Fossil Fuel Companies Enjoy Unprecedented Access to Climate Talks

Climate talks kicked off in Marrakech, Morocco on November 7. Delegations of international leaders, organizations and advisers will hammer out how to implement the global climate agreement signed last year in Paris. Fossil fuel companies are involved in a way that The Guardian calls “unprecedented.” The involvement of fossil fuel companies through the trade associations is a conflict of interest because the primary interest of the companies is extracting and burning fossil fuels, something there will inevitably need to be less of in the years to come.

There is another problem with involving fossil fuel companies. They have funded climate change denial. Back in 2011, an analysis by Carbon Brief found that nine out of ten of the authors of over 900 papers that cast doubt on climate change had some sort of relationship with the oil giant ExxonMobil. That is the same company that is in hot water legally for failing to warn investors and the public about the dangers of climate change despite knowing about them in the 1970s. The Guardian reports that ExxonMobil, along with representatives from other fossil fuel companies, will have “unquestioned access to most discussions in Marrakech, will be called upon for advice and will be walking the corridors and holding private discussions with countries that are trying to move the world to stop consuming the products those companies have based their businesses on.”

“Industries responsible for climate change must not be entrusted to solve it,” Kelle Louaillier, President of Corporate Accountability International, wrote in an opinion piece. According to Louaillier, the only way to “implement truly groundbreaking measures” like renewable energy projects “owned and operated by communities” is by removing fossil fuel companies “from the equation.”

Corporate Accountability International released an infographic one week before the climate talks in Marrakech. What it revealed is both the extent of the fossil fuel industry’s access to the talks and their influence over them. Take the World Coal Association, which is an accredited observer at the climate talks. The organization represents some of the largest coal corporations in the world including Peabody Energy, BHP Billiton and Rio Tinto. Trade associations such as the Business Council of Australia and BusinessEurope have members like ExxonMobil, BP, and Royal Dutch Shell. BusinessEurope has a long history of opposing European Union climate legislation. The trade association opposed the EU carbon tax in the 1990s and has tried to tone down the EU Emissions Trading Scheme. According to the organization Influence Map, the climate positions of BusinessEurope are “not aligned with most of its constituents” and it is “more obstructive than sectors most concerned about ambitious climate policy.”

The Competitive Enterprise Institute (CEI) is another trade association which is an accredited observer at the climate talks. The organization, founded in 1984, states on its website that it “questions global warming alarmism.” One of its top funders is ExxonMobil, which has contributed “at least $2.1 million since 1997,” according to DeSmogBlog. The Director of CEI’s Center for Energy and Environment is Myron Ebell, who is a climate change denier. (He's also been shortlisted to head the EPA in president-elect Trump's administration).

Countries representing nearly 70 percent of the world’s population called for the UN Framework Convention on Climate Change (UNFCCC) to identify and address conflicts of interest that may come up between environmental objectives and the interests of certain sectors like fossil fuel groups. The group of countries is called the Like Minded Group of Developing Countries (LMDC). Created at the Bonn Climate Change Conference in May 2012, it is a coalition of 24 countries, that includes several Arab countries, India, China, several emerging Asian economies and countries from the Caribbean and South America.

The UNFCCC chose to not listen to the concerns of the LMDC.

Some of the countries represented by the LMDC will be hit particularly hard by climate change impacts. Caribbean nations are a good example. As the Caribbean Climate Change Project (CCCP) points out, island nations “stand to feel the full brunt of climate change impacts.” One of those impacts is sea level rise. Take the Bahamas. According to the CCCP, sea level rise will cause the Bahamas to experience “considerable land loss” and that will have a negative effect on the tourism industry. Or take Jamaica which will also experience sea level rise that will impact tourism, but will also have its water resources affected by climate change.

Photo: Flickr/swong95765

Are Americans Really Using Less Energy?

One of the goals President Obama mentioned in his 2013 State of the Union address was to reduce the energy wasted in “American homes and businesses” by half by 2030. Energy efficiency has already caused great gains when it comes to energy use by American households.

Americans are only 4.5 percent of the world’s population, but they use almost 20 percent of its energy. According to World Population Balance, “every time an American spends a dollar, the energy equivalent of a cup of oil is used to produce what that dollar buys.”

So, is American energy use decreasing? Per-household energy use has decreased, according to EIA’s Residential Energy Consumption Survey (RECS) which is based on data from 2009, the latest data available. As James Berry, who worked on the Survey, told TriplePundit, “What we can say for sure is that average consumption per home has declined the last 30 years.”

The survey has been conducted every four years since 1980. Over time, while American houses have grown, the survey has shown that energy efficiency improvements reduced energy intensity -- offsetting over 70 percent of the growth in the number of households and the size of houses. Energy intensity decreased (improved) by about 37 percent in 2009 compared to 1980. The average home size from 1980 to 2009 increased by about 20 percent and Americans adopted both more and larger devices. Data by the Department of Energy’s Office of Energy Efficiency and Renewable Energy also shows that energy efficiency has caused energy use to decrease. The average U.S. home used 101,800 BTU of energy per square foot in 2012, 31 percent less than in 1970, after adjustments are made for efficiency improvements in electricity generation and weather effects.

The trend by American households of using less energy is continuing. Energy flow charts by Lawrence Livermore National Laboratory showed that Americans used less energy overall in 2015. The Laboratory releases energy flow charts annually that illustrate the consumption and use of energy in the U.S. In 2015, Americans used 0.8 quadrillion British Thermal Units (BTU) less than in 2014. However, there is a catch. Natural gas use increased by three percent while coal decreased by 12 percent. Modern gas-fired power plants can use up to 46 percent less energy, so most of the overall decrease in energy consumption can be traced to the shift from coal to natural gas.

Is the larger size of houses offsetting the gains from energy efficiency? The number of housing units in the U.S. increased by 80 percent over the past four decades. Houses have become bigger while they have also become energy efficient. But as the Pew Research Center puts it, the increase in the size of homes “wipes out nearly all efficiency gains.” The average home in 2012 was an estimated 1,864 square feet, 28 percent larger than the average home in 1970. And new homes are getting bigger and bigger. The average home completed in 2014 was 2,657 square feet, 57 percent bigger than in 1970. A 2013 report by the Energy Information Administration found that U.S. homes built in 2000 and later are 30 percent larger than homes built before 2000 and use two percent more energy. As a blog post by EIA pointed out that there would have been more gains from energy intensity improvements “if it were not for consumer preferences for larger homes and increased adoption of home appliances and electronics.”

There is a caveat with larger homes. “If you look at people who live in newer and larger homes, they tend to have double pane windows” Berry said. “Their homes are more insulated.” He added that while we are building bigger homes, they are consuming about as much energy as older homes. And much of that has to do with energy efficiency.

Location and size really do make a difference

Where Americans live matters when it comes to energy use. Some states use more electricity than others. While the average annual electricity consumption for a U.S. residential utility customer was 10,812 kilowatt hours (kWh) in 2015, the average for Louisiana was 15,435 kWh per residential customer, the highest annual electricity consumption among the states. Hawaii had the lowest at 6,166 kWh per residential customer. The population center of the U.S. from 1980 to 2009 continued to shift to the west and south. That shift lowered energy use by about 2.7 percent as populations relocated to more temperate climates.

There is an encouraging trend that might lead to Americans using even less energy, and that trend is tiny houses. It is hard to find exact numbers for the number of tiny houses in America, but there is a site that provides what it calls the Tiny House Map. It shows the people across the country who are building tiny houses. There are people building them in nearly every state. A tiny house is typically is about 100 to 400 square feet. A smaller house uses much less energy. An infographic on TinyHouseBuild.com illustrates the environmental benefits of a tiny house. A 2,598 square foot homes uses 12,773 kWh of energy a year, while a 186 square foot home uses only 1,144 kWh.

Millions Still Slaves to Fashion

By Brandee Butler, C&A Foundation

British Prime Minister Teresa May recently called it “the greatest human rights issue of our time.” Hillary Clinton committed to the cause when accepting her nomination as the Democratic presidential candidate. Last December, the UN Security Council held its first ever debate on human trafficking. Is modern slavery finally getting the political attention it so desperately deserves?

It’s about time. Slavery has not been condemned to history books as many would like to believe; it’s legacy endures. And it is happening right now, largely hidden from sight.

The International Labour Organisation (ILO) estimates the number of people suffering in some form of slavery at 21 million. But this estimate is likely conservative. The 2016 Global Slavery Index puts the figure at closer to 46 million – nearly the size of the entire population of Spain. More than half are women and girls, and despite industry efforts, many still work within the fashion supply chain.

C&A Foundation is working with local communities and the industry to tackle the problem in southern India. In partnership with the Freedom Fund and Terre des Hommes, we’ve been working to end the practice of Sumangali, a form of bonded labor that sees adolescent girls and young women contracted to textile spinning mills, working under terrible conditions for lowly wages.

Many fall ill and leave before the end of their tenure, receiving no pay at all. Others experience mental, physical, and sexual abuse, and are prevented from seeing family and friends. The experience leaves them traumatized, yet families continue to send their daughters to the mills, so desperate is the situation at home.

Sumangali might be unique to our industry, but the driving factors for it aren’t. Our experience on the ground has taught us that you cannot tackle modern slavery without addressing the complex and interconnected root causes of the problem – poverty, weak rule of law, and systemic gender discrimination, among them.

Industry and NGOs cannot do it alone either. Real political leadership is needed, which is why public statements by politicians – and better yet, commitments to act – are so important. Putting the problem in the spotlight forces us to look at what we’re doing, what is working, and what more is needed.

The search for solutions will get a boost this Friday when the United Nations University is scheduled to hold a meeting of its new Pathways Forum, a multi-stakeholder incubator of collaborative innovations to fight slavery, human trafficking and forced labour.

The ILO has also launched the Alliance 8.7 to “drive action to end forced labour, modern slavery, human trafficking and child labour in all its forms” – one of the UN Sustainable Development Goals (SDGs) for 2030.

Leading brands are also convening with the Organisation for Economic Cooperation and Development, and other government-led platforms like Germany’s Alliance for Sustainable Textiles, to leverage collective resources to tackle these issues.

An interim report by the Institute of Development Studies shows that our investment in the Freedom Fund’s hotspot approach is making a difference. There is much more to do, and one of the challenges we face is that the more you expose the issue, the deeper underground it goes to remain beyond the clutches of the law.

The Freedom Fund’s holistic approach counteracts that by pulling on multiple levers and working with critical actors – local government, mills, brands, civil society, and communities – to break the Sumangali system. But without addressing structural barriers to inequality and better opportunities on offer, there may always be people – girls and women especially – vulnerable to exploitation.

We must seize this moment to encourage all stakeholders to step up to the challenge, including investments in collaborative solutions that work. Lives and liberty, as well as the future of the industry, are at stake.

Brandee M. Butler is Head of Gender Justice and Human Rights at C&A Foundation. She drives partnerships and processes to support breakthrough innovations on key human rights challenges in the apparel sector, with a focus on forced labour, human trafficking, and gender equality. Prior to joining C&A Foundation, Brandee managed the Levi Strauss Foundation's HIV/AIDS, asset building, and worker rights portfolios in Europe, the Middle East, and Africa.

Dakota Pipeline Decision by Obama Administration Due As Nationwide Protests Mount

Less than 24 hours before protesters were due to launch a world-wide "day of action" against the construction of the Dakota Access Pipeline, the Obama Administration announced its decision: Approval of the last leg of the pipeline would be put on hold until local communities had been adequately consulted.The Standing Rock Sioux Tribe have been protesting the construction of the pipeline for more than a year, which it says would put the tribe's drinking and irrigation water at risk in an area that is already impacted by drought.

The decision by the US Army Corps of Engineers (USACE) follows more than a month of deliberations by the agency and weeks of escalating tensions between the water protectors -- as the opponents call themselves -- and heavily armed police on the banks of the Missouri River and the adjacent Lake Oahe. Reports of injured and maced protesters (and one report of a journalist shot in the back by police) have gone viral on social media, prompting the United Nations to condemn the "militarized response" by police and outcry from environmental and human rights groups.

It's also inflamed anger against the construction company, Energy Transfer Partners, which has refused to halt construction in those areas not under review by the USACE. On election day, as voters were heading to the polls, the company announced that it was "mobilizing horizontal drilling equipment" to complete the final leg of the construction. It has acknowledged that it would halt work for a "reasonable time period," but only if it could be assured that it could finish the pipeline. According to the company, the pipeline is complete accept for a section at the intersection of the Missouri River and Lake Oahe.The construction company has not said what it would do if the USACE were to turn down the company's request to drill under the lake as planned.

With the recent election of Donald Trump as the country's next president, the water protectors are pinning their hopes on Obama to come up with a compromise, if not an outright decision that would block the pipeline's controversial route. A denial of access to Lake Oahe would force the company to tear up and reroute portions of pipeline that had previously been approved by the USACE -- an action that would likely forestall its construction well into next year, when Donald Trump is due to take office.

And for the Standing Rock Sioux, that could be a problem. Trump has already signaled his support of the project, both in word and in financial investment. According to the Guardian Newspaper, Trump's financial disclosures indicate that he has as much as $1million invested in Energy Transfer Partners. He has additional investments in Phillips 66, which owns 25 percent of the pipeline. The investments didn't hurt the Trump's campaign, or the Republican party, either, both of which benefited from campaign donations from Energy Transfer of more than $100,000. The decision by the USACE not to grant completion of the pipeline may be viewed by many as the humane and environmentally sound thing to do, but it doesn't mean that Trump, with his financial support of the pipeline, won't try to reverse the Obama Administration's fix.

Still, the USACE's announcement that it planned to solicit input from community groups (the Standing Rock Sioux in particular) was anything but a useless gesture. The USACE's decision to delay a final answer helped thin the lines of protests planned for yesterday's "day of action." More than 200 protests were scheduled to take place across the globe yesterday, galvanized by indigenous groups that see the Standing Rock Sioux's plight a symbol of a growing infringement of Native rights across the globe. University students in Canada and the U.S. have also expressed their support for the movement at their banks. TD Bank customers closed down their accounts as part of a growing displeasure with companies that invest in the controversial pipeline.

Meanwhile in North Dakota, water protectors are digging in for what will likely become a difficult winter. Although the tents and makeshift homes have thinned considerably since the summer, the support for the water protectors' message hasn't. The fate of the Standing Rock Sioux's effort to protect its primary water source has become this decade's defining battle about the rights of a community to exist in the face of commerce and profit.

Image: Flickr/Fibonacci Blue

Sarkozy to Trump: Scrap COP21, and Europe Will Tax U.S. Imports

Many U.S. votes gravitated to Donald Trump last week because they believed this country had been pushed around on the global stage, and they were not going to take it anymore.

What they did not consider is that Trump’s ascendancy is also motivating many world leaders to flex their muscles and respond to the President-elect in kind.

Take Nicolas Sarkozy, who is hoping to unseat his successor François Hollande next year. In an interview with the French television TF1, the former French president and once again presidential contender said that if Trump pulls the U.S. out of the global climate treaty agreed at last year’s COP21 talks in Paris, Europe should impose a carbon tax on U.S. imports. Meanwhile Sarkozy channeled Trump’s rhetoric as he said that France, and Europe, should no longer be “weak” or “naïve” when it comes to the offshoring of manufacturing.

This is quite a turnaround for Sarkozy, the son of a Hungarian immigrant who upended French politics when he won election as President of France in 2007. Although he disagreed with much of American foreign policy last decade, he was not shy about expressing his affection for the U.S. during his first presidential campaign. French voters warmed up to his blunt talk and brash style, and the center-right candidate won by a comfortable margin in the final round of that year’s election. But France’s economy sputtered, and voters got bored with Sarkozy’s behavior and chaotic personal life. In 2012 he lost his reelection bid narrowly to Hollande.

But Sarkozy is back with a vengeance, and is trying to win the nomination of his party, which ironically has rebranded itself as “The Republicans.” France’s political establishment is threatened by the ultra-right National Front as its leader, Marine Le Pen, has a strong chance at becoming one of the two final candidates in next year’s presidential election. Meanwhile, Sarkozy is trailing a former prime minister and current Bordeaux mayor, Alain Juppé, for his party’s nomination. Hence Sarkozy has made an even harder turn to the right, calling for a ban on Muslim headscarves, the end of pork-free student meals for religious minorities and is calling for a harder line on immigration.

Sarkozy has also backtracked on environmental policies, which he championed early during his first term but then abandoned as the economy soured and his approval ratings cratered. He was criticized for openly questioning whether humans had a role in climate change, saying during an interview that “The Sahara did not become a desert because of industry.” Last year, Sarkozy was also critical of France’s role in the COP21 talks, saying they imposed “incredible risks” upon France.

As we learned last week in the U.S., however, appeals to nationalism and populism are now winning messages. Hence Sarkozy’s outburst reflects a delicate balance to appeal to French pride while assuring Europeans that he is committed to a united continent. Sarkozy’s threat of such a carbon tax would probably not float very far if he became President of France again – and it does come across as an idle taunt when considering the country’s parliament shelved a carbon tax plan last month. Plus such a tariff is the decision for Brussels to make, not Paris. But the lesson for Trump is that when it comes to foreign policy, including matters related to global cooperation on climate change, the more he huffs and puffs, the more huffing and puffing he will foment worldwide. The U.S. business community may be on a current joyride, as seen in the recent performance of the stock markets. But if more uncertainty like this piles on, the sighs of relief may soon give way to exasperation.

Image credit: World Economic Forum/Flickr

Alaska Airlines Forest-Powered Airplane Takes Flight

Watching a 737-800 push, taxi, and takeoff is nothing unusual. For most people, it is of little interest, taken for granted. Monday morning's Alaska Airlines Flight 4 from Seattle-Tacoma International Airport to Reagan National Airport in Washington, DC. was just one more.

What distinguished this flight was the fuel onboard, a blend of conventional kerosene-based Jet-A mixed with fuel extracted from a feedstock of "forest residuals," the limbs and branches left behind after harvesting of managed forests. Often burned as waste, a process developed by the Washington State University-led Northwest Advanced Renewables Alliance converts this wood material into fuel chemically indistinguishable from standard Jet-A. The biofuel is fully compliant with international ASTM Standards.

The past several years have seen steady advances in aviation biofuel development, from jatropha to camelina, demonstration flights are becoming more common as the industry grapples with new international standards to reduce emissions. The 20 percent biofuel blend used for Monday's flight adapted a patented technology from Gevo, Inc., a NARA partner. The two-step process converts cellulosic sugars into isobutanol alcohol, then into Gevo's Alcohol-to-Jet (ATJ) fuel.

Sourced from tribal lands and private forestry operations in the region, the 1,080 gallons of biofuel used will have minimal impact on Alaska Airlines overall greenhouse gas emissions. It is only a step toward a larger objective.

if the airline were able to replace 20 percent of its entire fuel supply at Sea-Tac Airport, it would reduce greenhouse gas emissions by about 142,000 metric tons of CO2. This is equivalent to taking approximately 30,000 passenger vehicles off the road for one year.

From feedstock to jet fuel, the Monday's successful demonstration emphasizes the value of integrating multiple stakeholders in the research and development of emerging technologies for sustainable aviation biofuels.

Partnership in progress

Flight 4 left SeaTac with 163 passengers, among them were several government officials along for the ride to help raise public awareness and cast a positive light on the possibilities of sustainable aviation biofuel.

"This latest milestone in Alaska's efforts to promote sustainable biofuels is especially exciting since it is uniquely sourced from the forest residuals in the Pacific Northwest," said Joe Sprague, Alaska Airlines' senior vice president of communications and external relations.

"NARA's accomplishments and the investment of the U.S. Department of Agriculture provide another key in helping Alaska Airlines and the aviation industry reduce its carbon footprint and dependency on fossil fuels," said Sprague.

The project highlights the urgent need to continue and foster new partnerships for research and development among industry, government, academia and public institutions.

"Today's flight comes after years of investments to help the aviation biofuels industry take off," said U.S. Senator Maria Cantwell. "By creating these sustainable biofuels, we will revitalize our rural agricultural communities, foster economic growth, reduce greenhouse gas emissions, and cut our dependence on foreign oil while growing our competitiveness in global markets."

As global commercial aviation continues to expand, so does the need to reduce greenhouse gas emissions from burning typical kerosene Jet-A. Monday's biofuel test not only advances the potential of sustainable aviation biofuel but is also an example of business and industry pushing forward together toward a more sustainable economy.

Image courtesy of Alaska Airlines

Ivanka Bangle Showcases Conflict of Interest in the Trump Era

New York Times journalist Eric Lipton was among the many who raised an eyebrow or two after noticing that Ivanka Trump’s jewelry company was quick to pounce at the opportunity to use her father’s presidency as yet another marketing tool.

Shortly after Donald Trump and members of his family were interviewed on 60 Minutes, Ivanka Trump Fine Jewelry sent a “style alert” to journalists to inform them that a bracelet that she wore during the segment could be purchased for $10,800.

Whether Ivanka Trump and her siblings will follow in the footsteps of past presidential family embarrassments such as Billy Carter, Neil Bush and Roger Clinton remains to be seen. Nevertheless, events over the past week show that the Trump Administration could present some of the largest conflicts of interest in recent history. And at a time when companies promise more transparency about their relationships with government, Trump wants the public to believe his presidency and his business interests will be separate because, as he has told the press, he said so.

But with Trump's three older children named to his presidential transition team, keeping his presidency and his businesses separate will be a tall order. On that point, over the past four decades, presidents dating back to Jimmy Carter and Ronald Reagan have placed their assets into a blind trust. Trump insists he is doing the same, only that his children will manage his business affairs.

Such a move is hardly a blind trust, as Richard Painter, an ethics lawyer during the George W. Bush Administration, argued yesterday in the Washington Post. Blind trusts in the past were administered by someone with no family ties, and that person in turn manages, buys and sells assets independently. That is what makes a blind trust “blind.”

Trump and his allies reply that with about 500 businesses under The Trump Organization umbrella, “it’s complicated.” Well, of course such a business portfolio would be complex. But enough of those businesses have ties in countries with which the U.S. has sensitive, even prickly, financial and diplomatic connections – including China and the Middle East, regions to which Trump directed much of his ire during the campaign. Then there are the questions about those businesses and properties that were developed due in part to government subsidies and tax incentives, both here in the U.S. and abroad.

The problem is that there is no U.S. federal law that requires the president to relinquish his or her business holdings and assets upon taking office. In the wake of the Watergate scandal and Richard Nixon’s resignation in 1974, Congress passed, with Jimmy Carter’s signature, the Ethics in Government Act of 1978. That legislation instructs members of Congress to recuse themselves from legislation that could have an impact on their personal financial interests. But no such rules are imposed on the executive branch, as lawmakers at the time believed the presidency was already complicated and exhaustive enough. Presidents and vice presidents are also exempt from most other federal ethics statutes, as well as bans against receiving large gifts.

The time has come to rethink this policy.

With Hillary Clinton’s lead in the popular vote approaching 1 million as of press time, Trump must start sending messages to the majority of voters who did not support him that he is fair, transparent and ready to govern without the distractions of his business empire. The only solutions are to sell off his beloved properties and other assets; arrange for The Trump Organization to launch an IPO and form a public company independent from the Trump family; or, as a compromise, transition those assets into a trust that is run separately from anyone with the Trump name. A 70-year-old man who will become president needs to focus on the nation’s problems and challenges without the distraction of his businesses for the next four years – and set an example for the U.S. and global business communities that he's committed to avoiding ethical distractions in the process.

Image credit: Eric Lipton/Twitter

It's Still A Green Economic Revolution

We have a new President. Regulations will be changed, diminished or eliminated. What has not changed is the growing consumer demand for goods and services that align value with values.

What has not change is a disruptive, global technology revolution involving artificial intelligence (AI), the Internet of Things (IoT), renewable energy and batteries. We are on the cusp of these technologies disruptively reshaping our homes, cars, businesses, factories, farms and cities.

The question is if a government led by a president that has called climate change a Chinese hoax can limit or stop today's global, multi-trillion dollar Green Economic Revolution. Will gutting the EPA and emissions regulations block the adoption of electric cars and solar power? Will America really shift back to coal as a result of this election?

Economics always wins, even green economies

Businesses from Apple to Walmart are adopting clean/smart tech and sustainable best practices. The two principal drivers pushing companies to go green are:

- Clean/smart technologies offer tremendous ROI through cost reductions

- Healthier and more sustainable products win customers.

Price competitiveness is the growth driver of sustainability and clean/smart technology. Today it costs only 75 cents per gasoline gallon equivalent to fuel an electric car. Electric cars in 2017 will enter their age of affordability with the launch of the Chevy Bolt and the Tesla 3. This is a global trend. From Asia to Europe the world’s car companies are creating economies of scale in manufacturing and innovation that will make smart, autonomous and electric cars the least cost solution.

The electricity to supply electric cars is also on a technology track to becoming more sustainable and cheaper. Wind and solar energy is disrupting the utility industry because their costs are now at, or below, the cost of fossil fuel generation. It is the lower cost for solar and wind, not regulation, that is shifting the world’s economy from coal. The emergence of net zero energy buildings enabled by solar, batteries, IoT and AI will disruptively reduce the amount of energy consumption per human occupant.

Changes in government regulation can enable or retard technology economics. We may be entering a period where government policy enables coal for political reasons. That type of action, because it damages our country’s economic competitiveness, is not sustainable. The economic realty is that one solar and wind are set up, there are no incremental fuel costs and marginal maintenance and repair costs. Economically, that's something!

Declining battery costs, combined with natural gas fueled power plants, will enable renewable energy to bridge periods when the sun does not shine and the winds do not blow. Coal, even with government regulatory support, has a diminished future based on its decreasing price competitiveness against solar, wind, natural gas, batteries and smart buildings. The real question is whether U.S. politics will allow utilities and coal companies to create barriers to entry that artificially preserve coal's market share until its price disadvantage causes a consumer/voter rebellion on behalf of cheaper renewable energy?

Consumers vote for more triple bottom line solutions

Consumers vote everyday at the cash register. They are voting for changes that align with their search for satisfaction on value and values.

Consumers are driving companies like McDonald’s into a revenue crisis. Consumers, confronting a weight/health crisis, are rejecting fast food loaded with fats, sugars, salt, caffeine and artificial ingredients even if they are offered at super-size-me prices. Today’s consumers, most especially millennials, seek tasty, price competitive and healthier food.

What consumers really thirst for are triple bottom products that are fun to use. Today, buying green feels too much like work. Plus, green products still can cost more than less sustainable products. Too often it is consumer guilt rather than fun that drives today’s green product consumption.

That is about to disruptively change. Smart/clean technologies are heading toward being engaging, liberating and fun. For example, autonomous electric vehicles will liberate us from seven year car loans plus deliver a huge fun factor. Consumers will be supplied with continuous choice in vehicles through mobility as a service. It will be fun and liberating to be able to pick among autonomous, smart and electric vehicles based on need, cost, convenience and fun. Lower emissions will be a “feel good” ancillary benefit.

CSR wins customers and millennial work associates

While America’s businesses may soon be operating in a less regulated environment, none should lose sight of the role that corporate responsibility (CSR) plays in winning customers and millennial generation work associates. CSR is now, and will remain, the basis of a business’ brand authenticity. Among millennials CSR is the human resources path to successful work associate recruitment.

The business bottom line is that CSR wins competitive advantage. It is the foundation of business success in the Green Economic Revolution. Look no further than Clif Bar’s 17 percent annual compounded growth rate to see how a triple bottom line focus builds business success. That is why companies from Google to Patagonia to Unilever place a strong focus on their CSR commitments.

"It’s the economy" is true in politics and the Green Economic Revolution

The Green Economic Revolution is not driven by government policy. It is an economic revolution. Change is achieved from customers buying green products that win on price, fun and values. The Green Economic Revolution is also a global technology trend that will disruptively change the economics of consumers, businesses and countries. Governments policy can slow or accelerate this 21st century mega trend. But it cannot stop it. The Green Economic Revolution is the invisible hand of the market driven by consumer demand and business opportunity.

This election has highlighted another key issue. There is a divergence in opportunity and alignment between urban and rural voters. Check back tomorrow to see how this issue might impact the Green Economic Revolution.

Government support for sustainability is “utterly pathetic”

What We Expect: Climate Impacts from a Trump Administration

The election of Donald Trump as President of the United States comes at a time where the world needs more engagement in climate policy. Unfortuantely, it also threatens to derail the world’s efforts to keep global warning below 1.5oC. The good news is that financial markets' interest in low-carbon and resilience finance can help counter-balance the expected scaling back of U.S. engagement.

Trump’s climate agenda

While Donald Trump as a candidate did not expound much on his views on climate policy beyond calling climate change “a hoax” and promising to revive the coal industry in the U.S., the Republican agenda on climate change is well established. Trump’s short list of potential nominees for EPA and Dept. of Energy seems to confirm his alignment with the most conservative aisle of the Republican party on all things climate and environment. We expect the impact of the Trump administration on climate policy to be three-fold:

First, we anticipate a hard stop or slow down of U.S. efforts to reduce greenhouse gas (GHG) emissions, starting with the Clean Power Plan, mired in court since 2015, but also including other environmental regulations on air, water and land conservation. The incoming administration will likely face legal challenges since the Supreme Court mandated the EPA to regulate GHG emissions under the Clean Air Act, but these typically unfold over years and the EPA can also count on industry-led lawsuits to help bring down some existing or in-progress regulations.

Second, we expect a sharp budget cut for the EPA, but also for development aid related to climate change (the U.S. is an important contributor to development finance institutions like the World Bank and the Inter-American Development Bank) and grants and subsidies to support local government. The Obama White House has been instrumental in providing concrete support and resources on adaptation and resilience, in particular with the Climate Data Initiative and the Climate Resilience Toolkit – the future of these programs is now called into question. Trump may also consider cutting funds for critical agencies like NOAA and NASA, which could impact long term climate data collection and analysis, similar to what we experienced in 2013 with the 'sequester.'

Third, the U.S. will likely shift from being a driving force for a strong global climate agreement to becoming a negative influence. This may provide an excuse for other countries to slow down their own efforts. While the future of the Paris agreement is not called into question even if the U.S. withdraws, the effectiveness of multilateral efforts will be undermined by the absence of the second largest emitter in the world at the table. It is unclear at this point if the EU and China can and will jointly take over that leadership role, but together they could provide a stabilizing influence and governments in both regions take climate change very seriously.

Market forces at play

However, many analysts have noted that even without policy support going forward, the transition to the low-carbon economy is already well underway. Trump is unlikely to succeed at reviving the coal industry with low natural gas prices, and renewables and low-carbon technologies have largely reached the point where they compete effectively with fossil fuels . Financial markets are providing steady support for new renewable and energy efficiency projects, with over $65.5B worth of green bonds issued in 2016 YTD.

The private sector’s support is also going to be needed for adaptation and resilience. Disengagment from climate policy at a time where each year breaks new heat records, and 2016 is already locked into the hottest year ever on record does not bode well for the future.

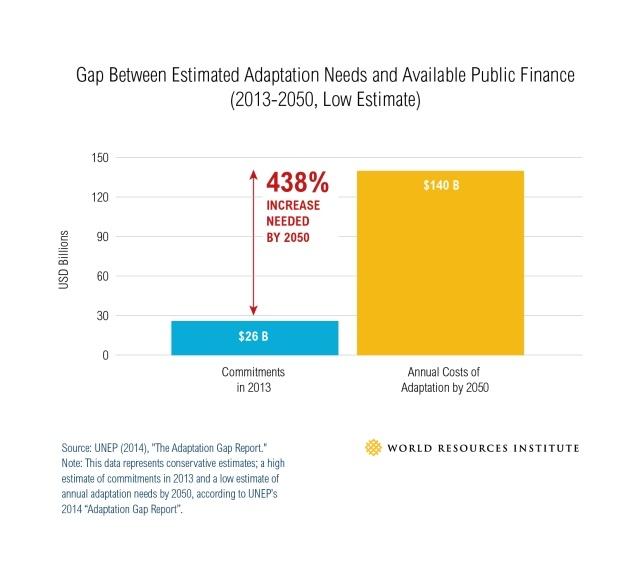

UNEP estimates the financing needed for adaptation will be at least $100B a year, while current adaptation funding from multilateral organizations hovers around $25B a year. While there is a strong consensus over the need to bring more private capital into adaptation and resilience investments, meaningful flows are yet to materialize.

Mobilizing private capital for adaptation

In this context, the discussion paper released today by the Global Adaptation and Resilience Investment (GARI) working group brings welcome insights into how investors see opportunities and barriers to adaptation investments. GARI was launched at Paris COP21, in conjunction with the UN Secretary General’s A2R Climate Resilience Initiative, to bring together private investors and other stakeholders to focus on the practical intersection of investment and climate adaptation and resilience. At COP22, GARI released Bridging the Adaptation Gap, a discussion paper that summarizes the discussions of over 150 private investors and other stakeholders in 2016.

The paper confirmed a high level of awareness among participants, with 70 percent of private investors surveyed declaring they see both risk and investment opportunity from the impact of climate change. Seventy-eight percent of respondents thought evaluating the physical risk from climate change was “very important,” and over 60 percent confirming that they were already, in fact, considering climate risk in their investment portfolio. The lack of a common approach to measuring climate risk, however, was identified as a critical barrier, with respondents calling for a transparent, practical approach to assess physical climate risk.

GARI also brought attention to investors’ interest in opportunities for investments in adaptation and resilience. Seventy percent of participants indicated they would consider making investments that supported adaptation to climate change or climate change resilience now. The paper catalogs various investment types, including existing infrastructure, corporate, and fixed asset investments that support adaptation and resilience to climate change. Over 60 percent of respondent investors are considering investments today in resilient infrastructure and in companies whose products address the impact of climate change on water, agriculture, healthcare, energy, and financial services.

Conclusion

The engagement shown by GARI participants, which includes some of the largest financial institutions in the world, opens the door to bringing private investors into a number of adaptation opportunities in need of funding, such as developing and deploying new and existing technologies to help deal with the effect of drought in agriculture, better flood prevention, resilient retrofits to infrastructure and cool, efficient housing.

Not all adaptation projects are suited to private sector investments however, and banks will not replace governments in investing in social capital, development projects and lifting the most vulnerable out of poverty. But leveraging and guiding financial flows towards projects that enhance economic and social resilience create a win-win opportunity and a powerful way to continue to make progress towards a low-carbon and resilient world in spite of political headwinds.

Image credits: Harout Arabian, WRI, 427mt