Diageo joins World Business Council for Sustainable Development

Drinks giant Diageo has become the newest member of the World Business Council for Sustainable Development (WBCSD).

Joining nearly 200 forward-thinking companies, some of Diageo’s existing initiatives include safeguarding natural resources, promoting local raw material sourcing and industry collaboration to encourage responsible alcohol consumption.

David Croft, Diageo’s global sustainable development director commented: “We have a responsibility to create shared value for our communities, our people and our shareholders and our sustainable development journey is an important part of that. We believe that our membership at WBCSD will facilitate productive new partnerships and opportunities that will help us on that journey.”

Diageo produces at 131 sites in over 30 countries, with products sold in nearly 200.

Pictured: Jude Law in advertising campaign for Johnnie Walker Blue Label.

Join Our Crowdfunding Campaign! #TechTitans and the Transportation Crisis

As you may have heard, TriplePundit is developing a three-part multimedia series to examine the challenges facing many tech companies when it comes to their impact on communities. Next up, TRANSPORTATION.

Along with the influx of new residents come congested freeways and new pressures on public transportation. The San Francisco Bay Area’s physical geography (a peninsula), and a lack of historical attention to mixed-use urban planning, have constrained affordable and desirable housing near centers of industry. The result is long commutes for many workers.

We’ll explore how people get to work: How long does it take, and how do people travel? We’ll also take a historical look at the urban planning decisions made by Silicon Valley cities. Finally, we’ll look at the private buses tech titans employ to get their employees to work. Is this a Band-Aid or an effective permanent solution?

We’ll investigate:

- The evolution of public transport and roads in the Bay Area – why is public transportation so difficult in the sprawling Silicon Valley?

- How the politics of a small number of homeowners cripples Caltrain and other transit options

Report: Curb Carbon Emissions or Grow Money Trees

Transitioning to clean energy is like saving for retirement: Invest a little now, and you’ll earn bigger dividends than investing a lot more later.

Citibank would agree. Its recent report says investing in low-carbon energy now would save everyone $1.8 trillion through 2040. In contrast, if everyone sits on the couch, eats potato chips, watches Netflix and waits until 2060 to take action, it will cost an additional $44 trillion.

To put that in perspective: You would have to spend $10 million every day for 273 years to spend just $1 trillion -- now, multiply that by 44. (You would think this would not be a difficult decision to make.)

However, several politicians are saying, "Sorry, not sorry." In fact, Sen. Ted Cruz (R-Texas) said the plan “will cause Americans’ electricity costs to skyrocket at a time when we can least afford it.” Apparently he has a Magic 8 Ball that says paying an additional $44 trillion will be no big deal in a few years.

But the longer we wait, the more issues we will have to fix like damage from droughts and floods. Hurricane Sandy, for example, cost $65 billion in damage.

Citibank isn’t alone in its view. “From where I sit, climate action is a must-do,” said Shaun Donovan, director of the U.S. Office of Management and Budget. “Climate denial will cost us billions of dollars.”

The Citibank report goes on to say that improvements aren’t going to break anyone’s wallet. “The incremental costs of following a low-carbon path are in context limited and seem affordable, the ‘return’ on that investment is acceptable and moreover the likely avoided liabilities are enormous,” the report’s authors state. “Given that all things being equal cleaner air has to be preferable to pollution, a very strong ‘Why would you not?’ argument begins to develop.”

In addition to saving money and having cleaner climate and better health, there is even another perk to reducing carbon emissions. The report suggests that acting now might boost the lagging global economy. (Go ahead, you can toast to this good news.)

If Thomas Edison were alive today, he would likely agree making changes now is a good idea. Back in 1931 he said: “We are like tenant farmers chopping down the fence around our house for fuel when we should be using nature’s inexhaustible sources of energy – sun, wind and tide. I’d put my money on the sun and solar energy. What a source of power!”

Image credit: Flickr/Wonderlane

Gamers to the Rescue: 'Huge' Energy Savings Potential In Computer Gaming

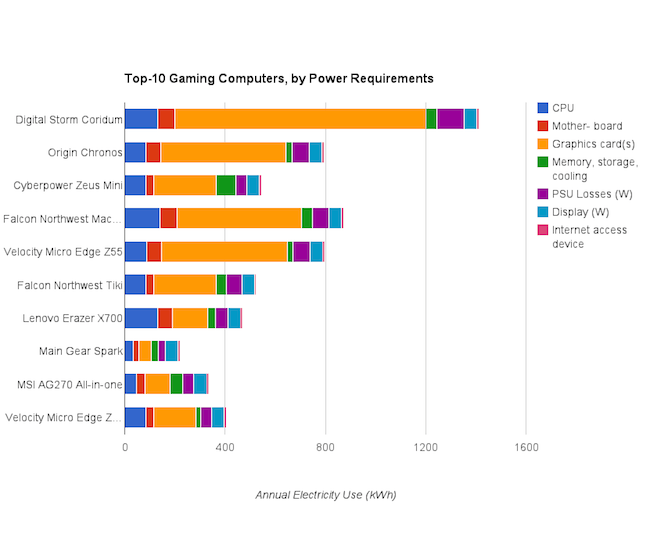

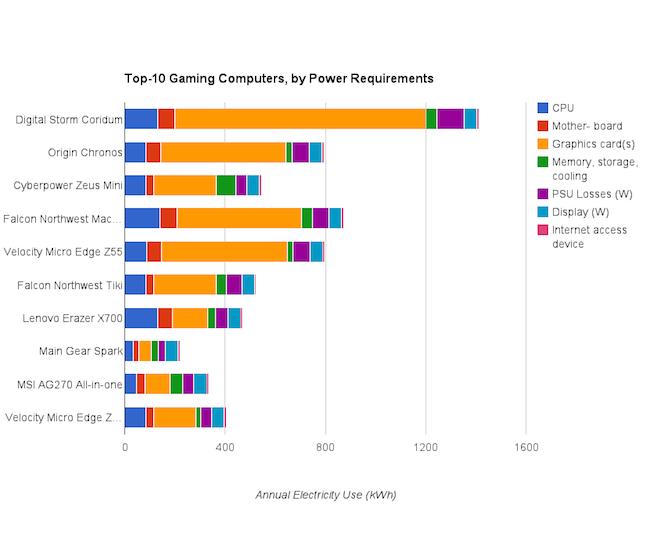

A first-of-its-kind study from Lawrence Berkeley National Laboratory has revealed that the global computer gaming industry can make a significant contribution to reducing carbon emissions. Gaming computers are powerful, graphics-heavy devices that use six times more energy than personal computers, and 10 times more energy than gaming consoles. The Berkeley Lab study found that, with some relatively simple system and component changes, energy use by gaming computers could be reduced by more than 75 percent.

The new study adds an interesting twist to the social-impact computer gaming movement, which has embraced gaming as a powerful influencing experience that can lead to positive behavior changes, and provide companies with a powerful new tool for engaging customers.

Computer gaming: All fun and games until the carbon footprint

The new Berkeley Lab computer gaming study is the first ever to produce an estimate of global energy use of personal computers designed for gaming. The methodology included direct measurements on custom-built gaming computers, deploying the gaming industry's own benchmarking tools.

If the gaming industry makes the changes suggested in the study, the potential energy savings is 75 percent. To put it in terms of power generation, the savings by 2020 would be equivalent to 40 typical 500-megawatt power plants that would not have to be built.

The year 2020 is only six years away, and during this time coal, natural gas and petroleum will still dominate the electricity generation landscape, so the direct carbon footprint savings is clear.

Berkeley researcher Evan Mills, who co-authored the study, notes that gaming computers have not faced the same kind of carbon footprint scrutiny that other computers and large appliances have encountered:

"It’s remarkable that there’s such a huge overlooked source of energy use right under our noses. The energy community has been looking at ordinary personal computers and consoles for a long time, but this variant, the gaming computer, is a very different animal ..." ... Your average gaming computer is like three refrigerators. When we use a computer to look at our email or tend our Facebook pages, the processor isn’t working hard at all. But when you’re gaming, the processor is screaming. Plus, the power draw at that peak load is much higher and the amount of time spent in that mode is much greater than on a standard PC."

According to the study, while only 2.5 percent of all personal computers globally are gaming computers, they account for 20 percent of the energy used by personal computers. The study calculated that computer gaming averages 1,400 kilowatt-hours per gamer annually, which is six times more than other personal computers, and 10 times more than gaming consoles.

Mills also warns that sales of relatively energy-efficient gaming consoles are slacking off even as the power-sucking desktop computer gaming market has been growing rapidly growing:

"There are 1 billion people around the world who are gaming now. And it’s a really diverse demographic. There are a lot of women; the median age is 31. And the popularity of these giant desktop gaming computers is growing fast."

The "opportunity areas" for improving gaming computer efficiency are numerous. Mills recommends that the current voluntary ratings for displays and power supplies should be tightened up, and ratings for additional components should be adopted. That includes motherboards, hard drives and peripherals.

The research team built five gaming computers in more efficient configurations and found that energy use could be halved without loss of performance. To get to the 75 percent figure, they also changed the operational settings for certain components.

Game designers also have an opportunity to pitch in by designing games to use energy more efficiently.

The study was sparked after Mills and his son -- who became his collaborator in the new study -- built a custom system at home. The energy-sucking nature of serious computer gaming quickly became evident on the household electricity bill.

That experience, and the subsequent study, inspired the research team to launch GreeningtheBeast.org, a platform for gamers and the computer gaming industry to organize for energy efficiency improvements.

Here's the breakdown according to the website:

"Based on our numbers, at the U.S. average of 4.4 hours a day of intense gaming, plus everything else you do on your machine, a typical rig might use 1,400 kilowatt-hours of electricity a year, or about $200 in energy bills at typical U.S. prices."In addition, depending on how dirty your local utility is, your rig could easily be spewing 1,500 pounds of the greenhouse gas [carbon dioxide] into the atmosphere at the same time. That's the middle of the range. How bad can it get ...? Over $1,000/year and 5,000 pounds of CO2!

What is a Rosenfeld?

The full study is available in the journal Energy Efficiency under the title, Taming the energy use of gaming computers. If you take a look, you'll notice that the research team references a unit of measurement called a Rosenfeld, which is the equivalent of the output of one typical 500-megawatt coal fired power plant, or 30 billion kilowatt-hours per year.

Back in 2010, a group of energy efficiency 'gurus' proposed the Rosenfeld as a simple, easily-grasped unit of energy savings.

The Rosenfeld would enable people to visualize the impact of their actions, much the same way as removing the equivalent in cars from the road helps people to visualize carbon savings.

As for Rosenfeld, the namesake of the new unit is Arthur Rosenfeld, former particle physicist and member of the California Energy Commission, whose interest in behavior changes related to energy use dates back to the 1970s oil embargo.

Rosenfeld was among the first observers to predict that economies don't necessarily need to consume more energy in order to grow, a phenomenon that is becoming more evident today.

Image credit: Flickr/macinate

Getting Serious About Sustainable Tourism

By Louise Twining-Ward

Sustainable tourism is getting renewed attention these days because of its inclusion in the United Nations' new Sustainable Development Goals (SDGs), but the idea is not new. Sometimes referred to as responsible, green, low-impact or eco-tourism, tourism designed to protect natural and cultural heritage and support the well-being of local communities is well established in destination-branding campaigns and certification programs around the world.

What is new is that sustainable tourism is increasingly mainstream. Not a niche, not a fad, not a market segment or simply CSR, it’s becoming a business imperative for hotels, airlines, cruise lines, car rental and other companies in the hospitality sector. Businesses that fail to take sustainability seriously enough will find themselves practicing a lot of risk management.

While industries like forestry, agriculture, fisheries and mining are based on extracting and selling natural resources, tourism thrives on preserving and enhancing natural and cultural assets. One in 11 people worldwide work in travel and tourism. The industry is currently worth $6.6 trillion, or 9 percent of global GDP, and it’s growing faster than the global economy. Annual global arrivals now top a billion people and are increasing by about 4 percent each year.

Tourism should be an ideal lever for global change. How many other multitrillion-dollar industries can you name for which sustainability is not only a key competitive advantage, but mission-critical for protecting the natural and social capital that attract customers in the first place? It’s hard to imagine a more powerful engine for spreading sustainable practices and positive impacts to every corner of the globe.

But as the industry has grown, so has its pressure on resources. Tourism leaves a mammoth footprint on land (both for development and food production), as well as high water and energy use. It generates 5 percent of global greenhouse gas emissions, and untold amounts of other waste. As global competition has intensified, in many places tourism wages have fallen, local people have been marginalized or displaced by development, cultural heritage sites have been overrun, and parks and coral reefs have been loved to death.

Done right, tourism actually contributes to local economies, conserves local lands and incentivizes the protection of cultural traditions. Decades of innovation by travel and tourism companies, governments, and international donor agencies has brought sustainable practices and and positive impacts to more destinations, and made sustainable choices available to more travelers than ever before.

But tourism still hasn’t been able to posit the kind of global-scale sustainability goals or demonstrate the kinds of verified, aggregated impacts some other global industries have. That may be what leads some, like the climate contrarian Bjorn Lomberg, to dismiss sustainable tourism as peripheral to global sustainability. By definition, tourism is so culturally and geographically diverse and so decentralized that it has lacked defined common goals and standards, and its collective impacts are notoriously difficult to monitor.

If those problems were solved, tourism would be recognized as a powerful global sustainability strategy, which is why the SDGs rightly call for framing and implementing policies to promote sustainable tourism and tools to measure its impact.

To that end, leading destinations, tour operators, hotel chains, airlines, cruise lines, environmental groups and others have signed onto the 10 Million Better campaign — an industry-wide awareness campaign with the shared goal of demonstrating improvement in the lives of 10 million people through sustainable tourism by 2025.

Tracking progress toward that goal requires a way to follow the ripple effects of tourism through local economies, communities and environments, which is technically difficult. Economists are getting better at assessing tourism’s economic multiplier effects using input-output models and satellite accounts. But our ability to quantify social, cultural and environmental impacts of sustainable tourism has lagged far behind.

The good news is: There’s now a serious global effort underway to tackle this problem. This summer the World Bank’s Sustainable Tourism Global Solutions Group and Sustainable Travel International convened a high-level meeting on tourism impact monitoring. Among the participants were the United Nations Environmental Program, the World Economic Forum, the U.N. World Tourism Organization, the World Travel and Tourism Council, travel industry leaders including Wyndham Resorts and PwC, the world’s largest professional services firm, as well as the World Wildlife Fund and Harvard, Cornell and George Washington universities.

Speakers and participants shared their progress on various new monitoring tools. The impact monitoring system being built as part of the 10 Million Better campaign is an integrated, accessible, open-source approach to capturing and reporting impacts. It includes a project calculator to assess the multiplier effect of sustainable tourism projects on destination communities. Another open-source tool, the Total Impact Management Model (TIMM), allows for measurement and monetization of social, environmental and economic impacts from across the value chain. Harvard’s International Sustainable Tourism Initiative presented its work on a visual forecasting tool to improve tourism development and management. It uses dynamic simulations and mapping to visualize alternative future scenarios for tourism destinations.

It’s no accident that these tools are becoming available just as the SDGs are launching, and the eyes of the world are turning to the Paris climate talks. On many fronts, there’s a palpable sense of urgency and specificity about setting and implementing global sustainability goals. Once armed with ways to monitor and scale up its collective environmental and social impacts, sustainable tourism can take us a long way toward meeting them.

Image credit: Flickr/Zachary Collier

Louise Twining-Ward, PhD is the CEO of Sustainable Travel International, whose mission is to improve lives and protect places through travel and tourism.

3p Weekend: 10 Companies With Sensible Gun Policies

With a busy week behind you and the weekend within reach, there’s no shame in taking things a bit easy on Friday afternoon. With this in mind, every Friday TriplePundit will give you a fun, easy read on a topic you care about. So, take a break from those endless email threads and spend five minutes catching up on the latest trends in sustainability and business.

I'll never forget when I, an East Coast girl living in Phoenix, noticed a sign in the window of a local bar reading, "Please no guns." Needless to say, I was aghast. "Bars have to explicitly ban guns here?," I wondered to myself. Yep, they sure do.

Arizona, like more than a dozen U.S. states, allows residents to openly carry firearms without a permit. More than 20 other states allow open-carry with a license, while only five, plus the District of Columbia, ban open-carry outright.

For those like me, who are uncomfortable with firearms, it can be more than a little unnerving to notice a handgun on the belt of the fellow behind you in line at Circle K. And considering the wave of violent gun crimes that have rocked the country in recent years, some companies are beginning to approach gun policies as a corporate social responsibility (CSR) issue. For these firms, allowing customers to openly carry guns inside their establishments can make the company appear complicit with its state's lax gun laws.

With that in mind, this week we tip our hats to companies that are braving the backlash and adopting sensible gun policies.

1. Starbucks

Starbucks CEO Howard Schultz wrote an open letter to the coffeehouse chain's customers in 2013, asking them to leave their firearms at home.“We are respectfully requesting that customers no longer bring firearms into our stores or outdoor seating areas — even in states where 'open carry' is permitted — unless they are authorized law enforcement personnel,” Schultz wrote. In the past, Starbucks followed state and local laws when it came to guns in its stores, but a wave of what Schultz called "uncivil" gatherings struck a nerve with company management.

"Pro-gun activists have used our stores as a political stage for media events misleadingly called 'Starbucks Appreciation Days' that disingenuously portray Starbucks as a champion of 'open carry.' To be clear: We do not want these events in our stores," Schultz concluded, recognizing that open carry is a contentious issue but politely stating that it's a debate his company no longer wants to take part in.

2. Chili's

In a 2014 statement coinciding with a similar announcement from Sonic, casual restaurant chain Chili's requested that customers not bring guns into its eateries.

Dallas-based Brinker International Inc., which owns the chain, said in a statement that it was dedicated to providing "a safe environment for our guests and team members," Business Insider reported last year.

3. Sonic

Sonic dropped its no-gun request on the same day as Chili's. The request, which stopped short of an outright ban, came after "members of the gun-rights group Open Carry Texas walked into Texas-area locations of Sonic and Chili's carrying assault rifles," Business Insider reported the day of the announcement.

4. Panera Bread

After a months-long discussion between Panera Bread and activist network Moms Demand Action, the fast-casual restaurant chain decided to speak up about guns in its stores.

Panera Bread CEO Ronald M. Shaich announced last year that the company will proactively ask guests at its 1,800 bakery-cafés to leave their firearms at home.

5. Target

Historically, Target has followed state and local laws when it came to allowing guns in its big-box retail locations. But in 2014, the company said it will no longer allow firearms inside its stores after campaigns by activist networks like Moms Demand Action.

6. Walmart

Walmart, the largest seller of guns and ammunition in the U.S., made waves last week when it announced it would no longer sell high-powered assault rifles that hold multiple rounds of ammunition.Arkadi Gerney, the senior vice president of the liberal think-tank Center for American Progress, had this to say: “In my experience working with Walmart in 2008, I found them to be extremely concerned about responsible gun sales. They definitely wanted to stay in the market and serve customers who wanted to buy guns, but they were very interested and responsive to ideas about how to make those sales safer and to make it less likely that the guns that they sell were ultimately misused.”

The company follows state and local laws when it comes to carrying guns in its retail locations, but employees are not allowed to bring firearms to work.

7. Chipotle

Sonic wasn't the only restaurant chain to get a visit from Open Carry Texas. In May of last year, members of the gun rights group entered a Dallas-area Chipotle carrying assault rifles, scaring some patrons, the Washington Post reported.

While the group's founder told Forbes the incident was not a political statement, just a meal after an event, it prompted the company to rethink its gun policies. Just a week later, Chipotle released a statement asking customers to leave their guns at home.

"Historically, we felt it enough to simply comply with local laws regarding the open or concealed carrying of firearms, because we believe that it is not fair to put our team members in the uncomfortable position of asking that customers refrain from bringing guns into our restaurants," Chris Arnold, communications director for Chipotle, told CBS News' Dallas-Forth Worth affiliate in a statement. "However, because the display of firearms in our restaurants has now created an environment that is potentially intimidating or uncomfortable for many of our customers, we think it is time to make this request."

8. Jack in the Box

Just 24 hours after activist group Moms Demand Action launched a petition to Jack in the Box asking the fast-food chain to enforce its policy prohibiting firearms in restaurants, the company answered the call.

Brian Luscomb, the company’s vice president of corporate communications, told the group: “The presence of guns inside a restaurant could create an uncomfortable situation for our guests and employees and lead to unintended consequences.”

9. Costco

On its website, Costco states that it "does not believe that it is necessary for firearms to be brought into its warehouse stores," U.S. News reports.

"'If you believe that our policy restricting members from bringing firearms into our warehouse stores is either unfair or excessively burdensome, or you cannot agree to abide by this policy, or you are dissatisfied for any other reason, Costco will promptly refund your annual membership fee in full."

10. New Seasons Market

New Seasons Market, a privately-owned grocery chain operating in the Portland metro area of Oregon and Washington, adopted a gun sense policy in 2014 on the heels of a similar decision by Panera Bread.“As the friendliest store in town, we work every day to ensure our staff, neighbors and customers feel safe and welcome in our stores. We’ve had a no-weapons policy in place for some time for our staff. We’re now respectfully asking our customers to leave their weapons at home too," New Seasons told activist group Moms Demand Action.

Know of a shop near you that has a similar policy? Drop the name in the comments!

Image credit: Flickr/Cory Doctorow

Sustainability Reporting: Why Bother?

By David Struhs

Let’s be honest: Most corporate sustainability reports are not read carefully, if they are read at all. So, why bother?

At Domtar, our CEO, John D. Williams, got to the heart of this question in his introduction to our company’s latest report when he wrote: "I hope your reading of this report will be as helpful to your own sustainability interests as preparing it was to ours."

With that sentence, John revealed a simple but often unspoken truth: A principal benefit of public reporting is, in fact, its very preparation. Nothing galvanizes an organization’s attention on its sustainability agenda more than periodically sending a report to customers, employees, investors and other stakeholders. It’s not unlike getting your house in order when you know you are throwing a party and inviting friends and relatives over.

That said, having made the investment and realized the internal management benefits of producing a public report, how can a company make sure its guests (i.e., its readers) enjoy and appreciate the results?

Here are some suggestions that have worked for us:

1. Put it on paper

While this may seem self-serving at first, coming from a paper company, the fact is all of our email boxes are overflowing. And seriously, how many people are really going to navigate from an email to a corporate website to only then be confronted with downloading a PDF file?

Nowadays, getting a well-designed, interesting magazine in the mail with well-written and inviting stories serves as an enticing excuse to take our eyes off a digital screen for a few minutes. This becomes even more compelling when accompanied with a personal note from a sender whom you know.

2. Keep it real

How do you make the repurposing of manufacturing byproducts interesting? Hint: It is not by talking about spent lime dregs, grits and wood ash. Instead, try telling a story from the point of view of the end user. In our case, that was a farmer:

"Managers at our mill in Plymouth, North Carolina, recognized the potential to blend together several byproducts from the manufacturing process to create a nutrient-balanced soil amendment," our report reads. "Chris LeFever, a local corn, wheat and soybean farmer began using Plymouth K-Lime, a new potash and lime fertilizer developed by the Plymouth mill, to grow higher yields, produce better looking crops, and save $35 an acre.'I like that it’s all natural … It’s clean, it breaks down well, and the roots get at it right away. With commodity prices going down and so much cost going up, these savings really help,' said LeFever."

Domtar’s industry-leading success in reducing our landfilling and turning former waste materials into new revenue streams comes alive when told by someone else. You can adapt this approach to your own sustainability success stories.

3. Make it memorable

Charts and graphs help make performance data digestible. Pictures make it remarkable. And people and their stories make it memorable. A good report uses all of the above.

Pie charts and bar graphs are stock-in-trade for corporate sustainability reporting – and Domtar’s report has its share of them. Unfortunately, by themselves, these charts too often fail to provide context to the general reader. That is why, where we could, we employed graphical elements that are more compelling.

For example, reporting that Domtar avoided landfilling 573,853 dry metric tons of manufacturing byproducts is just that – dry. Presenting that pictorially as 1.73 Empire State Buildings makes it remarkable.

But to make a performance story truly memorable, tell a person’s story. We shared Domtar’s commitment to improving water efficiency through the eyes of an intern:

"Follow the water. Simple instructions, you might think, until you realize that the maze of pipes before you was laid a hundred years before you were born. Oh, and there aren’t any diagrams."Enter Kevin … a recent graduate with a summer project to map water usage in one of our mills, to identify opportunities for improvement, and to assess the tradeoffs and consequences of changing water use.

"'When we started, there wasn’t a set of diagrams showing where water came in and where it went, so we grabbed flashlights and went to find out,' Kevin said."

Fast forward: Kevin’s successful project led to a full-time job with Domtar’s sustainability team. He is now part of a team building a model that will enable Domtar to better understand water efficiency opportunities at all 13 of Domtar’s mills.

Conclusion

Producing a corporate sustainability report may be its own reward, given how the internal process brings every corner of the organization together to focus on the company’s progress on its sustainability agenda. However, employing these three simple techniques increases the likelihood that your final product will connect and resonate with your customers, employees, communities and investors alike.

To get a copy of our latest effort, drop us a line at: [email protected]. We would be pleased to send you one and to learn what you think. You can hear more from Domtar’s sustainability experts through an upcoming webinar.

Image credit: Flickr/Jiri Brozovski

David Struhs is currently Vice President for Corporate Services and Sustainability at Domtar, North America’s largest manufacturer of uncoated freesheet paper, a leading global pulp supplier, and an innovative maker of absorbent hygiene products. At Domtar, David oversees environmental performance and sustainability; corporate communications; and certain human resources functions, including professional development.

Domtar serves markets in more than 60 countries, has approximately 10,000 employees, and annual sales of $5.6 billion.

Indonesia Sets New Climate Goals, But Are They Attainable?

For Indonesia, the world's top producer of palm oil, greenhouse gas emissions is a big problem. Thirty-seven percent of the country's emissions come from deforestation -- a process that has in the past supported the country's industrial expansion, but also draws stark criticism from environmentalists. Another 27 percent of the country's GHGs is generated from peat fires, with a prolonged burn that not only increases smog, but also heightens concern for global warming

This week, the government of Indonesia announced that it's upping its effort to reduce carbon emissions, modifying its 2020 goal of 26 percent unilaterally to a 29 percent cut by 2030. It's a bold aim for a country that still has significant challenges with meeting its earlier goals, and as Reuters recently noted, the government has yet to indicate how this will be accomplished.

In 2009, U.N.-REDD (Reducing Emissions from Deforestation and Forest Degradation) launched a number of projects that were aimed at preserving some of Indonesia's substantial forests, including international support and commitments at reducing peat fires. At the present time, some 60 REDD-supported initiatives are various stages of activity in Indonesia, all with the goal of helping the country to fulfill its GHG goals.

But critics argue that Indonesia has not taken steps to reduce its carbon footprint in substantial ways. Last month President Joko Widodo initiated a new coal plant that is expected to be the largest in the region. The new project is part of Indonesia's effort to raise its current power production by another 52,000 megawatts within the next five years. But it also reflects continued difference of opinion between Indonesia and some international partners on the best path to reaching its GHG goals.

In comparison to other countries with substantial tropical forests, Indonesia's former commitment to cut GHGs by 26 percent by 2020 was considered a moderate attempt to rectify a huge environmental challenge.

That may be part of the reason that Indonesia is now stepping forward with an even bolder commitment, months before the start of the U.N. Conference of Parties in Paris, where a global climate change agreement will be brought to the table. Countries that have contributed to Indonesia's stated efforts to reduce emissions will ask questions about the best way to both protect its vitally important crop production, and reduce its ongoing contributions to worsening climate change.

Image credits: 1) Flickr/a_rabin 2) Flickr/NASA Goddard Space Flight Center

Seabirds Are Eating a Heckuva Lot of Plastic

A new study found that most seabirds have plastic in their guts, and we're not talking about the pink flamingos on your neighbor's lawn.

The study, published in the journal Proceedings of the National Academy of Science, examined 186 species of pelagic seabirds. In case you’re not up to date on birdology (yes, that's a word), pelagic seabirds include albatrosses, puffins and storm petrels. These birds spend most of their time chillin’ on the open seas. They’re not beachcombers like seagulls. Therefore, you’d expect these seabirds to reflect how much trash is in the ocean while excluding beach trash.

How did the researchers figure out that most sea birds eat plastic? They looked at studies conducted between 1962 and 2012 then used models to determine that, if the studies were done today, up to 90 percent of the seabirds would have plastic in their guts. In other words, if a seabird Instagramed its breakfast, you might see plastic bottle caps.

How bad is it? The ocean can contain as many as 580,000 pieces of plastic per square kilometer (0.386 square miles). Imagine if your house floor was covered in thousands of Lego pieces, and then you had to eat those Lego pieces for breakfast. Now you know what it feels like to be a seabird.

Earlier this year, a study estimated that 4 million to 12 million metric tons of plastic invaded the ocean in 2010. Not only is that number incomprehensible, but it's also 4.5 percent of all plastic produced. As plastic production increases, more and more plastic will get washed into oceans. Unless plastic is someday made from fish (read: that will never happen), this is just not cool for seabirds.

When a bird gulps down a large piece of plastic, it can obstruct its gut and the animal may die. Also, plastic in the gut means there’s less room for real food … which also means it might die. Additionally, plastic doesn’t decompose for 450 to 600 years, which also means seabirds are more likely … to die. I wish I was done, but there’s more: Plastic such as fishing lines and hooks can get wrapped around birds and other sea life … causing them to die. A 2012 study examined the contents of 67 northern fulmars’ stomachs and discovered an average of 37 pieces of plastic in the birds’ guts. Those birds, you guessed it, had died.

All of this is more than a little depressing, so what’s the solution? Don’t use plastic. And if you do, make sure to properly discard it. Also, jumping on board with campaigns seeking to ban microbeads and plastic bags is a good start.

The only bird that looks good in plastic is a yellow rubber duckie. But honestly, I wouldn’t buy that either. Get your kids a fish aquarium instead so they can connect with real nature.

Image credit: Flickr/óskar elías sigurðsson

Ecotourism in Idaho: Our Discerning, Summering Palate

By Clinton Wilson

I just recently moved to Idaho from New York City, and it’s been all about enjoying the great outdoors in the summer of 2015. It’s outdoor theater and concert-going season at the Shakespeare festival and concerts at the botanical garden.

White-water rafting, camping and hiking in the mountains, boating day-trips to one of the state's many lakes, going to the Caldwell Night Rodeo and the Parma Motor-Vu drive-in cinema … these are things I couldn’t do in Manhattan’s Lower East Side.

At our neighborhood's weekly barbecue, we may be grilling hot dogs and hamburgers on the patio, but we still hold on to our epicurean disposition. We won’t turn away bags of chips, or (Idaho-style) potato salad, but we’ll sometimes find it hard to suppress our opprobrium when my parents ask for their black truffle Kobe burgers well-done. They can have it with their choice of endive, escarole or arugula.

With my (sometimes insufferably snobby) foodie friends, there’s an ongoing competition to pack and present the most appetizing, exotic food when we gather for an al fresco event. I’ve been trumping them all with a new online food find, Gift a Feast. Every time I buy one of their curated packages of food, locally grown and packaged in the San Francisco Bay Area, I know I’ll impress my crew with the novelties. They tell me they go out the next day and shop around to try and find what I’d introduced the night before.

I used to keep this secret to myself, like the roasted tomato salsa from San Francisco’s Papalote. It’s probably the best salsa in the world, famously defeating Bobby Flay in his Food Network Throwdown, and always throwing me into a salsa reverie.

There has always been a rich tradition of Mexican cuisine here in Idaho. You never had to travel very far to find authentic taquitos. We didn’t know what arugula was, but we definitely knew our salsa.

Like me, you probably missed National Grab Some Nuts Day on August 3, and Oren's Kitchen Wild Rosemary Almonds from Gift a Feast would have been a perfect contribution to our King Lear play-going that day had I planned ahead. National Nachos Day is just around the corner though.

Olives. We are all mad for great olives here in my circle of friends. Good Faith Farms' green Lucques olives seasoned with rosemary and lemon cured between six and 18 months in a brine solution of gourmet and local salts from Gift a Feast conquers anything my friends could procure from any grocery store around here.

We are a bit snobbish with the olive oil we generously drizzle over heirloom tomatoes and fresh mozzarella. The organic extra virgin olive oil from MoonShadow Grove or the oil from Ascolano olives, prized for their highly aromatic quality, quickly make their way in similar packages from the Bay Area, rounding out our summer evening spreads.

When I pine for New York City and great wine, I turn to Bottlerocket to make an informed wine choice for perfect pairing with food. This was another social win for me. A food and wine hero I would forever be in the Treasure Valley gastronomic circuit.

I couldn’t continue to keep these sites a secret; it was too much to keep from gifting to my foodie friends. Indeed, this is what I’m gifting them for the holidays.

I’ve secured my Feast of Appetizers basket -- complete with artisanal cheeses and candied citrus peel -- for the Caldwell Night Rodeo. It’s not my first rodeo, but it will be my first one with a gourmet food basket and a bottle of wine. Not sure if we’ll be ridiculed tonight, but any of my cowboy friends from high school are certainly welcome to join us for a toast from our 2013 Chateau Bellvue Rougier!

Image credits: 1) Flickr/Quinn Dombrowski 2) Clinton Wilson

Clinton Wilson is an inveterate traveler, enthusiast of anything related to technology, music, and cinema, and has written for Just Out Newsmagazine and Black Lamb in Portland, Oregon; PragueOne in the Czech Republic; and for Penguin Group in New York City. He recently relocated to Boise, Idaho from New York where he lives with his wife and three step-kids.