempt to sue Friends of the Earth Germany over its claims that thiacloprid, a pesticide manufactured by Bayer, harms bees.

Responding to the ruling by a judge in Dusseldorf that the environmental group had a right to voice its concerns, Friends of the Earth (England, Wales and Northern Ireland - FoE) bees campaigner Dave Timms said: “Bayer has been shown up as a corporate bully, trying to silence campaigners who are standing up for bees.

“The ruling is a victory for Friends of the Earth Germany, freedom of speech and for the many thousands of people who have taken action to protect bees across Europe.

“Now we want to see action from the European Commission to ensure that any pesticides with evidence of harm to bees are taken off our shelves and out of our fields for good.”

Campaigners have serious concerns about the impact of some of Bayer’s products on bees, including those containing the neonicotinoid thiacloprid, which is used by farmers and is on sale to gardeners in the UK.

Three other neonicotinoid pesticides were subject to a temporary ban in the EU from 2013 due to evidence that they harm bees. Although thiacloprid is not subject to that ban, FoE maintains that there is evidence that it can make bees more likely to die from common diseases and can impair their navigational abilities, making it harder for them to return to their hives.

Thiacloprid is used on crops in the UK such as oil seed rape and apples and it is sold to the public in garden bug-killing products.

FoE is now asking the European Commission to take a precautionary approach by suspending all uses of thiacloprid and to review its safety. The environment charity will also be contacting retailers in the UK asking them to stop selling products containing the chemical.

UK expertise to drive global climate change action?

The UK is to use its world-leading climate and adaptation expertise to help countries successfully tackle climate change.

To launch the programme, Secretary of State for Energy and Climate Change Ed Davey hosted a round table with representatives from government departments and the UK’s leading organisations at Royal Botanic Gardens, Kew.

The group’s aim is to create a flexible package that brings together the UK’s wide-ranging expertise, tailored to meet the needs of developing countries adapting to climate change.

Davey said: "The UK is a global leader in tackling climate change and the major threat it poses to our prosperity and security.

"With the crunch climate talks in Paris just months away, the world needs every ounce of expertise and effort available if we are to limit temperature rises and avoid the worst impacts of climate change.

"That is why I want to bring together the UK’s wide ranging climate service expertise so we can assist other nations in dealing with the impacts of climate change."

Climate services are becoming increasingly important across the world, driven by the growing awareness of our vulnerablitity to weather events and acceptance of the current and future impacts of climate change.

Examples include the Met Office using its world class expertise to improve seasonal forecasting in Africa and the Environment Agency’s Climate Ready Support Service, which provides advice and information to UK businesses, the public sector and other organisations on adapting to climate change.

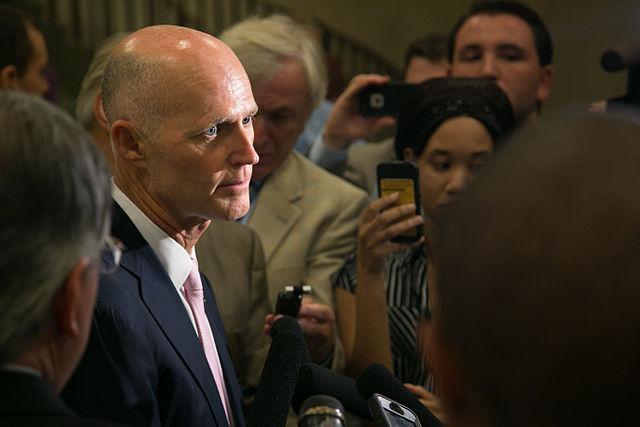

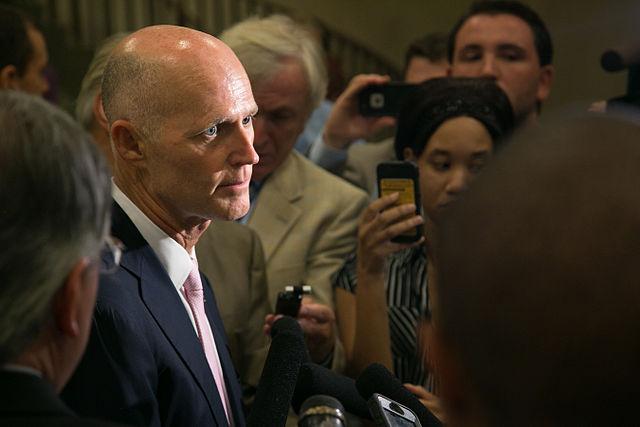

The Crazy Logic Behind Florida's Climate Change Ban

By now, many have heard about Florida's alleged climate change ban, which directs state workers to strike references to global warming, climate change and similar phenomena from their official communications.

According to several former employees who obviously objected to the constraint, this is a standard policy of the Gov. Rick Scott administration, who you may recall won his 2014 reelection by a narrow and tenuous margin. Needless to say, his winning platform, which included a candy-store assortment of last-minute "water and land" funding proposals, didn't mention fixing climate change.

Not surprisingly, the media had a field day with this news. Climate change is one of the greatest environmental threats Florida has faced in recent years (and it's had some doozies). Miles of sea-level terrain, combined with a predilection for sinkholes and an increasingly temperamental weather system, continue to wreak havoc on Florida's burgeoning communities.

But acknowledging that there might be a man-made component to Florida's weather system would also be precarious for the Scott administration. At the present time, the state stands to gain from a list of industrial investments, including hydraulic fracturing contracts (for which there has been some pushback in the state Senate). It also stands to benefit from the continued real estate boom in the very cities that have been pushing for new climate change policies.

What is the most interesting question, though, is how the state will fill out its next application for environmental disaster funding. In the last 15 years, Florida state, county and municipal agencies accessed the Federal Emergency Management Agency system more than 20 times, largely for hurricane and storm damage. This is relevant because FEMA now requires climate change to be addressed in mitigation assessments as a means of demonstrating that recipients are looking ahead at possible risks from tidal changes and other issues that signify the need for climate mitigation policies. The question is if, or when, the federal government would actually turn down a funding request if lives (and partisan politics) were at risk.

Yet there's some inverted logic to pretending that an environmental threat will just go away if you don't let workers acknowledge its presence. Industries that rely on Florida's water system will keep expanding. Real estate, Florida's historic industry, will continue to be built, and economic resiliency will continue -- at least for now. Bigger governments have proven that history and the future can be rewritten by the use of selective language.

But not all Florida agencies are buying into the ban. In fact, climate change as an environmental issue seems to have gained some notoriety in South Florida in the last few months. In addition to the Southeast Florida Regional Climate Change Compact, which we reported on last year when South Miami vowed to secede from the state, there's now the Climate Change Task Force, supported by no less than 13 different regional universities, and the 1,000 Friends of Florida organization representing private citizens within and beyond Florida.

And as these organizations have demonstrated, language doesn't rest with government policies. It rests with the foresight of those who are affected by the outcome. And it rests with Mother Nature. Policies of language only last as long as the vernacular remains relevant. And that, if the latest environmental studies for South Florida's coastline are anything to go by, could fall out of fashion very quickly.

Image of Rick Scott: State of Florida, Sara K. Brockmann

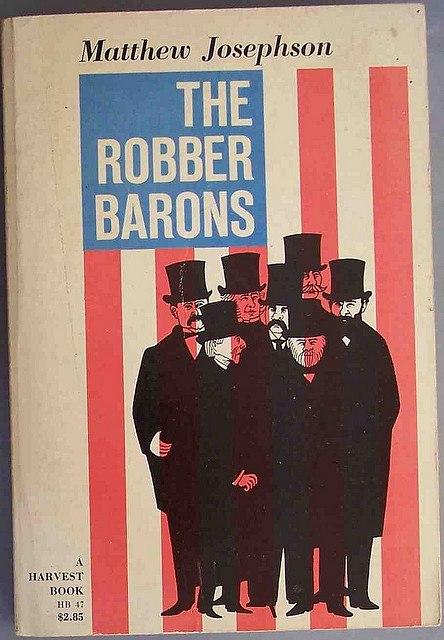

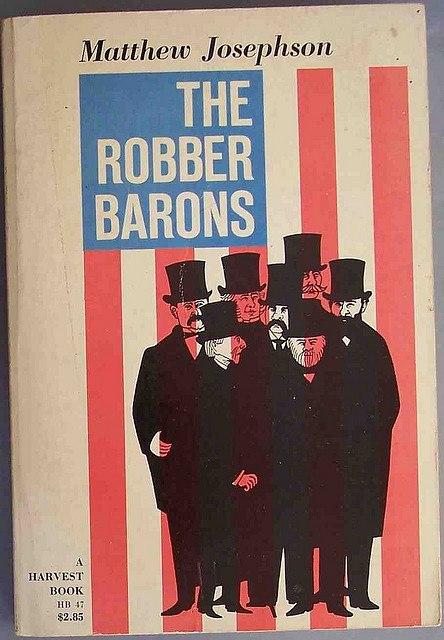

Uber Can't Buy Me Love

Uber's robber-baron approach to reputation management is getting old. Rockefeller and Mellon, who made their fortunes in oil, turned their reputations as shady businessmen around by making generous donations to the arts and education. But this strategy is very 19th century, and it has its limitations. Specifically, in today's information era, it isn't as easy to erase bad behavior by throwing a little money around.

Uber CEO Travis Kalanick secures his company's market share by operating illegally, ignoring local regulations, playing footloose with passenger privacy, profiting off of local tragedies and scamming the competition. Meanwhile, the company's reputation management consists of one-off efforts: adoptable puppies driven to your door during the puppy bowl, a partnership with No Kid Hungry to allow passengers to donate through the app, and a partnership with Goodwill to offer free pickups for Goodwill donations. Don't get me wrong, those are all worthy causes. Uber has definitely done more good than harm by supporting them. But the cutesy one-off philanthropic efforts are not doing much to improve the company's dirty-bathwater reputation.

Now, Uber is attempting to repair its reputation as a misogynist organization (see the India rape, Boob-er and Paris driver objectification scandals) through a partnership with U.N. Women.

Like its previous philanthropic efforts, this one certainly sounds impressive. The company plans to create 1 million jobs for women by 2020. However, my first reaction is a mild eye roll. First, those jobs will probably offer little to nothing in the way of benefits and security since Uber drivers are all independent contractors -- the gig economy is not really one that protects women's livelihoods. Second, Uber has shown to only care about safety and security after something bad happens (see the India rape scandal). Any protections for these legions of new drivers will more than likely be too little too late.

I for one, will continue to vote with my pocketbook by choosing Lyft.

While Uber has never hidden its "profit at all costs" approach to doing business, Lyft has been sustainable from the start. The company originally started as a carpooling app -- aimed at reducing congestion and building communities. It's got embedded sustainability written all over it. So, I believe the company when it announces a philanthropic initiative. And these initiatives improve Lyft's brand and reputation because they are a natural extension of what the company is already doing rather than an aberration.

Because the company operates with wellness in mind, its most recent effort to support Dress for Success -- offering free rides to underserved women on their way to job interviews -- is both beneficial and believable. In addition to doing good, this initiative has the intended impact of furthering the brand's reputation as a supporter of community.

These competing cause marketing campaigns demonstrate the financial value of a good reputation. I'm going to go out on a limb here and say that covering 3,000 Lyft rides for needy interviewees is probably cheaper than hiring 1 million women in the next five years. But Lyft's initiative did a better job of extending the brand's promise, and therefore it was more successful, at least for me.

Uber's approach reads as old-fashioned, off the mark and just a little desperate.

Image credit: Chris Drumm, Flickr

WWF to EU: Sustainability Is the €300B Investment Plan

With Europe long stuck in economic stagnation, the continent is abuzz with Jean-Claude Juncker’s €315 billion (US$337 billion) strategic investment plan. The idea is to kickstart the European Union’s economy by investing in transportation infrastructure, digital technologies and energy. But with more heads than a hydra, getting member states within the EU to agree on any proposal is a massive task.

Now, one of the world’s leading environmental NGOs is suggesting that Brussels takes a step back and rethink what long-term investment in Europe really means. World Wildlife Fund (WWF) is urging the EU to take action, but not the business-as-usual approach. Instead, the organization urges the economic bloc’s leaders to put natural capital first and not delay such action in the name of economic recovery.

The 100-plus page report calls for a “new sustainable economic paradigm” with an emphasis on environmental sustainability. But rather than lean on the long-term effects of climate change and environmental degradation, WWF argues that resource efficiency could generate the equivalent of some €300 billion annually — equal to the spend required under the Juncker Plan.

The keys, according to WWF, lie in five suggested steps — and the first few may elicit some eye-rolls for those suffering from framework and planning exhaustion.

First, the WWF suggests a revamped strategic vision for 2050. Among the usual resource efficiency, financial, climate and energy frameworks, the organization calls for five “cross-cutting priority frameworks.” Arguing that each policy shift cannot fit in any of the long-term frameworks, the WWF prods the EU to adopt policies that would inspire “eco-innovation,” green jobs, green public procurement, consumer empowerment and a new way to measure economic performance other than GDP. In one word, we are talking about investment. The WWF holds up Finland as an example: During the early 1990s economic crisis, the company ignored cuts to essential government services and instead invested in education along with research and development.

Next, the WWF clamors for a new climate and energy framework with a roadmap for 2030 — understandable since the flowery 2020 EU goals were fraught with plenty of thorns, including a focus on biofuels that did little except help ignite the food-versus-fuel debate. But rather than only focus on clean energy technologies, the WWF seeks more attention on energy efficiency. A 40 percent energy efficiency target, insists the EU, will reduce oil and gas imports significantly and therefore boost internal investment.

The third step ties into the oft-discussed goal of setting a price on nature. WWF advocates for an EU-wide target for resource efficiency by 2030, with a renewed effort to protect natural habitats and manage water more efficiently. Envisioning a dashboard that will monitor carbon, water, land and biodiversity footprints, WWF calls for ecosystems to be valued, and accounted, at national and EU levels. One example that WWF highlights is a project in Ireland that nixed the construction of a water treatment plant in favor of an integrated wetland — which ended up being cheaper and more effective.

Financial reform, which really integrates the environmental with the financial numbers, is an additional suggested step. The WWF directive encourages the EU to ban what it calls EHS, or environmentally harmful subsidies. From shale gas to certain agriculture subsidies, WWF wants not only reductions, but also an end to those subsidies. In addition, tax reform, such as a reduced VAT (value-added taxes) for more environmentally friendly products and services, are necessary to wean Europe away from fossil fuels and closer to a greener economy. And in a move that will pose a huge political problem, the WFF wants more of the EU budget spent on commitments to climate — 20 percent by 2016.

Finally, the WWF seeks a renewed international leadership on climate change and environmental leadership from Europe — a suggestion that will certainly not fall on deaf ears within the EU, but will also spark teeth-gnashing as many Europeans assumed they have been leaders on these fronts for over a generation.

The WWF proposal certainly does offer plenty of thoughtful points that EU leaders should consider. Whether this 28-state organization, and the business community, will pay attention is another matter. But as the cliché goes, doing the same thing over and over again while expecting different results only creates more insanity. And with more species and virgin land being lost at an accelerated rate over the past 40 years, the old way of 'build-first, clean up later' will not work in the long run if the planet is going to support 9 billion people by 2050.

Image credit: Leon Kaye

Based in Fresno, California, Leon Kaye is a business writer and strategic communications specialist. He has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. When he has time, he shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Louisiana Wetland Restoration Projects Valued at $1.6 Billion

By Kasey Krifka

A two-year assessment of the potential to develop blue carbon projects on Louisiana's coast estimates that carbon finance revenue can provide up to $1.6 billion in critical funding to assist with wetland restoration over the next 50 years.

The study, supported by Entergy Corp. through its Environmental Initiatives Fund, and prepared in partnership by New Orleans-based Tierra Resources and Portland-based nonprofit The Climate Trust, examines existing wetland restoration techniques — river diversions, hydrologic restoration, wetland assimilation and mangrove plantings — identifying areas for future scientific investigation to support carbon offset programs.

Findings from the report were shared by Tierra Resources and the American Carbon Registry at a free national webinar on March 5.

Initial study findings showed that restoration in Louisiana has the potential to produce over 1.8 million offsets per year and almost 92 million offsets over 50 years. This is the equivalent of taking approximately 350,000 cars off the road each year or 20 million cars off the road over 50 years. Wetland restoration techniques identified in this study could potentially generate $400 million to $1 billion in offset revenue depending on the dollar value of the carbon offset — with the potential for almost $630 million more by including prevented wetland loss in the carbon accounting.

Entergy’s commitment to the study stems from the company’s mission to create sustainable value for all its stakeholders. Wetlands play a crucial role in storm protection for many Entergy communities, helping preserve industries, businesses, homes, and livelihoods along with Entergy’s own facilities and assets.

“Entergy was pleased to be able to sponsor this important work and help unlock the huge potential for wetland carbon credits in Louisiana,” said Chuck Barlow, vice president for environmental strategy and policy for Entergy Corp. “By capitalizing on the economic benefits offered through carbon credits, more of Louisiana’s wetlands can be restored and preserved. Eventually, this work in Louisiana can be expanded to address other critical wetland areas throughout the nation and the world, making this study a first step, with the potential for major global impact.”

Of the restoration techniques studied, forested wetlands that receive treated municipal effluent -- referred to as wetland assimilation systems -- have the highest net offset yield per acre. However, it was concluded that river diversions and mangrove plantings have the potential to generate the largest volume of offsets in Louisiana due to the huge amount of acreage upon which these restoration techniques can be implemented. Additionally, carbon offsets from wetland assimilation systems and river diversions show potential to be stacked with water quality credits should these markets evolve in Louisiana.

The primary barrier to wetland carbon commercialization that was identified through this study is the high cost of wetland restoration. Carbon finance will likely lead to new public-private partnerships that leverage carbon funds with government restoration dollars to stimulate investment into wetland projects.

“The results of this study demonstrate that carbon finance has substantial potential to generate important revenue to support wetland restoration,” said lead author Dr. Sarah Mack, president and CEO of Tierra Resources. “Furthermore, this study points to Louisiana as an innovator of creative financing strategies for wetland restoration, and as creating new investment opportunities that will yield substantial economic and environmental benefits.”

The American Carbon Registry, a leading voluntary and California compliance Cap-and-Trade Offset Project Registry, in 2012 approved a methodology developed by Tierra Resources, which quantifies the greenhouse gas emission reductions and carbon sequestration associated with restoring degraded deltaic wetlands in the Mississippi Delta. This methodology allows landowners and project developers to document, quantify and seek verification for the greenhouse gas-reducing benefit of their wetland restoration projects, ultimately leading to certified offset credits that can be sold as carbon credits in the voluntary market.

“Carbon markets provide economic incentives for reducing carbon emissions, as well as an important and innovative approach to finance environmental restoration and conservation,” said Dick Kempka, chief commercial officer for The Climate Trust. “The opportunity to engage in this emerging sector and help provide a path for wetlands restoration to enter the carbon markets has been an exciting journey.”

The restoration of the Mississippi River Delta and the storage of blue carbon (the carbon captured by coastal ecosystems) is of national significance. The economic health of much of the United States depends on sustaining the navigation, flood control, energy production and seafood resources of this valuable deltaic river system. Each of those functions is currently at severe risk due to a coastal wetland loss rate of approximately one football field an hour.

“Wetland restoration provides a wealth of benefits including storm surge reduction, habitat preservation, carbon sequestration and recreation; as well as job creation, and economic development that are vital to Louisiana’s sustainability and resilience,” states Michael Hecht, president & CEO of Greater New Orleans, Inc. “By innovating creative financing solutions for coastal restoration, local companies like Tierra Resources are contributing to the growing hub of Emerging Environmental expertise that can be found in Greater New Orleans.”Image credit: Tierra Resources

Kasey Krifka is the Marketing and Communications Manager for The Climate Trust.

Access to Mobile Phones Opens Opportunities for Women in Burma

Only recently Burma (Myanmar) has opened its doors to the world after decades of rule by a military junta. While the rest of Southeast Asia’s economy has surged and its various cultures become more appreciated worldwide, Burma was cut off from the rest of the global community and became one of the world’s poorest nations.

Although opposition leader Aung San Suu Kyi’s freedom from house arrest and the easing of United States sanctions have sparked a rebuilding and return of companies to Burma, women still lag behind men in just about every health and economic metric. Mobile technology, however, can help open new doors for women and girls. One telecommunications company, Ooredoo, has partnered with various organizations to empower women while conducting business in Burma for only less than a year.

Ooredoo (formerly Qtel Group), based in Qatar, launched commercial services throughout Burma in 2014. It has partnered with the mobile telephony trade association GSMA to launch social enterprise programs and apps to focus on women’s health issues and digital inclusion.

Such programs are important because women own mobile phones at a far lower rate than men in low- and middle-income countries — in fact, the discrepancy is as much as 14 percent, according to GSMA. The result is less access to information, diminished chances to participate in the local economy and less personal freedom. Perhaps 14 percent sounds like a small difference, but globally that adds up to 200 million women in emerging economies without digital access.

The situation was particularly acute in Burma, where less than two years ago only 11 percent of the population had access to mobile phones. State control, long the bane of conducting any business in Burma because of incompetence and inefficiency, was partly why the cost of a SIM card hovered around US$200 in 2013. Ooredoo and another provider, Telenor, were granted licenses to operate in Burma last year, and they have a shot at boosting mobile penetration to about 75 percent next year.

Along with its entry into the Burmese market, Ooredoo has launched several education and outreach programs in the country. The company promotes a maternal healthcare app, MayMay, which provides medical information otherwise difficult to gather in Burma. Ooredoo has also sponsored Geek Girls, which supports women interested in writing code and becoming digital entrepreneurs. Ooredoo is only starting to scratch the surface in Burma: Digital literacy is very low now amongst women, but watch for it to rise sharply as residents find new ways to support their families and rise out of poverty in ways unthinkable just a few years ago.

Image credit: Sky89

Based in Fresno, California, Leon Kaye is a business writer and strategic communications specialist. He has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. When he has time, he shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Multi-Stakeholder Collaboration Builds Sustainable Supply Chains

Editor's Note: This post originally appeared on CSR Wire's Talkback Series.

By Thomas Camerata

Stakeholder collaboration can help management prepare for a better future: Stakeholder expertise on operations on the ground can unveil areas in supply chains where there is high risk potential and unexplored opportunities.

Companies can improve the environmental, social and economic impact of their supply chains by working with, for instance, suppliers. The challenge that climate change poses on supply chains is becoming increasingly more complex. A collaborative approach provides a robust starting point for addressing issues in a comprehensive, systematic way. Businesses can ensure that their actions create long-lasting positive impacts by collaborating with strategic partners that possess specific competences. This enables these businesses to positively affect the environment and communities they operate in, as well as their bottom line.

Every single year, the Swedish furniture giant Ikea uses nearly 1 percent of the world’s cotton production. The company partnered with Better Cotton to promote the sustainable use of resources within its supply chain for cotton. This allowed Ikea not only to improve the livelihoods of 43,000 farmers in South Asia, but also to significantly reduce the amounts of costly artificial fertilizers it used. Collaborating for more sustainable supply chains should be seen as a business imperative and significant source of shared value: Healthy farmers who feel safe at work and outside of work will outperform unhealthy ones any day.

Corporate operations that include environmental and social impacts reflect a very attractive way of doing business: They foster the sustainable development of societies as such, while allowing companies to grow more dynamically. The outcome essentially reconnects environmental and community success with economic success -- a factor duly noted by Swiss retail and wholesale giant Coop. By teaming up with South Pole Group and the World Wildlife Fund, Coop Switzerland was able to offset the emissions of all goods imported by air. This was done by investing in a community-based project that distributes efficient cookstoves to local Maasai villages in Kenya, among other activities. People from these Maasai villages currently represent the majority of the employees at Oserian Flower Farm, the Kenyan-based producer of Fair Trade certified roses, which exports flowers to Coop Switzerland. This type of client-specific development of investing in emissions reduction projects along a company’s supply chain is called insetting.

Nearly everyone around the globe uses stoves to cook food. Nonetheless, a great proportion of the world’s population risk respiratory diseases, poor health and premature death due to inadequate cooking stoves. Rudimentary stoves and open fires are the norm for nearly 3 billion human beings, including the Maasai people. By distributing energy-efficient cook stoves as part of the insetting project carried out by Coop and WWF, this multi-stakeholder initiative combined carbon mitigation with sustainable development.

The initiative successfully reduced emissions and harmful illnesses and halved the demand for firewood. Burning less wood saves additional trees from being cut down and shortens the time for firewood collection. This in turn translates to reducing deforestation along Coop’s supply chain and maximizing school attendance of Maasai children. The multiple positive impacts of this collaborative project helped it earn the coveted Gold Standard label. This prestigious label can only be awarded if a project consults with local stakeholders, continually reduces greenhouse gas emissions, and improves both the environment and people’s lives.

In summary, multi-stakeholder partnerships along companies’ supply chains, such as insetting, unlock a series of positive impacts for the environment, business and society. They provide a deeper understanding of a company’s stakeholder obligations and represent a genuine commitment to corporate social responsibility.

Thomas Camerata is the Director of Product Development at south pole group. He is an environmental scientist and an expert in the implementation of emission reduction projects. At south pole group Thomas is responsible for the development and distribution of new products for the carbon and energy market. Thomas has also co-founded the myclimate foundation and established the project platform Seed Sustainability.

New NREL Engineers Take Sustainability to Heart (and Home)

Earning a professional engineer (PE) license is no mean feat. Obtaining a job at the U.S. Department of Energy's National Renewable Energy Laboratory (NREL) in Golden, Colorado, is no cakewalk either. Just 20 percent of engineers earn a PE license -- which requires several years of work under the watchful eyes of a veteran engineer, then putting in hundreds of hours of study in order to pass two grueling eight-hour exams.

Overall sustainability in building and facilities' design and construction have come to be keystones not only in the professional aspects of the lives of four newly minted NREL PEs, but these engineers are also applying the same principles at home. Besides helping public- and private-sector organizations of all stripes reduce energy use and waste and take advantage of renewable energy resources, NREL's latest set of PEs are applying the same values and principles in carrying out projects outside of work – at home and in their communities.

Net-zero energy homes, buildings and government facilities

Lars Lisell, one of NREL's newly minted PEs, serves as “point man” on a project that's moving the U.S. Army's Fort Hunter-Liggett, in California's Salinas Valley, closer to its goal of being a net-zero energy facility by 2020. He and and his wife are also making strides toward making their 1920s-era brick bungalow in Denver a net zero-energy home.

Net-zero energy means the house, building or facility is designed and built to minimize energy use, and that all the energy used therein comes from on-site or shared, local renewable energy resources. At Fort Hunter-Liggett, Lisell and NREL's project team are on track to making the military base a net-zero energy facility by the end of the decade. Working with base and U.S. Army staff, NREL's project team is installing a large solar photovoltaic (PV) energy system, finding ways of improving energy efficiency and carrying out a waste-to-energy system.

Lisell and the NREL project team's work at Fort Hunter-Liggett is just one of many examples of how the lab is building sustainability into engineering, procurement and construction work right from the drawing board.

"We're helping to move the markets to a more sustainable place," Lisell was quoted in an NREL feature story. "A lot of our clients are government agencies, and it's a real win-win. We're helping them become more sustainable, and at the same time we're saving them dollars—and saving taxpayer dollars."

Solar panels, waste-to-energy systems and ground-source heat pumps

Lisell was also a member of NREL's Simuwatt Energy Auditor project team. Now licensed to Concept3D, Simuwatt Energy Auditor provides a means of conducting comprehensive home and building energy audits inexpensively. Use of the energy audit tool “has been shown to cut energy use significantly,” NREL highlights.

At their home in Denver, Lisell and his wife are moving toward their goal of having a net-zero energy home. They have installed solar panels on the roof and rewired the house so that it's ready for installation of a ground-source heat pump this summer. If it works, the Lisells' home could be carbon neutral by Labor Day. Explaining just how a ground-source heat pump works, Lisell said:

"You're using the ground as a big heat sink. During the summer, you're pumping heat out of your house into the ground; in winter, you pump heat out of the ground and into the house. And it provides hot water, too."

Similarly, newly-minted NREL PE Rachel Romero has a deeply ingrained commitment to sustainability. A championship-caliber freestyle swimmer at Michigan's Hope College, the mechanical engineer's love of water has carried over to her professional career.

At NREL, Romero has worked on U.S. Coast Guard's energy management program at its base in Kodiak, Alaska. Gradually, the Coast Guard and NREL are collaborating to replace fuel-oil burners in Kodiak with renewable sources of electricity, light and heat.

"I love my clients; I love my work," Romero said. "What really drives me is trying to push people to practice energy efficiency. I'm a very practical person. I won't just say that it can help save the planet, I will tell them to change out a light bulb because it will last longer and save them money in the long run ... Everyone in society has an opportunity to help out and solve these problems."

Romero's passion for energy efficiency is evident at home as well. Romero, her husband and two dogs are taking advantage of a Nest thermostat to reduce their energy use and utility bills. The smart thermostat enables Romero and her husband to adjust the temperature settings throughout their home at the touch of a button using the Nest smartphone app.

*Image credits: NREL