Finland lists first green bond on LSE with $500m issuance

How Companies Can Be Allies on Race Issues

Since the 2013 acquittal of George Zimmerman in the shooting death of African-American teenager Trayvon Martin, the Black Lives Matter (BLM) movement aimed to raise awareness about the systemic racism and violence the African-American community has endured for centuries in the U.S. Critics of the movement often reply that “all lives matter” and that the focus on deaths of African-Americans at the hands of police officers ends up encouraging violence.

Law enforcement violence against African-Americans is nothing new – but the proliferation of social media and cell phone cameras has finally made this problem a subject of daily conversation -- and daily tension for those following the headlines.

Tensions over the BLM movement and police violence, along with other racial issues, can manifest themselves in the workplace. At a time when some industries, including the technology sector in Silicon Valley and beyond, face criticism for a lack of diversity, the very discussion about BLM and the topic of race in general can at a minimum make employees uncomfortable: whether they are black, white, or any other race or ethnicity.

So, how can a company demonstrate that it is an ally of the BLM movement, or any group that considers itself underrepresented or the object of bias in the workplace? Is striving to be an “ally” even enough? And how can a company ensure such a conversation can make everyone at the office comfortable and feel open about discussing these issues, including, of course, white people?

To that end, TriplePundit spoke with Cecily Joseph, vice president of corporate responsibility and chief diversity officer of the technology company Symantec, which is based in Mountain View, California.

What it takes to be an ally

Joseph argues that those who suggest being an “ally” is more of a passive response need to take a look at history over the past 60 years. “In the broader context of racial equity as a whole, if we didn’t have allies during the Civil Rights era of the 1960s, if the African-American community did not have non-black people aligned with that cause back then, we would not as a society have been able to move forward," she told 3p.

Recent history also proves allies to be important for LGBT citizens as they sought equal treatment in the workplace and, then, marriage equality. “The strongest allies of the LGBT community are their parents,” Joseph said. “They may not be gay, but they were very active and lent support to their kids. So, I think to be an ‘ally’ is important, and it does have a role.”

The key, Joseph explained, is to put the word “active” in front of the word ally. And to be an active ally is particularly important for citizens who are in the position to move the needle and foster progress on issues related to racial equality.

Joseph noted that, as is the case with any company, hers is not perfect. As is the case with many businesses, and the individuals who work within them, Symantec is on what Joseph described as a “journey.” To move in a direction that fosters an inclusive and fair workplace, Joseph described a four-step process that she said is helping her company make progress.

Start from the beginning

First, make it clear that your company is not only actively recruiting, but is also striving to ensure a welcoming environment so it is possible to retain employees of all walks of life. And making that data publicly available lets both employees and potential employees know how the company is performing when it comes to diversity. True, the risk is that companies can be exposed to criticism over the numbers and percentages – but such moves also demonstrate transparency and commitment.

Next, ensure your employees are actively involved in company decisions. On that point, Symantec launched what it calls “employee resource groups” (ERGs): grassroots networks of employees who share a common experience, culture or characteristics and seek a common forum in which they can connect. But these groups should be far more than “networking” units with a LinkedIn group or MeetUp page. Companies should involve these groups with a bevy of decisions. Symantec ERGs serve as an advisory board on a wide span of issues, including diversity recruitment and philanthropic grants or investments.

Third, a long-term vision is needed to ensure the company can continue to make progress far into the future. Joseph described this tactic as developing a “pipeline.” For a technology company, investments in STEM (science, technology, engineering and mathematics) education in underserved communities are a start. Partnerships with schools, or funding programs that could encourage citizens to seek a career at your company – or, even more crucial, the wider industry at large – offer a company opportunities to show it is a genuine change agent in the communities in which it operates.

Finally, companies can use their brand equity to promote equality on a national and even an international level. We saw this last year in the U.S. in the months before the Supreme Court decision that legalized gay marriage. In fact, the Huffington Post counted 379 ally companies to be exact, with an A-to-Z roster that spanned from Alcoa to Zynga.

Having a company speak loud and clear on race, diversity and inclusion does not ensure buy-in from everyone, as Starbucks learned from its “Race Together” campaign last year. But leading a discussion in your own company can contribute to the broader conversation, and even help society move forward.

Acknowledge that bias exists, and work on it

A company can have a plan and policies in place, but daily interactions between employees may be different. And the bottom line is that tensions in the workplace that emanate from race are often the result of unconscious bias. As a recent segment on National Public Radio outlined, racial bias is hardly a police problem: It is everywhere, and for many kids it starts in preschool. The nut for companies to crack is to acknowledge that many of the biases we have as individuals are unconscious. Nevertheless, companies need to invest in bias training so the problem can be addressed in the workplace.

This is not about telling people they are biased or even racist, Joseph insisted. “We all have bias," she acknowledged. "So, in order to improve a work culture, the objective is not to tell people that they are racist. It’s to help people understand and learn how to objectively make good business decisions.”

Companies must put the right processes in place to allow more objective and less subjective decisions. This is especially important during the hiring process, when qualifications should be the focus while ensuring that bias does not affect the eventual decision of who should fill a position. And developing a fair set of questions for interviews is just the start. “We’ve all been influenced by our upbringing and what we see in the media,” Joseph concluded, “but let’s not allow bias to have an impact on our most important business decisions.”

Image credit: Tony Webster/Flickr

Researchers: Global Warming Could Wipe Out Maine Lobsters in 85 Years

The Gulf of Maine is warming at an alarming rate. Research by the National Oceanic and Atmospheric Administration shows ocean temperatures are rising at three times the rate of global averages. This increase in temperatures is linked to the collapse of the New England cod population, and new research shows the fate of the Maine lobster is likely similar.

A new report from the University of Maine Darling Marine Center and the Bigelow Laboratory for Ocean Sciences predicts the Maine lobster population will be wiped out by 2100 due to climate change. The study examined how lobster larvae are impacted by rising ocean temperatures and ocean acidification. Although acidification seems to have no significant impact on the larvae, warming temperatures are a different story. Lobsters reared in water that is 3 degrees Celsius warmer than current temperatures in the western Gulf of Maine had bleak survival rates.

“They developed twice as fast as they did in the current temperature of 16 degrees Celsius (61 degrees Fahrenheit), and they had noticeably lower survival,” says Jesica Waller, a graduate student at the Darling Marine Center and lead author of the study. “ ... Really only a handful made it to the last larval stage. We noticed it right from the start. We saw more dead larvae in the tank.”

The research involved raising over 3,000 lobster larvae until they exited the larvae stage, which takes approximately 30 days at current ocean temperatures. Walker also says these are short-term experiments and it is difficult to predict if lobster populations can adapt to temperature changes over time. More research is needed to predict this.

Although this research provides greater information about the fate of the Maine lobster, observations also yielded concern about this iconic crustacean. The Maine lobster population likes colder waters and is migrating north in search of them. Lobster fisheries off Long Island and Connecticut are in decline as the lobster move further north into Maine. In fact, a 2013 study from Princeton University found that Maine lobsters migrated about 43 miles north each decade between 1968 and 2008. If this trend continues, the Maine lobster will end up in Canadian waters. In other words, we can predict where populations will end up by studying the pace and direction of climate change, known as climate velocity.

"We don't want to restrict fishing when not needed, or blame climate change for a species collapse when fishing is to blame," Pinsky said. "There have not been many attempts before to connect fine-scale biological data with fine-scale climate data. Our research implies that climate can be very useful for predicting marine distribution shifts. We expect these species to follow climate velocity in the future."

Such shifts in marine populations can have a big economic impact on local communities that rely on lobster and other seafood for their livelihoods. Maine lobster fishermen hauled in a record-breaking $616.3 million catch in 2015 at $4.09 a pound, in a state with a population of just 1.3 million. The total input into the Maine economy is much larger when considering all that are involved in the industry, points out Jonathan Fulford, a candidate for the Maine Senate.

Lobstering is often a multi-generational family tradition and is one of the oldest continuously operated industries in North America, dating back to the 1600s. Lobstering has changed little over the years and still involves hauling lobster from traps by hand.

“The coastal Maine economy is driven by lobsters,” Fulford says. “In many of the communities throughout our state, lobstering is their lifeblood. If we lose the lobstering tradition, it will change coastal towns and islands completely.”

These recent studies highlight the importance of gaining a deeper understanding of climate change and its economic impacts. Proper planning can foster resiliency from the impacts of climate change on local economies, but there may be no way to mitigate the social impact of losing this iconic industry.

Image Credit: Flickr, Richard

Harvesting Water from Air with Solar: A Sustainable Drinking Water Solution?

The ability to harvest water from air is a technology that has existed for a long time, even going as far back as the Incas. But success in scaling up this technology has been elusive. The largest hurdle is that the technology is energy-intensive, making it cost-prohibitive with dubious results.

The end game has been plenty of startup companies that promised to revolutionize the delivery of drinking water, but ended up fading from view. Similar technologies, such as the harvesting of water from fog, were touted as a way to help communities cope with water stress, but again their scalability has proven to be a massive challenge.

Yet another startup, Palo Alto-based SunToWater, claims it has a residential and commercial drinking water solution that will not cause utility bills to skyrocket.

The system resembles a standard outdoor air-conditioning unit. Fans blow air over desiccant salts inside the module. Heat from solar thermal collectors bakes water out of those salts, which in turn creates steam that accumulates within a condenser and is then ready to use. The result, says the company, is a steady stream of water that can create a minimum of 40 gallons daily. Customers can purchase more than one unit and stack them, which would allow customers to collect enough water to maintain swimming pool levels, care for surrounding landscaping or, most importantly, offer a generously reliable source of drinking water.

Hence, a reliable drinking water system is available that could be used anywhere. SunToWater insists the system can work in any environment, even in a city suffering from high levels of air pollution, as those desiccant salts only collect water molecules, not airborne contaminants. Since it does not rely on freon, the company says the use of those salts also makes it feasible for the system to work in the harshest desert climate. And because the system was designed to operate “off-the-grid,” it can generate water while using 70 percent less power than other air-to-water machines.

The systems can now be "reserved" for $500 each. And as for the final cost once these are available for market? They will set you back $9,000 each, although the more you buy, the more you save (unless you only purchase two or three). Unfortunately, the company is making it difficult by not making the case of how these units will save consumers money – no lifecycle analysis and no comparisons to the costs of using municipal or bottled water. And most glaringly, there is no estimated time of arrival for the systems.

So, is this a viable solution for providing drinking water or an investment in a pipe dream? Harvesting water from air certainly offers a “wow” factor, but it is concerning that this technology has been around for years without much investor enthusiasm. Scientists, policy makers and researchers have focused on solutions like desalination or aquifer recharging instead. Time will tell if this solution will be cost effective, and I'd be reluctant to spring for the reservation without seeing more hard numbers.

Image credit: SunToWater

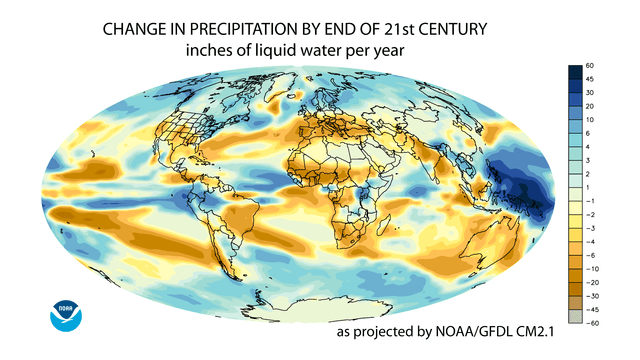

Climate Signals: Connecting Science to the Extreme Weather in Your Backyard

One of the biggest challenges in in raising awareness about climate change is visualizing it: More often than not, it is made up of subtle, hard-to-sense changes. Climate Signals, a new tool from Climate Nexus, aims to address this with a real-time, Web-based, visual database for climate-related events and impacts around the world.

Though in the beta phase, the tool is already impressive. It includes historical events – such as the Great Chicago Heat Wave of 1995 – as well as modern ones, such as Hurricane Matthew, which is barreling up the East Coast with a rare force and power.

Sustained strength of #HurricaneMatthew consistent with physics of #climatechange - warmers seas offer more potential energy. https://t.co/UW2tBKonyv

— Climate Signals (@ClimateSignals) October 5, 2016

Climate Signals allows us to understand how modern events are connected to climate change, and how historical ones could become more frequent if we don't curb greenhouse gas emissions quickly.

Unlike other complex scientific databases, Climate Signals is user-friendly, visual and intuitive, with a useful search function as well. It allows us to connect two things – extreme weather and climate change -- through scientific data and powerful visualizations in ways that, until recently, were a challenge. For example, the fires devastating much of California:

#Canyonfire in California delays rocket launch. 14 of California's largest wildfires burned in last 20 years. pic.twitter.com/d2KGAqYXvK

— Climate Signals (@ClimateSignals) September 20, 2016

Previously, this type of information could only be accessed by scientific specialists. The idea is to bring complex climate information to everyone, building a bridge between science and citizens, and empowering all of us to act. From the Climate Signals website:

"The relation between individual extreme events and broader climate trends can be very complex. Climate Signals cuts through that complexity by drawing a line from current events through a hierarchy of signals connected to the anthropogenic increase in atmospheric GHG concentrations."

This type of tool can be incredibly useful for businesses as well. Increasing environmental risk is becoming a major factor in business decision-making. Seeing how different regions are being affected by climate change can help companies better understand how their bottom line can be impacted by extreme weather events.

Moreover, businesses have access to wide-ranging information about climate change (and most, unlike ExxonMobil, do pay attention to this information). Climate Signals could also be a place where firms can share information about what they are seeing around the world -- for example, along the increasingly complex supply chains nearly all of us rely on every day.

We know – clearly – that we need to act. Having access to better information, and putting that information in the hands of everyone, can help us figure out how best to allocate often limited resources. I'll keep an eye on Climate Signals as a valuable tool to follow global climate impacts as they become more severe, frequent and widespread in the coming years.

Image credit: NOAA Geophysical Fluid Dynamics Laboratory via Wikimedia Commons

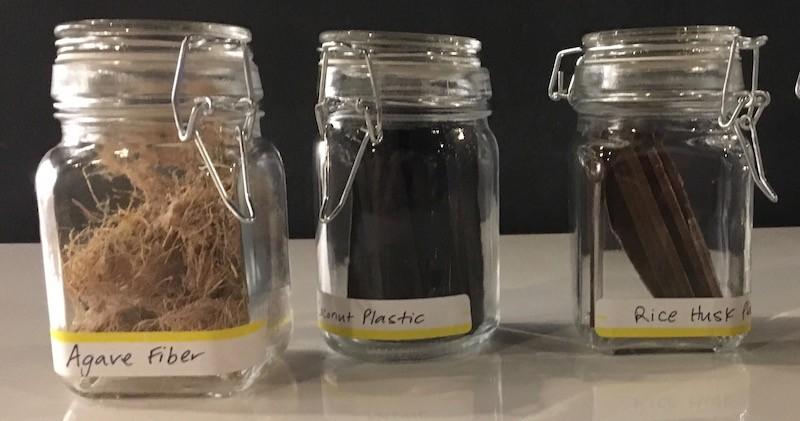

Ford Continues to Use Natural Fibers In Plastic Vehicle Components

Over the past few years, TriplePundit has reported on Ford Motor Co.’s use of bioplastics in its vehicles, both as a means of lightweighting certain components and as a way to reduce the fossil fuel content in vehicle parts.

Earlier this summer, the company partnered with Jose Cuervo to test the use of agave fibers in certain components such as air conditioning systems and wiring harnesses. These fibers, a byproduct of tequila production, join the list of other natural materials Ford incorporates into various components in vehicles on sale today.

We caught up again with Debbie Mielewski, Ford’s senior technical leader of sustainable materials, to check in with the automaker’s ongoing efforts to continually evaluate new biomaterials, as well as understand a little bit more about how to select suitable materials for various components. Also, we were curious to understand the opportunities and challenges of recycling these components at the end of a vehicle’s life.

Mielewski said her team’s ongoing goal is to innovate "better utilization of things that other people call waste.” Meaning, for example, natural fibers recovered from agricultural byproducts can be manufactured into various vehicle components; some parts are as simple as cup holders, while others are semi-structural in nature. For any given application, the natural fiber components are only substituted in once they are tested to meet specifications for performance and durability for a specific application.

There are, of course, some technical hurdles when developing certain materials. For example, some natural fibers contain impurities, which cause odor and volatiles to emanate if they get too hot. This means some fibers, like agave, are better in “underhood” applications rather than for interior components. Conversely, Ford has been able to purify cellulose fibers from trees to remove “low molecular weight bodies,” allowing them to withstand higher temperatures.

In addition, Ford tries to select fibers proximal to specific manufacturing locations. For example, the company uses wheat straw from nine farms in Ontario, Canada, and incorporates this waste material into storage bins for the Ford Flex that’s assembled there. The work being done with agave fibers will be relevant to manufacturing in Mexico, where blue agave farming is big business.

Some of these fibers are selected as filler material to reduce the amount of fossil-fuel derived plastic used in certain components -- often making the parts lighter in weight, too. Other times, natural fibers are blended into parts to add strength. In either case, a component may be comprised of up to 30 percent natural fibers.

Furthermore, as well as saving fossil fuels by reducing the polymer content of a component, these fibers often replace traditional filler materials such as talc (which is very energy intensive to mine) or strengthening material such as glass fiber (which is very energy intensive to manufacture). So, as Mielewski explained, “In all cases, these materials are better for the planet.”

In many cases, the natural fibers blended into polymers perform better than the traditional materials they replace. For example, in traditional glass fiber, the glass fibers themselves are three millimeters in length in a virgin state. But after molding into a complex part, those fibers break and can end up as little as half a millimeter in length. In other words, material properties are degraded in the manufacturing process. On the other hand, natural fibers in polymers used for strengthening can initially be cut to variable lengths as appropriate for a given application, and those fibers have been found to suffer no degradation even after remolding a component up to five times.

This attribute holds potential not only for strength, but also for recyclability at the end of a vehicle’s life. Whereas glass fiber has to be downcycled, maybe these natural fiber infused polymers could be more valuable for reuse?

Unfortunately though, despite the fact that these materials are recyclable, no recycling streams have been established as of yet. That's because the economics are not great at the moment.

With current oil prices being so low, Mielewski says virgin plastic works out cheaper. Furthermore, even if oil prices rise and recycling gains an advantage, recyclers will still have to work out how to efficiently detach the plastics from vehicle parts which tend to be comprised of mixed materials. Think about a car seat -- which has a structural base, a foam cushion and cover material. So, unfortunately, Mielewski explains, “You’ll have to have reasonably high oil prices and plastic prices to get people motivated in these technical areas.” Perhaps we can hope that by the time a car built today reaches end-of-life in 10-plus years, progress has been made in this area.

Despite limited recycling opportunities at the moment, fortunately, the use of natural fibers in plastic components do remain economically viable in Ford’s vehicles today, even with protracted low oil prices. That’s in part because Ford got a head start in developing these materials back in 2001 during another period when oil was cheap and the economics were not conducive. By going through the development cycle when oil was cheap, it meant that when oil prices spiked later in the decade, they had production-ready soy-based foams ready to roll out; a material which was more sustainable and had suddenly become cost effective.

Since then, Mielewski said Ford, “has established a corporate philosophy; that we must use sustainable materials when they meet performance requirements and they are affordable.”

Image courtesy of the author

The 5 Most Blatant Pinkwashing Cause Marketing Schemes

It is October: National Breast Cancer Awareness Month. This is a time for organizations, including the National Breast Cancer Foundation and the American Cancer Society, to raise awareness about a disease that affects almost 250,000 women in the U.S. each year and will kill approximately 40,000 of them.

It is also an important fundraising time for Susan G. Komen Foundation -- which, despite what the name of its annual “Race for the Cure” implies, only spends 20 percent of its funds on research and 37 percent on “education.” All totaled, the organization spends more money on administration than it does on treatment. In recent years, Komen garnered plenty of criticism for its excessive executive pay and its penchant to put politics ahead of purpose on issues involving Planned Parenthood and stem cell research.

Meanwhile, Komen is notorious for transforming the pink ribbon into a monetizing machine that has enriched corporations while making plenty of women resentful that their very personal and often lonely pain is leveraged to garner companies' positive press. Despite the annual outcry, companies continue to collect publicity, and revenues, on a bevy of cause marketing promotions that range from airline miles promotions to credit cards.

In fairness to Komen, other breast cancer charities are in on the act as well, which generates some funds for these charities. But as a 2009 University of Michigan study on cause marketing suggests, the revenues gained from such promotions often translate into even more profits as consumers “feel good” about patronizing a company that is trying to prove it cares.

So, what are some of the most garish pink ribbon-inspired cause marketing campaigns in recent memory? Here are five; readers are encouraged to add their ideas in the comment section at the end of this article.

1. Sabre pepper spray

Never mind the fact that crime has been on a downward trajectory for over two decades. Sabre has decided to prey on white people’s fear of dark alleys at night with its promotion of key ring pepper sprays (as shown above) and other products that benefit the National Breast Cancer Foundation. “Shop the pink models below to empower yourself and the women in your life!” exhorts the company.

2. Pink fried chicken

Eat a breast to save a breast, as ABC News asked several years ago?

KFC’s Buckets for Charity fomented plenty of backlash when Komen partnered with Yum! Brands in 2010. Even worse than this ill-thought campaign were the mealy-mouthed responses KFC executives offered when defending this alliance.

Perhaps that is why the pink buckets of chicken are not mentioned anywhere on Komen’s or KFC’s websites, and the Buckets for the Cure Site has long gone extinct.

Incidentally, medical professionals suggest excessive fat and processed foods should be prevented in order to curb the risk of breast cancer.

3. Pink fracking drill bits

The energy services firm Baker Hughes generated everything from eye-rolls to outrage with its announcement that donations to Komen were paired with painting 1,000 fracking drill bits pink.

The NGO Breast Cancer Action opposes fracking because the risky chemicals used in this process could expose people to endocrine disruptors and carcinogens linked to breast cancer. Despite the wide public scorn, the company still showcases this public relations stunt on its website.

4. Pink your drink

Brown Forman, parent company behind the French raspberry liqueur Chambord, invited consumers to “Party with a Cause” by having cupcakes and booze parties.

Not that there can be many parties: This year, the company says it will donate $5 for every attendee of such a party, but it has capped that donation at $10,000. The American Cancer Society advises women to minimize their alcohol consumption to one drink per day to reduce the risk of contracting this disease.

5. Test-drive cars to raise awareness

Over the years, automakers including BMW and Ford Motor Co. have encouraged consumers to test-drive their cars with a financial amount per mile driven going to charities including Komen.

That sounds noble, but the problem is the excessive driving – not to mention the fact that the emission of polycyclic aromatic hydrocarbons (PAHs) have been linked to an increase in breast cancer risk. The American Cancer society advises women to reduce their exposure to automobile exhaust as much as possible, including those from diesel cars.

Image credits: 1) Sabre 2) KFC 3) Baker Hughes 4) Chambourd 5) Bill McChesny/Flickr

5 Steps for Stronger Companies

By Paige Morrow

Today we face complex challenges that cannot be addressed by government or civil society alone, such as growing inequality, climate change, doing business within the limits of the planet’s resource boundaries, and negotiating the complicated relationship between globalization, development and human rights.

After the financial crisis, we've seen considerable debate about the role of corporations in society. It has become broadly accepted that corporations -- particularly the world’s largest publicly-traded corporations – need to be governed with respect for society and the environment. What is the role of companies in addressing the challenges of the 21st century? And how can their governance contribute to the greater good?

Listed below are a few key principles for creating long-term sustainable value and building resilience in big, publicly-traded companies, as well as some actions that businesses can take to move in the right direction.

1. Define the purpose of the corporation

A company's purpose determines its ability to recognize, respect and balance stakeholder needs, which are key to its long-term success.

The purpose of the publicly-traded company should be to create sustainable long-term value while contributing to societal well-being and environmental sustainability -- not just short-term shareholder value.

Corporations should create real value for customers and wealth for shareholders as joint and mutually-reinforcing objectives, while taking account of environmental sustainability and societal well-being.

What next? Companies can embed a clear statement of purpose and corresponding rights and responsibilities of directors, shareholders, and other stakeholders in governance documents and articles of incorporation.

2. Improve executive pay and employee incentives

Incentives effectively determine the goals of corporate directors and managers. A significant part of top executive pay consists of bonuses, which tend to be set based on short-term performance. This can perversely reward executives who divert corporate resources from investment in innovation or employee well-being to strategies aiming to increase short-term share price.

What next? Ensure that incentive structures and metrics are aligned with a company-specific, long-term value creation strategy that integrates financial and non-financial objectives.

3. Integrate stakeholder voice into decision-making

Businesses ignore the interests of stakeholders other than shareholders at their peril. Stakeholders are crucial to the company's long-term success; these include employees, creditors, suppliers, customers, local communities and the environment.

A business strategy that profits at their expense can quickly undercut a corporation’s social license. Moreover, the scale and complexity of social, environmental and economic challenges facing our societies require that businesses actively contribute to solving rather than causing them.

What next? Use a corporate form or governance arrangement that provides control or monitoring rights to stakeholders.

4. Clarify the obligations of company directors

Two distinct forms of obligations, called fiduciary duties, are relevant to improving corporate governance:

- Those of corporate directors to promote the success of the corporation, which are owed to the corporation itself.

- Those of institutional investors (such as pension fund trustees) to act in the interest of their beneficiaries.

There is a lot of confusion about the content of these obligations. Company directors and pensions are legally permitted, and in some cases required, to take the environment and human rights into account. Also, there is an obligation to proactively and critically evaluate material financial risks and opportunities -- which is increasingly being understood to include climate change, for example.

What next? This one is mostly for regulators. There is a need to clarify the content of fiduciary duties with respect to specific environmental and social issues, e.g. systemic financial stability in the case of banks, the mitigation of environmental impacts for mining companies, and the development of fair and sustainable supply chain models for the garment industry.

5. Improve corporate reporting

The way that businesses report on their activities to investors and other stakeholders can have a huge impact on how observers perceive the corporation. The form of reporting used creates powerful incentives for boards to set targets and the strategies use to hit those targets. Current accounting models focus mainly on short-term financial information and do not address many issues that are essential for businesses' ability to create sustainable value.

At the same time, investors are increasingly interested in the value creation process and there is a clear trend among successful corporations towards reporting on long-term value creation. This is supported by research that shows that corporations with good ESG performance and reporting outperform their peers on the stock market in the long-term and benefit from lower cost of capital.

What next? Companies can adopt the International Integrated Reporting (IR) Framework to meaningfully report on their value creation strategy, taking into account intangible assets and non-financial capitals.

These recommendations have been taken the ‘Corporate Governance for a Changing World: Report from a Global Roundtable Series,' which contains further thoughts about next steps for creating inclusive, sustainable and purposeful companies. The report presents an emerging comprehensive approach to corporate governance that can assist corporations to focus on a broad understanding of their purpose, long-term sustainable value, building resilience, and sustaining a strong social license.

Image credit: Pixabay

Paige Morrow is head of Brussels Operations at Frank Bold, a purpose-driven law firm. The firm leads the Purpose of the Corporation Project, which invites businesses, academics, policymakers, and civil society to debate the future of publicly traded companies. Connect with us on @purposeofcorp or on our Linkedin Group.

M&S wants us to get active for 30 minutes a day to help cut the risks of breast cancer

Companies driving progress on UN SDGs