Elon Musk’s Libertarian Case for a Carbon Tax

Tesla Motors CEO Elon Musk reiterated his calls for a carbon tax last week during an interview with a Reno newspaper about Tesla’s gigafactory in nearby Storey County, Nevada.

Musk’s stance is hardly new. He's gone on record saying we need a price on carbon to fight climate change and limit global temperature rise to 2 degrees Celsius by the end of this century. But these statements were slightly different.

Musk's conversation with the Reno Gazette-Journal at first focused on the tax breaks Nevada offered Tesla in order to sway the company to build in the Silver State. The question-and-answer session then morphed into more of a libertarian case for why a carbon tax is necessary.

When asked about subsidies for his company -- and the clean-energy industry at large -- Musk retorted with an attempt to turn such an argument on it head. He first called out subsidies for oil and gas, evident in the worldwide subsidies documented by organizations including the International Energy Agency (IEA).

“With respect to some of the other elements for solar panels and [electric vehicles], the big issue we have is that in reality if you accept the scientific consensus, every oil-burning activity is subsidized -- dramatically,” Elon Musk told the Reno Gazette-Journal.

If one believes there is value to the world’s atmosphere and oceans, and if such financial damages are not accounted for at a gasoline pump or coal-fired power plant, then the answer to many should be clear, Musk explained. Fossil fuels are already massively subsidized without any incentives to mitigate energy companies’ impact on the environment.

The solution, Musk went on, is to correct this “fundamental economic error” by establishing a carbon tax. Such a levy would correct the ongoing scenario of polluters emitting carbon and toxins into the air because there is no mechanism available to limit them. For libertarians who oppose any government intervention in the economy, such a tax could help solve this issue with minimal involvement.

An increasingly diverse coalition is calling for a carbon tax, and it includes the conventional energy companies that businesses such as Tesla are threatening to undermine. For example, ExxonMobil -- which has called for a carbon tax since 2009 -- recently amplified its message and said it will lobby the federal government more aggressively on this front.

From the energy companies’ point of view, such a tax is necessary for two reasons. First, it would create more certainty in the marketplace and help companies plan for future investments. Second, energy companies would prefer such a tax instead of more regulations across all levels of government — as well as in the overseas markets in which these companies operate.

Most advocates of carbon pricing agree that such a tax should be revenue-neutral, as ExxonMobil also suggests. British Columbia and Switzerland have already implemented such policies. Many analysts suggest these policies can even create jobs and stimulate the economy while encouraging further deployment of clean energy.

According to the Brookings Institution, revenues from a carbon tax could also help cushion the economic blow in regions such as West Virginia, where the decline of coal is severely impacting local communities. At a macroeconomic level, a carbon tax could be redistributed to taxpayers as rebates to help soften the blow of increased energy prices while more electricity generated by renewables is connected to the grid.

The bottom line is that carbon pricing can help transform national economies with minimal interference from regulators.

Musk’s call for a carbon tax echoes other analysts with a libertarian streak who see the need for solutions to climate change, but advocate for a more market-based approach. Case Western University Law School’s Jonathan Adler, for example, argued that a carbon tax would be more transparent and less onerous to implement than additional regulations or programs such as a cap-and-trade system. Ed Dolan, an economist, argued that a carbon tax would be a counterweight to regulations, as such pricing would put the onus on energy companies and heavily polluting industries to change how they operate – keeping the government out while making these companies responsible for their own environmental impacts.

But for a carbon tax to work here in the U.S., it would have to be implemented at a national level. And a recalcitrant Congress would never consider such legislation. But if today's motley crew of carbon pricing supporters, with energy companies in the mix, can make a business case (and write a few checks to some campaign accounts), perhaps such a policy can finally come to fruition after this year’s election.

Image credit: NVIDIA Corporation/Flickr

Don't Swallow: Rio Faces Health Concerns Ahead of Summer Games

As Olympic competitors converge on the Brazilian city of Rio de Janeiro this week, they come armed with important information that is meant to enhance their chances of winning that prestigious gold medal. Strategy and endurance play heavily into an athlete's competitive performance, but so does environment -- especially this year.

This season, in addition to getting a longer-than-usual list of vaccinations (diphtheria, rubella, haemophilius influenza type B, tetanus and polio are just a few), they will likely been coached on things to do and not do while competing in the Olympic games. This includes keeping one's mouth shut -- and not swallowing -- while swimming in Rio's polluted Guanabara Bay.

“Foreign athletes will literally be swimming in human crap, and they risk getting sick from all those microorganisms,” Dr. Daniel Becker told to the New York Times a few weeks ago. "It's sad but also worrisome." Becker is a pediatrician working in Rio.

Pollution isn't anything new on Rio's beaches. Sewage and untreated garbage have put key locations like Flamingo Beach off limits for swimming for years. Such pollution also makes it more likely that athletes competing at other beaches could get sick from the foamy sludge that percolates along the coastline.

The city has promised to clean up the water for years. Local government made a cleanup plan part of Rio's bid for the 2016 Summer Games, projecting an 80 percent cleanup by this year. And while those efforts are still far from complete, other cities, like nearby Niteroi prove that cleaning up Guanabara Bay is attainable.

Located a half-hour's boat from Rio on an adjacent coastline, Niteroi credits its use of a private sewage contractor and a reliance on public-private collaboration for its success. The city has already met the 95 percent benchmark in cleaning up its once-polluted beaches and is optimistic in meeting the 100 percent mark this year. Rio, on the other hand, is far from its stated goal of 80 percent cleanup.

It's not like environmental pollution is new to the Olympic Games. Contrary to what sports fans may think, the world's most prestigious game venues aren't usually chosen because they enhance robust health and fitness. In fact, many prior host cities were plagued with pollution, forcing competitors and tourists to be on alert for health concerns.

The 1968 Summer Olympics were held at more than 7,000 feet altitude in Mexico City, a city well known for its air pollution. In many cases, cities promised to devote a portion of revenue from the games to help address environmental concerns. Such promises were made in Albertville, France in 1992 and Beijing, China in 2008. Instead, both cities faced heavy criticism for their inability to control environmental degradation prior to the games, and as a result of the games' impact.

That's not to say all host cities struggled with environmental degradation and pollution while preparing for the games. Sydney, Australia, used its Olympic bid to boost pubic transportation with infrastructure that stayed in place after the games. Vancouver, British Columbia, Canada, did the same in preparation for its hosting of the 1986 World Fair.

With Zika still prevalent in Brazil, some athletes and physicians are questioning the value of holding a global competition in Rio this year. To date, more than a dozen athletes have turned in their tickets to the games, either due to concerns over Zika or other personal reasons.

And so far, more than 130 physicians across the globe signed a letter to Dr. Margaret Chan, director general of the World Health Organization (WHO). They called on Chan to either move or postpone this year's Summer Olympic Games in light of the possible risk to the public from exposure to the Zika virus. The WHO and the U.S. Centers for Disease Control and Prevention (CDC) maintain that Brazil's cooler weather at this time of year considerably reduces the risk of contracting the virus.

Some physicians are not convinced, however, and the roster of signatories is still growing. "We make this call despite the widespread fatalism that the Rio 2016 Games are inevitable or 'too big to fail.' History teaches this is wrong," say the signers. They point out that other Olympic games have been delayed, moved or cancelled due to risk to competitors or the public, including a Women's World Cup, which was rescheduled by the international football federation, FIFA.

"Given the public and ethical consequences, not doing so is irresponsible," the group concludes.

Image credit: Flickr/Rodrigo Soldon

More Charges for Officials Linked to Flint Water Crisis

The tragic Flint water crisis saga continued last week with more criminal charges. Six current and former state employees were charged with office misconduct, conspiracy and willful neglect of duty -- effectively bringing the total number of officials charged to nine.

The story began in the summer of 2012, when Flint, Michigan, officials sought to save money and explore alternative ways to provide its poverty-riddled city with a different water source. Flint previously relied on the Detroit Water and Sewerage Department for its water services. But the cost became increasingly unaffordable as the two cities — Flint and Detroit — saw their populations plummet. In 2004, Flint paid $11 million per million cubic feet of water. But nine years later, they saw the price spike to $19 million per million cubic feet.

But the search for a cheaper, alternative source wasn't worth the lead exposure that came from rusted, outdated pipes that carried highly corrosive water from the Flint River.

In an impoverished city that has seen unemployment rates climb, homes abandoned and companies shut down, the contaminated water only makes Flint more of a nightmare.

On top of the aging pipes and high lead levels, there has been an awful amount of mismanagement from officials Michigan’s Department of Environmental Quality (MDEQ). On July 13, 2015, a spokesman Brad Wurfel told radio listeners and Flint residents that they “can relax.” A month later MDEQ ditched two samples revealing high lead levels from a report, intentionally skewing the results of the test to meet federally-mandated requirements.

Wurfel made the news again when he openly refuted a study by Virginia Tech which tested hundreds of homes and revealed “‘serious’ levels of lead in city water.” When finally faced with the question of why corrosion control protocols weren’t in place to prevent any rusting pipes, MDEQ Director Dan Wyant blamed it on a misunderstanding about which protocol to follow given the population size of Flint — the team was following standards for a city with a population under 50,000.

It took all of that, plus a December 2015 State of Emergency issued by Flint’s mayor, for Wurfel and Wyant to officially announce their resignations. A report issued by the governor-created Flint Water Advisory Task Force pinned the primary responsibility for the fiasco on MDEQ.

The Task Force concluded:

“From a regulatory standpoint, to a protection of human health and the environment standpoint, they missed the boat completely. And it is extremely troublesome to me that an agency whose primary role, once again, is to protect human health and the environment came to these decisions, and they never backed off these decisions, no matter how many red flags they saw.”Michigan Attorney General Bill Schuette announced on April 20, two years after the saga began, that three officials — two MDEQ state officials and one city employee — would face criminal charges. Now, more than three months later, Schuette announced six more charges, three of which were against former MDEQ employees.

“Each of these individuals attempted to bury or cover up, to downplay or to hide information taht contradicted their own narrative, their story … These individuals concealed the truth and they were criminally wrong to do so,” Schuette said at a news conference last week in Flint.

Schuette hinted at the press conference that the recent charges may not be the last.

“We are way far from done,” Schuette said.

The Detroit Free Press reported that the investigation is expected to run a bill of at least $4.9 million.

Photo by Senate Democrats/Flickr

In the Age of Terror, What About Impact?

By Dr. Maximilian Martin

“Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.”No more safe locations. Temporary or permanent?

― Marie Curie

The financial crisis took away the notion of safe assets. The recent terrorist attacks in France, Germany, Saudi Arabia and the United States have done away with the notion of safe locations. The world has experienced a negative-step change. The question that looms now: Is this dangerous trend a temporary or permanent one?

Be it on the investment side or on the philanthropy side, for anyone engaged in the world of impact, this invites a series of questions that we had better not dodge. Perhaps most importantly is to consider how one can play a productive role in containing these violent challenges.

Security touches everyone. The dark side of the Age of the Citizen has arrived.

The Age of Terror is the dark side of the Age of the Citizen. Individuals have a greater power to create change than ever before in human history. Alas this holds true for negative change as well. In Bangladesh, a terror attack on a restaurant in Dhaka resulted in the tragic deaths of 20 hostages on July 1, many of them expatriates. The independent, a local newspaper in Dhaka, wrote last week that the “masterminds [had been] identified.”

The worst terrorist incident in the country’s history to date is hardly a development that makes bringing foreign investment capital to the country easier. Expatriates are resigning from their jobs, and hotels are empty. Yet the country needs money and specialist expertise to keep modernizing, and offer the poor majority a stake in society. For this reason my firm, Impact Economy, is working to render garment supply chains investable for impact in the country.

How can we avoid being the tail that wags the dog? No moving around deck chairs on the Titanic.

The enthusiasm about the emergence of new concepts that marry markets and social impact has been contagious. It is now time to seriously ask ourselves what we can do so this adds up to what’s needed to be done.

In 2003, I developed the first university course on social entrepreneurship in Europe. I am amazed how much the idea of social entrepreneurship has taken off since then. A whole social entrepreneurship “tribe” has come into being around the world.

The many are still a small minority in the big scheme of things. The Impact Tribe ought to amount to more than a tail relentlessly trying to wag the dog. Or worse, end up as great action on the deck of the Titanic when what needs fixing is the hull.

How can philanthropy step it up? Align with the realities of financial markets.

Even advanced economy governments are struggling to uphold cherished basics such as the monopoly of violence. The strong state that properly takes care of all its citizens’ needs is a fantasy. Markets are not a panacea to all problems either. This is not the moment to write off the importance of philanthropy, however old-fashioned it may seem to some. The idea of a “personal impact” keeps gaining ground. With their actions, more and more people are consciously trying to make a positive difference to the greater good. The question is how we can expect all of this to add up.

Today something fascinating is going on in the world of philanthropy. Patterns of wealth creation are turning out more and more people with the financial degrees of freedom to fund their philanthropic aspirations. The World Wealth Report 2016 expects high net worth individuals’ (HNWIs) financial wealth to almost double from $56.7 trillion last year to $106 trillion in 2025. The question is: What kind of world we will live in then?

(Endowed) institutionalized philanthropy is under very serious pressure on the other hand. The impact revolution has raised expectations about what a philanthropic effort needs to deliver over the short and medium term. The edifice of relationship-driven philanthropy is creaking. At the same time, the persistent zero interest rate environment undermines bond strategies. It leads to a reduction of sustainable revenues other than fresh donations. This is a problem for all established endowed foundations, which do not own a profitable company asset. They need to invest on capital markets, and still expect to pay out 2 to 5 percent of their endowment per year.

At the level of the individual institution, the only logical way forward will be a serious trimming of the fat on the grant administration side. This by leveraging information technology to deliver a similar or better philanthropic experience, at a lower cost. And without destroying the magic of creativity and relationships in philanthropy. Structurally, this challenge does not look so dissimilar compared to non-philanthropic (aka commercial) banks. Consider the triple whammy: over-regulation and dwindling margins have put their business models under real pressure. Technology lowers barriers to cannibalizing their offerings.

What about impact investing now? Put the foot on the accelerator.

Excluding illiquid assets and cash, the World Wealth Report 2016 calculated that 31 percent of high net worth investment portfolios around the world are based on the concept of social gain. Almost half of HNWIs said they expected to increase their impact investments over the next two years. This idea is gradually going mainstream.

In 2013, I wrote the baseline report circulated to all participants to the then G8’s first conference on impact investing. It was hosted by then British Prime Minister David Cameron. Now Brexit is under way. Impact investing is still looking for the amount of deal flow needed to graduate from a satellite to a core investment strategy. It is obvious that it would be too early to congratulate ourselves.

Rather than despair, we now need to put the foot on the accelerator. This includes acknowledging what works and what does not. In the end, fundamentals have the power of gravity. For example, deal size matters to absorb management costs. In an impact investing space where much still needs building, the sub-tribes of venture philanthropists and impact investors need to find ways to routinely work with each other, as part of an ecosystem. That is more productive than pointing fingers at the other’s supposed not getting what matters or how the world works. (For readers who want to unpack what this point is getting at, have a look at my recent book “Building the Impact Economy: Our Future Yea or Nay.”)

So what’s the job for Generation Impact? The time for 'small small' is over.

It is obvious that our post-Second World War way of life is under threat as never before in recent history. We had better make sure that the threats remain temporary, rather than becoming permanent.

Now is the time to ask ourselves hard questions about how we can plan to rein in the threats. Or better, how to put them back into Pandora’s Box. How can the “Impact Tribe” rise to the challenge? For sure, when it comes to bringing about a new order of things, passionate, talented people have a lot to bring to the table. Just think about the amazing amount of energy that has gone into formulating solutions to climate change and mobilizing people. COP21 would not have gone the way it did otherwise.

The bottom line is this: We need to carry on. The time for small small is over though. We need to develop a compelling vision for a resilient, prosperous world -- and we need to make it happen quickly. Formulating answers that work may require going outside one’s comfort zone. It will involve large-scale decisions shaped by the electoral process. This in addition to entrepreneurial and philanthropic action. Let us get started before the space for private initiative based on the love of humankind, and creativity, has been damaged irreversibly.

Image credit: Flickr/UCI UC Irvine

Maximilian Martin is the Founder and CEO of Impact Economy. Dr. Martin has been privileged to witness the impact revolution for almost twenty years from a variety of vantage points, including working for a strategy consultancy, a foundation, a bank, and running a startup. Having built knowledge and infrastructure which others have found useful, and having gotten his hands dirty implementing projects on the ground, he wants our generation to succeed at mastering the challenges that now lie before us.

Study: Abstinence Education Does Little to Prevent HIV/AIDS

Since 2003, the United States has devoted nearly $1.5 billion toward abstinence programs in Africa, aiming to halt the spread of HIV worldwide. The program was funded as part of a larger initiative — the President’s Emergency Plan for AIDS Relief, or PEPFAR — that targets regions deemed most susceptible to the disease.

PEPFAR, with funding from the U.S. government, has doled out more than $52 billion to fight the epidemic that debilitates nearly 40 million people worldwide. Most of the funding went toward medicine, testing and counseling. But a portion of the funds were allocated toward so-called preventative measures, like advertising that encourages Africans to wait until marriage to have sexual intercourse.

Health officials rave about the number of people receiving treatment. PEPFAR’s most recent annual report revealed the program tested and counseled more than 68.2 million people in 2015 alone. It’s also credited with supporting “life-saving antiretrovial treatment” for more than 9.5 million people.

And while PEPFAR as a whole appears to be a successful program agreed upon by both Republicans and Democrats in Congress, its abstinence funding may have been misguided.

Earlier this year, researchers from Stanford compared HIV/AIDS trends in 22 sub-Saharan African countries. Their research, published in the journal Health Affairs, found no association between PEPFAR funding for abstinence and faithfulness and a significant change in "high-risk sexual behavior.”

The researchers analyzed surveys collected from nearly 500,000 people who were asked a range of questions from “How many sexual partners do you have?” to “At what age did you first have sex?” Fourteen of the countries studied received PEPFAR funding, while the remaining eight did not. They found that the countries receiving abstinence funding through PEPFAR did not adopt lower-risk behaviors any faster than those without such funding.

Although the more than $1.4 billion devoted to abstinence training doesn’t represent a big chunk of the $52 billion set aside to combat HIV/AIDS, the study suggests it would be wise to find alternative funding priorities in order to “yield greater health benefits.”

That $1.4 billion was spent on sex education classes in schools and for public health advertisements on billboards and the radio. Funding for the abstinence program has been on the decline in recent years following its peak spending in 2008, when PEPFAR was rationing $250 million toward the program. In 2013, the funding of the abstinence and faithfulness program dropped to just $40 million.

NPR asked the agency whether or not the study would lower the funding even more. PEPFAR noted that the organization has a live platform and has adjusted its mission statement based on scientific studies and data before.

Image credit: Terrie Schweitzer/Flickr

Better Business Habits Can Embed Sustainability Into Your Organization

By Dale McIntyre

Today’s consumers favor businesses that try to make a positive impact on society and the environment. Last year, Nielsen found found that nearly 75 percent of millennials are willing to pay more for a sustainable product.

Two years ago, our company leaders at Pharos Systems International decided it was time to push ourselves and our employees toward an authentic mindset of sustainability that’s aligned with our brand. We began working toward certification as a B Corporation to demonstrate our commitment to the highest standards of social and environmental responsibility.

One step was to review all the products we use at the office to ensure that we buy from other companies that are committed to sustainability. We even changed the coffee we drink. To make it fun, we created a monthlong tasting poll, introducing a new sustainably sourced coffee each week.

The contest made the rationale for the change clear, and participation was strong. Our colleagues voted for their favorite brew, and we now purchase organically grown and sustainably sourced beans from a certified B Corp roaster. This type of change can be a lot of fun and a great engagement tool for employees.

But the work wasn’t all this simple and easy. In fact, it can be quite hard to become a certified B Corp — and it should be; it should require rigorous commitment. Too often, unsubstantiated claims are tossed around, and such greenwashing can affect how sustainability efforts are perceived. But when it’s clear your effort is genuine, you’re in for some unexpected benefits — from key millennial hires to new business partnerships with like-minded companies.

Here are some tips we learned along the way.

3 bad habits most organizations don’t realize they have

Companies can stop doing a few simple things to improve their carbon footprint and enable a mindset of sustainability to permeate their organizations.

1. Shopping by price alone. When price is the top priority, as is often the case with many purchasing professionals, important considerations may be lost. Shopping by true cost also takes into account the environmental and social impacts of a purchase.

The source of the cheapest cotton, for instance, may come at a greater social cost, as labor practices in some countries are not close to what we consider acceptable in the U.S. Likewise, goods may have to ship from farther away, which increases their carbon footprint. It’s important to evaluate the potential impact and cost before you make purchasing decisions.

2. Ignoring your individual carbon footprint. Our daily decisions impact the environment, both locally and globally. We drive to the office, turn on the lights, and plug in our computers without giving much thought to these routine actions.

It takes effort to establish new habits, like carpooling or taking public transportation when possible or remembering to turn off lights and computers instead of leaving them on for marginal convenience. Seemingly small acts can collectively make a significant difference.

3. Printing mindlessly. The paperless office has been hyped for the past 20 years, but it’s still not a reality for many companies. Print has many virtues in business, and it has improved: Printers are more efficient, and a variety of recycled paper and ink cartridge options are available. But these incremental improvements don’t mean the cost of printing is negligible. For many organizations, it’s one of the highest cost categories, and that cost is highly correlated to environmental impact.

People print for one of two reasons: to obtain a process-required hard copy or out of a habit of convenience. Fortunately, there’s technology that makes it easier for companies to reduce expensive, nonessential print volume.

4 steps to establish better habits

Company leaders can encourage employees to become more mindful of their behavior through engaging initiatives that encourage sustainability and help to establish better habits.

1. Prioritize. In nearly every facet of office life, there’s room to improve processes and behaviors to make them more sustainable. This presents many opportunities for growth, but too much at once can make initiatives seem unfocused and overwhelming for employees.

Start by championing five or fewer efforts. Dive deep to determine what’s most important in terms of value, as well as which harmful practices are most common in your workplace.

2. Set expectations, and explain them clearly. Set measurable sustainability goals for the long term — five years is a typical timeline. These metrics should be specific and tie in to your overall corporate strategy.

Instead of simply telling employees to reduce unnecessary printing, set a target to cut your organization’s total print volume by a desired amount — say, 50 percent.

3. Communicate, communicate, communicate. One factor that led to our achieving B Corp certification was the creation of mission statements and policies around our social and environmental impacts. To communicate these to everyone in the company, we produced training videos and tracked engagement.

To get people fired up, host discussions on your internal website and send invitations to conservation events like the daylight hour, when businesses volunteer to turn off lights for an hour and work by daylight. Such things help demonstrate the surprising impact that small actions can have when they catch on.

4. Create an internal sustainability interest group. When we did this, it was like pouring gas on a fire. We were pleasantly surprised by the high level of interest across the organization.

Identify employees who are already committed to sustainability, and ask them to take ownership of some of the initiatives. This has become one of our most active teams — the members use their personal time at lunch to work with this group, and the mutual learning and idea sharing has led to many effective programs.

Sustainability isn’t just a buzzword or something you can pay lip service to and then go about business as usual. It takes a lot of work and cooperation, but in the end, your reward will be engaged, proactive employees who care about creating a better world and a healthier, more profitable company.

Image credit: Pixabay

Dale McIntyre serves as a vice president at Pharos Systems International, an enterprise print solutions provider based in Rochester, New York. Dale provides strategic leadership in the areas of sustainability, brand, and customer engagement. He regularly shares his unique sustainability perspective on print strategy through blogs, webinars, and appearances.

3 Surprising Reasons For Low Oil Prices

The smiles on our faces while pumping gasoline comes from a historic 50 percent fall in oil prices. Most news commentators point to an oil over-supply as the reason. But that begs the question: Why? Since 1974, the Organization of Petroleum Exporting Countries (OPEC) has curtailed oil supplies to raise prices and profits. What changed that is causing oil producers to keep on pumping oil in the face of lower prices?

Steve Hanke, professor of applied economics at John Hopkins University, uses Net Present Value analysis to suggest why oil producers are selling so much oil at today’s low prices. In layman's terms, he believes oil producers are harvesting the proverbial bird in hand because they know that the two in the tree are taking flight. If so, what does that mean to us, our environment and the future for low pump prices?

Is the Net Present Value of oil changing?

Net Present Value is a tool for answering the question of whether you make more money selling a barrel of oil today for $40 or holding it for five years before selling. You would sell today if you think that $40, plus your future earnings on the $40, will be higher than a future price of oil. You would curtail supply and sell later if you are confident that the price of oil will rise higher than what you can earn on selling the oil today.

OPEC was formed to ensure future high oil prices or an escalating Net Present Value. OPEC pursued a strategy of curtailing supply to drive prices higher based on two key assumptions:

- The consumer thirst for oil will continue to increase

- The future will always allow individual oil producers to sell all the oil they want.

But what if today's oil producers see a disruptive future that negates these key cartel assumptions? Could we be on the threshold of a new era for oil, oil prices and oil emissions?

Disruptive changes devaluing oil and oil producers

There are three disruptive 21st century mega-trends that hold the potential of completely upending the role of oil in our economy and how oil emissions (plus coal emissions) are creating global warming. These three mega-trends are:

- Global warming is creating a Middle Eastern catastrophe. The Middle East is heading toward a climate catastrophe created by global-warming-enhanced heat waves. It is projected that the Middle East will become uninhabitable due to heat for months during the year. If the Syrian Civil War is actually a war over water scarcity acerbated by global warming, then consider the ramifications if the entire Middle East were too hot for humans. Assume you are Saudi Arabia, Iran and Iraq. Using Net Present Value analysis, it is better to sell all the oil you can at today’s low prices than bet on surviving the cooking of the Middle East.

- Electric cars win. Today’s electric cars are a niche market. The hybrid plug-in Chevy Volt just achieved an industry leading 100,000 unit sales since its 2011 launch. That success represents one half of one percent of 2015 U.S. car and truck sales. But electric cars are just now entering a period of declining prices driven by technology innovations and manufacturing economics of scale. In 2017 both Chevy and Tesla will be launching electric cars with a 200 miles range that sell for less than the average price of a new car (after incentives). 75 cents is the price per gallon equivalent for refueling an electric car from the grid. Many solar homeowners are refueling for “free.” Plus electric cars have faster straight-line acceleration than most V-8s. How soon will America, and the world, shift to electric cars if they cost less to buy, cost less to run, can be refueled at home or work, accelerate faster and social influencers pronounce them as “cool?” Even more so, if autonomous electric cars become a mainstream technology then ground transportation, and oil consumption, will forever be radically changed.

- World’s voters demand climate change solutions. How many more floods, droughts and wind storms will it take before voters demand that their government address manmade climate change? How will a swing state like Florida vote if its precious coastal cities are overwhelmed with costs tied to pushing back rising sea levels? Will voters in the United States, Japan and Europe continue to accept losing jobs to countries that win competitive advantage through pollution? If voters do swing on these issue then how much oil can be sold in a future where governments enact regulations, trade policies and taxes to curb emissions?

Not if but when

Oil producers are numbers driven, rational people. They are selling so much oil today because their future looks disruptive.

As consumers, we are not acting rationally. We are loving low gas prices to the max by buying record numbers of SUVs and full size pick up trucks.

Who do you think is right? Are the oil producers wrong to see a future where oil demand (and prices) fall because electric and autonomous vehicle technologies displace gasoline powered vehicles? Is Saudi Arabia, Iran and Iraq wrong to pump out all the oil they can because they see a coming climate catastrophe? Or are Americans right to live for today by buying gasoline powered vehicles that can take up to seven years to pay off? One of these two groups is really wrong. I am betting it is not the oil producers.

Image credit: Pixabay

Seventh Generation Establishes An Internal Carbon Tax

Seventh Generation has been an environmentally conscious company from the get-go. Founded in 1988, the company is named after an ancient Iroquois document that declares that “in our every deliberation, we must consider the impact of our decisions on the next seven generations.”

Now, the company is taking its environmental consciousness to a new level. Recently, Seventh Generation released its Corporate Consciousness 2015 Report which revealed the company is establishing an internal tax on its carbon emissions.

"The carbon tax anchors our greenhouse has reduction strategy in the heart of our business, activating our entire organization in support of our 2020 goal to obtain our energy from non-fossil fuel sources," said CEO John Replogle in a statement. "Decreasing our carbon footprint is mission-critical for Seventh Generation in caring for the next seven generations."Many companies put an internal price on carbon. A 2015 CDP report on carbon pricing in the corporate world found that the number of companies doing so tripled since 2014. A total of 435 companies participating in CDP’s survey reported using an internal price on carbon, up from 150 in 2014.

The companies include what CDP called “highly trusted brands,” such as Colgate-Palmolive and Campbell Soup. The list also includes global industrials like General Motors and financial giants like TD Bank. The “dramatic increase” in companies using an internal price on carbon “demonstrates the ongoing mainstreaming of carbon pricing as a high priority for business and an essential component of the corporate strategy toolkit,” according to CDP.

Seventh Generation's progress toward its 2020 goals

Seventh Generation has made good progress toward its 2020 goals, as the report details. One of those goals is to replace all virgin plastic used in product packaging with recycled or bio-based plastic and to look for plant-based alternatives to petroleum-based ingredients. The company has met 80 percent of that goal, to date, up four percent from 2013.The company has another packaging goal and that is for all to be either biodegradable or recyclable by 2020. It has achieved a 69 percent level, an increase of six percent since 2013. The ultimate goal is to generate zero waste for all of its products and packaging, and Seventh Generation states that is progressing towards that goal.

Seventh Generation’s research and development (R&D) teams are “focusing intensively” on its diaper products. Its Touch of Cloth diapers replaces a synthetic outer layer with a soft layer of 70 percent unbleached cotton grown in the U.S. and 30 percent plant-based rayon, both biodegradable materials. Through the use of cotton and plant-based rayon, 80,000 pounds of petrochemicals have been avoided in one year.

The use of recycled materials has saved 154,000 trees and 400,000 million cubic feet of landfill space. The use of plant-based and non-volatile organic ingredients (VOCs) saved 49,000 barrels of oil and 206,000 pounds of VOCs.

In one area Seventh Generation hasn’t made progress in the last few years. It has a goal to source only agricultural materials that are certified sustainable by a credible third party. Currently, 78 percent of wood pulp sourced is certified by the Forest Stewardship Council (FSC), which is down three percent from 2013, which the company attributes to changes in product mix FSC certification that ensures wood is harvested from responsibly managed forests.

Expanding through Seventh Generation Ventures

Two years ago, Seventh Generation started what Replogle describes in a foreword to the report as a “new means of extending our business model with the founding of our investment arm.” That investment arm is called Seventh Generation Ventures, and through it the company has purchased Gamilla, maker of gourmet coffee and tea products, and Bobble, a reusable bottled water company. Through the venture, Seventh Generation can “begin parenting different product lines that meet the growing needs of consumers who desire to live a healthy and environmentally-friendly lifestyle,” according to Replogle.One advantage of Seventh Generation Ventures is that it allows the company to expand instead of focusing on having a larger company buy them out. And it allows them to increase their array of eco-friendly products. Or as Ariel Schwartz, senior editor for Fast Co.Exist, put it in 2014, through Ventures, Seventh Generation is “buying a mini-empire of sustainable companies."

Image credit: Flickr/Elizabeth

Remember Teddy Roosevelt: Conservation Shouldn't Be Partisan

An environmentalist and a Republican walk into a bar...

The punch line is that the Republican and environmentalist are the same guy. Though it needn’t be a “punch line” at all.

Jim Brainard, mayor of Carmel, Indiana, reminds as many as will listen -- Democrat, Republican or “none of the above,” but especially his GOP colleagues -- that it wasn’t always like this.

“I like to try to look at it from a historical context,” Brainard told TriplePundit by telephone from his office shortly before leaving for the GOP convention earlier this month. “It was Teddy Roosevelt that set aside most of the national parkland. It was Dwight Eisenhower, a Republican, who set aside the Arctic Reserve. It was Dick Nixon who signed legislation for the EPA, the Endangered Species Act, the Clean Water Act, the [amended] Migratory Bird Act … our entire federal environmental regulatory system [was formed] under Nixon.”

Even Reagan himself had sympathy with environmental causes.

“[Reagan] believed the scientists who spent their lives studying these issues, went to Montreal and signed the Montreal Protocol to deal with the ozone hole,” Brainard said.

Wait, Reagan?

Reagan certainly did right on behalf of the global community when he signed the Montreal Protocol. But it’s also fair to say that the Reagan administration had an uneasy relationship with domestic environmental protection. During Reagan’s tenure, my father worked under Secretary of Interior James Watt, infamous for his disdain of conservation, environmentalists and liberals.

As chief of the biological services branch for the Office of Surface Mining, my father’s division was responsible for overseeing mine reclamation throughout the American West. Watt wanted none of it.

“Watt made our life miserable when I worked at OSM,” my father recently told me:

“He wanted to do away with us and tried to close our Denver office. It was miserable working for OSM then. It got so bad [that] everybody was desperately sending applications and trying to leave before Watt managed to get rid of us. But things did eventually stabilize. Watt had to be the worst Interior Secretary ever…” (Though Albert Fall, made infamous by his involvement in the 1922 Teapot Dome scandal, is arguably a strong contender.)

Watt’s intransigence for environmental law and conservation hints at an assumed narrative among many conservatives toward conservation that is often characterized as “environmental fascism.” Watt notoriously suggested that his critics had a “larger objective” of central control similar to the German Nazis and Russian Bolsheviks.

Such utterances from Watt proved a political liability for Reagan, eventually leading to his dismissal as Interior Secretary. Watt still managed to quintuple the amount of federal land leased to coal mining operations. He clearly valued unchecked development over preservation, conservation or reclamation.

For Brainard, this isn't being a true conservative at all.

Not your father's conservative party

Does Watt's partisan extremism represent a fracture in the conservative tradition? Maybe so, at least the tradition of conservation of which Brainard speaks. “Traditionally, these issues have been more or less non-partisan,” Brainard told us.

Take, for example, the Land and Water Conservation Fund. The LWCF provides for parks, wildlife refuges and historical cultural sites with money raised from offshore oil and gas development on the outer continental shelf. “That was done by unanimous voice vote in the House when it was first passed 51 years ago,” Brainard said.

If the creation of the LWCF demonstrates the promise of environmental non-partisanship, its subsequent implementation reveals a more troubled narrative, one that dogs the GOP to this day. Beleaguered by consistent underfunding, the LWCF has died a thousand deaths since its passage.

Congress denied permanent reauthorization of the fund last September. Temporary reauthorization was granted in December. The Energy Policy Modernization Act of 2016 seeks to make that permanent, but even with support from some Congressional Republicans, its future remains uncertain.

Despite the non-partisan impulse of their predecessors in Washington, conservation, environmental protection and sound energy policy struggle to find common ground in Congress. Mayor Brainard insists it doesn’t have to be this way.

“Quite honestly, if you’re conservative, but have questions about the science, wouldn’t you err on the conservative side, that there is a problem, as opposed to the more reckless -- you could say, liberal -- position and say, 'No, it’s not a problem. I don’t believe the scientists,’” Brainard asked rhetorically.

The view from the back porch

A popular six-term mayor, Brainard was awarded the Bicentennial Green Legacy Community Award for spearheading numerous initiatives,including energy efficiency and alternate-fuel city vehicles, a curbside recycling program, promoting mixed-use, pedestrian-friendly development, expansion of public green space, and implementation of roundabouts throughout the city to ease congestion and reduce pollution.

"... Carmel, through the mayor's leadership and community engagement, has distinguished itself as being a model of sustainability and is on a path that is exemplary,” John Gibson, state coordinator for Sustainable Indiana 2016, said in a press briefing.

“I think there are a lot of Republicans that do care about the environment. Certainly the environment in their cities,” said Brainard, referring to an old saying that “everybody looks at their city from the back porch.” Indeed, the nexus of change happens at the city level, where people live. “I have yet to meet a Republican, or a Democrat, that want to drink dirty water or breathe dirty air."

“There’s no ‘Republican’ way and no ‘Democratic’ way to move snow, fill potholes, run the fire department -- mayors are about providing services and a high quality of life to their constituents,” Brainard said. People living in cities “are concerned about climate."

As a trustee of the U.S. Conference of Mayors and co-chair of the Energy Independence and Climate Change Task Force, Brainard regularly takes his message to Washington. “Ninety-nine percent of the mayors in the country, at least one-third of whom are Republicans, signed, in essence, the Kyoto Protocol,” said Brainard, pledging voluntary targets to reduce emissions in their cities.

“I wish the Republicans in Washington got out more and talked to their average constituents more about what really concerns them,” Brainard said, “because I think there’d be a sea-shift of change if they would.”

BP: Beyond partisanship

Politics is, after all, about the art of the possible, not about “us” versus “them.” Or at least it should be.

“I’m so tired of party labels,” Brainard said. "[Conservation] should be a non-partisan issue."

“Our nation’s discussion should be about ideas, economic opportunity, and how it makes life in the United States better … and Americans safer. Not about party politics," Brainard says. "I'm very concerned that the debate has become so one-sided that people serving in Washington, in one party or the other, are literally told how to think about issues. That’s why I talk to the media and try to make an effort about it. Hopefully, if I do it, other Republicans that feel the same way but kept it quiet may start speaking out about it.”

Whether that will happen in the current divisive, circus-like atmosphere of American politics remains to be seen. If Brainard's outlook on environmental issues appears to rub against the grain of the Republican party in Washington, it doesn't seem to bother his constituents.

Adam Rome, writing in Discourse in Progress, echoes the historic conservative tradition of conservation:

"In October 1969," Rowe wrote, "six months before the first Earth Day, columnist James Kilpatrick challenged fellow conservatives to help solve the nation’s environmental problems. He feared that the Right would make little headway unless it overcame its image as 'the negative party,' and he argued that the issues of pollution and sprawl and DDT poisoning of the environment provided perfect opportunities to 'translate broad conservative principles' into 'affirmative actions.' The degradation of the environment, he concluded, was essentially 'a problem of conservation — of conserving some of the greatest values of America; and conservatives, of all people, ought to be in the vanguard of the fight.'”

We’ll all just have to hold our noses, move to common ground, and work together to figure these challenges out. They aren’t going away nor will they ever be solved through political posturing.

Circling back to our opening one-liner: a Republican and an environmentalist walk into a bar. It's no joke.

They sit down over a beer and consider how they can make their communities better for all their neighbors. Is that such a radical idea?

Remember Teddy Roosevelt.

This post is dedicated to my Father, who spent a career in public service and environmental stewardship. Through Republican and Democratic administrations, Dad stayed true to his calling -- to make a good life for his family and a better world for all. Thanks, Dad!

Image credit: Jenni Konrad under creative commons license, courtesy Flickr

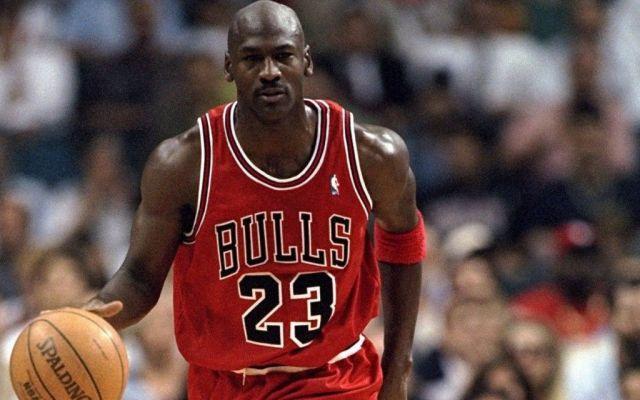

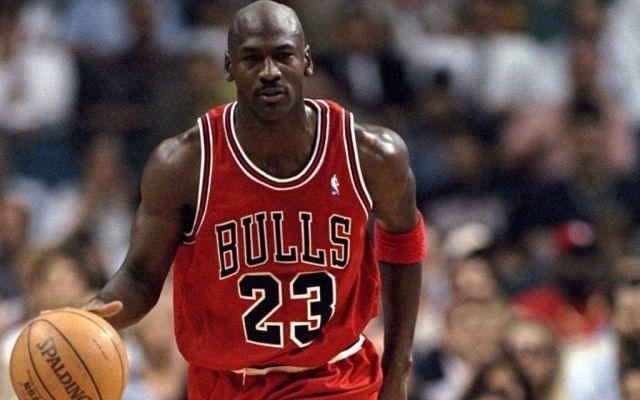

Michael Jordan Donates $2 Million Amid Recent Violence

Michael Jordan, one of the most decorated athletes of all time, used his stage and his bank account to speak out on the recent shootings of African Americans and police officers. The Charlotte Hornets owner and Chicago Bull legend donated $1 million each to the Institute for Community-Police Relations and the NAACP Legal Defense Fund to bridge the tensions between the blue community and the black community.

Jordan released a statement to The Undefeated outlining his concern for the recent violence and his hope to see the nonsense cease.

Here is his full statement:

“As a proud American, a father who lost his own dad in a senseless act of violence, and a black man, I have been deeply troubled by the deaths of African-Americans at the hands of law enforcement and angered by the cowardly and hateful targeting and killing of police officers. I grieve with the families who have lost loved ones, as I know their pain all too well.Jordan’s father, James R. Jordan, Sr., was found floating in a creek in South Carolina in the summer of 1993 after disappearing for three weeks. Jordan stepped away from basketball following his dad’s death to pursue a career in baseball but never made it out of the minor leagues. He returned to the hardwood a year later and on Father’s Day 1996 emotionally collapsed to the floor after securing his fourth championship, the first since his father’s passing.“I was raised by parents who taught me to love and respect people regardless of their race or background, so I am saddened and frustrated by the divisive rhetoric and racial tensions that seem to be getting worse as of late. I know this country is better than that, and I can no longer stay silent. We need to find solutions that ensure people of color receive fair and equal treatment AND that police officers – who put their lives on the line every day to protect us all – are respected and supported.

Over the past three decades I have seen up close the dedication of the law enforcement officers who protect me and my family. I have the greatest respect for their sacrifice and service. I also recognize that for many people of color their experiences with law enforcement have been different than mine. I have decided to speak out in the hope that we can come together as Americans, and through peaceful dialogue and education, achieve constructive change.

“To support that effort, I am making contributions of $1 million each to two organizations, the International Association of Chiefs of Police’s newly established Institute for Community-Police Relations and the NAACP Legal Defense Fund. The Institute for Community-Police Relations’ policy and oversight work is focused on building trust and promoting best practices in community policing. My donation to the NAACP Legal Defense Fund, the nation’s oldest civil rights law organization, will support its ongoing work in support of reforms that will build trust and respect between communities and law enforcement. Although I know these contributions alone are not enough to solve the problem, I hope the resources will help both organizations make a positive difference.

“We are privileged to live in the world’s greatest country – a country that has provided my family and me the greatest of opportunities. The problems we face didn’t happen overnight and they won’t be solved tomorrow, but if we all work together, we can foster greater understanding, positive change and create a more peaceful world for ourselves, our children, our families and our communities.”

It’s not uncommon for basketball players to use their stage and prominence as a tool to intersect sports and politics. NBA superstars LeBron James, Kyrie Irving, Kobe Bryant and Derrick Rose all donned black shirts reading “I can’t breathe” in pre-game warm-ups to spread awareness of Eric Garner’s death at the hands of an NYPD officer. The Los Angeles Clippers, amid the Donald Sterling scandal that saw their 80-year-old owner go on a racist rant to his 31-year-old mistress, wore their warm-ups inside out and considered not playing in the playoff game altogether.

But when it comes from arguably the best basketball player of all time — six NBA championships, six Finals MVPs, five MVPs, 14 All-Star appearances — people listen. And it’s a rare appearance of advocacy from Jordan, who has traditionally shied away from such opportunities. Kareem Abdul-Jabbar, the NBA’s all-time leading scorer, said Jordan “took commerce over conscious” in a 2015 NPR interview, alluding to Jordan’s propensity to prioritize capitalism over advocacy.

Jordan, who branded his name to be synonymous with expensive, highly-sought shoes, was quoted in NBA writer Sam Smith’s 1995 book "The Second Coming" that he wouldn’t take a political stance in a senatorial campaign because “Republicans buy sneakers, too.” Despite pledging donations to democratic campaigns, Jordan’s recent donations to the NAACP and the Institute for Community-Police Relations appears to be a milestone for the former North Carolina Tarheel.

The star whose worth more than a billion dollars may not be remembered as a great social justice leader like the late Muhammad Ali, but maybe this was Jordan’s coming out party.

Other athletes who have spoken against the recent slew of violence (from The Undefeated):

- Carmelo Anthony

- Chris Bosh

- DeMarcus Cousins

- Cam Newton

- Terrell Owens

- Chris Paul

- Richard Sherman

- Charles Tillman