This green and pleasant land?

Smart technology and low emissions cities are emerging across the globe. Elisabeth Jeffries reports on how businesses large and small are defining their roles and driving local government policy

Local business went up a gear when Bristol in the south west of England became European Green Capital in 2015. Local electric cycle retailer sales, Atmosphere Bikes, increased substantially. It is one of several SMEs engaged in lowering the city’s emissions. Bristol’s role not only as Green Capital, but as a partner in the COP21 climate change negotiations in Paris in December, has attracted a peloton of corporate campaigners of all shapes and sizes probably for similar reasons.

That is not always the case, of course. Whether in infrastructure sectors or not, corporates are usually known for their resistance to environmental or emissions regulations set either by local or central government.

“High policy goals scare off industry and that affects income. You end up compromising. Yet a lot of cities are capable of exceeding the minimum standards,” says Roman Mendle of Local Governments for Sustainability (ICLEI), a global association of local and metropolitan governments dedicated to sustainable development.

Yet Bristol’s activities have achieved the reverse. Companies scrambling to associate with the city’s ambitions as official partners are accountants KPMG, First Bus company and construction and infrastructure group Skanska. It has ten official supporters, ranging from Airbus to Ikea.

The city’s position appears subversive given a central government decision to block environmentally-friendly council initiatives in its July 2015 Housing Standards Review. It will be left to transport, commercial and public building initiatives to close the emissions gap. Among them, Skanska aims to play a role.

Working for the council since 2006, it has built or refurbished more than 40 Bristol schools. In one project, the company converted an old police station into a school rather than use up greenfield land. Another used straw bales as insulation material, generating average annual fuel bills around 40% lower than comparable size schools.

More recently, a school has taken over a disused office building and contains features designed to lower its emissions such as PV panels, an intelligent building monitoring system, smart lighting and water systems.

Partly as a result of its schools connection, the company can associate itself with an educational role championing emissions reduction. “Our status as Official Partner to Bristol2015 does allow us to promote the green values which we as a business share with Bristol2015. We’re using a variety of channels - print, online, events and so on - to deliver that message, as well as allowing the hoardings on our site at 66 Queen Square to host a number of banners showing the aims behind the Green Capital year,” explains John Mitchell, Communications Business Partner for Skanska UK.

It is a role shaded with a hint of innovation and progressive thinking. Bristol City Council, after all, is headed by architect George Ferguson, a mayor who chose not to be associated with any major party when running as an independent in 2012. He is Bristol’s first elected mayor. Its collaboration contrasts with many city procurement activities across the world. Local companies, many of whom are employers, utilities and suppliers, tend to opt for minimum standards.

“Regulation and standards are definitely very important. Industry really needs to know which standards they have to adhere to,” points out Roman Mendle. In China, for example, many buildings have failed to meet the better standards despite the urgent need to cut pollution. “They need private investors to construct buildings but almost no-one wants to build to a platinum standard. They can stay at the basic level and pocket the rest of the profits. No-one adheres to the higher standards,” he says.

There are exceptions, of course, and many of these may be found in smart technology and low emissions cities emerging across the globe. Among them, the C40 Cities Climate Leadership Group is a network of the world’s megacities committed to addressing climate change by acting both locally and collaboratively. “Ending climate change begins in cities,” runs its mantra. These range from Addis Abbaba in Ethiopia to Yokohama in Japan. Most of its partners are philanthropic foundations or charities. ICLEI itself runs a similar GreenClimateCities programme including the ICLEI broad aim to foster better relationships between mayors, councils, smaller and international businesses for the benefit of the climate, inhabitants and visitors.

So far, many of the initiatives are showcase projects whose individual buildings and zones go beyond the average standard. They include Masdar, the United Arab Emirates planned city investing in low carbon technologies and Tianjin, the eco-city in China. In Scotland, Glasgow has won a £24 million government demonstrator project award to make its city safer, smarter and more sustainable.

It includes a city observatory using data technology to improve the urban environment and operations rather like a control room. In London, Siemens runs the Crystal building, home to the world’s largest exhibition on the future of cities and claiming to be “one of the world’s most sustainable buildings.” A few have managed to mainstream low carbon technologies at least in some districts, such as the Black Forest city of Freiburg.

Well performing cities attract investment, of course, and that is another reason councils want to improve them. But what distinguishes each city from its competitors is the extent of collaboration between the local government and businesses sited there. In some cases, the urban environment is a battleground for power between central government, big business and local authorities - and the council loses out.

As Roman Mendle explains: “In developing countries and in some cities, as well as in smaller cities everywhere, the council may not be able to engage with large companies with big legal departments and may not have the expertise, so this [collaboration] may be risky,” he says. In some cities, much of the innovation has been driven by the council. Nevertheless, business partnerships with councils have been operating for many years. They take several forms.

They can be local businesses and SMEs working in the economic ecosystem or local branches of bigger corporate players.

Then there are engineering and infrastructure companies such as Netherlands electronic and lighting company Philips, GE or Siemens. Their engagement can be a solution to the environmental problem, but they are not necessarily based in the city. Utility providers may carry out work outsourced by the local authority. Finally, a local company can take a formative role in developing the fabric of a city.

But as the economic conditions evolve and climate change concerns increase, more are being formed. “We will see an increase in city-business cooperation in the future,” says Mendle, drawing attention to the “severe budget constraints” of local government. “They need to look into non-traditional sources of financing and investment such as international finance, but also private investment.” In addition, the private sector may offer much of the expertise needed by cities on available technologies, cost-efficient approaches to urban concerns, and innovative business models.

The best and most innovative partnerships bring positive branding benefits to the corporates involved while maintaining city autonomy. “Given the profit interest of the private sector, city-business cooperation or any private sector driven solution to urban challenges is an instrument that can be used to do certain things well like energy efficiency, but nothing else. The local government needs to remain in control to serve as a broker of citizen interests. If this principle is watered down or undermined, things can go very wrong,” says Mendle.

EIRIS partners with Brazil’s SITAWI and bolsters Latin American presence

EIRIS, a leading environmental, social and governance (ESG) research provider, revealed this August that Brazil’s innovative social and sustainable finance specialist SITAWI had joined EIRIS’ global network. In so doing it expands the ESG research provider’s network’s presence in Latin America where it already has a relationship with Ecovalores, a pioneering sustainability organisation based in Mexico City.

SITAWI, which has offices in Rio de Janeiro and São Paulo but operates across Latin America, joins EIRIS’ international network research and sales partners that spans 11 cities. Established in 1999, SITAWI works with the region’s leading players in social and sustainable finance, and is piloting innovative concepts for the region such as Social Impact bonds and Green bonds.

Besides Brazil and Mexico, the EIRIS network includes pioneering sustainability organisations in Australia, Germany, Israel, Spain and South Korea. Collectively the network promotes EIRIS research products and solution services to investors, and researches companies following EIRIS’ research methodology.

Specifically, SITAWI will contribute to the coverage of Brazilian and Latin American companies within EIRIS’ research universe of over 3,200 entities, and offer the whole suite of EIRIS products in Brazil. The research coverage is anticipated to span around 50 Brazilian and other South American companies.

Stephen Hine, EIRIS’ Deputy CEO, commenting said: “The structure of the EIRIS network is designed to enhance the quality of research and services provided to investors - combining global expertise, local insight and thought-leadership.” He added: “Partnering with regional experts SITAWI enriches the research we offer investors on Brazilian and Latin American companies, and strategically bolsters EIRIS’ presence in the region.”

SITAWI brings to EIRIS long-standing knowledge of the sustainable finance market in Brazil. The organisation’s current team of around twenty has expertise in supporting high-impact social projects, managing philanthropic assets directly (e.g. including managing philanthropic funds for large donors), and in advising financial institutions on incorporating ESG issues into business strategy and investment analysis.

Gustavo Pimentel, Managing Director (Research & Advisory) at SITAWI, who was voted the second best ESG analyst globally by investors in the Extel IRRI 2013 rankings, said: “Investors will now have access to ESG research on Brazilian and Latin American companies of the greatest breadth, depth and with local insight.”

Furthermore, the partnership will also “enable our local investors to access EIRIS Global Platform” - effectively a seamless delivery channel to global ESG research according to Pimentel. “Practising responsible investment in the region has never been easier,” he added. Currently Pimentel chairs the ESG Integration Working Group of the Principles for Responsible Investment (PRI) Brazil Network.

Although Brazil is the seventh largest economy in the world, it still ranks 85th in the Human Development Index. That said, BM&F BOVESPA, the São Paulo stock exchange, has played a proactive and influential role in raising ESG standards in the Brazilian market for the past decade. In December 2005 it launched its Corporate Sustainability Index (ISE), which was at the time was only the second emerging market sustainability index in the world.

The ISE index, which measures the total return on a theoretical portfolio of up to 40 stocks issued by companies that demonstrate a high level of commitment to corporate sustainability and social responsibility, has been instrumental in stimulating the development of other emerging market sustainability indices in India and the Middle East.

EIRIS currently provides responsible investment services to over 200 clients including asset owners, asset managers, banks, wealth managers and charities globally.

For more information on EIRIS see: www.eiris.org

SRI Fund Spotlight: CLI Framlington Health A

CLI Framlington Health A, an OEIC fund that seeks capital growth by investing in healthcare and medical services and products companies globally (including pharmaceutical producers, biotech firms and medical instrument makers), topped the European funds sector over the past one year to 31 July 2015 with a robust cumulative return of +52.58%.

Its performance over the past three and five years was highly impressive too with +119.32% (3rd) and +217.86% (2nd) over the respective periods. The top 5 regions for the fund, which is domiciled in the Isle of Man, are the US with 78.38% followed by the UK (5.72%), Eurozone (2.77%), Canada (2.35%) and Europe - ex Euro (1.65%).

The top five sectors for the fund are Healthcare (82.85%), Basic Materials (0.98%), Consumer Defensive (0.91%), Technology (0.83%) and Industrials (0.69%).

Among UK Registered Funds, the £569.94m AXA Framlington Health R Inc fund ranked first out of 253 funds over the past one year with a cumulative return of +36.20%. In fact it posted something of a triple first by virtue of being ranked first over both the past three years with +99.71% and an even more massive +172.83% over the past five.

The fund beat Pictet-Water HR USD into second spot over the past 12 months on +29.03%, which posted returns of +40.65% (96th) and +73.18% (24th) over past there and five years respectively.

Bottom ranked fund in this sector was Sparinvest SICAV Ethical High Yield Value Bond EUR R fund with a woeful -29.23% over a past one-year horizon (-6.07% over past three years). All of the bottom five funds here posted negative performances over the past one year, while the sector’s peer group average return was 5.25%.

Within the US Mutual funds sector with 163 funds, the US$2,087.10m Eventide Gilead N fund retained its number one ranking over the past one, three and five years with performances of +24.13%, +117.23% and +207.31%, respectively.

It was followed in second place over the past one year by the US$236.68m Brown Advisory Sustainable Growth I on +22.91% (+73.49%/8th over past three years).

The US$643.43m American Century NT Heritage Institution fund came third over the past year on +17.17% versus +62.79%/29th and +103.66%/30th over past three and five years. Timothy Plan Emerging Markets A fund bottom placed over the past year with -31%. The sector exhibited the best peer group average return over the past three years of +43.38%.

Ensuring a new crop of farmers

Continuing to create shared value for those along its supply chain, premium coffee business Nespresso has developed the one thing it knows a particular group of farmers need if they are to continue supplying high quality coffee: a retirement savings plan, says head of sustainability Jérôme Pérez

Coffee-farming is a tough business, especially in the remote, high-altitude region of Caldas in Colombia, one of many locations across the country where the optimal micro-climate offers the perfect conditions to produce the highest quality coffee demanded by the portioned coffee brand Nespresso.

The back-breaking daily routines for smallholder farmers there – who rely on the use of donkeys to get around and transport their goods to market – are taking their toll. The average age of coffee farmers in Caldas is 53. And, generally, the next generation of young people are turning their backs on the family business and going in search of jobs in the city instead.

It’s a challenging social issue – not only for the ageing farming community, but for Nespresso too.

The company’s unique approach to building resilience, trust and improving the wellbeing of suppliers along its value chain – known as the AAA Sustainable Quality Program – has been hugely successful since 2003, helping farmers improve the productivity and profitability of their farms, while ensuring a consistent supply of high quality coffee that meets the quality and aroma profiles required for its Grand Crus range.

But the company was keen to extend the scope of AAA, to look at social security issues too. “In places like Caldas, farmers are not always protected and are increasingly vulnerable to a range of external factors,” says Jérôme Pérez, head of sustainability at Nestlé Nespresso.

“So, we wanted to find out what the farmers wanted and needed most.”

The co-operative of farmers in the region unequivocally told Nespresso that they wanted access to a retirement savings plan. “So, that’s what we set out to do – to safeguard their futures and encourage young people to stay and produce coffee by developing a savings plan for them.”

A little over 12 months ago, the Farmer Future Program was born. By tapping into Colombia’s existing government-subsidised retirement savings scheme aimed at workers that are not covered by a traditional pension system – known as Beneficios Económicos Periódicos (BEPS) – coffee farmers that are operating within Nespresso’s AAA scheme have been given savings accounts, accessible at retirement age. Earlier this Summer, the first payments hit their accounts, with the Colombian government matching 20% of what each farmer invests. Fairtrade International is also a part of the programme, helping members of the cooperative determine how best to invest their earnings in the scheme.

Of the 850 farmers that have so far registered in the initiative, 164 of them have already decided to save additional money into the fund on their own.

And the public-private partnership allows the Colombian government to widen the reach of its own retirement savings scheme by reaching into Nespresso’s extensive farmer network – something that the company has invested heavily in during the past decade via its AAA scheme.

“We have created a ‘win-win’ scenario and, one year in, we are very happy with the level of engagement from farmers,” says Pérez. “And we’ve seen many more farmers wanting to join the AAA Program because of their ability to access the retirement savings plan. In fact, around 150 farmers joined the cooperatives thanks to this project .”

The ambition is to demonstrate the benefits of such an initiative, so that the programme can be rolled out throughout Colombia.

However, the social security issues that are most important to farmers is different from region to region, and country to country. “Some farmers want straightforward savings accounts. Some want crop insurance, or health insurance – every community has different needs,” says Pérez.

“Rather than impose a mechanism on coffee-growing communities, it’s important that we listen to the farmers to find out what it is they want and need most.”

Of course, the Future Farmer Program is an example of creating social value for Colombia’s coffee farmers. Unable to retire with dignity after working hard their whole lives, the scheme is designed to give the younger generation hope that coffee farming is a viable career option – and so preserving an essential part of Colombia’s economy and heritage.

But the decision is also about creating business value for Nespresso. By building resilience and supporting the wellbeing of the coffee-growing communities it so relies upon for its high-quality coffee supply, the company is helping to future-proof its business for the long-term.

Colombia is hugely important to Nespresso. For one thing, it is one of the only countries able to produce the required volumes of the diverse profiles that give its range of products its distinctive taste and characteristics. But coffee production faces many challenges and threats. Some areas remain unsafe due to political and social unrest. Average temperatures have crept up by one degree in the last 30 years, affecting productivity levels. Local infrastructure is patchy, with farmers struggling to access roads or water sources.

However, the intergenerational succession issue is arguably the biggest concern right now; without a new generation of coffee farmers coming through, the required volume of supply could run dry.

“What we are doing in Caldas is being watched with much interest in all coffee-growing regions – not only in Colombia but in other countries too,” adds Pérez.

“This unique approach, developed by strong partnerships, is one of the best ways we can mitigate the risks contributing to instability in the coffee-growing sector, and safeguard the future supply of coffee coming out of Colombia.”

The circular economy : why it’s a global sustainability priority

In the past few years, rising global sustainability developments have paved the way for surging numbers of corporate commitments and more decisive action by national governments. Even if sustainability is showing new signs of life, there are still major and challenging issues that need to be addressed that will lead to prosperity, writes Michael Spanos, managing director, Global Sustain.

In times where material wealth is cherished, the global population is rapidly rising and there is ever-growing consumption, the process by which products and services are delivered to our doors has become increasingly complex. On the other hand, decisions and actions taken by consumers may have a serious impact on the environment and consumers lack the necessary information so as to make smart decisions. The question, therefore, remains as to how far we can go without changing the way goods and services are produced and consumed. In a world of close to 9.6 billion people as the UN predicts by 2050, the challenge is to manage these interdependencies in a way that human development makes advances without causing harm to the environment and our planetary boundaries.

At the World Summit Rio+20 of 2012, the need to change the unsustainable way our societies consume and produce was recognised as one of the three overarching objectives for sustainable development. The need to change the pattern of production and consumption was also acknowledged in the first World Summit for the Environment and Development in Rio de Janeiro, Brazil (1992), and in the World Summit for Sustainable Development in Johannesburg (2002). Moreover, the European Commission identified Sustainable Consumption and Production (SCP) as a key objective in its renewed European Sustainable Development Strategy (SDS 2009) and is expected to propose a “circular economy package” by the end of 2015. The latter will be the first crucial piece of policy intervention that will lay down the transition path for different economy sectors. In addition to that, the Mediterranean is the first Region in having SCP as a top priority in its Sustainable Development Agenda and is currently preparing a specific Mediterranean Action Plan for SCP as part of the EU funded SwitchMed Initiative.

Sustainable production refers to manufacturers who ensure products are designed and manufactured with minimal impact on the environment throughout the product’s life cycle. Sustainable consumption refers to the understanding of “circular products” by considering the entire life cycle that allows consumers to make better purchasing decisions, use, maintain, reuse or recycle the product. Sustainable consumption and production provides the opportunity to harness creativity and create circumstances for a better future. It maximises the business potential to transform environmental and social challenges (fresh water quality and depletion, soil degradation, biodiversity loss, growing emissions, poverty etc.) into economic opportunities, innovation, restorative industry, job creation, GDP growth and better life quality.

Sectors influenced by circular economy on which we have to plan policies to mainstream SCP are among others: Food and Agriculture, Tourism, Housing and Construction, and Goods Manufacturing (including textiles, cosmetics, electrical and electronic equipment). Examples of SCP policies are renewable material strategies, eco-design, consumer campaigns, and so on and so forth. In terms of sustainable consumption, the Nu Spaarpas approach launched in the Netherlands is indicative of the things we can do in order to encourage it. Consumers earn green points when they separate waste for recycling, use public transport or purchase locally-produced, fair trade, or green products. The points can be redeemed for public transport tickets or discounts or sustainable goods.

According to a recent Ellen MacArthur Foundation report, shifting towards a growth within model - based on getting value from the existing stock of products and materials - would deliver better outcomes for the European economy and yield annual benefits of up to €1.8 trillion by 2030. Moreover, primary material consumption measured by car and construction materials, real estate land, synthetic fertiliser, pesticides, agricultural water use, fuels, and non-renewable electricity could drop 32% by 2030 and 53% by 2050, compared with today.

For circular economy to achieve results in a shared society, active participation and collaboration between relevant stakeholders is deeply needed. There are several players that are required to take action, since the successful implementation of SCP cannot be achieved as a standalone, without certain organisations taking part. Instead, it requires a holistic view of the role business of all sizes, public bodies, civil society and investors have to play. The challenge is to inspire a whole generation to adopt circular principles reflected in their daily personal and professional activities. Game changers that are willing to change their obsolete lifestyle is what we really need.

Taking all the above into consideration, once more this year, Global Sustain mission is to challenge, inspire and raise awareness about a critical sustainability issue. “Circular Economy: Towards Sustainable Consumption and Production” is the theme of our publication, the 2015/2016 Yearbook, that aims to trigger a global discussion on these topics for the ninth consecutive year. The 9th Global Sustain Yearbook will feature leading CEOs, corporations and organisations from all around the world, but with a specific focus on the Euro-Mediterranean region, whose SCP efforts are well-integrated into their organisational fabric.

The SwitchMed Initiative will be a collaborator in the preparation of the Yearbook. The publication will include the viewpoints of top experts, decision-makers, policy formers, and community leaders who will share their vision and expertise regarding this timely subject with a global audience. Particular topics that will be featured are: sustainable lifestyles, new consumption models, life cycle thinking, sustainable value chain, policies, strategies and action plans, eco-innovation and communication. In fact, contributions from big companies, small businesses, development agencies and policy-makers will start to be submitted around the time for SwitchMed Connect 2015, slated to take place in Barcelona on October 29-30, 2015.

At SwitchMed Connect, there will also be sessions exploring leverage areas for scaling up circular economy and sharing economy business models.

Join Our Crowdfunding Campaign! #TechTitans and the Housing Crisis

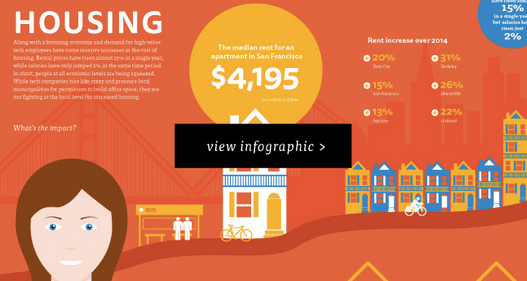

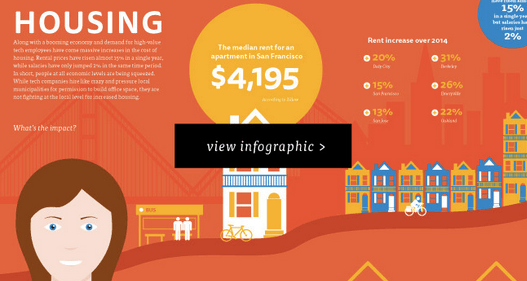

As you may have heard, TriplePundit is developing a three-part multimedia series to examine the challenges facing many tech companies when it comes to their impact on the communities in which they operate. First up, HOUSING.

Along with a booming economy and demand for high-value tech employees have come massive increases in the cost of housing. According to Zillow, the median rent price in San Francisco is $4,195, which is higher than the San Francisco Metro median of $3,000. Rental prices rose almost 15 percent in a single year, while salaries only jumped 2 percent in the same time period. In short, people at all economic levels are being squeezed. While tech companies hire like crazy and pressure local municipalities for permission to build office space, there is often no one fighting at the local level for increased housing.

- Why can’t we just build more high-rises? Zoning in the Bay Area.

- How corporate interests have influenced local city zoning regulations in Mountain View, Palo Alto and San Francisco, from housing and office allotments to tax breaks.

The $250 Trillion Green Economic Revolution

Editor's Note: This is the second post in a two-part series on the $250 trillion green economic revolution. In case you missed it, you can catch the first part here.

Climate change economics is emerging as a disruptive mega-trend driven by estimates that the cost of global climate change will reach a staggering $72 trillion. This scale of cost is unprecedented in human history. The only comparative I could find is that the cost of climate change is four times larger than the United State’s annual gross domestic production. The sheer scale of climate change costs can no longer be disputed or ignored by governments, businesses or consumers. Climate change economics will reshape world economies, industries and consumer behaviors resulting in a green economic revolution.

Climate change economics drives increased carbon regulation and taxes

The politics of change is slow and painful. Major regulations like the removal of lead from gasoline, mandatory automobile seat belts, and restrictions on the use and advertising of tobacco had 50-year maturations from initial advocacy for change to government regulatory/taxing actions.

In 1980 Walter Cronkite, America’s most watched newscaster, did a milestone story warning of climate change due to global warming. Thirty five years later, the world’s governments are now starting to act to regulate and/or tax carbon emissions. Despite lukewarm, at best, voter support for higher taxes or increased regulation of carbon emissions, the world's governments face an economic reality in which not acting is more harmful than acting.

The politics will be brutal, and even could be in doubt, but the only politically sustainable outcome is to dramatically limit carbon emissions to levels that mitigate climate change consequences on human health and the economy.

Climate change economics will drive stock valuations

Actions by governments, and consumers, to limit carbon emissions will create an unprecedented reallocation of capital. For example, the current declines in energy company valuations due to lower oil prices are a blip in comparison to potential declines if current estimates are correct -- that $100 trillion of fossil fuels must be left in the ground unburned to successfully mitigate climate change consequences.

Because electric utilities still generate 67 percent of their electricity from fossil fuels, they face an economic horizon in which their production assets are devalued or stranded by aggressive carbon taxes and/or regulations while at the same time customer-owned investments in renewable energy, smart buildings and energy efficiency deliver lower monthly bills than utility-supplied electricity. If you are an investor trying to figure out how Tesla Motors could have a $30 billion market capitalization while operating at a loss, then recognize that electrification using renewable energy is the transportation technology path governments will likely endorse to reduce transportation’s climate-changing carbon footprint.

Climate change economics will have a ancillary impact on stock valuations by increasing consumer awareness, as they search for more sustainable products that deliver ‘in me, on me and around me' human health and environmental solutions. For example, obesity is now projected to carry a global economic cost of more than $100 trillion during the 21st century.

A heightened consumer awareness around climate change and obesity will push a sustainable brands revolution where products must successfully align with consumers on the issue of human and planet health to achieve revenue and market share growth. Those products and companies that fail to align with these customer expectations are likely to be the 21st century’s “pink slime” product catastrophes.

Climate change economics will actually have a long-term positive impact on global stock markets. Capital and revenues will flow to companies that can deliver price competitive solutions. While individual restaurant chains will rise or fall on their ability to serve healthy and price competitive food, the overall industry will grow revenues from consumers attracted to eating healthy, affordable, diverse and tasty food. The automobile industry will thrive as an entire generation of fossil fuel vehicles are replaced with plug-in and plug-in hybrid vehicles. Home and commercial building values will soar in locations that offer high walkability, biking and mass transit opportunities. Smart technologies will have multiple killer app opportunities to use artificial intelligence in managing human and environmental health. Imagine walking up in the morning to Siri saying, “Your smoked salmon, tomato and avocado breakfast biscuit on a whole grain bun will be delivered by Amazon electric drone in 15 minutes!”

The stock market bottom-line of climate change economics will be measured by innovation, solutions, revenue growth and higher stock prices.

The $250 trillion green economic revolution

In 2007, my economic analysis projected a $10 trillion green economic revolution by 2017. That estimate now appears conservative. The green economic revolution is emerging as a $250 trillion revolution in how investors value stocks and how consumers make purchases.

This mega-trend has already begun as a growing number of investors divest from companies that win price competitive advantage through pollution. Consumers are in active search for sustainable products. Bottled water is projected to outsell soda by 2017. The Nest smart thermostat is an in-home sales winner. Customer-owned solar is grid price competitive in all states. Utility success with their utility commissions in redesigning rates to reduce solar’s economic attractiveness is sustainable only until customer-owned battery technologies gain price competitiveness through global manufacturing economies of scale.

The economic bottom-line is that climate change and obesity together represent approximately $240 trillion in projected economic damage. That is a monster sized business opportunity that entrepreneurs will harvest.

The politics of change will be in doubt. Lobbying by entrenched companies will be intense. Behavioral economics points to irrational consumer adoption of sustainable technologies due to their strongly held beliefs, a bias for the status-quo and procrastination. But ultimately the economics of sustainability will be so compelling that change will happen. Governments will act. Capital will be reallocated. Customers will change what they buy and who they buy from. The result will be a $250 trillion green economic revolution delivering solutions for manmade challenges to human and planet health. This will define the economics of the 21st century.

Image credit: Flickr/401(K) 2012

Q&A: Recent Grad Jamie Bohan Talks Strategy in a Changing World

We live in changing times. Today's business leaders must be ready to keep up with the curve-balls the 21st century is poised to throw at them, from shifting economic landscapes to a changing climate.

Recent grad Jamie Bohan took notice of this after ending a 20-year stint at Honeywell to manage the sustainability department of waste service company Republic Services. Strategic planning was becoming more difficult in the face of major disruptions in nearly all segments of the market, Bohan said. Her Fortune 500 clients expressed the same concerns.

Once skeptical of pursuing an MBA, Bohan ultimately decided on the Executive Master’s in Sustainability & Leadership (EMSL) program at Arizona State University, which focused on sustainability strategy and its role in business, among other things.

TriplePundit talked with Bohan to find out more about her decision to pursue a sustainability education and how it impacted her career.

TriplePundit: What made you decide to pursue a sustainability degree?

Jamie Bohan: I earned a Master’s in Sustainability Leadership (EMSL) from ASU in January of 2015.

My area of expertise is in business to business (B2B) strategy and growth, leveraging technology innovation. With broader roles, I began to notice that strategic planning and business continuity were becoming more and more difficult to manage due to massive disruption in nearly all segments of the market. My Fortune 500 clients were expressing the same concerns, and their needs were rapidly changing. This observation led me to the conclusion that something was missing from traditional strategic management tools that are in use today.

I’d been thinking about getting an MBA for several years, but I felt that I had a good grasp on the content taught in a traditional MBA through my work experience. In addition, it was the traditional MBA tools that were lacking. What I was looking for was a more integrated and broader view of the intersection of business, technology, society and the environment. I was particularly excited about the strategy elements of the EMSL degree. Sustainability brings a unique perspective to business strategy that has filled the gaps for me.

3p: What are you up to now? Briefly describe your current role and responsibilities and how long you've been on the job.

JB: I’ve been with Republic Services for almost three years, after a 20-year career at Honeywell. I currently lead the development of the sustainability program, and I manage our innovation strategy. Because we are an environmental company, sustainability is key to our overall corporate strategy. In this role, I look for ways to make our operations more effective, to grow revenue by creating new offerings, and to ensure that we can respond quickly to evolving requirements going forward.

I lean heavily on technology as a way to accomplish these goals, but sustainability provides the insights into what is happening in the market and what is driving customer behavior. Sustainability knowledge also helps to uncover a lot of hidden opportunities that would otherwise be missed.

3p: Have you found that your sustainability education was a benefit in the field?

JB: Absolutely. It helps me to guide my company toward success in a rapidly changing, complex world. Sustainability is not only about risk reduction and efficiency. The process of strategic planning and strategy formulation involves analysis of industry structure, external environment, risk assessment, scenario planning, opportunities, threats, etc. This analysis is greatly enhanced with a deep understanding of social and environmental issues – and their interdependencies with the business world.

Sustainability adds another layer to the typical economic analysis. So, I’ve woven sustainability concepts learned in this degree into the strategic planning process to open up new avenues for business growth – both organic and inorganic. It has really helped me to create competitive advantage for my company. In addition, I feel like I have a crystal ball that enables me to understand where and why technology and innovation are being applied to better protect my company from disruption and risk. More importantly, it enables me to craft a strategy that’s in line with where our customers are going.

3p: Do you have any advice for students who are thinking about a sustainability degree?

JB: My advice would be to make sure that it aligns with a practical aspect of what it is that you do, or want to do. For me, this degree was a layer on top of skills and education that I already had. It adds a nuance that most other people don’t have. The degree on its own isn’t where the value lies; it’s in bringing a different way of thinking to what I was already doing that has added tremendous value for me.

3p: What's your biggest sustainability pet peeve and why? Disposable grocery bags? Trash in the compost? Cars double-parked in the bike lane? Share your thoughts!

JB: I wouldn’t characterize it as a “pet peeve," rather more of a missed opportunity. Every action is part of a larger system that often leads to unintended consequences if not thought through. When I worked at Honeywell, the CEO Dave Cote used to say, “You have to go slow to go fast.” This means you have to take the time to do the analysis first, so that execution is straightforward and drives the right results.

This could not be more true today. We need to think deeply about the system in which we are the actors, and understand the other players in the system before we can charge off with a solution. This really gets back to the value of the EMSL degree – it’s all about understanding what the solution needs to be (the strategy piece) and then knowing how to lead people in the system to get there (leadership, communications and change management). That is the challenge of sustainability from my perspective.

Dallas Houses the Homeless, Saves Taxpayers Money

Dallas is looking to halt chronic homelessness, following the movement recently bolstered by its neighbors in Houston.

Fifty of Dallas’ most chronically homeless residents will move into small cottages in a neighborhood complex expected to feature green recreational space, solar energy and rainwater collection, according to the Corporation for Supportive Housing. Contractors broke ground for the project in mid-April, and those who have struggled most to find housing will finally settle into a home to call their own in November.

Not only is the city sweeping its most costly residents off its streets, but it’s also saving taxpayers money — a projected $1.3 million in total. A chronically homeless person jumping back and forth between prison and emergency health services costs the country nearly $40,000 a year, Keith Ackerman, executive director of Cottages at Hickory Crossing, told the Huffington Post. The cottage-fostering program will slash those prices to less than $13,000.

Dallas isn’t the first city to initiate such a program, and it’s been successful in the past. In 2012, Charlotte, North Carolina, introduced a program through nonprofit Moore Place, which provides homeless people support by way of social workers, therapists, nurses and psychologists while housing them in an 85-unit complex.

Houston joined the movement in early June, vowing to end chronic veteran homelessness over the next three years. The city plans to bring local agencies together to look after the roughly 3,650 homeless veterans.

The $8.2 million project included a partnership from a number of organizations, including the Corporation for Supportive Housing, which pledged a $50,000 grant and another $50,000 loan.

Located just half a mile away from the city, the Cottages at Hickory Crossing will revolutionize the fight against chronic homelessness by targeting those who can’t get out of a vicious cycle. Whether residents suffer from mental illnesses or substance abuse, the cottages give them a place to settle and regain control.

“Looking past the strong research, it just makes sense that someone who is homeless needs a stable place to live before they can really start working on recovery,” said Dallas County director of criminal justice, Ron Stretcher, in a news release.

Image courtesy of the Cottages at Hickory Crossing

Building Equality from the Lower 9th Ward to the Fort Peck Indian Reservation

Editor’s Note: This article originally appeared in the August issue of Green Money Journal. Check out more excerpts here.

By Jason Campbell

At a recent SRI Conference, I joined a community investing project tour of the Lower 9th Ward in New Orleans, which was completely devastated by Hurricane Katrina in 2005. The Make it Right Foundation (started by Brad Pitt in 2007) was working to help rebuild using the highest standards of green and sustainable building, along with guiding principles defined by the local community.

During the tour, I saw how this collaboration was helping a distressed community. It crossed my mind that a similar project might work on American Indian reservations.

Tom Darden, executive director of Make It Right, attended the SRI Conference, where he was kind enough to let me share with him the parallels I saw between the disaster of Hurricane Katrina and the economic disaster areas where many tribal reservations are located in the United States. My question for Tom and Make It Right was whether they would share their innovative model -- a community-driven approach to socially responsible and sustainable neighborhood development -- with Native Tribes and reservations in dire need. They said "yes," and we started with the Fort Peck Reservation in Montana.

Through a process employing extensive collaboration between the tribes of the Fort Peck Indian Reservation’s leadership, tribal citizens and with Make it Right Foundation, there will be 20 families living in LEED Platinum homes (funded through a low-income housing tax credit) in the fall of 2015. (Check out this USA Today article on the homes.) This is step one of a much larger nation-building vision driven by core principles generated by tribal citizens of the reservation.

Before I approached Make It Right at the SRI Conference, I inquired of Steven Heim, steering committee member of U.S. SIF’s Indigenous Peoples’ Working Group and director of ESG research and shareowner engagement at Boston Common Asset Management, about how I could better understand sustainable, responsible and impact investing particularly on the institutional side. This would be increasingly important to understand due to the work I was starting to do with tribes.

During my time with Boston Common, my sister sent me an article from my local Spokane, Washington, newspaper. A Spokane tribal citizen was on the front page of a multi-page article outlining the horrific impacts of a legacy uranium mine on the Spokane Indian Reservation.

Back in the late 1950s, a unit of Newmont Mining led the Spokane Tribe to believe that extracting uranium in support of the Cold War would create desperately needed jobs and be totally safe. Newmont used the tribe as a disposable workforce that is feeling the adverse effects even today. Newmont also never bothered to clean up the mine site that went dormant in the 1980s and is now a $200 million EPA superfund site. The resulting contamination includes high cancer rates and other diseases, contamination of water, sacred sites, medicinal plant gathering sites, and elk calving grounds.

Image credits: 1) Flickr/Aaron Gustafson 2) Jason Campbell

Article by Jason Campbell. Jason’s organization, Areté Development Group, was launched after graduating with an MBA from Gonzaga University. Areté Development Group focuses on serving American Indian sovereignty by building connected self-sustaining communities. Through culturally based policy development woven with cutting edge practices and strategic partners, Areté Development Group strives to contribute to a quality of life for citizens of Native nations that reflects the core values of individual Tribes. The development of sustainable capacity building opportunities, of which, socially responsible investing of financial assets is a part, represents the historic cultural values of stewardship and generosity.