Ford's Parking Spotter Could Keep You From the Endless Hunt

If you’re a car company and you want to do something to help reduce carbon emissions, what do you do? You start by making your cars more efficient by bringing on new technology, like hybrid powertrains. Then you incorporate electric cars, and possibly fuel cells and, of course, clean up your own internal operations. Happily, most car companies today are doing all of those things, to one degree or another.

All of these are on the critical path, with many more improvements in the pipeline. Are there any other stones left unturned in the search for improvement? Ford thinks so.

The company recently announced that it's teaming up with Georgia Tech to develop a Parking Spotter app. As the name suggests, this app will help users locate a parking spot more quickly and directly. Sounds helpful, but will it have an impact?

A study performed by the UCLA Department of Urban Planning, which carefully monitored a 15-block urban area, found that drivers “drove more than 950,000 miles, emitted 730 metric tons of carbon dioxide and burned 47,000 gallons of gas, looking for parking.”

According to Mike Tinskey, director of vehicle electrification at Ford, only 12 percent of drivers “find a parking spot immediately, without some kind of hunting.”

Ford is not the first to enter the smart parking fray. Others have attacked the problem under the Smart Cities umbrella called Intelligent Transportation Systems. Most of these make use of sensors installed in the street which can determine whether a given spot has a car in it or not. LA Express Park, for example, uses an app called Parker that connects with sensors in 6,000 parking spots in LA. It looks like a GPS screen, except it has open parking spots flagged. It’s not hard to imagine that, someday, GPS systems will have a feature like this built in.

Imagine you’re driving in New York City, cruising for a parking spot, hoping it won’t take the entire evening to find one. Suddenly you get a call from a friend who happens to mention that he just saw an open parking spot a few blocks from your current location, which you head to directly.

Ford’s new Parking Spotter app recreates that scenario, but it reduces the element of chance (or the need to have a friend nearby). It uses existing driver-assist sensors that many vehicles already have, including sonar (ultrasound), and some prototype software, to, in essence, “use the vehicle as a probe.”

These sensors are able to search out empty parking spots as drivers are cruising around the city. The information is fed to a cloud database and made available to other connected drivers who might be looking for a spot. It is, in essence, a crowdsourced parking app.

According to Tinskey, the idea came about in response to the question, “How can we go about finding parking spaces so that when a person maps their route, to get from point A to Point B on their navigation, whether it’s their phone or in their vehicle, can we give them more information to get to their final destination?”

Various sources describe the information as being collected as drivers enter and exit a parking facility, or from sensor scans taken as the car drives through the city streets. In either case, the data is transmitted to a cloud-resident database where other drivers can access it as a way to find an available spot.

Dave McCreadie, Ford's manager of electric vehicle infrastructure and smart grid technology, emphasized the fact that the new application utilized components already on the vehicle. The ultrasound sensors are used for obstacle detection and as part of the hands-free parking feature. Examination of existing parking apps, such as Streetline or ParkMe, found that the data behind these apps is scarce. "Our vehicles enrich the data, providing more information to the cloud," McCreadie said.

This app will certainly give drivers a leg up in the hunt for a parking space. In the process, it will likely reduce fuel consumption, emissions, commute times and stress levels. For those without the app, I’m afraid the job of finding a spot just got a little harder.

One other point: Hopefully the parking app will be smart enough to tell you which spots are legal at that particular moment and how long they will remain legal. Most cities know how to inflict pain on those unfortunate souls who cannot successfully decipher the often-cryptic parking signs.

Image courtesy of Ford Motor Co.

RP Siegel, PE, is an author, inventor and consultant. He has written for numerous publications ranging from Huffington Post to Mechanical Engineering. He and Roger Saillant co-wrote the successful eco-thriller Vapor Trails. RP, who is a regular contributor to Triple Pundit and Justmeans, sees it as his mission to help articulate and clarify the problems and challenges confronting our planet at this time, as well as the steadily emerging list of proposed solutions. His uniquely combined engineering and humanities background help to bring both global perspective and analytical detail to bear on the questions at hand. RP recently returned from Abu Dhabi where he attended the World Future Energy Summit as the winner of the Abu Dhabi blogging competition.

Follow RP Siegel on Twitter.

Renewables Mandate in Colorado Survives Rollback Attempt

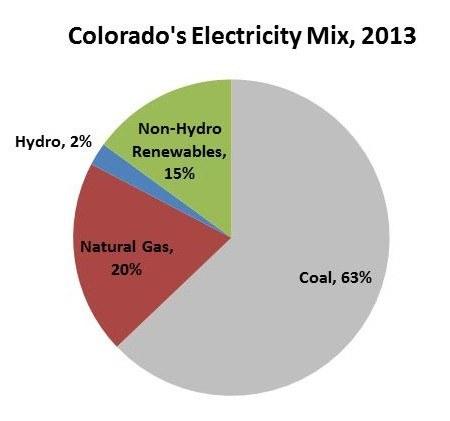

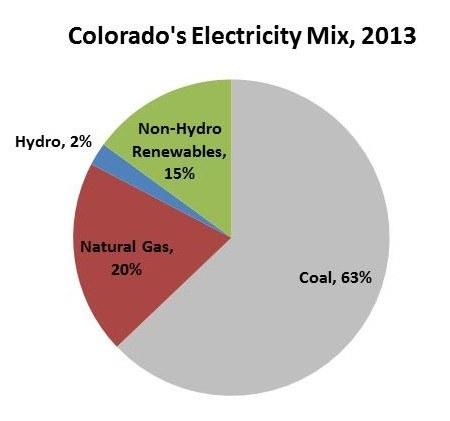

On Monday, the Colorado state legislature voted down a challenge to the state’s successful and popular Renewable Energy Standard, originally passed as the first of its kind in the country in 2004 by statewide ballot initiative.

Originally mandating that utilities and rural co-ops generate 15 percent of their power from renewables, the standard has since been expanded by state legislators twice. The most recent expansion raised the bar to 30 percent for city utilities and 20 percent for rural electric cooperatives, which serve a sizable chunk of the state -- more than 600,000 customers.

A recent poll showed that 76 percent of Coloradans support pro-renewable candidates, so it’s unclear which Coloradans bill sponsor Rep. Dan Thurlow (R-Grand Junction) has been talking to when he says he thinks “we’ve done enough.”

Senate Bill 44 died after some testimony before a House committee, as well as an earlier rally in the Denver state capitol sponsored by Conservation Colorado, Colorado Moms Know Best and others. It’s still amazing to watch environmentalists get up there and – in a strange mirror image of years of coal company messaging – watch the Sierra Club rep tell lawmakers that killing the RES would put more than 22,000 Coloradans out of work.

Xcel Energy has said it is on target to meet the Renewable Energy Standard mandate by 2020, so compliance really isn’t the problem. Xcel and Black Hills (the two biggest utilities in the state) both keep raising rates. This was brought up by Republican supporters of the rollback bill – a valid point for many low-income Coloradans. But clean-energy advocates argue that these higher rates aren’t because of the RES and that renewables actually save consumers money. ($25 million for Xcel customers alone, according to Doug Holland of the Sierra Club Rocky Mountain Chapter.)

The Center for the New Energy Economy (CNEE) does a state-by-state analysis that includes the status of renewable portfolio standards. Such standards have been passed in 29 states and the District of Columbia. And if any single law has had a more direct impact on transitioning from fossil fuels, it’s hard to pick one. CNEE (a research project of Colorado State University) has found that, once put into place, these standards are rarely rolled back (coal stronghold West Virginia being the exception) because they result in actual economic growth, physical turbines and panels, and native renewable industries, including R&D.

One surprising group giving testimony at the committee hearing on Monday was from the Colorado Technology Association, which, despite tech’s assumedly green patina, argued in favor of rolling back the RES so that they can lure data centers and other companies to Colorado with more choice in power supplies.

After the House committee voted 6-5 on a party-line vote to kill SB-44, the Union of Concerned Scientists (UCS) argued that it was time again for Colorado to up the ante:

“By signing long-term fixed price contracts for wind and solar, Xcel also sees these resources as providing a valuable long-term hedge against rising and volatile natural gas prices .... In fact, the Colorado Public Utilities Commission estimates that one of Xcel’s recent wind projects will actually save ratepayers $100 million over 25 years,” wrote Steve Clemmer, director of energy research for UCS, in a blog post.

Image credit: Governors' Wind Energy Coalition

Artisanal Mining: "Many Stakeholders, But No Winners"

By Paul Klein

“They live thinking the future is this afternoon,” said Juan Pablo Duque in describing the lives of artisanal and small-scale miners in Colombia.

Duque, senior vice president of Equilibria and formerly the CEO of Four Points Mining, has seen how artisanal and small-scale miners live and work first-hand. According to Duque, there are virtually no safety procedures, working conditions are extremely dangerous and serious accidents are frequent. “It’s very often that you hear about a mine that crashed down and killed many miners, and it was an informal mine," he says. “It also happens in South Africa. It happens in Nicaragua and in many other parts of the world.”

Globally, approximately 100 million people – including miners and their families – depend on illegal and informal mining, compared with about 7 million in large-scale industrial mining, according to the 2002 Global Report on Artisanal and Small-Scale Mining produced by the International Institute for Environment and Development

Tragedies such as the collapse of the Rana Plaza factory in Bangladesh have put a spotlight on unacceptable working conditions for garment workers in developing countries. In response, initiatives such as the Bangladesh Accord for Fire and Building Safety have the potential to improve the lives of workers and their families. However, the dangerous conditions in which artisanal and small-scale miners work remains largely invisible outside of the mining industry.

"Many stakeholders, but no winners"

In Colombia, it is estimated that illegal or informal miners are responsible for mining more than 80 percent of the gold produced in the country. Local sources believe that about 300,000 miners and their families are at high risk because of the dangerous conditions in which they work. For example, artisanal and small-scale miners can only purchase explosives from the military. “So they have to buy on the black market, or they build an explosive that is called ‘polvo loco.’ (That means crazy dust in English),” said Duque. The miners use mercury to capture the gold from the ore with their hands. Needless to say, mercury is highly toxic. Whole families are often involved, and child labor is not uncommon in many operations. Workers who are injured and unable to work lose their income entirely, leaving their families without money to buy food and other basic necessities.

During the time Duque was CEO of Four Points Mining, a company that operates in the municipality of Zaragoza in the Colombian department of Antioquia, he learned how complex the situation is and realized that there are many stakeholders but no winners.

First, he found that miners and their families who had no rights to the mining concession were illegally exploiting most of the mines and working in dangerous conditions. He also learned that these miners were very comfortable operating illegally on land held by concession-owners that is actually the property of a third party. Further, even though the concession-owners were not exploiting their own property, they were responsible to the state for environmental damage caused by the illegal miners. Finally, governments in Colombia are attempting to reduce illegal and informal mining by preventing foundries from purchasing from miners who don’t have official permits, and the police are confiscating gold from illegal and informal miners. As a result, foundries in Antioquia are going out of business because their access to gold from miners without permits is being significantly reduced.

A sustainable solution

Duque and his colleagues at Equilibria have envisioned a new approach that is informed by his in-depth understanding of the ways in which all the stakeholders are affected. He believes that an inclusive, cooperative model would leverage what each stakeholder brings to the table and deliver more efficient and sustainable operations. The increased profits could, in part, fund new social programs for miners and their families.

He believes the first step is to identify miners who want safer working conditions for themselves and their families and would prefer to operate legally. Next, the mothers and wives of miners need to be engaged. “Look, the legal system has better safety conditions, so you cannot be afraid anymore that your husband is at a high risk because now we can control it,” said Duque. “If he has an accident or is sick, you won’t have to worry about receiving money, because everyone will contribute to a cooperative system of social security.”

The new model brings together informal/illegal miners, the private sector, concession holders, foundries and the government to find sustainable solutions that harness the best technology, skills and capacities from all stakeholders. This approach would provide informal and illegal miners and mine developers with legal rights, social security and improved safety. The results would also include more jobs and viable employment alternatives for women, skills training for miners through partnerships with local colleges and educational scholarships for children of the miners. Concession holders would benefit from more cash flow, control over their property and reduced environmental damage. Foundries would have access to more legally mined gold and corruption would be reduced because bribes to officials would no longer be necessary.

By making it a priority to understand the needs of miners and their families, local communities, businesses and the government, Duque has build a high degree of trust among stakeholders that have not shared much common ground. His ideas have the potential to transform mining in Colombia and perhaps in other countries as well.

“It started as a strategy for security,” said Duque of his journey to find a better approach to mining in Colombia. “Then, it turned into a passion.”

Image credits: Flickr/Alejandro Arango (1 & 2)

Paul Klein is the President of Impakt, a B Corp based in Toronto and Bogotá that creates opportunities for corporations to benefit from being socially responsible.

The Latest and Loudest DC Lobby Force: Pizza

Pizza is definitely more American than apple pie, judging by all the restaurants and take-out joints you pass by during your commute. From your favorite corner eatery to the behemoths like Domino’s and Little Ceasar’s, pizza is part of the United States’ food, landscape and culture. Every day at least 40 million Americans eat pizza; one in four boys and teenagers consume at least a slice daily. All that fat and carbs on average provide at least one quarter of that American’s caloric intake, and one-third of the recommended amount of sodium. But pizza also provides one-third of a daily supply of calcium and half a day’s intake of lycopene.

Therein you have the foundation of a food fight with the U.S. Department of Agriculture (USDA) and Food and Drug Administration (FDA) on one side, against what first sounds like a benign organization, the American Pizza Community (APC). But the latter has become a formidable lobbying group that is fighting school lunch and calorie disclosure regulations tooth and nail.

Like many trade associations and lobbying groups, the APC likes to paint a picture of its membership as a beacon for small businesses, owned by guys who wear a Chef Boyardee hat as they spin yet another pizza crust with their index fingers.

But the reality is that the APC is a coalition of companies including Domino’s, Papa John’s, Little Ceasar’s, Pizza Hut and California Pizza Kitchen amongst its membership, along with suppliers including Coca-Cola, PepsiCo, the National Pork Producers Council and Tyson. And together these companies are thrusting a collective middle finger at what they say are onerous regulations pushed by clueless bureaucrats in Washington, D.C.

And to be fair, some of the APC’s arguments have a point. As the outcries against the increasing obesity rate in America led to more calls for calorie counts on menus, fast food companies and restaurant chains from McDonald’s to Darden (the Olive Garden outfit) scrambled to do so. Even the National Restaurant Association, long feared in D.C., collaborated on a menu labeling law. But when it comes to pizza, it’s complicated. First, there is not much of a point of disclosing calorie counts on a menu next to the cash register when most pizza cravers call for delivery or use their smartphone during yet another House of Cards mini-marathon—all on the same phone, of course. Just about every pizza outlet delivers—McDonald’s and Chipotle don’t. Should calorie counts be discussed during that phone call, or should they be on the smartphone app?

Therefore, as a recent Bloomberg article points out, the pizza industry felt that the aforementioned NRA threw it under the bus. As calorie disclosure rules got intertwined into the Affordable Care Act, the FDA proposed regulations mandating calorie counts for an entire pizza pie—which would freak out consumers since anyone over the age of 17 and not a defensive lineman has zero business eating an entire pizza. Why not disclose calories per slice? And what if you have extra pepperoni, anchovies, barbecued chicken, etc., etc., and a few hundred more etcetera’s? How long would that calorie count list be?

But the pizza lobby’s fight against regulators is not about protecting the corner pizzeria in your neighborhood from federal regulators, nor is it over discerning how many calories are really in a ham-pineapple-and-fried-egg pizza. This fight is about preserving its business, much of it thanks to these companies’ clutches on the federal, state and local treasuries. Before Michelle Obama’s “Let’s Move Campaign,” the federal government was long a friend of the pizza industry, thanks in part to agribusiness interests pushing the USDA to sell more cheese. A division of the agency worked with pizza companies like Domino’s load more cheese on their pizza, and sales surged. But in addition to subsidized marketing campaigns, at least one pizza manufacturer has a huge stake in the school lunch business.

Schwan’s Food Service, based in Minnesota, claims it has a 70 percent market share within the pizza segment of the multi-billion school food service sector. One graphic in the New York Times shows that at one point, within the $US20 billion school lunch industry, almost half a billion was spent on pizza (depending on your stance on this kerfuffle, you will be amused or appalled to learn the Times did not bother estimating national spend on baby carrots). Regulations that could affect whether tomato paste is a vegetable or not, including whole grains in the crust or cramming in more vegetables on that reheated slice of pie cuts into these business’s profits: and any business used to having government as a customer, when threatened, will not go down quietly. All you have to do is play the kid and consumer choice cards: kids love pizza (they aren’t fools), and tempeh-and-miso wraps are not cheap enough to tuck into school menus. Plus kids will just toss those wraps anyway.

Given the political climate in Congress and most state legislatures, the pizza industry will be safe and continue to grow. It is easy to demonize a hamburger; maligning a slice of (fake) Italian goodness is a tougher battle. And since America is generally a regulation-adverse nation in general, those who advocate for children’s health will need to find other tactics to win hearts and minds. Because as American as apple pie may be, pizza has a much better funded public relations campaign behind it.

Based in Fresno, California, Leon Kaye is a business writer and strategic communications specialist. He has also been featured in The Guardian, Clean Technica, Sustainable Brands, Earth911, Inhabitat, Architect Magazine and Wired.com. When he has time, he shares his thoughts on his own site, GreenGoPost.com. Follow him on Twitter and Instagram.

Image credit: Leon Kaye

5 Best Latin American Cities for Startups

Having grown rapidly to become “Latin America’s leading e-commerce site,” Dafiti is touting five of the region's major cities as hubs for launching new Internet-driven businesses.

Buenos Aires (Argentina), Medellín (Colombia), Monterrey (Mexico), São Paulo (Brazil) and Santiago (Chile) are becoming viable alternatives to the likes of Silicon Valley and counterparts in Europe, the company said.

Expanding from its initial base in São Paulo, Dafiti has launched e-commerce brands and businesses in all four of the other Latin American cities on the list. “The entrepreneurial scene has improved significantly in Latin America in the past decade and is emerging as as a strong competitor to its American and European counterparts,” Dafiti stated in a recent press release. “Entrepreneurs from all over the world are flocking to the continent to benefit from a number of brilliant funding programs and networking opportunities.”

Dafiti is one of a rapidly expanding aggregation of online e-commerce startups founded by Berlin's Rocket Internet Group, whose goal is to become “the largest Internet platform in the world outside of the U.S. and China.” In recent years, Rocket has “cloned” and acquired e-commerce brands outside retail fashion, including online food delivery.

Latin America's emerging startup hubs

Headquartered in Brazil, Dafiti employs some 1,500 people in South America's largest and most populous nation. It has employed over 2,000 more as it expanded and established a physical commercial presence in Argentina, Chile, Colombia and Mexico.

In a press release, Dafiti elaborated the reasons it believes Buenos Aires, Medellín, Monterrey, Santiago and São Paulo qualify as emerging hubs for entrepreneurial, Internet-driven startup businesses:

1. Buenos Aires, Argentina

As well as being the political, financial and commercial center of Argentina, Buenos Aires is one of the most cosmopolitan cities in South America and subsequently the region’s most dynamic startup hotspot.

- Funding and support: The locally well known seed fund accelerator NXTP Labs provides upcoming startups with a seed investment of US$25,000. Local government has also noted the benefits of successful commerce in the city and recently announced an initiative to invest US$3.5 million to support local startup accelerators.

- Trump card: The workforce here is both highly skilled and cost efficient: 35.2 percent of the working population hold a certificate in tertiary education, while the minimum wage stands at a reasonable US $548 per month (2015).

- Success story: Mercadolibre is the Argentinian eBay and the most successful startup in the country. Its service is now available in 13 countries, and eBay is a listed shareholder.

2. Medellín, Colombia

The startup flow in Colombia is growing exceptionally fast. The most recent Colombia Startups meeting, an annual event for entrepreneurs and investors, hosted 1,500 attendees -- 164 of whom were investors – which represented a 25 percent increase in attendees.

- Funding and support: Programs like Ruta N, an innovation and business center created by local government, aim to boost new businesses which promote and strengthen the scientific, technological and innovative development in Colombia. Ruta N offers support for new businesses to grow in departments including finance, recruitment and PR.

- Trump card: Medellín runs on a similar time zone to the West Coast of the United States, which has its own benefits in terms of ease of communication. In 2013 Medellín was named the most innovative city of the year by the Urban Land Institute due to its progress and potential.

- Success story: PagosOnline started with just US$5,000 in 2002. Thirteen years, a rebrand and an investment of US$10 million later, PagosOnline by PayU is now is the biggest platform for online payments in Latin America.

3. São Paulo, Brazil

The Brazilian economy is expanding rapidly and is subsequently a good landscape for both foreign and local businesses.

- Funding and support: The national startup initiative, Startup Brazil, supports companies less than four years old. This program provides support for startups in the form of investment, physical infrastructure, legal advice and training. The Brazilian government is also promoting initiatives for startups through its Tech Sampa program, which aims to create and attract innovative ventures in the field of technology.

- Trump card: As the largest economy in the southern hemisphere, São Paulo is a great environment for building contacts and expanding operations.

- Success story: Worth more than US$250 million, Dafiti, Brazil's largest online fashion retailer, is one of the most interesting startups in Latin America. Available in six countries, Dafiti is helping reshape the future of e-commerce in Latin America through its use of iBeacon technology.

4. Monterrey, Mexico

As México’s richest city, Monterrey is considered to be one of the best places to do business in the country and stands as a symbol of progress in Latin America.

- Funding and support: Startup Studio Monterrey, a Mexican startup incubator, recently launched a program to provide entrepreneurs with projects in the IT sector with specialized mentoring and workplaces. Entrepreneurs don't have to pay to be part of the program, but the incubator takes 6 percent of each project’s profits.

- Trump card: The tech industry in Monterrey has grown three times faster than the global average in the last 15 years. This rapid growth is generally attributed to the support and funding available in the city.

- Success story: Huichol Vertical Gardens has grown from a hobby to a thriving startup. Since growing the niche market in Monterrey, they have extended their operations all over Mexico and plan to expand from residential to corporate projects this year.

5. Santiago, Chile

Santiago is the economic, cultural and now the financial center of the country. Its increasing appeal to international entrepreneurs is one reason why the startup scene here is quickly becoming known as the “Chilecon Valley."

- Funding and support: The Chilean government’s program Startup Chile aims to attract world-class entrepreneurs to the country. If accepted onto the program, participants receive an initial US$40,000 grant, a year-long resident visa and support from entrepreneurs in the relevant sector.

- Trump card: Due to Chile’s reduced regulatory complexity, businesses are fully registered within an average of 5.5 days -- a drastic difference to the continent’s average of 30.1 days (World Bank Group).

- Success story: Motion Displays is an app which optimizes client-sales team contact for businesses. The startup currently has a partnership with Falabella, the largest department store in South America, and plans to expand into larger foreign markets in the coming year.

"Cloning" e-commerce brands and sustainable development

E-commerce sites alone do not a sustainable business make, however. Having raised billions of dollars in capital from a diverse mix of investment groups, including the World Bank Group's International Finance Corp. (IFC), Rocket Internet has also convinced the likes of J.P. Morgan Asset Management and the Ontario Teachers Pension Plan of its commercial merits and prospects.

Others question those merits. In particular, critics question the justification of the investments in Dafiti made by the IFC. (The World Bank Group member's primary mission is to provide equity capital for business ventures and projects that “end extreme poverty by 2030 and boost shared prosperity” in developing countries worldwide.)

Yet the billions it has raised from private- and public-sector investment groups has given Rocket the capital required to expand rapidly across world regions. Along the way, it has bought up small, local companies in each of the business sectors it targeted, including online food delivery.

To date, Rocket's Internet-based, “on-demand” food delivery businesses “cover over 140,000 restaurants across 64 global markets,” TechCrunch's Jon Russell reported. As Russell points out:

“Rocket Internet gained notoriety for a perceived policy of ‘cloning’ successful start-ups in a bid to make a quick buck by selling them later ... An IPO in Germany last year left many divided on its future plans, particularly with regard to exiting many of its global ventures — some of which have taken in hundreds of millions of dollars from investors.”

In advance of its IPO on the German stock market, Rocket and one of its biggest co-investors, Kinnevik, announced they would “consolidate five of the fashion brands that [Rocket] has established in emerging markets into a single entity that will have a combined valuation of €2.7 billion (US$3.5 billion),” Tech Crunch reported.

“The companies getting consolidated have florid, fantasitcal names — they include Dafiti (Latin America), Jabong (India), Lamoda (Russia and CIS), Namshi (Middle East) and Zalora (South East Asia and Australia). In contrast, the new umbrella group has a distinctly more prosaic moniker: It will be called Global Fashion Group (GFG).”

Along with the facts and arguments presented by Rocket Internet management in the business group's defense, the IFC has defended its investment in Rocket. It stated that Rocket's strategy of launching regionally-focused e-commerce brands and acquiring local businesses is helping to build a foundation for sustainable economic development, growth and job creation.

*Image credits: 1) Dafiti; 2) World Cities Culture Forum; 3) Rocket Internet

The Sharing Economy Comes to Facility Management

By Kim Tjoa

Our society is changing. ‘Us’ is becoming the new ‘me.' Access to items is becoming more important than actually possessing them. We are in the midst of a transition to a circular, sharing economy in which we make more efficient use of everything we already have. We are now looking to share, lend/borrow and exchange anything and everything.

The development to a sharing economy presents a huge chance for procurement and facility professionals. Why should we stay focused on buying while everybody else is sharing? Why not explore the possibility of sharing underutilized company assets (equipment, services, real estate and personnel) to save money or generate additional income?

Asset Sharing: Business-to-business collaboration

The sharing economy has gained immense popularity in 2014 but is projected to be an even bigger trend in 2015. This year will be epitomized by more efficiently utilizing what we already have through sharing (renting or trading) with others. At organizations and businesses all around the world, expensive equipment is standing idle, rooms are empty and important knowledge is not being used the way it could be. It would be a shame not to do anything with these assets. After all, anything that stands idle does not bring in any revenue, costs money and is definitely not sustainable.

Through the use of online sharing platforms such as FLOOW2, every business or organization is able to make supply and demand transparent. On a sharing marketplace, assets like trucks, cars, printing equipment, furniture, dining facilities, meeting rooms -- and also knowledge, skill and time of personnel -- become commercially visible for fellow businesses and organizations.

The business model of the future

The advantages of sharing idle assets are twofold. Businesses are able to save costs when they rent from each other instead of investing in the purchase of equipment or the hiring of personnel. Additionally, they are able to generate additional income by (temporarily) renting out assets.

Asset sharing wouldn’t be part of the business model of the future if, besides financial, it wouldn’t bring sustainable and social advantages. When businesses collaborate and utilize the assets that other organizations have already invested in, fewer new products will have to be produced, which will result in a more healthy use of resources and energy.

The new task and opportunity for procurement and facility management?

It sounds simple, and it is. However, business-to business sharing requires professional attention. That's a task that a facility professional would be well suited for, don’t you think?

For the past 15 years, procurement and facility mangers have successfully focused the ways in which facilities management (FM) businesses are able to run in a more (cost) effective way.

As of 2015, we notice that the opportunities for FM to continue the optimization process are few and far between. In many cases it will not be possible to save costs without letting the quality of the services and organizations deteriorate.

Current developments such as the sharing economy will change this trend, as it allows procurement and facility professionals to actually generate additional income while also helping the business become more sustainable and social. Asset sharing gives these professionals a tool to solidify their value within an organization. They will not have to ‘settle’ for the fact that there are empty office, storage and meeting spaces, that there are cafeterias that are only in use one hour per day, or company cars that don’t make the miles they could, employees not working to fullest potential and that knowledge stays hidden.

Putting it into practice

The switch to asset sharing will not be easy of course. The management team has to be on board, and an organization has to be ready and know how to embrace this new addition to their business.

It will be the task of facility managers to think along with the executives, advise them, and make an inventory of supply and demand. They should ask themselves, “What do we have temporarily available and what do we need?” They should actively implement the model in the daily business of their organizations and make sure that every employee knows that if an item is not available or if they are in need of something, that it’s better look to their neighbors before anything else. But, most importantly, they will need to be proactive about the management of matching supply and demand, closing deals, arranging transport and taking care of billing. Then, asset sharing will become anyone’s new business.

Image credit: Flickr/Flazingo Photos

Kim Tjoa is co-founder of FLOOW2 World’s Reset Button, the first B2B sharing marketplace for companies and organizations.

Startup Uses Biomimicry to Create High-Performance Metal Alloys

Used widely in nature, lamination – the deposition of fine layers of materials on top of one another – has long been known as a means of manufacturing stronger, more durable and longer lasting metals. Founded in 2006, Seattle's Modumetal is applying the process of lamination at nano-scale, enabling engineers to design and fabricate metals with superior performance characteristics and at lower cost than conventional methods.

The ability to cost-effectively fabricate nanolaminate metals that are more resistant to rust and corrosion alone would be a boon. Such materials could be used by engineering and construction companies for everything from civil engineering of public infrastructure to offshore energy (wind, as well as oil and gas), mining, home and building construction, tools, and consumer products. In a 2002 study, international corrosion authority NACE estimated corrosion in the U.S. results in direct costs of $276 billion a year across the economy.

At present, Modumetal's products fall into one of four lines: structural parts, coatings and claddings, thermal barriers, and armor. Its zinc-based alloy NanoGalv outperforms conventional galvanization processes by over seven times, Modumetal co-founder and CEO Christina Lomasney said during an October 2014 interview for Rigzone. That significantly reduces the need for replacement parts over the life of metal components, as well as the risks and costs of fatigue and failure.

Nano-scale manufacturing of metal laminates

Development, and subsequent acquisition, of a new process to cost-effectively manufacture nanolaminate metal alloys at scale was the pivotal breakthrough achieved by Modumetal's founders.

Rather than employing conventional vapor deposition – expensive and limited in terms of scale – Modumetal essentially “grows” custom-designed metals using an electrochemical process. This results in uniform deposition of nano-scale layers that conform to the exterior and interior contours of any object, no matter how complex its shape or form.

In an October, 2014 interview for Rigzone, Lomasney likened the process to the way Mother Nature builds structural components of living things, such as trees.

“If you look at a tree, you see the theme of a configured material,” Lomasney was quoted as saying. “In Mother Nature’s case, the structure is built so the seasons determine the density of the wood. In our case, electric field modulation is the equivalent of seasons, which is the core technology. We’re basically growing the laminated structure.”

The resulting nanolaminate metals and alloys can be designed to be lighter, stronger, more durable and more flexible than conventional metal products of whatever kind – steel, aluminum, etc. And they can be produced in high volume cost effectively, Modumetal touts.

Nanolaminate metal alloys: Lifecycle costs and commercial prospects

Major offshore oil and gas industry players have shown strong interest in Modumetal's manufacturing process and products. Chevron and ConocoPhillips have invested in the privately-held company.

Modumetal has also announced it's working with Hess on issues including corrosion, wear protection and structural reinforcement.

Building on its commercial prospects in the oil and gas industry, Modumetal in May 2014 announced it commissioned a new production facility in Washington state's Snohomish County. The new facility “is supporting production lines for coatings and claddings of oil and gas production and casing tubulars, and is already expanding to accommodate growing product interest,” management stated in a press release.

Added Lomasney: “By using our patented coating and cladding technology in demanding, highly corrosive and punishing environments, we are demonstrating significant improvements in the performance, durability and longevity of oil-producing assets, all while maintaining cost competitiveness with commodity metal products.”

All other things held constant, effectively extending the life of metal alloys used across economic sectors would mean less demand for these materials and less need to mine more metal ores. Such reductions would also result in less air, water and land pollution by way of mining and metals production, thereby enhancing environmental and socioeconomic sustainability and quality of life.

*Image credits: 1), 2) Modumetal; 2) BillLawrenceOnline

EU air pollution rules weaker than China’s, says Greenpeace

Europe’s coal plants will be allowed to emit more deadly pollutants than their Chinese counterparts under EU proposals for new air quality rules, according to Greenpeace.

A Greenpeace investigation has found new pollution limits for coal-fired power plants currently being discussed by the European Union are significantly weaker than those in place in China, as well as several times weaker than what’s already been achieved by the least polluting plants in other developed economies, including the US and Japan.

The findings come in the wake of a report by Europe’s environmental watchdog warning that hundreds of thousands of people could die prematurely in the EU over the next two decades if member states fail to tackle air pollution.

Commenting on the findings, Greenpeace UK energy campaigner Lawrence Carter said: "This is a classic case of the fox guarding the henhouse. By leaving the big polluters to write new air pollution rules, EU and UK ministers are guilty of a collective dereliction of duty. Toxic emissions are killing thousands of people across Europe every year, but rather than clamp down on polluters, politicians are allowing them to prioritise profit over public health. People in the UK could now end up paying with their health for our government's sell-out to the coal lobby on a vital issue like air quality."

Access the full report here.

CWF puts rabbits in the headlights

Compassion in World Farming is calling for greater welfare protection of rabbits through the addition of a Good Rabbit Award at its annual Good Farm Animal Welfare Awards.

Globally around 1.2 billion rabbits are slaughtered for meat each year, 99% of which are kept in cages. Europe accounts for 28% making them the second-most farmed animal in Europe (after broilers), and yet they are not protected by any species-specific EU legislation. The biggest producers are Italy (170 million slaughtered a year), Spain (59 million), France (39 million) and Germany (22 million). Barren cage housing is common, although alternatives are increasingly being implemented in response to consumer concern.

Dr. Tracey Jones, director of Food Business at Compassion in World Farming, said: “While barren battery cages for laying hens have been banned across the EU since 2012, barren cages are still the most common type of housing for rabbits. And yet they cause severe welfare issues due to insufficient space, social isolation or high stocking density, disease, injury, uncomfortable flooring and a lack of enrichment for behavioural expression. The routine use of antibiotics is also very high.”

The Good Rabbit Award joins the Good Egg Award, the Good Chicken Award, the Good Dairy Award and the Good Pig Award, all of which recognise companies committed to implementing substantial policy changes and practices that result in positive impacts for farm animals.

The Awards will be presented at the Milan Expo 2015 on 9 June 2015.

Picture credit: © Steffen Foerster  | Dreamstime Stock Photos

EIC makes election call for step change in energy efficiency

The Environmental Industries Commission (EIC) has published its manifesto calling on political parties of all colours to support the UK’s environmental technology and services sector in the lead-up to this year’s General Election.

EIC’s executive director, Matthew Farrow, commented: “The focus of the coming Election will be competing views on how to secure future economic growth and jobs. Yet current growth is already putting severe pressure on our natural resources and ecosystems.

“This presents an acute sustainability dilemma for the next government. The push for growth – not least to reduce the deficit – and the desire to build more homes, modernise our transport systems, and upgrade our energy infrastructure means that pressures on our natural resources and will get even greater over the next five years. Imagination, innovation and political will be needed to manage this dilemma.”

EIC’s five areas for action are:

· Make new infrastructure sustainable

· Deliver real air quality improvement to protect the public

· Enforce existing regulations properly

· Support exports of environmental goods and services

· Deliver a step change in energy efficiency

The manifesto also sets out ten policy recommendations which, maintains EIC, involve little or no public cost.

The document – ‘Priorities for the next Government’ – can be read here.

Picture credit: © Dengqingke | Dreamstime.com - Vote Photo